|

Daily Blog - Tiger Software Send any comments or questions |

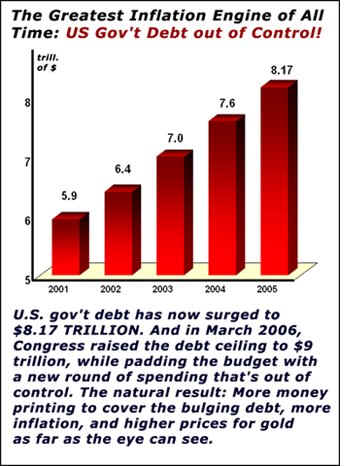

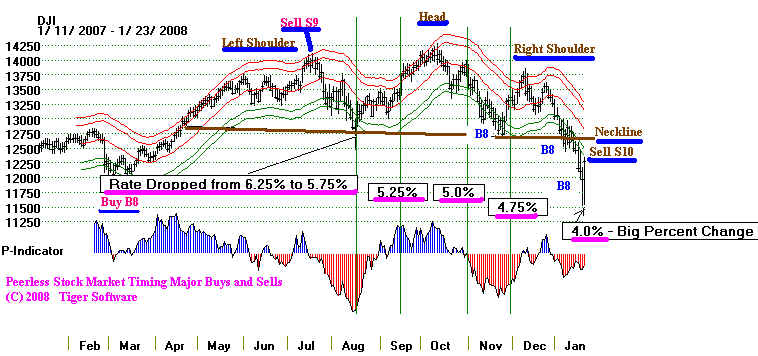

| It Pays To Understand How Political The Fed Really Is and To Use PeerlesS Stock Market Timing! Background and Defnitions. As much as any Washington institution, the Fed determines whether your business will grow or shrink, whether your stock portfolio will provide for retirement or you will not be able to retire and whether your neighbor will have a job or he will get laid off. The Fed Chairmen serve for 4 year terms, but usually much longer due to how massive is their authority and power. The Chairman is one of the seven Governors appointed by the President and confiremd by the Senate. Each of these Governors serves a 14-year term! Hence the independence of the FRB. The Discount Rate is set by the Fed. This is the rate of interest member banks are charged when they borrow from a Federal Reserve bank. The other key FED instrument of interest rates is the Federal Funds Rate. Changes in the Fed Discount Rate typically are followed by changes in the Fed Funds rate in the same direction and by about the same magnitude. This is the interest rate at which private banks lend balances at the Federal Reserve to other private depository insttitutions. In this study, I am mainly concerned with changes in the Fed's Discount Rate from 1955 to 2007 and how they impact the stock market. Because the Federal Reserve is so powerful, it is necessarily highly political, despite pretensions of independence. Actually, it is its political nature which makes it most predictable. Here is a review of 52 years of Fed Discount Rate changes, their politics and their impact on stock prices. During Presidential Election years, politics intrudes especially obviously. Is the Fed likely to reduce rates in September and October in these years more than in other years when there is no Presidential Election. It is sometimes mistakenly said that the Fed) cannot do anything in October of these years. Sam Stoval is quoted as saying the opposite is true. In the 9 presidential election years since 1976, the Fed has done "something" in August, September and October 7 times. (Source). The data I set out here can be used to provide a historical check on such statements. I will be using this myself repeatedly in pur Tiger/Peerless Hotline. Rate Hikes Are Bearish. I think you will agree from the data below that 3 discount rate hikes is normally bearish. Doing this in a short period of time, 3 month, is very likely to drop the market more than 10%. This was true on 9/22/1978. When rates were very low to begin with, as in 2002, three small rate highes did not stop the market in September 2004. In this case, the market when it started rising got used to the 1/4% rate hikes, much like the frog in water graudually brought to a boil. Big jumps in rates, by 1/2% in one accouncement are very likely to bring a 10% DJI drop of more. This was true in the aftermath if the rate hikes of 8/23/1957, 2/26/1973, 4/25/1974, 4/9/1984, 9/4/1987, 8/16/1994 and 5/16/2000. the Discount Rate by 1/2% last Friday. What will that mean for the market? Look through the history of rate changes, market conditions and Peerless signals and I hope you will get a keener insight into how the Fed acts, how political it is and what the likely outcome for stocks will be. Next year is the year of the Presidential Election. The Fed is now run by Republicans. Everything we know about the Bush White House shows how Republican partisianship is the most important qualification for most appointments, including those who sit on the Board of Governors who vote on decisions to raise and lower the discount rate, which sets the interest rate banks must pay to borrow money from the Fed.  Bernacke is a

