Last edited May 25, 2016 -- (C) William Schmidt, Ph.D.

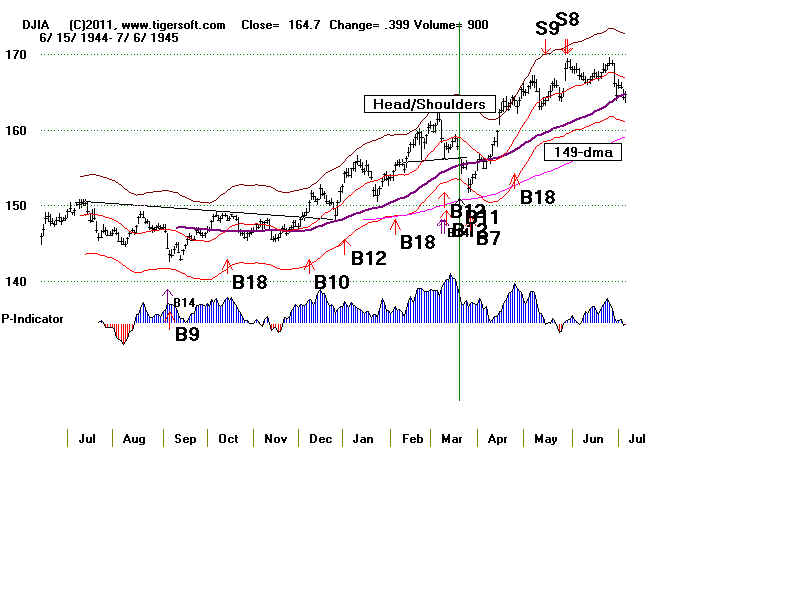

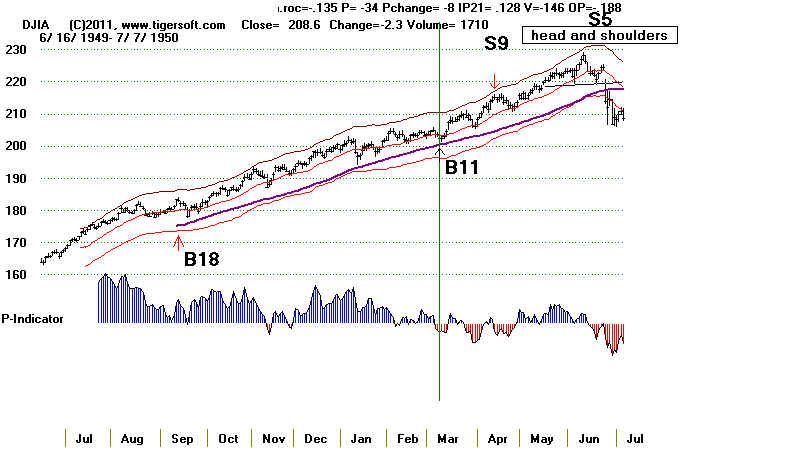

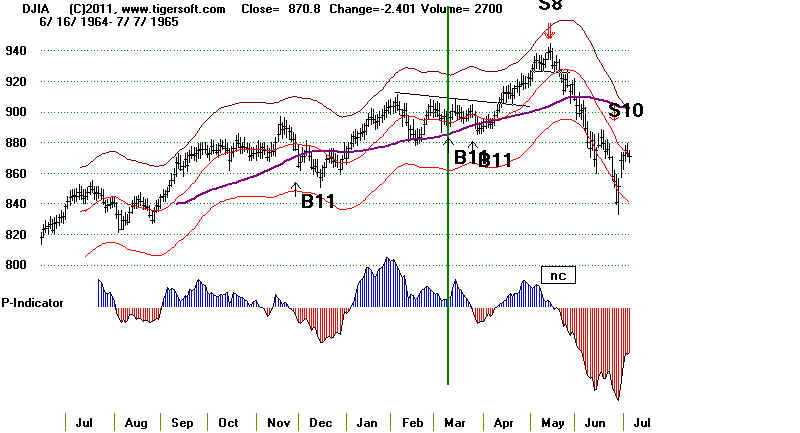

B11s occur when the DJI pulls-back to a rising 65-dma that it has not

been violated for two months. There must not have been a recent Sell S9

or S12. Their presence would increase too much the odds of a deeper

decline and also warn that the DJI is probably topping out and so upside

potential is more limited. When a head/shoulders is present at the time

of the Buy B11, the odds are then 44% that the DJI will still violate the

H/S neckline and the 65-dma. Be prepared in these cases for a small paper loss.

There have been 21 cases of Buy B11s since 1928. The average gain

was 12.3%. There was only 1 loss.

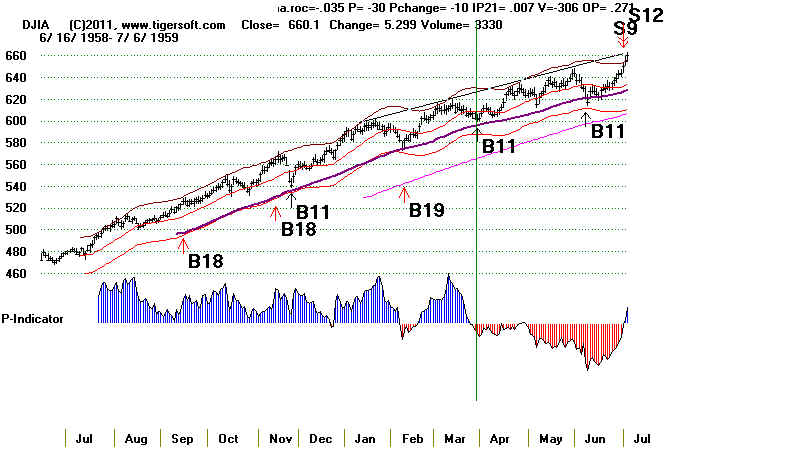

The signal derives from the observation that when the DJI is rising quickly,

there are sometimes quick retreats to the 65-dma and then just as quick surges

back up. See the case below in October 1935. These trigger a Buy B11

when conditions are right. (You can see the Basic program that produces

these signals at the bottom of this page.)

