Earlier Hotlines

previous

hotline

www.tigersoft.com/H77LION/INDEX.htm

www.tigersoft.com/H7TBR/INDEX.htm

www.tigersoft.com/HH9911/INDEX.htm

http://www.tigersoft.com/HH9911/olderINDEX.htm

http://www.tigersoft.com/HHH517/INDEX.htm

www.tigersoft.com/HHH517/XXXIndex.htm

www.tigersoft.com/HHH517/INDEX6917.htm

www.tigersoft.com/HHH517/OLDER.html

www.tigersoft.com/HH747/INDEX.html

www.tigersoft.com/HHLL217/INDEX.html

PREINDEX.html

www.tigersoftware.com/HL/INDEX.html

Hotlines: 2/4/2017 - 2/15/2017

These have somehow become corrupted. Some graphs

may be missing.

http://www.tigersoft.com/345HLN12/ZINDEX.html

http://www.tigersoft.com/333HLLL/INDEX.html

http://www.tigersoft.com/444HL444/INDEX.html

www.tigersoft.com/119HLPAZ/INDEX.html

http://www.tigersoft.com/888HLAZ/INDEX.html

www.tigersoft.com/821-HL/INDEX.html

http://www.tigersoft.com/816-HLN/INDEX.html

http://www.tigersoft.com/77HL7778/INDEX.html

http://www.tigersoft.com/64HRL/INDEX.html

http://www.tigersoft.com/55HL55/INDEX.html

HELP

A

Guide To Profitably Using The Tiger Nightly HOTLINE

Introduction

to Tiger/Peerless Buys and Sells.

Peerless

Buy and Sell Signals: 1928-2016

Individual Peerless signals explained:

http://tigersoftware.com/PeerlessStudies/Signals-Res/index.htm

http://www.tigersoft.com/PeerInst-2012-2013/

Explanation of each Peerless signal.

http://www.tigersoft.com/PeerInst-2012-2013/

Different

Types of TigerSoft/Peerless CHARTS, Signals and Indicators

-----> More HELP LINKS

Documentation

for TigerSoft Automatic and Optimized Signals.

How

reliable support is the DJI's rising 200-day ma?

SPY

Charts since 1994: Advisory Closing Power S7s, Accum. Index, 65-dma,

Optimized Signals.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

1/19/2016 --->

Corrections,Deeper Declines and Bear Markets since 1945.

1/21/2016

--->

High Velocity Declines since 1929

2/12/2016 --->

Presidential Elections Years and Bullish IP21 Positive Non-Confirmations at

Lower Band.

2/12/2016 --->

OBV NNCs

on DJI's Rally to 2.7% Upper Band when DJI's 65-dma is falling.

11/6/2016 --->

Killer Short Selling Techniques:

===>

Order Here

($42.50)

It's As Easy as

1,2,3

TigerSoft "Combination" Short-Selling...

Easy as 1-2-3 Short Sales

Earlier

Q-Answers

QuickSilver

Documentation (1/11/2016)

Our Different Signals

Better

understand the difference between Peerless DJI-based signals,

the one-year optimized red Signals

and the fixed signals based

on technical developments.

Introduction to

Tiger/Peerless Buys and Sells.

Different

Types of TigerSoft/Peerless CHARTS, Signals and Indicators

New

TigerPeerless

Installation and Basic Uses' Instruction

(11/25/2016)

See

the re-written materials on TigerSoft Buys and Sells.

A few more pages will be added. But users could

print this

main Installation and Uses' Page for reference.

Study-

Trading SPY WITHOUT Peerless - Some Guidelines.

When completed this will be

a new Tiger Trading E-Book.

Study-

Examples of "Hands above the Head" top patterns.

Study-

9/3/2017

TigerSoft (not

Peerless) charts of Major Tops as they occurred.

-------------------------------------------------------------------------------------------------------------

Watch the Bubble here:

Bitcoin -

https://finance.yahoo.com/quote/BTC-USD?p=BTC-USD

18,123.80

-847.39

(-4.4667%)

===> Please report any broken

or out-of-date links.

william_schmidt@hotmail.com

==============================================================================

==============================================================================

12/18/2017

25000 - Here

we come. The September

Buy B21 still operates.

The

DJI easily jumped to another new

high today. Its advance was more than matched by

SPY,

the NASDAQ,

QQQ and TECL.

Powered by TXN's new highs,

semi-conductors have bullishly turned

back up after

testing their 65-dma. The week before Christmas is usually bullish.

Since 1965,

the DJI has

rallied 69% of the time over the next 5 trading days and has gained on

average

1% over the

next ten days and 1.9% over the next month. DIA's IP21 is negative and

it is the

Public and foreign money which is now pushing up the DJI. But the DJI

is on a

mission.

It wants to reach 25,000 by Christmas and make big, splashy headlines to

induce

still more

buying. Today there was a big jump in the number of stocks above their

65-day ma.

The

percentage rose from 54% to 59%. The advance is lifting more and more

boats.

.

A buying stampede is

under way. Among stocks, the strongest

Bullish MAXCPs are the leaders,

but we are

getting trading bounces in the stocks showing new

red Stochastic Buys that

have rising

65-dma. And today, more buy outs were announced. See the list at

this site:

http://www.mergerjournal.com/2016/12/19/mergers-acquisitions-and-buyouts-announced-on-December-19-2016/

(I want to start posting some of these charts each night. See further

below.)

Crescendo or

Take-Off? Stay Tuned.

It has taken a

long time for the

markets to build up to this point in time. The Republican wager

on the

rich and Wall

Street is under way. If 1926 is the best guide, then we may see a

tradable

top

in February. But if the

market follows the scenarios posed by the the tax cuts of 1964 and 1986,

then we are not

likely to see a top in April. This second scenario is interesting

because that

is that is

most frequent outcome after a September B21. In any case, enjoy the

rally

and "don't

try to call a top ahead of Peerless" has to be my counsel.

BUY-OUT NEWS TODAY

Charts 12/18/2017

PEERLESS

DJI, Signals, Indicators Daily DJI

Volume 10-DayUp/Down Vol

DJI-AROC

Hourly DJIA

A/D Line for All Stocks

NASDAQ

S&P

OEX

NYSE

COMPQX

DJI-15 DJI-20

DJI-30

DIA

SPY

QQQ MDY

IWM TNA

CrudeOil

FAS

GLD

BBH

IBB

JETS

JNUG

KOL

NUGT

OIH

OIL

RSX

RETL

SDS

SLV

SOXL

TECL

TMF

TNA UGA

(gasoline)

XIV YINN

Commodities:

JJC, NIB,

CHOC

CORN,

WEAT

UUP

(Dollar)

AAPL ADBE

ALXN AMAT

AMGN AMD

AMZN

BA BABA BAC

BIDU

CAT

CVX

FB

GOOG

GS

HD

IBM

JPM M

(Macy's)

MSFT

NFLX

NVDA

QCOM

TSLA TXN

XOM WMT

ANDV (refinery),

CMG (Chipotle),

LRCX, SWKS,

TOWN New -

SPPI

(small Biotech)

12/18/2017

Bullish MAXCPs Bearish

MINCPs

Red Stoch.-Buys Today

|

|

Table 1

QuickSilver

Documentation

This is for short-term trading

leveraged ETFs.

It also provides a useful short-term outlook of these sectors ETF's

and the sectors they represewnt

Blue is Bullish

and

Red is Bearish.

1 Candle-Stick color is shortest-term. This

changes when close vis-a-vis opening changes.

So, in stocks or ETFs that advanced a long ways, traders should sell

when a higher

opening gives way to a decline that brings a drop below the previous

day's close.

2 5-dma AROC and Close-versus- pivot point is next

most short-term.

W = warning. Close is below PIVOT-Point.

3 Closing Power trend-direction vs. its 21-dma is next

most short-term.

4 IP21 is used to spot divergences and to estimate

underlying support.

5 > IP21 falling and below +.15 and its 21-dma is bearish in

an over-extended ETF, especially

when its Closing Power is falling and is below its 21-dma.

> IP21 below 07 with AROC below .07 is less likely to bring a rally

back up from 21-dma.

6 Note price trend-lines, support/resistance and price

patterns on charts.

