Santa Claus Buy B13

Peerless 2013

(C) Dec. 20, 2015 William Schmidt, Ph.D.

There have been 73

Buy B13s. The average B13 gain was 9.7%.

The biggest average gain (+18.0%) was seen in the year of

Mid-Term Elections. It was only 7.0% in the years of Presidential

Election Years.

Size of Gains:

Number of Cases

Returns by Size

of Gain

-----------------------

No. Pct.of Total

=>.10

25 .342

=>.05 - <.10 14

.192

=>.02 - <.05 25

.342

=>0 - <.02

6 .082

<0

3 .041

--------------------------------------

Total

73 1.0 (100%)

BREAKDOWN of BUY B13 TRADES: 1929-2013

=====================================

No. Date of Buy Peerless DJI Pct Paper

Signal Gain Loss

=============================================================================

1 19281218 B13 275.4 .135 None

---------------------------------------------------------------------

2 19321219 B13 60.1 .047 .061

----------------------------------------------------------------------

3 19331218 B13 97.2 .139 .019

----------------------------------------------------------------------

4 19341217 B13 100.9 .031 .013

----------------------------------------------------------------------

5 19351217 B13 140.6 .111 .012

----------------------------------------------------------------------

6 19361217 B13 180.8 .048 .027

---------------------------------------------------------------------

7 19371217 B13 124.9 .032 .05

----------------------------------------------------------------------

8 19381219 B13 150.4 .027 .005

----------------------------------------------------------------------

9 19391218 B13 149.2 .024 .004

----------------------------------------------------------------------

10 19401217 B13 130.5 .011 .016

----------------------------------------------------------------------

11 19441219 B13 151.6 .082 .019

----------------------------------------------------------------------

12 19451217 B13 190.4 .046 .006

----------------------------------------------------------------------

13 19471217 B13 179.8 -.013 .013

----------------------------------------------------------------------

14 19481217 B13 175.9 .024 .005

----------------------------------------------------------------------

15 19491220 B13 197.2 .119 .004

----------------------------------------------------------------------

16 19501218 B13 231.0 .122 .005

----------------------------------------------------------------------

17 19511217 B13 265.8 .032 .006

----------------------------------------------------------------------

18 19521217 B13 285.7 .022 .001

----------------------------------------------------------------------

19 19531217 B13 282.7 .056 .015

----------------------------------------------------------------------

20 19541222 B13 397.1 .18 .022

----------------------------------------------------------------------

21 19551219 B13 481.8 .077 .041 No SC rally..Judged S10 1/10/1956

----------------------------------------------------------------------

22 19571217 B13 425.7 .527 None

----------------------------------------------------------------------

23 19581223 B13 566.4 .148 None

----------------------------------------------------------------------

24 19591221 B13 675.9 .005 .009

----------------------------------------------------------------------

25 19601219 B13 615.6 .139 .008

----------------------------------------------------------------------

26 19611218 B13 727.7 .005 .01

----------------------------------------------------------------------

27 19621217 B13 645.5 .455 .008

----------------------------------------------------------------------

28 19631219 B13 763.9 .229 .009

----------------------------------------------------------------------

29 19641217 B13 863.6 .087 .001

----------------------------------------------------------------------

30 19651217 B13 957.9 .029 .005

----------------------------------------------------------------------

31 19661219 B13 798.99 .111 .016

----------------------------------------------------------------------

32 19671218 B13 881.65 .031 None

----------------------------------------------------------------------

33 19691218 B13 783.79 .033 None

----------------------------------------------------------------------

34 19701223 B13 823.11 .139 None

----------------------------------------------------------------------

35 19721218 B13 1013.25 .034 .013

----------------------------------------------------------------------

36 19731217 B13 811.12 .045 None

