The Upper Band and Accumulation Index Is

Still Negative.

(C) December 21 2013 William Schmidt, Ph.D.

There have been 82 Sell S9s since 1928. The average decline on a Sell S9

was 8.6% at the time of the next Peerless Buy signal. Janauary saw the

most Sell S12s ( 22 ). An average decline in this month was 9.0%. There

were 9 January S12s in the year after the Presidential Election and 6 in

the Second year of the Presidential Election cycle. They gained 10.7%

and 8.7%, respectively. These Sell S12s, thus, help us watch out for a

pivoting down by the market in these years.

The 2nd Year in the Presidential 4-year cycle saw the most Sell S12s of any

of these four years. December Sell S9s were generally the weakest.

Their declines averaged only 3.8% in 7 instances.

Size of profits if one shorted on

a Sell S12 and covered on the next Buy signal

-----------------------------------------------------------------------

>10% 22 26.8%

>5%-9.99% 32 39.0%

>2%-4.99% 15 18.3%

0% - 1.99% 6 7.3%

losses 7 8.5% 1 was loss was 4%.

-----------------------------

82

19290130 S12 312.6 .039

19290430 S12 319.3 .081

19290617 S12 319.3 -.029

19290828 S12 372.1 .436

19320909 S12 76.2 .083

19330106 S12 62.9 .183

19330117 S12 61.8 .168

19330705 S12 102.2 .058

19330719 S12 103.6 .07

19330817 S12 99.4 -.008

19331117 S12 98.1 .009

19331206 S12 101.3 .04

19340205 S12 110.7 .171

19340821 S12 92.6 .064

19340925 S12 92.7 -.028

19341005 S12 92.9 -.026

19350104 S12 104.7 .044

19360304 S12 156.7 .045

19371207 S12 128.3 .027

19380106 S12 128.9 .044

19380114 S12 131.8 .065

19380221 S12 129.5 .236

19380419 S12 116.3 .053

19380805 S12 144.5 .055

19380907 S12 143.1 .048

19381110 S12 157.5 .066

19390307 S12 149.4 .17

19410103 S12 132 .092

19410110 S12 133.6 .103

19410918 S12 128.14 .137

19490106 S12 180.2 .083

19490124 S12 180.8 .086

19561206 S12 492.7 .046

19590701 S12 650.2 .019

19591209 S12 671.2 -.007

19620710 S12 586 .012

19660106 S12 985.46 .213

19660914 S12 806.23 .06

19661025 S12 793.09 .004

19670424 S12 887.53 .019

19680108 S12 908.92 .086

19691016 S12 838.77 .066

19700102 S12 809.7 .056

19700616 S12 706.26 .052

19700720 S12 733.91 .036

19710816 S12 888.95 .071

19710823 S12 892.38 .074

19710831 S12 898.07 .08

19720804 S12 951.76 .032

19730111 S12 1051.7 .118

19731228 S12 848.02 .028

19740102 S12 855.32 .036

19740222 S12 855.99 .273

19740607 S12 853.72 .271

19740807 S12 797.56 .22

19741018 S12 654.88 .054

19750829 S12 835.34 .048

19780908 S12 907.74 .127

19810615 S12 1011.99 .172

19820129 S12 871.1 .073

19830106 S12 1070.92 .038

19840105 S12 1282.24 .108

19870506 S12 2342.19 .052

19870608 S12 2351.64 -.04

19871002 S12 2640.99 .342

19970918 S12 7922.72 .054

19970929 S12 7991.43 .062

19980708 S12 9174.97 .168

19990817 S12 11117.07 .099

20000111 S12 11511.08 .13

20020517 S12 10353.08 .209

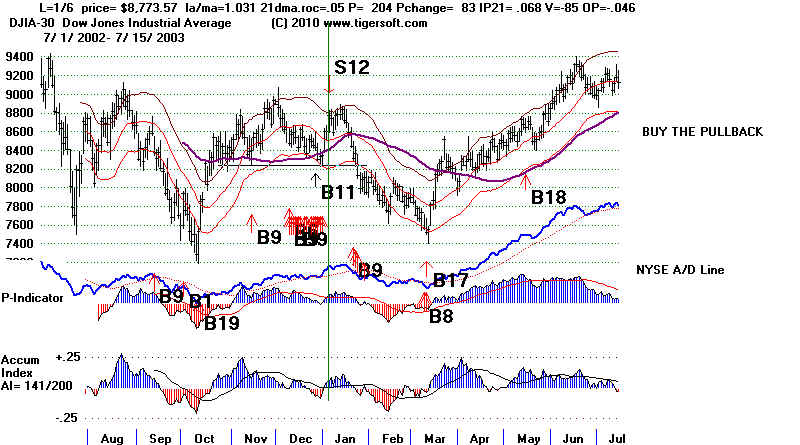

20030106 S12 8773.57 .137

20040405 S12 10558.37 .056

20071206 S12 13619.89 .099

20081105 S12 9139.27 .174

20090106 S12 9015.1 .087

20100616 S12 10409.46 .061

20110630 S12 12414.34 .075

20110830 S12 11559.95 .078

20111207 S12 12196.37 .035

20120103 S12 12397.38 -.015

20130910 S12 15191.06 .013

END

------------------------------------------------

No.= 82 .086

PE 10 .075 PE+1 25 .087 PE+2 28 .095 PE+3 19 .075 Jan 22 .090

4 in PE .077

9 in PE+1 .107

6 in PE+2 .081

3 in PE+3 .073

Feb 3 .227

Mar 2 .108

Apr 4 .052

May 2 .131

Jun 7 .080

Jul 6 .061

Aug 12 .104

Sep 9 .062

Oct 5 .088

Nov 3 .083

Dec 7 .038

1-10 39 .089 11-20 24 .075 21-31 19 .093 |

================================================================================

Revised:

2/14/2013

Sell

S12s occur when the DJI approaches the upper band and the

Accumulation Index is

negative, or nearly so. The P-Indicator cannot be too

positive. Seasonality is an important factor, too, with the period from

August through

February generally producing the most and the most

powerful Sell

S12s.

92 cases since 1929.

Avg. Decline at time of next Peerless Buy is 7%.

90% are profitable.

The average paper loss is 2%.

TigerSoft considers deeply

negative, red Accumulation Index (IP21) readings

as a sign that

"Big Money" and "Insiders" are selling. This is especially true

when

we see negative

readings when the DJI moves close to the upper band. Normally,

if the stock

market, were healthy, the Accumulation Index would turn very positive

on such a

rally.

Sell S12s are important because there are a number

of cases where

market tops do not show

a nearby Sell S9 or a head and shoulders top.

Look at the tops in

January 1966 and September 1998 for examples.

Sometimes, these

independent Sell S12s are seen with a simultanous

non-confirmation of a

new closing high by the NYSE A/D Line. That makes

the Sell S12 more

bearish, as does a subsequent breakdown by the NYSE A/D

Line of its

uptrend.

As of 2/14/2013, there

have been 91 Sell S12s since 1928. At the the time

of the next Peerless

Buy signal, the DJI was done an average 7.4%.

Since 1965, there have

been 44 Sell S12s,. Their average decline was 8.11%.

There were 16 Sell S12s

(17.6% of all cases) where the gains by going short the

DJI would have been

more than 10%. In 50 (or 54.9% of all cases) the gain

would have been more

than 5%. Sell S12s are generally made the most deadly if the V-Indicator

is negative or if there

is a simultaneous Sell S9 or Sell S15. In both these case,

the average S12 decline

jumps to 10.6%.

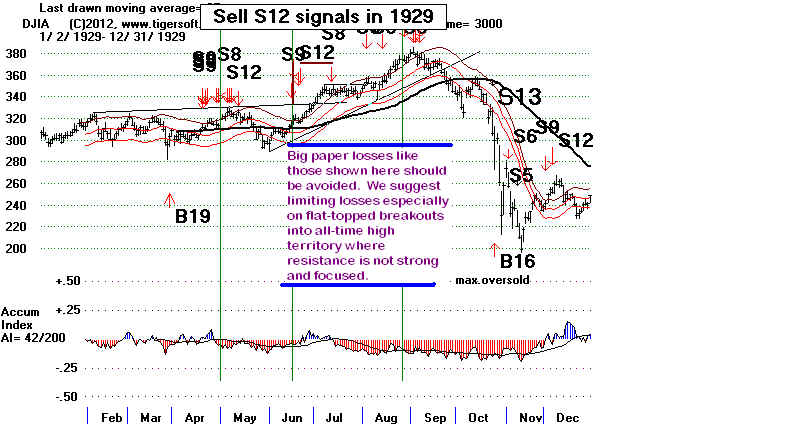

Count the Number of Recent Sell Signal Clusters

By my calculation, the DJI falls below the lower

3.5% band in 40%

Sell S12s since

1928. The more sets of major Sells, especially S9s and S12s,

in the

previous year without a decline of more than 7%, the more likely there will

be a big break.

This concept connects the vulnerability of the market

to the amount of red

Distribution over the last 7 months. This pattern of

multiple Peerless

Sell S9s and Sell S12s is most apparent in the Peerless

charts for 1929,

1938-1939, 1968-1969, 1972-1973, 1987, 1999-2000 and 2007-2008.

Their occurrence set the stage for the market's sharpest and deepest declines.

Not surprisingly then, we see that 40 of the Sell

S12s occurred between 1929 and

1941, a generally

bearish period. But only two took place between 1942 and 1956 when

the DJI

quintupled. There were also no Sell S12s between 1988 and and 1997, also period

during which the

DJI quintupled.

Typical Sell S12s

Besides

occuring on new highs and near the upper band when the Accumulation Index

is badly

lagging and often negative, what else can we say about Sell S12s?

What are

the accompanying key Peerless indicator readings to a typical Sell S12?

We can get a good

idea about when Sell S12s are most reliable simply by

studying the

average for each of the key values for these S12s. The highs and lows

for these key

values show the widest range possible. Many of the extremes come

from the pre-WWII

period. Advanced students of Peerless will want to study in more

detail the cases

where the key values reached extremes. For example, see how

7/10/1962

represented an extreme both for the P-I and the V-I. This was also a case

with a large

paper loss. Readers may want to be more suspicious of cases where

the key values'

maximum and minimum parameters are approached.

All Cases: 1928-2013

Avg.

