=========================================

Peerless, Tiger-Soft, Peerless/ Power-Ranker Prgms.

(C) 2016 - William Schmidt, Ph.D.

3/29/2018

http://tigersoft.com/Z/NEW-2016/INSTRUCTIONS.htm

=========================================

INSTALLATION AND BASIC OPERATIONS

=========================================

1. INSTALLATION INSTRUCTIONS

2. DATA DOWNLOADS

3. SETTING PARAMETERS

4. PEERLESS DJI CHART WITH AUTOMATIC BUYS and SELLS

5. SUPERIMPOSE DJI-BASED PEERLESS SIGNALS ON NASDAQ, etc

6. SELECT A TIGER DIRECTORY

7. SEE A TYPICAL STOCK/ETF CHART

8. RUBBER BAND LINES, DIAGONAL LINES, HORIZONTAL LINES, etc.

9. EXPERIMENT WITH DIFFERENT TIGERSOFT CHARTS

10. TRADING INDEX ETFS

11. QUICKSILVER RANKER

12. POWER RANKER

13. OPTIMIZED AND TREND-ABIDING SIGNALS

14. BULLISH MAXCPs versus BEARISH MINCPS

15. ADDITIONAL CHOICES FROM PEERCOMM-2016 SCREEN

16. ADDITIONAL PEERLESS-2016 CHOICES FROM TIGER SCREEN

17: ADDITIONAL CHOICES FROM MAIN 2016-GRAPHING SCREEN (Form 6)

18: ADDITIONAL CHOICES FROM OLDER GRAPHING SCREEN (Form6)

19: BUILDING YOUR OWN LIST OF STOCKS IN A SEPARATE TIGER DIRECTORY

20: EVALUATING A STOCK TECHNICALLY

21: TIGER BUY SIGNALS

22: TIGER SELL SIGNALS

23: USER SELECTED SCAN FOR A PARTICULAR SIGNAL

24: USER SELECTED SIGNALS' SET FOR DISPLAY ON A TIGER CHART

25: DUMMYING IN TENTATIVE DATA TO SEE IF NEW SIGNAL IS PRODUCED.

NEXT ->>> Tiger Trading Concepts

http://www.tigersoft.com/support/

http://tigersoft.com/Z/NEW-2016/INSTRUCTIONS.htm

=========================================

INSTALLATION AND BASIC OPERATIONS

=========================================

1. INSTALLATION INSTRUCTIONS

2. DATA DOWNLOADS

3. SETTING PARAMETERS

4. PEERLESS DJI CHART WITH AUTOMATIC BUYS and SELLS

5. SUPERIMPOSE DJI-BASED PEERLESS SIGNALS ON NASDAQ, etc

6. SELECT A TIGER DIRECTORY

7. SEE A TYPICAL STOCK/ETF CHART

8. RUBBER BAND LINES, DIAGONAL LINES, HORIZONTAL LINES, etc.

9. EXPERIMENT WITH DIFFERENT TIGERSOFT CHARTS

10. TRADING INDEX ETFS

11. QUICKSILVER RANKER

12. POWER RANKER

13. OPTIMIZED AND TREND-ABIDING SIGNALS

14. BULLISH MAXCPs versus BEARISH MINCPS

15. ADDITIONAL CHOICES FROM PEERCOMM-2016 SCREEN

16. ADDITIONAL PEERLESS-2016 CHOICES FROM TIGER SCREEN

17: ADDITIONAL CHOICES FROM MAIN 2016-GRAPHING SCREEN (Form 6)

18: ADDITIONAL CHOICES FROM OLDER GRAPHING SCREEN (Form6)

19: BUILDING YOUR OWN LIST OF STOCKS IN A SEPARATE TIGER DIRECTORY

20: EVALUATING A STOCK TECHNICALLY

21: TIGER BUY SIGNALS

22: TIGER SELL SIGNALS

23: USER SELECTED SCAN FOR A PARTICULAR SIGNAL

24: USER SELECTED SIGNALS' SET FOR DISPLAY ON A TIGER CHART

25: DUMMYING IN TENTATIVE DATA TO SEE IF NEW SIGNAL IS PRODUCED.

NEXT ->>> Tiger Trading Concepts

http://www.tigersoft.com/support/

1. INSTALLATION INSTRUCTIONS

This assumes you are in XP Mode or are using an XP.

(1) Close all other programs before running this installation.

(2) With the Tiger Installation Disk in your Computer, you must

run a series of separate programs.

First RUN the file 2010123.exe.

You can use START + RUN + f:\2010123.exe (where F is your CD drive.

Change the letter "F" as needed for your system.)

Alternatively, copy all the 7 files just below to your computer.

When they are all there, open and run 2010123.exe from your computer.

2010123.exe

2010123.w02

2010123.w03

2010123.w04

2010123.w05

2010123.w06

2010123.w07

You will see an image of a Tiger and get several prompts during

the installation. Just click OK for each.

After the programs are all installed, you may get an error message

at the point where the data is to be installed. This is not a problem.

The data needed will be put in place further below when using our

TigerSoft DATA page. So, you can abort the installation at this point,

because the initial programs will have been installed.

(You may also RUN STOCKS.exe, DJI-30.exe and PEER04.exe to install the

basic Stocks and Peerless data files as of 2/26/2015.)

(3) Next bring your TigerSoft/Peerless programs fully up to date.

Open and run each of the following five files.

(This installs the Tiger-Power-Ranker and installs a security code

we use to identify versions of the software.)

OPEN/RUN IN SEQUENCE THESE FROM YOUR COMPUTER:

1. winpeer.exe ... Older graphing program

7/27/2006 update and security check.

2. extra.exe ... Loads in history1.exe, history2.exe and

split.exe.

3. flagrank.exe ... Nightly flagging and ranking software.

4. power.exe ... Latest Analysis programs.

5. INSTPEER.exe 2018 version of main graphing program.

6. INSTCOMM.exe Install 2018 Peercomm.

7. INSTDIRL.exe Installs ascii symbols' lists in C:\peerless.

8. OVERRIDE.exe Current list of company names

to match with symbols. (This will need frequent

updating from the Tiger Data Page.) The most current

list here is on the Tiger Data Page.

8. Download DLL and VBX Files needed for TigerSoft

and Peerless (This step is usually not needed.)

This may require the building of C:\windows. But

do not do this until instructed by us.

Run these two files.

ZDLL1.exe -

to install the files into c:\peercomm\system

ZDLL2.exe -

to install the files into c:\peerless\winpeer

2. DATA DOWNLOADS

8 Using Firefox or Internet Explorer

go to the current Tiger Data Page.

As of 3/29/2018, it is at www.tigersoft.com/4XD78/INDEX.htm

(This changes regularly.)

From this Tiger Data Page, see how the data file

downloads work. On this page, you will find more than 90

different .exes which send the current data to your computer.

Pick just the ones you want for your purposes.

It is suggested that each night, or when needed that you

Open and Run PEER04.exe, DJI-30.exe, MAXCP.exe.

MINCP.exe and STOCKS.exe plus any of the others you like.

Each download places different current data in your computer.

It will place each set of data in a directory that corresponds

to the name of the download, with the exception of PEER04.exe

which places the data files in c:\peerless. Each download

replaces the previously updated data with the new data.

PEER04.exe - This loads the current DJI, NYSE A/D,

OEX, SP-500, NYSE and NASDAQ data,

as well as Hourly DJI and Weekly DJI.

STOCKS.exe - an assortment of high caps are loaded

into c:\stocks

DJI-30.exe - DJI and key ETFs are loaded into c:\DJI-30

MAXCP.exe - Current stocks making Closing Power new highs

are loaded into c:\MAXCP

MINCP.exe - Current stocks making Closing Power new highs

are loaded into c:\MAXCP

16-a.exe - Stocks beginning with the letter "A" are

loaded into c:\14-a

LEVERAGE.exe - Leveraged ETFs.

REITS.exe - REIT sector data are loaded into c:\REITS

------------------------------------------------------------------

3.SETTING PARAMETERS

Now you are ready to prepare the TIGER PROGRAMS for use.

1. Place the icon for PEERCOMM on your desk top.

Click Start + All Programs + find Tiger Investment

Software + with the left mouse key down drag the

Peercomm over to your desk top. (Alternatively,

you can find the program c:\peercomm\PEERCOMM.exe

using Windows Explorer and copy it to the desk top.)

Peercomm will lead you to the other programs.

2. Now start the TigerSoft programs.

Double-click the left mouse-key pointing to the Peercomm icon

This is the procedure you will regularly use. In the rare

event that the programs err out, use this procedure to restart

them.

3. Sizing. Place a chart on the screen to see how well the image fits

your monitor. Use these commands.

Peercomm + Charts2016 (upper right button +

Daily Stocks + AA (or any stock symbol) + OK.

How does the size of the image suit your monitor?

Is it too small?

Too large?

X-Axis - left to right.

Y-Axis - up-down.

Set the size of the graph on your monitor for the

Peerless/Tiger-2016 charts.

Use Peercomm + Peerless-2016 + Run Set Ups (upper left)

+ Initial Graph Choices(2)

+ 550 (A lower number expands the screen vertically)

+ 750 (A lower number expands the screen horizontally)

+ Y + N +Y

Then use Peercomm + Peerless-2016 + Run Set Ups

+ Initial Graph Choices(1) + Y

This gives you the same type of charts we most often use for Hotline.

