---- TIGERSOFT/PEERLESS

HOTLINE ----

(C)

1985-2020 William Schmidt, Ph.D. www.tigersoft.com

william_schmidt@hotmail.com All rights

strictly reserved

Current is May-Oct 2020 Hotlines

www.tigersoft.com/OLDINDEX.htm

Curremt Hotline ADDRESS

Go to www.tigersoft.com/1919H/INDEX.htm

and

www.tigersoft.com/191919H/INDEX.htm

************************************************

IMPORTANT

- Always CLICK REFRESH.

Server problem

here? Old images of this page may appear.

Always refresh this page and any other page that

seems incomplete or not up to date..

To refresh - Point mouse

at page and Hold down Control Key and hit F-5.

======================================================

10/12/2020

(Data used) 10/13/2020 4:50 AM. DJI futures -100.

======================================================

IMPORTANT

Earlier Hotlines:

www.tigersoft.com/777BLM/INDEX.htm

www.tigersoft.com/20HLM/INDEX.htm

www.tigersoft.com/2020NIGHT/INDEX.htm

www.tigersoft.com/4ACES1/INDEX.htm

www.tigersoft.com/48HLA/INDEX.htm

www.tigersoft.com/QUICKER/INDEX.htm

www.tigersoft.com/QUICK/INDEX.htm

www.tigersoft.com/77HLZ/INDEX.htm

www.tigersoft.com/44THL/INDEX.htm

www.tigersoft.com/21PEY3/INDEX-2.htm

www.tigersoft.com/19HLK5/INDEX.htm

www.tigersoft.com/44UHL/INDEX.htm

www.tigersoft.com/NHLP/INDEX.htm

www.tigersoft.com/7LHL/INDEX.htm

www.tigersoft.com/NHL718/INDEX.htm

www.tigersoft.com/21MAY18/INDEX.htm

www.tigersoft.com/55HEP/INDEX.htm

www.tigersoft.com/44H4L/INDEX2.htm

Earlier still: Go here...

HELP

A Guide

To Profitably Using The Tiger Nightly HOTLINE

Introduction to Tiger/Peerless Buys and

Sells.

Peerless Buy and

Sell Signals: 1928-2016

Individual Peerless signals explained:

http://tigersoftware.com/PeerlessStudies/Signals-Res/index.htm

http://www.tigersoft.com/PeerInst-2012-2013/

Explanation of each Peerless signal. http://www.tigersoft.com/PeerInst-2012-2013/

Different Types of

TigerSoft/Peerless CHARTS, Signals and Indicators

-----> More HELP LINKS

Documentation for

TigerSoft Automatic and Optimized Signals.

How reliable support is the

DJI's rising 200-day ma?

SPY Charts since

1994: Advisory Closing Power S7s, Accum. Index, 65-dma, Optimized Signals.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

1/19/2016 ---> Corrections,Deeper

Declines and Bear Markets since 1945.

1/21/2016

---> High

Velocity Declines since 1929

2/12/2016 ---> Presidential

Elections Years and Bullish IP21 Positive Non-Confirmations at Lower Band.

2/12/2016 ---> OBV NNCs on DJI's Rally to

2.7% Upper Band when DJI's 65-dma is falling.

11/6/2016 --->

Killer Short Selling

Techniques: ===> Order Here ($42.50)

It's As Easy as 1,2,3

TigerSoft "Combination" Short-Selling... Easy as 1-2-3 Short Sales

Earlier Q-Answers

QuickSilver Documentation (1/11/2016)

Our Different

Signals

Better understand the difference between

Peerless DJI-based signals,

the one-year optimized red Signals and the fixed signals based

on technical developments.

Introduction to Tiger/Peerless Buys and Sells.

Different Types of

TigerSoft/Peerless CHARTS, Signals and Indicators

New TigerPeerless Installation and

Basic Uses' Instruction

See the re-written materials on TigerSoft Buys and Sells.

Study- Trading SPY

WITHOUT Peerless - Some Guidelines.

When completed this will be a new Tiger Trading E-Book.

Study- Examples of

"Hands above the Head" top patterns.

Study- 9/3/2017 TigerSoft (not

Peerless) charts of Major Tops as they occurred.

===> Please report any broken or out-of-date links. william_schmidt@hotmail.com

====================================================================

====================================================================

10/12/2020 Take profits in TAN and

solar energy stocks. Note the red candle-sticks.

Red CandleStick days are probably our best warning of a short-term decline now

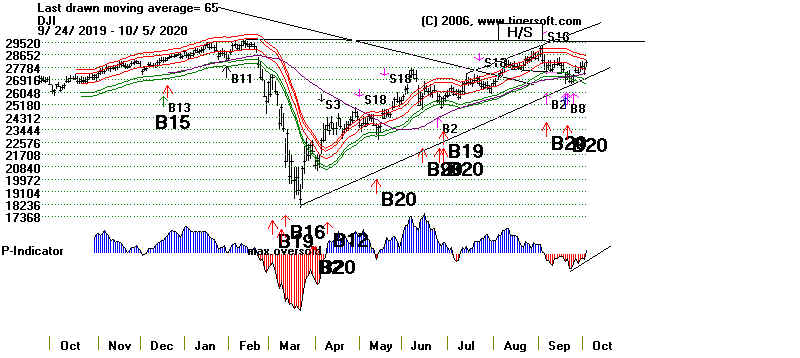

With the DJI near 29000, traders should probably expect a 5% decline in

the DJI if it closes 1% or more below its opening tomorrow. This would produce

a bearish red candle-stick. That is what started the last 8% decline. More

than

a 5% decline now seems unlikely because of QE-Infinity and because Octobers

seldom bring serious declines in a Presidential Election year.

.

The year 2020 has taught us to set aside Peerless S12s and

S9-Vs when the

FED goes all-in with what amounts to a three-year Quantitative Easing - Infinity

program. That is what the FED wants us to do. And who are we to argue.the

Fed-almighty. So, intermediate-term traders should probably abide by the

upward trend of the NYSE A/D Line. But we should understand that the upper

3.8% band brought a 7%-8% decline the last time it was reached. So, we should

be on guard. See the DJIA chart below.

At some point, the A/D Line uptrend will be broken.

Most likely Professionals

will see this coming. So, we have to watch for Closing Power trend-breaks

followed by very weak breadth numbers. Closing Power up-trends-breaks are

more dangerous near old price highs and when the Closing Power Line is below

its level on a comparable previous high. By this I am suggesting that there will

be more risk once SPY and QQQ reach the resistance of their old highs.

If the market turns down here, it will be because the Republicans

may lose control of the Senate. This seems unlikely. Democrats would have

to win Senate races in Colorado, Maine, Arizona and Iowa. Otherwise,

the partisan - Fed sponsored rally should zig-zag until the DJI closes

above 29000 and possibly until November.

| SPY Candlestick chart - 355 seems to be a good target here. |

| QQQ Candlestick chart |

Chinese Stocks May Avoid American Election Volatility

On a 5% DJI decline, we will probably be buying the leading Power-Ranked

Chinese stocks and ETFs. Some are shown below.

|

Charts 10/12/2020 (Click on Underlined link.) 2020 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol Stoch-20 Inverted Traders Index Graph of Pct of All Stocks above 65-dma Cum. Inverted Traders Index NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30 DIA QQQ MDY IWM TNA Short-Term Rates DOLLAR-UUP SPY http://tigersoft.com/2121CST/SPY.GIF recent 2006 vers-Peerless signals -- http://tigersoft.com/NEWPEER/UPD6112.BMP USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH PALL RSX RETL SDS AGQ SLV SOXL TECL TLT TMF TNA UGA (gasoline) USO (oil) and China: YINN CHAU Commodities: CANE CORN DBC JJC, NIB, CHOC CORN, CUT (paper) MOO, SOYB WEAT UUP (Dollar) LIT (Lithium) Stocks AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA BAC BIDU BLDP CAT CRM CVX CMG DE ENPH FB GILD GOOG GS HD IBM INTU JPM LRCX M (Macy's) MSFT NEM NFLX NKE NVDA PG REGN REV SO SQ QCOM QDEL TSLA TXN XOM V VRTX WFC WMT TOWN ZM New highs and Bullish MAXCPs http://tigersoft.com/MAXCP/10-12/BULLISH.htm Bearish MAXCPs - http://tigersoft.com/MINCP/10-12/BEARISH.htm |

Table 1

10/12/2018 QUICKSILVER on DJI-30 STOCKS.

