TigerSoft Hotline

(C) 2016 William Schmidt, Ph.D.

www.tigersoft.com

william_schmidt@hotmail.com

Please notice:

=================================

Previous Addresses -

www.tigersoft.com/821-HL/INDEX.html

http://www.tigersoft.com/816-HLN/INDEX.html

http://www.tigersoft.com/77HL7778/INDEX.html

http://www.tigersoft.com/64HRL/INDEX.html

http://www.tigersoft.com/55HL55/INDEX.html

-----> Suggestion <-----

A number of your email accounts are putting emails from me

using william_schmidt@hotmail into

the Junker folder. Please

"be-friend" an email from me so that you promptly get change

of address information regarding new Hotline links.

-----------------------------------------------------------------------------------------------------------------

HELP

A

Guide To Profitably Using The Tiger Nightly HOTLINE

Introduction

to Tiger/Peerless Buys and Sells.

Peerless

Buy and Sell Signals: 1928-2016

Individual Peerless signals explained:

http://tigersoftware.com/PeerlessStudies/Signals-Res/index.htm

http://www.tigersoft.com/PeerInst-2012-2013/

Explanation of each Peerless signal.

http://www.tigersoft.com/PeerInst-2012-2013/

Different

Types of TigerSoft/Peerless CHARTS, Signals and Indicators

Peerless Signals and DJI

Charts - version 7/4/2013

1965

1965-6 1966

1966-7

1967

1967-8

1968

1968-9

1969

1969-70 1970

1970-1

1971

1971-2 1972

1972-3

1973 1973-4

1974

1974-5 1975

1975-6

1976 1976-7

1977

1977-1978

1978

1978-79

1979

1979-80

1980

1980-1

1981

1981-2

1982

1982-1983

1983 1983-1984

1984

1984-1985

1985

1985-1986

1986

1986-1987

1987

1987-8

1988

1988-9 1989

1989-90

1990

1990-1 1991

1991-2

1992

1992-3

1993

1993-4

1994

1994-5

1995

1995-1996 1996

1996-7

1997

1997-8 1998

1998-1999

1999

1999-2000

2000

2000-1 2001

2001-2

2002

2002-3

2003

2003-4

2004

2004-5

2005 2005-6

2006

2006-7

2007

2007-8

2008

2008-9

2009

2009-10

2010

2010-11

2011

2011-12

2012

2012-2013

Documentation for

TigerSoft Automatic and Optimized Signals.

How reliable

support is the DJI's rising 200-day ma?

SPY

Charts since 1994: Advisory Closing Power S7s, Accum. Index, 65-dma, Optimized

Signals.

Previous Hotlines -

www.tigersoft.com/55HL55/INDEX.html

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

1/19/2016

--->

Corrections,Deeper Declines and Bear Markets since 1945.

1/21/2016

--->

High Velocity Declines since 1929

2/12/2016 --->

Presidential Elections Years and Bullish IP21 Positive Non-Confirmations at

Lower Band.

2/12/2016 --->

OBV NNCs on

DJI's Rally to 2.7% Upper Band when DJI's 65-dma is falling.

Earlier

Q-Answers

New

QuickSilver Documentation

(1/11/2016)

Our Different Signals

Better

understand the difference between Peerless DJI-based signals,

the one-year optimized red Signals and

the fixed signals based

on technical developments.

Introduction to

Tiger/Peerless Buys and Sells.

Different Types of TigerSoft/Peerless CHARTS, Signals and Indicators

===================================================================================

Peerless/TigerSoft Hotlines and

Links

8/25/2016

The Peerless Buys (Buy

B3, Buy B19,

Buy B20 and

Buy-B14) tell us that

the current decline will most likely not drop the DJI down 5% from its high.

Since 1945, only about once every 31 months, does the DJI fall 5% from its high

without a reliable Peerless Sell at or near the last peak.

Usually, a decline of 5% or more occurs when breadth is lagging the DJI.

a large H/S top appears and or the Accum. Index is glaringly red

as the DJI reaches a level 2.1% or more above the 21-dma. None of these

conditions have recently appeared

However, it is clear now that the DJI seems to be unable to get past the

(red) rising resistance line shown below. With that resistance being taken

as the ceiling for any advance now, traders in the DJI are showing that they

want to buy closer to the 65-dma where there is then more upside potential.

SOXL and

TECL, on the other hand, appear to have less resistance

overhead. They also show better internals than the DJI. As long as

their 5-day ma are rising, I would hold them in expectation of a Labor

Day Rally. But further DJI weakness will hurt them. This and the

fact that volume and volatility are likely to expand after Labor Day makes

me suggest that we simply trade long only those ETFs so long as their

5-day ma is rising.

We do see micro-sized H/S patterns in the DIA and SPY now. Any deeper

decline will violate them. This will prpbably be bearish enough to

drop them

back to their rising 65-dma. But without a Peerless Sell, I would expect

the 65-dma to hold. All the stocks' research I have done on

head/shoulders

supports the same conclusion. Head/Shoulders patterns that are completed

considerably above the 65-day ma can only be counted on to bring tests of

the 65-dma. Deeper declines are particularly unlikely when the 65-dma

momentum

is still strong and the Accum Index is positive. When we look at DIA and

SPY,

we see that their 65-dma are still rising nicely and the their Accum Indexes

are still positive.

|

|

More Considerations

Right now there are only 4 DJI-30 stocks that show their own bearish

Head/Shoulders

patterns. This is not enough to be scary. In each of the last 5 DJI

corrections

of more than 13%, no fewer than 12 or 13 of the DJI stocks had completed head/

shoulders before the decline could start in earnest.

Tomorrow at 10:00 Janet Yellen will make a speech on behalf of the FED. It

is

expected that she will say that keeping interest rates as low as they have been

runs too much risk of a speculative stock bubble, does not help the real Economy

and would be inflationary if the Economy were to be expanding normally. I

still doubt

if she will pin herself down about raising rates in September. I think

that she

is too cautious to do that.

Gold Stocks, Utilities and the DJI have been selling off in expectation, I

think,

that she will be more specific and definite about raising rates in September.

If

I am right, she will be vague and indefinite about when rates will next be

raised.

That ought to take some of the pressure of the market and a pre-Labor day

rally "should" occur.

But to be safe, watch the 5-day mvg, averages of the pivot-points of the

key ETFs. I would be long those that show rising 5-day ma and remain

above their pivot-points for tomorrow's close.

5-day ma Close Pivot Point

Comments

direction 8/25 for 8-26

-----------------------------------------------------------------------

DIA

Falling 184.37

185.32

SPY

Falling 217.7

218.54

QQQ

Falling 116.61

117.26

Cl.Pwr is rising.

IWM

Rising 123.31

122.94 Cl.Pwr

is rising.

SOXL

Rising

42.35 42.22

Both Op.Pwr.& Cl.Pwr. rising.

TECL

Rising

46.07 46.10

Cl.Pwr is rising.

Charts:Peerless

DJIA Hourly DJIA

DIA

NetIDOSC for DJI-30

SPY

QQQ

IWM

DJI-Utilities REITS

A/D Line-6000 Stocks

SOXL

TECL

IBB

FAS

Crude Oil

Major Indexes and A/D

Lines.

Key Tiger Software ETF

Charts

Bullish MAXCPs

Bearish

MINCPs

Charts of Key ETFs

Watch for Head/Shoulders Patterns

in the Groups/ETFs You Trade

The

recent sell-off in Gold and Silver stocks did not come out of the

blue. Many of the stocks in this hot industry group showed head/shoulders

tops recently. This should have allowed traders to confidently predict a

test of their rising 65-dma, at the least. See

NEM and ASA below.