4. PEERLESS DJI CHART WITH AUTOMATIC BUYS and SELLS

Use Peercomm + Peerless-2016 + Peerless Daily DJI +

OK (to DATA, the current DATA. You could use DATA6566 or

DATA87, DATA04 etc. to see older data and signals.

With Peerless DJI chart on screen, ask the computer

to show the Peerless Buys and Sells using the commands

Signals(1) (upper right)+ DJI Major Buys and Sells.

See all the key internal strength indicators next.

NYSE A/D Line

P-I (21-day ma of Daily NYSE Advances-Declines

Tiger Accumulation Index (Originally called "IP21" back in 1981)

With Peerless DJI chart on screen, enter Operations + DJI Chart and ADL,PI, Accum.Index.

To see what happens to $10,000 using Buys only at the

next day's opening after a signal. choose

Operations + What Happens to $10,000 (Buys Only) + Y.

Click X (upper right corner) three times to go back to the Main Peercomm Menu

For more information on Peerless Buys and Sells, see

Peerless Buy and Sell Signals: 1928-2016

Individual Peerless signals explained:

http://tigersoftware.com/PeerlessStudies/Signals-Res/index.htm

http://www.tigersoft.com/PeerInst-2012-2013/

http://www.tigersoft.com/PeerInst-2012-2013/

Peerless Signals and DJI Charts - version 7/4/2013

1965 1965-6 1966 1966-7 1967 1967-8 1968 1968-9 1969 1969-70 1970 1970-1 1971

1971-2 1972 1972-3 1973 1973-4 1974 1974-5 1975 1975-6 1976 1976-7 1977 1977-1978

1978 1978-79 1979 1979-80 1980 1980-1 1981 1981-2 1982 1982-1983 1983 1983-1984

1984 1984-1985 1985 1985-1986 1986 1986-1987 1987 1987-8 1988 1988-9 1989 1989-90

1990 1990-1 1991 1991-2 1992 1992-3 1993 1993-4 1994 1994-5 1995 1995-1996 1996

1996-7 1997 1997-8 1998 1998-1999 1999 1999-2000 2000 2000-1 2001 2001-2 2002

2002-3 2003 2003-4 2004 2004-5 2005 2005-6 2006 2006-7 2007 2007-8 2008 2008-9

2009 2009-10 2010 2010-11 2011 2011-12 2012 2012-2013 2013 2013-2014 2014 2014-2015

2015 2015-2016

5. SUPERIMPOSE DJI-BASED PEERLESS SIGNALS ON NASDAQ (SP-500, etc.)

Use Peercomm + Peerless-2016 + Peerless Daily DJI +

SHORT-TERM INDEXES + CURRENT NASDAQ + OK (for NASD)

+ Signals1 (Upper left) + Superimpose DJI Saved Signals.

To see what happens to $10,000 using Buys and Selling

Short at the next day's opening after a signal, choose

Operations + What Happens to $10,000 (Buys/Sell Short) + Y.

To see what happens to $10,000 using Buys only at the

next day's opening after a signal. choose

Operations + What Happens to $10,000 (Buys Only) + Y.

Click X (upper right corner) three times to go back to the Main Peercomm Menu

For more information on Peerless Buys and Sells, see

Peerless Buy and Sell Signals: 1928-2016

Individual Peerless signals explained:

http://tigersoftware.com/PeerlessStudies/Signals-Res/index.htm

http://www.tigersoft.com/PeerInst-2012-2013/

http://www.tigersoft.com/PeerInst-2012-2013/

Peerless Signals and DJI Charts - version 7/4/2013

1965 1965-6 1966 1966-7 1967 1967-8 1968 1968-9 1969 1969-70 1970 1970-1 1971

1971-2 1972 1972-3 1973 1973-4 1974 1974-5 1975 1975-6 1976 1976-7 1977 1977-1978

1978 1978-79 1979 1979-80 1980 1980-1 1981 1981-2 1982 1982-1983 1983 1983-1984

1984 1984-1985 1985 1985-1986 1986 1986-1987 1987 1987-8 1988 1988-9 1989 1989-90

1990 1990-1 1991 1991-2 1992 1992-3 1993 1993-4 1994 1994-5 1995 1995-1996 1996

1996-7 1997 1997-8 1998 1998-1999 1999 1999-2000 2000 2000-1 2001 2001-2 2002

2002-3 2003 2003-4 2004 2004-5 2005 2005-6 2006 2006-7 2007 2007-8 2008 2008-9

2009 2009-10 2010 2010-11 2011 2011-12 2012 2012-2013 2013 2013-2014 2014 2014-2015

2015 2015-2016

5. SUPERIMPOSE DJI-BASED PEERLESS SIGNALS ON NASDAQ (SP-500, etc.)

Use Peercomm + Peerless-2016 + Peerless Daily DJI +

SHORT-TERM INDEXES + CURRENT NASDAQ + OK (for NASD)

+ Signals1 (Upper left) + Superimpose DJI Saved Signals.

To see what happens to $10,000 using Buys and Selling

Short at the next day's opening after a signal, choose

Operations + What Happens to $10,000 (Buys/Sell Short) + Y.

6. SELECT A TIGER DIRECTORY

Use Peercomm + Select Folder(upper left button) + DJI-30 + OK

This allows you to change the assumed stock directory

to any of the Tiger data directories you have

downloaded.

7. SEE A TYPICAL STOCK/ETF CHART

Peercomm + Charts2016 (upper right button +

Daily Stocks + QQQ (or any stock symbol) + OK.

6. SELECT A TIGER DIRECTORY

Use Peercomm + Select Folder(upper left button) + DJI-30 + OK

This allows you to change the assumed stock directory

to any of the Tiger data directories you have

downloaded.

7. SEE A TYPICAL STOCK/ETF CHART

Peercomm + Charts2016 (upper right button +

Daily Stocks + QQQ (or any stock symbol) + OK.

There is a bar chart at the top with moving averages and bands,

a blue Closing Power beneath the bar chart,

a pink OBV Line,

a brown Relative Strength Line and

a blue/red Tiger Accumulation Index.

A 2016 Super Stock - NVDA

A 2016 Super Stock - NVDA

PINK (Magenta) CLOSING POWER DIVERGENCE SIGNALS

PINK (Magenta) CLOSING POWER DIVERGENCE SIGNALS

These are the Closing Power divergence signals. They are warnings,

either bullish or bearish. They are significant mainly when prices then

break to the other side of the 65-dma. You can make them appear or not appear

in the first place as you do a new chart by setting them up by using

Peercomm + Charts 2017-8 + Run/Setups (upper right)+

Set Initial Screen's Signals + "Y"es or "N"o in reply to first question on

upper left: "Do you want to see automatic (magenta) CP divergence

B7/S7 signals?"

These are the Closing Power divergence signals. They are warnings,

either bullish or bearish. They are significant mainly when prices then

break to the other side of the 65-dma. You can make them appear or not appear

in the first place as you do a new chart by setting them up by using

Peercomm + Charts 2017-8 + Run/Setups (upper right)+

Set Initial Screen's Signals + "Y"es or "N"o in reply to first question on

upper left: "Do you want to see automatic (magenta) CP divergence

B7/S7 signals?"

I've found a cluster of them for a month followed by a quick cross-over

of prices across the 65-dma is helpful. We also want to see confirming

Accumulation. But without a price cross-over, they are not significant.

The CP divergences from price show that Professionals are acting in ways

that are at variance with other market participants.

See how Boeings top in 2008 occurred after such a cluster of Closing Power

warnings.

I've found a cluster of them for a month followed by a quick cross-over

of prices across the 65-dma is helpful. We also want to see confirming

Accumulation. But without a price cross-over, they are not significant.

The CP divergences from price show that Professionals are acting in ways

that are at variance with other market participants.

See how Boeings top in 2008 occurred after such a cluster of Closing Power

warnings.

Note. PEERLESS/TIGER CHARTS

Note. PEERLESS/TIGER CHARTS

Generally, use Peercomm + Peerless-2016-8

(upper button on right). The older charting program

can be used, but its image can only be sized by changing

all your Image resolution settings to 600x800 and that

may not be satisfactory for you, though we with weaker

eyes are happy to use it.

8. RUBBER BAND LINES, DIAGONAL LINES,

HORIZONTAL LINES, etc.

On any chart you can extend a line from a fixed point using

Lines + Rubber Band ... Point and drag line where you want it extended.

Experiment with the other lines. The Vertical Line can be used

to see the key values on a specific date.

9. EXPERIMENT WITH DIFFERENT TIGERSOFT CHARTS.

CandleStick Chart - Opening and Closing Power, Accumulation Index

PEERCOMM + Peerless-2016 + Daily Stocks + any stock symbol in

directory + OK + Operations + Candle Stick + 0 + OK.

This chart lets us magnify a chart and see our most important

indicators, Accumulation Index and Closing Power.

6-month chart emphasizing 5-day ma and volume.

PEERCOMM + Peerless-2016 + Daily Stocks + any stock symbol in

directory + OK + Operations + Six-Month Chart.

6-month chart emphasizing 5-day ma and volume.

PEERCOMM + Peerless-2016 + Daily Stocks + any stock symbol in

directory + OK + Operations + Six-Month Chart.

Explode a chart to magnify it.

With a stock/ETF chart on screen:

Lines + Explode + click to points to define dates' boundaries.

What it will take to break a user-drawn

Closing Power trend-line?

PEERCOMM + Peerless-2016 + Daily Stocks + any stock symbol in

directory + OK + Lines + Explode Selected Screen Area + OK

+ two clicks of mouse showing horizontal (dates) borders

+ Lines + Draw Closing Power Trend: Show Statistics +

Carefully with two clicks show where Closing Power trend is supposed

to go and see what price level is needed the next day to break this

CP trend-line.

