------------------------------------------------------------------------------------------------------------------------------

BUY B2 - Buy at the Lower Band according to Parameters

which vary by Month in the 4-Year Presidential Cycle.

| Jan | Feb | Mar | April | May | June | July | Aug | Sept | Oct | Nov | Dec | Total | ||

| PresElec Year |

19360506 19520501 19720502 19960507 20000505 |

19480720 19480730 19600721 19600728 19680729 19720713 19840724 19960712 19960722 20040726 |

19360821 19680808 19760826 19920821 |

19521016 19721016 19801027 19841010 19921015 20001020 |

19401127 19481119 19481130 19561120 19561129 19761110 1980121 19801218 19841116 20001122 |

19281207 19361221 19961216 20001220 20121112 |

||||||||

| PE+1 | 19290215 19890227 |

19450327 19730326 |

19290527 | 19530828 19730823 |

19610925 | |||||||||

| PE+2 | 19380502 19460506 19860507 20100520 |

19940624 | 19700707 |

19380815 19380829 19700813 19780623 19880816 19880825 20100827 |

19380927 | 19381129 19501106 19581125 19821122 19821129 19861118 19881111 19881121 |

19341220 19381205 19501204 19661201 19821215 19941208 19981210 20021213 |

|||||||

| PE+3 | 19390628 19910624 20110603 |

19310807 19390810 19550809 |

19431110 | 19351202 19351213 19391201 19751203 19831215 19911211 |

There have been 95 Buy B2s since 1928. The average gain was

10.0%.

All produced a gain. The biggest average gains came in the

Second Year of

a Presidential Election, in February and from September to

December.

The lowest came in the Year after the Presidential Election and

in June and July.

Size of Percent Gains if DJI Sold Short

on Sell S2

and covered on next Peerless Buy

>10%

34

35.8%

5%-9.99% 31

32.6%

2%-4.99% 28

29.5%

0%-1.99% 2

2.1%

Losses

0

0%

Buy B2s: 1928-201319281207 B2 271.1 .153

19290215 B2 300.4 .057

19290527 B2 293.4 .069

19341220 B2 99.6 .044

19350531 B2 110.64 .198

19351202 B2 140.7 .11

19351213 B2 140.2 .114

19360506 B2 149.7 .265

19360821 B2 160.8 .178

19361221 B2 175.9 .077

19380502 B2 110.7 .065

19380815 B2 136.9 .045

19380829 B2 137.1 .044

19380927 B2 130.2 .21

19381129 B2 147.1 .05

19381205 B2 147.5 .047

19390628 B2 132.8 .16

19390810 B2 137.3 .122

19391201 B2 146.5 .043

19401127 B2 129.8 .017

19431110 B2 132.7 .236

19450327 B2 152.8 .073

19480720 B2 183.6 .034

19480730 B2 181.3 .047

19481110 B2 174.5 .033

19481119 B2 177 .018

19481130 B2 171.2 .053

19501106 B2 222.5 .164

19501204 B2 222.3 .166

19520501 B2 256.4 .06

19521016 B2 264.9 .102

19530828 B2 265.7 .124

19550809 B2 448 .048

19561120 B2 470.1 .048

19561129 B2 466.6 .056

19581125 B2 540.5 .191

19600721 B2 616.6 .029

19600728 B2 605.6 .048

19601025 B2 566 .239

19610925 B2 691.2 .058

19661201 B2 789.95 .124

19680729 B2 883.36 .107

19700707 B2 669.36 .063

19700813 B2 707.35 .325

19720502 B2 935.2 .032

19720713 B2 916.99 .033

19721016 B2 921.66 .137

19730326 B2 927.9 .043

19730823 B2 864.46 .04

19750529 B2 815 .061

19751203 B2 825.49 .223

19760826 B2 960.44 .051

19761110 B2 924.04 .065

19780623 B2 823.02 .103

19801027 B2 931.74 .059

19801210 B2 916.21 .062

19801218 B2 930.2 .046

19810504 B2 973.34 .04

19821122 B2 1000 .057

19821129 B2 1002.85 .054

19821215 B2 992.64 .079

19831215 B2 1236.79 .037

19840724 B2 1086.57 .187

19841010 B2 1177.23 .096

19841116 B2 1187.94 .086

19861118 B2 1817.21 .324

19880816 B2 2021.51 .08

19880825 B2 2010.85 .086

19881111 B2 2067.03 .124

19881121 B2 2065.97 .124

19890227 B2 2250.36 .231

19910624 B2 2913.01 .033

19910628 B2 2906.75 .035

19911205 B2 2889.09 .161

19920821 B2 3254.1 .076

19921015 B2 3174.68 .102

19940624 B2 3636.94 .068

19941208 B2 3685.73 .506

19960507 B2 5420.95 .06

19960712 B2 5510.56 .035

19961216 B2 6268.35 .094

19981210 B2 8841.58 .259

19990611 B2 10490.51 .061

20000505 B2 10577.86 .038

20001020 B2 10226.59 .06

20001122 B2 10399.32 .082

20001220 B2 10318.93 .09

20021213 B2 8433.71 .04

20040726 B2 9961.92 .033

20041022 B2 9757.81 .118

20100520 B2 10068.01 .034

20100827 B2 10150.65 .262

20110603 B2 12151.26 .022

20121112 B2 12815.08 .184

20130821 B2 14897.55 .02

------------------------------------------------

No.= 95 .100

(1945-2013 No.= 74 .098 )

PE 45 .085 PE +1 10 .076 PE +2 24 .139 PE +3 16 .104 Jan 0 - Feb 2 .144 Mar 2 .058 Apr 0 ---- May 11 .084 Jun 7 .059 Jul 10 .062 Aug 14 .107 Sep 2 .134 Oct 8 .114 Nov 19 .103 Dec 20 .124 1-10 20 .120

11-20 28 .107

21-31 47 .086

Code for Buy B2s is too lengthy to reproduce here.

They are broken down by months and year in the 4-year Presidentail

cycle. BCALC.bas - b2calc.

|

-----------------------------------------------------------------------------------

(C) 4/26/2013 William Schmidt, Ph.D.

Buying on a close between the DJI's

3.5% and 2.0% lower band only works

consistenly well when one also takes into

account the four year Presidential Cycle,

price momentum, the current IP21,

the V-Indicator and the DJI's chart. The latter

key values must not be unusually weak.

Valid Buy B2s mostly occurred from June to December

but never in September by design.

For momentum indicators, we use the

percent change of the DJI over the

last 65 days and the annualzied rate of change

of the 21-day ma. Beware of

buying at the lower band right after a mid-Summer

completed head and shoulders pattern

and too soon after a major Peerless Sell.

Most of the Buy B2s occur after May.

This has a lot to do with the trading range

and declines that are common after May.

Many have noticed this overall pattern.

http://allstarcharts.com/sell-in-may-and-go-away-2/

But I believe it is essential to

distringuish which year we are considering in the

four year cycle and whether a fiscally

conservative President is in office or a

Demcratic President who believes in

government stimulus using fiscal or monetary

policies.

Buy B2s Are Not Allowed in The Tear after A Presidential Election

The year after a Presidential

Election has historically has had to many big declines

that rupture the lower band to allow Buy

B2s. Bull markets or trading ranges occurred

only in 1921 and 1925 after April, for

four months in 1933, 1945, for the last 6 months of

1949 and the last 3 months of 1953.

Democrats after World War II stimulated the economy

through government invention. This

is seen in the bull markets of 1961, 1965, 1993, 1997

and 2009. The fiscally conservative

Democrat Carter was an exception. 1977 brought

an unrelenting bear bear market.

Market weakness was often quite

severe when a fiscally conservatove Democrat or

typical Republican was in office.

Just consider how weak the DJI was in 1917 after June.

