Earlier Hotlines

previous hotline

earlier hotline

www.tigersoft.com/H77LION/INDEX.htm

www.tigersoft.com/H7TBR/INDEX.htm

www.tigersoft.com/HH9911/INDEX.htm

http://www.tigersoft.com/HH9911/olderINDEX.htm

http://www.tigersoft.com/HHH517/INDEX.htm

www.tigersoft.com/HHH517/XXXIndex.htm

www.tigersoft.com/HHH517/INDEX6917.htm

www.tigersoft.com/HHH517/OLDER.html

www.tigersoft.com/HH747/INDEX.html

www.tigersoft.com/HHLL217/INDEX.html

PREINDEX.html

www.tigersoftware.com/HL/INDEX.html

Hotlines: 2/4/2017 - 2/15/2017

These have somehow become corrupted. Some graphs may be

missing.

http://www.tigersoft.com/345HLN12/ZINDEX.html

http://www.tigersoft.com/333HLLL/INDEX.html

http://www.tigersoft.com/444HL444/INDEX.html

www.tigersoft.com/119HLPAZ/INDEX.html

http://www.tigersoft.com/888HLAZ/INDEX.html

www.tigersoft.com/821-HL/INDEX.html

http://www.tigersoft.com/816-HLN/INDEX.html

http://www.tigersoft.com/77HL7778/INDEX.html

http://www.tigersoft.com/64HRL/INDEX.html

http://www.tigersoft.com/55HL55/INDEX.html

HELP

A

Guide To Profitably Using The Tiger Nightly HOTLINE

Introduction to Tiger/Peerless

Buys and Sells.

Peerless Buy and Sell Signals: 1928-2016

Individual Peerless signals explained:

http://tigersoftware.com/PeerlessStudies/Signals-Res/index.htm

http://www.tigersoft.com/PeerInst-2012-2013/

Explanation of each Peerless signal.

http://www.tigersoft.com/PeerInst-2012-2013/

Different

Types of TigerSoft/Peerless CHARTS, Signals and Indicators

----->

More HELP LINKS

Documentation

for TigerSoft Automatic and Optimized Signals.

How

reliable support is the DJI's rising 200-day ma?

SPY

Charts since 1994: Advisory Closing Power S7s, Accum. Index, 65-dma,

Optimized Signals.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

1/19/2016 --->

Corrections,Deeper Declines and Bear Markets since 1945.

1/21/2016

--->

High Velocity Declines since 1929

2/12/2016 --->

Presidential Elections Years and Bullish IP21 Positive Non-Confirmations at

Lower Band.

2/12/2016 --->

OBV NNCs

on DJI's Rally to 2.7% Upper Band when DJI's 65-dma is falling.

11/6/2016 --->

Killer Short Selling

Techniques: ===>

Order Here

($42.50)

It's As Easy as

1,2,3

TigerSoft "Combination" Short-Selling...

Easy as 1-2-3 Short Sales

Earlier Q-Answers

QuickSilver

Documentation (1/11/2016)

Our Different Signals

Better

understand the difference between Peerless DJI-based signals,

the one-year optimized red Signals

and the fixed signals based

on technical developments.

Introduction to

Tiger/Peerless Buys and Sells.

Different

Types of TigerSoft/Peerless CHARTS, Signals and Indicators

New

TigerPeerless

Installation and Basic Uses' Instruction

(11/25/2016)

See

the re-written materials on TigerSoft Buys and Sells.

A few more pages will be added. But users could

print this

main Installation and Uses' Page for reference.

Study-

Trading SPY WITHOUT Peerless - Some Guidelines.

When completed this will be

a new Tiger Trading E-Book.

Study-

Examples of "Hands above the Head" top patterns.

Study-

9/3/2017

TigerSoft (not

Peerless) charts of Major Tops as they occurred.

===> Please report any broken

or out-of-date links.

william_schmidt@hotmail.com

==============================================================================

==============================================================================

2/2/2018

Peerless is now on a Sell S9. In on-going bull

markets, the original 2007

bull market Sell S9

variant dropped the DJI below the lower band in

7 of 11 past cases when it

would have been

applied in January and February. With the DJI not having had a bear

market's

18% or more DJI

decline since March of 2009, lots of investors are now worried that

a

8.5%-14% correction, at least, is now under way. Certainly, I would expect

Friday's very

steady deep decline

to spill over to Monday and beyond.

I have added this Sell S9 variation to the regular

Peerless. It will be available to Elite Subscribers

on Monday.

Here is its track record and its coded requirements.

I suspect the DJI will not rebound much until it

reaches its rising 65-dma, about 800 points

below Friday's

close. A successful double-test of the rising 65-dma did take

place in September

1987, whereon the

DJI rallied to its upper band with all negative internals. This is

what generated

the October 1987

S9. The DJI then utterly collapsed after the newly appointed Fed Chairman,

Alan

Greenspan, went

ahead with a rate hike to defend the Dollar.

A comparison of the DJI's recent top now with the one in August 1987 seems appropriate.

Then like now,

there had been a long bull market and a correction was also long over-due.

Then

like now, the Dollar

had turned quite weak and this invited the FED to raise interest rates.

Then,

too, we had a new

Federal Reserve Chairman. He got his baptism in fire when the stock

market

cried like a baby

for a hand-out after falling 37% in just two months.

1987 Support at Rising 65-dma

True, our internals

are not so negative as in 1987, but certainly the political situation now is

much more

divided and

dangerous for investors, I would judge. Republicans in 2018 will need

to prevent a deep

decline if they

wish NOT to lose many Congressional seats in the Fall Election. As of

a week ago,

their polls seemed

to be rising as the stock market's gains were lifting 401K retirement

accounts. But a

serious decline now

would change this. The problem now is it's not clear how they can go

about the

fiscal pumping up

of the market any more. Of course, the FED could provide lot of new

liquidity, but

Trump campaigned

against this. Even quickly passing a big Infrastructure spending bill

may not do

the job if the bond

market tanks as a result of Debt and Inflation concerns.

Far-sighted investors

have no choice but

to be quite cautious now. So should we.

Conclusion: Stay clear of the major market ETFs

unless you are already short them.

If you have not

already, Sell any stock whose Closing Power uptrends are violated. Add

more

bearish MINCPs

short sales.

Weaker Openings Now Cannot Be A Good Sign

For years the DJI

has been boosted by higher openings. If that pattern changes now, I

would

fear this will be a

very bad sign for the stock market.

Lower Openings Have Led The DJI Down This Last Week,

Don't Fight This Down-Trend.

"Buy at the Close and Sell at the

Opening." (Rising Opening Power and Falling Closing Power)

At long last, the New York Times has finally taken note

of our findings. Now that they have,

I would suggest

that this

Tiger short-term trading technique may no longer work:

https://www.nytimes.com/2018/02/02/your-money/stock-market-after-hours-trading.html?emc=edit_th_180204&nl=todaysheadlines&nlid=58223894

Since SPY's inception in 1993, "all of ...(its)

price gain since 1993 has come outside regular trading hours...

If you had bought the SPY at the last second

of trading on each business day since 1993 and sold at the

market open the next day — capturing all of the net after-hour gains — your

cumulative price gain

would be 571 percent. On the other hand, if you had done the reverse, buying

the E.T.F. at the first

second of regular trading every morning at 9:30 a.m. and selling at the 4

p.m. close, you would be down

4.4 percent since 1993. "

Charts 2/2/2018

PEERLESS

DJI, Signals, Indicators Daily

DJI Volume 10-DayUp/Down Vol

V-Indicator

Hourly DJIA

A/D Line for All

Stocks

(new) A/D

Line for SP-500 Stocks

NASDAQ

S&P

OEX

NYSE COMPQX

DJI-15 DJI-20

DJI-30

DIA

SPY

QQQ MDY

IWM

TNA

CrudeOil

FAS

GLD

BBH

IBB

JETS

JNUG

KOL

NUGT

OIH

OIL

RSX

RETL

SDS

SLV

SOXL

TECL

TMF

TNA UGA

(gasoline)

XIV

YINN

Commodities:

JJC, NIB,

CHOC

CORN,

WEAT

UUP

(Dollar)

AAPL ADBE

ALXN

AMAT

AMGN AMD

AMZN

BA BABA BAC

BIDU

CAT

CVX

DE

FB

GOOG

GS HD

IBM JPM M

(Macy's)

MSFT NFLX

NVDA

QCOM TSLA

TXN

XOM

WMT

ANDV (refinery),

CMG (Chipotle), LRCX,

SWKS,

TOWN

Also SPPI WATT

SQ

2/2/2018

Bullish MAXCPs Bearish

MINCPs |

Table 1 QUICKSILVER on ETFS - 02/02/18

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS

---------------------------------------------------------------------------------------------

DIA 254.93 -6.69 W264.16 -208.9% ---- RED .109 ----

---------------------------------------------------------------------------------------------

COMPQX 7240.95 -144.91 W7466.51 -178.1% ---- RED .208 -.022

---------------------------------------------------------------------------------------------

SPY 275.45 -6.13 W284.68 -196.4% ---- RED .146 -.022

---------------------------------------------------------------------------------------------

