How reliable is buying when a rising 200 day ma

appears

to be successfully tested.

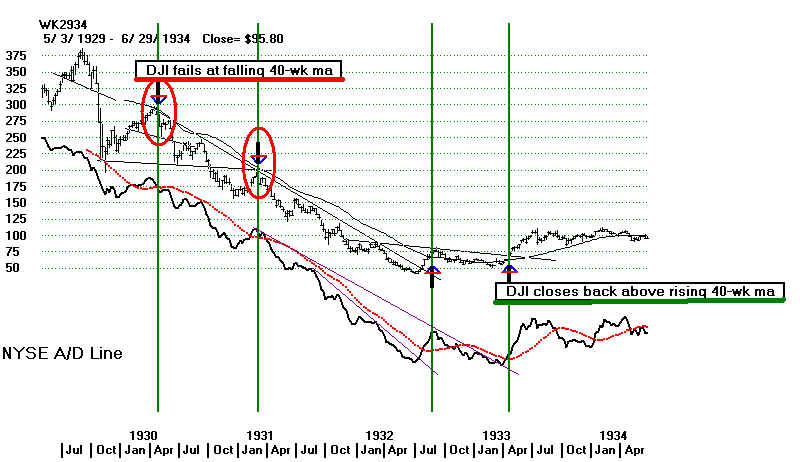

Here we assume the 40 wk ma is practically the same as the 200-day

ma.

The

200-day ma is considered broken when it either subsequently declines

more

than 10% or when it then needs to consolidate for 7 months or more.

In

a bull market, there was always at least one successful test of the 200-day

ma.

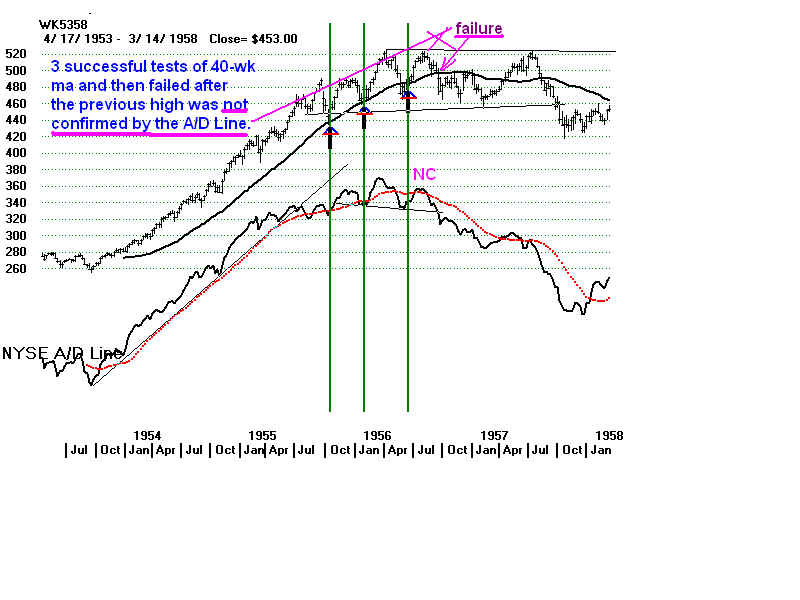

But it eventually fails. A failure is much more likely, but not guaranteed,

when

the DJI last new high was not confirmed by the weekly A/D Line.

Of

the 9 bull markets where there were at least 3 tests of the 65 dma,

in

7 cases the break occurred only when the A/D Line had failed to confirm the

last

DJI high. Only twice did the 200-day ma not hold up when the A/D Line

had

confirmed the DJI's strength.

Conclusion: We should probably consider the 200-

day ma a point to Buy as long as the

Weekly A/D Line

confirmed the last DJI high. The

first exception, in

mid 1946, took place after an

unmistakeable

head/shoulders had formed. The

other case was in

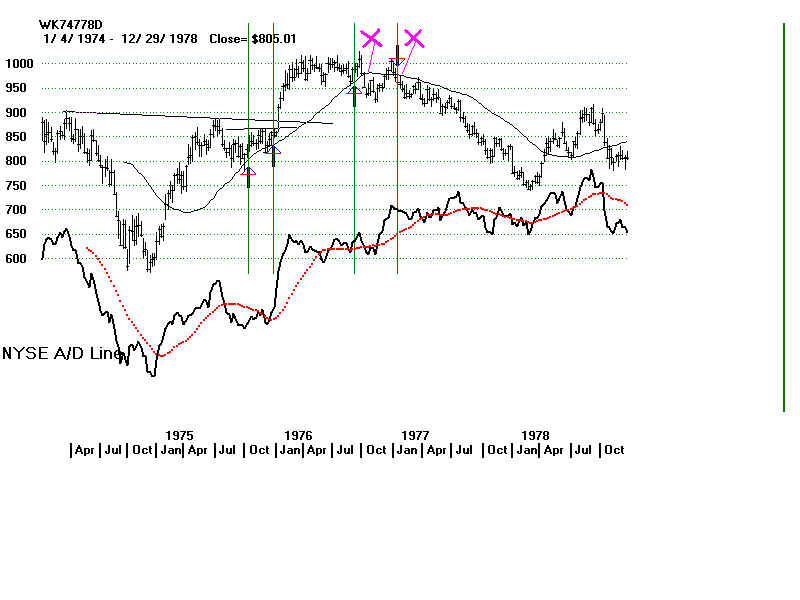

January and February 1977. In this

case, weekly

A/D Line only marginally confirmed the

DJI high.

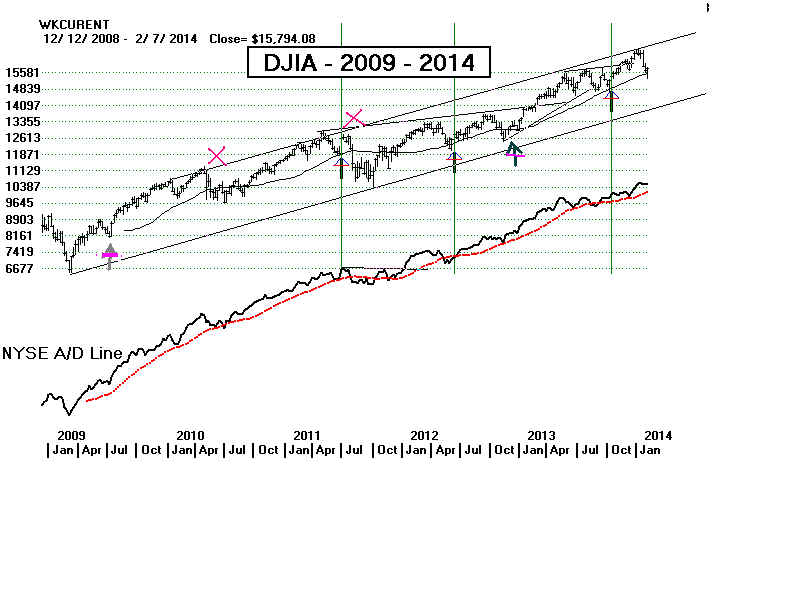

In the 2014 case, the weekly A/D Line did

confirm

the DJI high.

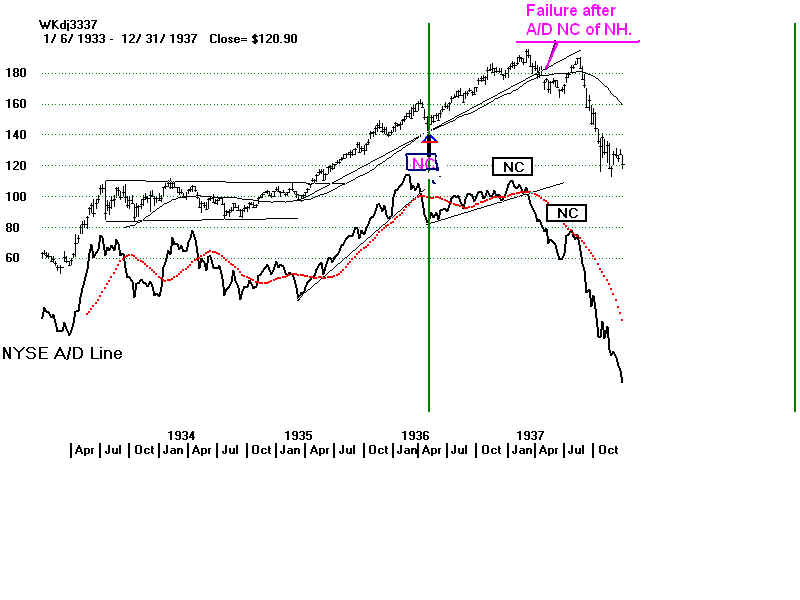

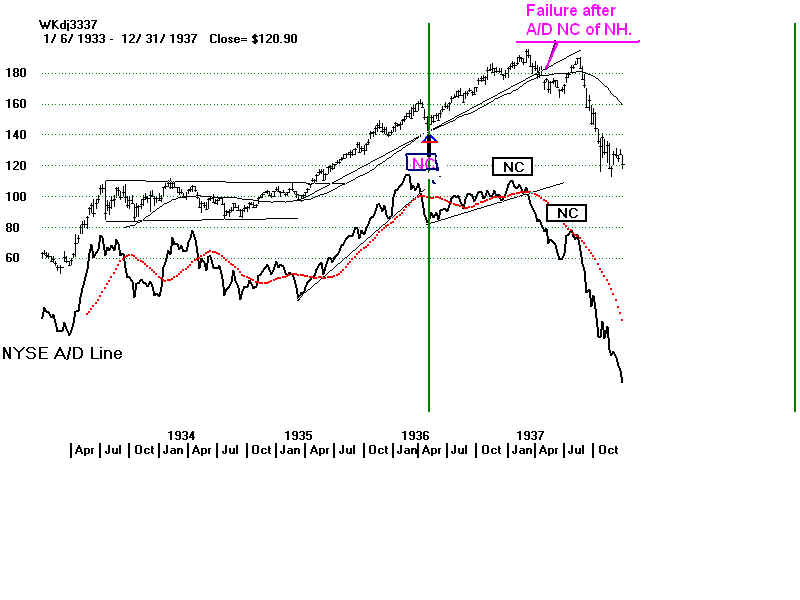

1935-1937 1 successful test and then a failure. NYSE A/D Line

failed to confirm the last higH.

