TigerSoft Hotline

(C) 2016 William Schmidt, Ph.D.

www.tigersoft.com

william_schmidt@hotmail.com

Current Address -

www.tigersoft.com/64HRL/INDEX.html

Previous Address -

www.tigersoft.com/55HL55/INDEX.html

----->

IMPORTANT NOTICE <-----

The market will be closed on July 4th. There will be a

hotline posted that evening for Tuesday's trading. A brief

hotline will be posted here tomorrow evening for Friday.

WE ARE MOVING

The address for this Hotline will be changed this weekend.

You should get a new address this weekend to be used

Sunday. If you do not, email me or look in your Junk folder.

----->

Suggestion <-----

A number of your email accounts are putting emails from me

using william_schmidt@hotmail into

the Junker folder. Please

"be-friend" an email from me so that you promptly get change

of address information regarding new Hotline links.

-----------------------------------------------------------------------------------------------------------------

HELP

A

Guide To Profitably Using The Tiger Nightly HOTLINE

Introduction

to Tiger/Peerless Buys and Sells.

Peerless

Buy and Sell Signals: 1928-2016

Individual Peerless signals explained:

http://tigersoftware.com/PeerlessStudies/Signals-Res/index.htm

http://www.tigersoft.com/PeerInst-2012-2013/

Explanation of each Peerless signal.

http://www.tigersoft.com/PeerInst-2012-2013/

Different

Types of TigerSoft/Peerless CHARTS, Signals and Indicators

Peerless Signals and DJI

Charts - version 7/4/2013

1965

1965-6 1966

1966-7

1967

1967-8

1968

1968-9

1969

1969-70 1970

1970-1

1971

1971-2 1972

1972-3

1973 1973-4

1974

1974-5 1975

1975-6

1976 1976-7

1977

1977-1978

1978

1978-79

1979

1979-80

1980

1980-1

1981

1981-2

1982

1982-1983

1983 1983-1984

1984

1984-1985

1985

1985-1986

1986

1986-1987

1987

1987-8

1988

1988-9 1989

1989-90

1990

1990-1 1991

1991-2

1992

1992-3

1993

1993-4

1994

1994-5

1995

1995-1996 1996

1996-7

1997

1997-8 1998

1998-1999

1999

1999-2000

2000

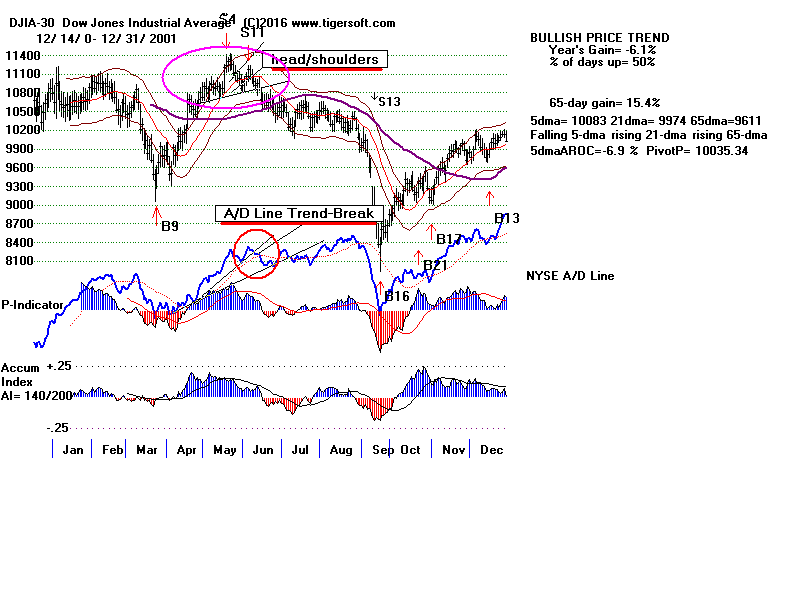

2000-1 2001

2001-2

2002

2002-3

2003

2003-4

2004

2004-5

2005 2005-6

2006

2006-7

2007

2007-8

2008

2008-9

2009

2009-10

2010

2010-11

2011

2011-12

2012

2012-2013

Documentation for

TigerSoft Automatic and Optimized Signals.

How reliable

support is the DJI's rising 200-day ma?

SPY

Charts since 1994: Advisory Closing Power S7s, Accum. Index, 65-dma, Optimized

Signals.

Previous Hotlines -

www.tigersoft.com/55HL55/INDEX.html

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

1/19/2016

--->

Corrections,Deeper Declines and Bear Markets since 1945.

1/21/2016

--->

High Velocity Declines since 1929

2/12/2016 --->

Presidential Elections Years and Bullish IP21 Positive Non-Confirmations at

Lower Band.

2/12/2016 --->

OBV NNCs on

DJI's Rally to 2.7% Upper Band when DJI's 65-dma is falling.

Earlier

Q-Answers

New

QuickSilver Documentation

(1/11/2016)

Our Different Signals

Better

understand the difference between Peerless DJI-based signals,

the one-year optimized red Signals and

the fixed signals based

on technical developments.

Introduction to

Tiger/Peerless Buys and Sells.

Different Types of TigerSoft/Peerless CHARTS, Signals and Indicators

===================================================================================

Peerless/TigerSoft Hotlines and Links

6/30/2016 The operative signals now are

Buy B3,

Buy B19 and

Buy B20. .

Relax and enjoy

the rally. CVX (our Tahiti

stock), UCO,

BRZU and

the ETFs on RED buys have done

quite well. Some of these ETFs

have reached over-sold status. If they give red Sells tomorrow, I

would take profits in them.

NYSE A/D Line made a 12-month high

ahead of the DJI. The FED is probably on hold

and US bonds and utilities look like a good place

to park EUROs and POUND in light of

continuing weakness in both.

Super Breadth: US Stocks Are The Place To Be, Apparently

and The FED will do its best to boost the market for the

remainder of this Presidential Election Year, With July

will come the historical possibility of a DJI new high, as

in 1964 and 1980.

The ratio of NYSE advancers to decliners was better than 3.75 today.

Tuesday and Wednesday this week, this ratio was above 5:1. Three

such consecutive good days has not occurred since 1950. It has only

been seen on seven earlier occasions. In each case the DJI rose at least

10% more over the next 4 to 16 weeks. Only twice (2/7 or 28.6%) was

there a retest of the lower band before the big rally. The risk:reward

ratio

now looks quite favorable. Continue to hold long positions and phase

out most short sales, especially those whose Closing Power breaks above

its downtrendline.

Earlier Cases of 3-StraightExtremely

Good Breadth Days

10/25/1934

Pullback but 18% rally in 2 months.

6/ /1938

No pullback. 12% rally in one month.

9/ /1938 Pullback

and then 12% rally in six weeks.

9/30/1938

No pullback.

and 10% rally in six weeks.

8/27/1945 No

pullback. and 14% rally in 14 weeks.

7/ /1950

Shallow pullback and 10% rally in 4 months

11/9/1950

Shallow pullback and 10% rally in 3 months

Charts: Peerless

DJIA Hourly DJIA

DIA

SPY

QQQ IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL TECL

Major Indexes and A/D Lines.

Key Tiger

Software ETF Charts

Bullish MAXCPs

Bearish MINCPs

Charts of Key ETFs

"FAST-FIVERS"

(See discussion of last night for background.)

The graphs linked to here are not updated.

Gain 5-day K Tomorrow?

OKS Buy

246% 79

No sell possible tomorrow.

DZK Buy

232% 96

Sell possible. +1.29 today

AKBA Sell

209% 61

No buy is possible...

SLCA Buy

202% 91

Sell possible. +.27 today

EWU Buy

154% 98

Sell possible. +.40 today

IPGP Buy 143%

39 No sell is possible...

CXO Buy

115% 39

No sell is possible....

ITT Buy 115%

36 No sell is possible....

CRZO Buy

112%

DO Buy

124% 60

No sell possible...

GMT Buy

110% 61 No

sell possible...

/

VRTX Buy

107% 91

Sell possible tomorrow +1.02

ATW Buy

102% 86

Sell possible tomorrow +.12

SAN Buy

93% 97

Sell possible. +.03 today

ERX Buy 106%

100 Sell likely tomorrow

+.77

BEAV Buy

90% 70

No Sell possible...

FAS Buy

85% 100

Sell likely tomorrow +.94

TGA Buy

75% 67 No Sell

possible

MA Buy 64%

8 No sell possible -4.07

MSFT Buy

48% 96

Sell possible... +.63

JPM Buy

44% 99

Sell possible ... +.94

---------------------------------------------------------------

Totals

20 red Buys 1 red Sell

8 could give Red Sells if their 5-dy Stoch.K-Line falls tomorrow.

2 have a K-Line value of 100. K-Line will fall unless they show

extreme strength and close at day's high. With these, I think

I would wait an additional day.

===================================================================================

6/29/2016 Now we have

a Peerless Buy B3, B19 and B20.

We're rollin'.

