---------------------------------------------------------------------------------------------------------------------------------------------------

DJI Is Down Sharply but OBV-Pct or Accumulation Index

is Improving and Nearly Positive

14 Cases. Avg Gain = approx 11.0% No losses.

Buy B4s in March (+19.5%) and June (+16.4%) were

the most profitable. Buy B4s in Novembers and

Presidential were much less profitable.

Size of Gains

>10% 7

5%-10% 3

2%-5% 4

Peerless Buy B5s:

1928-2013Date Signal DJI Gain

===============================================

19281218 B5 275.4 .135

19330616 B5 89.2 .146

19330720 B5 96.3 .032

19350311 B5 99.4 .333

19481115 B5 176 .024

19551007 B5 458.2 .132

19780627 B5 817.31 .111

19821123 B5 990.99 .067

19860717 B5 1781.78 .03

19870414 B5 2253.98 .039

19880328 B5 1979.77 .056

19900122 B5 2600.45 .142

20090623 B5 8322.91 .234

20111122 B5 11493.73 .053

-----------------------------------------------

No. = 14 .110

Size of Gains

>10% 7

5-10% 3

2%-5% 4

Returns by Year

No. Avg.

Pres. Election Years 3 .072

Year after Pres.El.Yr. 4 .140

Mid-Term Election Yr. 4 .088

Third Yr after Pres.E.Yr. 3 .137

Returns by Month

No. Avg.

January 1 .142

February - -

March 2 .195

April 1 .039

May - ----

June 3 .164

July 2 .031

August - ----

September - ----

October 1 .132

November 3 .048

December 1 .135

Days of Month

1-10 1 .132

11-20 6 .118

21-31 7 .099

Code:

For i = 80 To rn

If mo(i) = 8 Or mo(i) = 9 Then 588 ' Be wary of September declines.

If (yr(i) + 2) / 4 = Int((yr(i) + 2) / 4) And mo(i) = 2 Then 588 ' eliminates bad B5 in Feb 1934.

If (yr(i) + 2) / 4 = Int((yr(i) + 2) / 4) And mo(i) = 3 And da(i) < 20 Then 588

If mo(i) = 6 And da(i) > 20 Then 11115 ' Mkt often rallies towards end of June.

If mo(i) = 4 Then 11115 ' Aprils are less likely to bring declines.

For j = i - 25 To i

If S9(j) = 9 Then 588

If S9(j) = 12 Then 588

Next j

11115 highall = -999999

For j = i - 79 To i

If HI(j) > highall Then highall = HI(j)

Next j

highest = -999999

For j = i - 17 To i

If HI(j) > highest Then highest = HI(j)

Next j

dif = (highest - lo(i)) / highest

If highest <> highall Then 588

If roc(i) > -.6 And la(i) / ma(i) > .95 And la(i) / ma(i) < .97 And opma(i) > .005

And dif > .073 And dif < .12 Then 8211 ' This is a Buy B4

If dif < .108 Then 588

gap = (la(i - 1) - HI(i)) / lo(i - 1)

If gap > .0178 Then 588

If roc(i) < -.75 Then 588

If opma(i) > .01 Then 8211

If newipxxx(i) < 0 Then 588

For j = i - 20 To i

If S9(j) = 4 Then 588

Next j

8211 pi = i: : S9(i) = 105: mb(i) = 5: b5arrows (pi): i = i + 10 A Buy B4,

588 Next i

|

==============================================================================

Buy B5 - Down Sharply but OBV-Pct or Accumulation Index is at least

Nearly Positive. Last

edited 2/13/2012

Buy B5s require:

A sell-off of 6% to 11% in the last month.

Annualized Rate of Change of 21-dma > -.60

DJI must be 3% to 5% below its 21-day ma. la/ma >.95 <.97

OBVPct > -.03 or IP21 > -.03

11 earlier cases. Avg Gain = approx 10.2%

Paper Losses in 8 of 11 cases.

Paper Losses of more than 4% in 3 of 11 cases

Avg.Paper Loss = 2.2%.

The average gain after a Buy B5 is 10.5%. There were only 13 cases since

1928, but each was

profitable. The biggest gains occurred with the Buy B5s from November

to February, averaging

+14.1% in four cases. The other B5s were all much smaller. From

February to July, the B5s

only averaged 2.8%. Paper losses were under 3% in 8 of the 11 cases.

There were single paper losses

of 3%, 4% and 8%.

