There are two different Sell S7s. One is for Extreme Bear Markets like those

seen between 1929 and 1932. We could also apply them profitably in the deep bear

markets of 1937-1938 and 2008-2009. The second type of Sell S7s, which is

presented further below, occurs in more normal market environments. This

is the Sell S7 we would normally expect to encounter. It is easy to distinguish

from the first because it occurs on apparent strength.

The Two Different Sell S7s

#1 The DJI closes back below the 42-dma with negative internal readings

from the IP21 and the OPct is below -.10.

#2 The P-I and the current Accumulation index (IP21 widely fail to confirm a DJI

new high between April and September.

Extreme Bear Market Sell S7s: 1930-1932

S7 = DJI falls below 42-dma with IP21<10 and OPct<-.10

19300428 S7 276.9 .38

19300818 S7 227.8 .246

19300918 S7 234.2 .266

19310327 S7 177.3 .44

19320122 S7 78.8 .003

----------------------------------------------------------------

No. = 5 Avg. - .267

Deep Bear Market Sell S7s: 1937-1938

S7 = DJI falls below 42-dma with IP21<10 and OPct<-.10

(Using these Sell S7s and Normal Mode Buy signals)

19371209 S7 128.2 .026

19380316 S7 122.9 .195

19380419 S7 116.3 .053

19380524 S7 112.4 .016

-----------------------------------------------------------------------

No. = 4 .073

Deep Bear Market Sell S7s: 2008-2009

S7 = DJI falls below 42-dma with IP21<10 and OPct<-.10

(Using these Sell S7s and Normal Mode Buy signals)

20090112 S7 8764.05 .222

Sell S7s on False Strength:

The DJI's New High Is Widely Unconfirmed

by P-Indicator at Certain Times between

April and September.

More Exactly:

The DJI makes a 70 day new high.

The DJI must close above the 1.65% upper band and below the 3.0% upper band.

The P-Indicator is less than 20% of its 70 day high.

The Annualized 21-dma ROC must be below +.60.

The OPct must be below +.40.

The DJI must be up at least 3.7% over the last 65 trading days.

There have been 21 "normal" Sell S7s. The average DJI decline at the time

of the next Peerless Buy is .097

Trading results if one had shorted the DJI on these normal Sell S7s.

>10% 4

5%-9.99% 9

2%-4.99% 7

0%-1.99% 0

Losses 1

Sell S7s on False

Strength: 1928-201319290813 S7 354 .408

19370810 S7 186.9 .368

19450528 S7 168.2 .023

19550901 S7 469.6 .024

19570705 S7 516.9 .164

19570712 S7 520.8 .17

19590529 S7 643.8 .041

19650513 S7 938.9 .075

19670914 S7 929.44 .075

19680711 S7 922.82 .043

19720418 S7 968.92 .035

19720525 S7 969.07 .054

19760421 S7 1011.02 .05

19790920 S7 893.69 .095

19790921 S7 893.94 .096

19810424 S7 1020.35 .046

19930519 S7 3500.03 -.011

20000808 S7 10976.89 .067

20000811 S7 11027.8 .072

20060505 S7 11577.74 .049

20120501 S7 13279.32 .089

-------------------------------------------------

no. = 21 Avg. = .097

PE 7 .059 PE +1 8 .155 PE +2 1 .049 PE +3 5 .066 January 0 --- February 0 --- March 0 --- April 3 .044 May 7 .046 June 0 - July 3 .126 August 4 .229 September 9 .137 October 0 --- November 0 --- December 0 ---- 1-10 5 .078 11-20 3 .112 21-31 7 .058 |

Peerless S7 - last edited mid-2013.

DJI new highs above the 1.7% band with a widely

unconfirming P-Indicator,

reliably provide profitable points to sell at certain times in the the

4 year Presidential cycle. The results are improved even more

by eliminating cases of the basic Sell S7 that have extreme Peerless

key values. Below are the basic Sell S7s. They are arranged by the

Presidential Election year seasonality. An X marks those whose

parameters were unusually high or low and probably should therefore

be eliminated as being too unusual.

