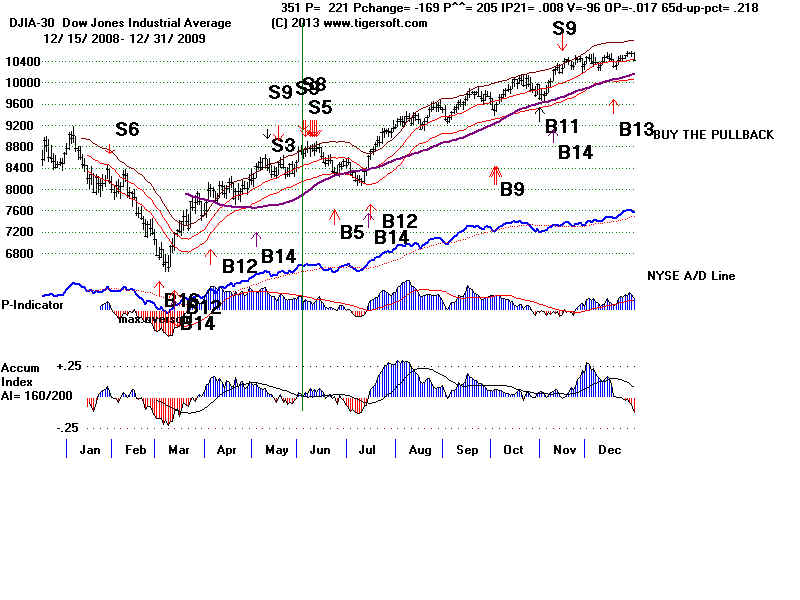

DJI new high clearly unconfirmed by P-Indicator

at upper band from May to July in any year.

