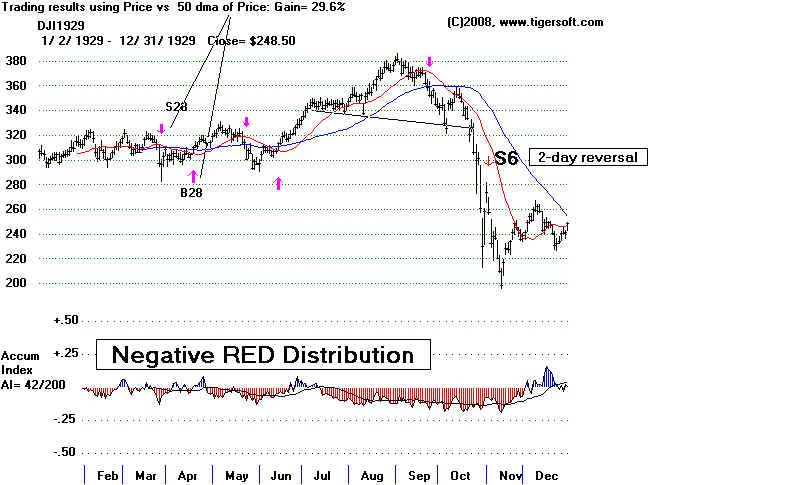

Steep 2-Day Reversal Back Down by Breadth or Price

Sell S6s signals usually are a sign of a very weak market. They most often occur because

of a dramatic (>2%) two-day price reversal. This we call "Type 2".

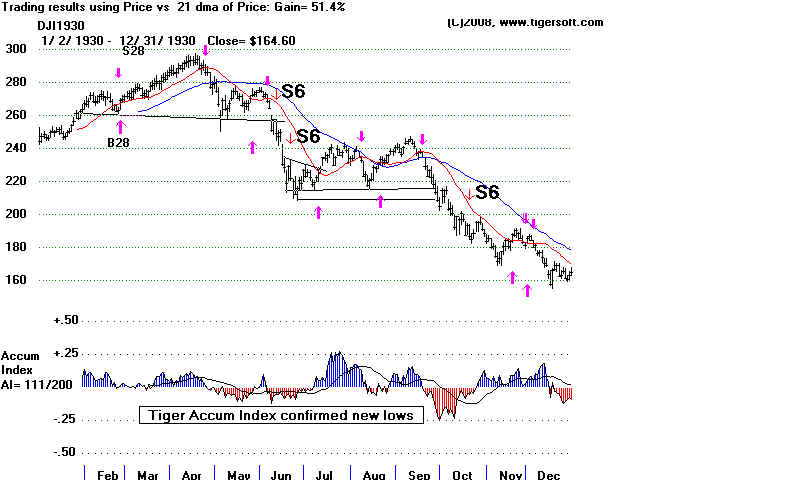

In the 2 1/2 years between 11/4/1929 and 5/9/1932, there were 12 Sell S6s. To get

these signals, the Tiger user must chooses "2.5% Reversals Down" under "Signals(1)" and

also post the signals using "Ectreme Bear Market Signals". In all of these Sell S6s,

one day 2%+ rallies were utterly snuffed out the next day with a 2+% decline.

They prodiuced an average 21.4% decline. These were all based on the Type 2 Sell S6s.

Extreme Bear Market Sell S6s

19291104 S6 257.7 .486 Type 2

19300611 S6 249.1 .310 Type 2

19300620 S6 221.9 .226 Type 2

19301021 S6 186.4 .078 Type 2

19310501 S6 145.6 .318 Type 2

19310924 S6 107.8 .079 Type 2

19311201 S6 91.2 .127 Type 2

19311208 S6 86.5 .08 Type 2

19311231 S6 78.1 .394 Type 2

19320422 S6 58.9 .197 Type 2

19320509 S6 57.0 .170 Type 2

19320929 S6 71.5 .108 Type 2

-------------------------------------------------------------

No. = 12 .214

Fortunately, most of the time we are not dealing with an Extreme Bear Market.

