TIgerSoft/Peerless HOTLINE

(C) 2016 William Schmidt, Ph.D.

www.tigersoft.com

william_schmidt@hotmail.com

---------------------- IMPORTANT

---------------------------------

This HOTLINE has changed its address

tonight.

An email was sent to all subscribers. But a few were returned.

Let me know if you did not get your email. Renewals are $400/year

of $235 for 6 months by CC.

-----------------------------------------------------------------------------------------------------------------

HELP

A

Guide To Profitably Using The Tiger Nightly HOTLINE

Introduction

to Tiger/Peerless Buys and Sells.

Peerless

Buy and Sell Signals: 1928-2016

Individual Peerless signals explained:

http://tigersoftware.com/PeerlessStudies/Signals-Res/index.htm

http://www.tigersoft.com/PeerInst-2012-2013/

Explanation of each Peerless signal.

http://www.tigersoft.com/PeerInst-2012-2013/

Different

Types of TigerSoft/Peerless CHARTS, Signals and Indicators

Peerless Signals and DJI

Charts - version 7/4/2013

1965

1965-6 1966

1966-7

1967

1967-8

1968

1968-9

1969

1969-70 1970

1970-1

1971

1971-2 1972

1972-3

1973 1973-4

1974

1974-5 1975

1975-6

1976 1976-7

1977

1977-1978

1978

1978-79

1979

1979-80

1980

1980-1

1981

1981-2

1982

1982-1983

1983 1983-1984

1984

1984-1985

1985

1985-1986

1986

1986-1987

1987

1987-8

1988

1988-9 1989

1989-90

1990

1990-1 1991

1991-2

1992

1992-3

1993

1993-4

1994

1994-5

1995

1995-1996 1996

1996-7

1997

1997-8 1998

1998-1999

1999

1999-2000

2000

2000-1 2001

2001-2

2002

2002-3

2003

2003-4

2004

2004-5

2005 2005-6

2006

2006-7

2007

2007-8

2008

2008-9

2009

2009-10

2010

2010-11

2011

2011-12

2012

2012-2013

Documentation for

TigerSoft Automatic and Optimized Signals.

How reliable

support is the DJI's rising 200-day ma?

SPY

Charts since 1994: Advisory Closing Power S7s, Accum. Index, 65-dma, Optimized

Signals.

1/19/2016

--->

Corrections,Deeper Declines and Bear Markets since 1945.

1/21/2016

--->

High Velocity Declines since 1929

2/12/2016 --->

Presidential Elections Years and Bullish IP21 Positive Non-Confirmations at

Lower Band.

2/12/2016 --->

OBV NNCs on

DJI's Rally to 2.7% Upper Band when DJI's 65-dma is falling.

Earlier

Q-Answers

New

QuickSilver Documentation

(1/11/2016)

Our Different Signals

Better

understand the difference between Peerless DJI-based signals,

the one-year optimized red Signals and

the fixed signals based

on technical developments.

Introduction to

Tiger/Peerless Buys and Sells.

Different Types of TigerSoft/Peerless CHARTS, Signals and Indicators

----------------------------------------------------------------------------------------------------------------

Important. You are at

www.tigersoft.com/55HL55/INDEX.html

This is new address for Nightly Tiger/Peerless Hotline.

===================================================================================

Hotline and Links -

5-23-2016 The DJI could not stay above its 65-dma today.

See in the

Peerless chart below see that its closed 2 points below that ma

today. Again tomorrow, I would have to go with the Buy B11

provided the DJI can get back above the 65-dma. Keep in mind that

Seasonality is bullish in the week before Memorial Day

(next Monday), so there is a good chance we will be able to

act profitably on the Buy B11 that was shown on Friday's close.

Traders, notice that the DJI will need to close 38 points above

today's close to bullishly turn up its short-term 5-day ma.

Modest Risk Now.

Look back at the charts of the past Buy B11s.

http://www.tigersoft.com/PeerInst-2012-2013/-b11.htm

There are 7 cases where the paper losses were between

1.5% and 3%, This accords with the 44% historical probability

of the DJI dropping below a head/shoulders' neckline after

a Buy B11. So, there is still a 35% to 44% chance of an additional

2% decline.

Modest Gain Potential

When we look back at the Buy B11s from mid-April to the

end of June, we do see that the gains were modest. So, again

I would expect only a limited rally, probably back above 18000

but not above 18300.

Buy B11s from Mid-April to End of June.

Gain

5/8/1959 .046

5/16/1986 .058

4/23/1993 .025

4/17/2006 .046

----------------------

Avg = 4.4%

Charts: Peerless DJIA Hourly DJIA DIA SPY QQQ IWM

DJI-Utilities DJI-Rails A/D Line-6000 Stocks

Crude Oil SOXL TECL

Major Indexes and A/D Lines.

Key Tiger Software ETF Charts

Bullish MAXCPs

Bearish MINCPs

QUICKSilver

Some Stock Ideas

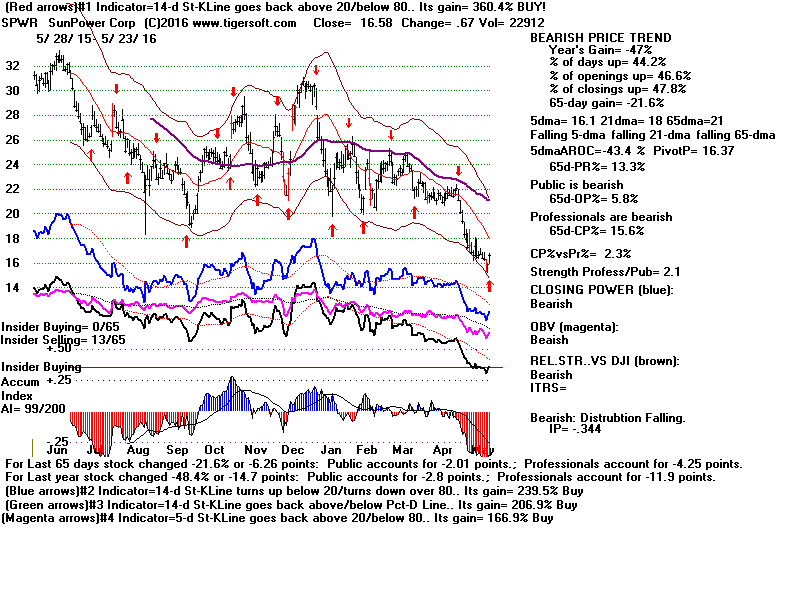

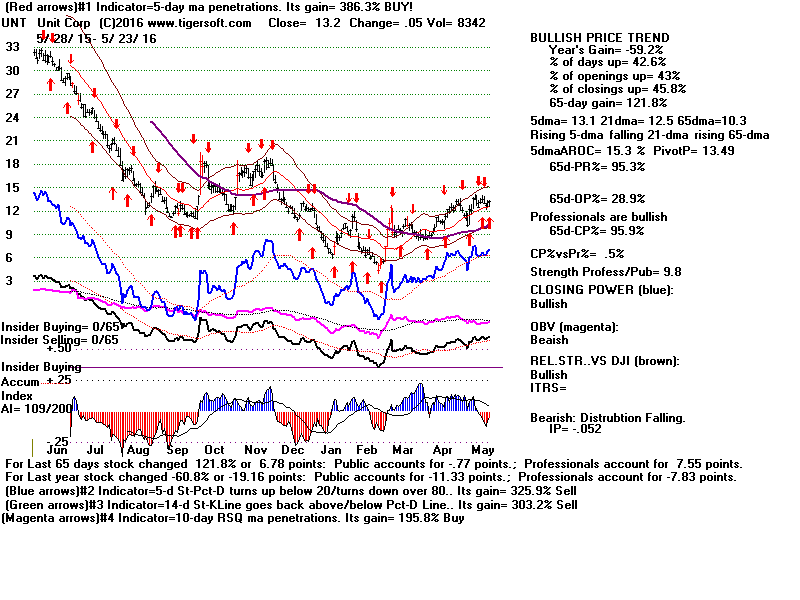

Using New "TigerSmart" Optimized Red Buys

(work in progress)

So how might we play a brief rally now? The

Bullish MAXCPs

are one way. Buying the highest AI/200 stock in the DJI-30, CAT

would be another. A third way, I'd like to suggest here, would be

be to buy the stocks giving new optimized Red Buys where the

trading system would have gained more than 150% for the last

year. In the next few days I will do a follow-up of these. There

are 11 shown below.

|

|

============================================================================

5-20-2016 Cover short in DIA

and take a long position in it

provided

the DJI can stay above its 65-dma

tomorrow. If it cannot do this, we will have to watch to

see if it can get back above its 65-dma on Tuesday

and act then.