Explode a chart to magnify it.

With a stock/ETF chart on screen:

Lines + Explode + click to points to define dates' boundaries.

What it will take to break a user-drawn

Closing Power trend-line?

PEERCOMM + Peerless-2016 + Daily Stocks + any stock symbol in

directory + OK + Lines + Explode Selected Screen Area + OK

+ two clicks of mouse showing horizontal (dates) borders

+ Lines + Draw Closing Power Trend: Show Statistics +

Carefully with two clicks show where Closing Power trend is supposed

to go and see what price level is needed the next day to break this

CP trend-line.

Chart an extra day of tentative data.

Peercomm + Older Charting + Daily Stocks + stock/ETF + OK

+ Operations + Re-Chart Using Tentative Day's New Data.

10. TRADING INDEX ETF FUNDS

The automatic signals that Peerless Stock Market Timing gives on the DJIA

can be superimposed on any ETF. But there are times when we want more.

This is usually because Peerless is an intermediate-term system and we may want

to short-term trade. In addition, we may choose to "clinch" a reversing Peerless

signal since each Peerless signal has some chance of being premature or

wrong. We should also appreciate that each ETF has a price-path

that is somewhat independent of the DJI. So how should we proceed?

How can we distinguish the best ETFs to short or buy from those with more risk

of not working out.

First, compare the IP21 (Current Accumulation) readings for the different

ETFs. We would prefer only to short an ETF with an IP21 level close to

of below all the others. With leveraged ETFs, we want to buy mostly ETFs

with IP21 readings above +.15 and short those with readings below -.15.

(With QQQ below, the IP21 is -.052. While this is bearish, we can can

also see that IP21 is above its rising 21-day ma.)

Secondly, Watch the Closing Power trend.

We want net-Professionals to be in agreement with us. We want the Closing

Power of our choice of ETFs to not have a rising Closing Power trend

if we short it and not have a falling Closing Power trend if we buy it.

Draw trendlines to see the Closing Power trends when they are over-extended,

otherwise use the "Bearish" or "Bullish" Closing Power notation to the

right of the chart. This shows whether the Closing Power is below a falling

CP ma or above a rising CP ma. (With QQQ below, the Closing Power is clearly

downtrending and rated "Bearish", too.)

Thirdly, compare the relative strengths of the major ETFs. Compare their

annualized 5-day rate of changes and compare their ITRS (this measures the

difference in performance between some other stock or ETF and the DJI).

Try mostly to buy the best of the six ETFs: DIA, SPY, MDY, OEX, QQQ and IWM.

Each has its data in the DJI-30 download or short the weakest.

Fourth, if we are "clinching" a Peerless Sell signal, we might want to sell

short not only the ETF that is weakest in terms of 5-dma AROC and ITRS,

we might also want to be sure that its Closing Power is below its 21-day ma

and falling.

And fifth, to be safer, we may want only to be short one of these ETFs

so long as their price-5-day ma is falling. If that moving average turns up,

we may want to cover the short or not go short it. Here we compare the

chart-posted pivot-point and the close on the chart. See the chart below.

If on the next day, QQQ closes above 117.11, it will mean that its 5-day ma

will turn up and we should probably cover our short sale.

Lastly, always look for chart patterns that show where the likely support

and resistance are. In QQQ's case below, resistance is at its falling (purple)

65-dma at 117 and temporary support is at 114. We would judge that a penetration

of 117 is likely to lead to a challenge of 119.5, its previous high.

Regarding 200-day ma support:

How reliable support is the DJI's rising 200-day ma?

Google "TigerSoft" "head and shoulders".

QQQ: A Bearish Example, on 11/14/2016

Chart an extra day of tentative data.

Peercomm + Older Charting + Daily Stocks + stock/ETF + OK

+ Operations + Re-Chart Using Tentative Day's New Data.

10. TRADING INDEX ETF FUNDS

The automatic signals that Peerless Stock Market Timing gives on the DJIA

can be superimposed on any ETF. But there are times when we want more.

This is usually because Peerless is an intermediate-term system and we may want

to short-term trade. In addition, we may choose to "clinch" a reversing Peerless

signal since each Peerless signal has some chance of being premature or

wrong. We should also appreciate that each ETF has a price-path

that is somewhat independent of the DJI. So how should we proceed?

How can we distinguish the best ETFs to short or buy from those with more risk

of not working out.

First, compare the IP21 (Current Accumulation) readings for the different

ETFs. We would prefer only to short an ETF with an IP21 level close to

of below all the others. With leveraged ETFs, we want to buy mostly ETFs

with IP21 readings above +.15 and short those with readings below -.15.

(With QQQ below, the IP21 is -.052. While this is bearish, we can can

also see that IP21 is above its rising 21-day ma.)

Secondly, Watch the Closing Power trend.

We want net-Professionals to be in agreement with us. We want the Closing

Power of our choice of ETFs to not have a rising Closing Power trend

if we short it and not have a falling Closing Power trend if we buy it.

Draw trendlines to see the Closing Power trends when they are over-extended,

otherwise use the "Bearish" or "Bullish" Closing Power notation to the

right of the chart. This shows whether the Closing Power is below a falling

CP ma or above a rising CP ma. (With QQQ below, the Closing Power is clearly

downtrending and rated "Bearish", too.)

Thirdly, compare the relative strengths of the major ETFs. Compare their

annualized 5-day rate of changes and compare their ITRS (this measures the

difference in performance between some other stock or ETF and the DJI).

Try mostly to buy the best of the six ETFs: DIA, SPY, MDY, OEX, QQQ and IWM.

Each has its data in the DJI-30 download or short the weakest.

Fourth, if we are "clinching" a Peerless Sell signal, we might want to sell

short not only the ETF that is weakest in terms of 5-dma AROC and ITRS,

we might also want to be sure that its Closing Power is below its 21-day ma

and falling.

And fifth, to be safer, we may want only to be short one of these ETFs

so long as their price-5-day ma is falling. If that moving average turns up,

we may want to cover the short or not go short it. Here we compare the

chart-posted pivot-point and the close on the chart. See the chart below.

If on the next day, QQQ closes above 117.11, it will mean that its 5-day ma

will turn up and we should probably cover our short sale.

Lastly, always look for chart patterns that show where the likely support

and resistance are. In QQQ's case below, resistance is at its falling (purple)

65-dma at 117 and temporary support is at 114. We would judge that a penetration

of 117 is likely to lead to a challenge of 119.5, its previous high.

Regarding 200-day ma support:

How reliable support is the DJI's rising 200-day ma?

Google "TigerSoft" "head and shoulders".

QQQ: A Bearish Example, on 11/14/2016

IWM: A Bullish Example, on 11/14/2016

In IWM's case, the megaphone-price pattern sets up resistance at 131-132.

Notice, too that its IP21 and ITRS are stronger than QQQ's and both its

Opening and Closing Power are stronger than QQQ's. This is the better

ETF to go long. And using the principle of abiding by the 5-day ma direction,

the risk here would seem limited.

IWM: A Bullish Example, on 11/14/2016

In IWM's case, the megaphone-price pattern sets up resistance at 131-132.

Notice, too that its IP21 and ITRS are stronger than QQQ's and both its

Opening and Closing Power are stronger than QQQ's. This is the better

ETF to go long. And using the principle of abiding by the 5-day ma direction,

the risk here would seem limited.

11. QUICKSILVER RANKER

To find the strongest leveraged ETF, we recommend downloading LEVERAGE

from the Tiger Data Page. This consists of all the leveraged ETFs.

Then run the Tiger "QuickSilver" program using the commands:

PEERCOMM + Select Folder + (choose) LEVERAGE + Ok + Charts 2016 +

Run/Setups + Run QuickSilver + after 20 seconds...

Examine table by choosing New Display (top) + BUYs.

See in the example shown below how all the stocks

met the QuickSilver requirements for a Buy except that their

volume did not rise on an UP-day. Falling volume on a down-day

is bullish, but we would prefer to see volume rising on an up-day.

And of course, try to buy these ETFs near their rising 5-day ma,

not at their 5-day ma upper bands.

More QuickSilver Documentation

11. QUICKSILVER RANKER

To find the strongest leveraged ETF, we recommend downloading LEVERAGE

from the Tiger Data Page. This consists of all the leveraged ETFs.

Then run the Tiger "QuickSilver" program using the commands:

PEERCOMM + Select Folder + (choose) LEVERAGE + Ok + Charts 2016 +

Run/Setups + Run QuickSilver + after 20 seconds...

Examine table by choosing New Display (top) + BUYs.

See in the example shown below how all the stocks

met the QuickSilver requirements for a Buy except that their

volume did not rise on an UP-day. Falling volume on a down-day

is bullish, but we would prefer to see volume rising on an up-day.

And of course, try to buy these ETFs near their rising 5-day ma,

not at their 5-day ma upper bands.

More QuickSilver Documentation

Directory= C:\leverage date= 11/16/16

5DAROC Symbol Last 5-dma Pivot Change

....................................................................................

