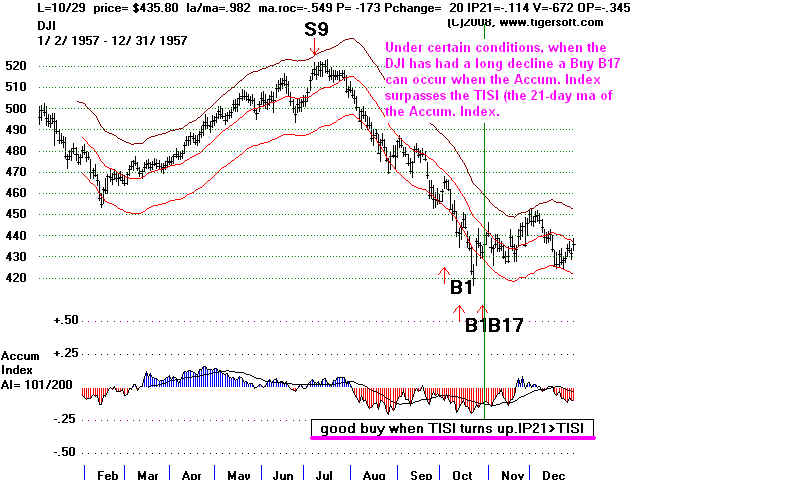

Buy B17s takes place when the DJI falls sufficiently below

the 21-day mvg.avg. but still shows a nearly positive or improving

Accumulation Index.

The average gain on the 72 Buy B17s between 1928 and 2013 was 11.1%

There was only one Buy B17 that did not bring at least a gain of 2%.

No losses were produced by this signal. The biggest gains generally

occurred in the Mid-Term Election Year (PE +2). They averaged 14.8%.

October Buy B11s were the most frequent and the most powerful,

averaging 15.1%. The B17s gains from April to July were much smaller.

Gains: 1928-2013

> 10% 29

5%-4.99% 24

2%-4.99% 18

0%-1.99% 1

losses 0

| 12/10/1928 B17

263.9

18.5%

No Paper Loss .94 .119 -43 9 -43 .01 -595 .137 .099 Here DJI was down 10% from high with IP21 positive in bullish month of December. 19301223 B17 232.7 .226

