The broad trading range, 52-70 seems to the main

dynamic here. Watch for the Accum. Index to

turn positive to tell us when there may be an upside

breakout and a worsening of it would warn that 50's

support may not hold.

NUGT Daily short-term chart

http://www.tigersoft.com/NUGT-charts/index.html

-----------------------------------------------------

Discontinued until NUGT appears again as a QUICK-PICK

----------------------------------------------------

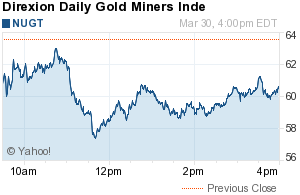

3-30-2016 No crossovers of pivot-close today..

The broad trading range, 52-70 seems to the main

dynamic here. Watch for the Accum. Index to

turn positive to tell us when there may be an upside

breakout and a worsening of it would warn that 50's

support may not hold.

-----------------------------------------------------------------------

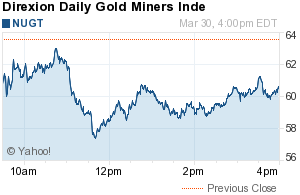

3-29-2016 NUGT ran back up towards its recent highs

and resistance on Fed Chairwoman Yellens surprisingly

Dovish comments. Perhaps, there will not even be

a rate hike in June. NUGT's Closing Power has turned

up.

========================================================

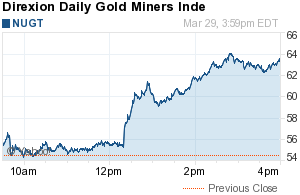

3-28-2016 NUGT continues to look vulnerable based on

negative Accum.Index and falling 5-dma. A break below

would make stock look very vulnerable. The 5-dma cannot

easily turn up.

But see Possible Bullish Inverted and H/S

------------------------------------------------------------------------------------

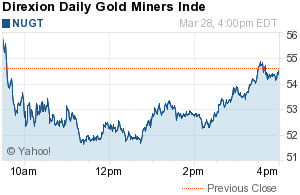

3-24-2016 NUGT has support at 50-52 and resistance between 68

and 70.

While another rally could occur like on Friday, the bearish facts remain: its

5-dma

is falling, its Accum. Index is negative and its Closing Power is falling.

If it is

bought for a day trade, be careful. Sell it if it drops below Friday's

close of

54.61 or on a rally back above 65.

-----------------------------------------------------------------------------------------------------------------

4-23-2016 Talk of a June rise in interest rates boosted

Dollar

and hurt Commodities, Previous Metals, Oil/Gas, Foreign ETFs,

China as well as major market ETFS, technology TECL, biotechs IBB

and Semi-Conductors. NUGT could violate its 53 support.

This

would bearishly show that the Hawks among the FOMC members

may win out.

NUGT's Closing Power and 5-dma are

falling. Bearishly NUGT could

not manage to bounce much off its lows. It would seem its is a

short at opening

for Day Traders. But cover if it turns positive or at close.

----------------------------------------------------------------------------------

4-22-2016 Hotline warned that both Gold and Silver show

bearish NNCs by Accum. Index. This is bearish for NUGT

----------------------------------------------------------------------------------

4-21-2016 Both-Up but IP21<0. 69-70 will

likely be resistance again.

Brussel's bombing will likely bring a quick test of it.

=====================================================

4-18-2016 NUGT's 5-day ma turned up today.

Both its Opening

and Closing Power are rising now. But the Accumulation

Index is

negative. The negative IP21 suggests that 70 will

continue to act as resistance.

There is little point in buying NUGT right now just below its

resistance,

except for very short-term trades. Friday's backing and

filling between

66 and 70 may well give us a sense of the intra-day trading

on Monday.

I would still use previous day's close as the key basic

point. Above

that is bullish, below that is bearish AND until there is

breakout over

70, I would only want to go long NUGT and do so when it

crosses

back above 66.32 (Friday's close.) or on a successful

test of that

level.

=================================================================

4-17-2016 Today was a profit-taking day for NUGT.

The early-crossovers

down and then back up would have produced a small-whipsaw

loss. Aggressive

traders tomorrow, use the previous day's close as the pivot

point, where above

it the stock is bullish and below the stock is bearish.

Fridays bring unusual

volatility to NUGT. So, I would continue to use its

crossovers to take positions

and close out the positions at the end of the day's trading.