P21 + ITRS score >+.25 is bullish 1 Bullish (CRM)

2 Bearish (CSCO, IBM)

HIGHEST AI/200 = CRM Second Highest Tied = AAPL and MSFT STOCKS CLOSECHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE AI/200 IP21 ITRS ------------------------------------------------------------------------------------------------------- ------------------------------------------------------------------------------------------------------- AAPL 124.4 7.43 116.5 342.5% Bullish BLUE 156 .087 .08 ---------------------------------------------------------------------------------------------------------- AMGN 239.51 2.81 256.01 -331.8% Bearish BLUE 134 .037 -.112 ---------------------------------------------------------------------------------------------------------- AXP 106.61 .27 103.89 130.4% ------- RED 97 -.024 .051 ---------------------------------------------------------------------------------------------------------- BA 167.35 .02 171.2 -115.9% Bearish RED 33 -.064 -.032 ---------------------------------------------------------------------------------------------------------- CAT 162.61 3.67 153.49 294% Bullish BLUE 117 -.024 .133 ---------------------------------------------------------------------------------------------------------- CRM 267.07 1.09 251.53 301.7% Bullish RED 192 .102 .279 Bullish ---------------------------------------------------------------------------------------------------------- CSCO 40.36 .51 38.57 228.1% ------- BLUE 119 -.048 -.234 Bearish ---------------------------------------------------------------------------------------------------------- CVX 74.51 .51 72.7 123% Bearish BLUE 77 -.034 -.204 ---------------------------------------------------------------------------------------------------------- DIS 124.97 -.01 123.37 65% Bearish BLUE 100 -.052 -.023 ---------------------------------------------------------------------------------------------------------- DOW 48.58 -.78 48.58 0% Bearish RED 60 -.128 .092 ---------------------------------------------------------------------------------------------------------- GS 214.12 6.58 201.8 301.4% ------- BLUE 60 .036 -.01 ---------------------------------------------------------------------------------------------------------- HD 286.91 .99 282.1 85.2% ------- RED 154 .109 -.011 ---------------------------------------------------------------------------------------------------------- HON 175.36 .98 168.72 194.1% ------- BLUE 109 -.004 .083 ---------------------------------------------------------------------------------------------------------- IBM 127.21 -.58 122.01 207.2% Bearish RED 111 -.244 -.056 Bearish ---------------------------------------------------------------------------------------------------------- INTC 53.88 1.06 51.69 209% Bullish BLUE 91 .064 .038 ---------------------------------------------------------------------------------------------------------- JNJ 151.84 .87 148.23 121.6% ------- BLUE 114 -.054 -.049 ---------------------------------------------------------------------------------------------------------- JPM 102.44 1.24 99.04 170.1% ------- BLUE 25 .032 -.031 ---------------------------------------------------------------------------------------------------------- KO 51.09 .28 49.38 171.6% Bearish BLUE 86 -.078 -.01 ---------------------------------------------------------------------------------------------------------- MCD 226.11 1.28 226.07 .9% Bullish BLUE 136 -.014 .073 ---------------------------------------------------------------------------------------------------------- MMM 168.65 -.65 162.75 178% Bearish RED 99 -.183 .03 ---------------------------------------------------------------------------------------------------------- MRK 80.36 0 81.24 -54.8% Bearish RED 93 -.083 -.09 ---------------------------------------------------------------------------------------------------------- MSFT 221.4 5.59 210.38 261.8% Bullish BLUE 156 .121 -.011 ---------------------------------------------------------------------------------------------------------- NKE 129.46 -1.52 127.91 60% ------- RED 133 -.116 .235 ---------------------------------------------------------------------------------------------------------- PG 144.49 1.57 139.39 181% Bullish BLUE 97 .063 .011 ---------------------------------------------------------------------------------------------------------- TRV 116.54 .71 111.91 203.5% Bullish BLUE 85 -.062 -.073 ---------------------------------------------------------------------------------------------------------- UNH 329.97 2.13 318.15 184% Bullish BLUE 112 -.008 -.001 ---------------------------------------------------------------------------------------------------------- V 206.4 -.24 203.54 70.4% Bearish RED 102 -.039 -.007 ---------------------------------------------------------------------------------------------------------- VZ 59.55 .22 59.66 -9.3% ------- BLUE 118 -.065 -.055 ---------------------------------------------------------------------------------------------------------- WBA 36.93 .59 36.62 42.5% ------- BLUE 82 .022 -.184 ---------------------------------------------------------------------------------------------------------- WMT 144.25 1.47 141.8 86.6% Bullish BLUE 126 -.07 .024 |

Table 2 QUICKSILVER on ETFS - 10/12/20 Bullish = 1 SOXL TECL

Bearish = 1 OIH

ITRS + IP21>.25 is considered "Bullish"

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS --------------------------------------------------------------------------------------------- --------------------------------------------------------------------------------------------- DIA 288.46 2.53 277.72 123% ------- BLUE .093 ---- --------------------------------------------------------------------------------------------- SPY 352.43 5.58 334.93 185.7% Bullish BLUE .082 -.012 --------------------------------------------------------------------------------------------- QQQ 294.53 8.82 275.16 256.2% Bullish BLUE .114 .017 --------------------------------------------------------------------------------------------- MDY 366.13 2.3 352.93 159.6% Bullish BLUE .205 -.013 --------------------------------------------------------------------------------------------- IWM 163.79 1.09 156.62 210.4% ------- BLUE .143 .02 --------------------------------------------------------------------------------------------- FAS 40.55 1.34 35.8 489.3% ------- BLUE .006 .068 --------------------------------------------------------------------------------------------- RETL 276.51 1.15 243.83 342.8% Bullish RED .058 .354 --------------------------------------------------------------------------------------------- SOXL 318.39 13.25 264.26 879.4% Bullish BLUE .171 .314 Bullish --------------------------------------------------------------------------------------------- TECL 358.71 26.76 296.25 761.8% Bullish BLUE .115 .233 Bullish --------------------------------------------------------------------------------------------- IBB 143.65 1.12 137.88 145.2% ------- ---- .255 -.022 --------------------------------------------------------------------------------------------- GLD 180.56 -.52 177.3 32.2% ------- ---- .093 -.117 --------------------------------------------------------------------------------------------- OIH 102.4 -.41 98.64 112.2% Bearish BLUE-.037 -.272 Bearish --------------------------------------------------------------------------------------------- GASL 3440 285 3685 -325.1% ------- RED -.021 .022 --------------------------------------------------------------------------------------------- |

