Sell on DJI Rallies To Upper Band after March

in the Presidential Election Year and in September the

year before the Presidential Electon when Internals

Are Not Especially Bullish.

Sell S2s: 1928-2013 19321111 S2 68.0 .135

19350909 S2 132.5 .033

19430920 S2 141.8 .071

19480615 S2 193.2 .05

19481022 S2 189.8 .061

19560409 S2 518.5 .079

19560802 S2 521 .075

19600614 S2 654.8 .058

19670918 S2 938.74 .084

19710907 S2 920.93 .103

19960520 S2 5748.82 .041

20000425 S2 11124.82 .049

20000906 S2 11310.64 .095

20001030 S2 10835.77 .029

20040902 S2 10290.28 .038

20070919 S2 13815.56 .062

----------------------------------------------------

no.=16 .066

2 9 5 0 0 PE 11 .065 PE +1 0 ---- PE +2 0 ---- PE +3 5 .076 January 0 ---- February 0 ---- March 0 ---- April 2 .099 May 1 .041 June 2 .054 July 0 ---- August 1 .069 September 7 .045 October 2 .045 November 1 .135 December 2 .049 1-10 6 .075 11-20 6 .078 21-31 5 .050 |

==============================================================================

3/30/2013 - last edited.

(C) 2013 Wm. Schmidt, Ph.D. www.tigersoft.com All rights strictly reserved.

Sell on DJI Rallies To Upper Band from April to September

in the Presidential

Election Year and in September the

year before the

Presidential Electon.

There have been 16 Sell S2s since 1929.

The average DJI drop afterwares

5.2%. All but three brought a DJI decline of at least 3% at the time of the

next Peerless Buy. The average DJI decline on a Sell S2 was 5.2%. None

brought a loss. And the biggest paper loss was only 3.0%. In 12 of the

16

cases of S2s there was no paper loss. This is remarkable in that the

key value's average internal strength readings were relatively high.

The average adjusted P-I was +320, the average IP21 was +.077 and

the average OPct was +.278. Only the V-Indicator's average readings

were somewhat low, a +34.8.

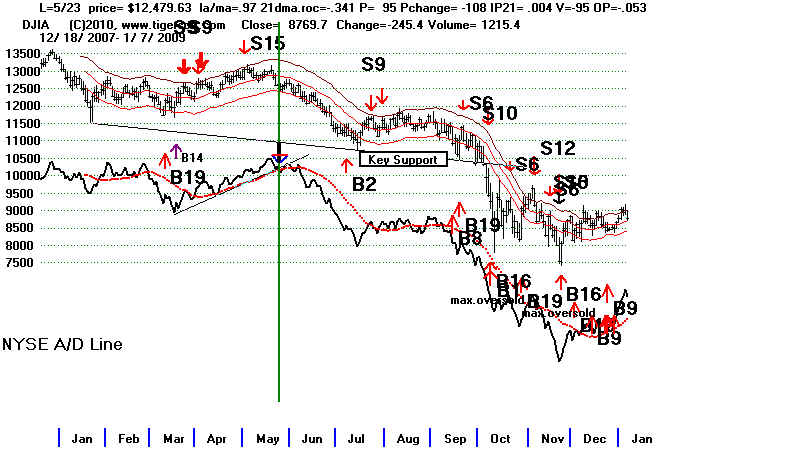

Sell S2s taking place when the A/ D Lie fails to confirm the DJI advance

typically fall further. The average DJI decline was 7.1% in their 7 cases,

compared with only 3.7% in the 9 instances where the A/D Line was

confirming the DJI strength.

The DJI must not have just jumped or fallen 2% from

the previous day

for the Sell S2 to be given.

The DJI may close only 1.2% over the 21- day ma provided the P-I Daily

change is negative (examples: the two cases in 1948) or the V-I is barely positive

or negative and the the P-I or IP21 are negative (examples: 1960 and

the two cases in 2000).

The P-Indicator and IP21 are allowed to be much higher if the DJI closes

3% over the 21-dma and this takes place in June, September or October

of the Presidential Election Year or the year before.

More than a third of all Sell S2s occurred in Septembers the year before

the Presidential Election: 1935, 1943, 1967, 1971, 1995 and 2007.

