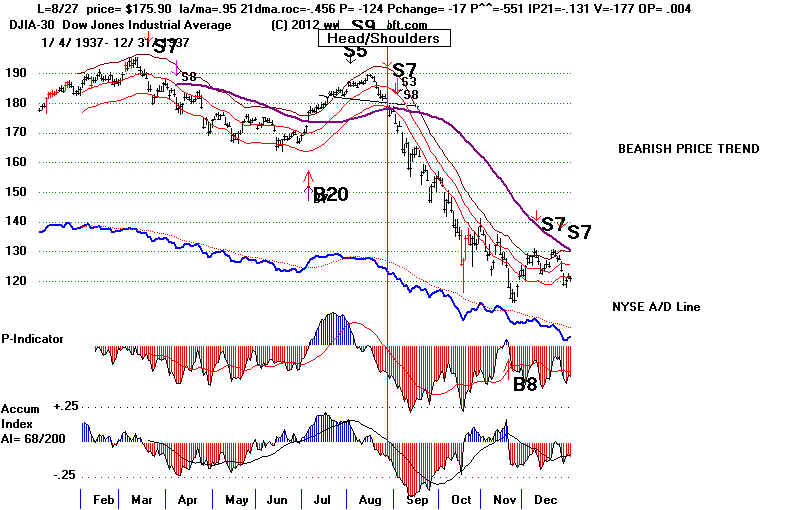

DJI closed below well-tested neckline support

in a Head and Shoulders Pattern

..... updated 4/24/2012

Nearly all the completed Head/Shoulders Sell S10s reinforce an earlier Peerless Sell.

But they should be recognized, first because they add significantly to the bearishness

of a market environment and, secondly, because they have the potential independently

to drop the stock market.

A completed head/shoulders pattern should be judged a Peerless Sell S10 when

the formation takes 30 says or longer and a Tiger Sell S5 when the pattern develops

in less time. It is not always possible for the computer to spot these patterns, mostly

because the necklines are not flat or are a little too irregular. The patterns are still

very important to watch for because of their reliabiliy as warnings of an impending decline.

The good news for readers here is that completed head and shoulders are rare

when Peerless is not already on a sell. In the 84 years between 1928 and 2012, there

have been only one case, April 2010, in all these years when a completed

head/shoulders in a bull market brought a subsequent decline below the neckline by more

than 5%. See all the cases of reversing head/shoulders' patterns at the bottom of this page,

These show that the pattern's bearishness cannot be said to be unleashed UNTIL the

neckline of the pattern is decisively violated,

HEAD AND SHOULDERS ARE IMPORTANT

The more of these patterns that appear in the same chart or even in the same larger pattern,

the more dangerous the market must be cosidered.

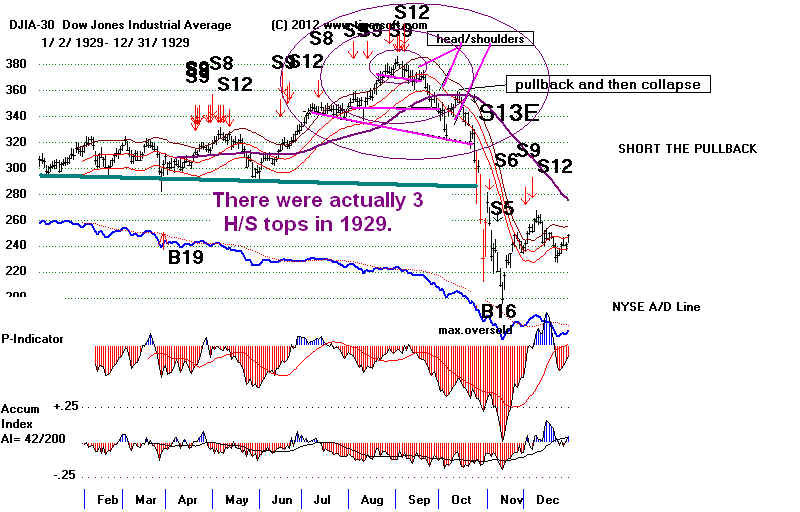

There were actually 3 head/shoulders tops in 1929.

1971 produced several different head/shoulders patterns.

head/shoulders

head/shoulders

Head/Shoulders

patterns have been considered important warnings by technicians

for many years.

For example, such patterns appeared before the big declines

of 1896, 1904,

1914, 1929 and 1930. The pattern's definition is just inexact enough to make

the count of

these patterns change depending on who is doing the counting. Still,

the most

important ones should be recognized on sight.

WHAT TO LOOK FOR

In these

patterns, you will see a left shoulder, which sometimes has several humps.

