Welcome

to Peerless Stock Market Timing

All Rights Reserved. (C) 2012 Wm. Schmidt, Ph.D

2012 Version Signals'

Peerless Shows History Does Repeat.

Track Record of Peerless Buys/Sells: 1928-1948 1948-2012

Peerless Is Alive and Growing.

Peerless changes somewhat as new

research is done

and reported on our Hotline. The changes must be reasonable

in terms of technical theory and back-test well.

Here are the changes after the fact since 1982 and when

the signals were incorporated.

1) 8/26/87 Sell S4 (2701.95) was incorporated in 2009.

We used A/D Line uptrend break for judged Sell S6 back then.

The S6 occurred on 8/27/87 (2675.06).

2) 2/3/94 S4 (3967.66) was was incorporated in 2009.

We used the completed head/shoulders for judged Sell S10

on 2/25/1994 (3838.78)

3) 3/10/1995 B10 (4035.610 was applied here even though

the A/D Line did not confirm the breakout because

I considered the pattern very bullish in the DJI, the

Accumulation Index was very positive and

the DJI was making a move into all-time high

where the path of least resistance was UP. I remember

making a very good Futures trader from Merrill very unhappy

with this because he was short. And he remained short

even though I was bullish. He was forced to leave the

business a few months later.

4) 10/3/1997 S12 was added real-time that night.

I showed the history of these back to the first one in 1966

for the first time in the next bu-weekly Peerless Forecasts.

5) Early 1999 A/D Line failures to confirm the DJI brought

multiple Sell S9s that were minimized in importance at the time

because of how strong the NASDAQ was. These were not revised

until 2009 Update when it was understood how bullish the 3rd

year in the Pres. Election cycle was.

6) June B9s in 2001 were not considered trustworthy

because of how weak the NASDAQ was and because of bearish

head/shoulders earlier that year in May. Research at the

time showed that such B9s were not to be trusted when

the Accum. Index was so red. This led to a rule change

that dropped B9s when the Accum. Index was below

a key level in these cases.

7) 7/24/02 Buy B19 was created on the night it occurred

based on research I did that night. It proved correct.

8) 7/18/2006 Buy B9 was reinstated for this case when

DJI had gotten up past the 65-dma with the AI having turned

positive. The June 2001 B9 revisions had themselves to

be revised to allow for the Buy signal here. Now we would

have the Closing Power to use to see that this was a valid

reversal.

9) 1/6/2009 Sell S12 (9015.10) was added on 1/9/2009 (8599.18)

despite very positive P-I based upon studying previous S12s in

severe bear markets back in 1930s for the first time.

10) 7/21/2011 Sell S9v (12724.41) was added at close

on 7/22/2011 (12681) when I realized how powerful this signal

was between April and September.

11) 5/14/2012 (12695.35) Buy B2 was dropped. DJI did fall

to 12127.95 on 6/5/2012, but there was no Peerless Buy

signal there. Because of format of data into yearly segments,

I have avoided testing the proposition that 200-day ma

is helpful, though clearly it is in some situations.

The Signals' Documentaon for the July 2012 version is shown below.

Documentation for previous 2005 version.

2007 Version' Signals' Results: 1965-207

http://www.tigersoft.com/majorpeerless.htm

Peerless 2012 software is $395. Order Now.

Peerless Stock Market Timing: 1915-2011 book - $125. Available in 2012.

------ OPERATING INSTRUCTIONS ------

Installation Instructions should have been sent you...

To place the signals on the current DJI use

PEERCOMM + Charts-2011 + Peerless Dalily DJI + DATA +

Signals-1 + "DJI Major Buys and Sells (Normal Mode)".

To redraw the graph showing the P-Indicator, A/D

Line and Accumulation Index

with the SAVED Peerless signals on the current DJI use

PEERCOMM + Charts-2011 + Peerless Dalily DJI + + DATA

+ Operations + "DJ chart, PI, ADL and Accum Index" +OK + OK

+ Signals(1) + "SuperImpose DJI Saved Signals"

+ Use Selected TigerSoft Signal + S5

Experment:

PEERCOMM + Charts - 2011 + Peerless Dalily DJI + DATA87 +

Operations + Restore Simple Bar Chart

+ Moving Avg. + 65

+ Indic. 1 + NYSE A/D Line + Yes

+ Signals (1) + DJI Major Buys and Sells (Normal Mode)

+ Operations + What Happens to $10,000 (Buys/Sell Short)

+ X + Lines + User Set Pct. Below Peak + OK

+ Point Mouse at August peak + OK

Lines + Rubber Band Lines between Two Points

Now Point mouse at Sept low and drag the the line to the right through next bottom

+ Operations + Add or Edit Personal Reminder + "Key Support Failures" + OK

Drag the message where you like and draw other rubber band lines.