Most (9 of the 16) Sell S2s occurred

with the 3% to 4.1% over the 21-day ma

In these cases, the internals are allowed to be quite positive in these

cases, but the P-I must not be more than +33 above its value on the previous day

in these cases. This factor and the DJI closing so close to the upper

3.5% at this time makes to market vulnerble in Septembers before the 20th

of the month. Late September and October are notoriously weak unless

the Fed is busy pumping money into the system. As for the, the higher internal

strength readings on some Sell S2s, they can be taken as a sign that the

market is over-bought and ready for a pullback.

The key values' highest levels reached for S2s when the DJI is close to

the upper band show that the readings can be quite positive and

still produce a decline at this time of year:

21-day ROC +1.051

P-I

+255

P-I Daily Change +32

Adjusted P-I +679

IP21

+.179

V-I

+182

OPct

+.477

65 day pct change. +.145

The internal strength parameters are lower in a typical Presidential

Election Year and in September which is historically the weakest month.

Volatility

tends to be lower from

June to September, especially in a

Presidential

Election year.

The reasons why there are no Sell S2s

in the year after

a Presidential Election are that if a Republican is

in the White House, the stock market should already

be declining and in the second year after it, there is often

a recovery in the second half of the year.

Sell S2s give us a way to trade profitably when

the market is relatively quiet and the internal strength

indicators are too high for other signals. The P-Indicator

should not be more than +40 above its previous day's

reading. In 8 of 11 cases it was below its previous

day's level.

Sell S2 Internals

PI^ - P-Indicator is not

adjusted for increaing number of stocks traded on NYSE.

Date Pct Gain

Paper Loss

LA/MA ANN ROC

P-I P=I Change Adjusted

IP21 V-I

OPct 65-day

Change PI

Pct Change

( PI^ - P-Indicator Adjusted for increaing number of stocks traded on NYSE. )

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------t

9/9/1935 +3.3% 1.7%

1.035 .615

58 -5

327 .085

18 .256 .145

9/20/1943 +3.8% none

1.033 .304

70 16

356

.10 39 .397 .013

( 10/7/43 B14 and B19

seem early in October.)