>>

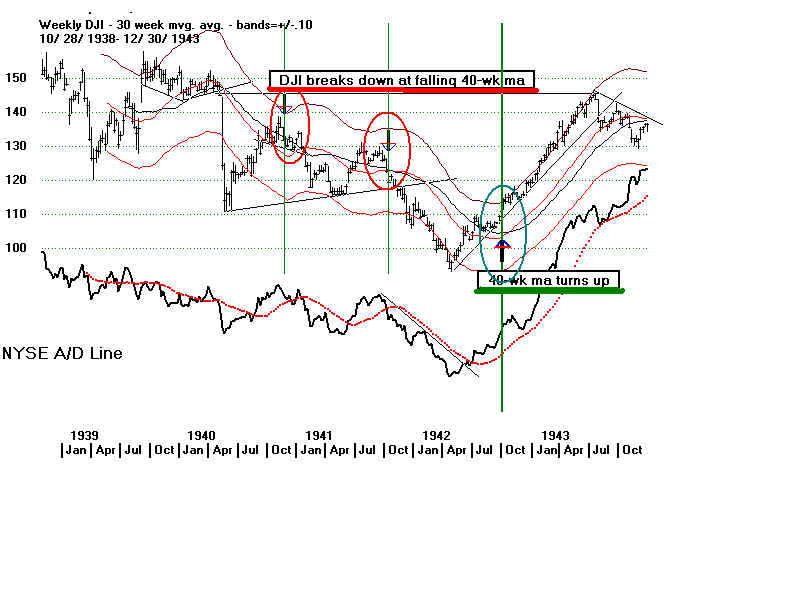

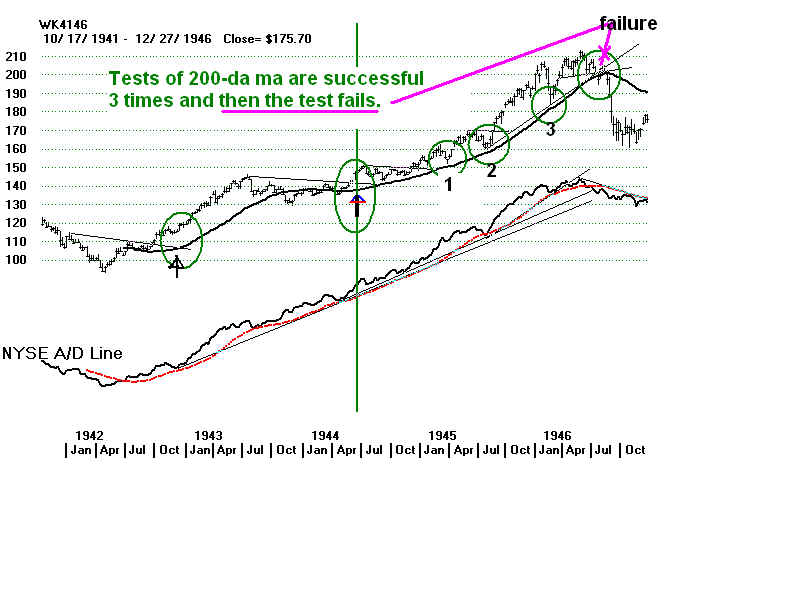

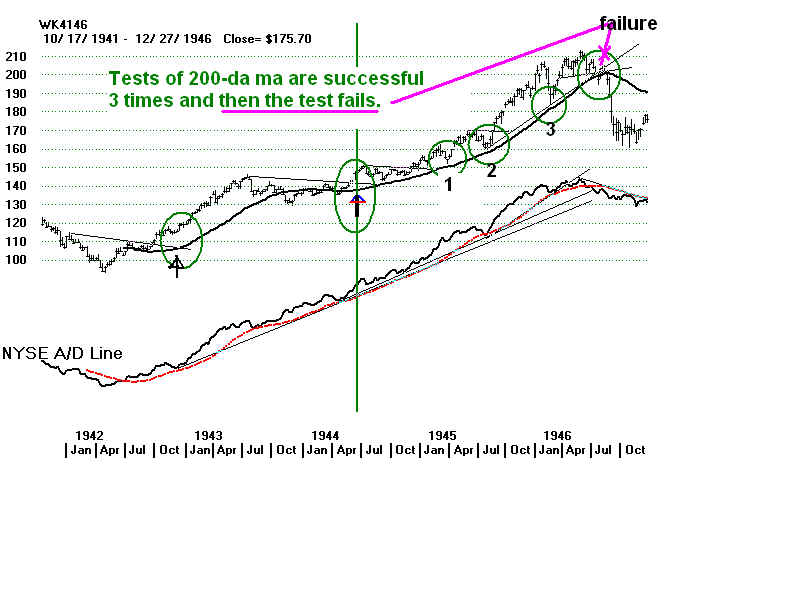

1941-1946 3 successful tests and failure.

NYSE A/D Line confirmed all the way up.

