Peerless Stock Market Timing: 1915-2011:

Automatic Buys and Sell Signals

TRACK RECORD OF BUYS/SELLS 1948-2011

234 reversing Buys and Sells.

Avg. Gain on a Buy was +11.6%

Avg. Gain on a Sell was +6.4%

(C) 2011 All rights reserved. www.tigersoft.com

CALLING ALL TOPS

and BOTTOMS, too

TRACK RECORD OF BUYS/SELLS 1949-2011

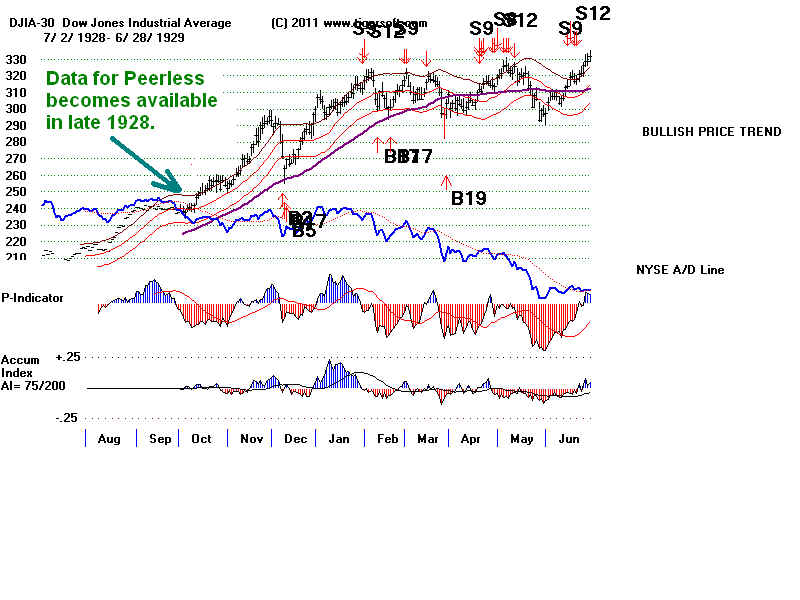

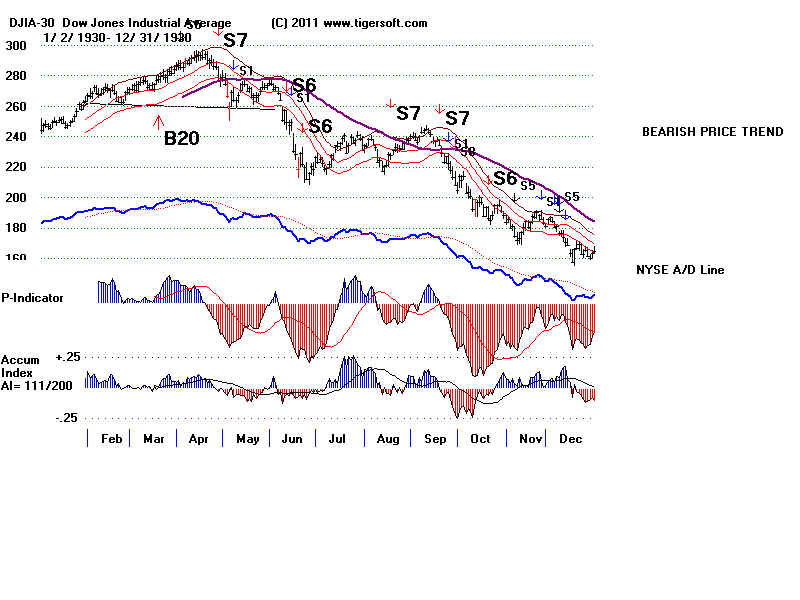

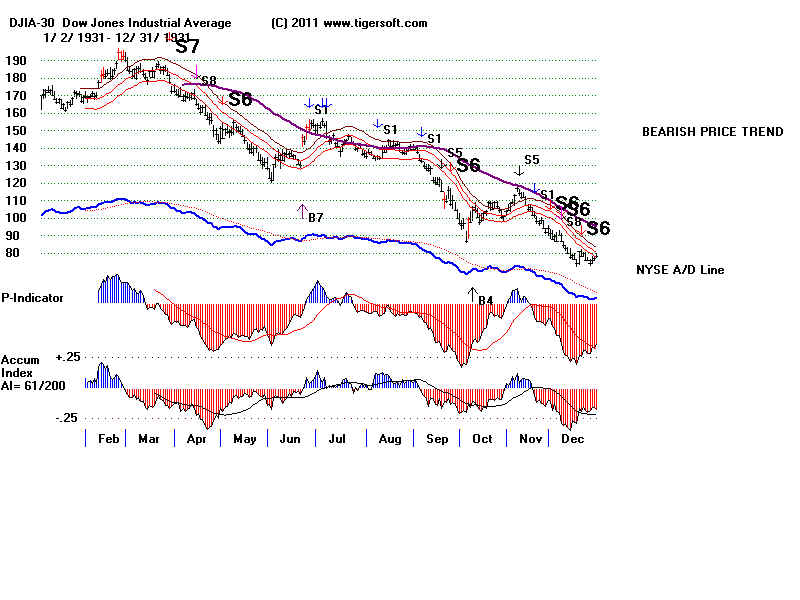

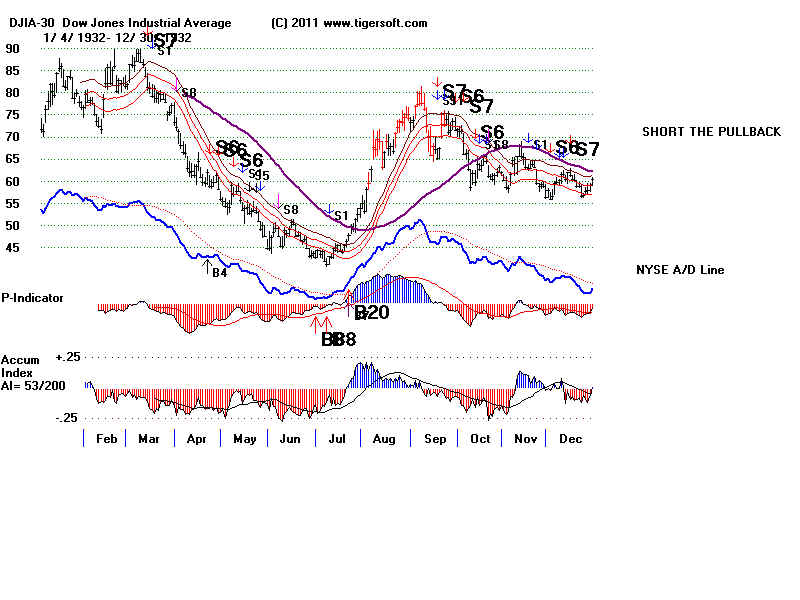

See also Track Record of Automatic Peerless Buys/Sells: 1928-1948

Introduction to Peerless Stock Market Timing

On-Line Book Order Here: $95

One Year of Peerless/Tiger HOTLINE $350

Peerless Stock Market Timing: 1929-2010 $395.

TigerSoft & Peerless Stock Market Timing: 1929-2010 $495.

The signals are based on readily available data and applied to the DJI for simplicty. The basic

Peerless indicators used could be calculated by hand. But the Peerless software and our Tiger

Data page make the production of the indicators and our Buy and Sell signals automatic.

These Peerless Buy and Sell signals can profitably be superimposed on most stocks and ETFs

worldwide. Our software does this and also lets users see gains and losses when it is assumed

that all trades are made at the Opening the day after the Buy or Sell.

Numbers are used to classify particular signals. Higher numbers signals are not necessarily

more powerful than lower numbered signals. Numbering them distinguishes one from another

and let users see the potency and reliability of each signal in the documentation. Our documentation

explains the general basis of each signal. "B" means Buy. "S" means Sell. The asteriix shows

the market was in "extreme Bearish Mode". Our Peerless system os always long or short.

It is assumed for simplicity that one always trades at the exact close of each signal. Users

can readily see the results using the day's opening.

Note: The Peerless charts do not show all the Buy and Sell signals for the first 100-days

because that much data is needed to produce the signals. There are lots of Buys and Sells

that are not reversing signals, i.e. a Buy after a Sell or a Sell after a Buy. The table below

gives all the reversing Buys and Sells for the period. These charts show all the signals.

