SELL S3 Peerless Software - December 13, 2013

Sell at

The Upper Band in February, March

April and May as long as Momentum and Breadth

Are Not above Moderately High Limits

There were no losses in any of the 11 Sell S3s. The

average DJI decline was 8.5%

at the time of the next Buy signal.

None took place in the Presidential Election year.

Size of Subsequent Declines

>10%

3

5%-9.99%

2

2%-4.99%

4

0%-1.99%

2

rallies

0 (number of losses if shorted.)

Sell S3s: 1928-2031

19350219 S3 105.9 .055 19390309 S3 151.3 .18 19470210 S3 183.6 .035 19510503 S3 263.1 .078 19670427 S3 894.82 .027

19690506 S3 962.06 .185

19740307 S3 869.06 .284

19910531 S3 3027.5 .038

20090511 S3 8418.77 .011

-------------------------------------------------

no. = 9 Avg. = Needs correction

PE 0 ---- PE +1 3 .071 PE +2 1 .284 PE +3 7 .063

January 0 ---- February 2 .045 March 2 .232 April 2 .028 May 5 .066 June 0 ---- July 0 ---- August 0 ---- September 0 ==== October 0 ---- November 0 ---- December 0 ----

1-10 4 .182 11-20 4 .023 21-31 3 .031

----------------------------------------------------------------------------------

Included in Peerless Software after April 5, 2013

(C) 2013 William Schmidt, Ph.D.

www.tigersoft.com

The 10 S3s since 1929 produce an average 4.9% DJI decline at the

next signal Except for

the April 1929, case they were all profitable and the biggest

paper loss was only 2.6%.

In a trading range, covering on a re-test of support is suggested

from the 1929 experience.

I like these signals because they validate the importance of the

upper 3.5% band over many

years. They also show seasonality. Aprils tend not to

produce market tops. So, not

allowing S3s until the end of the month seems appropriate.

The standards for Sell S3s have been refined as follows.

Sell S3s can only occur in February,

March and from April 26th to May 31st. The 65 day percent

change must not be below 2.2%.

We want a rally that can be reversed. The DJI must be

between 3.1% and 3.65% above the

21-day ma. The annualized rate of change of the

21-day ma must not be above 74% (.74).

The DJI must not be up more than 2% from the previous day. The

OPct is not allowed to be above +.58.

You can see below the an "X"

the cases this eliminates.

More effort could be done here. We have not yet tested

these standards on June, July,

August or September. I doubt that they would work well in

the last quarter when the market

is very often turning up from its typical May to October decline

or hesitation.