>

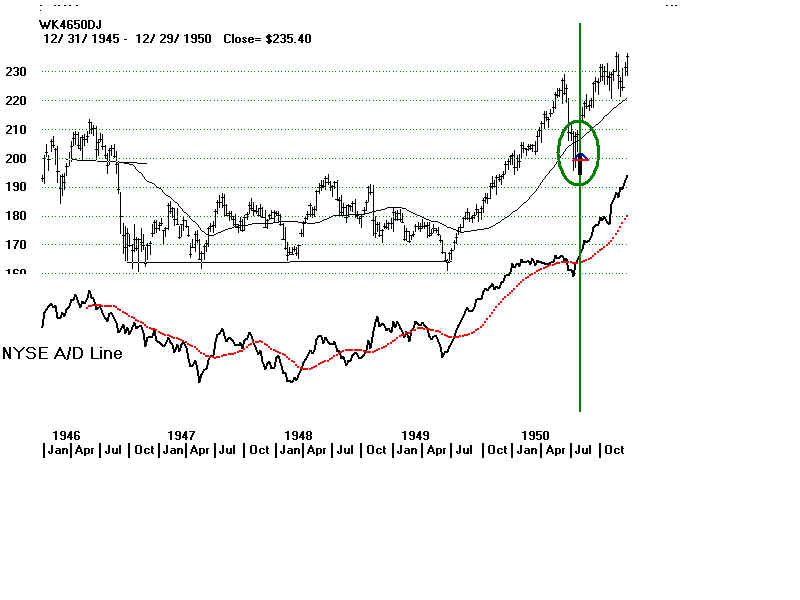

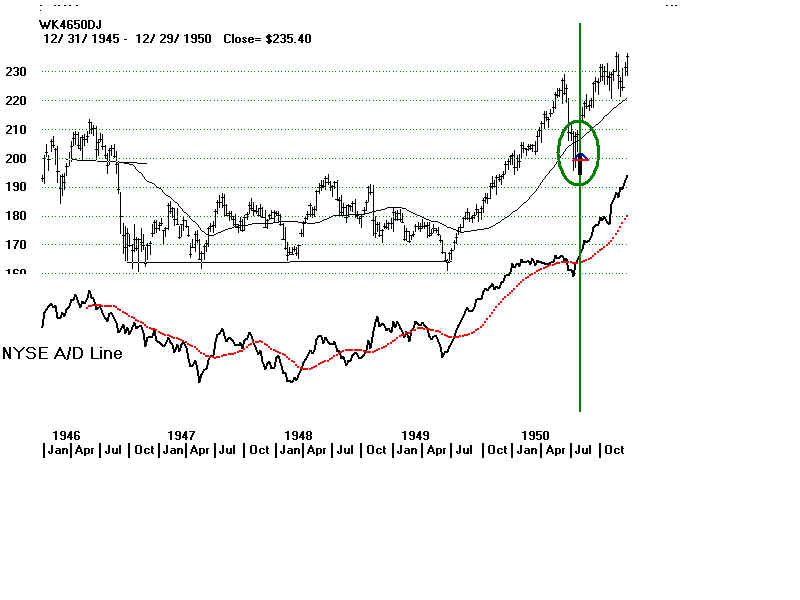

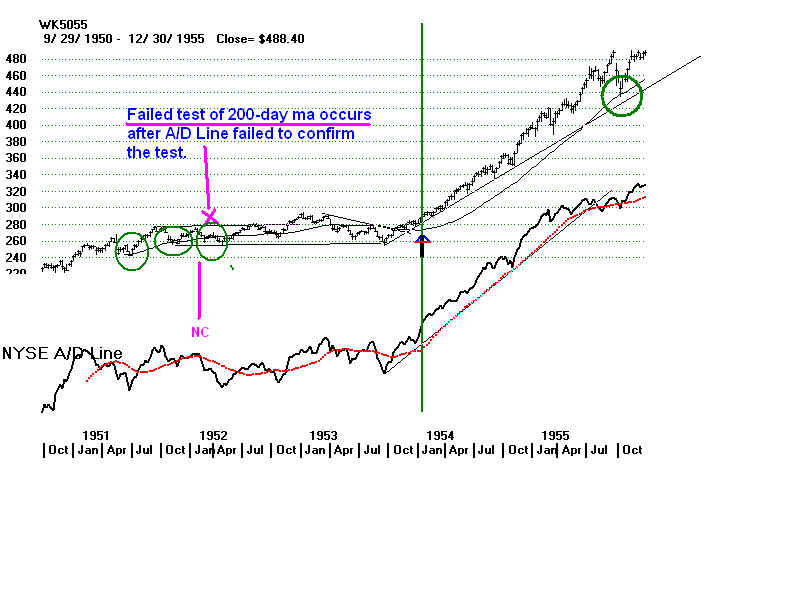

1949-1950 3 successful tests and failure. NYSE A/D Line

failed to confirm the last high.

>

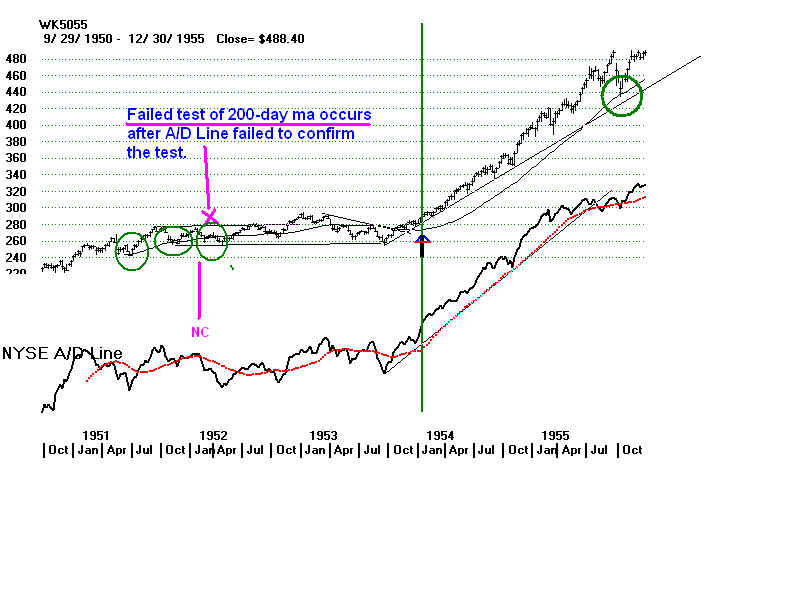

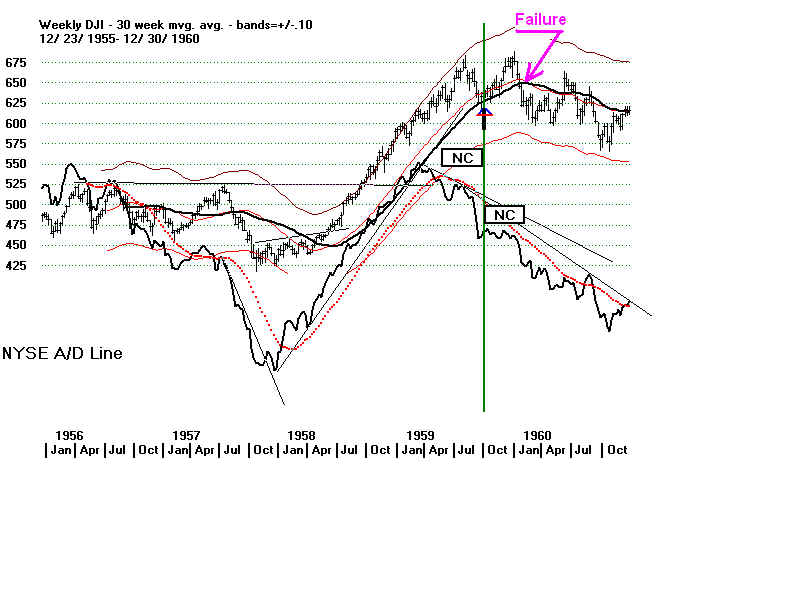

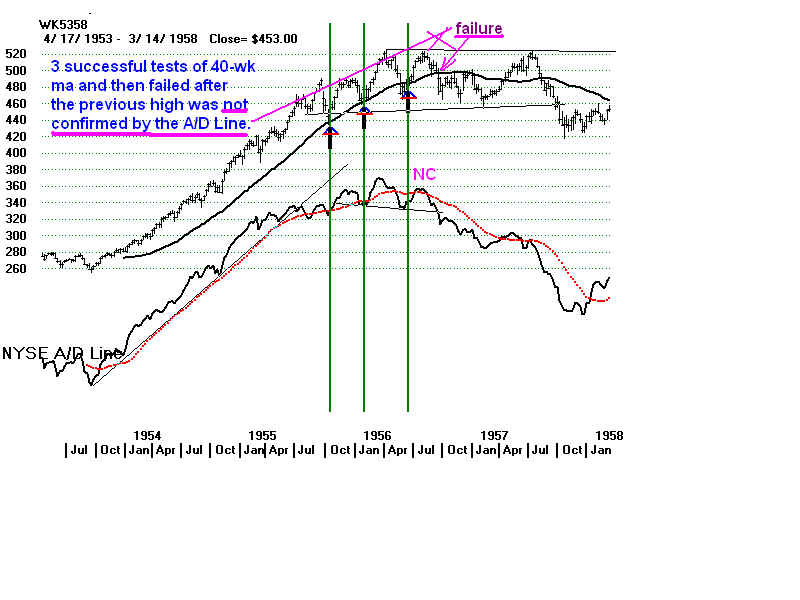

1954-1956 3 successful tests and failure. NYSE A/D Line failed to confirm the last high.

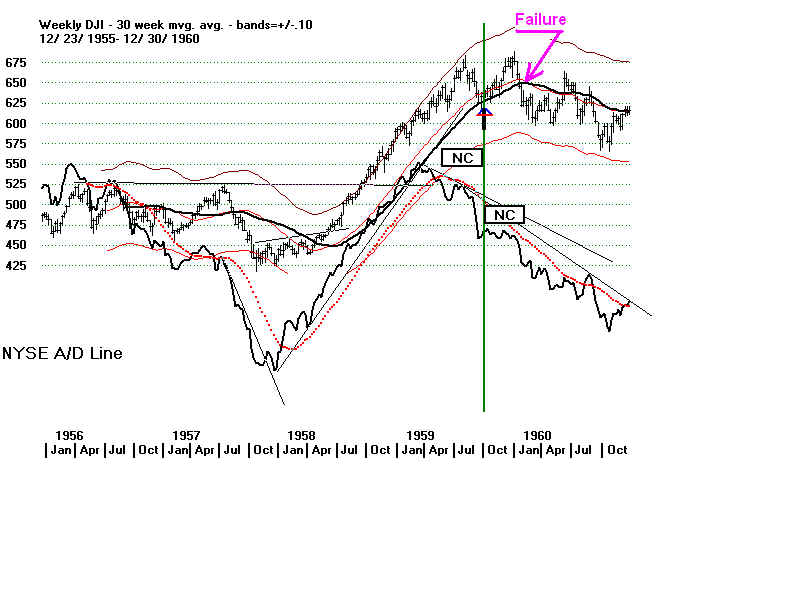

1958-1960

1 successful test and then a failure.

NYSE A/D Line failed to confirm the last high.

