TIGERSOFT/PEERLESS

HOTLINE

(C) 1985-2017 William Schmidt, Ph.D. www.tigersoft.com

All rights strictly reserved.

Tiger Software 858-273-5900 PO Box

22784 San Diego, CA 92192 Email

william_schmidt@hotmail.com

-------------------------------------------------------------------------------------------------------------

---------------------------- IMPORTANT

---------------------------------------

You are here:

www.tigersoft.com/HHH517/INDEX.htm

Earlier Hotlines

www.tigersoft.com/HHH517/OLDER.html

www.tigersoft.com/HH747/INDEX.html

www.tigersoft.com/HHLL217/INDEX.html

PREINDEX.html

www.tigersoftware.com/HL/INDEX.html

Most Recent Hotlines:

2/4/2017 - 2/15/2017

These have somehow become corrupted. Their graphs are missing.

http://www.tigersoft.com/345HLN12/ZINDEX.html

http://www.tigersoft.com/333HLLL/INDEX.html

http://www.tigersoft.com/444HL444/INDEX.html

www.tigersoft.com/119HLPAZ/INDEX.html

http://www.tigersoft.com/888HLAZ/INDEX.html

www.tigersoft.com/821-HL/INDEX.html

http://www.tigersoft.com/816-HLN/INDEX.html

http://www.tigersoft.com/77HL7778/INDEX.html

http://www.tigersoft.com/64HRL/INDEX.html

http://www.tigersoft.com/55HL55/INDEX.html

HELP

A

Guide To Profitably Using The Tiger Nightly HOTLINE

Introduction

to Tiger/Peerless Buys and Sells.

Peerless

Buy and Sell Signals: 1928-2016

Individual Peerless signals explained:

http://tigersoftware.com/PeerlessStudies/Signals-Res/index.htm

http://www.tigersoft.com/PeerInst-2012-2013/

Explanation of each Peerless signal.

http://www.tigersoft.com/PeerInst-2012-2013/

Different

Types of TigerSoft/Peerless CHARTS, Signals and Indicators

Peerless Signals and DJI

Charts - version 7/4/2013

1965

1965-6 1966

1966-7

1967

1967-8

1968

1968-9

1969

1969-70 1970

1970-1

1971

1971-2 1972

1972-3

1973 1973-4

1974

1974-5 1975

1975-6

1976 1976-7

1977

1977-1978

1978

1978-79

1979

1979-80

1980

1980-1

1981

1981-2

1982

1982-1983

1983 1983-1984

1984

1984-1985

1985

1985-1986

1986

1986-1987

1987

1987-8

1988

1988-9 1989

1989-90

1990

1990-1 1991

1991-2

1992

1992-3

1993

1993-4

1994

1994-5

1995

1995-1996 1996

1996-7

1997

1997-8 1998

1998-1999

1999

1999-2000

2000

2000-1 2001

2001-2

2002

2002-3

2003

2003-4

2004

2004-5

2005 2005-6

2006

2006-7

2007

2007-8

2008

2008-9

2009

2009-10

2010

2010-11

2011

2011-12

2012 2012-2013

2013

2013-2014

2014

2014-2015

2015

2015-2016

-----> More HELP LINKS

Documentation for

TigerSoft Automatic and Optimized Signals.

How

reliable support is the DJI's rising 200-day ma?

SPY

Charts since 1994: Advisory Closing Power S7s, Accum. Index, 65-dma, Optimized

Signals.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

1/19/2016 --->

Corrections,Deeper Declines and Bear Markets since 1945.

1/21/2016

--->

High Velocity Declines since 1929

2/12/2016 --->

Presidential Elections Years and Bullish IP21 Positive Non-Confirmations at

Lower Band.

2/12/2016 --->

OBV NNCs on

DJI's Rally to 2.7% Upper Band when DJI's 65-dma is falling.

11/6/2016 --->

Killer Short Selling Techniques:

===>

Order

Here

($42.50)

It's As Easy as 1,2,3

TigerSoft "Combination" Short-Selling...

Easy as 1-2-3 Short Sales

Earlier Q-Answers

QuickSilver

Documentation (1/11/2016)

Our Different Signals

Better

understand the difference between Peerless DJI-based signals,

the one-year optimized red Signals and

the fixed signals based

on technical developments.

Introduction to

Tiger/Peerless Buys and Sells.

Different Types of TigerSoft/Peerless CHARTS, Signals and Indicators

New

TigerPeerless

Installation and Basic Uses' Instruction

(11/25/2016)

See

the re-written materials on TigerSoft Buys and Sells.

A few more pages will be added. But users could print

this

main Installation and Uses' Page for reference.

NEW - 5/7/2017

Trading SPY WITHOUT

Peerless - Some Guidelines.

When completed this will be a

new Tiger Trading E-Book.

NEW - 5/10/2017

Examples of "Hands

above the Head" top patterns.

===> Please report any broken or

out-of-date links.

william_schmidt@hotmail.com

==============================================================================

6/9/17 A Tale of Two Cities: Friday, the

DJI was UP

nicely but the NASDAQ slumped

in another one of its cruel "Up and then Dump" two-day Reversal Days.

It appears that major funds are shifting their funds out of

high techs and

buying Bank Stocks and the DJI-30. Without a

new Peerless Sell, it is

most unlikely that the NASDAQ has just made a major top.

The DJI's advance got far fewer headlines than what happened on the

NASDAQ. The divergence between higher priced high techs and the DJI had

just

gotten too wide. With the FED about to raise rates, simple profit-taking

turned into a rout, all helped by short-selling on down-ticks.

Friday dropped

almost all of these high-flying high-techs closed far below their openings, thus

producing huge "Red Popcicles" and "Red Rolling Pins" on our Tiger charts.

Below we look at these patterns in history. For NVDA, the top performing

S&P 500 stock it was a case of just too many brokerages making their long

recommendations on Friday only AFTER its 25+% rise in a month. After

their rush to buy, who else was left I asked myself as I watched it open up 7

points, near 168.

The Peerless B10 makes the DJI now looks good for now,

so long as it does not tag

the 2.3% upper band with the V-I negative. Unfortunately, the DJI's upper

band is

only 250 points away and the V-Indicator, now at -48, is not likely to turn

positive. The Bank Stocks' ETF, FAS, is rising and must like the idea of

higher interest rates

and a stronger Dollar. The highest priced DJI-13 stocks rallied above

their 65-dma and

seem to have destroyed their sprawling potential head and shoulders.

Certainly, the tech bubble of 2000 saw many "Red Popcicle" tops like

have just occurred among the highest price techs on Friday. Is there a

parallel?

Probably not for the NASDAQ, as a whole. But many individual high-flyers

have

likely seen their highs for some time. With them set sell stops a percent

or two

below their close of Friday is my counsel.

I have studied the NASDAQ since 1967. (I was weaned

on the wild OTC markets

of 1967-1968. This reminds me that we still have not yet had a low-priced

stock craze

in this bullish market.)

See the

NASDAQ charts here since 1971.

The conclusion I reach from all this history is that nearly all the major tops

of

the NASDAQ would have been called by Peerless.

Only a few NASDAQ declines

of more than 8% occurred without a Peerless signal. These could all have

been spotted

at the time by watching for bearish NASDAQ head/shoulder patterns,

hands-above-the head pattern, false flat top breakouts and rising wedges.

Of course, when the NASDAQ gets too over-extended, it is also probably a good

idea

for traders to simply take profits when its up-trend-line is violated.

Bearish "Red Popcicles, Rolling-Pins and All Engulfings"

SOXL has several times rebounded quickly from one-day down-drafts to the rising

21-day ma. A partial recovery therefore would seem likely again. But

work with a Sell

Stop 2% below Friday's close to be safe. More on this tomorrow night.

What we will

want to see is a lower opening and a high that is 3 or more points above the

opening.

This will turn our candle-stick chart blue.

The

appearance of giant Red "Popcycles" are clearly bearish. There

is no point in attributing a big one-day sell-off to hedge funds. Only

big institutional selling could bring a stock like NVDA down so much.

Tiger's Red "Popcycles" appear when too many emotional buyers

act at the opening and then Professional and Institutional enter the fray and

rout the over-eager bulls. This often appears are very significant tops.

These "Popcycles" are a variation of the "Up and then Dump" two-day

Reversal Patterns traders must watch for in today's market of computerized

gun-slinging high-performance traders.

Know What Produces A "Red Popcicle"

Don't let a nice profit get away here when this

occurs. Sell stocks like NVDA

and and ETFS like SOXL tomorrow if they drop by more than a percent or two.

See a number of examples of "Red Popcycles" here.

www.tigersoft.com/Red-Popcicles/INDEX.htm

Traders of volatile stocks will also want to look at the longer discussion in my

E-Books, Explosive Super Stocks and Killer Short Sales. These may

be bought for $42.50 each.

http://tigersoft.com/Order_Forms/book-explo-all.htm

http://www.tigersoft.com/Order_Forms/book-short-selling.htm

A DJI 1.3% Rally Will Likely Bring A Sell S9-V

6/9/2017 Index and ETF Charts:

PEERLESS DJI, Signals, Indicators Daily DJI Split Volume 10-Day Up/Down Vol

Hourly DJIA A/D Line for All Stocks.