Presidential Election Year: From 4/18 to

8/11 (7/7 were good)

(1)

4/18/1972

+3.5% no paper loss Also Sell S9 and S15

968.92

1.019 .327 -20 4 -43 .054 -1

.149 .064

---------------------------------------------------------------------------------------------------------

(2)

4/21/1976 +4.4% -0.4% paper loss Also S15

1011.02 1.019

.345 -1 15 -2 .038 -1

.069 .067

--------------------------------------------------------------------------------------------------------

(3)

5/4/1992 +4.0% 1.0% paper loss

Earlier S9 and S15

3378.13

1.022 .52 48 51 94 .132

1 .33 .039

high

lowest allowed

--------------------------------------------------------------------------------------------------------

(4)

5/25/1972 +5.9% +0.2% paper

loss Also Sell S9 and S15

969.07

1.025 .279 -10 14 -20 .004 -1 .222

.059

--------------------------------------------------------------------------------------------------------

(5)

7/11/1968

+4.8% No paper loss No other signal at this time

922.82

1.017 .081 36 -18 83 -.052 5 -.008

.089

-------------------------------------------------------------------------------------------------------

8/9/2000 profitable but a 3% paper loss Sell S9 a week later was

better.

X 10976.89 1.024

.367 -1 -1 -1 -.019 -56 .333 .036

too low

-------------------------------------------------------------------------------------------------------

(6)

8/11/2000

+3% 2.6% paper loss Sell S9 a week later was better.

11027.8

1.026 .265 14 55 14 -.023 -62

.227 .06

-------------------------------------------------------------------------------------------------------

(7)

One Year after Presidential Election Year: From 4/24 to 7/10 (5/6 were good)

4/24/1981 +17.4% no paper loss ...

also a Sell S15

1020.35 1.018

.061 1 -11 3

-.012 -1 .11 .073

------------------------------------------------------------------------------------------------------------

5/2/1969 good also Sell S9 and

Sell S8.

X 957.17 1.03 .337 14

36 32 .109

0 .194 .02

high

low

------------------------------------------------------------------------------------------------------------

(8) 5/13/1965

+4.8% paper loss =

0.1% No other

signal at this time

938.9

1.018 .339 24

3 68 .11

-262 . 254 .04

------------------------------------------------------------------------------------------------------------

(9)

5/19/1993 +0.2% paper loss =

1.6% No other signal at this

time

3500.03

1.017 .196 -8 46 -13 .069 -1 -.076 .055

low

Bad B10 follows.

-------------------------------------------------------------------------------------------------------------

(10)

5/28/1945 +2.1%

paper loss = 0.5% Earlier S9

168.2

1.018 .31

9 6 41

.031 -68 .156 .055

------------------------------------------------------------------------------------------------------------

(11) 7/5/1957

+10%

paper loss = 0.8% Also

an S9.

516.9

1.02 .348 -32 23

-100 .056 -198 .305 .076

------------------------------------------------------------------------------------------------------------

Second Year after Presidential Election Year: No

Pattern: 5 good and 7 bad

Third Year after Presidential Election Year: May as delimited and

September worked well, 2 of 2, before the 21st..

------------------------------------------------------------------------------------------------------------

X

5/2/1975 good

(+3.7% gain and paper loss = 1.3%)

848.48

1.06

1.441 95 42 181 .126

2 .396 .171

too high too high

------------------------------------------------------------------------------------------------------------

(12) 5/14/1959 +2.4% paper

loss = 1.1% No other signal at this time

637

1.018 .467

-54 2 -159 .047 -417 .279

.085

------------------------------------------------------------------------------------------------------------

X 5/15/2007

13383.84 1.019 .603

45 -112 40 .132 -35 .598 .06

too high

too high

------------------------------------------------------------------------------------------------------------

(13) 5/29/59 +3.4%

no paper loss

No other signal at this time

643.8

1.021 .378 -46

5 -135 .006 -370

.216 .065

------------------------------------------------------------------------------------------------------------

X

7/16/2007 +4.7%

paper loss = 0.4% Also S4, S9 and S11.

