Buy B3

Version 10/14/2014 (C) 2013 William

Schmidt, Ph.D.

==================================================================================

Buy B3s occur when the DJI closes between the 3.5% and 4% lower bands

and the 20-day Stochastic Pct-D does not confirm the new

low.

They are only allowed from May to November, excepting

September.

There presently are no limits on how low the Pct-D may be.

But it should

be noted that in the 3 cases where the Pct-D was 9 or

less on the day of

the Buy B3, the average gain was only 6.3%,

There were no cases between

1928 and 2013 whewre the Pct-D was ever below 7,0

when a B3 was

given. Perhaps, the most recent case with a

Pct-D value of only 6.0

should not be allowed.

There

have been 25 B3s since 1929. The average gain was +16.1%.

The average paper loss was 1.3%, but one of the paper

losses was 11.8%.

This occurred near the bottom of a long bear market.

13 of the 25 Buy B3s occurred in just two months, October

and November.

They averaged quite high gains, around 20.0%.

Octobers:

Gains Paper

Losses

19571017 B3 436.9 .488

.032

19751001 B3 784.16

.281 none

19761008 B3 952.38 .034

.022

19921007 B3 3152.25 .110 .005

19991015 B3 10019.71 .120 none

------------------------------------

.255 .012

BUY B3s: 1928-2014 By Month in 4-Year Presidential Cycle

| |

Jan |

Feb |

Mar |

April |

May |

June |

July |

Aug |

Sept |

Oct |

Nov |

Dec |

|

PresElec

Year |

|

|

|

|

|

20120604 |

19600722

19960723 |

|

|

19761008 |

19481124 |

|

5 |

| PE+1 |

|

|

|

|

|

19370614

19530609 |

|

|

|

19571017 |

|

|

3 |

| PE+2 |

|

|

|

|

|

19820607 |

19740520 |

19710803 |

|

19621023

19921007 |

19781113

19941123 |

|

7 |

| PE+3 |

|

|

|

|

19470519

19740524 |

|

|

19750804

20070814 |

|

19511029

19751001

19991015

20071119 |

19431115

19711111 |

|

10 |

The 25 Peerless Buy B3s since 1928 gained on average 16.1%. Only one

occurred before 1943. By far the biggest gains

occurred in the second Year of the

4-year Presidential cycle.

B3s in 2nd Year of 4-Year

P.E.Cycle

19621023 B3 558.00

.682

19781113 B3 792.01

.118

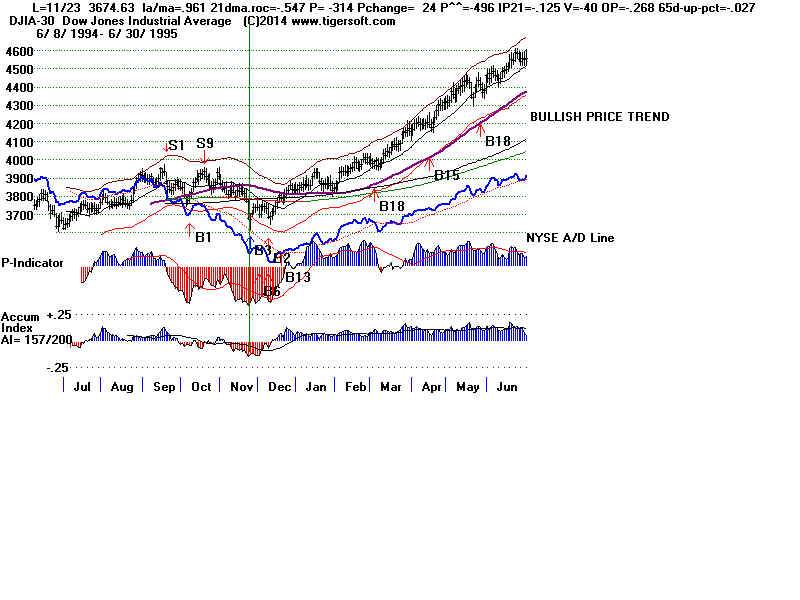

19941123 B3 3674.63

.510

Buy B3s taking place in the Presidential Election year

gained only 6.9%

in six cases.

Note that mid-Summer Buy B3s are sensitive to the year of

the 4-year

Presidential cycle that they would occur in. None

occur in the year after

the Presidential Election Year. The gains averaged a

modest +6.4%.