We do have to be careful when there are signs that the 65-dma might

be penetrated. Deteriorating breadth and negative Accumulation at

the last top are such warnings. We pick up on these by the presence

of Sell S9s or S12s. There can be no Buy B11, when there has been an

S9 or S12 signal in the two months prior to the point where there is a

pullback to the 65-dma,

The presence of a head/shoulders pattern is a warning that there is

almost a 50% chance of a quick decline below the neckline and the

65-dma. In 9 instances of head/shoulders patterns, there were 4 cases

where the neckline and 65-dma were decisively violated.

There are other factors associated with unusual degrees of success

from Buy B11s. For example, the highest average gains were those

occurring in the year after the Presidential Election, +21.3%. Presidential

Elections apart from the year 1944 when the US was at war, showed

only modest gains after a Buy B11.

May and June seldom bring Buy B11s and when they do. the gains have been

only half as good as normal. The best gains come when the B11 occurs in March

and October.

Noticeably weaker B11s seem to occur in the last 11 days of the month.

Size of Gains

>.10 10

.05-.099 2

.02-.049 6

0 - .019 1

loss 1

BUY B11:

1928-2016 la/ma AROC P P^^ P-Cha IP21 V-I OPct 65-day Pct.Ch.

1)

19351002 B11 128.1 .219 Case 2

.974 .072 -10 -22 -54 -.124 -159 .288 .078

----------------------------------------------------------------

2)

19401122 B11 131.7 .002 Case 5

.969 -.142 -29 -16 -145 -.008 -57 -.142 .026

----------------------------------------------------------------

3)

19440413 B11 137.7 .191 Case 5

.991 -.231 -40 -9 -213 -.124 -104 -.092 -.006

----------------------------------------------------------------

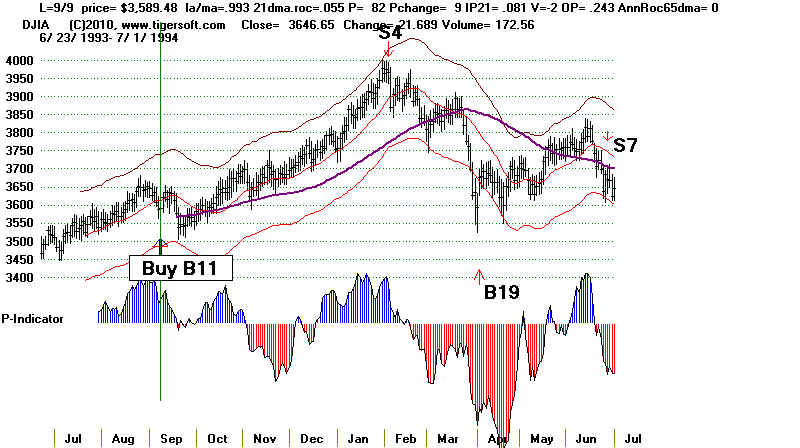

4)

19440804 B11 145.3 .129 Case 5

.983 -.306 -67 -9 -.187 -172 -.134 .054

paper loss = 2.4/145.3

----------------------------------------------------------------

5)

19440825 B11 147.0 .115 Case ?

.983 -.306 -67 -9 -.187 -172 -.134 .054

paper loss = 4.1/147.0

------------------------------------------------------------

6)

19450321 B11 155.3 .056 Case 3

.978 -.277 82 -46 371 .055 78 .044 .029

paper loss = 0

----------------------------------------------------------------

7)

19450705 B11 164.3 .212 Case 5

.984 -.271 -9 -26 -38 -.113 -131 -.02 .051

----------------------------------------------------------------

8)

19520825 B11 273.6 -.007 Case 5

.986 -.176 -16 -7 -59 .04 -79 .091 .039

----------------------------------------------------------------

9)

19590608 B11 621.6 .046 Case 1

.981 .004 -112 -55 329 -.041 -484 -.121 .019

----------------------------------------------------------------

10)

19701113 B11 759.79 .234 Case 5

.995 -.126 -126 -34 -266 -.272 -2 .15 .074

----------------------------------------------------------------

11)

19830708 B11 1207.23 .03 Case 5

.986 .211 -4 19 -7 .064 1 .076 .084

----------------------------------------------------------------

12)

19831103 B11 1227.13 .04 Case 5

.981 -.219 -132 -28 -260 .075 -10 .136 .024

----------------------------------------------------------------

13)

19850315 B11 1247.35 .463 Case 3

.976 -.47 -161 -51 -319 -.166 -13 -.31 .058

----------------------------------------------------------------

14)

19850809 B11 1320.79 .382 Case 5

.982 -.15 -85 -28 -169 .058 -3 .044 .056

----------------------------------------------------------------

15)

19860516 B11 1759.8 .058 Case 4

.976 -.627 -158 -36 -302 -.031 -18 -.252 .079

----------------------------------------------------------------

16)

19920327 B11 3231.44 .038 Case 5

.994 -.139 -128 -43 -248 -.062 -22 -.027 .059

----------------------------------------------------------------

17)

19930423 B11 3413.77 .025 Case 5

.995 -.11 -29 -16 -50 -.032 -28 -.006 .052

Paper loss = none

----------------------------------------------------------------

18)

19930702 B11 3483.96 .139 Case 5

.993 -.207 11 -7 19 -.035 -21 -.099 .014

Fell to 3449.92

----------------------------------------------------------------

19)

20031118 B11 9624.16 .103 Case 5

.987 -.188 129 -43 124 .022 -118 -.105 .022

----------------------------------------------------------------

20)

20060417 B11 11073.78 .046 Case 5

.989 -.191 -174 -67 -160 -.135 -142 -.038 .002

--------------------------------------------------------------------

21)