Volume could be better, but breadth could not get much better. We even

got a momentum based Peerless Buy B20 today. (Explanation

in next

hotline.) The DJI closed just a little under its 65-dma.

Tomorrow it should

make a valiant attempt to get past 17700. That would be impressive.

It would be

a big shock to all the "gloom and doomers". Let's see if the DJI can reach

18000

this week.

DIA: A false breakdown below 174?

The operative signals now are

Buy B3,

Buy B19 and Buy B20.

Relax and enjoy

the rally. CVX, UCO,

BRZU and new ETFs on RED buys have done

well.

They have not given any new SELLs yet.

Charts: Peerless

DJIA Hourly DJIA

DIA

SPY

QQQ IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL TECL

Major Indexes and A/D Lines.

Key Tiger

Software ETF Charts

Bullish MAXCPs

Bearish MINCPs

Charts of Key ETFs

"FAST-FIVERS"

I created a group of "FAST-FIVERS" tonight. These are the stocks and

ETFs whose best trading system (the one shown with red arrows on the

Tiger charts) is based on Buys being given by the fast 5-day Stochastic K-Line

turning up from below 20 and on Sells being given when the 5-day Stochastic

K-Line turns down. There are 20 of them in my list, shown below.

Only 2 are

on sells. The red Buys and Sells are working very well on them, the

annual gains ranging

from 42% for JPM to 246% for OKS. They are in a self-perpetuating

groove.

I believe that it is the Professionals and Market Makers who are making these

stocks and ETFs trade so profitably (and predictably IF you know the

secret of the 5-day Stochastics.) These are very short-term signals.

Until

we get more Sells, we should see higher prices.

Time is short tonight, but I will show how to use this list more fully

on Thursday night.

OKS Buy

246%

DZK Buy

222%

AKBA Sell

211%

SLCA Buy

200%

EWU Buy

147%

CXO Buy

117%

ITT Buy

113%

CRZO Buy

112%

DO Buy

107%

GMT Buy

106%

VRTX Sell

104%

ATW Buy

102%

SAN Buy

92%

ERX Buy

86%

BEAV Buy

84%

FAS Buy

78%

TGA Buy

75%

MA Buy

71%

MSFT Buy

47%

JPM Buy

42%

How To Trade These on The Day of The Signal

Most of these move quickly away from a Buy or Sell. Often the opening the

day after the signal is a good ways from previous day's close. You can

trade these

on the day of the signal just before the close if you test what you think is a

good

guess about what will be the day's opening, high, low, close and volume.

Use these commands: Peercomm + Older Charting + Daily Stocks + symbol.

Then when graph appears, use the Operations pull-down menu and choose

Rechart Using Tentative Day's Data. This will show you if you do will get a new

Buy or Sell that night. Note this method is for seeing stocks and ETFs

using

TigerSoft indicators and signals, and note, too, the data you've entered is only

temporarily stored. When you leave this operation, it is gone.

To see whether Peerless will give you a new major market signal in the minutes

before the close use PEECOMM + EDIT + Peerless Indexes + Peerless-DJI +

Append. Enter the provisional/tentative data. Save it. Chart

the DJI and then

place the Major Buys and Sells on it. When you download the night's data

from or website, it will be replaced.

==============================================================================

6/28/2016 Today brought a classical reversal upwards.

Whereas Monday the

DJI fell 260 on poor breadth (1937 more down than up), today it gapped up

and rallied up off the Friday's lower band. Once again it was

"turn-around" Tuesday

after an emotional selling climax on Monday. The ratio of NYSE advancers

to decliners today was a bullish 5.71:1. And impressively, the DJI surged

at the end of the day as mutual fund managers jumped in

for fear of missing

another rally to 18000.

A rally to the DJI's 65-dma, at the least, is strongly suggested by the history

of such

reversal days, by the earlier emotional selling induced by the unending barrage of

bearish

commentary on TV stations about the consequences of BREXIT

and by the bullish pre-July Fourth seasonality.

After this week, if volume does not

increase a lot, a retest of 17000 seems likely

given the historical finding that 11

of the

earlier 19 Bull Market B19s showed a

paper loss of 1% to 4.9% before

eventually going higher.

It was a classic Buy B19 using Peerless. Below are the most relevant

historical Buy B19 statistics I can come up with here.

See

the full comments here:

BUY B19

B19s occur after a sharp decline when the DJI suddenly rallies and shows a ratio

of advances

to declines more than 3:1 and up volume to down volume of more than 4:1, whereas

on the

day before the reverse ratio of breadth was true. There are several

variations on Buy B19s,

but this is always their central feature.

B19s are reliable and moderately profitable. Their average gain is 5x

their average paper loss.

Considering all B19s, they are more than twice as likely to occur since 2000

as before. The advent of Computerized Program Trading probably is responsible.

The last nine B19s, from mid-2007 to present, have averaged only 4.6% gain.

Paper loss occurred only 25% of the time in the June B19s. The average

gain

was 8.4%. But the average B19 gain was only 6.1% is an on-going Bull

Market.

June Buy B19s:

Gain Paper Loss

19650630 B19

868.04 .135 None

Correction

19670601 B19

864.98 .075

.02

Bull Market

19741007 B19

607.56 .078

None Bear Market

20130625 B19 14760.31

.048 None

Bull Market

-----------------------------------------------------------------------

.084 .025

11 of the 19 Bull Market B19s showed a paper loss of 1%

to 4.9%.

Election Year Bull Market B19s showed only modest 4% additional gains in DJI

at time of next Peerless Sell.

800930

B19 932.42

.058

.016

Late in Election year. DJI got back above 65-dma in a week but only made

nominal new high.

040312

B19 10240.08

.031 .019

DJI got back above 65-dma in three days but only made a nominal new high.

120411

B19 12805.39

.037 none

DJI got back above 65-dma in a week and went to new high at upper band.

--------------------------------------------------------------------------------------------------

No. = 3 Avg.Gain = .042

.012

.

Charts: Peerless

DJIA Hourly DJIA

DIA

SPY

QQQ IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL TECL

Major Indexes and A/D Lines.

Key Tiger

Software ETF Charts

Bullish MAXCPs

Bearish MINCPs

Charts of Key ETFs

What To Buy?

Besides bullish MAXCPs, buy UCO or CVX. BRZU is

trading especially well with its short-term Red Stochastics.

It's very hard to anticipate all the possibilities for the market

the next day here and provide a full list of contingencies.

My suggestion is run Tiger and see the red signals yourself.

You can put in dummy numbers before the close and get

both the Peerless and red Tiger signals so that they can be acted on

the day of the signal. We can get you all set up on a Fast

DELL XP laptop to make it even easier.

Example: Look at EWU (UK's ETF) below. Its Red Buys and Sells

are simply based on the 5-day Stochastic-Kline turning

up in oversold territory and turning down in the overbought

zone. They have gained more than 140% for the past year.

Seeing the red Buys and Sells shown here on your own

computer or with a little arithmetic before the close on

the day of the signal is very easy. There is always something

volatile that can be traded this way. If you do the calculations

by hand, know that the 5-day Stochastic K-Line is:

Let i = the current day,

Kline (i) = close (i)- 5day low / (high of last 5 days - low of last 5 days).

Clearly, EWU is being manipulated on this basis. This simple

system has gained 141% over the last year. That number drops

down to 105% if you use the next day's opening. Our software

assumes $10,000 is traded continually long and then short. A

charge of $40 per round trip trade is further assumed.

I will post a list of volatile stocks with similar optimized red 5-day

K-Line systems. Of course, they work best when Peerless gives

a good signal and when there is other technical support or resistance

shown.

===================================================================================

6/27/2016 The DJI has closed 3.6% below the 21-day ma.

The P-Indicator remains positive.

The Accum. Index is only slightly negative. This has given us a

New Reversing Buy B3.

Now we get to see how much of the overhead resistance the first rally up can eat

up.

For SPY and

DIA, I suspect the resistance on this rally will be the broken 65-dma.

The biggest negative here is how fast the DJI fell back to the lower band.

More than

5% in just 2 trading days. I suggest this owes especially to the unusually

bearish mass media

coverage of BREXIT and its fallout. For now, this has left stocks in

"strong hands"

and a rally is starting. Surely, so much pessimism invites a quick DJI

rally back

to its 65-dma. resistance. Seasonality is bullish enough. As long as

the Bank of England

does not raise its Minimum Lending Rate to protect the plunging Pound, I would

not be

short the major Indexes. This may be coming. But not immediately. I

did notice today

that the Chancellor of the Exchequer is starting to grease the skids for a rate

hike. He

announced that big cuts in spending and higher taxes are now necessary.

New Reversing Buy B3.

It tells us that the DJI's 20-day Stochastic is very oversold

and the internals (P-I and IP21) show more internal strength than the

price action does. It is not coded to preclude cases where the DJI has

has fallen 5% in two days, as we have here. Still, I think we can do well

here with the Bullish MAXCPs. I doubt if the Bearish MINCPs will

rally much. So, you can also stay hedged, if you like.

