===================================================================

Buy B1s Presidential Election Years

1928...1932...2012

===================================================================

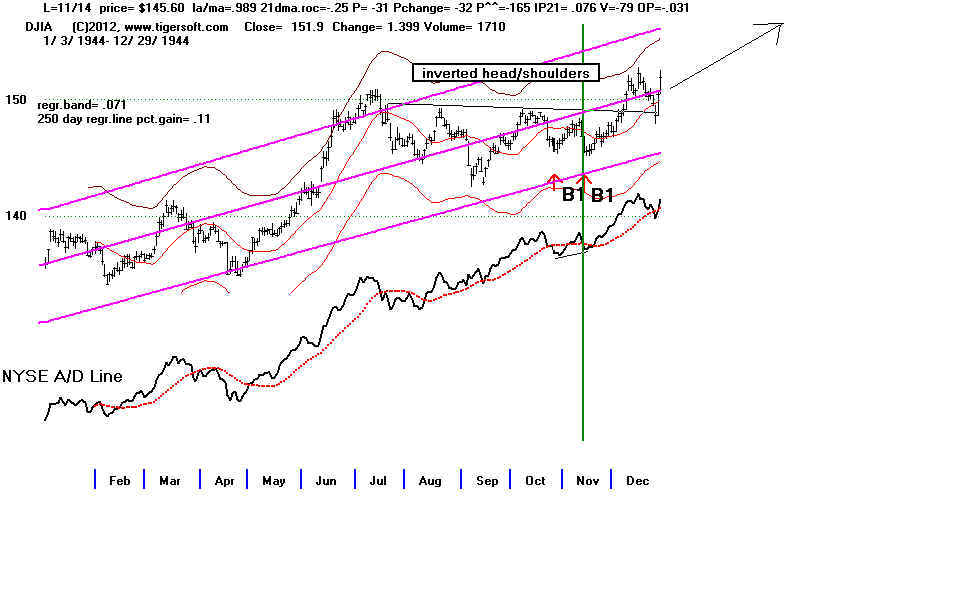

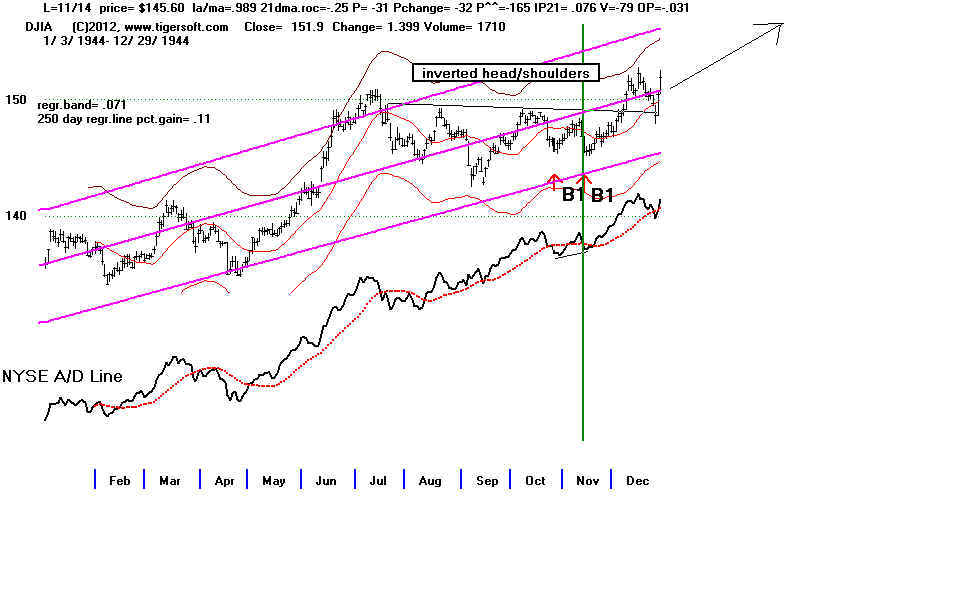

10/26/1944 145.8 +12.5% Sell S9 5/15/1945

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.988 .056 13 -20 72 .13 -28 0

No paper loss.

---------------------[---------------------------------------

11/14/1944 145.6 +12.6% Sell S9 5/15/1945

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.989 -.25 13 -32 -165 .076 -79 -.031

No paper loss.