S&P OEX NYSE NASDAQ COMPQX with CP

DIA SPY QQQ MDY IWM-TNA

Short Term Interest Rates DJI-Utilities DJI-Transp

CrudeOil FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL

RSX RETL SLV SOXL TECL TMF TNA XIV YINN

To STOCKS' CHARTS

AAPL ADBE ALXN AMAT AMGN AMZN BA BIDU CAT FB GOOG GS

HD IBM JPM MASI MSFT NVDA QCOM TSLA TXN

Others REN, JJC, NIB, WEAT UUP (Dollar)

6/9/17 Bullish MAXCPs Bearish MINCPs

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

6/9/17

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

EDU 1 .875 .875 .875 .875 1

JETS 1 1 1 .777 .777 .777

BONDFUND .964 .973 .973 .973 .973 .973

INFRA .909 .636 .545 .545 .545 .545

REGBANKS .888 .611 .222 .222 .333 .333

ETFS .882 .867 .867 .867 .867 .867

NIFTY .862 .896 .896 .862 .862 .862

HOMEBLDG .833 .833 .777 .722 .777 .777

FINANCE .826 .641 .456 .402 .402 .445

GAMING .8 .8 .733 .766 .766 .766

INSURANC .794 .588 .588 .558 .588 .705

MORNSTAR .773 .726 .676 .68 .714 .735

UTILITY .733 .733 .755 .755 .755 .755

SEMI .724 .87 .801 .801 .793 .818

INDEXES .718 .709 .718 .688 .688 .688

SOFTWARE .718 .765 .75 .781 .765 .796

BIGBANKS .714 .285 .285 .142 .142 .142

BEVERAGE .7 .75 .75 .8 .9 .85

DJI-13 .692 .692 .692 .692 .692 .692

SP-100 .68 .597 .577 .587 .587 .608

N=20

------------------------------------------------------------------------------------------

MILITARY .666 .644 .622 .666 .666 .711

ELECTRON .664 .752 .701 .721 .721 .726

SP500 .658 .602 .587 .575 .602 .618

REIT .652 .585 .559 .549 .554 .595

TRANSP .65 .65 .6 .55 .55 .6

CHINA .645 .693 .677 .661 .645 .709

RUS-1000 .637 .589 .562 .559 .584 .606

DOWJONES .633 .566 .6 .633 .6 .6

CHEM .625 .569 .527 .527 .527 .541

NASD-100 .615 .648 .626 .615 .648 .659

INDMATER .581 .5 .418 .418 .459 .418

HACKERS .555 .611 .666 .611 .666 .666

GREEN .548 .612 .516 .612 .548 .58

FOOD .533 .4 .333 .133 .266 .4

SOLAR .526 .684 .578 .631 .578 .736

BIOTECH .504 .508 .504 .483 .516 .52

N=16

------------------------------------------------------------------------------------------

GOLD .49 .584 .566 .584 .433 .396

AUTO .475 .425 .425 .425 .45 .475

RETAIL .456 .403 .368 .333 .368 .385

COMPUTER .44 .56 .52 .64 .6 .6

HOSPITAL .428 .428 .428 .142 .142 .142

COMODITY .38 .323 .366 .38 .338 .366

OILGAS .259 .24 .215 .259 .227 .24

N=7

------------------------------------------------------------------------------------------

COAL .222 .222 .222 .222 .222 .222

PIPELINE .222 .222 .111 .222 .222 .222

N=2

====================================================================================

6/8/17

The

DJI

should make a run upwards.

Today, FAS (the leveraged Financials ETF)

moved convincingly above its 65-dma and the lagging

IWM and MDY)

moved

closer to possible upside breakouts. But we still need to see IWM and MDY

make

new highs and we need to see the biggest Bank Stocks (BAC,

GS and JPM)

rise above their 65-dma and destroy the still extant head/shoulders patterns

they show.

MAXMIN/June-8-2017/Bearish.htmpics/NVDA.GIFpics/DATA.GIF

While we've been waiting for the DJI to finally move up, I've been saying for

sometime

that we should take advantage of the widening divergence between the best and

the worst

stocks as picked out by our Power Ranker with the

MAXCPs and

MINCPs

and

leveraged ETFs. This paid off again today.

SOXL

was up +5.46) and

NVDA +10.82.

Running in all-time high territory, sellers and shorts seem to have lost control

of

these. Similarly,

Crude OIL 's

decline has brought exceptionally swift

profits to

our bearish MINCP shorts in the group. In the case of the oil stocks, I

suggest not

covering them until we get a Stochastic Pct-D Buy. It is now positioned

to give

a new red Buy. But the current swift decline must stop first.

How much longer can the NASDAQ outperform the DJI?

How will we spot the next NASDAQ top?

The NASDAQ can outperform the DJI for a long, long

time if conditions are right.

Usually, the longer periods of out-performance by the NASDAQ come when Inflation

is a significant problem, such as 1967-1968 or 1976-October 1978 and June

1980-June

1981. Periods of NASDAQ out-performance also sometimes come soon after

the start of a new bull market (i.e. 1995) and also late in a bull market, as in

1999-2000.

Looking back at NASDAQ charts since 1990, I conclude that we must be on alert

for head/shoulder tops, turning-down of the 21-dma of ITRS for the NASDAQ vs the

DJI,

high volume reversal days near the upper band and of course any Peerless Sells.

None

of these bearish warnings are present. So, let's the NASDAQ longs keep

running.

6/8/2017 Index and ETF Charts:

PEERLESS DJI, Signals, Indicators Daily DJI Split Volume 10-Day Up/Down Vol

Hourly DJIA A/D Line for All Stocks.

S&P OEX NYSE NASDAQ COMPQX with CP

DIA SPY QQQ MDY IWM-TNA

Short Term Interest Rates DJI-Utilities DJI-Transp

CrudeOil FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL

RSX RETL SLV SOXL TECL TMF TNA XIV YINN

To STOCKS' CHARTS

AAPL ADBE ALXN AMAT AMGN AMZN BA BIDU CAT FB GOOG GS

HD IBM JPM MASI MSFT NVDA QCOM TSLA TXN

Others REN, JJC, NIB, WEAT UUP (Dollar)

6/8/17 Bullish MAXCPs Bearish MINCPs

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

6/8/17

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

JETS 1 1 .777 .777 .777 .888

BONDFUND .973 .973 .973 .973 .973 .964

NIFTY .896 .896 .862 .862 .862 .931

EDU .875 .875 .875 .875 1 1

SEMI .87 .801 .801 .793 .818 .827

ETFS .867 .867 .867 .867 .867 .867

HOMEBLDG .833 .777 .722 .777 .777 .611

GAMING .8 .733 .766 .766 .766 .766

SOFTWARE .765 .75 .781 .765 .796 .734

ELECTRON .752 .701 .726 .721 .726 .716

BEVERAGE .75 .75 .8 .9 .85 .9

UTILITY .733 .755 .755 .755 .755 .777

MORNSTAR .726 .676 .68 .714 .735 .718

INDEXES .714 .718 .688 .688 .683 .645

CHINA .693 .677 .661 .645 .693 .709

DJI-13 .692 .692 .692 .692 .692 .692

SOLAR .684 .578 .631 .578 .684 .736

N=17

--------------------------------------------------------------------------------------------

TRANSP .65 .6 .55 .55 .55 .6

NASD-100 .648 .626 .615 .648 .659 .67

MILITARY .644 .622 .666 .666 .711 .644

FINANCE .641 .456 .402 .402 .445 .413

INFRA .636 .545 .545 .545 .545 .545

GREEN .612 .516 .612 .548 .58 .58

HACKERS .611 .666 .611 .666 .666 .666

REGBANKS .611 .222 .222 .333 .305 .305

SP500 .602 .587 .575 .602 .614 .614

N=9

--------------------------------------------------------------------------------------------

SP-100 .597 .577 .587 .587 .597 .577

RUS-1000 .589 .562 .559 .584 .599 .596

INSURANC .588 .588 .558 .588 .705 .676

REIT .585 .559 .549 .554 .585 .533

GOLD .584 .566 .603 .433 .396 .32

CHEM .569 .527 .527 .527 .541 .513

DOWJONES .566 .6 .633 .6 .6 .566

COMPUTER .56 .52 .64 .6 .6 .64

BIOTECH .508 .504 .483 .516 .52 .459

N=9

--------------------------------------------------------------------------------------------

INDMATER .5 .418 .418 .459 .418 .428

HOSPITAL .428 .428 .142 .142 .142 .142

AUTO .425 .425 .425 .45 .475 .45

RETAIL .403 .368 .333 .368 .385 .403

FOOD .4 .333 .133 .266 .4 .333

COMODITY .323 .366 .38 .338 .366 .267

BIGBANKS .285 .285 .142 .142 .142 .142

OILGAS .24 .215 .259 .227 .24 .278

COAL .222 .222 .222 .222 .222 .333

PIPELINE .222 .111 .222 .222 .222 .333

N=11

====================================================================================

6/7/17

The Charts Tell

The Story better than Words.

The NASDAQ has broken out of its price channel.

Its uptrend is

accelerating in all-time high, where

sell orders cannot easily

be bunched to bring a reversal

because there is no clear

resistance level present from

the chart. The

NASDAQ's strength owes to its biggest

growth stocks, like

AAPL, ADBE,

AMZN, FB,

GOOG,

MSFT

etc. Smaller priced NASDAQ stocks are mostly not

the source of this

strength, unless they are in semi-conductors.

The Russell-2000 (IWM)

is not close making a new high now.

The whole camp of

semi-conductors has taken off. This

is not a small

group. See below its Tiger chart. The

A/D Line is making new

highs and shows no sign of a top.