Friday

brought a reversing Buy B11. This

May B11

has problems and limitations. As for the upside potential,

it seems

unlikely that we will see much more than a nominal new

high above 18300. This is because Buy B11s in May and

June get gains only about half the size of the 10% gains

that the signal typically brings.

It is important to appreciate also that the B11 gains are much

smaller in a Presidential Election when the US is not in a world war.

The three of these gained less than 2% on average.

And there is risk, when a head/shoulders pattern is present, since

the DJI breaks below the neckline (here about 17400) 44% of the time.

This alone should probably get us to wait another day.

But I think we do want to reverse positions on DIA if the

DJI can stay above its 65-dma. There are bullish forces at

work now. First, we do see support

coming in on each decline

below 17500. Secondly, we can guess that

the FED will be

most reluctant to raise interest rates if the May Jobs

Report

is as week as April's.

Thirdly, there ought to be a

bit of a

recovery before Memorial Day. The DJI has advanced

58% of the time over the next week since 1965. The average

DJI gain is 0.8% over the next two weeks. And fourthly, the

Hourly DJI's OBV-Line did not confirm the

recent drop to 17440.

Note the new Buy B11 on Friday. This

occurred because the DJI closed back

above its 65-dma.

===========================================================================

5-19-2016 Stay short DIA.

There was no Buy B11 signal today because

the DJI closed below its 65-dma by too great a margin. The

presence of bearish head/shoulders patterns in the

DJI and

SP-500 make this market look different from

the one other

case where there was a Buy B11 in May, that was in

1986

when DJI was running upwards and making a string of all-time

highs.

Charts: Peerless DJIA Hourly DJIA DIA SPY QQQ IWM

DJI-Utilities DJI-Rails A/D Line-6000 Stocks

Crude Oil SOXL TECL

Major Indexes and A/D Lines.

Key Tiger Software ETF Charts

Bullish MAXCPs

Bearish MINCPs

QUICKSilver

The Market Is Being Held Hostage by the FED.

. When Fiscal Policy Is Frozen in Political Stalemate,

This Is What We Get!

A weak rally from here may still occur. There may be a

bounce back to DJI-18000 if the the FED does not raise rates in June.

For one thing, because it is a Presidential Election Year, I think

we can expect the FED to be reluctant to raise interest rates. For

another, the April Jobs' numbers showed economic growth was

weakening. To the extent, that Yellen, as a Democrat, chooses

to use her influence, she can say the "consensus" of the next

FOMC meeting is whatever she chooses. Only if she is outvoted,

will rates go up.

So perhaps, the DJI will try to rally again to 18000 from where

it sits now, close to its 65-dma. For us, without a Buy signal from

Peerless, any rally would seem to be limited. And with the

head/shoulders pattern present, there may be other bearish

news which could snag the market.

Overseas' Weakness Again

As it is now, overseas' markets are all significantly below their

65-dma. This calls into question whether their turnarounds can

continue. If they do not soon recover, we could be right back in

a deflationary world economy. How long can the US hold

world's economy up then.

Populism is against any more free-trade deals in this country.

What if the terrible "T" word is used, namely tariffs. If Trump

or Sanders create a populist demand for tariffs, the actual passage

of such tariffs could tip the already fragile World Economy into

a Depression. Many economists blame the 1930 Smoot Hawley

Tariff for causing the 1930s' world-wide Depression.

Let's watch the charts of all foreign ETFs,

in Europe, in the

Developing World, in

Latin America and in

China.

==========================================================================

5-18-2016 Stay short DIA.

Sell any longs if they break their steep

Closing Power uptrends. Every recent rally has failed.

Professionals in New York must be getting tired of seeing

their efforts to support the market be quickly eclipsed

by weak openings the next day. This is because

Asian, European

and Emerging Markets seem to have ended their

recovery.

;

The Head/Shoulders patterns in the DJIA/DIA

and SP500/SPY

are classic. They are flat and they are symmetrical. A clear

violation of its neckline will occur on a closing below 17400.

Such a decline would also break the DJI's 65-dma. The minimal

DJI downside objective would then be 16900-17000.

When the 65-dma is also broken simultaneously,

these Head/Shoulders patterns are quite reliable. I show

hundreds of these patterns in my Short Selling book.

Their reliability is about 80% with stocks in all markets.

What is striking now is how many of the Tiger Indexes

of various sectors also show head/shoulders patterns.

The history of the DJI since 1888 shows at least a hundred

such top patterns. Maybe, maybe, there are ten failures, i.e.

where prices fail to fulfill their minimum downside price

objective. (See the links I posted last night to see many

of these H/S patterns on the DJI.)

See DJIA,

DJI-20, DJI-30,

Commodities,

Foreign ETFs,

Housing,

Industrial Materials,

Natural Gas,

Russell-1000,

Software and

SP-500

The 1987 Lessons of Gold

#1 Gold Big 4-Month Rally Warns of A Big Decline in DJI.

#2 Gold's New Warning: A Big Drop Today. See NEM below

how its collapse in October 1987 coincided with the

DJI's 33% sell-off.

#3 Do Not Look to Gold To Be A Safe Haven.

1987 Peak in Gold and Subsequent Crash

Today, the leveraged Gold ETFs, NUGT and

JNUG fell

more than 25%! This reminds me how NEM collapsed

in 1987 just before the Crash then. It had risen sharply

beforehand. But only when it, too, began a big sell-off

did the general market go over its cliff in October. Not

only that, this case suggests that Gold

and Silver will

not be a haven in the coming decline.

Charts: Peerless DJIA Hourly DJIA DIA SPY QQQ IWM

DJI-Utilities DJI-Rails A/D Line-6000 Stocks

Crude Oil SOXL TECL

Major Indexes and A/D Lines.

Key Tiger Software ETF Charts

Bullish MAXCPs

Bearish MINCPs

QUICKSilver

“I have seen the future and it doesn't work.”

Zardoz (1971)

I get the feeling that Hillary, Obama, the FED

and the market are all slow-walking toward the

cusp of an avoidable economic debacle. The Federal

Reserve's Helicopter is not taking off again. The

dropping of a trillion dollars into the hands of

Big Banks has run its course. It is not at all clear what can

hold the market up now?

Fed Is Seriously Considering Raising Interest Rates

in June, Meeting Minutes Say

By NY Times - BINYAMIN APPELBAUM

"The central bank sent an unusually frank message to Wall Street,

delivered

in the official account of the Fed's April meeting. "

The most recent FED minutes makes it seem that they are

no longer able to resist the pressures to raise interest-rates in June,

even though the US economy's growth is stalled at 1%/year

and does not match even the growth of population, much less

meet the needs of millions not working full time. And

now we have a tightening monetary policy?!

Where is the leadership? Federal budgets barely get passed.

There is fiscal paralysis. For years, it seems, the Republican

Congress continues to want to delay the starting of a

much needed, massive Public Works program. They

pay no political price for that. The President, a Milton Friedman

follower from Chicago and monetarist, acts like he is too

tired and too disinterested to have another spat with Congress

over such a program, something that is probably our last hope

to spark a real economic recovery.

Sanders does not help much. He is totally preoccupied

tilting, Don Quixote-like, with the Windmills of the

Democratic establishment. He has no chance to become

President but every campaign speech he makes attacking

Hillary's admittedly very poor judgment and close ties with

Wall Street only gives new strength to Donald Trump, the

insecure, egocentric wild-man pretend-Populist.

So, I expect Trump to become the next President. The risks

from that seem enormous and obvious. The kindest thing I can

think to say is that no one has a clue what a Trump administration

will do as President. Those who run money and own big stock

positions have every right to be perplexed and alarmed if the FED

unplugs the leaking dam walls in June. (Maybe, they'll

reconsider).

The Head/Shoulders Patterns tell us something not yet apparent

or visible is approaching the market and getting ready to clobber

stocks. This could be the catalyst for a steep decline. Once

the market starts melting down, new Hellicopter runs may

not matter. Who will want to borrow money to buy stocks

when the big dam breaks apart. Instead, they may just use the

money to buy leveraged short-ETFs.