19321031 B17 61.9 .099 fell to 58.3

.970 -1.779 -78 6 -551 -.l139 -349 -.272 .176

-----------------------------------------------------------------------

19321125 B17 58.8 .07 Fell to 58.00

.941 -.286 -39 -7 -272 .068 -73 .128 -.171

------------------------------------------------------------------------

19350305 B17 100.1 .324 Fell to 97.00

.973 -.185 -72 -37 -402 -.042 -101 .006 -.023

------------------------------------------------------------------------

19380126 B17 123.2 .036 ??? Fell to 118.5

.961 .400 11 -2 59 .044 -36 -.101 -.069

-------------------------------------------------------------------------

19380525 B17 .046 .307 Fell to 107.7

.962 -.341 -55 -3 -291 -.045 -51 -.033 -.146

---------------------------------------------------------------------------

19380815 B17 136.5 .048

8/12/1938 B17 136.5 .408 No paper loss

.963 .059 -36 -15 -186 -.015 -83 .025 .151

--------------------------------------------------------------------------

19411212 B17 110.6 .02 DJI fell to 106.3

.964 -.497 -57 24 -304 .046 -206 -.328 -.133

-------------------------------------------------------------------------

19430810 B17 136.2 .041 Fell to 129.60 before reversing.

.971 -.711 -69 12 -347 -.202 -189 -.271

--------------------------------------------------------------------------

19470114 B17 172.6 .064 Fell to 172.1

.980 -.088 -62 29 -258 .092 -140 .285 .031 -.016

----------------------------------------------------------------------------

19470317 B17 173.4 .063 .066 Fell to 163.6

.972 -.546 -50 12 205 0 -107 -.02 -.016

--------------------------------------------------------------------------

19470516 B17 165 .12 .118 Fell to 163.6

Next Sell was S4 on 10/22/1947 with DJI at 184.4

.971 -.21 -143 -41 -594 .221 -188 -.222 -.095

--------------------------------------------------------------------

???? 19480316 B17 165.4 .168

-----------------------------------------------------------------------

19481108 B17 178.2 .011 1.6 % Reversing

Fell to 171.2 Paper Loss = 4%

Next Sell was S12 on 1/7/1949 with DJI at 181.3

.962 -.225 146 -3 625 .122 221 .078 -.027

----------------------------------------------------------------------------

19510629 B17 242.6 .134 no paper loss

.934 -.958 -95 -20 -271 .018 -494 -.01 -.056

------------------------------------------------------------------------

19511029 B17 260.4 .053 Fell to 257.1

.974 -.906 -58 14 -164 .007 -424 -.11 -.025

------------------------------------------------------------------------

19511105 B17 259.8 .055 Fell to 257.1

.970 -.692 -105 -1 -318 -.035 -286 -.186 -.012

---------------------------------------------------------------------------

19551011 B17 438.6 .183 no paper loss

.934 -.958 -95 -20 -271 .018 -494 .063 -.056

---------------------------------------------------------------------------

19551018 B17 448.6 .156 no paper loss

.974 -.906 -58 14 -164 .007 -424 -.041 -.025

---------------------------------------------------------------------------

19570205 B17 470 .1 Fell to 454.8

.975 -.621 -97 -33 -307 -.085 -341 -.365 -.034

--------------------------------------------------------------------------

19570213 B17 462.1 .119 no paper loss

.975 -.569 -134 52 -425 -.061 -418 -.267 -.055

--------------------------------------------------------------------------

19571028 B17 432.1 .49

--------------------------------------------------------------------------

19590909 B17 637.6 .053

19590923 B17 624 .076

19600303 B17 612 .021

19601025 B17 566 .239

19671113 B17 859.74 .057

19680304 B17 830.56 .111

19690220 B17 916.65 .037

19690228 B17 905.21 .05

19711110 B17 826.15 .161

19730815 B17 874.17 .028

19740206 B17 824.62 .038

19750916 B17 795.13 .269

19761008 B17 952.38 .034

19770209 B17 933.84 .033

19780228 B17 742.12 .168

19790515 B17 825.88 .073

19791107 B17 796.67 .086

19801209 B17 934.04 .041

19810202 B17 932.25 .095

19811026 B17 830.96 .048

19830809 B17 1168.27 .092

19840307 B17 1143.63 .036

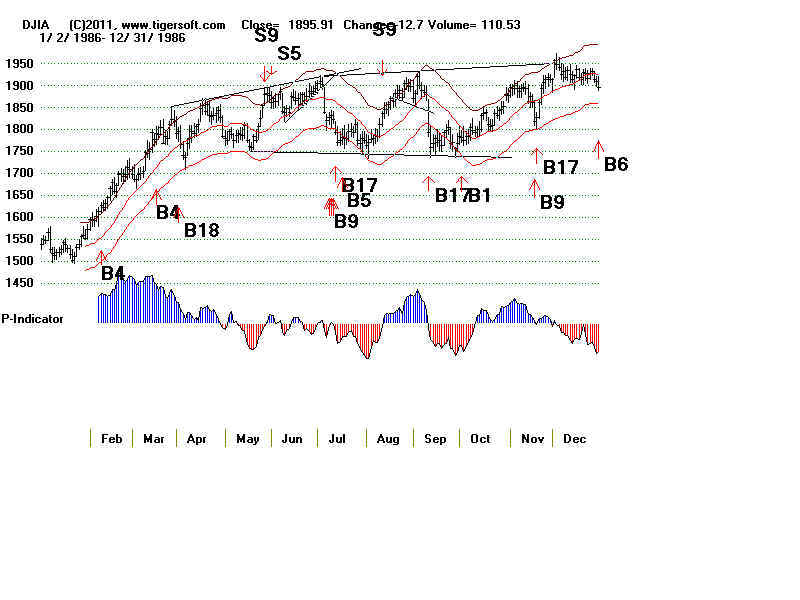

19860714 B17 1793.75 .023

19861119 B17 1826.63 .317

19870519 B17 2221.28 .059

19870904 B17 2561.38 .03

19880121 B17 1879.31 .072

19880325 B17 1978.95 .056

19881111 B17 2065.97 .124

19891026 B17 2613.73 .075

19900123 B17 2615.32 .136

19900201 B17 2586.26 .148

19900925 B17 2485.64 .218

19901010 B17 2407.92 .257

19911205 B17 2889.09 .161

19921007 B17 3152.25 .11

19930922 B17 3547.02 .119

19960717 B17 5376.88 .061

19961212 B17 6303.71 .088

19970401 B17 6611.05 .034

19981214 B17 8695.6 .281

19990527 B17 10466.92 .064

19991018 B17 10116.28 .11

20000309 B17 10010.73 .111

20011031 B17 9075.14 .115

20030311 B17 7524.06 .303

20100122 B17 10172.98 .083

20100209 B17 10058.64 .095

20100819 B17 10271.21 .247

20110608 B17 12048.94 .03

--------------------------------------------------------------------

No. = 72 Avg. = .111

29 24 18 1 PE 17 .085 PE + 1 14 .097 PE + 2 16 .148 PE + 3 25 ,112 January 5 .078 February 10 .088 March 9 .133 April 1 .034 May 5 .072 June 2 .082 July 2 .042 August 5 .091 September 6 .128 October 13 .151 November 8 .110 December 6 .136 1-10 23 .080 11-20 26 .132 21-31 23 .118 |

=============================================================

87 Closed Out Cases since 1928. Average Gain = 9.2%

Revised 3/9/2013

Buy B17s takes place when the DJI falls sufficiently below

the 21-day mvg.avg. but still shows a nearly positive or improving

Accumulation Index. Often there is a fairly high reading from the

P-Indicator.

It cannot appear within 12 trading days of a Sell S9 and is

risky to use if a head and shoulders pattern is completed. Do not

trust one where the low for the day is more than 10% below

21-dma.

Seasonality plays

a role with Buy B17s. For example, if there is a

January sell-off i a Presidential Election Year and the DJI drops more

than 8%,

1948, 1960, 1968, 1984 and 2000 all show that it is best to wait until

March

to employ the Buy B17.

There have been 87 Buy B17s

since 1928.

Three types of Buy B17 signals are to be distinguished.

1) The first (green) occurs in a rising market. See the 53

cases;

2) the second (red) occurs in a bear market;

3) the third (fuschia) is seen on a pullback in the first big advance

from a bear

market.

The first bull market

Buy B17 averages a gain of 8.7 in the DJI at the time

of the next Peerless Sell signal. The bear market variety gains

more than 9%,

There are 7 losses, four of them in bull market B17s and three of them

in

bear market Buy B17s.

The third type of B17 shows ?

cases. These are Buy B17s taking place

on the first pullback from the first big recovery from a bear

market. Their

average gain is 5.8%.

B17s that occur in October,

November and December are more than twice

as powerful as B17s that occur in January February, April, July and

August.

The next table needs correction for February and March

during Presidiential Election Years.

---------------------------------- Buy B17s by Month

---------------------------------

Month

Number

Avg., Gain at Time

of Cases of Next Peerless Sell

------------

-----------

-------------------------------

January

5

5%

February

7

4.9%

March

7

12%

April

2

6.1%

May

5

7.5%

June

2

12.9%

July

2

4.9%

August

4

4.5%

September 11

12.5%

October

15

11.4%

November 10

16.0%

December 8

8.9%

-------------------------------------------------

All Cases

88

9.2%

There is strong evidence that Buy B17s should

not be used

immediately after a Sell S10 head and shoulders' neckline failure

or broken support. Usually the next rally will not get past that

resistance and more new lows are needed.

BUY B17 This data must be edited further....

There have been 76 Buy 17s since 1942, The average gain was 9%. Not every single

Buy B17DJI trade was profitable when the DJI was sold at the time of the next major

Peerless Sell, but the 8 losses would have been small, if one also used the judged

Head and Shoulders rules. 39 of the 86 Buy B17s were immediately profitable. 18 were

profitable "almost immediately", meaning the trade's paper loss did not exceed 3% and the DJI

rallied within 6 weeks of the signal. Note that there were where 16 cases the paper loss

ranged between 3% and as much as 12%.

This signal takes place when the DJI falls sufficiently below the 21-day mvg.avg. but

still shows a nearly positive or positive Accumulation Index and a fairly high reading from

the P-Indicator. See the chart of the 2003 bottom above as an example or the chart from

1986 as another.

Sometimes, the signal is based on an improving current Accumulation Index

when there has been a substantial decline..The Buy B17 cannot appear within 12 trading

days of a Sell S9.

BUY B17s: 1928-2010

--------------------Buy B17 ----------------------------- -------- Next Opposite Major Sell Signal -------------------------------------------------------------------------------------------------------------------------

1

...B17 12/ 10/ 1928 263.9 +18.5% 1/ 30/ 1929 312.6 S9/S12

la/ma = .94 21-dma roc=.119 P= -43 (+9) IP21= .01 V=-595 OP= .136

(Bull Market variety.)

DJI rose immediately above the upper band.

la/ma=.94 21dma.roc=.119 la/65dma=1.025 65dma.roc=.357 P=-43 Pchange= 9

IP21= .01 V=-595 OP= .139

----------------------------------------------------------------------------------------------------------------------------------------

X This would not have occured if one used the Extreme Bearish Mode.

...B17 12/ 20/ 1929 230.9 +8.3% 1/10/31 250 S9 S12

(Bear Market variety.)

DJI rose immediately above the upper band.

la/ma=.971 21dma.roc=.617 la/65dma=.831 65dma.roc=-1.672 P= 15 Pchange=-27

IP21= .099 V=-154 OP= .026 ----------------------------------------------------------------------------------------------------------------------------------------

2

...B17 9/ 13/ 32 69.9 +7.6% 9/ 21/ 32 75.2 S2

(Rally from Bear Market Bottom variety.)

DJI fell 18% from peak and a 33% retracement to 65.16 and then rallied in a few days to upper band.

la/ma=.961 21dma.roc=1.117 la/65dma=1.22 65dma.roc=1.418 P= 49 Pchange=-11

IP21= -.002 V=-53 OP= .081

----------------------------------------------------------------------------------------------------------------------------------------

3

...B17 3/ 5/ 1935 100.1 +18.6% 6/ 17/ 1935 118.70 S12

la/ma = .973 21-dma roc= -.185 P= -72 (-37) IP21= -.042 10% below top

(Bull Market variety.)