Leaving out the cases above, we still see that Sell S6s nearly always denote a severely

bearish market environments, such as was seen in 1932, 1938 and 2008.. There

were 8 of these Sell S6s. They dropped the DJI 10.5% on avererage, 5 of these saw

an additional decline of more than 10%. Only one these Sell S6s would have brought

a loss to a short seller who covered on the next Peerless Buy signal. 4 of the 8 Sell S3s

were based on a dramatic reversal in breadth. They averaged a decline of 10.1%.

None of these Sell S6s took place between April and August or December. None

were seen in the Third Year of the 4-Year Presidential cycle.

Trading Results

(Selling Short on the Sell S3)

>10% 5

>5.0% - 9.99% 0

>2.0%- 4.99% 2

>0% - 1.99% 0

Loss 1

Sell S6s in

Normal Mode19320929 S6 71.5 .108 Type 2

6/2/32 Buy B16 47.3

19380316 S6 122.9 .195 Type 1 and 2

3/31/38 Buy B16 165.4

19460218 S6 201.6 .03 Type 1

2/21/46 Buy B19 195.6

19480205 S6 170.9 .032 Type 1

3/16/1948 Buy B17 165.4 .168

20080922 S6 11015.69 .177 Type 1

20081021 S6 9033.66 -.003 Type 2

10/28/08 Buy B1 9033.66 .008

20081114 S6 8497.31 .111 Type 2

20090129 S6 8149.01 .191 Type 2

3/5/09 Buy B16 6594.44

-------------------------------------------------

no. = 8 Avg. = .105

PE 5 .095 PE +1 1 .191 PE +2 2 .112 PE +3 0 ---- January 1 .191 February 2 .031 March 1 .195 April 0 - May 0 - June 0 - July 0 - August 0 - September 2 .143 October 1 -.003 November 1 111 December 0 ---- 1-10 1 .032

11-20 3 .112

21-31 4 .118

Extreme Bearish Mode - Selected 2-Day Reversal Sell S7

Type 2

----------------------------------------------

19291104 S6 257.7 .486

B16 11/12/1929 209.7

19300611 S6 249.1

19300620 S6 249.1

19301021 S6 186.4

B7 1/23/1931 171.8

19310501 S6 145.6 .318

19310924 S6 107.8 .079

B16 10/6/1931 99.3

19311201 S6 91.2 .127

19311208 S6 86.5 .08 B16 79.6

B16 12/11/1931 79.6

19311231 S6 78.1 .394

B7 2/11/1932 78.6

19320422 S6 58.9 .197

19320509 S6 57.0 .170

B16 6/2/1932 47.3

|

Type 1 - Very Sharp

Advances-Declines Reversal Down

For i = 51 To RN

If la(i) / ma(i) < .91 Then 47000

If mo(i) = 12 Then 47000

If la(i) / ma(i) < .9645 Then 47000

If adv(i - 1) / dec(i - 1) < 5 Then 47000 '5

If dec(i) / adv(i) < 4 Then 47000 '4

pi = i: ms(i) = 6: sells6arrows (pi): S9(i) = 6: : i = i + 10' change s9(i)=6

47000 Next i

Type 2 - Very Sharp Percent Change Reversal Down

For i = 23 To RN

If la(i) / ma(i) < .91 Then 16633

If mo(i) = 12 And da(i) > 17 Then 16633

If mo(i) = 1 And da(i) < 5 Then 16633

day1 = (la(i - 1) - la(i - 2)) / la(i - 2)

day2 = (la(i) - la(i - 1)) / la(i - 1)

If la(i) / ma(i) > .99 Then 16633

roc = ((ma(i) - ma(i - 1)) / ma(i - 1)) * 250

If roc > 0 Then 16633

If day1 > .0245 And day2 < -.025 Then pi = i: ms(i) = 6: sells6arrows (pi): S9(i) =

6:

16633 Next i

======================================================

2012 Peerless

very negative breadth on the next. Here are the cases.

