-----------------------------------------------------------------------------------------------------------------------------------------------------

There have been 136 Sell S9s since 1928. The average gain is 9.8%.

However, 11 (8.1%) of the Sell S9s brought a loss. The biggest was almost 5%.

Use a stop loss of 5% if you go short on a Sell S9. November and December

Sell S9s are often not worth going short. Their average gains would only have been 2.5% and

6.2%. February and March Sell S9s are consistenly quite profitable, but they do

not occur in the 3rd year of the 4-year Presidential cycle.

Size of Gains if S9 Used to Sell Short DJI

and position covered on next Peerless Buy

>10% 38 28.7%

5%-9.99% 57 41.9%

2%-4.99% 23 16.9%

0%-1.99% 7 5.1%

losses 11 8.1%

SELL S9s:

1928-2013 19290131 S9 317.5 .054

19290201 S9 319.7 .06

19290228 S9 317.4 .045

19290301 S9 321.2 .056

19290314 S9 316.3 .041

19290418 S9 311.9 .059

19290426 S9 314.2 .066

19290507 S9 321.9 .089

19290614 S9 313.7 -.047

19290903 S9 381.2 .45

19291204 S9 254.6 .086

19291211 S9 258.4 .099

19300417 S9 294.1 .416

19300529 S9 275.1 .375

19300714 S9 234.2 .266

19300826 S9 235.5 .27

19310623 S9 143.9 .31

19310630 S9 150.2 .339

19310702 S9 151.6 .345

19320113 S9 84.4 .069

19320216 S9 85.8 .449

19320301 S9 81.9 .422

19320607 S9 47.5 .099

19320615 S9 50.6 .154

19330918 S9 105.3 .077

19340411 S9 105.2 .127

19340620 S9 98.3 .118

19340821 S9 92.6 .064

19340927 S9 93.4 -.02

19341008 S9 92.5 -.03

19360402 S9 160.4 .067

19370211 S9 190.3 .13

19370303 S9 192.9 .142

19370310 S9 194.4 .149

19370813 S9 189.3 .376

19380107 S9 128.2 .039

19380119 S9 130.1 .053

19380413 S9 114.9 .042

19380421 S9 115.4 .046

19380510 S9 117.9 .062

19390913 S9 154.1 .049

19420106 S9 113.9 .14

19420511 S9 99.2 -.018

19420521 S9 99.7 -.013

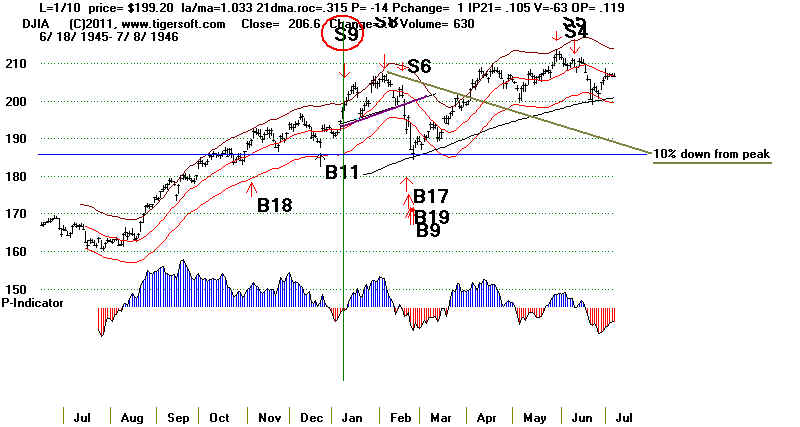

19460110 S9 199.2 .018

19510430 S9 259.1 .064

19561206 S9 492.7 .046

19600519 S9 624.6 .013

19601014 S9 596.5 .051

19610803 S9 715.7 .034

19620705 S9 583.9 .009

19620716 S9 588.1 .016

19660106 S9 985.46 .213

19660914 S9 806.23 .06

19661025 S9 793.09 .004

19690430 S9 950.18 .175

19690501 S9 949.22 .174

19700105 S9 811.31 .058

19700227 S9 777.59 .175

19700601 S9 710.36 .058

19700617 S9 704.68 .05

19700715 S9 711.66 .006

19710826 S9 906.1 .088

19720412 S9 966.96 .033

19720522 S9 965.31 .05

19720803 S9 947.7 .027

19720810 S9 952.89 .033

19730108 S9 1047.86 .114

19730411 S9 967.41 .096

19730711 S9 908.19 .037

19730905 S9 899.08 -.046

19731026 S9 987.06 .201

19740222 S9 855.99 .273

19740304 S9 853.18 .271

19740607 S9 853.72 .271

19750829 S9 835.34 .048

19750904 S9 838.31 .052

19770315 S9 965.01 .164

19781010 S9 891.63 .112

19790921 S9 893.94 .096

19800213 S9 903.84 .14

19801114 S9 986.35 .053

19810107 S9 980.89 .043

19811009 S9 873 .04

19820401 S9 833.24 .067

19820712 S9 824.87 .058

19821207 S9 1056.94 .061

19830726 S9 1243.69 .061

19840316 S9 1184.36 .083

19860812 S9 1835.49 .03

19870406 S9 2405.54 .063

19870506 S9 2342.19 .052

19870609 S9 2352.7 -.039

19871001 S9 2639.2 .341

19871228 S9 1942.97 .016

19891004 S9 2771.09 .057

19891011 S9 2773.36 .058

19900712 S9 2969.8 .174

19900719 S9 2993.81 .181

19920415 S9 3353.76 .03

19941019 S9 3936.04 .066

19960812 S9 5704.98 -.023

19970212 S9 6961.63 .05

19970219 S9 7020.13 .058

19970422 S9 6833.59 -.049

19980708 S9 9174.97 .168

19980923 S9 8154.41 .064

19990709 S9 11193.69 .105

19990817 S9 11117.07 .09

19991210 S9 11224.7 -.003

19991228 S9 11476.71 .128

20000814 S9 11176.14 .084

20020226 S9 10115.26 .19

20020517 S9 10353.08 .209

20020808 S9 8712.02 .062

20020816 S9 8778.06 .069

20060505 S9 11577.74 .049

20070717 S9 13971.55 .067

20071207 S9 13625.58 .099

20080324 S9 12548.64 .093

20080402 S9 12608.92 .097

20080723 S9 11632.38 .061

20080730 S9 11583.69 .058

20080808 S9 11734.32 .07

20090518 S9 8504.08 .021

20090604 S9 8750.24 .049

20090611 S9 8770.92 .051

20091113 S9 10270.47 -.004

20100616 S9 10409.46 .061

20100726 S9 10542.43 .026

20100809 S9 10698.75 .04

20110503 S9 12807.51 .051

20110705 S9 12569.87 .086

20110721 S9 12724.41 .098

20110831 S9 11613.53 .083

20111205 S9 12097.83 .027

------------------------------------------------

No. = 136 .098

PE 24 .094 PE +1 37 .088 PE +2 49 .104 PE +3 26 .104 ------- All Years ----- Jan 10 .080 Feb 10 .157 Mar 9 .158 Apr 16 .087 May 13 .086 Jun 13 .113 Jul 18 .101 Aug 17 .085 Sep 9 .087 Oct 10 .09 Nov 2 .025 Dec 9 .062 ----- PE ----- -----PE +1 ---- -----PE +2 ---- -----PE +3 ---- Jan 1 .069 3 .070 6 .087 0 ---- Feb 2 .295 5 .069 3 .217 0 ---- Mar 3 .199 5 .110 1 .271 0 ---- Apr 4 .057 5 .069 5 .140 2 .064 May 2 .031 6 .111 6 .111 2 .052 Jun 2 .127 3 .018 low 5 .112 3 .203 Jul 2 .060 1 .037 9 .100 6 .127 Aug 5 .038 2 .205 6 .127 4 .077 Sep 0 ---- 3 .160 3 .035 3 .066 Oct 1 .051 4 .038 4 .038 1 .341 Nov 1 .053 1 -.004 0 ---- 0 ---- Dec 1 .046 2 .093 1 .061 5 .053 1-10 47 .103 11-20 55 .088 21-31 34 .108

|

-----------------------------------------------------------------------------------------------------------

Last edited 2/17/2013

Sell S9s - - Rhymes with Strychnine and just as Deadly.

Sell S9s require a nearly negative P-Indicator reading when the

DJI closes

more than 2% over the 21-day

ma or the DJI's high is more an 2.6% over

the 21-day ma. Sell S9s

are not allowed in the beginning of the third year of a

Presidential cycle.

They are disallowed if the DJI rallies back too quickly from

a low. Depending on how

far the DJI is from the 21-day ma, the IP21 level must

also be low.

There two other types

Peerless Sells that are labeled as S9s for convience's

sake. One is the Sell

S9V. The DJI's must be over the 2.5% band with the V-Indicator

negative. See

details here.... The other occurs when the P-Indicator Sell S9V turns

negative after being positive

for more than 100 straight days. In these cases, the

DJI must have closed above

the 21-day ma. See details here...

Work in progress.

The major tops of 1929-1930, 1937, 1957, 1973, 1978, 1979,

1980, 1981, 1987, 1990, 1998, 2000,

2007-2008 all

began with Sell S9s. Multiple Sell

S9s and A Support

Failure Are Deadly.