-------------------------------------------------------------

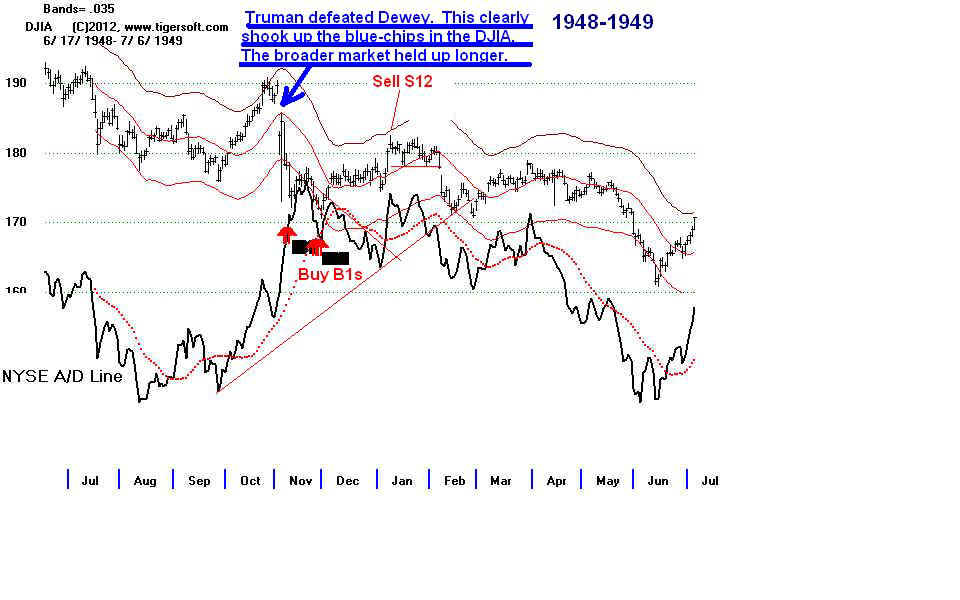

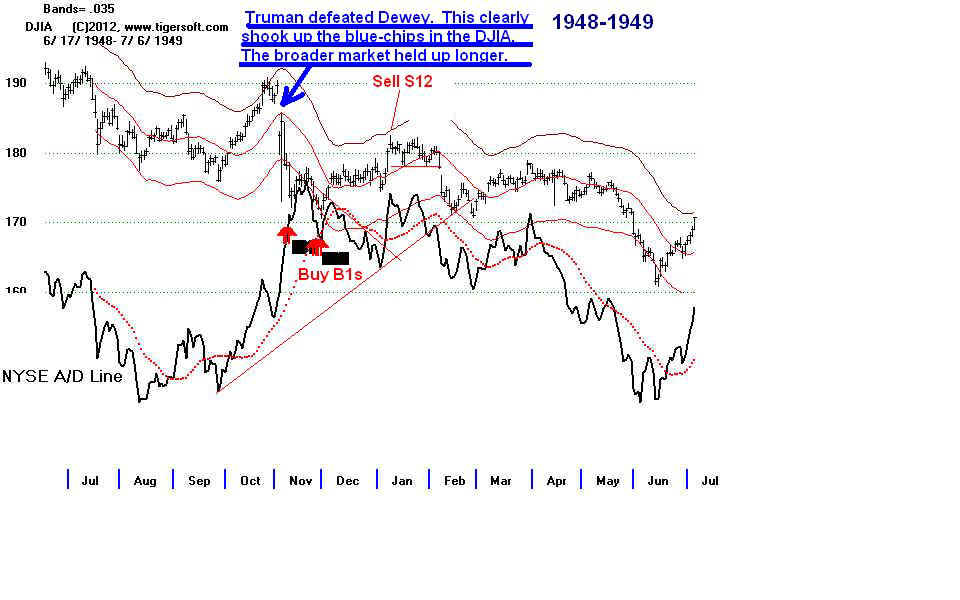

11/5/1948 178.4 +1.6% Sell S12 1/7/1949

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.962 -.18 149 43 -165 .161 222 .146

Paper loss = 4.0%

The New B1 Buys here were already designated as Buy B9s.

---------------------[---------------------------------------

11/14/1944 145.6 +12.6% Sell S9 5/15/1945

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.989 -.25 13 -32 -165 .076 -79 -.031

No paper loss.

-------------------------------------------------------------

11/5/1948 178.4 +1.6% Sell S12 1/7/1949

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.962 -.18 149 43 -165 .161 222 .146

Paper loss = 4.0%

The New B1 Buys here were already designated as Buy B9s.