High

Low

la/ma =

1.029 +1.074

(7/5/1933) 1.013 (9/18/1997)

ann.roc. = .218

+1.352

(7/5/1933)

-.721 (1/8/1932)

P =

-2.81

+347 (1/4/2001) -451 (7/10/1962)

IP21 = -.053

+.042 (1/3/1939) -.168

(12/11/1933)

VI =

-108

+108.3 (9/5/1932) -1390 (7/10/1962)

OPct = .053

+.58 (7/19/1933) -.31 (8/17/1933)

.

Sell S12s are reliable. Only 9 of the 91

Sell S12s since 1929 were reversed

by a Peerless Buy

Signal with the DJI higher than where it was when the Sell occurred.

There was only

instance of a closed out loss of more than 4.75%. This was the 6.5%

loss for the Sell

S12 on 4/19/1938. The DJI gain resulted from the decision by

Britain and

France not to go to war with Nazi Germany for

invading Czechoslovakia.

Since 1945, there

have been only a handful and they were small. Each had some warning signs.

Sell S12s since 1945.

Sell S12 Loss Considerations

---------------------------------------------------------------------------------------------------------------------------------

12 /9/1959 -0.7% - Right before December 17th and the Santa

Claus Buy

6/8/1987 -4.0% - Breakout into all time high

territory

6/30/2011 -1.4% - This was right before the mormally bullish July

4th holiday.

1/3/ 2012 -1.5% - Small loss... Reversing was

profitable.

63 of the 91 Sell S12s were closed out without a paper loss as much

as 2.5%.

Except in

one case, 7/10/1962, all the paper losses after 1938 were under 4.5%.

The 1962

exception saw a paper loss of 6%. A 5% stop loss is

suggested here with Sell S12s.

In 1929,

hyper-speculation drove prices up in a frenzy and there were two big paper

losses of

14% and 18% following a mid-year trading range breakout. These cases

shows the need to

work with stop losses after trading range breakout, especially ones

that take prices

into all-time high territory, where offerings become scarce for a while.

In addition the

coming of World War II caused violent market swings up and down.

There was a 9% paper

loss in the Sell S12 of 10/16/1935 and a 6.5% paper loss

after

4/19/1938. Study these cases below to see what went wrong.

The 16 biggest declines after a Sell S12 and their profits at the

time of the next Buy signal. :

19.9% 8/27/1929

42.8% 9/4/1929

42,3% 9/6/1929

22.3 3/20/1931

29.8% 2/15/1932

22.0% 1/6/1966

27.3% 2/ 22/ 1974

27.1% 6/7/1974

10.0% 10/21/1974

13.2% 9/8/1978

12.5% 1/5/1984

30.3% 10/2/1987

16.0% 7/8/1998

12.9% 1/4/2001

20.9% 5/17/2002

12.6% 12/6/2007

Somewhat surprisingly, given the general bullishness

of the year, the biggest declines

tended to

occur on Sell S12s in the year before a Presidential Election. The year after

the

Presidential Election produced Sell S12s that had 25% less downside power, on average.

Number

of Cases Avg. Decline

Presidential

Election Year (PEY)

13

+ 7.5%

PEY. + 1

1929,1933,1937....

26

+ 5.8%

PEY + 2

1930, 1934, 1938...

24

+ 7.9%

PEY + 3

1931, 1935, 1939...

28

+

8.9%

----------------------------------------------------------------------------------------------------

91

+7.3%

The biggest paper losses came in

1929 and on April 19, 1938 with a paper loss of 6.5%.

The heavy red

distribution in 1929 did not stop the DJI from breaking out in the Summer

and running

upward until early September. The ultimate 1929 crash was made worse by

this action.

I suggest not letting a paper loss from a Sell S12 getting more than 5%.

Just as the biggest paper loss after 1945 came in 1962 on a Sell S12 after the market

had crashed and

had started to recover, the biggest losses on closed out Sell S12 short

sale trades came

at the end of bear markets or intermediate-term declines.

In these cases,

we have to watch for a reversing breakout past resistance.

Biggest Closed Out Losses on Sell S12s

9/27/1934 -4.2%

10/5/1934 -4.7%

4/19/1938 -6.5%

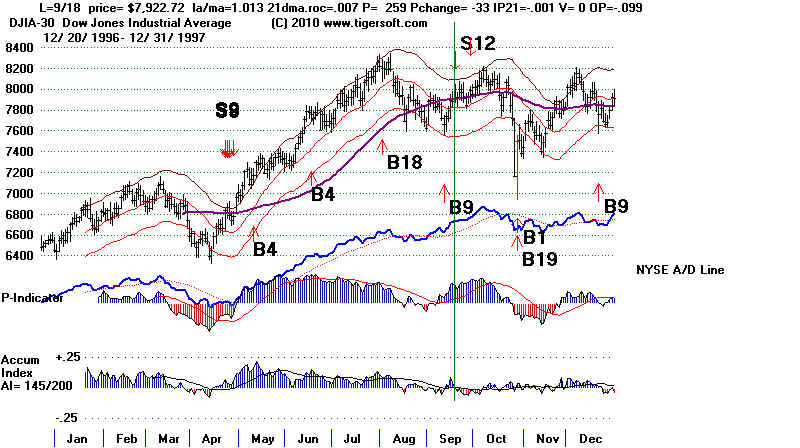

Clinching Sell S12s

My back-testing suggests that traders will do best over the long run

requiring tat a Sell S12 be "clinched", especially if the DJI is making

new highs into all-time high territory. The clinching of a Sell S12 occurs

when the NYSE A/D Line breaks its uptrendline. This additional rule

would have prevented two losing Sell S12s, one in June 1987 and

one in early 1999. In the case of 1997, shown below, it would have

served to keep us long for an additonal 3% rise past the first Sell S12

in early September.

Sell S12s by Month

of The Year

If seasonality is

bullish, as in late November, the DJI may only drop

to the next good

support, which is usually the lower band or the rising

65-day ma.

Limited declines are also seen when the Accumulation Index

quickly turns

positive.

Closer inspection of the S12 shows strong

monthly seasonality.

29.7% of all S12s occur in January, mostly

before the 14th. January

is a month when the market often pivots down

after the bullish Santa

Claus rally. Considering the number of

big January advances, Peerless

is important in keeping the number of S12 losses in

that month to

just one.

The end of Summer also brings many Sell S12

reversals down.

24.2% of the Sell S12s occur in August and

September. September

is the month of the year that has the lowest

probability of bringing

a DJI gain while Octobers are famous for often

bring a selling climax

in a bear market. Look at the big Autumn

sell-offs after Sell S12s in

1929, 1932, 1974 and 1987. In each case

there was also a Sell S9.

---------------------------------------

Sell S12 by Month ----------------------------------------------------

Month

Number of Avg.

Cases of note

Trades Gain

---------------------------------------------------------------------------------------------------------------

January

27

6.4%

February

3

20.5% 1932,1937, 1974,

March

2

13.2%

1939,

1976

April

5

2.3% 1929(2), 1936(2), 1967

May

2

13.1% 1972,

1987, 2002 (+20%)

June

5

6.5%

'29, '34,'74 (+27.1%),99,'06,'07, '10

July

6

5.4%

'33 (2),'59, '62,'70,'98

(+16%)

August

10

7.9% 1929 (3) + 15.%, +20%,

+21%

September

12 12,3%

'32,,'41,'66,'67,'97(2)

October

9

5.8%

'31,

'36,'66,'69,'74,'78,'87(+30.3%)

November 2

6.8%

2008

December 8

4.0%

'29,'33 (2),'37,'56,'59,'00,'07

---------------------------------------------------------------------------------------

91

7.3%

7

Sell S12 signals at the end of June and in early July often led to

paper losses. Users should note this and delay acting on them.

Sell S9s should probably be treated very carefully, too, at this

time. .

.

Paper Loss

Result of this change

6/17/1929

18%

Elimination would be very helpful.

7/11/1929

12%

very helpful.

7/5/1933

5%

A much better Sell S19 occurred on

7/19/1933.

7/1/1959

4%

A much better Sell S4 occurred on

8/3/1933.

7/10/1962

6%

DJI did decline to 21-dma. No better sell later on.

7/8/1998

2%

Premature but no better other Sell for big decline..

6/30/2006

Here the Sell S12 would have worked well.

.

6/30/2011

1.4%

Not having a Sell S12 would have avoided

a small whipsaw loss.

It is important that traders notice that the

Sell S12 losses in November

since 1929 can be avoided by strictly

forbidding a Sell S12 after

Novermber 11th. This makes sense in that

it has often been noted that

the period from the third week of November to

April of the next year is

a seasonally bullish period. So, selling

just before that bullish period

begins is bound to create problems. Users

will want to take this into

account, just as the software does

automatically from December 17th

to the end of the year, because of the Santa

Claus effect.

November S12s

.

X ...S12

11/ 14/ 1933

-6.7% Big Loss

OK

S12

11/10/1938

+5.7%

X

..S12 11/ 20/ 1997

-1.7%

OK .S12

11/ 5/ 2008

+12.0%

X ..

.S12 11/ 13/ 2009

-0.4%

Summer Rally versus Sell S12

Another seasonal phenomenon should

be noted. Aprils, Mays, June and

Julys

produce a much higher proportion of failed Sell S12s than the

other

months. This is because they have to face the Summer Rally

seasonality

tends to bring a DJI gain from the last week of June to

the first

week of September. What is also interesting is how much more

frequently

the S12s fail if they occur in the period after the 8th of June.

The average

gain is only 1.3% on an Sell 12 in this period that leads

up to the

typical start of the Summer Rally. The Peerless software has

tightened

conditions in June, so that the failed 1936 Sell S12s are

eliminated.

Note the "X" in the left column below. These no dates

no longer produce Sell S12s.

June S12s

...S9...S12 6/ 17/ 1929

+4.5%

X..S12

6/ 12/

1936

-4.6%

.X..S12

6/

25/ 1936

-1.4%

OK ...S12

6/7/ 1974

+27.1%

(Nixon Resignation)

OK

...S9...S12 6/ 8/ 1987

-4.0%

...S12

6/18/ 1999

+2.9%

...S12

6/30/ 2006

+3.1%

...S12

6/6/2010

+6.1%

...S12

6/30/2010

-1.3%

The presence of a negative V-Indicator with an Sell S12 is associated

with deeper subsequent

declines. Table S12-B shows independent Sell S12

occurring on strength.