Date

Gain Paper

LA/MA

AnnRoc P-I

P-I

Adj.P-I

IP21 V-I

Opct

65 Day

Loss

Change

Pct

Change

------------------------------------------------------------------------

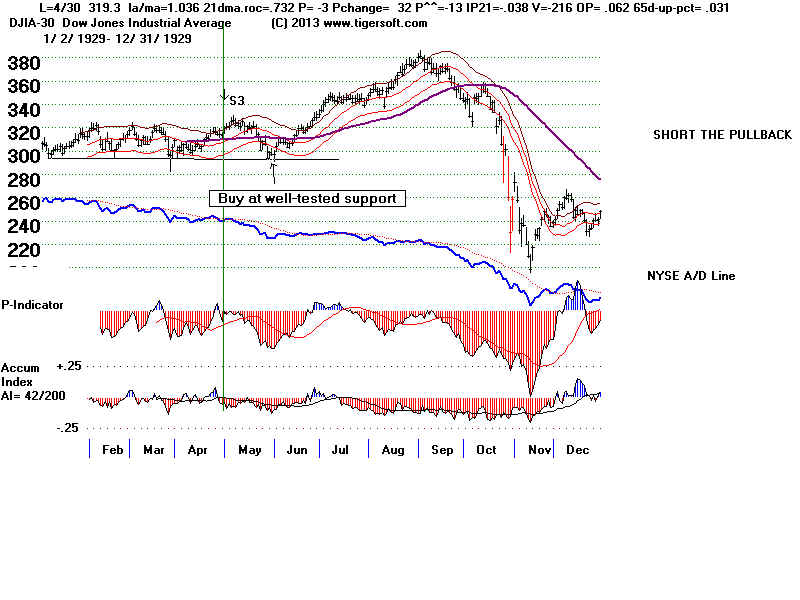

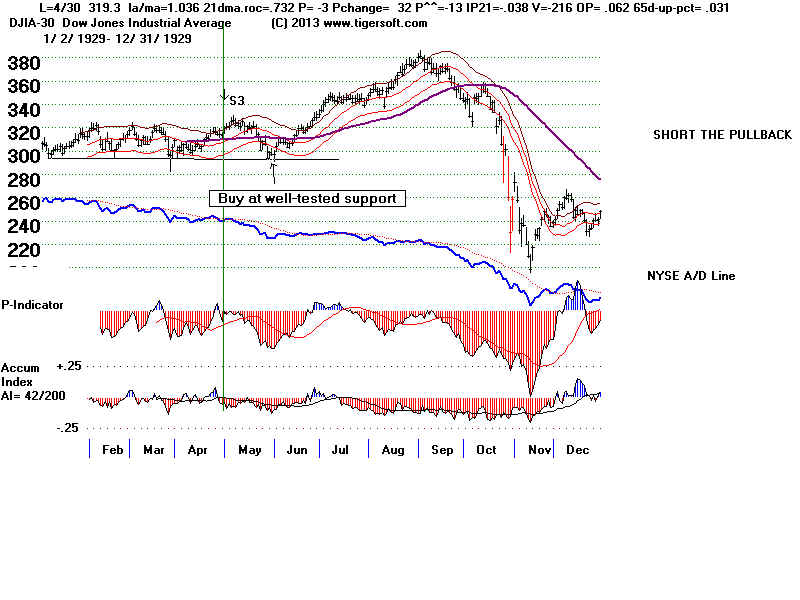

4/30/1929 -6.6% -6.6% 1.036 .732 -3 32 -13

-.038 -216 .062 .031

Late April is acceptable for a Sell S3.

The DJI did initially fall 3.5%. But there were not Buy signals.

One might have decided to cover this at support or a new closing low in May, which is a

month that bottoms are 4x more likely to be made than not.

May as Bottom and May as a Month for A Decline to Continue

Recoveries from

May bottoms (24)

1929, 1930, 1931, 1934, 1936, 1937, 1940, 1941

1944, 1947, 1951, 1952, 1955, 1956, 1960, 1966,

1967, 1970, 1972, 1974, 1976, 1977, 1981, 1983,

Failures To Rally in May (9)

1932, 1953, 1962, 1965, 1971, 1973, 1979, 1982, 2984,

In a flat trading range, prices often quickly bounce back and forth from resistance to

support and then resistance. Ignoring this would have

been costly. In that event, the trading range breakout should have been cause for

cutting short sale losses.