===========================================================================

5-17-2016 Stay short

DIA, Peerless did not issue a reversing

automatic Buy signal today even though the DJI closed 1.6%

below the 21-day ma and the P-Indicator remains positive at +98

and the current Accum. Index (IP21) is only slightly negative

at -.012.

Charts: Peerless DJIA Hourly DJIA DIA SPY QQQ IWM

DJI-Utilities DJI-Rails A/D Line-6000 Stocks

Crude Oil SOXL TECL

Major Indexes and A/D Lines.

Key Tiger Software ETF Charts

Bullish MAXCPs

Bearish MINCPs

QUICKSilver

Tomorrow - Possibly a Buy,

But Possibly A Judged Sell, too

If Both Occur, They Cancel

out Each Other.

If breadth is no worse than today, it will only take a small

additional decline to bring a Peerless Buy provided the

DJI closes not much below its 65-dma now at 16427.

However, note that a deeper decline or one on worse breadth

than today will most likely not bring a Peerless Buy signal.

We also have to be concerned about getting either a Tiger S5,

a Peerless S10 or a judged S10 if the DJI closes decisively

below the H/S neckline drawn roughly through the DJI's

recent hypothetical lows, 17440.

The H/S patterns we see now in the DJIA,

SP-500 and OEX

as well as the Tiger Indexes of DJI,

SP-500 are nearly perfectly

symmetrical, flat and very easy for all chartists to spot. Their

notoriety is thus enhanced and their bearishness thus becomes

more self-fulfilling.

With head/shoulders patterns, we often only later learn

why they are formed, i.e. what events like invasions,

missile crises, assassinations, terrorist attacks, new economic

policies lie behind them, But because Gold stocks are rising

very steeply, I believe that they are screaming a message

of caution for the general market. So, stay short

DIA for

now.

A

Judged

S10 Would Still Be Bearish.

Because these recent DJI lows set up a neckline in a head/shoulders

pattern that is less than 40 trading days long, we may have to

judge a Sell S10 if the DJI closes clearly below 17444.

That there have been no fewer than 7 reversals back up from

the neckline-support zone of 17444 to 17530, makes any decisive

breakdown more dangerous. These tests of lows here go back

33 trading days.

H/S

Pattern's

neckline lows:

4/1/2016 17515

4/7/2016 17444

5/4/2016 17530

5/6/2016 17519

5/13/2016 17500

5/17/2016 17450

| |

More Reading

about Sell S10s: Both Automatic and Judged.

www.tigersoft.com/judgedS10/index.html

Judged S10 Rules The results

from Peerless using automatic signals are

excellent. But they can be improved if one uses a

judged S10. The judged Sell S10 ...

www.tigersoft.com/HLZA15/

Oct 3, 2015 -

9/30/2015 The operative Peerless signal

is still the Sell S14. A DJI close below the

well-tested, flat support at 17000 would bes considered

a judged Sell S10.

|

|

==========================================================================

5-16-2016 We still have an operative Sell S2 to

guide us. Stay

short DIA.

In Presidential Election years this signal has averaged about

a 7.2% decline in the DJI. To reach this, the DJI will need

to close near 16800. Given the positive breadth, blue

Accumulation and the rising 65-dma, such a target seems

unlikely to be reached even given the DJI's head and shoulder

pattern.

We could cover our short in DIA if the DJI drops back towards

that 17500 neckline-support. But, I would just trust that the Peerless

system will tell us when it is time to buy back DIA and

go long. This is still a very defensive market. If that

changes and volume rises more on an advance, we can

then reconsider waiting for Peerless to tell us to buy

again. But right now, let's wait to cover. Buying at the

end of May often works out better.

This may all be mooted since a close near 17450 will likely bring

an automatic Buy B12, which is based on buying when

the DJI closes at a rising 65-dma that has not been

violated for 10 weeks or so.

Trading Range Peerless Sell S2s

in A Presidential Election Year, since 1928| PE = Presidential Gain if DJI Sold Short

Election Year and this position was

closed on next Peerless Buy.

=========================================================================

19480615 PE S2 193.2 .05 perfect

19481022 PE S2 189.8 .061 perfect

19560409 PE S2 518.5 .079 perfect

19560802 PE S2 521 .075 perfect

20000425 PE S2 11124.82 .049 perfect

20000906 PE S2 11310.64 .095 perfect

20001030 PE S2 10835.77 .060 Very small Paper Loss

20040902 PE S2 10290.28 .038 Very small Paper Loss

-------------------------------------------------------------------------

Avg = 7.2%

Charts: Peerless DJIA Hourly DJIA DIA SPY QQQ IWM

DJI-Utilities DJI-Rails A/D Line-6000 Stocks

Crude Oil SOXL TECL

Major Indexes and A/D Lines.

Key Tiger Software ETF Charts

Bullish MAXCPs Bearish MINCPs

QUICKSilver

Warren Buffet bet $1.1 Billion on Apples's stock

in the first quarter. He is not prone to make bad investment

decisions. He has friends on the FED. They must have

told him that they would not be raising rates. But now

he is down about 17% on that investment already. Was his

timing just bad? Perhaps, tech stocks are just out of favor

temporarily and this announcement will be the catalyst that

they need.

Let's keep an eye on AAPL and TECL, the leveraged

ETF for techs. Specifically, we will need to see

their Closing Power downtrends be violated with

them above their 65-dma. Until that happens, I

would assume the risks are judged by Professionals

here to be greater than the potential rewards.

AAPL To be a false breakdown, AAPL will need to stay

above its support-line shown below for a week.

TECL looks ready to challenge 40 again if its Closing Power can

break its downtrend and it can close back above its rising 65-dma.

A strong day tomorrow would do that.

TECL looks ready to challenge 40 again if its Closing Power can

break its downtrend and it can close back above its rising 65-dma.

A strong day tomorrow would do that.

==========================================================================

==========================================================================

5-13-2016 The Sell S2 still operates. Stay short DIA. We must

now wait to see if the DJIA, DIA, SPY, QQQ and IWM

can find the necessary support just below where each closed

on Friday, at the necklines of their head/shoulders patterns.

Another brief rally is likely this week. The rally would not

void the emerging head/shoulders and probably would quickly

fail. Commonly, head/shoulders patterns' right shoulders last

as long to form as the left shoulders took.

DJI's Bearish Head/Shoulders

must be scaring technically minded traders.

To get much a rally, we will need to see much more Blue

upside volume. See above the 10-day ma of Up and Down

Volume.

Charts: Peerless DJIA Hourly DJIA DIA SPY QQQ IWM

DJI-Utilities DJI-Rails A/D Line-6000 Stocks

Crude Oil SOXL TECL

Major Indexes and A/D Lines.

Key Tiger Software ETF Charts

Bullish MAXCPs Bearish MINCPs

QUICKSilver

In broad trading ranges, bids usually disappear in their middle.

We are in a broad trading range now with resistance at

18000 as resistance and 16000 as support. So, there is a

risk here that the market will drop sharply if the 65-dma

at 17250 is broken. Neither the Republican or likely

Democrat candidate for President generate a lot of public

trust or confidence.

But interest rates are likely to remain low, Mays tend to

bring shallow declines and Peerless will likely give a Buy B9

if the DJI closes more than 3% below the 21-day ma since

the P-Indicator is positive. It may also give a Buy B11 if

its closes near and above its 65-dma or produce a simple

Buy B2 around 17450.

A bigger drop with very bad breadth and high volume would

have to be judged a head/shoulders Sell S10/S5, as in May

2010, thereby nullifying any Buy signals on the breakdown,

See how completed H/S pattern on May 5th, 2010

brought a mini-selling panic. A Tiger S5 can be placed

on the screen here. In our situation, a completed H/S

should probably be allowed to play out and reach

its downside objective, the height of the pattern extended

downward from the neckline at 17500.

Watch The 4-Horsemen

Our "four horsemen" of a possible world-wide Deflationary

spiral are holding up. That's good news for bulls.

Only China as measured by YINN, the

3x-leveraged ETF,

has broken down below its 65-dma.

Our Commodities Index, Crude Oil and Foreign ETFs' Index

are still above it. (YINN represents the performance of the FTSE

China 50 Index).