The 1919-1921 bear market ended

only in April) 1921. Going forward we see severe bear

markets in 1929 after September,

1933 (where the DJI swang in 20%+ moves from down

to up and down and up and down),

1937, 1941, 1949 (the DJI fell until June),

1953 (DJI fell until September),

1957 (bear market from July to November),

1969 (bear market after May), 1973, 1977,

1981 (after April) and 2001.

Buy B2s Occur Most Often in A Presidential Election Year.

But They Must Be Applied Carefully.

The first few months in a Presidential

Election Year often show unusual weakness.

From the summary just below, you

can see that the most reliable lower band Buys

occur in the second half of the

year, but that buying at the lower band in September

was particularly unreliable because

the decline worsened in October.

Presidential Election Years

First, we consider the Buy B2s in

the Presidential Election year. From the summary

below, you can see that Buy B2s

have been carefully crafted to work around the many

cases. We do this mostly by

eliminating cases were the Peerless momentum and internal

strength indicators were unusally

weak. The 65-day pct change was below -.11 (-11%)

and the annualzied 21-day ma was

falling at a rate below -0.65 (-65%).

See below how often there was too

much weakness in the first few months of the year

and how often September declines to

the lower band brought steeper additional

declines in September.

1916 DJI declined steadily

until August.

1920 DJI declined all year

1924 DJI declined steadily until late May

1928 The lower band brought tradeable rebounds all year except June.

1932 DJI declined from February to July and from September to

November.

1936 The lower band brought tradeable rebounds all year except April

1940 Only minor rallies until June. May collapse.

1944 Tagging the 3% lower band worked well. 3x: February, April and September

1948 DJI declined until March. Lower band buys would have

failed in July and early November.

1952 DJI declined steadily until April.

1956 10% trading range made buying at lower band bad trades in May, August and

September.

1960 DJI declined steadily until April.

The lower band in September failed to bring a rebound.

1964 DJI rose all year. June,

August and December declines to lower 2% band brought rebounds

1968 DJI declined until March. Lower band reversals in March and early August.

1972 DJI rose in first and last 3 months of year. Good Buy B2s in May, July and October

1976 DJI rose in first two months. Many good

lower band buys except early

October

1980 DJI declined until April.

Lower band buys worked well after August.

1984 DJI declined

steadily until July Good lower band reversals in October and December.

1988 Buying at 3.5% lower band worked well in Jan,

March, May, August and November

1992 Buying at 3.5% lower band worked well in April,

August and October

1996 Buying at 3.5% lower band worked well in April,

May, July and December

2000 DJI declined until March.

In September and October, the lower band did not hold up.

2004 DJI declined until October.

Buying at 3.0% lower band worked well in May, July and October.

2008 Extreme bear market. Only December brought a successul lower band Buy.

2012 DJI rose. Lower band buys in April, May and October would have led to paper losses.

Automatic Buy B2s in a Presidential Election Year

=========================================

Presidential Year Buy B2s:

57 cases.

12 Decembers

10 Novembers

8 Octobers

None in September

8 Augusts

8 Julys

2 June

3 May

12/71928 271.1

+15.3% .966 .442 -52

-40 -52 -.03 -652 .223 .11

(271.1-263.9)/ 271.1 adv = 110

decl 598 DJI fell one more day to 263.9

Also 12/11/1928

5/6/1936

149,7 +15.4% 0 .977

-.945 -128 12 -566 -.077 -403 -.24 -.007

(149.7-146.7)/148.6

adv= 519 decl = 135 DJI rose next day

8/21/1936 160.8 +7.5% 0

.968 -.272 -56 -38 -248

-.144 -171 -.126 .073

12/21/1936 +7.7% 0 175.9

.972 -.414 -72 -4 -318 -.138 -282 -.221

.052

11/27/1940 129.8 +1.7%

-.142 -29 -16 -145

-.088 -57 -.005 .025

fell to 128.4 before rallyiing

Note B9 on decline to lower band in Sept. No need for a Buy B2.

9/14/1944 142.9 .977 -.293 22

-18 117 -.079 1 -.163 -.016

7/20/1948 183.6 +3.4% .971 -.503

-90 27 -384 -.052 -250 -.021 .016

Declined to 176 on 9/27

Note bearish head/shoulders pattern.

7/30/1948 181.3 +4.7% .969 -.521

-93 -46 -395 -.104 -237 -.204 .001

11/10/1948 174.5 +3.3% .945 -.483

165 -4 705 .097 262 .054 -.049

Fell to 171.2 on 11/30

11/19/1948 177.0 +1.8% .972 -.60

+178 5 +.057 +275 -.078 -.019

Fell to 171.2 on 11/30

11/30/1948 171.2 +5.3% .962 1.206

83 4 357 -.08 157 -.332 -.067

5/1/1952 256.4 6.0% 0

.979 -.49 -171 -7 -631

-.054 -320 -.373 -.07

adv= 160 decl = 728 DJI rose next day

10/16/1952

maybe 10/15/52 267.1 +9.3%

.987 -.057 -49 -16 -180 -.009

-133 -.114 -.03

(267.1- 263.9)/ 267.1

Old S8/New S16 12/30/52

6.1%

adv= 120 decl = 915 DJI fell one more day to 264.9

X 8/22/1956 bad .975 -.252 -106 -6 -335 .004 -.319 .107

.021

X 8/30/1956 bad .969 -.527 -154 -33 -488 -.083 -386

-.169 .036

11/20/1956

11/29/1956

7/21/1960

7/28/1960

10/25/1960

June 8, 1964 should be a Buy B2

800.3

.978 .434 -103 -20

-283 -225 -664 -.391 -.005

7/29/1968

8/8/1968

X 12/23/1968 bad

X 12/30/1968 bad

5/2/72

935.2 3.2%

.977 -.071 -110 -24 -235 -.036 -1

.132 .03

7/17/1972

maybe 7/18/72 911.72

3.9% .978 -425 -179 -9 -383

-.094 -3 -.34 -.062

(

911.72 - 910.45) / 911.72-

10/16/1972

8/26/1976 good .977 -.253 -64 12 -117 -.006 -2 -.072 -.012

10/18/1976

11/10/1976

10/27/1980

12/10/1980

12/18/1980

7/24/1984

10/10/1984

11/16/1984

gone why? 12/3/1984

8/10/1988

8/18/1988

11/11/1988

11/21/1988

8/21/1992

10/15/1992

5/7/1996

7/12/1996

7/22/1996

12/16/1996

5/5/2000

10/20/2000

11/22/2000

12/1/2000

12/20/2000

7/26/2004

10/22/2004

X 6/3/2008 cancelled by S9/S12

X 6/9/2008 cancelled by S9/S12

11/12/2012

Automatic Buy B2s in Second Year

after

A Presidential Election Year

===================================

1930

1934 Decline ended in July

12/20/1934 .98

1938

8/15/1938

8/29/1938

11/18/1938 .98

11/29/1938 .968

12/5/1938 .975

12/9/1938 .98

1942 Decline to May

1946

X 8/26/1946 terrible.

1950 Decline ends in July

11/6/1950

12/4/1950

1954

1958

11/25/1958 .977

1962 Decline until end of June

1966 Secline until end of October

X 8/10/1966 -.057 BAD

12/1/1966 .028

1970 Decline until May

8/13/1970

1974

1978 11/1/1978 -.04

1982 Decline until August

11/22/1982

11/29/1982

12/15/1982

1986

5/16/1986 .976 -.627 +.073

11/18/1986

1990 8/28/90 don't buy on jump from .903 cl/ma t days ago

2614.85

1994 12/8/1994 -.054 .98

1998 8/17/1998 is bad -.071

12/10 .976

12/16 .972

2002 Declines until July

12/13/2002 .973

12/19/2002 .966

2006

2010 8/20/2010 .974 -.023

2014

Automatic Buy B2s in Third Year

after

A Presidential Election Year

===============================

1931

X

B3 to be B2 8/5/1931

+5.7%

134.1 .953 -.995 -35 7 -198

.065 -222 -.073 -.115

1935

12/2 12/1935

140.7 .979 .017 21 -9 118 -.041 -102

-.298 .097

12/13/1935

140.2, .973 -.281 -13 -33 -72 -.168 .111

.049

Reversed by S15 on 2/18/1936. Too early for Sell S15?