Then there is a head, as prices run to new highs. But they stop suddenly and fall back

to a point near

the previous lows. This is further down than a steep price-uptrend

should normally

allow. There then follows a light volume rally. But it fails to make

a new high.

This forms a right shoulder, which also may have several humps but

usually is about

the size of, and shows the same duration as, the left shoulder.

Often we can

estimate about where the apex of the left shoulder will be by drawing

a line parallel

to the neckline from the apex of the right shoulder. But perfect symmetry

is probably the

exception. For example, the right shoulder was only half the size of

the left shoulder

in the 1990 H/S case shown below.

1990 Head and Shoulders Was Assymetrical

Prices must

close below the neckline to complete the head and shoulders top.

The safest

way to draw the neckline is by using the lowest hypothetical DJI lows,

but you

will see from the examples here that one can sometimes draw very

effective

lines that are nearly flat through the lowest closing prices. Note that

about a

third of all the head/shoulders formations that start are NOT completed

by a plunge

below the pattern's support line. These H/S patterns are aborted.

If the

neckline is not broken below and prices instead rise and surpass the apex

of the

right shoulder, short sellers usually cover and a good rally then ensues.

Here is a

recent study of the cases where the DJI rallies above the apex of the

right

shoulder. Link to study in

4/18/2011 Hotline.

After the

neckline is broken, expect a quick sell-off. About half of the time,

there is

then a low volume pullback towards the

neckline or the 65-day ma.

This

recovers about one half to two thirds of the amount lost from the right shoulder

apex to the

first lows made after the neckline is broken. This can be a very good

point to go

short, especially if the Accumulation Index is negative and/or the

NYSE A/D

Line is lagging. In such cases, only after the minor pullback fails, do prices

then

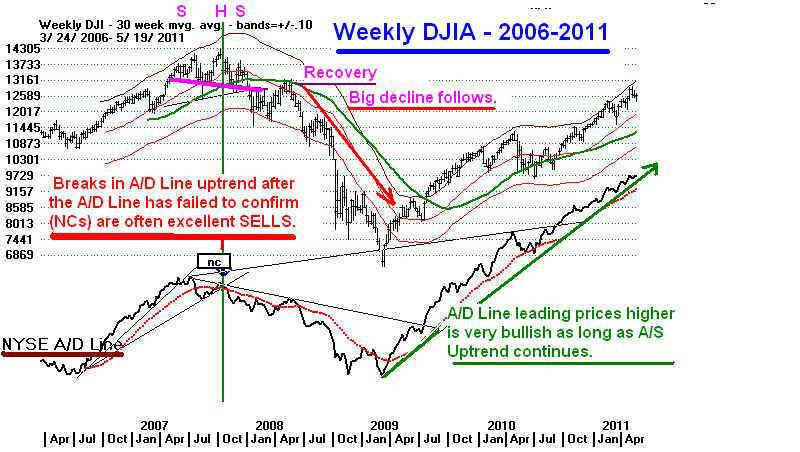

decline most precipitously. Weekly DJI charts show this, too. The 2007 peak

showed a

H/S top if one used the weekly closing prices to form the neckline.

------------------------------------------------------------------------------------------------------------------------------------------------------

WARNING:

DO NOT DEPEND ONLY ON H/S PATTERNS TO KNOW WHEN TO SELL.

IMPORTANT:

These H/S patterns occur just often enough to give the some

chartists the

sense that all they have to do is wait for a head and shoulders pattern

to know when to

sell. This is not correct. More tops are not formed

this way.

Readers should

use all our Peerless Sell Signals and know that when there is

afterwards also a

major price-support failure, a substantial decline and/or a bear market

will follow.

For example, there was no H/S top before the long 1973-1974 bear market.

To see how many

other types of market tops there are, other than H/S tops, look

at the

charts at http://alphaim.net/research/Pres_Cycle/index.html

------------------------------------------------------------------------------------------------------------------------------------------------------

HEAD AND SHOULDERS ARE IMPORTANT

The duration of

H/S patterns varies enormously. Day traders spot these patterns, too.

Our 5-year charts

of the DJI show plenty of them. They will be circled in red at

this site.

http://tigersoftware.com/TigerBlogs/May15,2011/index.html

Most can be

readily seen on a year's chart of daily data and last 10-75 trading days.

Lots of

examples are shown below.

The height

of the pattern, from the apex in the "head" to the neckline-support,

should be

measured. Subtract this amount from the point of breakdown below

the

neckline and get a minimum downside objective. Most times, a much bigger

decline

follows.

These H/S

patterns are very important to traders and investors. They are, I contend, the

market's way of

coping with suddenly bearish news that it does not expect. Most often,

when the DJI is

completing a head/shoulders pattern, the A/D Line will be weaker

than the DJI.