Mid-Summer Buy B3s

19600722 B3 609.8

.04

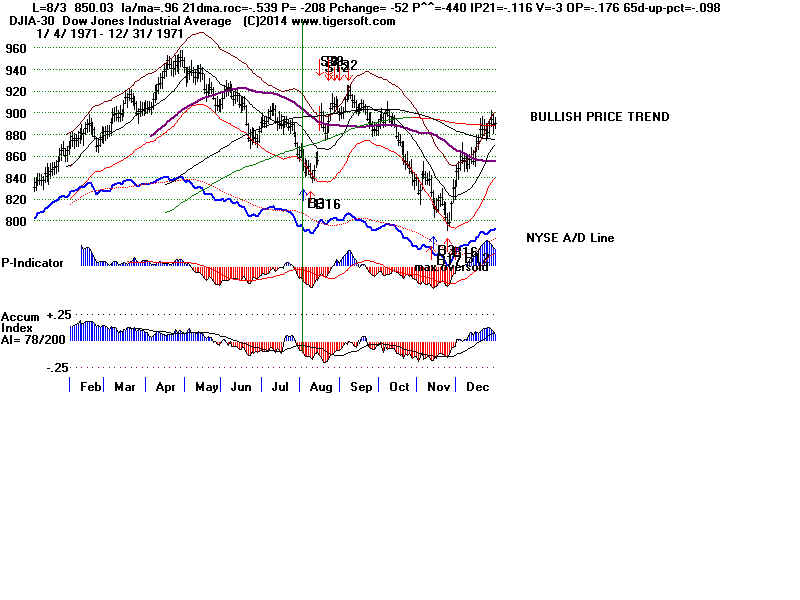

19710803 B3 850.03

.046

19750804 B3 818.05

.021

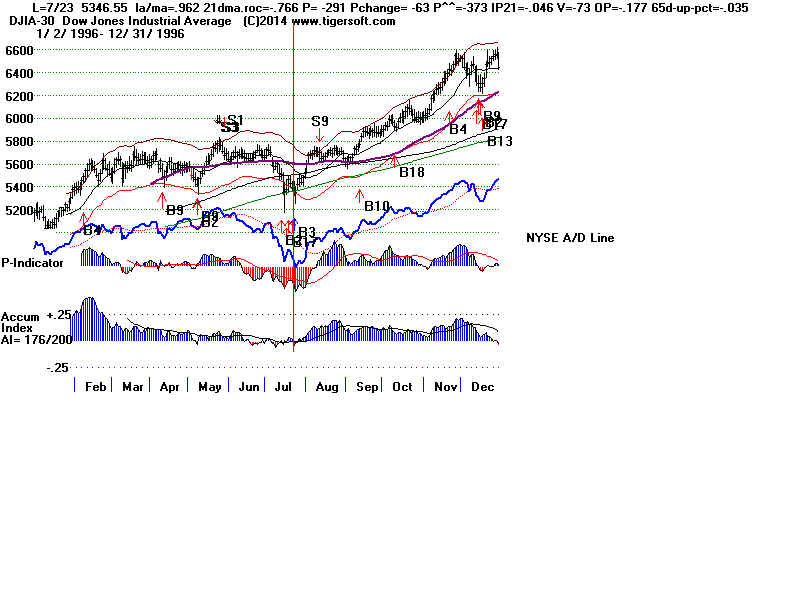

19960723

B3 5346.55 .067

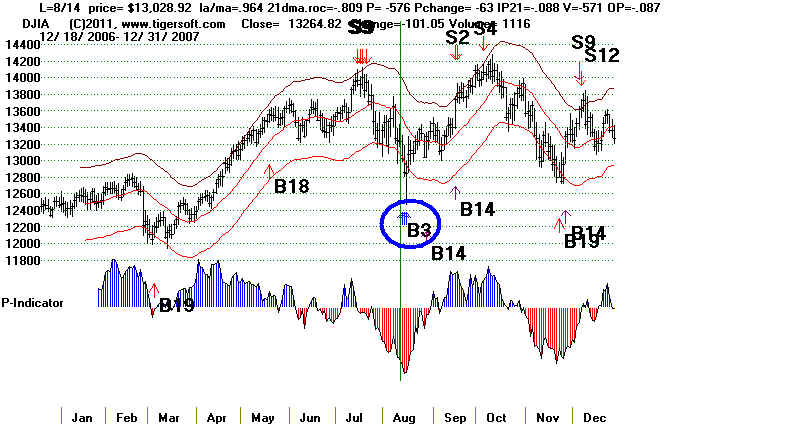

20070814 B3 13028.92

.060

20120604 B3 12101.46

.122

-----------------------------------------------

No. = 6 Avg. = 6.4%

When the

P-Indicator and Accumulation Index was confirming the

low made at the

time of the Buy B13, the gains were somewhat

smaller and the

paper losses somewhat higher.