Count of Stocks in Key Directories

20201012

-------------------------------

NEWHIGHS 285

NEWLOWS 13

MAXCP 39

MINCP 31

TTTNH 24

TTTNL 20

FASTUP 127

FASTDOWN 21

CPCROSSA 63

CPCROSSD 62

BIGVOLUP 4

BIGVODN 6

ACCUMVER 135

HIGHIP21 17

HIUPPCT 43

VHIP21 118

LOWACCUM 174

REDSELL 78

AUGSELS7 68

TRAPDOOR 9

|

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA 10/12/20 --------------------------------------------------------------------------------------- Directory Current day-1 day-2 day-3 day-4 day-5 ---------------------------------------------------------------------------------------- HOMEBLDG .941 .941 .941 .882 .882 .882 SOLAR .909 1 .909 .909 .909 .909 NASD-100 .87 .78 .72 .68 .53 .64 BIGBANKS .857 .714 .714 .571 .142 .285 TRANSP .85 .95 .95 .8 .7 .85 DJI-13 .846 .846 .846 .769 .615 .769 NIFTY .844 .777 .733 .666 .511 .666 GREEN .809 .904 .809 .761 .714 .714 UTILITY .789 .789 .789 .657 .631 .552 SEMI .788 .798 .692 .586 .49 .509 BEVERAGE .785 .857 .785 .571 .428 .571 FINANCE .777 .666 .753 .629 .444 .493 ELECTRON .775 .782 .721 .612 .517 .523 INDEXES .774 .751 .751 .762 .7 .74 SP500 .768 .737 .722 .665 .571 .636 DOWJONES .766 .766 .766 .7 .566 .733 HOSPITAL .761 .761 .857 .761 .523 .571 CHEM .75 .75 .75 .708 .645 .666 COMPUTER .75 .75 .7 .65 .55 .5 SP-100 .747 .703 .703 .637 .505 .604 INFRA .742 .771 .742 .742 .6 .685 AUTO .736 .763 .763 .763 .657 .657 GUNS .733 .733 .666 .666 .666 .733 RUS-1000 .733 .701 .699 .646 .564 .601 FIDSTKS .731 .685 .668 .594 .497 .588 INSURANC .73 .615 .615 .5 .423 .538 REGBANKS .73 .653 .73 .615 .5 .461 ETFS .714 .75 .66 .517 .428 .553 JETS .714 .928 .857 .642 .5 .785 RETAIL .714 .693 .714 .673 .612 .673 SOFTWARE .7 .616 .55 .533 .466 .466 INDMATER .666 .666 .666 .626 .533 .586 COMODITY .634 .682 .634 .634 .414 .487 FOOD .622 .679 .641 .622 .49 .547 CHINA .62 .6 .52 .5 .52 .52 REIT .617 .531 .631 .475 .51 .553 COAL .571 .714 .714 .714 .571 .571 BIOTECH .554 .56 .549 .522 .445 .45 HACKERS .55 .45 .3 .3 .1 .15 GAMING .523 .523 .476 .523 .428 .523 COPPER .5 .625 .5 .5 .25 .25 GOLD .408 .469 .163 .142 .102 .224 MILITARY .357 .321 .392 .25 .214 .321 EDU .333 .333 .333 .333 .333 .333 BONDFUND .287 .297 .267 .207 .217 .227 OILGAS .269 .293 .277 .23 .19 .19 |

=======================================================================

10/9/2020 Very few October tops

occur in a Presidential Election year

if the market is rising then. (See Hotline of

10/8/2020 This is

probably because the market tends to let the

partisans get their way until

soon after the actual Election. At that point, things get more interesting.

Novembers bring the most reversals.

With breadth so strong and a rising number of stocks

over their 65-dma,

let's allow the Bullish MAXCPs continue to run upwards, especially the solar

power ETFs/stocks, BABA and the very high A/I 200 stocks/ETFs. The oil

stocks remain the most bearish sector. Clearly, the market expects a Biden

victory. If "second guessing" about a Democrat victory begins on

schedule,

we have another 20 days of uptrend, as least. That should alloiw our

long high Accumulation and bullish MAXCPs to make more gains.

I do note that the current Accumulation Indexes (IP21) remain weak.

"Big money" is selling into strength each day. But the Closing Powers

are still in uptrends and the NYSE A/D Line is running in all-time high territory.

The very highest Power Ranked stocks out of all 6000 stocks and ETFs

are shown below. AI/200 score, AI/100 score, IP21 and ITRS are

the composite Power Rankings' main elements. These are QCLN, TTGT,

IIPR and ARKW.

|

Charts 10/9/2020 (Click on Underlined link.) 2020 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol Stoch-20 Inverted Traders Index Graph of Pct of All Stocks above 65-dma Cum. Inverted Traders Index NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30 DIA QQQ MDY IWM TNA Short-Term Rates DOLLAR-UUP SPY http://tigersoft.com/2121CST/SPY.GIF recent 2006 vers-Peerless signals -- http://tigersoft.com/NEWPEER/UPD6109.BMP USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH PALL RSX RETL SDS AGQ SLV SOXL TECL TLT TMF TNA UGA (gasoline) USO (oil) and China: YINN CHAU Commodities: CANE CORN DBC JJC, NIB, CHOC CORN, CUT (paper) MOO, SOYB WEAT UUP (Dollar) LIT (Lithium) Stocks AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA BAC BIDU BLDP CAT CRM CVX CMG DE ENPH FB GILD GOOG GS HD IBM INTU JPM LRCX M (Macy's) MSFT NEM NFLX NKE NVDA PG REGN REV SO SQ QCOM QDEL TSLA TXN XOM V VRTX WFC WMT TOWN ZM New highs and Bullish MAXCPs http://tigersoft.com/MAXCP/10-9/BULLISH.htm Bearish MAXCPs - http://tigersoft.com/MINCP/10-9/BEARISH.htm |

Table 1

10/9/2018 QUICKSILVER on DJI-30 STOCKS.

P21 + ITRS score >+.25 is bullish

1 Bullish (CRM)

3 Bearish (CSCO, CVX, IBM)

HIGHEST AI/200 = CRM Second Highest Tied = AAPL and MSFT STOCKS CLOSECHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE AI/200 IP21 ITRS ------------------------------------------------------------------------------------------------------- ------------------------------------------------------------------------------------------------------- AAPL 116.97 2 113.02 172.4% ------- BLUE 156 .019 .13 ---------------------------------------------------------------------------------------------------------- AMGN 236.7 -3.39 245.41 -173.9% Bearish RED 134 .026 -.124 ---------------------------------------------------------------------------------------------------------- AXP 106.34 .28 101.61 228.9% ------- BLUE 98 -.017 .037 ---------------------------------------------------------------------------------------------------------- BA 167.33 -.67 168.08 -22.6% ------- RED 33 -.045 -.053 ---------------------------------------------------------------------------------------------------------- CAT 158.94 2.28 149.94 293.6% ------- BLUE 118 -.033 .076 ---------------------------------------------------------------------------------------------------------- CRM 265.98 5.76 247.85 357% ------- BLUE 192 .091 .301 Bullish ---------------------------------------------------------------------------------------------------------- CSCO 39.85 .06 38.27 203% Bearish RED 119 -.061 -.228 Bearish ---------------------------------------------------------------------------------------------------------- CVX 74 -1.22 71.19 192.4% Bearish RED 77 -.063 -.228 Bearish ---------------------------------------------------------------------------------------------------------- DIS 124.98 1.89 122.55 99.1% Bearish BLUE 100 -.08 -.005 ---------------------------------------------------------------------------------------------------------- DOW 49.36 -.02 47.31 212.3% ------- RED 60 -.098 .097 ---------------------------------------------------------------------------------------------------------- GS 207.54 -.44 199.9 188.3% Bearish RED 59 .009 -.046 ---------------------------------------------------------------------------------------------------------- HD 285.92 1.4 279.31 117.6% ------- BLUE 154 .13 -.012 ---------------------------------------------------------------------------------------------------------- HON 174.38 .6 165.61 259% Bullish ---- 109 .019 .083 ---------------------------------------------------------------------------------------------------------- IBM 127.79 -3.7 120.57 291.1% Bearish RED 111 -.249 -.046 Bearish ---------------------------------------------------------------------------------------------------------- INTC 52.82 -.55 51.01 174% ------- RED 91 .026 .015 ---------------------------------------------------------------------------------------------------------- JNJ 150.97 2.08 146.24 160.3% ------- BLUE 115 -.035 -.058 ---------------------------------------------------------------------------------------------------------- JPM 101.2 -.58 97.89 166.7% ------- RED 24 .036 -.043 ---------------------------------------------------------------------------------------------------------- KO 50.81 .35 49.36 146.3% ------- BLUE 87 -.02 -.021 ---------------------------------------------------------------------------------------------------------- MCD 224.83 -.97 222.67 48% Bullish RED 137 -.035 .065 ---------------------------------------------------------------------------------------------------------- MMM 169.3 1.59 160.36 272.7% Bearish BLUE 100 -.139 .027 ---------------------------------------------------------------------------------------------------------- MRK 80.36 -.12 80.8 -27.4% Bearish RED 94 -.078 -.069 ---------------------------------------------------------------------------------------------------------- MSFT 215.81 5.23 206.19 230.6% Bullish BLUE 156 .09 -.028 ---------------------------------------------------------------------------------------------------------- NKE 130.98 1.27 126.64 169% Bullish BLUE 134 -.087 .267 ---------------------------------------------------------------------------------------------------------- PG 142.92 1.27 138.12 171.6% Bullish BLUE 97 .068 .001 ---------------------------------------------------------------------------------------------------------- TRV 115.83 .21 108.58 322.8% Bullish RED 86 -.081 -.087 ---------------------------------------------------------------------------------------------------------- UNH 327.84 5.43 311.98 249.3% Bullish BLUE 112 .013 -.012 ---------------------------------------------------------------------------------------------------------- V 206.64 3.66 201.46 128.1% Bearish BLUE 103 -.021 -.021 ---------------------------------------------------------------------------------------------------------- VZ 59.33 .14 59.24 7.6% ------- BLUE 119 -.082 -.051 ---------------------------------------------------------------------------------------------------------- WBA 36.34 -.73 35.77 78.3% ------- RED 81 .049 -.192 ---------------------------------------------------------------------------------------------------------- WMT 142.78 1.42 140.5 80.8% Bullish BLUE 126 -.08 .011 |

