---------------------------------------------------------------------------------------------------------------------------------------------------

P-Indicator is Positive of Nearly So

When DJI Falls below 1.9% Lower Band

There have been 58 standard Buy B9s since 1928 that have been closed out.

They averaged a gain of 10.8%. Only 2 produced a loss if one sold the DJI

at the next Peerless Sell. The biggest gains were in the 3rd year of Presidential

Election years, +14.5% and in Novembers, +15.7%. Presidential Election year

Buy B9s gained only 6.6%.

11 of the 58 Buy B9s would have have required a trader of the DJI to sustain

a paper loss 1% to 3.7%. In 27 cases, they called the bottom perfectly and there

was no paper loss. The other 20 would have brought a maximum paper loss of 1%.

Size of Gains

of Standard Buy B9s

>10% 26 44.8%

>5%-9.99% 16 27.6%

>2%-4.99% 11 19.0%

0%-1.999% 2 3.4%

losses 3 5.2%

-----------------------------------------

58

The "standard Buy B9s" are produced when the DJI falls below the 1.9% lower

band with the P-Indicator positive or nearly so. The lowest allowed P-Indicator

was -29 in 2006. Adjusted for the number of shares traded on the NYSE, the

in 1929, this would have meant a P-Indicator reading of -3. Our program does

adjust the P-Indicator over time.

The standard Sell S9 also does not allow August Sells. Trading losses would have

been very big in the Augusts of 1937, 1946 and 2001. Buy B9s. Buy B9s are also

not allowed from February to May in the first year after a Presidential Election year.

There is a much bigger probability of a decline in the first half of the Year after a

Presidential Election when a Republcan sits in the White House. This was the case

in 1929, 1953, 1957, 1969, 1973, 1981 and, 2001 (7 cases). It was not true in 1985,

1989 and 2005 (3 cases). It also took place in 1977, when a Democrat was in the

White House. Importantly, 1977 was a time when the DJI fell even while the

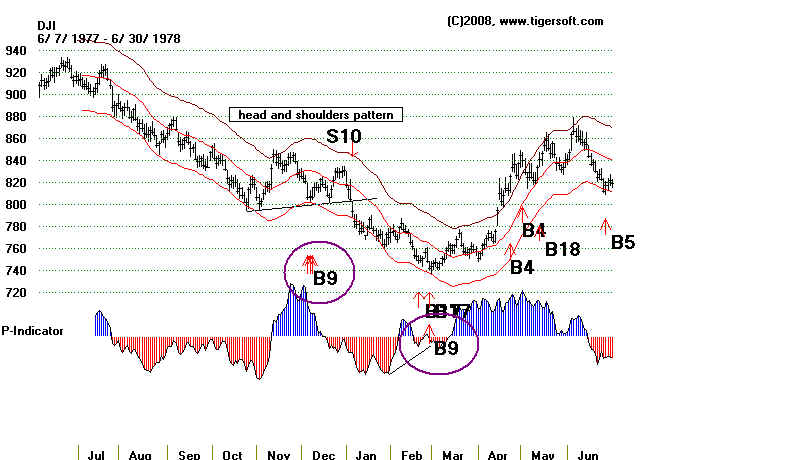

P-Indicator showed positive readings as the DJI fell near to the lower band.

Buy B9s are also denied in the immediate aftermath of a Sell S4, Sell S12,

Sell S15, Sell S16 or Sell S18. The Sell S16 has the effect of cancelling Buy B9s that

would otherwise have occurred in the Januaries of 1940, 1962, 1970 and 1981.

Proximate Sell S12s prevented B9s in February 1933, February 1934, February 1984

and August 1990. They can quickly follow a Sell S9. Such was true in January 1988.

For example, the case below is not allowed because of the

Sell S18 of 6/23/1975.

S17 --> X19750722 B9 846.76 -.013 rising Paper loss 6.5%

Another element here: do not be surprised if the DJI continues to fall a little longer

than normally, i.e. below the first tagging of the lower band after a head/shoulders

DJI price pattern is completed or after a Sell S10.

Other key values are sometimes considered in a minor way when determining

if a standard Buy B9 is given. Fpr example, back-testing shows that Mays often

start a decline. Accordingly, we do not allow a Buy B9 in May if the P-Indicator

is below 5 and the IP21 is negative. This eliminates the following loss.

LA/MA P-I IP21

X19820519 B9 835.90 -.02 .978 2 -.025 -1 .005

low negative

It is always recommended that Peerless users consider the other key values

when a Buy B9 approaches and compare past Buy B9s' key values with the

current levels for the IP21, V-I and ObvPct. See these other key values in the second

table below.

There are a few non-standard( ^^) Buy B9s. These occur when the DJI falls

below the 4.7% lower band and the key values are showing support.

19460225 B9^^ 187.20 .135 .930 -91 .008 -270 -.083

19800421 B9^^ 759.13 .299 .978 -60 -.050 -5 -.198

20010323 B9^^ 9504.78 .183 .929 -181 -.007 -231 -.098

20020918 B9 8172.45 .074 .953 -58 -.010 -210 -.242

Peerless users will find that this December 2013 version of Peerless no longer allows

Buy B9s above the 1.9% lower band or when P-Indicator is below -30. This leaves out the

case below: :

X 20091002 B9 LA/MA=.983 9487.67 P= + 403 IP21 = .067 >5% paper loss

Research Still To Do

If I were to add a new variation of Buy B9s, it would be a provision for allowing a slightly

higher lower band in a very strong and steady bull markets. Research would show, I think,

that is a sign of a strong market when the DJI is above a quickly rising 65-dma and the DJI refuses

to retreat even to the 1.9% lower band, all the while the P-Indicator and IP21 remain quite positive.

|

Buy B9s: 1928-2013 Positive or Nearly Positive P-I NCs at Lower Band Pct.Gain Up/Down/Sidewise Paper Loss 19350531 B9 110.64 .198 up none

19400112 B9 145.9 -.008 sidewise <1%

19431108 B9 131.7 .245 down 1.6%

19431117 B9 130.2 .26 down <1%

19431126 B9 131.3 .249 down none

19440907 B9 143.6 .142 flat <1%

19440914 B9 142.9 .142 flat none

19480920 B9 177.4 .07 falling <1%

19481122 B9 176.3 .022 falling 2.9%

19481129 B9 172 .048 falling <1%

19481201 B9 173.2 .040 falling none

19501106 B9 222.5 .164 rising none

19501204 B9 225.4 .166 rising none

19550117 B9 388.2 .207 rising none

19581125 B9 540.5 .191 rising none

19661201 B9 789.75 .124 falling <1%

19670412 B9 844.65 .051 rising none

19670519 B9 874.55 .064 rising 3.1%

X 19750528 B9 871.05 .058 rising <1%

19751203 B9 825.49 .223 rising <1%

19761005 B9 966.76 .018 falling 3.7%

19771206 B9 806.91 -.017 falling 1.7%

19780223 B9 750.95 .154 falling <1%

(19780228 B9 742.12 .168 falling none)

