20080502 S11 13058.2 .128 1.028 S4

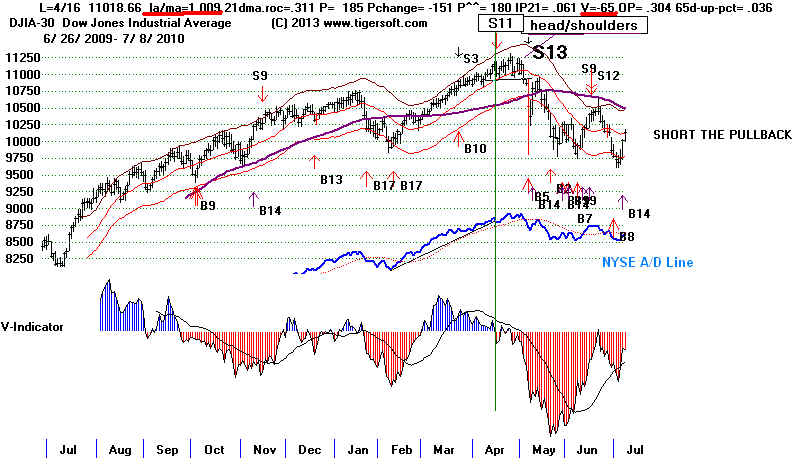

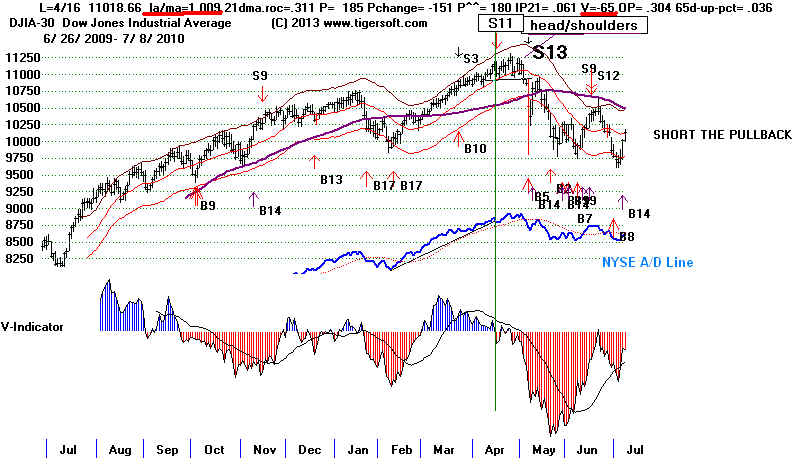

20100416 S11 11018.66 .086 1.009 S3

---------------------------------------------------------------------------

No. = 3 Avg.= 15.9%

===============================================================

===============================================================Sell S11

December 2013 Peerless (C) 2013 William Schmidt, Ph.D.

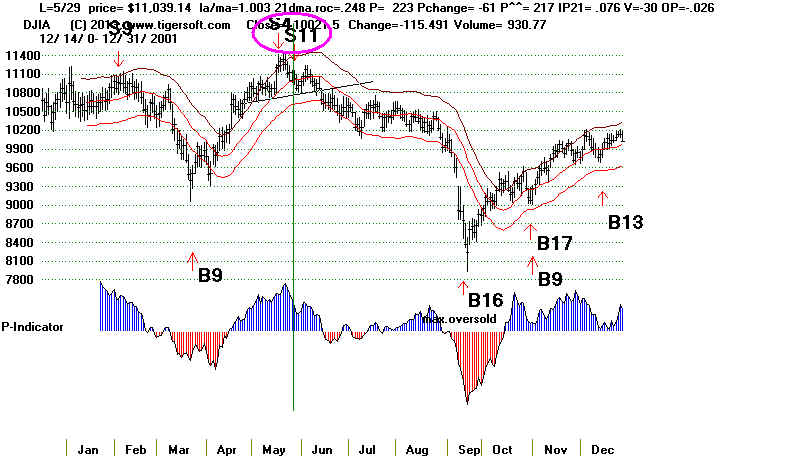

20010605

S11

11175.84

.263

1.012 S4

20080502

S11

13058.2

.128

1.028 S4

20100416

S11

11018.66

.086

1.009 S3

---------------------------------------------------------------------------

No.

