Peerless Stock Market Timing: 1915-2011:

Automatic Buys and Sell Signals

TRACK RECORD OF BUYS/SELLS 1928-1948

95 Reversing Buys and Sells.

Avg. Gain on a Buy was + 11.1%

Avg. Gain on a Sell was + 8.8%

William Schmidt, Ph.D. (Columbia University) EMAIL william_schmidt@hotmail.com About Us

(C) 2011 All rights reserved. www.tigersoft.com

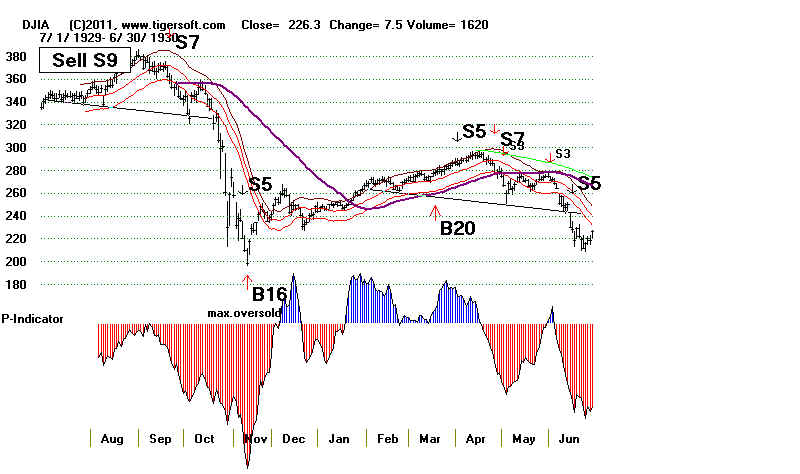

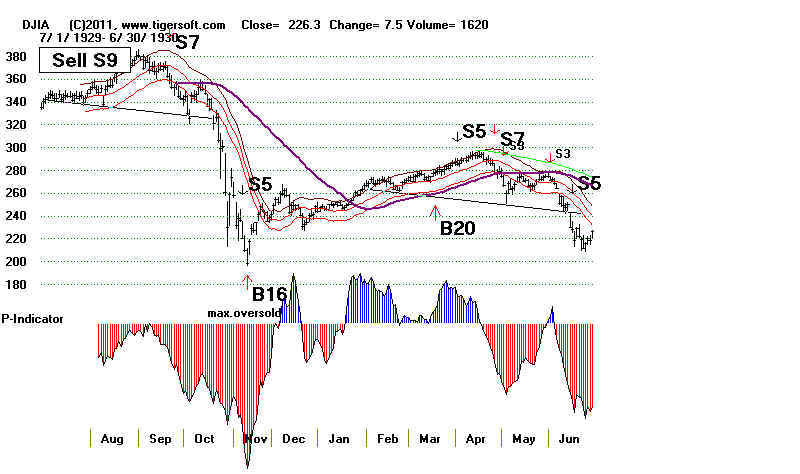

1929-1930 Peerless Chart of Start of The Worst Bear Market

with Automatic Peerless Buys and Sells that test best between 1928 and 2011.

Peerless Book shows these charts for every year since 1915.

and BOTTOMS, too

TRACK RECORD OF BUYS/SELLS 1928-1948

Track Record of Automatic Peerless Buys/Sells: 1948-2011

Introduction to Peerless Stock Market Timing

On-Line Book Order Here: $95

One Year of Peerless/Tiger HOTLINE $350

Peerless Stock Market Timing: 1929-2010 $395.

TigerSoft & Peerless Stock Market Timing: 1929-2010 $495.

TRACK RECORD OF BUYS/SELLS 1928-1948

The signals are based on historical data and applied to the DJI for simplicty. The basic

Peerless indicators used could be calculated by hand. But the Peerless software and our Tiger

Data page make easy the production of the indicators and our automatic Buy and Sell signals.

These Peerless Buy and Sell signals can profitably be superimposed on most stocks and ETFs

worldwide. Our software does this and also lets users see gains and losses when it is assumed

that all trades are made at the Opening the day after the Buy or Sell.

Numbers are used to classify particular signals. Higher numbers signals are not necessarily

more powerful than lower numbered signals. Numbering them distinguishes one from another

and let users see the historical potency and reliability of each signal in the documentation. Our documentation

explains the general basis of each signal. "B" means Buy. "S" means Sell. The asteriix shows

the market was in "extreme Bearish Mode". Our Peerless system is always long or short.

It is assumed for simplicity that one always trades at the exact close of each signal.