DJI fell to 97 and then rallied in way above the upper band.

la/ma=.973 21dma.roc=-.185 la/65dma=.976 65dma.roc=-.087 P=-72 Pchange=-37

IP21= -.042 V=-101 OP= -.074

----------------------------------------------------------------------------------------------------------------------------------------

4

...B17 8/ 12/ 1938 136.5 +5.1% 8/ 24/ 1938 143..5 S12

(Rally from Bear Market Bottom variety.)

DJI rose immediately to the upper band.

la/ma=.963 21dma.roc=.059 la/65dma=1.069 65dma.roc=.543 P=-36 Pchange=-15

IP21= -.015 V=-83 OP= .025

----------------------------------------------------------------------------------------------------------------------------------------

5

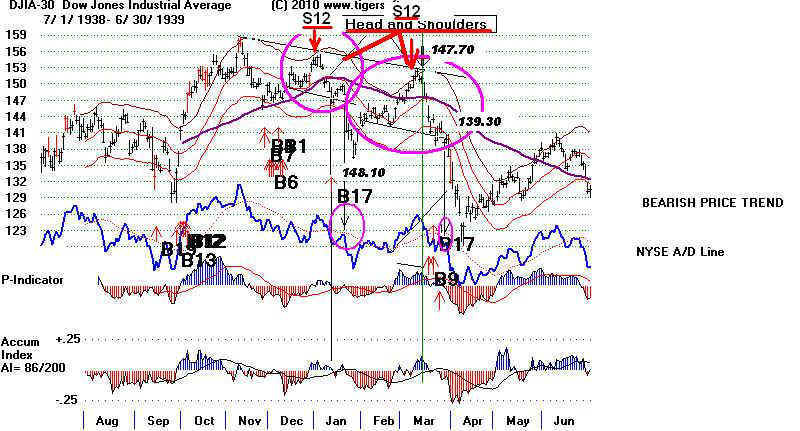

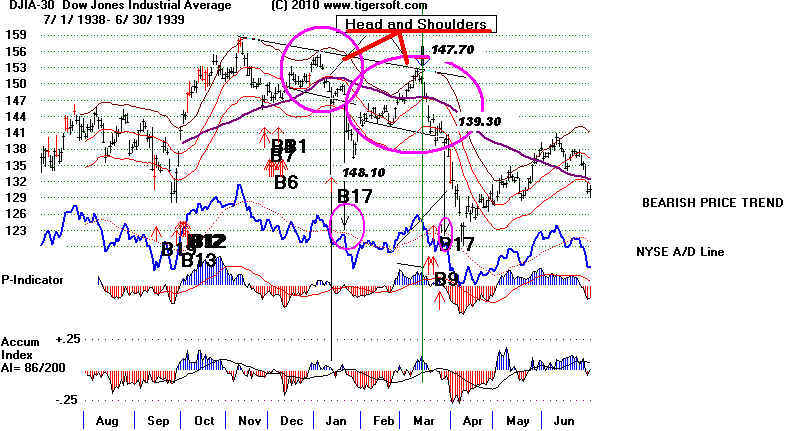

...B17 1/ 12/ 1939 147.3 +1.0% 3/6/1939 148.8 S12

la/ma = .973 21-dma roc= -.11 P= -12 (-25) IP21= .017 V= -45 OP = .057 7% below top

(Bull Market variety.)

DJI fell to 137 and then rallied to the upper band Paper loss = 7%

la/ma=.973 21dma.roc=-.11 la/65dma=.974 65dma.roc=-.026 P=-12 Pchange=-25

IP21= .017 V=-45 OP= .085

Note the first head and shoulders in chart below. Using the rule to sell on the right shoulder apex

of the head and shoulders pattern when the A/D Line uptrend was broken would have meant

selling at 148.10 or at the next day's week opening. This would have avoided an 8% decline

after the head and shoulders pattern's neckline support failed.

----------------------------------------------------------------------------------------------------------------------------------------

6

...B17 3/21/1939 143.40 -0.1% 15% paper loss

la/ma = .975 21-dma roc= -.121 P= 11 IP21= .001 12% below top

Note the second head and shoulders in chart below. Using the rule to sell on the right shoulder

apex of the head and shoulders pattern when the A/D Line uptrend was broken would have

meant selling at 139.30 on 3/28/1939 or at the next day's week opening. This would have avoided

a 9% decline after the head and shoulders pattern's neckline support failed.

----------------------------------------------------------------------------------------------------------------------------------------

7

...B17 10/ 27/ 1941

119.4

-4.4% 1/ 5/ 1942

114.2 S12

(Bear Market variety.)

Note previous head and shoulders

pattern,. DJI fell to 106 and then

rallied to the upper band.

la/ma=.972 21dma.roc=-.676

la/65dma=.948 65dma.roc=-.281

P=-71 Pchange= 21

- (Very weak internals for a DJI

only 3.8% below 21-dma)

---------------------------------------------------------------------------------------------------------------------------------------

8

...B17 12/ 12/ 1941

110.6

+3.3% 1/ 5/ 1942

114.2 S12

(Bear Market variety.)

DJI fell to 106 and then rallied to the upper band

la/ma=.99 21dma.roc=-.387 la/65dma=.945

65dma.roc=-.346 P=-54 Pchange= 19

IP21= .019 V=-99 OP= -.176

----------------------------------------------------------------------------------------------------------------------------------------

9

...B17 2/ 13/ 1942

106.7

-7.0% 5/ 11/ 1942

99.2 S9/S12

(Bear Market variety.)

DJI fell to 93 and then rallied to the upper band

la/ma=.974 21dma.roc=-.639 la/65dma=.955 65dma.roc=-.399

P=-58 Pchange=-4

IP21= -.068 V=-67 OP= -.405

----------------------------------------------------------------------------------------------------------------------------------------

10

...B17 2/ 19/ 1942 105.6

-6.1% 5/ 11/ 1942

99.2 S9/S12

Bear Market variety.)

DJI fell to 93 and then rallied to the upper band

la/ma=.973 21dma.roc=-.536

la/65dma=.95 65dma.roc=-.388 P=-71 Pchange= 0

IP21= -.04 V=-73 OP= -.21

---------------------------------------------------------------------------------------------------------------------------------------

11

...B17 8/10/43 136.20

-0.5%

11/5/43 135.5

S10

la/ma = .971 21-dma roc= -.711

P= -38 IP21= -.202 7% below top

(Bull Market variety.)

DJI

declined to 129.6 on 11/30/44 and then rallied.

la/ma=.971 21dma.roc=-.711 la/65dma=.968 65dma.roc=-.031 P=-38 Pchange= 7

IP21= -.202 V=-137 OP=

-.356

-----------------------------------------------------------------------------------------------------------------------------------------

12

...B17 2/13/46 198.7

2/18/46

+1.5% 201.6

S6

la/ma=.98 21-dma roc-

.188 P= -35 IP21= .115

Non-symmetrical HS Pattern followed.

(Bull Market variety.)

Quickly formed

a right shoulder in a head and shoulders pattern

and fell to low of 186 before rallying past the upper band. .

la/ma=1.028 21dma.roc=.865

la/65dma=1.061 65dma.roc=.423 P= 157 Pchange= 27

IP21= .26 V= 235 OP= .395

-----------------------------------------------------------------------------------------------------------------------------------------

13

...B17 1/14/47 172.6

10/22/47

+9.2% 184.40 S4

(BearMarket variety.)