I believe it is very important that these four

investment vehicles do not all drop below their 65-dma. If they

do it will be a warning sign that low interest rates cannot prop

the worlds' markets up outside of the US. If all these start

falling at once, we may find ourselves in a worse situation

than we were in for much of last year because the pressures

to raise rates will be greater. The Fed has bought $4 trillion in

f bonds and mortgages from banks. Only bad things will happen

to the market if it sells them and starts to tighten up its Open Market

monetary actions.

( https://www.aei.org/publication/since-2009-feds-qe-purchases-transferred-almost-half-trillion-dollars-treasury-isnt-gigantic-wealth-transfer/ )

=================================================================

5-12-2016 The Peerless Sell S2 is bringing

along a number of

bearish-looking head and shoulders' tops to back it up.

The DJI's top may take another week to fully develop

so that the right shoulder's size and length match

the left shoulder's. We remain short DIA.

Watch to see if the following head/shoulders' necklines

are violated.

5/12 Close Neckline

DIA 177.42

175 (DJI-30)

ERX 27.72

25.37 (Energy)

IWM 110.37

109.1 (Russell-2000)

NVDA 35.59

34.51 (stock Nividia)

OEX 915.96

905.25 (SP-100)

OIH 27.32

26.4 (Oil)

QQQ 105.89

104.54 (NASD-100)

SLV 16.82

16.10 (Silver)

SPY 206.56

204 (SP-500)

Trouble seems to be looming. Today AAPL broke to a

new 12-month low. China's YINN has

fallen 8 of the

last 10 days. The DJI's 10-day ma of Down Volume

remains above Up Volume. This is what happened

last year before large DJI declines.

Can low interest rates continue to boost enough defensive

stocks to hold the market up? How much more heavy

lifting can AMZN and FB do? Their respective PEs are

296:1 and 93:1. Professionals are starting to have doubts.

The Closing Power uptrends for DIA and SPY

could

soon be broken. They have already been bearishly violated

for QQQ and IWM

Since 1965, the DJI has risen only 40% of the time over

the next week. Most likely, we will see the DJI penetrate

is neckline support. But given the good breadth and

how positive the P-Indicator is, we will probably be

get a Buy B9 soon afterward. So, stay short DIA but

hold the defensive ETFs and stocks suggested here

as long as their Closing Powers are rising.

Charts: Peerless DJIA Hourly DJIA DIA SPY QQQ IWM

DJI-Utilities DJI-Rails A/D Line-6000 Stocks

Crude Oil SOXL TECL

Major Indexes and A/D Lines.

Key Tiger Software ETF Charts

Bullish MAXCPs Bearish MINCPs

QUICKSilver

==========================================================================

5-11-2016 Sell S2. What the bulls

feared, today has transpired:

the head/shoulders' patterns in the DJI and SP-500 are

taking clearer shape. If completed, look for the DJI

to fall to 17000.

Last night I wrote that "we may have just seen the rally

to right shoulder's apex in the SP-500 and DJIA.

In that case, the next few trading days may become

the right shoulder in head/shoulders patterns for the

DJI and SP-500."

The chief hope for the Bulls rests now on NY Professionals

and their continued buying of enough dividend-paying and

defensive stocks in DIA and SPY to keep these ETFs' Closing

Powers rising. Speculative stocks in the NASDAQ are

being avoided. See how Tiger's NASDAQ's

"NASDJI" indicator

remains quite negative.

Let's Watch 10-day ma of NYSE Up and Down Volume.

The problem for the Bulls is that Down-day volume

is growing.

If this continues another week, our Red 10-day ma of Down-

Volume will be dominating our Blue 10-day ma of Up-Volume

for about two weeks. In this, it would then start to resemble

the DJI's chart last year before two big sell-offs.

Charts: Peerless

DJIA

Hourly DJIA

DIA SPY

QQQ

IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL

TECL

Major Indexes and A/D Lines.

Key Tiger Software ETF Charts

Bullish

MAXCPs Bearish MINCPs

QUICKSilver

The good news is that the DJI's neckline at 17500 has not been

violated and breadth remains quite positive, showing that

the many dividend-paying stocks and bond funds on the

NYSE are holding up because the outlook for interest rates

staying unchanged is still very good.

Stay short DIA and hold your long positions

provided that their

rising Closing Powers are not violated.

============================================================================

5-10-2016

Today brought the expected rally towards 18000 on

the DJIA. Professionals were proven correct and

overseas' sellers wrong. The Pros on Wall Street are

usually proven right when the Opening Power goes in a

different direction.

It's also been hard to find very many good short sales among

the

Bearish MINCPs .

Our Stocks' Hotline remains long about

twice as many

Bullish

MAXCPs

as we are short among

Bearish MINCPs.

Here I've suggested hedging the short on DIA with longs

among the strongest military stocks, REITs and defensives.

Until the SPY and

DIA show Closing power weakness enough

to break their uptrends, this hedging will probably be continued here.

Volume Seems Too Low for A Big Rally.

NYSE daily Volume was lower than it should have been

if we were about to start a big advance upwards. 10-day

NYSE Down Volume is clearly above 10-day Up Vulume.

Though NYSE breadth was quite positive today (+1639

rise in A/D Line), volume was much lower than bulls must

have hoped for. Disappointing, too, the number of NYSE

new highs fell from 145 to 137.

More backing and filling is, therefore, likely. Today we

may have just seen the rally to right shoulder's apex in the

SP-500 and

DJIA. In that case, the next few trading days may

become the right shoulder in head/shoulders patterns for the

DJI and SP-500.

Charts: Peerless

DJIA

Hourly DJIA

DIA SPY

QQQ

IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL

TECL

Major Indexes and A/D Lines.

Key Tiger Software ETF Charts

Bullish

MAXCPs Bearish MINCPs

QUICKSilver

Hillary Support Is Weakening

Hillary's big double-state defeats (West Va and Nebr.) must

be un-nerving to the establishment Democrats who

are counting on her to easily beat Trump for the Presidency.

She has just about lost her national lead over him in the Polls.

So, maybe, today's rally should be called the "Trump rally".

If Trump really were to reduce the principal on the National

Debt , as he has suggested, by bargaining with creditors, it

would surely lead to printing a lot more money and big inflation.

Initially, that would cause a surge of buying durables, real estate,

gold and collectibles before they rise too much in price. But

then eventually, it would cause much, much higher interest rates,

as in the 1970s and early 1980s. That would cause a market slump.

My thinking is that Trump could end up being the next President,

so we better start thinking about what that could mean. For

a start, it may well bring a lot more volatility to the market.

============================================================================

5-9-2016

With the Peerless S2 signal un-reversed, the

potential head/shoulders patterns in the DJI and

SP-500 present what seem the most likely

scenarios, namely a brief rally and then a decline to

1850 on the SP-500 and 17000 on the DJI.

Here we assume that the right shoulder apexes are

not surpassed for these indexes and that the next

decline has enough downside volume to break the

neckline supports. While we wait to see if this

mildly bearish scenario plays out, I have suggested

buying some Reits, military stock leaders and

the leveraged ETF for Real Estate, DRN as hedges

against our shorts of DIA and some bearish MINCP

stocks

Note that a testing of the necklines could bring

a reversing Buy B9 since the P-Indicator is

likely still to be positive. The DJI would need

to close near 17500 for a Buy B9.

In the meantime, we have low interest rates and

a FED that clearly wants not to make the mistakes

it made in mid-2008 when it was slow to shore

up the Big Banks with "easier money" open market

operations and a Discount Rate cut. This year the

FED wishes not to become part of the political campaign.

Their private independence might then be challenged.

As a result also of the weakening economic data,

it does seem much less likely that the FED will jar the

market. So, buying the best performing REITs

and defensive issues seems a good plan.

Did you notice on the NYSE today, there were

many more breakout new highs. In fact, there were

145 new highs and only 14 new lows on the NYSE. By

contrast, the NASDAQ with its more speculative stocks

failed to draw the same interest. On the NASDAQ,

new lows outnumbered new highs by 10. So, this

remains a very defensive market. We can make money

here by hedging long and short, MAXCPs versus MINCPs.

Charts: Peerless

DJIA

Hourly DJIA

DIA SPY

QQQ

IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL

TECL

Major Indexes and A/D Lines.

Key Tiger Software ETF Charts

Bullish

MAXCPs Bearish MINCPs

QUICKSilver

==========================================================================

5-6-2016

Consider starting to hedge again by being long some of

highest Accumulation military

stocks and REITs, but

remaining short the weakest of the

BEARISH MINCP

stocks. This strategy often starts to work well in April

and May until September.