Table 2 QUICKSILVER on ETFS - 10/7/20 Bullish = 1 SOXL

Bearish = 1 OIH

ITRS + IP21>.25 is considered "Bullish"

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS --------------------------------------------------------------------------------------------- --------------------------------------------------------------------------------------------- DIA 285.93 1.64 281.51 162.7% ------- BLUE .089 -- --------------------------------------------------------------------------------------------- BA 167.33 -.67 171.2 -22.6% ------- RED -.045 -.053 --------------------------------------------------------------------------------------------- SPY 346.85 3.07 339.76 192.1% ------- BLUE .066 -.015 --------------------------------------------------------------------------------------------- QQQ 285.71 4.3 280.16 204.9% Bullish BLUE .084 .008 --------------------------------------------------------------------------------------------- MDY 363.83 .95 354.68 243.7% Bullish RED .192 -.022 --------------------------------------------------------------------------------------------- IWM 162.7 .84 157.07 312.3% ------- RED .121 .008 --------------------------------------------------------------------------------------------- FAS 39.21 .09 36.86 565.5% ------- RED -.013 .032 --------------------------------------------------------------------------------------------- SOXL 305.14 15.21 268.85 1116.3% Bullish BLUE .154 .238 Bullish --------------------------------------------------------------------------------------------- TECL 331.95 15.14 310.93 666.4% Bullish BLUE .076 .235 Bullish --------------------------------------------------------------------------------------------- IBB 142.53 1.15 139.57 312.1% ------- BLUE .233 -.046 --------------------------------------------------------------------------------------------- GLD 181.08 3.23 179.41 71.3% Bearish BLUE .073 -.101 --------------------------------------------------------------------------------------------- OIH 102.81 -1.64 100.13 303.2% Bearish RED -.053 -.277 Bearish --------------------------------------------------------------------------------------------- GASL 3440 285 3685 -325.1% ------- RED -.021 .027 --------------------------------------------------------------------------------------------- |

Table 3 Count of Stocks in Key Directories

20201009

-------------------------------

NEWHIGHS 380 Bullish >10:1

NEWLOWS 35

MAXCP 48

MINCP 31

TTTNH 35

TTTNL 14

FASTUP 215

FASTDOWN 18

CPCROSSA 30

CPCROSSD 160

BIGVOLUP 5

BIGVODN 9

ACCUMVER 132

HIGHIP21 18

HIUPPCT 39

REDSELL 80

AUGSELS7 80

TRAPDOOR 9

|

Table 4 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

10/9/20

Bullish = 40

Bearish = 6

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

SOLAR 1 .909 .909 .909 .909 .909

TRANSP .95 .95 .8 .7 .8 .8

HOMEBLDG .941 .941 .882 .882 .882 .764

JETS .928 .857 .642 .5 .714 .714

GREEN .904 .809 .761 .714 .714 .571

BEVERAGE .857 .785 .571 .428 .571 .5

DJI-13 .846 .846 .769 .615 .769 .461

SEMI .798 .692 .586 .49 .5 .423

UTILITY .789 .789 .657 .631 .552 .552

ELECTRON .782 .721 .612 .517 .517 .442

NASD-100 .78 .72 .68 .53 .63 .47

NIFTY .777 .733 .666 .511 .644 .466

INFRA .771 .742 .742 .6 .685 .6

AUTO .769 .769 .769 .666 .692 .589

DOWJONES .766 .766 .7 .566 .7 .5

HOSPITAL .761 .857 .761 .571 .571 .476

INDEXES .751 .751 .762 .7 .74 .615

CHEM .75 .75 .708 .645 .666 .562

COMPUTER .75 .7 .65 .55 .5 .5

ETFS .75 .66 .517 .428 .553 .375

SP500 .735 .724 .665 .571 .632 .533

GUNS .733 .666 .666 .666 .733 .666

BIGBANKS .714 .714 .571 .142 .285 0

COAL .714 .714 .714 .571 .571 .571

SP-100 .703 .703 .637 .505 .593 .461

RUS-1000 .701 .701 .646 .564 .6 .5

RETAIL .693 .714 .673 .612 .673 .612

COMODITY .682 .634 .634 .414 .487 .439

FIDSTKS .68 .668 .594 .497 .588 .497

FOOD .679 .641 .622 .49 .547 .49

INDMATER .666 .666 .626 .533 .586 .48

FINANCE .658 .743 .621 .439 .5 .39

REGBANKS .653 .73 .615 .5 .461 .153

COPPER .625 .5 .5 .25 .25 .25

SOFTWARE .616 .566 .533 .466 .466 .4

INSURANC .615 .615 .5 .423 .538 .384

CHINA .6 .52 .5 .52 .52 .46

BIOTECH .56 .549 .525 .445 .453 .32

REIT .535 .635 .471 .514 .564 .521

GAMING .523 .476 .523 .428 .523 .476

================================================================================================

GOLD .469 .163 .142 .102 .224 .142

HACKERS .45 .35 .3 .1 .15 .05

EDU .333 .333 .333 .333 .333 .333

MILITARY .321 .392 .25 .214 .321 .178

OILGAS .293 .277 .222 .19 .19 .166

BONDFUND .29 .26 .21 .21 .23 .26

|

=====================================================================

10/8/2010 Is A Big Trap Being Laid

for Democrats?

The market has a strong tendency at this time of the year

to make partisans pay a price for being too emotional. As explained

here recently, I believe the evidence now suggests that it is the Biden

supporters on Wall Street who are the ones who are most bullish now.

DIA, SPY and QQQ have reached the clearest resistance levels.

A breakout now on increased volume would be bullish. Another

minor pullback would not be particularly bearish, given the FED's

determination to support the market.

Stay long the bullish MAXCPs, especially the solar energy stocks,

as well as the highest AI/200 big techs and ETFS, CRM, BABA and

ARKW. Our short hedges, the big oils, are trying to rally based

on being over-sold, short-covering and hopes for huge bailout from

Congress. Cover 1/2 of the short positions if they close much higher

than their openngs tomorrow. This would mean a break in the Closing

Power down-trends. See the bearish MINCP charts tonight.

No New Peerless Sell from version-2020. Version-2006 does give

a Sell S12. What's the difference? Today, the A/D Line made a clear

new high much ahead of the DJI. In the 2020 version of Peerless such

good breadth at this time of the year in a Presidential Election Year works

against a Sell S12 occurring, even though the DJI has closed 2.8% over

the 21-day ma with our IP21 (Accum. Index) still negative.

Notice also the Closing Power uptrends and the bullish inverted head

and shoulders in the SPY and QQQ.

| DJIA - version 2020 |

| DIA

At

resistance. Watch for what DJI wants to do now. |

| SPY |

| QQQ |

Wall Street Likes to Take Advanatge

of Partisan Emotionalism

Another factor at work here is the strong tendency for the DJI to

become emotionally charged in Octobers when there is a Presidential

Election coming up. October peaks are relatively rare in these years

because political partisans tend to make rallies in this month carry

through to November or later. Since 1888, there have been 18 cases

where the DJI refused to peak on strength in October and waited

until at least November. Oppositely, there have been just 4 cases of

October peaks when the DJI had been rising. This suggests the odds

for the DJI to rally now are 18/22 or 82%. It is true

the tendency is

less pronounced since 2004, but this is a year of polorized opinions.

The market somehow knows how to take advantage of those who are

most partisan who come aboard late. This year, it's the Democrat

partisans who are most likely to be the victims of their own powerfully

anti-Trump passions!

Let me show the peaks in the fourth quarter of Presidential

Election

Years since 1886: I

have marked in blue the 18 years where a rally DJI

refused to reverse significantly in October and waited at least until

November. I have marked in fuscia the four

years where there was an

October peak. In black are those years where the DJI was

falling or flat

in October.

1888 - Sept peak and DJI fell 88 to 82 to December.

DJI fell as Republican beat Democrat.