1939

Now a Buy B3 - 8/18/1939

+13.7% 3% Reversing Buy Signal +13.7%

8/28/1939

1943

8/4/1943

136.9 .965 -.578 =58 18 -291 -.119 -175

-282 -.004

8/9/1943 +4.9%

135.2 .961 -.759 -82 -10 -411 -.191 -197

-.414 -.028

also 8/10/1943

1947

8/11/1947

179 .975 -.376 -64 -42 -266 -.067 -111

-.095 .041

Fell to 174/9 before reversing up.

12/8/1942

176.7 .978 -.342 -121 32 -505 -.049 -182

-.076 -.018

1951

1955

1959

1963

1967

6/5/67

847.77 .966 -.733 -192 -58 -480 -.083 -11

-.35 .001

8/28/87

894.71 .979 -.089 -104 -9 -260

-.035 -5 .016 .026

1971

8/9/1971 +6.8%

1/2% Reversing Buy

Signal +6.8%

.963 -.802 -277 -36 -586 -.159 -4 -.376

-.112

1975

8/8/1975 817.74

.973 -.764 -325 -35 -618 -.202 -5 -.316

-.023

Now a Buy B3 8/20/1975

+5.3%

Reversing Buy Signal

+5.3%

8/20/75 793.26

.965 -.772 -373 -13 -708 -.277 -6 -.258

-.055

12/3/75 825.49

.976 -.003 -8 -37 -16

-.028 -2 .008 .002

12/9/75 824.15

.977 -.164 -96 -8 -181

-.034 -2 .004 -.02

1979

1983

8/4/1983 .979 -.369 -206 -63 -404 -.044

-14 -.124 -.021

Also 8/8/83, 8/9/83, 8/10/83

Now a Buy B3 8/8/1983 +7.0%

Reversing Buy Signal +7.0%

12/15/1983 .978 -.163 -66 -48 -130 -.072

-8 -.233 .01

1987

1991

6/24

.978 .052 -60 -47 -111 .113 -9 .016 .019

Also 6/28

8/19

.968 -.469 -42 -62 -78 -.062 -9 -.319

.001

12/5

.975 -.57 -128 -15 -235 .034 -23 -.184 -.042

1995

1999

6/11/99

.978 -.564 -184 -7 -183 -.038 -90 -.224 .067

8/2/1999

.965 -.453 -272 -41 -271 -.049 -108 -.223

-.022

8/6/99

.978 -.448 -410 -30 -409 -.069 -140 -.202

-.023

2003

2007

8/14/2007 +5.5% 1%

Reversing Buy Signal

+5.5%

13028.92 .964 -.809 -576 -63 -519 -.088

-.023

2011

6/3/2011

.972 -.544 51 -6

51 -.036 -140 -.047 .006

2015

More

Considerations on Buy B2s

There have been --- reversing Buy B2s since 1928. All would have been closed

out profitably on the next Peerless Sell signal but in 4 csses, there would have

been a paper loss of between 5% and 9%. One could use a stop loss 5%

below where the Buy B2 signal is employed or judge a Sell S10 if key,

well-tested support is decisively broken.

The best way to avoid these losses is not take the Buy B2 when a DJI

or even an S&P head/shoulders pattern has appeared until the minimum

downside objective from this pattern has been completed. Instead use

the Judged S10 rules. Look at the examples of 1956, 1976, 1988, 2000

and October-November 2012 below. Learn to recognize these head/shoulders

patterns.

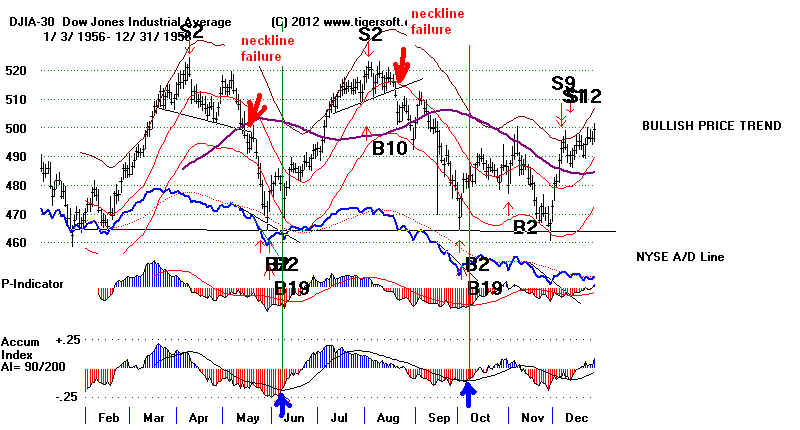

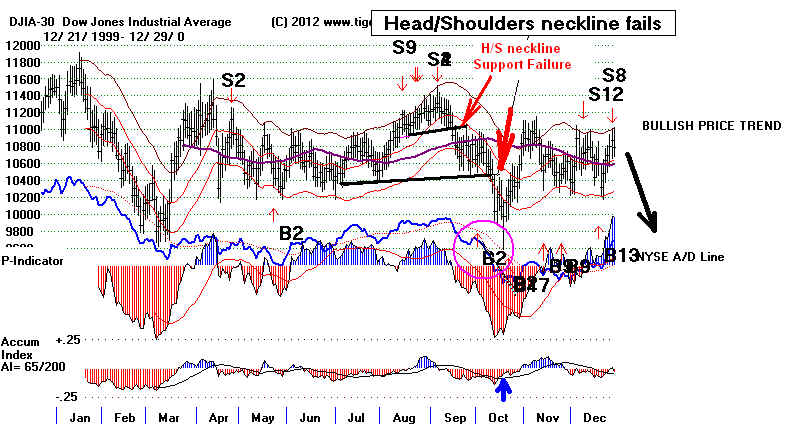

Be very careful when a Head/Shoulders pattern appears.

These normally bring declines below the lower band. This makes

Buy B2s risky at this time. Should this occur, it is probably best to

not Buy until the NYSE A/D Line breaks its downtrend.

1956 |

| 1976 There is no head/shoulders pattern here to get a minimum

downside objective, but the decline went 5% below the first Buy B2.  |

1988 |

2000 |

2012 |

Simple drops to the lower band if they do not follow neckline-breaks

or well-tested support breaks are ordinarily buying opportunities

in a Presidential Election Year unless a head/shoulders pattern has appeared.

Altogether Buy B2s averaged a gain of 8.4%. But additional weakness is not

uncommon, especially if well-tested support or a head/shoulders pattern

neckline is violated. In 13 cases, declines out-numbered advances on the

day of the Buy B2. In 9 of these 13 cases, the DJI fell at least a day

further.

Very little harm is done waiting another day to Buy in these cases.

Early and Mid-November seldom brings a bottom if there is an October-

November sell-off. For this reason Buy B2s are not ordinarily allowed

in November.

Reversing Buy B2s: 1928-2013

Date

DJIA

Pct. Gain

Reversing Sell

----------------------------------------------------------------------------------------------------------------------

6/15/1928 205.9 +4.1% .964 -.60 -114

7 -114 0 -829 -.193 .023

(205.9-202/ 205.9)

12/719/28 271.1 +15.3% .966 .442 -52 -40

-52 -.03 -652 .223 .11

(271.1-263.9)/ 271.1 adv = 110

decl 598 DJI fell one more day to 263.9

5/5/1936 148.6 +12.0% .967

-.887 -141 24 -623 -.097 -423 -.066 -.007

(148.6-146.7)/148.6

adv= 519 decl = 135 DJI rose next day

8/21/1936 160.8 +7.5% 0 .968 -.272

-56 -38 -248 -.144 -171 -.023 .073

Dec 1936

10/26/1944 145.8 +12.5% .988 -.056

13 -20 72 .130

-28 .097 0

(145.8 - 145.6)/145.8

7/19/1948 181.2 +4.7% .957

,689 -118 -46 -500 -.068 -288

-.119 .004

(181.2-176)/ 181.2

5/1/1952 256.4 6.0% 0

.979 -.49 -171 -7 -631

-.054 -320 -.373 -.07

adv= 160 decl = 728 DJI rose next day

10/15/52 267.1 +9.3%

.987

-.057 -49 -16 -180 -.009 -133

-.114 -.03

(267.1- 263.9)/ 267.1

Old S8/New S16 12/30/52

6.1%

adv= 120 decl = 915 DJI fell one more day to 264.9

5/15/1956 494.8

.975 -.337 -80 -16 -.255 -.154 -334 -.294

.054

(494.8 - 468.8) Big loss.