The V-Indicator Is only available after late 1965.

Importance of Negative Internals

and Pct over 21-day ma

Number of S12s Avg S12

Decline

---------------------------------------------------------------------------------------------------

with V-I negatve

73

10.6%

reinforced by Sell S9/S15, falling market since 1945 8

10.6%

over 4.0% upper band

12

10.3%

reinforced by Sell S9/S15, rising market since 1945 11 8.6%

with P-I, V-I and IP21 negative 47

8.22%

1965-2013 48-91

44

8.22%

over 3.5% upper band

19

8.19%

with IP21 and V-I negative

36

8.11

with P-I and V-I negative

49

8.08%

with P-I negative

50

8.05%

over 3.3% upper band

21

8.04%

1945-2013

50

7.7%

with IP21<0

84

7.61%

All S12 Cases

91

7.4%

over 2.6% upper band

49

7.36%

1928-1944

41

7.26%

with OPct negative

32

7.03%

over 2.3% upper band

66

6.93%

over 2.8% upper band

38

6.82%

between 2.6% and 3% upper band 30

6.45%

between 3% and 3.5% upper band 12

6.43%

upper band >2.09% <2.61% 25

6.20%

with Opct, IP21, P-I and V-I negative 20

6.15%

over 5% upper band

5

4.42%

Sell S12s are somewhat

more bearish when they occur with a simultaneous

Sell S9. (Table

S12-D)

As with S9s, it is best

to let a Sell S12 play itself out and not buy for at least

15 trading days even if

there is a Buy signal. In these cases, wait for the A/D Line

downtrend to be

broken. This is even more true if a head and shoulders

pattern develops...

Reinforced Sell S12 Signals since 1945

in A Rising Market

...S9...S12 7/1/1959 650.2

+1.9% Paper loss = 4%

...S9...S12 8/4/1972

947.7

+3.2%

Paper loss = 3.0%

...S9...S12...S15

8/29/1975 835.34 + 4.8% No paper loss

...S9...S12

10/11/1978 901.42

+7.2% No paper loss

...S9...S12

1/2/1981 972.78

+3.5% No paper loss

..S9...S12

5/6/1987 2342.19

+5.2% No Paper loss

...S9...S12

10/2/1987 2640.99 +30.3% No Paper loss

...S9...S12 7/8/1998

9174.97 +16.0% Paper loss = 2.0%

...S9...S12

8/17/1999 11117.07

+6.4% Paper loss = 2.0%

...S15...S1

1/7/2000 11522.56

+4.8% Paper

loss = 2.0%

..S9...S12 12/6/2007

13619.89 +12.6% Paper loss = 1.0%

-----------------------------------------------------------------------------------------------------------------

N=11

Avg = 8.6% Rising Market Variety

Reinforced Sell S12 Signals since 1945 in A

Falling Market

..S9...S12

7/10/1962 586

+0.6%

Paper loss = 6% Bear Market Variety

...S9...S12

9/15/1966 814.3

+1.4% No paper loss.

Bear Market Variety

...S9...S12

10/26/1966 814.3

+1.4% Paper loss = 2.5% Bear Market Variety

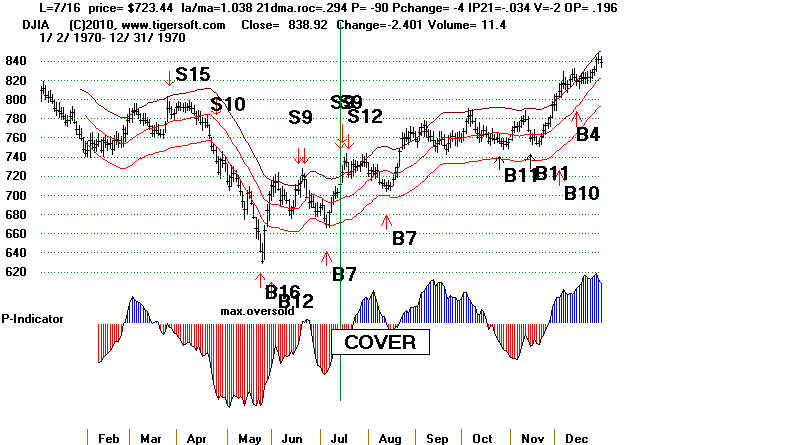

...S9...S12 7/16/1970 723.44

+2.2% Paper loss = 1.4% Bear Market Variety

...S9...S12 2/22/1974 855.99

+27.3% Paper loss = 4.0% Bear Market Variety

...S9...S12

6/7/1974 853.72

+27.1% No

paper loss Bear Market Variety

...S9...S12

1/29/1982 871.10

+5.4% No paper loss Bear Market Variety

...S9...S12

5/17/2002 10353.08 +20.9% No Paper loss

Bear Market Variety

-----------------------------------------------------------------------------------------------------------------

N = 8

Avg = 10.6% Bear

Market Variety

Sell S12s should cause B12 signals to be suppressed or cancelled

for 10 days. Example August 1934

Table S12-A Peerless Sell S12s: 1929-2013

(Editing has started 1/20/2013 using new, not yet released, February 2013 Peerless)

#42 ...S12 1/24/1949 180.8 +8.6%

1.009 .226 +47 IP21= -.009 -29 .094

Note the quickly formed head/shoulders pattern.

Soon after the DJI dropped below the lower band.

It was significant that there were no Sell S12s

between early 1949 and 1956, This was a periof when

Accummulation not Distribution was dominant, as

the DJI tripled in value.

#43 ...S12 12/6/1956 492.7 +4.6% Paper loss = 2%

1.029 -.067 P= -83 IP21= -.078 -316 -.143

#44 ...S9...S12 7/1/1959 650.2 +1.9% Paper loss = 4%

1.03 .24 P= -2 IP21= -.062 -177 .166

Selling just before the Fourth of July, which is usually

a bullish weekend, is not normally recommended.

#45 ...S12 12/9/1959 671.2 -0.7% Paper Loss = 1%

1.028 .371 P= 5 IP21=-.055 -216 .326

#46 ...S15...S12 1/5/1959 685.50 +9.8% No Paper Loss

1.018 .40 P= 4 IP21= -.038 -170 .095

#47 ...S9...S12 7/10/1962 586 +0.6% 6% Paper Loss

1.034 -.327 P= -451 IP21= -.113 -113 -.147

This S12 took place at what was to be near

the end of a bear market. It is probably worth

distibuishing S12s in rising markets from those

that do not.

#48 ...S12 1/6/1966 994.2 +22.0% 1% Paper Loss

1.02 .445 P= 49 IP21= -.028 5 .481

This signal was finally reversed at 775.72 on 8/30/66 by B19

#49 ...S9...S12 9/15/1966 814.3 +1.4% no paper loss.

1.029 .143 P= -174 IP21= -.078 -13 -.146

The DJI fell below the lower band to the bear market low.

#50 ...S9...S12 10/26/1966 814.3 +1.4% Paper Losss = 2.5%.

1.036 .108 P= -61 IP21= -.059 -9 .05

The DJI fell only to the lower 2.0% band.

From this low a bull market began.

#51 ...S12 4/24/1967 883.18 +1.4% Paper Losss = 1%

1.026 .15 P= 33 IP21= -.02 1 .183

#52 ...S12 9/14/1967 929.44 +7.5% Paper Losss 1%

1.024 .135 P= 12 IP21= -.009 2 .199

#53 ...S12 1/8/1968 908.92 +8.6% No paper loss.

1.02 .222 P=68 IP21= -.019 6 .163

This was important, because it was a typical January reversal downward,

|

SELL S12s in Rising Markets:(above 65-dma) and no Nearby S4,S6, S9s

------------------------------------------------------------------------------------

6/12/35 117.1 Reversal loss -8.7% OP= +.072 Avoided using A/D Line trend-break clinching.

CL/MA = 1.02

21-dayma ROC = .301

P=41 (very high for the number of NYSE stocks traded.)

IP21= -.032

V= -44

OPCT = .114

6/24/35 120. Reversal loss -6.1% OP= +.067 Avoided using A/D Line trend-break clinching.

CL/MA = 1.035

21-dayma ROC = .329

P = 29 (very high for the number of NYSE stocks traded.

IP21= -.024

V - -76

OPCT = .03

7/27/38 140.20 fell directly to 136.90 and lower band. OP= +.014

CL/MA = 1.014

21-dayma ROC = .838

P = 88 (very high for the number of NYSE stocks traded.

IP21= -.009

V = 131

OPCT = - .051

8/5/38 144.50 fell directly to 136.90 and lower band. OP= +.028

. 8/24/38 143.50 Fell immediately, reaching 129.90 below lower band a month later. OP= -.174

-----------------------

3/16/1967 868.49 fell directly to 842.43 .025 lower band in 3 weeks. OP= +.017

4/21/1967 883.18 Rallied to 899.89 and fell slightly below lower band in a month, 899.89. OP= +.179

---------------------------

9/14/1967 929.44 Rallied to 937.18 and fell below lower band in 6 weeks to 850. OP= +.109

-------------------

1/9/1968 908.29 Rallied to 900.24 and fell below lower band in 19 weeks to 825. OP= +.158

-----------------------

. 7/11/1968 922.82 Fell immediately, reaching 870.37 and lower band 3 weeks later. OP= -.008

10/21/1975 846.82 Rallied to 860.67 and then fell slightly below lower band, 793.80, on 9/30/75 .OP= +.125

---------------------------------

7/17/1978 839.05 Fell only to 21-dma immedately and then rallied OP= +.051

(9/11/1978 907.74 Declined to lower band at 857.16 in 7 trading days and rallied OP= +.187

and one months later fell below the lower band without a new Buy.

---------------------- )

4/1/1981 1014.14 Rose to 1024.05 and fell to the lower band in a month, 963.33 -.052

and two months later fell below the lower band without a new Buy.

----------------------

1/6/1983 1070.92 Rose to 1083.79 and fell to the lower band in 3 weeks, 1030.17 -.134

1/6/1984 1286.64 Immediately declined below lower band to 1134.63 on 2/23/1984 OP= -.154

--------------------

10/7/1997 8178.31 Immediately declined below lower band to 7161.15 on 10/27/1997 OP= +.118

-----------------------

6/18/1999 10855.55 DJI rallied to 11300 in 2 months before falling to 10019.71 on 10/15/1999 OP= +.046

The DJI fell below the lower band four months later and there was no intervening Buy.