19781218 B9 787.51 .125 falling none

19790206 B9 822.85 .077 rising 1.7%

19801028 B9 759.13 .058 falling none

X19810126 B9 938.91 .071 falling <1%

19811023 B9 837.99 .04 falling <1%

X19820519 B9 835.90 -.02 flat 2.0%

19820930 B9 896.25 .179 rising none

19821123 B9 990.99 .067 rising none

19830124 B9 1030.17 .207 rising <1%

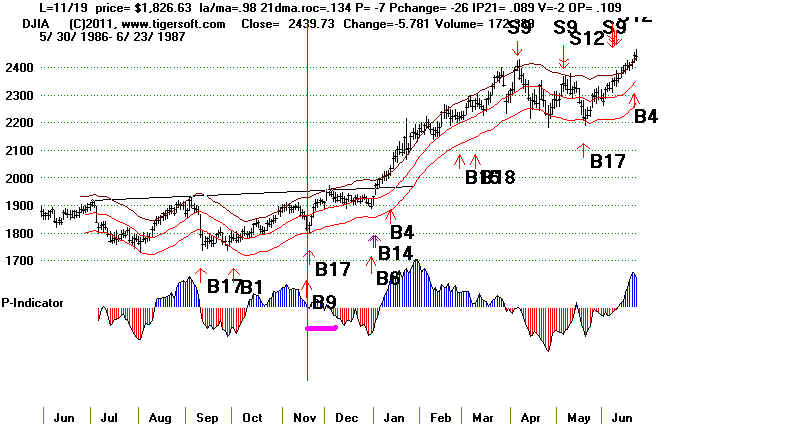

19860122 B9 1502.29 .215 rising <1%

19860407 B9 1735.51 .052 rising <1%

19860507 B9 1775.30 .049 rising <1%

19860709 B9 1826.07 .005 rising 3.4%

19861118 B9 1817.21 .324 rising none

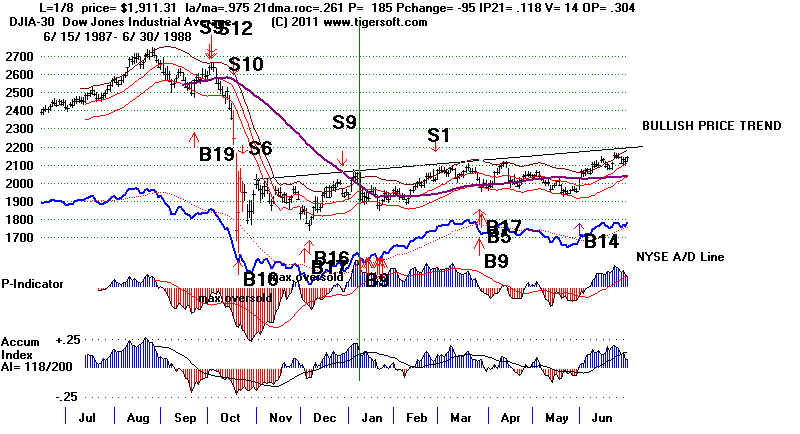

19880108 B9 1911.31 .059 rising 1.7%

19880122 B9 1903.51 .063 rising none

19880325 B9 1978.95 .056 rising none

19910321 B9 2855.45 .060 rising none

19960110 B9 5032.94 .103 rising none

19960410 B9 5485.98 .048 rising <1%

19960507 B9 5420.95 .06 rising none

19961213 B9 6304.87 .087 rising <1%

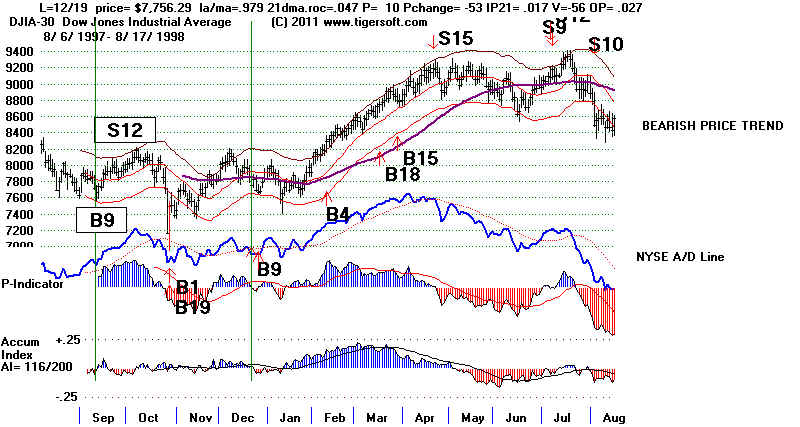

19970911 B9 7660.98 .034 rising none

19971219 B9 7756.29 .184 rising <1%

19981001 B9 7632.53 .459 falling none

19990524 B9 10654.67 .045 rising <1%

20001124 B9 10470.23 .042 falling none

20001220 B9 10318.93 .058 flat none

20021209 B9 8473.41 .035 rising 2.0%

20021219 B9 8364.8 .049 rising <1%

20041014 B9 9894.45 .103 falling 1.5%

20041025 B9 9749.99 .119 falling none

20050624 B9 10297.84 .124 falling <1%

20060718 B9 10799.23 .148 falling none

20081223 B9 8419.93 .055 falling none

20131007 B9 14996.48 .105 rising none

---------------------------------------------------------------------

No.= 58 .110

(Since 1945, no. = 51 Avg.Gain = .101)

PE 21 .066 low

PE + 1 6 .073

Jan (1) .071

none from

Jun (1) .124

Sep (1) .034

Oct (1) .04

Dec (2) .084

PE + 2 19 .140

PE + 3 12 .157

Jan 8 .115 Feb 3 .133 Mar 2 .058 Apr 3 .050 May 6 .066 June 1 .124 Jul 2 .077 Aug 0 ---- Sep 5 .113 Oct 6 .133 Nov 10 .161 high Dec 12 .094 1-10 17 .112 11-20 17 .112 21-30 24 .107 |

|

Buy B9s, Gains and Key Values: 1928-2013 Date Signal DJI Pct.Gain LA/MA P-I IP21 V-I OPct 19350531 B9 110.64 .198 .973 32 -.026 -32 .215

19400112 B9 145.9 -.008 .975 4 -.125 -31 .098

19431108 B9 131.7 .245 .958 158 -.261 126 -.225

19431117 B9 130.2 .26 .958 104 -.252 84 -.216

19431126 B9 131.3 .249 .979 84 -.251 72 -.250

19440907 B9 143.6 .142 .978 81 .044 70 -.033

19440914 B9 142.9 .142 .977 22 -.079 1 -.171

19480920 B9 177.4 .07 .975 13 -.017 -34 .024

19481122 B9 176.3 .022 .971 150 .031 245 -.097

19481129 B9 172 .048 .962 79 -.063 154 -.269

19481201 B9 173.2 .040 .978 125 -.029 204 -.051

19501106 B9 222.5 .164 .974 -4 .025 -105 .110

19501204 B9 225.4 .166 .971 198 .103 264 .215

19550117 B9 388.2 .207 .974 6 -.011 -274 -.025

19581125 B9 540.5 .191 .977 25 .039 -173 .255

19661201 B9 789.75 .124 .980 11 .049 2 -.102

19670412 B9 844.65 .051 .980 2 -.027 -1 -.014

19670519 B9 874.55 .064 .981 9 .008 5 .084

19750528 B9 817.04 .058 .978 69 -.002 0 .181

X19750722 B9 (follows S18) 846.76 -.013 .975 52 .009 0 -.04

19751203 B9 825.49 .223 .976 -8 -.028 -2 .008

19761005 B9 966.76 .018 .974 -13 -.001 -1 -.285

19771206 B9 806.91 -.017 .971 163 .044 1 .114

19780223 B9 750.95 .154 .979 -18 -.045 -2 -.102

19780228 B0 742.12 .168 .971 -14 -.055 -2 -.307

19781218 B9 787.51 .125 .975 8 -.007 -2 .04

19790206 B9 822.85 .077 .980 22 -.013 0 -.001

19801028 B9 759.13 .058 .980 4 -.053 -1 .136

19810126 B9 938.91 .071 .973 5 .048 -5 -.105

19811023 B9 837.99 .04 .981 53 .045 -.087

X19820519 B9 835.90 -.02 .978 2 -.025 -1 .005

low negative

19820930 B9 896.25 .179 .977 42 -.063 -2 -.182

19821123 B9 990.99 .067 .967 81 .009 -1 .067

19830124 B9 1030.17 .207 .968 56 -.027 1 -.063

19860122 B9 1502.29 .215 .981 4 .056 -9 -.287

19860407 B9 1735.51 .052 .980 25 .032 -2 .058

19860507 B9 1775.30 .049 .979 7 .028 -4 .038

19860709 B9 1826.07 .005 .978 -13 .050 -3 .093

19861118 B9 1817.21 .324 .975 18 .061 0 .022

19880108 B9 1911.31 .059 .975 185 .118 14 .318

19880122 B9 1903.51 .063 .974 102 .008 0 .113

19880325 B9 1978.95 .056 .963 3 .071 -3 .002

19910321 B9 2855.45 .060 .979 49 -.117 1 -.280

19960110 B9 5032.94 .103 .980 26 -.065 -43 -.055

19960410 B9 5485.98 .048 .976 6 .042 -15 -.081

19960507 B9 5420.95 .06 .979 41 -.034 -4 -.102

19961213 B9 6304.87 .087 .981 -5 .074 -23 .103

19970911 B9 7660.98 .034 .979 83 -.013 -32 -.127

19971219 B9 7756.29 .184 .979 10 .017 -57 .028

19981001 B9 7632.53 .459 ,966 9 .017 -81 -.075

19990524 B9 10654.67 .045 .978 31 .028 -37 -.009

20001124 B9 10470.23 .042 .979 55 .042 -77 -.131

20001220 B9 10318.93 .058 .975 51 -.077 -126 -.021

20021209 B9 8473.41 .035 .981 89 -.034 -92 -.086

20041014 B9 9894.45 .103 .978 114 -.054 -142 -.049

20041025 B9 9749.99 .119 .973 119 -.032 -141 -.260

20050624 B9 10297.84 .124 .979 356 -.121 13 .215

20060718 B9 10799.23 .148 .980 -28 -.124 -200 0

20081223 B9 8419.93 .055 .979 352 .055 85 .071

20091007 B9 14936.24 open .977 133 -.057 -63 -.150

|

======================================================

Being revised 7/16/2011

(C) 2011 www.tigersoft.com and William Schmidt, Ph.D.