6/21/44 +1.8% 1.3%

1.032 .708

127 -13 679 .113 182 .328 .053

6/15/48 +2.8% none

1.012 .287

13 -43

55 .042

-54 .116

.135

10/22/1948 +3.8% +3.0% 1.041 .694

110 11

469

.179 65 .445

.028

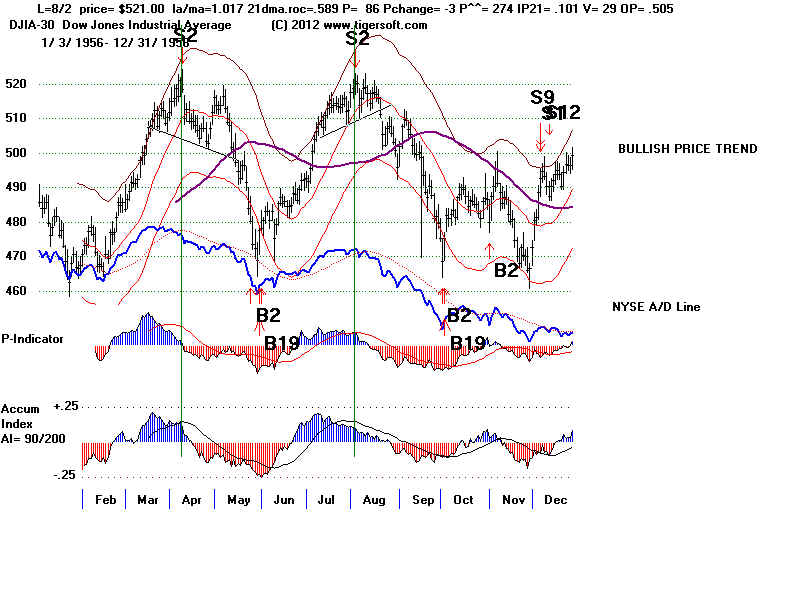

4/9/1956 +7.4% none

1.016

.610 12 -21

40 .109 -147

.437 .066

8/2/1956 +10.0% none

1.017 .589

86 -3

274 .101

29

.505 .013

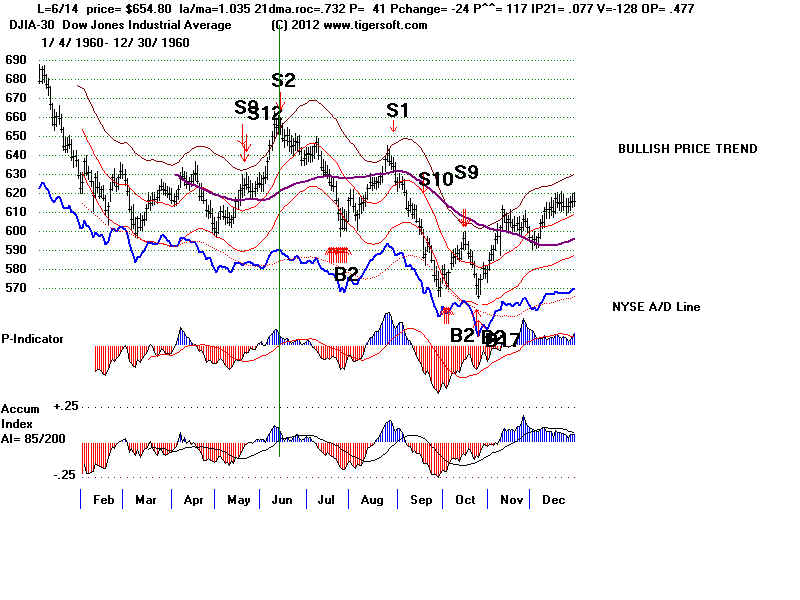

6/14/1960 +4.4% none

1.035 .732

41 -24

117 .077 -128 .477 .074

9/18/1967 +8.4% none

1.032 .269

26 3

65 .030

2

.267 .059

9/7/1971 +10.3% none

1.034 1.051

105 32

436

.000 1

.433 -.003

6/21/1976 +4.0% none

1.031 .124

28 -3

52

.058 0

.023 .027

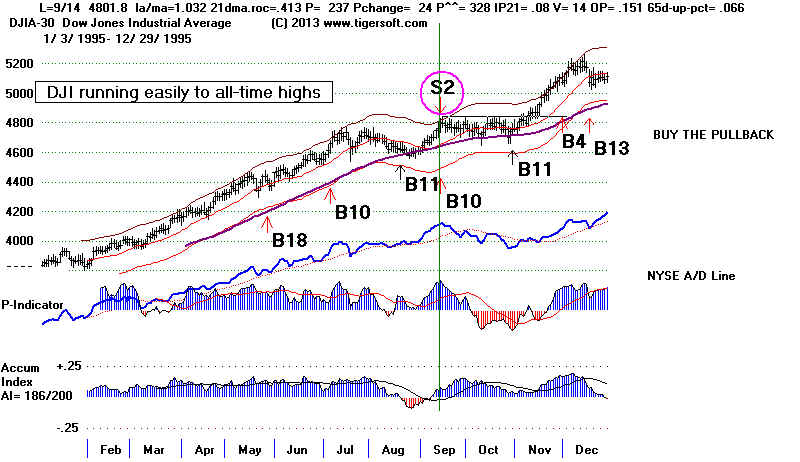

9/14/1995 +0.9% none

1.032 .413

237 24

328

.080 14

.151 .066

4/25/2000 +5.4% none

1.015 .013 -25 66

-25 -.034

-43 -.092 -.012

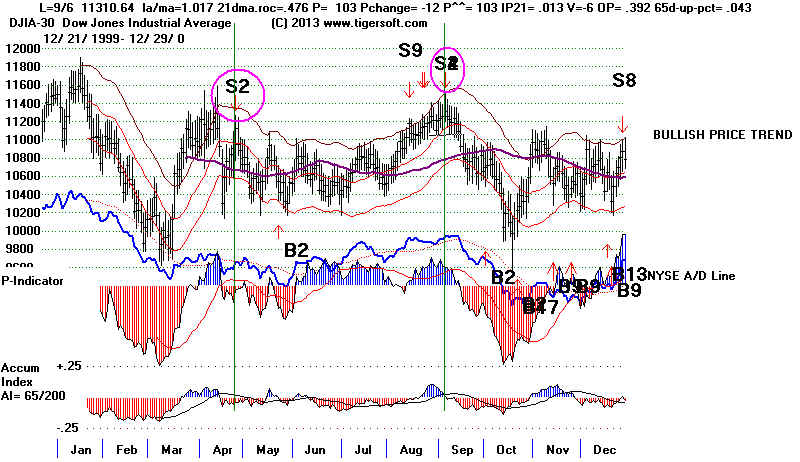

9/6/2000 +5.4% none

1.017 .476

103 -12

103

.013 -6

.392 .043

9/8/2004 +4.1% none

1.021 .589 532 -18

498 .172

89 .146 .006

9/19/2007 +7.4% +2.5%

1.027 .621

255 15

320

.106 69

.278 .045

-----------------------------------------------------------------------------------------------------------------------------------------------------

Avg. +5.2%

+0.53% 1.026

.480 111 +1.6

254

.077 34.8

.278 5.07%

More thoughts on Sell S2s.