CL/MA = 1.016

21-dayma ROC = -.035

P = 20 (very high for the number of NYSE stocks traded.

IP21= -.034

V - 49

OPCT = .046

----------------------------

7/17/2000 10804.27 Fell immediately to 10511.17 on 7/28/2000, then rallied to 11259.87 on 9/7/2000 and

then fell to 9975.02 on 10/18/2000 OP= +.193 and OP= +.12 on 2nd S12 two days later.

. 12/8/2000 10712.91 Fell immediately to lower band, 10487.29, on 12/21/2000

and then far below lower band to 9389.48, on 3/22/2000 OP= -.156

------------------------

10/15/2009 10062.94 (Dial Data corrected data) OP= -.07

CL/MA = 1.03

21-dayma ROC = .331

P = 149

IP21= .019

V = - 98

OPCT = -.07

10/21/2009 9949.36 (Dial Data uncorrected data)

CL/MA = 1.014

21-dayma ROC = .145

P = 62

IP21= .004

V = - 164

OPCT = -.207

11/131/2009 10279.47 (Dial Data uncorrected data)

CL/MA = 1.027

21-dayma ROC = .247

P = -110

IP21= -.007

V = - 216

OPCT = .08

Table S12-C

Peerless

Sell S12s with Negative V-Indicator Readings: 1966-2010Peerless Sell S12s: 1928-2009 Date DJI Gain

------------- ----------- --------

...S12 1/ 18/ 1966 994.2 +22.0%

Reversed at 775.72 on 8/30/66 by B19

1/18/1966 994.2 la/ma=1.02 21dma.roc=.445

la/65dma=1.036 65dma.roc=.227

P= 49 Pchange=-2 IP21= -.028 V= 5 OP= .495

------------------------------------------------------------------------------------

...S9...S12 9/ 15/ 1966 814.3 +6.9%

9/15/1966 814.3 la/ma=1.029 21dma.roc=-.143

la/65dma=.964 65dma.roc=-.405

P=-174 Pchange= 50 IP21= -.078 V=-13 OP= -.155

------------------------------------------------------------------------------------

...S12 10/ 26/ 1966 801.11 +1.4%

10/26/1966 801.11 la/ma=1.036 21dma.roc=.108

la/65dma=1.003 65dma.roc=-.246

P=-61 Pchange= 21 IP21= -.059 V=-9 OP= .054

------------------------------------------------------------------------------------

...S12 3/ 16/ 1967 868.49 -0.9%

3/16/1967 868.49 la/ma=1.025 21dma.roc=.163

la/65dma=1.041 65dma.roc=.221

P=-5 Pchange= 1 IP21= -.042 V= 6 OP= .017

------------------------------------------------------------------------------------

...S12 4/ 21/ 1967 883.18 +1.4%

4/21/1967 883.18 la/ma=1.022 21dma.roc=.174

la/65dma=1.032 65dma.roc=.16

P= 50 Pchange=-1 IP21= -.02 V= 2 OP= .186

------------------------------------------------------------------------------------

...S12 9/ 14/ 1967 929.44 +7.5%

9/14/1967 929.44 la/ma=1.024 21dma.roc=.135

la/65dma=1.035 65dma.roc=.185

P= 12 Pchange=-1 IP21= -.009 V= 2 OP= .211

------------------------------------------------------------------------------------

...S12 1/ 9/ 1968 908.29 +7.8%

1/9/1968 908.29 la/ma=1.018 21dma.roc=.215

la/65dma=1.023 65dma.roc=-.057

P= 72 Pchange= 4 IP21= -.025 V= 5 OP= .158

------------------------------------------------------------------------------------

...S12 7/ 11/ 1968 922.82 +4.8%

7/11/1968 922.82 la/ma=1.017 21dma.roc=.081

la/65dma=1.022 65dma.roc=.35

P= 36 Pchange=-18 IP21= -.052 V= 5 OP= -.008

------------------------------------------------------------------------------------

...S12 10/ 16/ 1969 838.77 +8.2%

10/16/1969 838.77 la/ma=1.025 21dma.roc=.178

la/65dma=1.018 65dma.roc=-.012

P= 24 Pchange= 31 IP21= -.012 V= 0 OP= -.099

------------------------------------------------------------------------------------

...S12 1/ 2/ 1970 809.7 +5.6%

1/2/1970 809.7 la/ma=1.026 21dma.roc=.126

la/65dma=.987 65dma.roc=-.016

P=-87 Pchange= 67 IP21= -.053 V=-2 OP= -.001

------------------------------------------------------------------------------------

...S9...S12 7/ 15/ 1970 711.66 +0.6%

7/15/1970 711.66 la/ma=1.023 21dma.roc=.416

la/65dma=1.007 65dma.roc=-.375

P=-87 Pchange= 16 IP21= -.016 V=-2 OP=.204

------------------------------------------------------------------------------------

...S12 8/ 24/ 1971 904.13 +8.6%

8/24/1971 904.13 la/ma=1.043 21dma.roc=.21

la/65dma=1.017 65dma.roc=-.077

P=-56 Pchange= 42 IP21= -.133 V=-1 OP= .09

------------------------------------------------------------------------------------

...S9...S12 5/ 22/ 1972 965.31 +5.6%

5/22/1972 965.31 la/ma=1.023 21dma.roc=.019

la/65dma= 65dma.roc=

P=-89 Pchange=13 IP21= -.031 V=-2 OP= .127

---------------------------------------------------------------------------

...S9...S12 8/ 3/ 1972 947.7 +2.7%

8/3/1972 947.7 la/ma=1.022 21dma.roc=.183

la/65dma=1.008 65dma.roc=.051

P=-82 Pchange=-3 IP21= -.056 V=-2 OP= -.138

-----------------------------------------------------------------------------

...S12 1/ 12/ 1973 1039.36 +15.9%

Reversed at 874.17 on 8/15/73 by B17

1/12/1973 1039.36 la/ma=1.011 21dma.roc=.036

la/65dma=1.042 65dma.roc=.362

P=-126 Pchange=-30 IP21= -.037 V=-3 OP= -.045

------------------------------------------------------------------------------------

...S12 7/ 12/ 1973 901.94 +3.1%

7/12/1973 901.94 la/ma=1.019 21dma.roc=-.336

la/65dma=.986 65dma.roc=-.192

P=-77 Pchange=-18 IP21= -.052 V=-2 OP= .014

------------------------------------------------------------------------------------

...S12 1/ 2/ 1974 855.32 +3.6%

1/2/1974 855.32 la/ma=1.038 21dma.roc=.292

la/65dma=.956 65dma.roc=-.421

P=-86 Pchange= 38 IP21= -.008 V=-2 OP= -.076

------------------------------------------------------------------------------------

...S9...S12 2/ 22/ 1974 855.99 +27.3%

Reversed at 621.95 on 9/27/1974 by B8

2/22/1974 855.99 la/ma=1.027 21dma.roc=-.214

la/65dma=1.022 65dma.roc=-.163

P= 21 Pchange= 7 IP21= -.083 V=-2 OP= -.084

------------------------------------------------------------------------------------

...S9...S12 6/ 7/ 1974 853.72 +27.1%

6/7/1974 853.72 la/ma=1.033 21dma.roc=.039

la/65dma=1.006 65dma.roc=-.119

P=-77 Pchange= 39 IP21= -.074 V=-2 OP= .032

------------------------------------------------------------------------------------

...S12 10/ 18/ 1974 654.88 +6.9%

10/18/1974 654.88 la/ma=1.033 21dma.roc=-.359

la/65dma=.947 65dma.roc=-.746

P= 100 Pchange=-28 IP21= -.071 V=-1 OP= -.153

------------------------------------------------------------------------------------

...S9...S12 8/ 29/ 1975 835.34 +4.8%

8/25/1975 812.34 la/ma=.994 21dma.roc=-.316

la/65dma=.967 65dma.roc=-.031

P=-238 Pchange= 49 IP21= -.193 V=-4 OP= -.207

------------------------------------------------------------------------------------

...S12 10/ 21/ 1975 846.82 +2.5%

10/21/1975 846.82 la/ma=1.031 21dma.roc=.383

la/65dma=1.031 65dma.roc=-.038

P= 91 Pchange= 34 IP21= .012 V= 0 OP= .133

------------------------------------------------------------------------------------

...S12 3/ 25/ 1976 1002.13 +3.5%

3/25/1976 1002.13 la/ma=1.017 21dma.roc=.091

la/65dma=1.053 65dma.roc=.662

P=-75 Pchange=-11 IP21= -.063 V=-1 OP= .201

------------------------------------------------------------------------------------

...S12 7/ 17/ 1978 839.05 -5.7%

7/17/1978 839.05 la/ma=1.02 21dma.roc=-.075

la/65dma=1.007 65dma.roc=.295

P=-90 Pchange= 52 IP21= -.014 V=-2 OP= .053

------------------------------------------------------------------------------------

...S12 9/ 11/ 1978 907.74 +13.2%

9/11/1978 907.74 la/ma=1.018 21dma.roc=.298

la/65dma=1.057 65dma.roc=.204

P= 138 Pchange= 29 IP21= -.068 V= 4 OP= .141

------------------------------------------------------------------------------------

...S9...S12 10/ 10/ 1978 891.63 +11.7%

10/10/1978 891.63 la/ma=1.02 21dma.roc=-.219

la/65dma=1.021 65dma.roc=.33

P=-139 Pchange=-19 IP21= -.136 V=-5 OP= -.19

------------------------------------------------------------------------------------

...S9...S12 10/ 11/ 1978 901.42 +12.6%

11/13/1978 792.01 la/ma=.961 21dma.roc=-1.508

la/65dma=.916 65dma.roc=-.439

P=-541 Pchange=-30 IP21=.144 V=-13 OP= -.382

------------------------------------------------------------------------------------

...S12 1/ 17/ 1980 863.57 +9.9%

1/17/1980 863.57 la/ma=1.022 21dma.roc=.267

la/65dma=1.042 65dma.roc=.151

P= 48 Pchange=-19 IP21= -.025 V= 1 OP= -.08

------------------------------------------------------------------------------------

...S9...S12 1/ 2/ 1981 972.78 +3.5%

1/2/1981 972.78 la/ma=1.029 21dma.roc=-.264

la/65dma=1.02 65dma.roc=.067

P=-71 Pchange= 30 IP21= -.04 V=-5 OP= -.017

------------------------------------------------------------------------------------