IP21 AI/200 OP-PWR CP-PWR PCT-Up Daily Vol. notes

====================================================================================

785.8 KRU 133 131.18 122.51 -3.7

.37 58 Rising Rising .47 vol.fell on down-day

---------------------------------------------------------------------------------------------

442.9 FAS 34.86 34.81 33.72 -.8

.31 163 Rising Rising .518 vol.fell on down-day

---------------------------------------------------------------------------------------------

334.6 UYG 82.67 82.52 80.47 -1.45

.39 169 Rising Rising .518 vol.fell on down-day

---------------------------------------------------------------------------------------------

295.9 YCS 70.01 68.73 67.29 -.13

.43 104 Rising Rising .494 vol.fell on down-day

---------------------------------------------------------------------------------------------

172 TMV 22.36 22.83 22.52 -.64

.26 92 Rising Rising .43 vol.fell on down-day

---------------------------------------------------------------------------------------------

164.5 DDM 76.01 75.85 75.35 -.31

.25 161 Rising Rising .526 vol.fell on down-day

---------------------------------------------------------------------------------------------

124 TBT 38.78 39.29 38.93 -.67

.26 100 Rising Rising .438 vol.fell on down-day

---------------------------------------------------------------------------------------------

110.3 PST 21.92 21.85 21.66 -.07

.34 65 Rising Rising .442 vol.fell on down-day

---------------------------------------------------------------------------------------------

-349.6 DGAZ 7.69 8.04 8.39 -.35

.2 71 Rising Rising .51 vol.fell on down-day

---------------------------------------------------------------------------------------------

To find those ETFs ranked as QuickSilver Buys, find those with

an 5-dma AROC > 500%,

an IP21>+.15,

rising Opening and Closing Power,

and rising volume on an up day.

These make excellent short-term trades as long as their Closing Power

is rising. See below:

12. POWER RANKER

12. POWER RANKER

To find the most bullish stocks from a 2-3 months perspective

in the universe of 6000, we recommend running the Tiger Power Ranker.

Select the stocks directory MAXCP and then Run ANALYSIS/RANK (lower left)

from the 8 button Peercomm screen. Click X at upper right to go

back to Peercomm screen when the ranking is finished. Do not click

return to Tiger Menu. Then choose Peerless-2016 + Daily Stocks.

Then pick "BULLISH" from the middle of the screen to see first stock,

the most bullish. Click OK.

Scrolling through a List of Stocks

After viewing this stock, Click 2 (down) on right of keyboard to see

the next, etc. Go up a stock in this list by clicking 8 (up).

(The NUM-LOCK key must be turned off for this

to work properly.)

Or to see the most bearish stocks, Select the stocks directory MINCP

and then run ANALYSIS/RANK (lower left) + X (upper right).

Then pick "BEARISH" from the middle of the screen to see first stock,

the most bullish. Click OK.

All the other useful items in the middle of the Choices' Menu may

be used with any directory provided you have run the Power Ranker

for that directory.

Bullish examples are: "New Highs", "IP21 over .25" and "HISTB12".

Bearish examples are: "New Lows", "HISTS9", "BOTHDOWN", "IPCRUNTI"

VERY IMPORTANT - When finished with ANALYSIS

Power Ranker) ALWAYS CLICK X. Do not click

the button in the middle. It will take you to the older

charting programs.

Now let's assume you want to look at stocks based on their

Power Ranking.

Click X and go back to the Main Peercomm 8-Button screen.

Click on these commands:

Charts-2016 + Ranking Results (top center) + Tiger Power Ranker.

Click on any row + Graph to see the Charts.

The columns show the following information:

Power = Power Ranking - high is bullish. low is bearish

___________________________________________________

AI/200 = How many days in the last 200 that Accum.Index

was positive. High number shows institutional

buying on weakness.

____________________________________________________

OBV%-Pr% ... below -10 shows bearish OBV divergence

from price Avoid these stocks.

____________________________________________________

IPA%-Pr% ... below -10 shows bearish IPA divergence

from price. Avoid these stocks.

____________________________________________________

Current IP21 ... Above +.375 is considered insider buying.

Below -.250 is considered insider selling.

____________________________________________________

Close Closing Price

____________________________________________________

Trend-50 AR bullishly above rising 50-dma

BF bearishly below falling 50-dma

____________________________________________________

CL/21-dma above 1.00 is bullish.

____________________________________________________

UP% = % of days stock has risen on day-to-day basis

for last year.

>50% is bullish but >60% is risky and may be over-bought.

__________________________________________________________

MACD Signal = Intermediate momentum trend.

__________________________________________________________

TGR Sig The First letter shows whether Opening Power

is Up or Down.

The second letter shows whether Closing power

is Up or Down.

UU is most bullish but often late in a trend.

UD is turning bearish

DU is early bullish.

DD is most bearish.

___________________________________________________________

I’d like... all the stocks in the directory listed

from highest returns to date to the lowest returns to date.

You can do it for 21, 50, 100 and 250 performance ranking:

Peercomm + Analyze/Rank for a directory + X at upper left when finished +

Charts-2016 + Ranking Results (top) + 21 or 50 or 100 0r 250 day ranking.

You also can do it for a different, odder number of days as follows:

Peercomm + Older Charting + Ranking Results + User Set Ranking (last in list)

+ your number of days to go back) + 1 (for Pct change ranking).

Then to chart one or more of them, click on a row and click Graph Stock.

(You could click 3 for IP21 to be basic of ranking.)

13. OPTIMIZED AND TREND-ABIDING SIGNALS

The red signals that appear are those based on the

optimized best system for the last year. The top

line tells you what the signals are based on and

their trading results over the last year. Stochastic

based Red arrows work best when the stock is

in a trading range and not trending too much.

Place the technical signals that generally work

best given the direction of the heavy purple 65-dma.

With a Tiger chart of the screen, use Signals(1) +

==>Stocks' Signals compatible with 65-dma.

For more information see Introduction to Tiger/Peerless Buys and Sells.

Documentation for TigerSoft Automatic and Optimized Signals.

Different Types of TigerSoft/Peerless CHARTS, Signals and Indicators

Tiger S9 + S12 + Closing Power Trend-Break. Easy as 1-2-3 Short Sales

14.BULLISH MAXCPs versus BEARISH MINCPS

Contrast the very Bullish looking and very Bearish

looking Stock/ETF

We often hedge. We buys some of the BULLISH MAXCPs and

short some of the BEARISH MINCPS. We believe in this

principle so strongly that we post the best and worst of these

stocks each night on our Hotline.

Very Bullish stock - TOWN

Signals shown: Automatic Optimized Red signals based here

on (see top of chart)

Also shown are

Very Bearish Bond Fund

Signals shown: Automatic Optimized Red signals based here

on (see top of chart)

Pink S7s warn of trouble when purple 65-dma is finally broken.

Use Signals(3) + Closing Power Divergence Signals.

Numbered technical signals shown for second half of chart.

Block off signals using Operations + Make Signals' Exclusion Zone + 2 clicks.

Then employ Signals (1) + signals technical consistent direction of

65-dma.

Very Bearish Bond Fund

Signals shown: Automatic Optimized Red signals based here

on (see top of chart)

Pink S7s warn of trouble when purple 65-dma is finally broken.

Use Signals(3) + Closing Power Divergence Signals.

Numbered technical signals shown for second half of chart.

Block off signals using Operations + Make Signals' Exclusion Zone + 2 clicks.

Then employ Signals (1) + signals technical consistent direction of

65-dma.

15. ADDITIONAL CHOICES: FROM PEERCOMM-2016 SCREEN

Only a few of these pull-down choices should be used unless advised by us.

The others you might want to use are noted below.

File

Optimize Bands and Drop Older Data.

Running this will give somewhat better fitting bands.

Stock Data Folders

Create Data File Folder from A-Z stocks.

Running this to create your own customized Tiger Data folder.

See instructions near top of Tiger Data Page.

View

Tiger Spreadsheet of Key Values.

First Run Tiger Power Ranker/Analysis from Peercomm page.

By clicking on top row of any column you can rank the items by

this key value. For example, AI/200 (longer term Accumulation)

or IP21 (Current Accumulation)

Tiger Power Ranker.

Instructions

Tiger/Peerless Instructions.

TigerSoft Core Concepts

15. ADDITIONAL CHOICES: FROM PEERCOMM-2016 SCREEN

Only a few of these pull-down choices should be used unless advised by us.

The others you might want to use are noted below.

File

Optimize Bands and Drop Older Data.

Running this will give somewhat better fitting bands.

Stock Data Folders

Create Data File Folder from A-Z stocks.

Running this to create your own customized Tiger Data folder.

See instructions near top of Tiger Data Page.

View

Tiger Spreadsheet of Key Values.

First Run Tiger Power Ranker/Analysis from Peercomm page.

By clicking on top row of any column you can rank the items by

this key value. For example, AI/200 (longer term Accumulation)

or IP21 (Current Accumulation)

Tiger Power Ranker.

Instructions

Tiger/Peerless Instructions.

TigerSoft Core Concepts

16: ADDITIONAL CHOICES FROM MAIN 2016-GRAPHING SCREEN (Form 6)

On the right of the screen, choose what is to be graphed. (Vital.)

Peerless Daily DJI (This is source of Peerless Buys and Sells, which have

been back-tested to 1928.)

Short-Term Indexes (Hourly DJI, NASDAQ, SP-500, NYSE and OEX)(Vital.)

Daily Stocks (This leads to key graphing of chosen stock/ETF.(Vital.)

Weekly Stocks (Data must be downloaded from Tiger Data Page. (Vital.)

Daily Stocks (This leads to key graphing of chosen stock/ETF.(Vital.)

Weekly Stocks (Data must be downloaded from Tiger Data Page. (Vital.)

Index of your list of stocks (A Tiger Index can be created of all stocks

in directory you are currently using.