Gains Paper

Losses

.04 .013

.046 .012

.177 .021

.021 .030

.118 .009

.026 .118

.510 .000

.060 .013

.122 .000

----------------

.124 .024

Buy B3s: 1928-2013

Pct Paper Loss

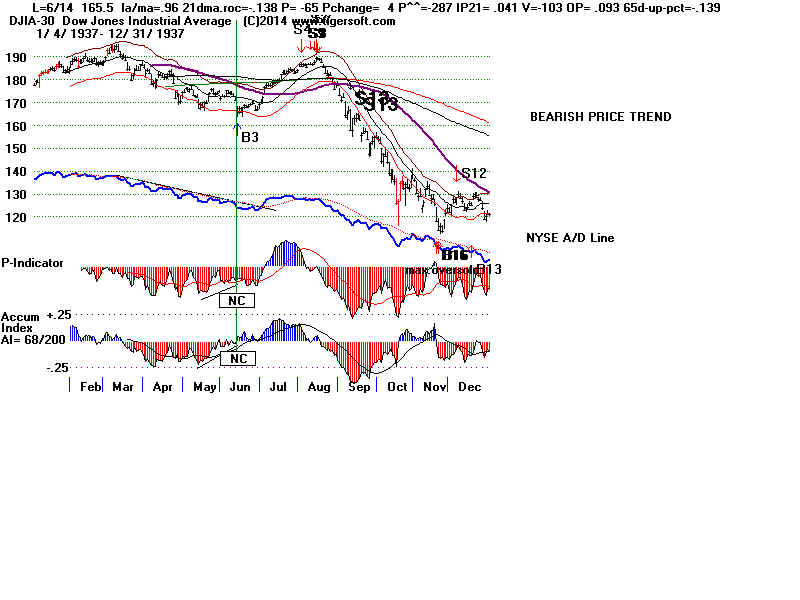

19370614 B3

165.6

.123 none

PI NC, AI-NC

Pct-D - 39.6

19431115 B3

131.6

.246 .015

A/D

NC

Pct-D - 15.4

19470519 B3

163.6

.127 none

PI NC, AI-NC

Pct-D - 14.0

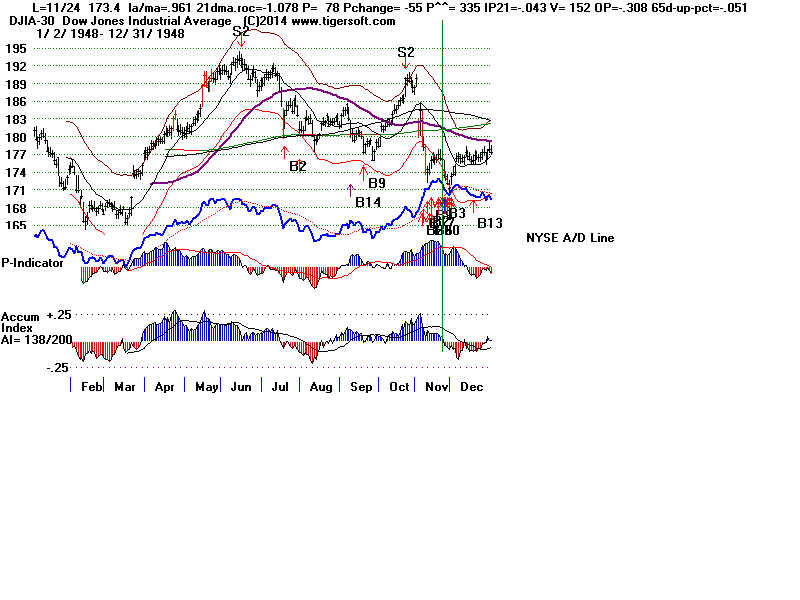

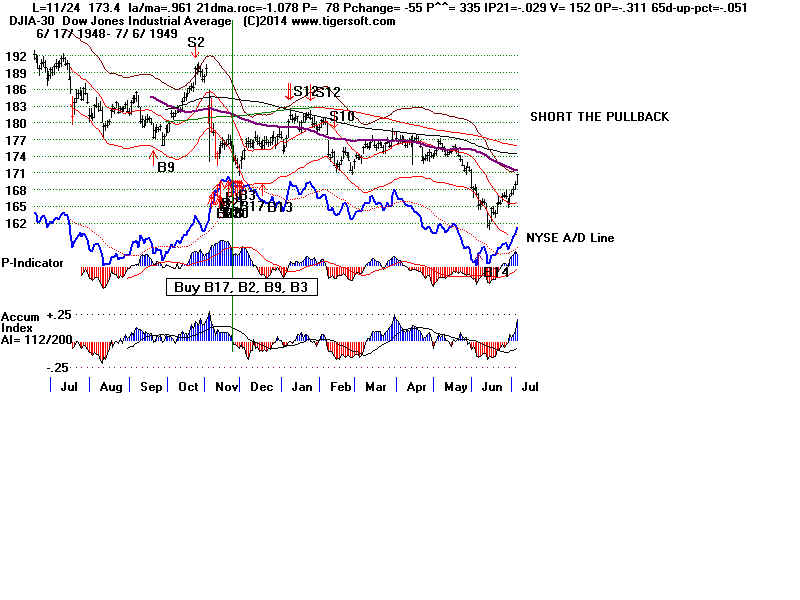

19481124 B3

173.4

.039 .013

PI and AI - both PMC

Pct-D - 17.0

19511029 B3

265.8

.053 .013

AI - PNC

Pct-D - 20.4

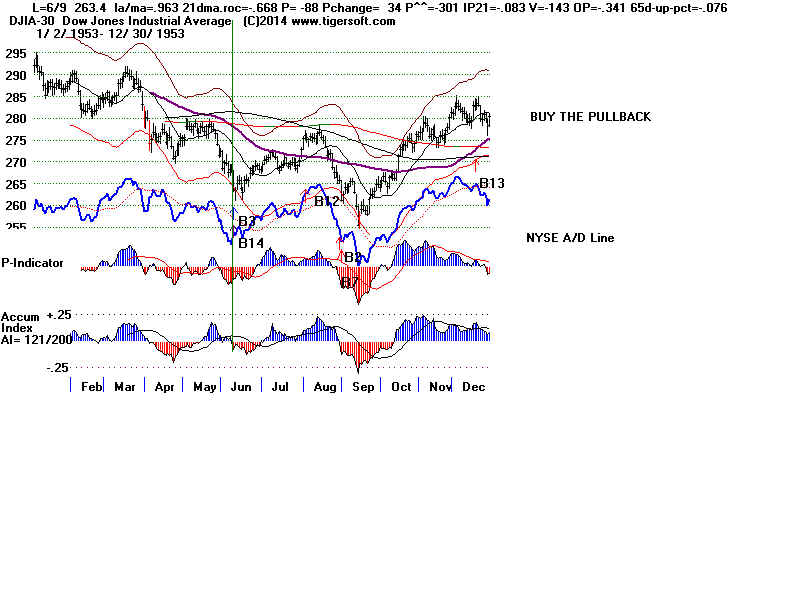

19530609 B3

263.4

.778 .022

PI -

minor NC

Pct-D - 9.8

19571017 B3

436.9

.488 .032

AI - minor NC

Pct-D = 19.8

19600722 B3

609.8

.04 .013

all confirmed.

Pct-D - 8.9

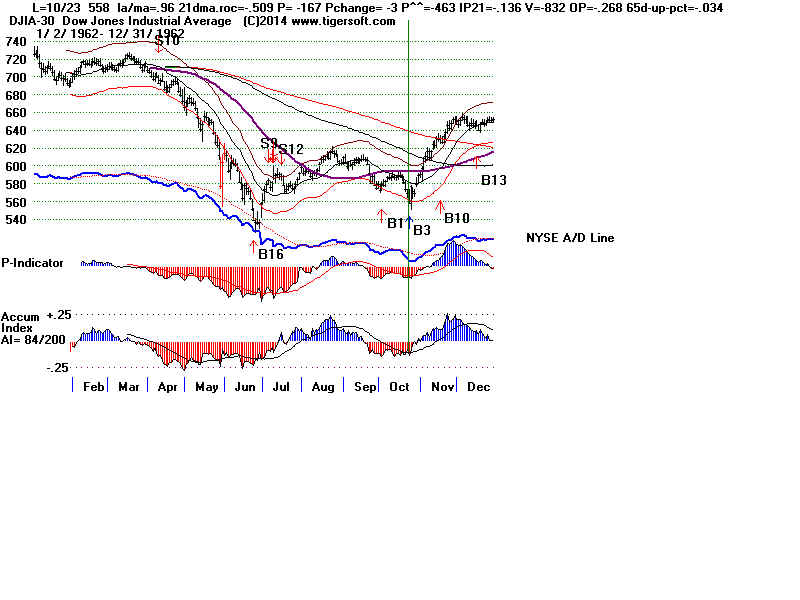

19621023 B3

558.00

.683 none

AI - minor NC

Pct-D = 12.2

19710803 B3

850.03

.046

.012 all confirmed.

Pct-D = 10.8

19711111 B3

814.91

.177 .021 all confirmed

Pct-D = 17.0

19740520 B3

812.42 .

051 .021

PI NC, AI-NC

Pct-D = 11.3

19750804 B3

818.05

.021 .030

all confirmed.

Pct-D = 11.3

19751001 B3

784.16

.281 none

PI NC, AI-NC

Pct-D = 11.3

19761008 B3

952.38

.034 .022

AI - PNC

Pct-D = 12.1

19781113 B3

792.01

.118 .009

all confirmed.

Pct-D = 17.6

19820607 B3

804.03

.026 .118

all confirmed.