The operative Sell S2 must now face off against a probable

rally in dividend paying stocks on the NYSE.

Interest

rates should not be going up soon. Friday's Jobs Report

showed the US economy is sputtering. 7 of the last 9 Jobs'

monthly reports showed a drop from 12 months before.

Look at the bottom of today's Hotline and note how a pattern

of monthly deterioration in the Jobs' numbers of 2007

led to a severe bear market in 2008-2009 The FED has to be

aware of this, one hopes.

But there is job growth: the numbers are positive even

though they are not matching what is needed to keep up

with the rising population. The weakening economy helps

explain why NASDAQ stocks, as a whole, are

clearly

the DJI.

Many defensive stocks remain in bull markets. With Hillary

ahead in the polls against Donald Trump, her past hawkishness

is boosting Lockheed (LMT),

Northrop (NOC) and

LLL.

Trump's real-estate ties are aiding Real Estate trusts and

DRN,

today's QuickSilver pick.

May most often brings a shallow decline and a bottom later

in the month, from which a nice advance then occurs. That

is clearly what Professionals are expecting. See how the

Closing Power for DIA and

SPY made recovery highs on

Friday.

A recovery bounce is suggested by the technical position

of quite a few of the ETFs. But there is a danger that the DJI

will only rally about a hundred more points and then

come down hard. That would set up a bearish-looking head

and shoulders pattern. If the 17500 neckline was then

penetrated, a downside objective of 17000 could be

calculated. But this is complicated by the fact that the Peerless

P-Indicator (the 21-day ma of Advances-Declines) remains

positive.

Charts: Peerless

DJIA

Hourly DJIA

DIA SPY

QQQ

IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL

TECL

Major Indexes and A/D Lines.

Key Tiger Software ETF Charts

Bullish

MAXCPs Bearish MINCPs

QUICKSilver

Monthly US Jobs Reports

red =

declining from 12 months earlier

blue = rising from 12 months earlier.

| US Job Growth by Month |

| Year |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

| 2006 |

278 |

316 |

281 |

183 |

23 |

82 |

207 |

181 |

158 |

4 |

208 |

171 |

| 2007 |

240 |

90 |

189 |

79 |

143 |

78 |

-33 |

-24 |

88 |

85 |

115 |

97 |

| 2008 |

19 |

-86 |

-78 |

-210 |

-185 |

-165 |

-209 |

-266 |

-452 |

-473 |

-769 |

-695 |

| 2009 |

-791 |

-703 |

-823 |

-686 |

-351 |

-470 |

-329 |

-212 |

-219 |

-200 |

-7 |

-279 |

| 2010 |

28 |

-69 |

163 |

243 |

522 |

-133 |

-70 |

-34 |

-52 |

257 |

123 |

88 |

| 2011 |

42 |

188 |

225 |

346 |

73 |

235 |

70 |

107 |

246 |

202 |

146 |

207 |

| 2012 |

338 |

257 |

239 |

75 |

115 |

87 |

143 |

190 |

181 |

132 |

149 |

243 |

| 2013 |

190 |

311 |

135 |

192 |

218 |

146 |

140 |

269 |

185 |

189 |

291 |

45 |

| 2014 |

187 |

168 |

272 |

310 |

213 |

306 |

232 |

218 |

286 |

200 |

331 |

292 |

| 2015 |

221 |

265 |

84 |

251 |

273 |

228 |

277 |

150 |

149 |

295 |

280 |

271 |

| 2016 |

168 |

233 |

208(P) |

160(P) |

|

|

|

|

|

|

|

|

|

|

===========================================================================

5-5-2016

Another weak and failed rally today. At the close

there were even 165 more down than up and the

leading group, Utilities, was down. The

NYSE A/D Line

finally broke ts uptrend. That leaves just Bonds as

the leaders. Not very impressive. Fear about the Jobs'

numbers tomorrow before the opening is making speculators

timid. So, our Peerless Sell S2 still

operates. I think

we should stay short DIA. Be careful

about being fooled

by the first, knee-jerk reaction to the Job's numbers.

A dangerous right shoulder could be formed without

Peerless giving a reversing Buy signal.

More and more technical damage is being done. See how

close to breaking their supports are the DJI and SP-500.

By far, the bigger danger, however, would occur if

they only briefly rally and then complete weak right shoulders

which set up ugly head/shoulders, as shown below.

Peerless Sell S2 and Bearish

Head/Shoulders Rally Scenarios.

Unless breadth turns very bad, there still a good chance

we will get a Buy B9 if the DJI closes below 17500,

That would make technicals complicated and somewhat

contradictory. We will just have to wait to see what

tomorrow brings. Patience is also indicated by

.

bearish seasonality for the next two weeks of May.

Since 1965, the DJI had risen just 46% of the time

|

over this period and shows an average decline of 0.4%

There seems little reason to hurry to buy with each

rally failing before even 18000 is reached.

Charts: Peerless

DJIA

Hourly DJIA

DIA SPY

QQQ

IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL

TECL

Major Indexes and A/D Lines.

Key Tiger Software ETF Charts

Bullish

MAXCPs Bearish MINCPs

QUICKSilver

===========================================================================

5-4-2016

No buy signal today, but the

DJI did close more than 1%

below the 21-day ma with the P-Indicator and Accum. Index

both positive. This is constructive. A close next below

17502, 148 points below today's close, would bring a

reversing Peerless Buy B9.

Professionals figure that weakness in Europe and higher

rates in the US will bring over hot international money

to the US. That, I think, is why the Closing Powers for

DIA and SPY

have not started downtrends, the NYSE

A/D Line is still rising and the recent

hourly DJI lows were

not confirmed by the OBV Line.

So, a bounce is indicated for tomorrow. However, I suspect

it will fail like others have in the last two weeks unless

the Jobs' Report Friday morning produces another "Goldilocks"

number. (One that is not too high, not too low and is

just right, somewhere between 220,000 - 230,000, I reckon.)

Charts: Peerless

DJIA

Hourly DJIA

DIA SPY

QQQ

IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL

TECL

Major Indexes and A/D Lines.

Key Tiger Software ETF Charts

Bullish

MAXCPs Bearish MINCPs

QUICKSilver

Will there be much of a rally? Perhaps, 18000. More than

18000 seems unlikely. Utilities are

the primary leadership now.

Utility fans for this group doubt that the month of June

will bring higher rates. See some of their leaders in

the charts of the

Bullish

MAXCPs

tonight.

Overall, the market remains very defensive. There is

not enough head-room. So, speculators are showing

caution and even timidity now.

How do we determine this? The Peerless Relative

Strength Indicator of the NASDAQ versus the DJI

(NASDJI)

is negative. Biotechs have dropped

below their 65-dma.

Semi-conductors have broken down from their recent

side-wise consolidation. The Closing Powers for

QQQ

and IWM have had their up-trends decisively

violated.

Transports are not moving and the hot

Mining group has

turned down with a vengeance, all for fear international|

rates will go higher soon if the Fed tightens. So, I have

conclude that Speculators are simply too unwilling to take

a chance that the Aprils' Jobs report will be too good and

that will bring an interest rate hike and the market will slide

back more. Without more speculators, how high can the

blue chips go in splendid isolation?

May generally remains a soft month. After May 4th, the

DJI has rallied only 40% of the time over

the next two weeks

since 1965. A better buying opportunity will probably

present itself. Stay short DIA.

--------------------------------------------------------------------------------------------------------------------------

5-3-2016 The

operative Peerless signal remains a Sell S2.

The NYSE A/D Line remains in an uptrend, but

the

chart above shows that is no longer true of all stocks.

Today's decline took the DJI 0.6% below its flat 21-day ma.

Price support is now at at 17617. The best support is at

the lower 3.5% band and the rising 65-dma, around 17200.

The DJI's Tiger Accumulation Index keeps

falling, warning

us not to trust rallies. Big Money keeps using intra-day

rallies to sell into.

Stay short DIA. The next two weeks are

seasonally week.

Since 1965, the DJI has risen only 40% of the time over this

period. The average decline is small, only -4.0%.