----------------------------------------------------------------------

37 19741217 B13 597.54 .447 .013

----------------------------------------------------------------------

38 19751217 B13 846.27 .193 .009

----------------------------------------------------------------------

39 19761220 B13 972.41 .012 None

----------------------------------------------------------------------

40 19771219 B13 807.95 -.018 .002

----------------------------------------------------------------------

41 19781218 B13 787.51 .125 None

----------------------------------------------------------------------

42 19791218 B13 838.65 .032 .041 0.8% over 21-dma. Fell to 1.8% LB on 1/3

----------------------------------------------------------------------

43 19801217 B13 928.5 .048 None

----------------------------------------------------------------------

44 19811217 B13 870.53 .001 .002

----------------------------------------------------------------------

45 19831219 B13 1244.61 .03 None

----------------------------------------------------------------------

46 19841217 B13 1176.79 .096 None

----------------------------------------------------------------------

47 19851224 B13 1519.15 .202 .011

----------------------------------------------------------------------

48 19861217 B13 1918.31 .254 .011

----------------------------------------------------------------------

49 19881222 B13 2160.36 .075 .007

----------------------------------------------------------------------

50 19891218 B13 2697.53 .042 .003

----------------------------------------------------------------------

51 19901217 B13 2593.32 .167 .049 0.9% over 21-dma. Fell to 4.9% LB on 1/9

----------------------------------------------------------------------

52 19911217 B13 2902.28 .156 None

----------------------------------------------------------------------

53 19921217 B13 3269.23 .071 None

----------------------------------------------------------------------

54 19931217 B13 3751.57 .058 None

----------------------------------------------------------------------

55 19941219 B13 3790.7 .464 .011

----------------------------------------------------------------------

56 19951218 B13 5075.21 .093 .008

----------------------------------------------------------------------

57 19961217 B13 6308.33 .087 None

----------------------------------------------------------------------

58 19971217 B13 7957.41 .153 None

----------------------------------------------------------------------

59 19981217 B13 8875.82 .255 None

----------------------------------------------------------------------

60 19991217 B13 11257.43 .019 .010

----------------------------------------------------------------------

61 20001218 B13 10645.42 .025 .031

----------------------------------------------------------------------

62 20011217 B13 9891.96 .023 None

----------------------------------------------------------------------

63 20021217 B13 8535.39 .028 .027

----------------------------------------------------------------------

64 20041217 B13 10649.92 .025 .027

----------------------------------------------------------------------

65 20051219 B13 10836.53 .068 .011

-----------------------------------------------------------------------

66 20061218 B13 12441.27 -.003 .016

----------------------------------------------------------------------

67 20081218 B13 8604.99 .04 .021

----------------------------------------------------------------------

68 20091217 B13 10308.26 .069 .039 0.5% over 21-dma. Fell to 2.6% LB on 12/20

----------------------------------------------------------------------

69 20101217 B13 11491.91 .114 None

----------------------------------------------------------------------

70 20111219 B13 11766.26 .054 .025

----------------------------------------------------------------------

71 20121217 B13 13235.39 .147 .022

----------------------------------------------------------------------

72 20131217 B13 15875.26 .04 None

----------------------------------------------------------------------

73 20131217 B13 15356.87 .055 None

----------------------------------------------------------------------

Total N0.= 73 .097

Returns by Year

---------------

No. Avg.Gain Pct.of Total

Pres. Election Years 20 .062 .274

Year after Pres.El.Yr. 20 .083 .277

Mid-Term Election Yr. 17 .18 .233

Year before Pres.El.Yr. 16 .07 .219

----------------------------------------------------------------------

Total 73 .097 1.0 (100%)

