TIGERSOFT AUTOMATIC and OPTIMIZED

BUY AND SELL SIGNALS

(C) 2013 William Schmidt, Ph.D. www.tigersoft.com 6/16/2013

---------------------------------------------------------------------------------------------------------------------------------------------------

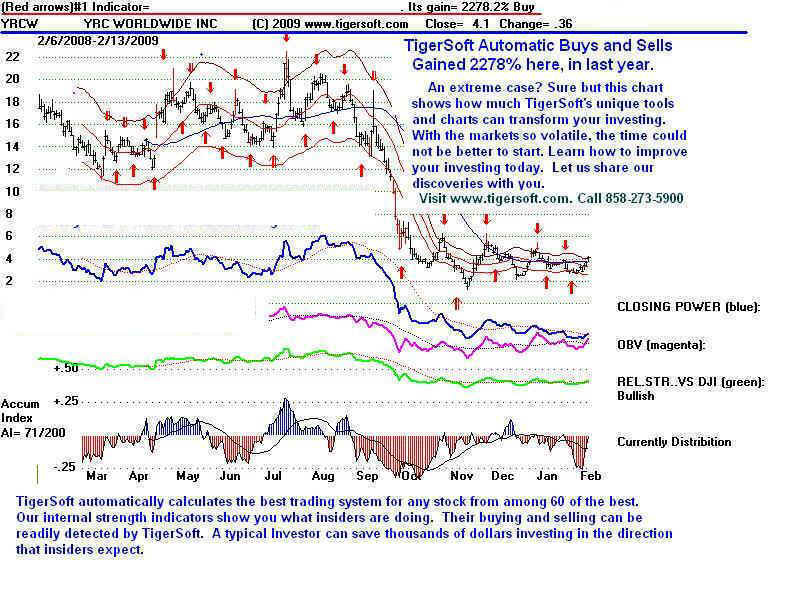

In a flash, the computer calculates which are the best of 60 different trading system

for the stock you are displaying using TigerSoft. They are often extremely profitable.

These Automatic Signals are Simple and often very Powerful and Profitable.

But we also need to establish some trading rules for using them.

I would also factor in:

1) new Peerless Buys and Sells,

2) the trend of Closing Power,

3) the levels of Accumulation and Relative Strength trends.

4) Price patterns and trends.

Breakouts above well-tested resistance,

Breakdowns below well-tested support,

Head/Shoulder Patterns

Rising 65-dma is usually very good place to buy after bulge of Intense Accumulation.

Falling 65-dma is usually very good place to short when Red Distribution is heavy.

5) How well a particular indicator works with a stock over a

long time is important.

6) Be cognizant of the signals produced by the 2nd, 3rd and 4th best systems

and not just the best system. This will give more confidence and will reduce

some of the paper losses.

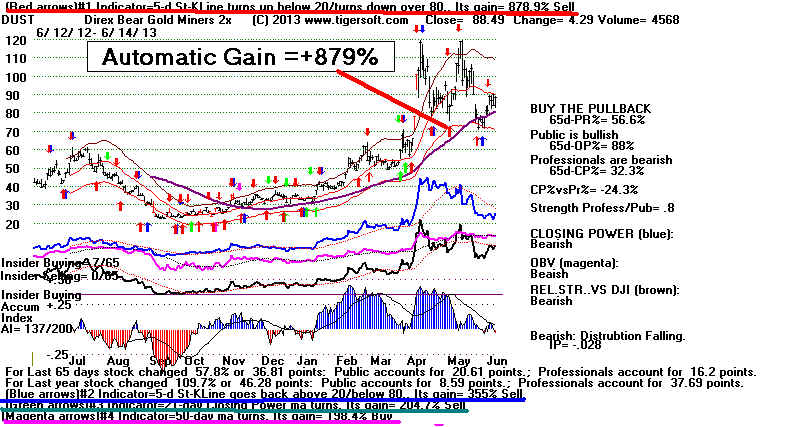

DUST Case Study

With the ETF DUST (shown below), a simple 5-day Stochastic systemm all

by itself gained 872.7%. Using the next day's opening to trade would have gained

+804%. There would have been 25 winning trades and 13 losing trades. Unfortunately,