-------------------------------------------------------------

11/24/1948 173.4 +4.6% Sell S12 1/7/1949

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.961 -1.078 78 -55 335 -.029 152 -.268

Paper loss = 1.3%

-------------------------------------------------------------

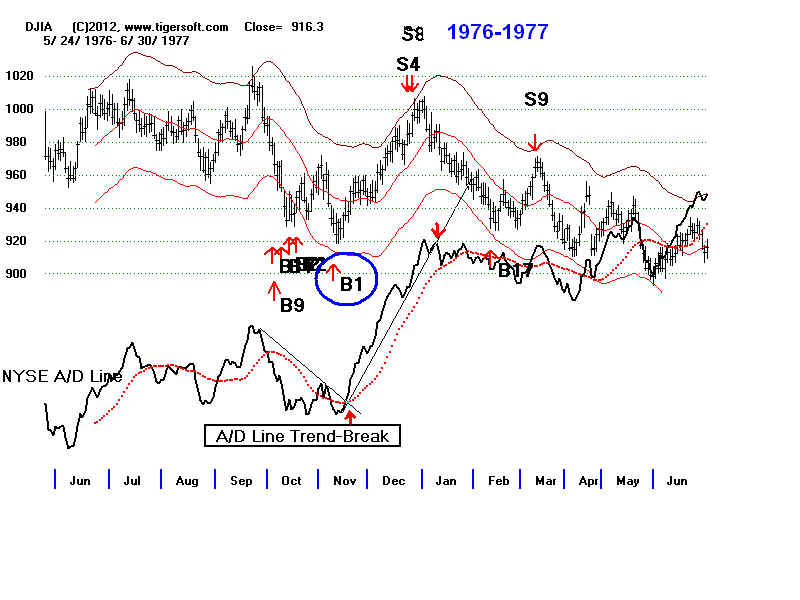

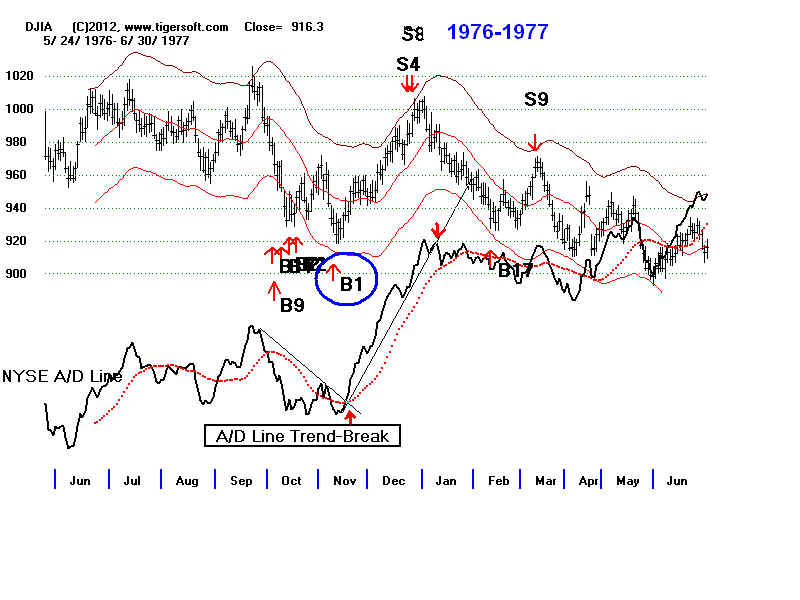

10/4/1976 977.98 +0.7% Sell S4 12/22/76

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.984 -.082 32 -8 60 .038 -1 -.174

Paper loss = 5.5%

The first Buy B9 has already been treated as a Buy B9

The second cluster is not now a Buy signal.

-------------------------------------------------------------

11/24/1948 173.4 +4.6% Sell S12 1/7/1949

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.961 -1.078 78 -55 335 -.029 152 -.268

Paper loss = 1.3%

-------------------------------------------------------------

10/4/1976 977.98 +0.7% Sell S4 12/22/76

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.984 -.082 32 -8 60 .038 -1 -.174

Paper loss = 5.5%

The first Buy B9 has already been treated as a Buy B9

The second cluster is not now a Buy signal.

-------------------------------------------------------------

11/9/1976 930.77 +5.8% Sell S4 12/22/76

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.983 -.271 -71 8 -131 .069 -3 -.047

Paper Loss = +.6%

-------------------------------------------------------------

11/9/1976 930.77 +5.8% Sell S4 12/22/76

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.983 -.271 -71 8 -131 .069 -3 -.047

Paper Loss = +.6%

-------------------------------------------------------------

10/2/1984 1191.36 +53.3% Sell S9 4/29/1986

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.983 -.324 -34 -28 -60 -.14 -4 -.094

Paper loss = 1.4%

-------------------------------------------------------------

11/16/1984 1187.94 +53.6% Sell S9 4/29/1986

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.983 -.324 -34 -28 -60 -.14 -4 -.094

Paper loss = 1.3%

These Buy B1s would be helpful additions.