Also AEM,

GG,

KGC,

GFI,

GDX,

CDE,

NGD and

RGLD

|

|

==================================================================================

8/24/2016

I keep expecting our standing Peerless Buys (Buy

B3, Buy B19,

Buy B20 and

Buy-B14)

to start a nice recovery in here. But something negative is clearly

weighing down the

DJIA, gold stocks (the previously strongest group) and Utilities (another

previously

very strong group). Today, this dark shadow finally sent technology and

semi-conductors down. Short-term traders must appreciate that though

the intermediate-term trend is still up, we could see a decline to 18000 on the

DJI or even a 5% drop from the recent high to 17800 if the next support

down at 18250 is violated. See the research I posted here last

night. My

suggestion is that ETF traders should trade long only those ETFs with a

rising 5-dma.

ETFs

8/24 5-dma

IP21

Close Pivot Point

------------------------------------------------------------

DIA

185.66 186.34

+.137 5-dma falling

SPY

217.85 218.86

+.184 5-dma falling

QQQ

116.8 117.29

+.189 5-dma falling

IWM

123.07 122.94

+.117

SOXL

41.84 41.15

+.107 Strongest of the 6

TECL

45.89 45.97

+.132 5-dma falling

Weakness tomorrow could easily complete the bearish-looking

"micro-head/shoulders

in the DJI". 18250 looks like it would then be the next DJI support

that will have to be tested.

Look for An Increase in Volatility and Volume

Given the "high diving board" appearance of many of the ETFs and the tendency of

of volatility to pick up when their is a decisive breakout or breakdown from

narrow

ranges like those that now govern DIA, SPY, QQQ and IWM

plus the tendency of trading

volume to pick up after Labor Day, I recommend that

traders only get or stay long

the ETFs below when and while their 5-day mvg.avgs. are rising.

If their close tomorrow

is below the "pivot-point" shown below, it means the 5-day ma will be falling

with

tomorrow's data.

FED GUESSING

We can only guess right now what is driving the market down.. My

guess is that the

market expects the FED this weekend to announce that their (the Fed's) tools,

i.e. monetary policy (interest rate determinations and their own open market

activities) should no longer be relied on to boost the market. These tools

can stop a

Crash but they don't help much Main Street in a recovery or bring enough real

economic growth. Easy money and quantitative easing, the argument goes,

are

distorting investments, causing a risky inflation of stock prices and only

making

the very rich on Wall Street even richer while the Middle Class and working

people's income stagnate.

My guess is that these well-known criticisms of the FED can no longer be pushed

aside. I suspect that the FED themselves will now invoke them when they

they

announce this weekend that rates must soon (September) be returned to more

normal levels barring an unforeseen drop in Jobs numbers in August.

===========================================================================

8/23/2016

Our Peerless Buys (Buy

B3, Buy B19,

Buy B20 and

Buy-B14 and the

seasonal strength just before Labor Day should now turn the major

ETFs back up. Though the DJI sold off after opening up 100, breadth

remained very good and the NYSE A/D Line made another 12-month

high ahead of the DJI-30. Usually we need to worry about the market

when the A/D Line is lagging the DJI, not so often when it is leading the

DJI.

Right now, the DJIA is lagging our favorite ETF right now,

SOXL,

by enough so that I would prefer to buy SOXL or QQQ. I think we

should

wait for the DIA's 5-day mvg.avg.. to turn up to buy it. The DJIA is being

held back because of concerns about what Janet Yellen will say

this weekend from the Fed Governors' gathering in Wyoming.

It has been the FOMC's hawks that have been doing most of the talking

recently. This has caused Utilities to drop more than 5% down from their

peak and violate their 6-month price uptrend and their 65-dms. The same

new

concerns about a rate hike this year have caused

Gold Stocks to fall back

almost to their rising 65-dma.

But there's probably more than Rate Hike fears at work here. There

is new enthusiasm for more speculative bonds and stocks now that the

Economy has been able to post two months' New Jobs' numbers over

250,000. Look at how strong

Junk Bonds are. In addition, the

NASDAQ's

"RELDJI" (relative strength vs the DJIA) is positive as it makes all-time

highs. Similarly, Semi-Conductors are outperforming the DJI and today

SOXL made a new all-time high to match its usual companion,

TECL.

I think we have to be buyers of SOXL and

QQQ now because their 5-day ma

are strong and technology stocks are taking over the leadership of the market

from the Utilities,

Gold Stocks and even the

DJI.

ETFs

8/23 5-dma

IP21

Close Pivot Point

------------------------------------------------------------

DIA

185.3 186.10

+.165 5-dma falling

SPY

218.97 218.37

+.267

QQQ

117.56 117.26

+.216

IWM

124.08 122.04

+.179

SOXL

42.95 40.26

+.243 Strongest of the 6

TECL

46.54 46.03

+.192 5-dma falling

Charts:Peerless

DJIA Hourly DJIA

DIA

NetIDOSC for DJI-30

SPY

QQQ

IWM

DJI-Utilities REITS

A/D Line-6000 Stocks

SOXL

TECL

IBB

FAS

Crude Oil

Major Indexes and A/D

Lines.

Key Tiger Software ETF

Charts

Bullish MAXCPs

Bearish

MINCPs

Charts of Key ETFs

Declines of 5% or more without a

Peerless Sell

Since 1945, about 71 years, there have been only 27 cases

where the DJI

fell more than 5% without Peerless having given a Sell. This means a DJI

decline of 5% to 11% occurred about once every 2.6 years without Peerless

giving an automatic warning. In bull markets making new highs, like the

present case, where Peerless was on a Buy, the biggest unheralded DJI declines

were from tops on:

Pct Decline

at nadir.

11/3/1982 7%

The previous top was 5.9% over 21-dma.

10/18/1991 7.0%

The previous top was 2.3% over 21-dma.

8/6/1997 7.4%

The previous top was 2.5% over 21-dma.

In all but 3 of all 27 cases, the previous top before the decline was

at least 1% over the 21-day ma. Our most recent top on 8/15/2016 was

only 0.7% over the 21-day ma. Only one of 27 of the "uncalled" tops took

place so close to the 21-day ma. (The full list will be provided in a day

or two.)

===================================================================================

8/22/2016

Our Peerless Buys

(Buy

B3, Buy B19,

Buy B20 and

Buy-B14 and the

seasonal strength just before Labor Day should now turn the DJI and the major

ETFs back up. It will take only a small advance tomorrow at the

close to turn up

most of the key 5-day ma up. A close above the key values listed below

will turn each up. I'm optimistic also because of the rising

HRDJI OBV-DISI

and the persistent strength of the A/D

Line.

ETFs

8/22 5-dma

IP21

Close Pivot Point

------------------------------------------------------------

DIA

185.12 185.76

+.185

SPY

218.63 217.96

+.267

QQQ

117.35 117.05

+.276

IWM

123.22 122.4

+.187

SOXL

42.27 40.28

+.286 Strongest of the 6

A close over 43 would be an all-time high.

TECL

46.04 46.09

+.192

Charts:Peerless

DJIA Hourly DJIA

DIA

NetIDOSC for DJI-30

SPY

QQQ

IWM

DJI-Utilities REITS

A/D Line-6000 Stocks

SOXL

TECL

IBB

FAS

Crude Oil

Major Indexes and A/D

Lines.

Key Tiger Software ETF

Charts

Bullish MAXCPs

Bearish

MINCPs

Charts of Key ETFs

What To Buy?