...S12 4/ 1/ 1981 1014.14 +16.9%

4/1/1981 1014.14 la/ma=1.024 21dma.roc=.58 la/65dma=1.049

65dma.roc=.203 P= 203 Pchange= 26

IP21= -.041 V= 5 OP= -.008

------------------------------------------------------------------------------------

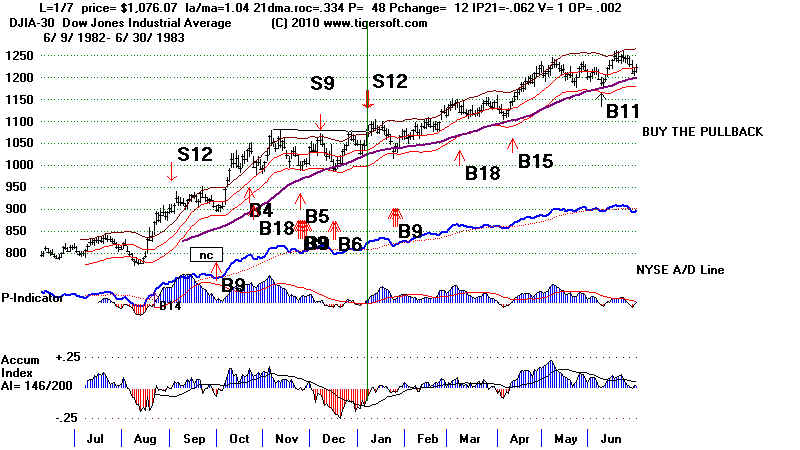

...S12 1/ 6/ 1983 1070.92 +3.8%

1/6/1983 1070.92 la/ma=1.036 21dma.roc=.161 la/65dma=1.046

65dma.roc=.616 P= 36 Pchange= 36

IP21= -.092 V= 0 OP= -.139

------------------------------------------------------------------------------------

...S12 1/ 7/ 1983 1076.07 +4.3%

1/7/1983 1076.07 la/ma=1.04 21dma.roc=.334 la/65dma=1.049

65dma.roc=.495 P= 48 Pchange= 12

IP21= -.062 V= 1 OP= .002

------------------------------------------------------------------------------------

...S12 1/ 6/ 1984 1286.64 +12.5%

1/6/1984 1286.64 la/ma=1.022 21dma.roc=.152 la/65dma=1.025

65dma.roc=.169 P= 34 Pchange= 28

IP21= -.035 V=-1 OP= -.162

------------------------------------------------------------------------------------

...S9...S12 5/ 6/ 1987 2342.19 +5.2%

5/6/1987 2342.19 la/ma=1.021 21dma.roc=-.328 la/65dma=1.03

65dma.roc=.275 P=-185 Pchange=-9

IP21= -.079 V=-15 OP= -.155

------------------------------------------------------------------------------------

...S9...S12 6/ 8/ 1987 2351.64 -4.0%

6/8/1987 2351.64 la/ma=1.026 21dma.roc=.088 la/65dma=1.022

65dma.roc=.125 P=-32 Pchange= 23

IP21= -.045 V=-4 OP= -.187

------------------------------------------------------------------------------------

...S9...S12 10/ 2/ 1987 2640.99 +30.3%

10/2/1987 2640.99 la/ma=1.026 21dma.roc=.18 la/65dma=1.026

65dma.roc=.346 P=-56 Pchange= 41

IP21= -.017 V=-7 OP= .072

------------------------------------------------------------------------------------

...S12 9/ 12/ 1988 2072.37 +0.3%

9/12/1988 2072.37 la/ma=1.02 21dma.roc=.194 la/65dma=.994

65dma.roc=-.039 P= 3 Pchange=-1

IP21= -.022 V= 2 OP= .073

------------------------------------------------------------------------------------

...S12 10/ 7/ 1997 8178.31 +8.3%

10/7/1997 8178.31 la/ma=1.033 21dma.roc=.517 la/65dma=1.028

65dma.roc=.154 P= 349 Pchange=-17

IP21= .017 V= 25 OP= .123

------------------------------------------------------------------------------------

...S12 11/ 20/ 1997 7826.61 -1.7%

11/20/1997 7826.61 la/ma=1.031 21dma.roc=-.326 la/65dma=1.002

65dma.roc=-.096 P=-106 Pchange= 74

IP21= -.014 V=-42 OP= .173

------------------------------------------------------------------------------------

...S12 7/ 7/ 1998 9085.04 +16.0%

7/7/1998 9085.04 la/ma=1.021 21dma.roc=.063 la/65dma=1.009

65dma.roc=.042 P=-5 Pchange=-38

IP21= -.047 V=-19 OP= .056

------------------------------------------------------------------------------------

...S9...S12 4/ 7/ 1999 10085.3 -5.6% Big Loss!

4/7/1999 10085.3 la/ma=1.021 21dma.roc=.432 la/65dma=1.059

65dma.roc=.365 P=-117 Pchange= 2

IP21= -.011 V=-41 OP= -.144

------------------------------------------------------------------------------------

...S12 6/ 18/ 1999 10855.55 +4.2%

6/18/1999 10855.55 la/ma=1.016 21dma.roc=-.035 la/65dma=1.03

65dma.roc=.356 P=-20 Pchange=-16

IP21= -.034 V=-49 OP= .048

------------------------------------------------------------------------------------

...S9...S12 8/ 17/ 1999 11117.07 +6.4%

8/17/1999 11117.07 la/ma=1.025 21dma.roc=-.077 la/65dma=1.025

65dma.roc=.072 P=-425 Pchange= 58

IP21= -.025 V=-119 OP= -.132

------------------------------------------------------------------------------------

( ...S12 12/ 17/ 1999 11257.43 Reversed at 10963.8 on 2/4/2000 by B17

not allowed because of likelihood Santa Claus Rally)

12/17/1999 11257.43 la/ma=1.014 21dma.roc=.402 la/65dma=1.052

65dma.roc=.187 P=-465 Pchange= 50

IP21= -.041 V=-108 OP= .111

------------------------------------------------------------------------------------

...S12 7/ 17/ 2000 10804.27 +0.3%

7/17/0 10804.27 la/ma=1.023 21dma.roc=.101 la/65dma=1.016

65dma.roc=-.117 P= 104 Pchange=-8

IP21= -.046 V=-61 OP= .202

------------------------------------------------------------------------------------

...S12 7/ 19/ 2000 10696.08 -0.7%

7/19/0 10696.08 la/ma=1.01 21dma.roc=.156 la/65dma=1.005

65dma.roc=.14 P= 72 Pchange=-22

IP21= -.033 V=-63 OP= .126

------------------------------------------------------------------------------------

...S12 12/ 8/ 2000 10712.91 +11.3%

12/8/0 10712.91 la/ma=1.012 21dma.roc=-.218 la/65dma=1.006

65dma.roc=-.198 P=-3 Pchange= 68

IP21= -.023 V=-121 OP= -.163

------------------------------------------------------------------------------------

...S12 4/ 10/ 2001 10102.74 -5.1% Big Loss

4/10/2001 10102.74 la/ma=1.031 21dma.roc=-.128

la/65dma=.971 65dma.roc=-.207

P=-121 Pchange= 134 IP21= .053 V=-174 OP= .099

------------------------------------------------------------------------------------

...S9...S12 10/ 10/ 2001 9240.86 -0.2%

10/10/2001 9240.86 la/ma=1.032 21dma.roc=-1.049 la/65dma=.933

65dma.roc=-.516 P=-212 Pchange= 96

IP21= .053 V=-245 OP= -.269

------------------------------------------------------------------------------------

...S12 5/ 14/ 2002 10298.14 +20.5%

5/14/2002 10298.14 la/ma=1.024 21dma.roc=.242

la/65dma=1.008 65dma.roc=.208

P= 107 Pchange= 75 IP21= -.024 V=-110 OP= -.004

------------------------------------------------------------------------------------

...S12 8/ 8/ 2002 8712.02 +4.3%

8/8/2002 8712.02 la/ma=1.039 21dma.roc=-.144

la/65dma=.941 65dma.roc=-.467

P=-271 Pchange= 132 IP21= .063 V=-327 OP= -.262

------------------------------------------------------------------------------------

...S12 1/ 6/ 2003 8773.57 +5.2%

1/6/2003 8773.57 la/ma=1.031 21dma.roc=.05

la/65dma=1.042 65dma.roc=.466

P= 204 Pchange= 83 IP21= .068 V=-85 OP= -.05

------------------------------------------------------------------------------------

...S12 4/ 5/ 2004 10558.37 +5.6%

4/5/2004 10558.37 la/ma=1.027 21dma.roc=-.043

la/65dma=1.007 65dma.roc=.038

P= 24 Pchange=-70 IP21= -.069 V=-145 OP= -.152

----------------------------------------------------------------------------------

...S12 6/ 30/ 2006 11150.22 +3.1%

6/30/2006 11150.22 la/ma=1.015 21dma.roc=-.119

la/65dma=.996 65dma.roc=-.023

P=-151 Pchange=-29 IP21=.078 V=-250 OP= -.224

------------------------------------------------------------------------------------

...S12 12/ 6/ 2007 13619.89 +3.3%

12/6/2007 13619.89 la/ma=1.035 21dma.roc=-.037

la/65dma=1.004 65dma.roc=.089

P=-146 Pchange= 47 IP21= -.075 V=-173 OP= -.095

------------------------------------------------------------------------------------

...S12 11/ 5/ 2008 9139.27 +12.0%

11/5/2008 9139.27 la/ma=1.02 21dma.roc=-.408

la/65dma=.873 65dma.roc=-.907

P=-137 Pchange= 26 IP21= -.051 V=-247 OP= -.27

------------------------------------------------------------------------------------

...S12 10/ 15/ 2009 10062.94 -3.6%

10/15/2009 10062.94 la/ma=1.03 21dma.roc=.331

la/65dma=1.064 65dma.roc=.589 P= 149 Pchange=-97

IP21= .019 V=-98 OP= -.074

------------------------------------------------------------------------------------

...S12 11/ 13/ 2009 10270.47 -0.4%

11/13/2009 10270.47 la/ma=1.027 21dma.roc=.247

la/65dma=1.054 65dma.roc=.345

P=-110 Pchange= 66 IP21= -.007 V=-216 OP= .085

------------------------------------------------------------------------------------

==========================================================

Number of trades = 104 Losses = 29 Gains = 75

Avg. Gain= ?