= 3 Avg.= 15.9%

===============================================================

===============================================================

Created 2/25/2013

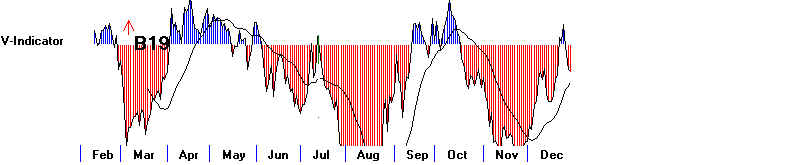

A Sell S11 signal results from a 10% rally from a 4 month

low with the

V-Indicator still negative. The DJI cannot be more than 3.8% above the

21-dma and must be at least 0.5% over the 21-dma. Sell S11s can only

take place between March and August. In addition, Sell S11s should also

occur when the DJI is up more than 9% from 65 days with the

P-Indicator above +170. Momentum and positive breadth then outweigh

the negative V-Indicator. (This was true in February 2004 and 2013.

Those signals are not allowed in the 3/13/2013 version of Peerless.)

The

failure of the February 2013 Sell S11 reinforces the general rule

that

Janaury take-offs nearly always rally until March, at least.

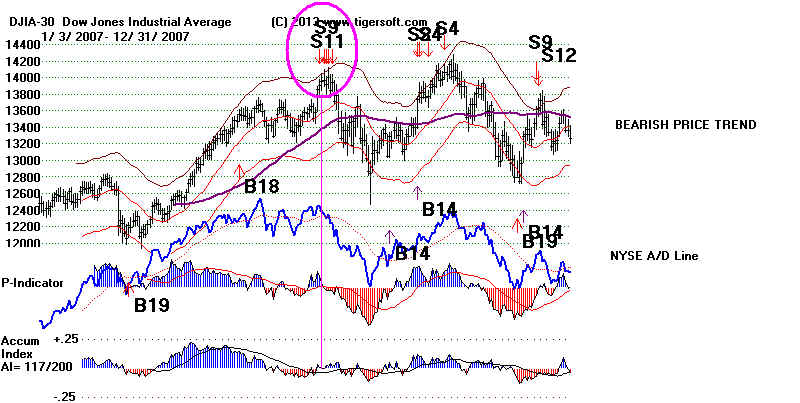

Sell S11 and S9 joined together to stop the

2003-2007 Bull Market. See how the V-Indicator

was negative after a 12%+ rally in the DJI.

7/13/2007 13907.25 LA/MA=1.026 21-dma-roc=.374 P=

+192 IP21= +.005 V= --15 Opct=.085

The Sell S11 occurs when the DJI is up 11% to 20% from its 65-day low

but shows a negative V-Indicator even though the DJI is 0.5% or more

above the 21-day ma. They can only occur between February 20th and

August 31st but they also are not allowed between June 20th and July

5th. This is in keeping with Arhtur Merrill's research on when the

"Summer Rally" usually starts. Note that the DJI must be above its

65-dma. It probably should be required to be above its 200-day ma.

The 1929-1933 data shows that a Sell S11 at this time is more profitable

but also runs a much higher risk of reaching a 5% stop loss, which

we would nornally want to use with Peerless Sells.

Usually by itself this is not a powerful signal, but it is

reliable and produces

only small paper losses. It also gives Peerless a way to call tops

like the one in May 2010, when Peerless gave no other Sell signal.

The typical gain is 6.7%. We only have

accurate data to create the

V-Indicator for the period from mid 1965 onwards.

Sell S11s: 1965-2013

S11

Other Gain When

Biggest Paper

Signals Reversed

Loss

-------------------------------------- ----------------------------------------------

1 3/2/1992

2.0%

none

2

3/25/1996

2.8%

0.8%

3

4/23/1998

also S15

16.5%

2.1% biggest paper loss

4 7/7/1999

also S9 7.0%

1.2%

5 5/25/2001

also S4

17.8%

1.2%

6

7/13/2007 also S9

4.4%

0.7%

7 5/2/2008

also S9 12.8%

none

8 4/16/2010

4.5%

1.7%

9 3/14/2012

also S15

3.6%

0.3%

---------------------------------------------------------------------

Number of S11s = 9

Acg. Gain = 7.93%

Paper Loss = 0.88%

February and Perhaps March Sell S11s Are of Limited Value

Very small gains have accrued to Sell S11s in February and March:

+2.3%, +2.8%, 5.6% and 3.6%

Their paper losses were very small, too:

0. 0.8%, 1.2%, .0.3%.