5/29/1956 477.7

.963 -.918 -161 35 -512 -.229

-501 -.583 -.016

10/31/1956 479.9 +2.7%

.99

.111 -12 -67

-38 .029 -123 -.097 =.078

(479.9 - 466/1) / 479.9

high

4/28/1960 604.3 +3.4%

.974

-.307 -.93 -16 -263

-.135 -416 -.136 -.059

(604.3- 599.6) / 604.3

7/18/60 626 +1.3%

.977

-.414 -70 -10

-198 -.084 -381 -.185

-.001

(626 - 601.7) / 626

1.3%

S1 8/29/60 8.9%

adv= 335 decl =635 DJI fell five more day to 601.7

10/3/1960 577.8 +3.2%

.97 -.961 -198 -11 -559 -.206

-680 -.384 -.109

(577.8 - 573.1)/ 573.1

10/24/60 71.9 3.2%

.983 -.272 -126

-13 -354 -.094 -539

-.185 -.066

(571.9 -

.566) / 571.9

S9 8/3/61

4.1%

adv= 149 decl = 926 DJI fell one more day to 566.00

June 8, 1964 should be a Buy B2

800.3

.978 .434 -103 -20 -283

-225 -664 -.391 -.005

8/1/1968 878/07 11.3% .972

-.313 -143 -4 -329 -.049 -15

-.242 -.036

(878.07 - 869.65) /

878.07

5/2/72 935.2 3.2%

.977 -.071 -110 -24

-235 -.036 -1 .132 .03

S12 5/22/72

5.6%

(935.2 - -925.12)/ 935.2

adv= 501 decl = 980 DJI fell one more day to 933.47

7/18/72 911.72 3.9% .978

-425 -179 -9 -383 -.094 -3 -.34

-.062

( 911.72 - 910.45) / 911.72-

S9 8/3/72

2.7%

adv= 443 decl = 820 DJI rose next day

10/16/72 921.66 13.7%

0 .976 -.323 -134

-21 -287 -.093 -3 -.177

-.001

S4 12/11/72 15.6%

adv= 415 decl = 985 DJI rose next day

10/5/76 966.76

1.8%

(966.76 -- 931.43) / 966.76

S4 12/22/76

9.4%

adv= 418 decl =1022 DJI fell one more day to 959.69

Dec 1976?

10/27/1980 931.74 +5.9% .98 -.105

-49 23 -95 -.094 -3 .04 .014

(931.74 - 917.75 )/ 931.74

Dec 1980

7/24/1984 1086.57 % 0

-.473 -219 -21 -383 -.-67 -14 -.308

-.066

1825.89 - 1086.57) / 1086.57

Should be a Buy on

10/9/1984 .975

-.27 -31 5 -54 -.17 -5 -.105

.034

Dec 1984 hould be a Buy on

12/10/1984 .98

-.56 -150 0 -263 -.134 -11

-.229 -.041

7/22/1988 +5.6% .976 -.478 -136

-67 -233 .024 -26 -.209 .039

(2066.99 - 1990.22)/ 2066.99

Should be a Buy on 11/14/1988 .964 -.378 -15

-22 -265 .027 -15 -.043 .013

8/21/92 3254.1 21.9%

.976 -.128 48 -28 93 -.061 -8

-.186 -.043

(3254.1 -

3136.58) / 3254.1

??? S4 2/3/94

7.4%

adv= 669 decl =1036 DJI fell one more day to 3228.17

4/11/1996 5487.07 4.8%

-.205 0

-6 1 .035 -16 -.068 .065

( 5487.07 -

5420.95 )/ 5487.07

5/7/1996 5420.95 6.0% 0

.979 -.372 41

82 52 -.034 -4 -.012 .008

7/11/96

5520.54

23.8%

S9 4/22/97 -4.9%

(

5520.54- 5346.55 )/ 5520.54

adv= 531 decl =2020 DJI fell two more days to 5349.51

Dec 1996 ?

4/17/2000 +5.1%

.964 -.014 -73 -14 -73 -.033 -71 -.18

-.098

X

5/3/00

10480.13

7.9%

S4 9/6/00

9.6%

adv= 815 decl =2149 DJI fell one more day to 10412.49

5/22/2000 +4.1% .985 -.335 -123 -50

-123 -.001 -62 -.071 .002

(10542.55 - 10299.24

)/10542.55

6/22/2000

.981 -.051 117 -32 117 -.06

-51 .07 -.051

(10404.75 - 10376/12)/

10404.75

10/2/2000 10700.13 +2.0% .977 -.558 -145

-47 -146 -.065 -115 -.245 .028

BAD (10700.13 - 9975.02 )/ 10700.13

Dec 2000

5/18/04 9968.51 3.5%

.976 -.546

-454 70 -425 -.082 337 -.056 -.067

( 9968.51 -

9814.66)/ 9 9968.51

7/19/04 10894.05 +2.2%

.98 .327 243 -16 227 -.10 -161 -.149

-.028

(10894.05 - 9814.66) / 10894.05

S2

9/2/04 3.8%

adv= 2389 decl = 924 DJI fell two more days to 9937.64

10/15/04 9933.38 10.1%

.983 -.366 94

-21 88 -.047 -145 -.028 -.024

(9933.38 - 9749.99) / 9933.38

7/8/2008 1384.21 +2.2% .966

-.831 -642 150 -578 -.157

-335 -.064 -.11

(11384.21 -10962.54) /

11384.21

S9 7/23/08

6.1%

adv= 2165 decl =1037 DJI rose next day

4/10/2012 11715.93 4.4% 0%

.969 -.187 -253 -160 -253 .025 -126 -.078

S15 5/1/12

13279.32

( 11715.93 -

)

adv= 462 decl =2612 DJI rose next day to 12805.29

X Buy B2

5/14/2012 3.5

12695.35

====

adv= 481 decl =2607

10/23/2012 13102.53

-.403 -38 -39 -38 -.154 -98 -.078

.028

13102.53 -

12542.38) BAD!

11/13/2012 12756.18 .969 -.515 -146 -99 -146

-.145 -128 .01 -.032

Good and Nov is

reliable.

-----------------------------------------------------------------------------------

Presidential Election years often feature DJI prices getting

caught in a trading

range for a significant part of the middle of the year and the rallies from October

lows. These tendencies allows us to buy profitably at the lower band using our Buy

B2.

This is made safer because Sell-offs of more than 10% are rare after April

in Presidential

Election

years. Of course, 1920, 1932, 1960 and 2008 are notable exceptions, as prices

in these years fell more than 10% after April. In each of these 4 cases, there was a

serious economic slow-down under way. Will 2012 be able to hold up?

So, buying at the lower band or well-tested support works well most of the time

in May or June and from August to October. Trading ranges dominated the DJI for the

Presidential Election Years as follows:

1916 - Slightly declining trading range until mid August.

1920 - Declining trading range until end of October.

1924 - Flat trading range from August to end of October.

1928 - mid March to mid August trading range followed by an

upside breakout.

1932 - Sell-off until June. August to September was a

head/shoulders top.

1936 - April Sell-off. Trading

range from July to end of September.

