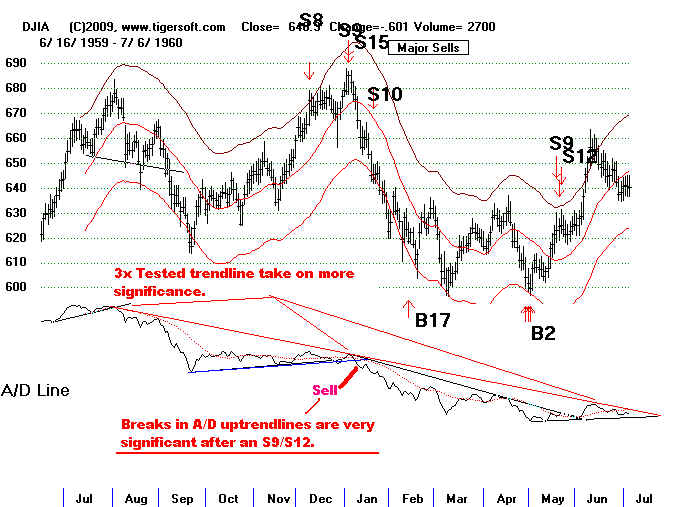

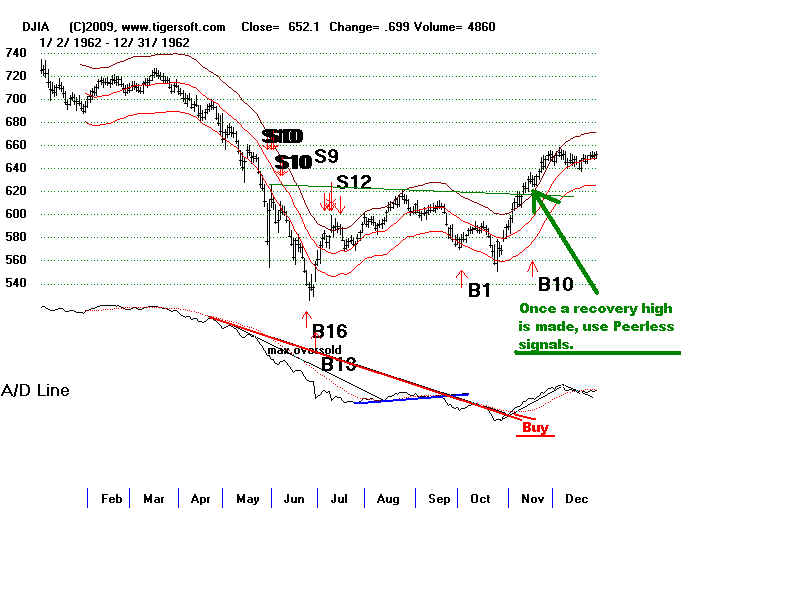

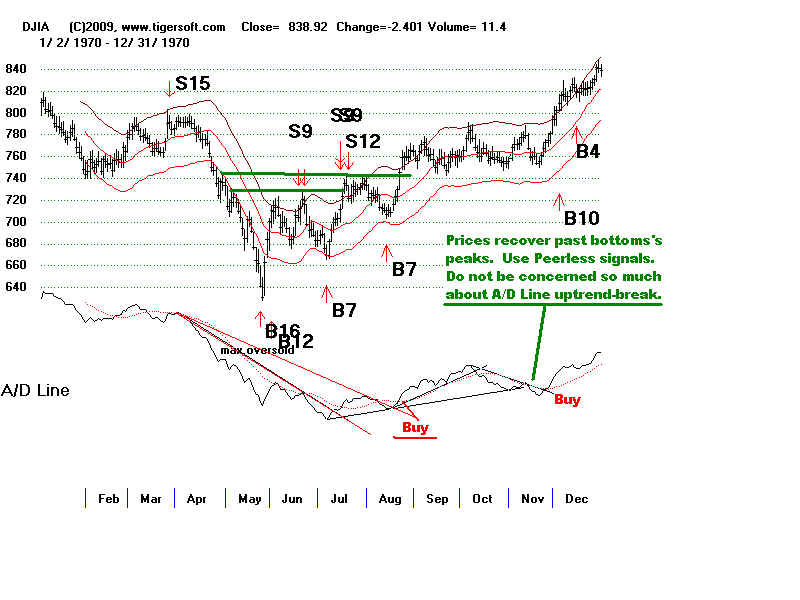

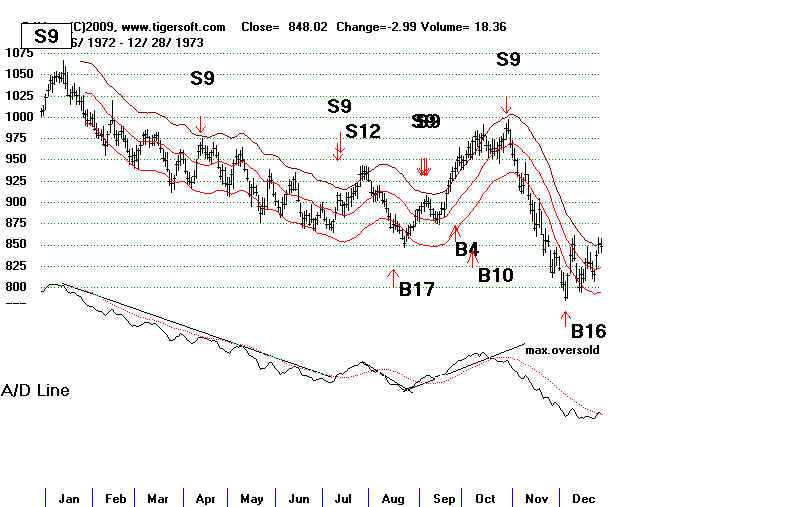

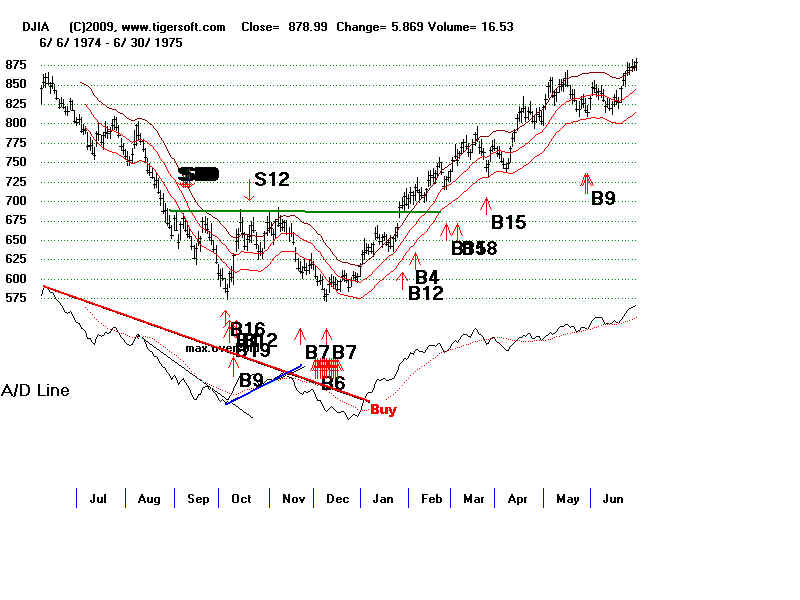