See how the Closing Power uptrends for QQQ,

IWM, SOXL

and TECL have been violated. It's

probably only a matter of time

before the same thing occurs for DIA and

SPY. These bluer

chip ETFs have not had Closing Power uptrend-breaks because

of the pattern of selling overseas and lower openings, which are

driven, I think, by the increased talk of rates being raised in the US.

The European economic policy makers continue to believe

that Government Austerity cures all economic ills. But they

apparently do not appreciate how much of the cheaply borrowed money

leaves the Continent of Europe and does not result in increased

investment in Europe.

(

Two Fed Officials Signal Markets May Be Wrong to Doubt June Hike

and

http://finance.yahoo.com/news/yellen-wants-it-both-ways--so-we-re-going-to-call-her--hovish-144213542.html#

)

Charts: Peerless

DJIA

Hourly DJIA

DIA SPY

QQQ

IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL

TECL

Major Indexes and A/D Lines.

Key Tiger Software ETF Charts

Bullish

MAXCPs Bearish MINCPs

QUICKSilver

The Fed is now talking about raising rates in June. This

will kill the benefits the Europe hoped to get from a 0%

Discount Rate. Hot international money usually goes to

wherever it can get a higher rate. Money will flow to the

US and not be used to invest in a European recovery.

This spills over to other economies, the biggest being China.

We now see a bearish head/shoulders in VGK

(European

stocks). The Chinese ETF, YINN, could not get

past

its resistance at 15 and now seems destined to test its lows.

The talk of a rise in rates in the US has also caused Gold stocks

to fall back again today. Because the FED does so much more

talking about raising rates than actually making that come to

pass, I suspect that Gold stocks will probably hold up

until rates are actually lifted. Reflecting the

Gold, Silver

and Oil Price outlook, Latin American

ETFs are now

approaching their best near-term supports in the current uptrend.

Caution rules right now. Traders want to see what the next

Jobs Report numbers are. A number for April above +250,000

would almost certainly give the FED's hawks the excuse

they need to raise rates, regardless of the consequences

overseas.

==============================================================================

5-2-2016 The

operative Peerless signal still is considered

a Sell S2. The DJI is too near the 18000 resistance

in a wide trading range with 16000 as the approximate

bottom to safely buy. But still the NYSE A/D Line is

rising strongly as is the DIA's Closing Power. These bullish

attributes should prevent the DJI from declining below

the 2.5% lower band this week.

But keep in mind that the DJI still sports a bearish head/shoulders

top and the huge advances in Gold Stocks are reminiscent

of preludes to a number of significant market tops. Fortunately,

May retreats back to the lower band often set up good places

to go long again.

Buying near the lower band late in May was consistently

profitable until recently. May declines turned into bear

market sell-off in 2001, 2002 and 2008. I found no fewer

than 18 cases where May bottoms brought excellent trading

rallies. See charts.

For now, lets do some watchful waiting this week. .

The Jobs' numbers will be released before Friday's opening.

Remember that "Good is Bad". An estimated increase

in April of more than 250,000 may be sufficient for the

FED to justify a June rate hike. Because, the pundits

in the Financial Press will start talking about this, I

thought it might help to be armed with the past numbers.

US Dept of Labor's Monthly Job Gains in 1,000s

|

|

| Year |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

| 2006 |

278 |

316 |

281 |

183 |

23 |

82 |

207 |

181 |

158 |

4 |

208 |

171 |

| 2007 |

240 |

90 |

189 |

79 |

143 |

78 |

-33 |

-24 |

88 |

85 |

115 |

97 |

| 2008 |

19 |

-86 |

-78 |

-210 |

-185 |

-165 |

-209 |

-266 |

-452 |

-473 |

-769 |

-695 |

| 2009 |

-791 |

-703 |

-823 |

-686 |

-351 |

-470 |

-329 |

-212 |

-219 |

-200 |

-7 |

-279 |

| 2010 |

28 |

-69 |

163 |

243 |

522 |

-133 |

-70 |

-34 |

-52 |

257 |

123 |

88 |

| 2011 |

42 |

188 |

225 |

346 |

73 |

235 |

70 |

107 |

246 |

202 |

146 |

207 |

| 2012 |

338 |

257 |

239 |

75 |

115 |

87 |

143 |

190 |

181 |

132 |

149 |

243 |

| 2013 |

190 |

311 |

135 |

192 |

218 |

146 |

140 |

269 |

185 |

189 |

291 |

45 |

| 2014 |

187 |

168 |

272 |

310 |

213 |

306 |

232 |

218 |

286 |

200 |

331 |

292 |

| 2015 |

221 |

265 |

84 |

251 |

273 |

228 |

277 |

150 |

149 |

295 |

280 |

271 |

| 2016 |

168 |

245(P) |

215(P) |

|

|

|

|

|

|

|

|

|

| P : preliminary |

http://data.bls.gov/timeseries/CES0000000001?output_view=net_1mth

|

|

. I Do Not Expect A. Rate Hike.

The FED is acting like it is limited by what the European

Central Bank is experimenting with. Their 0% Discount

Rate is meant to revive their stock markets. Their people

are told this "should" work to revive their sluggish economies,

too. But this is really the same "trickle-down" tripe the

Fed served us with QE-2 and QE-3. Still, what choice do they have.

Their politicians share the same automatic aversion to deliberate

deficit spending on Public Works as most of the Congress does.

Expect more "muddling through". Meanwhile, Gold should

keep rising.

Charts: Peerless

DJIA

Hourly DJIA

DIA SPY

QQQ

IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL

TECL

Major Indexes and A/D Lines.

Key Tiger Software ETF Charts

Bullish

MAXCPs Bearish MINCPs

QUICKSilver

------------------------------------------------------------------------------------------------------------------------

4-29-2016 I take the operative Peerless

signal to be a Sell S2.

A brief DJI rally seems likely. Friday, the DJI could not

close decisively break its neckline. The rising Closing Power of

SPY has not yet been broken.

QQQ has fallen to expected

short-term support, its rising 65-dma. But Gold's rise

represents a grave danger to the EURO and the

Dollar.

If interest rates are not raised, Gold and its surrogates

are likely to keep rising.

Stay short DIA and, for more aggressive longs,

hold

a mix of Gold, Silver, Oil Service Sectors and

Emerging

Market ETFs. Watch

GLD closely now. Big bankers

in the FED ultimately are loathe to allow its strength to

showcase severe potential weakness in the Euro and Dollar.

Gold has broken above the last resistance shown on

its Daily Chart. The weekly chart shows many points

resistance. The very number of them suggests sellers

have no one place to concentrate their sell orders

so as to better turn back Gold's rally.

WEEKLY GLD CHART

Charts: Peerless

DJIA

Hourly DJIA

DIA SPY

QQQ

IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL

TECL

Major Indexes and A/D Lines.

Key Tiger Software ETF Charts

Bullish

MAXCPs Bearish MINCPs

QUICKSilver

Gold and Silver Stocks explosion upwards is a result

how very oversold they were and how the European

Central Bank has declared it would keep its key

Discount Rate for banks at 0%. In theory, money

supply should grow fast and there should soon be

inflation. In theory, the Euro will become super-

plentiful. With it declining, the expectation is that

Gold will be the best safe haven. Because it pays

no dividend, any rise in European interest rates

should cause it to decline. But right now, as the

hottest performing investment around, it is attracting

thousands of speculators who are willing to bet that

neither the European Central Bank or the FED will

raise rates. In the short-run, they will probably

be right. But in the long run, the big banks cannot

allow their currencies to lose too much value relative

to Gold. At some point, US Treasuries would presumably

even be dumped by the Chinese in favor of Gold.

This the FED cannot allow.

----------------------------------------------------------------------------------------------------------------------------

4-28-2016 I take the operative Peerless

signal to be a Sell S2.

DJI and

SP-500 bulls must now fight off quickly appearing

head/shoulders patterns. Just because these are small

patterns does not make them less significant. The DJI's

neckline at 17780 is important to watch now. This is

50 points below the neckline support. If that support

does give way, way, I would expect the DJI next to decline

to the support of its rising 65-dma.

The DJI has slightly penetrated its 21-day ma. With the

current annualized rate of change of the 21-day ma now below

+.07 and the current IP21 below +.07, this mvg.avg.

will probably give way. So, therefore, will the neckline

at 17780. (Key Values DJI Chart).

We remain short DIA. A retreat to the

DJI's lower band

near 17250 would then seem to be the most likely next

scenario. It is also possible that we will see a deeper

decline, though still bounded by the broad trading range,

15700-18000. The best earlier examples of such

broad trading ranges are those of 1956-1957, 1986 and 2000.