1940 - May Sell-off and rising

price channel from June to October.

1944 - Flat trading range from mid June to end of November.

1948 - Flat trading range from mid April to end of October.

1952 - Rising price channel from mid January to mid November.

.

1956 - Broad trading range from January to end of December.

1960 - Trading range from March

to end of August.

1964 - Rising Price Channel for entire year.

1968 - Flat Trading range from early April to end of August.

1972 - Flat Trading range from early March to end of October.

1976 - Flat Trading range from February to mid September.

1980 - Flat Trading range from August to end of December.

1984 - Flat Trading range from August to end of December.

1988 - Rising Price Channel for entire year.

1992 - Flat trading range for entire year.

1996 - Flat trading range from February to early September.

2000 - Flat trading range from mid March to end of September

2004 - Rising Price Channel for entire year

2008 - Declining trend all year, except for brief

head/shoulder until mid November.

Buy B2s are Presidential Election Year Buys at the lower band from April

to December, except in September and November. The lower band is more often

fully tagged with these signals. The DJI should close more than 1.2% but not

more than 5% below the 21-day ma. The annualized Daily Rate of Change of

the 21-day ma must not be less than -61% with the V-Indicator below -200. Buy B2s

are not allowed in September; the probability of a sell-off sometime in late September

and October are too high. Other Buys take their place in November, but they can

occur in December, because the odds of a late December rally are so high.

We do have to be careful with Buy B2s. Major support could decisively

fail just after a Buy B2. Such support failures usually bring Sell S10s or judged

S10s. These bring additional sell-offs even when the computer cannot spot

a breakdown as a Sell S10 because it is not flat or the support level does not

last the requisite 40 trading days. Use the Tiger Sell S5 to find such breakdowns.

Waiting to see if a diagonal support holds or fails is probably a good tactic especially

in October.

It is also risky to use a Buy B2 within a month of a previous Buy B2, because this could

be the sign of a head and shoulders top formation. The case of mid 2012 stands out

because the second Buy B2 did occur as prices declined from a right shoulder-like

formation to the critical neckline support. A breaking of this particular support

was judged on 5/15/2012 here to be too dangerous to allow the Buy B2 to stand.

Disallow a Buy B2 with 30 trading days of an earlier B2.

Buy B2s, as in March

1980, can occur after a serious

decline.

| Up until 2012, there have been 16 reversing Buy B2s since 1928 that have been closed out. . All were profitable. The average gain was 8.4%. Note the signals' distribution by month: May 5 6.9% avg. but only 4.4% since 1960 July 4 August 1 October 4 December 1 When breadth is negative on the day of the Buy B2, the odds are nearly 75% that the DJI will fall, at least, one more day, Reversing Buy B2s: 1928-2013 Date DJIA Pct. Gain Reversing Sell ---------------------------------------------------------------------------------------------------------------------- Buy B2 12/7/28 271.1 15.3% S9 1/30/29 3.6% adv = 110 decl 598 DJI fell one more day to 263.9 Buy B2 5/5/36 148.6 14.1% S2 9/8/36 2.6% adv= 519 decl = 135 DJI rose next day BuY B2 5/1/52 256.4 6.0% S10 9/10/52 1.7% adv= 160 decl = 728 DJI rose next day Buy B2 10/15/52 267.1 9.3% S8 12/30/52 6.1% adv= 120 decl = 915 DJI fell one more day to 264.9 Buy B2 7/18/60 626 1.3% S1 8/29/60 8.9% adv= 335 decl =635 DJI fell five more day to 601.7 Buy B2 10/24/60 571.9 3.2% S9 8/3/61 4.1% adv= 149 decl = 926 DJI fell one more day to 566.00 Buy B2 5/2/72 935.2 3.2% S12 5/22/72 5.6% adv= 501 decl = 980 DJI fell one more day to 933.47 Buy B2 7/20/72 910.45 4.1% S9 8/3/72 2.7% adv= 443 decl = 820 DJI rose next day Buy B2 10/16/72 921.66 12.4% S4 12/11/72 15.6% adv= 415 decl = 985 DJI rose next day Buy B2 10/5/76 966.76 1.8% S4 12/22/76 9.4% adv= 418 decl =1022 DJI fell one more day to 959.69 Buy B2 8/21/92 3254.1 21.9% S4 2/3/94 7.4% adv= 669 decl =1036 DJI fell one more day to 3228.17 Buy B2 7/11/96 5520.54 23.8% S9 4/22/97 -4.9% adv= 531 decl =2020 DJI fell two more days to 5349.51 Buy B2 5/3/00 10480.13 7.9% S4 9/6/00 9.6% adv= 815 decl =2149 DJI fell one more day to 10412.49 Buy B2 5/18/04 9968.51 3.2% S2 9/2/04 3.8% adv= 2389 decl = 924 DJI fell two more days to 9937.64 Buy B2 7/8/2008 11384.21 2.2% S9 7/23/08 6.1% adv= 2165 decl =1037 DJI rose next day Buy B2 4/10/2012 11715.93 4.4% S15 5/1/12 13279.32 adv= 462 decl =2612 DJI rose next day to 12805.29 Buy B2 5/14/2012 12695.35 ==== adv= 481 decl =2607 ---------------------------------------------------------------------------------------------------------------------------- N=16 Avg.= +8.4% |

All

Buy B2s (both reversing and reinforcing)

Count of All Buy B2s by Month

Month Count

Average Gain

--------- ---------

-------------------

April

6

+8.0%

May

9

+5.2%

June

2

+8.5%

July

8

+2.9% low

August

5

+7.2%

September none -

not allowed

October 13

+9.8%

November none - not

allowed

December 1

+15.3%

----------------------------------------------

44 Avg.Gain = +6.9%

There were 43 Buy B2s, counting only the first such signal in a cluster.

The average gain at the time of the next Peerless Sell is 7.0%. All but one

wase profitable. 19 of the 43 trades brought small gains, +1% to 5%. 8

produced

gains of more than 10%. There were 3 cases where B2s brought gains of more

than 20%. October B2s were generally the most powerful. July B2s were

relatively weak, gaining only +2.9%.

Paper losses should be about expected half the time. There were 23 instances

where a Buy B2 brought a paper loss of more than 1%. 3 showed a bigger loss

than

than 4%. The best support in these cases was the first quarter low.

Biggest Paper Losses

Presidential Election years often feature DJI prices getting caught in a trading

range for a sustained part of the Summer, with a price breakdown and bottom in October

and then a rally after the Election is over so that partisans can celebrate with

buy orders as prices near a top which then leads to a decline the next year. The

Peerless Buy B2s take advantage of this tendency.

When employing the Buy B2, recognize that a deeper decline may occur if

well-tested support lies below the lower band. Take into account where the added

risks if there has already been a speculative boom, as in 1999-2000, and the NYSE

A/D Line has been lagging for some time. Mid-October sell-offs can bring a deeper

decline, even though there has been a Buy B2 in early October. The presence of a

completed head and shoulders pattern also adds extra downside risk, as in 1956.

Buy B2s that come in too close a succession may be considered less trustworthy,

because they thereby become too obvious or they may signify a bearish head and

shoulders top is forming. There are no cases of separate Buy B2s that come within a

month of each other, except the disallowed one in May 2012.

Below are the four biggest paper losses when taking an automatic Buy B2 and

their Peerless charts.

1. 8% paper loss 5/15/1956 - The lower band did

not work because of the presnce

of a very broad trading range. In this case, there was a completed

head/shoulders pattern, which warned of more weakness..

2. 5% paper loss 10/5/1976 - Mid-October

sell-off went below the lower band to well-tested

horizontal support. Early October B2s can be somewhat premature.

3. 5% paper loss 8/10/1988 - The best support was at the

bottom of the price channel.

4. 9% paper loss 10/2/2000 - Mid-October sell-off went

below the lower band to well-tested

horizontal support.