19300402 S5 285.3 .398

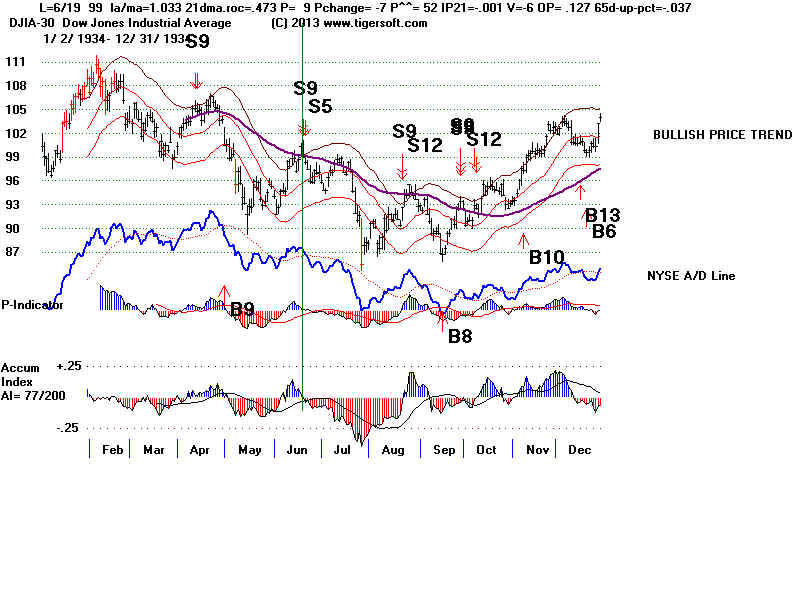

19340619 S5 99 .124

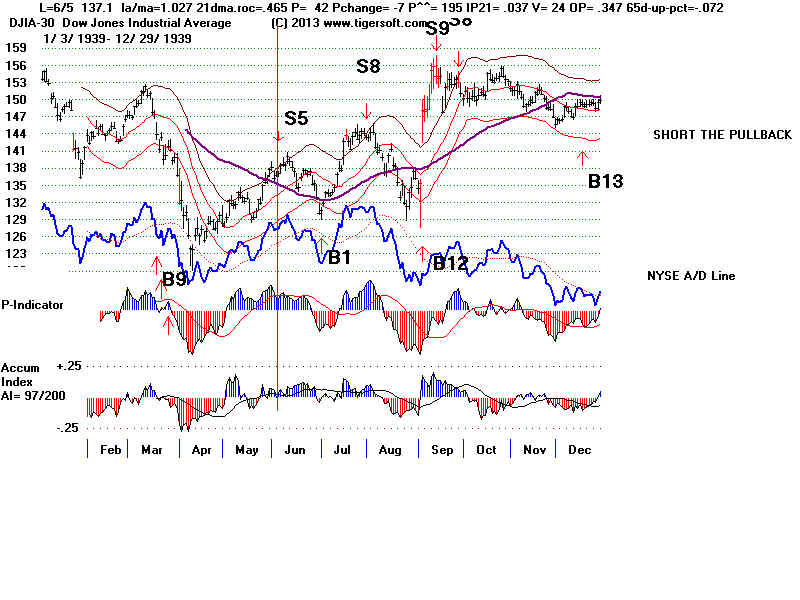

19390605 S5 137.1 .031

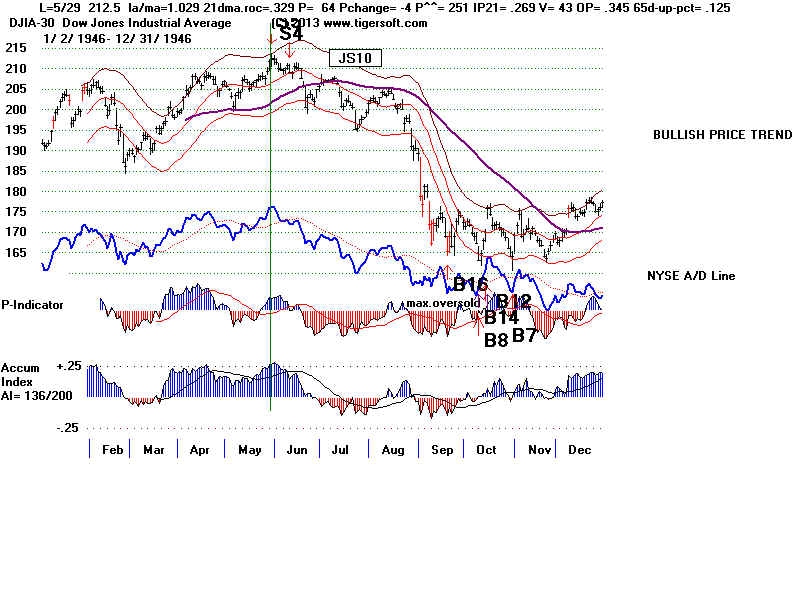

19460529 S5 212.5 .232

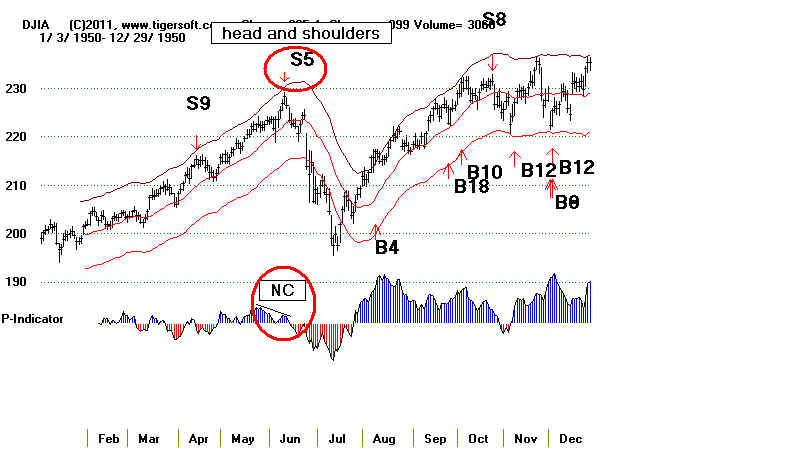

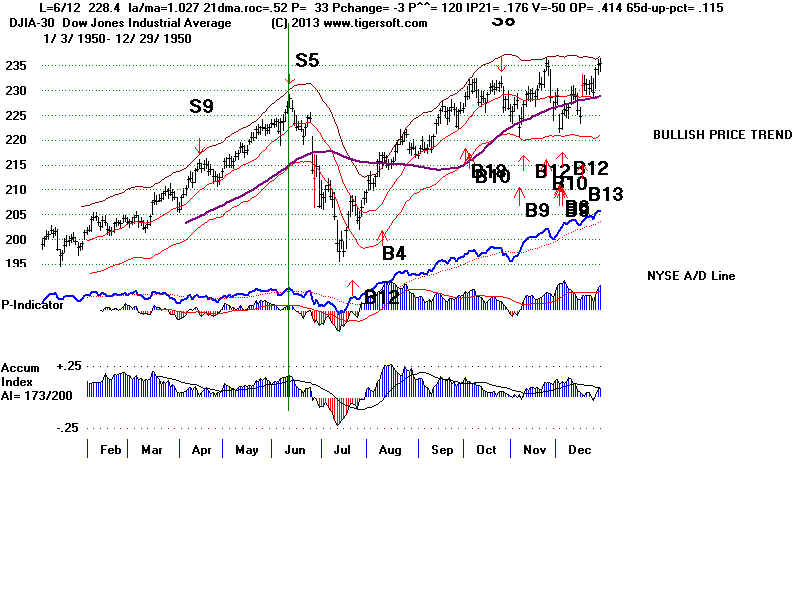

19500612 S5 228.4 .091

19560404 S5 518.7 .079

19760621 S5 1007.45 .047

19780606 S5 866.51 .05

19840501 S5 1182.89 .081

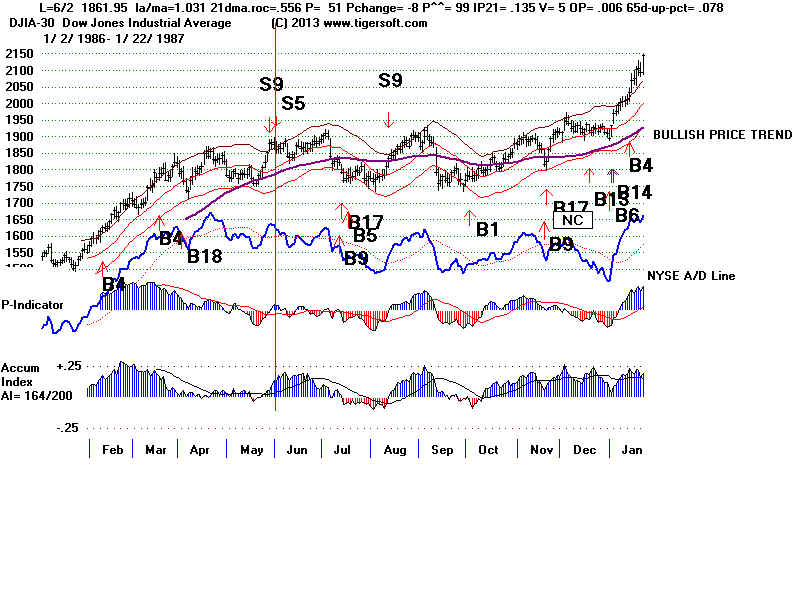

19860602 S5 1861.95 .022

19880408 S5 2090.19 .028

19910603 S5 3035.33 .04

19920421 S5 3348.61 .028

19990706 S5 11135.12 .091