Stay long

SOXL and NVDA.

The DJIA and its older blue

chips cannot even manage a successful breakout

to new highs. But

that may change. The Big Banks are an important component.

Today, FAS, the 3x

leveraged Financials broke its Closing Power

downtrend and closed

above the 65-day ma that has been

holding it back.

Perhaps, this means that the Big Banks will move up from here

and rupture their

bearish-looking head/shoulders. A rally in the DJI now would

be a big psychological

boost to the general market. Watch BAC,

GS and JPM.

Everything seems to depend on the Fed.

The FOMC meets next

Tuesday and Wednesday to decide whether they

will interest rates and

by how much.

Why does the Fed keep

talking about fighting inflation and of the

need to raise rates even

though real wages are not going up for most

Americans and inflation

is still only 2%?

Most pundits think that

they will raise rates. Surely, a rise in rates

may help the Dollar and,

therefore, Big Banks, but it will do no good for

Retailers, who are

already reeling, closing their doors and

see their stocks

struggling to avoid making more new lows.

The Fed's official

mandate is to fight inflation (there isn't much of this) and prevent

a recession that causes a

rise in Unemployment. On this basis, there seems

to be NO reason to raise

rates. But their focus is actually quite different than

what their mandate

suggests and we can benefit from it a lot.

They mostly view the

stock market as the real Economy.

Certainly in early 2009,

they all believed that the best way to

boost the Economy was to

turn the stock market back up. What a study

of the Federal Funds'

Rate changes show is that this was true also

at the bottoms of 1966,

1970, 1974, 1982, 1987,1998 and 2003.

And way before 1966, too,

let me say.

But what do you do now

when for most Americans real wages are flat

as hours worked are being

cut back? Are their backlogs? Is their

really an economic boom?

Still they focus on the

stock market and see it as over-valued.

So, they may raise rates,

despite the violation of their mandate.

Their excuse: Better to

cause a recession now than

a bigger Crash and

Depression later. I say this so that we watch

what they do about rates,

rather than their rationalizations.

One thing they have

right, their Open Market operations and the

Federal Funds rate, which

they effectively control, are the what most

good traders key off on.

My new Peerless book demonstrates the

tremendous predictive

power of the Federal Funds' changes for the

stock market. It

should be ready soon. I think you'll be amazed

at how easily the markets

swings in the past could have been predicted

this way. More on

the book next week.

Watch OIH's Closing Power downtrend.

Then there's the weakest sector, the Oil and Gas Drillers.

See the

Bearish MINCP Oil and Gas stocks.

They look miserable. But here

there may be some

improvement soon. The 20-day stochastic Pct-D

for Crude Oil is reaching

oversold status. Now it needs to

turn up from below "20".

Considering how well this indicator has

worked for the last year,

when Crude Oil gives a Stochastic Buy signal,

let's cover the shorts we

have in the Oil group. Many have dropped 20%

in less than 2 months.

6/7/2017 Index and ETF Charts:

PEERLESS DJI, Signals, Indicators Daily DJI Split Volume 10-Day Up/Down Vol

Hourly DJIA A/D Line for All Stocks.

S&P OEX NYSE NASDAQ COMPQX with CP

DIA SPY QQQ MDY IWM-TNA

Short Term Interest Rates DJI-Utilities DJI-Transp

CrudeOil FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL

RSX RETL SLV SOXL TECL TMF TNA XIV YINN

To STOCKS' CHARTS

AAPL ADBE ALXN AMAT AMGN AMZN BA BIDU CAT FB GOOG GS

HD IBM JPM MASI MSFT NVDA QCOM TSLA TXN

Others REN, JJC, NIB, WEAT UUP (Dollar)

6/7/17 Bullish MAXCPs Bearish MINCPs

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

6/7/17

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

JETS 1 .777 .777 .777 .888 .666

BONDFUND .973 .973 .973 .973 .964 .964

NIFTY .896 .862 .862 .862 .931 .965

EDU .875 .875 .875 1 1 1

ETFS .867 .867 .867 .867 .867 .852

SEMI .801 .801 .793 .818 .827 .775

HOMEBLDG .777 .722 .777 .777 .611 .611

UTILITY .755 .755 .755 .755 .777 .733

BEVERAGE .75 .8 .9 .85 .9 .8

SOFTWARE .75 .781 .765 .796 .718 .687

GAMING .733 .766 .766 .766 .733 .7

INDEXES .722 .688 .688 .683 .636 .58

ELECTRON .701 .726 .726 .726 .716 .664

DJI-13 .692 .692 .692 .692 .692 .692

CHINA .677 .661 .645 .693 .709 .693

MORNSTAR .676 .68 .714 .735 .718 .647

N=16

--------------------------------------------------------------------------------------------

HACKERS .666 .611 .666 .666 .666 .666

NASD-100 .626 .615 .648 .659 .67 .626

MILITARY .622 .666 .666 .711 .644 .666

DOWJONES .6 .633 .6 .6 .566 .533

TRANSP .6 .55 .55 .55 .6 .4

INSURANC .588 .558 .588 .705 .676 .588

SP500 .585 .573 .6 .612 .612 .554

SOLAR .578 .631 .578 .684 .736 .736

SP-100 .577 .587 .587 .597 .577 .536

GOLD .566 .603 .452 .396 .32 .377

RUS-1000 .562 .559 .584 .599 .592 .53

REIT .559 .549 .554 .585 .533 .471

INFRA .545 .545 .545 .545 .545 .545

CHEM .527 .527 .527 .541 .513 .416

COMPUTER .52 .64 .6 .6 .6 .52

GREEN .516 .612 .548 .58 .58 .58

BIOTECH .504 .483 .516 .52 .463 .414

N=17

--------------------------------------------------------------------------------------------

FINANCE .456 .402 .402 .445 .402 .326

HOSPITAL .428 .142 .142 .142 .142 0

AUTO .425 .425 .45 .475 .45 .375

INDMATER .418 .418 .459 .418 .428 .397

RETAIL .368 .333 .368 .385 .403 .333

COMODITY .366 .38 .338 .366 .267 .295

N=6

--------------------------------------------------------------------------------------------

FOOD .333 .133 .266 .4 .333 .333

BIGBANKS .285 .142 .142 .142 .142 .142

COAL .222 .222 .222 .222 .333 .222

REGBANKS .222 .222 .333 .305 .305 .194

OILGAS .215 .259 .227 .24 .265 .24

PIPELINE .111 .222 .222 .222 .333 .111

N=6

====================================================================================

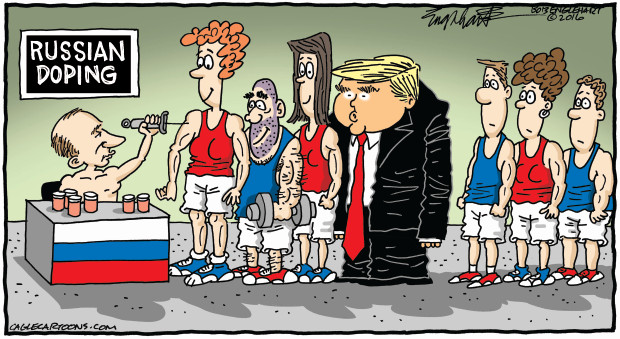

6/6/17

The Buy B10 still stands, but just by a little. See

the new research I

have done on B10s and flat top-breakouts further below. Much depends

on what the Fed will do this month and how the market will react to the

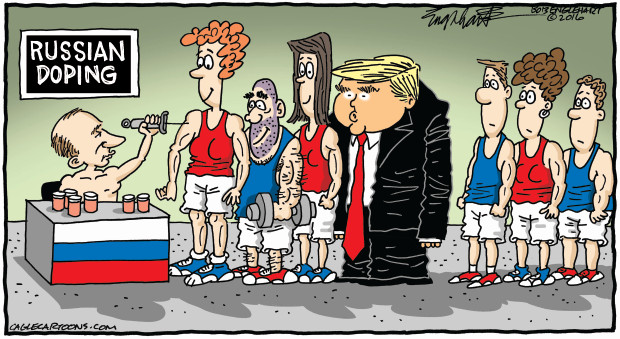

noise that the black crows and vultures make circling President Trump.

(

I have some Russian speaking subscribers. I can not help but be reminded

(

I have some Russian speaking subscribers. I can not help but be reminded

of this sad song about circling black ravens -

https://www.youtube.com/watch?v=lCuJJC3T8nM

- even though Trump's difficulties are far from tragic and are mostly of his own

making. Edgar

Allen Poe's famous poem, "The Raven" -

https://www.youtube.com/watch?v=WcqPQXqQXzI

reflects the potential ominousness of events in Washington, too -

https://www.youtube.com/watch?v=WcqPQXqQXzI

In the Godfather, too, a crow always portends dire events.)

For our purposes, I would stick with the powerful uptrends of

SOXL,

TECL and QQQ.

SPY still shows rising internals. So, I would

hold long

that, too, along with NVDA.

I mentioned Gold as looked like a Buy two weeks ago

because of its Buy B7 CP

bullish divergence arrows. I would say that Copper now looks like it shows

the

same type of Professional buying. Our Closing Power rules do require us to

wait until

it gets back above its 65-dma to buy it.

More Research on the

Buy B10 (Flat-topped breakout)

The DJI's hesitation and minor is not proof, in itself, that the B10 has failed.