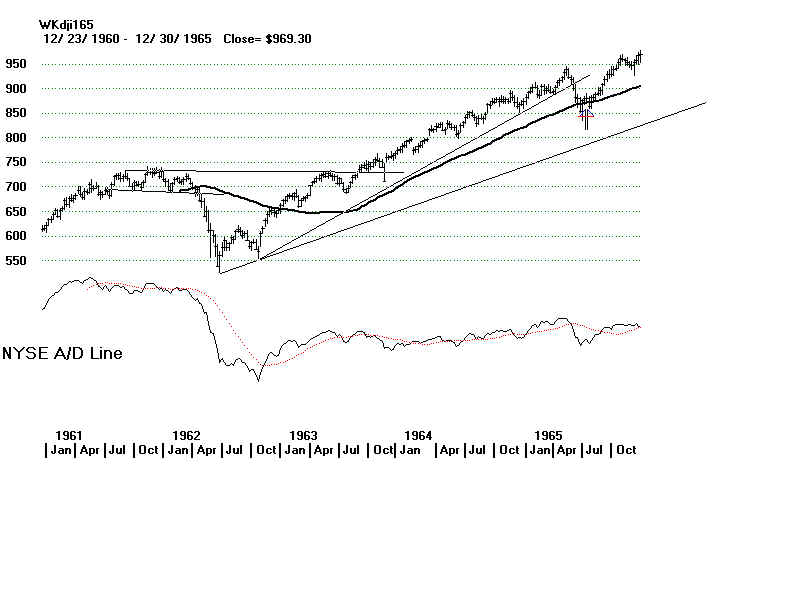

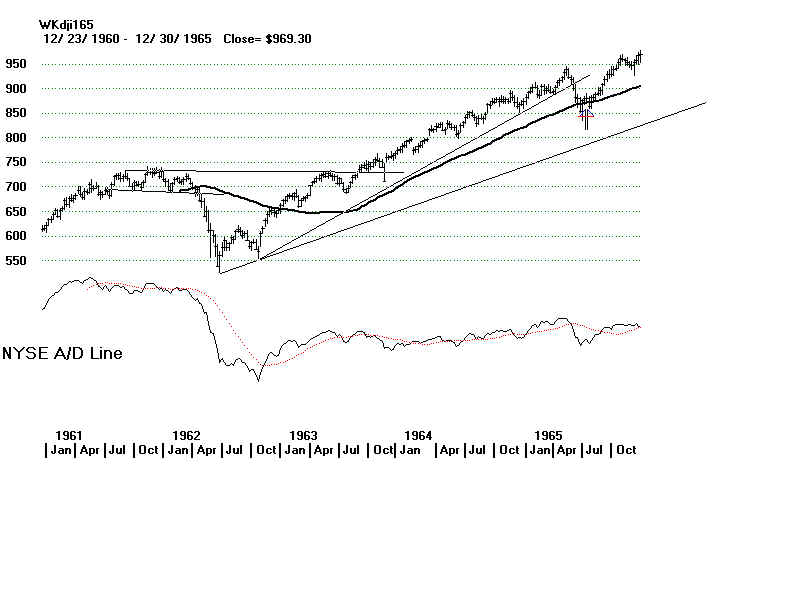

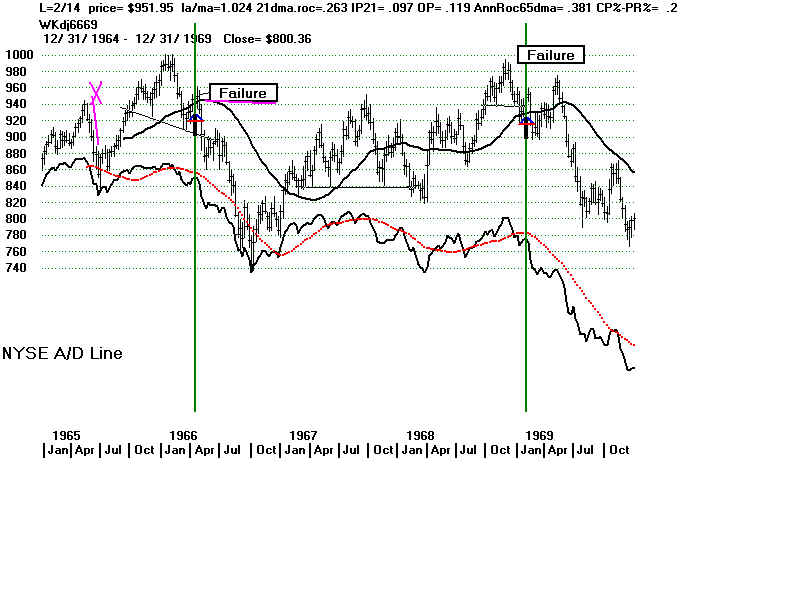

1963-1966

2 successful tests and then a failure.

NYSE A/D Line failed to confirm the last high.

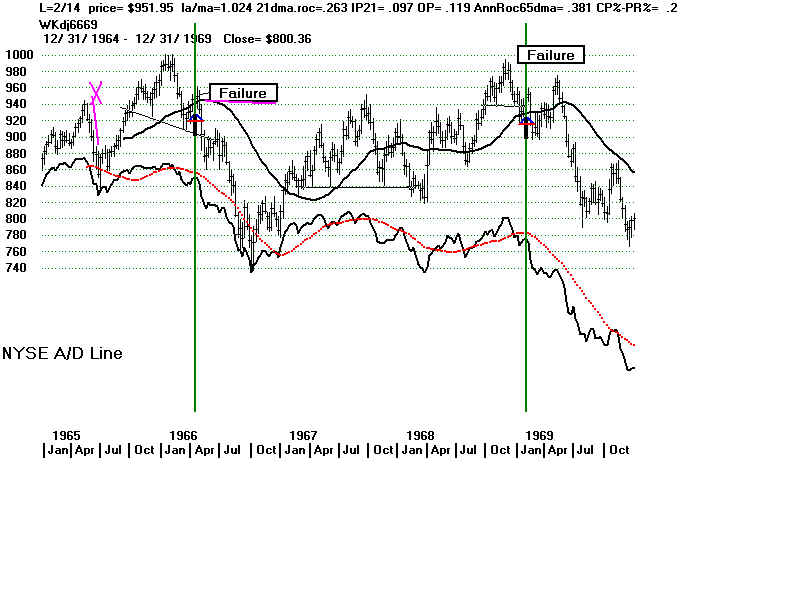

1967

1 successful test and then a failure.

NYSE A/D Line failed to confirm the last high.

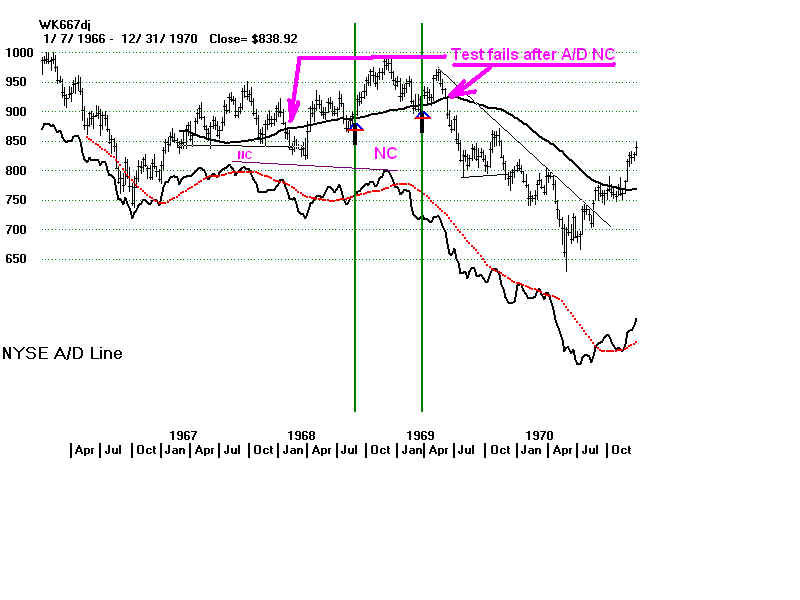

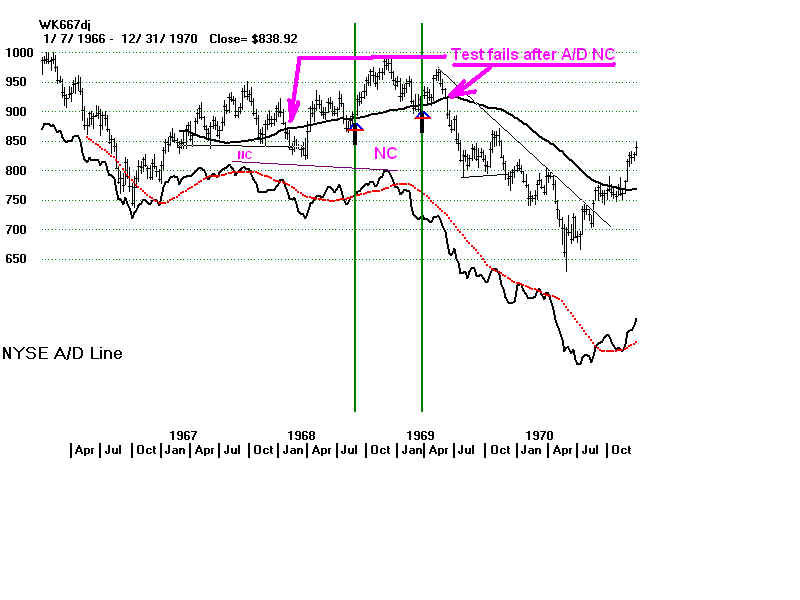

1968-1969

2 successful tests and then a failure.

NYSE A/D Line failed to confirm the last high.

1970-1971

1 successful test and then a failure.

NYSE A/D Line failed to confirm the last high.