-------------------------------------------------------------

10/2/1984 1191.36 +53.3% Sell S9 4/29/1986

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.983 -.324 -34 -28 -60 -.14 -4 -.094

Paper loss = 1.4%

-------------------------------------------------------------

11/16/1984 1187.94 +53.6% Sell S9 4/29/1986

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.983 -.324 -34 -28 -60 -.14 -4 -.094

Paper loss = 1.3%

These Buy B1s would be helpful additions.

-------------------------------------------------------------

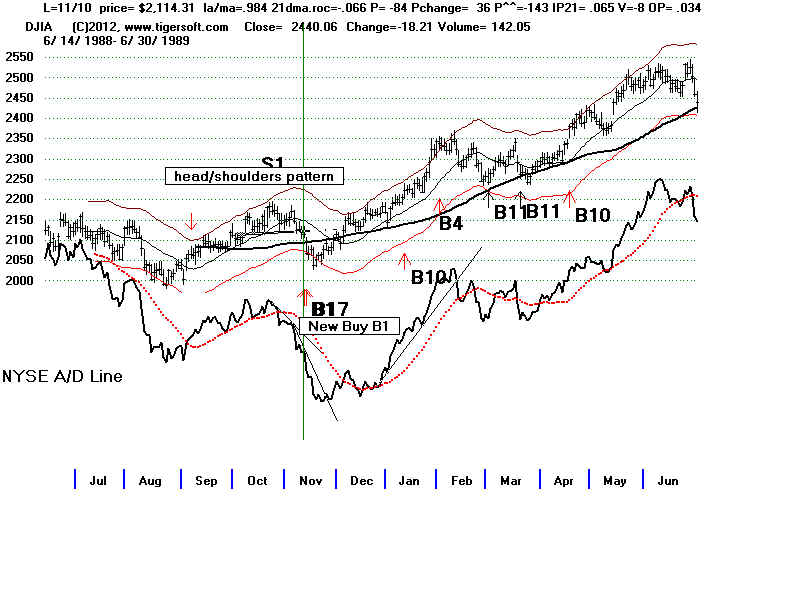

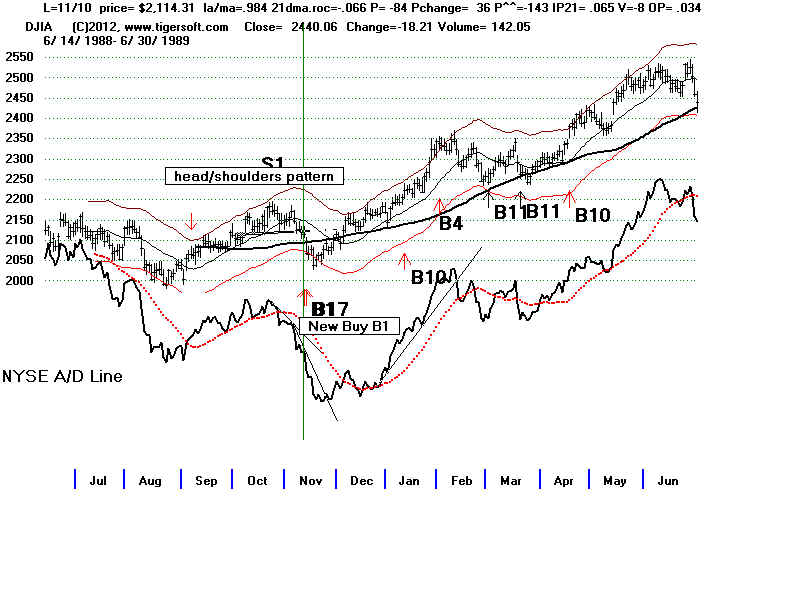

11/10/1988 2114.31 +31.1% Sell S9 10/4/1989

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.984 -.066 -84 36 -143 .065 -8 .034

Paper loss = 3.6%

The Buy B1 here is also a Buy B17 on exisiting software.

The NASDAQ was underperforming the DJI at this time.

It fell from 378.40 to a low of 365.07 on 11/21/1984 before turning up.