13950.98 1.028 .349 88 -105

79 -.003 -60 .083

.10

July S7s in

the 3rd year of the Presidential cycle can fail.

Examples 7/15/1987 and 7/28/1987.

-------------------------------------------------------------------------------------------------------------

(14) 9/14/1967 +7.5%

paper loss = 1.5% also Sell

S12

929.44

1.024 .135 12

-1 32

-.009 2 .20

.046

------------------------------------------------------------------------------------------------------------

(14) 9/20/1979 +10.9% paper loss = 0.4%

also S9

893.69 1.017 ..104

-74 16 -141 .063

-1 .037 .061

lowest

----------------------------------------------------------------------------------------------------------------------------

OLDER, NO LONGER USED SELL S7

----------------------------------------------------------------------------------------------------------------------------

- Used briefly from 2010 to 2011 -

On 3/3/2011 this

Sell S7 was left out of Peerless

NYSE A/D Line and Accumulation Index

Make New Lows Ahead of DJIA

Usually a bearish divergence by

the NYSE A/D from a series of DJIA tops

is a reliable warning that

the DJI itself will soon enter a bear market and decline

15% or 20% or more. The Sell

S7 is one other way to help predict when the DJI

would follow a much weaker

NYSE A/D Line to substantially lower prices.

There have been 13 cases since 1929. Though the average gain when betting

on a Sell S7 is 11%, only 3

of the 13 instances brought a decline of more than

5%. In 7 cases, the

decline 4.1% or under. This suggests that in most cases

a weak A.D Line does not

guarantee the DJI will break its major support. In three

cases we find important

breakdowns of support with a weak A/D Line leading the way

in the year after a

Presidential Election. These three cases averaged 27.8%. In the table

below I have made red these

post Presidential Election Year Sell S7s.

Sell S7s: 1929-2010

#1 45.1%

9/20/29

Post Presidential Election year.

#2 15.6%

1/22/40

The Sell S7 warned of coming German attack on W. Europe.

#3, 4.1%

9/19/56

Pres, Election Year

#4 7.1%

8/5/1957

Post Presidential Election year.

#5 0.5%

9/14/59

#6 22.6%

4/4/62

#7 3.0%

0/30/67

#8 31.3%

6/2/69

Post Presidential Election year.

#9 4.9%

10/19/71

#10 0.6%

7/13/72

Pres, Election Year

#11 2.6%

1/15/90

#12 2.9%

8/6/99

#13 3.7%

9/15/99

--------------------------------------------------

Avg, +11.9%

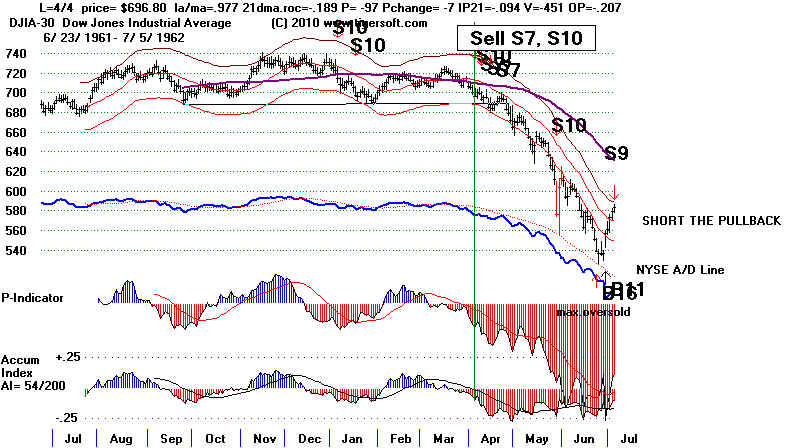

1962 Sell S7

before Massive Head/Shoulders Pattern

Gave Way

Sell S7s Are Reliably Bearish

All 11 of the Sell S7s were profitable and their average gain was

113% on S7 short sales

of DJIA which were then covered at the time of the next Buy.