QQQ 164.61 -3.35 W170.1 -186.5% ---- RED .159 -.019

---------------------------------------------------------------------------------------------

MDY 348.38 -7.16 W359.43 -197.5% Bearish RED .004 -.053

---------------------------------------------------------------------------------------------

IWM 153.83 -3.02 W158.7 -182.9% Bearish RED .037 -.06

---------------------------------------------------------------------------------------------

FAS 74.82 -4.88 W80.11 -432.8% ---- RED .169 .158

---------------------------------------------------------------------------------------------

RETL 36.22 -3.16 W44.85 -1038.5% Bearish RED .21 .146

---------------------------------------------------------------------------------------------

SOXL 157.03 -14.31 W180.55 -687.4% Bearish RED .025 -.133

---------------------------------------------------------------------------------------------

TECL 124.76 -12.26 W137.52 -597.2% Bearish RED .048 .04

---------------------------------------------------------------------------------------------

IBB 112.14 -1.84 W118.5 -253.9% ---- RED -.006 .002

---------------------------------------------------------------------------------------------

GLD 126.39 -1.68 W127.35 -65.8% ---- RED .098 -.047

---------------------------------------------------------------------------------------------

OIL 7.29 -.13 W7.34 -102.4% Bullish ---- .185 .126

---------------------------------------------------------------------------------------------

OIH 26.83 -1.19 W28.09 -337.5% Bearish RED .144 .029

---------------------------------------------------------------------------------------------

GASL 22.21 -3.12 W28.11 -1408% Bearish RED -.13 -.068

---------------------------------------------------------------------------------------------

UGA 33.27 -.46 W33.9 -129.1% Bullish BLUE .174 -.023

---------------------------------------------------------------------------------------------

UUP 23.27 .14 W23.32 2.2% Bearish ---- -.043 -.137

---------------------------------------------------------------------------------------------

IEF 102.22 -.38 W103.51 -75% Bearish RED -.173 -.124

---------------------------------------------------------------------------------------------

XLU 49.88 -.36 W50.39 -114.5% Bearish RED -.155 -.192

---------------------------------------------------------------------------------------------

WEAT 6.25 -.06 W6.28 55.5% Bullish ---- .096 -.074

---------------------------------------------------------------------------------------------

YINN 45.45 -2.18 W50.48 -836% ---- RED .124 .22

---------------------------------------------------------------------------------------------

RSX 22.98 -.56 W23.33 -134.4% ---- RED .181 -.036

---------------------------------------------------------------------------------------------

AAPL 160.5 -7.28 W167.96 -327% Bearish RED -.083 -.145

---------------------------------------------------------------------------------------------

GOOG 1111.9 -55.8 W1175.58 -273.1% Bullish RED .181 .003

---------------------------------------------------------------------------------------------

MSFT 91.78 -2.48 W93.92 -121.3% Bearish RED -.019 .023

---------------------------------------------------------------------------------------------

AMZN 1429.95 39.95 1417.68 98.3% ---- RED .091 .181

---------------------------------------------------------------------------------------------

FB 190.28 -2.81 185.98 7.4% Bullish RED .035 -.024

---------------------------------------------------------------------------------------------

NVDA 233.52 -6.98 W246.85 -201.2% Bullish RED .128 .002

---------------------------------------------------------------------------------------------

BA 348.91 -8.03 340.82 82.1% ---- RED .015 .23

---------------------------------------------------------------------------------------------

GS 260.04 -12.19 W272.48 -150% Bullish RED .14 .003

---------------------------------------------------------------------------------------------

HD 193.97 -5.93 W204.92 -326.7% ---- RED .121 .049

---------------------------------------------------------------------------------------------

CAT 157.49 -4.75 W162.58 -292.3% Bearish RED .077 .062

|

Table 2

Count of Stocks in Key Tiger Directories

Date = 180202

--------------------------------------

NEWHIGHS

42

NEWLOWS 256

So many new lows just a week from the DJI's new high is not good.MAXCP 26

MINCP 405 Professionals have turned quite bearish.

TTTNH 44

TTTNL 551

FASTUP 77

FASTDOWN 515 There is a lot of institutional dumping going on.

CPCROSSA 27

CPCROSSD 187

BIGVOLUP 5

BIGVODN 50

|

Table 3

Count of Stocks and New Highs in Key Tiger Directories

Date = 180202

No. NHs Pct

-------------------------------------------------------------------

INDEXES 194 12 6 %

RUS-1000 837 52 6 %

GAMING 28 1 4 %

AUTO 40 1 3 %

SOFTWARE 66 2 3 %

NASD-100 100 3 3 %

BIOTECH 387 8 2 %

FINANCE 93 1 1 %

MORNSTAR 238 2 1 %

SP500 485 5 1 %

REIT 178 1 1 %

Others: None

|

|

Table 4 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

2/2/18

Bullish = 34

Bearish = 11

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BIGMIL 1 1 1 1 1 1

HOSPITAL .875 1 1 1 .875 .875

ETFS .865 .925 .94 .94 .97 .97

BIGBANKS .857 .857 .857 .857 1 1

INDEXES .835 .927 .927 .932 .938 .927

FINANCE .774 .817 .806 .817 .827 .827

COMODITY .771 .828 .785 .8 .8 .828

SP-100 .77 .843 .864 .885 .895 .906

MORNSTAR .756 .861 .869 .873 .894 .92

TRANSP .75 .8 .85 .85 .8 .85

DOWJONES .733 .866 .833 .9 .9 .9

FOOD .733 .8 .6 .6 .666 .733

GAMING .714 .785 .785 .785 .785 .821

MILITARY .71 .763 .763 .815 .789 .763

RETAIL .698 .754 .792 .83 .867 .867

REGBANKS .696 .787 .696 .727 .757 .787

SOFTWARE .696 .757 .757 .727 .772 .818

DJI-13 .692 .846 .769 .923 .923 .923

NASD-100 .69 .79 .83 .82 .85 .88

NIFTY .666 .766 .766 .733 .8 .8

CHINA .656 .718 .765 .75 .75 .796

COMPUTER .652 .608 .608 .652 .739 .739

SP500 .645 .75 .777 .787 .812 .845

RUS-1000 .609 .719 .734 .75 .774 .802

AUTO .6 .75 .775 .875 .875 .9

BEVERAGE .6 .75 .75 .8 .8 .85

HACKERS .6 .64 .6 .6 .68 .72

INFRA .571 .742 .771 .857 .885 .942

PIPELINE .571 .714 .714 .714 .714 .714

INSURANC .562 .625 .625 .625 .625 .656

INDMATER .555 .677 .722 .766 .8 .855

JETS .555 .777 .666 .777 .666 .666

BIOTECH .542 .583 .583 .633 .687 .697

OILGAS .514 .7 .7 .707 .778 .8

N= 34

============================================================================================

COAL .5 .6 .7 .7 .8 .8

============================================================================================

GREEN .483 .548 .516 .516 .58 .548

GOLD .47 .764 .764 .725 .725 .862

ELECTRON .382 .483 .455 .488 .533 .573

CHEM .328 .546 .593 .578 .64 .671

SEMI .323 .438 .43 .446 .5 .553

HOMEBLDG .235 .352 .352 .411 .47 .647

UTILITY .162 .232 .279 .255 .232 .232

EDU .142 .285 .285 .285 .428 .714

SOLAR .142 .238 .238 .238 .38 .333

REIT .073 .112 .162 .123 .129 .179

BONDFUND .018 .036 .027 .018 .036 .081

N=11

|

===============================================================================

===============================================================================

2/1/2018

The evidence from tonight's research is compelling

that we should consider a

revised Sell S9 to have occurred on Tuesday's close. See below.

There have

been 11 of these revised S9s in January and February in rising markets since

1929.

All 11 brought declines to the lower 3% band. 7 of the 11 brought

declines below

the lower 3.5% band. The Futures are already dropping sharply.

This probably

has something to do with the necklines of head/shoulders being broken.

It has to do with

Trump's political difficulties. But there is a lot more at stake, as I

discuss below.

A DJI decline back to its 65-dma and the lower 3% next seems highly likely.

There

should be very good support there.

All this week I have suggested we should expect the

DJI to retreat from its very

overbought position. In particular, I noted that the recent rally has

brought a

gain that more than matches the average gain after a September Buy B21 and

so profits should be taken, rather than be too greedy. The

deterioration of

breadth was mentioned as a bearish factor. Monday and Tuesday both

were

days when the number of NYSE decliners was more than 4 times the number of

advancers. As a result, on January 30th, the P-I and the V-I turned

negative.

Since the DJI closed down at only the 1.3% upper band, no Peerless S9 was

given

on January 29th. But back in the days before 2008, Peerless also used

its

hypothetical high in relation to the 21-day ma. I believe that is why

a Sell S9

using the 2007 version of Peerless was given.

I do not have the source code for the 2007

version of Peerless. But I tested the

following parameters for January and February when the DJI was near its 12

month

highs and not in a bear market:

1) Close/21-dma must be above 1.013

2) Theoretical High/21-dma must be above 1.026

3) P-Indicator must be negative.