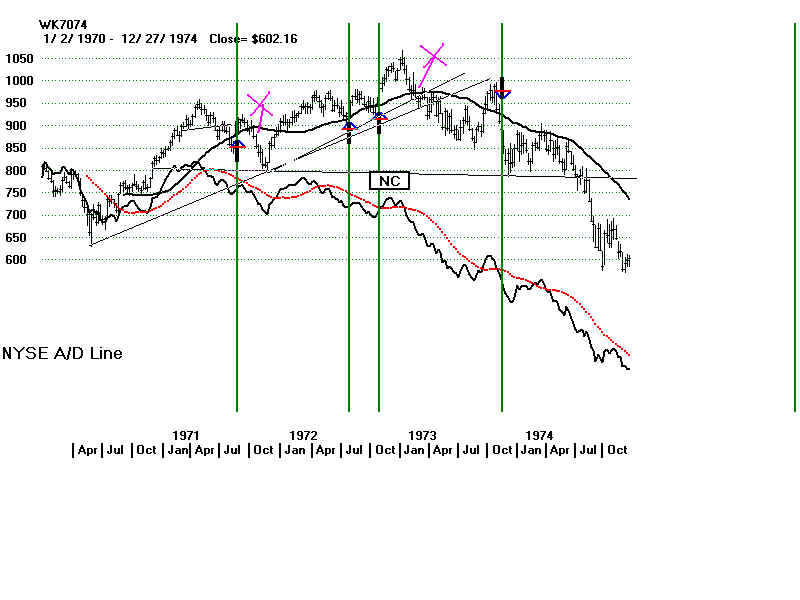

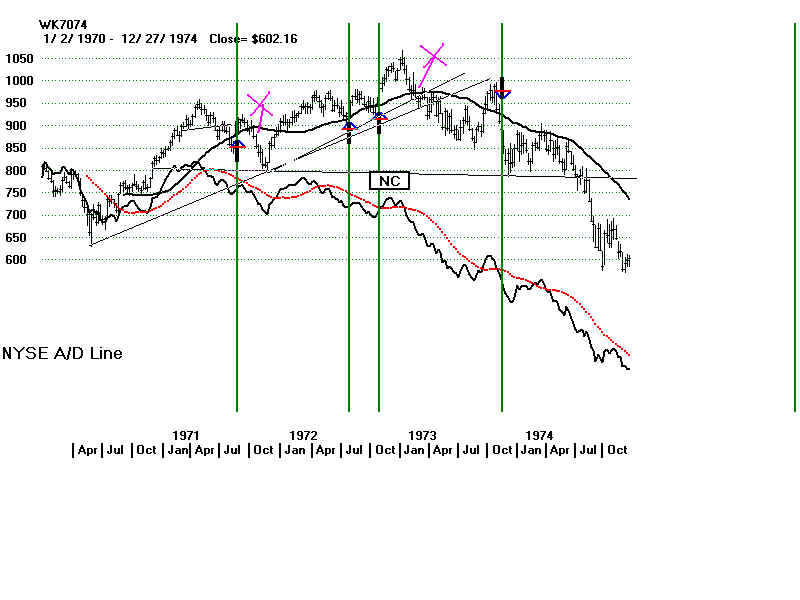

1972-1973

2 successful tests and then a failure.

NYSE A/D Line failed to confirm the last high.

>>

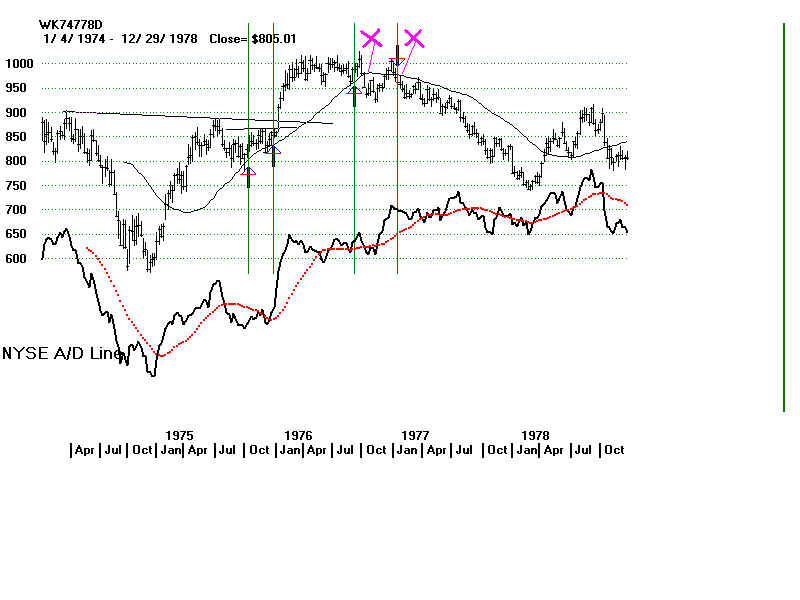

1975-1976 3 successful tests and failure.

NYSE A/D Line confirmed all the way up.

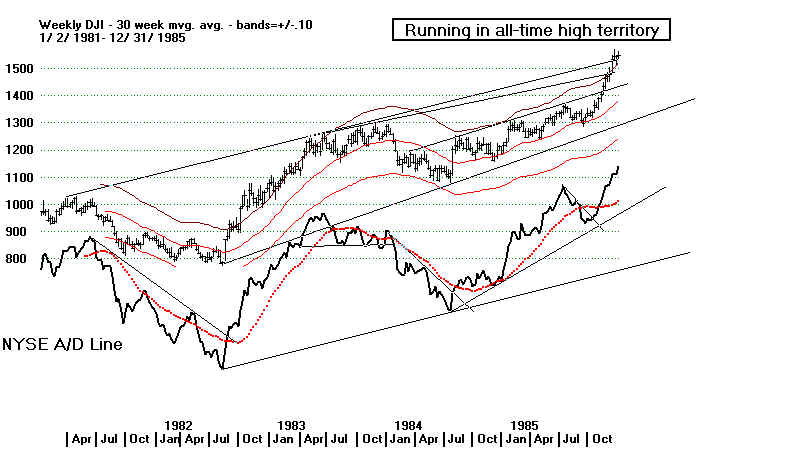

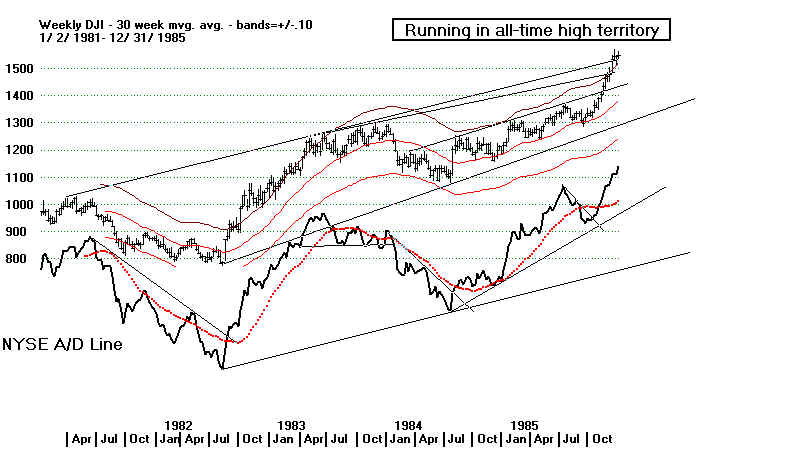

1983-1984

1 successful test and then a failure.

NYSE A/D Line failed to confirm the last high.

>

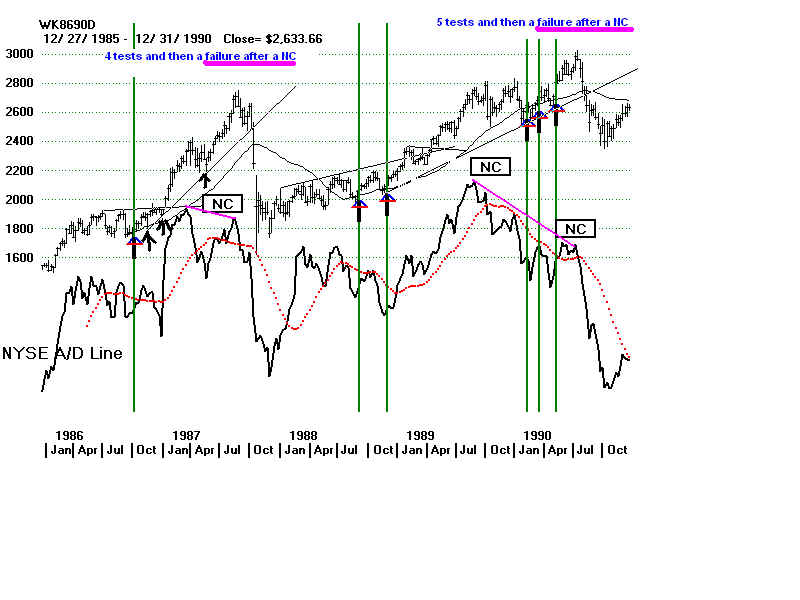

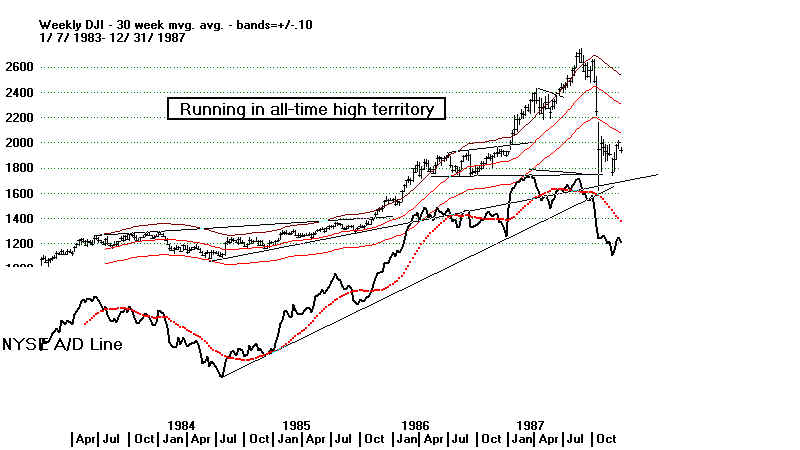

1985-1986 3 successful tests and 6 month consolidation. NYSE A/D Line failed to confirm the last high.