20160520 B11 17500.94 open Case ?

.986 -.323 40 +40 .004 -110 -.064 .066

====================================================================

Completed trades No.=20 Avg. = .123

Presidential Election Year 6 .106 (But there were 3 B11s in 1944.) PE + 1 7 .213 PE + 2 3 .113 PE + 3 4 .084 January 0 ---- February 0 ---- March 3 .186 April 3 .107 May 1 .058 June 1 .053 July 3 .127 August 4 .155 September - ---- October 1 .219 November 4 .095 December - ---- 1-10 8 .150 11-20 6 .183 21-31 6 .038

|

| B11s on Charts Included 9 cases where Head/Shoulders present Neckline & 65-dma held - 1935, 1941, Aug 1944, 1959, 1992 (5) Neckline & 65-dma violated - April 1944, Aug 1944, 1945, 1952, (4) No Cases of Broad trading ranges like 2016 brought Buy B11s. - |

| Code used: Sub b11calc () Static ma65(300) Erase ma65 Dim i As Integer, j As Integer For i = 1 To 65: ma65(65) = ma65(65) + la(i): Next i For i = 66 To rn: ma65(i) = ma65(i - 1) + la(i) - la(i - 65): Next i For i = 65 To rn: ma65(i) = ma65(i) / 65: Next i For i = 110 To rn ' Case 1 If (yr(i) + 1) / 4 <> Int((yr(i) + 1) / 4) Then 26666 If mo(i) <> 6 Then 26666 If la(i) / ma65(i) > 1.004 Then 26666 If la(i) / ma65(i) < .9942 Then 26666 If la(i) / ma(i) < .97 Then 26666 If la(i) / ma(i) > .9825 Then 26666 If newipxxx(i) < -.125 Then 26666 If opma(i) < -.2 Then 26666 annroc = ((ma(i) - ma(i - 1)) / ma(i - 1)) * 250 If annroc < -.4 Then 26666 For j = i - 10 To i If s9(j) = 9 Then 26666 Next j If pvv(i) < -561 Then 26666 pi = i: mb(i) = 11: buyb11arrows (pi): : i = i + 10 26666 Next i '-------------------------------------------------- For i = 110 To rn ' Case 2 If (yr(i) + 1) / 4 <> Int((yr(i) + 1) / 4) Then 46666 If la(i) / ma65(i) > 1.0076 Then 46666 If la(i) / ma65(i) < .994 Then 46666 If la(i) / ma(i) < .97 Then 46666 If la(i) / ma(i) > .98 Then 46666 If newipxxx(i) < -.125 Or p(i) < -70 Then 46666 If opma(i) < .275 Then 46666 If mo(i) <> 10 Then 46666 If pvv(i) < -310 Then 46666 pi = i: mb(i) = 11: buyb11arrows (pi): : i = i + 10 46666 Next i '------------------------------------------------ ' case 3 For i = 110 To rn If mo(i) <> 3 Then 66 If (yr(i) - 1) / 4 <> Int((yr(i) - 1) / 4) Then 66' If la(i) / ma65(i) > 1.002 Then 66 If la(i) / ma65(i) < .994 Then 66 If la(i) / ma(i) < .97 Then 66 If la(i) / ma(i) > .98 Then 66 If newipxxx(i) < -.166 Then 66 If pvv(i) < -14 Then 66 If opma(i) < -161 Then 66 pi = i: mb(i) = 11: buyb11arrows (pi): : i = i + 10 66 Next i '--------------------------------------------- ' ' case 4 For i = 110 To rn If mo(i) = 1 Then 6 If (yr(i) - 2) / 4 <> Int((yr(i) - 2) / 4) Then 6 If la(i) / ma65(i) > 1.002 Then 6 If la(i) / ma65(i) < .994 Then 6 If la(i) / ma(i) < .97 Then 6 If la(i) / ma(i) > .98 Then 6 If newipxxx(i) < -.032 Then 6 If mo(i) <> 5 Then 6 If pvv(i) < -310 Then 6 pi = i: mb(i) = 11: buyb11arrows (pi): : i = i + 10 6 Next i '------------------------------------------------------------ ' Case 5 For i = 110 To rn If mo(i) = 9 Or mo(i) = 10 Then 6612' excludes strange 1967 case If mo(i) = 7 And (yr(i) + 1) / 4 = Int((yr(i) + 1) / 4) And opma(i) < .01 Then 6612 AROC = 250 * (ma(i) - ma(i - 1)) / ma(i - 1) If mo(i) = 6 And ((yr(i)) - 1) / 4 = Int((yr(i) - 1) / 4) Then 6612 If mo(i) = 7 And (yr(i)) / 4 = Int((yr(i)) / 4) And pvv(i) < -165 And AROC < -.32 Then 6612 ' If la(i) / ma65(i) > 1.01 Then 6612 If la(i) / ma65(i) < .997 Then 6612 If lo(i) / ma65(i) < .994 Then 6612 For j = i - 50 To i ' If mo(j) = 11 And da(j) = 18 Then Stop If mo(i) = 6 And (yr(i) + 2) / 4 = Int((yr(i) + 2) / 4) Then 6612 If mo(i) = 6 And (yr(i)) / 4 = Int((yr(i)) / 4) Then 6612 If mo(i) = 6 And ((yr(i)) - 1) / 4 = Int((yr(i) - 1) / 4) Then 6612 If mo(i) = 2 And (yr(i) + 1) / 4 = Int((yr(i) + 1) / 4) Then 6612 'If j = 128 Then Stop ' If mo(j) = 7 And da(j) = 1 Then Stop If s9(j) = 9 Then 6612 If s9(j) = 4 And mo(i) <> 11 Then 6612 If s9(j) = 1 Then 6612 If s9(j) = 15 Then 6612 If s9(j) = 1 Then 6612 If s9(j) = 120 Then 6612 If s9(j) = 12 Then 6612 If s9(j) = 8 And (250 * (ma(j) - ma(j - 1)) / ma(j - 1)) < .5 Then 6612 Next j 'If mo(i) = 11 And da(i) = 18 Then Stop For j = i - 45 To i - 1 'If mo(i) = 6 And da(i) = 16 Then Stop 'If mo(i) = 11 Then Stop If lo(i) < .995 * ma65(j) Then 6612 If mo(j) <> 9 And la(j) < .998 * ma65(j) Then 6612 If mo(j) = 9 And la(j) < .997 * ma65(j) Then 6612 'If mo(j) = 11 And la(j) < .97 * ma65(j) Then 6612 Next j 'if la(i)/ma65(i)> If mo(i) = 9 And da(i) = 18 Then Stop If pvv(i) < -278 Or opma(i) < -.2 Then 6612 If la(i) / ma65(i) < 1.0045 Then : pi = i: mb(i) = 11: buyb11arrows (pi): i = i + 10 6612 Next i 56140 DoEvents End Sub |

=====================================================

Buy because Sell S11 paper loss has

reached

2.2%, taking it out of the range of

past S11s,

which should render it suspect,

void and reversed.