4) V-Indicator must be negative.

There were 11 of the 2007-like variations on our classic Sell S9. All

brought declines to

at least the 3% lower band. Six saw paper losses, all under 5%.

But most significantly,

7 of the 11 produced a DJI decline below the lower 3.5% band.

1) 1/30/1929 312.64

DJI rallied to 322.1

and then fell to lower 3.5% band.

2) 2/28/1929 317.4

DJI fell directly to the lower 3.5% band.

3) 2/15/1935 104.7

DJI rose to 107.2

and then fell to lower 3.5% band.

4) 2/11/1937 190.3

DJI rose to 194.4 (3/10)

and then fell below lower 3.5% band.

5) 1/3/1939 153.6

DJI fell directly below lower 3.5% band.

6) 1/9/1946 197.37

DJI rose to 206.6

and then fell below lower 3.5% band.

7) 2/1/1955 409.7

DJI rose to 419.7

and then fell below lower 3.5% band.

8) 1/3/1973 1939

DJI fell directly far below lower 3.5% band.

9) 2/13/1980 903.84

DJI fell directly far below lower 3.5% band.

10) 1/13/1999 9349.55

DJI fell directly to lower 3.0% band.

11) 1/7/2000 11522.56

DJI rose to 11722.98

and then fell far below the 3.5% lower

band.

What To Do?

Take profits in longs. Do not let a gain turn into a loss. Sell

when the steep Closing Power

uptrends are violated. Sell some of the bearish MINCP stocks short.

Because of Boeing's

unduly large impact on the DJI, I am reluctant to suggest shorting DIA.

January's

JOBs' Numbers Are Unusually Important

The Fed's postponing a rise in interest rates until

March did not help dividend stocks.

Investors again quickly unloaded utilities' stocks, REITs and bond funds

Thursday.

The explanation is simple. Rates have been very, very low. Now

they will almost

certainly be going up. Trump's tax cuts and increased spending on the

military, domestic

security and, possibly, infrastructure has many big investors in bonds

really spooked.

But there is a much bigger storm approaching. It

has to do with the Trump's wager

on the strong and the power of "trickle-down" economics. What if the Economy

does not

get as big a boost as Republicans are expecting from Trump's economic

agenda? That

could cause a big turnover in Congressional seats. It conceivably

could even cause the

Democrats to regain control of the House of Representatives. That has

to be on Republican

investors' minds. I believe this is why the DJI, SP-500, Mid-Caps, QQQ and

NASDAQ

have

all quickly formed compact little head/shoulders price patterns.

If I am right, then tomorrow's Jobs' numbers for

January have taken on a special significance.

They wobble and fluctuate, of course, month to month. But anything

short of a really good

number, say above 210,000 for new jobs could be politically troublesome.

Ordinarily, a

low number, one that is less than 12 months ago and also the previous

month,

can sometimes be viewed as a cause for the Fed to delay raising interest

rates. But not

only has the Fed largely guaranteed a raise in short-term rates in March,

now a low number

of new monthly jobs, below, say 150,000 would mean economic Growth is

probably not

good enough to boost Republicans' political fortunes, especially in the

Midwest "rust belt".

So tomorrow's January Jobs' numbers will be important for partisans and for

the stock

market, too. The new numbers will be reported an hour before the NYSE

opens. Below are

current numbers which we will use for comparison.

| |

| Year |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

| 2007 |

240 |

89 |

190 |

80 |

143 |

75 |

-34 |

-20 |

88 |

84 |

114 |

98 |

| 2008 |

17 |

-84 |

-78 |

-210 |

-186 |

-162 |

-213 |

-267 |

-450 |

-474 |

-766 |

-694 |

| 2009 |

-793 |

-702 |

-823 |

-687 |

-349 |

-471 |

-329 |

-213 |

-220 |

-204 |

-2 |

-275 |

| 2010 |

23 |

-68 |

164 |

243 |

524 |

-137 |

-68 |

-36 |

-52 |

262 |

119 |

87 |

| 2011 |

43 |

189 |

225 |

346 |

77 |

225 |

69 |

110 |

248 |

209 |

141 |

209 |

| 2012 |

358 |

237 |

233 |

78 |

115 |

76 |

143 |

177 |

203 |

146 |

132 |

244 |

| 2013 |

211 |

286 |

130 |

197 |

226 |

162 |

122 |

261 |

190 |

212 |

258 |

47 |

| 2014 |

190 |

151 |

272 |

329 |

246 |

304 |

202 |

230 |

280 |

227 |

312 |

255 |

| 2015 |

234 |

238 |

86 |

262 |

344 |

206 |

254 |

157 |

100 |

321 |

272 |

239 |

| 2016 |

126 |

237 |

225 |

153 |

43 |

297 |

291 |

176 |

249 |

124 |

164 |

155 |

| 2017 |

216 |

232 |

50 |

207 |

145 |

210 |

138 |

208 |

38 |

211 |

252(P) |

148(P) |

| P : preliminary |

|

|

Charts 2/1/2018

PEERLESS

DJI, Signals, Indicators Daily

DJI Volume 10-DayUp/Down Vol

V-Indicator

Hourly DJIA

A/D Line for All

Stocks

(new) A/D

Line for SP-500 Stocks

NASDAQ

S&P

OEX

NYSE COMPQX

DJI-15 DJI-20

DJI-30

DIA

SPY

QQQ MDY

IWM

TNA

CrudeOil

FAS

GLD

BBH

IBB

JETS

JNUG

KOL

NUGT

OIH

OIL

RSX

RETL

SDS

SLV

SOXL

TECL

TMF

TNA UGA

(gasoline)

XIV

YINN

Commodities:

JJC, NIB,

CHOC

CORN,

WEAT

UUP

(Dollar)

AAPL ADBE

ALXN

AMAT

AMGN AMD

AMZN

BA BABA BAC

BIDU

CAT

CVX

DE

FB

GOOG

GS HD

IBM JPM M

(Macy's)

MSFT NFLX

NVDA

QCOM TSLA

TXN

XOM

WMT

ANDV (refinery),

CMG (Chipotle), LRCX,

SWKS,

TOWN

Also SPPI WATT

SQ

2/1/2018

Bullish MAXCPs Bearish

MINCPs |

Table 1

QUICKSILVER on ETFS - 02/01/18 Bullish: Closing Power Rising = 15 Falling = 12

Warnings:

Below Pivot-Points = 26 of 31

5-dma Falling = 20 Rising = 11

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS

---------------------------------------------------------------------------------------------

---------------------------------------------------------------------------------------------

DIA 261.62 .18 W265.91 -40.5% Bullish BLUE .226 ------

---------------------------------------------------------------------------------------------

COMPQX 7385.86 -25.62 W7505.77 -17% Bullish BLUE .307 -.032

---------------------------------------------------------------------------------------------

SPY 281.58 -.32 W286.58 -30.3% Bullish BLUE .273 -.029

---------------------------------------------------------------------------------------------

QQQ 167.96 -1.44 W170.93 -11.5% Bullish RED .288 -.03

---------------------------------------------------------------------------------------------

MDY 355.54 .54 W362.51 -75.1% ---- BLUE .087 -.06

---------------------------------------------------------------------------------------------

IWM 156.85 .49 W159.6 -68.9% ---- BLUE .103 -.064

---------------------------------------------------------------------------------------------

FAS 79.7 .9 W81.71 -30.7% Bullish BLUE .268 .22

---------------------------------------------------------------------------------------------

RETL 39.38 -1.34 W45.02 -509.8% ---- RED .253 .264

---------------------------------------------------------------------------------------------

SOXL 171.34 -2.57 W181.13 169.4% ---- BLUE .141 -.041

---------------------------------------------------------------------------------------------

TECL 137.02 .18 W141.15 70.5% Bullish BLUE .214 .132

---------------------------------------------------------------------------------------------

IBB 113.98 -.1 W118.04 -113.5% Bullish BLUE .095 -.022

---------------------------------------------------------------------------------------------

GLD 128.07 .42 *128.07 3.9% Bullish BLUE .125 -.079

---------------------------------------------------------------------------------------------

OIL 7.42 .18 W7.44 89.1% Bullish BLUE .224 .105

---------------------------------------------------------------------------------------------

OIH 28.02 .56 W28.72 -115.5% ---- BLUE .241 .04

---------------------------------------------------------------------------------------------

GASL 25.33 .29 W29.74 -779% Bearish BLUE -.08 .005

---------------------------------------------------------------------------------------------

UGA 33.73 .11 W34.14 3% Bullish ---- .181 -.047

---------------------------------------------------------------------------------------------

UUP 23.13 -.12 W23.26 -38.7% Bearish RED .015 -.171

---------------------------------------------------------------------------------------------

IEF 102.6 -.7 W103.77 -71.4% Bearish RED -.161 -.155

---------------------------------------------------------------------------------------------

XLU 50.24 -.8 W51.04 -75.8% Bearish RED -.144 -.221

---------------------------------------------------------------------------------------------

WEAT 6.31 -.01 6.18 183.8% Bullish ---- .147 -.108

---------------------------------------------------------------------------------------------