------------------------------------------------------------------------

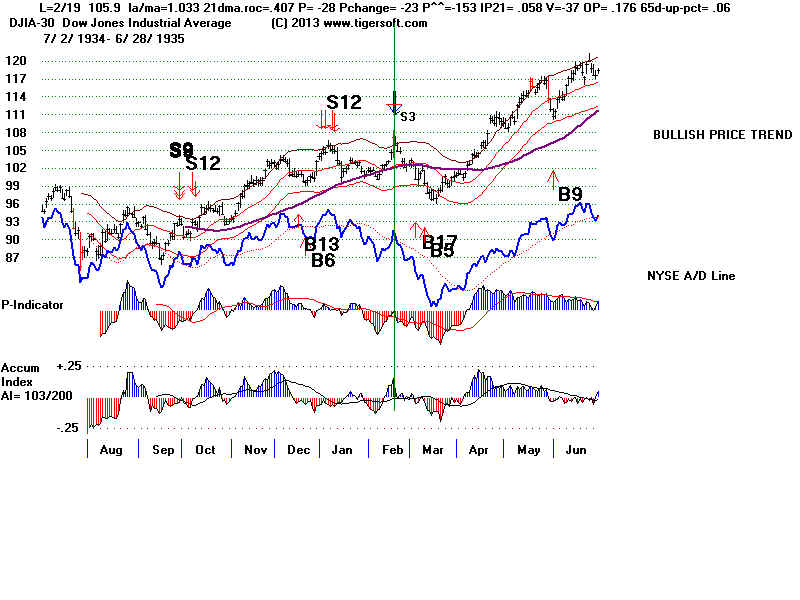

(1)

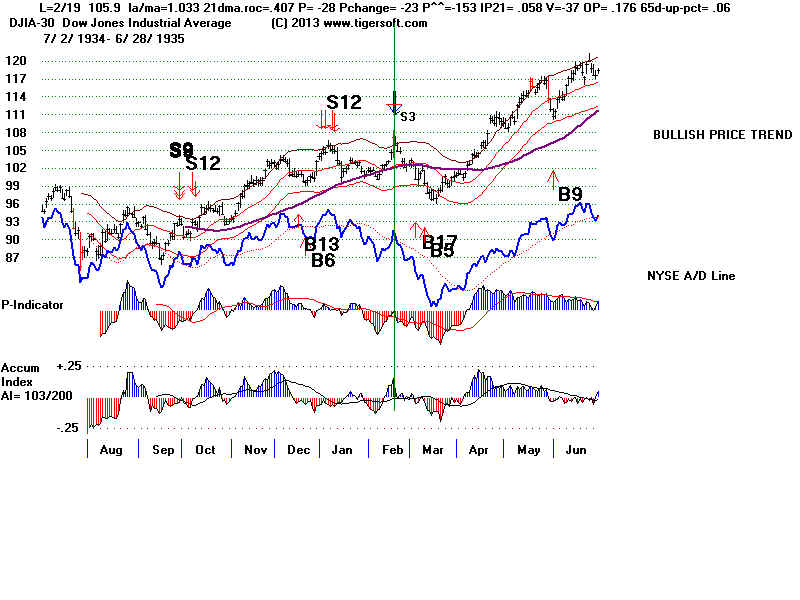

2/19/1935 +5.5% 0 1.033 .407 -28 -23

-153 .058

-37-.052 .06

------------------------------------------------------------------------

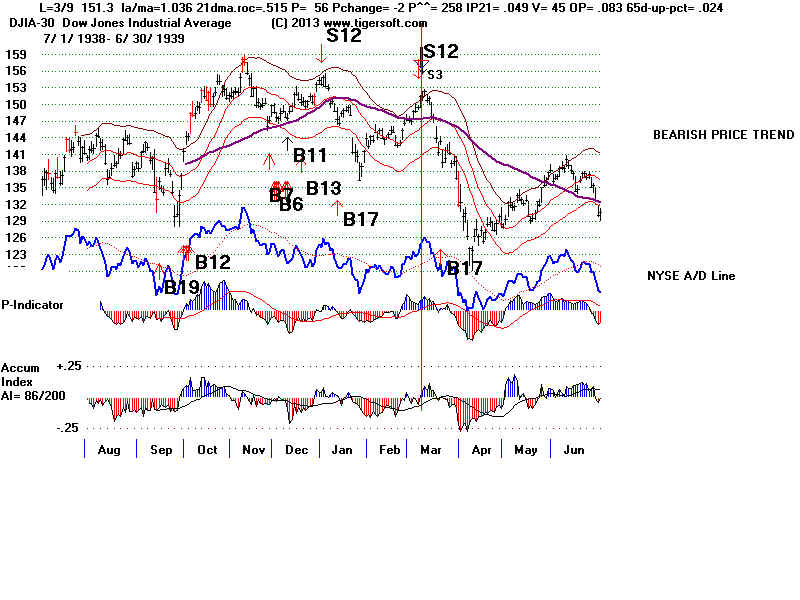

(2)