Number of completed trades = 47

Avg. Gain = 10.4%

The Buy B9 is usually very benign. It averaged a gain of 10,7% at the time of

the next

Peerless Sell in 47 cases since 1929.

Most of the biggest losses were before 1943..

. 42 of the 47 (89.3% of all cases) B9s would

have been closed out profitably.

17 (36.2%) produced a gain of more than

10% and 11 (23.4%) registered gains of more

than 17.7%.

There were, however, 6 (12.8%) B9 trades

that would have shown a paper loss of between

7% and 13%. Only two of these took

place after 1942. Ten ( 21.2% ) had paper losses of more

than 3%.

The Buy B9 occurs when the DJI's hypothetical low

approaches the lower band with the P-Indicator

positive or nearly so. The

Accumulation Index is usally nearly positive or much improved from the

previous lows. The exact

parameters are proprietary. However, the key values are shown on all

the B9s. This was one of our

original Peerless Buy signals. Besdies the 21-day P-Indicator we also

use the 18 day ma of NYSE advances

minus declines.

REVERSING BUY B9s

Buy B9

2/27/1934

103.7 1.4%

Sell S9 4/11/1934

105.2 4.5%

Buy B9

4/30/1934

100.5 -1.5%

Sell S9/S5 6/19/1934 99.0

12.4%

Buy B9/B17 3/21/1939

143.4 -0.1%

Sell S8 7/31/1939

143.3 4.2%

Buy B9

2/10/1942

106.8 -7.1% Sell

S9 5/11/1942 99.2

-5.2%

Buy B9

11/3/48 182.5

-0.7 Sell

S12 1/7/1949

181.3 8.9%

Buy B9 5/22/67

871.05

6.7 Sell

S12 9/14/67 929.44

7.5

Buy B9

12/6/77

806.91 -1.7

Sell S10 1/7/78 793.49

5.1

Buy B9

12/18/78

787.51 13.5 Sell

S9 9/21/79 893.94

10.9

Buy B9

1/26/81 938.91

8.7 Sell

S15 4/24/81 1020.35

17.4

Buy B9

10/23/81

837.99 -0.6

Sell S9

4/1/82 833.24

6.7

Buy B9

1/24/83

1030.17 20.7

Sell S9 7/26/83

1243.69 6.1

Buy B9

7/9/86

1826.07 0.5

Sell S9

8/12/86

1835.49 2.3

Buy B9

1/8/88

1911.31 6.3

Sell

S1 2/26/88

2023.21 2.2

Buy B9

3/25/88

1978.95 4.4

Sell

S2 9/6/88

2065.26 -0.1

Buy B9

4/10/96 5485.98

3.4 Sell

S1 5/29/96

5673.03 2.7

Buy B9

10/1/98 7632.53

42.2 Sell

S12 6/18/99

10855.55 4.2

Buy B9

3/23/01

9504.78 18.3

Sell

S4 5/17/01

11428.58 22.1

Buy B9

11/13/02 8398.49

4.5 Sell

S12 1/6/03

8773.57 5.2

Buy B9

1/22/03 8318.73

17.8 Sell

S4 10/15/03

9803.05 -0.6

Buy B9

10/14/04 9894.45

9.7 Sell

S8 12/28/04

10854.54 5.9

Buy B9

7/18/2006 10799.23 14.8

Sell S9

1/5/2007 12398.01

2.3

================================================================

N=21

Avg.= +7.7%

Avg.= +5.9%

We want to consider the performance of Buy B9s as it related to

month of the year

and type of market conditions that

prevail (bear market, trading range and bullmarket).

This will be done here soon.

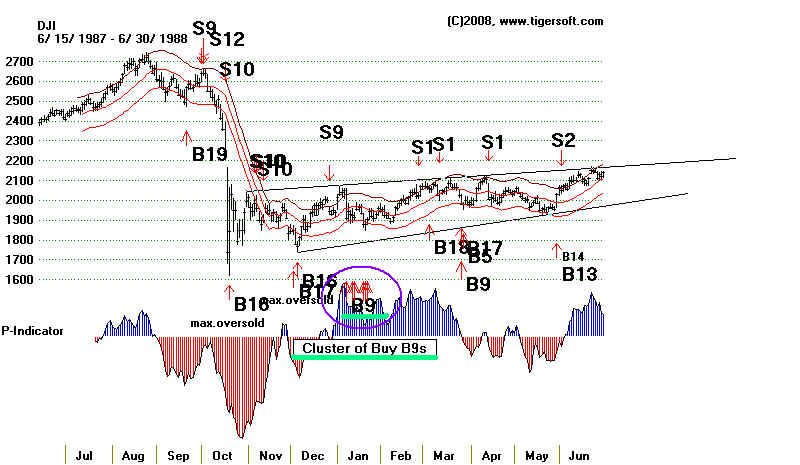

Buy B9s don't always bring an

immediate reversal upwards. Look at the cluster of Buy B9s

in January 1988 after the

Crash of the previous October.

Using a completed head.shoulders

pattern to sell when the neckline was violated

would have avoided the big losses

in 1938 and 2002.

It is helpful to discount or

discard B9s in the year after the Presidential Election from March

27th through the end of

September. Below are the cases that would have taken place in this period.

THIS BUY

SIGNAL SHOULD BE VOIDED BECAUSE OF THE PATTERN OF

WEAK MARKETS AT THIS TIME IN THE YEAR AFTER A PRESIDENTIAL

ELECTION.

3 / 28 / 1977

926.11

5 / 25 / 1977

903.24 -.016 Falsafe S10

.971 -.158 47

.006 0 .108 Pch=-26

5 / 26 / 1977

908.07 -.022

.977

-.201 7

.012 0 .103

The DJI fell more than 12% below the previous,

October 1976, high

and should have been sold. You should also note the breakdown

below well-tested declining support as the DJI fell below 880.

That should have been treated as a Sell S10. (The 12% down-line

in the chart below is from the January peak.)

In

additon, it best to treat with care Buy B9s in July generally. Only one of five led

to

a big gain and three were unprofitable. This is due

to the tendency of the market to be

weak from May to October. The software does not allow

Buys in Julys in the third

year of the 4-year Presidential cycle. This

eliminates those of July 1943 and 1975, both

of

which would have lost money.

(1)

7/2/1934 94.80 -.023 8/21/1934 S12

.978 .369 -8 1 -.059 -20 .019

also B9 on 7/3/1934.

Continuation head and shoulders pattern was completed and DJI fell to

85.50 and then rallied to the upper band and S9/S12.

(2)

7 / 29 / 1943 139.4 -.009 1/14/44 S1

A.)973 B) -.266 C)-11 D) -.039 E) -107 F).03

DJI fell gradually to 140 in mid November and then rallied.

The NYSE A/D Line rose steadily.

(3)

7 / 22 / 1975 846.76 -.013 8/29/1975 S12

.975 -.119 52 .009 0 .032 Pch = -66

The DJI fell to 791 on 8/21/1975 and then rallied to the upper band.

(4)

7 / 9 / 1986 1826.07 .005 8/12/11986 S9 1835.48

.978 -.09 -13 .05 -3 .088 Pch77

7 / 10 / 1986 1831.83 .002

.981 -.034 5 .068 1 .178 Pch = 17

7 / 11 / 1986 1821.43 .008

.976 -.157 -5 -11 .037 {ch = -11

(5) 7 / 18 / 2006 10799.23 .148 1/5/2007 S9 12398 Finally, is very risky to expect a B9 to reverse a steep downtrend where the ANNROC is less than -.70.