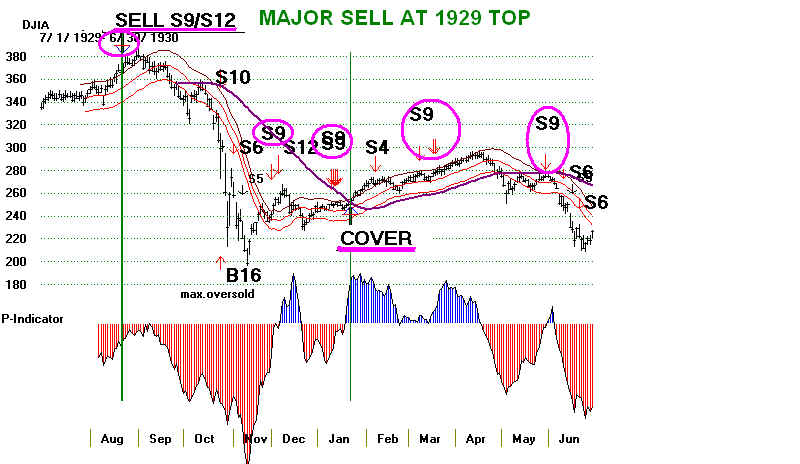

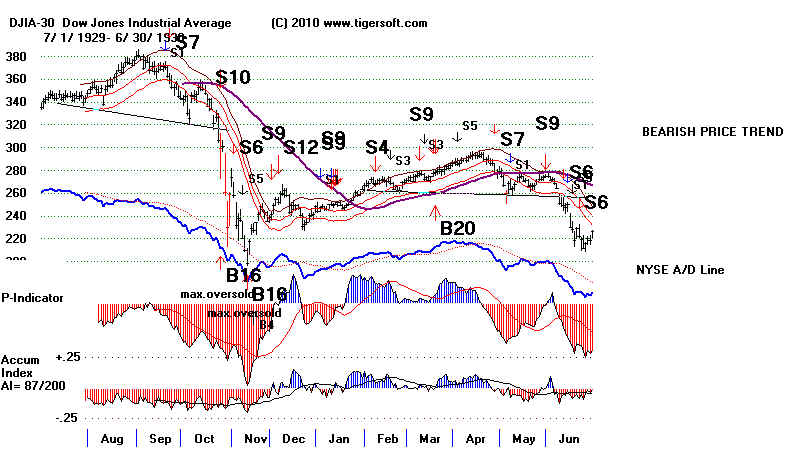

1929-1930

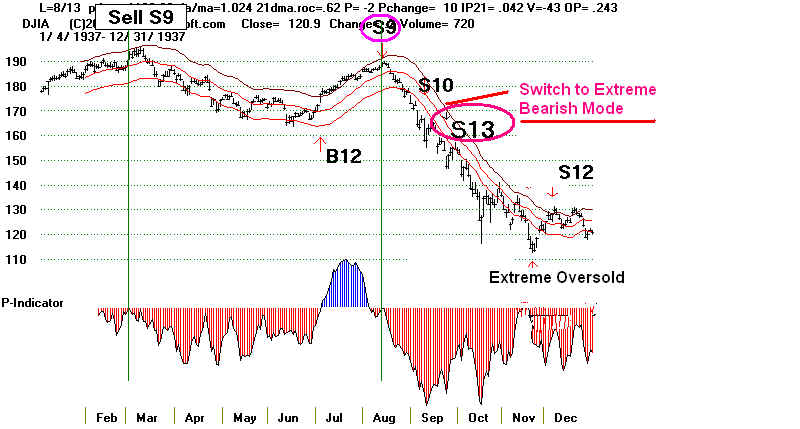

1937

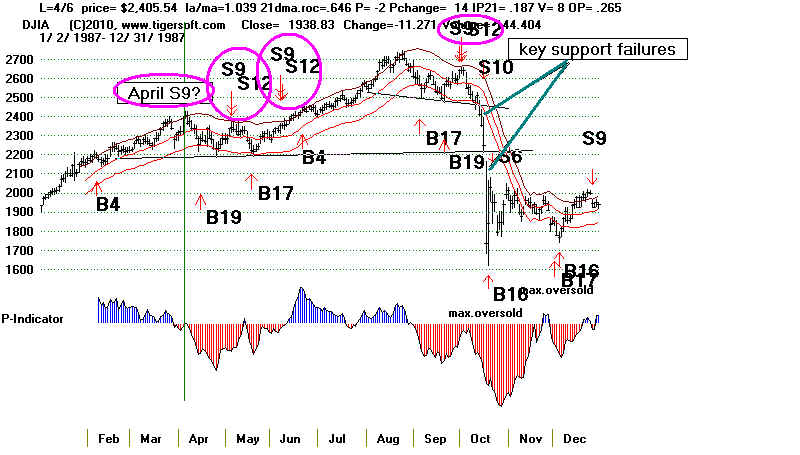

1987

Sell S9s occur when the DJI closes near the

upper band with

the P-Indicator negative.

Sell S9s occur on

strength. Especially when the

DJI is running

into, or nears, all-time high territory,

it is safer to

wait for the S9 to be "clinched". A

Sell S9 is

"clinched" when the number of daily

NYSE declines

exceed the number of NYSE advances

at the end of

trading, wither the same day as the

S9 or on a

subsequent day. If a new Peerless B9

occurs the S9 is

cancelled or reversed.

See the history

of Clinched S9s since 1965.

They reliably

predict a decline to at least the

lower band.

The median decline on the 115 S9s since

1928 is 5.5% at

the time of the next Buy signal.

The average

decline is 9.1%. In 32.3% of the cases

of Sell S9s the

DJI fell more than 8% at the point

of the next

reversal.

Because S9s

can occur on successive days,

here we consider

the first Sell S9 in a week to be

the key S9 in a

cluster. So, calculations are based

on gains per

cluster.

it is best to let

a Sell S9 play itself out if the market

turns down

sharply and not buy for at least 15 trading

days even if

there is a Buy signal. In these cases,

wait for the A/D

Line downtrend to be broken. This

is even more true

if a head and shoulders pattern

develops...

Use The 65-Day MA

We have to be careful of Sell S9s

that occur on recoveries after a sell-offs of less

than 44% from the bull market

highs. The market often recovers past them. This is not

true when the DJI drops more than

44% in a year. In these cases we would use the

Extreme Bearish Mode. The DJI

surpassing the 65-day ma with positive readings

from the P-Indicator and/or the

Accumulation Index should be treated as signals to cover

any short sales. Until there

are new automatic Peerless signals, then trade the trend

of the NYSE A/D Line. See the bad

S9/S12 signals in May 1942, January 1958.

August 1962, October 1966 and July

1970.

The Biggest Sell S9 Declines

The more sets of Sell S9s occurring without a

break in the market, the more dangerous the

market becomes. Sell S9s that occur in September

and early October are more likely to bring a severe

break in the market.

1929 Top - Marked by Multiple S9s

1930 Top - Marked by Multiple S9s

1987 Top - Marked by Multiple S9s

|

Reversing Sell S9s: 1929-2011 * = Extreme Bearish Mode signal. ** = P-I turns negative for first time after 100 days being positive. Peerless Date DJI Pct. Peerless Date DJI Pct. Signal Gain Signal Gain -------------------------------------------------=======------------------- (1-5) Sell S9 2/1/1929 312.6 3.6% Buy B17 2/8/1929 301.5 5.3% Sell S9 2/28/1929 317.4 4.5% Buy B17 3/27/1929 303.2 2.9% Sell S9 4/18/1929 311.9 27.0% *Buy B16 11/13/1929 198.7 35.1% Sell S9 4/11/1934 105.2 4.5% Buy B9 4/30/1934 100.5 -1.5% Sell S9/S5 6/19/1934 99.0 12.4% Buy B8 9/17/1934 86.7 7.7% (6-10) Sell S9/S12 9/27/1934 93.4 -6.6% Buy B6 12/20/1934 99.6 4.9% Sell S9 8/13/1937 189.3 37.6% *Buy B8 11/19/1937 118.1 8.6% Sell S9 9/13/1939 154.1 2.8% Buy B1 11/14/1939 149.8 -3.3% Sell S9 1/6/1942 113.9 6.2% Buy B9 2/10/1942 106.8 -7.1% Sell S9 5/11/1942 99.2 -5.2% Buy B4 6/5/1942 104.4 35.8% (11-15) Sell S9 6/7/1943 141.8 3.9% Buy B17 8/10/1943 136.2 8.6% Sell S9 5/15/1945 164.0 -3.6% Buy B10 8/24/1945 169.9 17.2% Sell S9 1/10/1946 199.2 3.4% Buy B17 2/20/1946 192.4 10.4% Sell S9 4/14/50 215.38 -1.6% Buy B4 8/9/50 216.9 6.2% Sell S9 7/8/57 518.4 10.3% Buy B1 10/2/57 465.0 -3.7% (16-20) Sell S9 1/7/58 447.8 -2.4% Buy B10 2/4/58 458.7 41.7% Sell S9/S12 7/1/59 650.2 -2.4% Buy B17 9/9/59 637.6 5.3% Sell S9 10/14/60 596.5 4.1% Buy B2 10/24/60 571.9 3.2% Sell S9 8/3/61 715.7 4.1% Buy B16 6/22/62 539.2 8.3% Sell S9 7/5/62 583.9 0.3% Buy B1 10/4/62 582.4 20.4% (21-25) Sell S9 10/25/66 703.09 0.4% Buy B6 12/1/66 788.95 12.4% Sell S9 4/30/69 950.18 24.4% Buy B8 1/27/70 763.99 1.8% Sell S9 2/27/70 777.59 17.5% Buy B16 5/25/70 641.36 9.9% Sell S9 6/17/70 704.68 5.0% Buy B7 7/7/70 669.36 6.3% Sell S9 7/15/70 711.66 0.6% Buy B7 8/13/70 707.35 32.5% (26-30) Sell S9 4/6/72 959.44 2.5% Buy B2 5/2/72 935.2 3.2% Sell S9 8/3/72 947.7 2.7% Buy B2 10/16/72 921.66 12.4% Sell S9 9/4/73 895.13 -5.0% Buy B4 9/25/73 940.55 4.9% Sell S9 10/26/73 987.06 20.1% Buy B16 12/5/73 788.31 8.5% Sell S9,S15 3/24/76 1009.21 4.2% Buy B2 10/5/76 966.76 1.8% (31-35) Sell S9 3/15/77 965.01 16.4% Buy B9 12/6/77 806.91 -1.7% Sell S9 9/21/79 893.94 10.9% Buy B17 11/7/79 796.67 8.6% Sell S9 11/14/80 986.35 5.3% Buy B17 12/9/80 934.04 3.3% Sell S9 1/2/81 980.89 4.1% Buy B9 1/23/81 940.19 8.9% Sell S9 10/9/81 873.00 4.0% Buy B9 10/23/81 837.99 -0.6% (36-40) Sell S9 4/1/82 833.24 6.7% Buy B8 8/11/82 777.21 36.0% Sell S9 12/7/82 1056.94 6.1% Buy B6 12/15/82 992.64 7.9% Sell S9 7/26/83 1243.69 6.1% Buy B17 8/9/83 1168.27 9.2% Sell S9 4/29/86 1825.89 -0.1% Buy B9 7/9/86 1826.07 0.5% Sell S9 8/12/86 1835.49 2.3% Buy B17 9/11/86 1792.89 34.2% (41-45) Sell S9 4/6/87 2405.54 7.7% Buy B17 5/19/87 2221.28 5.9% Sell S9 6/8/87 2351.64 -4.0% Buy B4 6/22/87 2445.51 10.5% Sell S9 12/28/87 1942.97 1.6% Buy B9 1/8/88 1911.31 6.3% Sell S9 10/4/89 2771.09 4.8% Buy B17 10/17/89 2638.73 6.5% Sell S9 7/12/90 2969.80 17.4% Buy B8 9/24/90 2452.97 6.3% (46-50) Sell S9 10/17/94 3923.93 5.7% Buy B6 12/1/94 3700.87 49.9% Sell S9 4/22/97 6833.59 -4.9% Buy B4 5/9/97 7169.53 10.5% Sell S9 2/26/02 10115.26 2.3% Buy B19 7/24/02 8191.29 7.9% Sell S9 5/5/2006 11577.74 4.9% Buy B14 6/15/2006 11015.19 1.2% Sell S9 1/5/2007 12398.01 2.3% Buy B17 3/2/2007 12114.1 15.3% (51-55) Sell S9 7/17/2007 13971.15 4.9% Buy B14 9/25/2007 13289.29 3.7% Sell S9 3/24/2008 12548.64 9.3% Buy B2 7/8/2008 11384.21 2.2% Sell S9 7/23/2008 12632.38 6.1% Buy B8 9/15/2008 10917.51 0.9 Sell S9 11/13/2009 10270.47 0.9% Buy B17 1/22/2010 10226.94 2.3 --------------------------------------------------------------------------- N=54 work in progress |

Sell S9s: 1929-2013

Signals shown here are the first Sell S9s in a week.