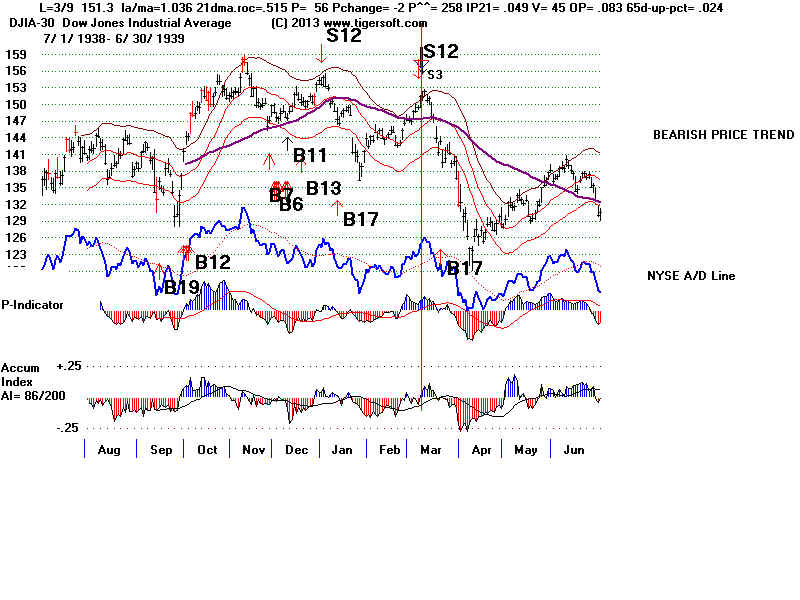

3/9/1939 Also an earlier S12

+5.2% 0 1.036

.515 56 -2 258

.049 45 .083 .024

------------------------------------------------------------------------

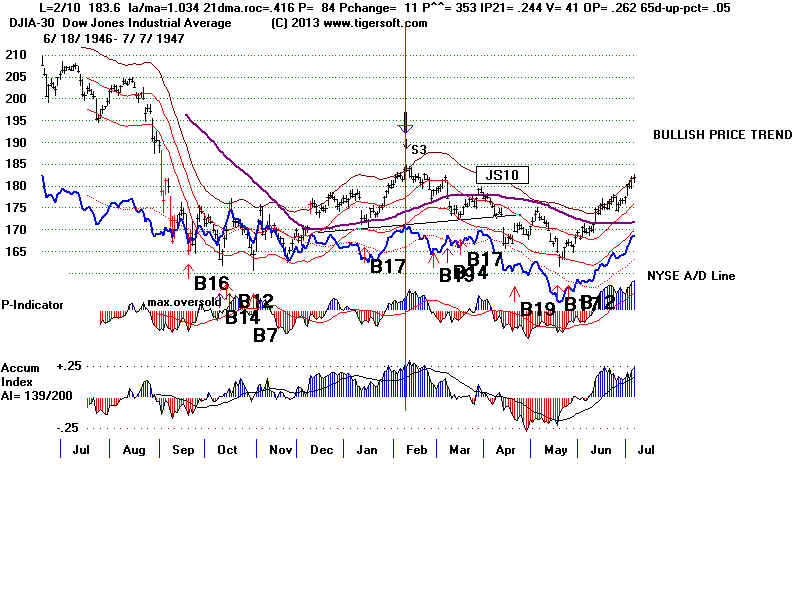

(3)