YINN 47.63 -2.16 W53.8 -240% Bullish RED .221 .292

---------------------------------------------------------------------------------------------

RSX 23.54 .05 W23.61 -55.3% Bullish BLUE .3 -.048

---------------------------------------------------------------------------------------------

AAPL 167.78 .35 W171.51 -98.5% Bearish BLUE -.014 -.135

---------------------------------------------------------------------------------------------

GOOG 1167.7 -2.24 W1175.84 -11.4% Bullish BLUE .303 .025

---------------------------------------------------------------------------------------------

MSFT 94.26 -.75 94.06 103.1% Bullish RED .06 .023

---------------------------------------------------------------------------------------------

AMZN 1390 -60.89 W1402.05 42.5% Bullish RED .194 .109

---------------------------------------------------------------------------------------------

FB 193.09 6.2 190 149.6% Bullish BLUE .108 -.042

---------------------------------------------------------------------------------------------

NVDA 240.5 -5.3 W243.33 85.4% Bullish BLUE .205 .017

---------------------------------------------------------------------------------------------

BA 356.94 2.57 343.22 201.1% Bullish BLUE .068 .24

---------------------------------------------------------------------------------------------

GS 272.23 4.34 268.14 59.4% Bullish BLUE .174 .023

---------------------------------------------------------------------------------------------

HD 199.9 -1 W207.23 -134% Bullish BLUE .205 .071

---------------------------------------------------------------------------------------------

CAT 162.24 -.54 W167.06 -215.9% Bearish BLUE .135 .071

|

Table 2

Count of Stocks in Key Tiger

Directories

Date = 180201

---------------------------------------------------------

NEWHIGHS 196

NEWLOWS 156

MAXCP

84

MINCP

223

TTTNH

83

TTTNL

281

FASTUP

75

FASTDOWN 237

CPCROSSA 211

CPCROSSD 71

BIGVOLUP

5

BIGVODN 21

|

Table 3

Count of Stocks and New Highs in Key Tiger Directories

2/1/2018

No NHs Pct.

-------------------------------------------------------------------

BIGMIL 6 4 67 %

BIGBANKS 7 2 29 %

DJI-13 13 3 23 %

MILITARY 38 8 21 %

GAMING 28 6 21 %

DOWJONES 30 5 17 %

FINANCE 93 14 15 %

=================================================

EDU 7 1 14 %

HOSPITAL 8 1 13 %

COMODITY 70 8 11 %

NIFTY 30 3 10 %

SP-100 96 10 10 %

INSURANC 32 3 9 %

NASD-100 100 8 8 %

SP500 485 34 7 %

RUS-1000 837 52 6 %

AUTO 40 2 5 %

INDEXES 194 10 5 %

MORNSTAR 238 11 5 %

TRANSP 20 1 5 %

BEVERAGE 20 1 5 %

BIOTECH 387 16 4 %

REGBANKS 33 1 3 %

ETFS 66 2 3 %

CHEM 64 1 2 %

SEMI 130 3 2 %

SOFTWARE 66 1 2 %

INDMATER 90 1 1 %

ELECTRON 178 2 1 %

REIT 178 1 1 %

====================================================

NONE:

GREEN HOMEBLDG HACKERS OILGAS INFRA CHINA SOLAR COMPUTER

COAL GOLD RETAIL UTILITY PIPELINE FOOD BONDFUND JETS

|

|

Table 4

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS

ABOVE 65-DMA

2/1/18Bullish = 38

Bearish = 8

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BIGMIL 1 1 1 1 1 1

HOSPITAL 1 1 1 .875 .875 .875

INDEXES .927 .927 .932 .938 .927 .927

ETFS .924 .939 .939 .969 .969 .969

DOWJONES .866 .833 .9 .9 .9 .9

MORNSTAR .861 .869 .873 .894 .92 .911

BIGBANKS .857 .857 .857 1 1 1

DJI-13 .846 .769 .923 .923 .923 .923

SP-100 .843 .864 .885 .895 .916 .927

COMODITY .828 .785 .8 .8 .8 .742

FINANCE .817 .806 .817 .827 .827 .849

FOOD .8 .6 .6 .666 .6 .4

TRANSP .8 .85 .85 .8 .85 .8

==========================================================================================

NASD-100 .79 .83 .82 .85 .89 .86

REGBANKS .787 .696 .727 .757 .787 .757

GAMING .785 .785 .785 .785 .821 .857

JETS .777 .666 .777 .666 .666 .666

NIFTY .766 .766 .733 .8 .8 .766

GOLD .764 .764 .725 .725 .862 .823

MILITARY .763 .763 .815 .789 .763 .789

SOFTWARE .757 .757 .727 .772 .818 .742

RETAIL .754 .792 .83 .867 .867 .867

AUTO .75 .775 .875 .875 .9 .875

BEVERAGE .75 .75 .8 .8 .85 .85

SP500 .75 .777 .787 .812 .851 .841

INFRA .742 .771 .857 .885 .942 .914

RUS-1000 .719 .734 .75 .774 .805 .801

CHINA .718 .765 .75 .75 .796 .781

PIPELINE .714 .714 .714 .714 .714 .714

OILGAS .7 .7 .707 .778 .8 .8

INDMATER .677 .722 .766 .8 .855 .855

HACKERS .64 .6 .6 .68 .72 .68

INSURANC .625 .625 .625 .625 .687 .75

COMPUTER .608 .608 .652 .739 .739 .739

COAL .6 .7 .7 .8 .8 .9

BIOTECH .583 .583 .633 .687 .695 .684

GREEN .548 .516 .516 .58 .548 .58

CHEM .546 .593 .578 .64 .671 .671

============================================================================================

ELECTRON .483 .455 .488 .533 .573 .511

SEMI .438 .43 .446 .5 .553 .469

HOMEBLDG .352 .352 .411 .47 .647 .647

EDU .285 .285 .285 .428 .714 .714

SOLAR .238 .238 .238 .38 .333 .333

UTILITY .232 .279 .255 .232 .232 .209

REIT .112 .162 .123 .129 .179 .235

BONDFUND .036 .027 .018 .036 .081 .099

N= 8

|

==============================================================================

==============================================================================

1/31/2018 I have

suggested doing some profit-taking and waiting for a pullback by the DJI

to buy again. In this way, we can again be positioned long to be

consistent with

the still active September Buy B21. That the 10-day Down Volume has

risen above the 10-day

Up Volume suggests this seems a good plan. So does the break in the

NYSE

A/D Line uptrend, which warns us that interest

rates are on the rise. It remains

to be seen if the DJI will decisively break below the near-term support at

25800;

such is the power of an accelerating uptrend. So patience seems

warranted as

far as the DJI goes. A continued decline in

Crude Oil and oil stocks would contribute

to a bigger DJI sell-off, so watch them now.

Should We Have Gotten an S9 on Tuesday?

An alert subscriber just emailed me, saying

that the 2006 version of Peerless would

have given a Sell S9 yesterday. There is no time tonight to back-test

it for January

and February. And I lost the source code for this version of Peerless

some time ago.

But the current version gives no such Sell S9 and I would trust the current

Peerless because

I know

how many hours went into back-testing all of its signals. See

2006 version's chart.

Still, tomorrow I will show this old S9's track record for this time of the

year. No time

tonight.

I still doubt if rising interest rates are ready to

bring a much bigger decline.

The bad breadth on the NYSE, so far, owes mostly to weak dividend plays,

bond

funds, REITs and utilities. I would suggest that an economic slow-down

is not in the

cards, judging from the still rising A/D Line for the SP-500 stocks shown

below.

The leading tech stocks (NVDA,

GOOG, MSFT and

AMZN) seem not to be

bothered by the prospects of higher interest rates. And so the

NASDAQ and

QQQ show very high levels of underlying

Accumulation. This suggests ample

support and only a limited pullback at this time. These stocks, QQQ

and the

NASDAQ are "tightly held". Because of this,

I would Buy QQQ if it makes a

run now and destroys its bearish-looking head/shoulders pattern. This

will

bring on another short-covering burst upwards.

There are a number of very special biotech

situations that look bullish. We see

them in the Bullish MAXCPs

tonight. The star performer is

Madrigal. Its preliminary

trials for a novel way to treat fatty livers not caused by drinking has had

a high degree of

success. While trials are always limited. the stunning results its

drug is getting

would occur less than once in 10,000 randomized samples. It used to be

a $300

stock. It is still only half of that price. We will watch to see who

makes a bid for it.

It epitomizes what we always hope to find using our Explosive Super Stock

screens.