S9

|

Table S12-D Simultaneous Peerless Sell S12s/S9s: 1928-2009

Date DJI Gain ------------- ----------- -------- ...S9...S12 10/ 16/ 1928 249.4 -8.7% Big Loss ...S9...S12 1/ 30/ 1929 312.6 +3.6% ...S9...S12 4/ 22/ 1929 315.3 +5.0% ...S9...S12 6/ 14/ 1929 313.7 +4.5% ...S9...S12 9/ 4/ 1929 379.6 +21.1%

...S9...S12 1/ 10/ 1930 250 +31.2% Reversed on 1/23/31 B7 171.8 ...S9...S12 6/ 20/ 1934 98.3 +7.1% ...S9...S12 9/ 27/ 1934 93.4 -8.0% Big Loss. ...S9...S12 4/ 2/ 1936 160.4 +7.4% ...S9...S12 4/ 6/ 1936 161.9 +8.2%

...S9...S12 5/ 11/ 1942 99.2 -5.2% ...S9...S12 1/ 7/ 1958 447.8 -2.4% ...S9...S12 7/ 1/ 1959 650.2 +1.9% ...S9...S12 7/ 10/ 1962 586 +1.2% ...S9...S12 9/ 15/ 1966 814.3 +6.9%

...S9...S12 7/ 15/ 1970 711.66 +0.6%

...S9...S12 5/ 22/ 1972 965.31 +5.6%

...S9...S12 8/ 3/ 1972 947.7 +2.7%

...S9...S12 2/ 22/ 1974 855.99 +27.3%

Reversed at 621.95 on 9/27/1974 by B8

...S9...S12 6/ 7/ 1974 853.72 +27.1%

...S9...S12 8/ 29/ 1975 835.34 +4.8% ...S9...S12 10/ 10/ 1978 891.63 +11.7% ...S9...S12 10/ 11/ 1978 901.42 +12.6% ...S9...S12 1/ 2/ 1981 972.78 +3.5% ...S9...S12 5/ 6/ 1987 2342.19 +5.2%

...S9...S12 6/ 8/ 1987 2351.64 -4.0%

...S9...S12 10/ 2/ 1987 2640.99 +30.3%

...S9...S12 4/ 7/ 1999 10085.3 -5.6% Big Loss!

...S9...S12 8/ 17/ 1999 11117.07 +6.4%

...S9...S12 10/ 10/ 2001 9240.86 -0.2%

==========================================================

Number of trades = 30 Losses = 7

Average Gain per trade = +6.7%

There were 5 Gains of more than 20%.

There were 4 Losses of more than 5%

#28...S12...S1 10/5/1936 2.8 Loss=-4.6% Reversed by B13 12/17/1936 180.8

1.026 .468 P- 2 IP21= -.03 -70 .183

also 10/7/1936

Important note:

A flat topped breakout just as the October S12 occurred.

The bullishness of this breakout overwhelmed the S12. Be careful

about acting on S12s right after a breakout above a series of tops

lined up this way.

#28...S12...S1 10/5/1936 2.8 Loss=-4.6% Reversed by B13 12/17/1936 180.8

1.026 .468 P- 2 IP21= -.03 -70 .183

also 10/7/1936

Important note:

A flat topped breakout just as the October S12 occurred.

The bullishness of this breakout overwhelmed the S12. Be careful

about acting on S12s right after a breakout above a series of tops

lined up this way.

#29 ...S12 12/7/1937 2.7% Reversed by B13 on 12/17/1937 124.9

No paper loss.

1.026 .468 P= 2 IP21= -.03 -70 .183

Note that in an extrene bear market, the Buy B13 should not be used.

Far better to cover short sale at the lower band at this time of year.

==============================================================================

X 1/6/1938 Gain = 4% Paper Loss = 4%

1.027 0 P- -51 IP21= -.086 -192 -.016

This Sell S12 is cancelled by the simultaneous Buy B12

=======================================================================

#30 ...S12 1/14/1938 132.5 +6.5% Zero Paper loss

1.039 .564 P= 13 IP21= -.015 -89 .029

Also ...S12 1/18/1938 131.5 +6.3%

1.033 .225 P= -21 IP21= -.049 -136 .011

Note that in an extrene bear market, the Buy B9 would

normally not be used, but covering on a test of the

earlier low would be reasonable. So we will use the

Buy B9 of 1/16/1938 with DJI at 123.20 to cover this short.

Far better to cover short sale at the lower band or on a test of

the earlier lows. That would have meant covering at 119.

---------------------------------------------------------------------------

#31 ...S12 2/21/1938 129.5 Gain = 4.3%

1.041 -.115 -49 IP21=-.074 -126 -.172

This set up the final decline in the 1937-1938 bear market.

It called right shoulder apex before the continuation head

and shoulders pattern was completed. A Buy B16 using normal

mode called the bottom.

-------------------------------------------------------------------------

#32 ...S12 4/19/1938 118.9 -6.5% Big Loss

1.055 -.226 -91 17 IP21= -.236 -229 -.121

Important comment:

DJI fell below lower band to 107.90 without giving a buy signal.

If one had covered when the A/D Line broke its downtrend,

one would have covered at 100.9 and made 12.7%. Clearly

when a short sale gain gets this big late in a bear market

one should lock in profits using this approach when the

A/D Line downtrend is broken.

#29 ...S12 12/7/1937 2.7% Reversed by B13 on 12/17/1937 124.9

No paper loss.

1.026 .468 P= 2 IP21= -.03 -70 .183

Note that in an extrene bear market, the Buy B13 should not be used.

Far better to cover short sale at the lower band at this time of year.

==============================================================================

X 1/6/1938 Gain = 4% Paper Loss = 4%

1.027 0 P- -51 IP21= -.086 -192 -.016

This Sell S12 is cancelled by the simultaneous Buy B12

=======================================================================

#30 ...S12 1/14/1938 132.5 +6.5% Zero Paper loss

1.039 .564 P= 13 IP21= -.015 -89 .029

Also ...S12 1/18/1938 131.5 +6.3%

1.033 .225 P= -21 IP21= -.049 -136 .011

Note that in an extrene bear market, the Buy B9 would

normally not be used, but covering on a test of the

earlier low would be reasonable. So we will use the

Buy B9 of 1/16/1938 with DJI at 123.20 to cover this short.

Far better to cover short sale at the lower band or on a test of

the earlier lows. That would have meant covering at 119.

---------------------------------------------------------------------------

#31 ...S12 2/21/1938 129.5 Gain = 4.3%

1.041 -.115 -49 IP21=-.074 -126 -.172

This set up the final decline in the 1937-1938 bear market.

It called right shoulder apex before the continuation head

and shoulders pattern was completed. A Buy B16 using normal

mode called the bottom.

-------------------------------------------------------------------------

#32 ...S12 4/19/1938 118.9 -6.5% Big Loss

1.055 -.226 -91 17 IP21= -.236 -229 -.121

Important comment:

DJI fell below lower band to 107.90 without giving a buy signal.

If one had covered when the A/D Line broke its downtrend,

one would have covered at 100.9 and made 12.7%. Clearly

when a short sale gain gets this big late in a bear market

one should lock in profits using this approach when the

A/D Line downtrend is broken.

#33 ...S12 8/5/1938 144.5 +5.5%

1.029 .595 40 IP21= -.024 28 .028

Typical decline to the lower band. No paper loss.

#34 ...S12 9/7/1938 143.1 +4.8%

1.019 .102 -39 IP21= -.079 -102 -.024

Decline slightly below the lower band. No paper loss.

#35 ...S12 11/10/1938 157.50 +5.7%

1.032 .618 63 IP21= .032 44 .124

Decline to the lower band. No paper loss.

The chart's Accumulation Index shows how the Accumulation

Index weakened on this and the Aug-Sept rallies to the upper

band, thereby forestalling a decline to the lower band.

#36 ...S12 1/3/1939 153.60 +4.1%

1.022 .397 -9 IP21= .042 -8 .244

Decline to the lower band. No paper loss.

The chart's Accumulation Index and the P-Indicator stayed

low despite the Santa Claus raly to the upper band. The

combination of distribution and poor breadth is more

likely to bring a breaking of the lower band. Even more

bearish, This was the fourth major Sell in 4 months.

A decline below the lower band should have been expected.

The decline that followed fulfilled the downside projections

based on the height of the pattern before the breakdown.

The Buy B17 was very premature.

#37 ...S12 3/7/1939 149.40 +4.0% 2% paper loss

1.028 .418 32 IP21= -.051 18 .212

This was the fifth major Sell in 6 months.

A decline below the lower band should have been expected.

The decline that followed fulfilled the downside projections

based on the height of the pattern before the breakdown.

The Buy B17 was very premature. Users should count the number

of recent automatic Sell signals.

Research note: The IPA Indicator, which is the cumulative

equivalent of the Accumulation index was steadily declining

and made new lows far ahead of prices in the seven months

before the NAZIs attacked Western Europe in April 1940.

12 month IPA lows while prices are more than 50% up

from their 100-day lows to their 100s is probably a reliable

Sell signal, but it will have to be researched.

#38 ...S12 1/3/1941 132.00 +4.5% 1% paper loss.

1.012 .11 -1 IP21= -.049 -44 .237

#39 ...S12 1/10/1941 133.60 +5.7%

1.02 .20 +45 IP21= -.068 +7 .46

also S12 on 1/11/1940 Gain = +5.5%

#40 ...S12 9/18/1941 128.8 +8.2% .

1.012 .30 +67 IP21=.002 +24 .094

The DJI dropped below the lower band. Wall Street insiders

were probably anticipating an undeclared war with Japan

because of its bellicosity and the resulting US oil embargo

on it. It should be noted that head/shoulders patterns

do sometimes occur before there is an attack on the US

or some other dire event

There were no S12s between 1941 and 1949.

The 3/29/1948 S12 using DATA48 appears because

the computer cannot take into account the earlier data

of the March 1948 take-off. The DATA4748 chart correctly

shows no S12 on 3/29/1948.