I would choose SOXL if it advances past 43 to

an all-time high.

What else will lead a rally in here? Typically, the

Bullish MAXCPs do well.

So, do any stocks that give a new Red Stochastic Buy. Looking at the

individual DJI stocks, I would favor those showing the highest current

Accum. Index. MRK's IP21 is the highest at +.398. INTC's IP21 is

+.278. Consider also buying CVX, whose AI/200 score is 192 if it can close

decisively back above its 65-dma. I would like to

AAPL move to a new

recovery high to destroy its micro-Head/Shoulders pattern.

==================================================================================

8/19/2016

A day or two more of weakness seems likely. Then seasonal

strength should bring a rally to new highs.

The Next Two Weeks

Seasonality should bring a good rally soon into Labor Day,

September 5th. Reflecting this, since 1965, the DJI has risen

59.2% of the time over the next 10 trading days. In Presidential

Election Years, the odds of a rally shift to 66.7% if the

past since 1968 is taken as a guide.

Downside Risk Seems Limited

Without a Peerless Sell, the micro-head/shoulders patterns will

probably not bring a DJI drop below 18400. Buy TECL back

either

when its 5-day ma turns back up or at its 43 support.

Our Peerless Buys (Buy

B3, Buy B19,

Buy B20 and

Buy-B14

are confronting a market that seems, for now, to have lost its ability to

rise with any vigor. Part of the problem is the way both NYSE Up

and Down Volume are drooping in the heat of August.

The DJI will need to rise by more than 80 at its close on

Monday to turn up its 5-day ma.

What's causing the subsidence and drying up of aggressive

buying? The rise in Crude Oil.

It will bring more inflation and this

will strengthen the determination of the anti-inflation "hawks

in the Federal Reserve. Reflecting this, the

DJI-15 (Utilities) fell back on

Friday from its 65-dma resistance. My own belief is that the FED

will not raise rates this year. It does not want to make the

same mistake it did in 2008. Utilities may hold back, though,

in expectation of higher rates next year.

The NASDAQ is developing into a problem, too. It pushed to an

all-time high, but now seems stuck in a rising wedge. Its rallies

have produced tops that are not rising as fast as its up-trendline.

Its chart shows that a micro-head/shoulders could be forming.

But the NASDAQ's Accumulation Index (IP21) now is very

positive. This should mean that there will plenty of big buyers should

it fall back to the 5000 round number support.

And then there are the micro-head/shoulders in the DJI, SP-500,

DIA and SPY. Micro-head/shoulders patterns are rare, but they

can certainly bring declines back to a rising 65-dma. Without a

new Peerless Sell signal, it is very unlikely the DJI will fall below

the support at the 3.5% lower band and the rising 65-dma.

Charts:Peerless

DJIA Hourly DJIA

DIA

NetIDOSC for DJI-30

SPY

QQQ

IWM

DJI-Utilities REITS

A/D Line-6000 Stocks

SOXL

TECL

IBB

FAS

Crude Oil

Major Indexes and A/D

Lines.

Key Tiger Software ETF

Charts

Bullish

MAXCPs

Bearish

MINCPs

Charts of Key ETFs

History of Head/Shoulders in DIA and SPY since

1995

There were 7 micro/mini Head/Shoulders on DIA since

1998.

All of these had a Peerless Sell signal first.

DIA

SPY

1995

N/A

none

1996

N/A

H/S in November aborted as prices rise above right

shoulder apex

1997

N/A

December - very quick and shallow decline only

1998

N/A

Aug - Multiple Peerless Sells. Big decline.

1999

May & Sept - Multiple Sells- Normal correction.

2000

Sept MACRO H/S

Sept -

Also Peerless Sell S4 at top.

2001

June

Feb - MICRO H/S & June

regular H/S - Peerless Sells. Bear Mkt.

2002

March MICRO H/S

Aug MICRO H/S - Peerless

Sells. Bear Mkt.

Also Peerless Sell S15 beforel top.

2003

2004

Sept MICRO H/S -

Peerless Sells. Interm. Decline.

2005

March MICRO H/S

March MICRO - Peerless

Sells. Interm. Decline

Also Peerless Sell S4 at top

2006

May

Nov - Peerless Sells. Interm. Decline

2007

Oct MICRO H/S

Peerless Sells. Intermed. Decline

Also Peerless Sell S4 at top.

2008

May MICRO H/S

June H/S - Peerless Sells. Bear Mkt.

Also Peerless Sell S4, S9, S15 at top.

2009

Aug MICRO - only shallow

decline

2010

April MINI H/S

April MINI H/S Peerless

Sell. Flash Crash

Also Peerless Sell S11 before top

2011

2012

Oct H/S

Sept. aborted.

2013

Aug H/S

Aug H/S October MICRO

2014

Oct/H/S

Nov H/S

2015

June MICRO H/S

FEB H/S & NOV H/S

Also Peerless Sell S12 at top

|

|

==================================================================================

8/18/2016

The operative Peerless Buys (Buy

B3, Buy B19,

Buy B20 and

Buy-B14

tells us any decline in here will soon be followed by more new highs.

The NYSE A/D Line bullishly made another new high ahead of the

DJIA itself. NYSE Down Volume keeps falling. And now the Hourly

DISI/OBV has turned up. So has the DJI-15 (Utilities), which got back

above its 65-dma. Meanwhile Crude Oil has risen back to its 65-dma

resistance but refuses to sell off. These are all constructive signs.

The past week's Hotlines present a number of studies suggesting

there will be more new highs:

1) The presence of only 2 head/shoulders patterns

in the DJI-30 compared to the 12 or 13 that appeared before

intermediate-term >13.5% selloffs in 2010, 2011, 2015 and 2016.

2) How well the market does each month until November

when the Democrat is about to win the Presidential Election.

3) How Semiconductors and TXN, in particular, usually top

out and show head/shoulders patterns before there is a serious

decline. Neither is true in here yet.

4) How a completed H/S pattern in the Utilities has brought

not a decline, but significant rallies for the DJI in each of its last 3

appearances since 2009 and the Federal Reserve's institution of "QE"

and "free money" for big banks.

5) How well the DJI does after after breaking out into all-time

high territory above well-tested flat resistance going back more than 5 months.

All this is very nice, but we do not want to let healthy profits slip away.

I suggest that traders close out volatile ETFs if their 5-day ma should

turn down. Therefore watch the QuickSilver 5-day ma pivot points,

as posted below. And let's also watch the short-term price patterns of

the key ETFs. These could be forming micro-H/S patterns. After our

experience with mini-H/S patterns in 2010, I think we have to be alert

for such patterns and not dismiss them. Another "flash crash" is

could happen. Perhaps, Obama's move to de-privatize prisons is an

opening salvo that could adversely affect other stocks and even the

market as a whole.

Charts:Peerless

DJIA Hourly DJIA

DIA

NetIDOSC for DJI-30

SPY

QQQ

IWM

DJI-Utilities REITS

A/D Line-6000 Stocks

SOXL

TECL

IBB

FAS

Crude Oil

Major Indexes and A/D

Lines.

Key Tiger Software ETF

Charts

Bullish

MAXCPs

Bearish

MINCPs

Charts of Key ETFs

The Market Does Not Like Sudden Changes

or De-Privatizations. The Obama Administration

has announced it will end he use of private for-profit

prisons. Might this spook the market? CXW lost

1/3 of its value today. Might there be other

moves to de-privatize that we should be looking at

as short sales? This does create a negative "buzz"

for certain other stocks. Someone on Yahoo wrote:

"Are private insurers next? UNH, HUM, AET? Government

may put pressure on them since they are raising rates so high (sic)

for next years."

https://gma.yahoo.com/justice-department-announces-effort-end-private-prisons-172756594--abc-news-topstories.html?hl=1&noRedirect=1

Potential Micro-H/S Patterns have appeared.