First Type of Sell S6: Breadth Two-Day Reversal:

Date DJI LA.MA ROC P-I P-Ch IP21 V-I Opct Reversing Peerless Buy

Date DJI Signal Gain of Short Sale

2/18/46 201.60 .996 -.112 -9 -24 .123 -91 -.061 2/21/46 195.6 B19 +3.0%

2/5/48 170.90 .976 -.605 -86 -.146 -151 -.232 3/22/48 173.7 B12 -1.6%

DJI dropped immediately to 165.70 on 2/11/46

9/22/08 11015.69 .974 -.436 -177 -78 .061 -112 .176

Second Type of Sell S6: Two-Day Greater Than 2.45% Reversal:

This type of two-day reversal down is defined as occurring when:

1) The DJI falls more than 2.5% after being up more than 2.45% the day before,

2.) The DJI is more than 1% below the 21-day ma and

3.) The annualized rate of change of the 21-day ma is below 0.

4)) Do not allow this signal from 12/26 to 1/5 because of "Santa Claus rally"

and year-end jump from an ending of tax-loss selling.

Date DJI

la/ma

ann.roc

IP21 Subsequent Results

-------------------------------------------------------------------------------------------------------------------------------------

11/4/29

257.70 .818

-2.70

-.081 DJI fell to 198.70 on

11/13/29

6/11/30

249.10 .93

-0.934 -.054 DJI fell to 211.80 on

6/24/ 30

6/20/30

221.90 .869

-2.016

-.083 DJI fell to 211.80 on

6/24/ 30

10/21/30

186.40 .908

-2.445

-.057 DJI rose to 194.90 on

10/28/30, then fell to 171.60 on 11/10

5/1/31

145.60 .907

-1.855

-.506 DJI rose to 154.48 on 5/8/31. then

fell to 121.70 on 6/2/31

9/24/31

107.80 .852

-2.69

-.13 DJI fell to

86.50 on 10/5/31

12/1/31

91.20 .879

-1.086

-.104 DJI fell to 73.80

on 12/17/31

12/8/31

86.50 .873

-3.109

-.287 DJI fell to 73.80

on 12/28/31

12/21/31

78.10 .903

-3.153

-.189 DJI fell to 73.80

on 12/28/31

4/22/32

58.90 .883

-3.468

-.167 DJI fell to 44.90 on

6/1/32

4/28/32

58.20 .917

-3.514 -.208 DJI fell to

44.90 on 6/1/32

5/9/32

57.00 .963

-1.181

-.039 DJI fell to 44.90 on

6/1/32

Excluded BAD 7/18/32 44.10

.994

-1.652 -.133 right before market took off to upside.

This was a classic case of a false breakdown: a flat bottom is penetrated and then

there is a recovery above the flat bottom.

9/29/32

71.50 .988

-0.46

-.069 DJI fell to

58.50 on 10/10/32

10/13/92

59.80 .877

-1.751 -.155

DJI rallied to 65 a few days later and then fell to 58.30 on 11/3

11/9/32

61.70 1.00

-.193 -.042

DJI rose to 68 on 11/11 and then fell to 55.90 on 12/2/32

Excluded

12/2/32 55.90 .909

-.83 -.014 2 week 8% rally

and then decline to new lows.

BAD 2/27/33

50.20 .876

-2.488

-.098 right at bottom!

This was a case where the DJI held at the round number 50 and then recovered. It was

also a week before the FDR was innaugurated.

BAD 12/26/33

96.30 .977

-0.277

-.181 DJI rallied to 101 in early

Jan 34 and then re-tested lows..

This should be excluded because of

the usual Santa Claus rally.

3/16/38

122.90 .966

-0.28

-.012 This was

right before decline to 100 in two weeks.

10/22/87 1950.43

.811 -3.106

-.171 DJI fell to 1793.93 on

10/26/87

9/22/08 11015.69

.974

-.436

.061

Subseq. Buy 10/8/08

9258.10 Gain=-+16.0% B1

10/21/08

9033.66 .922

-.146

-.146

Subseq. Buy 10/28/08

9065.12 Gain- -0.3% B19

Excluded 11/5/08

9139.27 1.02

-.408

-.051

Subseq. Buy 11/21/08 8046.42 +8.0%

B16

Excluded 12/9/08

8691.33 1.027 -.355

.036

Subseq. Buy 12/12/08 8629.68 +0.7%

B9

1/29/08 8149.01

.965

-.471

.05