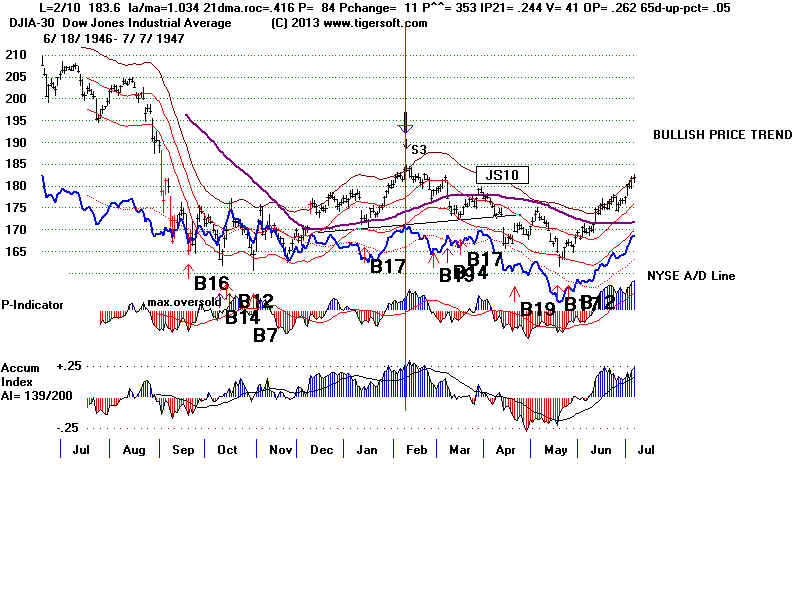

2/10/1947 +2.6% 0 1.034 .416 84 11

353 .244 41 .262 .05

------------------------------------------------------------------------

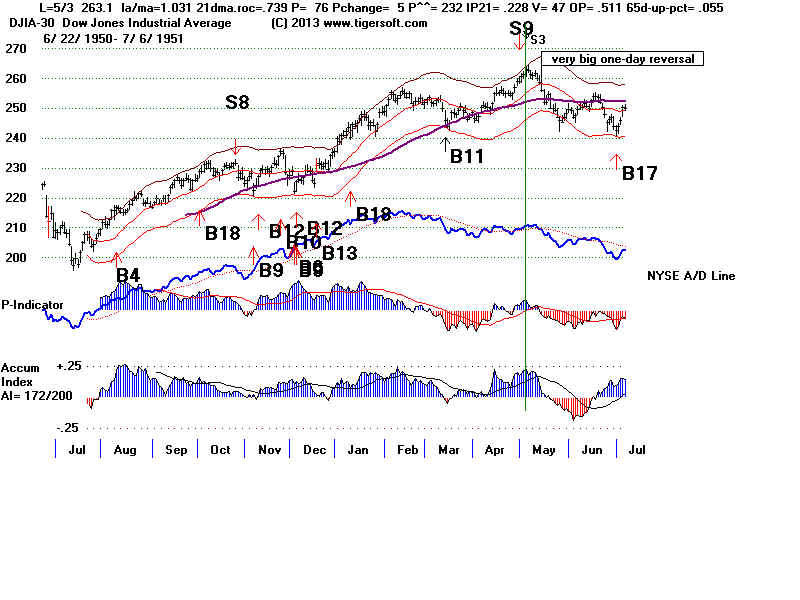

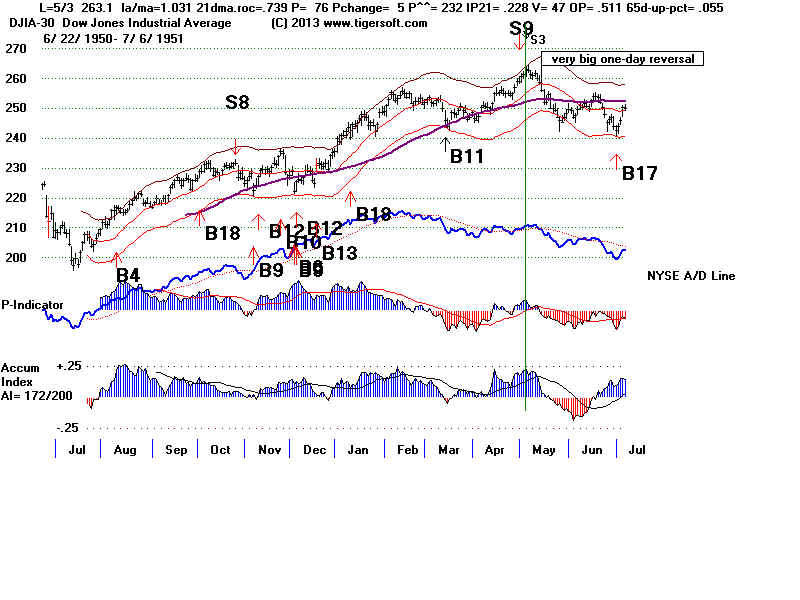

(4)

5/3/1951 +7.8% 0 1.031 .739 76

5 232 .228 47 .512 .055

------------------------------------------------------------------------

(5)

4/8/1963 X 1.035

.588 91 6 245 .092

97 .420 .062

Early April S3s are screened out. This rally did not peak until early June.

------------------------------------------------------------------------|

(6)

4/27/1967 +2.7% 1.6% 1.032 .326 45 14 114

.05 3 .273 .052

Late April is acceptable for a Sell S3.

------------------------------------------------------------------------

(7)

5/6/1969 +18.5% 0.7% 1.031 .553 78 44 175 .118

0 .309 .024

------------------------------------------------------------------------

(8)

3/7/1974 +5.5% 2.6% 1.035 .688 167 -10

298 .078 0 .343 .053

------------------------------------------------------------------------

5/11/1990 X Simulutaneous B14 - Too big a jump on

day of signal.

1.034 .316 -16 46 -31 .085

3 .31 .058

Jumps by more than 2.2% are not allowed.

------------------------------------------------------------------------

(9)

5/31/1991 +4.1% 0 1.034 .396 92 -4 170 .117 3 .38

.046

--------------------------------------------------------------------------

4/16/1992 X

1.032 .410 -66

-11 -128 .072 -11 .336 .032

Early April S3s are screened out. This rally did not peak until early June.