Use Indicators(1) + A/D Line (This shows group's A/D Line.

It is very handy to see the trend-changes in a directory's

combined A/D Line. This is a chart of the cumulative

daily advances-declines. At bottom of this chart

also appears a line showing how the percent of stocks

in this directory above 65-dma has changed over the last

year. (Vital.)

Index of your list of stocks (A Tiger Index can be created of all stocks

in directory you are currently using.

Use Indicators(1) + A/D Line (This shows group's A/D Line.

It is very handy to see the trend-changes in a directory's

combined A/D Line. This is a chart of the cumulative

daily advances-declines. At bottom of this chart

also appears a line showing how the percent of stocks

in this directory above 65-dma has changed over the last

year. (Vital.)

CHOICES FROM MAIN 2016-GRAPHING SCREEN (continued)

Below are the most important pull-down choices from top. Others should be used

when one has first learned how to use the choices set out here.

Run/Setups

Run QuickSilver =5 day AROC Ranking. (Very useful.)

Compute Peerless Gains (and maximum paper losses for all stocks in directory.)

Rank Directory's Stocks for Pct. over 65-dma.

Compute BOTH UP Statistics (for all stocks in directory.)

DJI Future based on Past Seasonality. (Very useful.)

Net IDOSC (Day to day predictor of DJI when in trading ranges).

Next Day Predictor (What stock best predicts DJI day to day.)

DJI Predictor (What stock is best predicted by DJI day to day.)

Edit

Send Symbols' List to File in Peerless (using name of directory)

Tiger Selections

#1 Indicators' Results (Shows which systems work best with each stock in directory).

Bullish Stocks for next 3 months (The shows spreadsheet of key values

and easy direct graphing)

Bearish Stocks for next 3 months (The shows spreadsheet of key values

and easy direct graphing)

Tiger Groups (Spreadsheet for all flagged groups and easy graphs of those clicked on.)

Multiple Factor Screening (Scan stocks for those meeting multiple conditions)

Ranking Results

Tiger Power Ranking (Shows results from last run of Power Ranker and easy graphs)

(Very useful.)

Tiger Accumulation Index (Shows AI/200 ranking results from last run of Power Ranker

and easy direct graphing. (Very useful.)

50-Day Pct. Change Ranking and Divergences. (Very useful.)

Recent Signals

Most Recent Signal for All Stocks (Scan for favored Tiger Technical Buys/Sells.)

Tiger technical Buys and Sells explained under HELP on this form.

Key Values

Spreadsheet Display (For all stocks in directory. Click top of column to rank)

Help

Glossary Of Key Indicators, Terms and Concepts (Vital for beginner to Tiger.)

Peerless Intermediate-Term Signs (Explanation and track record) (Very useful.)

Tiger Stock Signals Explained. (Very useful.)

Weekly Signals(Very useful.)

17: ADDITIONAL CHOICES FROM MAIN 2016-GRAPHING SCREEN (Form 6)

Below is more information on the most important pull-down choices from the top.

It is recommended that you first become more familiar with the numbered Tiger

technical signals...

PEERCOMM + Charts 2016 + Daily Stocks + Stock/ETF + OK

+ Help + Tiger Signals Explained.

File

Graph New Stock - You may also click "2" key on right side of keyboard.

SAVE - stock-symbol.GIF file created in c:\peerless (Very useful.)

Build/Run User-Defined Signals Set (Very useful.)

Signals(1)

DJI Major (Peerless) Buys and Sells (Most important.)

This choice is only valid for the DJI. It is the way we show the Peerless

signals on the DJI currently ('DATA') and historically ('DATA87' or 'DATA1112')

Superimpose (Peerless) DJI Saved Signals (Very important.)

Display User Selected Tiger Signal (Very Important.)

See the details of Tiger Technical Signals by using Help + Tiger Signals

Display A User Selected Set of Tiger Signals (Very Important.)

(1) Tiger's Form6 (graph on screen) + File + Build/Run User-Defined Signals Set

(2) Tiger's Form6 (graph on screen) + Signals(1)

+ Display A User Selected Set of Tiger Signals

Stock's Signals Compatible with 65-dma. (Very Important.)

Signals(2) - experimental

Use the Stochastic Buys and Sells that cater to your trading style.

5-day is for very short-term trading. 20-day is for intermediate-term.

90-day is for still longer term. After a long advance, watch for Closing

Power penetrations of 50-day ma.

Signals(3)

Closing Power Divergence Warnings: S7 (Very useful.)

Sell S7s are to be acted only after prices move to the other side of

the 65-dma. Until then, they are warnings. The data for the new Sell S7

- CP Divergences are posted each night on the TigerSoft Data Page.

Indic(1)

Use the Stochastic Buys and Sells that cater to your trading style.

5-day is for very short-term trading. 20-day is for intermediate-term.

90-day is for still longer term. (Very useful.)

CHOICES FROM MAIN 2016-GRAPHING SCREEN (continued)

Below are the most important pull-down choices from top. Others should be used

when one has first learned how to use the choices set out here.

Run/Setups

Run QuickSilver =5 day AROC Ranking. (Very useful.)

Compute Peerless Gains (and maximum paper losses for all stocks in directory.)

Rank Directory's Stocks for Pct. over 65-dma.

Compute BOTH UP Statistics (for all stocks in directory.)

DJI Future based on Past Seasonality. (Very useful.)

Net IDOSC (Day to day predictor of DJI when in trading ranges).

Next Day Predictor (What stock best predicts DJI day to day.)

DJI Predictor (What stock is best predicted by DJI day to day.)

Edit

Send Symbols' List to File in Peerless (using name of directory)

Tiger Selections

#1 Indicators' Results (Shows which systems work best with each stock in directory).

Bullish Stocks for next 3 months (The shows spreadsheet of key values

and easy direct graphing)

Bearish Stocks for next 3 months (The shows spreadsheet of key values

and easy direct graphing)

Tiger Groups (Spreadsheet for all flagged groups and easy graphs of those clicked on.)

Multiple Factor Screening (Scan stocks for those meeting multiple conditions)

Ranking Results

Tiger Power Ranking (Shows results from last run of Power Ranker and easy graphs)

(Very useful.)

Tiger Accumulation Index (Shows AI/200 ranking results from last run of Power Ranker

and easy direct graphing. (Very useful.)

50-Day Pct. Change Ranking and Divergences. (Very useful.)

Recent Signals

Most Recent Signal for All Stocks (Scan for favored Tiger Technical Buys/Sells.)

Tiger technical Buys and Sells explained under HELP on this form.

Key Values

Spreadsheet Display (For all stocks in directory. Click top of column to rank)

Help

Glossary Of Key Indicators, Terms and Concepts (Vital for beginner to Tiger.)

Peerless Intermediate-Term Signs (Explanation and track record) (Very useful.)

Tiger Stock Signals Explained. (Very useful.)

Weekly Signals(Very useful.)

17: ADDITIONAL CHOICES FROM MAIN 2016-GRAPHING SCREEN (Form 6)

Below is more information on the most important pull-down choices from the top.

It is recommended that you first become more familiar with the numbered Tiger

technical signals...

PEERCOMM + Charts 2016 + Daily Stocks + Stock/ETF + OK

+ Help + Tiger Signals Explained.

File

Graph New Stock - You may also click "2" key on right side of keyboard.

SAVE - stock-symbol.GIF file created in c:\peerless (Very useful.)

Build/Run User-Defined Signals Set (Very useful.)

Signals(1)

DJI Major (Peerless) Buys and Sells (Most important.)

This choice is only valid for the DJI. It is the way we show the Peerless

signals on the DJI currently ('DATA') and historically ('DATA87' or 'DATA1112')

Superimpose (Peerless) DJI Saved Signals (Very important.)

Display User Selected Tiger Signal (Very Important.)

See the details of Tiger Technical Signals by using Help + Tiger Signals

Display A User Selected Set of Tiger Signals (Very Important.)

(1) Tiger's Form6 (graph on screen) + File + Build/Run User-Defined Signals Set

(2) Tiger's Form6 (graph on screen) + Signals(1)

+ Display A User Selected Set of Tiger Signals

Stock's Signals Compatible with 65-dma. (Very Important.)

Signals(2) - experimental

Use the Stochastic Buys and Sells that cater to your trading style.

5-day is for very short-term trading. 20-day is for intermediate-term.

90-day is for still longer term. After a long advance, watch for Closing

Power penetrations of 50-day ma.

Signals(3)

Closing Power Divergence Warnings: S7 (Very useful.)

Sell S7s are to be acted only after prices move to the other side of

the 65-dma. Until then, they are warnings. The data for the new Sell S7

- CP Divergences are posted each night on the TigerSoft Data Page.

Indic(1)

Use the Stochastic Buys and Sells that cater to your trading style.

5-day is for very short-term trading. 20-day is for intermediate-term.

90-day is for still longer term. (Very useful.)

Annualized 5/21 day ROC (Useful.)

Spot trend-changes in momentum when stocks run up to support or

resistance.

Annualized 5/21 day ROC (Useful.)

Spot trend-changes in momentum when stocks run up to support or

resistance.

Graph Pct of A-Z Stocks over 65-dma (Useful.)

This can only be plotted when DATA (DJI) is charted.

Graph Pct of A-Z Stocks over 65-dma (Useful.)

This can only be plotted when DATA (DJI) is charted.

18: ADDITIONAL CHOICES FROM OLDER GRAPHING SCREEN (Form6)

There are only a handful of operations that you may want to

perform from the Older Charting Program. Most of the operations

in the older Charting Program are available in the current

Peerless charting program.