Both Opening and CLosing Power are rising, but NUGT's 5-dma

seems to

have turned down. See in the second chart how wide its

trading range is.

This should permit some nice day trading profits for the next

week. The

Fed's dovishness is certainly bullish as are the longer-term

mvg.averages.

So, trading long would be my preference still..

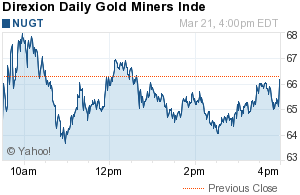

One-Day Chart

-------------------------------------------------------------------------------------------

4-16-2016 Today the Fed kept interest rates unchanged.

As a result

NUGT crossed back above its previous day's close around 58

and

closed near 69. Continue to use crossover's above the

previous

day's close as a Buy and then sell near the CLose. One

could also

do the reverse and sell short on reversals back down from

early

strength back below the pivot-point of the previous close.

Because

the uptrend is so strong, this is riskier.

One-Day Chart

----------------------------------------------------------------------------------------

4/15/2016 No report due to lack of time.

----------------------------------------------------------------------------------------

4-14-2016 Today the 5-dma has turned down, the Closing

Power is

no longer considered "Bullish" and rising and a potential

head/shoulders

is appearing. This type of pattern appeared at previous

tops.

=============================================================

4-11-2016 The 5-dma has flattened to a +57%. It

is not a good idea

to trade this on long side, considering how far it has

advanced. Selling it

short when it crossed the previous day's close could have

been justified.

=============================================================

4-10-2016 Today NUGT opened at 60.84, up 2.84 from the

previous

day's close. Our suggestion, because it is has a BOTHUP

status, was to

buy it on a positive opening, but work with a stop sell just

below the

previous day's close. That level was never approached.

So, the Tiger|

Day Trader would have held NUGT until the close, which was

65.89.

There is a point at which the Opening is too far above the

Opening to chase.

Today, we would have made 5.05. If we think of that is

a measure of the

upside potential, then I don't think we should chase a higher

opening|

tomorrow by more than, say, 4 points. If NUGT opens up

more than 4

points, do not chase it. Wait for a pullback nearer to

the previous day's

close and then a turn upwards.

If NUGT opens Friday down from Thursday's close, Buy it only

when

it rises intra-day above Friday's close. Do this only

in the first few hours

of trading.

NUGT is now considerably above the support of its 5-day and

even

more above its 21-dma. In this situation, there is more

downside

vulnerability. And recently Friday's have brought

bigger than usual

declines. Day-trading NUGT seems safer than placing a

Buy on

weakness order. However, one could buy at the 5-dma on

a decline.

In that case, know that it could retreat all the way down to

its rising

21-dma. It is probably a lot safer just to not buy NUGT

on weakness

tomorrow, Friday.

-------------------------------------------------------------------------------------------------------------------

4-9-2016 A small gain would have been using the

approach advocated for

Tiger Day Traders. NUGT opened 3 1/2 points below the

previous day's close

(57.47). Assuming we would have bought it at 57.48, it

then rose as high as 59.7

and closed at 58.000 where small profits could have been

taken. This was enough

to turn its CLosing Power back up. It now is in BOTH UP

mode.

When the

Opening Power and Closing Power are both rising

(above their rising 21-dma), we may get a day when there is a

higher opening and then a still higher close. As a

Tiger day trader trading

in these circumstances, buying at the opening

above the

close IS riskier, but it can still pay-off. If it opens

below the previous

day, wait to BUY it when it turns positive for the day.

Sell at the CLose

unless its prices go from positive to negative.

4-8-2016 NUGT's Closing

Power is no longer considered rising, but it

also is not falling; so, I would simply Buy on crossovers

above the previous day's

Close if the Opening is weak. (As the

Opening Power is still rising, this

is unlikely.) Or Sell Short if

NUGT opens up tomorrow and falls below the

previous day's low. With the Closing Power

neutral, I would not chase

an early advance in it.

Day traders,

today we saw one of NUGT's classic moves,

a 10% plus more to downside and a close near the day's lows.

Because

of the BOTHUP status, the best thing we would probably have

done

here is simply sell any long position taken on the positive

opening

as soon as NUGT dropped below its previous close. Since

it opened

at 69.12 and the previous close was at 66.87, this might

conceivably

have amounted to a 2.26 loss (69.12 - 66.86). But there

were signs

of trouble. Gold showed a red negative Accum.

divergence on its

advance the previous day, Silver had reached its

well-tested resistance

and NUGT rose on lower volume on the previous day. So

waiting a few

minutes in case the opening was "false" would have paid off.