#41 ...S12 1/6/1949 180.2 +8.3%

1.02 .263 P= -6 IP21=.-.016 -101 .0

#33 ...S12 8/5/1938 144.5 +5.5%

1.029 .595 40 IP21= -.024 28 .028

Typical decline to the lower band. No paper loss.

#34 ...S12 9/7/1938 143.1 +4.8%

1.019 .102 -39 IP21= -.079 -102 -.024

Decline slightly below the lower band. No paper loss.

#35 ...S12 11/10/1938 157.50 +5.7%

1.032 .618 63 IP21= .032 44 .124

Decline to the lower band. No paper loss.

The chart's Accumulation Index shows how the Accumulation

Index weakened on this and the Aug-Sept rallies to the upper

band, thereby forestalling a decline to the lower band.

#36 ...S12 1/3/1939 153.60 +4.1%

1.022 .397 -9 IP21= .042 -8 .244

Decline to the lower band. No paper loss.

The chart's Accumulation Index and the P-Indicator stayed

low despite the Santa Claus raly to the upper band. The

combination of distribution and poor breadth is more

likely to bring a breaking of the lower band. Even more

bearish, This was the fourth major Sell in 4 months.

A decline below the lower band should have been expected.

The decline that followed fulfilled the downside projections

based on the height of the pattern before the breakdown.

The Buy B17 was very premature.

#37 ...S12 3/7/1939 149.40 +4.0% 2% paper loss

1.028 .418 32 IP21= -.051 18 .212

This was the fifth major Sell in 6 months.

A decline below the lower band should have been expected.

The decline that followed fulfilled the downside projections

based on the height of the pattern before the breakdown.

The Buy B17 was very premature. Users should count the number

of recent automatic Sell signals.

Research note: The IPA Indicator, which is the cumulative

equivalent of the Accumulation index was steadily declining

and made new lows far ahead of prices in the seven months

before the NAZIs attacked Western Europe in April 1940.

12 month IPA lows while prices are more than 50% up

from their 100-day lows to their 100s is probably a reliable

Sell signal, but it will have to be researched.

#38 ...S12 1/3/1941 132.00 +4.5% 1% paper loss.

1.012 .11 -1 IP21= -.049 -44 .237

#39 ...S12 1/10/1941 133.60 +5.7%

1.02 .20 +45 IP21= -.068 +7 .46

also S12 on 1/11/1940 Gain = +5.5%

#40 ...S12 9/18/1941 128.8 +8.2% .

1.012 .30 +67 IP21=.002 +24 .094

The DJI dropped below the lower band. Wall Street insiders

were probably anticipating an undeclared war with Japan

because of its bellicosity and the resulting US oil embargo

on it. It should be noted that head/shoulders patterns

do sometimes occur before there is an attack on the US

or some other dire event

There were no S12s between 1941 and 1949.

The 3/29/1948 S12 using DATA48 appears because

the computer cannot take into account the earlier data

of the March 1948 take-off. The DATA4748 chart correctly

shows no S12 on 3/29/1948.

#41 ...S12 1/6/1949 180.2 +8.3%

1.02 .263 P= -6 IP21=.-.016 -101 .0 #54...S12 10/16/1969 838.77 +6.6% 3% Paper Loss

1.025 .178 P= -24 IP21 = -.012 0 -.047

Here we have a bear market Sell S12.

#55...S12 1/2/1970 809.7 +5.6% No paper loss

1.026 .126 P= -98 IP21 = -.053 -2 -.001

#54...S12 10/16/1969 838.77 +6.6% 3% Paper Loss

1.025 .178 P= -24 IP21 = -.012 0 -.047

Here we have a bear market Sell S12.

#55...S12 1/2/1970 809.7 +5.6% No paper loss

1.026 .126 P= -98 IP21 = -.053 -2 -.001

#56 ...S9...S12 7/16/1970 723.44 +2.2% Paper Loss = 1.4%

1.038 .294 P= -90 IP21 = -.034 -2 .196

At end of bear market.

#56 ...S9...S12 7/16/1970 723.44 +2.2% Paper Loss = 1.4%

1.038 .294 P= -90 IP21 = -.034 -2 .196

At end of bear market.

#57 ...S12 8/23/1971 892.38 +7.4% Paper Loss =4%

1.03 .063 P- -99 IP21- -.165 -2 .058

#58 ...S12 8/31/1971 898.07 +8.0% Paper Loss =2%

1.025 .451 P- 37 IP21- -.093 -1 .195

#59 ...S9...S12 8/4/1972 947.7 +3.2% 3% Paper Loss

1.026 .124 P- -95 IP21- -.025 -2 .144

#60 ...S12 1/11/1973 1039.36 +8.2% 1% Paper Loss

1.011 .036 P- -126 IP21=-.037 -3 -.043

See that this was the fourth major Sell in the past 7 months.

The subsequent break ot the 840 or even 900 support was a warning

of a bear market's onset.

Short-term reversal at 874.17 on 8/15/73 by B17

#61 ...S12 12/28/1973 848.02 +2.8% 3.8% Paper Loss

1.032 .117 P- +75 IP21= -.027 -1 .143

also

...S12 1/2/1974 855.32 +3.6% 2% Paper Loss

1.038 .292 P- -86 IP21= -.008 -2 -.074

This was a techinical rebound after a big decline.

#62 ...S9...S12 2/22/1974 855.99 +27.3% 4% Paper Loss

1.027 .214 P- 21 IP21= -.083 -2 -.07

Reversed at 621.95 on 9/27/1974 by B8

#63 ...S9...S12 6/7/1974 853.72 +27.1% no paper loss

1.033 .039 P= -27 IP21=-.074 -2 .004

#64 ...S9 8/7/1974 797.56 +22.0% no paper loss

1.023 .387 P= +32 IP21=-.043 -1 .03

#65 ...S12 10/21/1974 669.02 +10.0% no paper loss

1.057 -.018 P= 95 IP21=-.043 1 -.054

#66 ...S9...S12...S15 8/29/1975 835.34 +4.8% no paper loss

1.024 .055 P= -139 IP21=-.102 -3 .008

#67 ...S12 9/8/1978 907.74 +13.2% no paper loss

1.019 .216 P= 109 IP21=-.062 -3 .078

The DJI fell to the lower band, where there no Buy signal.

It recovered back to near the upper band and then collapsed.

#68 ...S9...S12 10/11/1978 901.42 +7.2% no paper loss

1.032 -.068 P=-126 IP21= -.124 -4 -.101

#69 ...S9...S12 1/2/1981 972.78 +3.5% no paper loss

1.029 -.264 P= -71 IP21=-.04 -5 -.016

#57 ...S12 8/23/1971 892.38 +7.4% Paper Loss =4%

1.03 .063 P- -99 IP21- -.165 -2 .058

#58 ...S12 8/31/1971 898.07 +8.0% Paper Loss =2%

1.025 .451 P- 37 IP21- -.093 -1 .195

#59 ...S9...S12 8/4/1972 947.7 +3.2% 3% Paper Loss

1.026 .124 P- -95 IP21- -.025 -2 .144

#60 ...S12 1/11/1973 1039.36 +8.2% 1% Paper Loss

1.011 .036 P- -126 IP21=-.037 -3 -.043

See that this was the fourth major Sell in the past 7 months.

The subsequent break ot the 840 or even 900 support was a warning

of a bear market's onset.

Short-term reversal at 874.17 on 8/15/73 by B17

#61 ...S12 12/28/1973 848.02 +2.8% 3.8% Paper Loss

1.032 .117 P- +75 IP21= -.027 -1 .143

also

...S12 1/2/1974 855.32 +3.6% 2% Paper Loss

1.038 .292 P- -86 IP21= -.008 -2 -.074

This was a techinical rebound after a big decline.

#62 ...S9...S12 2/22/1974 855.99 +27.3% 4% Paper Loss

1.027 .214 P- 21 IP21= -.083 -2 -.07

Reversed at 621.95 on 9/27/1974 by B8

#63 ...S9...S12 6/7/1974 853.72 +27.1% no paper loss

1.033 .039 P= -27 IP21=-.074 -2 .004

#64 ...S9 8/7/1974 797.56 +22.0% no paper loss

1.023 .387 P= +32 IP21=-.043 -1 .03

#65 ...S12 10/21/1974 669.02 +10.0% no paper loss

1.057 -.018 P= 95 IP21=-.043 1 -.054

#66 ...S9...S12...S15 8/29/1975 835.34 +4.8% no paper loss

1.024 .055 P= -139 IP21=-.102 -3 .008

#67 ...S12 9/8/1978 907.74 +13.2% no paper loss

1.019 .216 P= 109 IP21=-.062 -3 .078

The DJI fell to the lower band, where there no Buy signal.

It recovered back to near the upper band and then collapsed.

#68 ...S9...S12 10/11/1978 901.42 +7.2% no paper loss

1.032 -.068 P=-126 IP21= -.124 -4 -.101

#69 ...S9...S12 1/2/1981 972.78 +3.5% no paper loss

1.029 -.264 P= -71 IP21=-.04 -5 -.016

#70 ...S9...S12 1/29/1982 871.10 +5.4% no paper loss

1.02 -.028 P= -87 IP21=- +.005 -5 +.018

This was at right shoulder apex in continuation head/shoulders.

==========================================================================

Note that there is no S12 in August 1982 due to earlier Buys.

The DATA1982 charts show this properly.

#70 ...S9...S12 1/29/1982 871.10 +5.4% no paper loss

1.02 -.028 P= -87 IP21=- +.005 -5 +.018

This was at right shoulder apex in continuation head/shoulders.

==========================================================================

Note that there is no S12 in August 1982 due to earlier Buys.

The DATA1982 charts show this properly.