RANKING FOR YOUR CHOICE OF THE NUMBER OF DAYS BACK

It is sometimes handy to rank the stocks in a directory for how

they have done since a recent turning point in the DJI. For

example, Trump's victory was a clear cut turning point for

the market. That occurred on November 4th, 2016, 19 days back

from now. See below how to get a ranking of LEVERAGED STFS

over this time period.

This simple RANKING of THE STOCKS IN A DIRECTORY FOR PCT. CHANGE

OR IP21, etc. is very useful. Use the following commands:

PEERCOMM + OLDER CHARTING + RANKING RESULTS +

USER SET RANKING: Pct/Change, AI200, IP21

Days Back 19 (your choice) + OK

Basis of Ranking 1 (Pct change)

(or 2 (AI200) or 3 (IP21), 4 (Days over 21-dma)

or 5 (Pct of Days Openings are up) 6 (Pct of Days Closings are up).

OK

This produces a spread sheet that looks like the one shown below.

Here we see only the top 25 items to save space. The full listing

can be printed out. It also appears in the file named C:\peerless\RESU.txt

You may see any row's graph by clicking the row (the symbol) and then

clicking GRAPH).

C:\leverage Days back= 19

11 / 4 / 2016 - 12 / 2 / 2016

Rank Symbol Name Price Pct.Gain % over 50dma Long Term Accumulation (0-200)

--------- ----------------------------------- ---------- ------------ ----------- --------------

1 KRU ProShares Ultra KBW Regional Banking 151.74 55% 37% 62 48% 38%

2 GASL Direxion Daily Natural Gas Bull 3X 50.01 49% 17.3% 133 49% 49%

3 TNA Direxion Small Cap Bull 3x Shares 91.75 43% 15.4% 168 54% 53%

4 URTY ProShares UltraPro Russell 2000 107.35 43% 15.3% 170 52% 53%

5 UWTI VelocityShares 3x Long Crude ETN 25.72 43% 12% 121 47% 51%

6 DUST Direxion Daily Gold Miners Bear 3x Shares 50.08 40% 13.9% 90 47% 46%

7 FAS Direxion Financial Bull 3x Shares 37.17 34% 18.8% 167 56% 51%

8 ERX Direxion Energy Bull 3x Shares 38.77 32% 18% 170 48% 54%

9 TMV Direxion Daily 20 Yr Bear 3X Sh 24.07 30% 22% 103 48% 47%

10 UCO ProShares Ultra DJ Crude 11.21 29% 10.8% 130 47% 51%

11 DSLV VelocitySharesTM 3x Inverse Silver ETN 29.12 28% 13.4% 144 41% 50%

12 UWM ProShares Ultra Russell 2000 ETF 104.42 27% 10.4% 160 52% 53%

13 COPX Global X Copper Miners Etf 21.59 23% 18.3% 118 56% 50%

14 UDOW ProShares UltraPro Dow 30 86.38 23% 12.7% 151 53% 50%

15 UYG ProShares Ultra Financials 86.54 23% 13.3% 171 51% 52%

16 GLL Proshares Ultrashort Gold 87.3 22% 13.4% 121 44% 48%

17 DIG ProShares Ultra Oil & Gas ETF 42.59 21% 12.2% 159 50% 52%

18 DZZ DB Gold Double Short ETN 6.55 21% 12.4% 122 43% 46%

19 YCS ProShares UltraShort Yen 75.73 21% 14.7% 115 53% 51%

20 TBT ProShares UltraShort 20+ Year Treasury 40.83 19% 14.9% 111 47% 46%

21 UXI ProShares Ultra Industrials 48.43 18% 10.5% 149 43% 37%

22 ZSL Proshares Ultrashort Silver 35.81 18% 8.8% 124 41% 50%

23 BZQ ProShares UltraShort MSCI Brazil ETF 20.98 17% 15.5% 26 51% 46%

24 RETL Direxion Daily Retail Bull 3X 41.6 17% 2.2% 118 56% 47%

25 UYM ProShares Ultra Basic Materials 49.55 17% 11.8% 140 55% 55%

The older Tiger charting program produces a basic daily chart that

looks like the one below. It show the Tiger ITRS instead of Closing

Power. ITRS is the percent difference between the given stocks

performance and the DJIA's performance. Note that the size of the

graph on your screen here will probably be smaller. It can only be

be enlarged if you reset the basic screen resolution for you computer

to 600 X 800.

19: BUILDING YOUR OWN LIST OF STOCKS IN A SEPARATE DIRECTORY.

This can be done but only if you first download all

the A-Z stocks.

Next you must create a simple symbols'list containing the

symbols you want to follow.

The symbols must be placed in an ascii file in C:\PEERLESS

So, you might create c:\PEERLESS\GEORGE.txt

and, let's say,it holds 4 stocks: AAPL, AMGN, NEM, OIL

The file c:\PEERLESS\GEORGE.txt would have

each symbol left justified on a separate line.

Only capital letters should be used. The symbols' file

name must not be longer than 7 characters.

Download the special program to do this from

the TigerData Page. See near the top of the

Page -

---> INSTCOMM.exe (Installation file)

Installs PEERCOMM-2016 (This sends latest PEERCOMM

c:\PEERCOMM. You should then drag c:\PEERCOMM\PEERCOMM.exe

to your desktop.

INSTCOMM.exe installs BUILDER.exe and builds a directory named c:\TIGERSUP

which contains A-Z list of all valid symbols. This directory is needed

to create your own directory of stocks from an ascii list in c:\peerless.

You must also download the 16-a ... 16uvwxyz directories to

build a customized directory using the commands

With the list built in, say, c:\peerless\GEORGE.txt and INSTCOMM run

use these commands.

Peercomm + Stock Data Folders

+ Create Data Folder from A-Z Directories + name of your ascii list

(example - GEORGE). This will also be the new folder/

( See Links and Documentation for Tiger Users )

20: EVALUATING A STOCK TECHNICALLY

When you see a Tiger chart, here are the most important aspects to focus

on. Read the materials under HELP (upper right) when a stock chart is

on the screen.

Technical Questions for each stock?

1 What is the trend of the stock based on its 65-dma?

Up? Down? Uncertain/mixed?

2 How close is the stock to the expected support of a rising

65-dma or falling 65-dma?

3 Are there obvious price patterns?

Head/Shoulders? Flat-top breakout? Wedge? Broadening top?

4 How bullish (blue) or weak (red) is the Accumulation Index?

Is the Current Accumulation Index (IP21) above/below its 21-dma (TISI)

5 Is the Blue Closing Power Line rising or falling?

It it confirming or failing to confirm?

Is the CP% above or below Pr%?

Has CP broken its recent uptrend or downtrend?

Is the stock showing the Both-Up condition? Both-Down condition?

6 Is the 5-day ma rising or falling? Will the stock surpass or

fall below its 5-dma "pivot-point"?

7 Is the Relative Strength Quotient Line rising or falling?

What is the ITRS score? Is the stock a leader or a laggard?

8 Does the chart show new CP-Divergence Buy B8s or Sell S8s?

9 What is the operative (red) Optimized signal? A Buy or Sell?

How profitable has it been?

10 How effective have the superimposed Peerless Buys/Sells been with the stock?

What does Peerless suggest about the general market's outlook?

11 When you place the Tiger Buys consistent with the 65-dma on the chart,

what is the last signal? What does it tell you about the stock?

12 When you place all the Tiger Buys/Sells on the screen what is the

last signal? What does it tell you about the stock technically?

=========================================================================

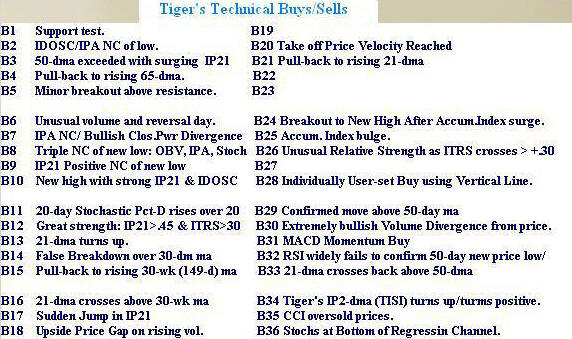

21: TIGER BUY SIGNALS

19: BUILDING YOUR OWN LIST OF STOCKS IN A SEPARATE DIRECTORY.

This can be done but only if you first download all

the A-Z stocks.

Next you must create a simple symbols'list containing the

symbols you want to follow.

The symbols must be placed in an ascii file in C:\PEERLESS

So, you might create c:\PEERLESS\GEORGE.txt

and, let's say,it holds 4 stocks: AAPL, AMGN, NEM, OIL

The file c:\PEERLESS\GEORGE.txt would have

each symbol left justified on a separate line.

Only capital letters should be used. The symbols' file

name must not be longer than 7 characters.

Download the special program to do this from

the TigerData Page. See near the top of the

Page -

---> INSTCOMM.exe (Installation file)

Installs PEERCOMM-2016 (This sends latest PEERCOMM

c:\PEERCOMM. You should then drag c:\PEERCOMM\PEERCOMM.exe

to your desktop.

INSTCOMM.exe installs BUILDER.exe and builds a directory named c:\TIGERSUP

which contains A-Z list of all valid symbols. This directory is needed

to create your own directory of stocks from an ascii list in c:\peerless.

You must also download the 16-a ... 16uvwxyz directories to

build a customized directory using the commands

With the list built in, say, c:\peerless\GEORGE.txt and INSTCOMM run

use these commands.