If someone came up to me and wanted one stock to buy, this is what I would

pick

for him.

http://www.madrigalpharma.com/wp-content/uploads/2018/01/Madrigal-Announces-EASL-Presentation.20180130_FINAL.pdf

Charts 1/31/2018

PEERLESS

DJI, Signals, Indicators Daily

DJI Volume 10-DayUp/Down Vol

V-Indicator

Hourly DJIA

A/D Line for All

Stocks

NASDAQ

S&P

OEX

NYSE COMPQX

DJI-15 DJI-20

DJI-30

DIA

SPY

QQQ MDY

IWM

TNA

CrudeOil

FAS

GLD

BBH

IBB

JETS

JNUG

KOL

NUGT

OIH

OIL

RSX

RETL

SDS

SLV

SOXL

TECL

TMF

TNA UGA

(gasoline)

XIV

YINN

Commodities:

JJC, NIB,

CHOC

CORN,

WEAT

UUP

(Dollar)

AAPL ADBE

ALXN

AMAT

AMGN AMD

AMZN

BA BABA BAC

BIDU

CAT

CVX

DE

FB

GOOG

GS HD

IBM JPM M

(Macy's)

MSFT NFLX

NVDA

QCOM TSLA

TXN

XOM

WMT

ANDV (refinery),

CMG (Chipotle), LRCX,

SWKS,

TOWN

Also SPPI WATT

SQ (Square)

1/31/2018

Bullish MAXCPs Bearish

MINCPs |

Table 1 QUICKSILVER on ETFS - 01/31/18

Bullish: Closing Power Rising = 21 Falling = 5

Warnings:

5-dma Falling = 21 Rising = 11

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS

---------------------------------------------------------------------------------------------

---------------------------------------------------------------------------------------------

DIA 261.44 .82 W263.75 -21.5% Bullish RED .231 -----

---------------------------------------------------------------------------------------------

COMPQX 7411.48 9 7411.16 -2.4% Bullish RED .373 -.022

---------------------------------------------------------------------------------------------

SPY 281.9 .14 W283.3 -22.5% Bullish RED .325 -.023

---------------------------------------------------------------------------------------------

QQQ 169.4 .7 168.35 29.2% Bullish RED .364 -.017

---------------------------------------------------------------------------------------------

MDY 355 -.7 W360.93 -85.8% ---- RED .173 -.051

---------------------------------------------------------------------------------------------

IWM 156.36 -.82 W159.03 -82.2% ---- RED .118 -.055

---------------------------------------------------------------------------------------------

FAS 78.8 1.1 W80.19 -99.4% Bullish BLUE .228 .204

---------------------------------------------------------------------------------------------

RETL 40.72 -1.16 W43.79 -404.9% ---- RED .303 .428

---------------------------------------------------------------------------------------------

SOXL 173.91 4.35 165.44 -17.5% ---- RED .2 -.031

---------------------------------------------------------------------------------------------

TECL 136.84 3.21 135.09 31.1% Bullish BLUE .264 .117

---------------------------------------------------------------------------------------------

IBB 114.08 -2.19 W116.63 -77.7% Bullish RED .152 -.012

---------------------------------------------------------------------------------------------

GLD 127.65 .85 W127.97 -46.2% ---- BLUE .133 -.061

---------------------------------------------------------------------------------------------

OIL 7.24 .07 W7.29 -122.7% Bullish BLUE .21 .123

---------------------------------------------------------------------------------------------

OIH 27.46 -.24 W28.67 -260.3% ---- RED .24 .042

---------------------------------------------------------------------------------------------

GASL 25.04 -.44 W29.63 -1036.7% Bearish RED -.022 .049

---------------------------------------------------------------------------------------------

UGA 33.62 .54 W33.71 -66.6% Bullish BLUE .114 -.023

---------------------------------------------------------------------------------------------

UUP 23.25 -.03 W23.31 -6.4% Bullish ---- .051 -.16

---------------------------------------------------------------------------------------------

IEF 103.3 .03 W104.08 -26.5% Bearish RED -.071 -.139

---------------------------------------------------------------------------------------------

XLU 51.04 .56 51.01 80% Bearish BLUE -.117 -.205

---------------------------------------------------------------------------------------------

WEAT 6.32 -.1 6.08 201.4% Bullish ---- .161 -.087

---------------------------------------------------------------------------------------------

YINN 49.79 1.78 W50.05 -225% Bullish RED .28 .34

---------------------------------------------------------------------------------------------

RSX 23.49 .23 W23.8 -61.6% Bullish ---- .337 -.028

---------------------------------------------------------------------------------------------

AAPL 167.43 .46 W171.11 -199.3% Bearish BLUE .017 -.134

---------------------------------------------------------------------------------------------

GOOG 1169.94 6.25 W1170.37 24.4% Bullish RED .331 .02

---------------------------------------------------------------------------------------------

MSFT 95.01 2.27 92.33 171.6% Bullish BLUE .104 .029

---------------------------------------------------------------------------------------------

AMZN 1450.89 13.07 1377.95 333.8% Bullish RED .31 .163

---------------------------------------------------------------------------------------------

FB 186.89 -.23 W187.48 9.1% Bullish RED .106 -.072

---------------------------------------------------------------------------------------------

NVDA 245.8 3.08 236.35 207.5% Bullish ---- .257 .049

---------------------------------------------------------------------------------------------

BA 354.37 16.66 343.11 289.5% Bullish RED .087 .231

---------------------------------------------------------------------------------------------

GS 267.89 -1.05 W269.03 41.1% Bullish RED .135 .006

---------------------------------------------------------------------------------------------

HD 200.9 -.91 W205.37 -129.7% Bullish RED .159 .086

---------------------------------------------------------------------------------------------

CAT 162.78 -.98 W169.37 -167.2% Bearish RED .114 .081

|

Table 2

Count of Stocks in Key Tiger Directories

Date = 180131

--------------------------------------

NEWHIGHS 119

NEWLOWS 102

MAXCP 41

MINCP 267

TTTNH 54

TTTNL 403

FASTUP 74

FASTDOWN 234

CPCROSSA 37

CPCROSSD 119

BIGVOLUP 6

BIGVODN 28

|

Table 3

Count of Stocks and New Highs in Key Tiger Directories

Date = 180131

No. NHs Pct

-------------------------------------------------------------------

BIGMIL 6 4 67 %

DJI-13 13 3 23 %

JETS 9 2 22 %

NIFTY 30 6 20 %

MILITARY 38 7 18 %

GAMING 28 5 18 %

DOWJONES 30 5 17 %

=========================================================

BEVERAGE 20 2 10 %

INSURANC 32 3 9 %

NASD-100 100 9 9 %

FINANCE 93 6 6 %

SP-100 96 6 6 %

SOFTWARE 66 4 6 %

AUTO 39 2 5 %

SP500 485 23 5 %

RUS-1000 837 38 5 %

HACKERS 25 1 4 %

MORNSTAR 238 9 4 %

BIOTECH 393 17 4 %

COMPUTER 23 1 4 %

GREEN 31 1 3 %

CHINA 64 2 3 %

INDEXES 194 4 2 %

RETAIL 53 1 2 %

INDMATER 90 1 1 %

ELECTRON 178 1 1 %

SEMI 130 1 1 %

REIT 178 1 1 %

------------------ None -------------------------------------

BIGBANKS REGBANKS HOMEBLDG CHEM ETFS OILGAS INFRA

TRANSP SOLAR COAL GOLD EDU UTILITY PIPELINE

COMODITY FOOD BONDFUND HOSPITAL

|

| |

Table 4 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

1/31/18

Bullish = 38

Bearish = 8

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BIGMIL 1 1 1 1 1 1

HOSPITAL 1 1 .875 .875 .875 .875

ETFS .939 .939 .969 .969 .969 .954

INDEXES .927 .932 .938 .927 .927 .938

MORNSTAR .869 .873 .894 .92 .911 .92

SP-100 .864 .885 .895 .916 .927 .927

BIGBANKS .857 .857 1 1 1 1

TRANSP .85 .85 .8 .85 .8 .9

DOWJONES .833 .9 .9 .9 .9 .933

NASD-100 .83 .82 .85 .89 .86 .86

FINANCE .806 .817 .827 .827 .849 .849

N=11

===========================================================================================

RETAIL .792 .83 .867 .867 .867 .867

COMODITY .785 .8 .8 .8 .742 .757

GAMING .785 .785 .785 .821 .857 .821

SP500 .777 .787 .812 .851 .841 .83

INFRA .771 .857 .885 .942 .914 .914

AUTO .769 .871 .871 .897 .871 .871

DJI-13 .769 .923 .923 .923 .923 1

NIFTY .766 .733 .8 .8 .766 .833

CHINA .765 .75 .75 .796 .781 .781

GOLD .764 .725 .725 .862 .803 .901

MILITARY .763 .815 .789 .763 .789 .763

SOFTWARE .757 .727 .772 .818 .742 .757

BEVERAGE .75 .8 .8 .85 .8 .8

RUS-1000 .734 .75 .774 .805 .802 .8

INDMATER .722 .766 .8 .855 .855 .855

PIPELINE .714 .714 .714 .714 .714 .714

COAL .7 .7 .8 .8 .9 .9

OILGAS .7 .707 .778 .8 .8 .814

REGBANKS .696 .727 .757 .787 .757 .818

JETS .666 .777 .666 .666 .666 .777

INSURANC .625 .625 .625 .687 .75 .687

COMPUTER .608 .652 .739 .739 .739 .782

FOOD .6 .6 .666 .6 .4 .466

HACKERS .6 .6 .68 .72 .72 .72

CHEM .593 .578 .64 .671 .671 .687

BIOTECH .587 .631 .689 .689 .676 .651

GREEN .516 .516 .58 .548 .58 .645

N=27

==============================================================================================

ELECTRON .455 .488 .533 .573 .505 .601

SEMI .43 .446 .5 .553 .461 .576

HOMEBLDG .352 .411 .47 .647 .647 .882

EDU .285 .285 .428 .714 .714 .714

UTILITY .279 .255 .232 .232 .209 .162

SOLAR .238 .238 .38 .333 .333 .38

REIT .162 .123 .129 .179 .235 .23

BONDFUND .027 .018 .036 .081 .081 .081

N=8

|

==============================================================================

1/30/2018

The Peerless September

Buy B21 has not been reversed. But a bigger pullback than

we have seen so far would seem healthy and likely. Tomorrow's recovery

will be

partisan-inspired. The State of The Union Message is mostly a political

cheer-leading

event. For this reason, the DJI may stall out soon after it closes the

downside gap in

today's

trading. A run up to 26400 would do this.