Only 2 of the 17 S7s

showed a paper loss: 1940 - 4% paper loss and 1999 -5%

paper loss.

They are most helpful as reinforcing Sell signals. They

show that an earlier Sell S9 is

probably going to produce a deep DJI decline. Sell S9 -

Sell S7s combinations

occurred in:

9/20/29 362.1

Gain = + 45.1%

8/5/57

500.80 Gain = + 7.1%

6/2/69

933.17

Gain = +31.3%

10/19/71 868.43

Gain = +4.9%

In a

Presidential Election Year, even with an S9, they are not likely to bring

a breaking of well-tested support unless a war is

coming.

7/13/72 916.99

Gain = +0.6%

The

presence of a head shoulders price pattern adds to their bearishness. See

the examples of

9/20/29 362.1

Gain = + 45.1%

9/19/56 488.7

Gain = + 4.1%

10/19/71

868.43 Gain = +4.9%

1/15/90 2669.37

Gain = +2.6%

Only rwice was an Sell S7 a reversing signal:

1/22/40 145.1

Gain = + 15.6% 4% paper loaa

9/19/56 488.70

Gain = + 4.1% no paper loss.

. Sell S7s do not always bring break below well-tested support.

See these cases. See how each of these cases took

place just before a Presidential

Election year.

9/14/59

633.80 Gain = + 0.5%

10/30/67 886.62

Gain = +3.0%

8/6/99

10714.03 Gain = +2.9%

When they do

bring a break in well-tested support, a serious decline is likely

to start. The rupture of the 860 support in 1969 led

quickly to much lower

prices after July 1969. See the chart below:

Seasonality and Sell S7s

Sell S7s are generally much more potent if they occur in

the first 6 months of the

year. They average 11.5% declines while those in the

second half of the year

showed only 1 of their 8 instances brought a decline by

more than 8.5%. The

weaker results for October S7s bear out the notion that

Octobers are more likely

to be the end of a bear market than the beginning because

of the selling climaxes

then. .

Distribution of Gains by Month

Cases

Avg.,

Jan

15.6% 2.6%

+9.0%

Feb

Mar

Apr

22.6%

+ 22.6%

May

June 31.3%

+31.3%

July

0.6%

+0.6%

Aug

7.1% 2.9%

+5.0%

Sept 45.1%

4.1% 0.5% 3.7% +13.4%

Oct

3.0% 4.9%

+3.95%

Nov

Dec

Requirements of a Sell S12

> A/D Line New 21 day low

> P-Indicator makes 21-day low

> Accum. Index makes 21-day low

> DJI's close is not down

more 8% in last 130 trading days

> DJI's close is below

21-day ma by more than 2.5% but less than 2.85%

Exclusions:

> Exclude cases

where Annualized ROC is below -.50 and IP21 is not below -.10,

> where

Annualized ROC is below -.72,

> where OPCT is greater than +.05,

> when there is a simultaneous Buy B17 (which should be counted),

> when there

was a Buy B17 in the two previous days and

> Nov cases (Odds of a December rally are too high)

> DJI should not already be down more than 7.5% from highs.

====================================================================================

The Instances of

Sell S7s

#1

9/20/29 362.1

.973 Gain = + 45.1%

No paper loss. Collapsed to 200 after a right shoulder

pattern.

(LA/MA AnnROC P-I

P-Ch. IP21

V-I

Opct.)

.973 -.112 -48 -5

-.119 -609

-.066

1929 Sell S7

S9/S12 at Top and Head/Shoulders

======================================================================

( X DJI was

already down more than 7.5%.)