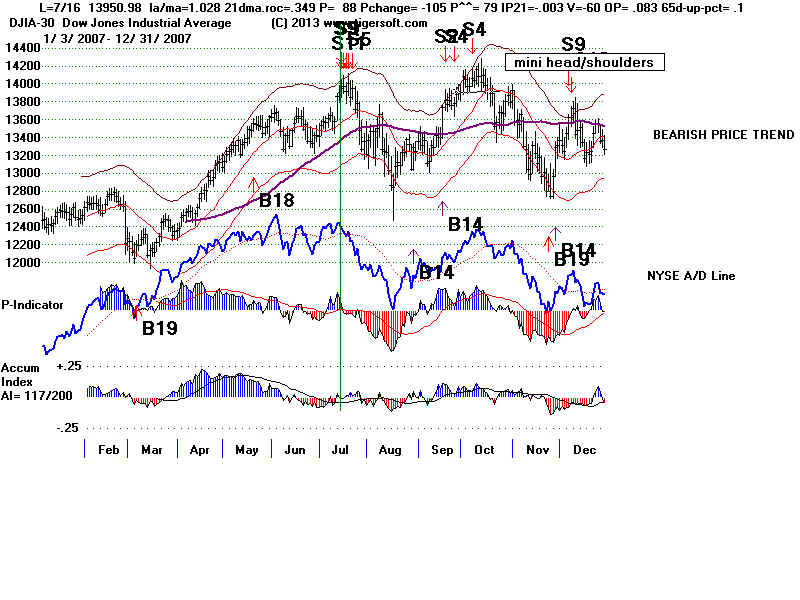

20070716 S5 13950.98 .047

20110503 S5 12807.51 .051

20130715 S5 15484.26 .038

-------------------------------------------------

no. = 17 Avg. = .087

3 6 8 0 0 PE 5 .053 PE +1 1 .038 PE +2 6 .153 PE +3 5 .052 January 0 - February 0 - March 0 - April 4 .133 May 3 .051 June 7 .036 July 7 .058 August 0 ---- September 0 ---- October 0 ---- November 0 ---- December 0 ---- 1-10 10 .087 11-20 4 .075 21-31 3 .102 |

=====================================================

DJI new high clearly unconfirmed by P-Indicator

at upper band from May to July in any year.