Note: The Peerless charts do not show all the Buy and Sell signals for the first 100-days

because that much data is needed to produce the signals. There are lots of Buys and Sells

that are not reversing signals, i.e. a Buy after a Sell or a Sell after a Buy. The table below

gives all the reversing Buys and Sells for the period.

Peerless provides you the data since 1965 so that you can

replicate results and better

study how the signals are produced. Our manual shows all the charts and

signals since 1915

and discusses the history and basis of each signal since 1928, when the necessary

data

to produce the signals first comes available.

.

PEERLESS AUTOMATIC BUYS AND SELLS:

1929-1948

Peerless Date DJI Pct. Signal Gain -------------------------------------------------------------------- Buy B2 12/7/1928 271.1 15.3% Sell S9 1/30/1929 312.6 3.6% Buy B17 2/8/1929 301.5 5.3% Sell S9 2/28/1929 317.4 4.5% Buy B17 3/27/1929 303.2 2.9% Sell S9 4/18/1929 311.9 27.0% *Buy B16 11/13/1929 198.7 35.1%

*Sell S5 4/2/1930 285.3 39.8%

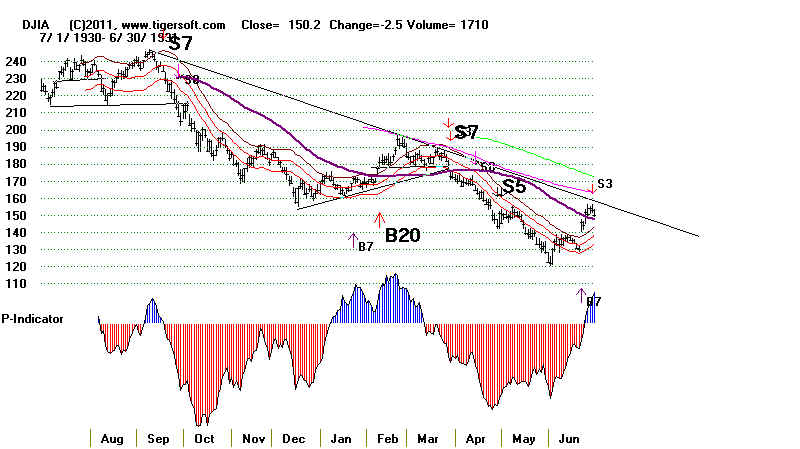

*Buy B7 1/23/1931 171.8 3.2% *Sell S7 3/27/1931 177.3 17.8% *Buy B7 6/22/1931 145.8 4.7% . *Sell S3 6/29/1931 152.7 30.2% *Buy B3 10/8/1931 105.8 7.7% *Sell S5 11/10/1931 113.9 31.0%

*Buy B7 2/11/1932 78.6 3.2% *Sell S3 3/14/1932 81.1 47.2% *Buy B8 6/30/1932 42.80 73.6% Sell S8 8/30/1932 74.30 5.9% Buy B17 9/13/1932 69.9 2.3% Sell S8 9/29/1932 71.5 12.9%

*Buy B7 1/5/1933 62.3 -5.1% *Sell S3 1/9/1933 59.1 -5.1% *Buy B8 3/15/1933 62.10 65.4% Sell S12 7/5/1933 102.7 14.2% Buy B7 10/23/1933 88.1 12.3% Sell S12 12/1/1933 98.9 1.7% Buy B7 12/18/1933 97.2 12.0% Sell S4 2/1/1934 108.9 4.8% Buy B9 2/27/1934 103.7 1.4% Sell S9 4/11/1934 105.2 4.5% Buy B9 4/30/1934 100.5 -1.5% Sell S9/S5 6/19/1934 99.0 12.4% Buy B8 9/17/1934 86.7 7.7% Sell S9/S12 9/27/1934 93.4 -6.6% Buy B6 12/20/1934 99.6 4.9%