Restore Simple Bar Chart + Moving Average

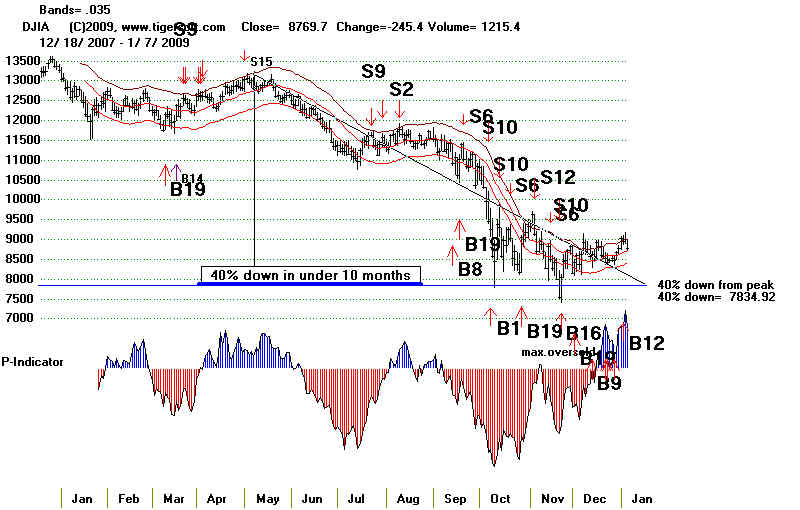

2008- Peerless Chart of DJIA

Use lines command to draw a line 40% down from a 10 month

high.

With DJI chart on the screen, use Lines + User Set

Pct below Peak.

When the DJI has closed more than 40% down from a 10% month high,

switch to the bearish mode. Use "Signals-1" +

"DJI Signals - Extreme Bear Market Mode".

When it is above that level, display the normal signals use "Signals-1"

+

"DJI Major Buys and Sells (Normal Mode)".

If you want to see the "Saved": signals for a period having both

normal and extreme bearish mode signals, use the "Superimpose

DJI Saved Signals"

under Signals-1.

Special Instructions and Signals

for When the DJI is in Extreme Bearish Mode:

www.tigersoftware.com/TigerBlogs/3-March-14-2009/index.html

www.tigersoftware.com/TigerBlogs/03-mar-01-firstof2009/index.html

www.tigersoftware.com/TigerBlogs/3-March--05-2009/index.html

Returning to Normal Market Mode

When the DJI recovers back above the 40%-Down Line used,

switch back to normal mode. While an increase in volume was the key

to confirming a recovery and the start of a new bull market in the past,

superb breadth, as has been seen since March 9th shows a very

playable advance. The NYSE A/D Line trend is very helpful because

once can watch it to see when neckline-resistance is too much for

a market that wants to, but is not quite ready, to start a bull market.

There are other signals under Signals-1. The only one

I suggest using all the time is

"2.5% - Two Day Reversals Down." and Tiger Signals S5.

Two-Day Reversal Sell S6 signals mostly occur in very, very weak markets.

Another sign of extreme weakness are optimized lower bands below -.12

S5s pont to head and shoulders patterns.

Others signals are on the DJI are often used in our nightly Hotline to make points about

the narket's

technical confitions.

Two-Day Reversal Sell S6 signals mostly occur in very, very weak markets.

Another sign of extreme weakness are optimized lower bands below -.12

Note that this is not the finished product.

It will take some time to integrate TigerSoft and the

Power-Ranker fully

into this package. But Peerless Stock Market Timing is sold as

a stand-alone program. An it is important that the signals

that are back-tested and studied the most are released.

A link will be provided each purchaser to revisions as they come out.

Instructions and Comments

The installation file is elsewhere.

Opening the installation file peerless.exe, places a

new file - peerless.exe -

into the folder (directory) c:\peerless\winpeer

Contact us for its location. Its price is $298 to existing subscribers.

After downloading it, to run peerless.exe you may Click Start + Run

and

enter "c:\peerless\winpeer\peerless.exe"

You may also use drag the file peerless.exe onto your desk

top

and double-click it tp run it.

Please read:

(1) When you graph the DJI

and choose signals, there are now two modes -

"Major Peerless Signals". "Extreme Bearish Market Mode"

There are many new signals. All the old signals have been re-inspected

and back-tested to 1942. Most have been revised.

(2) Documentation will be provided here for the signal's effectiveness,

as they occur or as soon as time permits.

(3) The Help routines in the software will exlplain the

general basis

of the signals. Super-imposing is not yet available, but will be added soon.

(4) Under Lines, see that you can place horizontal lines 10%, 12% or whatever...

below a peak you designate. You will also be able to draw a line

above a bottom. 10% rebonds are quite common.

5) The Vertical Line command command shows valuable information.

These are the key values for the Peerless signals. The materials will

try to show these key values for each of the signals.

Date - Close - Close/21-dma - 21-day ma ROC -

P-Indicator - Current Accum. Index - V-Indicator - OBVPct

|