4/7/2013 (C) 2013 William Schmidt, Ph.D. www.tigersoft.com

Sell S5's occur on new highs near the

upper band that are seriously unconfirmed

by the P-Indicator. Look at the charts for these signals below. You will see

that the

P-Indicator was less than half the levels of their 45 day highs. Note also that

they can only occur from May to July 20th. This rule is caused by the fact that

there

were two potential Sells S5s after the 21st of July which failed badly.

As refined here, they have been profitable, reliable and without large paper losses.

The biggest paper loss was only 2.5%. 7 of the 12 had no paper losses. A number

of them occurred at important tops, May 1946, June 1950, July 1990, July 2007,

and May 2011.

In all cases, the P-Indicator declined from its readings the day before on the day of the

signal.

The annualized momentum of the 21-day ma must not be over +.57. The highest

V-I

Indicator since 1965, when this indicator could first be calculated, was only +5.

I would not trust a Sell S5 with a V-Indicator above, say, +40 now.

The highest time-adjusted P-I among the Sell S5s was +251. If a Sell S5 should

occur

with the adjusted P-I above +260, I would discard the signal. While the IP21, OPct

and

65-day Pct Change indicators have a wide range when all years are considered, the

program

puts limits on them in the third year after the Presidential Election because of the

possibility

that the market may be extraordinarily strong into mid-Summer, at least, as in 1935,

1943, 1955, 1959, 1963, 1971, 1975, 1983, 1987, 1995, 2003 and 2011. July

Sell S5s in a Presidential Election year should not be allowed because of this

possibility unless the V -Indicator was negative, which was true in July 1999

and July 2007.

Sell S5s: 1929-2013

(1)

6 /19/1934 Also an S9.

12.4% none

1.033 .473

9 -7 52

-.001

-6

.128 -.037

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

6 /5/1939 3rd Year of Presidential cycle.

3.8% 2.2%

1.027 .465

42 -7 195

.037

24

.347 -.072

There should be a new Buy B? at

lower band at end of June. This is often a reversal time upwards.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

(2)

5/29/1946 An S4 occurred two weeks later. Remarkably, right at top!

23.2% none

1.029 .329

64 -4

251

.269

43

.345

.125

highest highest highest

--------------------------------------------------------------------------------------------------------------------------

(3)

6/12/1950 228.4 5.0% gain. 1% paper loss. Not a reversing signal

Remarkably, right at top!

9.1%

none 1.027

.52

33 -3

120

.176

-50

.43?

.115

--------------------------------------------------------------------------------------------------------------------------

(4)

6/21/1976 1007.45 Also an S2. DJI declined to lower band.

4.0% 0.7% 1.031

.124

28 -3 52

.058

0

.023

.027

--------------------------------------------------------------------------------------------------------------------------

(5)

6/6/1978 866.51

An S8 followed a week later. DJI declined to lower band. Remarkably, right at top!

5.7%

none

1.028 .53

88 -2 183

.027

3

.297

.137

--------------------------------------------------------------------------------------------------------------------------

(6)

6/2/1986 1861.95 An S9 occurred a few days

earlier. DJI fell below lower band to support.

2.2%

2.5%

1.031 .556

51 -8

99 .135

5

.006

.078

highest

highest

--------------------------------------------------------------------------------------------------------------------------

(7)

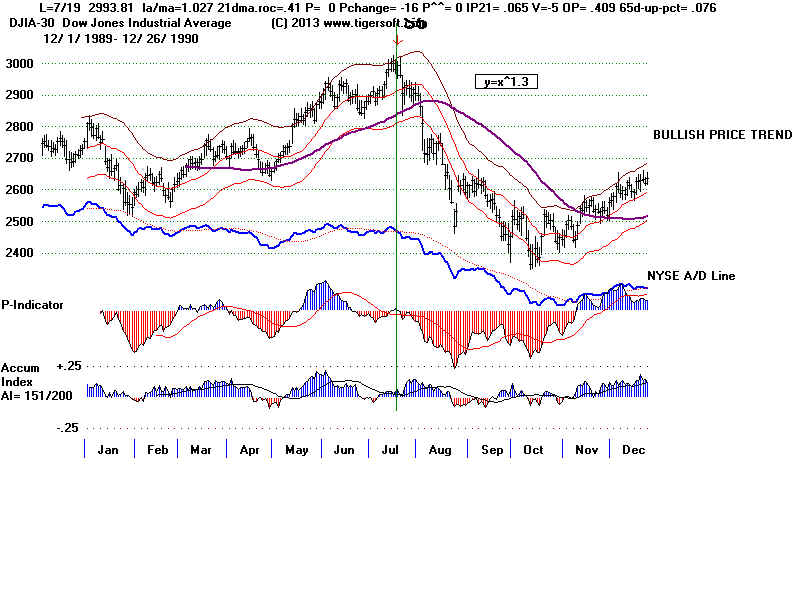

7/19/90 2993.81 Also an S9.