B5s usually take place with other Peerless Buys also occurring, especially B9s or

B17s, either at the

same time or in close proximty on a Peerless chart.

Reversing Buy B5s

Date

Gain Rev.Signal

Date

Rev.Signal Gain

--------------------------------------------------------------------------------------------------------------------------------------------

BUY B5

3/11/1935 33.9% Sell S8

9/17/1935 3.8%

Buy B5 11/22/63 32.0% Sell

S8 5/13/1965 5.1%

Buy B5 6/27/78 2.7% Sell

S12 7/17/1978 -5.7%

Buy B5 6/23/2009 19.5% Sell

S12 10/21/2009 -2.8%

---------------------------------------------------------------------------------------------------------------------

Avg Gain = +22.0%

| BUY B5s:

1929-2011 1 12/7/1928 271.10 +17.1% S12 1/31/29 317.5 la/ma ma-roc P-I P-ch IP21 V-I OPct .966 .442 -52 (-40) -.03 -652 0.223 Paper Loss = 3% Down 10% from 17-day high. Rallied above the upper band. -------------------------------------------------------------------- 2 11/15/1948 176.00 +18.3% 215.30 4/14/1950 la/ma ma-roc P-I P-ch IP21 V-I OPct .958 .504 187 (4) .085 285 .006 Paper Loss = 8% Down 8% from 17-day high. -------------------------------------------------------------------- 3 10/7/1955 458.20 +7.2% 3/6/1956 S12 la/ma ma-roc P-I P-ch IP21 V-I OPct .969 -.425 -30 .074 -343 .076 Paper Loss = 4% Down 6% from 17-day high. -------------------------------------------------------------------- 4 11/22/1963 711.50 + 32.0% Sell S8 5/13/1965 5.1% la/ma ma-roc P-I P-ch IP21 V-I OPct .953 -.557 -151 (-40) -.141 -1021 .007 No Paper Loss Down 6% from 17-day high. Jumped up strongly after JFK assassination. -------------------------------------------------------------------- 5 6/27/1978 817.31 + 2.7% 9/11/78 S12 (too early) la/ma ma-roc P-I P-ch IP21 V-I OPct .97 -.203 -114 ( 3) -.11 -1 .069 Paper Loss = 1% Down 6% from 17-day high. Hit bottom a week later and rallied above UB. -------------------------------------------------------------------- 6 11/23/1982 990.99 + 6.7% 12/7/1982 S9 la/ma ma-roc P-I P-ch IP21 V-I OPct .967 -.048 81 (42) .009 -1 .065 No Paper Loss Down 7% from 17-day high. Rallied immediately to upper band. -------------------------------------------------------------------- 7 7/17/1986 1781.78 + 3.0% 8/12/1986 S9 la/ma ma-roc P-I P-ch IP21 V-I OPct .963 -.539 -83 -.034 -11 .144 Paper Loss = 1% Down 7% from 17-day high. Went down 1% mor eover next week and rallied above the upper band. -------------------------------------------------------------------- 8 4/14/1987 2253.98 + 3.9% 5/6/1 987 S12 la/ma ma-roc P-I P-ch IP21 V-I OPct .966 .028 -203 .108 -17 .207 No Significant Paper Loss Down 6.5% from 17-day high. Rallied to the upper band from a test of the same lows two weeks later. -------------------------------------------------------------------- 9 3/28/1988 1979.77 + 1.3% 4/14/1988 S1 la/ma ma-roc P-I P-ch IP21 V-I OPct .964 -.252 -35 .08 -6 .005 No Paper Loss Down 6% from 17-day high. After a week of basing, DJI rose to upper band. -------------------------------------------------------------------- 10 1/22/1990 2600.45 + 14.2% 2969.8 7/30/1990 S9 la/ma ma-roc P-I P-ch IP21 V-I OPct .954 -.382 -69 -52 .019 -17 .018 Paper Loss = 2% Down 7% from 17-day high. Rallied above the upper band from a lower closing one weeks later. -------------------------------------------------------------------- 11. 6/23/2009 8322.91 + 19.5% 9949.36 10/21/2009 S12 la/ma ma-roc P-I P-ch IP21 V-I OPct .968 .063 36 (-14) .011 -115 .03 Paper Loss = 2.5% Down 6% from 17-day high. Rallied above the upper band from a lower closing two weeks later. ==================================================================== 12. 5/6/2010 10520.32 -1.1% 10409.46 6/16/2010 S12 la/ma ma-roc P-I P-ch IP21 V-I OPct Paper Loss = 5% .965 -.419 -137 (-131) .005 -153 .033 Down 7% from 17-day high. |

Avg.Gain= 10.2% Avg.Paper Loss = 2.2%

Buy B5's should suppress other Sells for ten trading days, about two weeks.