scholar with a special interest Bernacke is a

scholar with a special interest in the monetary mistakes that led to the Great Depression. He is also | methodical and, according to one of his MIT classmates whom I have talked with, painfully slow to articulate what others are already thnkiing, But each time he speaks, unlike Greenspan, Volcker or Bush, the market seems to rally. He seems eager to win praise and finds it especially difficult to displease. These are qualities of decency that I certainly admire. I think he will do whatever he can to avoid much more of a sell-off in the market. But is monetary policy enough? And what will he do when a Democrat takes over in 2009? That's when the Fed usually tightens monetary policy. Will that puncture the hyper-inflated balloon of expanded credit? Having said this, I should note that the Peerless System is a much better predictor of the market than Fed watching normally is. This is because of how often word gets out in advance about what the Fed will be doing. The DJI, for example, turned around at 12500 on Thursday mid-day and then jumped to 13175 on the announcement. "Somebody always knows." And they sold on the accouncement on Friday at the high for the day! "Don't Fight The Fed" Is Way Too Simple A Rule To Use. We want here also to test the proposition that three or more discount rate hikes in 6 months is very bearish. Some call this the "3 jumps and stumble" rule. These ideas have appeared occasionally n Barrons. In the listing of signals in the second half of this report, I use "***" to indicate this was the third consecutive rise in the Discount Rate in six months. It may surprise you that this rule succeeded only five times and that it failed three times, since 1955. Insiders usually have gotten wind of the plans to raise the Discount Rate, so often the market has already significantly declined when the the third hike is announced. There are many more reliable ways to predict the market. See the discussion of the 1970 bottom, for example. And in declining markets, there is always the possibility that rates will have to be lowered many more than three times to turn up a stock market in serious decline. Look at how many rate cuts were needed by Greenspan to turn the stock market up after 2001. 3 rises in 6 months: 9/9/1955 - DJI fell from 477 to 442 in a month and then entered a trading range between 466 and 520 for a year. 3/6/1959 DJI rose from 615 to 680 in next 4 months and then pulled back to 620 in next two. 5/4/1973 DJI was in early stages of a bear maket that would last another 19 months. 1/9/1978 DJI fell from 780 to 750 in next 3 months and then began rising for 7 months. 9/19/1979 DJI fell sharply from 880 to 800 on 6 weeks. 12/5/1980 DJI rose from 925 to 1020 in four months and then fell to 825 in the next 5 months, 11/15/1994 DJI fell from 3828 to 3775 in a month and then began a bull market. 5/16/2000 DJI began a 34 month bear market. 8/10/2004 DJI immediately started to rise from 9800 amd hit 10950 in six months.

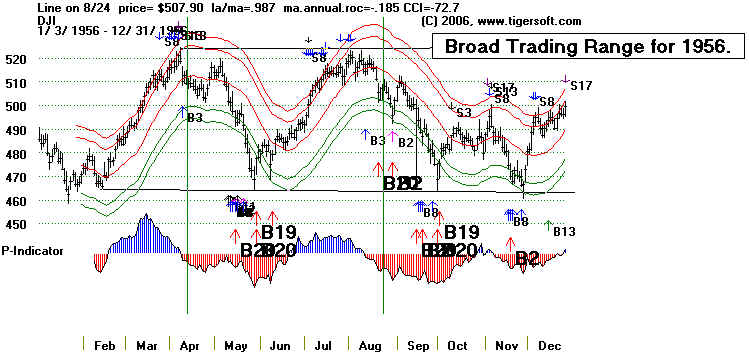

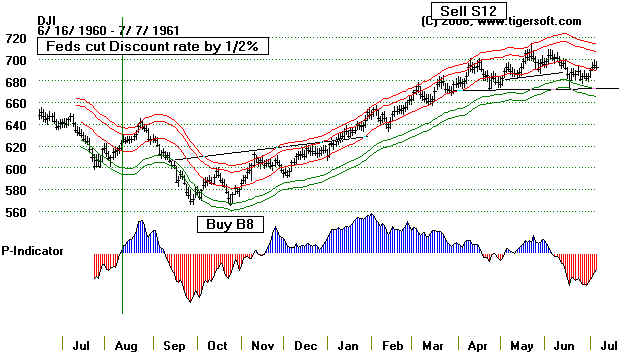

Fed Chairman Wm.McChesney Martin: 1951 to 1970 1956 and 1960 The Fed has tried to seem non-partisian and independent. But we may safely, I think, predict that they will do all they can to prop up the stock market through the end of next year. It did not used to be this way. While Eisenhower was President, the Fed raised rates as his re-election in November 1956 came closer. But then the Fed Chairman had been appointed by a Democrat, Truman. See the Fed's six rate hikes, shown below, between 8/15/1955 and 8/24/1956. They did much the same thing before the 1960 Presidential race. There were five rate hikes, but also a key rate decline five months before the November 1960 Presidential Election. Broad trading ranges dominated most of 1956 and 1960. The Fed wanted to preserve the appearance of independence. Its actions stabalized the market at this time, to avoid drawing attention to itself and to avoid making its own actions become the subject of the campaign.  1960