I count 8 previous flat topped breakout new highs where, like now, there

as no Peerless Sell and the DJI hesitated not far from the old highs for 4 days

to 2 months. In 4 cases, 8/1/1929,11/24/50, 3/3/55 and 10/6/83, the DJI's

breakout did fail and the DJI retreated back very to the lower band, never more,

before rallying to new highs. On the other hand, there were 4 cases, where

the DJI went new highs after a hesitation of 4 days to 2 months. These are

the cases of 3/2/1954, 11/3/73, 2/3/86 and 3/15/86. It might be helpful

to compare their most important key values, the P-I, IP21 and V-I.

Flat topped breakouts that were ultimately

successful

without a pullback to the lower band:

Date Signal

PI IP21

V1

-----------------------------------------------------------

3/2/1954 B10

+63 +.135

0

11/3/1972 none +120

+.283 +1

2/3/1986 none

+94 +.110

-2

3/15/2006 none +291

+.093 +81

--------------------------------------------------------

Avg.

+142 +.154 +20

Flat topped breakouts that failed and brought

a pullback to the lower band:

Date Signal

PI IP21

V1

-----------------------------------------------------------

8/1/1929 none

-89 -.094

-385

11/24/1950 none +130 +.111

+118

3/3/1955 none +105

.000 +74

10/6/1983 none +50

+.073 +1

----------------------------------------------------------

Avg. +49

-.0015 +48

I would say that the biggest differences between the

breakout

successes and failures is the successes average considerably

higher P-I and IP21 readings than the failures do. The failures

actually had somewhat higher V-I readings than the successes.

Still, the 1929 cases shows that a very low V-I reading is not good

and, of course, it will bring a Sell S9V on a rally to the 2.4% upper band.

This raises the question should we consider the V-I reading of -35

so bearish right now.

Here are the cases of past B10s with V-I readings below

-14. It would seem

that I could improve the program a little by leaving out Buy B10s when the

V-I is below -14 if the IP21 is not, say, above +.15. In our case,

the IP21

stood at +.121 on the recent marginal B10 breakout. This places it in "no

man's land",

neither with the two failures or the one success here.

DJI Gain

P-I IP21 V-I

19500316 B10 207.9 +.061

+37 +.203 -22 2 week hesitation and take-off.

20050304 B10 10940.85 -.003 +251

+.093 -15 Sell S4 2 days later and 8% decline.

20120314 B10 13194.10 -.005 +129

+.069 -24 Sell S1 5 days later and decline to LB.

----------------

6/6/2017 Index and ETF Charts:

PEERLESS DJI, Signals, Indicators Daily DJI Split Volume 10-Day Up/Down Vol

Hourly DJIA A/D Line for All Stocks.

S&P OEX NYSE NASDAQ COMPQX with CP

DIA SPY QQQ MDY IWM-TNA

Short Term Interest Rates DJI-Utilities DJI-Transp

CrudeOil FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL

RSX RETL SLV SOXL TECL TMF TNA XIV YINN

To STOCKS' CHARTS

AAPL ADBE ALXN AMAT AMGN AMZN BA BIDU CAT FB GOOG GS

HD IBM JPM MASI MSFT NVDA QCOM TSLA TXN

Others REN, JJC, NIB, WEAT UUP (Dollar)

6/6/17 Bullish MAXCPs Bearish MINCPs

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

6/6/17

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BONDFUND .973 .973 .973 .964 .964 .964

EDU .875 .875 1 1 1 1

ETFS .867 .867 .867 .867 .852 .867

NIFTY .862 .862 .862 .931 .965 .862

BEVERAGE .8 .9 .85 .9 .8 .8

SEMI .79 .781 .809 .818 .772 .763

GAMING .785 .785 .785 .75 .714 .714

JETS .777 .777 .777 .888 .666 .555

SOFTWARE .777 .761 .793 .714 .682 .714

UTILITY .755 .755 .755 .777 .733 .733

ELECTRON .726 .726 .731 .716 .675 .67

HOMEBLDG .722 .777 .777 .611 .611 .611

DJI-13 .692 .692 .692 .692 .692 .692

INDEXES .689 .689 .685 .637 .581 .568

MORNSTAR .68 .714 .735 .718 .651 .642

N=15

---------------------------------------------------------------------------------------------

MILITARY .666 .666 .711 .644 .666 .577

SOLAR .666 .6 .733 .8 .8 .866

CHINA .661 .645 .693 .709 .693 .709

COMPUTER .64 .6 .6 .6 .56 .52

DOWJONES .633 .6 .6 .566 .533 .533

NASD-100 .615 .648 .659 .67 .626 .604

GREEN .612 .548 .58 .58 .58 .58

HACKERS .611 .666 .666 .666 .666 .666

GOLD .6 .44 .4 .32 .38 .42

SP-100 .587 .587 .597 .577 .536 .536

SP500 .573 .6 .612 .612 .556 .543

RUS-1000 .559 .584 .599 .592 .532 .521

INSURANC .558 .588 .705 .676 .558 .5

TRANSP .55 .55 .55 .6 .4 .45

INFRA .545 .545 .545 .545 .545 .545

REIT .537 .543 .575 .521 .451 .44

CHEM .527 .527 .541 .513 .43 .444

N=17

---------------------------------------------------------------------------------------------

BIOTECH .48 .507 .511 .464 .413 .413

AUTO .425 .45 .475 .45 .375 .375

INDMATER .406 .447 .406 .416 .395 .416

FINANCE .402 .402 .445 .402 .326 .326

COMODITY .38 .338 .366 .267 .295 .253

N=5

--------------------------------------------------------------------------------------------

RETAIL .333 .368 .385 .403 .333 .333

OILGAS .259 .227 .24 .265 .24 .253

REGBANKS .228 .342 .314 .314 .2 .2

COAL .222 .222 .222 .333 .222 .222

PIPELINE .222 .222 .222 .333 .111 .222

BIGBANKS .142 .142 .142 .142 .142 .142

FOOD .133 .266 .4 .333 .333 .266

HOSPITAL .125 .125 .125 .125 0 .125

N=8

====================================================================================

6/5/17

Our Buy

B10 has not brought the runaway advance that the most bullish

flat top breakouts often do. I said yesterday Volume was clearly missing.

Perhaps. the usual early June gloom explain this. More likely, traders

needs now to see what the FED will do. Will they raise short-term rates?

Or will they delay? My guess is that they will delay and that could send

the DJI up considerably. Why? Because CPI Inflation is low and the

Unemployment could certainly go still lower. It's hard to argue the

economy

is running at full capacity. Backlogs are not building up. And for

the

Fed, temporizing has worked out well, why change?

Have you noticed that nearly all the

Bearish MINCPs are energy related?

That's the result of the current down-cycle in Crude Oil. Lower oil

prices,

of course, help most consumers and also lower the rate of inflation.

Simply

following Crude Oil's Stochastic-20 Pct

swings back and forth between 20

(Buy) and 80 (Sell) would have gained a trader almost 150% for the last

year. Not shabby! So, I suspect that Oil and Oil stocks have more to

decline

before they reverse upwards. As a whole, that works out well for the

general

market, if less so for the OEX and the

DJI, which has Exxon and Chevron in

it.

The most heavily weight DJI-30 stock remains Goldman Sachs.

Wouldn't

it be something, if it turned up here because rates are not going to go up?

True, it shows a sprawling head and shoulders pattern. But it is also

sitting

on its rising 200-day ma and the right shoulders seems to be taking too long

to be completed.

There still remains much less interest in the

Russell-2000 stocks than

the big high techs. SOXL,

QQQ and TECL are the ETFs

I would still be

long. Perhaps, like in 1967 and 1968, the big high techs will be the "high

flyers"

until the Fed finally does rates. Then after a 10% DJI decline, lower

priced stocks will get full attention in the next swing back upwards.

Usually

such a stage comes late in a bull market. So, this also argues against us

being near a major top.

SPY, though moving more slowly up, continues to look

good. Its breakouts,

one right after another this past year, are usually the hallmark of a genuine

bull market. And for now, its Opening and Closing Power are both rising.

We have to be optimistic here.

NVDA, our favorite semi-conductor made another new high even as

the DJI declined. It is in the "sweet spot" of the artificial intelligence

and semi-conductor boom.

Have any of you heard of a 30-year market cycle?

1957 (20% decline) - 1987 (37% decline) - 2017?

And bull markets 1923-1927+, 1953-1957, 1983-1987, 2013-?

The 1957 top was in July and the 1987 top was in August. Both showed

Peerless Sells. What these two tops shared was a failure by the A/D

Line to confirm the final high and then a trend-break in the A/D Line.

Fortunately, for now our A/D Line is very strong and has been leading,

not lagging the DJI.

6/5/2017 Index and ETF Charts:

PEERLESS DJI, Signals, Indicators Daily DJI Split Volume 10-Day Up/Down Vol

Hourly DJIA A/D Line for All Stocks.