-------------------------------------------------------------

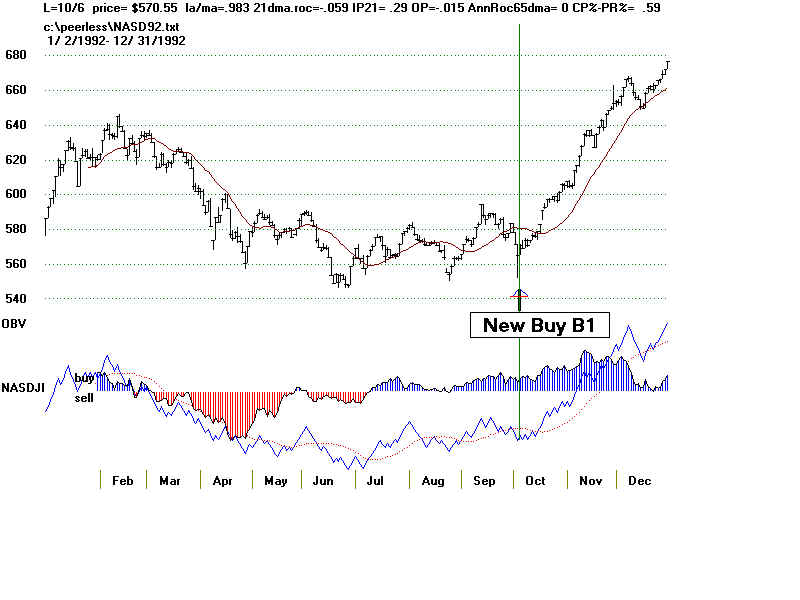

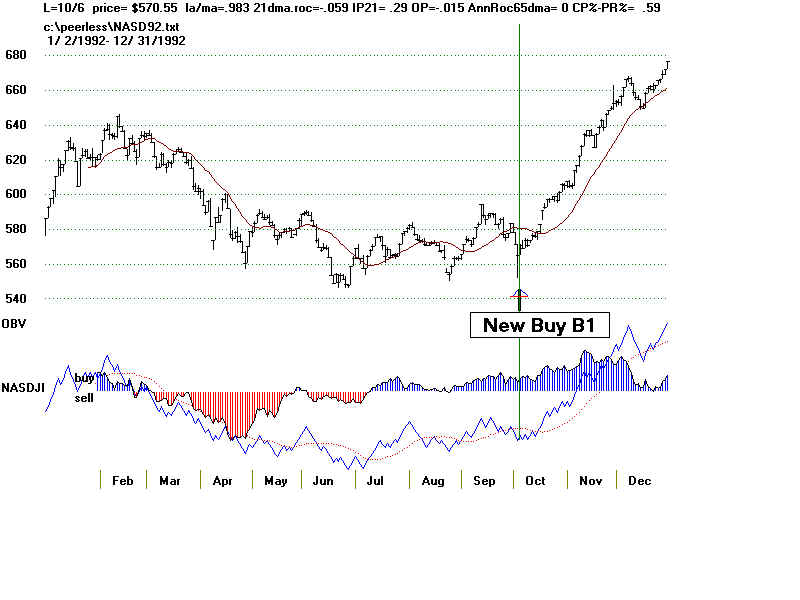

10/6/1992 3178.19 +24.8% Sell S4 2/3/1994

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.984 -.066 -84 36 -143 .065 -8 .034

Paper loss = 1.3%

The Buy B1 here is also a Buy B17 on exisiting software.

-------------------------------------------------------------

10/6/1992 3178.19 +24.8% Sell S4 2/3/1994

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.984 -.066 -84 36 -143 .065 -8 .034

Paper loss = 1.3%

The Buy B1 here is also a Buy B17 on exisiting software.