This is a highly reliable signal. Here it does not preclude an additional

paper loss

of 1.3% to 3.3%. But the gains are substantially greater than the paper

losses.

There is only one case where the DJI was down right before the

Buy B3 like we have just seen here. That was in November 1948. It

did bring

more paper losses after a quick failed rally. But it eventually was

profitable..

I think we have to be bullish unless the Hourly DJI's OBV Line starts again

showing tell-tale weakness. The main reason is that I have never heard

such

non-stop unadulterated fear-mongering about BREXIT by TV's talking heads.

All this nonsense has undoubtedly have put stocks in "strong hands". I

feel very

uncomfortable being short DIA or SPY when the talking heads are so bearish.

.

Seasonality is now more bullish as we go into the period around July 4th.

Since

1965, the DJI has risen 61% of the time over the next 3 trading days. It

then flattens out. But it is up 63% over the next 10 trading days.

The DJI futures are up 200 points as I write this. It looks like the DJI

is

ready to rally up to its 65-dma at 17700. That would be consistent with

the bullish seasonality up to the July 4th holiday. After that, more

probing for a

bottom near 17000 seems very likely, but this should produce a bottom.

I think we have to take this Buy Signal. But until the DJI's openings stop

being so

far away from the previous closes, consider Buying the best of the

MAXCPs

and hedge by shorting the weakest of the

Bearish MINCPs. Look also at the

ETFs traded best with short-term Stochastics. Those whose Buys and Sells

are dependent on a 5-day Stochastic-K-Line can be traded at the close for

the day of the signal if you do a little arithmetic or use Tiger's older

Peerless

to put in hypothetical data. See EWU (UK)

for example.

Here are some facts about the 25 instances of Buy B3s since 1928.

12/25 or 48% brought gains of more than 10%

6/25 brought gains of more than 5%

7/25 brought gains of less than 5%

No losses.

10/25 or 40% brought paper losses between 1.2% and 3.3%

Presidential Election Year B11 Results

11/24/1948 12.7% gain 1.5% paper loss

- closest parallel.

7/22/1960 4.0% gain 1.3% paper loss

10/8/1976 3.4% gain 3.0% paper loss

10/7/1992 11.4% gain 0.4% paper loss

7/23/1996 6.7% gain No paper

loss

6/4/2012 12.2% gain No paper

loss

---------------------------------------------

AVG 6 cases 8.3% gain 0.8% paper loss

4 Junes average gain of 10% in 4 cases. No Paper losses.

The links below will be posted later than usual

tonight.

Charts: Peerless

DJIA Hourly DJIA

DIA

SPY

QQQ IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL TECL

Major Indexes and A/D Lines.

Key Tiger

Software ETF Charts

Bullish MAXCPs

Bearish MINCPs

Charts of Key ETFs

The media's fear-mongering is not going to quickly stop. CNN, in

particular, is closely

tied to to the Big Banks and Multinationals. These are the folks who just

got a big dose

of how disaffected and alienated the British working class people are from the

rich and

powerful in the "City" and the "British Establishment". Look for

"belt-tightening" and

high interest rates to protect the Pound. These are measures aimed to

shore up

the "City" and the Pound, not bring more manufacturing jobs or better living

conditions.

All I wrote in my dissertation for Columbia University about Britain in the

1920s

seems to be repeating once again. Very sad.

See

http://tigersoftware.com/tigerblogs/83---2011/index.html

===================================================================================

6/24/2016 Friday's sell-off should be

considered a new

Peerless "Fail-Safe"

Sell S10. This is triggered when

when DJI drops 3.3% or more

in a single day, is still between lower 3% band

and 21-day ma,

and DJI is at or below its 65-dma.

There have only been 4 or 5 cases in the

past, but one was

right before

the

1987 Crash and another occurred when Truman unexpectedly bear

Dewey in the Presidential Election of 1948. Each case would have been

profitable

for short

sellers, though the next opening was often down from

the close

for the day of the

failsafe Sell S10. This is also the only case

where this type

of Sell S10 reverses a previous Peerless Buy, but support

failure Sell S10s can reverse a previous buy signal.

Failsafe S10s

1. 11/3/1948 Truman's surprise - DJI fell from 182.5 to 171.2

2. 10/6/1987 Greenspan decides to raise rates - DJI fell from 2549

to 1739

3. 4/14/1988 DJI fell from 2085.64 to 1952.59

4. 11/6/2008 DJI fell from 8695.75 to 755229

Plus

10/9/1979.

(A revised Peerless showing this S10 will be posted on the ESP Page

tomorrow.)

What If The DJI Recovers from 17400?

17400-17500 is a well-tested zone of support. The DJI has not

yet closed below it. Perhaps, 17400

will hold. But I doubt it. The DJI

closed

Friday at its lows on

very high volume. This is exactly what happened

in August 2015

as the DJI came down to the support at 17000. The next day in

plunged downward, very quickly below 16000.

Of course, the FED might intervene and change the picture. But I would

expect them to save whatever monetary arrows they still have left in

their quiver - and they

don't have

many left now - for use when the DJI

reaches a more defensible support level,

like

15500-16000, rather use them

all up here near the old highs.

If it looks like 17400 is holding tomorrow, wait for a failed rally to

17500-17700

to go short. The broken 65-dma is up at 17700.

What To Do?

Be careful here. There seems to be very little support beneath

174 in the chart of DIA.

I had previously said not to buy DIA. Sell any of the

other long positions

if their rising Closing

Power trends are violated. Go

short

some of the

Bearish MINCP and near

17500 go short DIA. A decisive break of

174 by DIA would set up a dangerous situation. There is little support

underneath it.

Charts: Peerless

DJIA Hourly DJIA

DIA

SPY

QQQ IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL TECL

Major Indexes and A/D Lines.

Key Tiger

Software ETF Charts

Bullish MAXCPs

Bearish MINCPs

Red Buys and Sells on major

ETFs

More Considerations

1) The DJI has now broken the 65-dma decisively

by a wide margin. That puts in serious doubt the validity

of the previous Buy B11 which is based on a decline to

the 65-dma support.

2) The past case that seems to be the closest parallel is when

everyone expected Dewey to defeat Truman in November

1948. The DJI then was also down sharply the day after the

Election.. There was a brief and weak recovery the following day,

but then the DJI declined for another month.

3) As

you know, the Hourly DISI/OBV was bearishly

making new

lows on the last few rallies by the DJI. This also happened just before

13.5% DJI declines in August 2015 and January 2016.

This pattern is definitely a warning we should heed.

|

|

4.) We have also called your attention to the many

head/shoulders

patterns the DJI and DIA were

making. These were warning

us of significant distribution

and some impending bad news.

5) A number of the most bullish MAXCP Utilities, Water Utilities

and Bonds were up Friday, even making new highs. This is

a sign of how desperate "hot money" is to flee Britain

and the Euro, too. This trend will likely continue until there

is a better sense of the what the new European Community

will look like in the coming years. That may take quite

a while to clarify. Investors dislike uncertainties. I would think

Bonds and Gold should continue to rise. Utilities may, too.

6. Do not trust the Bank of England. They warned everyone

such a vote would be disastrous. Now they are in a position

to fulfill their "veiled threat". Expect them to protect the "City",

London's financial community, their main client. I expect

them to raise interest rates to defend the Pound. When they were

forced off the

Gold Standard in mid-September 1931, the Bank

of England then jumped their Lending Rate from 4.5% to 6.0%

on September 21.

Fed's Discount Rate

June

1.5%

Bank of England Lending Rate July 30 1931

4.5%

Bank of England Lending Rate Sept 21 1931

6.0%

Fed's Discount Rate

October

2.76%

Fed's Discount Rate

November

3.5%

http://www.bankofengland.co.uk/statistics/documents/rates/baserate.pdf

In response,

the

FED more than doubled their own rates in 6 weeks.

The Depression

got much worse. More Banks failed. Deflation.

24%

Unemployment in 1932. The stock market fell 50% more over next

8 months.

The US Government had no solutions in 1931. Only in 1932,

when Washington was invaded by armies

of Protestors, did the Federal

Government start taking responsibility for Relief and Unemployment.

7 The most positive thing I can think of now is how unanimously all

the

CNN talking-heads are about BREXIT being a terrible event for England

and the rest of the World. Since, they were so wrong about the likelihood

of BREXIT winning. I suspect that they will be just as wrong about how

dire BREXIT will be. Some will benefit. Some will be hurt.

The Big Banks will have to scramble now. They may even be paid back

in local currencies on the Sovereign Bonds they hold. London real estate

developers

will also be hurt. If the stock market does dive, that could

mean a break in our own urban real estate bubbles.

So, now we must watch to see how each country in Western Europe

reacts

and watch their ETFs. I think it may well turn out that the

European Community may have to allow individual currencies again.

I think what is most unique and the most positive, compelling feature

is cultural anyways, the free flow of people across all these borders.

People

are now very angry about "Austerity" and losing their

manufacturing jobs to businesses run elsewhere. Making it harder

for capital to take jobs anywhere it wants would not end the cultural

inter-mixing that the Euro stands for, too.