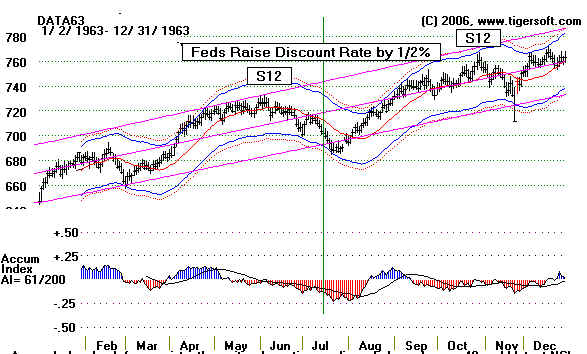

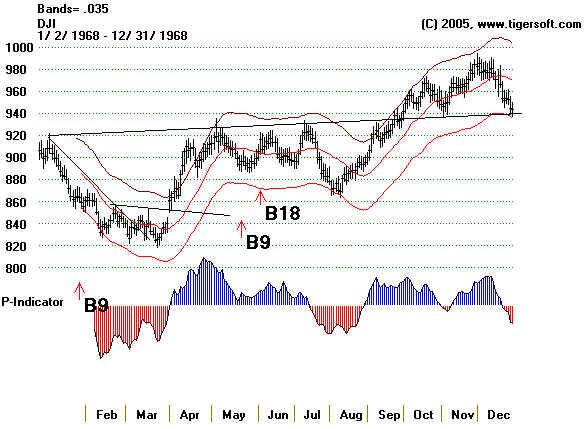

1960 "When Vice President Richard Nixon was running for President in 1959-1960, the Fed was undertaking a monetary tightening policy that resulted in a recession in April 1960. In his book Six Crises, Nixon later blamed his defeat in 1960 in part on Fed policy and the resulting tight credit conditions and slow growth. After finally winning the presidential election of 1968, Nixon named Burns to the Fed Chairmanship in 1970 with instructions to ensure easy access to credit when Nixon was running for reelection in 1972.[1] Later, when Burns resisted, negative press about him was planted in newspapers and, under the threat of legislation to dilute the Fed's influence, Burns and other Governors succumbed.[3][4] Inflation resulted, which Nixon attempted to manage through wage and price controls while the Fed under Burns maintained an expansive monetary policy. After the 1972 election, price controls began to fail and by 1974, the inflation rate was 12.3 percent.[1]" (Source: http://en.wikipedia.org/wiki/Arthur_F._Burns ) See also http://www.fame.org/HTM/Creating%20More%20Fiat%20Money%20and%20Winning%20an%20Election%20Bresiger%20Burns%204.htm ) 1961-1964 With Kennedy elected in a close race, the Fed was unusually quiescent. It did not raise rates until July 17, 1963. It also did not intervene positively in the panic that followed the Cuban Missle Crissi in the Fall of 1962. Perhaps, recognizing the 1964 Election was going to be by a landslide of sympathy for the Democrats, because of the assasination of JFK in November 1963, the Feds sat on their hands throughout the 1964 Presidential Election campaign. As a result the 1964 stock market continued the same gentle upwards trend it had shown in 1963. 1965-1968 The Fed raised rates for the most part in the year before the 1968 Presidential Election, raising them in November 1967 (which helped send the market down until March 1968), as well as in March and May of 1968. With the US war in Viet Nam raging in 1968 and the country dealing with widespread civic unrest set off by the assassinations of Martin Luther King and Robert Kennedy, the Fed lowered the Discount rate by a mild 1/4%, but raised margin requirements. No effort was made to help another Democrat to stay in the White House. Economic news played second fiddle anyway to the war in Viet Nam.  Arthur Burns was