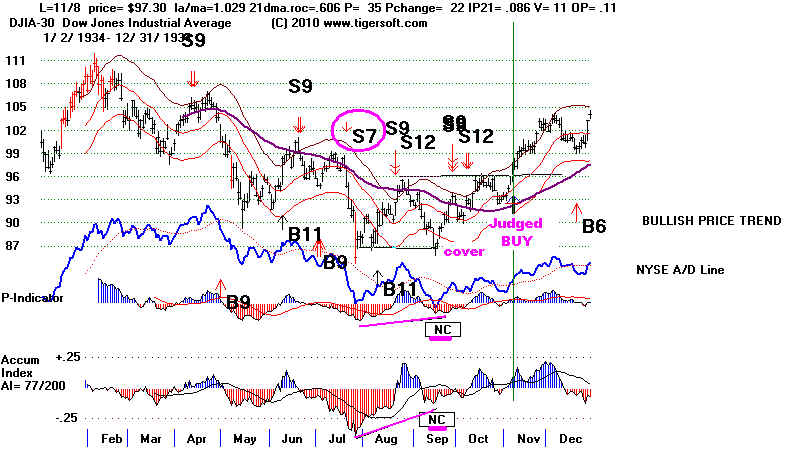

7/20/34 94.70

.977 Gain = + 3.6%

This was a reversing Sell.

No paper loss.

DJIA broke to new lows to 85.50 and rallied

.977 -.442 -83

-.18 -.245 -132

-.266

-=================================================================================

( X DJI was already down more than 7.5%.)

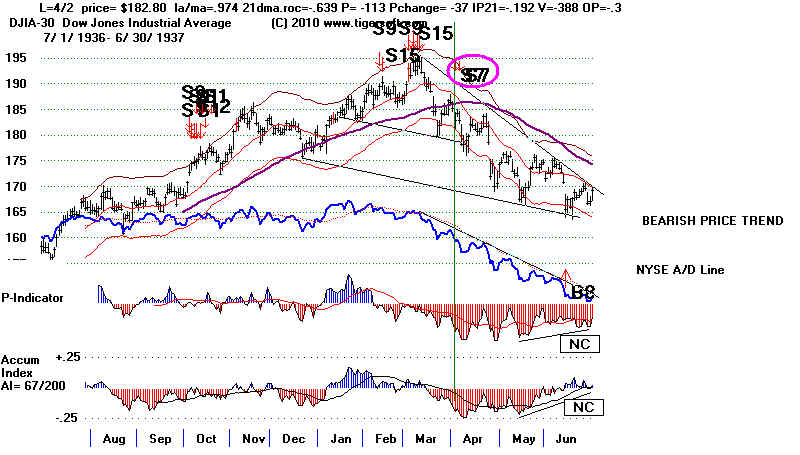

4/2/37 182.8

.974 ...

Gain

= + 9.5%

DJIA broke to new lows at 166.

No paper loss.

.974 -.639 -113

-37 -.192

-388 -.261

4/6/37 182.9

.979 ...

Gain

= + 9.5%

broke to new lows at 166.

.979 - .712 -122

-26 -.205 -400

-.291

--------------------------------------------------------------------------------------------------------------------------------------------------------

#2

1/22/40 145.1

.976

...

Gain = + 15.6%

This was a reversing Sell.

DJIA rallied to 151.30 before collapsing. 5% Paper Loss.

.976 -.32

-33 -13 -.119

-88 -.144

=====================================================================

Already down more than 7.5%

from highs

4/25/47 168.90

.979 ...

Gain = + 2.3%

Fell only to 163.60 and then rallied...3% paper loss.

This was a Sell S7 after the mini-bear market 1946.

.975 -.565 -133

-40 -.207 -204

-.159

=====================================================================

#3

9/19/56 488.70

.972 ...

Gain = + 4.1%

This was a reversing Sell.

Note head and shoulders top in July-August

and well tested support at 465.

DJIA fell immediately, but only to 470 support from the previous low.

No Paper Loss

.972 -.532 -152 0 -.189

-401 -.416

This was in a Presidential Election Year so we look for trading ranges.