"Free trade" is a misnomer. It is a choice, like tariffs or taxes on whiskey,

which politicians make or don't make, to benefit one segment of society and

hurt another. I still remember having to regurgitate a whole lot of free-trade

propaganda in ECON-101 to get a good grade. I knew it was not the whole story

then. And millions know it is not the whole story now.

===============================================================================

6/23/16

The "surprise" BREXIT vote has caused a dramatic

drop in the

Pound and in the Futures' markets generally. But, perhaps, it

was not such a surprise in this age of "populist revolt". The "STAYS"

were relying on telephone polling. (I thought this went out when the

Literary Digest predicted Alph Landon over FDR in 1936). I have

also not found London's bookies's odds worth much. They claimed

that there was far more money on STAY than BREXIT. This is

what the very weak Hourly DISI was

trying to tell us. Somebody

sure knew to do some heavy selling!

Buying Opportunity?

The normal reaction of Professionals to situations like this

where emotional selling is so dominant is to buy on early weakness

in expectation that there will be a rally when cooler heads prevail.

At least, that is what seems the most likely development. After all,

it will be 3 months before the next British Government tells the

European Union officially of the decision to "BREXIT". And after

that, Britain still has two years to negotiate new terms of its relationship

to the European Union.

The 3x leveraged gold miners' ETF, NUGT is

up 30%(!) overnight

on the news. Now we get to see if Professionals can control the

gold speculators. Until, they do, it would probably be prudent not

to try to call a bottom for the Pound, the Euro or the

EWU.

What worries me is that the Bank of England chimed in almost

immediately saying that they would support the Pound and the

FTSE with a reserve worth 250 billion Pounds. Currency

speculators like Soros hear such words as a challenge. Like

sharks, they can smell a bleeding currency an ocean away.

What I now fear most is the the Bank of England will eventually raise

its interest rates to try to defend the Pound. This will cause big

problems

for the FED's easy money policies. This is probably why they warned

Englishmen that BREXIT would produce dire financial and economic results.

On the Continent, we should now see more pressures from Greece,

Spain, Portugal and Italy to renegotiate their own relationship

with the European Central Bank. These centrifugal forces will

not immediately become evident. But they are probably now

inevitable. Big Banks do not want to be paid back in Pesos, Lire

of Drachma. So, the American big banks should now be watched

very closely.

The markets crave certainties. BREXIT has released all sorts

of dangers and fears now. Now we get to see how good the FED

really is in containing these demons before they take control.

Immediately ahead, I suspect Peerless may give a Buy B9 on tomorrow's

weakness. They are reliable. We would have to take it. It will

occur if the DJI closes 3% below the 21-day ma and shows a

positive P-I and IP21. A close near 17400 will probably bring such

a signal. But we should just wait and see, to be safer.

Charts: Peerless

DJIA Hourly DJIA

DIA

6-month DJI chart

SPY

QQQ IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL TECL

Major Indexes and A/D Lines.

Key Tiger

Software ETF Charts

Bullish MAXCPs

Bearish MINCPs

Red Buys and Sells on major

ETFs

====================================================================================

6/22/16

Peerless still shows a

Buy B11.

Breadth is strong.

Hourly DJIA

Volume remains quite weak. I take this to mean that the Buyers

will not be able to take the DJI up

beyond 18000 by much.

The steep Closing Power uptrends for DIA and

SPY have been violated.

Early strength is starting to give way significantly to late selling. These

warning signs, OBV and Closing Power, may just reflect the

concerns of Professionals waiting for the results of the BREXIT

vote tomorrow.

Because the DJI is trading so narrowly,

I have suggested either

working with the Bullish MAXCPs

or the automatic, optimized

Red Buys and Sells on major

ETFs. I have two more suggestions.

The highest AI/200 stock now is CVX. It should be bought as

a longer term investment. Buy ASX and trade it using its

Red optimized Buys and Sells. It has shown a striking tendency

to rise the day after the DJI rises. When the DJI rises, it lags

and the plays "catch-up". This is useful to know. See below...

Charts: Peerless

DJIA Hourly DJIA

DIA

6-month DJI chart

SPY

QQQ IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL TECL

Major Indexes and A/D Lines.

Key Tiger

Software ETF Charts

Bullish MAXCPs

Bearish MINCPs

QUICKSilver

We don't usually get the time to try out some of the lesser known

and used TigerSoft tools. Under Runs/Setups you can answer

the following questions.

What Stock Moves Today Best Predict the DJI Tomorrow?

ASR 56.5% (Its success rate was 56.9% in 2015.)

This seems a random relationship. It is a small South

American ADR.

CVX 56.5%

(Only 50.4% in 2015. Very reliable this year.)

That CVX shows such high Accumulation and looks so

good

is probably a good sign that DJI will go higher this Summer.

What Stock Moves Tomorrow Are Best Predicted by DJI moves

Today?

ASX + 65.7% (Only 50.8%

in 2015. Very reliable this year.)

The specialist for ASX must be away a lot this year and

is slow to move the stock up when the DJI rises. The

market does that the next day for him. Perhaps, we can

profitably buy this on days the market is up and sell at the end of

the next day or when there is a Sell.

CG +57.3%

(Only 50.0% in 2015. Very reliable this year.)

DEM + 58.1% (Only 48%

in 2015. Very reliable this year.)

EWY + 58.1% (Only

50.0% in 2015. Very reliable this year.)

---------------------------------------------------------------------------------------------------------------------------

6/21/16

Peerless still shows a

Buy B11. If we judge the

market's strength

by breadth we have to be bullish. The

NYSE A/D Line is rising

steadily and a lot faster than the DJIA.

But if we judge it by the

Hourly DJI's DISI/OBV Line, we would have to be quite frightened.

This measure of up-hour versus down hour volume is making 2-month

lows as the DJI sits on its 21-day and 65-dma.

Which view should we trust? Which will be

right?

Perched on its two important moving averages, the DJI seems

perched and ready to spring either way, with the outcome controlled

probably

by whatever is the outcome of the BREXIT vote in the UK.

By Thursday mid-day

in NYC, we should know the outcome of the

vote. The latest polls

show BREXIT losing by 2%.

http://www.mirror.co.uk/news/uk-news/eu-referendum-britain-poll-2016-7699714

I suspect that the polls are right.

That's why Peerless is on a

Buy and Gold stocks, for example, are weakening. Mostly we

are getting bullish readings from the indicators and statistics we

trust. Here are the ones I like to follow the most.

1) The Closing Powers for DIA and

SPY are rising.

2) The 5-day moving averages of DIA, SPY and QQQ are rising.

3) Tonight there were 198 MAXCP stocks and only 44 MINCPs.

4) While on the NASD there were 22 highs today and 27 lows,

on the NYSE, there were 61 new highs and only 5 new lows.

Totals remain bullish: 83 versus 32.

5) Of the 20 major ETFs examined, 14 show current

optimized

Red Buys and 6 show RED Sells.

My conclusion: a low volume rally will probably be seen if BREXIT

loses. In rising now, the DJI will be showing unusual seasonal strength.

Typically since 1965, the DJI has only risen 38% of the time over the

next week and 44% of the time over the next two weeks. That may

be a good sign that the DJI will achieve a breakout in July. That would

be more in keeping with how the market behaves in a Presidential

Election Year if it approves of who the next President will be.

Charts: Peerless

DJIA Hourly DJIA

DIA

6-month DJI chart

SPY

QQQ IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL TECL

Major Indexes and A/D Lines.

Key Tiger

Software ETF Charts

Bullish MAXCPs

Bearish MINCPs

QUICKSilver

===================================================================================

6/20/16

Peerless still shows a

Buy B11. The NYSE A/D Line is

rising

as is the 5-day ma of the DJIA.

Since March, the DJI has been

trading narrowly between its upper and lower 1.75% bands around

a 5-dma. At some point soon, I expect a much bigger move.

But until it breaks outside this confined area, it might be a good idea

to look at the trading possibilities offered by the Red Buys and Sells

on some of the foreign ETFs as well as FAS and UCO, among

others mentioned below..

Sporting new Tiger Red Buys, Oil and

Gas led the market's recovery

today. Though the ETF representing UK's

stocks gave a new Red Sell,

the ETFs for Germany,

Italy and

Europe did not.

We now have a red Buy on QQQ. With the

Closing Powers rising,

it certainly seems like the DJI will make it back

to 18000 and the

2% upper band. Volume will probably need to be higher if the

DJI is going to get much higher. See the way OBV is lagging

on the Hourly DJIA and

OEX charts.

Charts: Peerless

DJIA Hourly DJIA

DIA SPY

QQQ IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL TECL

Major Indexes and A/D Lines.

Key Tiger

Software ETF Charts

Bullish MAXCPs

Bearish MINCPs

QUICKSilver

About 60% of the most important ETFs

show TigerSoft RED Buys.