We will need to get another Peerless Buy signal to buy

DIA.

The Rise of Gold Stocks

Is A General Market Warning,

I am also concerned by how big advances in Gold

and Gold stocks can cause the FED to tighten rates.

Just before the October Crash of 1987 saw NEM,

a key gold stock, rise 125% in 11 weeks, It peaked

on 9/15/1987. Two weeks later we got our most famous

Sell S9. Five weeks after the Sell S9, the DJI was

down 33%.

The

"Nifty-35" May

Be Topping Out,

One of the reasons that the DJI is declining is the

fear that tech stocks will start to break down following

APPL's lead the last few days. Now at

94.83, it is

nearing important support at 93.

Charts: Peerless

DJIA

Hourly DJIA

DIA SPY

QQQ

IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL

TECL

Major Indexes and A/D Lines.

Key Tiger Software ETF Charts

Bullish

MAXCPs Bearish MINCPs

QUICKSilver

The New Boom in Gold/Silver Stocks

Another reason for the recent decline in blue chips and

many defensive stocks is that they've simply had very

good runs and now it's simply time for some profit-taking.

Some of that money is being shifted to the very hot

gold and silver stocks.

As you know, mining stocks declined throughout 2012,

2013, 2014 and 2015. That's a long bear market by

any measure. Since the beginning of this year, they

have been springing back,

With interest rates very low, the EURO and the Dollar

look suspect to "Gold-Bugs". The

mining stocks' up-trends

are outstanding. High performance funds cannot ignore

them. It has been an across-the-board mining stock rally,

but it is the smaller mining stocks that are now rising the

most steeply.

Because of how far they came down, I believe that they

could still rise a lot more before they reach significant

and over-powering resistance. See JNUG's weekly chart

below. This is the bullish leveraged ETF for smaller miners.

It is now 152, In theory, it may not face key resistance until

it reaches 600!

How Darvas Would Trade Them

In 2009 and 2010, many of the same stocks also made

big advances. But there is a big differences now.

In the earlier period they rose more gradually, rising up

and down from a steadily rising 65-day mvg.avgs.

Here they are rocketing upwards. Traders have to

use the rising 5-day ma and 10-day ma as points to buy

and they must also be prepared to buy the breakout-

new highs. Such breakout-buying is hard for most

people. But it must be used when extraordinarily

bullish news has excited both big money and increasing

numbers of speculators who do not want to be left out

of the action. Rallies like this seldom last longer than

a year. But they can be profitably traded.

This is the type of market favored by devotees of the

box system of Nicolas Darvas. As long as the floor of

each higher price-box is not closed below, folks using

the original Darvas system simply stay long after buying

on a breakout. See the boxes in the Daily JNUG chart

below.

(

https://en.wikipedia.org/wiki/Nicolas_Darvas

)

Daily JNUG

===========================================================================

4-27-2016 We need to see if the DJI can get

and stay above 18000

before trusting yesterday's B15. Breakout runs

just do not seem to happen in April or May in a

Presidential Election Year. I would hold DIA short and

trust the Sell S2 a little longer. I explained the reasoning

for this in last night's Hotline.

Charts: Peerless

DJIA

Hourly DJIA

DIA SPY

QQQ

IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL

TECL

Major Indexes and A/D Lines.

Key Tiger Software ETF Charts

Bullish

MAXCPs Bearish MINCPs

QUICKSilver

Hillary's victory over Sanders was expected. So

was today's Fed announcement that there would be

no April Rate hike. Taking profits in major market

ETFs on this news was probably the right tactic for

traders.

Overseas developments are taking all the

world's

market's down this morning.

http://www.bloomberg.com/

It's April. That means it time for another round of

the big austerity-obsessed European banks squaring off

against the long-suffering Greek people.

https://www.rt.com/business/341140-greece-imf-bailout-europe/

Institutional Dumping

Multiple Tiger Sell S14s Are Mean and Ugly

When Stock with S14s Break Support at 65-dma.

AAPL's awful earnings, Twitter's tanking and Chipotle's collapse

are warnings that US growth stocks could start to turn down badly.

These stocks' sell-offs should limit the upside potential for TNA and

QQQ. If their recent lows do not hold, look for them and the key

ETFs to fall further. All three look like good short sales.

The Sudden Rise of The Fallen and Long Depressed

With low interest rates in Europe gas come strength

in Gold, Silver

and South American ETFs like LBJ

and BRZU. The Oil and Gas service

sector OIH, shows

lots of Accumulation as it recovers. So does the

very depressed GASL. Buying small

positions in

these on 10% declines from their peaks is a tactic

that should continue to work so long as the European

Discount rate is effectively zero percent.

---------------------------------------------------------------------------------------------------------------------------

4-26-2016 I still take the operative

Peerless signal to be a

Sell S2 despite the Buy B15 that appeared today.

Stay short DIA. There is still a good chance that

the recent neckline-support levels for the DJI, SP-500

and QQQ will be broken. If that occurs, I would think the

DJI will have to test 17000 and its lower band.

The Buy B15 occurs because the DJI had risen

strongly and has not closed below its 21-day ma for

more than 40 some days. It has only occurred

once in April and once in May. Given the overhead

resistance, let's hold off taking the Buy B15 for now.

We may well see more inconclusive backing and

filling for the next month or two by the major

averages. Special situations and low-priced minerals'

stocks are the only good offerings now for traders

among stocks. They may heat up more.

Charts: Peerless

DJIA

Hourly DJIA

DIA SPY

QQQ

IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL

TECL

Major Indexes and A/D Lines.

Key Tiger Software ETF Charts

Bullish

MAXCPs Bearish MINCPs

QUICKSilver

The new B15's appearance is problematic mainly because

of the amount of overhead resistance in the DJI and the

bearish looking head and shoulders patterns that we

see now in the QQQ, NASDAQ, OEX, SP-500

and even the DJI. AAPL reported poorer than

expected earnings after the close today. Because

of its huge size, a much lower opening by AAPL

will almost certainly bring a test of these indexes

necklines. It will also mean the DJI will again test

its rising 21-dma. If these necklines are broken, I

would think the DJI will have to test its lower

band.

There is another problem with today's Buy B15.

Buy B15s seldom occur in April or May. There has been

only one B15 in April. True, that brought a big gain in 1995 and 1996.

But it also occurred after the DJI had already made a very bullish

flat topped breakout into all-time high territory. The

DJI is now 3% below such a breakout. The overhead resistance needs

to be eaten up before any April or May Buy B15.

The single May B15, in 1999, did occur above resistance,

but

because of how late it occurred in the ordinarily bullish

November-May period, it immediately brought a significant

paper loss. The DJI back fell to the lower band

And there is one more problem with taking seriously this

Buy B15 that we got today. This problem arises from the

market's typical behavior in a Presidential Election Year.

Breakouts in April or May just do not go anywhere in

these years. One has to go back to the wild and highly

speculative 1928 April and May breakouts to see them

succeed. Since then, any April or May breakouts have

proven to be failures.

So, we need to be cautious about taking this Buy B15

at present. It could succeed, I surmise. But that would

require the FED to go along with the zero-Discount rate

in Europe. We need more evidence that this is what they

will do.

Let's watch to see how these head/shoulders patterns

play out. At present, I would stay short DIA and avoid

most long positions, except for some foreign ETFs and

some of the strongest oil/gas stocks among the Bullish MAXCPs.

If these head/shoulders patterns are completed, they

should be treated as Tiger S5s. If the DJI completes

its head/shoulders, that, too will be a Tiger Sell S5.

My thinking right now is simply to change Peerless

so that Buy B15s simply cannot occur in April or May

in a Presidential Election Year.

The market is waiting.

I think it is waiting to see what the European Central Bank

and the Fed continue to do. Until Professionals jump

on the bearish side and DIA's Closing Power breaks its

uptrend and the NYSE A/D Line breaks its steep uptrend,

any decline will probably be limited.

The outcome of US Presidential Primaries will probably be Hillary

Clinton vs Donald Trump race. If so, Wall Street looks to be safely

in control for another four years. That will work to hold

the market up, too. Only a sudden rise in US interest rates would

pose much risk to the market. Because it's a Presidential Election

Year and the FED remembers 2008, they will probably be very

cautious and leave rates unchanged.