Buy B9s : 1928-2011

We consider the first signal in a set to be the significant signal.

Note the key values that are used to produce a Buy B9.

A Close/21-dma

B Annualized Rate of Change of 21-fma

C P-Indicator value

D Current Accum.Index value ("IP21")

E V-21 Value

F On-Bal.Vol. Pct.

Date DJI Gain Reversing Signal.

------------- ----------- -------- ----------

Note Regular mode Buy B9s should not have taken between 1929 and 1932,

because of how the Extreme Bearish Mode should have been applied.

The X shows extreme bearish mode would not have allowed these Buys.

X Extreme Bear Market rules should have applied.

8/8/1930 222.8 Gain= .037 8/27/30 S12/S9

LA/MA 21-dmaroc P IP21 V OPct

.949 -.233 -22 (-39) .015 -172 .087 .

DJI fell 217 4 days later and rallied to upper band and Sell

X Extreme Bear Market rules should have applied.

9/19/1930 229 Loss=. 091 9/29/30 S10

LA/MA 21-dmaroc P IP21 V OPct

.963 -.195 -20 (-25) .038 -186 -.064

X Extreme Bear Market rules should have applied.

1/15/1031 162.80 DJI rose to 194 on 2/24

LA/MA 21-dmaroc P IP21 V OPct

.979 -.036 31 (1) -.108 -58 .155

DJI rallied to 194. First EBM-S1 was on 2/2 at 168.70

Steep A/D Line uptrendline broken on 2/27 at 190.30.

Head and shoulders pattern developed.

Second EBM-S1 was on 3/13/1931 at 178.90

X Extreme Bear Market rules should have applied.

1/27/1932 77.80 .104 2/9/1932 S4

LA/MA 21-dmaroc P IP21 V OPct

.978 .60 69 (+6) .014 146 .192

There were follow-up B9s from 1/18-2/4/1932

DJI fell to 71.80 on 2/10 and rallied in 6 days to sell above upper band.

The top also saw a reversal day. There was an EBM-S1 at 82.10 on 2/26/1932

============================================================================

(1) Reversing Buy

2/27/1934 103.7 Gain= +1.4% 4/11/1934 S9 105.2 Paper Loss= 5%

LA/MA 21-dmaroc P IP21 V OPct

.965 -.354 52 (18) -.083 47 .075

DJI fell to 98.80 on 3/27/1934 and then rallied to upper band and S9.

----------------------------------------------------------------------------

(2) Reversing Buy

4/30/1934 100.5 Loss= 1.2% 6/19/1934 S9 99.0 Paper Loss= 8%

LA/MA 21-dmaroc P IP21 V OPct

.964 .023 21 (-48) .006 -23 .245

DJI fell to 91.80 on 5/14/1934 and rallied to upper band and sell.

The B9 fellowed three S9s from 4/11 to 4/13 on a lower high.

---------------------------------------------------------------------------

(3) 5/31/1935 110.64 Gain= +5.8% 6/12/1935 S12 No Paper loss

LA/MA 21-dmaroc P IP21 V OPct

.973 .203 32 (-11) -.026 -32 .247

DJI reversed with B9 and rallied to upper band and Sell. Market continued

higher, P-Indicator stayed positive for 5.5 months.

-------------------------------------------------------------------------

X Extreme Bear Market rules should have applied.

11/16/1937 127.9 Loss= 10.7% 11/29/1937 S10 Paper Loss= 11%

LA/MA 21-dmaroc P IP21 V OPct

.973 -.725 (too steep) 7 (+21) .103 .235

DJI fell to 115.80 and then rallied to the upper band and Sell.

X Extreme Bear Market rules should have applied.

1/26/1938 123.2 Gain = .036 2/17/1938 S12 Paper Loss= 4%

LA/MA 21-dmaroc P IP21 V OPct

.961 .40 11 (-2) .044 -36 .096

DJI fell to 118.50 and then raqllied ot the upper band and S12.

-----------------------------------------------------------------------

(4) Reversing Buy

3/21/1939 143.40 Loss= 10.7% 1/14/44 S1 Paper Loss= 12%

This was also a Buy B17

LA/MA 21-dmaroc P IP21 V OPct

.975 -.121 11 (+21) .001 -41 -.006

DJI fell to 125.40 on 4/18/39 and then rallied.

Note the completed head and shoulders pattern. Selling on the close below the neckline

of the DJI's price pattern would have limited the loss to 7.7%

-------------------------------------------------------------------------------------------------------------------------------------------

(5) Reversing Buy

2/10/1942 106.80 Loss= 7.1% 5/11/42 S9 Paper Loss= 14%

LA/MA 21-dmaroc P IP21 V OPct

.97 -.421 -32 (-34) -.024 -44 -.009

DJI fell to 92.90 on 4/20/42 and then rallied.

Only when the battles of World War II started to be won by the Allies

did the market turn upwards.A simple price-trendline would have worked

better in this case.

-------------------------------------------------------------------------------------------------------------------------------------------

(5) Reversing Buy

2/10/1942 106.80 Loss= 7.1% 5/11/42 S9 Paper Loss= 14%

LA/MA 21-dmaroc P IP21 V OPct

.97 -.421 -32 (-34) -.024 -44 -.009

DJI fell to 92.90 on 4/20/42 and then rallied.

Only when the battles of World War II started to be won by the Allies

did the market turn upwards.A simple price-trendline would have worked

better in this case.

--------------------------------------------------------------------------------------------------------------------------------------------

(6)

11/8/1943 131.7 Gain = +12.3% 1/14/44 S1 Paper Loss= 2%

LA/MA 21-dmaroc P IP21 V OPct

.958 -.527 158 (+32) -.261 126 -.214

DJI fell to 130 on 11/17/43 and then rallied until early January.

A series of additional B9s follow from 11/10/1943 to 11/26/1943.

-------------------------------------------------------------------------

(7)

9/7/1944 143.6 Gain= +14.2% 5/15/45 S9 No Paper Loss

LA/MA 21-dmaroc P IP21 V OPct

.978 -.105 81(-4) .044 70 -.026

This was at low in an inverted head and shoulders pattern.

--------------------------------------------------------------------------------------------------------------------------------------------

(6)

11/8/1943 131.7 Gain = +12.3% 1/14/44 S1 Paper Loss= 2%

LA/MA 21-dmaroc P IP21 V OPct

.958 -.527 158 (+32) -.261 126 -.214

DJI fell to 130 on 11/17/43 and then rallied until early January.

A series of additional B9s follow from 11/10/1943 to 11/26/1943.

-------------------------------------------------------------------------

(7)

9/7/1944 143.6 Gain= +14.2% 5/15/45 S9 No Paper Loss

LA/MA 21-dmaroc P IP21 V OPct

.978 -.105 81(-4) .044 70 -.026

This was at low in an inverted head and shoulders pattern.

---------------------------------------------------------------------------

(8)

2/25/1946 187.2 Gain= +14.2% 5/15/45 S9 No Paper Loss

Another B9 followed on 2/26/1945

LA/MA 21-dmaroc P IP21 V OPct

.930 -.684 -91(-64) .008 270 -.154

DJI fell the next day to 186.00 and then rallied past the upper band.

---------------------------------------------------------------------------

(9)

9/20/1948 177.4 Gain= +7.0% 10/22/48 S1 189.8 Paper Loss= 1%

LA/MA 21-dmaroc P IP21 V OPct

.975 -.34 13 (-37) -.017 -34 .006

The DJI fell to 1765 a few days later and then rose to resistance

in Presidential Election year trading range.

=============================================================================

(10))Reversing Buy

11/3/1948 182.5 Loss - 1.7% 181.30 1/7/1949 S12 Paper Loss= 7%

Additional Buy B9s follow from the next day to Decemeber 1, 1949

LA/MA 21-dmaroc P IP21 V OPct

.984 .167 92 (-3) .24 118 .212

The DJI fell rapidly from the upper band to below the lower band;

Wall Street was surprised when Truman beat Dewey for President..

The DJI fell to 171 on 11/30/1948 and rallied to 181 on 1/7/1949.