1892 - Nov. 10 peak ending minor rally.

DJI fell as Democrat beat Republican

Exception #1

1896 - Oct -12 peak ended big rally based on anticipated Republican

victory follow a recession widely blamed on Democrat Cleveland.

1900 - Nov. 10 peak ended rally. DJI

declined from 69-64

1904 - Nov. 20 peak ended rally. DJI declined from 73 to 66.

1908 - Nov. 5 peak ended rally. DJI declined from 88 to 84.

1912 - Sept. 20. DJI fell from 94 to 85 in December.

1916 - Nov. 21 peak. DJI fell from 110 to 92.

1920 - Sept 17 peak. On going bear market. Wall

Street bombed.

1924 - Strong advance until end of year as Repub.

re-elected.

1928 - Nov. 28 peak. DJI then declined from 290 to 265.

1932 - Nov. 11 minor peak in on-going bear market.

1936 - Nov. 17 minor peak. DJI declined from 185 to 177.

1940 - Nov. 7 minor peak. DJI declined from 138 to 132.

1944 - Dec. 15 minor peak. DJI declined only from 152 to 149.

1948 - Nov. 1 Peak. Rep loss resulted in decline from 190 to 171.

1952 - bottom made on Oct 22. DJI rallied stromgly as

Rep. won.

1956 - Nov. 5 peak. DJI then fell from 495 to 465.

1960 - Oct. 24 bottom. DJI rallied beyond end of year

despite JFK

beating Nixon.

1964 - Nov. 18 minor peak. DJI fell from 891 to

860.

1968 - Dec. 2 major peak. Bear market started.

(Oct. 18 peak brought only a 2.5% decline).

1972 - Oct. 16 bottom with DJI then rallying 11 weeks.

1976 - Sept. 22 - DJI then declined from 1014 to 924.

Exception #2 1980 - Oct. 16 - DJI then fell from 959 to

918 (about 4.4%)

1984 - Nov. 16 peak. DJI fell from 1244 to 1170.

Exception #3 1988 - Oct. 20- DJI then fell from 2181 to 2039.

1992 - Oct. 9 bottom. Strong rally despite election

of Democrat.

1996 - Nov. 26 peak. DJI fell from 6528 to to

6268.

2000 - Nov. 7 peak. DJI fell from 10952 to

to 10400.

2004 - Oct. 22 bottom. Strong rally.

2008 - Oct. 27 bottom. Rally until Nov. 4. On-going bear market.

Exception #4 2012 - Oct. 5- DJI then fell from

13610 to 12592.

2016 - Very flat market until election of Trump Rally from Nov. 3 bottom..

|

Charts 10/8/2020 (Click on Underlined link.) 2020 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol Stoch-20 Inverted Traders Index Graph of Pct of All Stocks above 65-dma Cum. Inverted Traders Index NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30 DIA QQQ MDY IWM TNA Short-Term Rates DOLLAR-UUP SPY http://tigersoft.com/2121CST/SPY.GIF recent 2006 vers-Peerless signals -- http://tigersoft.com/NEWPEER/UPD6108.BMP USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH PALL RSX RETL SDS AGQ SLV SOXL TECL TLT TMF TNA UGA (gasoline) USO (oil) and China: YINN CHAU Commodities: CANE CORN DBC JJC, NIB, CHOC CORN, CUT (paper) MOO, SOYB WEAT UUP (Dollar) LIT (Lithium) Stocks AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA BAC BIDU BLDP CAT CRM CVX CMG DE ENPH FB GILD GOOG GS HD IBM INTU JPM LRCX M (Macy's) MSFT NEM NFLX NKE NVDA PG REGN REV SO SQ QCOM QDEL TSLA TXN XOM V VRTX WFC WMT TOWN ZM New highs and Bullish MAXCPs http://tigersoft.com/MAXCP/10-8/BULLISH.htm Bearish MAXCPs - http://tigersoft.com/MINCP/10-8/BEARISH.htm |

Table 1

10/8/2018 QUICKSILVER on DJI-30 STOCKS.

P21 + ITRS score >+.25 is bullish

1 Bullish (CRM)

2 Bearish (CSCO, CVX,)

HIGHEST AI/200 = CRM Second Highest Tied = AAPL and MSFT STOCKS CLOSECHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE AI/200 IP21 ITRS ------------------------------------------------------------------------------------------------------- ------------------------------------------------------------------------------------------------------- AAPL 114.97 -.11 116.79 -79.2% ------- RED 156 -.054 .139 ---------------------------------------------------------------------------------------------------------- AMGN 240.09 -17.58 255.39 -301.9% Bearish RED 134 .01 -.106 ---------------------------------------------------------------------------------------------------------- AXP 106.06 2.68 101.33 231% Bullish BLUE 99 -.046 .026 ---------------------------------------------------------------------------------------------------------- BA 168 3.39 167.86 4.2% Bearish BLUE 33 -.049 -.059 ---------------------------------------------------------------------------------------------------------- CAT 156.66 1.89 146.71 328.8% ------- BLUE 119 -.1 .044 ----------------------------------------------------------------------------------------------- ----------- CRM 260.22 .24 253.45 134% ------- RED 192 .003 .273 Bullish ---------------------------------------------------------------------------------------------------------- CSCO 39.79 .39 38.8 127.8% Bearish ---- 119 -.081 -.219 Bearish ---------------------------------------------------------------------------------------------------------- CVX 75.22 1.44 70.42 333% Bearish BLUE 77 -.059 -.236 Bearish ---------------------------------------------------------------------------------------------------------- DIS 123.09 .18 123.31 -9% Bearish RED 100 -.157 -.006 ---------------------------------------------------------------------------------------------------------- DOW 49.38 1.08 46.11 343.2% ------- BLUE 61 -.136 .064 ---------------------------------------------------------------------------------------------------------- GS 207.98 4.38 198.55 234.6% Bearish BLUE 58 -.011 -.044 ---------------------------------------------------------------------------------------------------------- HD 284.52 1.73 277.62 123.4% Bearish BLUE 154 .092 .004 ---------------------------------------------------------------------------------------------------------- HON 173.78 2.23 163.68 301.9% Bullish BLUE 108 -.006 .053 ---------------------------------------------------------------------------------------------------------- IBM 131.49 7.42 121.09 426.4% Bullish BLUE 111 -.214 -.022 ---------------------------------------------------------------------------------------------------------- INTC 53.37 .7 52.24 109.1% Bullish BLUE 91 .022 .039 ---------------------------------------------------------------------------------------------------------- JNJ 148.89 1.01 147.32 53.3% Bearish BLUE 116 -.093 -.055 ---------------------------------------------------------------------------------------------------------- JPM 101.78 2.05 96.97 244.6% Bullish BLUE 23 -.002 -.05 ---------------------------------------------------------------------------------------------------------- KO 50.46 .9 49.18 129.9% Bearish BLUE 88 -.051 -.02 ---------------------------------------------------------------------------------------------------------- MCD 225.8 -.68 219.59 138.8% Bullish RED 138 -.036 .08 ---------------------------------------------------------------------------------------------------------- MMM 167.71 1.22 158.79 275.1% Bearish BLUE 101 -.176 .003 ---------------------------------------------------------------------------------------------------------- MRK 80.48 .44 81.64 -71.9% Bearish BLUE 95 -.088 -.057 ---------------------------------------------------------------------------------------------------------- MSFT 210.58 .75 212.46 -45% Bearish BLUE 156 .007 -.039 ---------------------------------------------------------------------------------------------------------- NKE 129.71 -.35 126.64 120.1% Bullish RED 135 -.121 .267 ---------------------------------------------------------------------------------------------------------- PG 141.65 .95 139.24 86.4% Bullish BLUE 97 .021 .033 ---------------------------------------------------------------------------------------------------------- TRV 115.62 1.82 107.81 352.7% Bullish BLUE 87 -.102 -.081 ---------------------------------------------------------------------------------------------------------- UNH 322.41 -.76 313.07 147.7% Bullish RED 112 -.054 -.019 ---------------------------------------------------------------------------------------------------------- V 202.98 .51 203.35 -9.1% Bearish RED 104 -.08 -.049 ---------------------------------------------------------------------------------------------------------- VZ 59.19 -.42 59.45 -21.9% ------- BLUE 120 -.124 -.04 ---------------------------------------------------------------------------------------------------------- WBA 37.07 .58 35.87 166% ------- BLUE 80 .058 -.17 ---------------------------------------------------------------------------------------------------------- WMT 141.36 .47 143.08 -60.8% ------- RED 126 -.133 .011 |