With the DJI locked in a narrowing trading range, it would

seem to be a good time now to trade with the automatic Red

Buy and Sells. Note that I have started posting all the ETFs whose

5-day Stochastics are now the best trading system on the Tiger

Data Page. For our purposes here it is probably sufficient to

to keep track of status of the Tiger Red signals for the following

ETFs. You can decide if you want to trade these or their leveraged

equivalents. Sometimes, the leveraged ETF gives a different

signal than the regular ETF. That is true now for DIA and

UDOW.

Current Gain Using Current

Signal Best System for last year

-----------------------------------------------------------------------------

DIA

90-day Stoch

Sell

Only

+19% (low is less reliable.)

(UDOW

21dma turns

Buy

+86% Leveraged DJI)

SPY

14-day St-Kline Buy

+35.4%

OEX 14-day St-Pct-D

Sell

+43.2%

QQQ

14-day St-Pct-D Buy!

+45.8%

IWM

14-day St-Kline

Sell

+30.8% Russell-2000

NASDAQ 14-day St-Pct-D Buy!

+49.8%

IBB

50-day St-Kline

Sell

+67.4% Biotechs

SOXL 14-day

St-Pct-D

Sell

+227.2% Semi-Conductors

TECL 14-day

St-Pct-D Buy

+135.5% Technology

FAS

5-day K-Line

Buy

+90.7% Banks

UCO

5-dma penetr. Buy

+113.7% Crude Oil

UGAZ 50-dRSQ turns

Buy

+160.2% Natl Gas

Food 21-dma IPA pen.

Buy

+23.7%

YINN 10-d RSQ pen.

Sell

+149.2% China

EWC 10-d RSQ pen.

Sell

+44.3% Canada

EWU 5-day K-Line

Sell

+109.4% U.K.

EWG 14-day St-Pct-D

Buy

+83.% Germany

VGK 5-day K-Line

Buy

+70.2% Europe

LBJ 21-dma turns

Buy!

+215.6% Developing

BRZU 5-day K-Line

Buy

+1187.2% Brazil

----------------------------------------------------------------

12 Buys

and 8

Sells

=================================================================================

6/17/16

Peerless still shows a

Buy B11. The DJI decline on

Friday

was artificially induced because of Options' Expirations. This

can be judged from the fact that there were 671 more up than

down on the NYSE despite the DJI's 58 point loss. The European

ETFs advanced on their short-term Red Buys.

Utilities were

particularly strong. The NYSE A/D Line uptrend is intact.

The Closing Powers for DIA and

SPY are rising. Assuming, the

DJI can close strongly tomorrow, it will get back above its

65-dma. This should induce additional buying.

However, a reversal downwards tomorrow would give the last 20

trading days the appearance of being yet another bearish head/shoulders.

So, Bulls will need to over-power the Bears after what looks like

will be a very positive opening tomorrow.

I still think that volume will need to expand a lot to allow the DJI

to rise much past 18000. But, Biotechs are not likely to keep

falling if the market moves up this week. So, close out any hedged

Bearish MINCP stocks that turn up at the close tomorrow. Any

rally in IBB will bring a new Red Buy for this ETF representing

NASDAQ biotechs.

The strength in Oil has sent most airlines'

stocks into a dive.

Let's watch them to see if their oversold Stochastics will turn

up and allow them to rally again. As long as Crude Oil (UCO)

stays above its 65-dma, I think it's best to assume that Deflation

is being kept safely at a distance, though rebels in Nigeria also

are affecting its supply. Short-term traders should buy UCO

based on its new red Buy. See below.

Charts: Peerless

DJIA Hourly DJIA

DIA SPY

QQQ IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL TECL

Major Indexes and A/D Lines.

Key Tiger

Software ETF Charts

Bullish MAXCPs

Bearish MINCPs

QUICKSilver

The optimized short-term red short-term stochastics applied

to the UK's ETF, EWU, will probably be as good a guide as

any regarding the chances for PREXIT. EWU's rally is positive

short-term news for DIA and American big

banks, FAS. But

weakness in a day or two could bring a new red Sell for EWU.

See below how its 5-day Stochastic K-Line is now in

over-bought territory. This red system has gained an amazing

101.7% over the last year. Until it fails, keep using it. There

is a 25% performance distance between taking the signals at

full advantage on the day of the signal and taking the signal

at the next day's opening. You can use the older Tiger programs

to put in hypothetical data. Place a chart of the screen and

under Operations, choose "Rechart using tentative data for next day."

You can also compute the 5-day K-Line's position quite easily.

This is the formula:

Stochastic-5-Kline = (Close - 5day low)

------------------------

5-day price range

==================================================================================

6/16/16

Peerless still shows a

Buy B11. Today the DJI opened

down

150 points and gradually rebounded all day and ended up 96.

This turned the Closing Powers back up at their rising 21-day ma.

So, Professionals must now be deemed to be net bullish on

DIA.

Nevertheless, I suspect there will need to be more testing of 17400-17500.

BREXIT overhangs the Financials. We need more "head-room"

to buy if 18000 and the upper 2% band are expected to block

the next rally. Seasonality is distinctly short-term bearish. Since

1965, the DJI has rallied only 36% of the time over the next week

and 44% of the time over the next two weeks.

Though we now see Red Optimized Buys on DIA

and SPY,

the charts of BBH,

OIL, QQQ,

SOXL and

UCO still show red

Sells.

NYSE Breadth and (up-volume minus down-volume were negative today

despite the DJI gain of 1/2%. Can the DJI lead the market back up

with this divergence? As long as we don't get a close below 17400,

the answer appears to be "Yes". Since the year 2000, there have been

6 such days when the DJI rose 1/2% or more but breadth and volume

were negative with the DJI not already below the lower band and

Peerless not already on multiple SELLs. In each case, the DJI rebounded

soon afterward to at least the 2% upper band.

Such action by the DJI used to be a bearish sign. But "hot" money

clearly now goes first to the big indexes at the start of a rally now.

Look

at the cases: 5/2/2009,

7/6/2009,

6/16/2011,

4/2/2013,

9/12/2015

and 12/12/2015. (I mark them on these charts with a B2s).

It is important to note that this unusual juxtaposition of a 1/2% jump

in the DJI with negative breadth and volume is not good to use as an

immediate Buy signal. In most of these cases, the DJI did drop

down a little further.

This is a new phenomenon. There were no cases between 2003 and 2007.

This is the third such case in the last year. This used to be primarily a

a bear market DJI. Thus, it occurred 4 times in 2008.

Charts: Peerless

DJIA Hourly DJIA

DIA SPY

QQQ IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL TECL

Major Indexes and A/D Lines.

Key Tiger

Software ETF Charts

Bullish MAXCPs

Bearish MINCPs

QUICKSilver

===================================================================================

6/15/16

Peerless still shows a

Buy B11. But the DJI's response to

the Federal Funds' rate being kept down near 1/4% was very

disappointing. Breadth remained positive as bonds, utilities

and mining stocks loved the news that low rates are likely

to be here until the Jobs' market looks much better. It is the

bank stocks that are frightened most by the prospects of BREXIT.

Fortunately, for Tiger Users, though the banks stocks show weakness

now, our Bullish MAXCPs are

mostly utilities, which are made

more attractive by low interest rates AND by being a haven against

the uncertainties in Europe because of BREXIT.

A nagging question stands out now. Has the FED used up all its

anti-recessionary ammunition? Given the political gridlock, what's

to protect us from a new economic slow-down?

Would not even a DJI decline of 15% push the economy over

into a recession, given the importance of the general level of

consumption by those who are well-off and directly affected by

such a decline?

Unfortunately, I can no longer say that Professionals remain

bullish on DIA and SPY. Their Closing Power uptrends were

violated today.

So, the short-term trend of DIA and SPY is now governed by their

falling 5-day mvg. averages. These cannot easily turn up. For now

short-term, traders should

not

hold DIA despite the Buy B11.

After all, the DJI is now below its 65-dma.

Otherwise, let's wait to see if the DJI's 17400 neckline support holds

and DIA can close back above its key short-term pivot-point, now

17900. For those who want to use

only Peerless signals, stay long

DIA, but treat a close below 17380 as a judged Sell S10.

Charts: Peerless

DJIA Hourly DJIA

DIA SPY

QQQ IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL TECL

Major Indexes and A/D Lines.

Key Tiger

Software ETF Charts

Bullish MAXCPs

Bearish MINCPs

QUICKSilver

So What if Britain Leaves

The European Economic Community?

Isn't everyone over-reacting? While the polls show that

the British favor BREXIT by 7%, they could be wrong and

if that is the vote, Britain would still have two years to

reach a new accord with the European Market. This is what

Switzerland and Norway have done. If the results are very close,

the British Government may even choose to ignore the voting.

That's all true. But the Big Banks would be hurt by BREXIT.

And US stocks and even Bonds and Utilities could be hit hard

in the coming months.

First, BREXIT would be a big blow to "The City", London's Wall Street.