=================================================================================

(11)

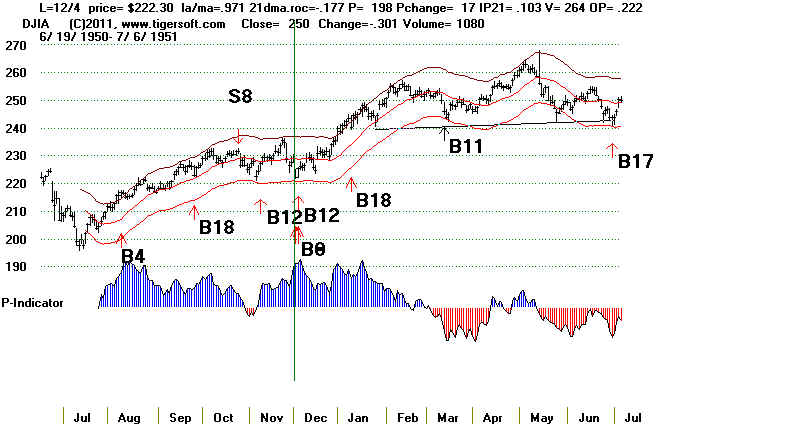

12/4/1950 222.3 Gain = +23.8% 275.1 9/17/1951 S4 No Paper Loss

Another Buy B9s followed the next day.

LA/MA 21-dmaroc P IP21 V OPct

.971 -.177 198(+17) .103 262 .203

This was bottom. DJI moved up steadily afterwards.

---------------------------------------------------------------------------

(8)

2/25/1946 187.2 Gain= +14.2% 5/15/45 S9 No Paper Loss

Another B9 followed on 2/26/1945

LA/MA 21-dmaroc P IP21 V OPct

.930 -.684 -91(-64) .008 270 -.154

DJI fell the next day to 186.00 and then rallied past the upper band.

---------------------------------------------------------------------------

(9)

9/20/1948 177.4 Gain= +7.0% 10/22/48 S1 189.8 Paper Loss= 1%

LA/MA 21-dmaroc P IP21 V OPct

.975 -.34 13 (-37) -.017 -34 .006

The DJI fell to 1765 a few days later and then rose to resistance

in Presidential Election year trading range.

=============================================================================

(10))Reversing Buy

11/3/1948 182.5 Loss - 1.7% 181.30 1/7/1949 S12 Paper Loss= 7%

Additional Buy B9s follow from the next day to Decemeber 1, 1949

LA/MA 21-dmaroc P IP21 V OPct

.984 .167 92 (-3) .24 118 .212

The DJI fell rapidly from the upper band to below the lower band;

Wall Street was surprised when Truman beat Dewey for President..

The DJI fell to 171 on 11/30/1948 and rallied to 181 on 1/7/1949.

=================================================================================

(11)

12/4/1950 222.3 Gain = +23.8% 275.1 9/17/1951 S4 No Paper Loss

Another Buy B9s followed the next day.

LA/MA 21-dmaroc P IP21 V OPct

.971 -.177 198(+17) .103 262 .203

This was bottom. DJI moved up steadily afterwards.

============================================================================

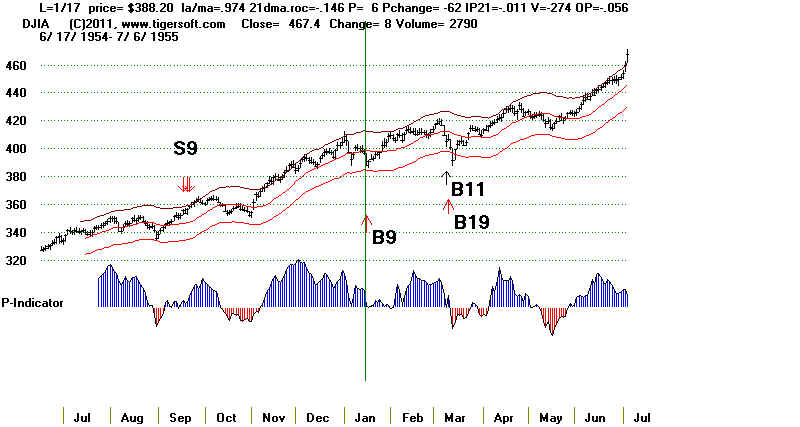

(12)

1/17/1955 388.2 Gain = +25.2% 9/22/1955 S4 486. No Paper Loss

LA/MA 21-dmaroc P IP21 V OPct

.974 .146 6 (-62) -.011 -274 -.056

This was bottom. Quick rally to upper band.

============================================================================

(12)

1/17/1955 388.2 Gain = +25.2% 9/22/1955 S4 486. No Paper Loss

LA/MA 21-dmaroc P IP21 V OPct

.974 .146 6 (-62) -.011 -274 -.056

This was bottom. Quick rally to upper band.

============================================================================

(13) Reversing Buy

5/22/1967 871.05 Gain = +6.7% 9/14/1967 S12 Paper loss = 4%

LA/MA 21-dmaroc P IP21 V OPct

.978 .162 -8 (-17) -.001 4 -.007

DJI fell to 842 on 6/5/1967 and then rallied.

============================================================================

(13) Reversing Buy

5/22/1967 871.05 Gain = +6.7% 9/14/1967 S12 Paper loss = 4%

LA/MA 21-dmaroc P IP21 V OPct

.978 .162 -8 (-17) -.001 4 -.007

DJI fell to 842 on 6/5/1967 and then rallied.

================================================================================

(14)

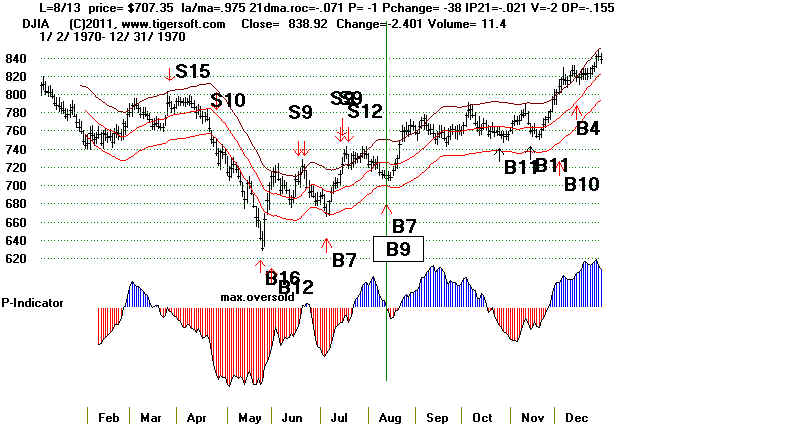

8/13/1970 707.35 Gain = +32.5% 5/6/1971 S9 937.39 No Paper Loss

LA/MA 21-dmaroc P IP21 V OPct

.975 -.071 -1 (-38) -.021 -2 -.155

The B9 does not show up because of simultaneous the B7.

This was the low.

================================================================================

(14)

8/13/1970 707.35 Gain = +32.5% 5/6/1971 S9 937.39 No Paper Loss

LA/MA 21-dmaroc P IP21 V OPct

.975 -.071 -1 (-38) -.021 -2 -.155

The B9 does not show up because of simultaneous the B7.

This was the low.

================================================================================

(15)

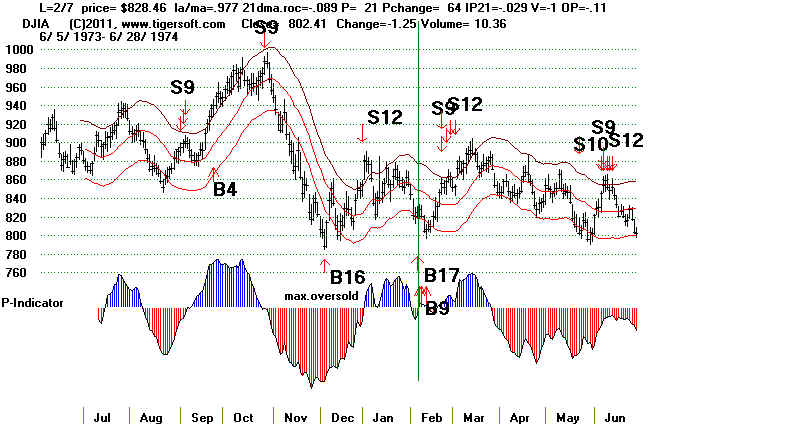

2/7/1974 828.46 Gain = +3.3% 2/22/1974 S12 855.99 Paper loss = 3%

There were also B9s on 2/8/1974 and 2/12/1974

LA/MA 21-dmaroc P IP21 V OPct

.977 -.089 21 (-64) -.029 -1 -.11

The DJI fell to 806 on 2/12 and then rallied to the upper band.