DJI

declined to 163.6 on 5/19/48 and then rallied. S10 here on 4/14/47? No..

S10s within a base are not so bearish. Nothing to reverse.

la/ma=.98 21dma.roc=-.088

la/65dma=1.005 65dma.roc=.118 P=-62 Pchange= 29

IP21= .092 V=-140 OP= .231

----------------------------------------------------------------------------------------------------------------------------------------

14

...B17 3/17/47 173.4

10/22/47 +6.3%

184.40 S4

(Bear Market variety.)

DJI

declined to 163.6 on 5/19/48 and then rallied.

S10s within a base are not so bearish. Nothing

to reverse.

la/ma=.972 21dma.roc=-.546

la/65dma=.975 65dma.roc=-.059 P=-50 Pchange= 12

IP21= 0 V=-107 OP= -.145

----------------------------------------------------------------------------------------------------------------------------------------

15

...B17 5/16/47 165

10/22/47 +11.8%

184.40 S4

(Bear Market variety.)

Rallied

immediately.

S10s within a

base are not so bearish. Nothing to reverse.

la/ma=.971 21dma.roc=-.21 la/65dma=.946

65dma.roc=-.379 P=-143 Pchange=-41

IP21= -.221 V=-188 OP= -.249

----------------------------------------------------------------------------------------------------------------------------------------

16

...B17 11/5/48 178.4

4/15/50 +20.8%

215.50 S9

(Bear Market variety.)

DJI

declined to 161.6 on 6/13/48 and then rallied.

la/ma=.958 21dma.roc=-.504

la/65dma=.967 65dma.roc=-.085 P= 187 Pchange= 4

IP21= .085 V= 285 OP= .006

---------------------------------------------------------------------------------------------------------------------------------------

17

...B17 11/24/48 173.4 (also B9)

4/15/1950

+24.3% 215.50 S9

(Bear Market variety.)

DJI declined to 161.6 on 6/13/48 and then rallied.

la/ma=.961 21dma.roc=-1.078 la/65dma=.955 65dma.roc=-.195 P= 78 Pchange=-55

IP21= -.029 V= 152 OP= -.278

---------------------------------------------------------------------------------------------------------------------------------------

18

...B17 6/29/51 242.60

8/30/51 +11.3%

274.2 S1

la/ma=.973 21-dma

roc- .339 P= -140 IP21= .102

uncompleted non-symmetrical HS Pattern

(Bull Market variety.)

Rallied

13% immediately in 10 weeks.

la/ma=.993 21dma.roc=-.555 la/65dma=.959

65dma.roc=-.236 P=-35 Pchange= 24

IP21= -.091 V=-83 OP= -.154

--------------------------------------------------------------------------------------------------------------------------------------

19

...B17 10/29/51 260.4

1/28/52 +5.3%

274.2 S1

la/ma=.962 21-dma roc= -.478

P= -73 (+22) IP21=.019 6% down from high

(Bull Market variety.)

Rallied almost immediately.

la/ma=.962 21dma.roc=-.478 la/65dma=.968

65dma.roc=.018 P=-73 Pchange= 22

IP21= .019 V=-231 OP= -.167

--------------------------------------------------------------------------------------------------------------------------------------

20

...B17 11/5/51 259.8

1/28/52 +5.5% 274.2 S1

la/ma=.97 21-dma roc=

-.692 P= -105 (-1) IP21= -.035 -286 -.172 6% down from high

(Bull Market variety.)

Rallied immediately.

la/ma=.97 21dma.roc=-.692 la/65dma=.965

65dma.roc=-.045 P=-105 Pchange=-1

IP21= -.035 V=-286 OP= -.186

-------------------------------------------------------------------------------------------------------------------------------------

21

...B17 4/7/53 275.2 .

3/9/1954 +8.8% 299.50 S15

la/ma=.964 21-dma roc=.40 P=-2

IP21=-.018

(Bull Market

variety.)

DJI

declined to 255.5 on 9/14/53 and then rallied.

...S10 4/ 23/

1953 270.7 +2.7% Isolated S10

This is not visually confirmed as a breakdown.

la/ma=.964 21dma.roc=-.4 la/65dma=.962

65dma.roc=-.225 P=-2 Pchange=-6

IP21= -.018 V=-148 OP= -.081

------------------------------------------------------------------------------------------------------------------------------------

22

...B17 9/26/55 455.6

9/26/55 +7.9%

491.4 S12

la/ma=.957 21-dma

roc= -.143 P= -26 (-59) IP21= .08 -300 .169 6%

down from high

(Bull Market

variety.)

DJI declined to 438.6 on 10/11/55 and then rallied.

la/ma=.957 21dma.roc=-.143

la/65dma=.982 65dma.roc=.056 P= 26 Pchange=-59

IP21= .08 V=-300 OP= .217

-----------------------------------------------------------------------------------------------------------------------------------

23

...B17 10/11/55 438.6

9/26/55 +12.0% 491.4 S12

la/ma=.934 21-dma roc=

-.958 P= -95 (-20) IP21= .018 -494 - .042 6% down from high

(Bull Market variety.)

Rallied immediately.

la/ma=.934 21dma.roc=-.958 la/65dma=.944

65dma.roc=-.212 P=-95 Pchange=-20

IP21= .018 V=-494 OP= .014

----------------------------------------------------------------------------------------------------------------------------------

24

...B17 10/18/55 448.6

9/26/55 +9.5% 491.4 S12

la/ma=.974 21-dma roc=

-.906 P= -58 (+14) IP21= .007 -424 - .146 6% down from high

(Bull Market

variety.)

Rallied immediately.

la/ma=.974 21dma.roc=-.906

la/65dma=.968 65dma.roc=-.096 P=-58 Pchange= 14

IP21= .007 V=-424 OP= -.1

---------------------------------------------------------------------------------------------------------------------------------

25

...B17 2/5/57

470

7/8/57 +10.3% 518.40

S9

la/ma=.982 21-dma roc= -.132

P= 12 IP21=-.064 8% down from high

(Bull Market variety.)

DJI

fell to 455 a week lated and then rallied above upper band.

la/ma=.975 21dma.roc=-.621

la/65dma=.968 65dma.roc=-.131 P=-97 Pchange=-33

IP21= -.085 V=-341 OP= -.342

--------------------------------------------------------------------------------------------------------------------------------

26

...B17 2/13/57 462.1

7/8/57 +12.2% 518.40 S9

la/ma=.977 21-dma roc=

-.606 P= -112 IP21=-.067 12% down from high

(Bull Market variety.)

Rallied immediately.

la/ma=.975 21dma.roc=-.569

la/65dma=.957 65dma.roc=-.212 P=-134 Pchange= 52

IP21= -.061 V=-418 OP= -.239

--------------------------------------------------------------------------------------------------------------------------------

27

...B17 10/28/57 432.10

4/17/50 +44.4% 624.1 S9

(Bear Market variety.)

Rallied immediately.

la/ma=.972 21dma.roc=-.662

la/65dma=.918 65dma.roc=-.673 P=-193 Pchange=-23

IP21= -.125 V=-705 OP= -.422

-------------------------------------------------------------------------------------------------------------------------------

28 9/9/59 637.6

12/8/59 +5.9% 685.5 S8

4% paper loss

Simultaneous H/S

la/ma=.974

21-dma roc= -.294 P= -104 (14) IP21=-.016 5% down from high

(Bull Market variety.)