appointed by Nixon is 1970 and Arthur Burns was

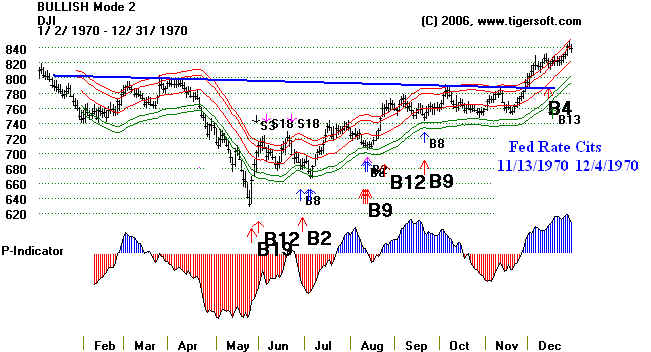

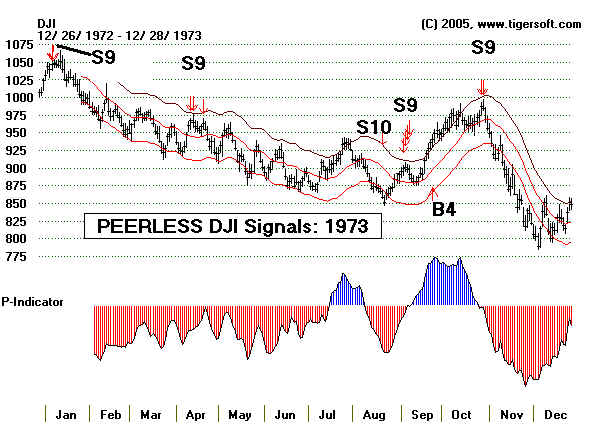

appointed by Nixon is 1970 andserved as Fed Chairman until 1978, 1969-1972 The Fed decided to drop the stock market very early in the new Republican President's tenure. It raised the Discount rate from 5.25% to 6.0% by April 4th, 1969. And the stock market fell sharply. (See Peerless charts of DJI below). The DJI fell from 970 in May 1969 to 540 in May 1970. Articles have appeared in Barron's suggesting the utility of watching for three successive Discount Rate/Fed Funds Rate hikes before selling out and three successive Discount Rate/Fed Funds Rate declines before buying. Multiple Peerless major Sell signals work better, especially after only two Discount Rate Hikes or Declines. Thus, Peerless gave many major Buy signals from May 1970 to the end of the year. The Fed showed it wanted the stock market to rise by lowering the Discount Rate fives times between November 1970 and February 1971. The DJI responded by roaring ahead, setting up the Republican Richard Nixon with a strong market going into the 1972 Presidential Election. When Nixon's 1971 New Economic Plan made investors fear that wages, prices and possibly incomes might be controlled, the stock market fell sharply. Nixon privately demanded the Fed cut interest rates and Burns stop stressing "fears of inflation" in his appearances before Congress. Adding to his pressure on the Fed, Nixon even let it be known that he was considering backing legislation which would expand the number of Fed Governors. This would let him "pack" the Fed with supporters who would back his more expansionist policies. He even spread a rumor that Burns wanted a $20,000 raise. Not surprisingly, the FED succumbed to this pressure. Burns had been Fed Chairman little more than a year. So, he accomodated the President. He cut the Discount Rate in November and December of 1971. That quickly had the desired effect and sent the market up sharply from a 790 low to 960 in the summer of 1972, the Presidential Election year. Nixon got what he wanted and was re-elected by a wide margin in November 1972. My conclusions are supported here by conservative writer Bruce Bartlett. "The inflation of the 1970s came about primarily because Fed Chairman Arthur Burns gunned the money supply to get Richard Nixon re-elected in 1972." http://72.14.253.104/search?q=cache:b2UpTlb83fIJ:www.heartland.org/Article.cfm%3FartId%3D15468+Carter+%22tight+money%22+Volcker&hl=en&ct=clnk&cd=2&gl=us&client=firefox-a See discussion between Nixon and Burns on Nixon Tapes. 1973-1976 With a Republican re-elected, the Fed decided to follow the same approach that they had used so effectively in 1969. They immediately set about bringing a market decline early in the incumbent's four year tenure, so that they would have plenty of time to make conditions turn-around before the 1976 Presidential year. They raised rates steeply, sending them from 4.5% to 7.5% by August 14, 1973. The market swooned. The previous bull market had been much more limited to blue chip and energy related stocks. With the DJI down already from 1050 to 875, they even raised rates again in April 1974 to 8.0%. The DJI then plunged sharply as Richard Nixon resigned, rather than face impeachment. By December 1974 the DJI had fallen 40%, from 1050 in January 1973 to 580. Many smaller stocks were down 80% or 90%. Finally, on December 9th, 1974 the Fed signalled they wanted the market to stop declining. They lowered rates by only 1/4%. It was enough to send the extremely oversold market up. The Fed then lowered the Discount rate 4 more times by May, 1975. Rates still stood at 6.0% until the Election Year. In January 1976, they lowered the rates one more time, to 5.5%. That had the desired effect and the DJI rose from 900 to nearly 1000. The markets anticipated this rate cut by starting up a month earlier and breaking out of a well-defined trading range backed by a Peerless Buy in November. The stock market then went sidewise again for the mast 8 months of 1976 and the Fed avoided public notice during the Presidential Election Year when it might otherwise have become the subject of political debate.  1977-1980