They would be hurt by the likely sudden drop in the value of the

Pound. Consequently, it must be expected that "The City" would

put tremendous pressure on the Chancellor of the Exchequer and

the Bank of England to raise interest rates to shore up the Pound.

Any big jump if British interest rates would rock the current world

of low interest rates. The FED and the European Central Bank might

feel compelled to respond in kind. Think what that would do to stocks

and bonds here. (It has happened before. In the Fall of 1931,

Britain

was forced off the Gold Standard by the Depression. The American

FED responded by boosting the Discount Rate from 1.5% to 3.5% in

less two months. The effects here were dire.)

Second, even if BREXIT does not lead to any dramatic changes in British

interest rates, Britain's departure from the EEC will be closely

watched in Athens, Rome. Lisbon and Madrid. Those who want

their Finance Ministers to challenge the reign of Austerity that the European

Central Bank has imposed on them will surely be emboldened. If the UK

can make the exit, why can't they? This is the last thing the Big Banks

in Europe and America want. They hold many billions in the government

debts of Greece, Italy, Portugal and Spain. They want to be paid back

in Euros, not Drachmas.... This is also a very big part of why our banks

have become frightened enough to send Jamie Diamond (JPM) and

President Obama over to try to fight off these dangers.

Britain’s chancellor of the

Exchequer, George Osborne, center, with Jamie Dimon, chief executive of JPMorgan

Chase, seated behind him, spoke about the referendum in Bournemouth, England,

this month.

Credit Will Oliver/European Pressphoto Agency

http://www.nytimes.com/2016/06/16/business/international/the-financial-plan-for-a-brexit-cross-your-fingers.html?emc=edit_th_20160616&nl=todaysheadlines&nlid=58223894

When we look at our Big Banks ETF, FAS, we still see lot of Accumulation.

So, for now, these dangers seem too futuristic to trade on. Still FAS

is in a downtrend. This is important because of how often whatever FAS

does, the DJI will soon do, too.

More Immediate Concerns

As a humble chartist, I have to be concerned that the DJI has

now repeatedly failed to get past its 18000 resistance - even with

a very accommodating FED. Now it must plumb for support

at 17000 or even 16000 if the 17400 support fails.

Doubts about the FED's monetary powers are only going to

turn more shrill if the DJI does start to fall as it did in January.

But now with rates so low and more Quantitative Easing probably

unthinkable given the $4.5 trillion worth of debt already on the Fed's

books, what can the FED still do to stimulate an economy whose growth

is slowing down very noticeably?

The Big Banks will always look after their own interests. If the

FED does provide Wall Street Banks with still more free money,

what is to prevent them from using it to go heavily short and on

down-ticks and without borrowing any stock, either? Certainly,

not the SEC, which just parrots the NYSE's spurious arguments that

derivatives and depressing short sales are a natural right, necessary

and provide extra liquidity.

As one who has researched DJI head/shoulders patterns in charts

going back to 1896, I have to write that their appearance is a

warning even when the DJI rallies back up to the right shoulders apex

and only then falls back to the neckline, as now.

And as a historian who has come to believe that seasonal price patterns

play a big role in market history, I think it's very important that there

has not been a significant June DJI breakout since 1928. (Sure,

1980 saw a Spring bull market, but the DJI did not make a breakout

until July 18th.) And, as I've shown recently, since 1945 all Junes

are 3 times more likely to bring a decline to at least the 2% lower

band from a top that tags the upper 2% band.

===================================================================================

6/14/16

Peerless remains on a

Buy B11. Unless Yellen

disappoints

us and unexpectedly raises rates, we should see a nice rebound

tomorrow. The Futures are up. Overseas' selling appears

to be relenting. The Indexes are testing their rising 65-dma

support. The NYSE A.D line is testing its uptrend. The Closing

Powers for DIA and SPY are at their rising trendlines. And

the red 10-day Down Volume has now reached but not surpassed

the blue 10-day Up Volume. The Inverted Traders' Index is in

the oversold territory that often brings a good rebound.

DJI "should" be able to rally again to 18000

and tag the 2% upper band.

DIA has given a new Red Buy and still shows

a rising Closing Power trend.

We should see a strong rebound. But plan to sell DIA if the DJI

tags the upper 2% band later this week, unless we get an additional

Peerless Buy signal. The 5-day ma of DIA is still falling. Junes

usually bring reversals at the 2% upper band and 18000 is clearly

where heavy pre-planned selling is scheduled. This is, after all

a bull market that is 7 years and 3 months' old.

Wild Cards

Wall Street is too complacent about Hillary's winning the Elections.

WikiLeaks claims possession of emails to and from her that show she

had highly sensitive and classified materials on her private server, something

which she has denied. Will the FBI really bring charges against her as

the Democratic candidate for President? If they are going to do this, it

be soon, not after she is the official candidate, I would think.

WikiLeaks will release new Clinton emails to add to incriminating evidence

SP-500 is in perfect position to bounce up

from its rising 65-dma.

Charts: Peerless

DJIA Hourly DJIA

DIA SPY

QQQ IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL TECL

Major Indexes and A/D Lines.

Key Tiger

Software ETF Charts

Bullish MAXCPs

Bearish MINCPs

QUICKSilver

Tonight we also see new optimized Buys, shown with

Blue "!",

from the cadre of European ETFs that have been leading the decline

because of BREXIT, namely, EWI,

EWG,

EWU and VGK.

Sector and Country ETFS on Red Sells

Best

Red Red System's ITRS

Relative to

System

Signal Yearly Gain

65-dma

--------------------------------------------------------------

Brazil

BRZU 5-d Stoch K

Sell 921%

+.002 below

DIA 21-dma turns

Buy!

23%

------ just below

EPU 21-dma turns Buy

63%

+.15 above

Italy

EWI 14-d Stoch K

Buy!

53%

-.061 below

Germany

EWG 14-d Stoch K Buy!

75%

-.035 below

Unit.King.

EWU 5-d Stoch K

Buy!

99%

-.031 below

FAS 5-d Stoch K

Sell 81%

+.009 below ma

GLD 50-dma turns Buy

23%

+.059 above

Biotechs

IBB 20-d

StoPctD Sell 69%

-.028 below

ILF 21-d OBV

Sell 57% -.03 below

IWM 14-d Stoch K Sell

32%

+.041 above

Airlines

JETS 5-d Stoch K

Sell 64%

-.137 below

JNUG 50-dayRSQ Buy

453%

+1.268 above

MDY 14-d Stoch K Sell

38%

+.032 above

OIH 5-d Stoch K

Sell 103%

+.143 above

NASD-100 QQQ

20-d StoPctD Sell

51%

-.016 just below

RSX 5-d Stoch K

Buy! 43%

+.056 above

SLV 21-dma IPA

Buy 42%

+.167 above

SOXL 50-d Stoch K Sell

212%

+.079 above

SPY 14-d Stoch K

Sell 36%

+.01 above

Technology TECL

14-d Stoch K Sell

138%

-.076 just below

UCO 5-dma penetr. Sell

103%

+.62 above

European VGK

14-d Stoch K Buy

61% -.052 below

Emerg.Mkts VWO

5-d Stoch K Sell

62%

-.02 below

XOP 5-d Stoch K

Sell 75%

+.189 above

China

YINN 10-d RSQ pen. Sell

215%

-.053 below

====================================================================================

6/13/16

The DJI is now testing its rising 65-dma.

Buy B11s in

the past seldom have big losses. Utilities

and Gold are

holding up well. This suggests that the FOMC will not

be raising rates in June. BREXIT may cause lots of

mischief for the EURO. That may hurt US big banks.

But it is not clear to me how this will impact US stocks.

I would stick with DIA but hedge, as shown below.

We have to be concerned that the DJI's last rally was quickly

stunted by big sellers who are expecting a bigger decline.

On the last rally, the DJI merely closed 1.5% over its 21-

dma at its peak. It needed to close another 1/2% higher

to get a Sell S2 or S9V.

If we were creating a Peerless system that worked well

for only the period since 2000, we would happily use the

1.5% band for closings in June to get a Sell S2. Since 2000,

there are no June take-offs and there are a number of peaks

1.5% over the 21-day ma that bring declines to the 2%

lower band.

But our Peerless signals must test very well for the whole

period, 1928-2016, to be allowed. Sells in June when

the DJI closes 1.5% over the 21-dma "only" work 75%

of the time since 1945.

See

June Tops

Outnumber Big June Advances by 3:1

For now, all this should make us hedge our longs with

a good number of Bearish MINCPs.

Another way to hedge is by shorting some of the sector

and country ETFs that are on automatic red (optimized)

Sells provided that they are below thier 65-dma and show

a negative ITRS (relative strength to the DJI.) The 11 ETFs

in red meet these criteria.

See a list of 26 candidates below. The graphs of these are

regularly shown here.

Charts: Peerless

DJIA Hourly DJIA

DIA SPY

QQQ IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL TECL

Major Indexes and A/D Lines.