(Introduced temporarily on 3/8/2013)

or

Buy on GLANCING TEST OF RISING 65-DAY MA

LAST REVISED 5/29/2011

(c) 2011

William Schmidt - www.tigersoft.com

They

confirn a power advance is occuring and provide a great way to add to positions

in what is often a powerful

advance. They cannot occur immediately after a major Sell

and the 65-day moving

average must not have been violated by more than 1% for

two months.

Buy B11s are usually powerful

Buys. There have been 66 completed Buy B11s

since 1928. Their

average gain is 12.5% at the time of the next reversing Peerless Sell.

In 67 occurrences, there have

only been 2 losses, both minor. There were 15 cases

when the B11 gained more than

20%. In 31 cases, or 46.3% of all cases, the gain

was over 10%.

Buy B11 gains are apt to be

greatest when the IP21 is positive along with the P-Indicator,

V-Indicator or Accumulation

Index. The biggest average gains were in October, August

and March. The lowest

gains were in July, June and December.

In

exceptionally strong markets, instead of using a 65-day ma, the adept trader may

want to watch for pullbacks

to a rising 50-day, provided it has not been violated

for the last six weeks.

See the 1953-1954 and 1995-1996 periods.

The presence of a completed head and shoulders patterns often

will bring a decline,

perhaps 4% or so, below the

rising 65-day ,ma. This is seen in March 1945, June 1963

and March 1997.

A positive IP21 (current Accumulation Index) reading at the time of a Buy

B11

generally brings bigger advances.

In the 23 cases where the IP21 was greater than 0

the average gain for a B11 was 17.4%, 33% higher than for all B11s. Where

both the P-Indicator and IP21 was greater than 0, the average gain for a Buy B11

was 16.8%. There were 9 cases. Positive IP21 with positive V-Indicator Buy

B11s were

scarce. There were only 3. But the average gain was an impressive 26.9%. When

the IP21 and OPct were both positive, the Buy B11 brought an average gain of

17.6% in a more reliable 14 cases. Where the V-Indicator is negative anf the P-I,

IP21 and OPct indicators are positive the DJI gained an average 10.3%

Buy B11s with Positive Accumulation Index (IP21) >0

Date

Gain

LA/MA

21dmaROC P-I

IP21

V

OPct

1/21/36 +6.9% .996 -.381

93 .084 104 .112

8/26/42 +34.2% .996 -.101

16

.024

-5 .094

9/11/42 +33.9% .995 .056

27 .073

0 .17

3/20/45 +2.5% .983 -.135

127 .069

150 .243

12/21/45 +5.3% .986 -.025

24

.083

-28 .069

3/9/50 +6.4% .99

-.135 -34 .128 -146 -.142

8/30/54 +42.5% .985 -.227

-34 .056 -270 -.025

11/25/58 +20.3% .977 .022

25

.039

-173 .249

3/31/59 +8.1% .988 -.035

-30 .007

-306 .271

10/26/70 +24.2% .989 -.083

-103 .016

-2 .062

6/8/83 +4.9% .981 - .42

-37 .003

-5 -.012

7/5/83 +2.9% .988 - .044

-54 .005

-1 .058

11/3/83 +4.0% .981 - .219

-132 .075

-10 .13

10/4/84 +53.8% .982 - .213

-11 .147

3 -.037

8/6/85 +37.8% .984 -.029

-59 .09

-2 .124

3/20/89 +22.5% .989 -.254

-75 .033

-8 .145

7/3/89 +13.0% .984 -.31

-67 .011 -11 -.091

5/10/93 +15.2% 1.002 -.162 51 .03 -7 .025

6/10/93 +13.6% .995

.078 -69 .092 -9 .133

9/9/93 +10.3% .993

.055 82 .081 -2 .242

8/18/95 +20.2% .988 -.061

100

.005

1 -.249

10/30/95 +16.7% .999 -.081

-164 .048 -43 -.062

3/20/1997 +0.2% .982 -.342

-191

.008 -50

-.072

9/25/03 +4.9% .984 .004

300

.023

-29 .035

------------------------------------------------------------------------------------------

N=24 Avg. Buy B11 Gain = 16.8%

Paper Losses

In 67 cases, there were 22 paper losses of more than 2%. Still the paper losses

are limited. Only 7 of the paper losses were more than 3%. None of the declines

after a Buy B11 saw the DJI go below the rising 200-day ma. Most did not reach

the 149-day ma (30-week ma.

The presence of a head and shoulders did make a decline below the 65-dma likely.

A positive IP21 (current Accumulation Index) only occurred in 1 of the 7 cases

where the paper loss was more than 3%, and it was only +.008. The more negative

were all the internal strength indicators (P-I, IP21, V-I and OPct), the more likely the

DJI would fall an additional 2% before rallying.

Paper Losses of 2% or Greater after a Buy B11.

