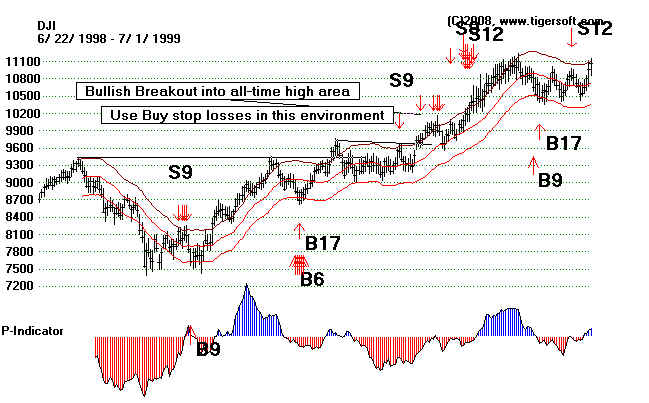

The February to April 1999 rally occurred despite multiple Peerless sell signals.

This illustrates the need for working with stop losses, especially when the DJI is

rising into all-time high territory. The break in the NYSE A/D Line downtrend

might have been used to cover short positions in the overall market, especially

since each of the three main oscillators shown here turned positive and were above

their risign moving averages.

Using NYSE A/D Line trendbreak as sign to cover shorts would have helped here.

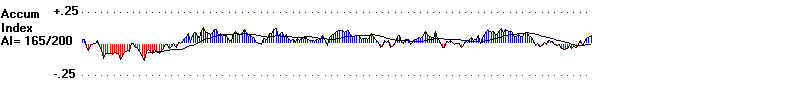

That Accum. Index was above its black ma should

have been used to confirm decision to cut losses.

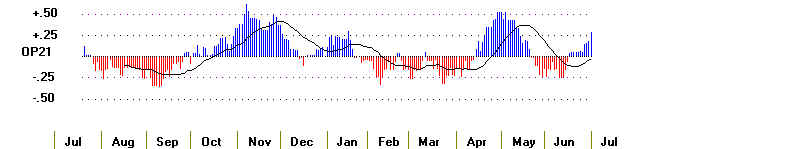

That OP21 was above its black ma should also

have been used to confirm decision to cut losses.