Since 1968, except for 2008, the stock

market has tended to move only modestly

in

the middle of the Presidential Campaign, from April to mid-September. Selling at

the upper

band or at well-tested resistance after a rally is usually a good idea at this time.

The Sell S2

makes this automatic. Using NYSE A/D Line up-trend-breaks to clinch or confirm the

Sell

S2 at this time also works well.

Know that volatility is lower in the Summer of a Presidential Election year, at least

until

there is a decisive breakout above well-tested resistance can be used by the alert trader

even when there is no Sell S2. If the DJI reaches well-tested resistance in June or

September

in a Presidential Election year, be prepared for a decline back to the lower band even if

there is

no other Peerless Sell. Below are some examples. A retreat on a third test in

June 1984

called on the DJI to plumb for support. A fifth test of resistance very often brings

a decline.

This was true in November 1984.

Sell S2s with A/D Line NC vs

Sell S2s with no A/D Line NC

June 1948 2.8

April 1956 7.4

September 1935 3.3%

Aug 1956 10.0

September 1943 3.8%

June 1960 4.4

June 1944

1.8%

Sept 1967 8.4

October 1948 3.8%

Sept 1971 10.3

June 1976 4.0%

April 2000 5.4

Sept 1995

0.9%

--------------------

Sept 2000 5.4%

Avg - 7.1%

Sept 2004 3.1%

Sept 2007

7.4%

---------------------------

3.7%

Judged Sell S2s? The Sell S2 is NOT just a signal for Presidential Election years. It is true that most S2s and more trading ranges occur in Election years. (Examples: 1972, 1976, 1984, 1988, 2000, 2004), but Trading ranges do occur in other years after March. 1983, 1991, 1996 and 2005. Watch for and use well-tested support and resistance lines when they do. 1984 Judged Sell Judged Sell  |

2004

Judged Sell  |

Date DJI Gain

------------- ----------- --------

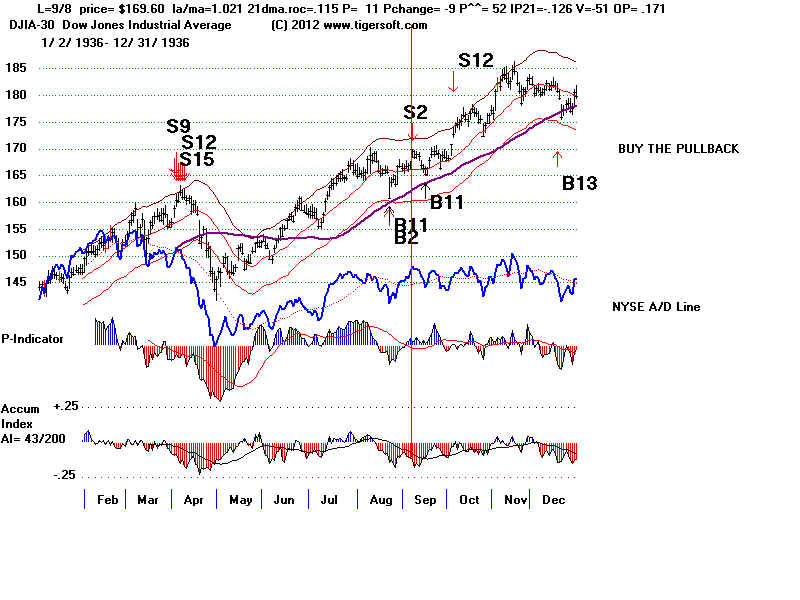

#1 9/9/35 132.5 +3.3% 1.7% paper loss

Also 9/10/36 133.2 +3.8%

LA/MA ANN ROC P-I P ch IP21 V-I OPct

1.035 .615 58 -5 .085 18 .492

Reversing Sell....DJI declined to the lower band where a Buy B11 occurred.