The P-Indicator and the Accumulation Index will usually be negative on the

right shoulder.

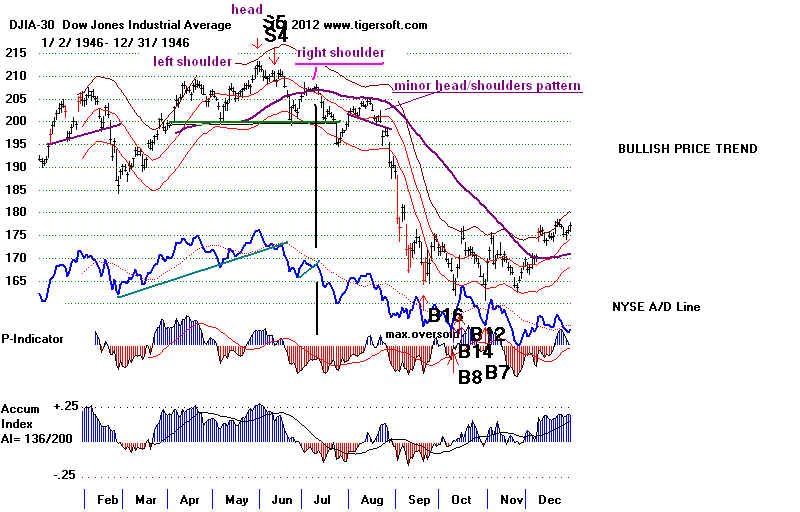

In the next

chart, see how the DJI broke below the neckline in July 1946. That

should have been

taken as a reinforcing Sell S10. ("Reinforcing", because the

DJI was already

on a Sell). Almost immediately, the DJI recovered back to the

resistance of the

65-day ma and formed a much smaller H/S pattern. The breakdown

in this second

pattern's neckline produced a dramatic, nearly vertical decline.

This decline was

so quick, there was even a Congressional investigation shortly

afterwards into

who was manipulating the stock market then.

Head and Shoulders Predict Bad News for Stocks

Some would say

that the pattern's well-known bearishness makes them self-fulfilling.

But there is more

to them than this. They often occur before very significant news, which

may take Wall

Street by surprise: invasions, attacks on US (Pearl Harbor) or allies

(Iraq invasion of

oil rich Kuwait in 1990), the Cuban Missile Crisis in 1990, going off

Gold Standard in

1990, World Trade Center bombing 2001, Presidential heart attacks

and assasinations

(JFK in 1963), as well as BP's massive oil spill in the Gulf in 2010..

Labor unrest can

cause a head/shoulders. 1946 saw more labor strikes than in any year in

American history. Corporate

profits and Wall Street felt threatened. Union membership

doubled, from 7.2

million in 1940 to 14.5 million at the end of World War II. There had

been a no strike

pledge during the war. After the war, pent-up grievances found

expression in

strikes. A wave of strikes spread seeeminly everywhere and from oil

workers to

railroad workers and coal miners. Then in September 1946, longshoremen

shut down most of

the entire West coast and a general strike was called in Oakland

in December

1946.

So, H/S patterns

give you advance warnings when the stock market is weakening

and news will

soon hit that is likely to drop the stock market. What we spot is

Big Money takes

profits over a period of time, so much so that significant new highs

can no longer be

made. Stocks are being distributed to the less informed in the process

of the

head/shoulders pattern. What the Public thinks is a pause before another advance

is actually a

lull before a storm. When the price neckline is broken, the market can no

longer be held

up. Patient big money distribution turns to hasty big money dumping

and then

institutional and public panic. Volume picks up dramatically.

Learn to spot the

insider and professional, big money selling:

1.

Initially, heavy big money selling causes the stock or the market to fall below the last

high.

Normally in a bull market, the most recent point of breakout acts as support

if the uptrend is

likely to continue,

2. Then, there is

a rally, but the recovery is quickly over-powered by the selling

on strength.

As a result, the DJI falls back and closes near its dailly lows. This causes

of Accumulation

Index to register negative, Red

Distribution on the right

shoulder.

3. If we look at

the ETF for the DIA, the Blue Closing Power will be declining. Professionals

are selling after

the opening, making prices drop far below openings. You can also see

the heavy

professional selling in Tiger candlesticks charts, as red trading days instead of

blue days.