Date Paper Loss LA/MA MAROC

P-I IP21 V-I OPct

-------------------------------------------------------------------------------------------

4/13/44

4%

.991 -.231

-40 -.124

-104 -.088

8/4/44 2%

1.003 .041

25

-.034

-15 .113

8/24/44

4%

1.003 .041

25

-.034

-15

.058

3/20/45 2.5%

.983 -.135

127

-.069

150

.143

8/20/47 2%

.983

.314 -43 -.091

-90 -.196

8/30/54 2%

.985 -.227

-34

.056 -270 -.025

3/9/55

3%

.983 -.136

-2 -.061 -226 .133

1/16/56

3%

986 -.113

-20

-.183 -187 -.04

5/10/56

6%

.995 -.259 -53 -.173

-279 -.204

5/15/61 2%

.989 -.019

-87 -.012

-502

.014

5/24/63 2%

.996 -.049

-21 -.053

-393 -.045

11/30/64 2%

.999 -.047

-28 -.021

-405 - .028

7/3/68

3%

.998 .109

63

-.049

8 - .035

9/26/80 2%

.993 - .038

-5

- .011 -1

.124

7/5/83 2%

.988 - .044

-54

.005

-1 .058

10/4/84 2%

.982 - .213

-11

.147

3 - .037

This case did see a rally back to upper band, before the decline.

3/14/85 2%

.998 -.162

-42

-.121 -3

-.182

8/6/85 2%

.984 -.029

-59 .09

-2 .124

4/26/91 2%

.994 -.021

-67 -

.022 -3 -.026

3/27/92 2%

.994 -.139

-128 - .062 -22 .131

3/20/97 6%

.982 -.342

-191

.008 -50

-.072

3/10/11 2%

983 -.242

59

.044 -154 - .033

----------------------------------------------------------------------------------------------------------------

17/22 16/22 19/22 13/22

Negative

Multiple BUY B11s Are Markers of Major Bull Markets

Since 1929, there have been 10 major bull markets which might have

been

recognized by the extended advances they made and a third Buy B11 without

as much as a 10% DJI decline occurring. The third Buy B11 averaged a gain

of 11.0%, although only 3 of the Buy B11s gained this much. The medium

gain was 7.35%. When the first or second Buy B11 shows a positive P-Indicator

and IP21, the average gain was 27.5% in 4 cases. In the two cases when both

the P-Indicator and IP21 were positive on the thrid Buy B11, the DJI subsequently

rose 11.1% from the third Buy B11..

Sets of Buy B11s in Major Bull Markets

Date

DJI

Gain P-I

P-I^^ IP21 V-I

OPct 65-day

Pct Change

----------------------------------------------------------------------------------------------------------------------------------

10/2/35

128.10

+10.8%

-10 -54

-.124 -159 +

.277 .07

1/21/36

143.5

+6.9%

+93 +416 .084

103 + .118 .049

8/21/36 160.8%

+5.5% -56 -248 -.144

-171 + .013 .073

8/26/42

105.6

+34.2%

+16 +81

.024 0 + .093

.014

9/11/42 106

+33.9% +27

+140 .073

0 + .083

.014

4/13/44 137.7

+7.4% -40 -213

-.124 -104 +

.076

-.006

8/4/44 145.3

+12.9%

-67

-353 -.187

-172 -.143

.051

lowest

8/24/44

147.1

+11.5% +25

+134 -.034 -15 + .058

.048

3/20/45 156.4

+4.9%

+127 +577

..069 +150 +.243

.036

12/21/45 189.10

+5.3% +24 +110

.083 -28

+.069 .075

8/30/54

341.3

+42.5%

-34

-112

.056 -207

+.022

.043

3/9/55 404.9

+21.4% -2

-4 -.061 -226 +.135 .03

8/22/55

452.6

+7.4% -104 -298

-.06

-313 -.012 .072

1/16/56 476.2

+8.9% -20 -64

-.183

-187 -.064

.078

11/25/58

540.50

+20.3%

25 +81

.039 -173 .249

.059

3/31/59 601.70

+8.1%

-30 -88

.007

-306 .271 .058

6/8/59

621.6

+4.6%

-112 -55

-.041

-484

.002 -.041

4/27/64

811.9

+ 21.1%

-44 -122

-.119

-545 .047 .035

11/10/64

870.6

-40

-109 .059 -500 -.184 .047

11/30/64

875.40

+7.3%

-28 -77 -.021 -405

.041 .045

3/10/65 892.40

+5.2%

41

-.077

3/25/65

898.30

+4.5% -10

-.073

6/8/83

1185.5

+4.9%

-37

.003

7/5/83

1208.53

+2.9%

-54

.005

11/3/83

1227.13

+4.0%

-132

.075

10/4/84

1187.57 +53.8% -11

.147

3/14/85

1260.05

+43.9% -111

-.089

3/29/85

1266.78 +44.1% -42

-.181

8/6/85

1325.16 +37.8% -59

.09

3/1/89

2243.04 +23.5%

-89

-.116

3/20/89

2262.5

+22.5% -75

.033

7/3/89

2452.77 +13.0% -67

.011

4/7/93

3397.77

+16.8% -77

- .028

4/23/93 3413.77

+16.2% -29

- .032

5/10/93

3443.28

+15.2% 51

.03

6/10/93 3491.72

+13.6% -69

.092

6/25/93 3490.89

+13.7% -33

-.033

9/9/93

3589.48

+10.3% 82

.081

8/18/95

4614.78

+20.2% 100

.005

10/30/95 4756.57

+16.7% -164 -226

.048 -43 -.062 .008

(

3/20/1997

6820.28

+0.2% -191

-223 .008 -50 -.072

.08

head and shoulders. Not in 3/2013

Peerless)

11/30/2010 11006.02

+13.0% -36

-.146

3/10/2011

11984.61

+ 59

.044

5/24/2011

12356.21

+26

.02

BUY B11s Average Gain by Month

Cases Avg.Gain

--------- --------------

January 2

7.9%

February 0

--------

March 14

14.4%

April 7

11.6%

May 3

12.9%

June 8

6.0%

July 3

5.2%

August 10

17.9%

September 6

9.9%

October 5

22.1%

November 5

13.6%

December 4

6.0%

==========================

67 Avg.=

In exceptionally strong markets, the same concept of a retreat to a rising 50-day ma works well.