the biggest paper losses were very sizeable: 37.6% on long trades and 32.2%

on short trades. It is necessary to understand the limitations as well as the

strengths of TigerSoft's aututmatic Buys and Sells. There are many steps

Tiger users can take to avoid such big paper losses. This study shows

how find these very profitable trading situations and also how to limit paper losses.

Detailed DUST Case Study

http://tigersoft.com/Automatic-Signals/DUST-CaseStudy/index.htm

----------------------------------------------------------------------------------------------------------------------------

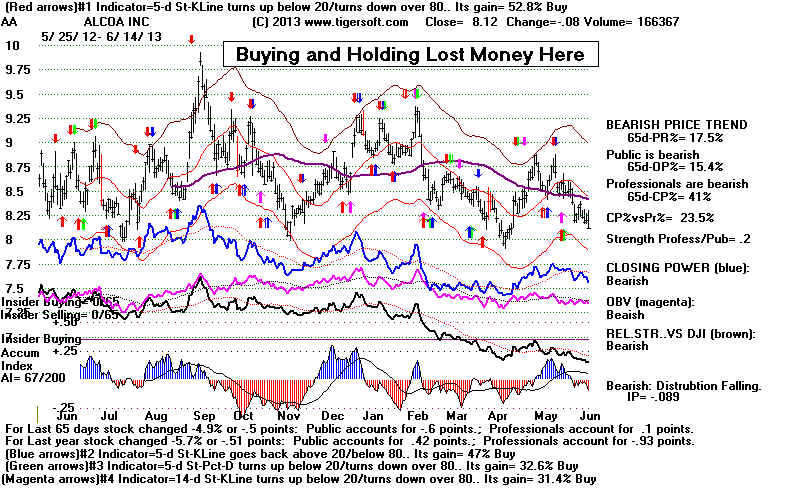

Selling Options Is An Option.

Many times a stock is stuck in neutral. Using the red automatic signals based on short

term stochastics can turn this situation around and make it profitable. Options could

be written very profitably here. Sometimes, it is more profitable to trade on the next day's

opening can actually be more profitable. That was true here by 5%. In this situation, there

was no paper loss bigger than 9.8%. There were 21 qinning trades and 7 losses.

----------------------------------------------------------------------------------------------------------------------------

The Best of The Best

When a frequency distribution is done of the various best Tiger automatic systems, we

consistently find that 5-day Stochastics generally occur 3 times more than chance would

allow. With NASDAQ-100 stocks 29% of all the stocks trade best with one of the 5

different 5-day Stochastics. Among the Stochastic systems, two occur more than 4x more

than chance would suggest. See the separate study of The Frequency of the

5-day Stochastics Being The Best Trading Systen from 1990-2013. It reaches the same

conclusion but it does show there is considerable variation in their frequencies

from year to year. Even so these 2 Stochastic-5 systems still out performed chance

in the worst years, 1995-1999, 2003 and 2008-2009.