S&P OEX NYSE NASDAQ COMPQX with CP

DIA SPY QQQ MDY IWM-TNA

Short Term Interest Rates DJI-Utilities DJI-Transp

CrudeOil FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL

RSX RETL SLV SOXL TECL TMF TNA XIV YINN

To STOCKS' CHARTS

AAPL ADBE ALXN AMAT AMGN AMZN BA BIDU CAT FB GOOG GS

HD IBM JPM MASI MSFT NVDA QCOM TSLA TXN

Others REN, JJC, NIB, WEAT UUP (Dollar)

6/5/17 Bullish MAXCPs Bearish MINCPs

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

6/5/17

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BONDFUND .973 .973 .964 .964 .973 .973

BEVERAGE .9 .85 .9 .8 .8 .85

ETFS .867 .867 .867 .852 .867 .882

NIFTY .862 .862 .931 .965 .862 .862

EDU .833 1 1 1 1 1

GAMING .785 .785 .75 .714 .714 .714

SEMI .781 .809 .818 .772 .772 .772

HOMEBLDG .777 .777 .611 .611 .611 .666

JETS .777 .777 .888 .666 .555 .666

SOFTWARE .765 .796 .718 .687 .703 .718

UTILITY .755 .755 .777 .733 .733 .733

ELECTRON .717 .722 .711 .668 .673 .663

MORNSTAR .714 .735 .718 .651 .647 .668

DJI-13 .692 .692 .692 .692 .692 .692

INDEXES .689 .685 .637 .581 .568 .594

N=15

--------------------------------------------------------------------------------------------

HACKERS .666 .666 .666 .666 .666 .666

MILITARY .666 .711 .644 .666 .6 .622

NASD-100 .655 .666 .677 .634 .612 .623

CHINA .645 .693 .709 .693 .709 .709

SP500 .602 .614 .614 .558 .543 .554

COMPUTER .6 .6 .6 .56 .56 .52

DOWJONES .6 .6 .566 .533 .533 .533

INSURANC .588 .705 .676 .558 .5 .558

SP-100 .587 .597 .577 .536 .536 .536

RUS-1000 .584 .599 .592 .532 .519 .535

SOLAR .578 .684 .736 .736 .789 .789

REIT .554 .585 .533 .466 .45 .487

TRANSP .55 .55 .6 .4 .45 .45

GREEN .548 .58 .58 .58 .612 .645

INFRA .545 .545 .545 .545 .545 .545

CHEM .529 .544 .514 .426 .441 .441

BIOTECH .511 .511 .456 .417 .413 .448

N=17

-------------------------------------------------------------------------------------------

INDMATER .459 .418 .428 .408 .418 .428

AUTO .45 .475 .45 .375 .375 .375

GOLD .44 .4 .32 .38 .42 .52

FINANCE .402 .445 .402 .326 .326 .402

RETAIL .368 .385 .403 .333 .333 .315

REGBANKS .342 .314 .314 .2 .171 .285

COMODITY .338 .366 .267 .295 .253 .338

N=7

-------------------------------------------------------------------------------------------

FOOD .266 .4 .333 .333 .266 .2

OILGAS .227 .24 .266 .24 .259 .298

COAL .222 .222 .333 .222 .222 .333

BIGBANKS .142 .142 .142 .142 .142 .142

HOSPITAL .142 .142 .142 0 .142 .285

PIPELINE .125 .125 .25 0 .125 .25

N=6

====================================================================================

6/2/17 We finally got a

Buy B10, with the DJI close above the flat resistance

at 21200. But breakouts "should" be on higher volume, not lower

volume.

They

"should" prompt a quick move higher. We got only a marginal breakout

and there seems to be no follow-through buying overseas. Breadth did not

improve and the Peerless V-Indicator remain negative. So, more narrow

backing and filling seems likely.

As long as the VI is negative, any

1%

additional advance will give us a Sell S9-v.

It would be constructive, and help our Volume indicators, if some of the money

that is now going into high priced NASDAQ stock and ETFs would instead

be placed in the medium and lower priced stocks that make up the

Russell- 2000 (IWM) and Midcaps (MDY).

SOXL remains the strongest

ETF and continues warranting holding.

Note all the Vol. NCs below.

The NASDAQ and Big High Techs, particularly Semi-Conductors

remain the Leaders

IWM needs to breakout, too.

Here are the earlier Buy B10s and flat topped breakouts to a 12-month

high from DJI consolidations of 3-5 months.

2017 4 months - Lots of volume non-confirmations but breadth is very

strong.

2016 4

months. Advance

after Trump election despite lagging internals.

1998 3

months. Failure.

V= only +28

1997-1998

4.5 months. Good advance.

(Broad pattern).

1995 3

months Strong advance.

1993 3

months DJI went sidewise for a month,

then up. Simultaneous Peerless Sell.

1988 4.2

months Failure.

V= only +11

NOW THE FED MUST DECIDE.

This Friday's Job Report showed a May increase of less than 140,000.

The market's initial response was that this was low enough to

prevent the FED from raising rates at their mid June meeting.

The last 3 months have averaged 120,000, which is well below the

150,000 which many economists estimate is needed just to cover the

gradual growth in the work force. But because the many people

who no longer look for full-time work are not counted, the official level

of Unemployment fell a new 16 year low, 4.3%. Some pundits say

market must soon obey the iron-clad laws of the normal business cycle

and now with "full employment", we will soon see the start of a bear

market.

What I have discovered is that there is still room for Unemployment to

go lower and much depends on when the FEDs start to aggressively

tighten credit. See also that the Prime Rate is far below the levels it

has

reached as market tops since 1957 were being made. The CPI

Inflation rate (2.2% ) currently remains quite modest compared to

its levels are earlier market tops. On this basis, too, there would also seem

good reason for the FED not to raise rates in June.

But with the Jobs' numbers

slipping, if they do raise rates, they may be making a bearish mistake which

will hurt the markets considerably.

(Current CPI data:

http://www.inflation.eu/inflation-rates/united-states/current-cpi-inflation-united-states.aspx

)

Business Cycles since 1945

Lowest Unemployment Rate Bull Market Peak

Prime Rate Increases

June 1, 2017 4.3%

?

Current Prime Rate = 4.0%,

starting March 16, 2017

It had been raised to 3.75%

on December 15, 2016 and

3.5% on December 17, 2015

and was previously 3.25%

starting December 16, 2008.

----------------------------------------------------------------------------------------

October 2006 4.4%

Oct 9, 2007

Prime Rate had been raised steadily from

4.0% on June 27, 2003

to 8.25% on June 29, 2006.

Showing a Fed "panic", it was lowered

to 5.0% in quick steps at end of 2007

and early 2008 to 5.0% on April 30, 2008.

----------------------------------------------------------------------------------------

April 2000

3.8% March 24, 2000

Prime Rate was raised by 1/2%

to from 8.25% on July 1, 1999.

It then rose quickly to 9.5% on

May 17, 2000.

----------------------------------------------------------------------------------------

July 17, 1998 Prime Rate

was raised from 8.25%

to 8.5% on March 27, 1997 and

was holding steady at market top.

----------------------------------------------------------------------------------------

March 1989

5.0% July 16, 1990

Prime Rate actually fell from 11.5%

(Kuwait invasion) on February 24, 1989 to

10% on

January 8, 1990.

----------------------------------------------------------------------------------------

August 25, 1987 Prime Rate was raised steadily from

7.5% on August 26, 1986

to 9.25% on October 7, 1987.

----------------------------------------------------------------------------------------

May 1979

5.6% April 27, 1981

On April 2, 1980, the Prime Rate

reached 20%. It had been rising

steadily

since November 24, 1976 when it was

6.25%. On December 19, 1980 it

reached 21.5%

----------------------------------------------------------------------------------------

October 1973 4.6%

Jan 11, 1973

Prime Rate raised steadily in 1/4%

steps from 4.5% on March 20, 1972

to 10% on September 18, 1973.

----------------------------------------------------------------------------------------

September 1968 3.4%

Nov. 29, 1968 Prime Rate raised

in 1/2% steps

to 6% on November 20, 1967 and

6.5% on April 19, 1968. It was then

raised in 1/4% steps to 7% on

January 7, 1969 and finally 8.5% on

June 9, 1969.

----------------------------------------------------------------------------------------

December 13, 1961 Prime Rate was 4.5%

and unchanged

(JFK threats to business

since 1960.

and Cuban Missile Crisis.)

----------------------------------------------------------------------------------------

June 1959

5.0% January 5, 1960

Prime Rate raised by 1/4 to 4.5%

on May 18, 1959 and 5% on

September 1, 1959.

----------------------------------------------------------------------------------------

March 1957

3.7% July 12, 1957

Prime Rate was raised steadily

(1/4% lifts) from March 17, 1954

to August 6, 1957 when it had

reached 4.5%.

----------------------------------------------------------------------------------------

May 1953

2.5% no bear market.

Prime Rate raised steadily (1/4%

lifts) from 1948 to April 27, 1953

when it had reached 3.25%.

"By February 1951, CPI inflation had reached an annualized rate of 21%.

As the Korean War intensified, the Fed faced the possibility of having to

monetize a substantial issuance of new government debt, which would have

placed even greater upward pressure on prices. But the administration

continued to urge the Fed to maintain the peg, a position the FOMC found

increasingly untenable."

https://www.federalreservehistory.org/essays/treasury_fed_accord

----------------------------------------------------------------------------------------

January 1948 3.4%

June 15, 1948 Prime

Rate boosted from

1.75% to 2.0% Aug1,'48.

Note that between June 1946 and June 1947 Consumer Price Index inflation was

17.6%, and from June 1947 to June 1948 it was 9.5%.

The Fed's priority was switching from financing war bonds to restricting

inflation

(

http://www.fedprimerate.com/wall_street_journal_prime_rate_history.htm )

------------------------------------------------

Average

4.1%

6/2/2017 Index and ETF Charts:

PEERLESS DJI, Signals, Indicators Daily DJI Split Volume 10-Day Up/Down Vol

Hourly DJIA A/D Line for All Stocks.