Fell to 617 and then rallied.

-----------------------------------------------------------------------------------------------------------------------------

29

...B17 9/15/59 630.8

1/5/60

+8.7% 685.5 S9 2% loss Simultaneous H/S

la/ma=.971

21-dma roc= -.51 P= -172 IP21=-.045 5%

down from high

(Bull Market variety.)

Fell to

617 and then rallied.

la/ma=.971 21dma.roc=-.51 la/65dma=.965

65dma.roc=.02 P=-172 Pchange=-33

IP21= -.045 V=-533 OP= -.277

----------------------------------------------------------------------------------------------------------------------------

30

...B17 9/23/59 624

12/8/59 +9.9% 685.5 S9 none

Simultaneous H/S

la/ma=.972

21-dma roc= -.541 P= -203 IP21=-.085 8% down from

high

(Bull Market variety.)

Rallied immediately.

In the chart below, see

that it would have been safer not use a Buy B17 until the minimum

downside objective has been reached.

That was the bottom. One could also have waited

for the steep A/D Line downtrend to be

violated to the upside to Buy again.

----------------------------------------------------------------------------------------------------------------------------

X This signal was replace in March 2013 with a B17 in March

in keeping with

the patterns of sell-offs producing 10% or more declines in the first

quarter

of a Presidential Election Year.

...B17 2/11/60 618.60

5/18/60 +0.7% 623 S12

3% paper loss

la/ma=.972

21-dma roc= -.705 P= -124 IP21= -.172 13% down from high

(Bull Market variety.)

DJI declined

to 599.6 on 5/2/60 and then rallied.

------------------------------------------------------------------------------------------------------------------------------------------

31 3/3/1960 612.00

Gain = 1.0% Paper loss = 2.1%

.981

-.474

84

-.073

-383

-.178

This is in place of former Buy B17 on 2/11/1960

---------------------------------------------------------------------------------------------------------------------------

32

...B17 10/25/60 566.00 .

8/3/61 +26.4% 715.7 S15

Rallied immediately.

(Bear Market variety.)

la/ma=.973 21dma.roc=-.227

la/65dma=.936 65dma.roc=-.228 P=-107 Pchange= 18

IP21= -.108 V=-473 OP= -.183

--------------------------------------------------------------------------------------------------------------------------

33

...B17 11/13/67 859.74

1/9/68 +5.6% 908.29 S12

Rallied immediately.

la/ma=.975

21-dma roc= -.719 P= -232 (+10) IP21= -.218 V=-19

OP=-.515 10% down from high

(Bull Market

variety.)

-------------------------------------------------------------------------------------------------------------------------

This B17 signal has been replaced by a March 1968 Buy B17.

X ...B17 2/14/68 837.38

7/11/68 +10.2% 922.82 S12 2% paper loss

la/ma=.971

21-dma roc= -.762 P= -260 (+10) IP21= -.178 V=-22 OP=-.425 10% down

from high

(Bull Market

variety.) . DJI was down

13% from high.)

. Bottom was 3/22/1968 from 826.05

-------------------------------------------------------------------------------------------------------------------------------

34 Buy B17 3/4/1968 830.56 Gain = 17.7%

Paper Loss = 0.5%

.982

-.350

-197

-.087

-18 -.051

Bottom not made

until 3/22/1968

Here the signal

waits until IP21 rises above it 21-day ma by +.02 or

or the IP21

21-day ma turns up.

-------------------------------------------------------------------------------------------------------------------------

35

...B17 2/20/69 916.65

4/30/69 +3.7% 950.18 S9 Rallied almost immediately.

la/ma=.974

21-dma roc= -.167 P= -139 (-31) IP21= .016 V=-2 OP= .115

(Bull Market variety.)

----------------------------------------------------------------------------------------------------------------------

36

...B17 2/25/69 899.80

4/30/69 +5.6% 950.18 S9 Rallied almost immediately

la/ma=.97

21-dma roc= -.423 P= -264 (-1) IP21= -.056 V=-3

OP= .041 10% down from high

(Bull Market

variety.)

----------------------------------------------------------------------------------------------------------------------

37

...B17 2/28/69 905.21 .

4/30/69 +5.0%

950.18 S9

(Bull Market

variety.)

Rallied immediately

la/ma=.97 21dma.roc=-.423 la/65dma=.955

65dma.roc=-.238 P=-264 Pchange=-1

IP21= .006 V=-3 OP= .064

------------------------------------------------------------------------------------------------------------------------

38

...B17 11/10/71 826.15

3/9/72 +14.1% 942.81 S4

(Bear Market

variety.)

DJI declined to 797.97 on 11/23/71 and then rallied.

la/ma=.973 21dma.roc=-.941 la/65dma=.938 65dma.roc=-.059 P=-270 Pchange=-45

IP21= -.178 V=-4 OP= -.387.

------------------------------------------------------------------------------------------------------------------------

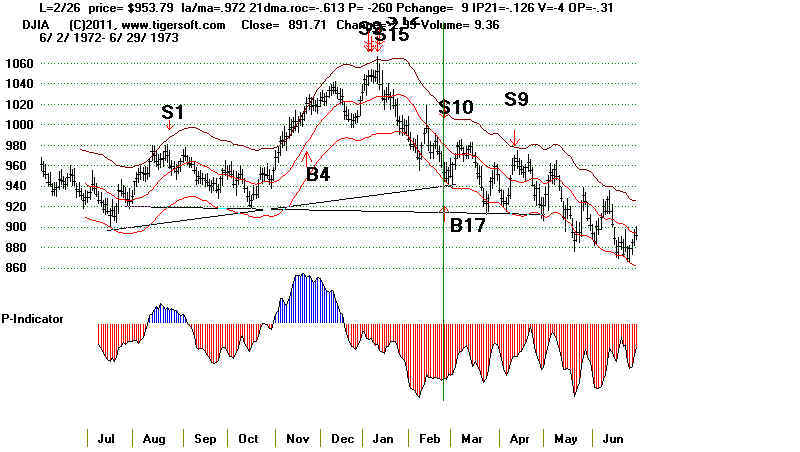

X This signal

should be considered void, because there was a simultaneous Sell S10.

...B17 2/26/73 959.79

4/11/73

+1.4% 967.41 S9 4% paper loss

la/ma=.972 21-dma roc= -.613 P=-260

(9) IP21= -.126 V= -4 OP= -.31

(Bull Market variety.)

DJI declined to 922.71 on 3/23/73 and then rallied.

------------------------------------------------------------------------------------------------------------------------

39

...B17 8/15/73 874.17

9/4/73

+2.4% 895.39 S9

(Bear Market variety.)

Rallied almost immediately. Boittom was

8/22/73 at 851.90.

la/ma=.961 21dma.roc=-.312 la/65dma=.97

65dma.roc=-.152 P=-155 Pchange=-13

IP21= .005 V=-2 OP= .099

------------------------------------------------------------------------------------------------------------------------

40

...B17 2/6/74 824.62

2/22/74 +3.8% 855.99

S12

(Bear Market variety.)

Rallied almost immediately. Boittom was

2/11/74 at 803.90.

la/ma=.972 21dma.roc=-.52 la/65dma=.969

65dma.roc=-.561 P=-44 Pchange= 33

IP21= -.078 V=-2 OP= -.206

------------------------------------------------------------------------------------------------------------------------

41

...B17 9/16/75 795.13

10/21/75 +6.5% 846.82 S12 none incomplete H/S Shoulders

la/ma=.974

21-dma roc= -.444 P=-160 (-50) IP21= -.133

V= -3 OP= -.232

(Bull Market variety.)