--------------------------------------------------------------------------------------------------------------------------

4-26-2016 The operative signal remains a

Peerless Sell S2.

However, short-term support is apparent. The Closing Powers for DIA.

SPY and QQQ are still in uptrends. So is the NYSE A/D Line.

Let's watch the QQQ now. It could forming a little head/shoulders

pattern. You may remember that we noticed a similar pattern

in the Dow Jones Utilities as it tested its neckline similarly.

It has not broken its support. Fed watchers, apparently,

have not decided whether there will be a June rate hike.

Charts: Peerless

DJIA

Hourly DJIA

DIA SPY

QQQ

IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL

TECL

Major Indexes and A/D Lines.

Key Tiger Software ETF Charts

Bullish

MAXCPs Bearish MINCPs

QUICKSilver

Professionals Have Insider Information on Rates.

Watch Them Closely Now.

A lot depends on whether the European Central Bank continues

its very low rates. If it does keep its Discount Rate at 0%, that

will put pressure on the FED also to keep rates low. To have

them much higher would hurt the Euro and drain "Hot Money"

away from Europe to the US just when they are seeking to

encourage| new investments in Europe. Would the US

financially sabotage Europe?

Assuming the FED chooses to go along with very low ECB

rates, that should allow the DJI to move to a nominal new high

despite the Peerless Sell. A bigger rally would seem unlikely.

One has to go back to 1928 (when the boom became a bubble)

to find a case where the DJI made a big move up from an April

or May breakout in a Presidential Election year.

One of the main reasons for monitoring what Professionals

are doing is because they have contacts within not only the

Fed but also the Bank of England, in Brussels and the European

Central Bank.

One thing I've learned about predicting the stock market:

more than any other factor, its Central bank changes of

Discount Rates that hold the most sway over what the

stock market does... unless (and this is important) there are

extraordinary emotional forces at work at the same time.

An Untold Story about 1919

As you all probably know, there was a famous Wall Street

trader named in the 1920s named Jesse Livermore. He made a

colossal amount selling short just before the Crash in 1929. What is

not so well know is that he had spies within the Bank of England.

Only a few days after the DJI peaked on September 3rd 1929,

Livermore received a telegram that the Bank of England was about to

raise its own Discount Rate from 5.5% to 6.5% in an effort to

get British "hot money" to withdraw their funds from Wall Street

before the cataclysm came.

"On the morning of 4 September 1929, the New York hedge fund

operator Jesse Livermore received a message from a source in London

according to which a “high official” of the Bank of England – either Montagu

Norman or one of his minions – had told a luncheon group of City of London

men that “the American bubble has burst.” The same official was also quoted

as saying that Norman was looking for an excuse to raise the discount rate

before the end of the month..."

(

http://tarpley.net/online-books/against-oligarchy/british-financial-warfare/

)

The same author insists that it was always the intent of the Bank of England

to restore the "City" of London (the financial community there) to its

former position as the center of world Finance. He presents evidence

showing that the Bank of England was even hoping for a US Crash.

Did they actually design their Rate Hike to do that? Or

was their move to a very deflationary 6.5% simply a response

to the Fed's rate hike to 6% a month earlier? The author claims that

when JP Morgan heard of the actual B of E rate hike on September

29th and, five days later, how the Labour Government's Chancellor

of the Exchequer Phillip Snowden was calling the full one percent rate

hike a necessary step to end the dangerous US stock market "orgy

of speculation", he became enraged, feeling betrayed. At that point he

ordered going even more heavily short.

============================================================================

4-22-2016 Peerless now shows the operative signal

to be a Sell S2.

Lots of Indexes and Sectors appear to have reached resistance

levels. See for example the SP-500,

QQQ and OEX.

A pullback to re-group seems likely even though

the NYSE

A/D Line remains in a steep uptrend.

Professionals have

not yet switched from net Bullish to net Bearish. The DJI

which is the first Index they jump on to attract buyers or

sellers is still rising. Until DIA's Closing

Power uptrend is

broken, there is still some chance that new lower interest

rates will be unveiled to push the market higher. The Federal

Reserve may not want to risk another 10%-14% sell-off

in this a Presidential Election Year.

Charts: Peerless

DJIA

Hourly DJIA

DIA SPY

QQQ

IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL

TECL

Major Indexes and A/D Lines.

Key Tiger Software ETF Charts

Bullish

MAXCPs Bearish MINCPs

QUICKSilver

Medtronics (below) has been a 2-year base just

below 80. A

breakout over 80 would look especially appealing

as a place for chartists to buy.

------------------------------------------------------------------------------------------------------------------

4-21-2016 Yesterday brought a reversing Sell S2 from

Peerless.

The head/shoulders pattern of the

DJ-Utilities worsened

today. Some 40 S&P-500 stocks now show

completed

head/shoulders patterns.

The Closing

Powers for the key ETFs have not yet been

broken. Ordinarily, we would

prefer to wait for these uptrendlines

to be broken, before suggesting

going short DIA. But these

Sell S2 signals are very reliable,

especially when the

DJI seems locked in a broad trading

range in a Presidential

Election Year. So, I suggest going

short DIA or some of the stocks

showing completed head/shoulders

patterns where the

stock has also closed below its

65-dma.

See these SP-500

H/S stocks here.

Charts: Peerless

DJIA

Hourly DJIA

DIA SPY

QQQ

IWM

Crude Oil

SOXL

TECL

Major Indexes and A/D Lines.

--->

http://tigersoft.com/MAJOR-INDEXES/INDEX.htm

Key Tiger Software ETF Charts

Bullish

MAXCPs

Bearish MINCPs

QUICKSilver

The German Finance

Minister, Schäuble,

has come out strongly

against the zero-interest rate policies of

Mario Draghi, the head of the

European Central Bank. The markets are

interpreting the

German bankers' opposition as being powerful

enough to threaten

any long-term "helicopter - free money"

plan.

http://www.politico.eu/article/3-messages-from-draghi-for-ecb-critics/

This is a highly

reliable Sell. 2/3 of the cases have

occurred in a Presidential Election year.

The average

decline by the DJI when reversed with a

Peerless

Buy is 7%. The closest parallels to now

among

earlier S2 signals were those occurring in

Presidential

Election years and when the DJI was visibly

locked

in a broad trading range. Those are the

cases in

1948, 1956, 2000 and 2004.

Trading Range

Peerless Sell S2s

in A Presidential Election Year,

since 1928| PE = Presidential Gain if DJI Sold Short

Election Year and this position was

closed on next Peerless Buy.

=========================================================================

19480615 PE S2 193.2 .05 perfect

19481022 PE S2 189.8 .061 perfect

19560409 PE S2 518.5 .079 perfect

19560802 PE S2 521 .075 perfect

20000425 PE S2 11124.82 .049 perfect

20000906 PE S2 11310.64 .095 perfect

20001030 PE S2 10835.77 .060 Very small Paper Loss

20040902 PE S2 10290.28 .038 Very small Paper Loss

-------------------------------------------------------------------------

Avg = 7.2%

================================================================================

4-20-2016 Today brought a reversing Sell S2 from Peerless.

This is a highly reliable Sell. 2/3 of the cases have

occurred in a Presidential Election year. The average

decline by the DJI when reversed with a Peerless

Buy is 7%. See the list of S2s further below. S2s

are based on the DJI approaching the upper band

in certain months in the 4-year Presidential cycle

with significantly weakening internals.

While our internals now are not negative, the DJ Utilities

quickly completed a bearish-looking head and shoulders

today. Fear must be returning that the FED will raise rates

in June. See these charts further below.

While our internals now are not negative, the DJ Utilities

quickly completed a bearish-looking head and shoulders

today. Fear must be returning that the FED will raise rates

in June. See these charts further below.

QUICKSilver

Just by looking at the DJI, it is not clear that it will immediately

fall back. But it did close 2.1% above the 21-day ma and

is in the zone of resistance from the highs of last Summer.

Today the NYSE A/D Line has made another new high

far ahead of the DJI, The DIA's Closing Power is still

rising. Conclusion: I would take some profits in general

market ETFs. But let's wait until the DIA's Closing Power

breaks its uptrend before selling short DIA.

QUICKSilver

Just by looking at the DJI, it is not clear that it will immediately

fall back. But it did close 2.1% above the 21-day ma and

is in the zone of resistance from the highs of last Summer.