S&P OEX NYSE NASDAQ COMPQX with CP

DIA SPY QQQ MDY IWM-TNA

Short Term Interest Rates DJI-Utilities DJI-Transp

CrudeOil FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL

RSX RETL SLV SOXL TECL TMF TNA XIV YINN

To STOCKS' CHARTS

AAPL ADBE

ALXN

AMAT AMGN AMZN BA BIDU CAT FB GOOG GS

HD

IBM JPM MASI MSFT NVDA QCOM TSLA

TXN

Others REN, JJC, NIB, WEAT UUP (Dollar)

6/2/17 Bullish MAXCPs Bearish MINCPs

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

6/2/17

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

EDU 1 1 1 1 1 1

BONDFUND .973 .964 .964 .973 .973 .964

ETFS .867 .867 .852 .867 .882 .882

NIFTY .862 .931 .965 .862 .862 .896

BEVERAGE .85 .9 .8 .8 .85 .8

SEMI .818 .827 .784 .784 .784 .775

SOFTWARE .796 .718 .687 .703 .718 .734

HOMEBLDG .777 .611 .611 .611 .666 .777

JETS .777 .888 .666 .555 .666 .777

GAMING .766 .733 .7 .7 .7 .7

UTILITY .755 .777 .733 .733 .711 .755

MORNSTAR .735 .718 .651 .647 .663 .663

ELECTRON .731 .721 .68 .68 .67 .659

MILITARY .711 .644 .666 .6 .622 .6

INSURANC .705 .676 .558 .5 .558 .558

CHINA .693 .709 .693 .709 .709 .725

DJI-13 .692 .692 .692 .692 .692 .692

INDEXES .685 .637 .581 .568 .594 .59

SOLAR .684 .736 .736 .789 .789 .789

n=19

-------------------------------------------------------------------------------------------

HACKERS .666 .666 .666 .666 .666 .722

NASD-100 .666 .677 .634 .612 .623 .677

SP500 .614 .614 .558 .543 .554 .564

COMPUTER .6 .6 .56 .56 .52 .56

DOWJONES .6 .566 .533 .533 .533 .533

RUS-1000 .599 .592 .532 .519 .535 .545

SP-100 .597 .577 .536 .536 .536 .525

REIT .585 .533 .466 .45 .487 .528

GREEN .58 .58 .58 .612 .645 .58

TRANSP .55 .6 .4 .45 .45 .5

INFRA .545 .545 .545 .545 .545 .545

CHEM .541 .513 .43 .444 .444 .458

BIOTECH .515 .456 .409 .417 .444 .472

n=13

-------------------------------------------------------------------------------------------

AUTO .475 .45 .375 .375 .375 .4

FINANCE .445 .402 .326 .326 .402 .423

INDMATER .418 .428 .408 .418 .428 .428

GOLD .415 .339 .396 .415 .509 .433

FOOD .4 .333 .333 .266 .2 .133

RETAIL .385 .403 .333 .333 .315 .298

COMODITY .366 .267 .295 .253 .338 .281

REGBANKS .305 .305 .194 .166 .277 .25

n=8

-------------------------------------------------------------------------------------------

OILGAS .24 .265 .24 .259 .297 .265

COAL .222 .333 .222 .222 .333 .333

PIPELINE .222 .333 .111 .222 .333 .333

BIGBANKS .142 .142 .142 .142 .142 .142

HOSPITAL .142 .142 0 .142 .285 .428

n=5

------------------------------------------------------------------------------------------------------------------------------

6/1/17 As has

been the pattern for some time, breadth was excellent today

but NYSE volume fell compared to Wednesday's decline. The nearly perfectly

flat

DJI resistance sets up a Peerless Buy B10 breakout tomorrow on a DJI close above

21188. But because the V-Indicator remains so negative, we will get a new

Sell S9V

if the DJI closes above the 2.3% band, now about 21476. So, the most

bullish

thing the DJI could do now is not to advance too much on the breakout while NYSE

Up Volume rises quickly, as more lower and medium priced stocks receive new

investment funds. This will probably require the FED to put a hold on their

plans

to raise rates. MDY and IWM

have been lagging the DJI.

Much of the

buying surge today owed to Trump's expected decision not

to let the

US be bound by international concerns about man-made climate change due to the

use

of carbon-dioxide producing fuels Accordingly, today's decision made

coal burning

Utilities and Chemical look good today. US multi-nationals did less well,

their investors

started wondering if Trumps nationalist policies could cause an overseas

backlash

against US firms. DJ-Utilities made a year high

today.

The flat top chart pattern of the DJI is clearly bullish and beckons for a

breakout.

Professional traders know this and many were buying today because they believed

a good Jobs report tomorrow would finally allow a breakout.

A third element in today's surge (There were almost 5x

more advancers than decliners.)

were hopes among Biotech stock holders that Congress will soon be in recess and

this

reduce the political "heat" about the high cost of drugs in the US.

Cover DIA and

FAS if we do get a Buy B10 and buy

SPY and QQQ.. Note

that a big breakout tomorrow on excellent breadth should allow the NASDAQ

to make its own breakout above its rising resistance line and start a dramatic

vertical ascent. This will depend on the advance enveloping

MDY and IWM,

which took good strides in that direction today.

Tomorrow's Jobs Numbers?

My guess is that a Jobs number tomorrow above 200,000 will

bring the Fed

to raise short term rates modestly later this month. That will be

considered

as a sign that the Fed has confidence in the US economy. A number between

145,000 and 195,000 ought to be bullish, too, because it would give pause to

a rate hike.

But less than 140,000 would probably be taken to mean we are

facing

a weakening economy with over-priced stocks.

| |

| Year |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

| 2007 |

240 |

89 |

190 |

80 |

143 |

75 |

-34 |

-20 |

88 |

84 |

114 |

98 |

| 2008 |

17 |

-84 |

-78 |

-210 |

-186 |

-162 |

-213 |

-267 |

-450 |

-474 |

-766 |

-694 |

| 2009 |

-793 |

-702 |

-823 |

-687 |

-349 |

-471 |

-329 |

-213 |

-220 |

-204 |

-2 |

-275 |

| 2010 |

23 |

-68 |

164 |

243 |

524 |

-137 |

-68 |

-36 |

-52 |

262 |

119 |

87 |

| 2011 |

43 |

189 |

225 |

346 |

77 |

225 |

69 |

110 |

248 |

209 |

141 |

209 |

| 2012 |

358 |

237 |

233 |

78 |

115 |

76 |

143 |

177 |

203 |

146 |

132 |

244 |

| 2013 |

211 |

286 |

130 |

197 |

226 |

162 |

122 |

261 |

190 |

212 |

258 |

47 |

| 2014 |

190 |

151 |

272 |

329 |

246 |

304 |

202 |

230 |

280 |

227 |

312 |

255 |

| 2015 |

234 |

238 |

86 |

262 |

344 |

206 |

254 |

157 |

100 |

321 |

272 |

239 |

| 2016 |

126 |

237 |

225 |

153 |

43 |

297 |

291 |

176 |

249 |

124 |

164 |

155 |

| 2017 |

216 |

232 |

50(P) |

174(P)) |

138(P) |

|

|

|

|

|

|

|

| P : preliminary |

|

|

6/1/2017 Index and ETF Charts:

PEERLESS DJI, Signals, Indicators Daily DJI Split Volume 10-Day Up/Down Vol

Hourly DJIA A/D Line for All Stocks.

S&P OEX NYSE NASDAQ COMPQX with CP

DIA SPY QQQ MDY IWM-TNA

Short Term Interest Rates DJI-Utilities DJI-Transp

CrudeOil FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL

RSX RETL SLV SOXL TECL TMF TNA XIV YINN

To STOCKS' CHARTS

AAPL ADBE

ALXN

AMAT AMGN AMZN BA BIDU CAT FB GOOG GS

HD

IBM JPM MASI MSFT NVDA QCOM TSLA

TXN

Others REN, JJC, NIB, WEAT UUP (Dollar)

6/1/17 Bullish MAXCPs Bearish MINCPs

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

6/1/17

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

EDU 1 1 1 1 1 1

BONDFUND .964 .964 .973 .973 .964 .964

NIFTY .931 .965 .862 .862 .896 .896

BEVERAGE .9 .8 .8 .85 .85 .85

JETS .888 .666 .555 .666 .777 .555

ETFS .867 .852 .867 .882 .882 .882

SEMI .827 .784 .784 .784 .775 .758

UTILITY .777 .733 .733 .711 .755 .644

SOLAR .736 .736 .789 .789 .789 .789

GAMING .733 .7 .7 .7 .7 .7

ELECTRON .721 .68 .685 .67 .659 .659

MORNSTAR .718 .651 .647 .663 .663 .642

SOFTWARE .718 .687 .703 .718 .734 .718

CHINA .709 .693 .709 .709 .725 .629

DJI-13 .692 .692 .692 .692 .692 .692

NASD-100 .677 .634 .612 .623 .666 .612

INSURANC .676 .558 .5 .558 .588 .529

N=17

---------------------------------------------------------------------------------------------