-------------------------------------------------------------

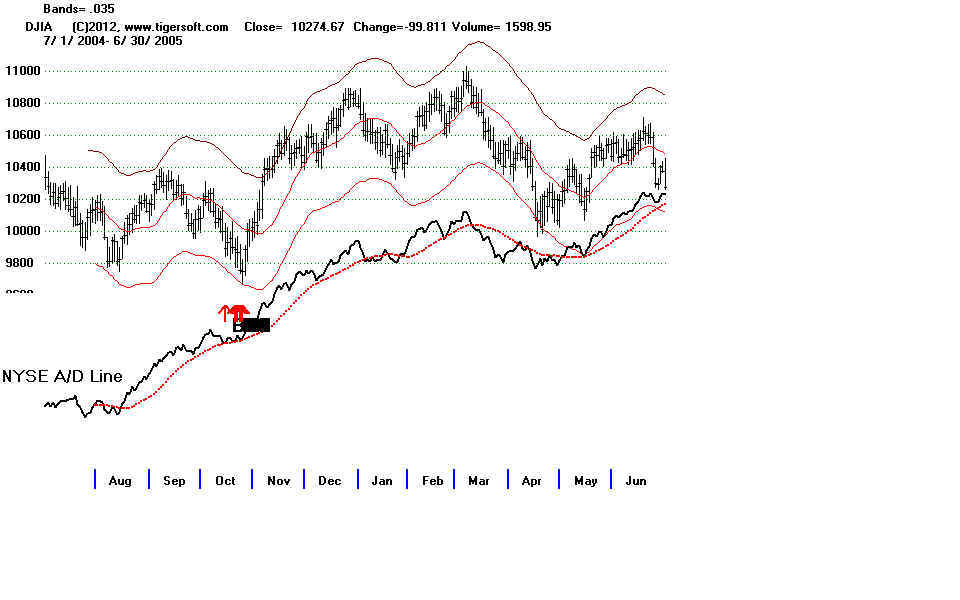

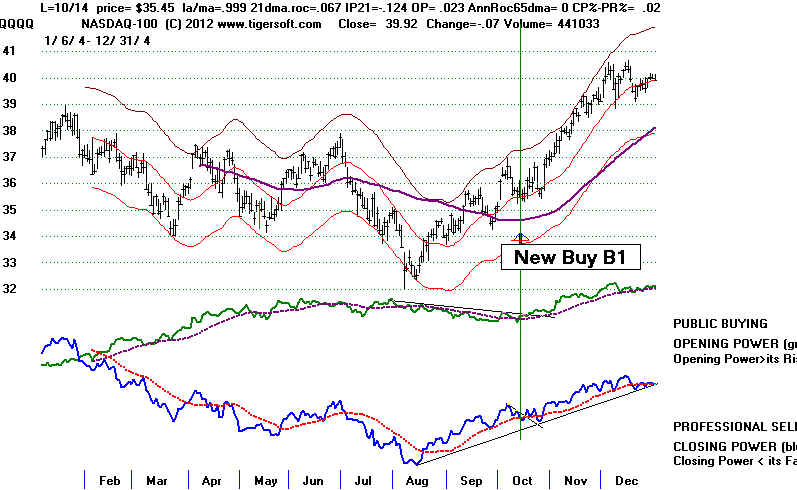

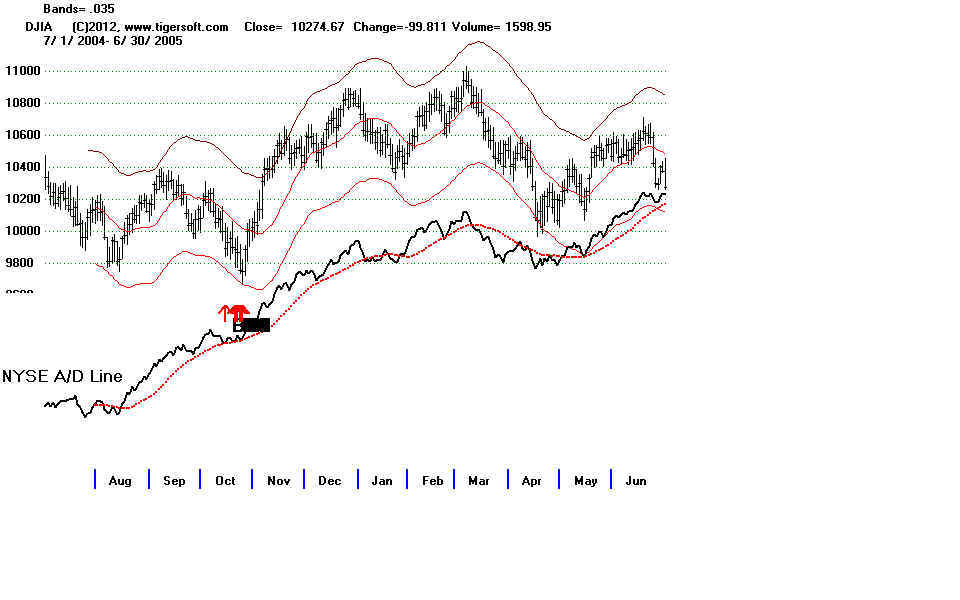

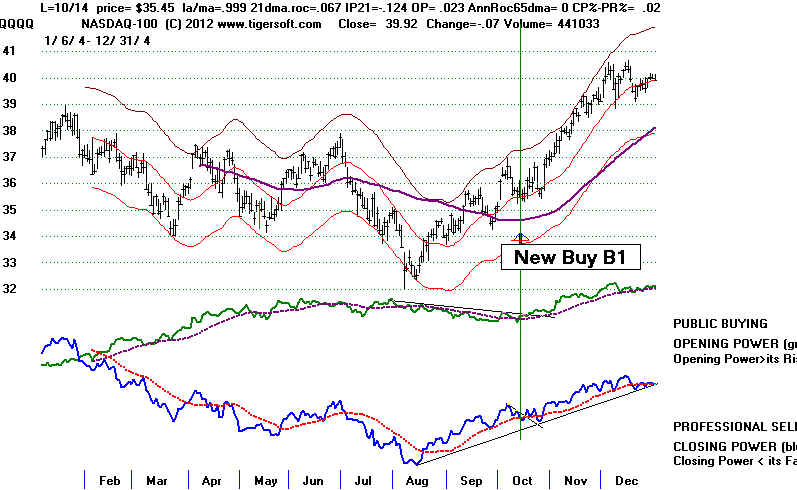

10/14/2004 9894.45 +9.7% Sell S8 12/28/2004

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.984 -.066 -84 36 -143 .065 -8 .034

Paper loss = 0.1%

On the NASDAQ chart, the NASDJI was very positive.