Buy B2 -

8% paper loss 5/15/1956  |

Buy B2 - 5% paper loss 10/5/1976  |

Buy B2 - 5% paper loss 8/10/1988  |

| Buy B2 - 9% paper loss 10/2/2000 |

Paper Losses and Buy B2s

In light of the paper losses, one might decide to buy on additional weakness

after a Buy B2, but this would have resulted in chasing and buying at much higher prices

in those cases where the Buy B2 was a reversing signal and the gains were

more substantial. In 8 of the 23 cases where the Buy B2 reversed a Peerless

Sell,

the B2's gain was more than 5%. The three cases where the resulting gains

were +25.1%, 13.7% and 21.9% are reason enough not to delay buying very much

when a Buy B2 occurs.

10/24/1960 Gain

= +25.1%

10/16/1972 Gain = +13.7%

8/21/1992

Gain = + 21.9%

Weak price momentum can be reversed by a Buy B2, as long as the

DJI does not close more than 5% below the 21-day ma or the 21-dma is not

falling at a rate or more than an annualized rate of 97%. There are 9 Buy B2s

where the ANN-ROC is lower than -60% but not lower than -97%. Each brought

a gain of more than 3%. The median gain is 4.6% in these cases.

B2 Date

Ann

Roc IP21

%Gain of a Buy B2

5/5/1936

-.887

-.097

Gain = 5.5%

Reversing Buy....No paper loss.

5/13/1936

-.83

-.035 Gain = 3.3%

Not a reversing Buy Signal. No paper loss.

10/1/1956

-.656

-.186

Gain = +5.1%

Reversing Buy.

This was a paper loss of 1%

10/3/1960

-.961

-.206 Gain = +3.2%

Reversing Buy.

No Paper Loss

4/3/1980

-.907

-.066 Gain = +21.3%

Not a reversing Buy. Paper loss = 3%

6/15/1984

-.704

-.125 Gain = +12.8%

.

Not a reversing Buy. No Paper loss

7/11/1996

-.312

-.013

Gain = + 3.4%

Reversing Buy. Paper Loss

= 2%

7/8/2008

-.831

-.157 Gain

= + 2.2%

Reversing Buy. Paper Loss = 4%

. October

Buy B2s Are The Most Bullish

October Buy B2s are the most common and also the most likely to bring a

gain of more than 5%. 8 of the 13 B2s in October produced gains of more

than that at the time of the next Buy. Two were responsible for 24% gains.

I believe Buy B2s are successful because partisans regularly celebrate the outcome

of the Presidential Election. This is once of the most reliable season patterns

in the stock market. There were no Buy B2 losses, but 2 showed paper losses

of more than 5%. Both were in early October.

10/5/1976

966.76

Gain = +3.0%

.974 -.268

-13 -46 -.001 -1

-.265

DJI fell to 922 in mid October and then rallied to 1000.08 and Sell S2 on

12/28/77.)

Reversing Buy. Paper loss = 5%

10/2/2000

10700.13

Gain = + 0.1%

.977 -.558 -145

-47

-.065 -115

-.245

DJI fell to 9700 intra-day on 10/18/2000 and then rose to 10712.91 and Sell S12 on

12/8/2000

Not a reversing Buy Paper Loss = 9%

More B2s followed from 10/6/2000 to 10/23/2000. These were not used here in the

calculations.

The signals are more likely to work out more powerfully if the P-Indicator and

Accumulation Index show higher levels then on the previous low at the time

of the Buy B2.

BUY B2s: 1928-2012

1.

12/7/1928 271.1

Gain = 15.3%

.966 .442 -52 -40 -.03 -652

.223

Just

before the B2, the DJI was significantly above the Buy B2.

Reversing Buy....3% paper loss.

--------------------------------------------------------------------------------------------------------------------------

None in 1932

--------------------------------------------------------------------------------------------------------------------------

2.

5/5/1936

148.60

Gain = 5.5%

.967 -.887 -141 24 -.097 -423 -.066

Just before the B2, the DJI reached the Buy

B2.

Reversing Buy....No paper loss.

--------------------------------------------------------------------------------------------------------------------------

X - This B2 follows too closely an earlier B2.

5/13/1936 147.9

Gain = 3.3%

.986 -.83 -.92 36 -.035 -295

-.188

Not a reversing Buy Signal. No paper loss.

-------------------------------------------------------------------------------------------------------------------------

3.

8/21/1936

160.80 Gain = + 5.5%

.968 -.272 -.56 -38

-.144 171 -.071

Just before the B2, the DJI reached the Buy

B2.

Not a reversing Buy Signal...No paper loss.

-------------------------------------------------------------------------------------------------------------------------

None in 1940

--------------------------------------------------------------------------------------------------------------------------

4.

4/18/1944 135.1 Gain = +

9.5%

.976 -.489 -102 -34

-.233 -176 -.296

Next sell was on Sell S2 at 147.9 on 6/21/44

In next week, there were B2s on 4/1944 and 4/21/44

Not a reversing Buy Signal. No paper loss.

---------------------------------------------------------------------------------------------------------------------------

5.

10/26/1944

145.80 Gain = + 12.5%

.988 -.056

13 -20 .13 -28 -.144

The next sell was on Sell S9 at 154 on 5/15/45.

Continuation Signal. No paper loss.

-------------------------------------------------------------------------------------------------------------------------

6.

7/19/1948

181.2 Gain = +2.3% Paper

loss - (191.2-176)/181,2 =

3%

.971 -.503 -90

27 -.052 -250 -.08

A Buy B2 after a completed H/S Pattern like the one shown below is

risky.

DJI fell to 176 on 9/27 before rallying to 186.2 and Sell S1 on

10/19/48.

There were 5 more Buy B2s up until 8/2/1948 as part of this cluster.

Not a reversing Buy

Signal. Paper loss =3%.

At this

time, B2s also appeared on 7/20/48-8/3/48. Only the first

occurrence in this series is considered here.

--------------------------------------------------------------------------------------------------------------------------

7.

5/1/1952

256.4 Gain = +6.0%

.979 -.49

-171 -7 -.054 -320 -.374

DJI rallied immediately to 280 and then formed a head/shoulders top.

This was a reversing

Buy Signal. No

Paper loss.

-------------------------------------------------------------------------------------------------------------------------

8.

10/15/1952

267.10 Gain = +9.3%

.987 -.057

-49 -16 -.009 -133

-.114

DJI fell to 263. 2% paper loss. Rallied to Sell S8 at 292 on 12/30/1952.

This was a reversing Buy.

At this time, there was another Buy B2 on `10/22/52 at 263.1. It is not

separated out here

for statistical purposes.

--------------------------------------------------------------------------------------------------------------------------

9.

5/15/1956

494.80 Gain = +3.9%

.975 -.337

-80 -16 -.154 334

-.294

DJI fell from 510 to a low of 467 on 5/28/1956.

It then rallied to Sell S9 at 513.9 on 8/6/56.

The additonal Buy B2s here from 5/16/56 to 5/29/56 are considered part of the

same set.

This was not a reversing Buy. Paper

Loss = 8%

------------------------------------------------------------------------------------------------------------------------

10.

10/1/1956

468.70 Gain = +5.1%

. .949 -.656 -173

-5 -.186 -462 -.394

DJI fell from 468.70 to a low of 463 on 11/29/1956. This was a paper loss of 1%

It then rallied to Sell S12 at 492.7 on 12/6/56.

Reversing Buy.

There was a second Buy B2 on the next

day, 10/2/1956, with the DJI at 479.9

-----------------------------------------------------------------------------------------------------------------------

X - Disallow this B2 because it occcured too

close to an earlier B2.

10/31/1956

479.90 Gain = +2.7%

.99 .111

-12 -67

.029 -123 -.097

DJI fell from 479.90 to a low of 463 on 11/29/1956. This was a paper loss of 3%

It then rallied to Sell S12 at 492.7 on 12/6/56.

This was not a reversing Buy.