================================================================================

(15)

2/7/1974 828.46 Gain = +3.3% 2/22/1974 S12 855.99 Paper loss = 3%

There were also B9s on 2/8/1974 and 2/12/1974

LA/MA 21-dmaroc P IP21 V OPct

.977 -.089 21 (-64) -.029 -1 -.11

The DJI fell to 806 on 2/12 and then rallied to the upper band.

===============================================================================

(16)

10/9/1974 631.02 Gain = +6.1% 10/21/1974 S12 669.82 No Paper loss

LA/MA 21-dmaroc P IP21 V OPct

.999 -.511 -27 (+72) -.064 -2 -.327

The DJI had turned up from the bottom and rallied past the upper band.

===============================================================================

(17)

5/28/1975 817.04 Gain = +7.4% 7/1/1975 S8 877.42 No Paper loss

There was also a Buy B9 on the next day.

LA/MA 21-dmaroc P IP21 V OPct

.978 .10 69 (-7) -.002 0 .174

The DJI turned up immediately and rallied to the upper band.

===============================================================================

(16)

10/9/1974 631.02 Gain = +6.1% 10/21/1974 S12 669.82 No Paper loss

LA/MA 21-dmaroc P IP21 V OPct

.999 -.511 -27 (+72) -.064 -2 -.327

The DJI had turned up from the bottom and rallied past the upper band.

===============================================================================

(17)

5/28/1975 817.04 Gain = +7.4% 7/1/1975 S8 877.42 No Paper loss

There was also a Buy B9 on the next day.

LA/MA 21-dmaroc P IP21 V OPct

.978 .10 69 (-7) -.002 0 .174

The DJI turned up immediately and rallied to the upper band.

===============================================================================

(18)

12/3/1975 825.49 Gain = +22.3% 3/24/76 1009.21 Paper loss = 1%

LA/MA 21-dmaroc P IP21 V OPct

.976 -.003 -8 (+37) -.028 -2 .008

The DJI fell to 818.8 on 12/9/1975 and then rallied past the upper band.

===============================================================================

(19)

10/5/1976 966.76 Gain = +1.8% 12/22/76 984.54 Paper loss = 4%

LA/MA 21-dmaroc P IP21 V OPct

.974 -.268 -13 (-46) -.001 -1 -.265

The DJI fell to 925 on 11/10/1975 and then rallied to the upper band.

It is usually a better idea to sell in the week after Christmas

than the week before it. Selling on 12/22/76 does not take into

account the 90% probability of a Santa Claus rally.

==============================================================================

X

The May 1977 Buy B9 is not allowed by the software, even though the lower band

of the DJI is approached witht the P-Indicator still positive. This is because of strong tendency

for markets to be weak in the first 9 months of the year after a Presidential Election.

5/26/1977 908.07

LA/MA 21-dmaroc P IP21 V OPct

.977 -.201 7 (-41) .012 0 .103

The DJI fell more than 12% below the previous, October 1976, high

and should have been sold. You should also note the breakdown

below well-tested declining support as the DJI fell below 880.

That should have been treated as a Sell S10. If one had taken this

Buy signal, it should have been exited when the DJI fall more than

13.5% below its September peak. That line crossed about 880. See the

chart below.

===============================================================================

(18)

12/3/1975 825.49 Gain = +22.3% 3/24/76 1009.21 Paper loss = 1%

LA/MA 21-dmaroc P IP21 V OPct

.976 -.003 -8 (+37) -.028 -2 .008

The DJI fell to 818.8 on 12/9/1975 and then rallied past the upper band.

===============================================================================

(19)

10/5/1976 966.76 Gain = +1.8% 12/22/76 984.54 Paper loss = 4%

LA/MA 21-dmaroc P IP21 V OPct

.974 -.268 -13 (-46) -.001 -1 -.265

The DJI fell to 925 on 11/10/1975 and then rallied to the upper band.

It is usually a better idea to sell in the week after Christmas

than the week before it. Selling on 12/22/76 does not take into

account the 90% probability of a Santa Claus rally.

==============================================================================

X

The May 1977 Buy B9 is not allowed by the software, even though the lower band

of the DJI is approached witht the P-Indicator still positive. This is because of strong tendency

for markets to be weak in the first 9 months of the year after a Presidential Election.

5/26/1977 908.07

LA/MA 21-dmaroc P IP21 V OPct

.977 -.201 7 (-41) .012 0 .103

The DJI fell more than 12% below the previous, October 1976, high

and should have been sold. You should also note the breakdown

below well-tested declining support as the DJI fell below 880.

That should have been treated as a Sell S10. If one had taken this

Buy signal, it should have been exited when the DJI fall more than

13.5% below its September peak. That line crossed about 880. See the

chart below.

-------------------------------------------------------------------------------

(20) Reversing Buy

12/6/1977 806.91 Loss = +1.7% 1/7/78 S10 793.49 Paper loss = 2%

There were also B9s on the next two days.

LA/MA 21-dmaroc P IP21 V OPct

.971 -.043 163 (-89) .044 1 .109

This was reversed at a 1.7% loss by the support failure and Sell S10.

There was a continuation head and shoulders pattern to warn you

==============================================================================

(21)

2/28/1978 742.12 Gain= +16.8% 7/17/78 S12 No Paper Loss

LA/MA 21-dmaroc P IP21 V OPct

.971 -.342 -14 (-24) -.055 -2 -.291

This signal exactly called the bottom of the 1977-1978 bear market.

-------------------------------------------------------------------------------

(20) Reversing Buy

12/6/1977 806.91 Loss = +1.7% 1/7/78 S10 793.49 Paper loss = 2%

There were also B9s on the next two days.

LA/MA 21-dmaroc P IP21 V OPct

.971 -.043 163 (-89) .044 1 .109

This was reversed at a 1.7% loss by the support failure and Sell S10.

There was a continuation head and shoulders pattern to warn you

==============================================================================

(21)

2/28/1978 742.12 Gain= +16.8% 7/17/78 S12 No Paper Loss

LA/MA 21-dmaroc P IP21 V OPct

.971 -.342 -14 (-24) -.055 -2 -.291

This signal exactly called the bottom of the 1977-1978 bear market.

==============================================================================

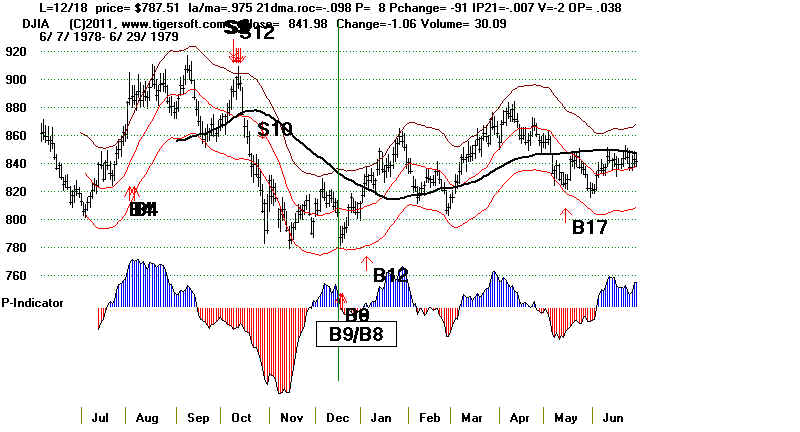

(22) Reversing Buy

12/18/1978 787.51 Gain= +13.5% 9/21/79 S4 893.94 No Paper Loss

also B8

LA/MA 21-dmaroc P IP21 V OPct

.975 -.098 9 (-91) -.007 -2 .038

DJI rallied immediately and rose in zig-zag fashion until the next Fall. sign

==============================================================================

(22) Reversing Buy

12/18/1978 787.51 Gain= +13.5% 9/21/79 S4 893.94 No Paper Loss

also B8

LA/MA 21-dmaroc P IP21 V OPct

.975 -.098 9 (-91) -.007 -2 .038

DJI rallied immediately and rose in zig-zag fashion until the next Fall. sign

============================================================================

(23)