-------------------------------------------------------------

10/14/2004 9894.45 +9.7% Sell S8 12/28/2004

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.984 -.066 -84 36 -143 .065 -8 .034

Paper loss = 0.1%

On the NASDAQ chart, the NASDJI was very positive.

-------------------------------------------------------------

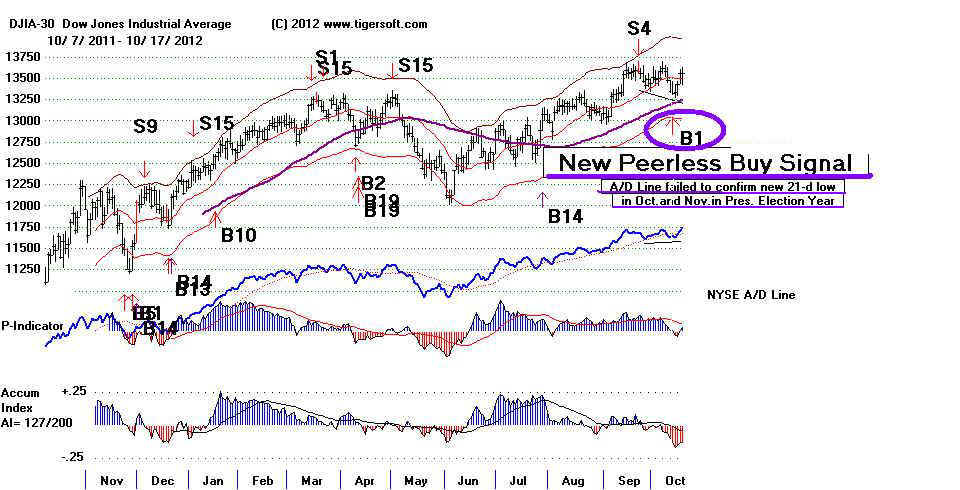

10/11/2012 13326.39

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.986 -.006 32 2 32 -.119 -65 -.086

Paper loss = open

-------------------------------------------------------------

10/11/2012 13326.39

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.986 -.006 32 2 32 -.119 -65 -.086

Paper loss = open

-------------------------------------------------------------

Number = 11 Avg = 19.1%

===================================================================

New Buy B1s The Year after a Presidential Election Year

1929...1933...2009

===================================================================

10/11/1977 832.3 -4.7% Sell S10 1/7/1978

10/17/1997 7847.03 +17.0% Sell S15 4/21/1998

10/28/1997 7498.32 +22.5% Sell S15 4/21/1998

10/21/2005 10215.22 +13.3% Sell S9 5/5/2006

Number = 4 Avg = 12.0%

===================================================================

New Buy B1s in The Second Year after a Presidential Election Year

1930...1934...2010

===================================================================

11/6/1950 222.5 +23.6% Sell S4 9/7/1951 275.1

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.986 -.006 32 2 32 -.119 -65 -.086

No Paper loss

-------------------------------------------------------------

10/4/1962 582.4 +20.4% Sell S10 7/1/1963

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.982 .335 -114 35 -317 -.082 -595 -.017

6% Paper loss ...DJI declined to 558.00 before rallying.

-------------------------------------------------------------

11/30/1966 791.59 +12.1% Sell S12 4/25/1967

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.981 -.241 16 -15 41 .078 3 -.082

0.8% Paper loss ...DJI declined to 875.69 before rallying.

-------------------------------------------------------------

10/7/1994 3979.43 +3.3% Sell S9 10/17/1994

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.984 .342 -323 -9 -511 -.043 -50 -.188

No Paper loss

-------------------------------------------------------------

10/1/2002 7938.79 +10.5% Sell S12 1/6/2003

11/30/2010 11006.02 +16.4% Sell S9 5/2/2011

Number = 6 Avg = 14.4%

===================================================================

New Buy B1s in The Third Year after a Presidential Election Year

1930...1934...2010

===================================================================

11/4/1943 136.3 +8.5% Sell S2 6/21/1944

10/29/1951 260.4 +5.3% Sell S1 1/28/1952

10/14/1971 878.36 +9.2% Sell S1 4/6/1972

10/22/1971 852.37 +12.6% Sell S1 4/6/1972

10/11/1979 844.62 -3.5% Sell S10 10/19/1979

10/4/1991 2961.76 +11.6% Sell S15 4/14/1992

96 point paper loss. 3+%

11/15/1991 2943.20 +12.3% Sell S15 4/14/1992

10/19/2007 13522.02 +0.7% Sell S12 12/6/2007

DJI fell to 12743 before rallying. Paper Loss = 6%

Number = 8 Avg = 7.1%

|

---------------------[---------------------------------------

11/14/1944 145.6 +12.6% Sell S9 5/15/1945

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.989 -.25 13 -32 -165 .076 -79 -.031

No paper loss.