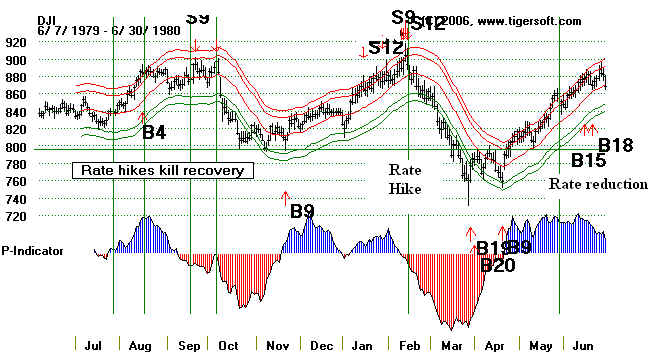

1977-1980Discount rates went up and up with Democrat Carter in the White House. The pattern of allowing a stock market decline the year after the Presidential Election year (i.e. 1957, 1969, 1973, 1977 and 1981) continued. The Discount Rate rose from 5.25% to 6.5% as the stock market fell. After the DJI had fallen 26%, it bottomed in March 1978. A perfect example of an inverted head and shoulders bottom appeared. So did a major Peerless Buy, right at the bottom. The market rebounded strongly without Fed help. The Fed was willing to allow more market weakness, as they raised interest rates over and over again. On 9/22/1978 they increased the Discount Rate to 8.0%. This was the fourth rise in four months. Then they did it again on 10/16//78, pegging it at 8.5%. This and a very timely Peerless Sell sent the DJI into the "October 1978 Massacre". And it did not stop there. The Fed repeated the same pattern in 1979, raising rates for four straight months, until they stood at 12.0%. This brought on the "October 1979 Massacre", also called perfectly by Peerless major Sells. As if to show Democrats, that they would not tolerate them in the White House, the Fed raised rates to 13.0% on February 15, 1980. This and a new set of Peerless Sells caused the "Bunker Hunt panic" of March 1980. At this point, the Fed must have realized that their extremely tight money policies could, if continued, easily become the subject of debate in the 1980 Presidential Election Year. They finally lowered rates to 11.0% in June 1980 and a mere (sarcasm here!) 10% in July 1980. But to be sure Carter would not be re-elected, they raised rates back to 11.0% six weeks before the Election. The Fed's actions in dramatically raising interest rates went a long ways in defeating Carter and making him look ineffectual.  Paul Volcker - P[resident of the Federal Reserve Bank of New York from Paul Volcker - P[resident of the Federal Reserve Bank of New York from 1975 to 1979, Chairmanship of the Federal Reserve - 1979 to 1987 "Tight Money" Paul Volcker was appointed by Carter in August 1979 to be Federal Reserve Chairman. He had been UnderScretary of the Treasury under Richard Nixon. Volcker sabotaged Carter and the peanut farmer - nuclear engineer from Georgia never even saw it coming! Volcker used the excuse of rising commodity prices to raise interest under Reagan, too, but it was early in Reagan's Administration that he did this. At the time, Carter was seen as having made a dire mistake. He has put "Dracula in charge of the blood bank. To us, it meas a crash ... is more likely than ever." Why did Carter make this mistake? More may be written about that here. Suffice it say now that Carter was naive and trusted Republican and NY banker David Rockefeller. Volker testified before Congress for eight years. I was always surprised that Congress accepted his testimony and the economic suffering his tight money caused with relatively little criticism, apart from home builders and union representatives. He surely made a lot of wealthy fixed income people happy! They apparently have much mnre influence. 1981-1987 Volcker raised the Discount Rate to a high of 14% by April 1981. By October, the DJI had fallen to 820 and he started to ease off his anti-inflation throttle. In November and December 1981, he lowered the rates to 12%. When the market started to sink again in 1982, he lowered the Discount Rate no less than seven times by December 1982, to 8.5%. That, of course, launched a very rapid rise in the stock market. Real-time, we got a record number of major Buys at this time. The DJI went from a low of 780 in Auhust to 1075 by the end of 1982. Volcker was certainly aware that his renomination to continue as Fed Chairman in mid 1983 required him to show he knew how to lower rates, too. Volcker returned to his tight money policies once more. That was in April 1984 and while the market was correcting from its 50% advannce since August 1982. It continued down until late July and then surged upwards. Investors remembered the similar take-off in the late Summer only two years before. Volcker obliged the market and steadily lowered interest rates for the rest of his term in office. By then the DJI was well above 2400, up 200% from the August 1982 bottom. This made Reoublicans look very good at running the economy.  President