Buy B5s occur when the DJI

closes 2% to 4.6% below the 21-day ma with either the

Accumulation Index or OBVPct above -.03 With Buy B5s, we skip August and

September,

which is right before the weakest period in market's yearly cycle. We also

disallow the

Buy B5 under certain other conditions.

Skip if there has been a Sell S9 or S12 within the last 35 days.

Skip if nether the current Accumulation Index or OBVPCT is less than 0.

Skip if the DJI gaps down more than 1.78% from previous day.

Skip if the DJI's ROC is under -.60 in case of OBVPCT positive NCs.

Skip if the DJI's ROC is under -.75 in case of AI positive NCs.

Skip if the DJI is down less than 10.8% from high of last 79 trading days to today's low.

Buy B5s: 1928-1941

Second row shows CL/MA, ROC, P21, IP21, V21, OP21

Date DJI Gain Reversing Signal

------------- ----------- -------- ----------------

1 12/7/1928 271.10 +17.1% S12 1/31/29 317.5

.966 .442 -52 -40 -.03 -652 0.223

Also a B2 and B17. DJI fell one more day to 263.90 and rallied.

Paper Loss = 3%

Simultaneous B2/B9

--------------------------------------------------------------------

2 2/15/1929 300.4 +3.8% S9 4/19/29 311.9

.967 -.088 -91 -28 -.085 -797 -.03

Also a B17. DJI rallied but then fell to 296.5 before tallying again.

Paper Loss = 1%

Simultaneous B17

A Buy B5 might have occurred on the 5/28/1929, but it was not

allowed because the P-Indicator as -115. When the P-I is adjusted

for the relatively small number of stocks trading in 1929, it is

5x greater. The steeply falling A/D Line in 1929 would have made

a Buy B5 on 5/28/1929 very suspect and would have been only

applied to a limited number of DJIA-30 stocks.

---------------------------------------------------------------------

Standard Buy B5s were not allowed until 1933 bottom

because extreme bearish mode should have been applied

in October 1929. The only B5 in this period would have

lost 10.5% is taken on 4/29/1930 and not sold until S6

on 6/11/1930.

---------------------------------------------------------------------

---------------------------------------------------------------------

Standard Buy B5s were not allowed until 1933 bottom

because extreme bearish mode should have been applied

in October 1929. The only B5 in this period would have

lost 10.5% is taken on 4/29/1930 and not sold until S6

on 6/11/1930.

---------------------------------------------------------------------

Buy B5s: 1942-2008

Second row shows CL/MA, ROC, P21, IP21, V21, OP21

Date DJI Gain Reversing Signal

------------- ----------- -------- ----------------

3 11/15/1948 176.00 18.3% 215.30 4/14/1950

.958 .504 187 .085 285 .006

This marked a two month bottom and the DJI rose to 182, but then

fell to 162 in June 1949. In third case selling at the apex of

a potential right shoulder in a broad head and shoulders pattern

would have helped. There was a head and shoulders top to have properly

sold on. The A/D Line did not make a new high when this appeared.

Paper Loss = 8%

Simultaneous Buy B9

When a head and shoulders pattern appears as it did in January

and February, it is best to sell when the A/D Line's uptrend is

broken when a head and shoulders pattern is present. In this case,

it would have meant selling at 177.90 on 2/4/1949. As you can see

from the chart below, this would have greatly improved trading this

year.

-----------------------------------------------------------------------

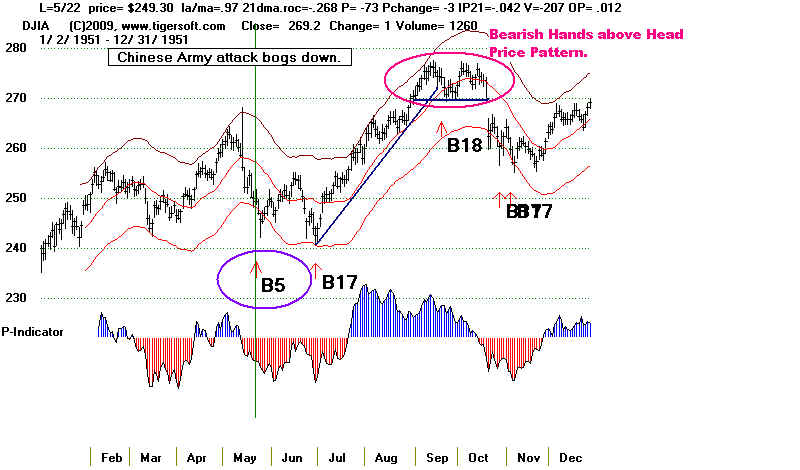

The case below did not ooccur in 2010 and later versions of Peerless.