====================================================================

#4

8/5/1957 500.80 .974

... Gain = + 7.1%

Declined immediately. Note "two/thirds a head/shoulders" pattern.

No paper loss.

.974 -.372 -112 -38 -.08 -339 -.13

8/9/1957 496.80 .994

... Gain = + 6.4%

This second S7 was already down more than 7.5%

declined immediately

.994 -.136 5 -.092 -365 -.212

===================================================================

#5

9/14/1959 633.80 ... Gain = +

0.5%

Nearby B17s are warning that decline is nearly over.

DJI fell only to 615. No paper loss.

This was a week from the bottom.

Notice flat support where it reversed.

.973 -.394 -140 -16 -.051 -460 -.17

==================================================================================

#6

4/4/1962 696.8 Gain= +22.6%

Immediate decline as head and shoulders pattern gave way, No Paper

loss.

.977 -.189 -97

-7 -.094

-451 -.207

4/9/1962 692.9 Gain = +22.2%

.974 -.359 -132 -41

-.148 -536 -.299

4/13/1962 687.9 .216

+21.6%

.975 -.599 -172 -3 -.226 -638 -.501

==================================================================================

#7

10/30/67 886.62 +3.0%

Declined only to 855. No paper loss.

.976 -.523 -187 -13 -.148 -12 -.324

=================================================================================

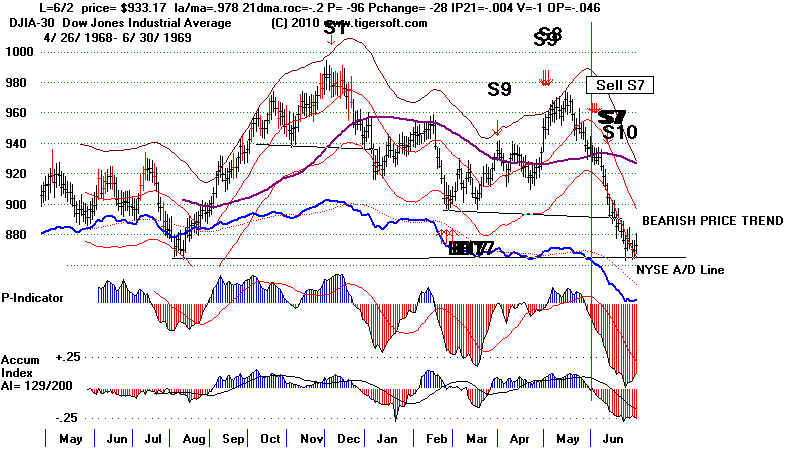

#8

6/2/69 933.17

Gain = 31.3%

Start of 1969-1970 bear market.

No paper loss.

Bottom was at 641.36 finally on 5/25/1970

.978 -.20 -96 -28 -.004 -1 -.046

There had previously been a Sell S9.

6/2/69 930.70

Start of 1969-1970 bear market.

Bottom was at 641.36 on 5/25/1970

.978 -.20 -96 -28 -.004 -1 -.046

There had previously been a Sell S9.

=====================================================================

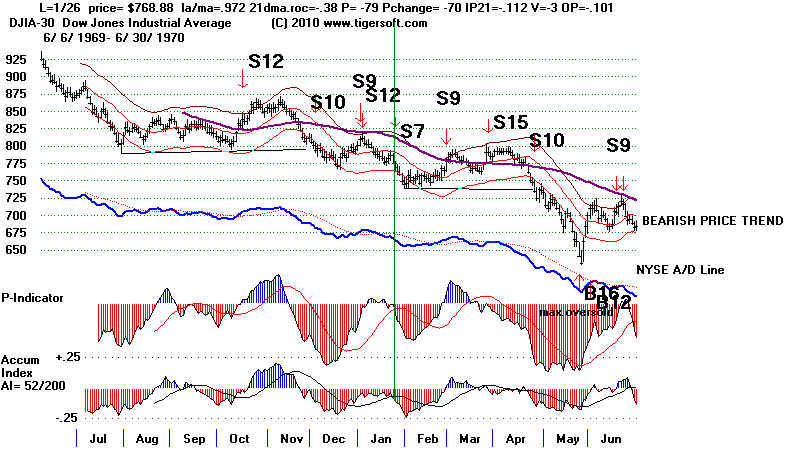

DJI already

down more than 7.5%.