------------------------------------------------------------------------

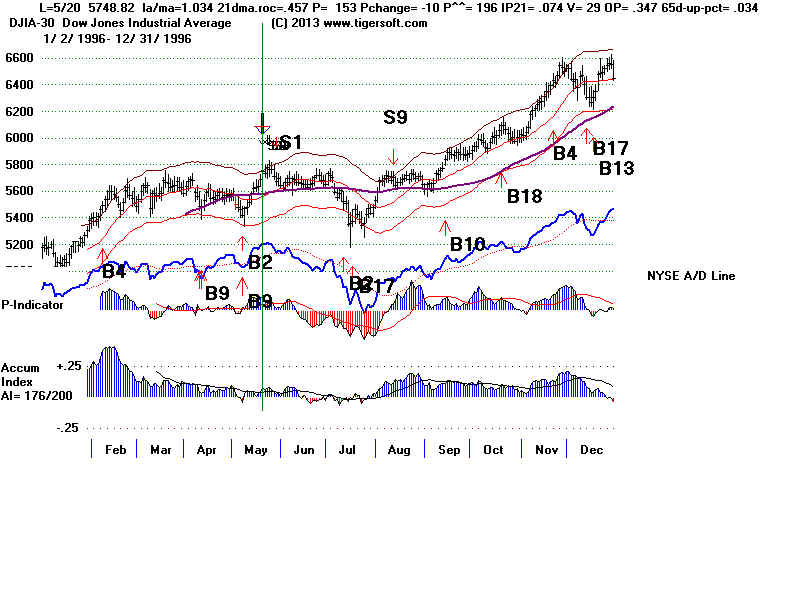

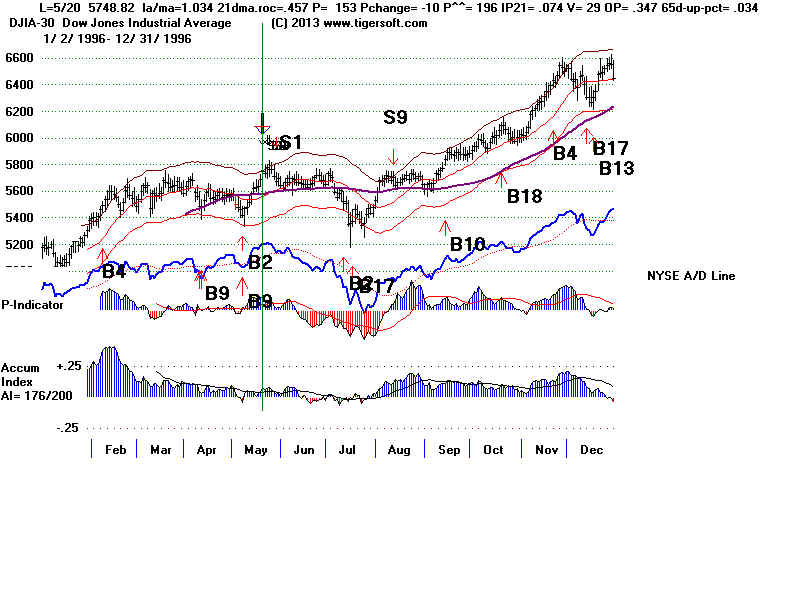

(10)

5/20/1996 +4.0% 0.5% 1.034 .457 153 -10

196 .074 29 .349 .034

------------------------------------------------------------------------

4/20/2007 X

1.032 .489

239 -16 216

.171 95 .683 .043

too high

Mid April S3s are screened out. This rally did not peak until

July.

---------------------------------------------------------------------------

4/26/2007 X

1.035 .668

321 48 289 .182 47 .592 .03

too high

----------------------------------------------------------------------------

5/11/2009 X

1.032 .49 501 -176 467 .032 107 .058 .041

too high too

high

--------------------------------------------------------------------------

3/23/2010 X

Premature 1.031 .571 590 67 573 .166

90 .436 .041

The high P-I cancels this as a Sell S3

too high

-----------------------------------------------------------------------------------

Avg Gain = +4.9%

|

|

|

|

|

|

|

|

|

|

====================================================================================

OLDER 2011 SELL S3 BELOW IS DISCONTINUED

====================================================================================

Negative Non-Confirmation of DJI Advance

by P-Indicator and V-Indicator with A Seemingly

High Accumulation Index.

Created 12/11/2010

Very Positive DJIA Accumulation Versus Bearishly Negative

P-Indicator and V-Indicator Readings.

Today's

Peerless internals show a very respectable +.13 reading from the Accumulation Index,

but negative Peerless P-I

(-14) and V-I (-8) numbers. The OPct is also negative, -.141. How bearish

is this? To test it, I

created tonight a new Peerless Sell signal based on the DJI being 1.4%

(CL/MA=1.014) over the 21-day

ma with a P-Indicator below -5, the V-I being 0 or less and the

OPct not being over +.35.

The results in the 81 year period from 1929 to 2010 are impressive,

I think. We should

consider putting a new Sell S3 into new Peerless software. Below are tits trading

results for the 14 cases that

resemble most the market now. More thought has to be given how

this affects the results of

the entire Peerless system, given the existing Buys and Sells.

With internal strength

readings like those now, the DJI fell to the lower band in 7 cases. Three

of these were in December.

In 4 cases (1930, 1933, 1935 and 1973), the DJI fell below the lower

band. If we accept this evidence to be sufficient to incorporate

the Sell S3 into our Peerless

arsenal, we would expect a

decline to the lower band in the next 6 weeks.