5/22/1951 249.3 5.5% 262.90 8/3/1951 S4

.97 -268 -73 -.042 -207 .007

DJI needed to form a double bottom at 242 before rallying to 276 in

September.

-----------------------------------------------------------------------

The case below did not ooccur in 2010 and later versions of Peerless.

5/22/1951 249.3 5.5% 262.90 8/3/1951 S4

.97 -268 -73 -.042 -207 .007

DJI needed to form a double bottom at 242 before rallying to 276 in

September.

------------------------------------------------------------------------

4 10/7/1955 458.20 7.2% 3/6/1956 S12

.969 -.425 -30 .074 -343 .076

DJI fell to 439 a week later before rallying.

Paper Loss = 4%

Buy B17 occurred a few days later.

------------------------------------------------------------------------

4 10/7/1955 458.20 7.2% 3/6/1956 S12

.969 -.425 -30 .074 -343 .076

DJI fell to 439 a week later before rallying.

Paper Loss = 4%

Buy B17 occurred a few days later.

-----------------------------------------------------------------------

5 11/22/63 711/50 32.0% Sell S8 5/13/1965 5.1%

.953 -.557 -151 (-40) -.141 -.1021 .007

JFK assassination. DJI rose sharply

6 6/27/1978 817.31 2.7% 9/11/78 S12 (too early)

.97 -.203 -114 -.11 -1 .069

DJI fell to 807 and then rallied to 905 in September.

Paper Loss = 1%

No other signal at this bottom.

If one were automatically to disallow Sell signals for 10 trading

days after the Buy B5, the gain here would have been +11.1%

-----------------------------------------------------------------------

5 11/22/63 711/50 32.0% Sell S8 5/13/1965 5.1%

.953 -.557 -151 (-40) -.141 -.1021 .007

JFK assassination. DJI rose sharply

6 6/27/1978 817.31 2.7% 9/11/78 S12 (too early)

.97 -.203 -114 -.11 -1 .069

DJI fell to 807 and then rallied to 905 in September.

Paper Loss = 1%

No other signal at this bottom.

If one were automatically to disallow Sell signals for 10 trading

days after the Buy B5, the gain here would have been +11.1%

-----------------------------------------------------------------------

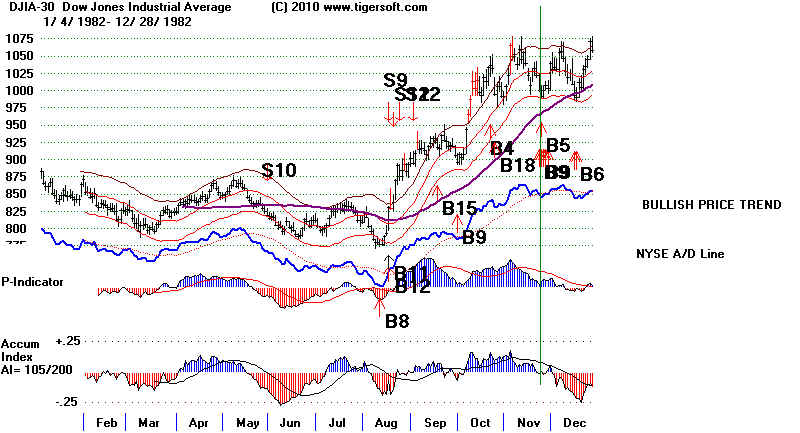

7 11/23/1982 990.99 6.7% 12/7/1982 S9

.967 -.048 81 .009 -1 .065

This was bottom before a rally to upper band.

No Paper Loss

Buy B9 occurred simultaneously.

-----------------------------------------------------------------------

7 11/23/1982 990.99 6.7% 12/7/1982 S9

.967 -.048 81 .009 -1 .065

This was bottom before a rally to upper band.

No Paper Loss

Buy B9 occurred simultaneously.