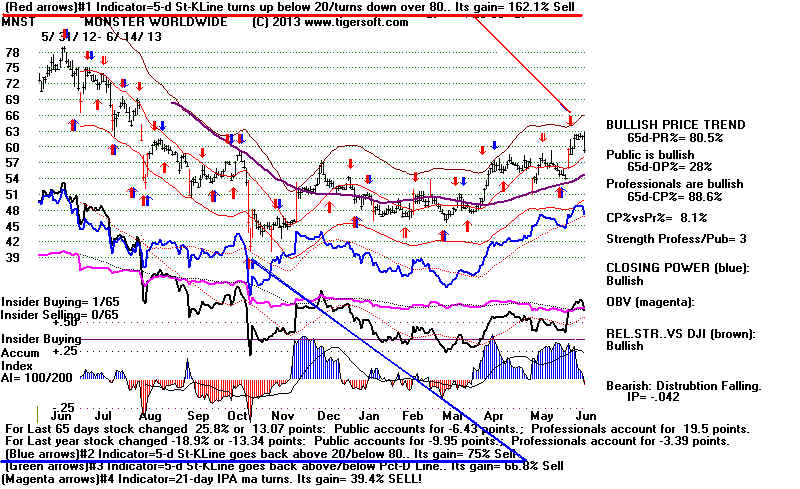

By far the most commonly occurring best systems are:

1) The 5-day K-Line turning up from below 20 or turning down from above 80.

5/30/12 - 6/14/2013 Pct of Cases Probability of Being Best System

A stocks - .0808

B stocks .0736

DJI stocks .10

QQQ stocks .1702

SP-500 stks .105

chance .0196

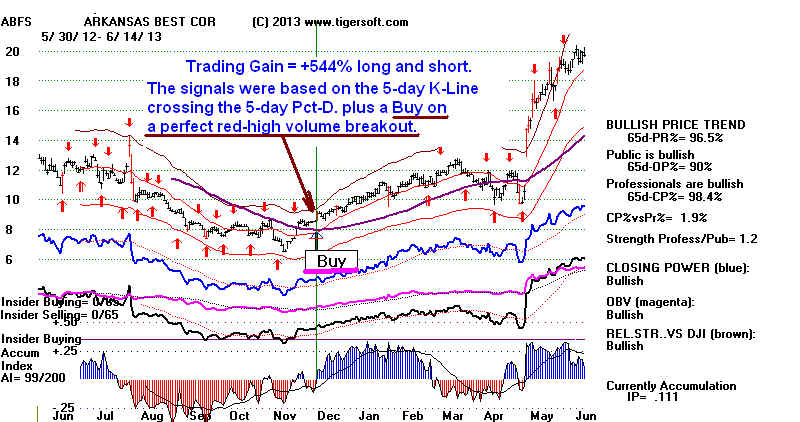

2) the 5-day K-Line crossing the 5-day Pct-D

5/30/12 - 6/14/2013 Pct of Cases Probability of Being Best System

A stocks - .0727

B stocks .0796

C stocks .0763

DJI stocks .10

QQQ stocks .0744

SP-500 stks .0903

chance .0196

Clearly the bigger the company, the more likely one of these two stochastics

will be the best trading system. That these numbers are so high in a market

that is near its all-time high, shows their continuing power.

A very good trading approach is to find a stock that trades well with one of these

two systems and add to it some additional trading rules, such as "Buy on a breakout

when prices close above a well-tested flat resistance and show red high volume

to confirm the breakout. Following such a modified system would have gained

a whopping +544% from 6/19/2012 to 6/14/2013. See its chart below.

-----------------------------------------------------------------------------------------------------------------------------

There are quite

a few TigerSoft tools to let you find

There are quite

a few TigerSoft tools to let you find and use the best trading systems and their automatic signals.

Please read "Using TigerSoft To Get Most out of These Automatic Signals"

http://ww.tigersoft.comAutomatic-Signals/Start/index.htm

-----------------------------------------------------------------------------------------------------------------------------