Pct-D = 7.0

19921007 B3

3152.25

.11 .005 AI - PNC

Pct-D = 27.1

19941123 B3

3674.63

.510 none all confirmed.

Pct-D = 9.8

19960723 B3

5346.55

.067 none

AI - PNC

Pct-D = 36.3

19991015 B3

10019.71

.120 none

PI NC, AI-NC

Pct-D = 17.6

20050415 B3

10087.51

.148 none

PI NC

Pct-D = 9.9

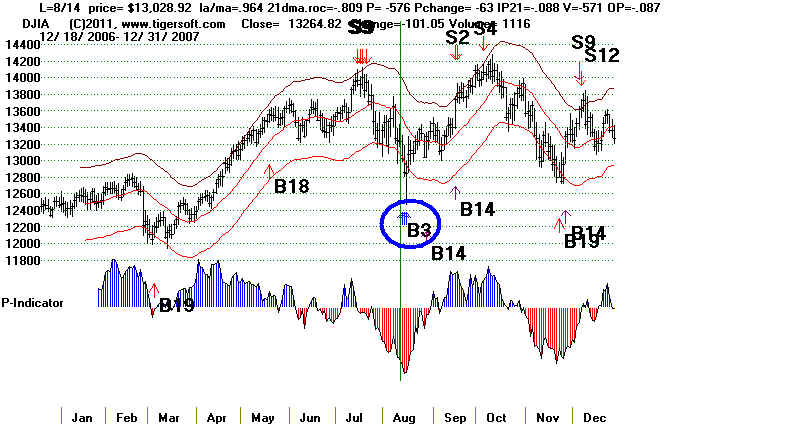

20070814 B3

13028.92

.060 .013 all confirmed.

Pct-D = 18.1

20071119 B3

12958.44

.051 .017

PI NC, AI-NC

Pct-D = 16.9

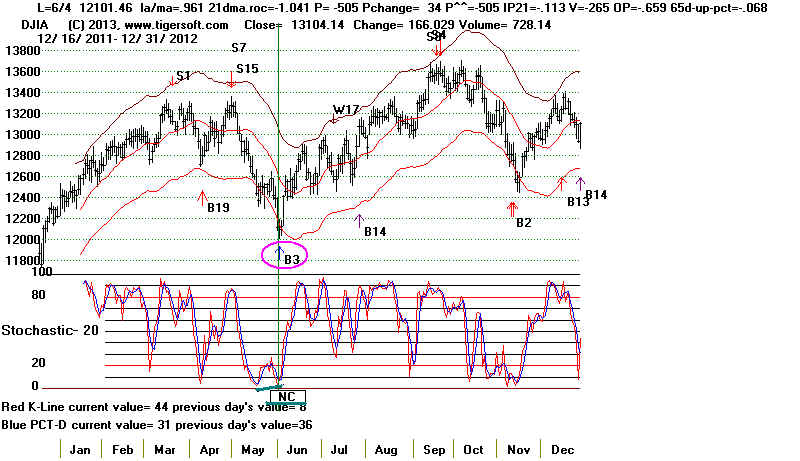

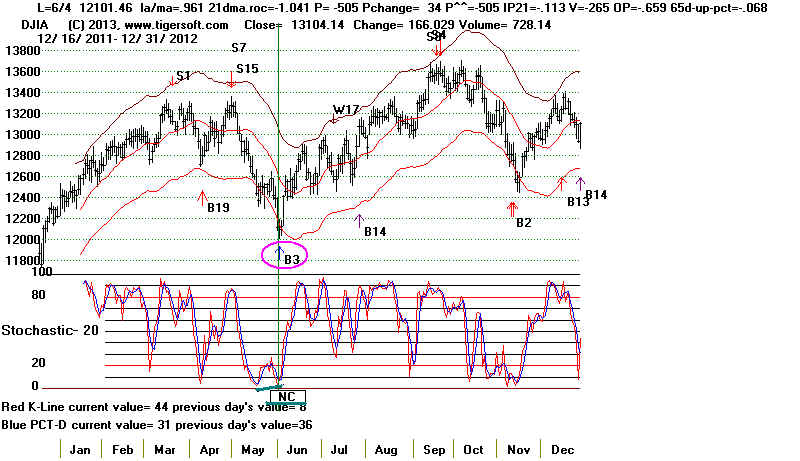

20120604 B3

12101.46

.122 none

all

confirmed.

Pct-D = 7.4

-----------------------------------------------------------------------------

n=25 .161 .013

New

2014 B3

16315.19

Pct-D = 6.0

|

Waiting

for the CLosing Power to hook up and confirm the

Buy B3 caused a much less favorable Buy point in all the

cases since 1994. We must start there because Closing

Power

data only becomes available with SPY in 1994.

19941123 B3

3674.63

.510 none all confirmed.

SPY 45.25 vs CP trend-break = 45.60

19960723 B3

5346.55

.067 none

AI - PNC

SPY 62.68 vs CP trendbreak = 63.62

19991015 B3

10019.71

.120 none

PI NC, AI-NC

SPY 124.87 vs CP trendbreak =

128.25

20050415 B3

10087.51

.148 none

PI NC

SPY 114.15 vs CP trendbreak =

115.27

20070814 B3

13028.92

.060 .013 all confirmed.

SPY 145.23 vs CP trendbreak = 146.65

20071119 B3

12958.44

.051 .017

PI NC, AI-NC

SPY 143.76 vs CP trendbreak =

147.13

20120604 B3

12101.46

.122 none

all

confirmed.

SPY 128.10 vs CP trendbreak = 129.07

=================================================================================

2012-Early 2013 Peerless Buy

B3s

BUY at the 3.6%-4.0% LOWER BAND

when the Blue 20-day Stochastic PctD

fails to confirm

the DJI new low.

April-July and Oct.-Nov.

Note that the B3 can only occur

when the DJI closes 3.6% to 4.0% below the 21-day ma.

This signal is not allowed to follow Sell S9s or Sell S12s by 30

trading days or

less. Sometimes such a Buy signal would still have worked well, but too

many times

it would have failed badly. Look at some of the cases where it failed

badly below

and keep this in mind: 6/6/2008, 6/4/2002, 9/21/1999, 10/12/1987 and

6/11/1969.