Reagan appointed Alan Greenspan (left) President

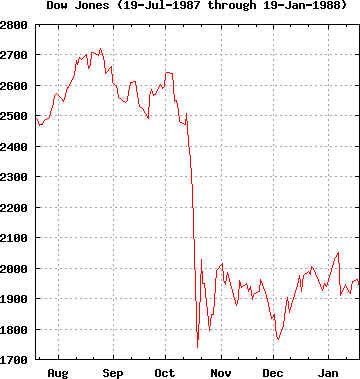

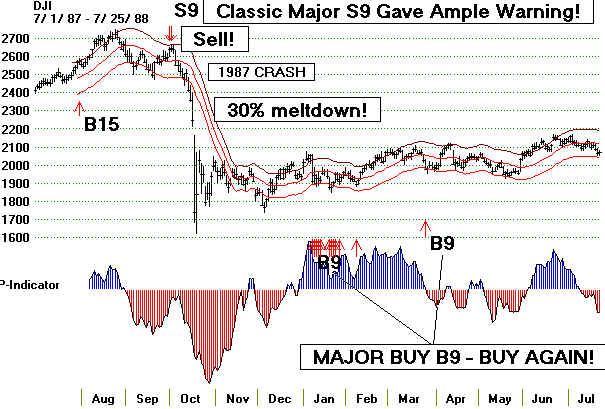

Reagan appointed Alan Greenspan (left) to replace Paul Volcker (center) as chairman of the Federal Reserve Board in June 1987. 1987 - 1992 "S9/S12"  Greenspan was made Chairman of the Fed in June 1987. Early in September with the DJI at 2500, the Fed raised the Discount rate to 6.0%. The Fed Funds rate had been 6.1% in February 1987 when the stock market was romping upwards. It rose to 6.73% in August and then 7.22% in September under Greenspan. Fed watchers got "spooked". Was this to be a return to the "tight money" policies of Volcker? The DJI rallied and everthing seemed fine in early October. But Peerless gave a real-time major Sell from all its three most important indicators. And within three weeks the DJI had plunged from 2600 to 1740! The Fed did not cut the Discount Rate, but they did give private guarantees to brokerages and Specialists that they wpuld get all the credit they needed to weather the panic. And the Fed Funds rate was slashed by an unprecedented 60 basis points. This was a demonstration that the Fed would prevent a repeat of 1929.

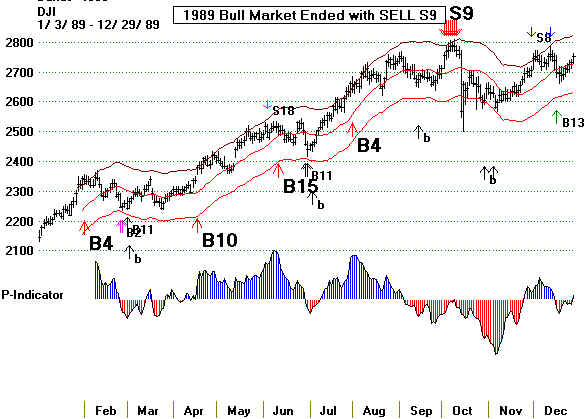

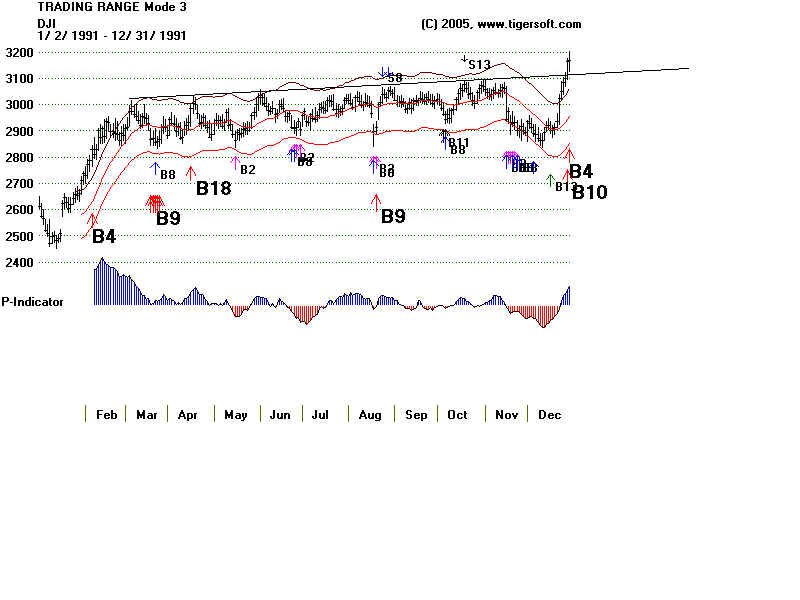

1998-1992 The Fed raised the Discount Rate just once in 1988 and one again in 1989, to 7.0%. When the stock market plunged 20% with Iraq's invasion of Kuwait, the Fed lowered rates in December and again in February to 6.0%. That boosted the market, as did the pride of a swift military victory by an international force led by the US to remove Iraq from Kuwait. The Fed soon set about to drop interest rates and boost the chances of getting Bush I re-elected in November 1992. The Discount Rate fell dramaticaly from 6.0% in February 1991 to 3.5% in December 1991. Not surprisingly, this lifted the stock market, even as fears of an enveloping savings and loan scandal grew. By July 1992, Greenspan and company had lowered rates to 3.0%. Surprisingly, it was not enough. I still recall watching Bush look at his watch during the Presidential debate with Clinton. That was a serious mistake. 1992 - 1996 Greenspan and the Fed did not raise rates the year after Clinton took office, as the Fed usually has done. I argue that this is normally done when a Republican is in the White House, so that rates can be cut in the second half of his term to give the public a rosier view of the economy during the Presidential Election year. Whatever the reason, the Fed waited. And then early in 1994, without any apparent good reason, Greenspan started talking about tightening rates. The DJI quickly fell 10% and started working its way back up. To drive it back down, the Fed raised the rates three more times by February 1, 2005.