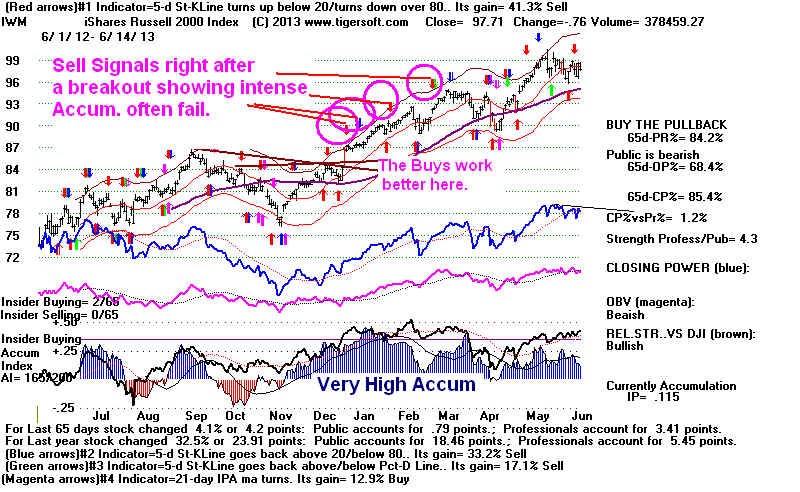

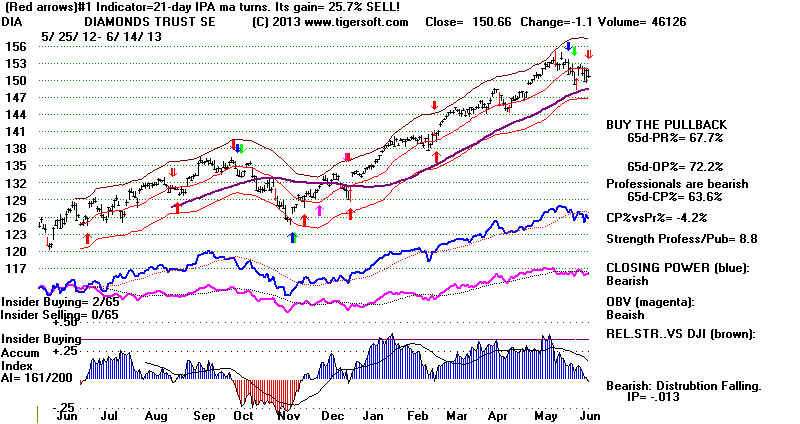

There's Strength in Numbers

Very often when there has not been a signal for a long time, the sudden appearance

of one or more signals, it a good alert to a reversal. See how the cluster of multiple

Sells using the FOUR best trading systems together, caught the tops in DIA in

September 2012. The biggest paper loss here was only 1.2% long

or short. There were 9 winning trades and just 1 loss. The gain was 34.6%.

Note that the chart below displays the top 4 systems' signals.

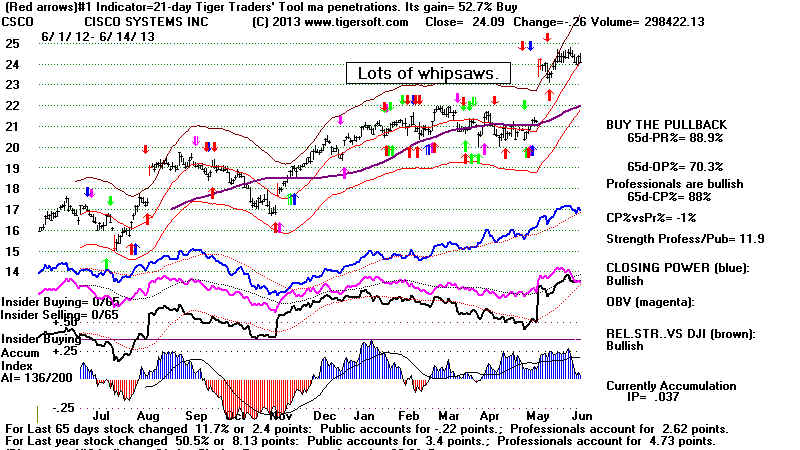

A Quick Study of The Effectiveness of

Using The Best Two Trading Systems' Automatic Signals

You will want to do your own study of using more than just the Red #1 best system's

Buy and Sell signals. I am convinced that using the Red #1 and the Blue #2 signals

together tends to produce a high return and may even prevent a larger paper loss.