Table 2 QUICKSILVER on ETFS - 10/7/20 Bullish = 1 SOXL

Bearish = 1 OIH

ITRS + IP21>.25 is considered "Bullish"

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS --------------------------------------------------------------------------------------------- --------------------------------------------------------------------------------------------- DIA 284.29 1.37 276.8 110.1% Bearish RED .04 ----- --------------------------------------------------------------------------------------------- SPY 343.78 3.02 333.84 99.9% Bearish BLUE-.001 -.013 --------------------------------------------------------------------------------------------- QQQ 281.41 1.49 274.31 -15.1% Bearish RED .01 .013 --------------------------------------------------------------------------------------------- MDY 362.88 3.79 346.52 275.7% Bullish BLUE .162 -.017 --------------------------------------------------------------------------------------------- IWM 161.86 1.82 152.85 310.8% ------- BLUE .083 .013 --------------------------------------------------------------------------------------------- FAS 39.12 1.58 35.04 674% Bearish BLUE-.045 .008 --------------------------------------------------------------------------------------------- SOXL 289.93 9.73 244.94 396% Bullish BLUE .093 .261 Bullish --------------------------------------------------------------------------------------------- TECL 316.81 4.72 291.24 21% ------- RED -.005 .21 --------------------------------------------------------------------------------------------- IBB 141.38 .39 133.87 170.9% ------- RED .157 -.036 --------------------------------------------------------------------------------------------- GLD 177.85 .63 178.54 -23.8% Bearish RED -.023 -.11 --------------------------------------------------------------------------------------------- OIH 104.45 4.79 96.75 523.1% Bearish BLUE-.07 -.274 Bearish --------------------------------------------------------------------------------------------- |

Table 3 - Count of Stocks in Key Directories

20201008

-------------------------------

NEWHIGHS 327 Bullish

NEWLOWS 24

MAXCP 38

MINCP 13

TTTNH 29

TTTNL 13

FASTUP 263 Bullish

FASTDOWN 23

CPCROSSA 61

CPCROSSD 54

BIGVOLUP 10

BIGVODN 9

ACCUMVER 132

HIGHIP21 13

HIUPPCT 34

REDSELL 84

AUGSELS7 73

TRAPDOOR 10

|

Table 4 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

10/8/20

Bullish = 38

Bearish = 7

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

TRANSP .95 .8 .7 .8 .8 .65

HOMEBLDG .941 .882 .882 .882 .764 .764

SOLAR .909 .909 .909 .909 .909 .909

HOSPITAL .857 .761 .571 .619 .523 .428

JETS .857 .642 .5 .714 .714 .571

DJI-13 .846 .769 .615 .769 .461 .538

GREEN .809 .761 .714 .714 .571 .619

UTILITY .789 .657 .631 .552 .552 .526

BEVERAGE .785 .571 .428 .571 .5 .571

AUTO .769 .769 .666 .692 .615 .564

DOWJONES .766 .7 .566 .7 .5 .6

INDEXES .755 .767 .704 .744 .63 .647

CHEM .75 .708 .645 .666 .562 .5

FINANCE .743 .621 .439 .5 .402 .28

INFRA .742 .742 .6 .685 .6 .571

NIFTY .733 .666 .511 .644 .466 .666

REGBANKS .73 .615 .5 .461 .192 .115

SP500 .724 .668 .571 .632 .542 .523

ELECTRON .721 .612 .517 .517 .442 .469

NASD-100 .72 .68 .53 .63 .47 .66

BIGBANKS .714 .571 .142 .285 0 0

COAL .714 .714 .571 .571 .571 .571

RETAIL .714 .673 .612 .673 .612 .653

SP-100 .703 .637 .505 .593 .461 .494

COMPUTER .7 .65 .55 .5 .5 .5

RUS-1000 .7 .647 .563 .599 .504 .464

SEMI .692 .586 .49 .5 .423 .5

FIDSTKS .668 .594 .497 .588 .502 .497

GUNS .666 .666 .666 .733 .733 .6

INDMATER .666 .626 .533 .586 .506 .506

ETFS .66 .517 .428 .553 .375 .41

COMODITY .634 .634 .414 .487 .463 .439

FOOD .634 .615 .48 .538 .48 .48

REIT .631 .475 .51 .56 .517 .333

INSURANC .615 .5 .423 .538 .423 .307

SOFTWARE .566 .55 .466 .466 .4 .483

BIOTECH .549 .525 .448 .453 .322 .392

CHINA .52 .5 .52 .52 .46 .52

-----------------------------------------------------------------------------------------------

COPPER .5 .5 .25 .25 .375 .125

-----------------------------------------------------------------------------------------------

GAMING .476 .523 .428 .523 .476 .523

MILITARY .392 .25 .214 .321 .178 .178

HACKERS .35 .35 .1 .15 .05 .25

EDU .333 .333 .333 .333 .333 .333

OILGAS .277 .222 .182 .19 .166 .166

BONDFUND .267 .207 .217 .227 .267 .267

GOLD .163 .142 .102 .224 .183 .244

|

====================================================================

10/7/2020 Hedging by being

long the bullish MAXCPs has done better

than if we were long DIA. Why change course before the

almost inevitable victory celebration by partisan Democrats,

assuming Biden wins as the polls now strongly suggest.

Breadth (the NYSE A/D Line) is about to

make

a 12-month high. See below. Breadth is our best indicator

for showing the effects of what the FED is doing

and the direction they want the market to go in.

The negative Accumulation Index warns us that

"big money" is not so happy about Biden's big lead at

the polls. Thus, they are net sellers on the current rally.

How do we decide which force is more powerful?

As long as the DIA's Closing Power is rising, we

can safely assume that Wall Street Professionals

are bullish, when taken as a whole, in the current market.

Of course, they watch the FED from close-up and

they are well aware of what big money and insiders are

doing. They are flexible, apolitical and usually right about

the market's major direction. So we should watch

them closely.

The pundits tell us this is a Biden Rally,

that Wall Street

is eager to return to a quieter kind of President. That's part

of what's happening. There are many cases when the market

celebrates the coming Election victory of its favorite. The FED's

QE-Infinity is playing a big role, too; all the infusion of capital

can find no place better to invest now than Wall Street.

The DJIA is full of "dinosaurs" one of my friends says.

There is a lot of truth to this. But it is this index that gets

most of the headlines and which has data going back to 1885

for our historical studies. On the other hand, the newer tech

stocks are in the QQQ. And it is here that we see many of the

companies that are part of the new era where folks work at home

on smaller and smaller devices, where robotics and self-teaching

chips are found along with much, much more that amounts to

a revolution in marketing and industrial engineering. So, it

is significant now that the QQQ could be forming an inverted

head/shoulders. A breakout above QQQ's red resistance line

should be construed bullishly.

But the DJI is now 2.6% over the 21-dma with the

IP21-Accumulation

and V-Indicator still negative. So, a Sell S12 seems likely if the DJI's

rally goes much higher. An October reversal may still occur if no

Relief Package is approved. Let's wait and see if we get a new Sell

first. Recent Sell S12s have not worked. The FED clearly does not

want to allow any significant decline for fear it may get out of control.