(Sell S9Vs are shown elsewhere.)

Sell S9 Date DJI Gain/Loss Paper Loss

========================================================

1 S9...S12 2/1/1929 319.7 +5.7% Zero

LA/MA ANNROC P IP21 V-I Opct

1.043 .545 -20 -.002 -408 .29

Declined to LB (lower band) and timely Buy B17.

-------------------------------------------------------------------------

2 S9 2/28/1929 317.4 +4.5% Zero

LA/MA ANNROC P IP21 V-I Opct

1.021 .13 -27 +.057 -459 .146

also S9 3/1/1929 321.2 +5.6%

Reversing Sell

Declined below LB and then Buy B19.

-------------------------------------------------------------------------

3 S9 3/14/1929 316.3 +4.1% Zero

LA/MA ANNROC P IP21 V-I Opct

1.022 .227 -3 -.015 -276 .092

Declined below LB. Reversed with B19

198.7 11/13/29 B16

-------------------------------------------------------------------------

4 S9 4/18/1929 311.9 +2.5% 4% paper loss

LA/MA ANNROC P IP21 V-I Opct

1.024 -.219 -60 +.01 -710 -.131

also S9...S12 4/22/1929 315.3 +3.5%

Declined below LB. Reversed with B19 Reversing Sell

--------------------------------------------------------------------------

5 S9 4/26/1929 314.2 +3.2% 2% paper loss

LA/MA ANNROC P IP21 V-I Opct

1.023 .427 -8 -.038 -239 .061

S9 4/ 29/ 1929 313.8 +36.7%

Declined below LB. Reversed with B19

---------------------------------------------------------------------------

6 S9 5/7/1929 321.9 +5.5% No paper loss.

LA/MA ANNROC P IP21 V-I Opct

1.028 .778 -15 -.081 -235 .271

S9 5/10/1929 325.7 +39.0%

DJI fell below LB. Reversed with B19.

--------------------------------------------------------------------------

7 S9...S12 6/14/1929 313.7 -5.5% 5.5% maximum paper loss

LA/MA ANNROC P IP21 V-I Opct

1.021 -.221 -59 -.035 -542 .162

S9 6/ 19/ 1929 316.4 +37.2% 198.7 11/13/29 B16

S9 6/ 20/ 1929 317.7 +37.5% 198.7 11/13/29 B16

5.5% maximum paper loss or closed out when DJI closed above flat 4x tested resistance

into all-time high territory should normally be used by traders to cover their shorts.

There is too much risk of a significant additional advance. That took place on 7/2/1929.

Eventually the DJI did decline below the Lower Band if one had only used the automatic

Peerless Buys and Sells.

--------------------------------------------------------------------------

8 S9 8/2/1929 353.1 +43.7% -5.5% 5.5% maximum paper loss

LA/MA ANNROC P IP21 V-I Opct

1.024 .384 -32 -.111 -402 .217

5.5% maximum paper loss - The DJI's peak (highest closing) was on 9/3/1929 at 381.20.

The DJI Declined below LB. Use "Extreme Bear Market" mode Buy B16 to close out

a short position.

--------------------------------------------------------------------------

9 S9 8/13/1929 354 Loss = - 5.5% 5.5% maximum paper loss

LA/MA ANNROC P IP21 V-I Opct

1.021 .416 -64 -.088 -570 .218

5.5% maximum paper loss - The DJI's peak (highest closing) was on 9/3/1929 at 381.20.

The DJI Declined below LB. Use "Extreme Bear Market" mode Buy B16 to close out

a short position.

-------------------

--------------------------------------------------------------------------

10 S9 9/3/1929 381.2 +43.0% No paper loss

LA/MA ANNROC P IP21 V-I Opct

1.051 .025 -14 -.126 -351 .139

S9 9/ 4/ 1929 379.6

S9 9/ 6/ 1929 376.3

Declined below LB - The multiple Sell signals, 9 months' DJI divergence

from the NYSE A/D Line downtrend and head/shoulders top set up the

biggest bear market in history. Use "Extreme Bear Market" mode Buy B16 to

close out a short position on 10/24/1929 at 217.3.

-----------------------------------------------------------------------------------------------------------------------------------------------------

-----------------------------------------------------------------------------------------------------------------------------------------------------

The Peerless Sell S13 on 10/23/1929 tells us to switch to bearish mode.

Sell Sell S9/S12 signals are not as reliable in it, because of the

much greater volatility in brief bear market short-covering rallies.

The next 9 Sell S9s are treated as though there was no Extreme Beairsh

Mode.

X S9 12/2/1929

December S9 signals are not allowed in the Extreme Bearish Mode.

Decembers bring rallies in this mode.

LA/MA ANNROC P IP21 V-I Opct

1.024 -.949 -62 -.002 -1233 -.108

DJI rallied to 290 peak in 3 months before declining.Paper Loss = 18%

Eventually declined below LB

December S9 signals are not allowed in the Extreme Bearish Mode.

Decembers bring rallies in this mode.

The 12/2/11930 Sell S9 is also not allowed.

----------------------------------------------------------------------------

X S9...S12 1 10/1930 250 +31.2% 198.7 11/13/29 B16

LA/MA ANNROC P IP21 V-I Opct

1.023 .593 -57 -.047 -547 -.01

S9 1/ 13/ 1930 249.6 +31.2% 171.8 1/23/31 B7

S9 1/ 14/ 1930 250.4 +31.3% 171.8 1/23/31 B7

S9 1/ 15/ 1930 251.5 +31.7% 171.8 1/23/31 B7

DJI rallied to 290 peak in 3 months before declining.

January S9 signals are not allowed in the Extreme Bearish Mode.

----------------------------------------------------------------------------

X S9 3/10/1930 276.9 +38.0%

LA/MA ANNROC P IP21 V-I Opct

1.026 .367 +15 -.02 -150 -.01

DJI rallied to 290 peak in 6 weeks before declining. Paper Loss = 5.5%

Eventually declined below LB

March S9 signals are not allowed in the Extreme Bearish Mode.

----------------------------------------------------------------------------

X S9 3/18/1930 277.3 +38.0%

LA/MA ANNROC P IP21 V-I Opct

1.023 .299 +23 -.008 -115 .311

DJI rallied to 290 peak in 5 weeks before declining.

S9 3/19/1930 277.9 +38.2% 171.8 1/23/31 B7

Paper Loss = 5% Eventually declined below LB

March S9 signals are not allowed in the Extreme Bearish Mode.

---------------------------------------------------------------------------

11. S9 5/29/1930 275.1 +19.0% Gain No paper loss.

LA/MA ANNROC P IP21 V-I Opct

1.022 -.181 -8 -.001 -461 .12

Declined below LB. Here the regular Peerless is used to close

out this large and quick profit. A May S9 is allowed in

Extreme Bearish Mode.

---------------------------------------------------------------------------

12 S9 8/27/1930 237.9 +21.6% paper loss.=3%

LA/MA ANNROC P IP21 V-I Opct

1.033 -.026 -36 +.034 -277 .114

Declined below LB. Here the regular Peerless B16 is used to close

out this large and quick profit. August S9s are allowed in the

Extreme Bearish Mode.

other S8s: 8/28/1930, 9/2/1930,9/4/1930

-----------------------------------------------------------------------------

13 S9 9/5/1930 240.4 +22.5% paper loss.= 1%

LA/MA ANNROC P IP21 V-I Opct

1.022 -.181 -8 -.001 -461 .12

Declined below LB. Here the regular Peerless B16 is used to close

out this large and quick profit. August S9s are allowed in the

Extreme Bearish Mode.

-----------------------------------------------------------------------------

14 S9 8/19/1931 141.70 +21.8% No Paper loss

LA/MA ANNROC P IP21 V-I Opct

1.022 -.428 -53 +.038 -170 .078

Declined below LB. Here the regular Peerless B16 is used to close

out this large and quick profit. August S9s are allowed in the

Extreme Bearish Mode

==============================================================================================

X S9 10/27/1931

March S9s are Not allowed in the Extreme Bearish Mode

X 3/1/1932 81.90

LA/MA ANNROC P IP21 V-I Opct

1.028 +.779 -36 -.041 -117 .028

Declined below LB.

March S9s are Not allowed in the Extreme Bearish Mode

==============================================================================================

15 S9 9/18/1933 105.3 +7.7% No Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.03 +.689 -17 +.097 -163 .161

DJI fell below the lower band. Note the completed head/shoulders.

-----------------------------------------------------------------------------------------------------------------------------------------------------

16 S9 4/11/1934 105.2 +4.5% 1% paper loss.

LA/MA ANNROC P IP21 V-I Opct

1.02 +.117 +33 +.016 -17 .208

S9 4/ 12/ 1934 104.8 +4.1% 100.5 4/30/34 B9

S9 4/ 13/ 1934 104.9 +4.2% 100.5 4/30/34 B9

DJI fell below the lower band. Completed head/shoulders. .