Key Tiger

Software ETF Charts

Bullish MAXCPs

Bearish MINCPs

QUICKSilver

Sector and Country ETFS on Red Sells

Best

Red Red System's ITRS

Relative to

System

Signal Yearly Gain

65-dma

--------------------------------------------------------------

Brazil

BRZU 5-d Stoch K

Sell 875%

-.082 below

DIA 21-dma turns

Sell 23%

------ just above

EPU 21-dma turns Buy

67%

+.14 above

Italy

EWI 14-d Stoch K

Sell 51%

-.056 below

Germany

EWG 14-d Stoch K Sell

75%

-.01 below

Unit.King.

EWU 5-d Stoch K Sell

95%

-.004 below

FAS 5-d Stoch K

Sell 76%

+.026 at ma

GLD 50-dma turns Buy

22%

+.051 above

Biotechs

IBB 20-d

StoPctD Sell

70%

-.012 below

ILF 21-d OBV

Buy 57%

-.045 below

IWM 14-d Stoch K Sell

31%

+.035 above

Airlines

JETS 5-d Stoch K

Sell 60%

-.104 below

JNUG 50-dayRSQ Buy

499%

+1.221 above

MDY 14-d Stoch K Sell

38%

+.026 above

OIH 5-d Stoch K

Sell 103%

+.132 above

NASD-100 QQQ

20-d StoPctD Sell

51%

-.019 just below

RSX 5-d Stoch K

Sell 42%

+.042 above

SLV 21-dma IPA

Buy 42%

+.158 above

SOXL 50-d Stoch K Sell

211%

+.053 above

SPY 14-d Stoch K

Sell 36%

+.009 above

Technology TECL

14-d Stoch K Sell

139%

-.089 just below

UCO 5-dma penetr. Sell

118%

+.54 above

Cons/Ret VGK

14-d Stoch K Sell

56%

-.015 below

Emerg.Mkts VWO

5-d Stoch K Sell

61%

-.024 below

XOP 5-d Stoch K

Sell 75%

+.173 above

China

YINN 10-d RSQ pen. Sell

215%

-.091 sell

===================================================================================

6/10/16

We still show a Buy B11 to be the current

Peerless signal.

The DIA's Closing Power is rising. But

a re-testing of

the DJI's 65-dma seems likely.

18000 and the 2% upper

band look like imposing resistance unless there is a big

surge in up-Volume.

There are some attractive new short sales among our

Bearish MINCPs. I

suggest doing a little hedging. That

is what we will do on our Tiger Stocks' Hotline.

If the DJI manages a rally later this week leading up to the

announcement Wednesday by the FOMC and tags the 2%

upper band, I believe I should then sell DIA. There appears to

be more downside risk from there than upside potential.

UCO is still in an uptrend, but must close

back above

13.25 to keep a rising 5-day ma. So, short-term traders should

sell it Monday if it closes below that. It still shows rising

Accumulation, so I believe that it is an intermediate-term hold.

News

The latest act of terrorism and mass killing in America should

add to weakness early Monday. Concern about BREXIT adds

to the bearishness, though no one, I suspect, really knows

how the vote will actually turn out or what the consequences will be.

There is less uncertainty about what the Fed's FOMC will

do on Wednesday. Because of May's very weak Jobs'

numbers, the FOMC will probably do nothing. Our Tiger Index of Utilities

remains in a firm uptrend. The only way Utilities could be rising

at an annualized rate of 26% at this time would be if competing

interest rates are expected to stay very low.

BREXIT

Good breadth has been the "saving grace" of the

rally since

February. But Friday saw more NYSE decliners than any day since

February bottom. Profit-taking in Oil stocks was only part of

the reason for the weakness. New British Polls place the likely

number of those voting to exit the European Economic Community

to be 10% above those in favor of staying it. This introduces

a new level of uncertainty for Foreign stock markets and US

Big Banks. 18%-20% of all NYSE

stocks are foreign owned.

As a consequence, it was weak along with most

foreign ETFs.

Even though we have not gotten a new Peerless

Sell, Junes

often do bring very tradable declines and recently have tended

not to bring ralliesany higher then the 2% upper band and a closing

not much more than 1.5% over the 21-day ma. See

new study of

June Tops.

I think we have to start drawing in the 2% upper

band in the Summers.

DIA's Closing Is Still Rising

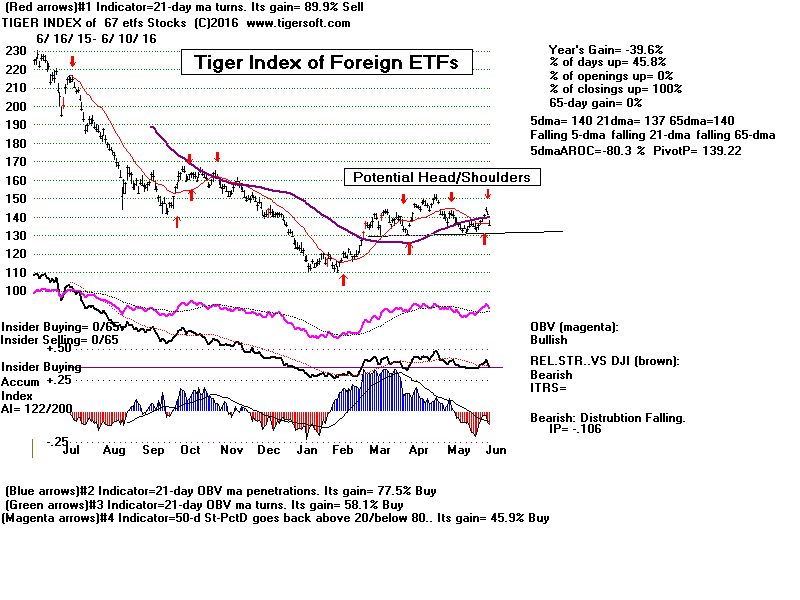

Break in 65-dma by Foreign ETFS

Crude Oil (UCO).

Charts: Peerless

DJIA Hourly DJIA

DIA SPY

QQQ IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL TECL

Major Indexes and A/D Lines.

Key Tiger

Software ETF Charts

Bullish MAXCPs

Bearish MINCPs

QUICKSilver

June Tops

Outnumber Big June Advances by 3:1

This late in a bull market, we have to take note of how often there

are June tops and how there have not been any continuous advances

in June since 1999. Historically, I reckon the odds are about 3:1

that the DJI either has seen a top that will take the DJI down to a

point at least 2% below the 21-day ma or we will see it in that June

top in the next two weeks.

Research done this weeks shows that there have been 36 instances

since 1945 where the DJI peaked with a closing at least 1.5% over

the 21-day ma and then fell away and closed at least 2% below the 21-day

ma. There have have only been 12 cases where June allowed a rising

market to pass right through it and go substantially higher. None of

these cases have occurred since 2000.

Some of these peaks near the 2% upper band did not produce a Peerless

Sell signal. While, I don't see this tendency as powerful enough to

incorporate into Peerless for the whole period since 1928, we should

note the recent tendency for tops to occur before the 3.5% upper band is

reached and not necessarily wait for Peerless to sell.

More work will be done later this week on this study.

====================================================================================

6/09/16

Lack of convincing Up-Volume has been a problem

for this rally. The Hourly DJI's

OBV Line is lagging

Prices considerably. Now today the 10-day ma of

Down-Volume turned up and the 10-day ma of Up-Volume

turned down. The DJI's perch above 18000 has given

way to yet another retreat from the overhead resistance.

Since breadth has been excellent, since there are so many

more MAXCPs than

MINCPs and since Peerless

remains on

a Buy signal, I have to think the decline will probably be

limited by the rising 65-dma again.

The leadership here is not so great.

Semi-conductors and

technology stocks have not participated in

this two week bounce.

It is hard to see this old bull market jumping above the 18000 fence

when one leg consists of Utilities

and the other is made up of

Gold Stocks. I also call your attention today to the way Food

commodities are rising. This may make it easier for the Hawks

on the FOMC to tell the Public that the "Inflationary Menace"

must be fought even at the expense of risking a recession.

DJI - Peerless remains on a Buy.

Excellent Breadth, but NYSE Down Volume is Rising

DIA's Closing Power is Rising

SPY's Closing Power is Rising

Food Commodities

Seasonality since 1965 shows that there is a 58% probability

of the DJI being higher from current levels a week from now,

but that drops to only 52% two seeks from now.

We probably will have to expect to be

sellers on the next rally

up to the 2% upper band based on the more modest record

of Buy B11s in April and May.

-

We should not expect a market-takeoff based on Peerless.

None of Peerless Buy B11s in the period

from mid April to the

end of June gained as much as 6%. So,

the likelihood is for

another Peerless Sell somewhere between

18000 and 18350.

Buy

B11 from Mid-April to End of June.

Gain at

time of next

Peerless

Sell.

5/8/1959 .046

5/16/1986 .058

4/23/1993 .025

4/17/2006 .046

----------------------

Avg = 4.4%

Charts: Peerless

DJIA Hourly DJIA

DIA SPY

QQQ IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL TECL

Major Indexes and A/D Lines.