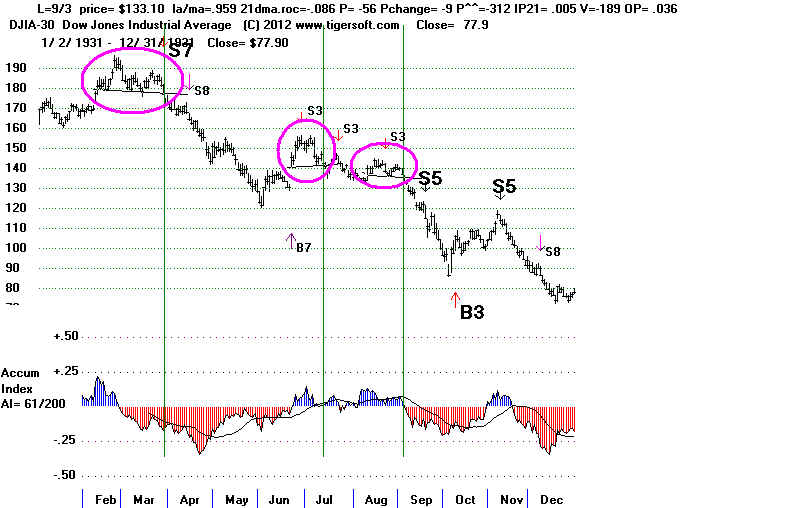

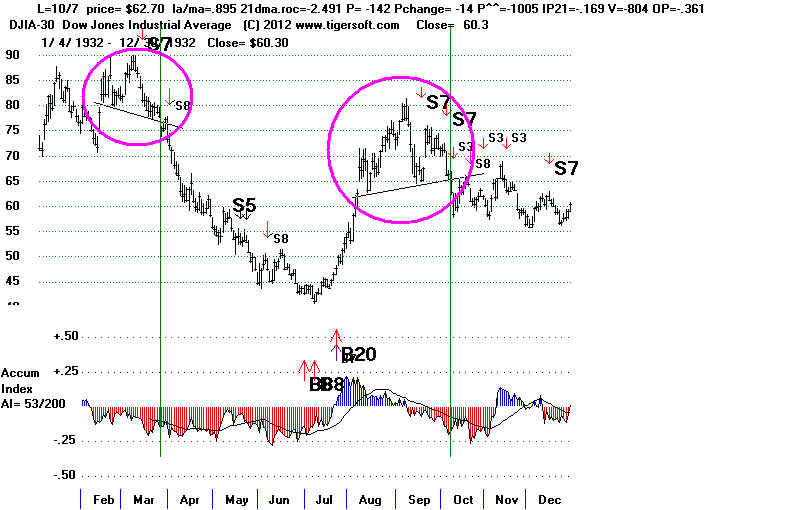

A HISTORY OF

DJI HEAD AND SHOULDER PATTERNS

Date cl/ma roc P Pch IP21 V Opct 1. 9/19/1929 .993 .07 -44 -2 -.114 -581 -.065 3/26/1931 .987 -.581 -46 -1 -.144 -379 -.242 3/23/1932 .948 -.244 -61 7 -.098 -251 .038 10/5/1932 .926 -1.185 -105 -20 -.145 -676 -.342 10/6/1941 .99 -.131 -14 -4 -.179 -62 -.192 7/22/1946 .982 0 -67 21 .001 -116 .023 breakdown fails short-term 8/21/1946 .994 .284 47 30 .122 2 .201 2/11/1952 .989 -.079 9 -16 .04 -97 .097 4/14/1952 .995 -.004 -52 -26 .013 -15 -.018 7/26/1957 1.00 .32 0 -9 .072 -134 .274 (minor pattern) 8/17/1959 .989 .023 -31 4 -.034 280 .155 breakdown failed. 9/4/1959 .994 -.359 -93 10 -.056 -387 -.097 4/11/1962 .98 -.362 -132 -3 .181 -533 -.398 big decline 6/26/1963 .984 -.153 -51 -23 -.093 -498 -.052 11/14/1963 .994 -.076 -36 -11 -.027 -539 +.11 (limited decline, 6/17/1971 .991 -.16 -137 7 -.069 -2 .073 10/13/1971 .993 -.171 -57 20 -.07 -1 -.05 3/26/1997 .993 -.27 -183 -8 -.008 -46 -.166 10/23/1997 .98 -.088 -10 -87 .057 -32 .012 only brief decline. 7/31/1998 .976 -.216 -351 -124 -.026 -96 -.149 6/12/2001 .989 .137 156 19 .103 -63 .269 3mo before 9/11. 9/16/2002 .970 -.602 109 -53 .061 -103 -.123 11/29/2010 .987 -.065 40 -26 .154 -83 .118 NO Breakdown. Rally followed. 11/15/2007 .98 -.449 -286 -163 .05 -252 -.237 12/28/2007 .997 .068 -13 -114 .003 -77 .319 5/28/2008 .996 .003 190 -26 .027 -39 .047 7/6/2009 .975 -.592 -101 -108 -.096 -161 -.221 No breakdown. Rally. 6/24/2011 .984 -.451 -77 -87 -.143 -184 -.063 |

How serious is the Sell S10? There were 15 earlier cases of Sell S10 when there was a

head and shoulders pattern and the DJI was not down more than 10%. In 14 of 15 the DJI fell

more than 5%. In 8 of the 16 cases the DJI fell more than 10% in the following 6 months.