Bulls, the animal that is, are

actually color-blind like most four-legged animals. So,

it is the

movement of the cape that gets them in trouble,

not the color. We should

not be fooled now by

a sudden lurch upwards. Buying on a decent pullback will be safer unless

Peerless first

generates a Sell signal. That could happen. We might get a Sell at DJI-26600

later this

week since both the the P-Indicator and V-Indicators are

now negative. As the DJI is

currently 1.3% over the 21-dma, a 300 point rally up from here on

poor breadth

and

low up-volume could bring a Sell S9.

Possibly good earnings this week for tech stocks, AAPL, GOOG and AMAZON will

lift

the NASDAQ, though profit-taking on the positive news seems just as likely.

Trump's

promise to take on the Drug Companies and their high prices may bring about

some weakness

on the NASDAQ, too.

Did you know that the City of New York is suing fossil fuel companies for

keeping to

themselves knowledge of their role in causing man-made global warming?

Seems far-fetched,

right? But oil stocks have turned weak.

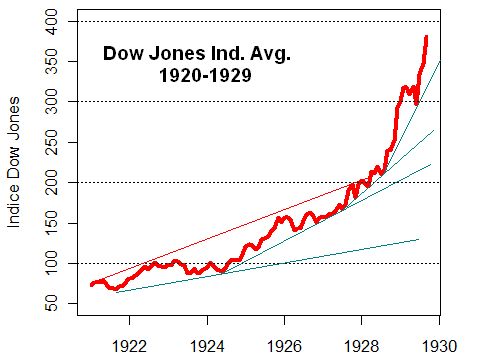

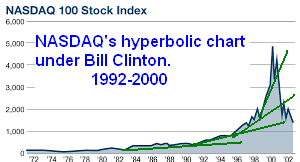

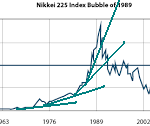

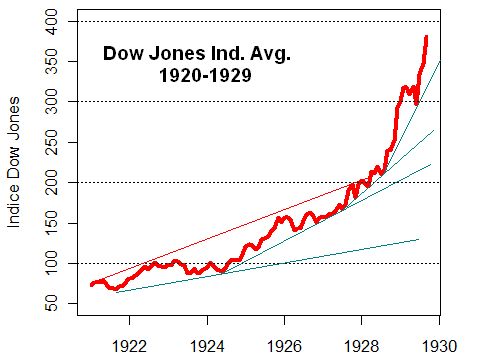

I am always ruminating on historical parallels. Trump's tax cut and

de-Regulation are right

out of the 1920s, from the play-books of Harding and Coolidge. The

policies' parallels here

are quite close. Along with low interest rates and margin

requirements, these policies

produced the extraordinary bull market of the 1920s. But there are two

important differences.

The first is the absence now of many, many new consumer goods. In the

1920s cars, radios,

refrigerators, washing machines... were all relatively new. The second

difference is in the area

of consumer credit. At the start of the 1920s boom, consumer credit

was relatively new and

consumers were not as tapped out as they are now. This means the

dangers of over-production

and lack of consumer demand do over-hang the market. Most people need

credit, a lot of

it, to buy a new car. We should watch Ford's stock. See below.

If tariffs on auto imports are

not enacted, Ford is in trouble. The American market is already

shrinking because credit

is harder to get now than in the past.

On balance, the bullish parallels are still much more weighty. The tax cuts

have not yet had a

chance to work their "voo-doo" magic and there has not yet been a take-over

binge. So, let's

plan to buy on a 5%-7% dip from here.

Today was the second day in a row when the ratio of NYSE decliners to

advancers

was more than 4:1. This should reinforce our resolve not to chase the

market at this

point. So should the fact that there were substantially more new lows

than new highs

today on the NYSE and the NASDAQ. See Table 2.

==============================================================================

1/29/2018 Let's not be too

greedy in here. That could get us in trouble. Take some

profits. There are many big "Red Popsicles" in Table 1. Table 2

shows us

that Professionals are doing a lot of dumping now. MAXCPs outnumbers

MINCPs by a wide margin and the number of new lows is quite high

considering that the DJI is only one day away from its high. It is

even conceivable

that a new Peerless Sell signal could be devised that tests well and fit in

here.

The ratio of declining stocks to advancing stocks was 4.4 today. This

shows

a big rush to sell by Professionals. What are they afraid of?

Peerless has given no Sell signal, but how can

taking some very ripe profits hurt?

That seems only prudent, I admit. So go ahead.

But understand that we may

only be able to re-enter at a higher price.

Today the number of NYSE decliners (2467) were

4.429 times the number of

advancers (557). Clearly there was a rush to sell dividend shares.

But it was more

than that. Interest rates rising are only one explanation.

Another is that Trump is now

in deeper political trouble than before A third is that investors are

afraid of a bad surprise from

Trump's State of The Union message Tuesday night. Adding some bearish

MINCPs

short sales to hedge with will help.

There is a good chance that the DJI will fall no further than the 21-dma.

Of course, that

is still a 3% decline. Such

a poor breadth ratio like we saw today with the DJI so far above

the 21-day ma, 3% now, is quite rare. Only once in the five earlier

cases with the DJI more

than 2% over the 21 day ma, did the DJI break below the 21-dma by as much as

the 3% lower

band. So, the odds of a 6% or more decline now are, perhaps, only 20%.

This would

seem to suggest that we should ride out the current decline. But why

take a chance?

You have nice profits from the Buy B21, take them. As of today's

close, the September

B21 has gained +18.6% on the DJI. This is a percent higher than they

have averaged

in the past. Let's not be greedy.

============================================================================

==========================================================================

==========================================================================

A decline is certainly indicated. Below see all the cases of such poor

breadth when the

DJI was simply above the 21-dma. Only in 34% of the cases, did the

storm of selling

quickly pass. In 55% of the cases, such poor breadth was followed by a

decline to

at least the 2% lower band, but sometimes much lower..

Below are all the cases of such a poor breadth ratio

since 1945. Note that "la/ma" shows

how far the DJI is above the 21-dma. "Bad" means this case would

have failed as a sell signal

because the DJI advanced significantly without even a decline to the 21-dma.

"Good" means

a sell signal here would have brought a decline to the lower 2% band, at

least. "Flat" means

a sell signal here would have stopped the rally for 3 weeks or more.

There have been 38 cases of such poor breadth since 1945 with the DJI above

the 21-dma.

in 21 (55%) cases, the DJI fell at least to the lower 3% band but in 13

(34%) instances, the DJI

quickly rallied significantly. In the remaining 4, the DJI hesitated

for a few weeks and then

rose significantly. This would seem to argue for some

profit-taking now, especially when our

profits are so big.

Sell?

Date

la/ma outcome

----------------------------------------------------------

BAD 8/20/1945

1.002 DJI rallied

GOOD 12/12/1945 1.011

DJI fell to lower 2% band

GOOD 8/14/1946 1.008 Bear

market followed.

GOOD 10/17/1947 1.01 DJI

fell to lower 3.5% band.

GOOD 1/10/1948 1.006 DJI

fell to 3% lower band.

GOOD 5/6/1948

1.013 DJI fell to lower 3.5% band

GOOD 9/8/1948 1.004

DJI fell to lower 2% band

GOOD 10/24/1948 1.01 DJI

fell below lower 3.5% band.

GOOD 12/26/1948 1.001 DJI

fell below lower 3.5% band.

BAD 10/17/1949

1.009 DJI rallied.

BAD 8/25/1950

1.011 DJI rallied

BAD 1/10/1951

1.027 DJI rallied

STOP 1/5/1955

1.002 3-weeks sidewise.

GOOD 8/6/1956

1.001 DJI fell below lower 3.5% band.

BAD

12/10/1962 1.008 DJI declined only to ma and then

rose.

GOOD 9/21/1966 1.003 DJI

fell below lower 3.5% band.

BAD

2/25/1975 1.002 DJI rallied

GOOD 10/16/1978

1.001 DJI fell below lower 3.5% band.

GOOD 10/8/1979 1.002

DJI fell below lower 3.5% band.

STOP 8/18/1980

1.009 DJI stopped rallying and went sidewise.

BAD 10/25/1982 1.024

DJI fell only to 21-dma and rise sharply.