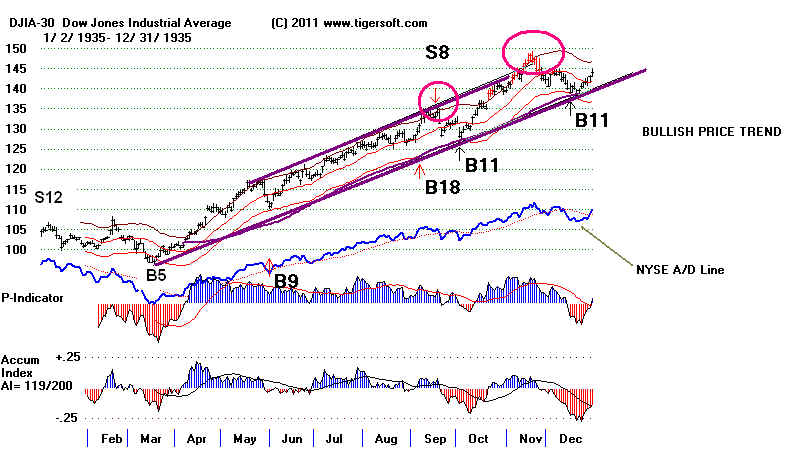

Sell S12 1/2/1935 104.5 4.2% BUY B5 3/11/1935 99.4 33.9% Sell S8 9/17/1935 133.1 3.8% Buy B11 10/2/1935 128.1 19.8%

Sell S15 2/18/1936 153.4 3.1% Buy B2 5/5/1936 148.6 14.1% Sell S2 9/8/1936 169.6 2.6% Buy B11 9/16/1936 165.2 4.6% Sell S12 10/5/1936 172.8 4.2%

Buy B8 6/14/1937 165.5 14.4%

Sell S9 8/13/1937 189.3 37.6%

*Buy B8 11/19/1937 118.1 8.6%

*sELL s7 12/9/1937 128.20 7.5%

*Buy B7 6/20/1938 118.6 21.8% Sell S12 8/5/1938 144.5 5.5% Buy B17 8/12/1938 136.5 15.4% Sell S12 11/10/1938 157.5 5.7% Buy B6 12/1/1938 148.6 3.4%

sELL S12 1/3/1939 153.6 4.1% Buy B17 1/12/1939 147.3 1.4% Sell S12 3/7/1939 149.4 4.0% Buy B9/B17 3/21/1939 143.4 -0.1% Sell S8 7/31/1939 143.3 4.2% Buy B7 8/11/1939 137.3 12.2% Sell S9 9/13/1939 154.1 2.8% Buy B1 11/14/1939 149.8 -3.3%

Sell S10 5/10/1940 144.8 15.5% Buy B16 5/20/1940 122.4 10.4% Sell S4 10/3/1940 135.1 6.7%

Buy B19 2/20/1941 119.9 7.4% Sell S12 9/18/1941 128.8 8.2% Buy B1 11/7/1941 118.3 -3.7%

Sell S9 1/6/1942 113.9 6.2% Buy B9 2/10/1942 106.8 -7.1% Sell S9 5/11/1942 99.2 -5.2% Buy B4 6/5/1942 104.4 35.8%

Sell S9 6/7/1943 141.8 3.9% Buy B17 8/10/1943 136.2 8.6%

Sell S2 6/21/1944 147.9 1.8% Buy B11 8/4/1944 145.3 12.9%

Sell S9 5/15/1945 164 -3.6% Buy B10 8/24/1945 169.9 17.2%

Sell S9 1/10/1946 199.2 0.3% Buy B17 2/13/1946 198.7 1.5% Sell S6 2/18/1946 201.6 3.0% Buy B19 2/21/1946 195.6 8.6% Sell S5 5/29/1946 212.5 23.2% Buy B14 10/9/1946 163.1 2.2%

Sell S10 4/14/1947 166.7 -1.7% Buy B19 4/21/1947 169.5 8.8% Sell S4 10/22/1947 184.4 5.8%

Buy B12 3/22/1948 173.7 11.2%

Sell S2 6/15/1948 193.2 2.8%

Buy B11 7/15/1948 187.7 -1.2%

Sell S2 9/7/1948 185.4 2.8%

Buy B14 9/9/1948 180.3 5.3%

Sell S1 10/22/1948 189.8 3.8%

Buy B9 11/3/1948 182.5 -0.7%

.

Sell S12 1/7/1949 181.3 8.9%

Buy B14 6/6/1949 165.2 24.3%

--------------------------------------------

95 trades avg gain = 9.94%

48 long trades: avg gain = 11.05%

8 losses (17.0% of long trades)

7 gains of more than 20% (14.9%)

17 gains of more than 10% (36.2%)

24 gains of more than 7% (51.5%)

27 gains of more than 5% (57.4%)

47 short trades: avg gain = 8.81%

6 losses (13.0% of long trades)

7 gains of more than 20% (15.2%)

12 gains of more than 10% (26.1%)

15 gains of more than 7% (32.6%)

21 gains of more than 5% (45.7%)

from Book/Software Peerless Stock Market Timing: 1915-2011

1929-1930