1934's chart shows that the volatility was higher back then. When bands are

optimized to bracket 95% of the highs and lows, instead of the normal 3.5%, the

upper band is 5.5% and the lower band is 8%. In an Extreme Bear, we see lower bands

below 12%. So, this was still a vast improvement from 1932 and 1932-1933 when

the lower band was 20% below the 21-day ma.

Note also in the chart below that the S9 here did not quite have the P-Indicator in negative

territory. The V-Indicator was, however, a -.17. This would also have been a Sell S9V

if it had occurred between May and September. The Sell S9 sometimes is produced when

the upper band is reached and the V-I is negative and the P-I and IP21 are almost negative.

-----------------------------------------------------------------------------------------------------------------------------------------------------

17 S9 6/19/1934 99 +12.4% , no paper loss

LA/MA ANNROC P IP21 V-I Opct

1.033 +.473 +9 -.001 -6 .154

S9...S12 6/ 20/ 1934 98.3 +7.1%

DJI fell below the lower band and no paper loss..

Reversed: 91.3 8/9/34 B13

-----------------------------------------------------------------------------

18. S9/S12 8/21/1934 92.60 +6.4% Paper loss = 1%.

LA/MA ANNROC P IP21 V-I Opct

1.029 +.093 +31 -.021 -87 -.014

DJI fell below the lower band. A perfect B8 occurred at bottom on 9/17/1934.

-----------------------------------------------------------------------------

19. S9/S12 9/27/1934 93.40 5.2% Loss 5.2% Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.029 -.105 -40 -.036 -80 -.117

5.2% Paper Loss.

Reversed: 11/8/1934 B10 97.3

Note: Septembers should bring weakness.

When they do not it can be a warning of higher prices ahead.

The S9/S12 should have been reversed by a classic breakout past well-tested flat resistance

on 11/7/34 with the DJIA at 97.60. Traders should have seen this coming by the failure of the DJI

on the last decline to fall to its lower band. See next chart.

-----------------------------------------------------------------------------

20. S9 10/5/1934 92.9 4.7% loss Paper loss = 4.7%

LA/MA ANNROC P IP21 V-I Opct

1.028 .145 -17 -.014 -49 .028

Also S8 on 10/8/1934. 5.2% loss.

The S9/S12 was reversed by a classic breakout B10 past well-tested

flat resistance on 11/7/34 with the DJIA at 97.30.

-------------------------------------------------------------------------------------------------------------------------------------------------

X This next Sell S9 is not allowed because of the bullish seasonality in the year before

a Presidential Election. It is an extreme NNC by the P-Indicator with

the DJI 4.7% over the 21-dma. Possibly, it should be allowed.

2/18/1935 107.20 +6.6% 100.1 3/5/35 B17 100.1

LA/MA ANNROC P IP21 V-I Opct

1.047 .618 -5 +.151 -7 .318

This case shows an extreme variance between P-Indicator and IP21.

It would have been reversed on 3/4/35 B17 100.1

-------------------------------------------------------------------------------------------------------------------------------------------------

21 S9...S12...S15 4/3/1936 160.1 +7.2% 1% Paper Loss.

LA/MA ANNROC P IP21 V-I Opct

1.024 .198 -37 -.126 -250 .035

S9...S12 4/ 6/ 1936 161.9 +8.2%

S9 4/ 7/ 1936 160.9 +7.6%

S9 4/ 8/ 1936 160.9 +7.6%

This was a classic S9 after a long advance.

The DJI fell 11% and recovered.

DJIA fell below the lower band.

--------------------------------------------------------------------------------------------------------------------------------------------------------

X ( S9/S12 10/6/1936 174.4

1.034 .523 -1 +.005 -69 .202

This was treated as an S12. But it is doubtful because of the just completed

price breakout past 3 recent highs that line up perfectly. Another problem here:

it is a Presidential Election year and normally the DJI rallies from an October low in

that year to give partisans a chance to celebrate. It would have brought a 4% loss.

-------------------------------------------------------------------------------------------------------------------------------------------------------

22 S15...S9 2/11/1937 190.3 +13.0% 2% Paper Loss.

LA/MA ANNROC P IP21 V-I Opct

1.022 .468 -11 .055 -203 .227

Reversed:

DJIA fell far below the lower band to a Buy B8 in June..

-----------------------------------------------------------------------------

23 S9 3/3/1937 192.9 +14.2% No Paper Loss.

LA/MA ANNROC P IP21 V-I Opct

1.025 .52 -6 .075 -208 .18

S9 3/ 9/ 1937 193.3 +14.4%

S9 3/ 10/ 1937 194.4 +14.9%

Reversed:

DJIA fell far below the lower band to a Buy B8 in June..

----------------------------------------------------------------------------

24 S9 8/13/1937 189.3 +36.1% no paper loss

LA/MA ANNROC P IP21 V-I Opct

1.024 .62 -2 -.042 -43 .243

DJIA fell far below the lower band. No Paper Loss.

Reversed: 118.10 12/31/37 B8

Because of speed of deep collapse, users should use Extreme Bearish

Mode. Note the warning Sell S13 to that effect. The normal MAX Oversold

Condition should NOT be applied. That would have given a premature

but on 10/6/1937 at 147.20 as opposed to the Extreme's Buy B16 on 11/23/1937

with the DJI at 115.80.

Transition to Extreme Mode from Normal Mode when S13 appears.

----------------------------------------------------------------------------

24 S9 8/13/1937 189.3 +36.1% no paper loss

LA/MA ANNROC P IP21 V-I Opct

1.024 .62 -2 -.042 -43 .243

DJIA fell far below the lower band. No Paper Loss.

Reversed: 118.10 12/31/37 B8

Because of speed of deep collapse, users should use Extreme Bearish

Mode. Note the warning Sell S13 to that effect. The normal MAX Oversold

Condition should NOT be applied. That would have given a premature

but on 10/6/1937 at 147.20 as opposed to the Extreme's Buy B16 on 11/23/1937

with the DJI at 115.80.

Transition to Extreme Mode from Normal Mode when S13 appears.

Transition back from Extreme Mode to Normal Mode when 200-day ma broken

This is the simplest approach. But we did not use it in 2008-2009.

Instead, we used the 40% down from the year's highs line as

the boundary of which to use.

Here is Extemel Mode chart for 1937-1938.

Transition back from Extreme Mode to Normal Mode when 200-day ma broken

This is the simplest approach. But we did not use it in 2008-2009.

Instead, we used the 40% down from the year's highs line as

the boundary of which to use.

Here is Extemel Mode chart for 1937-1938.

Normal Sell S9s during the Extreme Bearish Mode are not counted here because they

are not considered reliable until the DJI rises past the 200-day ma. They do produce

declines to the lower band or tests of neckline-supports, but knowing when to cover is

problematic. The normal mode Buys are mostly premature, except for the January B9

and March 31 Buy B16.

Note in the chart that the normal Buy B16 worked perfectly on 4/31/1938 in the breakdown

of the DJI on 3/31/1938 below the continuation H/S neckline. This was the 3rd normal

B16 in 12 months.

1/6/1938 128.9 -0.7%

1.035

1/19/1938 130.1 +5.3%

1/21/1938 130.7 +5.7%

4/13/1938 114.9 -7.8%

4/14/1938 116.8 -6.1%

4/18/1938 118.9 -4.2%

4/20/1938 115.4 -7.4%

4/25/1938 116.2 -6.6%

4/26/1938 113.9 -8.8%

5/10/1938 117.9 -5.1%

Normal Sell S9s during the Extreme Bearish Mode are not counted here because they

are not considered reliable until the DJI rises past the 200-day ma. They do produce

declines to the lower band or tests of neckline-supports, but knowing when to cover is

problematic. The normal mode Buys are mostly premature, except for the January B9

and March 31 Buy B16.

Note in the chart that the normal Buy B16 worked perfectly on 4/31/1938 in the breakdown

of the DJI on 3/31/1938 below the continuation H/S neckline. This was the 3rd normal

B16 in 12 months.

1/6/1938 128.9 -0.7%

1.035

1/19/1938 130.1 +5.3%

1/21/1938 130.7 +5.7%

4/13/1938 114.9 -7.8%

4/14/1938 116.8 -6.1%

4/18/1938 118.9 -4.2%

4/20/1938 115.4 -7.4%

4/25/1938 116.2 -6.6%

4/26/1938 113.9 -8.8%

5/10/1938 117.9 -5.1%

=====================================================================================

25 S9 9/13/1939 151.4 +3.2% No Paper Loss.

LA/MA ANNROC P IP21 V-I Opct

1.095 1.181 -43 + .138 +56 +.317

very high

DJIA fell only to the lower band and then Buy B13 on 12/18/1939. No Paper Loss.

-----------------------------------------------------------------------------

26 S9 1/6/1942 113.9 +5.6%

LA/MA ANNROC P IP21 V-I Opct

1.034 .291 -59 .022 -249 -.143

S9 1/ 7/ 1942 113.1 +5.6%

DJIA fell far below the lower band. No Paper Loss.

The February Buy signals on weakness were premature. A reversal

did not take place until 4/28/1942.

---------------------------------------------------------------------------

=====================================================================================

25 S9 9/13/1939 151.4 +3.2% No Paper Loss.

LA/MA ANNROC P IP21 V-I Opct

1.095 1.181 -43 + .138 +56 +.317

very high

DJIA fell only to the lower band and then Buy B13 on 12/18/1939. No Paper Loss.

-----------------------------------------------------------------------------

26 S9 1/6/1942 113.9 +5.6%

LA/MA ANNROC P IP21 V-I Opct

1.034 .291 -59 .022 -249 -.143

S9 1/ 7/ 1942 113.1 +5.6%

DJIA fell far below the lower band. No Paper Loss.

The February Buy signals on weakness were premature. A reversal

did not take place until 4/28/1942.

---------------------------------------------------------------------------

27 S9...S12 5/ 11/ 1942 99.2 -5.2% Paper loss = 5.2%

LA/MA ANNROC P IP21 V-I Opct

1.027 -.062 -42 -.162 -53 -.027

The DJI rallied past 65-day ma with posiitve internals.

This probably should have meant covering,before the Buy B4.

---------------------------------------------------------------------------

28 S9 5/21/1942 99.7 -4.7% Paper loss = 4.7%

LA/MA ANNROC P IP21 V-I Opct

1.03 -.308 -12 0 -26 .141

The DJI rallied past 65-day ma with posiitve internals.