BAD 12/28/1988

1.021 DJI fell only to 21-dma and rose sharply.

BAD 3/17/1989

1.001 slight 4 day decline and then strong rally.

GOOD 4/13/2004

1.007 DJI fell below lower 3.5% band.

GOOD 5/24/2007 1.008

After a run to upper band, DJI fell below LB

GOOD 7/24/2007 1.003

DJI fell below lower 3.5% band.

GOOD 12/11/2007 1.017 Bear

market began.

GOOD 7/24/2008 1.001

Bear market followed.

BAD

3/30/2009 1.042 New bull market

continues.

BAD 5/13/2009

1.011 Bull market continues

STOP 11/19/2009

1.026 DJI went flat for a month. .

BAD

10/19/2010

GOOD 7/11/2011

1.023 DJI fell below lower band.

GOOD 11/1/2011

1.008 DJI fell below lower band. (No Peerless Sell here).

BAD

4/15/2013 1.001 DJI fell slightly and

then rallied strongly.

GOOD 7/17/2014

1.002 DJI fell to lower band.

GOOD 9/22/2014

1.004 DJI fell below lower band.

STOP 8/19/2017

1.002 DJI went sidewise for a month.

UNDECIDED 1/29/2018

1.030

Charts 1/29/2018

PEERLESS

DJI, Signals, Indicators Daily

DJI Volume 10-DayUp/Down Vol

V-Indicator

Hourly DJIA

A/D Line for All

Stocks

NASDAQ

S&P

OEX

NYSE COMPQX

DJI-15 DJI-20

DJI-30

DIA

SPY

QQQ MDY

IWM

TNA

CrudeOil

FAS

GLD

BBH

IBB

JETS

JNUG

KOL

NUGT

OIH

OIL

RSX

RETL

SDS

SLV

SOXL

TECL

TMF

TNA UGA

(gasoline)

XIV

YINN

Commodities:

JJC, NIB,

CHOC

CORN,

WEAT

UUP

(Dollar)

AAPL ADBE

ALXN

AMAT

AMGN AMD

AMZN

BA BABA BAC

BIDU

CAT

CVX

DE

FB

GOOG

GS HD

IBM JPM M

(Macy's)

MSFT NFLX

NVDA

QCOM TSLA

TXN

XOM

WMT

ANDV (refinery),

CMG (Chipotle), LRCX,

SWKS,

TOWN

Also SPPI WATT

SQ (Square)

1/29/2018 Bullish MAXCPs Bearish

MINCPs |

Table 1

QUICKSILVER on ETFS - 01/29/18

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS

---------------------------------------------------------------------------------------------

DIA 264.16 -1.75 261.87 41.4% Bullish RED .319 ----

---------------------------------------------------------------------------------------------

COMPQX 7466.51 -39.26 7460.29 39.3% Bullish RED .378 -.019

---------------------------------------------------------------------------------------------

SPY 284.68 -1.9 283.29 35.1% Bullish RED .376 -.023

---------------------------------------------------------------------------------------------

QQQ 170.1 -.83 169.51 58.6% Bullish RED .299 -.018

---------------------------------------------------------------------------------------------

MDY 359.43 -3.08 W362.1 -27.9% Bullish RED .177 -.046

---------------------------------------------------------------------------------------------

IWM 158.7 -.9 W159.96 -23.5% Bullish RED .165 -.042

---------------------------------------------------------------------------------------------

FAS 80.11 -1.6 79.48 82.4% Bullish RED .258 .216

---------------------------------------------------------------------------------------------

RETL 44.85 -.17 W45.26 -42.5% Bullish BLUE .413 .677

---------------------------------------------------------------------------------------------

SOXL 180.55 -.58 W187.42 -76% Bullish BLUE .241 .015

---------------------------------------------------------------------------------------------

TECL 137.52 -3.63 W139.23 18.2% Bullish RED .23 .129

---------------------------------------------------------------------------------------------

IBB 118.5 .46 116.81 127.8% Bullish BLUE .233 .038

---------------------------------------------------------------------------------------------

GLD 127.35 -.72 127.28 27.4% Bullish RED .137 -.08

---------------------------------------------------------------------------------------------

OIL 7.34 -.1 7.22 178.3% Bullish ---- .203 .117

---------------------------------------------------------------------------------------------

OIH 28.09 -.63 W29.32 -220.7% ---- RED .261 .027

---------------------------------------------------------------------------------------------

GASL 28.11 -1.63 W31.28 -399.1% Bearish RED .047 .155

---------------------------------------------------------------------------------------------

UGA 33.9 -.24 33.9 67.9% Bullish RED .228 -.054

---------------------------------------------------------------------------------------------

UUP 23.32 .06 W23.51 -53.5% Bearish ---- .055 -.171

---------------------------------------------------------------------------------------------

IEF 103.51 -.26 W104.05 -11.5% Bearish ---- -.056 -.15

---------------------------------------------------------------------------------------------

XLU 50.39 -.65 W50.54 32.6% Bearish RED -.178 -.241

---------------------------------------------------------------------------------------------

WEAT 6.28 .1 5.94 239.6% ---- ---- .181 -.123

---------------------------------------------------------------------------------------------

YINN 50.48 -3.32 W51.26 156.2% Bullish RED .323 .374

---------------------------------------------------------------------------------------------

RSX 23.33 -.28 W23.58 -44.4% Bullish RED .322 -.057

---------------------------------------------------------------------------------------------

AAPL 167.96 -3.55 W177.04 -259.5% Bearish RED -.076 -.147

---------------------------------------------------------------------------------------------

GOOG 1175.58 -.26 1169.97 84.7% Bullish RED .35 .018

---------------------------------------------------------------------------------------------

MSFT 93.92 -.14 91.9 125.1% Bullish RED .041 -.01

---------------------------------------------------------------------------------------------

AMZN 1417.68 15.63 1362.54 330.9% Bullish BLUE .311 .119

---------------------------------------------------------------------------------------------

FB 185.98 -4.02 W189.35 16.2% Bullish RED .07 -.083

---------------------------------------------------------------------------------------------

NVDA 246.85 3.52 238.91 276.9% Bullish BLUE .242 .025

---------------------------------------------------------------------------------------------

BA 340.82 -2.4 335.59 41.6% Bullish RED .12 .174

---------------------------------------------------------------------------------------------

GS 272.48 4.34 260.09 206.9% Bullish BLUE .17 .021

---------------------------------------------------------------------------------------------

HD 204.92 -2.31 204.9 11.2% Bullish RED .069 .092

---------------------------------------------------------------------------------------------

CAT 162.58 -4.48 W169.43 -245.8% Bearish RED .115 .055

|

Table 2

Count of Stocks in Key Tiger Directories

Date = 180129

--------------------------------------

NEWHIGHS

225

NEWLOWS

130 This is a lot of

new lows when the DJI is only 1 day from its high.

MAXCP

96

MINCP

252 Professionals are much more bearish than

bullish.