Returns by Day of Month

-----------------------

No. Avg.Gain Pct.of Total

-------------------------------------------------------

1-10 0 0 0

11-20 67 .094 .918

21-31 6 .124 .082

-------------------------------------------------------

Total 77 .098 1.0 (100%)

|

======================================================

(C) 2012 www.tigersoft.com

Last updated 12/23/2012

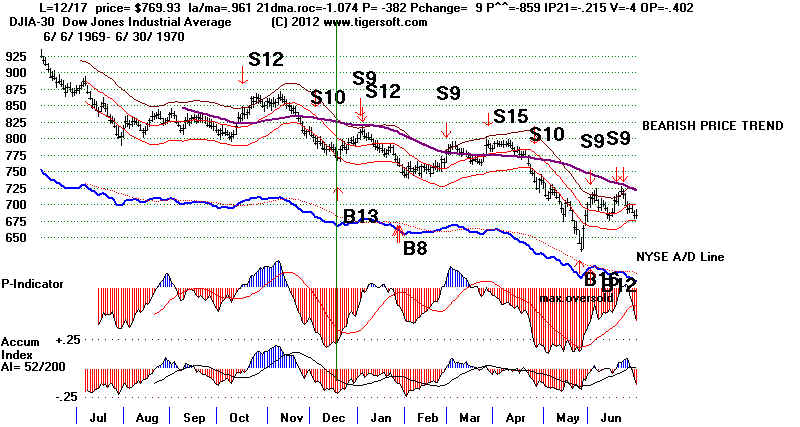

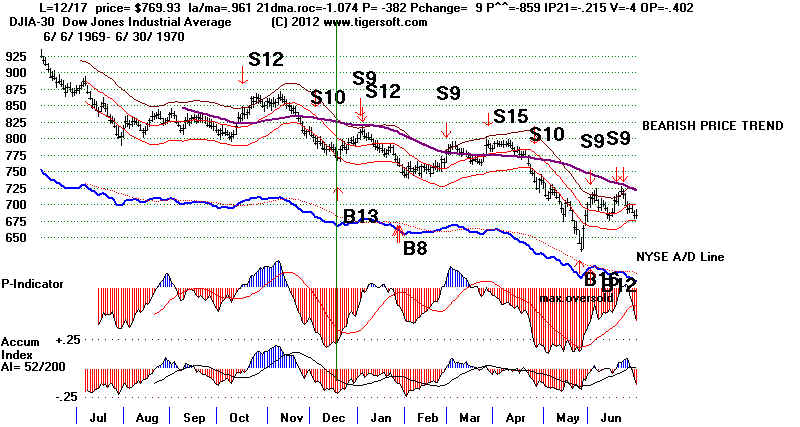

The odds of the DJI rising in the 10 trading days after December

17th are

89% and the average gain is more than 2% in the period 1965 to

2011. The

regularity of a Santa Claus rally is important. It shows

being well-known

as a bullish period does not prevent it from workign over and

over again.

Perhaps, it shows how self-fulfilling such expectations are.

Perhaps,

it shows what a positive and generous mood can do for stocks.

Too bad,

this mood cannot last the whole year.

As defined here and shown in blue, are the 69 Buy

B13s ebtween 1928 and 2011.

They may only occur when the DJI closes between below the

2% upper band between

December 17th and December 24th. There are no internal

strength or Presidential

Election cycle limitations.

The Buy B13 is not to be trusted if there has been a Peerless

Sell Sell S9 or Sell S12 signal

within the last ten days, or after December 7th. All

pre-December 17th December Sell S4s

prevent a Buy B13 from being shown. See December

1968. These disallowed

"Buy B13s" are shown in red here.

In Green you can see that such a signal would usually

work out well if the DJI closed above the 2% upper band.

In red, you can see the

cases where there was an earlier Sell after December 7th.

Very few Buy B13s are reversing signals. So, the average

gains are sometimes

very big. In 20 cases they were more than 10%.

The signals allow a buyer to

get ready for what often is a January take-off in prices.

Buy B13s work both

in on-going bull markets and at bottoms of bear markets.

Even in a severe

bear market, like 1929 to 1932, you can see from the red

notations below that

in severe bear markets, like in December 1970 and 1973, Buy

B13s brought

very tradeable rallies.

Paper Losses.