QUICKSILVER on ETFS - 12/18/17

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS

---------------------------------------------------------------------------------------------

---------------------------------------------------------------------------------------------

DIA 247.79 1.54 245.44 73.7% ---- RED -.036 ----

---------------------------------------------------------------------------------------------

COMPQX 6994.76 58.18 6862.32 87.0% ---- BLUE .063 -.028

---------------------------------------------------------------------------------------------

SPY 268.2 1.69 266.78 35.5% Bullish BLUE .029 -.035

---------------------------------------------------------------------------------------------

QQQ 158.64 .99 155.69 87.7% ---- BLUE .061 -.015

---------------------------------------------------------------------------------------------

MDY 346.03 3.56 343.22 27.9% Bearish BLUE -.138 -.042

---------------------------------------------------------------------------------------------

IWM 154.3 2.06 150.88 97.5% Bearish BLUE -.079 -.061

---------------------------------------------------------------------------------------------

FAS 69.79 1.43 69.39 151.6% Bearish BLUE -.057 .101

---------------------------------------------------------------------------------------------

RETL 36.87 2.78 33.53 251.7% Bullish BLUE .224 .189

---------------------------------------------------------------------------------------------

SOXL 146.81 9.27 132 400.8% Bearish BLUE -.052 .124

---------------------------------------------------------------------------------------------

TECL 119.1 2.99 112.44 286.2% ---- BLUE .099 .186

---------------------------------------------------------------------------------------------

IBB 106.36 -.24 105.76 6.1% Bearish RED .03 -.152

---------------------------------------------------------------------------------------------

GLD 119.73 .55 118.15 72.5% ---- BLUE .016 -.1

---------------------------------------------------------------------------------------------

OIL 6.12 -.02 6.12 -89.8% Bearish ---- .079 .116

---------------------------------------------------------------------------------------------

OIH 24.33 -.09 W25.24 -177% ---- BLUE -.053 -.132

---------------------------------------------------------------------------------------------

GASL 20.96 1.14 W22.02 -381.7% Bearish BLUE -.228 -.157

---------------------------------------------------------------------------------------------

UGA 30.11 .24 W30.6 -165% Bearish BLUE .007 -.003

---------------------------------------------------------------------------------------------

UUP 24.37 -.06 W24.48 -14.3% ---- BLUE .042 -.089

---------------------------------------------------------------------------------------------

IEF 105.88 -.24 105.75 1.9% Bullish RED .147 -.091

---------------------------------------------------------------------------------------------

CORN 16.58 .01 W16.65 -36% ---- ---- -.087 -.137

---------------------------------------------------------------------------------------------

WEAT 5.9 .01 5.81 42.6% Bearish ---- -.134 -.185

---------------------------------------------------------------------------------------------

YINN 32.2 .47 31.26 1.6% ---- BLUE .045 -.103

---------------------------------------------------------------------------------------------

RSX 21.09 -.84 W21.92 -209.1% Bearish ---- -.092 -.136

---------------------------------------------------------------------------------------------

AAPL 176.42 2.45 171.7 108.7% Bullish BLUE .108 .047

---------------------------------------------------------------------------------------------

GOOG 1077.14 12.95 1040.48 172.1% Bullish BLUE .038 .011

---------------------------------------------------------------------------------------------

MSFT 86.38 -.47 85.58 67.2% Bullish RED .059 .048

---------------------------------------------------------------------------------------------

AMZN 1190.58 11.44 1165.08 92.5% Bearish BLUE .029 .114

---------------------------------------------------------------------------------------------

FB 180.82 .64 176.96 49.8% Bearish RED -.054 -.039

---------------------------------------------------------------------------------------------

NVDA 197.9 6.34 190.84 85.3% Bearish BLUE -.048 .003

---------------------------------------------------------------------------------------------

BA 296.14 2.2 289.94 223.4% Bullish BLUE -.014 .056

---------------------------------------------------------------------------------------------

GS 260.02 2.85 257.68 193.8% ---- ---- -.114 -.032

|

Table 2 COMPARISONS

OF BULLISH AND BEARISH GROUPS

12/16 12/15 12/14 12/13 12/12 12/11

12/8 12/7 12/6 12/5

12/4 12/1 11/30 11/29 11/28

11/27 11/24 11/21 11/20 11/17

NEWHIGHS

553 309

103

268 223 234 288 159 91 107 340 197 536 500 582

209 439 615

363 244

NEWLOWS 43 49 56 25 52

41 37 50 65 53 37 16 31 57 265 59 31 62 50 229

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

MAXCPs

133

122 53

123

83 84 90 90

50

42

92 105 266 262 320

101 166

406 339 295

MINCPs

76

65 142 67 99 75 93 73

141

135 152 93 80 110 93

94 42 63 52 40

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

TTTNHs

146 118

75 110 72 73 76 75 46

44

72 53 139

161 143 79 110 196 172 169

TTTNLs

90 98 192

99 161 155 177 109 219 248

402 286 162 230 124 144

66 186 184 79

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

FASTUP

166 126 123 175

101

108 96 80

79

95

180 126

128 130 141 143 205 245 189 158

FASTDOWN

96 125

109 91 132 134 169

195 233 248 210 156 123 97 74 64 58 72 100 136

|

Table 3Count of Stocks and New Highs in Key Tiger Directories

Date = 171218

No NHs Pct.

-------------------------------------------------------------------

BIGBANKS 7 4 57 %

DJI-13 13 6 46 %

BIGMIL 6 2 33 %

DOWJONES 30 10 33 %

INDEXES 195 61 31 %

TRANSP 20 6 30 %

MORNSTAR 238 66 28 %

INFRA 11 3 27 %

SP-100 96 24 25 %

FINANCE 92 19 21 %

ETFS 65 13 20 %

NASD-100 105 20 19 %

RETAIL 53 10 19 %

MILITARY 38 7 18 %

NIFTY 30 5 17 %

COMPUTER 23 4 17 %

GREEN 31 5 16 %

SP500 486 78 16 %

==================================================================

RUS-1000 838 118 14 %

HOMEBLDG 17 2 12 %

SOFTWARE 66 8 12 %

CHEM 64 7 11 %

REIT 178 19 11 %

JETS 9 1 11 %

INDMATER 92 9 10 %

BEVERAGE 20 2 10 %

INSURANC 32 3 9 %

HACKERS 25 2 8 %

GAMING 28 2 7 %

REGBANKS 33 2 6 %

ELECTRON 179 11 6 %

SEMI 131 8 6 %

AUTO 39 2 5 %

SOLAR 21 1 5 %

BIOTECH 386 15 4 %

OILGAS 142 2 1 %

COMODITY 71 1 1 %

======================================================

None: CHINA COAL GOLD EDU UTILITY

PIPELINE FOOD BONDFUND HOSPITAL

|

|

Table 4

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

12/18/17

Bullish = 35

Bearish = 9

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

DJI-13 100% 1 1 1 1 1

INFRA 1 .818 .818 .909 .909 1

JETS 1 .888 .888 .888 .888 .888

TRANSP 1 .9 .8 .9 .9 .9

DOWJONES .933 .9 .9 .866 .833 .9

BIGBANKS .857 .857 .857 1 1 1

MORNSTAR .852 .806 .731 .794 .81 .81

FINANCE .847 .76 .684 .695 .717 .684

BIGMIL .833 .833 .833 .833 .833 .833

SP-100 .822 .802 .791 .822 .812 .843

N=10

-------------------------------------------------------------------------------------------

RETAIL .792 .754 .716 .735 .754 .773

REGBANKS .787 .696 .515 .696 .696 .636

NIFTY .766 .7 .7 .733 .733 .666

SP500 .761 .728 .693 .738 .744 .753

RUS-1000 .743 .696 .659 .71 .718 .72

MILITARY .736 .71 .657 .71 .71 .684

EDU .714 .571 .428 .714 .714 .714

GAMING .714 .678 .678 .678 .75 .714

HOMEBLDG .705 .647 .647 .705 .705 .705

BEVERAGE .7 .65 .65 .6 .6 .55

INDEXES .697 .646 .676 .707 .687 .671

HACKERS .68 .68 .68 .6 .6 .64

NASD-100 .676 .647 .657 .657 .647 .609

REIT .662 .617 .528 .539 .528 .483

SOFTWARE .651 .59 .575 .606 .59 .59

GREEN .645 .548 .516 .612 .645 .58

AUTO .641 .538 .435 .512 .564 .564

ETFS .63 .446 .523 .584 .523 .6

COMPUTER .608 .608 .521 .565 .565 .565

ELECTRON .608 .536 .458 .502 .502 .519

CHEM .593 .5 .406 .5 .484 .5

INSURANC .593 .625 .5 .593 .656 .625

INDMATER .586 .565 .456 .5 .532 .521

SEMI .58 .465 .389 .427 .412 .442

SOLAR .523 .476 .476 .476 .428 .523

=============================================================================================

COAL .5 .375 .375 .375 .375 .375

HOSPITAL .5 .5 .375 .5 .5 .375

=============================================================================================

OILGAS .471 .38 .394 .45 .507 .5

UTILITY .465 .581 .534 .581 .604 .697

CHINA .453 .406 .453 .546 .39 .484

BIOTECH .406 .409 .391 .432 .386 .401

COMODITY .394 .352 .323 .323 .352 .352

GOLD .204 .183 .142 .142 .122 .04

BONDFUND .153 .171 .243 .216 .162 .27

PIPELINE .142 .142 0 0 0 0

FOOD .133 .133 .133 .133 .133 .066

N=9

|

| |

==============================================================================

==============================================================================

12/15/2017 The September

Buy B21 still operates. The

DJI is soaring into all-time

high territory where sell-orders cannot easily be bunched or placed

confidently.

The upwards momentum in the DJI is accelerating. See the blue

exponential

uptrend in the DJI chart below. The slope for this is Y = mx<>2.

Its steepness

is as high as the software currently allows. Besides this, the

NASDAQ's AI/200

score remains at a record high, 200 and QQQ burst into all-time high

territory.

There are many very bullish technical signs. The DJI's optimized lower band

around the

21-dma is at a record minimum, -1.5%. Short-term, the search for

optimized,

new Stochastic Buys produced lots more tonight than was seen at any time

this

past week. Apparently, a new market charge upwards is beginning.

We have to like the way the DJI has completely disregarded the often weak

seasonality

of the first two weeks of December. Hedge fund Bears have a big

problem now. They

must cover or lose clients when they write their year-end reports. All

this is occurring

at exactly the same time when other fund managers are engaging in aggressive

window-

dressing by buying leading DJI-30 stocks AND many corporations, flush with

more

and more cash, shop around for smaller companies that they can buy out.

(Regarding

Buyouts, see the discussion of FOXA and LNCE below.)

BUBBLE

BUBBLE

The only problem I can see now is the Bitcoin's

vertical advance. This is a bubble,

if ever there was one. It is backed by nothing but emotion and greed.

It will surely

end badly. Now that it is about to be traded in Chicago, shorts may

slow it down.