Will there be much of a rebound?

In 10 of 15 cases there is a rebound before the big decline develops. But waiting for a rebound

is risky. In the five cases there was no rebound, prices swooned badly. When down-day volume

does not pick up on the break of the neckline by much, there is more likely to be a rebound.

Only in two cases, 1946 and 1971, was the a recovery rally of about 5% from where the Sell S10

occurred.

The absence of a previous S9 or S12 does not preclude a serious decline. Look at the cases of 1946

and 1962 for example. No previous sell signal occurred, yet big declines followed the completion

of these head and shoulers patterns.

In all but 1 of the 15 earlier S10 head and shoulders SELLs the NYSE A/D Line made at least

a 6 week new low at the time of the signal. In the one exeption, the decline was a relatively

small 6.7%.

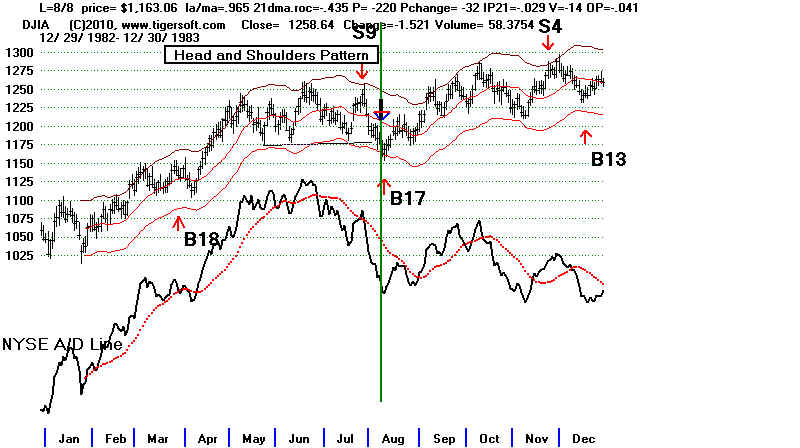

A new Buy B17 Signal (as in 1983) in the bullish month of July coupled with a rise back above

the neckline is your alert to the fact that the head and shoulders pattern has dailed and

a rally will quickly force shorts to cover.

Here are the cases gain of the 15 earlier cases. Click on the links to see their charts.

This should help you see what the market is up against.

Charts Rebound Rally? Ealier Sell?

1. 9/26/1930 213.30 DJI fell to 157.5 on 12/16/30 No S9/S12

LA/MA=.90 21-dma= -1.242 P=-58 IP21= -.148 V=-550 OPct=-.259

A/D Line simultaneously made a 9 month low.

(There were two Head and Shoulder patterns in previous three months)

Decline was more than 10%

2 5/10/1940 144.80 DJI fell to 111.80 in a month... No None

LA/MA= .979 21-dma= -0.41 P=-85 IP21= -.225 V=-207 OPct= +.069

A/D Line simultaneously made a 10 week low.

(Head and Shoulders Pattern.)

Decline is more than 10%

3. 1/29/1941 126.00 DJI fell to 115.50 on 4/20/40 Yes - rally to 124.60 Earlier Sell S10

LA/MA= .965 21-dma= -0.455 P=-24 IP21= -.182 V= -39 OPct= +.056

A/D Line simultaneously made a 10 week low.

(Head and Shoulders Pattern.)

Decline was more than 10%

4. 10/7/1941 124.40 DJI fell to 93.90 on 4/27/42 No None

LA/MA= .98 21-dma= -0.29 P=-43 IP21= -.216 V= -85 OPct= -.323

A/D Line simultaneously made a 5 week low.

(Head and Shoulders Pattern.)

Decline is more than 10%

5 7/23/1946 195.20 DJI fell to 163.10 on 10/19/1946 Yes - rally to 204.00 None

LA/MA= .958 21-dma= -0.461 P= -117 IP21= -.124 V= -188 OPct= -.111

A/D Line simultaneously made a 4 month low.

(Head and Shoulders Pattern.)