But they are not perfect. Below are the cases where a paper

loss would have

been more than 3%. ^ of the 69 Buy B13s brought a paper

loss of more than 4%.

Date

la/ma

21-dmaroc

P-I

IP21

VI

OPct Gain

Paper Loss

====================================================================================

12/19/32

1.002

-.554

-62 -.096

-160

-.097

3.7%

5%

In a bear market.

-------------------------------------------------------------------------------------------------------------------------------------------------------

12/17/37 1.014 -.251 -567 -.131 -238 .085 3.2% 5%

In a bear market.

-----------------------------------------------------------------------------

12/19/38 1.009 -.191 -330 -.118 -116 .088 -0.7% 9.3%

DJI did rally to 2.4% band on 1/4/39

------------------------------------------------------------------------------

12/19/55 .997 -.086 65 -.148 -113 -.035 7.6% 6.3%

--------------------------------- ---------------------------------------------

12/17/81 .994 .277 -50 .03 -1 .252 -4.3% 7.7%

In a bear market.

------------------------------------------------------------------------------

12/17/09 .991 -.148 130 .015 -120 -.049 1.0% 4%

-----------------------------------------------------------------------------------

------------------- BUY B13s since 1928 ------------------------

Remember B13 cannot follow An S9/612 on 12/7/2007

To be trusted as normal they ust occur when the DJI close is

between .965 and 1.02 of the 21-day ma.

Date

la/ma

21-dmaroc

P-I

IP21

VI

OPct

Gain

Paper Loss

====================================================================================

12/18/28 .98 -.055

13.5% none

-------------------------------------------------------------------------------

(1929 - S12 on 12/5 DJI falls to 6.7% below 21-dma on 12/20

and

then rallies strongly)

-----------------------------------------------------------------------------

12/17/30 .926 -.988 -622

.034 -599 -.246

3.8% NONE

-----------------------------------------------------------------------------

12/17/31 .833 -4.28 -1367

-.285 -936 -.543 6%

3%

If one does not allow S6 in the Sanata Claus period.

12% 3%

-----------------------------------------------------------------------------

12/19/32

1.002

-.554 -62

-.096

-160

-.097

3.7%

5%

-----------------------------------------------------------------------------

12/18/33

.974 -.215

-42

-301

-.226

-.107

12.0%

2%

-----------------------------------------------------------------------------

12/17/34

.993

.141

159

-.029

.202

3.6

1%

------------------------------------------------- ----------------------------

12/17/35

.980

-.472

-280 -.214

-303

-.01

9.1%

1%

-------------------------------------------------------------------------------------------------------------------------------------------

12/17/36

.997

-.269

-237 -.143

-264

-.202

4.8%

3%

-------------------------------------------------------------------------------------------------------------------------------------------

12/17/37

1.014

-.251

-567 -.131

-238

.085

3.2%

5%

--------------------------------------------------------------------------------------------------------------------------------------------

12/19/38

1.009

-.191

-330

-.118 -116

.088

-0.7%

9.3%

Rallies to 2.4% bandon 1/4/39 150.4

to 136.40

-------------------------------------------------------------------------------------------------------------------------------------------

12/18/39

1.005 -.16

-253

-.10

-71

-.252

-2.9%

3%

Reversing Buy Rallied to 2.6% upper band 1/3/1940 top

--------------------------------------------------------------------------------------------------------------------------------------------

12/17/40

.993 -.461

-287 -.129

-95

-.158

2.4%

2%

-------------------------------------------------------------------------------------------------------------------------------------------

12/17/41

.960

-.709

-403

.004 -234

-.393

4.1%

3%

------------------------------------------------------------------------------

12/17/42 1.029 Perfect Buy

------------------------------------------------------------------------------

12/17/43 1.02 excellent Buy

------------------------------------------------------------------------------

12/19/44

1.018

.464

703

.209

132

.489

8.2%

2%

-------------------------------------------------------------------------------------------------------------------------------------------