Rallied almost immediately.

------------------------------------------------------------------------------------------------------------------------

42

...B17 10/8/76 952.38 (also

B2) 12/27/76 +4.6% 996.09 S8 2% Paper Loss

la/ma=.964

21-dma roc= -.415

P=-150 (-12) IP21= -.042 V= -3 OP= -.374

(Bull Market variety.)

Rallied almost immediately. Boittom was

11/10/75 at 924.04.

------------------------------------------------------------------------------------------------------------------------

43

...B17 2/9/77 933.84

3/15/77 +3.3% 965.01 S9

(Bear Market variety.)

Rallied immediately.

la/ma=.975 21dma.roc=-.531 la/65dma=.969 65dma.roc=0 P=-46 Pchange= 0

IP21= -.072 V=-2 OP= -.228

------------------------------------------------------------------------------------------------------------------------

44

...B17 2/21/78 749.32 .

6/13/78 +14.4% 856.98 S8

(Bear Market variety.)

Rallied almost immediately.

la/ma=.975 21dma.roc=-.427

la/65dma=.938 65dma.roc=-.423 P=-53 Pchange=-17

IP21= -.07 V=-2 OP= -.237

------------------------------------------------------------------------------------------------------------------------

45

...B17 5/15/79 825.88

8/23/79

+6.6% 880.38 S4 No paper loss H/S Shoulders

la/ma=.972

21-dma roc= -.484 P= -150 (+38) IP21= -.107 V= -3 OP=

.072

Minimum downside objective reached from

completed H/S Pattern.

(Bull Market variety.)

------------------------------------------------------------------------------------------------------------------------

46

...B17 11/7/79 796.67

1/16/80

+8.6% 865.19 S4 Rallied immediately.

la/ma=.972 21-dma roc= -.882 P=-275 (+34)

IP21= -.101 V= -9 OP= -.573

(Bull

Market variety.)

---------------------------------------------------------------------------------------------------------------------------------

47

...B17 12/9/80 934.04

1/2/81

+3.5% 972.78 S12 3% Paper Loss

H/S pattern

la/ma=.96 21-dma roc= -.02 P=-123 (-7)

IP21= -.062 V= -1 OP= -.152

(Bull

Market variety.)

----------------------------------------------------------------------------------------------------------------------------------

48

...B17 2/2/81 932.25

4/1/81

+8.8% 932.25 S12 Rallied

immediately. H/S pattern

la/ma=.971

21-dma roc= -.501 P= -120 IP21= -.005

(Bull Market variety.)

Minimum

downside objective reached from completed H/S Pattern.

-----------------------------------------------------------------------------------------------------------------------------------

49

...B17 10/26/81 830.96

4/1/82 +0.3% 833.24 S9

(Bear Market

variety.)

DJI declined to 776.92 on 8/12/82 and then rallied.

la/ma=.972 21dma.roc=.097 la/65dma=.939

65dma.roc=-.46 P= 100 Pchange= 46

IP21= .069 V= 2 OP= -.067

------------------------------------------------------------------------------------------------------------------------------------

50

...B17 8/9/83 1168.27 .

11/22/83 +9.2% 1275.81 S4 Rallied immediately.

(Bull Market

variety.)

la/ma=.971 21-dma

roc= -.467 P--239 (-19) IP21-

.022 V= -14 OP= -.028

Supoprt line held after B17 and fifth test.

-------------------------------------------------------------------------------------------------------------------------------------

51 ...B17 5/22/84 1116.82

10/19/84 +9.8% 1225.93 S1

(Down

13.5% from peak...??? >> Bull Market Variety.)

DJI declined to 1086.57 on 7/24/84 and then rallied.

la/ma=1.027

21dma.roc=.345 la/65dma=1.021 65dma.roc=-.116 P= 3 Pchange= 39

IP21= .032 V= 0 OP= .225

------------------------------------------------------------------------------------------------------------------------------------

52. Buy B17 1143.63 Gain = +3.6% No

Paper Loss Gain = +3.6%

. 989 -.315 -208

-.021 -11 -.173

----------------------------------------------------------------------------------------------------------------------------------------------------

53

...B17 7/14/86 1973.45

8/12/86 +2.3% 1835.49 S9 Rallied almost immediately.

(Bull

Market variety.) 6% down from high

la/ma=.962 21dma.roc=-.285

la/65dma=.977 65dma.roc=-.002 P=-48 Pchange=-44 IP21= .018 V=-5 OP= .088

--------------------------------------------------------------------------------------------------------------------------------------

54

...B17 9/11/86 1792.89

5/6/87

+30.6% 2342.19 S9 Rallied almost immediately.

(Bull Market

variety.)

la/ma=.955 21dma.roc=-.27 la/65dma=.973 65dma.roc=-.093

P=-25 Pchange=-106 IP21= .074 V=-7 OP= -.05

---------------------------------------------------------------------------------------------------------------------------------------

55

...B17 11/19/86 1826.63

5/6/87 +28.2% 2342.19 S9 Rallied immediately.

(Bull Market variety.)

la/ma=.98

21dma.roc=.134 la/65dma=.994 65dma.roc=-.076 P=-7 Pchange=-26 IP21= .089 V=-2 OP= .113

--------------------------------------------------------------------------------------------------------------------------------------

56

...B17 5/19/87 2221.28 .

6/8/87 +5.9%

2353.61 S12 Rallied

immediately.

(Bull

Market variety.)

la/ma=.97 21dma.roc=-.256 la/65dma=.97 65dma.roc=.063

P=-153 Pchange=-34 IP21= -.086 V=-10 OP= -.158

--------------------------------------------------------------------------------------------------------------------------------------

57

...B17 9/4/87 2561.38

9/4/87

+3.0% 2561.38 S9 Rallied almost immediately.

(Bull Market

variety.)

la/ma=.963

21dma.roc=-.147 la/65dma=1.015 65dma.roc=.342 P=-117 Pchange=-49 IP21= .019 V=-12 OP=

-.102

--------------------------------------------------------------------------------------------------------------------------------------

58

...B17 12/2/87 1848.97

12/28/87 +5.1% 1942.97

S9

(Bear Market

variety.)

Rallied immediately.

la/ma=.963 21dma.roc=-1.02

la/65dma=.827 65dma.roc=-1.394 P=-139 Pchange=-23

IP21= .004 V=-27 OP= -.089

--------------------------------------------------------------------------------------------------------------------------------------

59

...B17 3/25/88 1978.95 B9

4/14/88 +1.3%

1978.95 S1

(Rally up off Bear Market Bottom

variety.)

Rallied immediately.

la/ma=.963 21dma.roc=-.223

la/65dma=.994 65dma.roc=0 P= 3 Pchange=-32

IP21= .071 V=-3 OP= .002

--------------------------------------------------------------------------------------------------------------------------------------

60

...B17 11/11/88 2067.03 .

10/4/89

+34.1% 2771.09 S9 Rallied immediately.

(Bull Market variety.)

la/ma=.963 21dma.roc=-.367

la/65dma=.986 65dma.roc=.05 P=-133 Pchange=-50 IP21= .025 V=-15 OP= -.053

--------------------------------------------------------------------------------------------------------------------------------------

61

...B17 10/17/89 2638.73

1/2/90

+6.5% 2810.15

S15 1% Paper Loss.