TTTNH

71

TTTNL

360

FASTUP

119

FASTDOWN

135

CPCROSSA

47

CPCROSSD

122

BIGVOLUP

3

BIGVODN

31 There is big rush for the exits here! |

Table 3Count of Stocks and New Highs in Key Tiger Directories

Date = 180129

-------------------------------------------------------------------

BIGMIL 6 3 50 %

JETS 9 3 33 %

BIGBANKS 7 2 29 %

MILITARY 38 9 24 %

GAMING 28 6 21 %

NASD-100 100 16 16 %

TRANSP 20 3 15 %

RETAIL 53 8 15 %

======================================================

EDU 7 1 14 %

DOWJONES 30 4 13 %

NIFTY 30 4 13 %

HOSPITAL 8 1 13 %

SP-100 96 11 11 %

BIOTECH 386 44 11 %

INFRA 35 4 11 %

SP500 485 52 11 %

INDEXES 194 19 10 %

FINANCE 93 8 9 %

MORNSTAR 238 22 9 %

DJI-13 13 1 8 %

RUS-1000 837 68 8 %

COMODITY 70 5 7 %

HOMEBLDG 17 1 6 %

SOFTWARE 66 4 6 %

INSURANC 32 2 6 %

BEVERAGE 20 1 5 %

COMPUTER 23 1 4 %

REGBANKS 33 1 3 %

AUTO 39 1 3 %

OILGAS 141 4 3 %

CHINA 64 2 3 %

CHEM 64 1 2 %

ELECTRON 178 3 2 %

SEMI 130 2 2 %

INDMATER 90 1 1 %

====================================================

None: GREEN ETFS HACKERS SOLAR COAL GOLD

REIT UTILITY PIPELINE FOOD BONDFUND

|

| |

Table 4

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

1/29/18

Bullish = 39

Bearish = 6

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BIGBANKS 1 1 1 1 1 1

BIGMIL 1 1 1 1 1 1

ETFS .969 .969 .969 .954 .954 .954

INDEXES .938 .927 .927 .932 .907 .907

DJI-13 .923 .923 .923 1 1 1

DOWJONES .9 .9 .9 .933 .933 .966

SP-100 .895 .916 .927 .927 .937 .947

MORNSTAR .894 .92 .911 .92 .928 .911

INFRA .885 .942 .914 .885 .942 .885

HOSPITAL .875 .875 .875 .875 .875 .875

AUTO .871 .897 .871 .871 .871 .923

RETAIL .867 .867 .867 .867 .867 .867

NASD-100 .85 .89 .86 .86 .89 .87

FINANCE .827 .827 .849 .849 .903 .881

SP500 .812 .851 .841 .83 .837 .835

BEVERAGE .8 .85 .8 .8 .8 .85

COAL .8 .8 .9 .9 .8 .8

COMODITY .8 .8 .742 .757 .7 .7

INDMATER .8 .855 .855 .855 .844 .855

NIFTY .8 .8 .766 .833 .866 .866

TRANSP .8 .85 .8 .9 .95 .9

MILITARY .789 .763 .789 .736 .736 .789

GAMING .785 .821 .857 .821 .821 .821

RUS-1000 .774 .805 .802 .799 .806 .799

OILGAS .773 .794 .794 .808 .815 .815

SOFTWARE .772 .818 .742 .757 .818 .787

REGBANKS .757 .787 .757 .787 .848 .909

CHINA .75 .796 .781 .781 .796 .796

COMPUTER .739 .739 .739 .782 .826 .826

GOLD .725 .862 .803 .901 .862 .862

PIPELINE .714 .714 .714 .714 .714 .714

BIOTECH .689 .696 .683 .655 .699 .681

HACKERS .68 .72 .72 .72 .68 .72

FOOD .666 .6 .4 .466 .333 .266

JETS .666 .666 .666 .777 .888 .777

CHEM .64 .671 .671 .687 .687 .687

INSURANC .625 .687 .75 .687 .718 .687

GREEN .58 .548 .58 .645 .677 .741

ELECTRON .533 .573 .505 .595 .657 .64

===========================================================================================

SEMI .5 .553 .461 .569 .6 .623

============================================================================================

HOMEBLDG .47 .647 .647 .882 .882 .882

EDU .428 .714 .714 .714 .714 .714

SOLAR .38 .333 .333 .38 .38 .428

UTILITY .232 .232 .209 .162 .139 .116

REIT .124 .175 .231 .225 .248 .163

BONDFUND .036 .081 .081 .081 .099 .081

|

==============================================================================

1/26/2018 The

September Peerless

Buy B21 and the recent Buy B18 both predict

higher prices.

All the key major market ETFs are running in all-time high territory above

the most

likely resistance lines. Each of these shows a rising Closing Power

and a 5-day ma.

Hold your long positions. Largely avoid the short side.

There has recently been a string of weak openings in the market on Monday

mornings

followed by renewed strength. That appears to be building up here.

Perhaps, the market

is a little nervous about the President's State of the Union Speech, or

perhaps about earnings

this week. In either case, the accelerating uptrend should make any

decline very brief.

Traders should still be buyers on weakness. I would favor stocks whose

Closing Powers

are making new highs, show steady Accumulation (AI/200>150) and high

recent accumulation

(IP21>.30). In this market, I would not buy laggards like CMG.

Here are examples

of stocks and an ETF that might be bought on weakness.

ENTA 78.32 AI/200=179 IP21=.46

Closing Power at high.

NYT

22.95 AI/200=166 IP21=.512 Closing Power at high.

TDG

314.13 AI/200=151 IP21=.38 Closing Power at high

UDOW 116.82

AI/200=163 IP21= .443 Closing Power at high.

==============================================================================

1/25/2018

More research on yesterday's Buy B18

signal shows it was unusually

powerful back in the second and sixth years of the Eisenhower Presidency.

The parallel with now is that the Trump Administration may also succeed

in launching a huge program of infrastructure spending. See in Table A

below

the huge DJI

gains on the Buy B18s in 1954 and 1958 at the time of the next Sell:

+56.1%, +34.0%, +28.7%, +21.8%, +16.4%. Of course, Trump may still

fail to get the infrastructure program funded and passed. Such a failure

would

almost certainly end the current upswing. In this vein, note how small the B18s'

gains were under Reagan and Bush

II,

also Republicans:

+2.5%. +7.6%, -0.6%, +4.8%, +3.3% +4.5%. (+3.7% on

average.

(See also the older research on the B18s here:

http://www.tigersoft.com/2018/Buy-B18.html )

Today was a strange day in the market. The DJI

rose 1/2%, but the NASDAQ

fell and there were 252 more down than up on the NYSE. The DJI-30 got

disproportionately big boosts again from its three high priced and heaviest

weighted

components: BA, GS and MMM. They accounted for more than 100 points of

the DJI's total gain. In the past year, we have not found days like

this to be bearish.

The A/D Line can lag for a day without mattering. In fact, the Buy B18

is based on

exceptional NYSE breadth strength.

What about earlier?

Has it been bearish in the past when the DJI closed

3.5% above the 21-day ma on a 1/2% advance with more up than down on the

NYSE? Since

1965, there were just four past instances where the DJI closed 3.2%

to 4% over the 21-day ma, rose by more than 0.4% from the previous day and

there were

at least 150 more down than up on the NYSE. 3 of 4 were very near a tradable

top.

http://www.tigersoft.com/2XYZHHH/AD-Divergences.htm

"The Ruling on the Field" (the Peerless Buy

B21/B18) Stands

(This is a reference to how US National Football

handles coaches'

challenges to the rulings by the games' referees. It is, after all,

almost Super Bowl time. )

The conclusion one might reach from this is that there is a 75% chance of a

decline to the

lower band in the next two months. But without a regular Peerless Sell

signal, I

would

rather trust the extraordinary upward momentum and only suggest shorting

some of

the bearish MINCPs if you want to hedge.

Hold all the major market

ETFs. After all, the NYSE A/D Line is

still in an

uptrend; there are 10x more new highs

than new lows (Table 2); the key major

market ETFs still show rising Closing Powers and

5-day moving averages (Table 1)

and

40 of our sectors show more than 50% of their

stocks above their 65-dma as

opposed

to only 6 that bearishly show the opposite.

I still think we are going to get some 500-point up-days or even a

1000-point up-day

to bring about a buying climax to this amazing bull market.

Table A

Peerless Buy B18s: 1929-2017

Blue: Republican President in 2nd Year of Four Year Presidential Cycle

Date

Signal DJI

Gain Paper

Loss

Low

----------------------------------------------------------------------------

19420804 B18 105.6

.348

none

19421015 B18 113.3

.257

113.1 <1%

10/28

19430219 B18 126.7

.124

none 0

19430420 B18 128.5

.108

none 0

19440103 B18 135.9

.207 134.2

-.013

2/7

19441016 B18 148.1

.107

145.6 -.017

11/14

19450214 B18 157.1

.044

155.5 -.010

3/23

19450511 B18 163.2

.005

none 0

19451011 B18 185.7

.073

none 0

19451213 B18 193.5

.029

189.1 -.023

12/21

19490829 B18 177.8

.241

none 0

19501013 B18 228.5

.134

222.3 -.027

12/2

19510110 B18 240.4

.078

none 0

19540318 B18 300.1

.561

296.4 -.012

3/25

19540802 B18 349.6

.340

335.8 -.039

8/31

19550110 B18 400.9

.168

388.2 -.032

1/17

19580801 B18 505.4

.287

502.7 -.005

8/18

19581003 B18 533.7

.218

none 0

19581203 B18 558.8

.164

none 0

19610201 B18 649.3

.08

637.00 -.019

2/13

19650315 B18 899.9

.043

887.8 -.013

3/29

19670303 B18 846.6

.032

842.43 -.005

4/10

19710128 B18 865.14

.084

none 0

19710329 B18 903.48

.038

none 0

19750305 B18 752.82

.149

742.88 -.013

4/07

19780512 B18 840.70

.031

none 0

19821201 B18 1031.09

.025

none 0

19830308 B18 1119.78

.111

1113.49 -.006

4/6

19851220 B18 1543.00

.183

none 0

19860303 B18 1696.67

.076

1686.30 -.006

3/4

19870310 B18 2280.09

.055

2248.44 -.014

3/16

19910326 B18 2914.85

.039

2873.02 -.014

4/9

19930317 B18 3426.74

.158

3370.81 -.016

4/2

19950303 B18 3989.61

.391

3979.23 -.003

3/8

19950525 B18 4412.23

.258

4369.00 -.010

5/26

19950801 B18 4700.37

.181

4580.62 -.025

8/24

19961009 B18 5930.62

.156

none 0

19980317 B18 8749.99

.050

none 0

20020103 B18

10172.14 -.006

9618.24 -.054

1/29

20030514 B18 8647.82

.134

8491.36 -.018

5/20

20031217 B18 10145.26 .047

none 0

20041221 B18 10759.43 .014

none 0

20060111 B18 11043.44 .048

10667.3 -.034

1/20

20060315 B18 11209.77 .033

11073.7 -.012

4/17

20061005 B18 11866.69 .045

none 0

20061204 B18 12283.85 .009

none 0

20070518 B18 13556.53 .026

13266.7 -.021

6/7

20130201 B18 14009.79 .083

13784.1 -.016

2/15