--------------------------------------------------------------------------------------------------------------------------------

X Signal cancelled due to Presidential Election Year seasonality.

9/8/36 169.6 +2.6% No paper loss

LA/MA ANN ROC P-I P ch IP21 V-I OPct

1.021 .115 11 -9 .126 -51 .171

Reversing Sell...DJI declined to the lower band where a Buy B11 occurred.

-------------------------------------------------------------------------------------------------------------------------------

X 9/18/39 147.8 LOSS = 0.9% 3.4% paper loss

This was down 4% from previous day and is not allowed in 2013 software.

LA/MA ANN ROC P-I P ch IP21 V-I OPct

1.037 .796 -54 -21 .102 3 .251

NOT a Reversing Sell... DJI rallied to 153.10 and then declined to the lower band (9/27/39)

1935 |

1943 |

1944 |

1948 |

1956 |

1960 |

1967 |

1971 |

1976 |

1995 |

2000 |

2004 |

2007 |

Code

Static

A(15)

A(1) = Val(text1.Text)

A(2) = Val(text2.Text)

A(3) = Val(text3.Text)

A(4) = Val(text4.Text)

A(5) = Val(text5.Text)

A(6) = Val(text6.Text)

A(7) = Val(text7.Text)

A(8) = Val(text8.Text)

A(9) = Val(text9.Text)

A(10) = Val(text10.Text)

A(11) = Val(text11.Text)

A(12) = Val(text12.Text)

A(13) = Val(text13.Text)

A(14) = Val(text14.Text)

'A(15) = Val(text15.Text)

For i = 1 To 14

SUM = SUM + A(i)

Next i

AVG = SUM / 14

TEXT16.Text = Str$(AVG)

-------------------------------------------------------------------------------------------------------------------------------

No Sell S2s in 1940-1942

------------------------------------------------------------------------------------------------------------------------

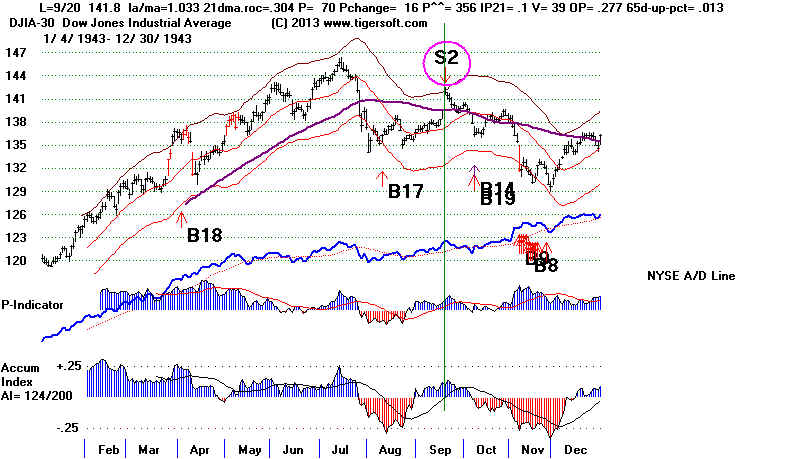

#2 9/20/43

147.8

+3.8% No paper loss

LA/MA

ANN ROC P-I P

ch IP21 V-I

OPct

1.033

.304 70 16 .10 39

.379

Reversing Sell...

DJI rallied to 153.10 and then declined to

the lower band (9/27/39)

After forming a head/shoulders pattern,

it fell 5% further.

-------------------------------------------------------------------------------------------------------------------------------

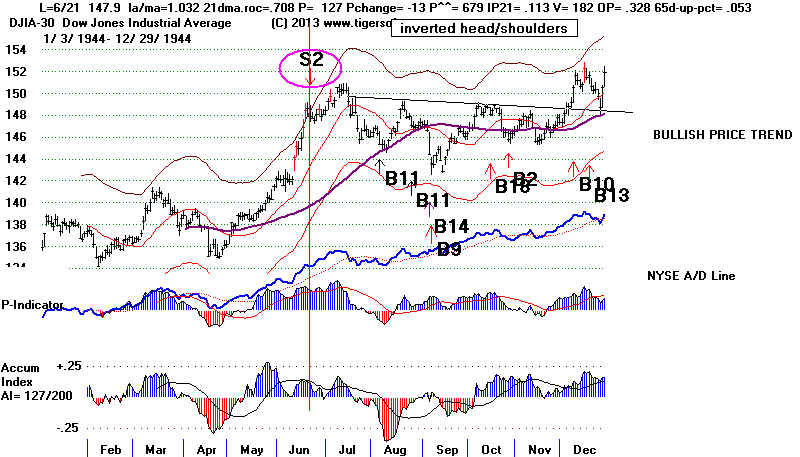

#3 6/21/1944

147.9

+1.8% 1.3% paper loss

LA/MA ANN ROC P-I P ch

IP21

V-I OPct

1.032

.708 127 -13 .113 192 .393

Reversing Sell...