12/17/45

.991 -.043

116

.071

-34

.109

4.6%

1%

-------------------------------------------------------------------------------------------------------------------------------------------

(12/17/46 1.026 .336

-162

.155 -57

.255 5%

174.50-184.40 )

------------------------------------------------------------------------------

12/17/47 1.00 -.04 -148 .072 -96 .088 -1.3% -1.3%

------------------------------------------------------------------------------

12/17/48 1.004 -.014 -267 -.102 -137 -.021 3.1% 0%

-------------------------------------------------------------------------------

12/20/49 1.013 .233 208 .216 14 .113 9.2% 1%

-------------------------------------------------------------------------------

12/18/50 1.01 .109 392 .027 114 .156 231-275 none

--------------------------------------------------------------------------------

12/17/51 1.013 .222 67 .055 -41 .104 6.5% 1%

--------------------------------------------------------------------------------

12/17/52 1.01 .472 484 .174 120 .359 2.2% none

--------------------------------------------------------------------------------

12/17/53 1.01 .375 151 .164 -18 .096 5.9% 1%

--------------------------------------------------------------------------------

12/22/54 1.017 .538 378 .078 116 .268 397 -486 3%

--------------------------------------------------------------------------------

12/19/55 .997 -.086 65 -.148 -113 -.035 7.6% 6.3%

------------------------------------------------------------------------------

December 12 Sell S1 and Sell S12 on 12/6/56

12/17/56 1.027 .337 -121 -.002 -230 .142 8.9%

----------------------------------------------------------------------------

12/17/57 .972 -.369 -85 -.047 -200 -.026 34.5% none

-------------------------------------- -------------------------------------------

12/23/58 1.01 .144 -24 -.025 -247 .168 14.8% none

----------------------------------------------------------------------------------

12/21/59 1.017 .585 49 -.016 -177 .411 1.4% 1%

----------------------------------------------------------------------------------

12/19/61 1.018 .264 146 .074 -72 .1296 15.6 none

----------------------------------------------------------------------------------

12/17/62 1.001 .303 224 .095 127 .293 645.50- 740.30 1%

---------------------------------------------------------------------------------

12/19/63 1.016 .46 -82 .015 -439 .325 763.90-938.90 1%

---------------------------------------------------------------------------------

12/17/64 .989 -.297 -328 -.138 -761 -.138 8.7% none

---------------------------------------------------------------------------------

12/17/65 1.008 .016 50 -.002 6 .019 2.9% 1%

------------------------------------------------------------------------------

12/19/66 .995 -.252 -62 .027 1 -.108 11.1% 2%

------------------------------------------------------------------------------

12/18/67 1.002 .297 75 .002 3 .231 3.0% none

------------------------------------------------------------------------------

Sell S4 on December 5

12/17/68 .997 .082 173 .047 12 .028 -3.6% 17%

-----------------------------------------------------------------------------

---------------------------------------------------------------------------------

12/28/69 .982 .982 -767 -.189 -3 -.374 3.3% none

Reversing

----------------------------------------------------------------------------------

12/23/70 1.016 ,820 511 .155 1 .557 13.9% none

----------------------------------------------------------------------------------

1971 1.039 powerful advance.

----------------------------------------------------------------------------------

12/18/72 .991 .111 -20 .065 0 .192 3.4% 1%

----------------------------------------------------------------------------------

12/17/73 .978 -.907 -634 -.099 -5 -.243 5.4% none

---------------------------------------------------------------------------------

12/17/74 .992 -.986 -488 -.182 -3 -.098 597.54 to 877.42 none

---------------------------------------------------------------------------------

12/17/75 1.007 -.147 -210 -.027 -3 .074 19.3% 1%

---------------------------------------------------------------------------------"

12/20/76 1.011 .276 426 .052 2 .187 1.2% none

---------------------------------------------------------------------------------

12/19/77 .981 -.345 -60 -.063 -2 -.032 -1.8% -1.8%

---------------------------------------------------------------------------------