--------------------------------------------------------------------

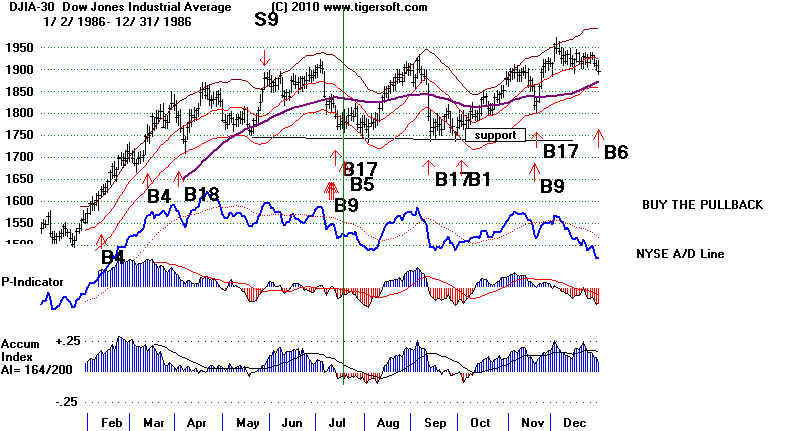

8 7/17/1986 1781.78 3.0% 8/12/1986 S9

.963 -.539 -83 -.034 -11 .144

This was bottom before a rally above upper band.

Buy B9 and B17 occurred a few days earlier

No Paper Loss

--------------------------------------------------------------------

8 7/17/1986 1781.78 3.0% 8/12/1986 S9

.963 -.539 -83 -.034 -11 .144

This was bottom before a rally above upper band.

Buy B9 and B17 occurred a few days earlier

No Paper Loss

--------------------------------------------------------------------

9 4/14/1987 2253.98 3.9% 5/6/1987 S12

.966 .028 -203 .108 -17 .207

DJI fell to 2230.54 and then rallied to the upper band.

Buy B19 occurred the next day.

Paper Loss = 1%

--------------------------------------------------------------------

10 3/28/1988 1979.77 1.3% 4/14/1988 S1

.964 -.252 -35 .08 -6 .005

This was bottom before a rally to upper band.

Simultaneous B17.

No Paper Loss

--------------------------------------------------------------------

9 4/14/1987 2253.98 3.9% 5/6/1987 S12

.966 .028 -203 .108 -17 .207

DJI fell to 2230.54 and then rallied to the upper band.

Buy B19 occurred the next day.

Paper Loss = 1%

--------------------------------------------------------------------

10 3/28/1988 1979.77 1.3% 4/14/1988 S1

.964 -.252 -35 .08 -6 .005

This was bottom before a rally to upper band.

Simultaneous B17.

No Paper Loss

--------------------------------------------------------------------

11 10/16/1989 2657.38 5.7% 1/2/1990 S15

.98 -.075 -75 .109 -1 .187

DJI fell to 2582 on 11/6/89 and then rallied.

Simultaneous B17.

Paper Loss = 3%

See chart below.

--------------------------------------------------------------------

12 1/22/1990 2600.45 14.2% 2969.8 7/30/1990 S9

.954 -.382 -69 .019 -17 .018

DJI falls to 2543 and then rallied to 3000 in July 1990.

Buy B17 occurred the next day.

Paper Loss = 2%

--------------------------------------------------------------------

11 10/16/1989 2657.38 5.7% 1/2/1990 S15

.98 -.075 -75 .109 -1 .187

DJI fell to 2582 on 11/6/89 and then rallied.

Simultaneous B17.

Paper Loss = 3%

See chart below.

--------------------------------------------------------------------

12 1/22/1990 2600.45 14.2% 2969.8 7/30/1990 S9

.954 -.382 -69 .019 -17 .018

DJI falls to 2543 and then rallied to 3000 in July 1990.

Buy B17 occurred the next day.

Paper Loss = 2%

13. 8322.91 6/23/2009 19.5% Sell S12 10/21/2009 -2.8%

.968 .063 36 (-14) .011 -115 .03

DJI fell to 8178 (paper loss of 2.5%) and then rallied to 3000 in July 1990.

Buy B17 occurred the next day.

====================================================================

Total Number of trades = 13

Avg. Gain = 10% approx.

13. 8322.91 6/23/2009 19.5% Sell S12 10/21/2009 -2.8%

.968 .063 36 (-14) .011 -115 .03

DJI fell to 8178 (paper loss of 2.5%) and then rallied to 3000 in July 1990.

Buy B17 occurred the next day.

====================================================================

Total Number of trades = 13

Avg. Gain = 10% approx.