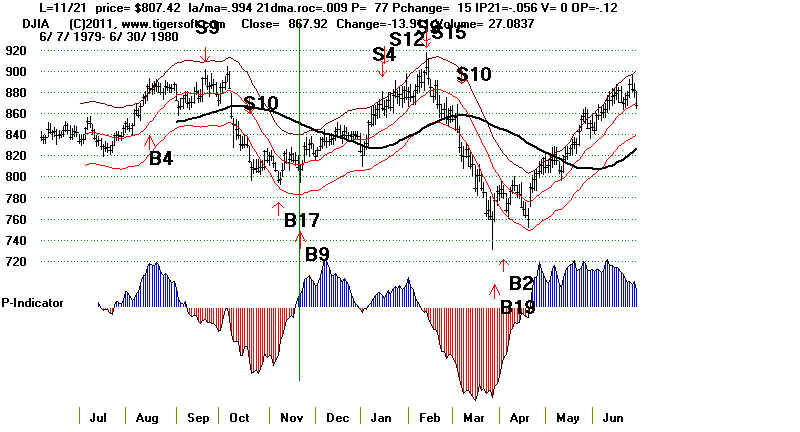

11/21/1979 807.42 Gain= +7.2% 1/16/80 S4 865.19 No Paper Loss

LA/MA 21-dmaroc P IP21 V OPct

.994 .009 77 (-15) -.056 0 -.121

DJI immediately rallied to the upper band.

============================================================================

(23)

11/21/1979 807.42 Gain= +7.2% 1/16/80 S4 865.19 No Paper Loss

LA/MA 21-dmaroc P IP21 V OPct

.994 .009 77 (-15) -.056 0 -.121

DJI immediately rallied to the upper band.

==============================================================================

(24)

1/26/1981 938.91 Gain= +8.7% 4/24/81 S15 1028.35 No Paper Loss

LA/MA 21-dmaroc P IP21 V OPct

.973 -.245 5 (-54) .048 -5 -.101

DJI immediately rallied to the upper band.

==============================================================================

(24)

1/26/1981 938.91 Gain= +8.7% 4/24/81 S15 1028.35 No Paper Loss

LA/MA 21-dmaroc P IP21 V OPct

.973 -.245 5 (-54) .048 -5 -.101

DJI immediately rallied to the upper band.

==============================================================================

(25) Reversing Buy

10/23/1981 837.99 Loss = 0.6% 4/1/02 S9 833.24 No Paper Loss

Two more Buy B9s followed on 10/26/81 and 10/29/81

LA/MA 21-dmaroc P IP21 V OPct

.997 .074 43 (+1) .04 -1 -.102

DJI immediately rallied to the upper band, but there was no

automatic Sell signal there. It then fell to 795.47 (5% Paper Loss)

and rallied again to the upper band.

==============================================================================

(25) Reversing Buy

10/23/1981 837.99 Loss = 0.6% 4/1/02 S9 833.24 No Paper Loss

Two more Buy B9s followed on 10/26/81 and 10/29/81

LA/MA 21-dmaroc P IP21 V OPct

.997 .074 43 (+1) .04 -1 -.102

DJI immediately rallied to the upper band, but there was no

automatic Sell signal there. It then fell to 795.47 (5% Paper Loss)

and rallied again to the upper band.

==============================================================================

(26))

9/30/1982 896.25 Gain=+17.9% 12/7/1982 S9 1056.94 Paper loss = 1%

LA/MA 21-dmaroc P IP21 V OPct

.977 -.066 42 (+58) -.063 -2 -.176

DJI rallied past the upper band.

==============================================================================

(26))

9/30/1982 896.25 Gain=+17.9% 12/7/1982 S9 1056.94 Paper loss = 1%

LA/MA 21-dmaroc P IP21 V OPct

.977 -.066 42 (+58) -.063 -2 -.176

DJI rallied past the upper band.

===============================================================================

(27)

11/22/1982 1000 Gain= 5.7% 12/7/1982 S9 1056.9 No paper loss

Two more B9s followed on 11/25/1982 and 11/29/1982.

LA/MA 21-dmaroc P IP21 V OPct

.975 -.365 38(-53) -.006 -3 .055

DJI fell to 990 and then rallied to the upper band.

See chart above.

===================================================================================

(28) Reversing Buy

1/24/1983 1030.17 Gain = +20.7% 7/26/1983 S9 1243.69 No Paper Loss

Two more B9s followed on 11/25/1982 and 11/29/1982.

LA/MA 21-dmaroc P IP21 V OPct

.968 -.167 56 (-86) -.027 -1 -.061

DJI rallied immediately.

See chart above.

==================================================================================

(29) Reversing Buy

7/9/1986 1826.07 Gain =+0.5% 8/12/11986 S9 1835.48 Paper loss = 3%

Two more B9s followed on 7/10/1986 and 7/11/1986.

LA/MA 21-dmaroc P IP21 V OPct

.978 -.09 -13 (+77) .05 -3 .088

DJI fell to 1774 two weeks later and then rallied to top of trading range.

===============================================================================

(27)

11/22/1982 1000 Gain= 5.7% 12/7/1982 S9 1056.9 No paper loss

Two more B9s followed on 11/25/1982 and 11/29/1982.

LA/MA 21-dmaroc P IP21 V OPct

.975 -.365 38(-53) -.006 -3 .055

DJI fell to 990 and then rallied to the upper band.

See chart above.

===================================================================================

(28) Reversing Buy

1/24/1983 1030.17 Gain = +20.7% 7/26/1983 S9 1243.69 No Paper Loss

Two more B9s followed on 11/25/1982 and 11/29/1982.

LA/MA 21-dmaroc P IP21 V OPct

.968 -.167 56 (-86) -.027 -1 -.061

DJI rallied immediately.

See chart above.

==================================================================================

(29) Reversing Buy

7/9/1986 1826.07 Gain =+0.5% 8/12/11986 S9 1835.48 Paper loss = 3%

Two more B9s followed on 7/10/1986 and 7/11/1986.

LA/MA 21-dmaroc P IP21 V OPct

.978 -.09 -13 (+77) .05 -3 .088

DJI fell to 1774 two weeks later and then rallied to top of trading range.

==================================================================================

(30)

11/18/1986 1817.21 Gain = +32.1% 4/6/1987 S9 2405.54 No Paper Loss

LA/MA 21-dmaroc P IP21 V OPct

.975 .04 18 (-22) .061 0 .021

DJI rallied immediately past the upper band.

==================================================================================

(30)

11/18/1986 1817.21 Gain = +32.1% 4/6/1987 S9 2405.54 No Paper Loss

LA/MA 21-dmaroc P IP21 V OPct

.975 .04 18 (-22) .061 0 .021

DJI rallied immediately past the upper band.

==================================================================================

(31) Reversing Buy

1/8/1988 1911.31 Gain = +5.9% 2/26/88 S1 2023.21 Paper loss = 2%

There were 5 more Buy B9s between 1/13/1988 and 1/22/1988

LA/MA 21-dmaroc P IP21 V OPct

.975 .261 185 (-95) .118 13 .303

DJI fell to 1879 and then rallied a little past the upper band to

the rising resistance line.

==================================================================================

(31) Reversing Buy

1/8/1988 1911.31 Gain = +5.9% 2/26/88 S1 2023.21 Paper loss = 2%

There were 5 more Buy B9s between 1/13/1988 and 1/22/1988

LA/MA 21-dmaroc P IP21 V OPct

.975 .261 185 (-95) .118 13 .303

DJI fell to 1879 and then rallied a little past the upper band to

the rising resistance line.

==================================================================================

(32) Reversing Buy

3/25/1988 1978.95 Gain = +4.4% 9/6/1988 S2 2065.79 Paper loss = 1%

There was also a Buy B17 and B5 on the day of the B9.

LA/MA 21-dmaroc P IP21 V OPct

.963 -.223 3 (-32) .071 -3 .002

DJI rose immediately to the upper band. But there was no sell and

it declined to 1958.72 and then rallied to the upper band. Selling

at well tested resistance would have meant selling at 2159

See the chart above.

==================================================================================

(33) Reversing Buy

4/10/1996 5485.98 Gain = 3.4% 5/29/1996 S1 5673.83 Paper loss = 1%

There was also a Buy B9 on the next day

LA/MA 21-dmaroc P IP21 V OPct

.976 -.201 6 (-68) .042 -15 -.077

DJI turned slipped down to 5420.95 and then rallied to upper band Sell.