12/18/78 .975 -.098 17 -.007 -2 .038 787.51 to 893.94 none

also a Buy B9

-----------------------------------------------------------------------------

12/18/79 1.013 .33 309 .012 3 .138 3.2% 2%

---------------------------------------------------------------------------------

12/17/80 .968 -.715 -525 -.066 -8 -.061 4.8% none

---------------------------------------------------------------------------------

12/17/81 .994 .277 -50 .03 -1 .252 -4.3% 67/870

Already in a bear market

---------------------------------------------------------------------------------

1982 Sell S9 on 12/7 A buy B13 would have brought a quick gain from

1011.5o to 1070.92. Key support held and there was a Buy B6 also at this time.

---------------------------------------------------------------------------------

12/19/83 .985 -.063 -150 -.051 -7 -.158 3.4% none

---------------------------------------------------------------------------------

12/17/84 .991 -.294 -121 -.073 -5 -.099 1176.79 to 1825.89 none

----------------------------------------------------------------------------------

12/24/85 1.011 .435 137 .022 7 .06 20.2% 1%

----------------------------------------------------------------------------------

12/17/86 1.004 -.361 -189 .184 -8 .107 25.4% 1%

----------------------------------------------------------------------------------

12/17/87 1.02 .014 -95 .085 -12 .197 1.0% nobe

This slightly misses being an autimatic Buy,

----------------------------------------------------------------------------------

12/22/88 1.016 .529 50 .124 9 .098 2160.36-2771 1%

----------------------------------------------------------------------------------

12/18/89 .995 .272 -62 .073 -9 .096 4.2% none

----------------------------------------------------------------------------------

12/17/90 1.009 .224 222 .117 4 .093 2593-2470 -3306

----------------------------------------------------------------------------------

12/17/91 .998 -.167 -271 .014 -23 .182 13.9% none

----------------------------------------------------------------------------------

12/17/92 .998 .276 235 .064 =7 .136 3268-3968 1%

------------------------------------------------------------------------------------

12/17/93 1.011 .152 0 .05 -13 .348 5.8% none

------------------------------------------------------------------------------------

12/19/94 1.015 -.119 -206 .067 -3 -.082 3791-4802 none

------------------------------------------------------------------------------------

12/18/95 .993 .247 103 .072 -11 .182 9.3% 1%

------------------------------------------------------------------------------------

12/17/96 .982 -.074 -91 .051 -37 .042 8.3% none

------------------------------------------------------------------------------------

12/17/97 1.005 .39 92 .019 -37 .019 15.4% 4.7%

7957 -7580

----------------------------------------------------------------------------------

12/17/98 .982 -.145 -177 .055 -45 .001 22.3% none

----------------------------------------------------------------------------------

12/17/99 1.024 .402 -463 -.041 -108 .107 1.9% none

----------------------------------------------------------------------------------

12/18/00 .985 -.306 1 -.075 -140 -.076 1.9%

Note on 2/5/2001 2.5% upper band reached and VI= -3. Should be an S9V

10645.42 to 10965.85

----------------------------------------------------------------------------------

12/17/01 .999 .024 54 .062 -97 -.061 2.3% 3%

----------------------------------------------------------------------------------

12/17/02 .985 -.06 119 -.024 -96 -.184 2.8% 3%

----------------------------------------------------------------------------------

not a signal

12/17/03 1.028 .525 375 .048 9 .286 would be 5.8% none

------------------------------------------------------------------------------------

12/17/04 1.009 .113 206 .102 -17 .212 1.9% none

------------------------------------------------------------------------------------

12/19/05 .999 .128 232 -.103 -16 -.08 6.8% 2%

------------------------------------------------------------------------------------

12/18/06 1.012 .131 216 ,039 -9 .168 -0.3% 1%

------------------------------------------------------------------------------------

2007 S9/S12 on 12/6/2007

------------------------------------------------------------------------------------

12/18/08 1.011 .252 161 .066 18 .15 4.8% 2%

------------------------------------------------------------------------------------

12/17/09 .991 -.148 130 .015 -120 -.049 1.0% 4%

This doe snot take into account H/S Sell S5

-----------------------------------------------------------------------------------

12/17/10 1.018 .511 208 .147 113 .009 11.4% NONE

-----------------------------------------------------------------------------------

12/19/11 .995 -.004 -166 -.128 -93 -.096 FINISH

There was a Sell S9 on December 5, 2011.