A rally tomorrow would bullishly abort them. But

a sell-off and a close below their green necklines

would complete them.

|

|

2010 Mini-H/S in DJIA/DIA

|

I would not be too concerned yet about the appearance of

what might become micro-head/shoulders pattern in the DJI, NASDAQ,

SP-500, OEX and NYSE if they should make a 10 day closing low. The

completion of such patterns would "probably" have only minor and

very short-term significance. See the potential micro-H/S pattern just

above.

I have circled them in pink and the neckline-supports are shown in green.

It would take a sharp sell-off over the next two trading days to break their

necklines. If these necklines were broken, caution would be then required,

remembering April 2010's quick mini H/S tops just after the British Pete.

big spill in the Gulf of Mexico. That brought a "flash crash" and a

13.5%

decline.

2010 Flash Crash Mini H/S Patterns in DIA and SPY shown

below

took 18 days to form and be completed. Our micro-H/S patterns now have

been traced out over only 9 days, so far. Red Down-Day volume was

also noticeably higher as the markets started down in 2010. So, I doubt

if these micro-H/S patterns will be completed or be as bearish if they are.

|

|

On the other hand, a rally here would obliterate these patterns

and that would be bullish. I think this is a good time to watch and use

the 5-day ma. Declines by the major ETFs belowtheir 5-dma pivot points

tomorrow should be used to take profits and Sell.

Last night, I suggested applying this rule. That would have meant selling

TECL and BRZU today. See the pivot points on their charts. Remember

that

a close below those levels on Friday will cause their 5-day ma to be falling,

which in the present circumstances I would take to be a QuickSilver Sell.

8/18/2016 QuickSilver Key Values and Big ETFs

ETF Closing 5-dma

Closing IP21 ITRS

Price Pivot Point

Powers

to apply

to tomorrow's

Close

----------------------------------------------------------------------------------

DIA 186.34

185.9

NH

NC +.19

------

SPY 218.86

218.46

rising +.242

-.004

QQQ 117.29

117.20 rising

+.262 +.028

IWM 122.94

122.19 rising

+.126 +.003

SOXL 41.15

39.52

rising +.302

+.278

TECL 45.97

46.41

rising +.181

+.153

BRZU 150.5

152.43

rising +.11 +.555

YINN 19.19

18,19 rising

+.28 +.235

==================================================================================

8/17/2016

The operative Peerless Buys (Buy

B3, Buy B19,

Buy B20 and

Buy-B14

remain in effect. We should see more new highs.

But the shallow short-term decline

we are seeing now is apt to continue

if there is not a rally tomorrow. We can say this based on the fact that

the

"pivot-points" (for the 5-day ma) could easily be closed below at tomorrow's

close. A close below these pivot points will cause their

5-day ma

to turn down. Short term traders in volatile and leveraged ETFS should

probably take profits in these ETFs when they close below their "5-dma

pivot-points". TECL's 6-dma did turn down today. Let's lock in profits

in it. Elsewhere, intermediate-term investors can wait to Sell when we get a

a new Peerless sell signal or a head/shoulders pattern is completed in them.

ETF Closing 5-dma

Closing IP21 ITRS Tiger

Price Pivot Point

Powers

Signal

to apply

to tomorrow's

Close

---------------------------------------------------------------------------------------------

DIA

186.1

186.3

NH NC +.163

------ Buy

SPY 218.37

218.65

rising +.227

-.006

Buy

QQQ 117.26

117.25 rising

+.282 +.027

Sell

IWM 122.04

122.07 rising

+.116 +.001

Sell

SOXL 40.26

39.02

rising +.278

+.268 Sell

TECL 46.03

46.62

rising +.212

+.161 Buy

BRZU 153.41

158.42

rising +.126

+.824 Sell

YINN 18.76

18.04 rising

+.275 +.217

Buy

Charts:Peerless

DJIA Hourly DJIA

DIA

NetIDOSC for DJI-30

SPY

QQQ

IWM

DJI-Utilities REITS

A/D Line-6000 Stocks

SOXL

TECL

IBB

FAS

Crude Oil

Major Indexes and A/D

Lines.

Key Tiger Software ETF

Charts

Bullish

MAXCPs

Bearish

MINCPs

Charts of Key ETFs

How many head/shoulders tops typically appear

among DJI-30 stocks at market tops?

Presently there only 2 two such H/S patterns among DJI-30 stocks:

JNJ and VZ.

Before January 2016 top: 12 DJI stocks showed H/S patterns.

(AAPL,

DIS, GS,

JNJ, MMM,

MSFT, NKE,

UNH, UTX,

V, VZ and

XOM.)

Before July 2015 top: 13 DJI stocks showed H/S patterns.

(BA, CAT,

CSCO, CVX,

DD, DIS,

GS, JNJ,

NKE, PG,

UTX, VZ,

XOM)

Before July 2011 top: 12 DJI stocks showed H/S patterns.

(AAPL,

AXP, BA,

CAT (hands above head),

HD, JPM,

MMM, MRK,

NKE, PFE,

UNH, WMT)

Before April 2010 top: 12 DJI stocks showed H/S patterns.

(CSCO, GE,

HD, IBM,

JNJ, JPM,

KO, MCD,

MSFT, PG,

TRV, WFC,

and see DIA's H/S top, too.)

==================================================================================

8/16/2016

The break in the Closing Power uptrend for DIA following its

failure to confirm the recent high is bearish enough to allow

the DJI to retest 18300, and DIA 183,

provided DIA closes

below 185.12 tomorrow and its 5-dma therefore turns down.

A further shallow decline would then be called for. But without

a new Peerless Sell, I would continue to hold long positions in

TECL, SOXL,

LBJ, BRZU

and YINN.

When Peerless operates under major Buys as now

(Buy

B3, Buy B19,

Buy B20 and

Buy-B14), there can still

be

DJI declines to the lower band, but they are relatively

rare and we generally are better off waiting for higher prices.

I think that applies now, despite the completion by the Utilities

of a second head/shoulders pattern this year. See the

Utilities'

H/S Top Pattern Study further below.

Of more concern would be the appearance of a number of

completed head/shoulders

patterns in the DJI-30.

Presently, there are only two such H/S patterns among DJI-30 stocks:

JNJ and VZ. By contrast, before the DJI's big January sell-off this year,

no fewer than 12 DJI stocks showed H/S patterns. Look at their charts.

Except for JNJ and VZ, no others show such bearish patterns. I think

this has to be considered another bullish factor for now: See all these

Jan 2016 H/S DJI stocks: AAPL,

DIS, GS,

JNJ, MMM,

MSFT, NKE,

UNH, UTX,

V, VZ and

XOM. This would make a useful study

for earlier

declines. I will try to do a little more work here and start to regularly

report the number of currently extant DJI H/S patterns.

Stay long this market...

Charts:Peerless

DJIA Hourly DJIA

DIA

NetIDOSC for DJI-30

SPY

QQQ

IWM

DJI-Utilities REITS

A/D Line-6000 Stocks

SOXL

TECL

IBB

FAS

Crude Oil

Major Indexes and A/D

Lines.

Key Tiger Software ETF

Charts

Bullish

MAXCPs

Bearish

MINCPs

Charts of Key ETFs

What happens when DJI-Utilities completes a

head/shoulders

pattern and Peerless does not show a major Sell?