Though TigerSoft's Power Ranking system has worked well in

finding

the most bullish and bearish stocks, Peerless remain in a quandry:

the Peerless-2020 version has not given any buys for a month while

the Peerless-2006 software in bullish mode has not given only recent

Buys. Rather than choose between the different versions, our Hotline

has opted to hedge with longs in the highest AI/200 stocks and

the bullish Solar Power stocks. This has worked well. Why change

approaches.

| TAN |

To TAN and the other solar power stocks, we should consider being

long CRM, the highest AI/200 stock in the DJI, BABA (the leading

Chinese internet play) and ARKW (American internet "cloud" ETF

with an AI/200 score of 198). See these just below. (Cloud-based

software, offers users the option of not running programs on their

own machines but on a server somewhere else.)

| CRM |

| BABA |

| ARKW |

The bearish MINCPS remain in downtrends but are not making

new

yearly lows. Still the big oil stocks (like XOM and BP should make good

stocks to be short as investors ponder how long travel will be restricted

and how Biden's policies will hurt fossil fuel companies.

|

XOM - Stocks dropped from the DJI-30 seldom come alive and rise sharply. |

| BP |

|

Charts 10/7/2020 (Click on Underlined link.) 2020 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol Stoch-20 Inverted Traders Index Graph of Pct of All Stocks above 65-dma Cum. Inverted Traders Index NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30 DIA QQQ MDY IWM TNA Short-Term Rates DOLLAR-UUP SPY http://tigersoft.com/2121CST/SPY.GIF recent 2006 vers-Peerless signals -- http://tigersoft.com/NEWPEER/UPD6107.BMP USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH PALL RSX RETL SDS AGQ SLV SOXL TECL TLT TMF TNA UGA (gasoline) USO (oil) and China: YINN CHAU Commodities: CANE CORN DBC JJC, NIB, CHOC CORN, CUT (paper) MOO, SOYB WEAT UUP (Dollar) LIT (Lithium) Stocks AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA BAC BIDU BLDP CAT CRM CVX CMG DE ENPH FB GILD GOOG GS HD IBM INTU JPM LRCX M (Macy's) MSFT NEM NFLX NKE NVDA PG REGN REV SO SQ QCOM QDEL TSLA TXN XOM V VRTX WFC WMT TOWN ZM New highs and Bullish MAXCPs http://tigersoft.com/MAXCP/10-7/BULLISH.htm Bearish MAXCPs - http://tigersoft.com/MINCP/10-7/BEARISH.htm |

Table 1

10/7/2018 QUICKSILVER on DJI-30 STOCKS.

P21 + ITRS score >+.25 is bullish

1 Bullish (CRM)

2 Bearish (CSCO, CVX,)

HIGHEST AI/200 = CRM Second Highest Tied = AAPL and MSFT STOCKS CLOSECHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE AI/200 IP21 ITRS

-------------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------------------

AAPL 115.08 1.92 115.81 -31.7% ------- BLUE 157 -.035 .162

----------------------------------------------------------------------------------------------------------

AMGN 257.67 4.98 254.16 69.4% Bullish BLUE 134 .113 -.063

----------------------------------------------------------------------------------------------------------

AXP 103.38 1.62 100.25 153.8% Bearish BLUE 100 -.074 .023

----------------------------------------------------------------------------------------------------------

BA 164.61 5.07 165.26 -19.5% Bearish BLUE 33 -.077 -.108

----------------------------------------------------------------------------------------------------------

CAT 154.77 3.24 149.15 187.1% ------- BLUE 120 -.112 .049

----------------------------------------------------------------------------------------------------------

CRM 259.98 9.84 251.32 172.6% ------- BLUE 192 .045 .3

Bullish

----------------------------------------------------------------------------------------------------------

CSCO 39.4 .83 39.39 1.3% Bearish BLUE 119 -.057 -.221

Bearish

----------------------------------------------------------------------------------------------------------

CVX 73.78 1.48 72 124.1% Bearish BLUE 77 -.103 -.244

Bearish

----------------------------------------------------------------------------------------------------------

DIS 122.91 1.98 124.08 -47.6% Bearish BLUE 100 -.173 -.014

----------------------------------------------------------------------------------------------------------

DOW 48.3 .42 47.05 131.9% ------- RED 62 -.16 .061

----------------------------------------------------------------------------------------------------------

GS 203.6 2.51 200.97 65.6% Bearish BLUE 58 -.095 -.062

----------------------------------------------------------------------------------------------------------

HD 282.79 6.32 277.71 91.2% ------- BLUE 154 .087 -.006

----------------------------------------------------------------------------------------------------------

HON 171.55 4.66 164.61 209.2% Bullish BLUE 108 -.056 .057

----------------------------------------------------------------------------------------------------------

IBM 124.07 2.1 121.67 98.8% Bullish BLUE 111 -.149 -.075

----------------------------------------------------------------------------------------------------------

INTC 52.67 1.3 51.78 86.2% Bullish BLUE 91 .014 -.002

----------------------------------------------------------------------------------------------------------

JNJ 147.88 1.62 148.88 -33.9% Bearish BLUE 117 -.086 -.065

----------------------------------------------------------------------------------------------------------

JPM 99.73 1.71 96.27 177.2% ------- BLUE 23 -.03 -.047

----------------------------------------------------------------------------------------------------------

KO 49.56 .62 49.37 19.3% Bearish BLUE 89 -.081 -.043

----------------------------------------------------------------------------------------------------------

MCD 226.48 2.39 219.49 157.2% Bullish BLUE 139 -.057 .082

----------------------------------------------------------------------------------------------------------

MMM 166.49 4.26 160.18 196.1% Bearish BLUE 102 -.192 0

----------------------------------------------------------------------------------------------------------

MRK 80.04 .41 82.95 -179.1% Bearish ---- 96 -.05 -.068

----------------------------------------------------------------------------------------------------------

MSFT 209.83 3.92 210.33 -12% ------- BLUE 156 -.002 -.033

----------------------------------------------------------------------------------------------------------

NKE 130.06 2.41 125.54 178.1% Bullish BLUE 136 -.099 .279

----------------------------------------------------------------------------------------------------------

PG 140.7 1.09 138.99 61.5% Bullish BLUE 97 .004 .028

----------------------------------------------------------------------------------------------------------

TRV 113.8 2.27 108.19 255.9% ------- BLUE 88 -.115 -.083

----------------------------------------------------------------------------------------------------------

UNH 323.17 8.72 311.77 181.6% Bullish BLUE 113 -.039 .006

----------------------------------------------------------------------------------------------------------

V 202.47 2.02 199.97 62% Bearish BLUE 105 -.073 -.043

----------------------------------------------------------------------------------------------------------

VZ 59.61 .15 59.49 10.1% Bearish BLUE 121 -.148 -.035

----------------------------------------------------------------------------------------------------------

WBA 36.49 .54 35.92 79.1% ------- BLUE 79 -.019 -.175

----------------------------------------------------------------------------------------------------------

WMT 140.89 .26 139.91 34.7% ------- RED 126 -.155 -.003

|

Table 2 QUICKSILVER on ETFS - 10/7/20 Bullish = 2 SOXL and TECL

Bearish = 1 OIH

ITRS + IP21>.25 is considered "Bullish"

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS --------------------------------------------------------------------------------------------- --------------------------------------------------------------------------------------------- DIA 282.92 5.2 278.14 97.4% Bearish BLUE .019 ----- --------------------------------------------------------------------------------------------- SPY 340.76 5.83 337.04 87.3% Bearish BLUE-.021 -.011 --------------------------------------------------------------------------------------------- QQQ 279.92 4.76 282.25 37.4% ------- BLUE .031 .018 --------------------------------------------------------------------------------------------- MDY 359.09 6.16 343.51 291.7% Bullish BLUE .141 -.006 --------------------------------------------------------------------------------------------- IWM 160.04 3.42 152.18 333.4% Bullish BLUE .066 .023 --------------------------------------------------------------------------------------------- FAS 37.54 1.74 34.28 521.8% Bearish BLUE-.068 .023 --------------------------------------------------------------------------------------------- SOXL 280.2 15.94 268.91 519.4% Bullish BLUE .091 .299 Bullish --------------------------------------------------------------------------------------------- TECL 312.09 15.84 315.53 103% ------- BLUE .014 .243 Bullish --------------------------------------------------------------------------------------------- IBB 140.99 3.11 136.67 204.1% Bullish BLUE .163 -.051 --------------------------------------------------------------------------------------------- GLD 177.22 -.08 178.7 2.8% Bearish BLUE-.007 -.107 --------------------------------------------------------------------------------------------- OIH 99.66 1.02 94.21 100% Bearish BLUE-.158 -.295 Bearish --------------------------------------------------------------------------------------------- |