Peerless provides you the data since 1965 so that you can replicate results and better

study how the signals are produced. Our manual shows all the charts and signals since 1915

and discusses the history and basis of each signal since 1928, when the necessary data

to produce the signals first comes available.

Peerless Date DJIA Pct. Signal Gain -------------------------------------------------- SELL S1 10/22/48 189.8 3.8 BUY B9 11/3/48 182.5 -0.7

Sell S12 1/7/1949 181.3 8.9% Buy B14 6/6/1949 165.2 24.3%SELL S9 4/14/50 215.38 -1.6

BUY B4 8/9/50 216.9 6.2 SELL S8 10/25/50 231.5 1.9 BUY B12 11/9/50 227.2 21.1 SELL S4 9/17/51 275.15 5.2 BUY B17 10/29/51 260.42 5.3 SELL S1 1/28/52 274.2 6.5 BUY B2 5/1/52 256.4 6.0 SELL S10 9/10/52 271.7 1.7 BUY B2 10/15/52 267.1 9.3 SELL S8 12/30/52 292.0 6.1 BUY B14 4/6/53 274.1 -1.2 SELL S10 4/23/53 270.7 2.7 BUY B14 6/9/53 263.4 13.7 SELL S15 3/9/53 299.50 -0.2 BUY B14 3/18/53 300.1 61.9 SELL S4 9/22/55 486.00 6.3 BUY B17 9/26/55 455.6 13.8

SELL S4 4/9/56 518.5 3.3 BUY B11 5/10/56 501.6 2.5 SELL S2 8/2/56 521.00 10.0 BUY B2 10/1/56 468.7 5.2 SELL S12 8/2/56 492.7 10.0 BUY B17 2/5/57 470.0 10.3 SELL S9 7/8/57 518.4 10.3 BUY B1 10/2/57 465.0 -3.7 SELL S9 1/7/58 447.8 -2.4 BUY B10 2/4/58 458.7 41.7 SELL S9/S12 7/1/59 650.2 -2.4 BUY B17 9/9/59 637.6 5.3 SELL S12 12/9/59 671.2 7.8

BUY B17 2/11/60 618.6 0.7 SELL S12 5/18/60 623.0 -0.5 BUY B2 7/18/60 624.7 1.3 SELL S1 8/29/60 634.4 8.9 BUY B2 10/3/60 577.8 3.2 SELL S9 10/14/60 596.5 4.1 BUY B2 10/24/60 571.9 3.2 SELL S9 8/3/61 715.7 4.1 BUY B16 6/22/62 539.2 8.3 SELL S9 7/5/62 583.9 0.3 BUY B1 10/4/62 582.4 20.4 SELL S10 7/1/63 701.3 -1.5 BUY B5 11/22/63 711.5 32.0 SELL S8 5/13/65 938.9 5.1 BUY B10 8/16/65 891.1 3.2

SELL S4 1/10/66 985.41 21.3 BUY B19 8/30/66 775.72 3.9 SELL S4/S9 9/14/66 806.23 6.0 BUY B8 10/3/66 757.96 4.6 SELL S9 10/25/66 703.09 0.4 BUY B6 12/1/66 788.95 12.4 SELL S12 4/24/67 887.53 1.9 BUY B9 5/22/67 871.05 6.7 SELL S12 9/14/67 929.44 7.5 BUY B17 11/13/67 859.74 5.6 SELL S12 1/9/68 908.29 7.8 BUY B17 2/14/68 837.38 7.5 SELL S2 9/3/68 900.36 -3.9 BUY B10 9/30/68 935.79 4.5 SELL S1 12/5/68 977.69 6.2 BUY B17 2/20/69 916.65 3.7 SELL S9 4/30/69 950.18 24.4 BUY B8 1/27/70 763.99 1.8 SELL S9 2/27/70 777.59 17.5 BUY B16 5/25/70 641.36 9.9 SELL S9 6/17/70 704.68 5.0 BUY B7 7/7/70 669.36 6.3 SELL S9 7/15/70 711.66 0.6 BUY B7 8/13/70 707.35 32.5 SELL S9 5/6/71 937.39 11.9

BUY B17 11/10/71 826.15 16.1 SELL S9 4/6/72 959.44 2.5 BUY B2 5/2/72 935.2 3.2 SELL S12 5/22/72 965.31 5.6 BUY B2 7/20/72 910.45 4.1 SELL S9 8/3/72 947.7 2.7 BUY B2 10/16/72 921.66 12.4 SELL S4 12/11/72 1036.27 15.6