The signal is restricted to

only 4 months of the year. Either there were insufficient

cases to trust the B3 in these months (February and March) or there

were a number

of failures in the month (September).

The Buy B3 is not allowed where the DJI jumps up 3% or more in a few

days

back to the lower 4% band. Example 8/17/1971.

The Buy B3 is not allowed in June when the V-Indicator is very

negative, below

-300. There are no other internal strength requirements.

The improving Srochastic

Pct-D is the key element here.

Some of the gains were very good. Usually they occurred with

other Peerless

nearby Buy signals. These Buy signals in October and November

have

led to some very big advances:

2013 version of Peerless - This list is not complete.

Sell B3s: 1928-2013

#1 6/14/1937 +12.3% no Paper loss

165.5 .96 -.138 -65 4 -287 .041 -103 .093 -.139

---------------------------------------------------------------------------

#2 11/15/1943 +24.6% on 5/14/1944 1.6% paper loss

131.6 .963 -.426 152 11 769 -.201 125 -.079 -.034

---------------------------------------------------------------------------

#3 5/19/1947 +12.7% no Paper loss

163.6 .963 -.224 -124 18 -517 -.124 -180 -.344 -.10

---------------------------------------------------------------------------

#4 11/24/1948 +3.9% 1.3% paper loss

173.4 .961 -1.078 78 -55 335 -.043 152 -.237 -.051

----------------------------------------------------------------------------

#5 10/29//1951 +5.3% 2.4% paper loss

260.4 .962 -.478 -73 22 -220 .019 -231 -.167 .005

----------------------------------------------------------------------------

#6 6/9/1953 +79.9% on 7/27/1955. 1.9% paper loss

263.4 .963 -.668 -88 34 -301 -.083 -143 -.452 -.076

----------------------------------------------------------------------------

#7 10/23/1962 +68.1% on 5/13/1965 no Paper loss

558 .960 -.509 -167 -3 -463 -.136 -832 -.285 -.034

----------------------------------------------------------------------------

#8 11/11/1971 +17.7% 2.1% paper loss

814.91 .964 -1.036 -300 -30 -635 -.184 -4 -.388 -.038

----------------------------------------------------------------------------

#9 5/20/1974 +6.5% 2.1% paper loss

812.42 .964 -.752 -310 15 -310 -.098 -4 -.264 .003

----------------------------------------------------------------------------

#10 10/1/1976 +3.4% 3.0% paper loss

952.38 .964 -.415 -54 -8 -54 -.003 -2 -.276 -.04

---------------------------------------------------------------------------

#11 11/13/1978 +11,8% on 8/22/1979. 0.6% paper loss

792.01 .961 -1.508 -541 -30 -1119 -.144 -13 -.382 -.111

--------------------------------------------------------------------------

#12 6/7/1982 +2.6% DJI rose from 804.03 to ???

2.6% paper loss

804.03 .961 -.839 -266 -46 -512 -.235 -11 -.504 .005

--------------------------------------------------------------------------

#13 10/7/1992 +11.0% DJI fell from 3152.25 to 3136.58 and then rallied.

3152.25 .963 -.393 -122 11 -236 .011 -22 -.248 -.044

--------------------------------------------------------------------------

#14 11/23/1994 No Paper loss. DJI rallied from 3674.63 to 5549.21 on 2/27/94

This signal cancelled Sell S10 on same day.

3674.64 .961 -.547 -314 24 -496 -.125 -40 -.268 -.027

--------------------------------------------------------------------------

#15 4/15/2005 excellent DJI fell from 10087.51 to 10127.41 and then rallied

to 11577/74 on 5/5/2006.

10087.51 .965 -.619 -350 -13 -472 -.215 -338 -.252 -.045

--------------------------------------------------------------------------

#16 11/19/2007 +5.1% DJI fell from 12958.44 to 12743.44 and then

rallied.

12958.44 .963 -.493 -490 2 -368 .016 -272 -.186 -.01

--------------------------------------------------------------------------

#17 6/4/2012 +12.2% No paper los.

12101.46 .961 -1.041 -505 34 -505 -.113 -265 -.659 -.068

-------------------------------------------------------------------------

The older B3 has been added to an expanded Buy B3

Last updated - November 8, 2011

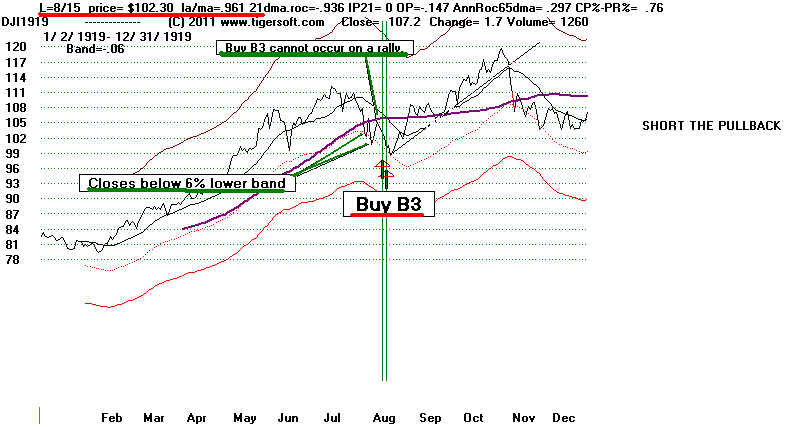

Buy B3s only can occur in August. The DJI must

be between 3.1% (la/ma=.969)

and 6.0% (la/ma=.94) below the 21-dma. The current Accumulation Index (IP21) must

not be below -.102.

The Buy B3 can only occur in the year before a Presidential Election. It is not

allowed in other years, for good reason. Big paper losses would have occurred in

8 of 18 cases if the B3 were applied to years other than those just before a Presidential

Election year. Clearly the Buy B3 depends on the predictable efforts by an incumbent

administration to boost the economy in time for a Presidential Election Year. This

is

more of a factor than a Labor Day bounce in early September.

Since 1929, there have been 9 Buy B3s, counting only the

first such signal in a cluster.

The average gain at the time of the next Peerless Sell is 9.5%. All were

profitable.

In only one case, just before World War II, was there a paper loss as large as 3%.

Bigger gains tend to occur around the 20th of August. When the Buy B2 reverses

a Sell signal, the average gain is a more modest +6.8%.

