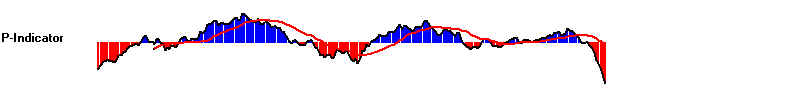

AND THE NYSE A/D LINE HAS BEEN MUCH STRONGER THAN THE DJI

(C) 2011 William Schmidt, Ph.D. 6/6/2011

There are three cases of this since 1965. Two conclusions

emerge: 1) Sell if the NYSE A/D Line uptrend is broken and

2) Sell if the DJI closes more than 13.5% down from its high.

The Lesson of the 2009 chart is that we should require a very

clear break in the NYSE A/D Line uptrend. The break should

probably be for 2 days, not just one. And if the market turns

up the sharply on the second day, consider the test of the A/D Line

uptrend successful and Buy.

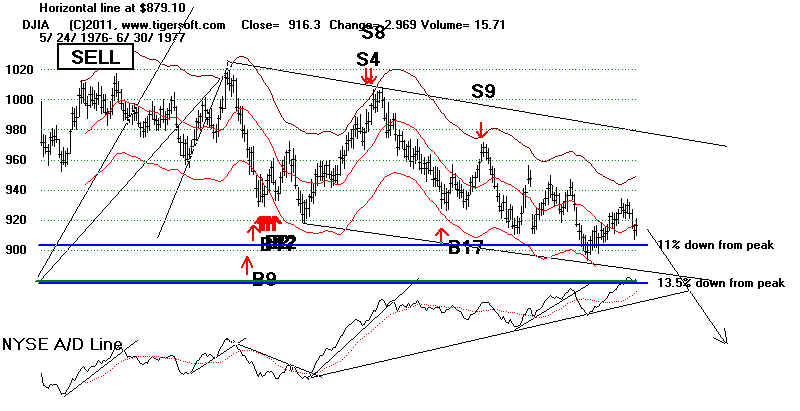

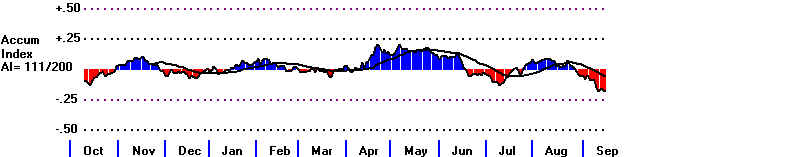

In the first half of 1977 the DJI started gradually declining.

The NYSE A/D Line not only held up, it made new highs in May

and June of 1977 while the DJI was down 10% from its high.

Only when the DJI broke below 880, and had declined 13.5% from

its peak, the NYSE began to play catch-up on the downside and

fell more sharply. A decline in the DJI is common in the years

after a Presidential Election. In this case, Peerless Sell signals

on the DJI would have helped.

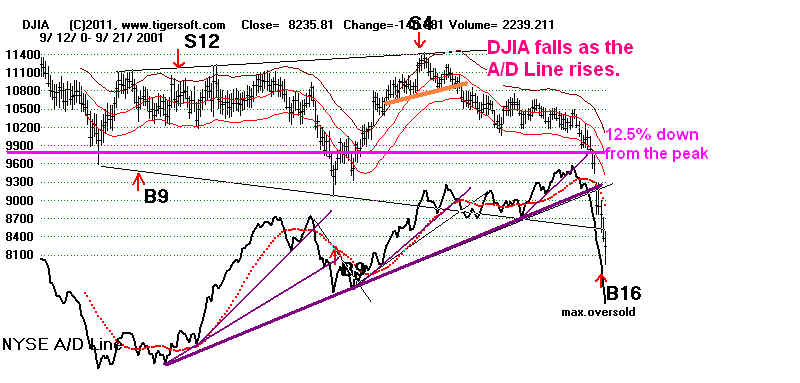

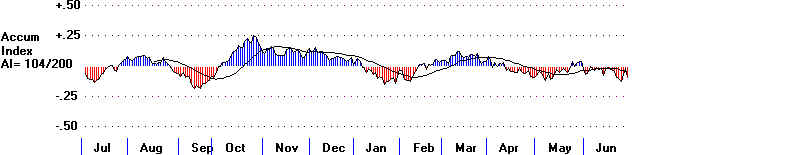

In August 2001, the NYSE A/D Line made new highs even though

the DJI was down nearly 10% from its highs. Only after the A/D

Line broke its uptrend and the DJI has fallen 13.5%, did the A/D

Line turn steeply down with the DJI in the days before the 9/11

attack on the World Trade Center. This was also in a year after

a Presidential Election. Apparently, terrorists were busy selling

short DJI-30 stocks before the attack, but did not bother with

somewhat smaller corporations.

Only in May 2002, when the A/D Line had broken its uptrend

did the A/D Line stop making new highs and get in synch with the

falling DJI. The decline of both accelerated when the DJI fell

below the 13.5% fail-safe level down from its March high. The

2002 decline was a continuation of the bubble-break of 2000.

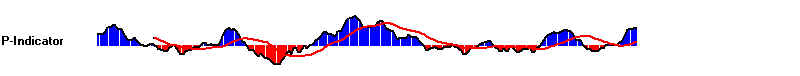

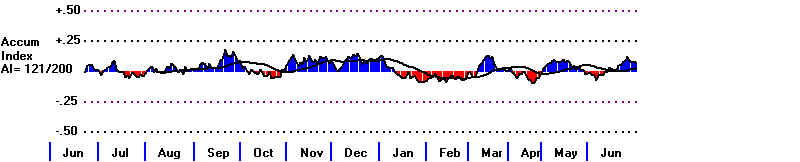

In November 2009, the NYSE A/D Line uptrend of 8 months was

violated for a day and then turned up. This proved a good short-

term Buy despite the Sell S9. The next break was more significant.

A few months later the DJI tested the 13.5% fail safe level, held

and then turned up. The trendbreaks of the A/D Line were helpful

in this period.

1977

2002