BUY B17 8/15/73 874.17 2.4 SELL S9 9/4/73 895.13 -5.0 BUY B4 9/25/73 940.55 4.9 SELL S9 10/26/73 987.06 20.1 BUY B16 12/5/73 788.31 8.5 SELL S12 1/2/74 855.32 3.6 BUY B17 2/6/74 824.62 3.8 SELL S12 2/22/74 855.99 27.3 BUY B17 9/27/74 621.95 7.7 SELL S12 10/21/74 669.82 10.0 BUY B6 12/2/74 603.02 45.5 SELL S8 7/1/75 877.42 9.4

BUY B17 9/16/75 795.13 26.9 SELL S9,S15 3/24/76 1009.21 4.2 BUY B2 10/5/76 966.76 1.8 SELL S4 12/22/76 984.54 9.4

BUY B17 2/9/77 933.04 3.3 SELL S9 3/15/77 965.01 16.4 BUY B9 12/6/77 806.91 -1.7 SELL S10 1/7/78 793.49 5.1 BUY B8 2/17/78 752.69 15.1 SELL S8 6/6/78 866.51 5.7 BUY B5 6/27/78 817.31 2.7 SELL S12 7/17/78 839.05 -5.7 BUY B4 8/3/78 886.87 0.5 SELL S12 10/10/78 891.65 11.7 BUY B9 12/18/78 787.51 13.5

SELL S9 9/21/79 893.94 10.9 BUY B17 11/7/79 796.67 8.6 SELL S4 1/16/80 865.19 10.1 BUY B19 3/28/80 777.65 23.2 SELL S2 8/22/80 958.19 1.9 BUY B11 9/26/80 940.10 4.9 SELL S9 11/14/80 986.35 5.3 BUY B17 12/9/80 934.04 3.3

SELL S9 1/2/81 980.89 4.1 BUY B9 1/23/81 940.19 8.9 SELL S15 4/24/81 1020.35 17.4 BUY B19 9/28/81 842.56 3.6 SELL S9 10/9/81 873.00 4.0 BUY B9 10/23/81 837.99 -0.6 SELL S9 4/1/82 833.24 6.7 BUY B8 8/11/82 777.21 36.0 SELL S9 12/7/82 1056.94 6.1 BUY B6 12/15/82 992.64 7.9

SELL S12 1/6/83 1070.92 3.8 BUY B9 1/24/83 1030.17 20.7 SELL S9 7/26/83 1243.69 6.1 BUY B17 8/9/83 1168.27 9.2 SELL S4 11/22/83 1275.81 12.5

BUY B17 5/22/84 1116.62 63.5 SELL S9 4/29/86 1825.89 -0.1 BUY B9 7/9/86 1826.07 0.5 SELL S9 8/12/86 1835.49 2.3 BUY B17 9/11/86 1792.89 34.2 SELL S9 4/6/87 2405.54 7.7 BUY B17 5/19/87 2221.28 5.9 SELL S9 6/8/87 2351.64 -4.0 BUY B4 6/22/87 2445.51 10.5 SELL S4 8/26/87 2701.85 5.2

BUY B17 9/4/87 2561.38 3.0 SELL S9/S12 10/1/87 2639.2 30.2 BUY B16 10/20/87 1841.01 5.9 SELL S6 10/22/87 1950.43 5.2 BUY B17 12/2/87 1848.97 5.1 SELL S9 12/28/87 1942.97 1.6

BUY B9 1/8/88 1911.31 6.3 SELL S1 2/26/88 2023.21 2.2 BUY B9 3/25/88 1978.95 4.4 SELL S2 9/6/88 2065.26 -0.1 BUY B17 11/11/88 2067.03 34.1 SELL S9 10/4/89 2771.09 4.8 BUY B17 10/17/89 2638.73 6.5

SELL S15 1/2/90 2810.15 6.9 BUY B17 1/23/90 2615.32 13.6 SELL S9 7/12/90 2969.80 17.4 BUY B8 9/24/90 2452.97 6.3 SELL S15 4/14/92 3306.13 1.6 BUY B2 8/21/92 3254.1 21.9 SELL S4 2/3/94 3967.66 7.4 BUY B19 4/5/94 3675.41 6.8 SELL S9 10/17/94 3923.93 5.7 BUY B6 12/1/94 3700.87 49.9