DJI rose to 150 and then fell towards lower band.

Waiting for the NYSE A/D Line uptrend to be broken would

have helped a trader get the actual top.

A/D Line

Trend Break

------------------------------------------------------------------------------------------------------------------------

-----

#4 ( Also S11) 6/15/1948 193.20 Gain =

+2.8% No paper loss

LA/MA ANN ROC

P-I P ch IP21

V-I OPct

1.018 .157 14

9 .128 39 0

Reversing Sell...DJI immediately fell to the lower band.

A completed head/shoulders dropped the

DJI down below the lower band.

------------------------------------------------------------------------------------------------------------------------

-----

#5 4/9/1956

518.50

+7.4% No paper loss

LAMA ANN ROC

P-I P ch IP21

V-I

OPct

1.016 .61 12 -21 .109

-147 .437

DJI fell below the lower band.

A completed head/shoulders dropped the DJI

down below the lower band.

-------------------------------------------------------------------------------------------------------------------------------

#6 8/2/1956

521.0

+10.0% No paper loss

LA/MA ANN ROC

P-I P ch IP21

V-I OPct

1.017 .589 86 -3 .101

29 .505

DJI fell below the lower band.

-------------------------------------------------------------------------------------------------------------------------------

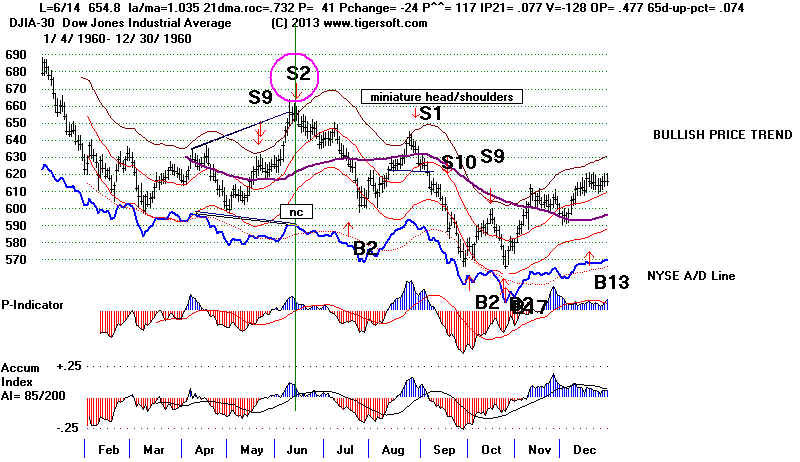

#7 6/14 /1960 654.8

4.4% No

paper loss

LA/MA ANN

ROC P-I P

ch IP21

V-I OPct

1.035 .732 41 -24

.077 128 .477

DJI immediately declined. With A/D Line very weak, it would

not have helped to wait for the A/D line trend-break to go short.

See how the decline brought a drop to well-tested support.

S9

-------------------------------------------------------------------------------------------------------------------------------

#8 9/18

/1967 938.74

8.4% No

paper loss

LA/MA

ANN ROC P-I P ch

IP21 V-I

OPct

1.032 .269 26 3

.03 2 .303

Not reversing bond...

DJI rallied to 943 and then declined below the lower band.

With A/D Line very weak, it would not have helped to wait for the A/D line

trend-break to go short. See how the decline brought a drop to well-tested support.

-------------------------------------------------------------------------------------------------------------------------------

No Sell S2 in 1972 but waiting for the NYSE A/D Line uptrend

to be broken on the July-August Summer rally would have helped

a trader pick a short-term top and make a profitable quick trade

of 3.9% on a short sale initiated and closed out on the A/D Line

trend-breaks. The automatic S1 signal would have been superior,

but not the S9s.