Buy B3

Gain

Paper Loss

8/5/1931

+5.7%

8/18/1939

+13.7%

3%

Reversing Buy Signal +13.7%

8/9/1943

+4.9%

Reversing Buy Signal

+4.9%

8/9/1971 +6.8% 1/2%

Reversing Buy Signal +6.8%

8/20/1975 +5.3%

Reversing Buy Signal

+5.3%

8/8/1983 +7.0%

Reversing Buy Signal +7.0%

8/19/1991 +14.1%

less than 1/2%

8/2/1999

+4.4%

Reversing Buy Signal +4.4%

8/14/2007 +5.5% 1%

Reversing Buy Signal +5.5%

--------------------------------------------------------------------------------------------------------------

Avg. Gain = 9.5%

Avg. Gain = 6.8%

Buy B3 Buy at Lower Band in August in a year before Election

#1 8/5/31 134.10 +5.7% no Paper Loss

la/ma maroc P-I P ch. IP21 V-I OBVPct

.953 -0.995 -35 +7 .065 -222 -.073

DJI rallied to upper band on 8/14/1931, 144.20

There were also B3s on 8/6 and 8/20

--------------------------------------------------------------------------

Best buying opportunity in 1935 was on 8/20/1935 at the 21-day

may at 126.30 la.ma=1.002 .208 32 -19 .001 -36 .271

--------------------------------------------------------------------------

#2 8/18/1939 135.50 +13.7% 3% Paper Loss

la/ma maroc P-I P ch. IP21 V-I OBVPct

.966 .034 -20 -49 .049 -3 .113

Reversing Signal DJI fell to 131.30.

There were also B3s on 8/21, 8/22 and 8/23, 8/24 and 8/25.

Low was 8/23/39 .942 -.957 -142 -24 -.118 -170 -.165

Note the testing of earlier support, but the neckline

was not violated of H/S. Then DJI rallied above upper band.

----------------------------------------------------------------------------

#3 8/9/43 135.2 +4.9% no Paper Loss

la/ma maroc P-I P ch. IP21 V-I OBVPct

.94 -.799 -83 -36 -.161 -204 -.144

Reversing Signal There had been a Sell S9 on 6/7/93

Note September Sell S2 at the upper band.

la/ma maroc P-I P ch. IP21 V-I OBVPct

9/20/43 1.033 .304 70 16 .10 39 .452

-----------------------------------------------------------------------

8/9/55

la/ma maroc P-I P ch. IP21 V-I OBVPct

.974 -.397 -81 -43 -.093 -285 .051

RALLY TO UPPER BAND.

The decline did not go deep enough for a Buy B3

-----------------------------------------------------------------------

8/19/59

la/ma maroc P-I P ch. IP21 V-I OBVPct

.973 -.268 -84 -41 -.054 -403 .06

LIMITED RIGHT SHOULDER RALLY and H/S Pattern developed.

The decline did not go deep enough for a Buy B3.

-----------------------------------------------------------------------

8/28/67

la/ma maroc P-I P ch. IP21 V-I OBVPct

.979 -.089 -104 -9 -.035 -5 .017

RALLY TO UPPER BAND.

The decline did not go deep enough for a Buy B3.

-----------------------------------------------------------------------

#4 8/9/71 842.65 +6.8% Paper Loss 1/2%

la/ma maroc P-I P ch. IP21 V-I OBVPct

.963 -.802 -277 -36 -.159 -4 -.376

Reversing Signal RALLY TO UPPER BAND

There was also a Buy B3 on 8/10/71

la/ma maroc P-I P ch. IP21 V-I OBVPct

.962 -.868 -288 -12 -.174 -4 .456

-----------------------------------------------------------------------

8/9/55

la/ma maroc P-I P ch. IP21 V-I OBVPct

.974 -.397 -81 -43 -.093 -285 .051

RALLY TO UPPER BAND.

The decline did not go deep enough for a Buy B3

-----------------------------------------------------------------------

8/19/59

la/ma maroc P-I P ch. IP21 V-I OBVPct

.973 -.268 -84 -41 -.054 -403 .06

LIMITED RIGHT SHOULDER RALLY and H/S Pattern developed.

The decline did not go deep enough for a Buy B3.

-----------------------------------------------------------------------

8/28/67

la/ma maroc P-I P ch. IP21 V-I OBVPct

.979 -.089 -104 -9 -.035 -5 .017

RALLY TO UPPER BAND.

The decline did not go deep enough for a Buy B3.

-----------------------------------------------------------------------

#4 8/9/71 842.65 +6.8% Paper Loss 1/2%

la/ma maroc P-I P ch. IP21 V-I OBVPct

.963 -.802 -277 -36 -.159 -4 -.376

Reversing Signal RALLY TO UPPER BAND

There was also a Buy B3 on 8/10/71

la/ma maroc P-I P ch. IP21 V-I OBVPct

.962 -.868 -288 -12 -.174 -4 .456

========================================================================

#5 8/20/1975 793.26 +5.3% No Paper Loss

la/ma maroc P-I P ch. IP21 V-I OBVPct

.962 -.75 -224 -47 -.172 -4 -.301

Reversing Signal RALLY TO UPPER BAND

========================================================================

#6 8/8/1983 1163.06 +7.0% No Paper Loss

la/ma maroc P-I P ch. IP21 V-I OBVPct

.965 -.435 -220 -32 -.029 -14 -.041

Reversing Signal RALLY ABOVE UPPER BAND

==========================================================================

#7 8/19/1991 2898.03 +14.1% Paper Loss less than 1/2%

la/ma maroc P-I P ch. IP21 V-I OBVPct

.968 -.469 -42 -62 -.062 -9 -.319

RALLY TO UPPER BAND

-----------------------------------------------------------------------

#8 8/2/1999 10645.96 +4.4% No Paper Loss

la/ma maroc P-I P ch. IP21 V-I OBVPct

.965 -.453 -272 -41 -.049 -108 -.223

Reversing Signal RALLY TO UPPER BAND

---------------------------------------------------------------------

#9 8/14/2007 13028.92 +5.5% Paper Loss less - 1%

la/ma maroc P-I P ch. IP21 V-I OBVPct

.966 -.334 -429 -94 -.07 -480 .116

Reversing Signal

DECLINED TO 12845 AND THEN RALLIED ABOVE UPPER BAND.