----------------------------------------------------------------------------------------------------------------------

11.

4/28/1960

604.30

Gain =

+7.5%

.974 -.307 -93

-16 -.135 -416

-.182

DJI bottomed here and rallied to 649.40 and Sell S2 on 6/15/60.

The simultaneous S7 would have delayed this Buy until 5/2/69

when there was another Buy B2.

5/2/1960

599.60

Gain = +8.3%

.969 -.327 -94

0 -.139

-425 -.189

This was not a reversing Buy. No Paper Loss.

----------------------------------------------------------------------------------------------------------------------

12.

7/18/1960

626.00

Gain =

+1.3%

.977 .414 -70

-10 -.084 -381

-.185

DJI fell to 600 and then rallied to 638.2 and Sell S1 on 8/29/60.

3% Paper Loss

and Reversing

Buy.

There were additional Buy

B2s from 7/19/1969 to 7/28/1960.

They are not used in calculating the statistics for Buy B2s.

----------------------------------------------------------------------------------------------------------------------

13.

10/3/1960 577.80

Gain = +3.2%

.97 -.961 -198

-11 -.206 -680 -.384

DJI bottomed here and rallied to 596.5 and Sell S9 on 10/14/60.)

No Paper Loss and Reversing Buy.

----------------------------------------------------------------------------------------------------------------------

X - Disallow this B2 because of earlier B2 being

too close in time.

The Buy B17 the next day was better by being 1%

lower..

10/24/1960 571.90

Gain = +25.1%

.983 -.272 -126

-13 -.094 -539

-.185

DJI bottomed here and rallied to 715.70 and Sell S9 on 8/3/61.

This was a bullish time of the year normally and there were bullish divergences

by the P-Indicator and Accum. Index.

1% Paper Loss

----------------------------------------------------------------------------------------------------------------------

1964 - no trades

----------------------------------------------------------------------------------------------------------------------

14.

8/1/1968

878.07 Gain = +2.5%

.972 -.313 -143

-4 -.049

-15 -.242

DJI bottomed at 868 and rallied to 900.36 and Sell S2 on 9/4/68.

Paper Loss = 1% and Not a

Reversing Buy.

There were additional B2s on 8/2/68 to 8/9/68.

They were not used in the statistics.

----------------------------------------------------------------------------------------------------------------------

15.

5/2/1972

935.2 Gain = +3.2%

.977 -.071 -110 -16

-.036 -1 .133

DJI fell to 931 and rallied to 965.31 and Sell S12 on 5/22/72

0.4% Paper Loss and Reversing Buy.

----------------------------------------------------------------------------------------------------------------------

16.

7/20/1972

910.45 Gain = +4.1%

.979 -.483 -178 -16

-.138 -3 -.336

DJI bottomed here and rallied to 947.7 and Sell S12 on 8/3/72

No Paper Loss and Reversing Buy.

----------------------------------------------------------------------------------------------------------------------

17.

10/16/1972

921.66

Gain = +13.7%

.976 -.323 -134 -21

-.093 -3 .232

DJI bottomed here and rallied to 1047.9 and Sell S9 on 1/5/73.

No Paper Loss and Reversing Buy.

----------------------------------------------------------------------------------------------------------------------

18.

10/5/1976

966.76

Gain = +3.0%

.974 -.268

-13 -46

-.001 -1 -.265

DJI fell to 922 in mid October and then rallied to 1000.08 and

Sell S2 on 12/28/77.)

Reversing Buy.

Paper loss = 5%

----------------------------------------------------------------------------------------------------------------------

19.

4/3/1980

784.13

Gain = +21.3%

.987 -.907 -293

47 -.066 -10 -.303

DJI fell to 757 in mid April and then rallied to 950.94 and Sell S2 on

8/7/80.

Not a reversing Buy. Paper loss = 3%

----------------------------------------------------------------------------------------------------------------------

20.

10/27/1980

931.74 Gain = +5.9%

.98 -.105

-49 23 -.094

-3 .04

DJI fell to 918 four days later and then rallied to 986.35 and

Sell S9 on 11/14/80.

Not a reversing Buy. Paper loss = 1%

There were B2s also on 10/30/1980-10/31/80. These were not used in

calculating statistics.

----------------------------------------------------------------------------------------------------------------------

21.

7/22/1984

1086.57 Gain = +12.8%

.972 -.473 -210

-21 -.067

-14 -.308

DJI bottomed here and then rallied to 1225.93 and Sell S1 on 10/19/1984.

Not a reversing Buy.

----------------------------------------------------------------------------------------------------------------------

22.

.

10/10/1984

1177.23 Gain = +4.1%

.978 -.205 -53

-23 -.101 -5

-.011

DJI bottomed here and then rallied to 1225.93 and Sell S1 on 10/19/1984.

Not a reversing Buy. No Paper Loss.

----------------------------------------------------------------------------------------------------------------------

23.

7/22/1988

2066.99

Gain = - 0.1%

.976 -.478

-136 -67 .024

-26 -.209

DJI bottomed at 1990 in mid August and then

rallied to 2065.26 and Sell S2 on 9/6/1988.

Not a reversing

Buy. Paper loss = 4%

Another B2 followed on 7/27/2008 that was not used here

in calculations.

----------------------------------------------------------------------------------------------------------------------

X - This B2 is cancelled because of

earlier B2 being to close in time.

8/10/1988

2034.14

Gain = 1.5%

.969 -.331 -153

-28 .042 -15

.084

DJI bottomed at 1990 in mid August and then rallied to 2065.26 and Sell S2 on

9/6/1988.

Paper loss = 5%

More B2s followed from 8/11/2008 to 8/23/2008. These

were not used here in the calculations.

----------------------------------------------------------------------------------------------------------------------

24.

8/21/1992

3254.10

Gain = + 21.9%

.976

.128 48

-28

-.061 -8 -.186

DJI bottomed here, then rallied to 3350 and then declined to 3150

before again rallying up throughout 1993.

Reversing Buy. Paper Loss = 3%

More B2s followed from 8/24/2008 to 8/25/2008. These were not

used here in the calculations.

----------------------------------------------------------------------------------------------------------------------

25.

10/15/1992

3174.68

Gain

= + 25.0%

.982 -.531

-113

12

-.005 26

.346

DJI bottomed at 3135 a week later and then rallied to 3967.66 at

beginning of 1994.

Not a reversing Buy. No Paper Loss

----------------------------------------------------------------------------------------------------------------------

26.

4/11/1996

5487.07 Gain = + 3.4%

.977 -.205

0

-6

.035

-16 -.067

Also a Buy B9

DJI fell to 5400 intra-day on 5/8/96 and then rose to 5673.83 and Sell S1 on

5/29/96

Not a reversing Buy. Paper Loss = 2%

---------------------------------------------------------------------------------------------------------------------------------------------

X - This B2 is cancelled because of earlier B2

being to close in time.

If the head/shoulders pattern had been completed there,

it would have been bad for this Buy B2.

5/7/1996

5420.95

Gain = + 4.7%

.979 -.372

41

82

-.034 -4

-.012

Also a Buy B9

Not a reversing Sell. No paper loss.

Another B2 followed on 5/12/1996 but was not counted in calculated in

counting statistics.

---------------------------------------------------------------------------------------------------------------------

27.

7/11/1996

5520.54 Gain = + 3.3%

.977 -.312 -225

-67 -.013

-47 -.134

DJI fell to 5250 intra-day and then rose for rest of year.

Reversing Buy. Paper Loss = 6%

More B2s followed from 7/16/1996 to 7/24/1996. These

were not used here in the calculations.

----------------------------------------------------------------------------------------------------------------------

28.

4 /17/ 2000

10582.51

Gain = + 5.1%

.964 -.014

-73

-14

-.033 71

-.18

DJI fell to 10250 intra-day on 6/30/2000 and then rose to 10804.27 and Sell S12 on

7/17/2000

Not a reversing Buy Paper Loss = 3%

More B2s followed from 4/18/2000 to 4/24/2000. These were not used here in

the calculations.