Decline is more than 10%

6. 4/11/1947 173.40 DJI fell to 163.60 on 5/20/1947 Yes - rally to 174.20 None

LA/MA= .951 21-dma= -0.951 P= -115 IP21= -.102 V= -184 OPct= -.174

A/D Line simultaneously made a 10 week low.

(Head and Shoulders Pattern.)

7. 1/14/1948 177.40 DJI fell to 165.40 on 3/16/1948 Yes...rally to 173.90 Earlier S10

LA/MA= .987 21-dma= -0.066 P= -34 IP21= -.029 V= -103 OPct= +..065

A/D Line DID NOT simultaneously made a 6 week low.

(Head and Shoulders Pattern.) 6.7% decline to February 1948 low at 165.

8. 9/10/1952 271.70 DJI fell to 263.10 on 10/22/1950 Yes .. rally to 272.40 Earlier S1

LA/MA= .987 21-dma= -0.371 P= -63 IP21= -.103 V= -148 OPct= -..345

A/D Line simultaneously made a 10 week low

(Head and Shoulders Pattern.) Closed out with a 1.7% gain.

9. 1/5/1962 714.80 DJI fell to 535.70 on 6/26/62 Yes ... rally to 722.30 None

(Also S10 1/17/61 at 697.40)

LA/MA= .983 21-dma= -0271 P= -100 IP21= -.104 V= -591 OPct= -.045

A/D Line simultaneously made a 7 week low

(Head and Shoulders pattern.)

Decline is more than 10%

10. 4/9/1962 692.90 DJI fell to to 535.70 on 6/26/62 Yes ... rally to 694.60 None

LA/MA= .974 21-dma= -359 P= -100 IP21= -.148 V= -536 OPct= -.299

A/D Line simultaneously made a 10 month low

(Head and Shoulders pattern.)

Decline is more than 10%

11. 6/21/1971 876.53 DJI fell to 797.97 on 11/23/71 Yes...rally to 920.93 Earlier S9

LA/MA= .963 21-dma= -.912 P= -47 IP21= -.138 V= -3 OPct= -.133

A/D Line simultaneously made a 4.5 month low

(A clear head and shoulders pattern.)

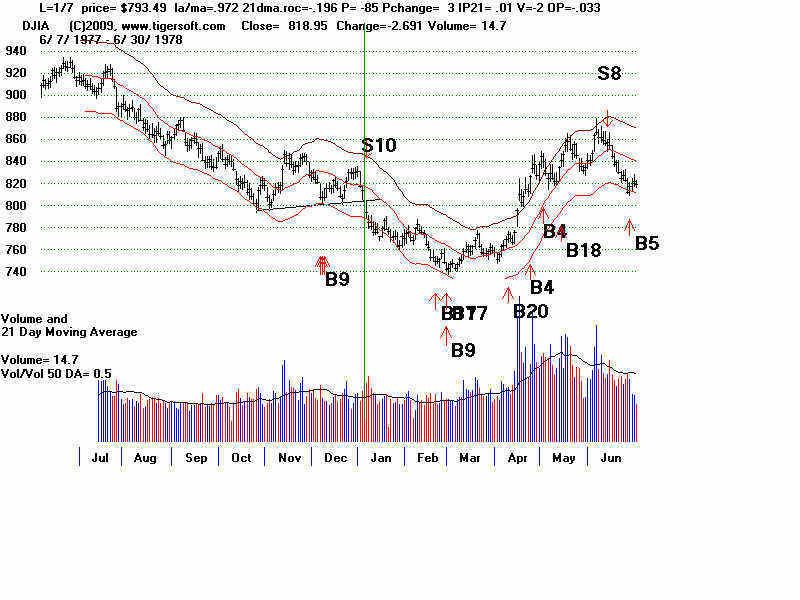

12 1/7/1977 793.49 DJI fell to743.33 on 3/1/1978 None None

LA/MA= .972 21-dma= -.196 P= +3 IP21= .01 V= -2 OPct= -.033

A/D Line simultaneously made a 6 week low

(Continuation Head and shoulders Pattern.)

13 3/7/1980 820.56 DJI fell to 759.13 on 4/21/79 None Earlier S9/S12/S15

LA/MA= .944 21-dma= -.836 P= -455 IP21= -.103 V= -12 OPct= -.155

A/D Line simultaneously made a 8 month low

(A Head and Shoulders Pattern).