Selling

it short when it quickly broke below its previous day's close

could under

the circumstances been entertained, too. An especially

weak closing

is often how a BOTHUP advance by NUGT ends. If it was

sold short

as it broke below the previous day's close, covering it near

the close

would have been quite profitable. There was no reason a

day trader

would want to hold it over-night.

3-7-2016 Warnings

=====================================================

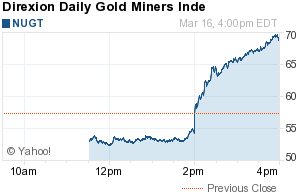

3-7-2016 Day traders,

NUGT has a BOTH UP status.

When the

Opening Power and Closing Power are both rising

(above their rising 21-dma), we are bound to get days like

today,

when there is a higher opening and then a still higher close.

As a day trader with this vehicle, buying at the opening

above the

close IS riskier, but it can still pay-off. As today. it

opened at

63.01 and went down only to 62.47 (but never below its

previous

day's closing of 60.73 and then rose nicely to 69.92 before

closing at 66.47.

The BOTH UP status can last a week or two.

Eventually,

we may buy NUGT and the stock will fall not just below

the

opening but below the previous day's close. At that

point

we will have to quickly sell at a loss then OR buy

DUST.

-----------------------------------------------------------------------------------------------

3-4-2016 Day traders,

we saw a Reversal Day. Usually, we place closing

Sell Stops just beneath the close of the reversal day.

But with so much momentum,

I would NOT sell short. Instead,

look for a failure of a strong new uptrend-Reversal

Day to bring a follow-though decline. That should be taken as a Buy.

Usually the type of reversal days we saw Friday

do bring declines. But commodities, Gold

and foreign ETFs are the leaders now. On this basis,

they should all go up next week. And in

recoveries after long declines, price reversals are

often fake-outs. In fact, that is how we can tell that

prices will go higher: the reversal days in a new bull

market don't bring reverses. See how the last two

reversal days did not bring further declines. Instead,

prices rose. So, a move early in the day back above

the close, should be used as a Buy. A failure of the

Reversal Day to bring a follow-though decline should

be taken as a Buy.

3-3-2016 Day traders,

when both Opening and Closing Power are rising

we expect steep vertical advances. At the end of

the move, it is the Closing

Power which ordinarily drops first. The opposite it true when

we have a

"BOTH-DOWN" situation.

----------------------------------------------------------------------------------------------------

3-2-2016 Day traders,

when NUGT's Closing Power is rising, we

usually

do well buying near the openings and selling at the close.

Here that would

have meant buying just above the previous day's close on a

successful

early test of that and selling at the close.

(Day traders,

when the Closing Power is falling, we have

to expect weakness after the

opening. So, either selling short when prices drop below the

previous day's

close or selling short on an early failed rally back up to the

previous day's

close should consistently work. Of course, if the 5-dma trend

is very strong or

very weak and confirmed by Closing Power and the Accumulation

Index,

it is usually best just to hold the positions overnight.)

------------------------------------------------------------------------------------------------------------------

3-1-2016 Day traders, if NUGT opens

considerably lower and then turns positive by moving

above its previous day's close, it should be bought and then sold

at the close.

Vice verse, day traders should consider selling it short (or going

long DUST)

when NUGT opens a good deal higher and then drops into negative

territory,

In the latter case, day traders will want to close it out at the

end of the day.

This does not produce a trade every day, but it has been

consistently profitable.

2/12/2016 Gain = +4.20/52.57 long

2/18/2016 Gain = +8.40/46.32 long

2/22/2016 Gain = +1.15/45.56 long

2/25/2016 Gain = +2.62/56.20 long

3/1/2016 Gain = +6.85/59.03 short

NUGT has broke its price-uptrend, but the

steeply rising 21-day ma

at 46.8 should act as support.

2-29-2016

6-26-2016

Price, Relative Strength,

Closing Power, Opening Power

Accumulation

Daily Volume

-------------------------------------------------------------------------------

6-23-2016

Price, Relative Strength,

Closing Power, Opening Power

Accumulation

Daily Volume