-------------------------------------------------------------

11/5/1948 178.4 +1.6% Sell S12 1/7/1949

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.962 -.18 149 43 -165 .161 222 .146

Paper loss = 4.0%

The New B1 Buys here were already designated as Buy B9s.

---------------------[---------------------------------------

11/14/1944 145.6 +12.6% Sell S9 5/15/1945

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.989 -.25 13 -32 -165 .076 -79 -.031

No paper loss.

-------------------------------------------------------------

11/5/1948 178.4 +1.6% Sell S12 1/7/1949

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.962 -.18 149 43 -165 .161 222 .146

Paper loss = 4.0%

The New B1 Buys here were already designated as Buy B9s.

-------------------------------------------------------------

11/24/1948 173.4 +4.6% Sell S12 1/7/1949

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.961 -1.078 78 -55 335 -.029 152 -.268

Paper loss = 1.3%

-------------------------------------------------------------

10/4/1976 977.98 +0.7% Sell S4 12/22/76

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.984 -.082 32 -8 60 .038 -1 -.174

Paper loss = 5.5%

The first Buy B9 has already been treated as a Buy B9

The second cluster is not now a Buy signal.

-------------------------------------------------------------

11/24/1948 173.4 +4.6% Sell S12 1/7/1949

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.961 -1.078 78 -55 335 -.029 152 -.268

Paper loss = 1.3%

-------------------------------------------------------------

10/4/1976 977.98 +0.7% Sell S4 12/22/76

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.984 -.082 32 -8 60 .038 -1 -.174

Paper loss = 5.5%

The first Buy B9 has already been treated as a Buy B9

The second cluster is not now a Buy signal.

-------------------------------------------------------------

11/9/1976 930.77 +5.8% Sell S4 12/22/76

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.983 -.271 -71 8 -131 .069 -3 -.047

Paper Loss = +.6%

-------------------------------------------------------------

11/9/1976 930.77 +5.8% Sell S4 12/22/76

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.983 -.271 -71 8 -131 .069 -3 -.047

Paper Loss = +.6%

-------------------------------------------------------------

10/2/1984 1191.36 +53.3% Sell S9 4/29/1986

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.983 -.324 -34 -28 -60 -.14 -4 -.094

Paper loss = 1.4%

-------------------------------------------------------------

11/16/1984 1187.94 +53.6% Sell S9 4/29/1986

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.983 -.324 -34 -28 -60 -.14 -4 -.094

Paper loss = 1.3%

These Buy B1s would be helpful additions.

-------------------------------------------------------------

10/2/1984 1191.36 +53.3% Sell S9 4/29/1986

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.983 -.324 -34 -28 -60 -.14 -4 -.094

Paper loss = 1.4%

-------------------------------------------------------------

11/16/1984 1187.94 +53.6% Sell S9 4/29/1986

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.983 -.324 -34 -28 -60 -.14 -4 -.094

Paper loss = 1.3%

These Buy B1s would be helpful additions.

-------------------------------------------------------------

10/6/1992 3178.19 +24.8% Sell S4 2/3/1994

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.984 -.066 -84 36 -143 .065 -8 .034

Paper loss = 1.3%

The Buy B1 here is also a Buy B17 on exisiting software.

-------------------------------------------------------------

10/6/1992 3178.19 +24.8% Sell S4 2/3/1994

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.984 -.066 -84 36 -143 .065 -8 .034

Paper loss = 1.3%

The Buy B1 here is also a Buy B17 on exisiting software.

-------------------------------------------------------------

10/14/2004 9894.45 +9.7% Sell S8 12/28/2004

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.984 -.066 -84 36 -143 .065 -8 .034

Paper loss = 0.1%

On the NASDAQ chart, the NASDJI was very positive.

-------------------------------------------------------------

10/14/2004 9894.45 +9.7% Sell S8 12/28/2004

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.984 -.066 -84 36 -143 .065 -8 .034

Paper loss = 0.1%

On the NASDAQ chart, the NASDJI was very positive.

-------------------------------------------------------------

10/11/2012 13326.39

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.986 -.006 32 2 32 -.119 -65 -.086

Paper loss = open

-------------------------------------------------------------

10/11/2012 13326.39

la/ma 21dma ROC P-I P-ch P^^ IP21 V-I OP

.986 -.006 32 2 32 -.119 -65 -.086

Paper loss = open