There have been 9 cases since 1988. In 5 cases the DJI fell to or near

to the lower 3.5% band. But in 4 cases, the DJI rallied instead of

falling.

In the last 3 cases, when there was no Peerless Sell, the DJI rallied.

It is more bearish, when charts show more than one head/shoulders pattern.

The DJI-15 also completed a head/shoulders pattern in April.

---> See all the Utilities

and DJI charts since 1988 here.

DJI-15 (Utilities) H/S Completed

DJI reaction

1 H/S Pattern completed in July 1989 -->

DJI fell 3.8% below 21-dma. No Peerless sell signal.

2 H/S Pattern completed in Aug 1992 --> DJI fell

3.5% below 21-dma. No Peerless sell signal.

3 H/S Pattern completed in Sept 1993 --> DJI fell

2.5% below 21-dma. No Peerless sell signal.

4 H/S Pattern completed in Nov 1995 --> DJI

rose instead of falling. No

Peerless sell signal.

5 H/S Pattern completed in June 2007 --> DJI fell

2.0% below 21-dma. No Peerless sell signal.

6 H/S Pattern completed in Dec 2009 --> DJI fell 4.0%

below 21-dma. No Peerless sell signal.

7 H/S Pattern completed in Aug 2012 --> DJI

rose instead of falling. No

Peerless sell signal.

8 H/S Pattern completed in May 2013 --> DJI

rose instead of falling. No

Peerless sell signal.

9 H/S Pattern completed in May 2014 --> DJI

rose instead of falling. No

Peerless sell signal.

================================================================================

8/15/2016 The still active Peerless Buys (Buy

B3, Buy B19,

Buy B20 and

Buy-B14

should continue to guide us. But the shift away from dividend to tech

stocks and the strongest of Chinese and Emerging markets intensified.

Today, the DJI-15 (Utilities) closed below both its rising 65-dma and its 5%

down-from-the high line. This is a bearish sign for utilities and

dividend plays, generally. But the investment shift away from dividends

to growth is long over-due and usually occurs naturally in an economic

recovery. I suspect the DJI will show some minor weakness now to reflect

this shift. You can see the Hourly

DJI's DISI-OBV Line is in a minor down-

trend. Fortunately, NYSE Down

Volume is bullishly in its own downtrend.

Utilities Have Broken Their Uptrend-line.

Both Opening and Closing Power are falling.

SOXL, TECL,

YINN and BRZU

should keep rising and should not

be sold until Peerless gives a Sell

or they form Head/Shoulders tops.

SOXL (Semi-conductors) rose to a recovery new high above 40 and

is now challenging its all-time high of 42.46 on June 1, 2015. Since

semi-conductors

are such a capital intensive industry, a breakout into all-time high territory

by SOXL

would have to be taken as as an important vote of confidence that economic

growth

will increase world-wide. The same interpretation, that there is a

world-wide

turnaround under way, also would explain the powerful rebound of

Crude

Oil up from its test of its

200-day ma.

Our favorite technical pick, TECL (3x-technology ETF), closed at 48 today,

up exactly 20% since its perfect, flat-topped July 13th breakout into all-time

high territory. Continue to hold both SOXL and TECL. They trade very

well

with the Peerless signals.

Today also brought a very big jump in some volatile and speculative Chinese

stocks. YINN has almost gotten back to 20. Look at the beautifully

bullish Chinese stock charts of WB,

BABA,

CQQQ and

SINA.

Charts: Peerless

DJIA Hourly DJIA

DIA

NetIDOSC for DJI-30

SPY

QQQ

IWM

DJI-Utilities REITS

A/D Line-6000 Stocks

SOXL

TECL

IBB

FAS

Crude Oil

Major Indexes and A/D

Lines.

Key Tiger Software ETF

Charts

Bullish

MAXCPs

Bearish Stocks not posted tonight.

Charts of Key ETFs

One explanation for today's shift to NASDAQ stocks - and the NASDAQ

made an all-time high today - is that the Governor of the San Francisco Fed

made the case for Congress exacting automatic fiscal stimulants for

when the US economy is weak and inflation is not a problem so that

the FED will not have to use monetary stimulants so much. It is surprising

to hear a member of the Federal Reserve take such a Keynesian view, even

to the point where he seems to be advocating a big new Public Works program.

(Would this work, assuming Congress would somehow go along with it? As I

see it, there are two big problems with Public Works spending, which is

certainly

badly needed, are, first, that it will drive up interest rates and this will

hurt all

those seniors who are now overloaded with low-interest bonds and dividend

stocks. AND, second, that the famous Keynesian multiplier is much smaller

now, because so little manufacturing is still done in the US. Public

works

spending may have more of a stimulative effect for China than America!

See ....

SF Fed Federal

Reserve Bank of San Francisco. Search SF Fed ... 2016-23 |

August 15, 2016

====================================================================================

8/12/2016 Peerless Buys (Buy

B3, Buy B19,

Buy B20 and

Buy-B14 operate

still.

We could fuss over the low volume or how DIA's

Closing Power is not

above its 21-day ma, but these are not so bearish as to bring much of

a decline and I think there is more potential elsewhere anyway.

It does not pay to tell the DJIA or

the overall market to go down

after a flat-topped breakout from a 6-months or more trading range,

such as we saw when the DJI cleared 18000 and then 18000 recently,

which then goes into all-time high ground. Such patterns take a long

time to be built. They normally set up really nice advances unless

Peerless gives a Sell signal. Look at the cases of

Jan 1987,

Dec

1991,

March 1995,

October 1996,

May 1997,

Feb 1999 and see how failed breakout

of Jan. 2000 was properly identified as such by Peerless Sell signals.

The "talking heads" tell us August and September are bearish months

and the market can go nowhere at time of year. But, I've shown recently

that

when a Democrat is ahead in the Presidential Polls, as long as we are

not at war or suffering an economic slow-down/melt-down, the odds are better

than 2:1 that August will up, that September will be up and that October will be

up.

The Market as "Suction-Cup Climbing Man".

The market reminds me of the man using suction-cups climbing Trump Towers.

It is creeping upwards despite all the bearish commentary. As long as

there

is no rain in the form of Hillary pushing to breakup the big banks, to tax computer

trading or to make the tax on capital gains the same as ordinary income, I expect

the "suction-cup" market should continue to rise steadily if not dramatically.

I think there is a good chance that there is an international economic

turn-around. A Trump resurgence and protectionism would dampen

the rises in Chinese,

Brazil and

Latin American stocks, as would another

sell-off in Crude Oil. But right now,

there appears to be considerable upside

potential in these non-US markets' stocks. Watch also

Semi-Conductors (SOXL)

to see if it can make an all-time high above 42. Our favorite

TECL keeps

rising, after its perfect breakout above 40. Below I list 21 stocks/ETFs

that are trading particularly well with our Peerless Buys and Sells. Until

we get a Peerless sell signal, I expect the most bullish of these to keep

rising.

I will post their data on Tiger's Data Page as BIGPEER.exe Monday night.

Charts: Peerless

DJIA Hourly DJIA

DIA

NetIDOSC for DJI-30

SPY

QQQ

IWM

DJI-Utilities REITS

A/D Line-6000 Stocks

SOXL

TECL

IBB

FAS

Crude Oil

Major Indexes and A/D

Lines.

Key Tiger Software ETF

Charts

Bullish

MAXCPs Bearish MINCPs

Charts of Key ETFs

WHAT STOCKS/HAVE BEEN TRADED BEST

WITH PEERLESS BUYS and SELLS?