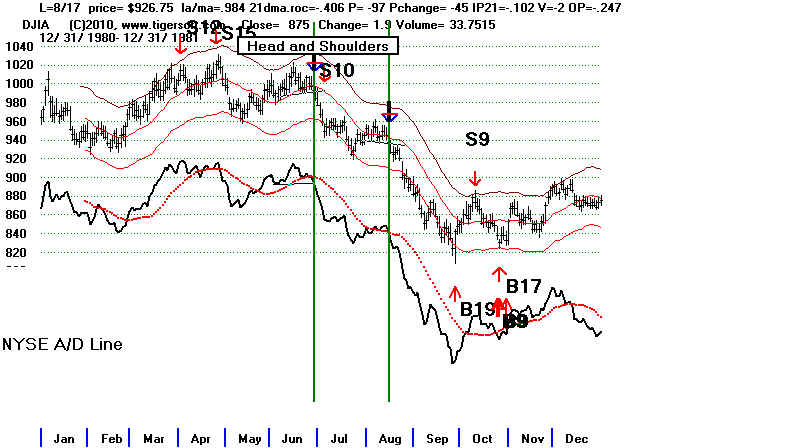

14. 7/6/1981 949.30 DJI fell to 824.01 on 9/25/81 Yes...rally to 952.91 Earlier S12/S15

LA/MA= .957 21-dma= -.45 P= -147 IP21= -.148 V= -4 OPct= -.278

A/D Line simultaneously made a 14 week low

(Head and Shoulders Pattern).

Decline is more than 10%

1983 - False Breakdown even when A/D Line confirms breakdown.

The Buy B17, the fact that it was Summer and the failire of the breakdown were the key bullish elements here.

15. 8/4/1998 9195.47 DJI fell to 7539.07 on 8/31/98. Yes .. rally to 8714.65 Earlier S9/S12

LA/MA= .937 21-dma= -.792 P= -534 IP21= -.119 V= -141 OPct= -.247

A/D Line simultaneously made a 6 month low

(Head and Shoulders Pattern).

Decline is more than 10%

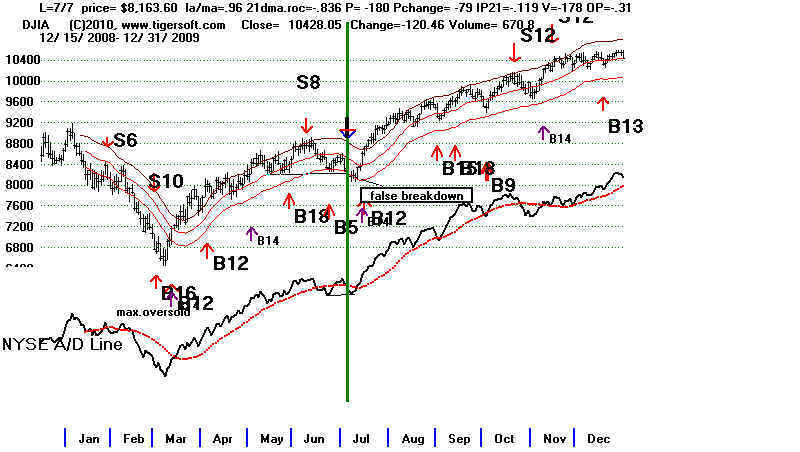

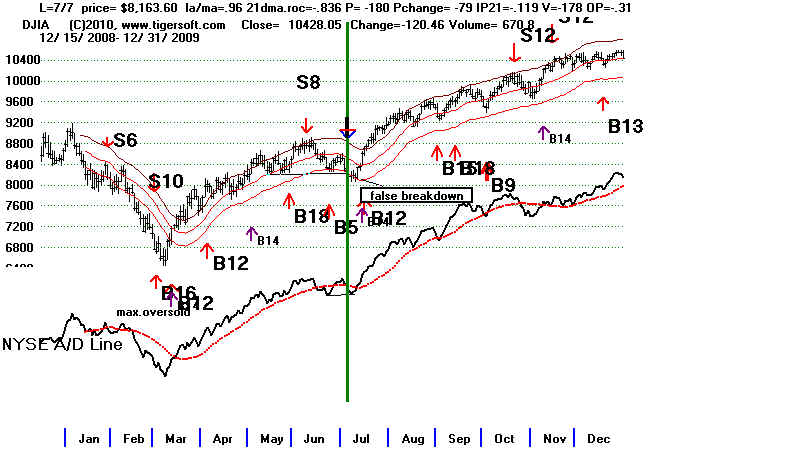

16. 7/7/2009 8163.60 DJI rose quickly when neckline exceeded.

LA/MA= .96 21-dma= -.836 P= -180 IP21= -.119 V= -178 OPct= -.306

A/D Line DID NOT simultaneously made a 6 week low.