Internet Boom

2001-2007 8/24/1956 3.0% This brings another 10% correction from recent highs.  8/23/1957 3.50% Brought an additional 10% drop. 11/15/1957 3.00% Brought decline to lower band. Then brought rising prices. 01/24/1958 2.75% Brought decline to lower band. Then brought rising prices. 03/07/1958 2.25% -1.2% Brought decline to lower band. Then brought rising prices. 04/18/1958 1.75% -1/2% Brought upside breakout and rising prices. 09/12/1958, 2.00 Had no effect. 11/07/1958, 2.50 Brought decline to lower band and resumption of rally. 03/06/1959, 3.00 Brought shallow decline to lower band and rally's resumption. 05/29/1959, 3.50 Brought decline to lower band and resumption of rally.  09/11/1959, 4.00 DJI fell to lower band after last rate increase. 06/10/1960, 3.50 mkt fell back to and below lower band. Decline continued until an October 1960 bottom. Discount Rate raised  08/12/1960, 3.00 Mkt declined to lower band. Peak had been in January 1960 at 690. Bottom was not until October 1960 at 570.  Democrat was in White House. 07/17/1963, 3.50  11/24/1964, 4.00  12/08/1965, 4.50 3rd successive increase is bearish. Top in January 1966 at 990 and decline to 780 in October 1966. Fed. Discount Rate Rise 12/08/1956  4/7/1967 4.00 Drop confirms recovery from October 1966 lows. Bull market continues through September 11/20/1967 4.50 Rallied to upper band and then 8% decline. Discount Rate Drop Discount Rate Rise 4/7/2007 11/20/2007  3/22/1968 5.00 Rate Rise was right at bottom. 5/6/1968 5.50 Rise in rates in on-going bull market 8/30/1968 5.25 Sends market up until December 12/18/1968 5.50 Marks top in bull market. Market rallies until early December 1968. Rate Rises Rate Drop Rate Rise 3/22/68 5/6/68 8/30/1968 12/18/1968