I went through 6000 and came up with the 21

shown in TABLE 2, shown further below. Each of these would have seen

an investment of $10,000 in them double to more than $20,000 being

long only while Peerless was on a Buy signal in the last 12 months.

Big gains are nice, of course, but, in addition, which of these

did not produce a paper loss of more than 5% on their long positions?

Only AMKR and LOCK. Since LOCK has only been traded a few years. So

AMKR is of most interest. It is in the strong semi-conductor field.

Amkor Technology, Inc. provides outsourced semiconductor

packaging and test services in the United States and internationally.

Located in Tempe, AZ, the company offers turnkey packaging and

test services, including semiconductor wafer bumps, wafer probes,

wafer backgrinds, package design, packaging, and test and drop

shipment services.

As you can see below, only in 2012 was it not successfully traded with

Peerless on the long side. What I like about AMKR is how few large paper losses

there have been. We compare its gains and losses to DIA later tonight.

How well did Peerless do with AMKR for each of the last 10 years?

How consistently profitable. What about the big paper losses?

Could they have been anticipated? Look at the AMKR charts in the

years where the paper loss was more than 20%: 2008 (extreme bear market),

2013 and 2015.

Long Trades' Avg. Gain

using Peerless Buys and Sells.

All trades here are taken at next day's opening.

AMKR max paper DIA max QQQ max

loss gain loss gain loss

------------------------------------------------------------------------

2005 +57.3 -19.4% 5.0% -1.5% 13.9% -3.5%

2006 +45.0% -7.0% 15.5% -2.8% 11.7% -7.9%

2007 +37.6% -9.7% 26.5% -3.8% 29.6% -4.9%%

2008 +13.9% -30.0% 9.6% -16.2% 0.4% -19.0%

2009 +245.5% -9.3% 58.1% -3.4% 77.4% -3.8%%

2010 +126.7% -6.9% 36.9% -3.0% 62.1% -4.1%%

2011 +17.7% -10.6% 21.2% -5.5% 17.7% -7.2%%

2012 -7.8% -11.5% 17.2% -2.4% 21.4% -3.2%%

2013 +38.7% -26.1% 26.4% -1.4% 29.5% -3.1%%

2013-2014 +219.3% -4.6% 21.8% -1.4% 23.2% -3.1%%

2014 +36.9% -13.3% 16.4% -6.4% 26.0% -3.6%%

2015 +12.9% -29.6% 14.1% -1.9% 18.8% -2.1%%

2015-2016 +132.1% -3.2% 14.5% -2.6% 19.0% -8.9%

Peerless Signals and Trading Gains Starting with $10000

-----------------------------------------------------------------

Directory=C:\goodpeer

8/ 18/ 15- 8/ 12/ 16

Number of Symbols= 21

How well did Peerless do with AMKR for each of the last 10 years?

How consistently profitable. What about the big paper losses?

Could they have been anticipated? Look at the AMKR charts in the

years where the paper loss was more than 20%: 2008 (extreme bear market),

2013 and 2015.

Long Trades' Avg. Gain

using Peerless Buys and Sells.

All trades here are taken at next day's opening.