=========================================================================

#71...S12 1/6/1983 1070.92 +3.8% 1% paper loss

1.036 .161 P= 36 IP21= -.092 0 -.134

very over-bought

also 1/7/1983 1076.07 +4.3% 1% paper loss

1.04 .334 P= 48 IP21= -.062 1 -.002

=========================================================================

#71...S12 1/6/1983 1070.92 +3.8% 1% paper loss

1.036 .161 P= 36 IP21= -.092 0 -.134

very over-bought

also 1/7/1983 1076.07 +4.3% 1% paper loss

1.04 .334 P= 48 IP21= -.062 1 -.002

#72...S12 1/5/1984 1282.24 +10.8% less than 1/2% paper loss

1.022 .152 P= 34 IP21 = -.035 -1 -.154

also ...S12 1/6/1984 1286.64 +1.1%

1.022 .152 P= 34 IP21 = -.035 -1 -.154

#72...S12 1/5/1984 1282.24 +10.8% less than 1/2% paper loss

1.022 .152 P= 34 IP21 = -.035 -1 -.154

also ...S12 1/6/1984 1286.64 +1.1%

1.022 .152 P= 34 IP21 = -.035 -1 -.154

#73 ...S9...S12 5/6/1987 2342.19 +5.2% No Paper loss

1.021 -.328 P= -185 IP21= -.079 -15 -.147

#74 ...S12 6/8/1987 2351.64 -4.0% Paper Loss = -4%

1.026 .088 P= -32 IP21= -.045 -4 -.176

If one had waited for decliners to outnumber advancers, there

would have been no clinching of this Sell S12.

#75 ...S9...S12 10/2/1987 2640.99 +30.3%

1.026 .18 P= -56 IP21= -.017 -7 .068

This was 4th S9/S12 in 7 months. The fifth set of major Sells.

This shows high vulnerability in the stock market.

#73 ...S9...S12 5/6/1987 2342.19 +5.2% No Paper loss

1.021 -.328 P= -185 IP21= -.079 -15 -.147

#74 ...S12 6/8/1987 2351.64 -4.0% Paper Loss = -4%

1.026 .088 P= -32 IP21= -.045 -4 -.176

If one had waited for decliners to outnumber advancers, there

would have been no clinching of this Sell S12.

#75 ...S9...S12 10/2/1987 2640.99 +30.3%

1.026 .18 P= -56 IP21= -.017 -7 .068

This was 4th S9/S12 in 7 months. The fifth set of major Sells.

This shows high vulnerability in the stock market.

Resume editing here.

#76...S12 9/18/1997 7922.72 +5.4% 4.5% Paper Loss

1.013 .007 P=259 IP21= -.001 0 -.009

low

DJI rallied to 8178 peak on 10/7/1997 before declining

below the lower band. A rally closer to the upper band

might have been expected.

#77 ...S12 9/29/1997 7991.43 +6.2%

1.018 .451 P=335 IP21= -.017 19 -.06

Resume editing here.

#76...S12 9/18/1997 7922.72 +5.4% 4.5% Paper Loss

1.013 .007 P=259 IP21= -.001 0 -.009

low

DJI rallied to 8178 peak on 10/7/1997 before declining

below the lower band. A rally closer to the upper band

might have been expected.

#77 ...S12 9/29/1997 7991.43 +6.2%

1.018 .451 P=335 IP21= -.017 19 -.06

#78 ...S9...S12 7/8/1998 9174.97 +16.0% Paper Loss=2%

1.02 .053 P= -5 IP21= -.039 -24 .05

#78 ...S9...S12 7/8/1998 9174.97 +16.0% Paper Loss=2%

1.02 .053 P= -5 IP21= -.039 -24 .05

On 5/12/99 the IP21 closed below its 21-day ma fo rthe first

time in more than a month. The DJI was up 20% in the last

3 months. This was a day before the DJI fell back to the

support of the rising 65-dma. There was no Peerless

Sell. But perhaps, such conditions deserve one.

1.021 .671 312 .057 29 .33

Possibly the Sell S4 rules should be changed.

editors note: 2/8/2013...

#79 ...S9...S12 8/17/1999 11117.07 +6.4% Paper Loss=2%

1.025 -.077 P= -425 IP21= -.025 -119 -.126

DJI rallied to 3.9% band and 11326.03 before falling

below the lower band. See how it reversed right at the

rising resistance line. Its failure there added to the

bearishness given the long bull market run from 1982.

The DJI was up more than 10000 points in 17 years.

#80 ...S15...S12 1/7/2000 11522.56 +13.1% Paper Loss=2%

1.021 .48 P= -23 IP21= -.028 -59 .341

DJI peaked a week later on 1/14/2000 at 11722.98.

#81 ...S12 1/4/2001 10912.41 No Paper Loss

1.02 .392 P= +347 IP21= -.007 -36 .091

An early January pivot down.

#82 ...S9...S12 5/17/2002 10353.08 +20.9% No Paper Loss

1.028 .175 P= 48 IP21= -.018 -148 .079

On 5/12/99 the IP21 closed below its 21-day ma fo rthe first

time in more than a month. The DJI was up 20% in the last

3 months. This was a day before the DJI fell back to the

support of the rising 65-dma. There was no Peerless

Sell. But perhaps, such conditions deserve one.

1.021 .671 312 .057 29 .33

Possibly the Sell S4 rules should be changed.

editors note: 2/8/2013...

#79 ...S9...S12 8/17/1999 11117.07 +6.4% Paper Loss=2%

1.025 -.077 P= -425 IP21= -.025 -119 -.126

DJI rallied to 3.9% band and 11326.03 before falling

below the lower band. See how it reversed right at the

rising resistance line. Its failure there added to the

bearishness given the long bull market run from 1982.

The DJI was up more than 10000 points in 17 years.

#80 ...S15...S12 1/7/2000 11522.56 +13.1% Paper Loss=2%

1.021 .48 P= -23 IP21= -.028 -59 .341

DJI peaked a week later on 1/14/2000 at 11722.98.

#81 ...S12 1/4/2001 10912.41 No Paper Loss

1.02 .392 P= +347 IP21= -.007 -36 .091

An early January pivot down.

#82 ...S9...S12 5/17/2002 10353.08 +20.9% No Paper Loss

1.028 .175 P= 48 IP21= -.018 -148 .079

#83 ...S12 1/6/2003 8773.57 +5.2% Paper loss under 1/2%

1.031 .05 P= 184 IP21= .034 -67 -.06

#83 ...S12 1/6/2003 8773.57 +5.2% Paper loss under 1/2%

1.031 .05 P= 184 IP21= .034 -67 -.06

#84 ...S12 4/5/2004 10558.37 +4.4% No Paper loss

1.027 -.043 P= 24 IP21 = -.069 -145 -.144

This was a rebound failure rally. It did not reverse a Buy.

---------------------------------------------------------------------

X ..S12 6/30/2006 11150.22 +3.1%

1.015 -.119 P = -151 IP21= -.078 -250 -.215

too low.

Back-testing shows that a rally only 1.5% above

the 21-day ma is often wrong. But it is not often

that all the internal strength indicators are negative

on even such a rally. The period before July 4th is

usually bullish. Ordinarily, we would wait for an

additional rise.

---------------------------------------------------------------------

#85 ..S12...S9 12/6/2007 13619.89 +12.6% 1% Paper Loss.

1.035 -.037 P= -146 IP21= -.075 -173 -.122

These were very negative internals for a DJI 3.5%

over the 21-day ma. And given the earlier Sells,

considerability vulnerability was suggested.

#86 ...S12 11/5/2008 9139.27 +7.9% No Paper loss

1.02 -.408 P= -137 IP21 -.051 -247 -.255

#87 ...S12 1/6/2009 9815.1 +8.7% No Paper loss

1.037 .878 P= 562 IP21= .028 97 -.066

#88 ...S12 6/16/2010 10409.46 +6.1% Paper Loss - under 1/2%

1.025 -.253 P= 12 IP21= -.013 150 -.196

#89 ...S12 6/30/2011 12414/34 Loss=-1.4% Paper Loss = 1.4%

1.027 .122 P= 78 IP21= -.067 -116 .012

Sell S12s right before the 4th of July tend to be premature.

That was true here.

#90 ...S12 9/1/2011 12493.57 +6.3% No paper loss

1.022 -.426 P- 43 IP21= -.036 -182 .151

Sell S12s right before the 4th of July tend to be premature.

That was true here.

#91 ...S12 12/7/2011 12196.37 +3.5% No paper loss

1.029 .129 P- -35 IP21= -.27 -68 .098

#92 ...S12 1/3/2012 12397.38 -1.5% Paper Loss = 1.5%

1.025 +.372 P- 246 IP21= -.09 +1 .01

Sell S12s right before the 4th of July tend to be premature.

That was true here.

==========================================================

Number of trades = 92

Avg. Gain= 7.52%

#84 ...S12 4/5/2004 10558.37 +4.4% No Paper loss

1.027 -.043 P= 24 IP21 = -.069 -145 -.144

This was a rebound failure rally. It did not reverse a Buy.

---------------------------------------------------------------------

X ..S12 6/30/2006 11150.22 +3.1%

1.015 -.119 P = -151 IP21= -.078 -250 -.215

too low.

Back-testing shows that a rally only 1.5% above

the 21-day ma is often wrong. But it is not often

that all the internal strength indicators are negative

on even such a rally. The period before July 4th is

usually bullish. Ordinarily, we would wait for an

additional rise.

---------------------------------------------------------------------

#85 ..S12...S9 12/6/2007 13619.89 +12.6% 1% Paper Loss.

1.035 -.037 P= -146 IP21= -.075 -173 -.122

These were very negative internals for a DJI 3.5%

over the 21-day ma. And given the earlier Sells,

considerability vulnerability was suggested.

#86 ...S12 11/5/2008 9139.27 +7.9% No Paper loss

1.02 -.408 P= -137 IP21 -.051 -247 -.255

#87 ...S12 1/6/2009 9815.1 +8.7% No Paper loss

1.037 .878 P= 562 IP21= .028 97 -.066

#88 ...S12 6/16/2010 10409.46 +6.1% Paper Loss - under 1/2%

1.025 -.253 P= 12 IP21= -.013 150 -.196

#89 ...S12 6/30/2011 12414/34 Loss=-1.4% Paper Loss = 1.4%

1.027 .122 P= 78 IP21= -.067 -116 .012

Sell S12s right before the 4th of July tend to be premature.

That was true here.

#90 ...S12 9/1/2011 12493.57 +6.3% No paper loss

1.022 -.426 P- 43 IP21= -.036 -182 .151

Sell S12s right before the 4th of July tend to be premature.

That was true here.

#91 ...S12 12/7/2011 12196.37 +3.5% No paper loss

1.029 .129 P- -35 IP21= -.27 -68 .098

#92 ...S12 1/3/2012 12397.38 -1.5% Paper Loss = 1.5%

1.025 +.372 P- 246 IP21= -.09 +1 .01

Sell S12s right before the 4th of July tend to be premature.

That was true here.

==========================================================

Number of trades = 92

Avg. Gain= 7.52%