========================================================================

#5 8/20/1975 793.26 +5.3% No Paper Loss

la/ma maroc P-I P ch. IP21 V-I OBVPct

.962 -.75 -224 -47 -.172 -4 -.301

Reversing Signal RALLY TO UPPER BAND

========================================================================

#6 8/8/1983 1163.06 +7.0% No Paper Loss

la/ma maroc P-I P ch. IP21 V-I OBVPct

.965 -.435 -220 -32 -.029 -14 -.041

Reversing Signal RALLY ABOVE UPPER BAND

==========================================================================

#7 8/19/1991 2898.03 +14.1% Paper Loss less than 1/2%

la/ma maroc P-I P ch. IP21 V-I OBVPct

.968 -.469 -42 -62 -.062 -9 -.319

RALLY TO UPPER BAND

-----------------------------------------------------------------------

#8 8/2/1999 10645.96 +4.4% No Paper Loss

la/ma maroc P-I P ch. IP21 V-I OBVPct

.965 -.453 -272 -41 -.049 -108 -.223

Reversing Signal RALLY TO UPPER BAND

---------------------------------------------------------------------

#9 8/14/2007 13028.92 +5.5% Paper Loss less - 1%

la/ma maroc P-I P ch. IP21 V-I OBVPct

.966 -.334 -429 -94 -.07 -480 .116

Reversing Signal

DECLINED TO 12845 AND THEN RALLIED ABOVE UPPER BAND.

----------------------------------------------------------------------

X 8/8/2011 Decline went too far below the lower band.

la/ma maroc P-I P ch. IP21 V-I OBVPct

.885 -1.787 -786 -85 -.275 -477 -.37

----------------------------------------------------------------------

X 8/8/2011 Decline went too far below the lower band.

la/ma maroc P-I P ch. IP21 V-I OBVPct

.885 -1.787 -786 -85 -.275 -477 -.37

|

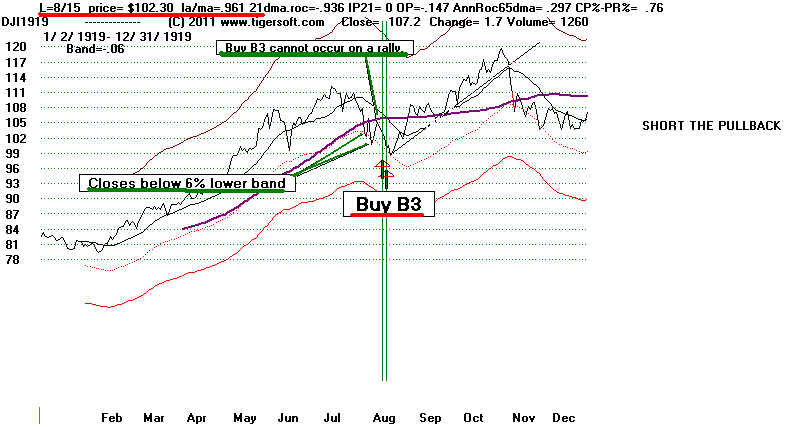

1919

|

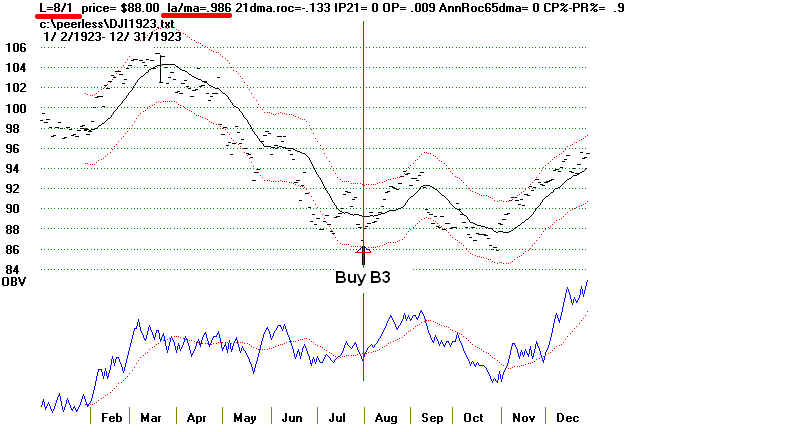

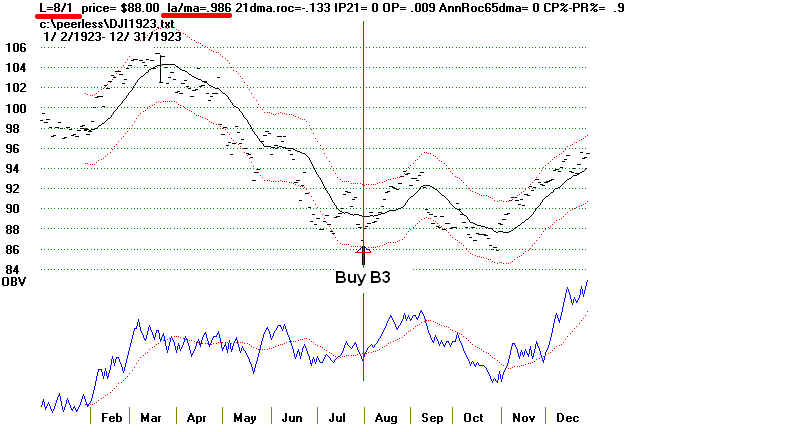

1923

|

Research shows the B3 does not work well in years other than those

that follow the year

before a Presidential Election year.

August Buy B3s in A Presidential Election Year.

8/21/36 +5.5% also B11/B2 no

paper loss

8/10/88 +1.5% 1% paper loss

August Buy B3s in The Year after A Presidential Election Year.

8/26/37 -17.4% (late in August)

8/31/53 +14.7% Paper loss = 3%

8/14/57 +33.7% 10% Paper loss 485.90...Rallied to Sell S12

on 7/1/59. 650.2

8/14/73 +2.8% no paper loss

8/24/81 -3.0% 8% paper loss

8/15/97 +3.0% 1% paper loss

8/30/01 +2.0% 10% paper loss.

----------------------------------------------------

3 of 7 cases showed a paper loss of 8% to 10%.

August Buy B3s in The Second Year after A Presidential Election Year.