AMKR max paper DIA max QQQ max

loss gain loss gain loss

------------------------------------------------------------------------

2005 +57.3 -19.4% 5.0% -1.5% 13.9% -3.5%

2006 +45.0% -7.0% 15.5% -2.8% 11.7% -7.9%

2007 +37.6% -9.7% 26.5% -3.8% 29.6% -4.9%%

2008 +13.9% -30.0% 9.6% -16.2% 0.4% -19.0%

2009 +245.5% -9.3% 58.1% -3.4% 77.4% -3.8%%

2010 +126.7% -6.9% 36.9% -3.0% 62.1% -4.1%%

2011 +17.7% -10.6% 21.2% -5.5% 17.7% -7.2%%

2012 -7.8% -11.5% 17.2% -2.4% 21.4% -3.2%%

2013 +38.7% -26.1% 26.4% -1.4% 29.5% -3.1%%

2013-2014 +219.3% -4.6% 21.8% -1.4% 23.2% -3.1%%

2014 +36.9% -13.3% 16.4% -6.4% 26.0% -3.6%%

2015 +12.9% -29.6% 14.1% -1.9% 18.8% -2.1%%

2015-2016 +132.1% -3.2% 14.5% -2.6% 19.0% -8.9%

Peerless Signals and Trading Gains Starting with $10000

-----------------------------------------------------------------

Directory=C:\goodpeer

8/ 18/ 15- 8/ 12/ 16

Number of Symbols= 21

Symbol $10000. Biggest-- Gains/Losses 5% Stops- 10% Stops

------ becomes Paper---- ------------ triggered triggered

------ ------- Loss Pct

============================================================================

ADXS Long 28125 25.8 4 1 2 2

ADXS Short 18857 8 4 1

combined +474%

AGTC Long 21005 15.2 4 1 3 2

AGTC Short 15305 19.6 4 1 1

combined +231%

AMKR Long 22283 3.2 3 2 NONE NONE

AMKR Short 13059 10.8 3 1 2 1

combined +231%

ANIP Long 23488 8.1 4 1 1

ANIP Short 13179 6.2 3 1 1

combined +275%

ARWR Long 20523 6.1 3 2 1

ARWR Short 16029 6.1 4 1

combined +250%

AVP Long 23136 32.3 3 2 2 1

AVP Short 12060 33.5 3 1 1 1

combined +199%

AXDX Long 28346 7.3 4 1 1

AXDX Short 18724 5.1 4 1

combined +445%

BCOV Long 25489 5.9 4 1 1

BCOV Short 10941 10.1 2 2 2 1

combined +180%

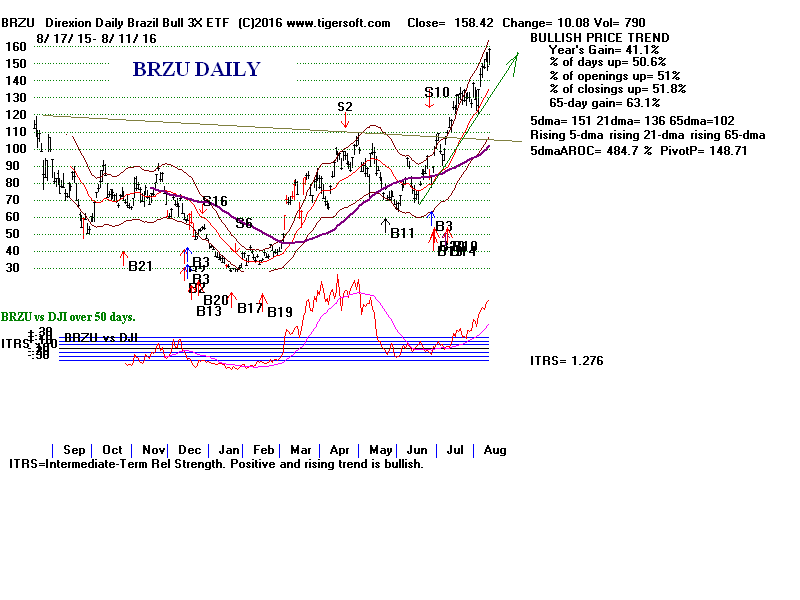

BRZU Long 39748 33.3 3 2 3 1

BRZU Short 12163 55.1 2 2 2 2

combined +422%

CECO Long 24002 11 2 3 3 2

CECO Short 12017 16.6 3 1 1 1

combined +194%

CSTM Long 27656 18.9 3 2 3 3

CSTM Short 18491 13.4 4 2 2

combined +452%

CYTK Long 25958 16.8 4 1 2 1

CYTK Short 14420 3.4 3 1 NONE NONE

combined +276%

HWAY Long 26028 15 3 2 1 1

HWAY Short 11949 7 3 1 1

combined +217%

JOY Long 22688 37.9 3 2 3 1

JOY Short 10646 35.5 3 1 2 1

combined +150%

KTOS Long 20449 22.2 2 3 3 1

KTOS Short 14565 6.4 3 1 2

combined +211%

LOCK Long 25545 3.8 4 1 NONE NONE

LOCK Short 13841 7.1 4 2

combined +267%

LXRX Long 23331 13.6 5 2 2

LXRX Short 14432 6 3 1 1

combined +240%

NKTR Long 26264 9.5 5 1

NKTR Short 16094 7 4 1

combined +336%

NPTN Long 27974 11.5 4 1 1 1

NPTN Short 12896 24.3 3 1 2 2

combined +272%

NUS Long 21890 15.2 5 1 1

NUS Short 13274 10.4 4 2 1

combined +198%

X Long 29502 35.7 3 2 2 1

X Short 14079 20.2 3 1 1 1

combined +363%

|

====================================================================================

8/11/2016 Our Peerless Buys

(Buy

B3, Buy B19,

Buy B20 and

Buy-B14

have properly kept us long as the SP-500,

NASDAQ and

DJI all made all-time high closings today.

With a little more

follow-through, I would say that the path of least resistance

is up.

Some minor profit-taking is a short-term, but

it looks like there will

be much more upside progress ahead. It would be nice to see

an increase in Up-Hour and Advancing Stocks' Volume. The

Hourly DJI's OBV Line broke its

uptrend-line today and the

V-Indicator is only slightly positive. But bullishly, there were 768

more up than down on the NYSE. TECL and

SOXL both rose.

Long depressed Emerging Economies' ETFs like those of Brazil and Latin

America (LBJ) continued to rise, boosted no doubt by the big jump in Crude

Oil prices. Considering how beaten down ETFs like

BRZU, LBJ

and UBR are, they should remain exceptionally

strong, certainly as long

as their Closing Powers are rising

and Peerless does not give a Sell signal.

Charts: Peerless

DJIA Hourly DJIA

DIA

NetIDOSC for DJI-30

SPY

QQQ

IWM

DJI-Utilities REITS

A/D Line-6000 Stocks

SOXL

TECL

IBB

FAS

Crude Oil

Major Indexes and A/D

Lines.

Key Tiger Software ETF

Charts

Bullish

MAXCPs Bearish MINCPs

Charts of Key ETFs

Table 1 below shows how well certain leveraged ETFs can be

traded on the long side, buying when Peerless gives a reversing Buy signal

and selling when Peerless gives a Sell Signal. The best are

A starting $10,000

would have now become

BRZU 3x Brazil

$41,266

UBR 2x Brazil

$26,456

LBJ Latin Amer.

$24,498

SOXL Semi-Cond.

$21,217

What makes BRZU so interesting is how well Peerless does in the past with

it. See

http://tigersoft.com/BRAZIL/index.html If the world economy is,

in fact, turning back upwards, as suggested by the strength we see in foreign

ETFs, YINN and

Crude Oil. then BRZU along with

UBR and LBJ could rise

a lot more. We have only to look at the 5-year charts of previously

depressed

JNUG and NUGT to see how far back upwards BRZU could still move.

"Long and Short" "Long"

Short

2001

+78.6% +31.5% +35.8%

2002

+62.1% +8.1% +50.0%

2003

+122.8% +124.9% -0.9%

2004

+87.2% +63.5% +14.5%

2005

+45.6% +45.6% no trades

2006

+133.7% +74.3% +34.1%

2007

+141.1% +119.8% +12.5%

2008

+155.3% +18.8% +115.0%

2009

+110.2% +108.8% +1.0%

2010

+29.3% +18.5% +9.2%

2011

+87.2% +24.3% +50.6%

2012

data not available

2013

+55.3%

-14.2%

+59.4%

2014

-29.4%

-64.7%

+30.0%

2015

+471.9%

+58.2

+258.7%

2015-2016 +583.2%

+367.0% +38.5%

BRZU DAILY

BRZU WEEKLY

| |

|

|

Table 1

Peerless returns on Leveraged ETF Longs over 50% in last Year,

excluding precious metals.Peerless Signals and Trading Gains Starting with $10000

-------------------------------------------------------

Directory=C:\leverage

8/ 17/ 15- 8/ 11/ 16

Symbol $10000. Biggest-- Gains/Losses 5% Stops- 10% Stops

------ becomes Paper---- ------------ triggered triggered

------ ------- Loss Pct

============================================================================

BRZU Long 41266 33.3 3 2 3 1

BRZU Short 12163 55.1 2 2 2 2

-------------------------------------------------------------------------------------------------------------------------------------

CURE Long 16418 3.9 3 2

CURE Short 13606 4.1 3 1

-------------------------------------------------------------------------------------------------------------------------------------

DRN Long 18461 16.3 5 1 1

DRN Short 12736 17.2 3 1 1 1

-------------------------------------------------------------------------------------------------------------------------------------

EDC Long 17141 31.8 3 2 2 1

EDC Short 13472 17.8 2 2 1 1

-------------------------------------------------------------------------------------------------------------------------------------

INDL Long 16700 30.3 3 2 2 1

INDL Short 16158 9 3 1 1

-------------------------------------------------------------------------------------------------------------------------------------

LBJ Long 24498 27.4 3 2 3 1

LBJ Short 12010 40 2 2 2 2

-------------------------------------------------------------------------------------------------------------------------------------

RETL Long 18147 12 4 1 2 1

RETL Short 13441 6.2 3 1 1

-------------------------------------------------------------------------------------------------------------------------------------

ROM Long 15286 5.9 3 2 1

ROM Short 13192 6.6 4 1

-------------------------------------------------------------------------------------------------------------------------------------

SOXL Long 21217 11.2 3 2 1 1

SOXL Short 13599 13.2 4 1 1

-------------------------------------------------------------------------------------------------------------------------------------

TECL Long 17252 9.4 2 3 1

TECL Short 13622 11 4 1 1

-------------------------------------------------------------------------------------------------------------------------------------

TNA Long 18676 12.4 2 3 2 1

TNA Short 14950 10.5 4 1 1

-------------------------------------------------------------------------------------------------------------------------------------

TQQQ Long 16675 9.4 3 2 2

TQQQ Short 14825 5.9 4 1

-------------------------------------------------------------------------------------------------------------------------------------

UBR Long 26456 21.4 3 2 2 1

UBR Short 10722 37.7 2 2 2 2

-------------------------------------------------------------------------------------------------------------------------------------

UDOW Long 15556 7 3 2 1

UDOW Short 12348 10.3 2 2 1 1

-------------------------------------------------------------------------------------------------------------------------------------

UPRO Long 15335 9.8 3 2 1

UPRO Short 12563 9.8 2 2 1

-------------------------------------------------------------------------------------------------------------------------------------

URE Long 15116 9 5 1

URE Short 11906 9.1 3 1 1

-------------------------------------------------------------------------------------------------------------------------------------

URTY Long 18702 12.3 2 3 2 1

URTY Short 14876 10.6 4 1 1

-------------------------------------------------------------------------------------------------------------------------------------

USD Long 17395 6.5 4 1 1

USD Short 12897 9 4 1

-------------------------------------------------------------------------------------------------------------------------------------

UWM Long 15447 8.1 3 2 1

UWM Short 13203 6.8 4 1

-------------------------------------------------------------------------------------------------------------------------------------

YINN Long 15986 32.7 3 2 3 1

YINN Short 16287 13.7 2 2 1 1

-------------------------------------------------------------------------------------------------------------------------------------

|

-------------------------------------------------------------------------------------------------------------------------------------------------

8/10/2016 Our Peerless Buys (Buy

B3, Buy B19,

Buy B20 and

Buy-B14

still stand. The Hourly DJI

and Utilities are now at good

short-term support, but today's trading produced short-term

red (optimized Tiger) Sells on IWM,

MDY, SPY,

VGK, XOP

and YINN. A small retreat for them

would not be a bad thing.