See the 1953-1954 and 1995-1996 periods.

|

Reversing

Buy B11s There were only 5 reversing Buy B11s since 1928. All were profitable. The average gain was 8.9%. Note the signals' distribution by month: May 1 August 1 September 2 October 1 Reversing Buy B11s: 1928-2011 Date DJIA Pct. Gain Reversing Sell ---------------------------------------------------------------------------------------------------------------------- Buy B11 10/2/35 128.1 19.6% S15 2/18/36 3.1% Buy B11 9/16/36 165.2 4.6% S12 10/5/36 4.2% Buy B11 8/4/44 145.3 12.9% S9 5/15/45 -3.6% Buy B11 5/10/56 501.6 2.5% S2 8/2/56 10.0% Buy B11 9/26/80 940.1 4.9% S9 11/14/80 5.3% ---------------------------------------------------------------------------------------------------------------------------- N=5 Avg.= +8.9% |

BUY B11s - 1929-2011

Date DJIA Gain

-----------------------------------------------------------------------------------------------------------------------------------------------------

1. 10/2/35 128.10 +10.8% Reversing Buy.

LA/MA 21dmaROC P-I IP21 V OPct

.974 -.072 -10 -.124 -159 .281 Head/Shoulders was not completed.

Immediate rally. No paper loss.

2. 12/16/35 139.10 +10.3%

LA/MA 21dmaROC P-I IP21 V OPct

.968 .537 -51 -.224 -298 .018 Head/Shoulders was not completed.

Immediate rally. No paper loss.

3. 1/21/36 143.5 +6.9%

LA/MA 21dmaROC P-I IP21 V OPct

.996 -.381 +93 .084 104 .112

Immediate rally. No paper loss. Positive IP21 is bullish.

4. 8/21/36 160.8% +5.5%

LA/MA 21dmaROC P-I IP21 V OPct

.968 -.272 -56 -.144 -171 -.071

Immediate rally. No paper loss.

5. 9/16/36

165.2

+4.6% Reversing Buy

LA/MA 21dmaROC

P-I IP21

V

OPct

.994 -.014 +6

-.116

-62 -.026

Good signal but prices keep rising past

Sells because of flat topped breakout.

Immediate rally. No paper loss.

6. 12/9/38

146.10

+4.2%

LA/MA 21dmaROC P-I

IP21

V OPct

.98

-.592 -109 -.083 -195 -.142

No paper loss

7. 8/15/41 124.9

+3.1%

LA/MA 21dmaROC P-I

IP21

V OPct

.976 -.205

-4 -.017 -29

-.24

No paper loss.

8. 9/9/41 127.4

+1.1% CL/MA=1.00 (too high?)

LA/MA

21dmaROC P-I IP21

V

OPct

1.000 -.103 18

-.056 -16 -.174

Normally, we want to buy 2% to 3% below the 21-day ma to

have some

good upside potential. No paper loss.

9. 8/26/42

105.6

+34.2%

Next sell was on 6/7/1942 with DJI at 141.8

LA/MA 21dmaROC P-I

IP21

V OPct

.996 -.101

16

.024 -5

.094

No paper loss.

10. 9/11/42

106

+33.9%

LA/MA 21dmaROC P-I

IP21

V OPct

.995 .056

27 .073

0 .17

No paper loss.

11. 4/13/44

137.7

+7.4%

next Sell ... S2 - 6/21/1944 at 147.9

LA/MA

21dmaROC P-I IP21

V

OPct

.991 -.231 -40

-.124 -104 -.088

Paper Loss = 4%

12. 8/4/44

145.3

+12.9% next Sell ... S9 - 5/15/1945 at 164 Reversing Buy.

LA/MA 21dmaROC

P-I IP21

V

OPct

1.003 .041

25 -.034 -15 .113

Paper Loss = 2%

13. 8/24/44

147.1

1.003 (too high?) +11.5% next Sell... S9

- 5/15/1945 at 164

LA/MA

21dmaROC P-I IP21

V

OPct

1.003 .041

25 -.034 -15 .058

Paper Loss =

4%

14.

3/20/45

156.4

+4.9% Head and

Shoulders present.

LA/MA

21dmaROC P-I

IP21

V

OPct

.983 -.135

127 -.069

150 .143

H/S completed. Fell to

152.30 and then rallied. Paper

Loss = 2.5%

15. 12/21/45 189.10

+5.3%

LA/MA 21dmaROC

P-I IP21

V

OPct

.986 -.025

24 18 .083

-28 .069 No paper loss. DJI

rallied immediately.

16. 8/20/47

179.00

+3.0%

LA/MA

21dmaROC P-I

IP21

V

OPct

.983 .314

-43 -9 -.091 -90

-.196

DJI fell to 175 and then rallied. 2%

Paper Loss.

17. 3/9/50

202.3

+6.4%

LA/MA

21dmaROC P-I

IP21

V

OPct

.99 -.135

-34 -8 .128

-146 -.142 No paper loss.

18. 3/13/51

245.9

+11.5%

LA/MA

21dmaROC P-I

IP21

V

OPct

.974 -.348

-111 -59 -.024

-290 -.028

Rallied two days later. No paper loss. Next sell - S4 on 9/17/51 at 275.15

19. 8/30/54

341.3

+42.5%

LA/MA

21dmaROC P-I

IP21

V

OPct

.985 -.227

-34 -40 .056 -270 -.025

DJI fell to 335.80 and then rallied to 486 on 9/22/55. 2% Paper loss.

20. 3/9/55

404.9

+21.4%

LA/MA

21dmaROC P-I

IP21

V

OPct

.983 -.136

-2 -48 -.061

-226 .133

DJI fell to 391.40 and then rallied. 3% paper loss.

Next sell was on 3/6/56 at 491.4

21. 8/22/55

452.6

7.4%

LA/MA 21dmaROC

P-I IP21

V

OPct

.988

-.314 -104 -24

-.06 -313 -.012

DJI rallied

immediately.

22. 1/16/56

476.2

+8.9%

LA/MA 21dmaROC

P-I IP21

V

OPct

.986 -.113

-20 -11

-.183 -187 -.04

DJI fell to 462. 3% paper loss and DJI then rallied.

23. 5/10/56

501.60

+3.9% Reversing Buy

LA/MA 21dmaROC

P-I

IP21

V OPct

.995 -.259

-53

-41 -.173

-279 -.204

DJI fell to 468. 6% paper loss and DJI then rallied.