This probably should have meant covering,before the

Buy B4 on 6/5/1942.

---------------------------------------------------------------------------

29 S9 6/2/1942 101.3 -3.1% Paper loss = 3.1%

LA/MA ANNROC P IP21 V-I Opct

1.024 .555 22 .12 -2 .213

Also 6/3/1942 102.2 -2.2%

===========================================================================

S9<B> #1 6/7/1943 141.8 +1.7%

LA/MA ANNROC P IP21 V-I Opct

1.016 .248 -11 .012 -113 .055

This is called an S9<B>. It is differerent from typical S9s.

It occurs when P-Indicator finally turns positive after

being negative after being positive for more than 100 straight

days. The DJI must also be above the 21-dma.

---------------------------------------------------------------------------

X S9<B> 5/15/1945 141.8 +1.7%

LA/MA ANNROC P IP21 V-I Opct

.998 .116 -2 .013 -87 .151

This was not an S9<B>. The DJI must also be above the 21-dma

at the time of the signal..

===========================================================================

30 S9 1/10/1946 199.2 +3.4% Paper loss - 3.7%

LA/MA ANNROC P IP21 V-I Opct

1.033 .315 -14 .105 -63 .119

DJI completed a compact , asymmetrical head/shoulders. Internals

did not weaken much, but DJI did drop below lower band. Note in chart

below how DJI turned back up at rising 140-day (30-wk ma). This

also down exactly 10% from the highest closing.

===========================================================================

S9<B> #1 6/7/1943 141.8 +1.7%

LA/MA ANNROC P IP21 V-I Opct

1.016 .248 -11 .012 -113 .055

This is called an S9<B>. It is differerent from typical S9s.

It occurs when P-Indicator finally turns positive after

being negative after being positive for more than 100 straight

days. The DJI must also be above the 21-dma.

---------------------------------------------------------------------------

X S9<B> 5/15/1945 141.8 +1.7%

LA/MA ANNROC P IP21 V-I Opct

.998 .116 -2 .013 -87 .151

This was not an S9<B>. The DJI must also be above the 21-dma

at the time of the signal..

===========================================================================

30 S9 1/10/1946 199.2 +3.4% Paper loss - 3.7%

LA/MA ANNROC P IP21 V-I Opct

1.033 .315 -14 .105 -63 .119

DJI completed a compact , asymmetrical head/shoulders. Internals

did not weaken much, but DJI did drop below lower band. Note in chart

below how DJI turned back up at rising 140-day (30-wk ma). This

also down exactly 10% from the highest closing.

---------------------------------------------------------------------------

---------------------------------------------------------------------------

31 S9 4/14/1950 215.3 +3.5% Paper loss = 4.2%

LA/MA ANNROC P IP21 V-I Opct

1.026 .443 -28 -43 .022 -189 .404

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

32 S9 4/30/1951 259.10 +6.4% Paper loss = 1.5%

LA/MA ANNROC P IP21 V-I Opct

1.024 .50 +26 -21 .179 -23 .336

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

---------------------------------------------------------------------------

The next occurence is not an S9 because of the special bullishness of the first quarter

in the year before a Presidential Election.. See also 1999.

X 2/ 1/ 1955 409.7 -0.1%

LA/MA ANNROC P IP21 V-I Opct

1.028 .024 -3 10 047 -292 .154

2/ 2/ 1955 407.1

---------------------------------------------------------------------------

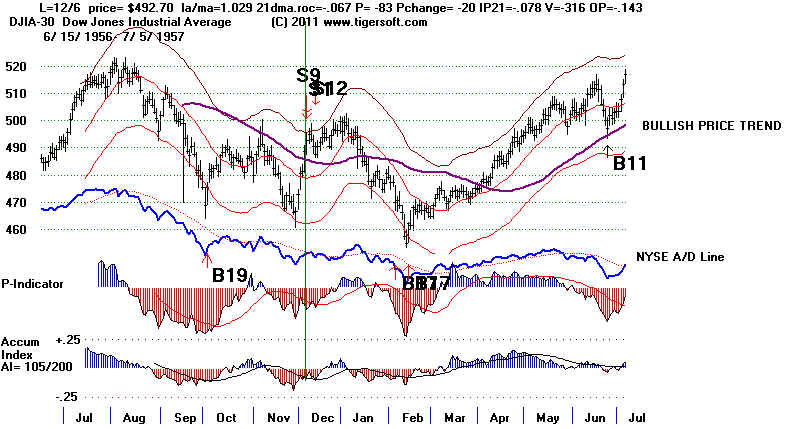

33 S9/S12 12/6/1956 492.7 +4.6% 1% paper loss.

LA/MA ANNROC P IP21 V-I Opct

1.029 -.067 -83(-20) -.078 -316 .143

DJI rallied to 496.00 and then fall below lower band.

---------------------------------------------------------------------------

---------------------------------------------------------------------------

34 S9 7/8/1957 518.4 +10.3% No paper loss

LA/MA ANNROC P IP21 V-I Opct

1.022 .324 -27 4 -86 .038 -188 .311

Reversing. DJI fell below lower band.

The Buy B1 on 10/2/1957 was premature. Expect more of

a selling climax on a decline like this into OCtober.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------[----

The date below did not give a Sell S9 or S12 because of the B12 signal on the day before.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------[----

The date below did not give a Sell S9 or S12 because of the B12 signal on the day before.

X 1/7/1958 447.8 -2.4%

LA/MA ANNROC P IP21 V-I Opct

1.027 -.049 -3 15 -10 -.051 -192 .054

---------------------------------------------------------------------------

35 S9...S12 7/1/1959 650.2 +4.0% 4.3% paper loss.

LA/MA ANNROC P IP21 V-I Opct

1.03 .24 -2(+38) -.062 -177 .166

Note: Selling short right before the July 4th holiday is not

a good idea. DJI rallied to 674.90 and then fall below

lower band, with the completed H/S probably spooking traders.

---------------------------------------------------------------------------

36 S9 5/19/1960 624.6 -0.2% 5.1% paper loss

LA/MA ANNROC P IP21 V-I Opct

1.022 .115 -39(+28) -.02 -310 .047

DJI rallied to 656.40 and then fall below lower band.

S9 5/20/ 1960 625.2 -0.1% 626 7/18/60 B2

Note: The surpassing by the DJI of the 640 resistance

with the DJI above the 65-dma and the P-Indicator very positive,

all should have caused short covering before the 5.0% stop

maximum loss was reached.

37 S9 10/14/1960 596.5 +4.1% No paper loss

LA/MA ANNROC P IP21 V-I Opct

1.021 .124 -70(+27) -.078 -390 .032 .

DJI fell to lower band.

S9 10/17/1960 593.3 +3.6%

Reversing.

---------------------------------------------------------------------------

37 S9 10/14/1960 596.5 +4.1% No paper loss

LA/MA ANNROC P IP21 V-I Opct

1.021 .124 -70(+27) -.078 -390 .032 .

DJI fell to lower band.

S9 10/17/1960 593.3 +3.6%

Reversing.

---------------------------------------------------------------------------

38 S9 8/3/1961 715.7 -1.7% loss 3% paper loss.

LA/MA ANNROC P IP21 V-I Opct

1.032 .395 -8(-9) .017 -185 .281

DJI rallied to 734.30 on 11/15. A Santa Claus

Buy was given on 12/18/1961. That rally was short-lived.

The DJI then fell far below the lower band. The big decline

was reversed by Buy B16 with DJI at 539.2 on 6/22/62.

Also S9 8/7/1961 719.5

----------------------------------------------------------------------------

39 S12, S9 7/5/1962 583.9 +0.3% 5.4% paper loss.

There was a paper loss of 5.41% (615.5 -583.9)/583.9

If one had held throughout the rally, there

would have been a gain of 0.3%. It is to avoid

this loss that we place the maximum paper loss at 5.5%

LA/MA ANNROC P P** IP21 V-I Opct

1.025 -.23 -301 16 -987 -.093 -871 -.218 Reversing.

DJI rallied to 612 and then fell to lower band.

S9 7/ 9/ 1962 580.8 +0.4%

1.024 -.448 -348 7 -967 -.065 -1110 -.238

S9...S12 7/ 10/ 1962 586 +1.2%

1.034 -.327 -451 -103 -1252 -.103 -1390 -.13

Reversed: 578.7 10/2/62 B1

-------------------------------------------------------------------------

40 7/16/1962 588.1 +1.0% 4% paper loss.

LA/MA ANNROC P IP21 V-I Opct

1.034 .527 -284 35 .082 -742 -.137

Reversed:

Note: Early July S9s are problematic. They warn of a decline,

but they are premature. In practice,it is better to waitin

these cases for the internal strength indicators' rising

trendlines to be broken. This would have produced a Sell

Short judged signal on 9/7/1962 with the DJI at 600.89 and

would have resulted in a 3.1% gain instead of a 5% maximum loss.

The reversing signal was a Buy B1 at 578.7 on 10/2/62.

---------------------------------------------------------------------------

41 S9 9/14/1966 806.23 +6.0% No Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.018 -.43 -225 +24 -.104 -15 -.22

DJI immediately declined slightly below the lower band.

This was reversed by Buy B8 on 10/3/66 at 757.96.

Also S9...S12 9/15/1966 814.3 +6.9%

S9 9/16/1966 814.3 +6.9%

S9 9/19/1966 810.85 +6.5%

S9 9/20/1966 806.01 +6.0%

---------------------------------------------------------------------------

---------------------------------------------------------------------------

41 S9 9/14/1966 806.23 +6.0% No Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.018 -.43 -225 +24 -.104 -15 -.22

DJI immediately declined slightly below the lower band.

This was reversed by Buy B8 on 10/3/66 at 757.96.

Also S9...S12 9/15/1966 814.3 +6.9%

S9 9/16/1966 814.3 +6.9%

S9 9/19/1966 810.85 +6.5%

S9 9/20/1966 806.01 +6.0%

---------------------------------------------------------------------------

42 S9 10/25/1966 793.09 +0.4% 4% Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.026 .008 -82 +3 -.08 -11 .048

DJI rose to 823 before falling one half to lower band from mvg.

avg. Reversed: 789.75 12/1/66 B6

----------------------------------------------------------------------- .