It would permit some consolidation and base-building.

I have to remain bullish until Peerless gives a major Sell.

Two new pieces of research support that conclusion. First,

I mentioned the importance of semi-conductors as "canaries

in the coal mine", warning of trouble. That is particularly true

of Texas Instruments (TXN). Since as far back as 1987, but

probably further, TXN has marked tops for it AND the overall

market by showing very timely, bearish head/shoulders patterns.

Since TXN shows none now, I think we must give it,

SOXL and the market

as a whole more room to run. See the study I am developing

further below.

Secondly, we are now in the Presidential Election Year, of course.

Since 1916, when the US was not itself at war or in a worsening

Depression or Financial crisis, the market has shown a strong

tendency to rally over the next three months when the Democrat

running for President was far out in

front of the Republican.

Like it or now, Trump keeps having problems conducting a successful

campaign in search of independent voters. His problems are mostly of

his own

making, but they also provide the establishment media just what they

need to work him over even more. I had thought

his needless clashes

with so many other

people would quickly end after his

Nomination. That

is not the case. So, his poll numbers are weakening

and his lack of

diplomatic and political skills appear now to be making

him his own worst

enemy.

Hillary Clinton is quite vulnerable, but Trump keeps turning

attention away from her failings to his own. That helps Democrats

and should aid stock market bulls until November.

Historically, the market seems to like Democrats in most Augusts, Septembers

and Octobers up to the Presidential Election. My new research on this topic

suggests we should not sell yet. If there is a retreat, it will

probably end up

being only a constructive, sidewise consolidation as the market sets up for

a rally into November. This, at least, was the case in

1916,

1936,

1940,

1964

and 1996.

2012 was the main exception.

Charts: Peerless

DJIA Hourly DJIA

DIA

NetIDOSC for DJI-30

SPY

QQQ

IWM

DJI-Utilities REITS

A/D Line-6000 Stocks

SOXL

TECL

IBB

FAS

Crude Oil

Major Indexes and A/D

Lines.

Key Tiger Software ETF

Charts

Bullish

MAXCPs Bearish MINCPs

Charts of Key ETFs

NO BIG DECLINE AT LEAST UNTIL TEXAS INSTRUMENTS

(TXN) FORMS A BEARISH TOP PATTERN.

Before nearly every big DJI decline since 1987, TXN formed either a bearish

head/shoulders top pattern or a "hands above the head" speculative top.

All these charts will be shown tomorrow night. This was true before the

January 2016 general market sell-off. See chart below. That we still

do

not see a top developing in TXN should give us some faith that still higher

prices lie ahead for the general market.

1987 Head/Shoulders

1989 early Head/Shoulders

1990 "hands above the head" speculative top.

1997 Head/Shoulders

1998 Head/Shoulders

Jan 2000 Head/Shoulders

2000 Head/Shoulders

2002 Head/Shoulders

2007 Head/Shoulders

2008 Head/Shoulders

2010 Flat - DJI high not confirmed

2011 Head/Shoulders

Aug 2015 already falling

Jan 2016 Head/Shoulders

==============================================================

HOW DJI BEHAVES IN SECOND HALF OF

PRES.ELECTION YEAR

WHEN DEMS WIN WHITE HOUSE: 1916-2012.

(All DJI charts)

DJI Chart

Aug Sept

Oct Nov

Aug 10 Nov 7 Background

------------------------------------------------------------------------------------------------------------------

1916

377 vs 254 up

up up

flat

98.10 107.2

US not at war.

1932 472 vs

59 up

flat

down down

69.4

64.6 Depression worsening

1936 523 vs

8 flat

up up

down

168.8 188.3

Depression not worsening.

1940 449 vs

82 up

flat up

down

126.4 137.8

US not at war.

1944 432 vs

99 down up

flat up

145.7 147.9

US at war.

1948 303 vs

189 down flat

up down

180

178.4 Dewey expected to win

1964 486 vs

52 up

up flat

down

829.4 876.9

US not at war.

1976 297 vs

240 flat down

up up

999.43 943.07

Economic Stagnation.

1996 379 vs

159 flat up

up up

5681

6206 Bull Market

2008 365 vs

173 flat

down down

down

11734 8943

Depression worsening

2012 332 vs

206 up

up

down down

13208 12933

Economic Stagnation.

---------------------------------------------------------

5 up 6 up

6 up 3 up

6 up

2 down 2 down 3 down 7

down 5 down

===================================================================================

8-9-2016 See

Hotline here.

===================================================================================

8-8-2016 Our Peerless Buys (Buy

B3, Buy B19,

Buy B20 and

Buy-B1

still stand. Though the

DJI slipped back a

little, there were

more up than down and the

Hourly DISI/OBV

trend is still rising, too.

The

DIA's Closing Power's

trend is no longer up, but this indicator

is decidedly pointing higher for the

OEX,

SPY,

QQQ,

IWM,

TECL,

SOXL,

IBB and

FAS. Also making recovery

highs today were

the

foreign ETFs,

Brazil,

emerging markets and

YINN.

I doubt if a turn downwards now by the

DJI or the Utilities will stop

the general movement higher. There are

enough periods when

the DJ-15 falls while the DJI-30 rises ,

so that I think we should not

place too much emphasis on it. See

Utilities

since 1988 study.

Generally speaking, Wall Street is

probably pleased that Trump

is dropping in the recent polls. I also

continue to believe that the

FED will not raise rates until November,

after the Presidential

Election.

Charts: Peerless

DJIA Hourly DJIA

DIA

NetIDOSC for DJI-30

SPY

QQQ

IWM

DJI-Utilities REITS

A/D Line-6000 Stocks

SOXL

TECL

IBB

FAS

Crude Oil

Major Indexes and A/D

Lines.

Key Tiger Software ETF

Charts

Bullish

MAXCPs

Bearish MINCPs

Charts of Key ETFs

The Peerless Buys and Sells have worked

well for most of the

last year. "It's important to do

nothing if nothing needs to be done"

(JFK, the conservative.)

Tiger Index of

Stocks Peerless Signals' Gain

since Oct 28, 2015

(Buying and Selling Short

at opening the day after

a reversing Peerless signal)

DJI-30

50.9%

OEX-100

51.1%

QQQ-100

48.2%

SP-500

44.3%

RUSS-1000

46.7%

BIG BANKS

91.0%

BIOTECHS

106.2%

COMMODITIES

only +12.5%

FOREIGN ETFS

136.6%

GOLD

only 15.1%

NIFTY-35

54.7%

OIL STOCKS

only 14.0%

FAS

+117%

IBB

+63.4%

SOXL

+195.8%

TECL

+143.3%

TNA

+190.8%

Tiger says to sell SOXL. Peerless does not say to

sell it yet.

42.6 is its 5-year high. See second weekly chart

below. We

should get back there on this advance.

Weekly Resistance on SOXL

=======================================================================