A/D Line

Trend Break

-------------------------------------------------------------------

#9 6/21/1976

1007.45 +4.0% Paper loss = 0.7%

LA/MA

ANN ROC P-I P ch

IP21 V-I

OPct

1.031 .124 28 -3

.058 0 .023

Note that using the NYSE A/D Line uptrend-break in the September

rally when there was no Sell would have gained a trader 2.5%

using the next Peerless Buy to cover the short sale.

A/D Line Trend Breaks

--------------------------------------------------------------------

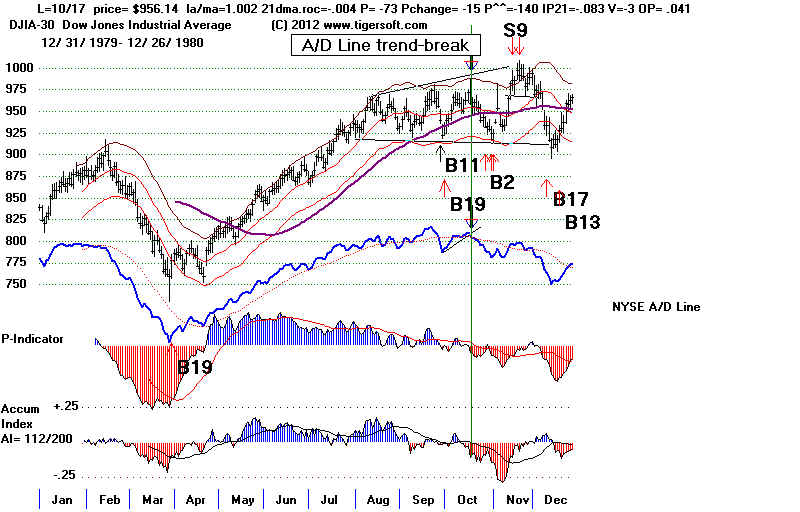

No Sell S2 in 1980 but waiting for the NYSE A/D Line uptrend

to be broken on the September rally would have helped

a trader pick a short-term top and make a profitable quick trade

of 3.1% on a short sale initiated on the A/D Line trend-break

and closed out on the next Peerless Buy or else buying at the

well-tested support line.

A/D Line

Trend Break

--------------------------------------------------------------------

No Sell S2 in 1984 but Selling on fifth test of flat resistance

would have worked out well here. A/D Line trendbreaks are late here.

----------------------------------------------------------------

X Eliminated in 2012 updates.

9/6/88

2065.26 Loss = 0.1% Paper loss = 5.6%

LA/MA

ANN ROC P-I P ch

IP21 V-I

OPct

1.017 -.315 -128 21

-.087 -16 -.139

Waiting for for the NYSE A/D Line uptrend to be broken on the

August-September-October rally would have helped a trader

make a profitable quick trade of 4.5% on a short sale

initiated on the A/D Line trend-break and closed out on the

next Peerless Buy.

A/D Line

Trend Break

----------------------------------------------------------------

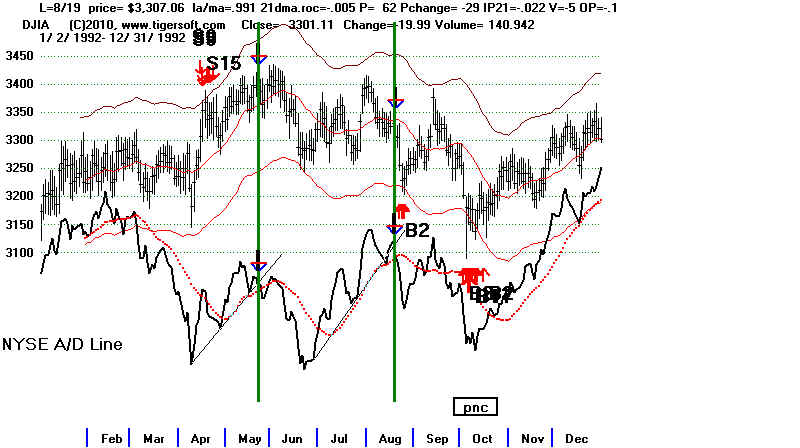

No Sell S2 in 1992 but waiting for the NYSE A/D Line uptrend

to be broken on the April-June and July-August rallies would

have helped a trader make a profitable quick trade of 3.9%

and 1.6% on short sales initiated on the A/D Line trend-break

and closed out on the next Peerless Buy.