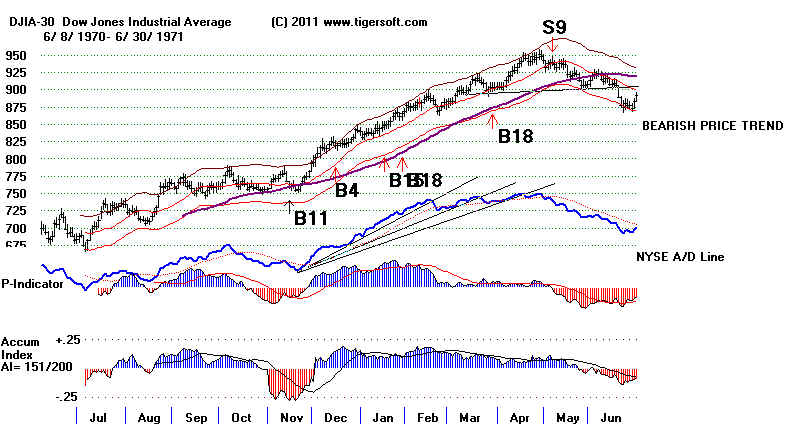

43 S9 4/30/1969 950.18 +19.0% Paper Loss = 1.9%

LA/MA ANNROC P P^^ IP21 V-I Opct

1.025 .189 -30 +11 -66 .083 -1 .138

S9 5/1/1969

LA/MA ANNROC P P^^ IP21 V-I Opct

1.023 .207 -22 +7 -49 .087 -1 .131

S8 5/2/1969

LA/MA ANNROC P P^^ IP21 V-I Opct

1.03 .337 14 +36 +32 .109 0 .190

DJI rallied to 968.85 and then fall below the lower band.

Reversed: 769.93 12/17/69 B13

---------------------------------------------------------------------------

44 S9 1/5/1970 811.31 +5.8% No paper loss

LA/MA ANNROC P P^^ IP21 V-I Opct

1.027 .271 -15 +72 -31 -.034 -1 .086

DJI fell immediately below the lower band. Reversed: 763.99 1/27/70 B8

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

45 S9 2/27/1970 777.59 +8.6% Paper Loss = 1.9%

LA/MA ANNROC P P^^ IP21 V-I Opct

1.03 .296 61 +48 129 .023 -1 .006

DJI rallied to 788.15. Paper loss = 10.56/777.59 amd then fall below the lower band.

Reversed: 710.36 6/1/70 B12

--------------------------------------------------------------------------

--------------------------------------------------------------------------

X S9 6/1/1970 710.36 +5.0%

LA/MA ANNROC P P^^ IP21 V-I Opct

1.028 -.40 -237 +40 -501 -.026 -3 -.125

This S9 had a simultaneous B12. The B12 cancels the S9.

This is not considered an S9 or a Sell.

Reversed: 669.36 7/7/70 B7

---------------------------------------------------------------------------

---------------------------------------------------------------------------

46 S9 6/17/1970 704.68 +5.0% Paper Loss = 1.6%

LA/MA ANNROC P P^^ IP21 V-I Opct

1.026 .23 -109 +38 -230 .001 -2 -.139

DJI rallied to 716.11 and then fall to the lower band.

S9 6/22/1970 716.11 +6.5% 669.36 7/7/70

LA/MA ANNROC P P^^ IP21 V-I Opct

1.032 .929 5 -7 12 .071 -1 .061

Reversed: 669.36 7/7/70 B7

---------------------------------------------------------------------------

47 S9...S12 7/15/1970 711.66 +0.6% Paper Loss = 3.3%

LA/MA ANNROC P P^^ IP21 V-I Opct

1.023 .416 -87 16 -184 - .016 -2 .193

S9 7/ 21/1970 722.07 +2.0%

DJI rallied to 735.56. Then fell to near the lower band on 8/13/70

where a B7 occurred. Reversed: 707.35 8/13/70 B7

LA/MA ANNROC P P^^ IP21 V-I Opct

1.033 .028 -88 -42 -185 - .065 -2 .076

-----------------------------------------------------------------------

Below is a special type of Sell S9. The P-Indicator turns

negative after being positive 100 straight days. It is seen

when the earlier 6 months' data is graphed.

S9<B> #2

5/6/1971 937.39 +3.7% No Paper loss.

LA/MA ANNROC P P^^ IP21 V-I Opct

.999 .313 -15 -34 -32 .076 -1 .279

Head and shoulders breakdown followed this S9B. DJi fell below the lower band. No Paper loss.

888.95 8/16/71 B13

---------------------------------------------------------------------------

---------------------------------------------------------------------------

47 S9 8/17/1971 899.9 +8.2% Paper Loss = 2.3%

LA/MA ANNROC P P^^ IP21 V-I Opct

1.038 .048 -93 33 -196 .153 -1 - .001

DJI rallied to 920.93 on 9/9/1971 before falling below lower band, a consequence

of the Head/Shoulders pattern that formed.

---------------------------------------------------------------------------

-

48 S12, S9 8/26/1971 906.1 +8.8% Paper Loss = 1.6%

LA/MA ANNROC P P^^ IP21 V-I Opct

1.041 .467 24 33 50 -.105 -1 .173

Reversed: 826.15 11/10/71 B17

DJI rallied to 920.93 on 9/9/1971 before falling below lower band, a consequence

of the Head/Shoulders pattern that formed.

---------------------------------------------------------------------------

49 S15,S9 4/12/1972 966.96 +5.7% No Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.023 .483 -2 .087 0 .237

Reversed: 911.72 7/18/72 B2

---------------------------------------------------------------------------

50 S9...S12 5/22/1972 965.31 +5.6% Paper Loss = 0.6%

LA/MA ANNROC P IP21 V-I Opct

1.023 .019 -89 -.031 -2 .128

S9 5/ 24/ 1972 965.46 +5.6%

S9 5/ 25/ 1972 969.07 +5.9%

DJI declined to lower band.

Reversed: 911.72 7/18/72 B2

---------------------------------------------------------------------------

51 S9 5/30/1972 971.18 +6.1% No Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.025 .214 -19 -.005 -1 .224

DJI declined to lower band.

Reversed: 911.72 7/18/72 B2

---------------------------------------------------------------------------

52 S9...S12 8/3/1972 947.7 +2.7% Paper Loss = 2.3%

921.66 10/16/72 B2

LA/MA ANNROC P IP21 V-I Opct

1.022 .183 -92 -.056 -2 -.13

S9 8/ 4/ 1972 951.76 +3.2%

S9 8/ 7/ 1972 953.12 +3.3%

S9 8/ 8/ 1972 952.44 +3.2%

S9 8/ 9/ 1972 951.16 +3.1%

Reversed: 911.72 7/18/72 B2 921.66 10/16/72 B2

---------------------------------------------------------------------------

53 S9 8/10/1972 952.89 +3.3% Paper Loss = 1.8%

LA/MA ANNROC P IP21 V-I Opct

1.022 .373 -5 . 06 -1 ,01

Reversed: 921.66 10/16/72 B2

---------------------------------------------------------------------------

54 S9 1/8/1973 1047.86 +9.0% Paper Loss = 0.4%

LA/MA ANNROC P IP21 V-I Opct

1.022 .290 -72 .052 -2 ,138

S9 1/ 11/ 1973 1051.7 +16.9%

Reversed: 953.75 2/26/73 B17

---------------------------------------------------------------------------

55 S9 4/11/1973 967.41 +9.6% No Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.023 - .109 -158 . 049 -3 -.095

Reversed: 874.17 8/15/73 B17

---------------------------------------------------------------------------

56 S9 7/11/1973 908.19 +3.7% Paper Loss = 2.06%

LA/MA ANNROC P IP21 V-I Opct

1.024 - .093 -60 -.01 -2 .118

Reversed: 874.17 8/15/73 B17

Note: The short-covering rally in July never turned up the 65-dma.

---------------------------------------------------------------------------

57 S9 9/5/1973 899.00 -4.6% Paper Loss = 4.6%

LA/MA ANNROC P IP21 V-I Opct

1.016 - .182 -79 .013 -2 -.189

S9 9/6/1973 901.04 -4.4%

Reversed: 940.55 9/25/73 B4

Note: Here the short-covering rally in September turned up the 65-dma with

the P-Indicator positive and rising. This was a warning to cover..

---------------------------------------------------------------------------

58 S9 10/26/1973 987.06 +20.1% No Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.021 .417 -9 .163 -1 .242

Reversed: 788.31 12/5/73 B16

---------------------------------------------------------------------------

59 S9...S12 2/22/1974 855.99 +4.0% Paper Loss = 4.2%

LA/MA ANNROC P IP21 V-I Opct

1.027 -.214 21 -.083 -2 -.08

S9 2/ 26/ 1974 858.51 +27.6%

S9 2/ 28/ 1974 860.53 +27.7%

Reversed: 621.95 6/3/74 B19

---------------------------------------------------------------------------

59 S9 3/4/1974 853.18 +3.7% Paper Loss = 4.5%

LA/MA ANNROC P IP21 V-I Opct

1.024 -.034 40 .014 -1 .131

Reversed: 621.95 6/3/74 B19

---------------------------------------------------------------------------

59 S9 6/6/1974 845.35 +26.4% Paper Loss = 1.7%

LA/MA ANNROC P IP21 V-I Opct

1.023 -.026 -117 -.065 -2 .001

S9...S12 6/ 7/ 1974 853.72 +27.1%

S9 6/ 11/ 1974 852.08 +27.0%

S9 6/ 12/ 1974 848.56 +26.7%

S9 6/ 13/ 1974 852.08 +27.0%

Reversed: 621.95 9/27/74 B8

===========================================================================

Note

7/24/1974 did not produce an automatic Sell S9, but you can see

in the chart below how close it came to doing so. Given the

bear market, this had to be interpreted as severely bearish.

LA/MA ANNROC P P^^ IP21 V-I Opct

1.019 -.159 -121 -216 -.089 -2 -.022

8/7/1974 did not produce an automatic Sell S9, but you can see

how close it came to doing so.