A paper loss for the 2/22/2013 above 2.2% is not consistent with these

Sell S10s. February and March Sell S11s are probably not worth applying.

Date

Gain Paper Loss

La/Ma Ann.roc

P-I IP21

V-I

OPct 65-day

Pct Change

--------------------------------------------------------------------------------------------------------------------------------------

X February Sell S11s generate gains that are too small. Markets this

strong usually

move up until March, at least.

2/26/1992 2.3%

0

1.009

.156 -16

.021 -12 -.035 .107

DJI declined to 3208.63

on 3/12/1992 and Buy B11..

-------------------------------------------------------------------------------------------------------------------------------------

1 3/2/1992

2.0% 0

1.006

.111 +1 .017 -102

-.118

.100

DJI declined to 3208.63

on 3/12/1992 and Buy B11.

2 3/25/1996

2.8% 0.8%

1.009 .028

4 .071

-31

-.064

.103

DJI declined to 5487.07 on

4/11/1996 and Buy B2/B9.

3 4/23/1998

16.5% 2.1%

1.016 .316

-71 .037

-26 -.039 .138

also S15

biggest paper loss

DJI declined to 8665.29 on

6/16/1998 and B9 at 7632.53 on 10/1/98.

4 7/7/1999

7.0% 1.2%

1.037 .307

16 .05 -15

.178 .105

also S9

DJI declined to 10019.71 on

10/15/1999 and B1/B17.

5 5/25/2001 17.8% 1.2%

1.015

.013 -25 -.034

-43 -.093

.054

also S4

DJI declined far below low band because of 9/11.

There had just been a Sell S4 and a head/shoulders pattern

was forming.

--------------------------------------------------------------------------------------------------------------------------------------

X February Sell S11s generate gains that are too small. Markets this

strong usually

move up until March, at least.

2/17/2004 5.6%

1.2%

1.012 .181

+212

.06

-15 .053 .091

also S9

high

high

--------------------------------------------------------------------------------------------------------------------------------------

6 7/13/2007 4.4% 0.7% 1.008

.341 -55

.043 -75

.221

.102

also S9

7 5/2/2008

12.8% 0

1.028 . 406

+173 .036

-29

.077 .047

also S9

8 4/16/2010

4.5% 1.7%

1.009

.311 +185 .061 -65

.290 .035

9 3/14/2012

3.6% 0.3%

1.019

.295 +129 .069

-24

.231

.090

also S15

--------------------------------------------------------------------------------------------------------------------------------------

X February Sell S11s generate gains that are too small. Markets this

strong usually

move up until March, at least.

2/22/2013 ?

?

1.004

.189 +174

.061 -34

.043 .101

high

high

--------------------------------------------------------------------------------------------------------------------------------------

The

V-Indicator can only be estimated for the period before 1965

because Barrons did not keep NYSE Up and Down Stocks' Volume from the

NYSE

Advances and Declines data. The software does not allow S11s between

1928

and 1965.

Sell S11s: 1929-1965

X 2/27/1929 3.6%

No paper loss

X

6/25/1929 33.4 but 2.3% stop loss

reached. first

A very bullish period and trading range took this speculative market

up 25% by September.

X

2/27/1930 2.3% paper loss reached

Below 200-day ma

X

4/16/1930 Right at peak before

collapse. No paper loss

DJI had reversed from falling 200-day ma.

X 8/18/1931 25.1%

No paper loss

DJI was below 200-day ma

(Using exttreme Brearish Mode B16 to cover)

X

3/23/1933 - 2.3% paper loss reached

DJI was below 200-day ma

X

3/3/1936 3.3% 2.3% paper loss reached 3 % paper loss

X

8/10/1936 7.5% No paper loss.

X 7/13/1939 Dropped

below lower band. but no good buy signal

X 5/29/1945

Dropped to lower band but no automatic Buy.

X 6/5/1948

2.8% No Paper Loss

X 7/7/1954

1.7% No paper loss.

X

4/3/1961 -2.0% DJI rose

until May. 3.5% Paper Loss