A/D Line Trend Breaks

-----------------------------------------------------------------------

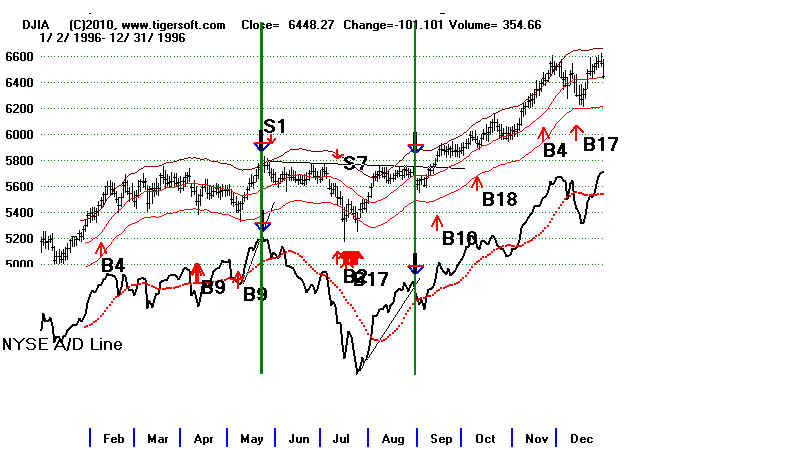

No Sell S2 in 1996 but waiting for the NYSE A/D Line uptrend

to be broken on the May and July-August rallies would

have helped a trader make one profitable quick trade of 3.1%

but also have caused a loss of 4.0% on short sales initiated

on the A/D Line trend-break and closed out on the next Peerless Buy.

When the DJI is at or near an all-time high, traders should realize

that short sales are much riskier, because of how easily prices

can be advanced in the absence of significant resistance.

A/D Line Trend Breaks

---------------------------------------------------------------------

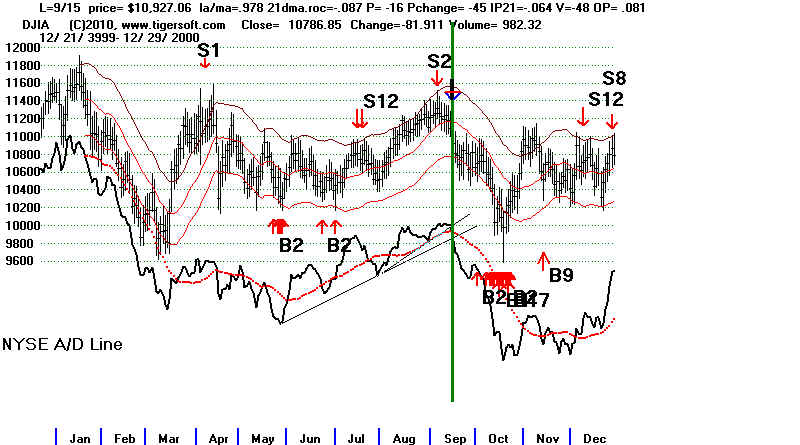

#10 9/6/2000

11310.64 +5.4% No paper loss

LA/MA

ANN ROC P-I

P ch

IP21 V-I

OPct

1.017 .476 103

-12 .013 -6 .392

In this case, using the A/L Line trendbreak in September

would have meant a trading gain of 2.1%, 3.3% less than

using the Peerless Sell S2.

A/D Line

Trend Break

----------------------------------------------------------------------

#11 9/8/2004

10313.36 +4.1%

LA/MA ANN ROC

P-I P ch

IP21 V-I

OPct

1.021 .589

532 -18 .172 89 .146

The A/D Line strength compared to the DJI was so pronounced

in this year that it would not have seemed prudent to even

take the Sell S2 short sale, though in this case it proved

profitable. Using the A/D Line trend break in July would

have enabled a trader to make a 0.8% quick gain. When breadth

is this strong vis-a-vis the DJIA, it is usually better to

focus on the Peerless buy signals.

A/D Line

Trend Break

--------------------------------------------------------------------

No Sell S2 in 2008 but waiting for the NYSE A/D Line uptrend

to be broken on the March-May rally would have helped a trader

make one profitable quick trade of 8.8% in case the trader

had ignored the automatic Sells at this time.

A/D Line

Trend Break

==========================================================

Automatic Sell S2s

Number of trades = 11

Avg. Gain= 4.9%