SELL S1 2/27/96 5549.21 1.1 BUY B9 4/10/96 5485.98 3.4 SELL S1 5/29/96 5673.03 2.7 BUY B2 7/11/96 5520.54 23.8 SELL S9 4/22/97 6833.59 -4.9 BUY B4 5/9/97 7169.53 10.5 SELL S12 9/18/97 7922.72 5.4 BUY B1/B19 10/28/97 7498.32 22.5

SELL S15 4/21/98 9184.94 16.9 BUY B9 10/1/98 7632.53 42.2 SELL S12 6/18/99 10855.55 4.2 BUY B1 10/4/99 10401.23 7.9 SELL S9 12/10/99 11224.7 2.3 BUY B17 2/4/00 10963.80 1.5 SELL S2 4/25/00 11124.82 5.8 BUY B2 5/3/00 10480.13 7.9 SELL S4 9/6/00 11310.64 9.6 BUY B17 10/20/00 10226.59 4.8 SELL S12 12/8/00 10712.91 11.3 BUY B9 3/23/01 9504.78 18.3 SELL S4 5/17/01 11428.58 22.1 BUY B16 9/19/01 8759.13 15.5 SELL S9 2/26/02 10115.26 2.3 BUY B19 7/24/02 8191.29 7.9 SELL S12 10/15/02 8255.68 -1.7 BUY B9 11/13/02 8398.49 4.5 SELL S12 1/6/03 8773.57 5.2 BUY B9 1/22/03 8318.73 17.8 SELL S4 10/15/03 9803.05 -0.6 BUY B18 11/3/03 9858.46 8.9 SELL S15 2/11/04 10737.7 7.2 BUY B2 5/18/04 9968.51 3.2 SELL S2 9/2/04 10290.28 3.8 BUY B9 10/14/04 9894.45 9.7 SELL S8 12/28/04 10854.54 5.9 BUY B19 4/21/2005 10218.6 13.3 SELL S9 5/5/2006 11577.74 4.9 BUY B14 6/15/2006 11015.19 1.2 SELL S12 6/30/2006 11150.22 3.1 BUY B9 7/18/2006 10799.23 14.8 SELL S9 1/5/2007 12398.01 2.3 BUY B17 3/2/2007 12114.1 15.3 SELL S9 7/17/2007 13971.15 4.9 BUY B14 9/25/2007 13289.29 3.7 SELL S4 10/15/2003 13778.65 4.0 BUY B1 11/14/2007 13223 3.0 SELL S12 12/6/2007 13619.89 12.6

BUY B8 3/7/2008 11899.69 5.5 SELL S9 3/24/2008 12548.64 9.3 BUY B2 7/8/2008 11384.21 2.2 SELL S9 7/23/2008 12632.38 6.1 BUY B8 9/15/2008 10917.51 0.9 SELL S6 9/22/2008 11015.69 16.0 BUY B16 10/8/2008 9258.1 -2.4 SELL S6 10/21/2008 9033.66 10.9 BUY B16 11/21/2008 8046.42 12.0 SELL S12 1/6/2009 9015.10 8.7 BUY B19 1/21/2009 8228.1 -1.0 SELL S6 1/29/2009 8149.01 10.9 BUY B17 2/17/2009 7552.6 -6.5 SELL S5 2/27/2009 7062.93 -1.5 BUY B14 3/12/2009 7170.06 22.2 SELL S8 6/9/2009 8763.06 5.0 BUY B5 6/23/2009 8322.91 19.5 SELL S12 10/21/2009 9949.36 -2.8 BUY B14 11/9/2009 10226.94 0.4 SELL S9 11/13/2009 10270.47 0.9

BUY B17 1/22/2010 10226.94 2.3 SELL S12 6/16/2010 10409.46 6.3 BUY B8 6/30/2010 9774.02 26.8 ---------------------------------------------- N = 236 Avg.Gain= 9.1% Buys N=118 Avg.Gain= 11.7% 111 gains 8 losses Sells N=118 Avg.Gain= 6.4% 101 gains 14 losses