24. 6/24/57

497.10

+4.3%

LA/MA 21dmaROC

P-I IP21

V

OPct

.984 -.163

-126

-.031

-392 -.012

No paper loss. DJI rose immediately.

25. 11/25/58

540.50 +20.3%

LA/MA 21dmaROC

P-I IP21

V

OPct

.977 .022

25 -9

.039 -173

.249

No paper loss. DJI rose immediately.

26. 3/31/59

601.70

+8.1%

LA/MA

21dmaROC P-I

IP21

V

OPct

.988 -.035

-30 -10 .007 -306 .271

No paper loss. DJI rose immediately.

27. 6/8/59

621.6 +4.6%

LA/MA 21dmaROC

P-I

IP21

V OPct

.981 .004 -112 -55

-.041 -484 -.013

DJI fell to 617.60. 0.6% Paper Loss. DJI then rose.

28. 6/15/61

691.2

+ 3.5%

LA/MA 21dmaROC

P-I

IP21

V OPct

.989

-.019 -87 -32

-.012 -502 .014

DJI fell to 679.30. 2% Paper Loss. DJI then rose.

29. 6/24/63

718.4

- 2.4%

Head/Shoulders completed.

worn LA/MA 21dmaROC

P-I

IP21

V OPct

.996 -.049 -21 -1

-.053 -393

-.045

2.4% Paper Loss.

30. 4/27/64

811.9

+ 21.1%

LA/MA 21dmaROC

P-I IP21

V

OPct

.988

-.058 -44 -28

-.119 -545 .046

DJI fell to 805.50. Paper loss of 1%.

It then rallied to 938.3 on 5/13/65.

31. 5/18/64

821.3

+19.7%

LA/MA

21dmaROC P-I

IP21

V

OPct

.999

-.087 -65 -17

-.092 -644 - .138

DJI fell to 805.50. Paper loss of 1%.

It then rallied to 938.3 on 5/13/65..

32.

11/30/64 875.40

+7.3%

LA/MA 21dmaROC

P-I IP21

V

OPct

.999

-.047 -28 -28

-.021 -405 - .028

DJI fell to 860.10. Paper loss of 2%.

It then rallied.

33. 3/10/65 892.40

+5.2%

LA/MA 21dmaROC

P-I IP21

V

OPct

.999

-.073 41 12

-.077 -234

.035

DJI fell to 889.10. Paper loss of 0.3%.

It then rallied.

34. 3/25/65 898.30

+4.5%

LA/MA 21dmaROC

P-I IP21

V

OPct

1.0

.007 -10 -23

-.073 417 -

.059

DJI fell to 889.10. Paper loss of 0.3%. It then rallied.

35. 4/7/67

853.34

+4.0%

LA/MA 21dmaROC

P-I

IP21

V OPct

.99

.138

21 -16 -.059

-1 .105

DJI fell to 842.43.

Paper loss of 1%. It then rallied to upper band.

36. 7/3/68

903.51

-0.3%

LA/MA 21dmaROC

P-I IP21

V

OPct

.998

.109 63

22 -.049

8 - .035

DJI fell to 870.37.

Paper loss of 3%. It then rallied to upper band.

37.

10/26/70 756.43

+24.2%

LA/MA 21dmaROC

P-I

IP21

V OPct

.989

-.083 -103 -20

.016 -2

.062

DJI hesitated and

then rallied to 937.39 on 5/6/71. No paper loss.

38.

11/13/70 759.79

+23.4%

LA/MA 21dmaROC

P-I IP21

V

OPct

.995

- .126 -126 -34 -

.087 -2 .143

DJI hesitated and

then rallied to 937.39 on 5/6/71. No paper loss.

39. 9/26/80

940.10 +4.9%

LA/MA 21dmaROC

P-I

IP21

V OPct

.993

- .038 -5 -29

- .011 -1

.124

DJI fell to

921.93. 2% paper loss. DJI then rallied to upper band.

40. 6/8/83

1185.5

+4.9%

LA/MA 21dmaROC

P-I

IP21

V OPct

.981

- .42 -37 -39

.003

-5 -.012

DJI rallied

to upper band. No paper loss.

41. 7/5/83

1208.53

+2.9%

LA/MA 21dmaROC

P-I

IP21

V OPct

.988

- .044 -54 -57

.005

-1 .058

DJI fell to

1189.90. Paper loss was 2%. DJI then rallied to upper band.

42. 11/3/83

1227.13

+4.0%

LA/MA 21dmaROC

P-I

IP21

V OPct

.981

- .219 -132 -28

.075

-10 .13

DJI fell to

1214.94. Paper loss was 1%. DJI then rallied to upper band.

43. 10/4/84

1187.57

+53.8%

LA/MA 21dmaROC

P-I

IP21

V OPct

.982

- .213 -11 21

.147

3 - .037

DJI fell to

1189.90. Paper loss was 2%. DJI then rallied to 1825.89 pm 4/29/86

44 3/14/85

1260.05

+43.9%

LA/MA 21dmaROC

P-I IP21

V

OPct

.984 -.154 -111

-6 -.089 -8 -.183

DJI fell . 2% Paper Loss. DJI then rose to 1825.89 on 4/29/85.

45 516/1986

1759.80 +6.7%

LA/MA 21dmaROC

P-I IP21

V

OPct

.976 -.627

-158 -36 -.031

-18 -.243

Two days later,

DJI rose to 1878.28 on 4/29/86.

46

3/29/85 1266.78

+44.1%

LA/MA 21dmaROC

P-I IP21

V

OPct

.998 -.162

-42 -6 -.121

-3 -.182

DJI fell . 2% Paper Loss. DJI then rose to 1825.89 on 4/29/85.

46. 8/6/85

1325.16

+37.8%

LA/MA 21dmaROC

P-I

IP21

V OPct

.984 -.029

-59 -29 .09

-2 .124

DJI fell to

1300.40. 2% Paper Loss. DJI then rose to 1825.89 on 4/29/85.

47. 3/1/89

2243.04

+23.5%

LA/MA 21dmaROC

P-I

IP21

V OPct

.974 -.512

-89 -29 -.116

-9 -.228

DJI reversed

upwards immediately. DJI rose to 2771.09 on 10/4/89.