Peercomm + Stock Data Folders

+ Create Data Folder from A-Z Directories + name of your ascii list

(example - GEORGE). This will also be the new folder/

( See Links and Documentation for Tiger Users )

20: EVALUATING A STOCK TECHNICALLY

When you see a Tiger chart, here are the most important aspects to focus

on. Read the materials under HELP (upper right) when a stock chart is

on the screen.

Technical Questions for each stock?

1 What is the trend of the stock based on its 65-dma?

Up? Down? Uncertain/mixed?

2 How close is the stock to the expected support of a rising

65-dma or falling 65-dma?

3 Are there obvious price patterns?

Head/Shoulders? Flat-top breakout? Wedge? Broadening top?

4 How bullish (blue) or weak (red) is the Accumulation Index?

Is the Current Accumulation Index (IP21) above/below its 21-dma (TISI)

5 Is the Blue Closing Power Line rising or falling?

It it confirming or failing to confirm?

Is the CP% above or below Pr%?

Has CP broken its recent uptrend or downtrend?

Is the stock showing the Both-Up condition? Both-Down condition?

6 Is the 5-day ma rising or falling? Will the stock surpass or

fall below its 5-dma "pivot-point"?

7 Is the Relative Strength Quotient Line rising or falling?

What is the ITRS score? Is the stock a leader or a laggard?

8 Does the chart show new CP-Divergence Buy B8s or Sell S8s?

9 What is the operative (red) Optimized signal? A Buy or Sell?

How profitable has it been?

10 How effective have the superimposed Peerless Buys/Sells been with the stock?

What does Peerless suggest about the general market's outlook?

11 When you place the Tiger Buys consistent with the 65-dma on the chart,

what is the last signal? What does it tell you about the stock?

12 When you place all the Tiger Buys/Sells on the screen what is the

last signal? What does it tell you about the stock technically?

=========================================================================

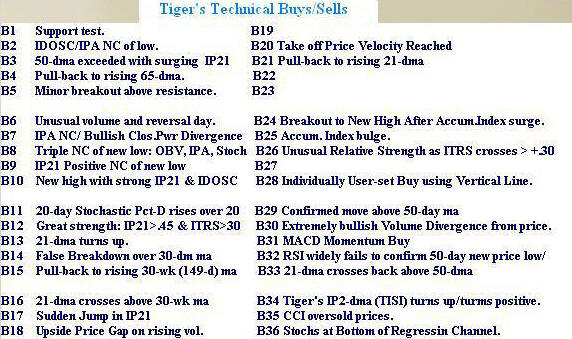

21: TIGER BUY SIGNALS

Peercomm + Charts-2016 + Daily Stocks +

any symbol that is listed on left + OK +

Help (upper right) Tiger Buys/Sells Explained

Do not confuse TigerSoft Buys/Sells with Peerless which are based on DJI

and back-tested to 1928.

Below are some of the most important signals.

CP-Divergence B7/S7

Peercomm + Charts-2016 + Daily Stocks +

any symbol that is listed on left + OK + Operations + Restore Simple Bar Chart +

Signals(3) + Closing Power Divergence Warnings (B7 and S7)

Peercomm + Charts-2016 + Daily Stocks +

any symbol that is listed on left + OK +

Help (upper right) Tiger Buys/Sells Explained

Do not confuse TigerSoft Buys/Sells with Peerless which are based on DJI

and back-tested to 1928.

Below are some of the most important signals.

CP-Divergence B7/S7

Peercomm + Charts-2016 + Daily Stocks +

any symbol that is listed on left + OK + Operations + Restore Simple Bar Chart +

Signals(3) + Closing Power Divergence Warnings (B7 and S7)

Buy B4 at rising 65-dma

Peercomm + Charts-2016 + Daily Stocks +

any symbol that is listed on left + OK + Operations + Restore Simple Bar Chart +

Mvg.Avg. + 65-unit + Indic(2) + Accumulation Index

+ Signals(1) + Display User Selected TigerSoft Signal + B4

Buy B4 at rising 65-dma

Peercomm + Charts-2016 + Daily Stocks +

any symbol that is listed on left + OK + Operations + Restore Simple Bar Chart +

Mvg.Avg. + 65-unit + Indic(2) + Accumulation Index

+ Signals(1) + Display User Selected TigerSoft Signal + B4

Sell S7 at falling 65-dma

Peercomm + Charts-2016 + Daily Stocks +

any symbol that is listed on left + OK + Operations + Restore Simple Bar Chart +

Mvg.Avg. + 65-unit + Indic(3) + Basis of Move

+ Signals(1) + Display User Selected TigerSoft Signal + S7

Sell S7 at falling 65-dma

Peercomm + Charts-2016 + Daily Stocks +

any symbol that is listed on left + OK + Operations + Restore Simple Bar Chart +

Mvg.Avg. + 65-unit + Indic(3) + Basis of Move

+ Signals(1) + Display User Selected TigerSoft Signal + S7

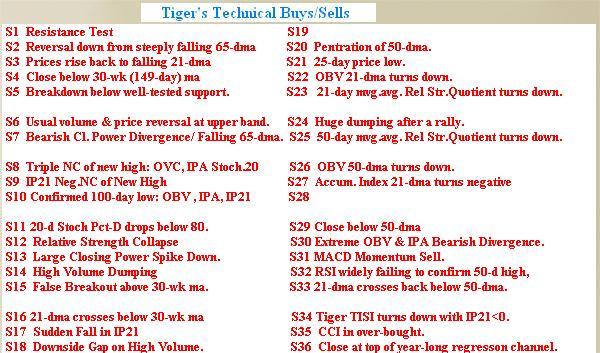

TigerSoft Technical Buy Signals

(Do not confuse with Peerless DJIA-based Buys)

B1 SUPPORT TEST

case 1: 5 or more tests of 50-day low within 3.9% of low.

IP21>.25 and ITRS>0"

case 2: 3 or more tests within .26 points of 25 day low."

close is above 15."

ITRS greater than it was 21 days earlier."

ITRS>-.1"

case 3: 4 or more tests within .26 of 25-day low."

close above 15."

IP21>.25"

A minor buy signal. Not common. This suggests accumulation at a fixed price (the lows).

Note that the price-support shows more than simply a number of successful tests at a

fixed price level. The ITRS (Relative Strength) must be better than -.10 and

IP21 must normally show support, too, by being above +.25.

B2 PULLBACK TO WITHIN 1% OF A RISING 65-dma (There should be a comparable SELL).

CP%-PR% must not be less than -.316 - Closing Power can lag!

OBVPCT must not be overbought (+.20).

OBVPCT must not have shown a recent negative non-confirmation at upper band.

The IP21, OPCT and CP%-PR% should not all be very negtive."

Very often this is a great buy signal. It is important to use the Closing Power's

hooks up back upward to Buy.

A recent bulge of Accumulation above .375 enhances the likelihood of success here.

Even when there is no Buy B2 as stock falls to rising 65-dma, it will turn out to

be a good place to buy. Often all that is needed is waiting for the CP to

break its minor downtrend and the stock will start rising swiftly back to new highs.

B3 50 DAY MA EXCEEDED AND IP21 SURGE

Stock crosses above 50-day mvg. avg. at close.

IP21>.30"

ITRS>.10"

(No signals for 52 days, 10 days between signals.)

The higher the current Accumulation (IP21), the greater the likelihood of a big

advance. A Buy B2-B3 combination should work well here.

Generally, we avoid short sales in stocks with rising 65-dma. And a B3 would

be a good reason to cover a stock if one is short.

Long positions are warranted if the stock shows high Accumulation, a strong Closing

Power, has broken above evident resistance and has headroom before encountering

likely resistance. Where the stock shows consistently positive accumulation (AI>180)

and has a recent IP21 bulge>.45, the stock is a strong buy unless it is late in a

general market upswing. But even then, we can usually exit in plenty of time,

simply by selling if the extended Closing Power uptrend is violated.

The ITRS (Relative Strength) needs only be better than .10. The best signals take

place soon after strong PEERLESS buy signals.

These are often the next BULLISH MAXCP stocks. See if you can identify one industry

group that is over-represented among these high Accumulation bouncers up off the

65-dma. Industry-wide strength will increase your rate of success.

B4 BUY ON PULLBACK TO RISING 65-DMA (This is the opposite of the Tiger Sell S7)

> Stock must not be 2% over the 21-dma or 1% below it.

> IP21 > -.15

(No signals for 52 days, 10 days between signals)

Often a stock has a healthy correction back to its rising 50-day mvg. avg.

The faster the 65-dma is rising, up to a point, the more likely a stock will

falling will rebound from it. The B4 signal will work well with high Accumulation

Index stocks that are ranked as 'bullish' but it is not necessary for the

IP21 to have a positive reading to get a profitable recovery from the 65-dma.

Still, Bullish Closing Power-Divergence Buy B7s are a good combination to have

working in combination with the B4s.

B5 MINOR BREAKOUT ABOVE HORIZONTAL RESISTANCE

Case 1: Close above 50-day high that had been tested more than 3 times.

A "test" requires the the difference between high and 50-day high

to be less than 2.5% and separated by 3 days. (Not very restrictive.)

Additional requirements: ITRS> .1 and IP21>.20.

Case 2: Similar breakout above a high that had been tested at least 3 times.

ITRS>-.10 and IP21>.45 "

(No signals for 52 days, 5 days between signals)"""

There Horizontal trading range breakouts are particularly significant when the stock

is clearly uptrending amd the stock's internals are very positive and confirming>

They are much more reliable when relative strength is superior.