If it crashes badly, the spill-over could adversely affect normal financial

markets.

Watch its daily prices on Yahoo. It cannot escape Government controls

and

taxation. The Libertarians who think that they have found a way to do

this are

only fooling themselves and others. Wall Street and CBOE insiders will

know when

regulatory stresses will be placed on Bitcoin. I expect that we will

see a head/shoulder

top when it is ready to decline significantly.

https://finance.yahoo.com/quote/BTCUSD%3DX?p=BTCUSD%3DX

Puts and Calls on Bitcoins?

Current price chart:

https://www.worldcoinindex.com/coin/bitcoin

Is this the

equivalent of the 16th century tulip mania? Or 1929

stock market

Or Silver in 1980. Unregulated markets often yield hyperbolic rises

and then waterfall-declines.

Read

Extraordinary Popular Delusions and the Madness of Crowds (1841),

South Sea Bubble

and the

Mississippi Company. The Chicago Mercantile

Exchange (CME)

has announced it

plans to launch Bitcoin futures in the fourth-quarter of 2017.

http://www.cmegroup.com/education/cme-bitcoin-futures-frequently-asked-questions.html

https://www.cnbc.com/2017/12/08/with-bitcoin-futures-set-to-trade-heres-how-its-going-to-work.html

DIS Buyout of FOXA

Terms of this cautious buyout would seem to leave room for a possible

bidding war

and more FOXA stock appreciation. "In the fullness of time", this will

become

known. What is clear right now is that there were big buyers coming

into FOXA

in October, if we judge from the blue Accumulation on its price weakness

back then

followed by a big increase in volume. See how false looking the final

drop to 25

looked from our vantage point. This should be a technical pattern that

we can

profitably look for in other stocks, especially now that the general

regulatory and

financial climate for Buyouts and Mergers would seem to becoming favorable.

See

https://www.nytimes.com/2017/12/14/business/dealbook/disney-fox-deal.html

Flat Top Breakouts, High Accumulation and

Volume Surges

The second technical pattern often occurring just before a buy-out is

announced

is a flat-top breakout with excellent internals. See LNCE below.

In this case

the "secret talks" became public knowledge.

https://finance.yahoo.com/news/campbell-soup-advanced-talks-buy-220029970.html

In the regulatory and financial environment we are in it should pay folks to

consult

a site like

https://www.benzinga.com/news/rumors

and run their ideas through our

software to see if the patterns shown here are appearing.

Charts 12/15/2017

PEERLESS

DJI, Signals, Indicators Daily DJI

Volume 10-DayUp/Down Vol

DJI-AROC

Hourly DJIA

A/D Line for All Stocks

NASDAQ

S&P

OEX

NYSE

COMPQX

DJI-15 DJI-20

DJI-30

DIA

SPY

QQQ MDY

IWM TNA

CrudeOil

FAS

GLD

BBH

IBB

JETS

JNUG

KOL

NUGT

OIH

OIL

RSX

RETL

SDS

SLV

SOXL

TECL

TMF

TNA UGA

(gasoline)

XIV YINN

Commodities:

JJC, NIB,

CHOC

CORN,

WEAT

UUP

(Dollar)

AAPL ADBE

ALXN AMAT

AMGN AMD

AMZN

BA BABA BAC

BIDU

CAT

CVX

FB

GOOG

GS

HD

IBM

JPM M

(Macy's)

MSFT

NFLX

NVDA

QCOM

TSLA TXN

XOM WMT

ANDV (refinery),

CMG (Chipotle),

LRCX, SWKS,

TOWN New -

SPPI

(small Biotech)

12/15/2017

Bullish MAXCPs Bearish

MINCPs

Red Stoch.-Buys Today

Table 1

QuickSilver

Documentation

This is for short-term trading

leveraged ETFs.

It also provides a useful short-term outlook of these sectors ETF's

and the sectors they represewnt

Blue is Bullish

and

Red is Bearish.

1 Candle-Stick color is shortest-term. This

changes when close vis-a-vis opening changes.

So, in stocks or ETFs that advanced a long ways, traders should sell

when a higher

opening gives way to a decline that brings a drop below the previous

day's close.

2 5-dma AROC and Close-versus- pivot point is next

most short-term.

W = warning. Close is below PIVOT-Point.

3 Closing Power trend-direction vs. its 21-dma is next

most short-term.

4 IP21 is used to spot divergences and to estimate

underlying support.

5 > IP21 falling and below +.15 and its 21-dma is bearish in

an over-extended ETF, especially

when its Closing Power is falling and is below its 21-dma.

> IP21 below 07 with AROC below .07 is less likely to bring a rally

back up from 21-dma.

6 Note price trend-lines, support/resistance and price

patterns on charts.

QUICKSILVER on ETFS - 12/15/17ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS

---------------------------------------------------------------------------------------------

---------------------------------------------------------------------------------------------

DIA 246.25 .68 244.17 53.7% Bullish ---- -.006 ----

---------------------------------------------------------------------------------------------

COMPQX 6936.58 80.05 6875.08 70.3% ---- BLUE .073 -.028

---------------------------------------------------------------------------------------------

SPY 266.51 .85 266.31 18.8% Bullish BLUE .061 -.035

---------------------------------------------------------------------------------------------

QQQ 157.65 1.77 155.9 94.8% Bullish BLUE .064 -.013

---------------------------------------------------------------------------------------------

MDY 342.47 2.09 W344.12 -27.4% Bearish BLUE -.129 -.047

---------------------------------------------------------------------------------------------

IWM 152.24 2.14 151.35 27.5% Bearish BLUE -.072 -.069

---------------------------------------------------------------------------------------------

FAS 68.36 1.74 67.73 31% Bearish BLUE -.075 .082

---------------------------------------------------------------------------------------------

RETL 34.09 1.58 W35.16 -195.7% Bullish BLUE .218 .076

---------------------------------------------------------------------------------------------

SOXL 137.54 5.86 136.08 142.4% Bearish BLUE -.104 .07

---------------------------------------------------------------------------------------------

TECL 116.11 3.92 112.62 275.5% ---- BLUE .086 .169

---------------------------------------------------------------------------------------------

IBB 106.6 1.43 106.23 25% Bearish BLUE .1 -.143

---------------------------------------------------------------------------------------------

GLD 119.18 .25 118.01 29.5% Bearish RED .02 -.093

---------------------------------------------------------------------------------------------

OIL 6.14 .04 W6.23 0% Bearish ---- .068 .081

---------------------------------------------------------------------------------------------

OIH 24.42 -.08 W25.21 -68.2% Bearish RED -.097 -.137

---------------------------------------------------------------------------------------------

GASL 19.82 -1.06 W22.59 -398.7% Bearish RED -.224 -.249

---------------------------------------------------------------------------------------------

UGA 29.87 -.32 W31.11 -176.9% Bearish RED -.001 -.045

---------------------------------------------------------------------------------------------

UUP 24.43 .1 W24.44 -2% Bearish BLUE -.007 -.081

---------------------------------------------------------------------------------------------

IEF 106.12 -.02 105.84 9.9% Bullish BLUE .137 -.083

---------------------------------------------------------------------------------------------

CORN 16.57 -.1 W16.7 -80.8% Bearish RED -.101 -.128

---------------------------------------------------------------------------------------------

WEAT 5.89 -.01 5.85 -25.6% Bearish ---- -.125 -.174

---------------------------------------------------------------------------------------------

YINN 31.73 -.57 W32.19 43.6% ---- BLUE .05 -.144

---------------------------------------------------------------------------------------------

RSX 21.93 -.08 W22.01 82.1% Bearish RED -.067 -.101

---------------------------------------------------------------------------------------------

AAPL 173.97 1.75 172.67 134% Bullish BLUE .093 .038

---------------------------------------------------------------------------------------------

GOOG 1064.19 15.04 1041.1 130.3% Bullish BLUE .014 .015

---------------------------------------------------------------------------------------------

MSFT 86.85 2.16 85.23 158.2% Bullish BLUE .095 .061

---------------------------------------------------------------------------------------------

AMZN 1179.14 4.88 1168.92 73.4% Bearish RED .036 .12

---------------------------------------------------------------------------------------------

FB 180.18 1.79 179.04 33.1% Bearish BLUE -.046 -.03

---------------------------------------------------------------------------------------------

NVDA 191.56 5.09 W194.66 1.8% Bearish BLUE -.111 -.022

---------------------------------------------------------------------------------------------

BA 293.94 .06 283.16 139.1% Bullish RED -.045 .054

---------------------------------------------------------------------------------------------

GS 257.17 1.69 250.13 134.3% ---- BLUE -.101 -.037

Table 2 COMPARISONS

OF BULLISH AND BEARISH GROUPS

12/15

12/14 12/13 12/12 12/11 12/8 12/7 12/6

12/5 12/4 12/1 11/30 11/29

11/28 11/27 11/24 11/21 11/20 11/17

11/16

NEWHIGHS 309

103

268 223 234 288 159 91 107 340 197 536 500 582 209

439 615 363 244 273

NEWLOWS 49 56 25 52

41 37 50 65 53 37 16 31 57 265 59 31 62 50 229 150

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

MAXCPs

122 53

123

83 84 90 90

50

42

92 105 266 262 320

101 166

406 339 295 321

MINCPs

65 142 67 99 75 93 73

141

135 152 93 80 110 93

94 42 63 52 40

74

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

TTTNHs 118

75 110 72 73 76 75 46

44

72 53 139

161 143 79 110 196 172 169

154

TTTNLs

98 192

99 161 155 177 109 219 248

402 286 162 230 124 144

66 186 184 79 78

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

FASTUP

126 123 175

101

108 96 80

79

95

180 126

128 130 141 143 205 245 189 158

148

FASTDOWN

125

109 91 132 134 169

195 233 248 210 156 123 97 74 64 58 72 100 136

177

|

Table 3Count of Stocks and New Highs in Key Tiger Directories

Date = 171215

No. NHs Pct

-------------------------------------------------------------------

BIGMIL 6 5 83 %

DOWJONES 30 8 27 %

DJI-13 13 3 23 %

MILITARY 38 8 21 %

SP-100 96 19 20 %

INFRA 11 2 18 %

INDEXES 195 33 17 %

TRANSP 20 3 15 %

BEVERAGE 20 3 15 %

-------------------------------------------------------------------

SOFTWARE 66 9 14 %

EDU 7 1 14 %

NIFTY 30 4 13 %

NASD-100 105 13 12 %

GAMING 28 3 11 %

MORNSTAR 238 27 11 %

JETS 9 1 11 %

SP500 486 43 9 %

RUS-1000 838 72 9 %

COMPUTER 23 2 9 %

RETAIL 53 5 9 %

INSURANC 32 2 6 %

REIT 178 11 6 %

ETFS 65 3 5 %

ELECTRON 179 7 4 %

HACKERS 25 1 4 %

OILGAS 142 5 4 %

GREEN 31 1 3 %

REGBANKS 33 1 3 %

FINANCE 92 3 3 %

INDMATER 92 3 3 %

SEMI 131 4 3 %

BIOTECH 386 13 3 %

COMODITY 71 2 3 %

CHEM 64 1 2 %

UTILITY 43 1 2 %

BONDFUND 111 2 2 %

----------------------------------------------------

None BIGBANKS AUTO HOMEBLDG CHINA SOLAR COAL

GOLD PIPELINE FOOD HOSPITAL

|

|

Table 4 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

12/15/17

Bullish = 32

Bearish = 12

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

DJI-13 1 1 1 1 1 1

DOWJONES .9 .9 .866 .833 .866 .866

TRANSP .9 .8 .9 .9 .9 .9

JETS .888 .888 .888 .888 .888 .888

BIGBANKS .857 .857 1 1 1 1

BIGMIL .833 .833 .833 .833 .833 .833

INFRA .818 .818 .909 .909 1 1

MORNSTAR .806 .731 .794 .81 .81 .781

SP-100 .802 .791 .822 .812 .833 .812

----------------------------------------------------------------------------------------------

FINANCE .76 .684 .695 .717 .684 .739

RETAIL .754 .716 .735 .754 .773 .773

SP500 .728 .693 .738 .744 .755 .746

MILITARY .71 .657 .71 .71 .684 .71

NIFTY .7 .7 .733 .733 .7 .666

REGBANKS .696 .515 .696 .696 .636 .696

RUS-1000 .696 .659 .71 .718 .721 .714

HACKERS .68 .68 .6 .6 .64 .64

GAMING .678 .678 .678 .75 .75 .607

BEVERAGE .65 .65 .6 .6 .55 .6

HOMEBLDG .647 .647 .705 .705 .705 .764

NASD-100 .647 .657 .657 .647 .628 .609

INDEXES .646 .676 .707 .687 .671 .651

INSURANC .625 .5 .593 .656 .625 .625

REIT .617 .528 .539 .528 .477 .477

COMPUTER .608 .521 .565 .565 .565 .565

SOFTWARE .59 .575 .606 .59 .606 .636

UTILITY .581 .534 .581 .604 .697 .674

EDU .571 .428 .714 .714 .714 .714

INDMATER .565 .456 .5 .532 .51 .456

AUTO .55 .45 .525 .575 .575 .575

GREEN .548 .516 .612 .645 .612 .612

ELECTRON .536 .458 .502 .502 .536 .502

==============================================================================================

CHEM .5 .406 .5 .484 .484 .468

HOSPITAL .5 .375 .5 .5 .375 .375

==============================================================================================

SOLAR .476 .476 .476 .428 .523 .523

SEMI .465 .389 .427 .412 .458 .412

ETFS .446 .523 .584 .523 .6 .523

BIOTECH .409 .391 .432 .386 .404 .435

CHINA .406 .453 .546 .39 .484 .359

OILGAS .38 .394 .45 .507 .507 .429

COAL .375 .375 .375 .375 .375 .5

COMODITY .352 .323 .323 .352 .352 .352

GOLD .183 .142 .142 .122 .04 .02

BONDFUND .171 .243 .216 .162 .27 .288

PIPELINE .142 0 0 0 0 0

FOOD .133 .133 .133 .133 .066 .133

N=12

|

|

==============================================================================

==============================================================================

12/14/2017 The September

Buy B21 still operates. But some minor

profit-taking cannot

be ruled out. Down Volume was disproportionately heavy today. It

outweighed

Up Volume by 460 million shares. DIA's IP21 has even turned negative.

Clearly there is some profit-taking going on now that the DJI is approaching

its

3% upper band. We see this especially in the MDY (midcaps),

IWM

(Russell-2000),

OIH and GASL, which now show across-the-board red and bearish

Quicksilver

readings. See Table 2.

I admit that it can't be a positive that SOXL is having a hard time

recovering from

its 65-dma. But Texas Instruments made a

new high today AND Boeing

does not seem

to even mind that American Airlines ordered $25 billion in jets from Airbus.

(Chump

change to Boeing.)

But don't worry yet. In the middle of next week, the market typically

starts rising

from the bullish Santa Claus effect. Secondly, the new wave of

big-time

mergers may now be starting. Today, for $50+ billion, Disney bought

the lion's

share of 20th Century Fox.

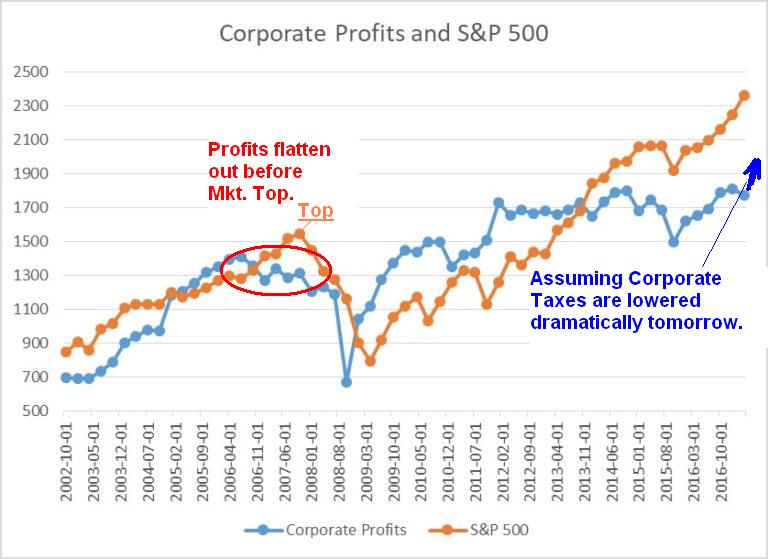

What's more, the cutting of the corporate tax rate and reducing the amount of

income tax

the very rich pay IS extraordinarily bullish for the stock market and the

economy, too,

at least for a while. True, much of this may have already been built

into stock prices.

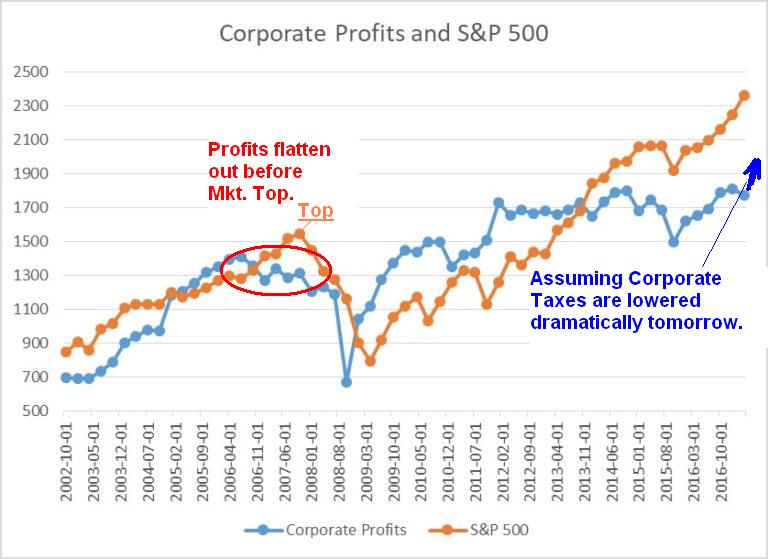

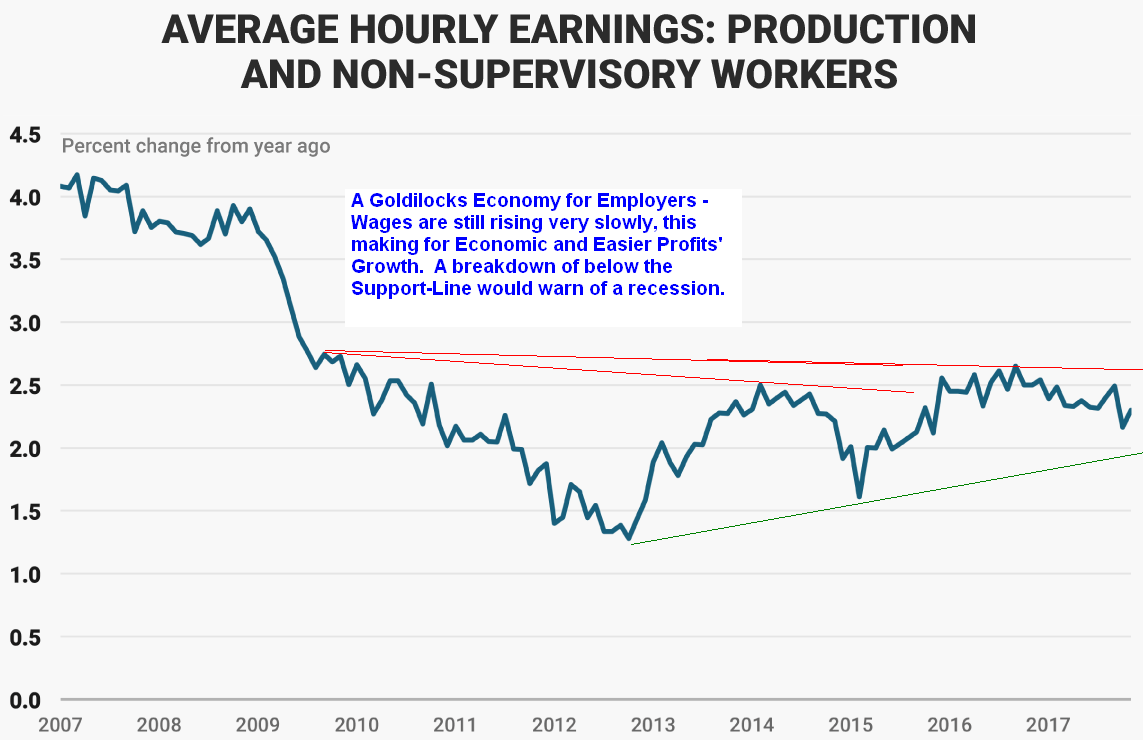

But the Big Picture, shown in Tables 5-7 below shows that Corporate Profits

are already very strong, that the monthly Job Creation numbers are well

above

the 200,000 level that is bullish for the market and that workers' wages are

moving

up very slowly. So, "inflation" is tame. Bullishly,

Gold is going

nowhere and the

FED is actually moving very slowly to raise rates. This is still a

'Goldilocks Economy'.

And now it's about to get a super-stimulus in the form of a big tax cut for

precisely those

who buy 95% of all stocks. The market can still go much higher.

Why sell now?

At least, wait for Peerless to give some sort of Sell.

|

Charts 12/14/2017

PEERLESS

DJI, Signals, Indicators Daily DJI

Volume 10-DayUp/Down Vol

DJI-AROC

Hourly DJIA

A/D Line for All Stocks

NASDAQ

S&P

OEX

NYSE

COMPQX

DJI-15 DJI-20

DJI-30

DIA

SPY

QQQ MDY

IWM TNA

CrudeOil

FAS

GLD

BBH

IBB

JETS

JNUG

KOL

NUGT

OIH

OIL

RSX

RETL

SDS

SLV

SOXL

TECL

TMF

TNA UGA

(gasoline)

XIV YINN

Commodities:

JJC, NIB,

CHOC

CORN,

WEAT

UUP

(Dollar)

AAPL ADBE

ALXN AMAT

AMGN AMD

AMZN

BA BABA BAC

BIDU

CAT

CVX

FB

GOOG

GS

HD

IBM

JPM M

(Macy's)

MSFT

NFLX

NVDA

QCOM

TSLA TXN

XOM WMT

ANDV (refinery),

CMG (Chipotle),

LRCX, SWKS,

TOWN New -

SPPI

(small Biotech)

12/14/2017

Bullish MAXCPs Bearish

MINCPs

Red Stoch.-Buys Today

Table 1

QuickSilver

Documentation

This is for short-term trading

leveraged ETFs.

It also provides a useful short-term outlook of these sectors ETF's

and the sectors they represewnt

Blue is Bullish

and

Red is Bearish.

1 Candle-Stick color is shortest-term. This

changes when close vis-a-vis opening changes.

So, in stocks or ETFs that advanced a long ways, traders should sell

when a higher

opening gives way to a decline that brings a drop below the previous

day's close.

2 5-dma AROC and Close-versus- pivot point is next

most short-term.

W = warning. Close is below PIVOT-Point.

3 Closing Power trend-direction vs. its 21-dma is next

most short-term.

4 IP21 is used to spot divergences and to estimate

underlying support.

5 > IP21 falling and below +.15 and its 21-dma is bearish in

an over-extended ETF, especially

when its Closing Power is falling and is below its 21-dma.

> IP21 below 07 with AROC below .07 is less likely to bring a rally

back up from 21-dma.

6 Note price trend-lines, support/resistance and price

patterns on charts.

QUICKSILVER on ETFS - 12/14/17

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS

---------------------------------------------------------------------------------------------

---------------------------------------------------------------------------------------------

DIA 245.57 -.73 243.62 65.7% Bullish RED -.018 ----

---------------------------------------------------------------------------------------------

COMPQX 6856.53 -19.27 6840.08 31.9% Bearish RED .031 -.035

---------------------------------------------------------------------------------------------

SPY 265.66 -1.09 265.51 29.9% ---- RED .034 -.035

---------------------------------------------------------------------------------------------

QQQ 155.88 -.11 154.7 59.9% Bearish RED .02 -.017

---------------------------------------------------------------------------------------------

MDY 340.38 -2.88 W344.35 -39.1% Bearish RED -.117 -.053

---------------------------------------------------------------------------------------------

IWM 150.1 -1.68 W151.41 -38.7% Bearish RED -.079 -.083

---------------------------------------------------------------------------------------------

FAS 66.62 -.88 W67.94 -22.8% Bearish RED -.071 .081

---------------------------------------------------------------------------------------------

RETL 32.51 -2.06 W35.43 -238.6% ---- RED .218 .045

---------------------------------------------------------------------------------------------

SOXL 131.68 -.3 W133.75 -155.7% Bearish RED -.122 .02

---------------------------------------------------------------------------------------------

TECL 112.19 -.49 109.94 173.6% Bearish RED .035 .158

---------------------------------------------------------------------------------------------

IBB 105.17 -1.55 W106.07 52.9% Bearish RED .082 -.158

---------------------------------------------------------------------------------------------

GLD 118.93 -.24 118.48 18.6% ---- RED .006 -.103

---------------------------------------------------------------------------------------------

OIL 6.1 .07 W6.14 57.3% Bearish BLUE .039 .098

---------------------------------------------------------------------------------------------

OIH 24.5 -.39 W24.76 4% Bearish RED -.038 -.13

---------------------------------------------------------------------------------------------

GASL 20.88 -.56 W21.55 18.5% Bearish RED -.141 -.188

---------------------------------------------------------------------------------------------

UGA 30.19 .41 W30.95 -71.9% Bearish BLUE .025 -.01

---------------------------------------------------------------------------------------------

UUP 24.33 .02 W24.44 -14.3% Bearish ---- -.03 -.083

---------------------------------------------------------------------------------------------

IEF 106.14 -.04 105.91 7.1% Bullish BLUE .144 -.087

---------------------------------------------------------------------------------------------

CORN 16.67 -.01 W16.84 -41.8% ---- ---- -.01 -.121

---------------------------------------------------------------------------------------------

WEAT 5.9 .03 W5.92 -59.5% Bearish ---- -.122 -.176

---------------------------------------------------------------------------------------------

YINN 32.3 -.92 31.45 371.7% Bearish RED .01 -.083

---------------------------------------------------------------------------------------------

RSX 22.01 -.09 21.57 114.6% Bearish ---- -.103 -.097

---------------------------------------------------------------------------------------------

AAPL 172.22 -.05 169.37 84.8% Bullish RED .025 .037

---------------------------------------------------------------------------------------------

GOOG 1049.15 8.54 1037.05 87.8% Bullish BLUE -.047 .018

---------------------------------------------------------------------------------------------

MSFT 84.69 -.66 84.16 130.1% Bearish RED -.003 .049

---------------------------------------------------------------------------------------------

AMZN 1174.26 10.13 1162 62.2% Bearish BLUE .008 .132

---------------------------------------------------------------------------------------------

FB 178.39 .09 W179 -49% ---- BLUE -.092 -.025

---------------------------------------------------------------------------------------------

NVDA 186.47 .29 W191.49 -144.5% Bearish BLUE -.153 -.054

---------------------------------------------------------------------------------------------

BA 293.88 2.04 285.9 207.8% Bullish BLUE .017 .064

---------------------------------------------------------------------------------------------

GS 255.48 -.08 250.35 137.1% Bullish RED -.086 -.021

Table 2 COMPARISONS

OF BULLISH AND BEARISH GROUPS

12/14 12/13 12/12 12/11 12/8 12/7 12/6

12/5 12/4 12/1 11/30 11/29

11/28 11/27 11/24 11/21 11/20 11/17

11/16

NEWHIGHS

103

268 223 234 288 159 91 107 340 197 536 500 582 209

439 615 363 244 273

NEWLOWS

56 25 52

41 37 50 65 53 37 16 31 57 265 59 31 62 50 229 150

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

MAXCPs

53

123

83 84 90 90

50

42

92 105 266 262 320

101 166

406 339 295 321

MINCPs

142 67 99 75 93 73

141

135 152 93 80 110 93

94 42 63 52 40

74

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

TTTNHs

75 110 72 73 76 75 46

44

72 53 139

161 143 79 110 196 172 169

154

TTTNLs

192

99 161 155 177 109 219 248

402 286 162 230 124 144

66 186 184 79 78

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

FASTUP

123 175

101

108 96 80

79

95

180 126

128 130 141 143 205 245 189 158

148

FASTDOWN

109 91 132 134 169

195 233 248 210 156 123 97 74 64 58 72 100 136

177

|

Table 3Count of Stocks and New Highs in Key Tiger Directories

Date = 171214

No. NHs Pct.

-------------------------------------------------------------------

BIGMIL 6 1 17 %

===================================================================

JETS 9 1 11 %

DJI-13 13 1 8 %

DOWJONES 30 2 7 %

GAMING 28 2 7 %

NASD-100 105 5 5 %

UTILITY 43 2 5 %

BEVERAGE 20 1 5 %

SP-100 96 4 4 %

HACKERS 25 1 4 %

COMPUTER 23 1 4 %

REIT 178 7 4 %

RETAIL 53 2 4 %

GREEN 31 1 3 %

MILITARY 38 1 3 %

ETFS 65 2 3 %

MORNSTAR 238 7 3 %

SOFTWARE 66 2 3 %

COMODITY 71 2 3 %

CHEM 64 1 2 %

FINANCE 92 2 2 %

INDEXES 195 3 2 %

ELECTRON 179 4 2 %

SEMI 131 3 2 %

OILGAS 142 3 2 %

SP500 486 8 2 %

RUS-1000 838 18 2 %

CHINA 64 1 2 %

BONDFUND 111 2 2 %

INDMATER 92 1 1 %

BIOTECH 386 5 1 %

====================================================

None: BIGBANKS BIGBANKS AUTO HOMEBLDG NIFTY

INFRA INSURANC TRANSP SOLAR COAL GOLD EDU

PIPELINE FOOD HOSPITAL

|

|

Table 4 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

12/14/17

Bullish = 28

Bearish = 17

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

DJI-13 100% 1 1 1 1 1

DOWJONES .9 .866 .833 .866 .9 .833

JETS .888 .888 .888 .888 .888 .888

BIGBANKS .857 1 1 1 1 1

BIGMIL .833 .833 .833 .833 .833 .833

INFRA .818 .909 .909 1 1 1

TRANSP .8 .9 .9 .9 .9 .9

N=7

----------------------------------------------------------------------------------------------

SP-100 .791 .822 .812 .833 .822 .76

MORNSTAR .731 .794 .81 .81 .781 .764

RETAIL .716 .735 .754 .773 .754 .754

NIFTY .7 .733 .733 .7 .666 .666

SP500 .693 .738 .744 .755 .748 .718

FINANCE .684 .695 .717 .684 .75 .739

HACKERS .68 .6 .6 .64 .64 .64

GAMING .678 .678 .75 .75 .607 .535

INDEXES .676 .707 .687 .671 .651 .666

RUS-1000 .659 .71 .718 .721 .715 .694

MILITARY .657 .71 .71 .684 .71 .736

NASD-100 .657 .657 .647 .628 .609 .59

BEVERAGE .65 .6 .6 .55 .6 .65

HOMEBLDG .647 .705 .705 .705 .764 .764

SOFTWARE .575 .606 .59 .606 .636 .606

UTILITY .534 .581 .604 .697 .674 .674

REIT .528 .539 .528 .477 .483 .438

ETFS .523 .584 .523 .6 .507 .4

COMPUTER .521 .565 .565 .565 .565 .565

GREEN .516 .612 .645 .612 .612 .58

REGBANKS .515 .696 .696 .636 .727 .757

N=21

--------------------------------------------------------------------------------------------

INSURANC .5 .593 .656 .625 .625 .656

--------------------------------------------------------------------------------------------

SOLAR .476 .476 .428 .523 .523 .476

ELECTRON .458 .502 .502 .536 .508 .53

INDMATER .456 .5 .532 .51 .456 .478

CHINA .453 .546 .39 .484 .359 .343

AUTO .435 .512 .564 .564 .564 .589

EDU .428 .714 .714 .714 .714 .714

CHEM .406 .5 .484 .484 .468 .546

OILGAS .394 .45 .507 .507 .429 .422

BIOTECH .391 .432 .386 .404 .432 .378

SEMI .389 .427 .412 .458 .419 .442

COAL .375 .375 .375 .375 .5 .5

HOSPITAL .375 .5 .5 .375 .375 .375

COMODITY .323 .323 .352 .352 .352 .352

BONDFUND .243 .216 .162 .27 .288 .405

GOLD .142 .142 .122 .04 .02 0

FOOD .133 .133 .133 .066 .133 .133

PIPELINE 0 0 0 0 0 0

N= 17

|

|

|

Table

5-7 The Bigger Picture:

Much Higher Corporate Profits are very Bullish.

Small or Flat Wages - Bullish.

200,000 New Jobs/month - Bullish

|

Monthly Change

in Non-Farm Jobs. Red shows

a decline. Bright red shows a

decline of more than 200(,000).

A bright blue

shows a rise of

more than

200(,000). |

| Year |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

| 2007 |

240 |

89 |

190 |

80 |

143 |

75 |

-34 |

-20 |

88 |

84 |

114 |

98 |

| 2008 |

17 |

-84 |

-78 |

-210 |

-186 |

-162 |

-213 |

-267 |

-450 |

-474 |

-766 |

-694 |

| 2009 |

-793 |

-702 |

-823 |

-687 |

-349 |

-471 |

-329 |

-213 |

-220 |

-204 |

-2 |

-275 |

| 2010 |

23 |

-68 |

164 |

243 |

524 |

-137 |

-68 |

-36 |

-52 |

262 |

119 |

87 |

| 2011 |

43 |

189 |

225 |

346 |

77 |

225 |

69 |

110 |

248 |

209 |

141 |

209 |

| 2012 |

358 |

237 |

233 |

78 |

115 |

76 |

143 |

177 |

203 |

146 |

132 |

244 |

| 2013 |

211 |

286 |

130 |

197 |

226 |

162 |

122 |

261 |

190 |

212 |

258 |

47 |

| 2014 |

190 |

151 |

272 |

329 |

246 |

304 |

202 |

230 |

280 |

227 |

312 |

255 |

| 2015 |

234 |

238 |

86 |

262 |

344 |

206 |

254 |

157 |

100 |

321 |

272 |

239 |

| 2016 |

126 |

237 |

225 |

153 |

43 |

297 |

291 |

176 |

249 |

124 |

164 |

155 |

| 2017 |

216 |

232 |

50 |

207 |

145 |

210 |

138 |

208 |

38 |

244(P) |

228(P) |

|

| P : preliminary |

|

|

==========================================================================

==========================================================================

12/13/2017 The September

Buy B21 still operates. The DJI has about reached the

top of its price

bands. The NYSE A/D Line is lagging slightly, but our primary internal

strength indicators,

P-I and IP21 are sufficiently positive to prevent a Peerless Sell.

Accordingly, we must

believe the message of its chart, namely that there has been a

channel-breakouts and

a rally to 25500-25750 must now be called for. As mentioned here, the

large majority

of the rallies that follow such a strong market continue to rise for three

or four more months

into the new year. That remains the most likely scenario now. Of

course, we have to be

selective, Table 1's most bullish ETFs remain those with across-the board

(blue) Quicksilver

ratings and those sectors that have the highest percentage of their stocks

making new

highs (Table 3) and are above their 65-dma. (Table 4).

Fidelity and MorningStar Sector Rankings

Because there is a fairly continuous short-term rotation among sectors, it

is advisable

for traders to watch the 21-day performance rankings of the Morningstar Star

and

Fidelity Funds. Those at the top are apt to go still higher until they

break their 21-dma

uptrend. A similar approach can be used for the leveraged ETF group,

except that

here I would watch the 5-day ranking and use closes below the 5-day

pivot-point

and rallies to extremes above the 5-day ma as times to take profits.

Most of the bullish

MAXCPs come from top performing sectors. Meanwhile, the top Tahiti

(longer term)

stock in the DJI-30, ranked by AI/200 score, is MSFT. Because December

is so bullish

generally and experiences very few big sell-offs, the stocks giving

red stochastic Buys

should prove to be profitable trading vehicles for the next two weeks.

Fidelity Select Fund - 21- Day Pct Change Ranking

11 / 13 / 2017 - 12 / 13 / 2017

Rank Symbol Name Price 21-day Pct Gain

--------- ----------------------------------- --------------

1 FSRFX Transportation 107.51 9%

2 FSLBX Brokerage/Invmt Mgmt 85.66 8%

3 FSTCX Telecommunications 68.83 8%

4 FSAIX Air Transportation 89.17 7%

5 FSRPX Retailing 135.28 7%

6 FIDSX Financial Serv. 116.53 6%

7 FSRBX Banking 35.95 6%

8 FSVLX Consumer Finance 16.2 6%

9 FSDCX Communications Equip. 36.37 5%

10 DIA DJI ETF 246.3 4%

------------------------------------------------------------

38 FSNGX Natural Gas 23.47 -4%

39 FSPTX Technology 179.55 -7%

40 FSUTX Utilities 81.7 -7%

41 FSESX Energy 41.93 -9%

42 FSELX Semiconductors 110.44 -13%

|

Mornstar Funds' 21-Day Performance Ranking

Rank Symbol Name Price Pct.Gain

--------- ----------------------------------- ---------- -----------

1 MG514 Drug Delivery 693.25 20%

2 MG747 Apparel Stores 2710.69 20%

3 MG758 Food Wholesale 1277.82 18%

4 MG738 Auto Parts Stores 2423.8 17%

5 MG322 Textile/Footwear/Acc. 2879.06 16%

6 MG741 Sporting Goods Stores 817.45 15%

7 MG742 Toy & Hobby Stores 145.44 15%

8 MG771 Major Airlines 358.26 15%

9 MG517 Diagnostic Substances 843.97 14%

10 MG735 Electronic Stores 1086.89 14%

------

229 MG135 Gold 272.69 -4%

230 MG744 Music & Video Stores 3482.27 -4%

231 MG830 -Electronics- 3427.03 -4%

232 MG316 Toys & Games 779.11 -5%

233 MG835 Semiconductor-Equipmen 8627.54 -5%

234 MG124 Oil & Gas Drilling & Expl. 770.22 -7%

235 MG833 Semiconductor-Specialized 20217.75 -7%

236 MG834 Semiconductor-Integrated Cir 937.57 -7%

237 MG832 Semiconductor-Memory Chips 3188.51 -8%

238 MG911 Foreign Utilities 354.18 -11%

-----------------------------------------------------------------------------------

|

NVDA (See chart further below) has

turned down sharply since it reported stellar

earnings. Its Closing Power is now making new one-year lows far ahead

of prices,

its Accum. Index is negative and we see S14 high volume dumping signals.

Technically,

we have to say, "Sell". Something is wrong with NVDA. We must

wait for Professionals

to turn bullish. But let's give more chance for SOXL to firm up at its

nearby support.

|

Links to Charts

Charts 12/13/2017

PEERLESS

DJI, Signals, Indicators Daily DJI

Volume 10-DayUp/Down Vol

DJI-AROC

Hourly DJIA

A/D Line for All Stocks

NASDAQ

S&P

OEX

NYSE

COMPQX

DJI-15 DJI-20

DJI-30

DIA

SPY

QQQ MDY

IWM TNA

CrudeOil

FAS

GLD

BBH

IBB

JETS

JNUG

KOL

NUGT

OIH

OIL

RSX

RETL

SDS

SLV

SOXL

TECL

TMF

TNA UGA

(gasoline)

XIV YINN

Commodities:

JJC, NIB,

CHOC

CORN,

WEAT

UUP

(Dollar)

AAPL ADBE

ALXN AMAT

AMGN AMD

AMZN

BA BABA BAC

BIDU

CAT

CVX

FB

GOOG

GS

HD

IBM

JPM M

(Macy's)

MSFT

NFLX

NVDA

QCOM

TSLA TXN

XOM WMT

ANDV (refinery),

CMG (Chipotle),

LRCX, SWKS,

TOWN New -

SPPI

(small Biotech)

12/13/2017

Bullish MAXCPs Bearish

MINCPs

Red Stoch.-Buys Today |

Table 1

QuickSilver

Documentation

This is for short-term trading

leveraged ETFs.

It also provides a useful short-term outlook of these sectors ETF's

and the sectors they represewnt

Blue is Bullish

and

Red is Bearish.

1 Candle-Stick color is shortest-term. This

changes when close vis-a-vis opening changes.

So, in stocks or ETFs that advanced a long ways, traders should sell

when a higher

opening gives way to a decline that brings a drop below the previous

day's close.

2 5-dma AROC and Close-versus- pivot point is next

most short-term.

W = warning. Close is below PIVOT-Point.

3 Closing Power trend-direction vs. its 21-dma is next

most short-term.

4 IP21 is used to spot divergences and to estimate

underlying support.

5 > IP21 falling and below +.15 and its 21-dma is bearish in

an over-extended ETF, especially

when its Closing Power is falling and is below its 21-dma.

> IP21 below 07 with AROC below .07 is less likely to bring a rally

back up from 21-dma.

6 Note price trend-lines, support/resistance and price

patterns on charts.

QUICKSILVER on ETFS - 12/13/17

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS

---------------------------------------------------------------------------------------------

---------------------------------------------------------------------------------------------

DIA 246.3 .86 242.36 96.1% Bullish BLUE .064 ---

---------------------------------------------------------------------------------------------

COMPQX 6875.8 13.48 6812.84 72.7% Bearish RED .102 -.036

---------------------------------------------------------------------------------------------

SPY 266.75 -.03 264.07 66.2% Bullish RED .12 -.034

---------------------------------------------------------------------------------------------

QQQ 155.99 .3 154.02 80.4% Bearish RED .066 -.019

---------------------------------------------------------------------------------------------

MDY 343.26 .04 343.07 35.1% ---- RED -.059 -.049

---------------------------------------------------------------------------------------------

IWM 151.78 .9 151.27 51.6% Bearish BLUE -.031 -.079

---------------------------------------------------------------------------------------------

FAS 67.5 -1.89 66.93 96.1% ---- RED -.018 .086

---------------------------------------------------------------------------------------------

RETL 34.57 1.04 34.16 158.7% Bullish BLUE .231 .087

---------------------------------------------------------------------------------------------

SOXL 131.98 -.02 W135.85 -.4% Bearish RED -.101 .026

---------------------------------------------------------------------------------------------

TECL 112.68 .24 108.33 286.5% Bearish RED .082 .155

---------------------------------------------------------------------------------------------

IBB 106.72 .96 104.05 197.3% ---- BLUE .084 -.141

---------------------------------------------------------------------------------------------

GLD 119.17 1.02 118.49 -37.9% ---- BLUE .034 -.102

---------------------------------------------------------------------------------------------

OIL 6.03 -.09 6.03 73.9% Bearish RED -.059 .064

---------------------------------------------------------------------------------------------

OIH 24.89 -.35 24.48 100.7% Bearish RED -.044 -.121

---------------------------------------------------------------------------------------------

GASL 21.44 -.58 20.8 197.6% Bearish RED -.194 -.178

---------------------------------------------------------------------------------------------

UGA 29.78 -.82 W30.63 -47.3% Bearish RED -.013 -.018

---------------------------------------------------------------------------------------------

UUP 24.31 -.17 W24.4 -8.2% Bearish RED -.065 -.089

---------------------------------------------------------------------------------------------

IEF 106.18 .43 105.99 0% Bullish BLUE .142 -.091

---------------------------------------------------------------------------------------------

CORN 16.68 .03 W16.81 -44.7% Bearish BLUE -.054 -.128

---------------------------------------------------------------------------------------------

WEAT 5.87 .06 W5.97 -118.4% Bearish ---- -.12 -.192

---------------------------------------------------------------------------------------------

YINN 33.22 1.96 29.95 505% Bearish BLUE .025 -.05

---------------------------------------------------------------------------------------------

RSX 22.1 .18 21.51 133.6% Bearish BLUE -.134 -.095

---------------------------------------------------------------------------------------------

AAPL 172.27 .57 169.32 95.6% ---- RED -.005 .026

---------------------------------------------------------------------------------------------

GOOG 1040.61 .13 1030.93 107.5% Bullish RED -.007 -.002

---------------------------------------------------------------------------------------------

MSFT 85.35 -.23 82.49 152.9% Bullish RED .064 .061

---------------------------------------------------------------------------------------------

AMZN 1164.13 -.95 1159.79 50.7% Bearish RED .021 .128

---------------------------------------------------------------------------------------------

FB 178.3 1.34 W180.14 62.8% ---- BLUE -.075 -.04

---------------------------------------------------------------------------------------------

NVDA 186.18 -4.66 W191.99 -80.4% Bearish RED -.116 -.051

---------------------------------------------------------------------------------------------

BA 291.84 1.9 281.97 239% Bullish BLUE .055 .054

---------------------------------------------------------------------------------------------

GS 255.56 -2.12 248.56 191.8% Bullish RED -.062 -.031

|

|

|

Table 2 COMPARISONS

OF BULLISH AND BEARISH GROUPS

12/13 12/12 12/11 12/8 12/7 12/6

12/5 12/4 12/1 11/30 11/29

11/28 11/27 11/24 11/21 11/20 11/17

11/16

NEWHIGHS

268 223 234 288 159 91 107 340 197 536 500 582 209

439 615 363 244 273

NEWLOWS 25 52

41 37 50 65 53 37 16 31 57 265 59 31 62 50 229 150

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

MAXCPs

123

83 84 90 90

50

42

92 105 266 262 320

101 166

406 339 295 321

MINCPs

67 99 75 93 73

141

135 152 93 80 110 93

94 42 63 52 40

74

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

TTTNHs

110 72 73 76 75 46

44

72 53 139

161 143 79 110 196 172 169

154

TTTNLs

99 161 155 177 109 219 248

402 286 162 230 124 144

66 186 184 79 78

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

FASTUP

175

101

108 96 80

79

95

180 126

128 130 141 143 205 245 189 158

148

FASTDOWN

91 132 134 169

195 233 248 210 156 123 97 74 64 58 72 100 136

177

|

Table 3

Count of Stocks and New Highs in Key Tiger Directories

Date = 171213

No. NHs Pct.

-------------------------------------------------------------------

BIGMIL 6 3 50 %

DJI-13 13 4 31 %

DOWJONES 30 7 23 %

TRANSP 20 4 20 %

INFRA 11 2 18 %

HACKERS 25 4 16 %

--------------------------------------------------------------------

ETFS 65 8 12 %

SP-100 96 11 11 %

GAMING 28 3 11 %

INDMATER 92 10 11 %

INDEXES 195 21 11 %

MORNSTAR 238 27 11 %

COMPUTER 23 2 9 %

CHEM 64 5 8 %

MILITARY 38 3 8 %

SOFTWARE 66 5 8 %

FOOD 15 1 7 %

SP500 486 29 6 %

NASD-100 105 6 6 %

RUS-1000 839 46 5 %

UTILITY 43 2 5 %

BEVERAGE 20 1 5 %

RETAIL 53 2 4 %

COMODITY 71 3 4 %

GREEN 31 1 3 %

AUTO 40 1 3 %

FINANCE 92 3 3 %

OILGAS 143 5 3 %

BIOTECH 386 13 3 %

INSURANC 32 1 3 %

REIT 178 5 3 %

ELECTRON 179 1 1 %

BONDFUND 111 1 1 %

--------------------------------------------------

None BIGBANKS REGBANKS HOMEBLDG NIFTY SEMI

CHINA SOLAR COAL GOLD EDU PIPELINE JETS

|

|

Table 4

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

12/13/17

Bullish = 33

Bearish = 10

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BIGBANKS 100% 1 1 1 1 1

DJI-13 100% 1 1 1 1 1

INFRA .909 .909 1 1 1 .909

TRANSP .9 .9 .9 .9 .9 .85

JETS .888 .888 .888 .888 .888 .888

DOWJONES .866 .833 .866 .9 .833 .9

BIGMIL .833 .833 .833 .833 .833 .666

SP-100 .822 .812 .833 .822 .76 .77

--------------------------------------------------------------------------------------------

MORNSTAR .794 .81 .81 .781 .773 .714

SP500 .738 .744 .755 .748 .722 .705

RETAIL .735 .754 .773 .754 .754 .773

NIFTY .733 .733 .7 .666 .666 .633

EDU .714 .714 .714 .714 .714 .714

MILITARY .71 .71 .684 .71 .736 .631

RUS-1000 .709 .717 .721 .715 .697 .675

INDEXES .707 .687 .671 .651 .666 .646

HOMEBLDG .705 .705 .705 .764 .764 .764

REGBANKS .696 .696 .636 .727 .787 .757

FINANCE .695 .717 .684 .75 .75 .728

GAMING .678 .75 .75 .607 .535 .571

NASD-100 .657 .647 .628 .609 .59 .561

GREEN .612 .645 .612 .612 .58 .483

SOFTWARE .606 .59 .606 .636 .606 .606

BEVERAGE .6 .6 .55 .6 .65 .65

HACKERS .6 .6 .64 .64 .64 .64

INSURANC .593 .656 .625 .625 .656 .687

ETFS .584 .523 .6 .507 .4 .246

UTILITY .581 .604 .697 .674 .674 .697

COMPUTER .565 .565 .565 .565 .565 .521

CHINA .546 .39 .484 .359 .343 .375

REIT .539 .528 .477 .483 .443 .387

AUTO .525 .575 .575 .575 .6 .575

ELECTRON .502 .502 .536 .508 .53 .48

N=25

---------------------------------------------------------------------------------------------

CHEM .5 .484 .484 .468 .562 .515

HOSPITAL .5 .5 .375 .375 .375 .375

INDMATER .5 .532 .51 .456 .478 .456

---------------------------------------------------------------------------------------------

SOLAR .476 .428 .523 .523 .476 .333

OILGAS .447 .503 .503 .426 .44 .419

BIOTECH .432 .386 .404 .432 .378 .357

SEMI .427 .412 .458 .419 .442 .389

COAL .375 .375 .375 .5 .5 .5

COMODITY .323 .352 .352 .352 .352 .338

BONDFUND .216 .162 .27 .288 .378 .396

GOLD .142 .122 .04 .02 0 .02

FOOD .133 .133 .066 .133 .133 .133

PIPELINE 0 0 0 0 0 0

N=10

|

---------------------------------------------------------------------------------------------------------------

---------------------------------------------------------------------------------------------------------------

12/12/2017 The September

Buy B21 still operates. Despite the NASDAQ's decline

and the fact that there were 260 more down than up on the NYSE, the DJI

moved up 118 today. All but 20 points in the DJI's gain was made by

possible

by big jumps up in its two highest priced DJI stocks, Goldman Sachs (+7.55)

and

Boeing (+6.78). (The divisor is .145. So the 14.33 gain in these two

stocks

boosted the DJI by 98.8 points.)

Are the DJI's highest priced stocks doing too much

of the heavy listing?

Not yet. Look at the strong uptrends of

the A/D Line and the Tiger Index

of the SP-500. This is still a broad advance. I expect it to

widen more

as the new year starts.

I have observed that RCA's position in early 1929 could be a model for

what may still happen with Boeing. By February 1929 when RCA split 5:1

and

became a $100 stock again, it had risen almost 100% from where it had been

in October 1928. Boeing is now the stock that almost every fund

manager

wants to show in its end-of-the-year holdings. What will it be when it

splits?

Secondly, the break-out above the

top of its 1600-point wide price channel

at 24000

posits a new minimum price target now of 25600. So, one day's weakness

in the breadth is probably not enough to stop the DJI now, especially in

this typically

bullish month of December. Peerless has been built to call major tops.

For

a major top to occur in December we need to see much weaker P-I and IP21

scores. (They were negative in 2007 before that year's prescient December S9

of that year. They are very positive now.)

At the least, we need to see the NYSE A/D Line break its uptrend as it did

in

1968 and then show immediate weakness for the rest of the month. The

Fed will

raise rates tomorrow. But they will not raise them so sharply as to hurt the

Retailer's

in this their most important month. Yellen will pass along to her successor

the big

challenge of how and when the stock market 'bubble' is to be safely cooled

off.

Thirdly, in the Table below, we see the DJI's strength, such as we now see

in mid-

December, was almost always a harbinger of still more gains next year,

so long

as the P-I and IP21 remain amply positive and the DJI does not even dip far

enough

back for the next two weeks to get a Buy B13 (Santa Claus buy).

DJI Past Closings between +2.0% and +3.0% Upper Band

from Dec 12th through Dec 16th,

Cases all had

Positive P-I and V-I

1965-2017

Next Decline to Tag Lower 3% Band.

1 19701216

819.07 ---> Rose to 950.82 on 4/28/1971.

2 19711214

855.14 ---> Rose to 968.92 on

4/18/1971

3 19761213

974.24 ---> Rose

only to 999.69 on

12/30/1976.

4 19791214

842.75 ---> Rose to 903.84 on 2/23/1980. There was a Santa

Claus B13.

5 19851212

1511.24 ---> Rose to 1821.72 on 3/27/1985.

6 19891212

2752.13 ----> Rose only to 2810.15 on 1/2/1990. There was a

Santa Claus B13.

7 19901212

2622.28 ---> Rose only to 2633.66 on 12/21/1991

There was a Santa Claus B13.

8 19951212

5174.92 ---> Rose to 5686.6 on 3/18/1996. There was a Santa

Claus B13.

9 20031212

10042.16 --->Rose to 10732.29 on 2/11/2004

10 20101214

11476.54 --->Rose to 12391.25 on 2/18/2011 There was a Santa

Claus B13.

11 20121212

13245.45 --->Rose to 15387.58 on 5/21/2013 There was a Santa

Claus B13.

12 20161214

19792.53 ---> Still rising without tagging

lower 3% band. |

Links to Charts

Charts 12/12/2017

PEERLESS

DJI, Signals, Indicators Daily DJI

Volume 10-DayUp/Down Vol

DJI-AROC

Hourly DJIA

A/D Line for All Stocks

NASDAQ

S&P

OEX

NYSE

COMPQX

DJI-15 DJI-20

DJI-30

DIA

SPY

QQQ MDY

IWM TNA

CrudeOil

FAS

GLD

BBH

IBB

JETS

JNUG

KOL

NUGT

OIH

OIL

RSX

RETL

SDS

SLV

SOXL

TECL

TMF

TNA UGA

(gasoline)

XIV YINN

Commodities:

JJC, NIB,

CHOC

CORN,

WEAT

UUP

(Dollar)

AAPL ADBE

ALXN AMAT

AMGN AMD

AMZN

BA BABA BAC

BIDU

CAT

CVX

FB

GOOG

GS

HD

IBM

JPM M

(Macy's)

MSFT

NFLX

NVDA

QCOM

TSLA TXN

XOM WMT

ANDV (refinery),

CMG (Chipotle),

LRCX, SWKS,

TOWN New -

SPPI

(small Biotech)

12/12/2017

Bullish MAXCPs Bearish

MINCPs

Red Stoch.-Buys Today |

Table 1

QuickSilver

Documentation

This is for short-term trading

leveraged ETFs.

It also provides a useful short-term outlook of these sectors ETF's

and the sectors they represewnt

Blue is Bullish

and

Red is Bearish.

1 Candle-Stick color is shortest-term. This

changes when close vis-a-vis opening changes.

So, in stocks or ETFs that advanced a long ways, traders should sell

when a higher

opening gives way to a decline that brings a drop below the previous

day's close.

2 5-dma AROC and Close-versus- pivot point is next

most short-term.

W = warning. Close is below PIVOT-Point.

3 Closing Power trend-direction vs. its 21-dma is next

most short-term.

4 IP21 is used to spot divergences and to estimate

underlying support.

5 > IP21 falling and below +.15 and its 21-dma is bearish in

an over-extended ETF, especially

when its Closing Power is falling and is below its 21-dma.

> IP21 below 07 with AROC below .07 is less likely to bring a rally

back up from 21-dma.

6 Note price trend-lines, support/resistance and price

patterns on charts.

QUICKSILVER on ETFS - 12/12/17

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS

---------------------------------------------------------------------------------------------

DIA 245.44 1.27 241.62 70.6% Bullish BLUE .092 ----

---------------------------------------------------------------------------------------------

COMPQX 6862.32 -12.76 6776.38 73.5% ---- RED .163 -.037

---------------------------------------------------------------------------------------------

SPY 266.78 .47 263.24 67.9% Bullish BLUE .193 -.032

---------------------------------------------------------------------------------------------

QQQ 155.69 -.21 153.5 93.4% ---- RED .093 -.02

---------------------------------------------------------------------------------------------