48. 3/20/89

2262.5

+22.5%

LA/MA 21dmaROC

P-I

IP21

V OPct

.989 -.254 -75

-49 .033

-8 .145

DJI fell to

2257.86. 0.3% Paper Loss. DJI rose to 2771.09 on 10/4/89.

49. 7/3/89

2452.77

+13.0%

LA/MA 21dmaROC

P-I IP21

V

OPct

.984 -.31

-67 -27 .011

-11 -.091

DJI rose immediately.

No Paper loss.

50. 4/26/91

2912.38

+13.5%

LA/MA 21dmaROC

P-I IP21

V

OPct

.994 -.021

-67 -18 - .022

-3 -.026

DJI fell to 2865 and

then rose to 3306.13 on 4/14/92. 2%

paper loss.

51.

3/12/92

3208.63

+3.0%

LA/MA 21dmaROC

P-I IP21

V

OPct

.986 -.157

-151 -27 - .053

-28 -.263

DJI fell to 3181.35

and then rose. 0.6% paper

loss.

52.

3/27/92

3231.44 +2.3%

LA/MA 21dmaROC

P-I IP21

V

OPct

.994 -.139

-128 -43 - .062

-22 .131

DJI fell to 3181.35

and then rose. 2% paper

loss.

53.

4/7/93

3397.77

+16.8%

LA/MA 21dmaROC

P-I IP21

V

OPct

.998 -.26 -77

-5 - .028

-29 .002

DJI rose

immediately. No paper loss. Next sell at 3967.66 on 2/3/94

54. 4/23/93

3413.77

+16.2%

LA/MA 21dmaROC

P-I IP21

V

OPct

.995 -.11 -29

-16 - .032

-28 .006

DJI rose

immediately. No paper loss. Next sell at 3967.66 on 2/3/94

55. 5/10/93

3443.28

+15.2%

LA/MA 21dmaROC

P-I IP21

V

OPct

1.002 -.162 51 6

.03

-7 .025

DJI rose

immediately. No paper loss. Next sell at 3967.66 on 2/3/94

56. 6/10/93

3491.72

+13.6%

LA/MA 21dmaROC

P-I IP21

V

OPct

.995

.078 -69 -22

.092

-9 .133

DJI fell to

3449.92. 1% Paper Loss Next sell at 3967.66 on 2/3/94

57. 6/25/93

3490.89

+13.7%

LA/MA 21dmaROC

P-I IP21

V

OPct

.993

-.167 -33 -15

-.033 -22

.108

DJI fell to

3449.92. 1% Paper Loss. Next sell at 3967.66

on 2/3/94

58. 9/9/93

3589.48

+10.3%

LA/MA 21dmaROC

P-I

IP21

V OPct

.993

.055 82

9 .081

-2 .242

DJI fell to

3537.23. Paper loss = 1.5%. DJI then rallied to next Sell at 3967.66 on 2/3/94

59. 10/4/94

3801.13

+3.2%

LA/MA 21dmaROC

P-I IP21

V

OPct

.991 -.259

-262 -52 -.047

-43 -.106

DJI fell to

3797.43. Paper loss = 0%. DJI then rallied ro resistance.

60. 8/18/95

4614.78

+20.2%

LA/MA 21dmaROC

P-I

IP21

V OPct

. 988 -.061

100 -20

.005

1 -.249

DJI

fell slightly for a week and then rose. 0.4% Paper Loss. Next

Sell on 2/27/96 at 5549.21.

61. 10/30/95

4756.57 +16.7%

LA/MA 21dmaROC

P-I

IP21

V OPct

. 999 -.081

-164 -19

.048 -43 -.062

DJI

rose immediately. No paper loss. Advanced until next Sell on 2/27/96 at 5549.21.

62.

3/20/1997

6820.28

+0.2% Note head

and shoulders.

LA/MA 21dmaROC

P-I

IP21

V OPct

.982 -.342

-191 -30 .008

-50 -.072

DJI

declined to 6391.69. 6.3% Paper

Loss. Note the head/shoulders pattern

that was

completed soon after the Buy B11. DJI then rallied to Sell S9 at upper band.

63 . 6/15/1999

10594

+2.5%

LA/MA 21dmaROC

P-I

P-I^^

IP21

V OPct

.991 -.354 -136 +96

-136 -.045

-76 -.144

DJI rose immediately. No Paper Loss.

64. 12/26/02

8432.61

+4.0%

LA/MA 21dmaROC

P-I

IP21

V OPct

.981 -.576 50 +5

-.068

210 -.334

DJI rose immediately. No Paper Loss.

65. 9/25/03

9343.95

+4.9%

LA/MA 21dmaROC

P-I

IP21

V OPct

.984 .004 300 -66

.023

-29 .035

DJI fell to 9275.06. 1% Paper

Loss. DJI then rallied to sell at

upper band and Sell.

66. 4/13/06

11137.65

+4.0%

LA/MA 21dmaROC

P-I

IP21

V OPct

.994 -.077 -107

-62 -.116 -123 .051

DJI fell to 11074. 0.5% Paper

Loss. DJI rallied to upper band

and Sell.

67. 11/30/2010

11006.02

+13.0%

LA/MA 21dmaROC

P-I

IP21

V OPct

.983 -.12 -36

-72 -.146

-108 .002

DJI rose immediately. As of 5/27/2011 with DJI at 12441.58, there is no

reversing Sell.

68 3/10/2011

11984.61

open ...

LA/MA 21dmaROC

P-I IP21

V

OPct

983

-.242 59

-139

.044

-154 - .033

DJI fell 2% and then rallied. 2% Paper

Loss.

As of 5/27/2011 with DJI at

12441.58, there is no reversing Sell.

69 5/24/2011

12356.21

open ...

LA/MA 21dmaROC

P-I IP21

V

OPct

.978 -.117 26 0

.02

-119 .022

DJI rose immediately. No paper loss.

As of 5/27/2011 with DJI at

12441.58, there is no reversing Sell.