HACKERS .666 .666 .666 .666 .722 .722

MILITARY .644 .666 .6 .622 .622 .555

INDEXES .637 .581 .568 .594 .59 .59

SP500 .614 .558 .543 .554 .562 .535

HOMEBLDG .611 .611 .611 .666 .777 .777

COMPUTER .6 .56 .56 .52 .56 .48

TRANSP .6 .4 .45 .45 .5 .4

RUS-1000 .592 .532 .519 .535 .546 .53

GREEN .58 .58 .612 .645 .612 .58

SP-100 .577 .536 .536 .536 .525 .515

DOWJONES .566 .533 .533 .533 .533 .566

INFRA .545 .545 .545 .545 .545 .545

REIT .533 .466 .45 .487 .528 .538

CHEM .513 .43 .444 .444 .444 .444

N=14

---------------------------------------------------------------------------------------------

BIOTECH .46 .409 .409 .448 .48 .503

AUTO .45 .375 .375 .375 .4 .4

INDMATER .428 .408 .418 .428 .428 .428

RETAIL .403 .333 .333 .315 .298 .228

FINANCE .402 .326 .326 .402 .413 .38

GOLD .339 .396 .433 .509 .433 .471

COAL .333 .222 .222 .333 .333 .444

FOOD .333 .333 .266 .2 .133 .133

PIPELINE .333 .111 .222 .333 .333 .333

REGBANKS .305 .194 .166 .277 .25 .25

COMODITY .267 .295 .253 .338 .267 .394

OILGAS .265 .24 .259 .297 .259 .322

N=12

---------------------------------------------------------------------------------------------

BIGBANKS .142 .142 .142 .142 .142 .142

HOSPITAL .142 0 .142 .285 .428 .285

N=2

====================================================================================

5/31/17

Today the DJI stubbornly refused to sell off and break

even its 21-day ma

support despite ugly Head/Shoulder patterns in the Big

Banks, despite the

rising short interest rates and despite the latest poll purportedly showing more

than 40% favor the impeachment of Trump.

The DJI remains caught between its resistance at 21200 and

its support

at 20800. Similarly, the Peerless technicals are divided. The

NYSE A/D

Line is uptrending much more so than the DJI. This and the flat resistance

at 21200 would seem to call for a DJI breakout Buy B10. But down-day

volume keeps rising on declines (as it did today and the day before) and

our Peerless V-I remains very negative. This means that any DJI breakout

B10 will quickly be met with a Sell S9-V when the DJI closes 2.3% over the

21-day ma.

The operative Peerless

Sell

S4 still warns us still to respect June's

bearish seasonality and the bearishness seen in the Big Banks'

head/shoulders patterns.

Stay hedged. Stay short DIA, RETL and some of many bearish MINCPs but

stay long SOXL and TECL.

Traders should go short FAS (representing Big Banks).

I suspect their weakness is mostly caused by the view that the Fed will soon

raise rates. See the Short-Term Rate chart below and what that is doing to

10-year Bonds.

5/31/2017 Index and ETF Charts:

PEERLESS DJI, Signals, Indicators Daily DJI Split Volume 10-Day Up/Down Vol

Hourly DJIA A/D Line for All Stocks.

S&P OEX NYSE NASDAQ COMPQX with CP

DIA SPY QQQ MDY IWM-TNA

Short Term Interest Rates DJI-Utilities DJI-Transp

CrudeOil FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL

RSX RETL SLV SOXL TECL TMF TNA XIV YINN

To STOCKS' CHARTS

AAPL ADBE

ALXN

AMAT AMGN AMZN BA BIDU CAT FB GOOG GS

HD

IBM JPM MASI MSFT NVDA QCOM TSLA

TXN

Others REN, JJC, NIB, WEAT UUP (Dollar)

5/31/17 Bullish MAXCPs Bearish MINCPs

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

5/31/17

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

EDU 1 1 1 1 1 1

NIFTY .965 .862 .862 .896 .896 .896

BONDFUND .964 .973 .973 .964 .964 .955

ETFS .852 .867 .882 .882 .882 .867

BEVERAGE .8 .8 .85 .85 .85 .85

SEMI .784 .784 .784 .775 .767 .732

SOLAR .736 .789 .789 .789 .789 .736

UTILITY .733 .733 .711 .755 .644 .622

GAMING .7 .7 .7 .7 .7 .7

CHINA .693 .709 .709 .725 .629 .629

DJI-13 .692 .692 .692 .692 .692 .692

SOFTWARE .687 .703 .718 .734 .718 .687

ELECTRON .68 .685 .675 .659 .664 .644

N=13

=============================================================================================

HACKERS .666 .666 .666 .722 .722 .722

JETS .666 .555 .666 .777 .555 .555

MILITARY .666 .6 .622 .622 .555 .511

MORNSTAR .651 .647 .663 .663 .638 .63

NASD-100 .634 .612 .623 .666 .612 .591

HOMEBLDG .611 .611 .666 .777 .777 .722

INDEXES .581 .568 .594 .59 .59 .556

GREEN .58 .612 .645 .612 .58 .58

COMPUTER .56 .56 .52 .56 .48 .48

INSURANC .558 .5 .558 .588 .529 .47

SP500 .558 .543 .554 .562 .533 .527

INFRA .545 .545 .545 .545 .545 .727

SP-100 .536 .536 .536 .525 .515 .463

DOWJONES .533 .533 .533 .533 .566 .533

RUS-1000 .53 .518 .535 .546 .529 .517

N=15

==============================================================================================

==============================================================================================

REIT .466 .45 .487 .528 .538 .512

CHEM .43 .444 .444 .444 .444 .486

BIOTECH .413 .409 .44 .484 .511 .515

INDMATER .408 .418 .428 .428 .428 .459

TRANSP .4 .45 .45 .5 .4 .4

GOLD .396 .433 .528 .433 .452 .396

AUTO .375 .375 .375 .4 .4 .375

FOOD .333 .266 .2 .133 .133 .333

RETAIL .333 .333 .315 .298 .228 .263

N=9

=============================================================================================

FINANCE .326 .326 .402 .413 .38 .38

COMODITY .295 .253 .338 .267 .394 .436

OILGAS .24 .259 .297 .259 .303 .341

COAL .222 .222 .333 .333 .444 .444

REGBANKS .194 .166 .277 .25 .25 .222

BIGBANKS .142 .142 .142 .142 .142 .142

PIPELINE .111 .222 .333 .333 .333 .333

HOSPITAL 0 .142 .285 .428 .285 .285

N=8

====================================================================================

5/30/17

Sell

Short Some of the many Bearish MINCPs.

Watch the Big

Banks, they may about to fall through a "trap-door".

But hold long

SOXL and NVDA.

They rose today despite the DJI's 50-point loss.

But Stick With The Most Bullish

Stocks and ETFS,

I love the way Semi-Conductors and

NVDA keeps rising. Robots,

and artificial intelligence look as inevitable now as computers did in the

1980s.

As chips get smaller and smaller, more and more programming can

be imbedded in them. And this is not static programming. It uses

artificial intelligence and the chips gets smarter. This is a powerful trend and

we want to play it as long as we safely can. We should probably hold

these

investment vehicles quite tightly, at least, until we see a major top forming

in the DJI or at least until we see a lot more weakness in the

NYSE A/D Line.

The latter is a very stubborn uptrend, despite the fact that a Fed Rate hike

looks like a good possibility next month..

By itself, the current Peerless

Sell

S4 is not very bearish. The

DJI's Accum. Index

is in a rising trend now. Probably on a 5% decline in the DJI from here is all

that

should be expected based on the "isolated" S4's history. Recall also from

last night

that a limited June decline is typically followed by a July recovery when a

Republican

is President in the year after the Election.

The Banks Look Bearish.

That is not a good sign for the general market.

Look at JPM's head/shoulders top below. Head/Shoulders patterns appeared

in JPM before each of the DJI's biggest declines since 1987:

See 1987,

1990,

1998,

2000,

2007,

2008

History shows that the the DJI does not go very far in one direction or the

other without the big banks like BAC and JPM going in the same direction.

We also only have to think back to 2008, when the Big Banks led the market

down into its deepest decline since the early 1930s.

I have to mention another bearish aspect of the market now. This is one

that we can exploit and profit from. See how many Retail stocks, Oil

stocks

and now big Biotechs show bearish trends and internal strength indicators.

They offer us near perfect, classic short sales using Tiger's Killer Short Sale

approaches.

http://www.tigersoft.com/--5--/

See also

http://www.tigersoft.com/Intro/The-Boggest-Decliners/Whats-down.htm

The fact is that there are an unusually small number of individual stocks among

our

Bullish MAXCPs. There are many more individual stocks among our Bearish

MINCPs.

Will this be a warning of a big decline? At the very least, it is an

invitation that we

should not ignore to play some very bearish trends on the short side

The Divide between the Strongest and

Weakest Stocks keeps widening.

Is this a metaphor of the how fast technological change is

now occurring

and how this is creating a whole new universe of corporate winners and

losers.

The same split is widening between the richest and all the rest of us, not just

in America.

What I worry about is that 1929 will repeat. By this I mean that consumers

will

be unable to keep on buying all that is produced by the companies whose

stocks we trade. Call it "over-production" or "under-consumption". by the

middle of 1929, GNP actually started to turn down. Our rate of Growth

now is not so great that this could not happen again, especially if the FED

tightens too much.

Fortunately, the stock market's technicals now look nothing like they did in

1929,

when the NYSE A/D Line was falling for 7 months before the August 2nd peak,

when the Tiger Accumulation Index had been mostly red for many months

and when millions of small investors had turned to the stock market.

5/30/2017 Index and ETF Charts:

PEERLESS DJI, Signals, Indicators Daily DJI Split Volume 10-Day Up/Down Vol

Hourly DJIA A/D Line for All Stocks.