(Bull

Market variety.)

la/ma=.974 21dma.roc=-.214 la/65dma=.983 65dma.roc=.12 P=-91

Pchange=-16 IP21= .106 V=-6 OP= .091

--------------------------------------------------------------------------------------------------------------------------------------

62

...B17 10/26/89 2613.73

1/2/90 + 7.5%

2810.15 S15 Rallied

immediately.

(Bull Market

variety.)

la/ma=.967 21dma.roc=-.261 la/65dma=.97 65dma.roc=.043

P=-116 Pchange=-26 IP21= .161 V=-14 OP= .059

--------------------------------------------------------------------------------------------------------------------------------------

63

...B17 1/23/90 2615.32 .

7/12/90 +13.2% 2969.80 S9 2% paper loss

(Bull Market variety.

la/ma=.961 21dma.roc=-.331 la/65dma=.972 65dma.roc=-.098 P=-93

Pchange=-24 IP21= .03 V=-19 OP= .021

--------------------------------------------------------------------------------------------------------------------------------------

64

...B17 2/1/1990 2586.26

7/12/90 +14.8% 2969.80 S9 1% paper loss

(Bull Market variety.)

la/ma=.971

21dma.roc=-.995 la/65dma=.964 65dma.roc=-.025 P=-313 Pchange= 3 IP21= -.034 V=-38

OP= -.335

--------------------------------------------------------------------------------------------------------------------------------------

65

...B17 9/25/90 2485.64

4/15/92 +34.9%

3353.76 S9

(Bear Market variety.)

Rallied almost immediately.

la/ma=.963 21dma.roc=-.218

la/65dma=.903 65dma.r oc=-.519 P=-118 Pchange=-14

IP21= .057 V=-18 OP= -.061

--------------------------------------------------------------------------------------------------------------------------------------

66

...B17 10/10/90 2407.92

4/15/92 +39.3% 3353.76 S9|

(Bear Market variety.)

Rallied immediately.

la/ma=.96 21dma.roc=-.967 la/65dma=.898

65dma.roc=-.691 P=-314 Pchange=-30

IP21= -.016 V=-37 OP= -.267

--------------------------------------------------------------------------------------------------------------------------------------

67

...B17 11/22/91 2902.73

4/14/92 +13.9% 3306.13 S9 Rallied almost immediately.

(Bull Market variety.)

la/ma=.962 21dma.roc=-.447 la/65dma=.962 65dma.roc=-.134

P=-62 Pchange=-5 IP21= .054 V=-16 OP= -.128

--------------------------------------------------------------------------------------------------------------------------------------

68

...B17 12/5/91 2889.09

4/14/92 +14.4% 3306.13

S9 Rallied

immediately.

(Bull Market variety.)

la/ma=.975

21dma.roc=-.57 la/65dma=.962 65dma.roc=-.153 P=-128 Pchange=-15 IP21= .034 V=-23

OP= -.193

--------------------------------------------------------------------------------------------------------------------------------------

69

...B17 9/22/93 3547.02

2/23/94

+11.9% 3967.66

S4 Rallied immediately.

(Bull Market variety.)

la/ma=.98 21dma.roc=-.194 la/65dma=.994 65dma.roc=.039 P= 12

Pchange= 36 IP21= .089 V=-13 OP= -.057

--------------------------------------------------------------------------------------------------------------------------------------

70

...B17 7/17/96 5376.88

8/9/96 +5.7%

5681 S2 Rallied immediately.

(Bull Market variety.)

la/ma=.959 21dma.roc=-.585

la/65dma=.957 65dma.roc=-.148 P=-268 Pchange= 55 IP21= -.012 V=-62 OP=

.01

--------------------------------------------------------------------------------------------------------------------------------------

71

...B17 12/12/96 6303.71

4/22/97

+8.4% 6833.69 S9 Rallied immediately.

(Bull Market variety.)

la/ma=.981

21-dma roc= .07 P= 22 (-47) IP21= .083 V=

-20 OP= .06

--------------------------------------------------------------------------------------------------------------------------------------

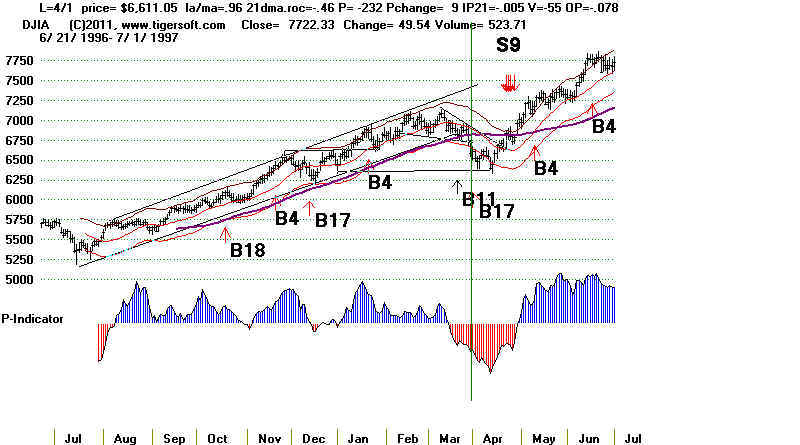

72

...B17 4/1/97 6611.05

4/22/97 +3.4% 6833.69 S9

Rallied almost immediately.

(Bull Market

variety.) Note head/shoulders

pattern was completed.

la/ma=.960

21-dma roc= -.46 P=-232 (+9) IP21= -.005

V= -55 OP= -.078

--------------------------------------------------------------------------------------------------------------------------------------

734

...B17 10/28/97 7498.32

11/20/97 +4.4% 7826.61

S12 Rallied immediately.

This was also a Buy B1 and B19. This was 13.4% down from

high.

(Bear Market variety.)

la/ma=.944 21-dma roc= -.737 P= -175 (+2) IP21= .037

V= -48 OP= -.058

--------------------------------------------------------------------------------------------------------------------------------------

74

...B17 12/14/98 8695.60 .96

2/23/99 +9.8% 9544.42

S9 Rallied immediately.

(Recovery

from Bear Market variety.)

la/ma=.96 21dma.roc=-.176

la/65dma=1.021 65dma.roc=.407 P=-130 Pchange=-54 IP21= .028 V=-51 OP=

-.019

--------------------------------------------------------------------------------------------------------------------------------------

75

...B17 5/27/99 10466.32 .963

5/27/99 +3.7%

10855.55 S12 2%

paper loss

(Bull Market

variety.)

la/ma=.963 21dma.roc=-.414 la/65dma=1.017 65dma.roc=.399 P=-90

Pchange=-65 IP21= -.019 V=-70 OP= -.205

--------------------------------------------------------------------------------------------------------------------------------------

76

...B17 10/18/99 10116.28 .

12/28/99

+13.4% 11476.718 S9 Rallied immediately.