1/26/70 768.88

Gain = +16.6%

.972 -.38 -79 -70 -.112 -3 -.101

This was in an on-going bear market.

5% paper loss.

DJI immediately fell to 745, then rallied to 790 and then fell to 641 bottom.

========================================================================

#9

10/19/71 868.43 Gain = +4.9%

No paper loss.

.977 -.491 -134 -9 -.122 -2 -.226

========================================================================

#10

7/13/72 916.99

Gain = +0.6%

This was in a Presidential Election year.

The DJI was already at well-tested support.

No paper loss.

.979 -.27 -143 -25 -.086 -3 -.323

7/17/1972 914.96 Gain = +.4%

This was in a Presidential Election year.

This was at well-tested support.

.979 -.395 -171 -18 -.102 -3 -.334

=========================================================================

The DJI was already down 7.5%

8/21/81

920.57 Gain = +8.5%

No paper loss

.979 -.101 -37 -15 -.068 -1 -16

========================================================================

#11

1/15/90 2669.37 Gain = +2.6%

No paper loss.

.975 -.398 -110 -36 .002 -25 -.314

1/17/90 2659.13 Gain = +2.2%

.975 -.398 -110 -36 .002 -25 -.314

1/18/90 2669.38 Gain = +2.5%

.976 -.136 -50 29 .06 -13 -.093

========================================================================

#12

8/6/99 10714.03 Gain = +2.9%

Paper Loss = 5% as DJI first rallied to 11300

.978 -.448 -410 -30 -.069 -140 -.202

==========================================================================

#13

9/15/99 10801.42

Gain = +3.7%

No paper loss.

.978 -.264 -214 -21 -.007 -95 -.132

See chart above.

=================================================================

Number of trades = 13

Avg. Gain= +10.3%

Red key variables are outside the acceptable range.

Date DJI Gain LA/MA

------------- ----------- -------- ----------

EXCLUDED

5/20/29 312.7 .979 tested lows and rallied to new highs.

.979 -.078 -66 -13 -.075 -561 .16

===

EXCLUDED

8/9/29 338. .977 ... rallied to 382 and then collapsed

.977 -.172 -82 -26 -.14 654 .128

====

EXCLUDED

6/17/37 167.7 .975 ...This was bottom

.975 -.152 -70 -10 .058 -117 .068

====

EXCLUDE

11/29/39 146.9 .977 ... fell to 144.70 and rallied to 151.30

.977 -.522 -106 -12 -.063 -171 -.283

EXCLUDE

11/30/39 145.7 .972 ... fell to 144.70 and rallied to 151.30

.972 -.594 -123 -18 -.079 -192 -.295

EXCLUDE

11/29/56 499.50 .972 ,,,This was bottom.

.972 -.502 -116 -25 -.125 -381 -.339

November lows in a Presidential Election Year often bring

excellent recoveries.

EXCLUDED

8/19/1959 646.50 .973 ... fell to 615

rallied back to 21-dma and declined below lower band.

.973 -.268 -84 -41 -.054 -403 .06

EXCLUDE

2/5/1960 626.80 ...... fell to 600 Only +1.3% drop to 2/11/60 Buy B17

.973 -.937 -154 -3 -.22 -575 -.33

fell to 600 before rallying.

This was in a Presidential Election year.

EXCLUDED

4/16/1962 684 .212

La/ma=.972 21-dma-roc= -.646 P= -180 Pch= -9 IP21 = -.235 V= -659 OP= -.501

Fourth in series are voided normally.