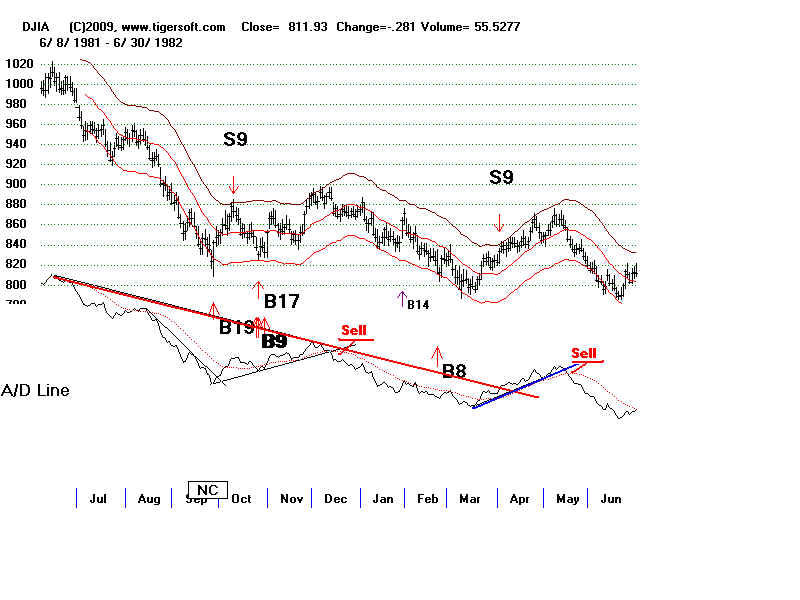

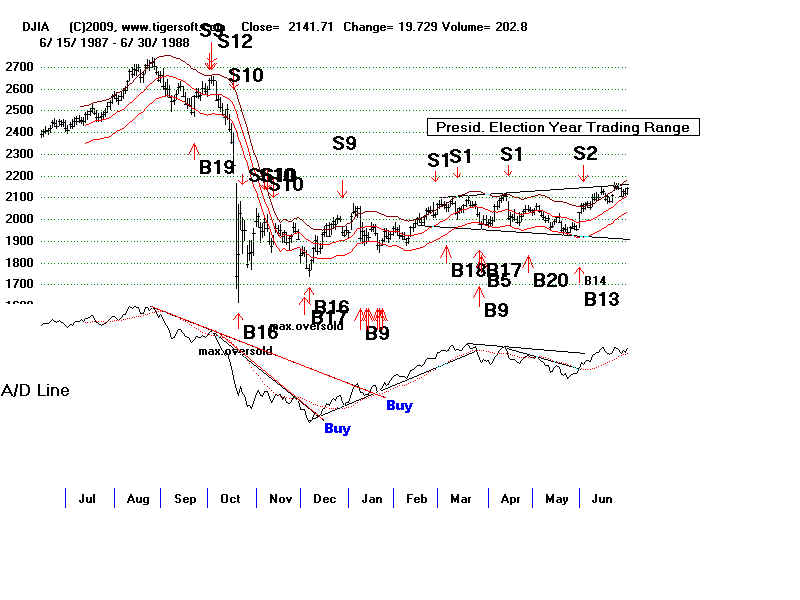

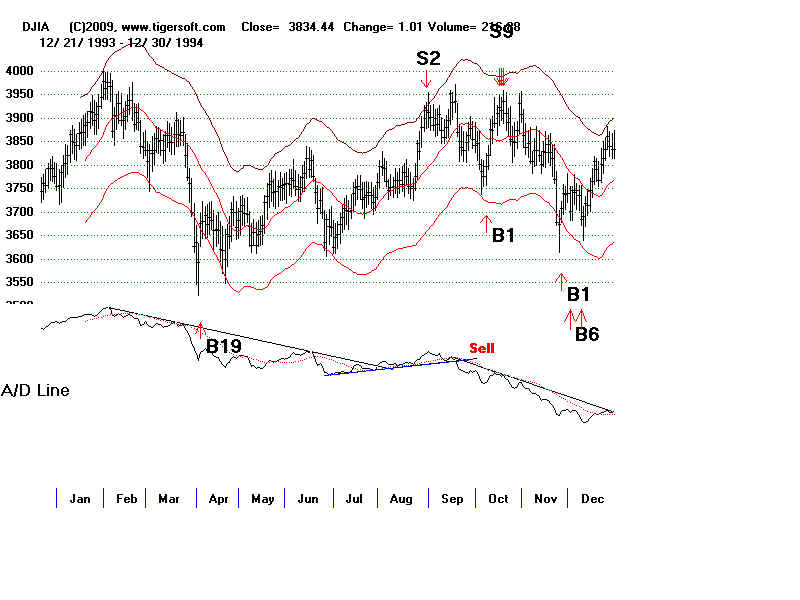

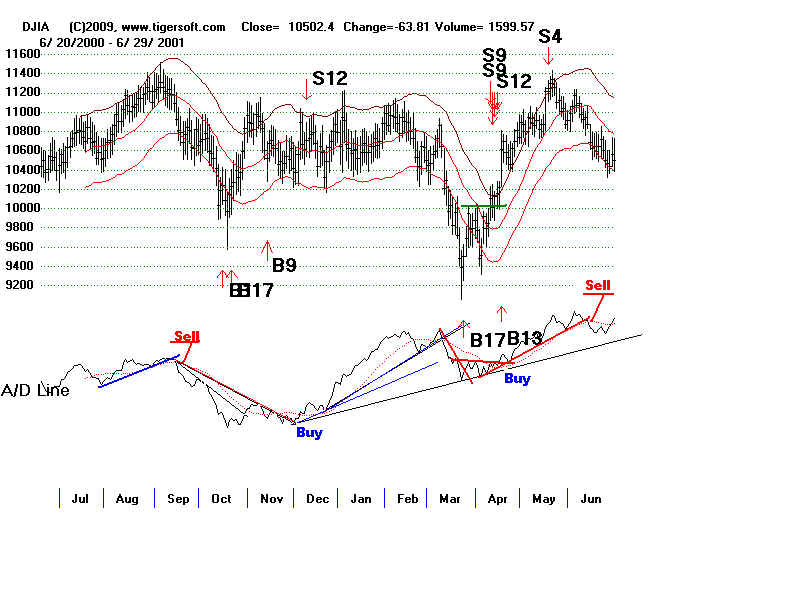

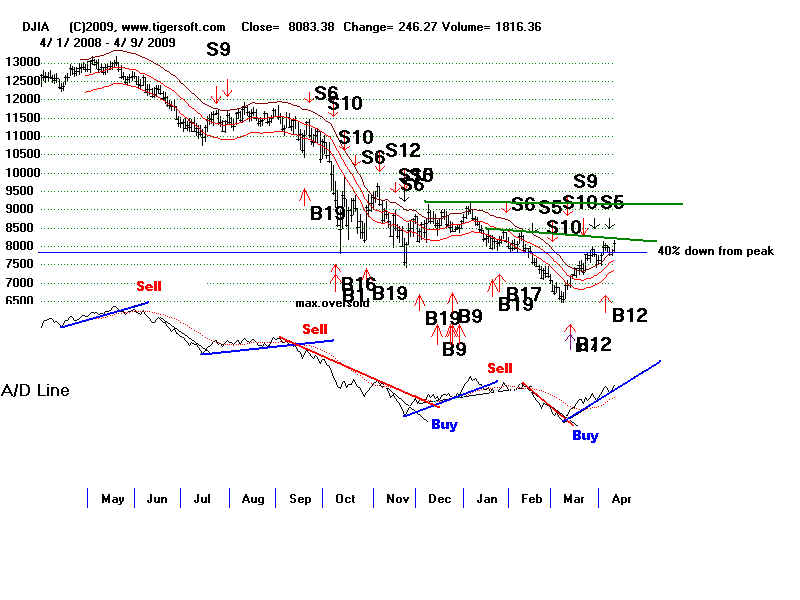

and NYSE A/D LINE TRENDS

1959-2009

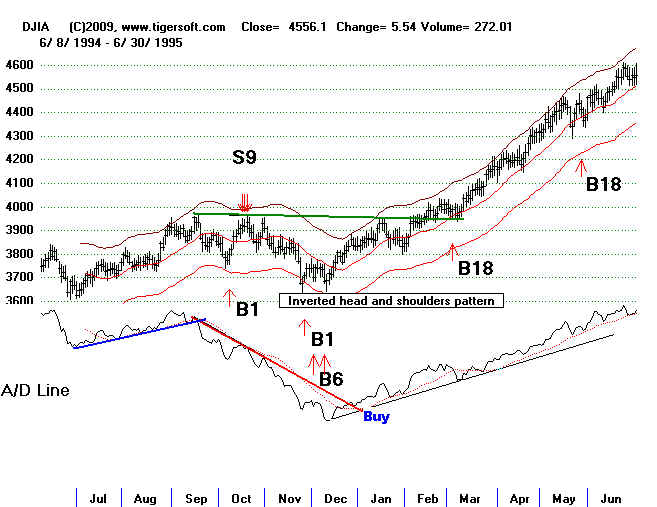

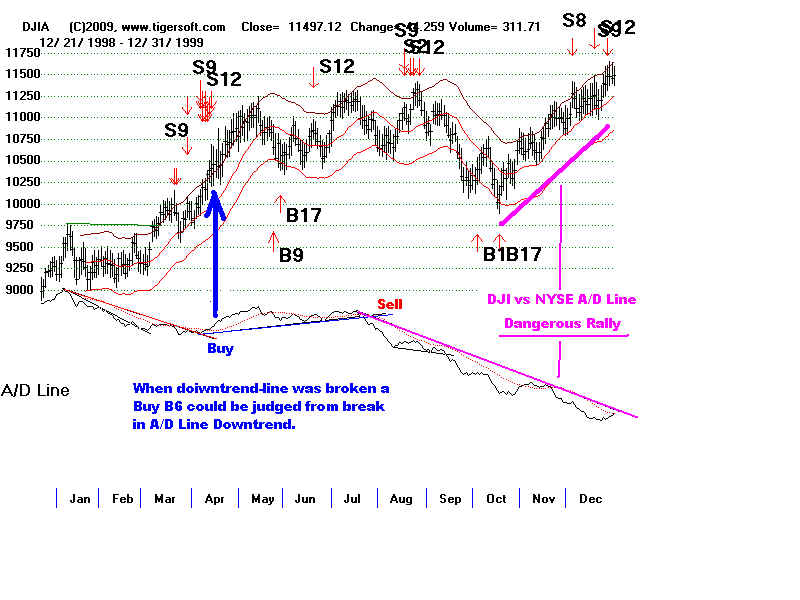

The NYSE A/D Line will often show you when

key trend changes are taking place in the stock market.

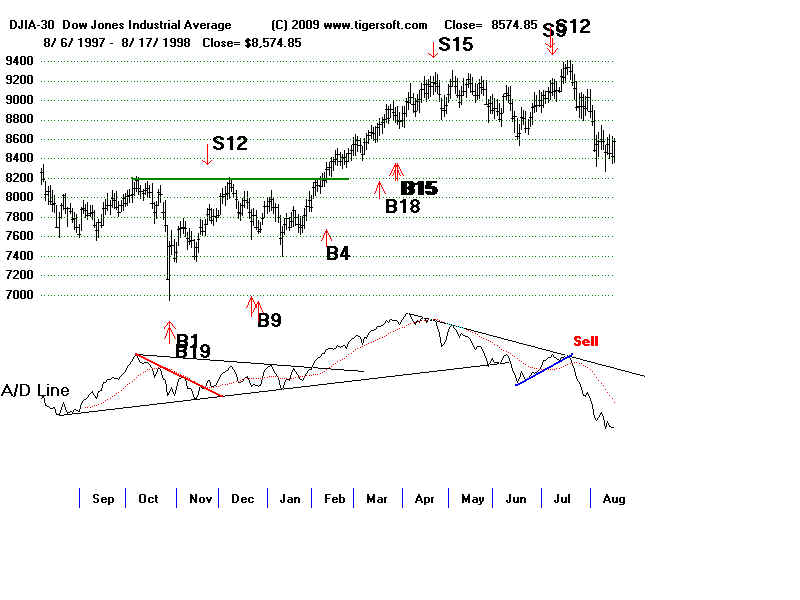