LA/MA ANNROC P P^^ IP21 V-I Opct

1.025 .387 32 57 -.042 -1 -.004

===========================================================================

===========================================================================

59 S9...S12 9/4/1975 838.31 +5.2% No Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.026 .411 -61 -.023 -2 .195

S9 9/5/1975 835.97 +4.9%

Reversed: 795.1 9/16/75 B17

---------------------------------------------------------------------------

60 S15.S9 3/24/1976 1009.21 +4.2% Paper Loss = 0.5%

LA/MA ANNROC P IP21 V-I Opct

1.024 .192 -64 -.033 -1 .253

Reversed: 966.76 10/5/76 B9...B2

---------------------------------------------------------------------------

61 S9 3/15/1977 965.01 +6.4% Paper Loss = 0.3%

LA/MA ANNROC P IP21 V-I Opct

1.024 .216 26 .06 -1 .052

Reversed: 903.24 5/25/77 B9

-----------------------------------------------------------------------------------

62 S9...S12 10/10/1978 891.63 +11.7% Paper Loss = 1.1%

LA/MA ANNROC P IP21 V-I Opct

1.02 -.219 -139 -.136 -5 -.184

S9...S12 10/ 11/ 1978 901.42 +12.6%

S9 10/ 12/ 1978 896.74 +12.2%

S9 10/ 13/ 1978 897.09 +12.3%

Reversed: 787.51 12/18/78 B6...B9

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

63 S9 9/21/1979 893.94 +10.9% Paper Loss = 0.7%

LA/MA ANNROC P IP21 V-I Opct

1.017 (low) .11 -69 .049 -1 .152

The high was 2.623% over the 21-day ma. This satisfies the need for the market being "over-bought".

Late September S9s can be considered riskier because they are nearer October, often a month

if steep declines. So, the threshold can be lower regarding LA/MA, than earlier in the month....

Perhaps 10/5/78 should have been a Sell S9. A new closing high was made and P-I was 05.

The close here was 1.018 of the ma.

Reversed: 796.67 11/7/79 B9

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

64 S9...S4 2/13/1980 903.84 +14.0% No Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.028 .478 -26 -.01 -1 .205

Reversed: 777.65 3/28/80 B19

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

65 S9 11/14/1980 986.35 +5.3% Paper Loss = 0.5%

LA/MA ANNROC P IP21 V-I Opct

1.042 .175 -93 -.11 -1 .182

also S9 11/19/1980 991.04 +5.8%

Reversed: 934.04 12/9/80 B17

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

65 S9...S12 1/2/1981 972.78 +3.5% Paper Loss = 3.5%

LA/MA ANNROC P IP21 V-I Opct

1.029 -.264 -71 -.04 -5 -.016

also S9 1/7/1981 980.89 +4.3%

Reversed: 938.91 1/26/81 B9

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

66 S9 10/9/1981 873 +4.0% No Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.024 .148 -12 .066 -4 -.123

Reversed: 837.99 10/23/81 B9

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

67 S9 4/1/1982 833.24 +6.7% Paper Loss = 3.4%

LA/MA ANNROC P IP21 V-I Opct

1.026 .265 45 .004 0 .135

Reversed: 777.21 8/11/82 B8

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

68 S9 7/12/1982 824.87 +5.8% Paper Loss = 0.9%

LA/MA ANNROC P IP21 V-I Opct

1.026 .388 -13 .07 -3 .121

Also S9 7/ 13/ 1982 824.2 +5.7%

S9 7/ 14/ 1982 828.39 +6.2%

S9 7/ 15/ 1982 828.2 +6.2%

S9 7/ 16/ 1982 828.67 +6.2%

Reversed: 777.21 8/11/82 B8

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

69 S9 12/7/1982 1056.94 +6.1% No Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.028 .06 +21 -.05 -4 -.048

Reversed: 992.64 12/15/82 B6

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

70 S9 7/26/1983 1243.69 +6.1% No Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.024 .02 -73 .058 -4 .183

Reversed: 1168.27 8/9/83 B17

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

71 S9 3/16/1984 1184.36 +5.7% No Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.024 .264 +7 .001 1 .111

Reversed: 1125.31 5/22/84 B17

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

X S9 10/14/1985 1354.73 -6.3%

LA/MA ANNROC P IP21 V-I Opct

1.025 .318 -34 .052 -1 .094

Reversed: 1440.02 11/18/85 B4

This case was exceptional. One of the DJI stockS, General Foods

was overnight bid up dramatically on a hostile take-over offer

by Philip (addiction, cancer,emphysema) Morris. That

took the DJI more quickly to the upper band than would otherwise

have happened. No automatic Peerless Sell signal appears here. At the time, it was not considered

a trustworthy example of a Sell S9 because of the huge jump in GF and how it exaggerated the rise of the

DJI on what would have otherwise not been a much bigger down day.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Special S9 - The signal below is an instance the rule giving an

automatic Sell when the P-Indicator turns negative after

being positive 100 straight dayy and with the DJI above

the 21-day ma.

S9<B> #3 S9 4/29/1986 1825.89 +3.6% No Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.01 .048 -1 .049 -9 .112

Reversed: 1826.07 7/9/86

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

72 S9 5/28/1986 1878.28 +2.3% Paper Loss = 1.6%

LA/MA ANNROC P IP21 V-I Opct

1.047 .229 -19 .052 -2 -.11

Reversed: 1792.89 9/11/86 B17

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

72 S9 8/12/1986 1835.49 +2.3% Paper Loss = 4.6%

LA/MA ANNROC P IP21 V-I Opct

1.01 .048 -1 .049 -9 .112

Reversed: 1792.89 9/11/86 B17

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

73 S9 4/6/1987 2405.54 +6.3% No Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.039 .646 -2 .187 +8 .27

Reversed: 2342.19 4/14/87 B5

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

74 S9...S12 5/6/1987 2342.19 +5.2% No Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.021 -.328 -185 -.079 -15 -.15

Reversed: 2221.28 5/19/87 B17

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

74 S9...S12 6/8/1987 2351.64 -4.0% Paper Loss = 4.0%

LA/MA ANNROC P IP21 V-I Opct

1.026 .088 -32 -.045 -4 -.18

S9 6/ 9/ 1987 2352.7

S9 6/ 10/ 1987 2353.61

These last 3 sell signals were never clinched

before the next Buy. When the DJI is at an

all-time high it can help to wait for daily

declines to exceed advances and then act on the Sell.

Reversed: 2445.51 6/22/87 B4

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

75 86 S9 10/1/1987 2639.2 +30.2% Paper Loss = 0.1%

LA/MA ANNROC P IP21 V-I Opct

1.026 .131 -98 -.009 -12 -.026

Also S9...S12 10/ 2/ 1987 2640.99 +30.3%

LA/MA ANNROC P IP21 V-I Opct

1.026 .18 -56 -.017 -7 .068

Reversed: 1841.01 10/20/87 B16

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

76 87 S9 12/28/1987 1942.97 +1.6% No Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.021 -.025 -37 .132 -8 .157

This a dubious Sell because of cross-currents from tax loss selling

at the end of the year and because current Accum. Index reading was

a very positive +.132 on this day.

Reversed: 1942.97 12/28/87 B9

Paper Loss = 88/2031.50

============================================================================

The early 2013 update will disallow this instance because the DJI

did not close 2.0% above the 21-dma and the hypothetical high

was not 2.6% over the 21-day ma. and making a new 50-day high.made.

X S9 9/6/1988 2065.26 -0.1%

LA/MA ANNROC P IP21 V-I Opct

1.017 -.315 -128 -.087 -16 -.139

low

S9 9/ 7/ 1988 2065.79

LA/MA ANNROC P IP21 V-I Opct

1.018 -244 -110 -.063 -13 -.054

low

Reversed: 2067.03 11/11/88 B17

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

77 S9 10/4/1989 2771.09 +4.8% Paper Loss = 0.1%

LA/MA ANNROC P IP21 V-I Opct

1.028 .177 -49 .018 -13 -.054

S9 10/11/1989 2773.36 +4.9%

Reversed: 2638.73 10/17/89 B17

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

78 S9 7/12/1990 2969.8 +17.4% Paper Loss = 1.0%

LA/MA ANNROC P IP21 V-I Opct

1.025 .15 -45 .052 -10 .233

Reversed: 2452.97 9/24/90 B8

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

79 S9 4/15/1992 3353.76 +3.0% Paper Loss = 1.8%

LA/MA ANNROC P IP21 V-I Opct

1.03 .358 -56 .049 -11 .239

S9 4/ 20/ 1992 3336.31 +2.5%

S9 4/ 21/ 1992 3343.25 +2.7%

S9 4/ 23/ 1992 3348.61 +2.8%

Reversed: 3254.1 8/21/92 B2

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

80 S9 10/19/1994 3936.04 +5.8% No Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.021 .207 -114 -.009 -17 .017

Reversed: 3708.27 11/25/94 B1

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

80 S9 8/12/1996 5704.90 -2.3% Paper Loss = 2.3%

LA/MA ANNROC P IP21 V-I Opct

1.034 .420 +76 ,118 -7 .313

Reversed: 5838.52 9/13/96 B10

The signal above is an Sell S9V. It is the V-Indicator'e negativity that produces the Sell.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

81 S9V 2/12/1997 6961.63 +5.0% Paper Loss = 1.8%

LA/MA ANNROC P IP21 V-I Opct

1.025 .35 +59 .103 -6 .021

Also S9s on 2/14/97, 2/18 and, 2/19

Reversed: 6611.05 4/1/97 B17

The signal above is an Sell S9V. It is the V-Indicator'e negativity that produces the Sell.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

82 S9 4/22/1997 6833.59 -4.9% Paper Loss = 4.9%

LA/MA ANNROC P IP21 V-I Opct

1.03 .052 -172 .075 -48 .046

S9 4/23/1997 6812.72 -5.2%

S9 4/24/1997 6792.25 -5.6%

S9 4/28/1997 6783.02 -5.5%

Paper loss = 4.9%

Reversed: 7169.53 5/9/97 B4

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

83 S9 7/8/1998 9174.97 +16.8% Paper Loss = 1.5%

LA/MA ANNROC P IP21 V-I Opct

1.03 .141 + 2 -.025 -17 .058

Reversed: 7632.53 10/1/98 B9

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

84 S9 9/23/1998 8154.41 +6.4% No Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.026 .616 -201 .018 -90 -.051

S9 9/ 25/ 1998 8028.77 +4.9%

S9 9/ 28/ 1998 8108.84 +5.9%

S9 9/ 29/ 1998 8080.52 +5.5%

Reversed: 7632.53 10/1/98 B9

In on-going big declines, the internal strength indicators are normally much more negative

than in a rising market that reverses with a Sell S9. This means that much lower levels

for the P-Indicator, etc. are not signs of another big decline.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Note:

The next Sell S9 are not allowed because of the bullish seasonality in the year before

a Presidential Election for the first four months. The magnet of 10000 was drawing prices

upwards and the DJI was at an all-time high.