EXCLUDED

11/15/67 855.18 This was a bottom, 10% down from previous high.

There had been a series of tests of 840-860. (Good example of support).

There had been a Buy B17 on 11/13/67.

Notice improving P-Indicator

.976 -.722 -234 26 -.211 -19 -.51

EXCLUDED

2/8/68 gain - +1.5%

.976, -.731, -171, -48, -.199, -15, -.532

EXCLUDED

3/5/68 loss - 4.1% (Better to also use A/D Line)

.979, -.483, -222, -25, -133, -21, -.158

There had been a Buy B17 on 2/14/68

This was in a Presidential Election Year.

Notice P-Indicator was rising.

A/D Line trend break occurred on 3/27/68 with DJI at 836.57.

Using A/D Line the loss would have been 1.2%

This was a March Sell S7. These are bad for S7s.

EXCLUDED

2/20/69 916.65 (Signal cancelled by B17)

.974 -.167 -139 -31 .076 -2 .115

Sumulataneous B17. Cannot be counted. B17 should be counted.

EXCLUDED

3/3/69 908.63 (Signal should be cancelled by B17 on 2/28/69

.976 -.376 -266 -2 .008 -3 .086

There had been a B17 on previous day

March S7s do not work well.

EXCLUDE

7/28/71 872.01 -1.9%

.979 -.015 -49 -23 -.001 -2 .056

EXCLUDE

7/18/1972 911.72 +3.9%

We should skip at least a day between S7s.

This was in a Presidential Election year.

This was at well-tested support.

.978 -.425 -179 -9 -.094 -3 -.342

EXCLUDE

9/16/74 795.13

.974 -.444 -160 -50 -.133 03 -.232

This was at well-tested support.

Sumulataneous B17. Cannot be counted. B17 should be counted.

EXCLUDE

11/7/74 796.67

,972 -.882 -275 34 -.101 9 -.574

Sumultaneous B17. Cannot be counted. B17 should be counted.

EXCLUDE

3/12/82 797.37

.975 -.571 -108 -46 -.118 -8 -.279

At support and after long bear market,

P-Indicator NC

Subsequent trend-break in A/D Line is a Buy.

March S7s do not work well.

EXCLUDE

11/21/88 2065.97

.975 -.659 -251 -21 -.084 -.101

There had been a Buy B17 on 11/11/88

At well tested diagonal support.

Novembers do not produce good results.

EXCLUDE

4/18/94 3620.42 LOSS

.973 -.781 -439 -55 -.043 -62 -.182

This was bottom.

This was third of 3600 and 10% from high.

EXCLUDE

4/19/94 3619.82 LOSS

.977 -.883 -474 -35 -.082 -65 -.302

This was bottom.

This was third of 3600 and 10% from high.

EXCLUDE

4/20/94 3598.71 LOSS

.974 -.855 -456 17 -.082 -66 -316

This was bottom.

This was third of 3600 and 10% from high.

EXCLUDE

7/11/96 5520.54 (+2.9%)

.977 -.312 -225 -67 -.013 -47 -.134

Sumulataneous B17. Cannot be counted. B17 should be counted.

EXCLUDE

3/6/00 10170.50 -4.1%

.977 -.96 -400 -86 -.176 -140 -113.

Great weakness in price shown by 21-dayroc of -.96

Down 12% from highs - AVOID - this is likely to be support.

March S7s don't work.

5/23/00 10422.27 -1.1%

.976 -.538 -113 9 -.033 -68 -.159

IP21 of -.033 is too high for the great weakness in price shown by 21-dayroc of -.538

Surrounded by Buy B2s.

Down 12% from highs - AVOID - this is likely to be support.

5/25/00 10323.92

.972 -.695 -186 -7 -.04 -92 -.154

IP21 of -.04 is too high for the great weakness in price shown by 21-dayroc of -.695

Surrounded by Buy B2s.

Down 12% from highs - AVOID - this is likely to be support.