4/4/1969 6.00 Discount RateRise 4/4/69  11/13/1970 5.75 Bull market is launched. 12/4/1970 5.50 Bull market continues.  1/8/1971 5.25% Drop in rates in on-going bull market 1/22/1971 5.0% Drop in rates in on-going bull market 2/19/1971 4.75% Drop in rates in on-going bull market 7/16/1971 5.0% Starts market decline. DJI declines 15%. 11/19/1971 4.75% Decline brought to a stop. 12/17/1971 4.5% Drop in rates in on-going bull market  1/15/1973 5.0% Start of Big Trouble and bear Market. 2/26/1973 5.5% 5/4/1973 5.75% 5/11/1973 6.0% 6/11/1973 6.5% 7/2/1973 7.0% 8/14/1973 7.5% This steady set of rate hikes was most bearish!  4/25/1974 8.0% Guarantees additional weakness! 12/9/1974 7.75% Ends bear market - tight at bottom. Rate Increase Drop 12/9/1974  1/10/1975 7.25% 2/5/1975 6.75% Drop in rates in on-going bull market 3/10/1975 6.25% Drop in rates in on-going bull market 5/16/1975 6.00% Drop in rates in on-going bull market  1/19/1976 5.50% Drop sets off excellent rally. 11/22/1976 5.25% Drop permits year-end rally.  Democrat in Presidency 8/31/1977 5.75% sends market lower. 10/26/1977 6.00% bear market rally to upper band and then much lower. 1/9/1978 6.50%+1.2% sends bear market lower. 5/11/1978 7.00% +1.2% rate hike does not stop bullish recovery but does bring decline to lower band.  7/3/1978 7.25% 8/21/1978 7.75% 9/22/1978 8.00% 3rd Rise in 3 months! Warning! 10/16/1978 8.5% Fed determined to drop the market. 11/01/1978 9.5% Still raising rates despite market drop.  7/29/1979 10.0% 8/17/1979 10.5% 9/19/1979 11.0% Fed determined to drop the market. 10/8/1979 12.0% 2/15/1980 13.0% Fed determined to drop the market 5/30/1980 12.0% Market is rallying from April low. 6/13/1990 11.0% Drop in rates in on-going bull market  7/28/1980 10.0% Drop in rates in on-going bull market 9/26/1980 11.0% Tightening again. 11/17/1980 12.0% Stops rally and drops DJI to lower band. 12/5/1980 13.0% Drops DJI to lower band and support.  5/5/1981 14.0% Fed seemed determined to drop the market 11/2/1981 13.0% Fed next decides to support market 12/4/1981 12.0% Fed supporting market for Christams rally.  7/20/1982 3rd Rate Cut 11.5% Bullish drop in Discount Rate after decline. 8/2/1982 11.00% Market explodes upwards 8/16/1982 10.5% 8/27/1982 10.0% 10/12/1982 9.5% Drop in rates in on-going bull market 11/22/1982 9.0% Drop in rates in on-going bull market 12/15/1982 8.5% Drop in rates in on-going bull market  4/9/1984 9.0% Rate hike leads to more of a decline. 11/21/1984 8.5% Mkt declines to lower band. 12/24/1984 8.0% Drop in rates in on-going bull market  5/24/1985 7.5% Drop in rates in on-going bull market  3/7/1986 7.0% Drop in rates in on-going bull market 4/21/1986 6.5% Drop in rates in on-going bull market 7/11/1986 6.0% Drop in rates in on-going bull market 8/21/1986 5.5% Drop in rates in on-going bull market  9/4/1987 6.0% Mkt rallies to upper band and then Big October 1987 Crash! Rate Hike  8/9/1988 6.5% Mkt declines to lower band, then up.  2/24/1989 7.0% Mkt declines to lower band, then up.  20% Decline from July 1990 Peak. 12/19/1990 6.50% Helped turn market back up. Lowered Rate  Republican in White House. Rate Cuts Are Aimed To Help Him Get Elected. 12/19/1990 6.50% Helped turn market back up. 2/1/ 1991 6.0% 4/30/1991 5.5% Drop in rates in on-going bull market 9/13/1991 5.0% Drop in rates in on-going bull market 11/6/1991 4.5% Drop in rates in on-going bull market 12/20/1991 3.5% Drop in rates in on-going bull market  7/3/1992 3.0% Drop in rates in on-going bull market Democrat in White House 5/17/1994 3.5% Market had already fallen. 8/16/1994 4.0% 11/15/1994 4.75% 3rd consecutive rate hike. 2/1/1995 5.25% Could not stop powerful breakout. 1/31/1996 5.0% Drop in rates in on-going bull market This helped propel market higher. 10/15/1998 4.75% Drop in rates after 20% correction. 11/17/1998 4.5% Market moved higher. 8/24/1999 4.75% 11/16/1999 5.0% ( 2/2/2000 5.25% DJI falls more than 10% 3/21/2000 5.5% 5/16/2000 6.0% Determined to drop the market. Republican in White House 1/3/2001 5.75% 1/4/2001 5.50% 1/31/2001 5.0% 3/20/2001 4.5% 4/18/2001 4.0% 5/15/2001 3.50% 6/27/2001 3.25% 8/21/2001 3.0% 9/17/2001 2.5% 10/2/2001 2.0% 11/6/2001 1.5% 12/11/2001 1.25% 11/6/2002 0.75% Very low rates neeed to reverse bear market. January 2003 -- Change to "primary - secondary" discount rates. 1/25/2003 1.75% to 2.00% 6/30/2004 2.25% 8/10/2004 2.5% 3rd rise did not bring a decline. 9/21/2004 2.75% 11/10/2004 3.0% 12/14/2004 3.25% 2/2/2005 3.5% 3/22/2005 3.75% 5/3/2005 4.0% 6/30/2005 4.25% 8/9/2005 4.5% 9/20/2005 4.75% 11/1/2005 5.0% 12/13/2005 5.25% 12/31/2005 5.5% 3/28/2006 5.75% 5/10/2006 6.0% 6/29/2006 6.25% 8/17/2007 5.75% Drop in rates in bull market usually brings market rally. 9/18/2007 5.25% 11/1/2007 5.0% 12/02/2007 4.75% A briefer rally. 1/22/2008 4.0%-3/4% Stunning rally from 11,750 to 12,378 in two days  (Source: http://minneapolisfed.org/research/data/us/disc.cfm ) Want more to read on the subject?

" The focal point of the book is the celebrated and controversial tenure of Federal Reserve Chairman P aul Volker (1979-1987), but the mechanics of central banking so clearly and concisely explained are just as much applicable today as in 1980 - or 1950 for that matter. Greider divides the book into three more-or-less equal

thirds. The first covers the inflationary surge of the

,,, Link to Fed Funds Rate History. Definition. ,,,, ,,, ,,,

,,,

|

| . . . .

|

Clintom reappointed Greenspan on

January 4, 2000

Clintom reappointed Greenspan on

January 4, 2000