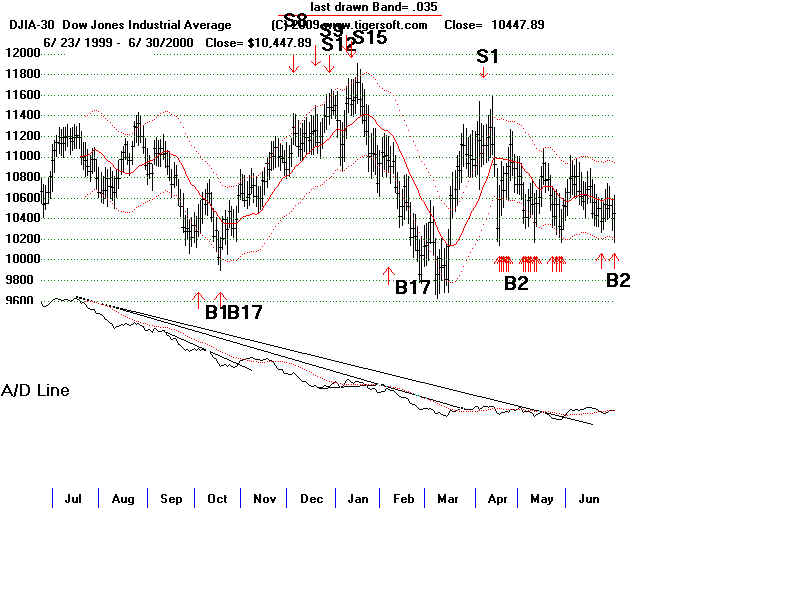

But there are also times when the DJI and the A/D Line

are moving in different directions.

After a Peerless Buy a break in the NYSE A/D Line

is bullish. Until the DJI is able to make a breakout above

its bottom formation resistance, the NYSE A/D Line uptrend

must be watched. If the A/D Line breaks below its uptrend

before there is a price breakout above the bottom pattern's

resistance, expect another decline.