Key Tiger

Software ETF Charts

Bullish MAXCPs

Bearish MINCPs

QUICKSilver

Short DGAZ

TigerSmart Works!

Twelve days ago, two days after our last Peerless Buy signal, I listed the 12

stocks

that had just given TigerSmart automatic red Buys and whose gains using the best

system were over 100%. Below are the results so far. The average

gain since

is +8.4%, certainly much more than the DJI has advanced.

The best results came with the 3 stocks whose Red Buy signal was based on prices

coming back above the 5-day ma. This adds credence to our QuickSilver

system.

C:\tgrsmart Days back= 12

5 / 23 / 2016 - 6 / 9 / 2016

Rank Symbol Name Price Pct.Gain

since 5/23

--------- ----------------------------------- ---------- ------------

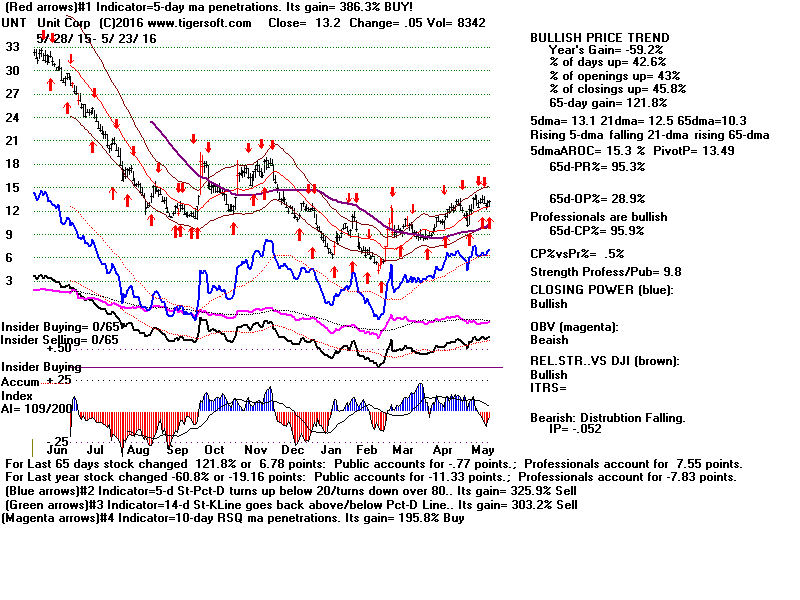

1 UNT Unit Corp 16.82 27% Based on 5-dma penetration.

2 CLNE Clean Energy Fuels Corp 3.64 18% 5-d Stochastic

3 MSB Mesabi Trust Cbi 10.55 15% Based on 5-dma penetration.

4 AXLL Axiall Corporation 25.81 13% Based on 5-dma penetration.

5 DYN Dynegy Inc 20.74 10%

6 GV Goldfield Corp 3.1 9%

7 ENPH Enphase Energy Inc 2.1 6%

8 IMN Imation Corp 1.72 5%

9 KPTI Karyopharm Therapeutics Inc 9.12 4%

10 BHP BHP Billiton Limited ADS 27.98 3% 5-d Stochastic

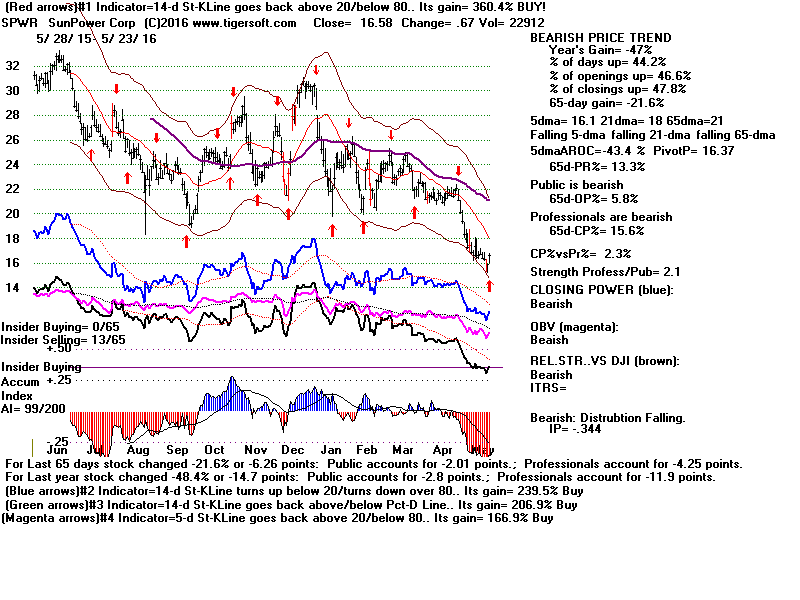

11 SPWR SunPower Corp 16.85 1%

12 FCX Freeport-McMoran Inc 10.9 -5% 21-d CP ma penetr.

=============================================================================================

Avg 8.4%

===================================================================================

6/8/2016 The Hotline from last night is

not loading properly.

Here are its central points. I am trying to restore the

Hotline page. But its contents may be lost. We'll see.

Hold DIA and

UCO.

We are still on a Buy B11. The A/D

Line is streaking upwards.

But the Hourly DJI clearly shows

volume is a problem. So, since

the SP-500 has reached a well-tested

resistance level and the DJI

has closed above 18000. a minor retreat seems likely.

The FED may now be tempted to try to jawbone the Dollar

back up. Protecting the Dollar is usually their highest priority.

The Gang of 5 anti-Dollar Investments have been running up

recently because most observers do not see a rate hike this Summer.

The "Gang of 5" are what I was calling the 5 Horsemen of the

Deflation Apocalypse:

Gold Stocks

Crude Oil(UCO) and

Crude Oil Stocks

Commodities

YINN (leading Chinese stocks)

Foreign ETFs

Gold stocks are the leaders of this group. They are on the

verge of breaking out above the top of a broadening formation.

Such a breakout would boost the whole group. Commodities

have completed an inverted Head/Shoulders and so will be

hard to stop. Oil is slanting upwards with good internals.

But Foreign Stocks and YINN have reached their upper price

bands and show negative no-confirmations from their Tiger

Accumulation Index.

Restored Version

Hotline and Links -

6-8-2016 We still have the Peerless Buy B11 as our

active signal.

But volume remains weak. See the bearish

OBV divergence

from Prices in the

Hourly DJI chart. The

SP-500 has now

reached its well-tested resistance line

and the DJI has managed

to close above 18000. I would think that

there will be another

small pull-back in the

DJI and the SP-500. The

NASDAQ

and Russell-2000 ETF,

IWM, also are nearing their resistance

levels, too.

Commodities have broken above a neckline in an inverted

head/shoulders pattern. Gold's strength

is highly unusual.

Another big move up in Gold would cause a

lot of new buying and

short-covering in what I call the

anti-Dollar "Gang of 5". The

Fed may try to "jawbone" down these

inflationary plays. That may

work with foreign ETFs and YINN, but Oil

seems to be in a solid

new uptrend. So, I would continue to

hold DIA and UCO.

Charts: Peerless

DJIA Hourly DJIA

DIA SPY

QQQ IWM

DJI-Utilities

DJI-Rails

A/D Line-6000 Stocks

Crude Oil

SOXL TECL

Major Indexes and A/D Lines.

Key Tiger

Software ETF Charts

Bullish MAXCPs

Bearish MINCPs

(no Bearish... tonight)

The last few days have seen big jumps in

our "Gang of 5"

anti-Dollar plays:

1) Commodities,

2) Crude Oil Stocks,

3) Gold stocks,

4) Foreign Stocks and

5) the Chinese major stocks'

ETF, YINN.

Recently they have stopped being the

"Five Horsemen of

a Deflationary Apocalypse". Their rises

were all a very

predictable response to growing

expectations that the

Fed would keep rates unchanged a lot

longer than previously

expected. The poor May Jobs' Report has

reinforced this

view.

Will this Inflation-Loving "Gang of 5" keep rising?

I would watch Gold stocks. Gold

Stocks are the leader.

Gold turned up first and gold stocks are

the strongest of "Gang of 5".

If Gold stocks are any indication of what

lies ahead now for this

Gang of Five, then they all are likely

entering a wild phase where

they could go up even faster, provided

Gold stocks now achieve

a new breakout.

I suspect the Dollar's weakness will now

cause the Fed to do or

say something to try to get the "Gang of

5" to retreat. The Fed's

highest priority is usually to protect

the Dollar and retrain the

"Gang of 5". You can see negative

non-confirmations by the

Accum. Index as YINN and Foreign Stocks

have rallied to their upper band.

===========================================================================

6-7-2016 Wall Street has to like Hillary's

clear victory over Sanders

in the "big enchelada", California.

Still. Sanders got 43%

of the vote. The Fed would be wise to

take note and not

cause another big market sell-off or

serious recession by

raising rates prematurely, otherwise a

true populist will

win next time.

The DJI would now need to close up 1% and

the Peerless V-I

would have to fall 9 to turn negative and

bring on a "S9V".