----------------------------------------------------------------------------------------------------------------------

X - This B2 is cancelled because of earlier B2 being

to close in time.

5 /3/ 2000

10480.13 Gain = + 7.9%

.962 -.808

-111

-64

-.049 -93

-.181

DJI fell to 10250 intra-day on 6/30/2000 and then rose to 10804.27 and Sell S12 on

7/17/2000

Reversing Buy. Paper Loss = 3%

More B2s followed from 5/4/2000 to 5/11/2000. These were not used here in the

calculations.

---------------------------------------------------------------------------------------------------------------------------------------------

29.

5 /22/ 2000

10542.55

Gain = + 7.3%

.985 -.335

-123 -50

-.001 -62

-.071

DJI fell to 10250 intra-day on 6/30/2000 and then rose to 10804.27 and Sell S12 on

7/17/2000

Not a reversing Buy Paper Loss = 3%

More B2s followed from 5/24/2000 to 5/26/2000. These

were not used here in the calculations.

----------------------------------------------------------------------------------------------------------------------

30.

6 /22/ 2000

10376.12 Gain = +4.1%

.981 -.052

117 -32

-.06 -51

-.07

DJI fell to 10250 intra-day on 6/30/2000 and then rose to 10804.27 and Sell S12 on

7/17/2000

Not a reversing Buy Paper Loss = 2%

----------------------------------------------------------------------------------------------------------------------

31.

10/2/2000

10700.13

Gain = + 0.1%

.977 -.558

-145

-47 -.065 -115

-.245

DJI fell to 9700 intra-day on 10/18/2000 and then rose to 10712.91 and Sell S12 on

12/8/2000

Not a reversing Buy Paper Loss = 9%

More B2s followed from 10/6/2000 to 10/23/2000. These were not used here in

the calculations.

----------------------------------------------------------------------------------------------------------------------

32.

5/18/2004

9968.51

Gain = + 3.2%

.976 -.546 -454

70

-.082 -337 -.056

DJI rose immediately and then rose to 10400 and then fell back to 9900 in July

and then rose again to Sell S2 on 9/7/2004

Reversing

Buy. Paper Loss = 2%

More B2s followed from 5/19/2004 to 5/21/2004. These were not used here in the

calculations.

----------------------------------------------------------------------------------------------------------------------

33.

7/19/2004

10094.06

Gain = + 1.9%

.98 -.327

243 -16

-.1

-161 -.049

DJI fell to 9800 intra-day on 8/13/2004 and then rose to 10342.79 and

Sell S2 on 9/7/2004

Reversing Buy. Paper Loss = 3%

More B2s followed from 7/21/2004 to 7/23/2004. These were not used here

in the calculations.

----------------------------------------------------------------------------------------------------------------------

X - This B2 is cancelled because of earlier B2 being to

close in time.

X.

8/6/ 2004

9815.33 Gain = + 4.8%

-.972 -.419 -57

10

-.049 -273 .024

DJI rose immediately then rose to 10342.79 and Sell S2 on 9/2/2004

Not a revewrsing Buy

Another B2 followed on 8/9/2004

----------------------------------------------------------------------------------------------------------------------

34.

10/15/2004

9933.38 Gain = + 9.3%

.983 -.366 94

-21 -.047

-145 -.028

DJI fell to 9740 intra-day on 10/25/2004 and then rose to 10854,54 on

12/28/2004.

Not a revewrsing Buy Paper Loss = 2%

----------------------------------------------------------------------------------------------------------------------

35. 7/8/2008

11384.21 Gain = + 2.2%

.966 -.831 -642

-157 -.157 -335 -.065

DJI fell to 11000 intra-day a few days later and then rose to 11632 on

7/23/2008 where an S9 occurred.

Because of the steepness of the decline (ROC = -.831)and low V-Indicator

(-335) readings, we were not

surprised that there was more weakness.

Reversing Buy. Paper Loss = 4%

------------------------------------------------------------------------------------------------------------------------------------------------

36.

4/10/2012

12715.93 Gain = + 4.4%

.969 -.187 -253

-160

.025 -126 -.078

DJI immediately rallied back to its previous highs where a Sell S15 reversed

the trend.

Reversing Buy. No Paper Loss

------------------------------------------------------------------------------------------------------------------------------------------------

X - This B2 was cancelled because of earlier B2 being to

close in time.

The Buy B2 here was ruled too dangerous because of what

might happen if the key support

was broken.

4/10/2012

12695/35

September

Buy B2s Are Not Allowed.

Octobers Often Bring Clmax Selling.

October Bottoms Make for Much Better Buys By Than September.

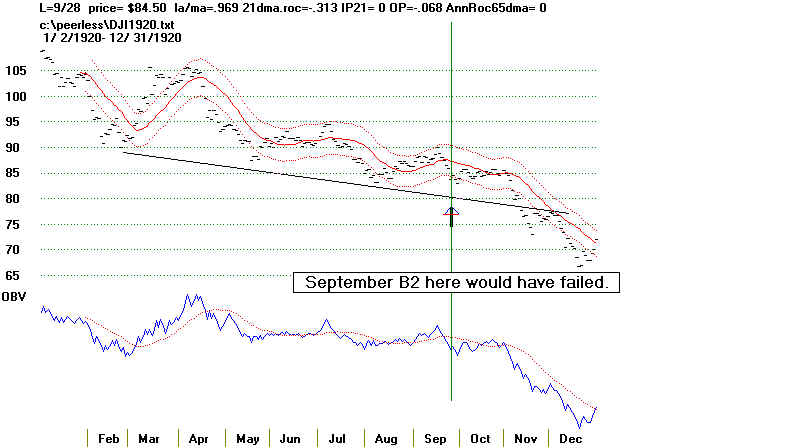

In Septembers there should be no Buy B2s. In 4 cases a Buy B2 would

have worked out, but in 9 cases, it would have been better to wait for October.

September B2's can lose a lot of money. If you have any doubts, see the charts of

1920 and 2008 in the charts below the list of signals.

.

Only in 1924, 1932, 1944 and 1948 would buying at the lower band in September

in a Pres. Election Year have worked out.

There were 11 Septembers where the 3.0% lower band was not reached.

Hypothetical

B2s in Septembers of Presidential Election Years: 1916 - 2008

1916 - No B2 pullback in Sept.

1920 - September and October B2 would have lost 20% by

December.

1924 - A Buy B2 4.0% below 21-dma would have worked for a

rally to 3.0% upper band.

1928 - No B2 pullback in Sept

1932 - Buying 6.6% below 21-d ma and selling at upper band

would have worked in Sept.

1936 - No B2 pullback in Sept

1940 - No B2 pullback in Sept. Good one on October.

1944 - There was a B9 in September. Market rose from it.

1948 - There was a B9 in September. Market rose from it.

1952 - A September B2 would have been premature, as there was

a better October B2.

1956 - There was a good B2 on 10/1 -Rally to 3% upper band.

Later it gained 5.1%

1960 - Any Sept. B2 would have been premature. 10/3 Buy B2

gained 3.2%

1964 - No B2 pullback in Sept.

1968 - No B2 pullback in Sept.

1972 - Better buying opportunity in October. 10/16 B2 worked

out.

1976 - Better buying opportunity in October.

1980 - No B2 pullback in Sept

Buy B19 on 9/30 worked out.

1984 - Better Buy B2 on 10/10 worked out, gaining 4.1%

1988 - No Buy B2 pullback in Sept.

1992 - Better Buy B2 on 10/2. Good gain.

1996 - No B2 pullback in Sept.

2000 - Much Better Buy B2 later in October.

2004 - No Buy B2 pullback in Sept. Good one in October.

2008 - Much Better Buy B2 later in October.

DJIA - 1920 - Do Not Buy at Lower Band using Buy B2

DJIA - 2008 - Do Not Buy at Lower Band using Buy B2