DJI declined below lower band. Remarkably, right at top!

18.1%

none 1.027

.41

0 -16 0

.065

-5

.406 .076

--------------------------------------------------------------------------------------------------------------------------

(8)

6/3/91 3035.33

3rd Year of Presidential

cycle.

4.4%

none 1.035

.393

80 -13

148 .135

1

.376

.05

As for reversing this signal,

compare this with the 7/22/1975 case where buying at lower band

was premature. Buying late in

August would be consistent with expecting a rally going into Labor Day.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

(9)

7/6/99 11135.12 An S9

and a S11 also occurred here. 3rd

Year of Presidential cycle.

7.1% 0.6%

1.034 .371

58 -43 57

.043

-6

.171 .116

negative

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

(10)

7/16/07 13950.98

3rd Year of

Presidential cycle.

Remarkably, right at top!

4.7% 0.4%

1.028

.349 88

-105 79

- .003 -60 .086

.10

negative

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

(11)

6/3/2009

There were also S9 and an S5 and S8.

4.1%

1.1%

1.027

.351 221 -169 205

.008 -96

-.018

.218

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

(12) 23807.51 Also Sell S9.

3rd Year of

Presidential cycle.

Remarkably, right at top!

5/3/2011

4.4% gain. 1% paper loss. This was a reversing signal. DJI declined below lower band.

5.9%

none

1.027

.412 113 -99 113 .154

-47

.336

.076

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

N=12

AVG.

Below are some near Sell S5s. These were

eliminated, each for the

combination

of reasons given:

X 1 6/17/1935 year before election

P = 34 or P**|= 194 (too

high)

65 day pct up was .184 (too

high)

X 2 7/24/1935 year before election

P= 34 or P**= 193 (too high)

65-day up pcr was up .115 (too high)

X 3 6/29/1954 (a bad time to sell, right before July 4th!)

P= 37 or P^^= 125

65-day up pct = .112 (high)

X 4 6/7/1955 year before election

P = 40 or P^^= 116

65-day upp pct = .034

la/ma = 1.028 not close enough to upper band in bullish year before Presidential

election and

the DJI up over 65 days. If it were down over 65 days, the dangerous bullishness

would not be

there and the DJI could be a little further below the upper band, as in the case in 1938.

X 5 7/22/1958 (late July is a problem

-- too close to Labor Day rally. )

P= 63

or P**= 63

65-day up pct = .092

|

|

|

|

|

|

|

|

|

|

|

|

|

Sample Peerless Program Code.

Earlier 2011 Code for Normal Mode Code:Sell S5

For i = 66 To rn ' starts at day 66 and goes to end of year's data file.

If (yr(i) + 1) / 4 = Int((yr(i) + 1) / 4) Then 19992 ' Eliminates year after Presidential Election.

If mo(i) < 5 Then 19992 Eliminates all but May, June and July

If mo(i) > 7 Then 19992

If opma(i) > .46 Then 19992 ' Eliminates those cases where there is a buying stampede.

If (la(i) / ma(i)) < 1.0265 Or (la(i) / ma(i)) > 1.035 Then 19992 ' Eliminates those cases not just below upper band.

If p(i) < 0 Then 19992 'Peerless S9s will pick this up

If p(i) > 93 Then 19992 'P-Indicator cannot be too positive.

If p(i) > p(i - 1) Then 19992 'If P-Indicator is rising from previus say, eliminate the case.

If aroc(i) > .6 Then 19992 ' 'If Annualized Rate of Change of 21-dma is too strong, eliminate the case.

'Find highest level of P-Indicator in last 45 days.

maxp = -999999

For j = i - 45 To i - 1

If p(j) > maxp Then maxp = p(j)

Next j

If p(i) > .5 * maxp Then 19992 'Current P-Indicator value must be below 1/2 of its 45 day high.

s9(i) = 5: ms(i) = 5: : pi = i: : psells5arrows (pi): i = i + 5 ' Runs routine to place Sell S5 arrows on screen

' Skips 5 days ahead.

19992 Next i: