+TigerSoft Hotline

(C) 2017 William Schmidt, Ph.D.

www.tigersoft.com

william_schmidt@hotmail.com

You are here:

www.tigersoft.com/345HLN12/INDEX.html

Previous Addresses

http://www.tigersoft.com/333HLLL/INDEX.html

http://www.tigersoft.com/444HL444/INDEX.html

www.tigersoft.com/119HLPAZ/INDEX.html

http://www.tigersoft.com/888HLAZ/INDEX.html

www.tigersoft.com/821-HL/INDEX.html

http://www.tigersoft.com/816-HLN/INDEX.html

http://www.tigersoft.com/77HL7778/INDEX.html

http://www.tigersoft.com/64HRL/INDEX.html

http://www.tigersoft.com/55HL55/INDEX.html

----->

Suggestion <-----

A number of your email accounts are putting emails from me

using

william_schmidt@hotmail into

the Junker folder. Please

"be-friend" an email from me so that you promptly get change

of address information regarding new Hotline links.

-----------------------------------------------------------------------------------------------------------------

HELP

A

Guide To Profitably Using The Tiger Nightly HOTLINE

Introduction

to Tiger/Peerless Buys and Sells.

Peerless

Buy and Sell Signals: 1928-2016

Individual Peerless signals explained:

http://tigersoftware.com/PeerlessStudies/Signals-Res/index.htm

http://www.tigersoft.com/PeerInst-2012-2013/

Explanation of each Peerless signal.

http://www.tigersoft.com/PeerInst-2012-2013/

Different

Types of TigerSoft/Peerless CHARTS, Signals and Indicators

Peerless Signals and DJI

Charts - version 7/4/2013

1965

1965-6 1966

1966-7

1967

1967-8

1968

1968-9

1969

1969-70 1970

1970-1

1971

1971-2 1972

1972-3

1973 1973-4

1974

1974-5 1975

1975-6

1976 1976-7

1977

1977-1978

1978

1978-79

1979

1979-80

1980

1980-1

1981

1981-2

1982

1982-1983

1983 1983-1984

1984 1984-1985

1985

1985-1986

1986

1986-1987

1987

1987-8

1988

1988-9 1989

1989-90

1990

1990-1 1991

1991-2

1992

1992-3

1993

1993-4

1994

1994-5

1995

1995-1996 1996

1996-7

1997

1997-8 1998

1998-1999

1999

1999-2000

2000

2000-1 2001

2001-2

2002

2002-3

2003

2003-4

2004

2004-5

2005 2005-6

2006

2006-7

2007

2007-8

2008

2008-9

2009

2009-10

2010

2010-11

2011

2011-12

2012 2012-2013

2013

2013-2014

2014

2014-2015

2015

2015-2016

Documentation for

TigerSoft Automatic and Optimized Signals.

How reliable

support is the DJI's rising 200-day ma?

SPY

Charts since 1994: Advisory Closing Power S7s, Accum. Index, 65-dma, Optimized

Signals.

Previous Hotlines -

www.tigersoft.com/55HL55/INDEX.html

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

1/19/2016

--->

Corrections,Deeper Declines and Bear Markets since 1945.

1/21/2016

--->

High Velocity Declines since 1929

2/12/2016 --->

Presidential Elections Years and Bullish IP21 Positive Non-Confirmations at

Lower Band.

2/12/2016 --->

OBV NNCs on

DJI's Rally to 2.7% Upper Band when DJI's 65-dma is falling.

11/6/2016 --->

Killer Short Selling Techniques:

===>

Order Here

($42.50)

It's As Easy as 1,2,3

TigerSoft "Combination" Short-Selling...

Easy as 1-2-3 Short Sales

Earlier

Q-Answers

QuickSilver Documentation

(1/11/2016)

Our Different Signals

Better

understand the difference between Peerless DJI-based signals,

the one-year optimized red Signals and

the fixed signals based

on technical developments.

Introduction to

Tiger/Peerless Buys and Sells.

Different Types of TigerSoft/Peerless CHARTS, Signals and Indicators

New

TigerPeerless Installation and Basic

Uses' Instruction

(11/25/2016)

See

the re-written materials on TigerSoft Buys and Sells.

A few more pages will be added. But users could print this

main Installation and Uses' Page for reference.

12-7-2016 The

Tiger Elite Page will have a revised Peerless later tonight.

It gives the new Peerless Buy B4, not to be confused with

the

revised Tiger Buy B4 for stocks and ETFs (buy at rising 65-dma)

and a revised Sell S7 (sell at

falling 65-dma.

Do not confuse TigerSoft Buys/Sells

with Peerless which are based on DJI and back-tested to 1928.

Examples: CP-Divergence B7/S7

Buy B4 at rising 65-dma

Sell S7 at falling 65-dma

=========================================================================================================

1-17-2017

>

Breadth Is Bullish but Professionals Remain Bearish.

> Respect

The Outcome of The Battle Going on between

Bulls and Bears in DJI-30.

>

Watch Goldman Sachs (GS) Tomorrow.

The DJI is moving farther and farther out to the end of

what will either be

a flat and narrow trading range

to propel itself higher on an upside breakout

or a high diving board

from which a steep sell-off will soon follow. A breakout

decisively above 20000 will bring a judged Peerless

Buy B10

. A breakdown

close below 19680 will bring a Peerless

Judged S10 . The DJI's

tight price range

that we are watching so closely started on December 13th. If it is not

resolved

by the end of this week, it will be more than 5-weeks old. Such longevity

is

usually bearish in these patterns.

High-Priced DJI Stocks Must Rally Tomorrow.

Their

importance is directly related to their price. No other stock is

nearly as important as GS, which declined much more than the others today.

DJI-13 One Day Performance

1 / 13 / 2017 - 1 / 17 / 2017

Rank Symbol Name Price Pct.Gain

--------- -------------------------------------------------------------------

1 MCD McDonalds Corp 122.75 1-2%

2 IBM Int Business Machines 167.89 0-1%

3 HD Home Depot Inc 135.93 0-1%

4 TRV The Travelers Companies Inc 117.46 0-1%

5 JNJ Johnson & Johnson 114.87 0-1%

6 AAPL Apple Inc 120 0-1%

7 MMM 3M Company 177.26 -1%

8 UNH UnitedHealth Group Inc. 160.66 -1%

9 BA Boeing Co 157.67 -1%

10 CVX Chevron Corp 116.28 -1%

11 DIS The Walt Disney Company 107.97 -1%

12 UTX United Technologies Corp 109.97 -1%

13 GS Goldman Sachs Group Inc 235.74 -4%

GS's Opening Tomorrow May Be The Key

Tomorrow morning before the opening Goldman Sachs is scheduled to announce its

earnings. How it behaves then will be very important, as Goldman Sachs

(GS) is by far the

most heavily weighted stock in the most watched index of the stock market,

the DJI-30.

Today GS sold off partly because of general nervousness about its earnings plus

the

new President-Elect's criticism of a strong Dollar because of how it hurts

exports

and US manufacturing and helps imports of non-US goods. Wall Street roots

for a

strong Dollar because they want the US to be the world's financial center.

They benefit

enormously if wealthy foreigners put their money in the US.

Today's 8+ point drop in GS sent nearly all banks and financials down. FAS

which closely rises and falls as the DJI does nearly broke its recent support.

As these have been the leaders, such a breakdown would remove the biggest

bullish sector propelling the market higher.

The Rising QQQ and NASDAQ

The QQQ and the NASDAQ are still in bullish uptrends. Their up-slope is a

modest

20% annualized. The years 2000 and 2007-2008 show that they can hold up

for a

month or two, if the DJI breaks down, but not much more than that.

To Tiger/Peerless Charts:

1/17/17:

PEERLESS

DJI, Signals, Indicators DJI-13

Hourly DJIA

S&P

OEX

NYSE

NASDAQ

COMPQX with Closing Power

DIA

QQQ SPY

IWM

Short-Term Rates

DJI-Utilities DJI-Transp

A/D Line-6000 Stocks

Crude Oil

FAS

GLD IBB

JETS JNUG

NUGT RSX

SLV SOXL

TECL YINN

AAPL, AMZN,

FB, GOOG,

GS MSFT

1/17/17:

Bullish MAXCP Stocks (1/13/2017)

1/17/2017 Bearish MINCP Stocks

|

|

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

1/17/17

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BIGBANKS 1oo% 1 1 1 1 1

EDU 1oo% 1 1 1 1 1

INFRA 1oo% 1 1 1 .909 .818

JETS 1oo% 1 1 1 1 .777

REGBANKS .972 1 1 1 1 1

HOMEBLDG .944 .944 .944 .888 .777 .722

GOLD .943 .679 .603 .603 .622 .603

MORNSTAR .911 .903 .899 .907 .907 .882

FINANCE .903 .913 .924 .913 .892 .881

PIPELINE .888 .888 .888 1 .777 1

UTILITY .866 .8 .822 .8 .666 .711

NIFTY .857 .885 .914 .914 .885 .885

AUTO .85 .875 .875 .925 .95 .925

TRANSP .85 .85 .85 .9 .85 .85

SP-100 .824 .793 .804 .804 .804 .814

INDMATER .808 .818 .808 .848 .818 .797

REIT .807 .755 .765 .75 .77 .807

COMODITY .802 .661 .704 .647 .619 .633

DOWJONES .8 .8 .8 .8 .8 .8

FOOD .8 .733 .8 .4 .6 .6

INDEXES .794 .777 .764 .768 .773 .777

INSURANC .789 .815 .842 .868 .868 .868

RUS-1000 .786 .778 .76 .766 .747 .745

NASD-100 .784 .774 .784 .774 .795 .763

SP500 .784 .756 .752 .748 .739 .75

SEMI .766 .8 .758 .791 .716 .7

ELECTRON .752 .778 .731 .747 .701 .69

ETFS .75 .794 .735 .72 .602 .558

SOFTWARE .734 .734 .718 .75 .671 .64

OILGAS .725 .712 .75 .756 .7 .737

CHEM .718 .732 .718 .774 .774 .746

HOSPITAL .714 .714 .714 .714 .428 .428

N=32

COMPUTER .64 .68 .6 .6 .64 .6

GAMING .633 .666 .6 .633 .566 .466

HACKERS .611 .611 .555 .722 .555 .444

MILITARY .6 .755 .666 .688 .688 .666

GREEN .548 .58 .516 .548 .548 .516

BONDFUND .531 .513 .432 .297 .261 .225

SOLAR .526 .526 .421 .526 .368 .315

BIOTECH .501 .599 .548 .552 .622 .603

RETAIL .444 .425 .425 .407 .5 .425

CHINA .4 .353 .261 .307 .292 .184

COAL .333 .555 .444 .555 .444 .444

BEVERAGE .3 .25 .25 .3 .3 .3

N=2

==========================================================================================================

1-13-2017

The current Peerless Buy B4 causes us to expect an

upside breakout by the DJI

above 20000 soon. Technology stocks in the QQQ and NASDAQ are

already pushing that

ETF into all-time high territory. This is certainly a bullish sign.

Speculative energies

are on the increase. True - the DJI''s Accumulation Index is negative.

This mostly shows

the steady selling on rallies to 20000. But more important, I think, the NYSE

A/D Line is now making

new highs ahead of the DJI. As long as the A/D Line stays in its uptrend,

we have no choice

but to remain bullish.

I would think that a DJI breakout above 20000 to accompany Trump's Inauguration

will be a perfect way to get more investors into the stock market. This is

what

Wall Street wants. I can't believe all the money fueling the rally has had

as its purpose

just bringing the DJI up only to the all-too-obvious resistance at 20000.

The stage,

I still think, has been now set up for much higher prices.

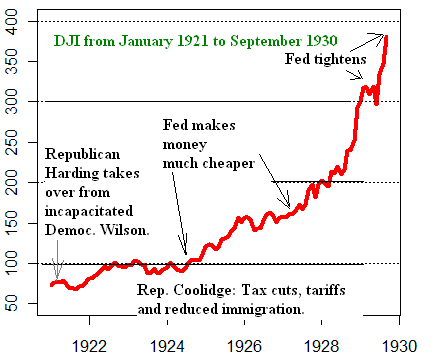

The 1928 - Breakout-Take-Off

I have given some examples of narrow trading ranges near the yearly highs

and

have suggested that for the DJI breakout to be valid and likely lead to a big

advance,

we need to see a decisive breakout before the present horizontal range lasts

more

than 5 or 6 weeks. This is also what the authors of the "bible" of

"Technical Analysis

of Stock Trends" set forth. (

https://www.amazon.com/Technical-Analysis-Trends-Robert-Edwards/dp/0814408648

)

I have added the argument that we should be watching our TigerSoft IPA

Indicator.

This is the cumulative (daily) Tiger Accumulation Index, If the IPA starts

to weaken,

while the DJI is locked in its trading range, there is usually trouble ahead.

The best

examples of this that I showed were early 1962 and early 1966. On the

other hand

if the IPA starts to rise, expect an upside breakout, such as occurred early in

1987.

There is another historical parallel I should mention. Look back to the

DJI's narrow

5-week trading formation in September and October 1928. See what followed

an

an upside breakout back then. The price patterns then and now seem quite

similar.

In mid September, the Dow Jones' Corporation's increased the number of DJI

component

stocks from 20 to 30 and included for the first time of the hottest stock of the

1920s,

high-priced RCA.

(

https://en.wikipedia.org/wiki/Historical_components_of_the_Dow_Jones_Industrial_Average

)

Even though, the market then was deemed highly speculative and over-priced

AND even

though the FED had raised rates several times in 1928, speculative market forces

propelled

the DJI much higher until early September 1929.

I am not suggesting the DJI is near a major top by showing the DJI chart of

1928. The current NYSE A/D Line is up-trending. At the top in 1929,

it had been

declining for months. RCA had been booming for years. Goldman Sachs

could

be in the early stages of a bull market.

.

.

QQQ is already running in all-time high territory ahead

of DJI. It rates

buying in here.

To Tiger/Peerless Charts:

1/13/17:

PEERLESS

DJI, Signals, Indicators DJI-13

Hourly DJIA

S&P

OEX

NYSE

NASDAQ

COMPQX with Closing Power

DIA

QQQ SPY

IWM

Short-Term Rates

DJI-Utilities DJI-Transp

A/D Line-6000 Stocks

Crude Oil

FAS

GLD IBB

JETS JNUG

NUGT RSX

SLV SOXL

TECL YINN

AAPL, AMZN,

FB, GOOG,

GS MSFT

Bullish MAXCP Stocks

Bearish MINCP Stocks.

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

1/13/17

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BIGBANKS 100% 1 1 1 1 1

EDU 100% 1 1 1 1 1

INFRA 100% 1 1 .909 .818 .909

JETS 100% 1 1 1 .888 .888

REGBANKS 100% 1 1 1 1 1

HOMEBLDG .944 .944 .888 .777 .722 .833

FINANCE .913 .924 .913 .892 .881 .913

MORNSTAR .903 .899 .907 .907 .886 .907

PIPELINE .888 .888 1 .777 1 1

NIFTY .885 .914 .914 .885 .885 .914

AUTO .875 .875 .925 .95 .925 .975

TRANSP .85 .85 .9 .85 .85 .9

UTILITY .85 .85 .9 .85 .85 .9

INDMATER .818 .808 .848 .818 .808 .838

INSURANC .815 .842 .868 .868 .868 .894

DOWJONES .8 .8 .8 .8 .8 .866

SEMI .8 .758 .791 .716 .7 .683

ETFS .794 .735 .72 .602 .544 .514

SP-100 .793 .804 .804 .804 .814 .835

ELECTRON .778 .731 .747 .701 .69 .67

RUS-1000 .778 .76 .766 .747 .748 .792

INDEXES .777 .764 .768 .773 .773 .773

NASD-100 .774 .784 .774 .795 .763 .763

SP500 .756 .752 .748 .739 .752 .797

MILITARY .755 .666 .688 .688 .666 .755

REIT .755 .765 .75 .77 .802 .906

SOFTWARE .734 .718 .75 .671 .625 .687

FOOD .733 .8 .4 .6 .6 .6

CHEM .732 .718 .774 .774 .746 .788

HOSPITAL .714 .714 .714 .428 .428 .428

OILGAS .712 .75 .756 .7 .731 .837

COMPUTER .68 .6 .6 .64 .6 .6

GOLD .679 .603 .603 .622 .603 .528

N=31

GAMING .666 .6 .633 .566 .466 .566

COMODITY .661 .704 .647 .619 .633 .619

HACKERS .611 .555 .722 .555 .444 .5

BIOTECH .599 .548 .556 .622 .599 .587

GREEN .58 .516 .548 .548 .516 .58

COAL .555 .444 .555 .444 .444 .555

SOLAR .526 .421 .526 .368 .315 .315

BONDFUND .513 .432 .297 .261 .207 .162

RETAIL .425 .425 .407 .5 .425 .444

CHINA .353 .261 .307 .292 .2 .215

BEVERAGE .25 .25 .3 .3 .3 .55

N=1

=========================================================================================================

1-12-2017 High

Diving Board Top?

Or Flat Topped "Box" Pattern

Beckoning for A Breakout.

The current Peerless Buy B4 gives us hope for an

upside breakout by the DJI

above 20000. But what had looked like a flat-topped rectangle formation

that

usually brings a steep vertical ascent on a breakout to new highs is starting to

look like a bearish "high diving board". The longer the DJI remains in a

price

formation, the more the market will resemble the DJI's price action before

Hitler's

army attacked France in 1940 and JFK attacked US Steel in 1962.

(For details of second case, see

http://www.tigersoft.com/Tiger-Blogs/7-22-2007/ )

Both of these cases brought steep sell-offs. Both showed falling IPAs and

narrow

and trading ranges that lasted more than 6 months. Another parallel: Trump

is nothing

if he is not bellicose and seems always ready to get into a fight. So,

these two earlier

parallels stand out.

However, the good news is that the market may

decide to ignore Trump's words and

enjoy his actions, which should bring lower taxes, fewer regulations and minimal

numbers of prosecutions of corporations and Wall Street for fraud,

malfeasance

and misrepresentation. Thus, the DJI turned around from what was almost a

175 point

early decline (presumably to accommodate the many Trump-haters out there) and

fell only modestly. This caused our IPA

Indicator to turn up and rise above its 21-dma.

The IPA's rise now is particularly important, for it is this indicator more than

any

other that showed the market's internal weakness in 1940 and 1961-1962 before

the big sell-offs of those years.

So, maybe, just maybe, Wall Street will soon breakout upwards and start a

delayed January

take-off, perhaps like the one in January 1987. See its chart below.

See how the

IPA Indicator turned up on the breakout. In our case, we may yet see red

Distribution turn

into re-Accumulation along with a DJI take-off to the upside. Let's give

the market more

chance to achieve a price breakout to confound Trump's detractors and bring the

masses

back into the market.

Time Is Running Out for A Breakout

I still believe that we can give the DJI another week to

breakout of its narrow and

flat rectangle price pattern. But "box" patterns are not

supposed to last more

than six weeks. If it takes longer than that, especially

with weakening

Accumulation

as measured by our cumulative Intra-Day Volume IPA indicator,

then the odds shift

to a decline to the lower band and the support also of the

65-dma.

I cannot help but see parallels between the DJI's chart

now with

a high diving board. A little bounce up for a short-lived breakout would

by this scenario be followed by a steep dive. Supporting this expected

scenario are

the many past DJI cases shown yesterday here

where the DJI went narrowly sidewise

in a bull market with the Tiger IPA Indicator falling and then sold off to the

lower

band.

Another point: the MDY shows a bearish-looking "Hands above the Head

Pattern".

This is not a good omen. These only appear when speculation has become

dangerously excessive.

Hedging is recommended while we wait for either

breakdowns below

recent support or an upside DJI breakout confirmed by breadth and

a rising Closing Powers for ours key ETFs.

When the DJI and the broader market is confined to a trading range, it usually

pays

to buy the most bullish looking MAXCPs and sell short the weakest MINCPs.

See

their charts below. Also consider buying GNCMA (chart shown below).

Long distance

carriers are now the best performing Morningside group since the

Presidential

Election.

To Tiger/Peerless Charts:

1/12/17:

PEERLESS

DJI, Signals, Indicators DJI-13

Hourly DJIA

S&P

OEX

NYSE

NASDAQ

COMPQX with Closing Power

DIA

QQQ SPY

IWM

Short-Term Rates

DJI-Utilities DJI-Transp

A/D Line-6000 Stocks

Crude Oil

FAS

GLD IBB

JETS JNUG

NUGT RSX

SLV SOXL

TECL YINN

AAPL, AMZN,

FB, GOOG,

GS MSFT

RANKING OF

MORNINGSIDE SECTORS FOR PCT. GAIN

SINCE TRUMP WON PRESIDENTIAL ELECTION

Strongest performing group was "Long Distance

Carriers", up 41%

compared with second-best, up 31% - Pacific NW Regional Banks.

The best performing stock in the long distance carriers is an Alaskan Cable

company,

GNCMA. In chart below see how its recent Buy B12 and nice pullback support

now to support.

1/12/17:

Bullish MAXCP Stocks (shown below)

1/12/17:

Bearsh MAXCP Stocks (shown below)

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMAa

1/12/17

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BIGBANKS 1 1 1 1 1 1

EDU 1 1 1 1 1 1

INFRA 1 1 .909 .818 .909 .909

JETS 1 1 1 .888 .888 .888

REGBANKS 1 1 1 1 1 .972

HOMEBLDG .944 .888 .777 .722 .833 .833

FINANCE .924 .913 .892 .881 .903 .881

NIFTY .914 .914 .885 .885 .914 .8

MORNSTAR .899 .907 .907 .886 .907 .928

PIPELINE .888 1 .777 1 1 1

AUTO .875 .925 .95 .925 .975 .95

TRANSP .85 .9 .85 .85 .9 .85

INSURANC .842 .868 .868 .868 .868 .894

UTILITY .822 .8 .666 .711 .777 .777

INDMATER .808 .848 .818 .808 .828 .848

SP-100 .804 .804 .804 .814 .835 .824

DOWJONES .8 .8 .8 .8 .866 .866

FOOD .8 .4 .6 .6 .533 .4

NASD-100 .784 .774 .795 .763 .763 .763

REIT .765 .75 .77 .802 .885 .916

INDEXES .764 .768 .773 .773 .773 .794

RUS-1000 .76 .766 .747 .748 .781 .791

SEMI .758 .791 .716 .7 .683 .658

SP500 .752 .748 .739 .752 .79 .782

OILGAS .75 .756 .7 .731 .831 .843

ETFS .735 .72 .602 .544 .514 .588

ELECTRON .731 .747 .701 .69 .664 .659

CHEM .718 .774 .774 .746 .788 .802

SOFTWARE .718 .75 .671 .625 .671 .687

HOSPITAL .714 .714 .428 .428 .428 .428

COMODITY .704 .647 .619 .633 .633 .661

N=31

MILITARY .666 .688 .688 .666 .755 .755

GOLD .603 .603 .622 .603 .528 .716

COMPUTER .6 .6 .64 .6 .6 .64

GAMING .6 .633 .566 .466 .566 .6

HACKERS .555 .722 .555 .444 .444 .444

BIOTECH .549 .556 .627 .603 .572 .556

GREEN .516 .548 .548 .516 .58 .612

COAL .444 .555 .444 .444 .555 .555

BONDFUND .432 .297 .261 .207 .144 .153

RETAIL .425 .407 .5 .425 .444 .444

SOLAR .421 .526 .368 .315 .315 .315

CHINA .261 .307 .292 .2 .215 .215

BEVERAGE .25 .3 .3 .3 .55 .6

N=2

=========================================================================================================

1-11-2017

Please

read about the "high diving board" danger if we do not get a breakout in

in the next week or if the DJI instead breaks down out of its rectangle

pattern.

High Diving

Board?

High Diving Board Top?

Or Flat Topped "Box" Pattern

Beckoning for A Breakout.

We can give the DJI only as much as 5 weeks to

breakout of its narrow and

flat rectangle price pattern. As we've been in the "box" pattern almost a

month,

time is running out for a breakout to the upside.

If it takes longer than that, especially

with weakening

Accumulation as measured

by our cumulative Intra-Day Volume IPA indicator,

then the odds shift to a decline

to the lower band and the support also of the

65-dma.

Flat tops do beckon for a breakout, but at some point there resistance looks too

imposing. We see how a flat resistance in a narrow trading range loses its

bullishness

after 4 or 5 weeks. In the present case, the DJI hit its peak on December

13th with

a hypothetical high of around 20060 and it hits low in the current pattern the

next

day at 19696.24. Since then, these two levels have confined the DJI.

Consider the past cases where such flat topped patterns developed over 5

or more

weeks with a falling IPA. See the below past charts of these longer flat

topped DJI

rectangles in a rising market that are also showing falling daily IPA

readings.

Pattern

Breakout/Breakdown Outcome

-------------------------------------------------------------

May 1940 Down sharply

Jan 1956 Down

Jan 1962 Down sharply

June 1963 Down

Nov 1964 Down

Feb 1966 Down Sharply

July 1968 Down

April 1983 Up

Jan 1987 Up

Oct 2012 Down

Aug 2013 Down

July 2015 Down

May 1940 Down sharply

|

Jan 1956 Down

|

Jan 1962 Down

sharply

|

Feb 1966 Down

Sharply

|

To Tiger/Peerless Charts:

1/11/17:

PEERLESS

DJI, Signals, Indicators DJI-13

Hourly DJIA

S&P

OEX

NYSE

NASDAQ

COMPQX with Closing Power

DIA

QQQ SPY

IWM

M

Short-Term Rates

DJI-Utilities DJI-Transp

A/D Line-6000 Stocks

GLD IBB

JETS JNUG

NUGT SOXL

TECL

FAS SOXL

Crude Oil YINN

AAPL, AMZN,

FB, GOOG,

GS MSFT

1/11/17:

Bullish MAXCP Stocks (shown below)

Bullish

MAXCP Stocks (shown below)

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

1/11/17

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BIGBANKS 100% 1 1 1 1 1

EDU 100% 1 1 1 1 .875

INFRA 100% .909 .818 .909 .909 .909

JETS 100% 1 .888 .888 .888 .888

PIPELINE 100% .777 1 1 1 1

REGBANKS 100% 1 1 1 .972 1

AUTO .925 .95 .925 .975 .95 .975

NIFTY .914 .885 .885 .914 .828 .742

FINANCE .913 .892 .881 .903 .881 .903

MORNSTAR .907 .907 .886 .907 .928 .911

TRANSP .9 .85 .85 .9 .85 .9

HOMEBLDG .888 .777 .722 .833 .833 .888

INSURANC .868 .868 .868 .868 .894 .894

INDMATER .848 .818 .808 .828 .848 .828

SP-100 .804 .804 .814 .835 .824 .793

DOWJONES .8 .8 .8 .866 .866 .833

UTILITY .8 .666 .711 .777 .777 .711

SEMI .791 .716 .7 .683 .658 .658

CHEM .774 .774 .746 .788 .802 .816

NASD-100 .774 .795 .763 .763 .752 .698

INDEXES .765 .769 .769 .769 .79 .753

RUS-1000 .765 .745 .747 .78 .786 .784

OILGAS .756 .7 .731 .831 .843 .806

REIT .75 .77 .802 .885 .901 .89

SP500 .748 .739 .752 .79 .778 .775

ELECTRON .747 .701 .69 .664 .659 .649

SOFTWARE .746 .666 .619 .666 .682 .603

HACKERS .722 .555 .444 .444 .444 .277

ETFS .72 .602 .544 .514 .573 .455

HOSPITAL .714 .428 .428 .428 .428 .428

MILITARY .688 .688 .666 .755 .755 .8

N=31 (rising)

COMODITY .647 .619 .633 .633 .661 .605

GAMING .633 .566 .466 .566 .6 .6

GOLD .603 .622 .603 .528 .716 .415

COMPUTER .6 .64 .6 .6 .64 .68

SOLAR .562 .375 .312 .312 .312 .375

BIOTECH .556 .626 .603 .568 .54 .552

COAL .555 .444 .444 .555 .555 .555

GREEN .548 .548 .516 .58 .612 .645

RETAIL .407 .5 .425 .444 .462 .574

FOOD .4 .6 .6 .533 .4 .533

CHINA .307 .292 .2 .215 .215 .169

BEVERAGE .3 .3 .3 .55 .6 .65

BONDFUND .297 .261 .207 .144 .144 .108

N=3

---------------------------------------------------------------------------------------------------------------------------------------------------------------

1-10-2017

The Peerless Buy B4 still calls for more new highs and

the DJI's flat top at

20000 still looks like it will be broken above. But time

may be running out if one

follows the time-table in which a top occurs in the days just before

Presidential Inauguration.

A lot of Professionals seem to be waiting to see how Trump handles himself

in his first

full-scale news conference since being elected. Will he fire up the

partisans and non-believers

or will he scare investors by being irrational or bellicose? A lot depends

on how the new

President handles himself.

Bullish Pre-Inaugural Bullishness

When we look only at Presidential Election years since 1968 we see a bullish

seasonal period lies ahead for various numbers of trading days following January

10th.

Of course, there are only 12 cases and this is probably too small to rely on.

But it

does suggest we should not yet be sellers..

3 days out 5-days out 10-days out

21-days out

----------- ----------- ------------

------------

Pct of times up

66.7% 70.8%

66.7% 79.2%

Average DJI Gain 0.8%

+1.0% +1.0%

+1.9%

20,000 is clearly inviting some steady selling each time it is approached.

This might

be expected from such a round number. But it seems too obvious a

resistance-level

to become a significant top. As long as the NYSE breadth is good and the

DJI does

does not jump too quickly up to the 2% band or higher, Peerless cannot give a

Sell.

And as long as the DJI does not breakdown from its "box" pattern and thereby

cause a drop to the next support downward, the 65-day ma, I think we will see

the DJI grab some splashy headlines by closing above 20,000 just as Trump is

inaugurated.

Note today that there were 849 more up than down on the NYSE, The

NYSE A/D Line

remains in an uptrend. Only 19 stocks made new 52-week new lows compared

with

95 that made new highs. 27 of our stock groups show more than 2/3 of their

component

stocks above the 65-dma. Only 3 groups show the reverse.

It's true that Professionals are more cautious. We show 93 MAXCP stocks

(where the Closing Power is making a new 52-week high) and now 41 MINCP stocks

(where the Closing Power is making a new 52-week low). And it's true that

the

Closing Power for DIA is down-trending and

below its 21-day. But that Closing Power

will very likely turn up sharply if the DJI does shoot up past 2000.

Professional cautiousness is still also very evident in the Closing Powers for

SPY.

MDY, IWM

and even FAS. I think that

Professionals are wary about how Trump will

handle himself in his first full-scale press conference of the year.

Perhaps, it will fire up the

partisans and cause a life-off. Or, perhaps Trump will gaffe badly or say

something

so bellicose it will cause a war scare. Watch it. For now, it's not

surprising the market is

on hold in here just below the round number 20,000.

Instead of buying on a Flat-Top Breakout by DIA or on a pullback to its 65-dma,

consider buying some of the stocks just crossing back above their 65-dma that

also show

an extremely bullish Closing Power divergence from price (Augmented S7 or

CP%-Pr%>.37).

We offer no list of such stocks each night, but they can easily be found by

running the Power Ranker

against the NEAR65 group of stocks and then examining the most "bullish" ones

(#12) ones

or those with Closing Power new highs (#23). Click here to see the current

list. I suggest

having the computer show the purple "augmented B7s" by choosing the first item

under

Signals(3). The Buy B7s should only be acted on when prices get above the

65-dma and

the Accum. Index is positive.

Augmented B7s (Very Bullish Closing

Power Divergence from Price.)

The opposites, Augmented Sell S7s are a group we provide data for each night.

Here we

would act on these S7s only when the stock falls below the 65-dma with (red)

Distribution.

All these will show purple Sell S7s currently. Use the Power Ranker

against them.

Look for additional bearish signs, especially well-tested support about to be

broken.

Augmented Sell S7s (Very Bearish

Closing Power Divergence from Price.)

To Tiger/Peerless Charts:

1/10/17:

Peerless

DJIA and A/D Line

DJI-OBVPCT

Hourly DJIA

S&P

OEX

NYSE

NASDAQ

DIA

QQQ SPY

IWM

Short-Term Rates

DJI-Utilities

REITS

A/D Line-6000 Stocks

SOXL TECL

FAS

Crude Oil

1/10/17:

Bullish MAXCPs -

Bearish MINCPs

- Very few specimens here. Notice absence

of Bonds.

Augmented Sell S7s (Very Bearish

Closing Power Divergence from Price.)

Augmented B7s (Very Bullish Closing

Power Divergence from Price.)

1/10/17:

Bank Stocks - DB (Deutsche

Bank), WFC (Wells Fargo), GS

(Goldman Sachs),

FAS,

Super Stock -

NVDA (Rebounding up from rising

21-dma...)

Stocks:

AAPL, BIDU,

IBM, TXN,

AMZN, CAT, FB,

GOOG, JPM,

MSFT,

TXN

ETFS:

BBH, BRZU,

DIA, DUST,

FAS, GASL,

GLD, IWM,

JETS,

JNUG, KOL, MDY,

NUGT, OIH, OIL,

RETL,

RSX, SLV,

SOXL, TECL,

TMF, TNA,

UGAZ, UPW,

VGK, YINN

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

1/10/17

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BIGBANKS 100% 1 1 1 1 1

EDU 100% 1 1 1 .875 1

JETS 100% .888 .888 .888 .888 .888

REGBANKS 100% 1 1 .972 1 1

AUTO .95 .925 .975 .95 .975 .925

INFRA .909 .818 .909 .909 .909 .909

MORNSTAR .907 .886 .907 .928 .911 .844

FINANCE .892 .881 .903 .881 .903 .881

NIFTY .885 .885 .914 .828 .771 .685

INSURANC .868 .868 .868 .894 .894 .894

TRANSP .85 .85 .9 .85 .9 .9

INDMATER .818 .808 .828 .848 .828 .747

SP-100 .804 .814 .835 .824 .793 .773

DOWJONES .8 .8 .866 .866 .833 .866

NASD-100 .795 .763 .763 .752 .709 .612

HOMEBLDG .777 .722 .833 .833 .888 .833

PIPELINE .777 1 1 1 1 .888

CHEM .774 .746 .788 .802 .816 .774

REIT .77 .802 .885 .901 .88 .765

INDEXES .769 .769 .769 .79 .753 .719

RUS-1000 .745 .747 .78 .786 .781 .717

SP500 .739 .752 .79 .778 .778 .71

SEMI .716 .7 .683 .658 .658 .641

ELECTRON .701 .69 .664 .659 .649 .628

OILGAS .7 .731 .831 .843 .806 .762

MILITARY .688 .666 .755 .755 .8 .777

SOFTWARE .671 .625 .671 .687 .609 .5

N=27, + 1 for day (>.666)

UTILITY .666 .711 .777 .777 .711 .644

COMPUTER .64 .6 .6 .64 .68 .68

BIOTECH .626 .603 .571 .54 .54 .431

GOLD .622 .603 .528 .716 .396 .339

COMODITY .619 .633 .633 .661 .605 .507

ETFS .602 .544 .514 .573 .455 .382

FOOD .6 .6 .533 .4 .533 .2

(Quick recovery)

GAMING .566 .466 .566 .6 .6 .566

HACKERS .555 .444 .444 .444 .277 .277

(Quick recovery)

GREEN .548 .516 .58 .612 .645 .612

RETAIL .5 .425 .444 .462 .574 .555

COAL .444 .444 .555 .555 .555 .444

HOSPITAL .428 .428 .428 .428 .428 .285

SOLAR .368 .315 .315 .315 .368 .315

BEVERAGE .3 .3 .55 .6 .65 .5

CHINA .292 .2 .215 .215 .169 .153

BONDFUND .261 .207 .144 .144 .099 .09

N=3

=========================================================================================================

1-9-2017

The Peerless Buy B4 still calls for more new highs and

the DJI's flat top at

20000 still looks like it will be broken above.

(Hotline had to be abbreviated and emailed out due to server of tigersoft.com

going down for early AM. Below is Hotline that was emailed at 4:04 AM

PCT).

"Stick with the Buy B4 for all the reasons previously given.

As long as the DJI stays inside its current

box, approximately

20000 and 19600, the odds favor an upside breakout. Nicolas

Darvas, who wrote 2 books about these patterns, said simply

that within the price boxes, there are random movements

that mean very little.

"However, I would say that a breakdown below the bottom of

these box patterns for any ETFs showing them would call for

a decline to the 65-day ma.

"QQQ may be able to breakout more decisively

to boost the market.

But be careful of IWM,

MDY, JETS.

A rupture of their recent support

level looks more threatening because their patterns look

less rectangular and more like ordinary top patterns.

"I will complete the regular hotline on the

www.tigersoft.com

site later this early morning if I am able and will have to

set up another Hotline page tomorrow night on

www.tigersoftware.com

as a contingency against the server problems continuing."

To Tiger/Peerless Charts:

1/9/17:

Peerless

DJIA and A/D Line

DJI-OBVPCT

Hourly DJIA

S&P

OEX

NYSE

NASDAQ

DIA

QQQ SPY

IWM

Short-Term Rates

DJI-Utilities

REITS

A/D Line-6000 Stocks

SOXL TECL

FAS

Crude Oil

1/9/17:

Bullish MAXCPs -

Bearish MINCPs

- Very few specimens here. Notice absence

of Bonds.

1/9/17:

Bank Stocks - DB (Deutsche

Bank), WFC (Wells Fargo), GS

(Goldman Sachs),

FAS,

Super Stock -

NVDA (still? - Profit taking as new

year begins...)

Stocks:

AAPL, BIDU,

IBM, TXN,

AMZN, CAT, FB,

GOOG, JPM,

MSFT,

TXN

ETFS:

BBH, BRZU,

DIA, DUST,

FAS, GASL,

GLD, IWM,

JETS,

JNUG, KOL, MDY,

NUGT, OIH, OIL,

RETL,

RSX, SLV,

SOXL, TECL,

TMF, TNA,

UGAZ, UPW,

VGK, YINN

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

1/9/17

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BIGBANKS 100 1 1 1 1 1

EDU 100 1 1 .875 1 1

PIPELINE 100 1 1 1 .888 .888

REGBANKS 100 1 .972 1 1 1

AUTO .925 .975 .95 .975 .925 .825

JETS .888 .888 .888 .888 .888 .777

MORNSTAR .886 .907 .928 .911 .84 .777

NIFTY .885 .914 .828 .771 .685 .685

FINANCE .881 .903 .881 .903 .881 .817

INSURANC .868 .868 .894 .894 .894 .921

TRANSP .85 .9 .85 .9 .9 .9

INFRA .818 .909 .909 .909 .909 .909

SP-100 .814 .835 .824 .793 .762 .68

INDMATER .808 .828 .848 .828 .747 .666

REIT .802 .885 .901 .88 .765 .718

DOWJONES .8 .866 .866 .833 .866 .733

INDEXES .769 .769 .79 .753 .702 .677

NASD-100 .765 .765 .755 .712 .606 .553

SP500 .752 .79 .778 .778 .708 .636

RUS-1000 .747 .78 .786 .781 .715 .661

CHEM .746 .788 .802 .816 .774 .746

OILGAS .731 .831 .843 .806 .762 .725

HOMEBLDG .722 .833 .833 .888 .833 .833

UTILITY .711 .777 .777 .711 .644 .666

SEMI .7 .683 .658 .658 .65 .633

ELECTRON .69 .664 .659 .649 .628 .639

N=26

MILITARY .666 .755 .755 .8 .755 .688

COMODITY .633 .633 .661 .605 .507 .492

SOFTWARE .625 .671 .687 .609 .5 .437

BIOTECH .603 .571 .54 .54 .42 .381

(rising)

GOLD .603 .528 .716 .396 .339 .245

COMPUTER .6 .6 .64 .68 .6 .64

FOOD .6 .533 .4 .533 .2 .133

(rising)

ETFS .544 .514 .573 .455 .367 .338

GREEN .516 .58 .612 .645 .58 .58

GAMING .466 .566 .6 .6 .566 .533

COAL .444 .555 .555 .555 .444 .333

HACKERS .444 .444 .444 .277 .222 .222

HOSPITAL .428 .428 .428 .428 .285 .142

RETAIL .425 .444 .462 .574 .555 .444

SOLAR .315 .315 .315 .368 .315 .263

BEVERAGE .3 .55 .6 .65 .45 .35

BONDFUND .207 .144 .144 .099 .09 .063

CHINA .2 .215 .215 .169 .153 .107

N=4

=========================================================================================================

1-6-2017

The Peerless Buy B4 still calls for more new highs and the DJI's flat top at

20000 still looks like it will be broken above. However, the advance will

have to

come from some new Trump stimulus. It will not come from the Santa Claus

and new year's buying effect. Those seasonal forces are now used up.

In fact,

seasonality now is slightly bearish. Since 1965, the DJI has risen only

42.9%

of the time over the 3 trading days following January 8th. Over the next

10 days,

it actually averages a slight loss of 0.4%. A little more backing and

filling

would actually be constructive.

At this time, I think we must still consider Financials and Big Banks to still

offer the most trading opportunities. It is not clear yet that the Biotechs'

rebound

is much more than what happens when year-end tax-loss selling comes to an end.

It will not take much of a rise in the 13 highest priced DJI stocks

to achieve a flat topped breakout in their Tiger Index. This would

very likely bring a DJI advance over 20000. That would create quite

a lot of media "buzz" and Trump partisan excitement.

The Jobs' figure of 159,000 net new private jobs for December shows a weakening

but still growing economy. This is what the weakening Retail stocks have

been saying.

Consumer buying is not strong. Bulls have a right, I think, to

expect that this will

deter the FED from raising rates for a while. And this will help the

beaten down Bonds,

REITS, Golds.

GS will only need to rally 2.1 points to score a flat topped breakout.

As the highest priced DJI-30 stock, this could give that average enough

boost to surpass the much watched 20,000 round number resistance.

It should also send the 3x leveraged financials' ETF FAS up as well.

I have looked back to see if one day's negative breadth on a day when the DJI

rallies is bearish. The answer is only briefly since 2009. So, my

conclusion here

is to hold FAS because of its breakout and give the DJI a chance to run up past

20,000 to draw in new buyers. Let's watch QQQ, too. It is now

bullishly in all-time high

territory. A breakout by GS ought to send FAS up nicely. When the

market starts

to look a little tired, it is often a good idea for safety's sake to play the

very highest

Accumulation stocks (AI/200) of the 6000 that Tiger screens and places in the

download file

"ACCUMHOR". The best of these are shown below. TOWN is the only one

properly

positioned to be purchased, just below its 21-day ma. XOM, the highest

AI/200 stock

in the DJI is similarly positioned but its Closing Power is now falling.

AI/200 LA/MA

MNR 200

1.04

TOWN 199

.99

OCFC 196

1.04

Tiger/Peerless Charts:

1/6/17:

Peerless

DJIA and A/D Line

DJI-OBVPCT

Hourly DJIA

S&P

OEX

NYSE

NASDAQ

DIA

QQQ SPY

IWM

Short-Term Rates

DJI-Utilities

REITS

A/D Line-6000 Stocks

SOXL TECL

FAS

Crude Oil

1/6/17:

Bullish MAXCPs -

Bearish MINCPs

- Very few specimens here. Notice absence

of Bonds.

1/6/17:

Bank Stocks - DB (Deutsche

Bank), WFC (Wells Fargo), GS

(Goldman Sachs),

FAS,

Super Stock -

NVDA (still? - Profit taking as new

year begins...)

Stocks:

AAPL, BIDU,

IBM, TXN,

AMZN, CAT, FB,

GOOG, JPM,

MSFT,

TXN

ETFS:

BBH, BRZU,

DIA, DUST,

FAS, GASL,

GLD, IWM,

JETS,

JNUG, KOL, MDY,

NUGT, OIH, OIL,

RETL,

RSX, SLV,

SOXL, TECL,

TMF, TNA,

UGAZ, UPW,

VGK, YINN

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

1/6/17

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BIGBANKS 100% 1 1 1 1 1

EDU 100% 1 .875 1 1 .875

PIPELINE 100% 1 1 .888 .777 .777

REGBANKS 100% .972 1 1 1 1

AUTO .975 .95 .975 .925 .85 .875

NIFTY .914 .828 .771 .685 .685 .714

INFRA .909 .909 .909 .909 .909 .909

MORNSTAR .907 .928 .911 .84 .773 .785

FINANCE .903 .881 .903 .881 .817 .838

TRANSP .9 .85 .9 .9 .9 .9

JETS .888 .888 .888 .888 .777 .777

REIT .885 .901 .88 .765 .718 .656

INSURANC .868 .894 .894 .894 .921 .921

DOWJONES .866 .866 .833 .866 .733 .733

SP-100 .835 .824 .793 .762 .69 .742

HOMEBLDG .833 .833 .888 .833 .833 .833

OILGAS .831 .843 .806 .762 .718 .725

INDMATER .828 .848 .828 .747 .686 .717

SP500 .79 .778 .778 .708 .642 .668

CHEM .788 .802 .816 .774 .746 .76

RUS-1000 .78 .786 .781 .715 .664 .67

UTILITY .777 .777 .711 .644 .644 .711

INDEXES .774 .79 .753 .702 .677 .661

NASD-100 .763 .752 .709 .602 .559 .58

MILITARY .755 .755 .8 .755 .711 .755

SEMI .683 .658 .658 .65 .633 .633

SOFTWARE .671 .687 .609 .5 .437 .5

N=27 still expanding!

ELECTRON .664 .659 .649 .628 .644 .639

COMODITY .633 .661 .605 .507 .492 .492

COMPUTER .6 .64 .68 .6 .64 .68

GREEN .58 .612 .645 .58 .58 .612

BIOTECH .571 .54 .54 .42 .381 .389

GAMING .566 .6 .6 .566 .533 .566

COAL .555 .555 .555 .444 .444 .555

BEVERAGE .55 .6 .65 .45 .35 .45

FOOD .533 .4 .533 .2 .133 .133

GOLD .528 .716 .396 .339 .245 .283

ETFS .514 .573 .455 .367 .338 .338

HACKERS .444 .444 .277 .222 .222 .277

RETAIL .444 .462 .574 .555 .462 .537

HOSPITAL .428 .428 .428 .285 .142 .142

SOLAR .315 .315 .368 .315 .263 .263

CHINA .215 .215 .169 .153 .107 .107

BONDFUND .144 .144 .099 .09 .054 .054

===========================================================================================================

1-5-2017

The Peerless Buy B4 calls for more new highs.

The many index and ETF

flat tops beckon for breakouts. The A/D Lines are bullish for all the

important

general market indexes. While Professionals seem unwilling to induce price

breakouts, they may just be waiting to see what tomorrow's Job numbers are.

We have to be impressed that the DJI has not been below the 21-day ma since

November 4th.

Bulls need now to see, I think, a December Jobs Report between 150,000 and 210,000.

This would

be growth sufficient to cover the increase in population, but would

not itself be inflationary. On the other hand, Jobs' numbers

higher than 210,000

along with the higher oil prices and local minimum wage increases would give the

Hawks

plenty of ammunition to use to get another

rate hike soon. There is

another possibility, which seems unlikely; namely, that a Jobs' number will

come in much below 150,000. That would suggest a weakening

economy. It

would reinforce the sense that Main Street and Wall Street are living in two

different realms. This would further rattle Retail stocks. With the

market

having now risen nearly 8 years without more than a 17% correction, such low

numbers could cause another January decline, though not so deep as in 2009,

2014, 2015 and 2016.

Private New Jobs

in 1000s in US. |

| Year |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

| 2006 |

278 |

316 |

281 |

183 |

23 |

82 |

207 |

181 |

158 |

4 |

208 |

171 |

| 2007 |

240 |

90 |

189 |

79 |

143 |

78 |

-33 |

-24 |

88 |

85 |

115 |

97 |

| 2008 |

19 |

-86 |

-78 |

-210 |

-185 |

-165 |

-209 |

-266 |

-452 |

-473 |

-769 |

-695 |

| 2009 |

-791 |

-703 |

-823 |

-686 |

-351 |

-470 |

-329 |

-212 |

-219 |

-200 |

-7 |

-279 |

| 2010 |

28 |

-69 |

163 |

243 |

522 |

-133 |

-70 |

-34 |

-52 |

257 |

123 |

88 |

| 2011 |

42 |

188 |

225 |

346 |

73 |

235 |

70 |

107 |

246 |

202 |

146 |

207 |

| 2012 |

338 |

257 |

239 |

75 |

115 |

87 |

143 |

190 |

181 |

132 |

149 |

243 |

| 2013 |

190 |

311 |

135 |

192 |

218 |

146 |

140 |

269 |

185 |

189 |

291 |

45 |

| 2014 |

187 |

168 |

272 |

310 |

213 |

306 |

232 |

218 |

286 |

200 |

331 |

292 |

| 2015 |

221 |

265 |

84 |

251 |

273 |

228 |

277 |

150 |

149 |

295 |

280 |

271 |

| 2016 |

168 |

233 |

186 |

144 |

24 |

271 |

252 |

176 |

208 |

142(P) |

178(P) |

|

| P : preliminary |

|

|

http://data.bls.gov/timeseries/CES0000000001?output_view=net_1mth

The DJIA-30 Looks Over-Extended Compared to the Other

Indexes.

Don't be alarmed. This is normal now, given how the DJI is weighted and

how the Leveraged ETFs' tails can wildly wag the Index dogs.

The 13 highest priced DJI stocks have produced 1479 of its splashy 2000 point

gain

since November 3rd, the day before the Election. This is caused by the

fact that

the DJIA is weighted solely by price. Even more distorted, just one of its

30

components, GS, accounts for 455 of the DJIA's Trump Rally's 2000 points.

That's

nearly 20%.

Of course, the way the DJI weights its winners most heavily in its computation

is not accidental. The DJIA-30 is a very important advertisement for Wall

Street.

It also gives traders who know this a big advantage. Some of them will

seek to buy into these

highest priced DJI stocks to rig a run-up so that they can sell all their stocks

to the

unsuspecting public. And as long as the high priced DJI stocks keep

rising, all is

well, the bull market looks solid and prices elsewhere rise, too.

My guess is that

renewed buying in the DJI-13 in a week or two will cause the DJI to briskly get

up above 20000 just before the Trump Inauguration. That will give traders

a

higher level where they can take some very nice profits selling to Republican

partisans.

But at some point, the traders will surely stop buying the DJI's "nifty" stocks.

If the

other indexes (which are volume and capitalization weighted) and their A/D Lines

then

start to sell-off, we may then be seeing a sign that that the "jig is up".

Fortunately, the A/D Lines

for the SP-500, NASDAQ-100 and Russell-1000 are in strong uptrends.

So the market

looks relatively safe.

But there is still short-term risk. If the traders who bought heavily into

the DJI's

high priced stocks, decide to dump them for some reason, such as a very weak

Jobs

number or a very high Jobs Number, then the DJI-30 could make a quick

decline back towards its 3.5% lower band. That would cause a shake-out

elsewhere.

So let's watch our DJI-13 in here to see if its recent support level holds. I

will post it

in the charts that are linked to just below.

TIGER INDEXES:

SP-500, QQQ, RUSS-1000, DIA

(Weighted by avg price x avg trading volume)

Note that prices and their A/D Lines are all in bullish uptrends.

Their flat tops are bullish, too.

Tiger/Peerless Charts:

1/5/17:

Peerless

DJIA and A/D Line

DJI-OBVPCT

Hourly DJIA

S&P

OEX

NYSE

NASDAQ

DIA

QQQ SPY

IWM

Short-Term Rates

DJI-Utilities

REITS

A/D Line-6000 Stocks

SOXL TECL

FAS

Crude Oil

1/5/17:

Bullish MAXCPs -

Bearish MINCPs

- Very few specimens here. Notice absence

of Bonds.

1/5/17:

Bank Stocks - DB (Deutsche

Bank), WFC (Wells Fargo), GS

(Goldman Sachs),

FAS,

Super Stock -

NVDA (still? - Profit taking as new

year begins...)

Stocks:

AAPL, BIDU,

IBM, TXN,

AMZN, CAT, FB,

GOOG, JPM,

MSFT,

TXN

ETFS:

BBH, BRZU,

DIA, DUST,

FAS, GASL,

GLD, IWM,

JETS,

JNUG, KOL, MDY,

NUGT, OIH, OIL,

RETL,

RSX, SLV,

SOXL, TECL,

TMF, TNA,

UGAZ, UPW,

VGK, YINN

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

1/5/17

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BIGBANKS 100% 1 1 1 1 1

PIPELINE 100% 1 .9 .8 .7 .8

MORNSTAR .928 .911 .84 .773 .785 .777

AUTO .926 .951 .902 .829 .853 .878

REGBANKS .923 .948 .923 .948 .948 .948

INFRA .909 .909 .909 .909 .909 .909

JETS .909 .909 .909 .818 .818 .818

INSURANC .894 .894 .894 .921 .921 .921

EDU .888 .777 .888 .888 .777 .777

FINANCE .881 .903 .881 .817 .838 .827

REIT .875 .855 .746 .701 .641 .601

TRANSP .85 .9 .9 .9 .9 .9

OILGAS .843 .806 .762 .718 .718 .725

INDMATER .836 .817 .74 .682 .711 .692

HOMEBLDG .833 .888 .833 .833 .833 .833

NIFTY .828 .771 .685 .685 .714 .714

SP-100 .826 .795 .765 .693 .744 .714

CHEM .808 .821 .78 .753 .767 .753

INDEXES .79 .753 .702 .677 .661 .652

RUS-1000 .783 .779 .715 .667 .674 .66

SP500 .778 .778 .708 .642 .668 .653

MILITARY .755 .8 .755 .711 .755 .733

NASD-100 .75 .708 .604 .562 .593 .562

UTILITY .73 .692 .634 .615 .692 .615

GOLD .722 .407 .351 .259 .296 .222

SOFTWARE .691 .617 .514 .455 .529 .411

COMODITY .671 .614 .514 .5 .5 .485

N=27

ELECTRON .659 .649 .628 .644 .639 .659

SEMI .658 .658 .65 .633 .633 .658

COMPUTER .633 .666 .6 .633 .666 .6

DOWJONES .633 .666 .6 .633 .666 .6

BEVERAGE .6 .65 .45 .35 .45 .35

GAMING .6 .6 .566 .533 .566 .533

ETFS .573 .455 .367 .338 .323 .22

GREEN .558 .588 .529 .529 .558 .588

BIOTECH .549 .549 .431 .393 .397 .397

COAL .5 .5 .4 .4 .5 .6

RETAIL .446 .553 .535 .446 .517 .517

HOSPITAL .428 .428 .285 .142 .142 .142

HACKERS .421 .263 .21 .21 .263 .263

FOOD .4 .533 .2 .133 .133 .2

SOLAR .315 .368 .315 .263 .263 .315

CHINA .215 .169 .153 .107 .107 .107

BONDFUND .144 .099 .09 .054 .054 .027

N=3

=========================================================================================

1-4-2017

The Peerless Buy B4 calls for more new highs. Bank

and finance stocks

are leading the way higher. In its own way this is quite healthy.

Big banks

control the destinies of so much in national politics and economics as well as

finance,

it is a bullish sign that the troubles of 2007-2009 are very distant.

Technically, we easily spot the Banks' strength using TigerSoft and Peerless.

Regional banks again dominate the Bullish MAXCPs and their leveraged ETF,

FAS, made today a fine, bullish looking flat-topped breakouts. True, GS

and JPM did

not participate. So, this may hold FAS back a little.

A bigger worry would be if bank stocks rose in isolation and got too far ahead

of the overall market. Watching the steady advance of the

Russell-2000 today

and the 5%+ rise in its leveraged ETF, TNA, I would think we have to bullish.

In fact, there is a good chance that we are seeing a January take-off.

That notion is

supported by the fact that the DJI has now gone more than two months without

falling

below its 21-dma. In the 2006 version of Peerless, this was enough for a

Buy B15 signal.

Since then, the Buy B15 has become more conditional. But the purpose

of the Buy B15

is the same; it tells us that the market is becoming exceptionally strong

and we should

give it plenty of chance to run.

In that vein, notice how the NYSE A/D Line bullishly made a new high ahead of

the DJIA. Breadth was superb today. On the NYSE, there were 2606

advancers

and only 466 decliners today. The number of new lows on the NASDAQ and

NYSE

have shrunk to just 11 and 5, respectively. With year-end tax-loss

selling over,

shorts are busy covering beaten-down stocks, especially Golds, Bonds and foreign

ETFs, too, as rising Oil prices means more inflation which may check the

Dollar's rise.

In addition, the number of groups with more than 66.7% of their stocks above

their

65-dma has risen again. Their number rose from 23 to 25 today. Last

year,

we saw that number steadily rise after Trump's victory. The promise of

lower

taxes on corporations and on wealthy individuals along with fewer regulations,

is exactly what Wall Street wanted. Resist the urge to sell too much by

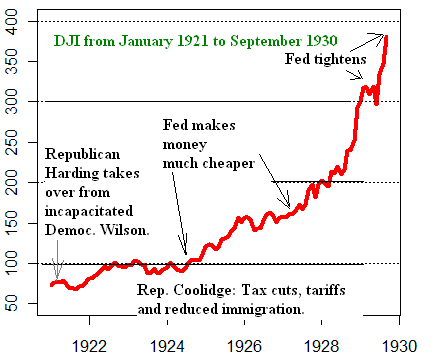

looking again

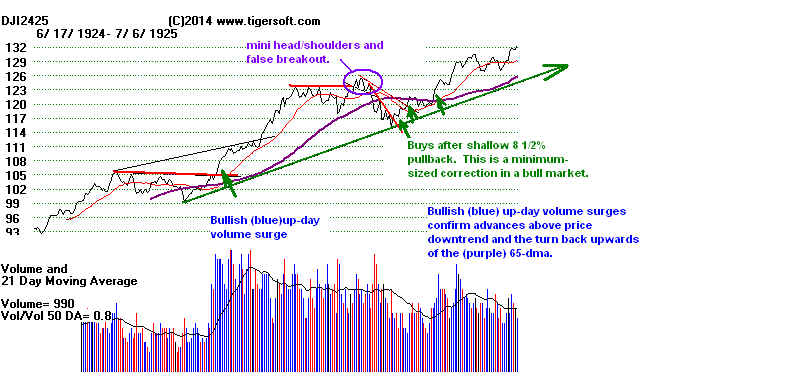

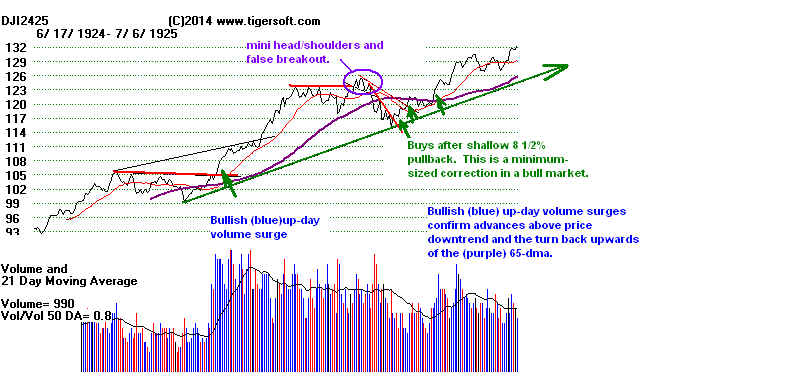

at the 1925 chart of the DJI chart and remember how Coolidge also campaigned

on a platform of markedly lower taxes, fewer regulations and higher tariffs

to protect American industry.

1925 Was A Very Bullish Year

Tiger/Peerless Charts:

1/4/17:

Peerless

DJIA and A/D Line

DJI-OBVPCT

Hourly DJIA

S&P

OEX

NYSE

NASDAQ

DIA

QQQ SPY

IWM

Short-Term Rates

DJI-Utilities

REITS

A/D Line-6000 Stocks

SOXL TECL

FAS

Crude Oil

1/4/17:

Bullish MAXCPs -

Again lots of banks.

Bearish MINCPs

- Very few specimens here. Notice absence

of Bonds.

1/4/17:

Bank Stocks - DB (Deutsche

Bank), WFC (Wells Fargo), GS

(Goldman Sachs),

FAS,

Super Stock -

NVDA (still? - Profit taking as new

year begins...)

Stocks:

AAPL, BIDU,

IBM, TXN,

AMZN, CAT, FB,

GOOG, JPM,

MSFT,

TXN

ETFS:

BBH, BRZU,

DIA, DUST,

FAS, GASL,

GLD, IWM,

JETS,

JNUG, KOL, MDY,

NUGT, OIH, OIL,

RETL,

RSX, SLV,

SOXL, TECL,

TMF, TNA,

UGAZ, UPW,

VGK, YINN

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

1/4/17

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BIGBANKS 100% 1 1 1 1 1

PIPELINE 100% .9 .8 .7 .8 1

AUTO .951 .902 .829 .853 .878 .902

REGBANKS .948 .948 .923 .948 .948 .948

MORNSTAR .911 .84 .773 .785 .773 .827

INFRA .909 .909 .909 .909 .909 .909

JETS .909 .909 .818 .818 .818 .818

FINANCE .903 .881 .817 .838 .827 .86

TRANSP .9 .9 .9 .9 .9 .9

INSURANC .894 .894 .921 .921 .921 .921

HOMEBLDG .888 .833 .833 .833 .833 .833

REIT .855 .746 .701 .636 .577 .656

DOWJONES .833 .866 .733 .733 .733 .8

CHEM .821 .78 .753 .767 .753 .794

INDMATER .817 .74 .682 .711 .692 .721

OILGAS .806 .762 .718 .718 .725 .762

MILITARY .8 .755 .711 .755 .733 .755

SP-100 .795 .765 .693 .744 .714 .775

RUS-1000 .778 .715 .666 .674 .655 .715

SP500 .778 .708 .642 .668 .646 .71

EDU .777 .888 .888 .777 .777 .888

NIFTY .771 .685 .685 .714 .714 .771

INDEXES .756 .705 .68 .663 .655 .672

NASD-100 .708 .604 .562 .593 .562 .645

UTILITY .673 .634 .634 .673 .596 .673

N=25

COMPUTER .666 .6 .633 .666 .6 .733

SEMI .658 .65 .633 .633 .658 .708

BEVERAGE .65 .45 .35 .45 .35 .35

ELECTRON .649 .628 .644 .639 .659 .701

SOFTWARE .617 .514 .455 .529 .411 .544

COMODITY .605 .507 .492 .492 .478 .478

GAMING .6 .566 .533 .566 .533 .566

GREEN .588 .529 .529 .558 .588 .588

RETAIL .553 .535 .446 .517 .5 .535

BIOTECH .549 .431 .393 .397 .393 .446

FOOD .533 .2 .133 .133 .2 .2

COAL .5 .4 .4 .5 .6 .7

ETFS .455 .367 .338 .323 .22 .25

HOSPITAL .428 .285 .142 .142 .142 .285

GOLD .407 .351 .259 .296 .222 .185

SOLAR .368 .315 .263 .263 .315 .315

HACKERS .263 .21 .21 .263 .263 .263

CHINA .169 .153 .107 .107 .107 .138

BONDFUND .099 .09 .054 .054 .027 .018

N=3

========================================================================================================

1-3-2017

The Peerless Buy B4 calls for more new highs.

I

believe that the Finance stocks are the most likely to lead another market

advance.

Tops are seldom made from flat tops like the DJI and FAS now show. Usually

in such cases,

first there is a breakout to run in the shorts, at the very least. The

Closing Powers can lag

in these cases. The Closing Powers play catch up because Professionals are

too smart to be

stubbornly bearish. (Read about

Darvas Box patterns. They have quite a

history. And they

show a superb way to make money in a super bull market.)

At the bottom of this Hotline,

see some SPY examples of valid flat-topped price breakouts even when the

Closing Power

was lagging.

The Professional Day Traders who sold on early strength today may be losing

control of the market.

Other Professionals drove the DJI up 95 points in the last two hours. It

sure looks like

20000 will again be tested.

Today looked pretty bullish. The DJI jumped up from its still fast-rising

21-day ma. On the NYSE,

advancers outpaced decliners by 3:1. And volume rose by a third.

Lagging volume has been

a concern.

Tiger/Peerless Charts:

1/3/17:

Peerless

DJIA and A/D Line

DJI-OBVPCT

Hourly DJIA

S&P

OEX

NYSE

NASDAQ

DIA

QQQ SPY

IWM

Short-Term Rates

DJI-Utilities

REITS

A/D Line-6000 Stocks

SOXL TECL

FAS

Crude Oil

1/3/17:

Bullish MAXCPs

Bearish MINCPs - Notice absence

of Bonds.

1/3/17:

Bank Stocks - DB (Deutsche

Bank), WFC (Wells Fargo), GS

(Goldman Sachs),

FAS,

Super Stock -

NVDA (still? - Profit taking as new

year begins...)

Stocks:

AAPL, BIDU,

IBM, TXN,

AMZN, CAT, FB,

GOOG, JPM,

MSFT,

TXN

ETFS:

BBH, BRZU,

DIA, DUST,

FAS, GASL,

GLD, IWM,

JETS,

JNUG, KOL, MDY,

NUGT, OIH, OIL,

RETL,

RSX, SLV,

SOXL, TECL,

TMF, TNA,

UGAZ, UPW,

VGK, YINN

Flat Tops "Trump" falling Closing Powers.

Below are some SPY examples from the great bull market,

1995-2000. See how the flat

top breakouts occurred over and over even though Closing Power was lagging for a

while.

Usually the price breakout caused the Closing Power downtrendline to be broken.

Professionals

know the bullishness of flat topped breakouts.

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

1/3/17

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BIGBANKS 100% 1 1 1 1 1

REGBANKS .948 .948 .923 .948 .948 .948

INFRA .909 .909 .909 .909 .909 .909

JETS .909 .818 .818 .818 .818 .818

AUTO .902 .829 .853 .878 .902 .902

PIPELINE .9 .8 .7 .8 1 1

TRANSP .9 .9 .9 .9 .9 .9

INSURANC .894 .921 .921 .921 .921 .894

EDU .888 .888 .777 .777 .777 .888

FINANCE .881 .817 .838 .827 .86 .849

DOWJONES .866 .733 .733 .733 .8 .8

MORNSTAR .84 .773 .785 .773 .823 .815

HOMEBLDG .833 .833 .833 .833 .833 .833

CHEM .78 .753 .767 .753 .794 .821

SP-100 .765 .693 .744 .714 .775 .755

OILGAS .762 .718 .718 .725 .762 .756

MILITARY .755 .711 .755 .733 .755 .755

REIT .746 .701 .636 .572 .631 .641

INDMATER .74 .682 .711 .692 .721 .711

RUS-1000 .714 .664 .671 .651 .708 .697

SP500 .708 .642 .668 .646 .71 .695

INDEXES .702 .677 .661 .652 .669 .669

NIFTY-35 .685 .685 .714 .714 .771 .742

N=23

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

1/3/17

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BIGBANKS 100% 1 1 1 1 1

REGBANKS .948 .948 .923 .948 .948 .948

INFRA .909 .909 .909 .909 .909 .909

JETS .909 .818 .818 .818 .818 .818

AUTO .902 .829 .853 .878 .902 .902

PIPELINE .9 .8 .7 .8 1 1

TRANSP .9 .9 .9 .9 .9 .9

INSURANC .894 .921 .921 .921 .921 .894

EDU .888 .888 .777 .777 .777 .888

FINANCE .881 .817 .838 .827 .86 .849

DOWJONES .866 .733 .733 .733 .8 .8

MORNSTAR .84 .773 .785 .773 .823 .815

HOMEBLDG .833 .833 .833 .833 .833 .833

CHEM .78 .753 .767 .753 .794 .821

SP-100 .765 .693 .744 .714 .775 .755

OILGAS .762 .718 .718 .725 .762 .756

MILITARY .755 .711 .755 .733 .755 .755

REIT .746 .701 .636 .572 .631 .641

INDMATER .74 .682 .711 .692 .721 .711

RUS-1000 .714 .664 .671 .651 .708 .697

SP500 .708 .642 .668 .646 .71 .695

INDEXES .702 .677 .661 .652 .669 .669

NIFTY-35 .685 .685 .714 .714 .771 .742

N=23

SEMI .65 .633 .633 .658 .708 .7

ELECTRON .628 .644 .639 .659 .701 .701

UTILITY .615 .634 .692 .576 .673 .653

NASD-100 .604 .562 .593 .562 .645 .625

COMPUTER .6 .633 .666 .6 .733 .666

GAMING .566 .533 .566 .533 .566 .533

RETAIL .535 .446 .517 .5 .535 .553

GREEN .529 .529 .558 .588 .588 .588

SOFTWARE .514 .455 .529 .411 .544 .5

COMODITY .507 .492 .492 .478 .478 .478

BEVERAGE .45 .35 .45 .35 .35 .35

BIOTECH .431 .393 .397 .393 .439 .454

COAL .4 .4 .5 .6 .7 .7

ETFS .367 .338 .323 .22 .25 .264

GOLD .351 .259 .296 .222 .185 .166

SOLAR .315 .263 .263 .315 .315 .315

HOSPITAL .285 .142 .142 .142 .285 .285

HACKERS .21 .21 .263 .263 .263 .21

FOOD .2 .133 .133 .2 .2 .2

CHINA .153 .107 .107 .107 .138 .107

BONDFUND .09 .054 .054 .027 .018 .036

N=6

===========================================================================================

12-30-2016

The Peerless Buy B4 calls for more new highs. But it

remains to be seen,

however, if Professionals are ready to turn bullish.

Short term traders will want to see SPY's 5-day ma turn up and its Closing

Power break its down-trend to be buyers. See below how Professionals

have been net sellers

recently while the Public and foreigners have been

net buyers. Usually,

the Professionals turn out to be right.

Who Is More Partisan?

The Trump buyers now? Or the Democrats who deny Trump all legitimacy?

For us, trusting our Indicators will probably work out best. The DJI has

fallen back to its falling 21-day ma and appears to be staging a good bounce

as the New Year starts. But Professionals have been recent sellers; so we

must watch

to see if they bullishly join the bulls tomorrow and the market closes up higher

than its

opening tomorrow. That action should be bullish enough to take the DJI up

to its 20300 and

the rising red parallel-line resistance shown further below tomorrow.

Will Feds Dare To Raise Rates All Alone?

Not talked much about is the effect we will see here because the Bank of

England chose not to follow the Fed and raise interest rates. They decided

on December 15th to

hold their rates unchanged even though the US Fed

raised their short-term rates. The British decision set off a spirited, if

brief,

rally in leveraged Gold Mining shares and also in Bonds. NUGT rose 50%

in just a week.

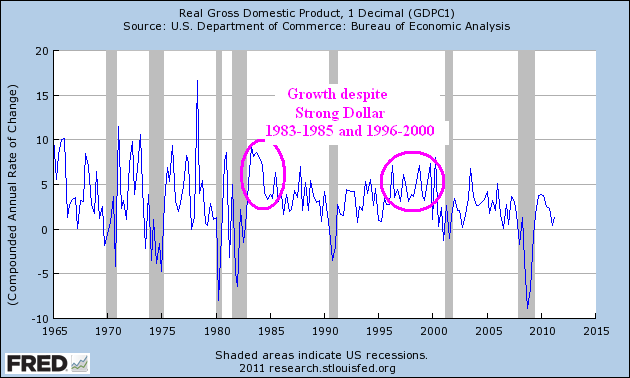

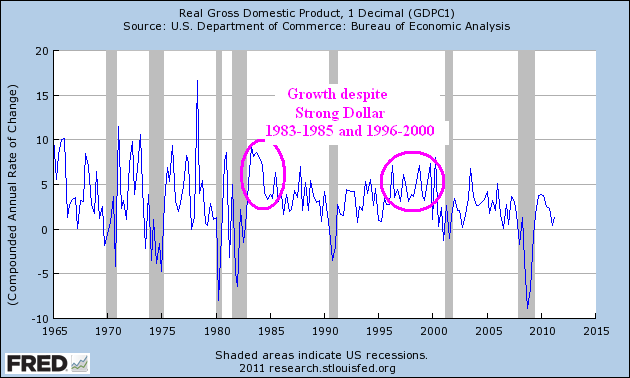

One would think that the British decision will work against the Fed raising

rates soon

unless they want to risk creating a much stronger Dollar with its negative

consequences

for US manufacturing exports, which Trump professes to want to promote.

Bullish Seasonalities May Last Another Week or Two.

Perhaps, the DJI will peak just as Trump Is Inaugurated...

Let's also take in account the seasonality of January and how the

market has welcomed Republican Presidents as they start a new term

in office.

After January 2nd, since 1965 the DJI usually rises for 3 more trading days.

It then pauses and makes little progress for the next two weeks.

3 trading days out from Jan 2 - DJI typically rises 65.3% of time and gains 0.6%

5 trading days out from Jan 2 - DJI typically rises 59.2% of time and gains 0.3%

10 trading days out from Jan 2 - DJI typically rises 63.3% of time and gains

0.6%

21 trading days out from Jan 2 - DJI typically rises 63..3% of time and gains 1%

Based on Trump being a Republican, if history repeats what happened in

7 of 8 cases, the DJI will not peak until somewhere between Jan. 5 and

Feb. 5.

first peak

Republican before decline

Presidents to lower band.

-------------------------------------

Coolidge 1/13/1925

Hoover

2/5/1929

Eisenhower 1/5/1953

Nixon

12/5/1969

Nixon

1/11/1973

Reagan 1/6/1981

Bush-Sr 2/1/1989

Bush-Jr 2/1/2001

The DJI is

testing the support of its rising 21-day ma. That moving average is rising

at an

annualized rate of 42.3%. This usually is enough to cause a reversal back

upwards.

--------- -----------

Tiger/Peerless Charts:

12/30/16:

Peerless

DJIA and A/D Line

DJI-OBVPCT

Hourly DJIA

S&P

OEX

NYSE

NASDAQ

DIA

QQQ SPY

IWM

Short-Term Rates

DJI-Utilities

REITS

A/D Line-6000 Stocks

SOXL TECL

FAS

Crude Oil

12/30/16:

Bullish MAXCPs

Bearish MINCPs - Notice absence

of Bonds. This due to British failure to raise rates.

12/30/16:

Bank Stocks - DB (Deutsche

Bank), WFC (Wells Fargo), GS

(Goldman Sachs),

FAS,

Super Stock -

NVDA

Stocks:

AAPL, BIDU,

IBM, TXN,

AMZN, CAT, FB,

GOOG, JPM,

MSFT,

TXN

ETFS:

BBH, BRZU,

DIA, DUST,

FAS, GASL,

GLD, IWM,

JETS,

JNUG, KOL, MDY,

NUGT, OIH, OIL,

RETL,

RSX, SLV,

SOXL, TECL,

TMF, TNA,

UGAZ, UPW,

VGK, YINN

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

12/30/16

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BIGBANKS 100% 1 1 1 1 1

REGBANKS .948 .948 .923 .948 .948 .948

INSURANC .921 .921 .921 .921 .894 .894

INFRA .909 .909 .909 .909 .909 .909

TRANSP .9 .9 .9 .9 .9 .9

EDU .888 .777 .777 .777 .888 .888

HOMEBLDG .833 .833 .833 .833 .833 .833

JETS .818 .818 .818 .818 .818 .818

FINANCE .817 .838 .827 .86 .849 .849

AUTO .813 .837 .86 .883 .883 .883

PIPELINE .8 .7 .8 1 1 .9

MORNSTAR .773 .785 .773 .823 .81 .794

CHEM .753 .767 .753 .794 .821 .794

DOWJONES .733 .733 .733 .8 .8 .766

OILGAS .718 .718 .725 .762 .756 .781

MILITARY .711 .755 .733 .755 .755 .755

REIT .701 .636 .572 .626 .621 .626

SP-100 .693 .744 .714 .775 .755 .734

NIFTY .685 .714 .714 .771 .742 .742

INDMATER .682 .711 .692 .721 .711 .701

INDEXES .677 .661 .652 .669 .669 .656

N= 21

RUS-1000 .665 .672 .654 .71 .699 .686

ELECTRON .644 .639 .659 .701 .701 .675

SP500 .642 .668 .646 .71 .695 .678

COMPUTER .633 .666 .6 .733 .666 .666

SEMI .633 .633 .658 .708 .7 .675

UTILITY .615 .692 .596 .653 .653 .634

NASD-100 .562 .593 .562 .645 .625 .593

GAMING .533 .566 .533 .566 .533 .533

GREEN .514 .542 .571 .571 .571 .542

HACKERS .514 .542 .571 .571 .571 .542

COMODITY .492 .492 .478 .478 .478 .464

SOFTWARE .455 .529 .411 .544 .485 .411

RETAIL .446 .517 .5 .535 .553 .535

COAL .4 .5 .6 .7 .7 .6

BIOTECH .393 .397 .393 .439 .454 .386

BEVERAGE .35 .45 .35 .35 .35 .3

ETFS .338 .323 .22 .25 .235 .235

SOLAR .263 .263 .315 .315 .315 .368

GOLD .259 .296 .222 .185 .166 .166

HOSPITAL .142 .142 .142 .285 .285 .285

FOOD .133 .133 .2 .2 .2 .133

CHINA .107 .107 .107 .138 .107 .123

BONDFUND .054 .054 .027 .018 .036 .027

N=6

==================================================================================================

12-29-2016 Since

1965, the DJI has rallied 70.4% of the time over

the next five trading days and averaged a gain of 0.8%.

This helps us believe that the DJI will not slip

back much here and

make a successful attempt at getting past the 20000 resistance before Trump's

Inauguration. But, first, because nearly all the key ETFs are

showing falling

Closing Powers (net Professional selling) and falling 5-day mvg. averages,

I have to think that more profit-taking probably lies ahead and short-term

traders

should just wait to buy.

The operative Peerless signal is a Buy B4. But a series of low volume

rally-days with weak breadth which close near their days' lows could bring

a Sell S12 about 350-400-points higher than today's close. So stay tuned.

A quick spike above

20000 to celebrate the New Year might prove to be

a trap for unwary Trump partisans deploying new funds in January.

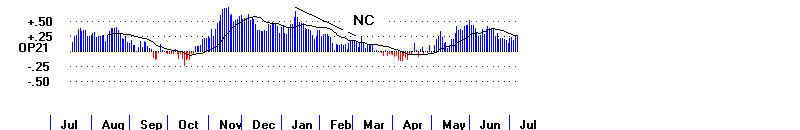

The data below show that the DJI failed recently to reach the 1.7% upper band

with the

IP21 and VI negative. In addition, the P-Indicator stands comfortably

above zero.

That explains why we have not seen a Peerless Sell signal (an S9, S12 or S16

recently.

It's true that there are almost 3x more stocks stocks traded on the NYSE now

than back in

1966, but even multiplying the PI value below for 1/6/1966, we see that the P-I

now is still

higher than in any cases below where the DJI declined from a late December or

early January top.

Thus, all this new data, in Table I, reinforces the research shown earlier

about the bullishness of a

December 17th-2-th close 2% over the 21-day ma, as happened this year. So,

most likely

we have not seen the DJI high yet on this advance.

But right now, we should, I think, wait for the key ETFs to stop showing falling

Closing Powers and 5-day moving averages. See Table II below in today's

Hotline.

Table I

Late December and Early January

Peaks and Pivots-Down in Rising Markets

Date

Peerless Signal LA/MA PI IP21 VI

Outcome