>

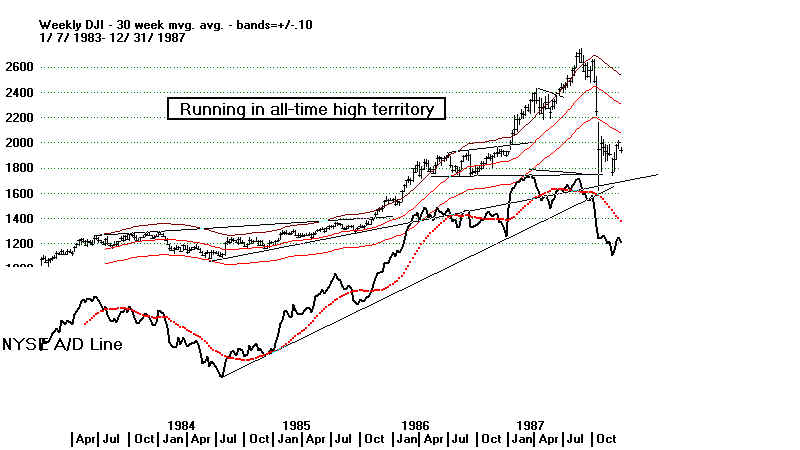

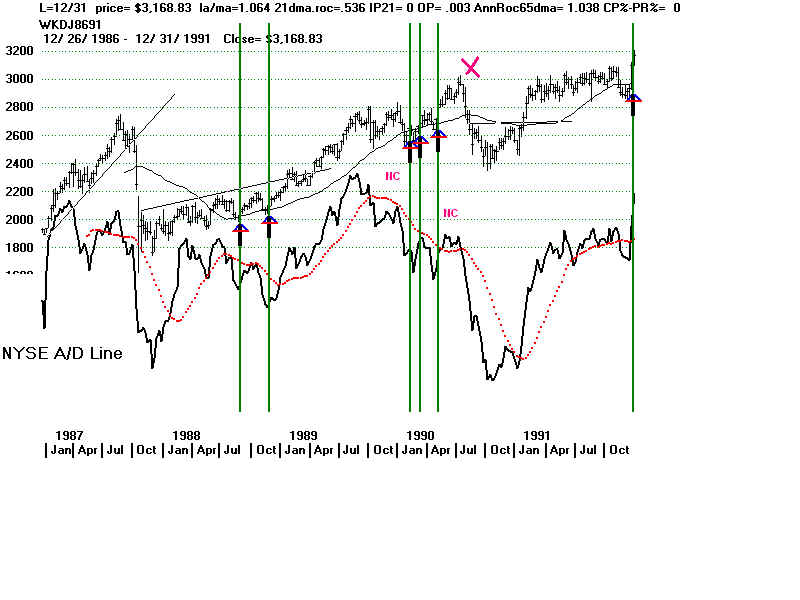

1986-1987 1 successful tests and failure. NYSE A/D Line

failed to confirm the last high.

>

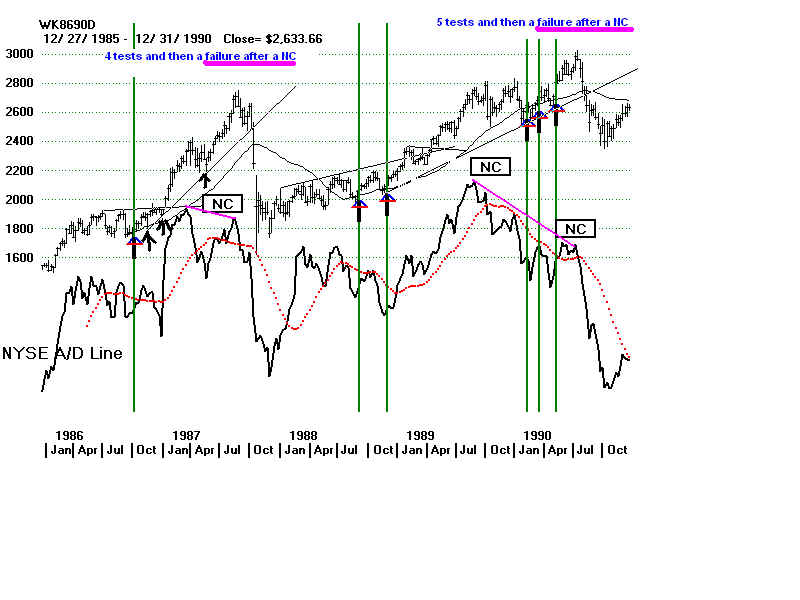

1988-1990 5 successful tests and failure. NYSE A/D Line

failed to confirm the last high.