See the next chart.

====================================================================================

(34)

5/7/1996 5420.95 Gain = 4.7% 5/29/1996 S1 5673.83 No Paper Loss

LA/MA 21-dmaroc P IP21 V OPct

.979 -.372 41(+82) -.034 -4 -.012 Pch = 82

DJI immediately turned up and then rallied to upper band Sell.

==================================================================================

(32) Reversing Buy

3/25/1988 1978.95 Gain = +4.4% 9/6/1988 S2 2065.79 Paper loss = 1%

There was also a Buy B17 and B5 on the day of the B9.

LA/MA 21-dmaroc P IP21 V OPct

.963 -.223 3 (-32) .071 -3 .002

DJI rose immediately to the upper band. But there was no sell and

it declined to 1958.72 and then rallied to the upper band. Selling

at well tested resistance would have meant selling at 2159

See the chart above.

==================================================================================

(33) Reversing Buy

4/10/1996 5485.98 Gain = 3.4% 5/29/1996 S1 5673.83 Paper loss = 1%

There was also a Buy B9 on the next day

LA/MA 21-dmaroc P IP21 V OPct

.976 -.201 6 (-68) .042 -15 -.077

DJI turned slipped down to 5420.95 and then rallied to upper band Sell.

See the next chart.

====================================================================================

(34)

5/7/1996 5420.95 Gain = 4.7% 5/29/1996 S1 5673.83 No Paper Loss

LA/MA 21-dmaroc P IP21 V OPct

.979 -.372 41(+82) -.034 -4 -.012 Pch = 82

DJI immediately turned up and then rallied to upper band Sell.

====================================================================================

(35)

9/11/1997 7660.98 Gain =+3.4% 9/18/1997 S12 7922.72 No Paper Loss

LA/MA 21-dmaroc P IP21 V OPct

.979 -.455 83 (-10) -.013 -32 -.122

DJI turned up immediately and rallied to upper band and an automatic Sell.

====================================================================================

(36)

12/19/1997 7756.29 Gain = +18.4% 7/7/1998 S12 8178.31 No Paper Loss

There was also a Buy B9 on 12/24/1999.

LA/MA 21-dmaroc P IP21 V OPct

.979 .407 10 (+53) -.017 -57 .027

DJI fell to 7580.42 and then rallied past the upper band.

====================================================================================

(35)

9/11/1997 7660.98 Gain =+3.4% 9/18/1997 S12 7922.72 No Paper Loss

LA/MA 21-dmaroc P IP21 V OPct

.979 -.455 83 (-10) -.013 -32 -.122

DJI turned up immediately and rallied to upper band and an automatic Sell.

====================================================================================

(36)

12/19/1997 7756.29 Gain = +18.4% 7/7/1998 S12 8178.31 No Paper Loss

There was also a Buy B9 on 12/24/1999.

LA/MA 21-dmaroc P IP21 V OPct

.979 .407 10 (+53) -.017 -57 .027

DJI fell to 7580.42 and then rallied past the upper band.

===================================================================================

(37) Reversing Buy

10/1/1998 7632.53 Gain = +42.2% 6/18/99 S12 10855.55 No Paper Loss

LA/MA 21-dmaroc P IP21 V OPct

.966 -.293 9 (-115).017 -81 -.072

DJI bottomed here over next week. Note A/D Line continued to

fall, but Accumulation Index stayed positive.

===================================================================================

(37) Reversing Buy

10/1/1998 7632.53 Gain = +42.2% 6/18/99 S12 10855.55 No Paper Loss

LA/MA 21-dmaroc P IP21 V OPct

.966 -.293 9 (-115).017 -81 -.072

DJI bottomed here over next week. Note A/D Line continued to

fall, but Accumulation Index stayed positive.

===================================================================================

(38)

5/24/1999 10654.67 Gain = +1.9% 6/18/1999 S12 10866.55 Paper loss = 1%

LA/MA 21-dmaroc P IP21 V OPct

.978 -.038 31 (-59) .028 -37 -.009

DJI fell to 10560 and then rallied to an upper band Sell.

========================================================================================

(39)

11/13/2000 10517.25 Gain= +1.9% 12/8/2000 S12 10712.91 Paper loss = 2%

LA/MA 21-dmaroc P IP21 V OPct

.996 -.367 -50 (-50) .08 -78 -.034

DJI fell to 10300 and then rallied to an upper band Sell.

====================================================================================

(40) Reversing

3/23/2001 9504.78 Gain= +18.2% 5/17/2001 S4 11248.58 No Paper Loss

LA/MA 21-dmaroc P IP21 V OPct

.929 -1.183 -181 (+80) -.007 -231 -.094

DJI fell to 10300 and then rallied above the upper band.

Here the DJI was very oversold but the Accumulation Index was nearly

positive and the daily change of the P-Indicator was a big +80.

====================================================================================

(41)

11/1/2001 9263.9 Gain= +9.2% 2/26/2002 S9 10115.26 No Paper Loss

LA/MA 21-dmaroc P IP21 V OPct

1.001 .18 83 (+9) .192 -94 .045

DJI rallied immediately and above the upper band.

====================================================================================

(42)

9/3/2002 8308.05 Gain = +5.6% 1/6/2003 S12 8773.57 Paper loss = 13%

7 more Buy B9s between 9/4/2002 and 9/17/2002

LA/MA 21-dmaroc P IP21 V OPct

.956 -.007 189 (-16) .122 -29 .025

DJI fell to 7286 and then long rally from deeply oversold to resistance

of earlier peak.

====================================================================================

(43) Reversing Buy.

11/13/2002 8398.49 Gain= +4.5% 1/6/2003 S12 8773.57 Paper loss = 1%

LA/MA 21-dmaroc P IP21 V OPct

.996 .202 -99 (-83) .089 -73 .232

DJI fell to 8341.63 and then rallied to the upper band and a Sell.

=====================================================================================

(44)

12/9/2002 8473.41 Gain= +3.5% 1/6/2003 S12 8773.57 Paper loss = 2%

Five more Buy B9s from 12/`0/2002 to 12/16/2002 followed.

LA/MA 21-dmaroc P IP21 V OPct

.981 .155 122 (-22) -.004 -110 -.069

DJI fell to 8332 and then rallied to the upper band.

============================================================================

(45) Reversing Buy

1/22/2003 8318.73 Gain = 17.8% 10/15/03 S4 903.05 Paper loss = 9%

Three more Buy B9s from 1/23/2003 to 1/29/2003 followed.

LA/MA 21-dmaroc P IP21 V OPct

.97 -.064 121 (-30) .012 -78 -.07

DJI fell to 7552.07 six weeks later and then turned up. The DJI

needed to complete a classicly price-proportioned inverted head

and shoulders pattern. I rallied above the upper band and neckline.

======================================================================================

(46)

10/14/2004 9894.45 Gain = +9.7% 12/28/2004 S8 10854.54 Paper loss = 1%

Four more Buy B9s from 10/18/2004 to 10/26/2004 followed.

LA/MA 21-dmaroc P IP21 V OPct

.978 -.396 114 (-1) -.054 -142 -.046

DJI fell to 9749.99 and then rallied above the upper band.

===========================================================================

(47) Reversing Buy

7/18/2006 10799.23 Gain=+14.8% 1/5/2007 S9 12398 No Paper Loss

LA/MA 21-dmaroc P IP21 V OPct

.98 -.232 -28 (+55) -.124 -200 0

DJI rallied immediately above the upper band.

======================================================================================

(X) With DJI having dropped more than 40% in 10 months and below

its 65-dma, the Extreme Bearish Mode should have been used.

12/12/2008 8629.68 Gain = 4.5% 1/6/2009 S12 9015.1 Paper loss = 3%

Three more Buy B9s from 12/22/2008 to 12/29/2008 followed.

LA/MA 21-dmaroc P IP21 V OPct

1.019 -.489 10 .089 -1 .239

DJI fell to 8419.49 before rallying to a Sell at the upper band.

=============================================================================

======================================================================================

Number of completed trades = 47

Avg. Gain = 10.4%

5 losses: the two biggest were 7.1% and 10.7%, the 3 others were under 2%

9 paper losses were greater than 4%.

4 paper losses were greater than 8%, only one of which was after 1940