-----------------------------------------------------------------------------------

12/17/12 1.017 .636 481 .144 76 .246 OPEN

------------------------------------------------------------------------------------

=================================================================================

Santa Claus Buy B13 (Earlier Documentation)

In the earlier version, shown below, B13s occur on the first DJI close

below the 21-day ma after December 16th and before

December 25th.

Only 3 of the 41 cases brought a paper loss of more than 4%.

Buy B13s: 1929-2011

Date Gain Paper Loss Internals

la/ma ma-roc P-I IP21 V-I OPct

12/17/28 15.7% none .961 .034 -38 -.027 -518 .044

12/18/29 1.3% 5.7% .999 .875 42 .116 -47 .034

12/17/30 3.8% none .926 -.988 -125 .034 -599 -.246

12/17/31 5.8% 3.5% .833 -4.28 -242 -.285 -936 -.543

12/20/32 6.0% 3.7% .984 -.814 -75 -.090 -186 -.143

12/18/33 12.0% 1.95% .974 -.215 -42 -.226 -158 -.107

12/17/34 4.9%/3.6% 1.3% .993 .141 28 -.029

12/17/35 9.1% none .980 .472 -51 -.214 -303 -.01

12/17/36 13.0%/4.8% 2.7% .997 -.269 -54 -.143 -264 -.234

none in 1937 - 1940

12/17/41 2.4%/4.1% 1.6% .993 -.461 -58 -.129 -95 -.112

none in 1942 - 1945

12/17/45 4.6% 0.7%

none in 1947 - 1952

12/22/53 7.0% 0.6%

none in 1954 - 1952

12/19/55 7.6% 4.0%

none in 1956

12/17/57 Big Gain none

none in 1958-1960

2/18/61 -1.8% 1.8%

2/18/62 9.6% none

none in 1964-1965

12/19/66 11.1% 1.7%

none in 1967-1968

12/17/69 5.2% none

none in 1970-1971

12/18/72 3.4%

1.3%

12/17/73 5.4% none

12/17/74 Big Gain none

12/22/75 20.3% none

none in 1976

12/19/77 -1.8%

1.8%

none in 1978-1979

12/17/80 4.8% none

12/17/81 -4.3% 8.6%

B13 could not reversed a Sell in a Bear Market.

none in 1982

12/19/83 3.4% none

12/17/84 big gain

none in 1985

12/18/86 25.8% 0.8%

none in 1987 -1988

12/18/89 4.2% none

none in 1990

12/17/91 13.9% none

12/17/92 big gain 0.5%

none in 1993-1994

12/17/95 9.3% 0.8%

12/17/96 8.3% none

12/18/97 17.1% 2.5%

12/17/98 22.3% none

none in 1999

12/19/00 6.3% 2.5%

12/17/01 2.3% 2.8%

12/17/02 2.8% 2.3%

none in 2003-2004

12/19/05 6.8% 1.6%

none in 2006-2007

12/22/08 5.8% none

*12/17/09 1.0%

4.8%

(*There has been an S9 on 11/13/2009 )

none in 2010-2011

------------------------------------------------------------------------------------------------------------------------------------------

B13s Eliminated

by Allowing for Sell S9s.

Date LA/MA

Gain Reversing Signal

12/17/40 .993 2.4%

1/10/41 S12

12/17/47 .999 -1.3%

1/14/48 S10 Bear

market