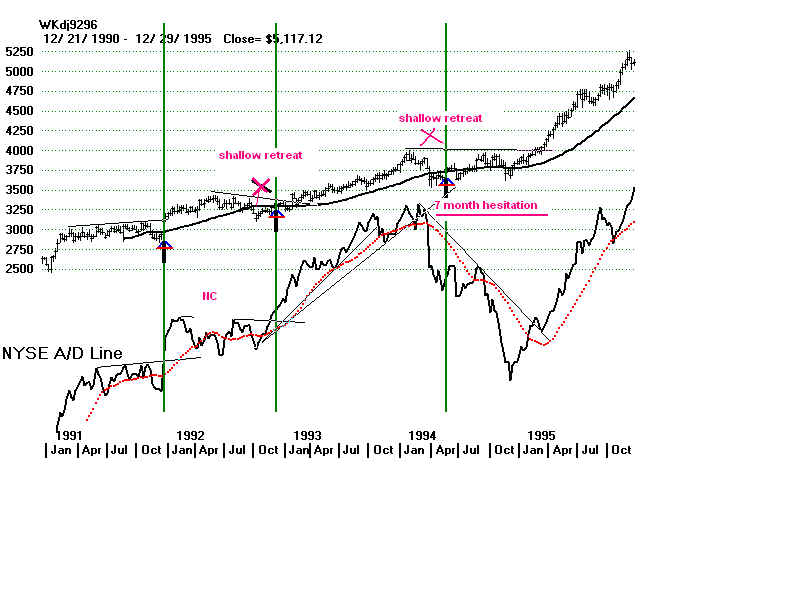

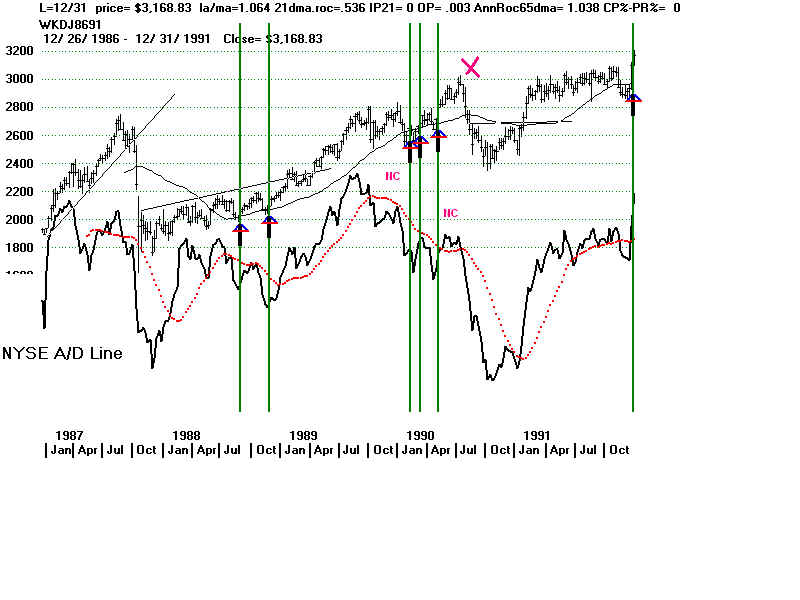

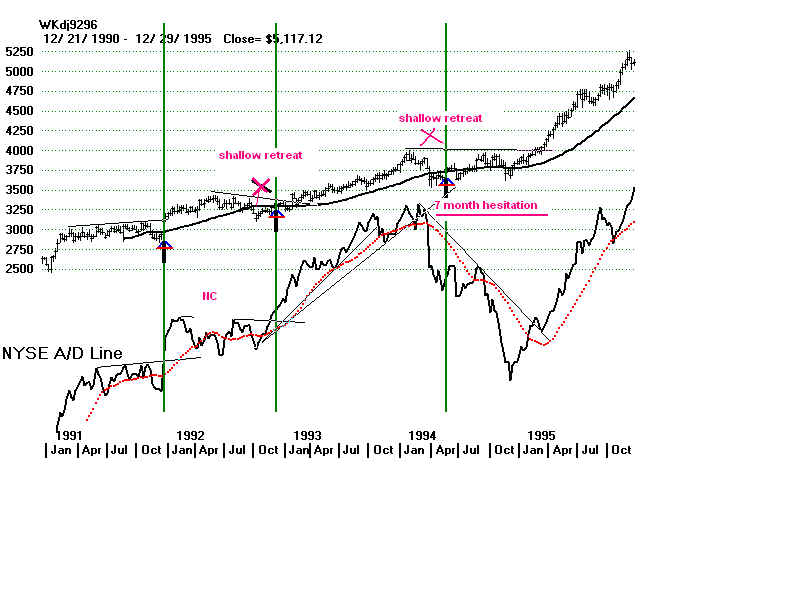

1991-1994

2 successful tests (in that the decline did exceed 10%) and then 7 month hesitation.

>

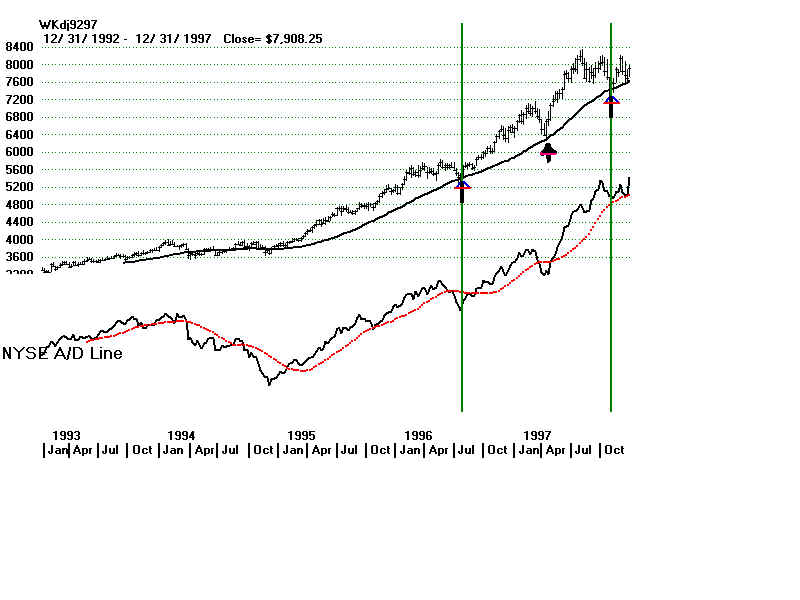

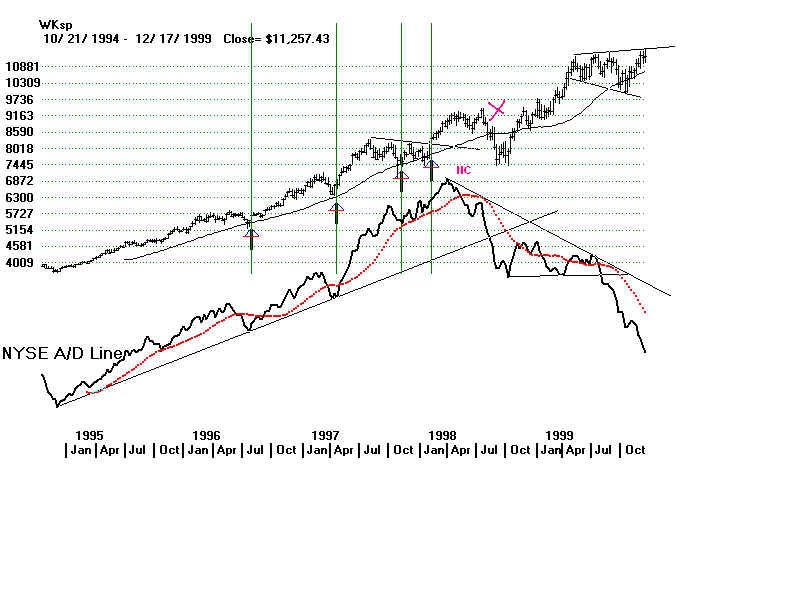

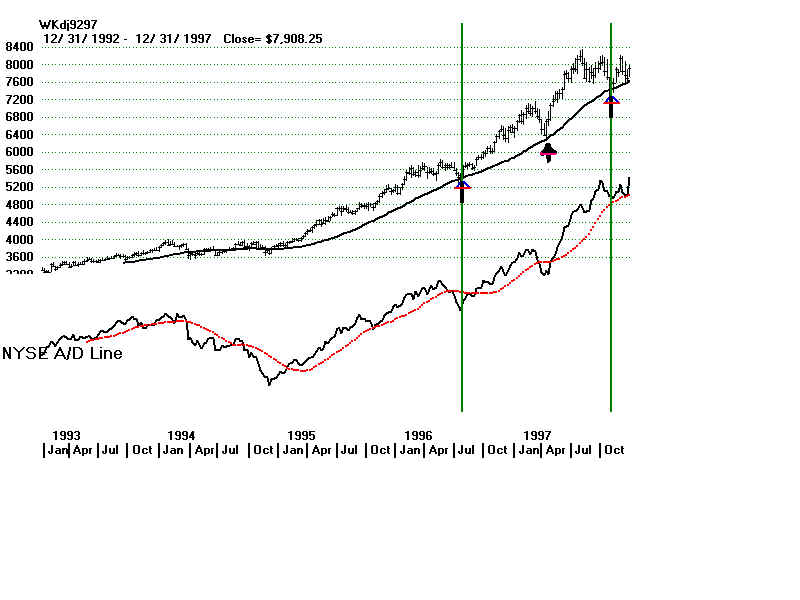

1995-1998

3 successful tests and failure. NYSE A/D

Line failed to confirm the last high.