PEERLESS SELL S3 TRADING RESULTS:

1929-2010 |

#1

11/24/1930 DJI fell below lower band in 3 weeks.

+6.5% (regular Peerless mode)

CL/MA ROC P-I IP21 V-I Opct

1.021 .013 -17 +.139 -235 .13

8/7/1996 DJI fell half way to lower band and then rose sharply after

breakout into all-time high territory.

-2.1%

There was a breakout past well-tested resistance into all-time

high territory. At all-time, be prepared to quickly reverse the Sell S3.

CL/MA ROC P-I IP21 V-I Opct

1.041 .297 -31 +.134 -30 .281

|

Supplemental Materials

Bearish P-Indicator versus Bullish Accumulation Index.

The worsening breadth since early

November has only seen a limited decline in

Tiger's Current Accumulation Index

(IP21). It is a seeminlgy bullish +.113 despite the

P-Indicator being -97. The

recent IP21 drop is probably enough to give a Sell S9 if the DJI should

tag the upper 3.5% band or close more

than 2.5% above the 21-day ma. But even without a

major Sell, we should probably expect

only a retreat from the 11400 resistance to the 11100 support.

This would almost certainly cause

declines in the "Bearish" MINCP stocks. The "Bullish" MAXCP

stocks would need to consolidate their

recent very good gains.

Positive Current AI (IP21) and Much Weaker P-Indicator

I have studied many cases where there is

no Sell S9, but the P-Indicator is significantly

weaker than the Accumulation Index, as is

true now. In 10 if 12 cases, they brought declines

to at least the lower band, though

Decembers are a somewhat special case, because of the

seasonal bullihness. Here are the

cases that I could find.

12/8/2010 P and V-I are now lagging A/I badly

CL/MA ROC P-I

IP21 V-I

Opct

1.014 -.306 -97 +.113 -56 - .138

1. June 7, 1943 141.80 DJI

dropped to Lower Band.

CL/MA ROC

P-I IP21

V-I Opct

1.016 .248 -11 +.012 -113 .054

2. June 12, 1950 228.40 DJI dropped below Lower

Band.

CL/MA ROC P-I

IP21 V-I

Opct

1.027 .52 + 33 + .176

-50 .414

3. August 1, 1952 279.80 DJI dropped to

Lower Band.

CL/MA ROC P-I

IP21

V-I

Opct

1.013 .211 +23 + .086

-41 .409

4. July 26, 1955 468.40

DJI dropped to Lower Band.

CL/MA ROC P-I

IP21

V-I

Opct

1.02

.507 +10

+.057 -159

.385

5. Aptil 21, 1959 629.20

DJI dropped only half way to Lower Band from MA.

CL/MA ROC P-I

IP21

V-I

Opct

1.031 .367 -16 +.03

-251

.257

6.

November 8, 1962

DJI

rallied.

CL/MA ROC P-I

IP21

V-I

Opct

1.038 .445 -21 +.03 -340

.051

7.

April 20, 1971

DJI dropped below first tagging of Lower Band.

CL/MA ROC P-I

IP21

V-I

Opct

1.03 .41

+15 +

.057 0

.499

8

October 11, 1983

DJI dropped to Lower

Band.

CL/MA ROC P-I

IP21 V-I

Opct

1.015 .345

+ 39

+ .127 2

.12

9

uly 1, 1986

DJI dropped below Lower Band.

CL/MA ROC P-I

IP21 V-I

Opct

1.018

.265 +

3 +.109

2

.173

10 August 16, 2002

DJI dropped below Lower Band.

CL/MA ROC P-I

IP21

V-I

Opct

1.042 .522

+ 2

+ .134

-180

-.067

11 October 21, 2002

DJI dropped below Lower Band.

CL/MA ROC P-I

IP21

V-I

Opct

1.09

.842 -141

+ .064

-157 .058