8/8/30 +6.8% also a B9 2%

paper loss

8/12/38 +15.4% 5% paper

loss

8/27/46 -3.5% 15% paper loss

8/18/66 -0.6% 5% paper loss

8/14/74 -9.5% 22% paper loss

8/6/82 +34.8%

no paper loss

8/3/90 +17.7% 16% paper loss

8/5/02 +8.3% no paper loss

8/24/10 +27.6%

Paper loss = 1%

----------------------------------------------------

5 of 9 cases showed a paper loss of 5% to 22%.

-----------------------------------------------------------------------

8/9/55

la/ma maroc P-I P ch. IP21 V-I OBVPct

.974 -.397 -81 -43 -.093 -285 .051

RALLY TO UPPER BAND.

The decline did not go deep enough for a Buy B3

-----------------------------------------------------------------------

8/19/59

la/ma maroc P-I P ch. IP21 V-I OBVPct

.973 -.268 -84 -41 -.054 -403 .06

LIMITED RIGHT SHOULDER RALLY and H/S Pattern developed.

The decline did not go deep enough for a Buy B3.

-----------------------------------------------------------------------

8/28/67

la/ma maroc P-I P ch. IP21 V-I OBVPct

.979 -.089 -104 -9 -.035 -5 .017

RALLY TO UPPER BAND.

The decline did not go deep enough for a Buy B3.

-----------------------------------------------------------------------

#4 8/9/71 842.65 +6.8% Paper Loss 1/2%

la/ma maroc P-I P ch. IP21 V-I OBVPct

.963 -.802 -277 -36 -.159 -4 -.376

Reversing Signal RALLY TO UPPER BAND

There was also a Buy B3 on 8/10/71

la/ma maroc P-I P ch. IP21 V-I OBVPct

.962 -.868 -288 -12 -.174 -4 .456

-----------------------------------------------------------------------

8/9/55

la/ma maroc P-I P ch. IP21 V-I OBVPct

.974 -.397 -81 -43 -.093 -285 .051

RALLY TO UPPER BAND.

The decline did not go deep enough for a Buy B3

-----------------------------------------------------------------------

8/19/59

la/ma maroc P-I P ch. IP21 V-I OBVPct

.973 -.268 -84 -41 -.054 -403 .06

LIMITED RIGHT SHOULDER RALLY and H/S Pattern developed.

The decline did not go deep enough for a Buy B3.

-----------------------------------------------------------------------

8/28/67

la/ma maroc P-I P ch. IP21 V-I OBVPct

.979 -.089 -104 -9 -.035 -5 .017

RALLY TO UPPER BAND.

The decline did not go deep enough for a Buy B3.

-----------------------------------------------------------------------

#4 8/9/71 842.65 +6.8% Paper Loss 1/2%

la/ma maroc P-I P ch. IP21 V-I OBVPct

.963 -.802 -277 -36 -.159 -4 -.376

Reversing Signal RALLY TO UPPER BAND

There was also a Buy B3 on 8/10/71

la/ma maroc P-I P ch. IP21 V-I OBVPct

.962 -.868 -288 -12 -.174 -4 .456

========================================================================

#5 8/20/1975 793.26 +5.3% No Paper Loss

la/ma maroc P-I P ch. IP21 V-I OBVPct

.962 -.75 -224 -47 -.172 -4 -.301

Reversing Signal RALLY TO UPPER BAND

========================================================================

#6 8/8/1983 1163.06 +7.0% No Paper Loss

la/ma maroc P-I P ch. IP21 V-I OBVPct

.965 -.435 -220 -32 -.029 -14 -.041

Reversing Signal RALLY ABOVE UPPER BAND

==========================================================================

#7 8/19/1991 2898.03 +14.1% Paper Loss less than 1/2%

la/ma maroc P-I P ch. IP21 V-I OBVPct

.968 -.469 -42 -62 -.062 -9 -.319

RALLY TO UPPER BAND

-----------------------------------------------------------------------

#8 8/2/1999 10645.96 +4.4% No Paper Loss

la/ma maroc P-I P ch. IP21 V-I OBVPct

.965 -.453 -272 -41 -.049 -108 -.223

Reversing Signal RALLY TO UPPER BAND

---------------------------------------------------------------------

#9 8/14/2007 13028.92 +5.5% Paper Loss less - 1%

la/ma maroc P-I P ch. IP21 V-I OBVPct

.966 -.334 -429 -94 -.07 -480 .116

Reversing Signal

DECLINED TO 12845 AND THEN RALLIED ABOVE UPPER BAND.

========================================================================

#5 8/20/1975 793.26 +5.3% No Paper Loss

la/ma maroc P-I P ch. IP21 V-I OBVPct

.962 -.75 -224 -47 -.172 -4 -.301

Reversing Signal RALLY TO UPPER BAND

========================================================================

#6 8/8/1983 1163.06 +7.0% No Paper Loss

la/ma maroc P-I P ch. IP21 V-I OBVPct

.965 -.435 -220 -32 -.029 -14 -.041

Reversing Signal RALLY ABOVE UPPER BAND

==========================================================================

#7 8/19/1991 2898.03 +14.1% Paper Loss less than 1/2%

la/ma maroc P-I P ch. IP21 V-I OBVPct

.968 -.469 -42 -62 -.062 -9 -.319

RALLY TO UPPER BAND

-----------------------------------------------------------------------

#8 8/2/1999 10645.96 +4.4% No Paper Loss

la/ma maroc P-I P ch. IP21 V-I OBVPct

.965 -.453 -272 -41 -.049 -108 -.223

Reversing Signal RALLY TO UPPER BAND

---------------------------------------------------------------------

#9 8/14/2007 13028.92 +5.5% Paper Loss less - 1%

la/ma maroc P-I P ch. IP21 V-I OBVPct

.966 -.334 -429 -94 -.07 -480 .116

Reversing Signal

DECLINED TO 12845 AND THEN RALLIED ABOVE UPPER BAND.

----------------------------------------------------------------------

X 8/8/2011 Decline went too far below the lower band.

la/ma maroc P-I P ch. IP21 V-I OBVPct

.885 -1.787 -786 -85 -.275 -477 -.37

----------------------------------------------------------------------

X 8/8/2011 Decline went too far below the lower band.

la/ma maroc P-I P ch. IP21 V-I OBVPct

.885 -1.787 -786 -85 -.275 -477 -.37