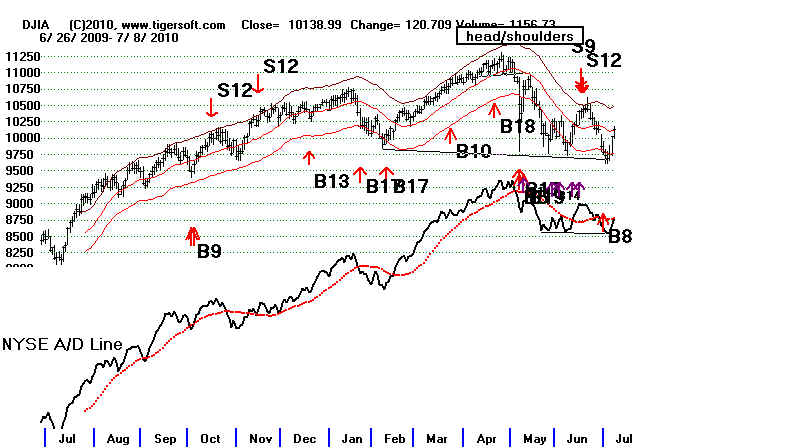

16. 7/1/2010 9732.53

LA/MA= .96 21-dma= -.605 P= -140 IP21= -.106 V= -231 OPct= -.195

The DJI was down more than 13% from its high.

DJI did not break below neckline decisively and clearly.

A/D Line DID NOT simultaneously made a 6 week low.

INDEPENDENT HEAD/SHOULDER TOPS THAT MIGHT BE CONSIDERED AS REVERSING A PEERLESS BUY.

|

There are other Sell S10s. Some of

them have Head and Shoulders tops and some do not.

Here are those not covered by the

first set of parameters shown above. S10s are to be

cancelled if there is a Buy B16 a

few days before the S10, as in April 1931..

1. 1/24/1929

No

Warlier S8/S9

LA/MA= .937 21-dma= -.792 P= -534 IP21= -.119 V= -141 OPct= -.247

A/D Line simultaneously made a 6 month low

(Head

and Shoulders Pattern).

Decline is more than 10%

2 9/14/1931 121.30

LA/MA= .891 21-dma= -1.642 P= -125 IP21= -.008 V= -443 OPct= -.273

A/D Line simultaneously made a 6 month low

(This

was NOT a Head and Shoulders Pattern).

Decline is more than 10%

3. 11/25/1931 94.20

LA/MA= .896 21-dma= -1.375 P= -81 IP21= -.133 V= -314 OPct= -.105

A/D Line simultaneously made a 6 month low

(This

was NOT a Head and Shoulders Pattern).

Decline is more than 10%

4. 4/1/1932 72.29

LA/MA= .894 21-dma= -2.062 P= -121 IP21= -.223 V= -422 OPct= -.359

A/D Line simultaneously made a 6 month low

(This was NOT a Head and Shoulders Pattern).

Decline is more than 10%

http://alphaim.net/research/Pres_Cycle/Year_4/4_DJI_Stacked.html

http://alphaim.net/research/Pres_Cycle/index.html

Internal Strength Readings The Day before A Head/Shoulders Pattern

Is Completed by a CLose below the Neckline: 1929-2011

Internal Strength Readings The Day before A Head/Shoulders Pattern

Is Completed by a CLose below the Neckline: 1929-2011 Continuation Head/Shoulders

Date DJI cl/ma roc P Pch IP21 V Opct

3 9/19/1930 229 .963 -.195 -20 -25 -.038 -186 .025

Continuation Head/Shoulders

Date DJI cl/ma roc P Pch IP21 V Opct

4 12/9/1930 176.50 .969 -.137 -36 18 -.146 -230 .085

Continuation Head/Shoulders

Date DJI cl/ma roc P Pch IP21 V Opct

3 9/19/1930 229 .963 -.195 -20 -25 -.038 -186 .025

Continuation Head/Shoulders

Date DJI cl/ma roc P Pch IP21 V Opct

4 12/9/1930 176.50 .969 -.137 -36 18 -.146 -230 .085

8/27/1937 175.90 .95 -.456 -124 -17 -.131 -177 .004

8/27/1937 175.90 .95 -.456 -124 -17 -.131 -177 .004

3/29/1939 .958 -.611 -26 -9 -.046 -108 -.15

3/29/1939 .958 -.611 -26 -9 -.046 -108 -.15

6/27/1939 .987 -.061 -24 -8 .094 -41 .198

10/22/1929 .953 -1.125 -129 28 -.132 -986 -.321

6/11/1939 .93 -.934 -84 -25 -.054 -606 .113

6/27/1939 .987 -.061 -24 -8 .094 -41 .198

10/22/1929 .953 -1.125 -129 28 -.132 -986 -.321

6/11/1939 .93 -.934 -84 -25 -.054 -606 .113