These strong B5 breakouts should cause you to set aside minor sell signals for

several weeks. Often minor sell signals after a B5 or B10 produce limited declines.

The breakout point becomes support and then the rally resumes.

B5s are not reliable when internals and momentum are not quite positive.

In fact, they probably should not be considered at all when the stock's

65-dma is not clearly rising.

B6 UNUSUAL VOLUME AND PRICE REBERSAL BELOW 21-DMA

Volume has more than doubled avg. daily volume and the stock must

close near its highs.

If the stock is below 30-wk vg. avg., stock's low must be at least

half of distance between mvg. avg. and lower band.

Use the B6 signal to retake positions in the strongest stocks for another run

to new highs or to take profits in a shorted stock that has fulfilled its minimum

objectives and whose decline is over-extended.

Look for B6s near expected levels of support.

The appearance of the B6 signal advises that a consolidation is likely in a weak stock.

B7 CLOSE NEAR LOWER BAND WITH RISING IPA MA

or

(Magenta) BULLISH CP DIVERGENCE

Case 1 - Closes more than 85% of way from 21-day mvg.avg. to lower band.

50 day mvg.avg.of IPA is rising.

50 day ma of IPA is 10% above what it was 21-days earlier.

Case 2 - Price is much weaker than Closing Power when comparing the 65-day range of each.

Advisory Purple B7 to be acted only only after prices surpass its 65-dma.

The B7 is meant to tell you that the stock has been under mounting accumulation

or professional buying on weakness. This we determine from the fact that the 50-day moving average

of IPA has been rising for two or more days and that it also is quite a bit above what it was

21 days earlier.

At the lower band the stock is a buy unless - and this is important - there has just

been a serious uptrend or horizontal support failure or if the stock has made a big gap down.

In these cases the support will probably be overcome. This is a counter-trend signal.

Try to use it when there is upside potential.

The B7 signal will work best with high Accumulation Index stocks that are ranked as 'bullish'."

In this case a lagging OBV is not a serious obstacle to a rally.

The CP-DIVERGENCE B7 usually does not bring much of a rally until suddenly the

stock gets past its 65-dma. Be caseful using when its 65-dma is falling. It may

take considerable time before it can get past its 65-dma.

B8 TRIPLE NON-CONFIRMATION OF NEW PRICE LOW

Bullishly the OBV, IPA and Stochastic-20 fail to make a new low along with the price low.

The stock should be near the lower band.

The B8 suggests the stock has retreated further down than its trading volume warrants.

This is often a sign that the stock is making a false new low and should start up again.

By itself this signal only advises of a reversal to the 21-day moving average. However,

if general market conditions are favorable or if the stock has high levels of accumulation

or is in a strong up-trend or can breakout above a flat top on its next advance,

then a very good rally can ensue and the B8 often marks its start."

B9 IP21 POSITIVE NON-CONFIRMATION AT LOWER BAND.

> The stock's low should be at least 90% of the way to its lower band from

its 21-day mvg.avg.

> Close must be above its 50 day mvg.avg. ."

> ITRS>-.15 and IP21>.0

(No signals for 52 days,10 days between signals)

The B9 tells you the stock has probably dropped in a false or temporary way to its lower band.

Be careful using the signal with trend-less stocks. The stock may still gap down to the

lower band very quickly and falls below a well-tested support or trendline.

A positive OBVPct and non-confirming Closing Power helps the reliabilty of the B9.

The B9 signal will work best with high Accumulation Index stocks that are ranked as 'bullish'.

B10 FRESH NEW HIGH with STRONG ITRS & IP21"

> The stock makes a New high closing above its previous 39-day high and IP21>.25

> Volume must jump 50% on breakout

> For stocks above $8, the ITRS must be above .40.

> For stocks $6-$8, the ITRS must be above .45.

> For stocks stocks $4-$6, the ITRS must be above .5

(No signals for 101 days, 40 days between signals)

The B10 signal is a major buy signal. It tells you that the trend of stock is apt

to be up for the next three to six months.

Use trendlines to determine exactly where the breakout point was. This will act as

support on the next decline or two.

The B10 signal will work especially well with high Accumulation Index stocks that are

ranked as 'bullish'. The B10 commonly occurs early in a big advance. It seldom occurs

in a stock which will be a poorer performer.

Quick price reversals back below the breakout point are dangerous if many other

stocks behave similiarly. This should not happen if the Accumulation is high

and the Closing Power confirms the breakout unless the general market has suddenly

become vulnerable.

B11 20-DAY STOCHASTIC PCT-D CROSSES BACK ABOVE 20.

By itself, this is a crude signal.

It works best with strongly uptrending stocks when Tiger Buys B10,B12,B3,B4,B8 are present or

when you expect the uptrend to start soon because of a Tiger B7 or B9.

Short-term traders of mixed-trend stocks can use B11 signals here as a 'clincher'.

You may want to experiment with the Stochastic-5 (K-Line) or Stochastic-15's K-Line.

An upside penetration of the PCT-D Line by the K-Line after the K-Line has dipped below

20 can also be used as a buy signal.

The B11 signal is best used with 'bullish' high Accumulation Index stocks and

when the 20-day Stochastic is one of the best trading systems to date.

B12 IP21 BULGE AND GREAT RELATIVE STRENGTH

IP21>.45 and ITRS is above .3

(No signals for 52 days, 50 days between signals

This an uncommon signal. It is often associated with the beginnings of major

stock advance. This is even nore so if a Buy B20 (take-occ veleocity) signal

soon follows.

The Buy B12 is our most important stocks' buy signal. It tells you that the

stock has had a bulge of intense and aggressive accumulation which has

suddenly pushed the stock up so much that it is outperforming the DJI by 30%

over the last 50 trading days.

It appears near the start of more than half of amy given year's top performers.

In some years, as in 1991 and 1992, that perecentage has been closer to 80%.

Most often the two bullish conditions used here occur at different points of time.

So long as they both occur within about fifteen days of each other, judge a very

'near' B12 signal to have taken place."

The B12 signal will work best when there is consistently positive AI

and the stock breaks out of a long base formation.

B13 CLOSING POWER TAKE-OFF

> Closing Power Pct rises to a point above its previous 50-day high."

> Volume must be above 760. "

> One-day change must not be above 9%. "

The B13 signal shows that Professionals are rushing into the stock. They may only

be seeking minor 8% to 10% gain. Be care careful if the stock then reverses at

the resistance if its falling 65-dma.

Do not chase a B13 stock that is already up 10% or more in a day or two.

Where the 65-dma is rising, the B13 is a reliable Buy signal if one trades with

the rising 65-dma.

B14 SUDDEN INCREASE IN IP21 (Current Accumulation)

> IP21 jumps by more than .07 in one day.

> Stock must have a concurrent ITRS move above +.10

> IP21 must be above +.10

(No signals for first 52 days. Ten days between signals.

B14 signifies that stock may be experiencing a take-off.

Usually it is best to have Closing Power in uptrend or turning up.

Be very careful with very thinly traded stocks."

B14s may lead to an IP21 level of +.375, which strongly suggests insider buying.

B15 PULLBACK TO RISING 30 WK (149-day) Mvg. Avg.

> Low pulls back to within 2% of the rising 30-wk mvg.avg.

> Low must not be more than 2% below it.

> ITRS>-.20

> Most important, the 30-wk mvg. avg. must be rising at an annualized rate of more

than 10%.

The B15 signal often gives an excellent buying point for the short-term trader.

The risk is small if one sells out immediately upon a closing below the 30-week mvg. avg.

by a point while the upside potential is indicated by the rate of change of the

30-week mvg. avg. If the stock does turn back up, it could easily rise to a level

of 20% to 30% above this rising mvg. avg. over the next few months.

One aspect not to not overlook, this signal lets you buy a stock that has already

had a serious 'shakeout'.

It is best to use the B15 signal when there has been a pattern of consistently

positive readings from the Accumulation. Our theory holds that this tells you the stock

is in tight hands and can easily turn back upwards a long way.

B16 21 DAY MOVING AVERAGE CROSSES ABOVE 30-WK MA

The B16 signal gives notice that the 30-week mvg. will most likely turning up

soon. Often this signal lets you buy a depressed stock that will soon rise 20%-30%

as institutions buy it when its 30-week mvg. avg or 200-day mvg. avg. turns up.

Look for other signs of a reversal: bulges of Accumulation and recent new

lows widely unconfirmed by OBV, IP21 and Closing Power.

Watch volume. It must increase dramatically if stock is to make strong recovery.

B17 SUDDEN JUMP IN IP21

> IP21 improves by +.2 in five days or .25 in seven days.

There are NO ITRS considerations.

(Ten days between signals.)

All the considerations of B14s apply here. The most important is that

you should expect resistance on a rise back to the 65-dma and support at

a rising 65-dma.

B18 UPSIDE PRICE GAP UP ON RISING VOLUME.

> The gap upwards must take prices up so today's low is more than 1% above yesterday's high.

> Today's volume must be more than 20% above yesterday's.

> The stock should be strong at the close on the day of the gap and end up

being more than 75% of the way from the day's low to the day's high.

Unless this proves to be an "exhaustion" or "climax" move, the B18 signal advises

you that it is probable that the stock will behave well for the next few weeks,

at least. Often this signal leads to a rise of 20%-30% as institutions continue

to buy the stock aggressively.

If the stock is already up more than 50% in six months, it is possible that the

gap represents a bearish exhaustion gap, in which case nearly everyone who has