S&P OEX NYSE NASDAQ COMPQX with CP

DIA SPY QQQ MDY IWM-TNA

Short Term Interest Rates DJI-Utilities DJI-Transp

CrudeOil FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL

RSX RETL SLV SOXL TECL TMF TNA XIV YINN

To STOCKS' CHARTS

AAPL ADBE

ALXN

AMAT AMGN AMZN BA BIDU CAT FB GOOG GS

HD

IBM JPM MASI MSFT NVDA QCOM TSLA

TXN

Others REN, JJC, NIB, WEAT UUP (Dollar)

5/30/17 Bullish MAXCPs Bearish MINCPs incl Retailers and

TrapDoors

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

5/30/17

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

EDU 1 1 1 1 1 1

BONDFUND .973 .973 .964 .964 .955 .946

ETFS .867 .882 .882 .882 .867 .852

NIFTY .862 .862 .896 .896 .896 .827

BEVERAGE .8 .85 .85 .85 .85 .85

SOLAR .789 .789 .789 .789 .736 .684

SEMI .784 .784 .775 .767 .732 .732

UTILITY .733 .711 .755 .644 .622 .577

CHINA .709 .709 .725 .629 .629 .645

SOFTWARE .703 .718 .734 .718 .687 .671

GAMING .7 .7 .7 .7 .7 .733

DJI-13 .692 .692 .692 .692 .692 .692

ELECTRON .685 .675 .664 .664 .644 .639

N=13

============================================================================================

HACKERS .666 .666 .722 .722 .722 .666

MORNSTAR .647 .663 .663 .638 .63 .638

GREEN .612 .645 .612 .58 .58 .58

HOMEBLDG .611 .666 .777 .777 .722 .833

NASD-100 .604 .615 .659 .604 .582 .593

MILITARY .6 .622 .622 .555 .511 .488

INDEXES .568 .594 .59 .59 .56 .573

COMPUTER .56 .52 .56 .48 .48 .48

JETS .555 .666 .777 .555 .555 .555

INFRA .545 .545 .545 .545 .727 .636

SP500 .543 .554 .562 .533 .527 .52

SP-100 .536 .536 .525 .515 .463 .474

DOWJONES .533 .533 .533 .566 .533 .533

RUS-1000 .518 .535 .546 .529 .517 .511

N=14

============================================================================================

INSURANC .5 .558 .588 .529 .47 .411

REIT .45 .487 .528 .538 .507 .492

TRANSP .45 .45 .5 .4 .4 .35

CHEM .444 .444 .444 .444 .486 .43

GOLD .433 .528 .452 .452 .396 .603

INDMATER .418 .428 .428 .428 .459 .418

BIOTECH .414 .447 .483 .516 .528 .5

AUTO .375 .375 .4 .4 .375 .375

N=8

===========================================================================================

RETAIL .333 .315 .298 .228 .263 .28

FINANCE .326 .402 .413 .38 .38 .315

FOOD .266 .2 .133 .133 .333 .4

OILGAS .259 .297 .259 .303 .329 .354

COMODITY .242 .328 .257 .385 .414 .485

COAL .222 .333 .333 .444 .444 .333

PIPELINE .222 .333 .333 .333 .333 .333

REGBANKS .166 .277 .25 .25 .222 .222

BIGBANKS .142 .142 .142 .142 .142 .142

HOSPITAL .142 .285 .428 .285 .285 .285

N=10

====================================================================================

5/26/17

Play

The Strongest Trends Now. The biggest high

techs are the

clear leaders. They are taking a lot of investment capital away from

weaker sections. Thus, low priced stocks, IWM (Russell-2000)

and MDY (mid-caps) are not yet participating in the bullish trends

shown by the biggest high techs. Watch

tomorrow to see if TECL

can get past its last apparent resistance, the top of its price channel.

The DJI, itself, is at a high inflection point. The

bullish seasonality before

Memorial Day could not take the DJI to new highs, though it has done

that for SPY, QQQ,

TECL and SOXL. Stick with the trends for now.

I would remain long SOXL and NVDA but short

RETL and some

of the most bearish MINCPs. Using Peerless we remain short

DIA

so long as it does not produce a close above 21161.

If the DJI turns down here next week, out of respect for the active Sell

S4,

the SPY, QQQ, TECL and SOXL will probably pull back, too. But perhaps

not much. In addition, flat tops in the DJI usually bring breakouts, so at

this

point I would stay with the bullish trends of QQQ, TECL and SOXL. See

below from their ITRS readings how much stronger they are over the last

50 trading days than the DJI is. Each of these ETFs now show both rising

Opening and Closing Powers. In this "Both-Up" condition, it is usually

the Closing Power than must turn down and break its uptrend before a

significant decline can occur.

5-dma IP21

ITRS 5/26

5/30 Pivot Point

AROC

Close

---------------------------------------------------------------------------------------------

DIA

+66.2% +.135 ------

210.54 -.04 208.65

SPY +70.8% +.159 +.008

241.71 -.05 239.52

QQQ +121.3%

+.324

+.065 141.22

+.25 139.00

COMPQX +102.9%

+.441

+.047

6210.19 +4.93 6133.62

TECL +309.9%

+.262 +.166

78.55 -.07 75.67

SOXL +336.2%

+.272 +.234

94.99 +1.55 91.68

What Lies Ahead?

June Gloom,

A Patriotic Rally but then

August

Is Awful, much of the time.

Seasonality is now bearish in the first year after a Presidential Election.

Our software reports that the DJI rallies only 36% of the time over

the next two weeks in the first years after a Presidential Election since

1965.

This bearish seasonality report is also supported from the data for when

a Republican was President, as now, in the first year after the Presidential

Election. Since 1915, there have been 12 cases to study. June

produces

a decline in these years 75% of the time. But July rallies 75% of the

time.

August then turns bearish 75% of the time.

DJI DJI at end DJI

at end DJI at end

of June of July

of August

-------------------------------------------------------------------------------------------------

Harding 5/29/1921

74.80

68.50

68.40

67.10

then up a lot.

Coolidge 5/29/1925 129.90

131.00

133.80

141.20

then up a lot.

Hoover 5/29/1929

297.4

331.70 347.70

380.3 then

the

Crash!

Eisenhower 5/29/1953 272.3

268.3

275.4

261.2 then

up a lot.

Eisenhower 5/29/1957 504.9

503.3

508.5

484.4 then down 3 mo.

Nixon

5/29/1969 937.56

873.19

815.47 836.72 802.2 in 1 mo.

Nixon

5/29/1973 908.87

891.71

925.4

890.95

rally, then

crash.

Reagan 5/29/1981

991.75

976.88

952.34 881.47 down 1 more mo.

Reagan 5/29/1985

1315

1335

1347

1334

soon up a lot

Bush-Sr 5/29/1989

2480

2440

2661

2737

8% correction.

Bush-Jr 5/29/2001

10912

10502

10523

9950 3 wks=8376

Bush-Jr 5/29/2005

10467

10275

10641

10482

2 wks=10217

----------------------------------------------------------------------------------------------------------------

3 up

9 up 3-up

5 up

9 down 3 down

9-down 7 down

5/26/2017 Index and ETF Charts:

PEERLESS DJI, Signals, Indicators Daily DJI Split Volume 10-Day Up/Down Vol

Hourly DJIA A/D Line for All Stocks.

S&P OEX NYSE NASDAQ COMPQX with CP

DIA SPY QQQ MDY IWM-TNA

Short Term Interest Rates DJI-Utilities DJI-Transp

CrudeOil FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL

RSX RETL SLV SOXL TECL TMF TNA XIV YINN

To STOCKS' CHARTS

AAPL ADBE

ALXN

AMAT AMGN AMZN BA BIDU CAT FB GOOG GS

HD

IBM JPM MASI MSFT NVDA QCOM TSLA

TXN

Others REN, JJC, NIB, WEAT UUP (Dollar)

5/26/17 Bullish MAXCPs Bearish MINCPs incl Retailers and

TrapDoors

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

5/26/17

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

EDU 1 1 1 1 1 1

BONDFUND .973 .964 .964 .955 .946 .91

ETFS .882 .882 .882 .867 .867 .867

NIFTY .862 .896 .896 .896 .827 .827

BEVERAGE .85 .85 .85 .85 .85 .85

SOLAR .789 .789 .789 .736 .684 .684

SEMI .784 .775 .767 .732 .732 .698

SOFTWARE .718 .734 .718 .687 .671 .703

GAMING .714 .714 .714 .714 .75 .678

UTILITY .711 .755 .644 .622 .577 .488

CHINA .709 .725 .629 .629 .645 .645

DJI-13 .692 .692 .692 .692 .692 .615

HACKERS .687 .75 .75 .75 .687 .687

ELECTRON .675 .664 .67 .644 .639 .587

N=14

--------------------------------------------------------------------------------------------

HOMEBLDG .666 .777 .777 .722 .833 .833

JETS .666 .777 .555 .555 .555 .666

MORNSTAR .663 .663 .638 .63 .638 .592

GREEN .645 .612 .58 .58 .58 .58

MILITARY .622 .622 .555 .511 .488 .488

NASD-100 .615 .659 .604 .582 .593 .582

INDEXES .59 .59 .59 .56 .577 .525

INSURANC .558 .588 .529 .47 .441 .382

SP500 .554 .562 .533 .527 .52 .483

INFRA .545 .545 .545 .727 .636 .636

SP-100 .536 .525 .515 .463 .474 .422