X S9 2/ 23/ 1999 9544.42 -11.6%

LA/MA ANNROC P IP21 V-I Opct

1.026 .543 -254 .065 -58 .04

Big Loss!

This was clinched the same day.

Reversed: 10654.67 5/24/99 B9

X S9 3/ 9/ 1999 9693.76 -9.9%

LA/MA ANNROC P IP21 V-I Opct

1.033 .495 -177 .04 -52 -.141

Big Loss!

This was clinched the same day.

Reversed: 10654.67 5/24/99 B9

X S9 3/ 17/ 1999 9879.41 -7.8%

LA/MA ANNROC P IP21 V-I Opct

1.033 .727 -41 .045 -18 -.13

Big Loss!

This was clinched the same day.

S9 3/ 19/ 1999 9903.55 -7.6%

Big Loss!

This was clinched the same day.

S9 3/ 22/ 1999 9890.51 -7.7%

Big Loss!

This was clinched the same day.

Reversed: 10654.67 5/24/99 B9

X S9 3/ 29/ 1999 10006.78 -6.5%

LA/MA ANNROC P IP21 V-I Opct

1.027 .858 -30 .029 -2 -.12

Big Loss!

This was clinched on 3/30/199 with DJI at 9913.26

Reversed: 10654.67 5/24/99 B9

X S9...S12 4/ 7/ 1999 10085.3 -5.6%

LA/MA ANNROC P IP21 V-I Opct

1.021 .432 -177 - .011 -41 -.138

Big Loss!

This was clinched the same day.

S9 4/ 8/ 1999 10197.69 -4.5%

This was clinced on 4/20/1999 with DJIA at 10448.55

S9 4/ 9/ 1999 10173.83 -4.7%

This was clinced on 4/20/1999 with DJIA at 10448.55

10654.67 5/24/99 B9

S9 4/ 12/ 1999 10339.51 -3.0%

This was clinced on 4/20/1999 with DJIA at 10448.55

S9 4/ 13/ 1999 10395.01 -2.5%

This was clinced on 4/20/1999 with DJIA at 10448.55

S9 4/ 14/ 1999 10411.66 -2.3%

This was clinced on 4/20/1999 with DJIA at 10448.55

Reversed: 10654.67 5/24/99 B9

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

============================================================================

85 7/9/1999 11193.69 +7.1% No Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.025 -.077 -425 - .025 -119 -.126

Automatically reversed: 10401.23 10/4/99 B1

Note:

As a decline after the first Sell S9 of the year, covering at

the lower band would have been reasonable. It usually takes

more than one set of Sell S9s to bring a deeper decline.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

86 S9...S12 8/17/1999 11117.07 +6.4% Paper Loss = 1.9%

LA/MA ANNROC P IP21 V-I Opct

1.025 -.077 -425 - .025 -119 -.126

Paper Loss = 2%

S9 8/20/ 1999 11100.6 +6.3%

S9 8/23/ 1999 11299.76 +8.0%

S9 8/24/ 1999 11283.3 +7.8%

Reversed: 10401.23 10/4/99 B1

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

86 S9 12/10/1999 11224.70 -0.3% Paper Loss = 0.3%

LA/MA ANNROC P IP21 V-I Opct

1.021 .68 -391 .01 -60 .001

Reversed: 11257.43 12/17/99 B13

----------------------------------------------------------------------------

87 S9 12/28/1999 11476.71 +12.8% Paper loss = 2.1%

LA/MA ANNROC P IP21 V-I Opct

1.026 .52 -315 - .052 -85 .157

Reversed: 10963.80 2/4/2000 B17

As this was the 3rd Sell S9 in 4 months, a decline below the lower band should have been

expected. A testing of the

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

88 S9 8/14/2000 11176.14 +4.3% Paper loss = 1.2%

LA/MA ANNROC P IP21 V-I Opct

1.039 .403 32 - .004 -53 .222

Reversed: 8759.13 10/2/01 B2

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

89 S9 8/22/2000 11139.15 +4.0% Paper loss = 1.5%

LA/MA ANNROC P IP21 V-I Opct

1.027 .499 108 .023 -5 .392

8/23/ 2000 11144.65 +4.0%

Reversed: 8759.13 10/2/01 B2

This is an Sell S9V. It is the V-Indicator'e negativity that produces the Sell

-------------------------------------------------------------------------------

90 S9 2/5/2001 10965.85 +13.3% No Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.025 .059 287 .069 -3 .039

Reversed: 8759.13 10/2/01 B2

This is an Sell S9V. It is the V-Indicator'e negativity that produces the Sell

----------------------------------------------------------------------------

-----------------------------------------------------------------------------

X The signals below appear using the 2007 version of Peerless.

But new versions have eliminated it. They now consider the

rate of recovery from the lows.

S9 4/ 11/ 2001 10013.46 +12.5%

LA/MA ANNROC P IP21 V-I Opct

1.024 -.337 -140 .016 -187 .002

The paper loss here would have been 13%.

S9 4/ 12/ 2001 10126.94 +13.5%

S9 4/ 16/ 2001 10158.56 +13.8%

Reversed: 8759.13 9/19/01 B16

-----------------------------------------------------------------------------

X The signals below appear using the 2007 version of Peerless.

But new versions have eliminated it. They now consider the

rate of recovery from the lows.

S9. 10/ 10/ 2001 9240.86 -0.2%

LA/MA ANNROC P IP21 V-I Opct

1.032 -1.409 -212 .053 -245 -.258

S9 10/ 11/ 2001 9410.45 +1.6%

9263.9 11/1/01 B9

--------------------------------------------------------------------

91 S9 2/26/2002 10115.26 +19.0% Paper loss = 5.1%

LA/MA ANNROC P IP21 V-I Opct

1.027 .333 68 .047 -160 -.062

high

S9 2/ 27/2002 10127.58 +19.1%

LA/MA ANNROC P IP21 V-I Opct

1.027 .316 93 .02 -147 -.055

high

Reversed: 8191.25 7/24/02 B19

This is an Sell S9V. It is the V-Indicator'e negativity that produces the Sell

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

92 S12, S9 5/17/2002 10353.08 +20.9% No Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.028 .175 48 .018 -148 .079

Reversed: 8191.25 7/24/02 B19

This is an Sell S9V. It is the V-Indicator'e negativity that produces the Sell S9.

---------------------------------------------------------------------------

93 S9 8/8/2002 8712.02 +4.6% Paper loss = 3.9%

LA/MA ANNROC P IP21 V-I Opct

1.039 -.144 -271 .063 -327 -.254

also S9 8/12/202 8688.89 -5.4%

Reversed: 8191.25 9/3/02 B9

Note

After such a long and brutal decline, we should look

for a test of the lows and not buy prematurely at the lower band.

This is worthy of more study.

-----------------------------------------------------------------------------

94 S9 8/16/2002 8778.06 +5.4% Paper loss = 3.1%

LA/MA ANNROC P IP21 V-I Opct

1.028 .175 48 .018 -148 .079

also S9 8/12/202 8688.89 +5.4%

Reversed: 8191.25 9/3/02 B9

Note

After such a long and brutal decline, we should look

for a test of the lows and not buy prematurely at the lower band.

This is worthy of more study.

=============================================================================

This was a SPECIAL S9 -

P-I turns negative after being positive for 100 days

and DJI is above 21-dma.

S9 2/20/2004 10619.03 +6.1% No Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.028 .175 -9 .018 -148 .079

Reversed: 9968.51 5/18/04 B2

==============================================================================

94 S9 5/5/2006 11577.74 +4.9% Paper loss = 0.6%

LA/MA ANNROC P IP21 V-I Opct

1.026 .357 -10 .035 -62 .158

S9 5/8/2006 11584.54 +4.9%

Reversed: 11015.19 6/15/06 B14

=============================================================================

SPECIAL S9 - P turns negative after being positive for 100 days

and DJI is above 21-dma.

1/ 5/ 2007 12398.01 +2.3% No Paper Loss.

LA/MA ANNROC P IP21 V-I Opct

1.021 .11 -8 .017 -119 .112

Reversed: 12207.59 3/6/07 B19

=============================================================================

95 S9 7/17/2007 13971.55 +4.9% Paper Loss = 0.2%

LA/MA ANNROC P IP21 V-I Opct

1.028 .291 -27 -.083 -121 .068

S9 7/18/2007 13918.22 +4.4%

S9 7/19/2007 14000.41 +5.1%

S9 7/23/2007 13943.42 +4.7%

Reversed: 13289.29 8/29/07 B14

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

96 S9 12/7/2007 13625.58 +3.4% Paper Loss = 0.7%

LA/MA ANNROC P IP21 V-I Opct

1.034 .295 -15 -.035 -105 .032

Reversed: 11899.69 3/7/08 B8

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

97 S9 3/24/2008 12548.64 +9.3% Paper Loss = 4.1%

LA/MA ANNROC P IP21 V-I Opct

1.024 .257 -209 .116 -208 .072

S9 3/25/2008

Reversed: 11384.21 7/8/08 B2

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

98 S9 4/2/2008 12608.92 +9.7% Paper Loss = 3.6%

LA/MA ANNROC P IP21 V-I Opct

1.031 .341 -75 .042 -185 -.059

S9...S4 4/ 3/ 2008 12626.03 +9.8%

S9 4/ 4/ 2008 12609.42 +9.7% )

Reversed: 11384.21 7/8/08 B2

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

99 S9 5/2/2008 13058.20 +9.7% No Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.031 .341 -75 .042 -185 -.059

Reversed: 11384.21 7/8/08 B2

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

100 S9 7/23/2008 11632.38 +6.1% Paper Loss = 1.3%

LA/MA ANNROC P IP21 V-I Opct

1.022 -.22 -266 -.002 -211 .052

Reversed: 10917.51 9/15/08 B8

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

101 S9 7/30/2008 11583.69 +5.8% Paper Loss = 1.7%

LA/MA ANNROC P IP21 V-I Opct

1.023 .246 -105 .058 -158 .146

Reversed: 10917.51 9/15/08 B8

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

102 S9 8/8/2008 11734.32 +7.0% No Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.03 .529 91 .088 -81 .071

Reversed: 10917.51 9/15/08 B8

This is an Sell S9V.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

103 S9, S12 11/13/2009 10270.47 -0.4% Paper Loss = 3.2%

LA/MA ANNROC P IP21 V-I Opct

1.027 .247 -110 -.007 -216 .081

10172.98 1/22/09 B17

Reversed: 10308.26 12/17/09 B13