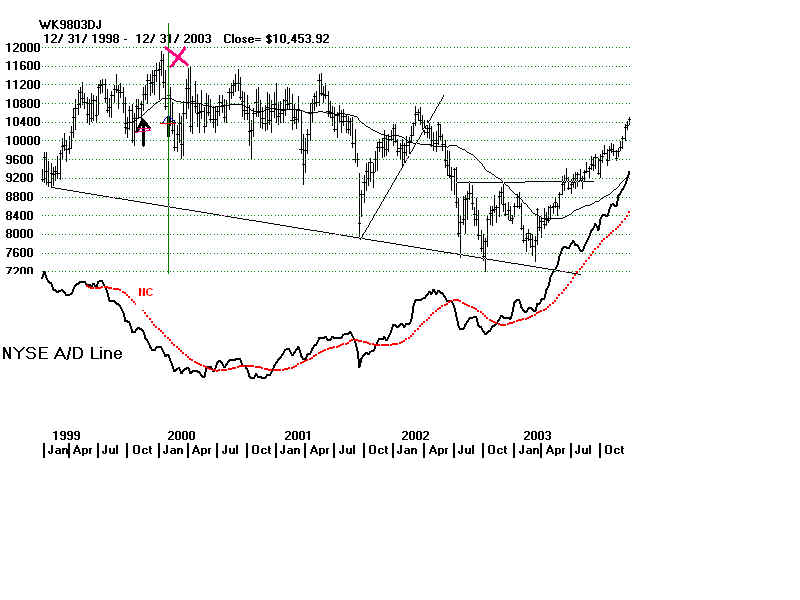

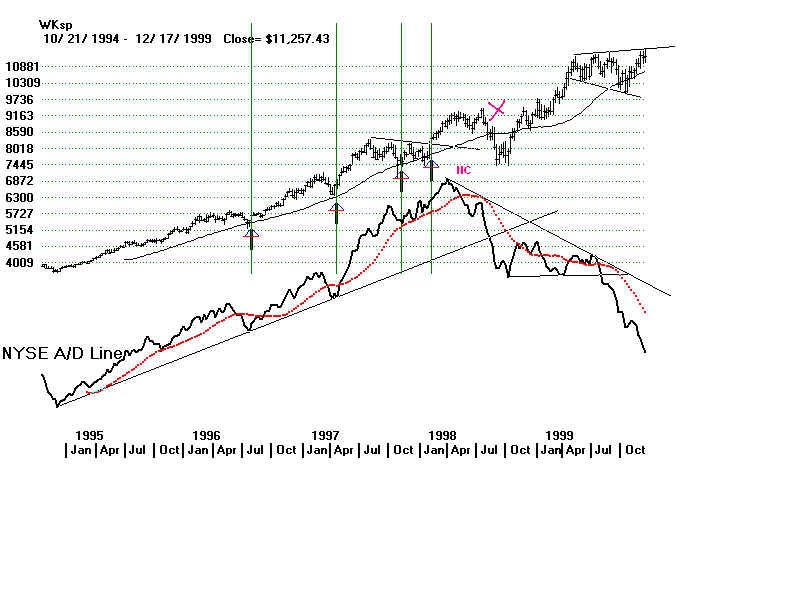

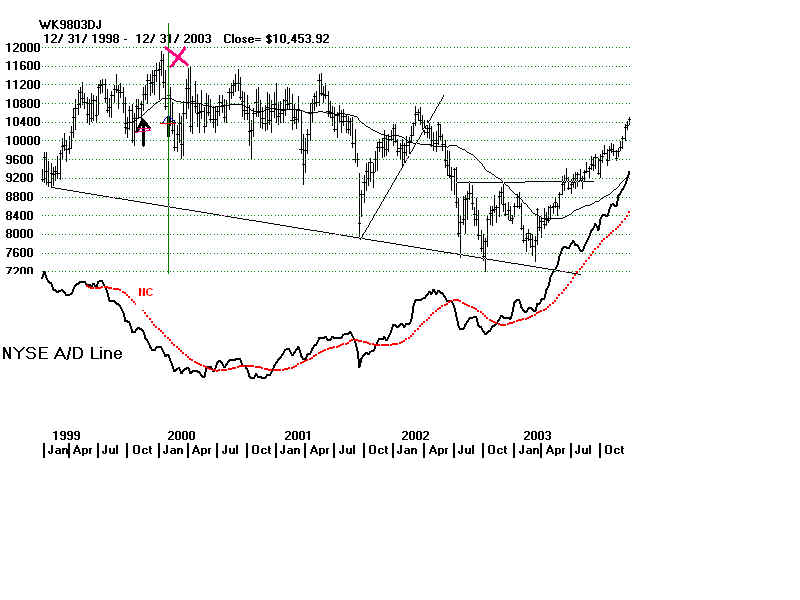

1999-2000

1 successful test and then a failure.

NYSE A/D Line failed to confirm the last high.

>

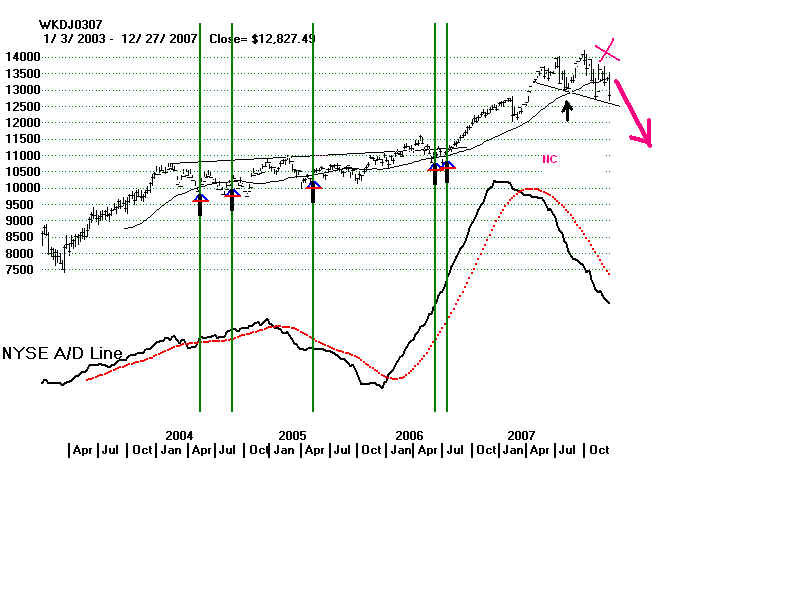

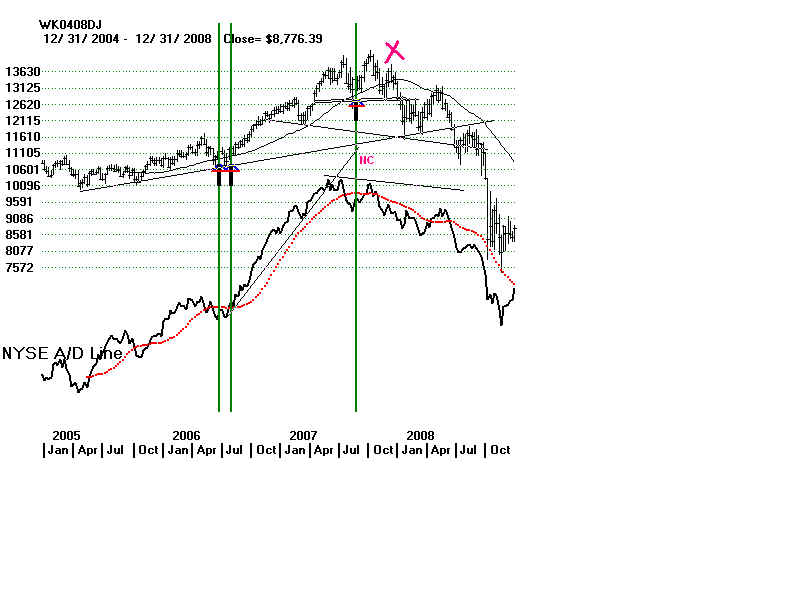

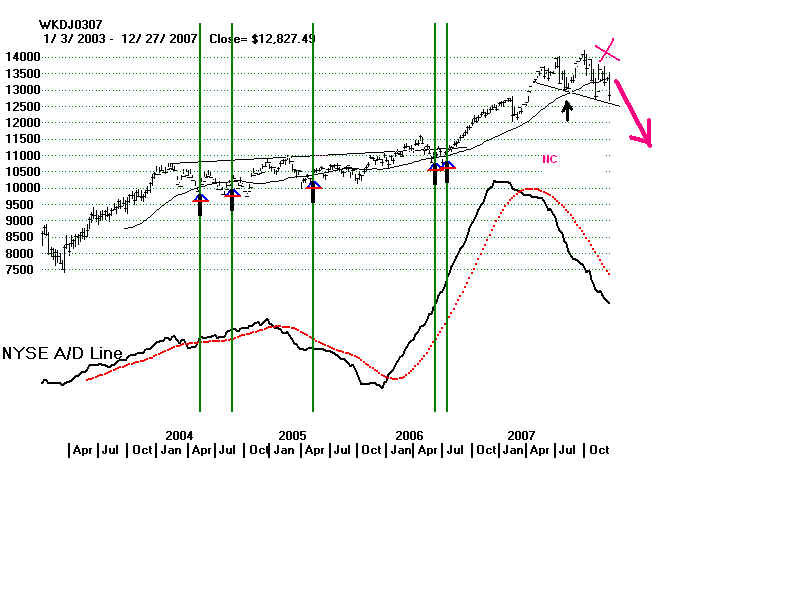

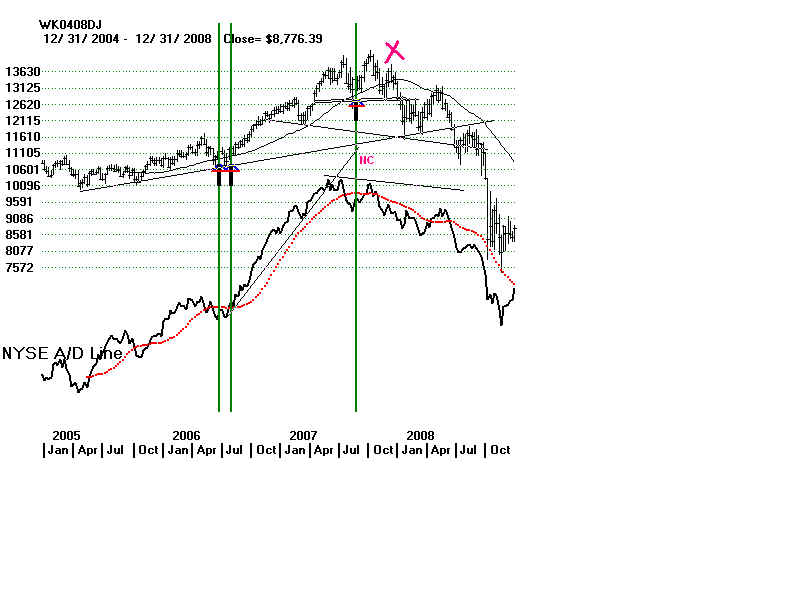

2004-2007 7 successful tests and failure. NYSE A/D Line

failed to confirm the last high.

2009-2010 1 successful test and failure.

NYSE A/D Line confirmed all the way up.

2010-2011

1 successful test and failure. NYSE A/D Line confirmed all the way up.

2012-2014

4 successful test and ???????. NYSE A/D Line confirmed all the way up.

Weekly TIGER DJI charts - http://tigersoftware.com/TigerBlogs/May15,2011/index.html

|

|

|

|

|

|

|

|

|

|

|

|

|

|

80-85 is missing  |

|

|

|

|

|

|

|

|