(Bull Market

variety.)

la/ma=.973 21dma.roc=-.785 la/65dma=.94

65dma.roc=-.391 P=-505 Pchange=-60 IP21= -.075 V=-159 OP= -.24

--------------------------------------------------------------------------------------------------------------------------------------

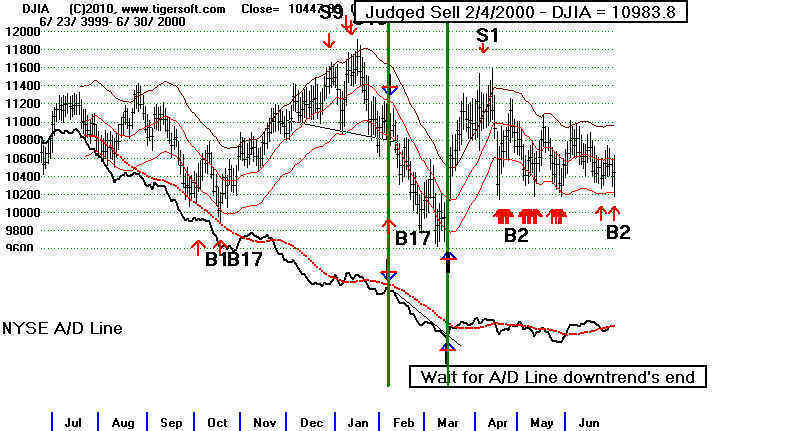

X Version 3/9/2013 replaced this B17 with a March Buy

B17.

...B17 2/4/2000 10963.8

4/6/2000

+1.4% 11114.27 S1 11%

paper loss H/S pattern

(Bull

Market variety.)

DJI declined to 9086.57 on 7/24/84 and then rallied.

la/ma=.975 21dma.roc=-.168 la/65dma=.985 65dma.roc=.132 P=-53

Pchange=-30 IP21= -.102 V=-73 OP= .038

See in the chart below that a judged

Sell based on the right shoulder apex being

clinched as A/D

Line turned down would have also have occurred on 2/4/2000.

This should have

negated the Buy B17. The DJI subsequently fell 11%

more with the

Head and Shoulders pattern playing out its minimum downside

objective.

Later buying when the A/D Line downtrend was broken would

have avoided the

11% paper loss and meant buying on 3/15/2000 at 10131.41

or at the next

day's opening.

--------------------------------------------------------------------------------------------------------------------------[

77 B17 3/9/2000 10010.73

Gain = 11.1% Paper Loss - 0

.976

-1.094

-413

-.136 -139

-.028

This replaced previous Buy B17 of 2/14/2010

--------------------------------------------------------------------------------------------------------------------------------------

78

...B17 10/20/2000 10226.59 . B2

12/8/2000 +4.8% 10712.91 S12

Rallied immediately.

(Bear

Market variety.)

DJI declined to 9811.24 on 3/14/00 and then rallied.

la/ma=.975 21dma.roc=-.61 la/65dma=.945

65dma.roc=-.22 P=-295 Pchange= 49 IP21= -.026 V=-134 OP= -.141

--------------------------------------------------------------------------------------------------------------------------------------

79

...B17 3/23/2001 9504.78

4/10/01 +6.3% 10102.74 S12

Rallied immediately.

(Bear

Market variety.)

la/ma=.929 21dma.roc=-1.183 la/65dma=.899 65dma.roc=-.415

P=-181 Pchange= 80 IP21= -.007 V=-231 OP= -.098

--------------------------------------------------------------------------------------------------------------------------------------

80

...B17 9/3/2002 8308.05 956

1/6/03 +5.6%

8773.57 S12 13% Paper Loss

(Bear

Market variety.)

DJI declined to 7286.27 on 10/19/2002 and then rallied.

la/ma=.956 21dma.roc=-.007 la/65dma=.933 65dma.roc=-.697 P= 189

Pchange=-16 IP21= .122 V=-29 OP= .027

--------------------------------------------------------------------------------------------------------------------------------------

81

...B17 3/11/03 7524.06

10/15/03 +30.3% 9803.05 S4

Rallied immediately.

(Bear

Market variety.)

la/ma=.962

21dma.roc=-.516 la/65dma=.914 65dma.roc=-.566 P=-102 Pchange= 27

IP21= -.033 V=-196 OP= -.117

--------------------------------------------------------------------------------------------------------------------------------------

82

...B17 3/2/07 12114.1

7/17/07 +15.3% 13971.55 S9 Rallied immediately

(Bull

Market variety.)

la/ma=.962 21dma.roc=-.479 la/65dma=.971 65dma.roc=-.052 P= 77

Pchange=-82 IP21= -.022 V=-202 OP= -.093

--------------------------------------------------------------------------------------------------------------------------------------

83

...B17 11/23/07 12980.88 B19

3/24/08 +4.9% 12548.64 S9 Rallied immediately.

(Bear Market variety.)

la/ma=.958 21dma.roc=-.779

la/65dma=.943 65dma.roc=-.124 P=-414 Pchange= 140 IP21= -.089 V=-315 OP= -.217

--------------------------------------------------------------------------------------------------------------------------------------

X (This signal has been excluded.

...B17 10/8/08 9258.10 B16, B1

10/14/08 +0.6% 9310.99 S10

(Bear Market variety.)

DJI declined to 8000 intra-day on 10/10/2009 and then rallied.

la/ma=.862 21dma.roc=-2.168 la/65dma=.826 65dma.roc=-.728 P=-791 Pchange= 31

IP21= -.032 V=-375 OP= -.176

--------------------------------------------------------------------------------------------------------------------------------------

84

...B17 1/26/09 8116.03 .

1/29/09 +0.4% 8149.01 S6

(Bear Market variety.)

la/ma=.957 21dma.roc=-.425

la/65dma=.944 65dma.roc=-.411 P= 177 Pchange= 74

IP21= .063 V=-105 OP= -.092

--------------------------------------------------------------------------------------------------------------------------------------

X This should be excluded because DJI was down more than 40% in previous 10

months.

Should use EXTREME BEARISH MODE.

...B17 2/17/09

7552.60

2/27/09 -6.5%

7062.93 S5

(Recovery

from Bear Market variety.)

la/ma=.937

21dma.roc=-.971 P= 117

Pchange=-140 IP21= -.003 V=-189 OP=- .137

-------------------------------------------------------------------------------------------------------------------------------------

X This should be eliminated because low of day was more than 10%

below 21-dma

...B17 5/6/10

10520.32

6/16/10

-1.1% 10409.46 S12

This was also a Buy B5

(Bull Market variety.)

la/ma=.953 21dma.roc=-.406 P=

-62 Pchange= 74 IP21= .071 V=-285 OP= .237

----------------------------------------------------------------------------------------------------------------------------------------------------

85

...B17 8/24/10

10040.45

OPEN

(Bull Market variety.)

la/ma=.961 21dma.roc=-.571 P= -144

Pchange = -165 IP21= .016 V=-220 OP= -.523

DJI fell to 9700 (Paper Loss of 3%) and then rallied above upper band.

-------------------------------------------------------------------------------------------------------------------------------------

86

...B17 6/8/11

12048.94 Gain =

3.0%

Paper

Loss = (12048.94 - 11897.27)

12048.94

(Bull Market variety.)

la/ma=.97 21dma.roc=-.608

P= -157 (-127) IP21= .067 V= -203 OP= -.218

DJI soon recovered to the upper band.

------------------------------------------------------------------------------------------------------------------

87

...B17 9 /26/ /11 11043.86

Gain =

9.5%

Paper

Loss = (11043.86 -

10655.30) / 11043.86

The bottom here showed a classic false

breakdown, based on the many internal strnegth indicators

which did not confirm this low. Note also the many Buy signals.