Count of Stocks in Key Directories

20201007

-------------------------------

NEWHIGHS 283

NEWLOWS 41

MAXCP 55

MINCP 20

TTTNH 49

TTTNL 23

FASTUP 224

FASTDOWN 20

CPCROSSA 62

CPCROSSD 58

BIGVOLUP 8

BIGVODN 7

ACCUMVER 130

HIGHIP21 16

HIUPPCT 35

REDSELL 85

AUGSELS7 58

TRAPDOOR 12

|

Table 4 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

10/7/20

Bullish = 35

Bearish = 7

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

SOLAR .916 .916 .916 .916 .916 .833

HOMEBLDG .882 .882 .882 .764 .764 .764

TRANSP .8 .7 .8 .8 .65 .65

AUTO .769 .666 .692 .615 .589 .487

DJI-13 .769 .615 .769 .461 .538 .615

GREEN .761 .714 .714 .571 .619 .523

HOSPITAL .761 .571 .619 .571 .428 .428

INDEXES .755 .704 .744 .63 .659 .573

INFRA .742 .6 .685 .6 .571 .485

COAL .714 .571 .571 .571 .571 .571

CHEM .708 .645 .666 .562 .52 .458

DOWJONES .7 .566 .7 .5 .6 .633

NASD-100 .68 .53 .63 .47 .67 .56

RETAIL .673 .612 .673 .612 .653 .612

SP500 .668 .573 .632 .542 .531 .512

GUNS .666 .666 .733 .733 .6 .533

NIFTY .666 .511 .644 .466 .666 .533

UTILITY .657 .631 .552 .552 .526 .421

COMPUTER .65 .55 .5 .5 .5 .55

RUS-1000 .647 .564 .599 .504 .472 .432

JETS .642 .5 .714 .714 .571 .428

SP-100 .637 .505 .593 .461 .494 .516

COMODITY .634 .414 .487 .463 .439 .56

INDMATER .626 .533 .586 .506 .506 .453

FINANCE .625 .45 .512 .4 .287 .25

FOOD .615 .48 .538 .48 .48 .557

REGBANKS .615 .5 .461 .192 .115 .115

ELECTRON .612 .517 .517 .442 .476 .387

FIDSTKS .594 .497 .588 .502 .508 .52

SEMI .586 .49 .5 .423 .5 .394

BEVERAGE .571 .428 .571 .5 .571 .428

BIGBANKS .571 .142 .285 0 0 0

SOFTWARE .55 .483 .466 .4 .483 .416

BIOTECH .525 .448 .456 .322 .392 .336

GAMING .523 .428 .523 .476 .523 .476

ETFS .517 .428 .553 .375 .428 .321

============================================================================================

CHINA .5 .52 .52 .46 .52 .46

COPPER .5 .25 .25 .375 .125 .5

INSURANC .5 .423 .538 .423 .307 .384

============================================================================================

REIT .475 .51 .56 .517 .347 .241

HACKERS .35 .15 .15 .05 .25 .1

EDU .333 .333 .333 .333 .333 .333

MILITARY .25 .214 .321 .178 .178 .214

OILGAS .222 .182 .182 .166 .166 .134

BONDFUND .207 .217 .227 .267 .297 .257

GOLD .142 .102 .224 .183 .244 .224

|

========================================================================

10/6/2020 The

Peerless-2020 system remains on Sells.

Stay hedged as previously suggested. Buy BABA.

Expect more erratic moves by the market. The market is on QE-Infinity

steroids and thinks it is invincible. A DJI move above 29600 in November

would be in keeping with the tendency of the market to allow partisans a

chance to celebrate. But the technicals now show any rally must fight through

the large supply of stock overhead as well as the the erratic and contradictory

statements coming from the White House. I believe we can make money with

much less anxiety from now to November by hedging.

Though the A/D Line is strong our Accumulation Index is negative for the DJI

and quite a few important stocks that are facing stiff resistance from their

head/shoulders' right shoulder apexes. This remains a good time to avoid the

DIA, SPY, QQQ and NASDAQ indexes and their ETFs. An October

downside surprise still may still lay ahead, though it's looking more and more

that Wall Street will want to celebrate a Biden victory, given that's whom their

"big money" is backing.

|

DJIA - Peerless - 2020 signals |

|

DIA |

Continue to stay hedged by being long the solar powered stocks and TAN

(their ETF), CRM (our DJIA-30 Tahiti stock) and a long new recommendation

that represents an escape from much of the craziness right now, Chinese internet

giant BABA. At the same time, stay short the bearish Oil stocks, like XOM,

CVX, BP and the ETF OIH.

BULLISH

BEARISH OILS TO USE HEDGING

STOCKS WITH HEAD and SHOULDERS PATTERNS AND RED

DISTRIBUTION.

As long as the prices below do not close above the resistance

lines shown, there is still considerable

risk in the market. A Biden victory may bring a anti-Trump

partisan celebration, but once

that is over, the realites of Biden's very different political

agenda should start to spook the

market. Trump over-night swich back to backing a new relief

stimulus may be a sign of instability

that probably derives from his illness and the steroid treatments

he is getting. If so, there may

be more wild moves ahead for the market.

======================================================================

10/6/2020

Today the

majority of all stocks (about 6000) are now above their 65-dma

What's going on? The bearish month of September produced only a slight

decline. This is bullish. Moreover, the DJI's rise is now being fueled

by both

Opening and Closer Power rising. The A/D Line's rise continues strongly.

The P-Indicator has turned positive.

But the Accumulation Index remains negative, so a new Sell S12 could

occur if the current rally keeps going. But the strength here is building, as

though it is inviting the Democrats to celebrate a November victory or to

give Republicans one more chance to get out before taxes are raised. Either

way, the DJI's strength must be taking into account a Biden victory. That

means more new highs by the ETF TAN and the solar power stocks in

the Bullish MAXCPs. Oil stocks are still the obvious shorts, for now.

2006-Version of Peerless disregards normal bearish seasonality of September.

2020 version of Peerless gave no Buys in September because of normally

bearish seasonality. A defeat of Trump in November is now being looked

forward to by much of Wall Street. I say that based on the behavior now

of the market, itself, and because of Wall Street's big campaign contributions

to Biden. Meanwhile, the FED wants to fulfull its promise of a DJI new high

by Election time, or perhaps sooner, using QE-Infinity.

I suggested that the big banks were at a pivotal point, their 65-dma. Their

advance Monday has to be bullishly construed. Several categories of stocks

are about to breakout: casinos, guns stocks (sporting goods) an Chinese

stocks. We will look at those tomorrow night.

Stay hedged, long CRM (the highest AI/200 stock in the DJI) and the solar power

stocks. We will be watching sporting good stocks and Chinese stocks making

new highs for possible buy recommendations.

|

Charts 10/5/2020 (Click on Underlined link.) 2020 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol Stoch-20 Inverted Traders Index Graph of Pct of All Stocks above 65-dma Cum. Inverted Traders Index NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30 DIA QQQ MDY IWM TNA Short-Term Rates DOLLAR-UUP SPY http://tigersoft.com/2121CST/SPY.GIF recent 2006 vers-Peerless signals -- http://tigersoft.com/NEWPEER/UPD6105.BMP USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH PALL RSX RETL SDS AGQ SLV SOXL TECL TLT TMF TNA UGA (gasoline) USO (oil) and China: YINN CHAU Commodities: CANE CORN DBC JJC, NIB, CHOC CORN, CUT (paper) MOO, SOYB WEAT UUP (Dollar) LIT (Lithium) Stocks AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA BAC BIDU BLDP CAT CRM CVX CMG DE ENPH FB GILD GOOG GS HD IBM INTU JPM LRCX M (Macy's) MSFT NEM NFLX NKE NVDA PG REGN REV SO SQ QCOM QDEL TSLA TXN XOM V VRTX WFC WMT TOWN ZM New highs and Bullish MAXCPs http://tigersoft.com/MAXCP/10-5/BULLISH.htm Bearish MAXCPs - http://tigersoft.com/MINCP/10-5/BEARISH.htm |

Table 1

10/5/2018 QUICKSILVER on DJI-30 STOCKS.

P21 + ITRS score >+.25 is bullish

0 Bullish

4 Bearish (CSCO, CVX, IBM, TRV)

HIGHEST AI/200 = CRM Second Highest Tied = AAPL and MSFT STOCKS CLOSECHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE AI/200 IP21 ITRS

-------------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------------------

AAPL 116.5 3.48 114.96 67% ------- BLUE 159 -.026 .194

----------------------------------------------------------------------------------------------------------

AMGN 256.01 10.6 247.03 179.6% Bullish BLUE 134 .086 -.031

----------------------------------------------------------------------------------------------------------

AXP 103.89 2.28 98.82 253.6% Bullish BLUE 102 -.096 .026

----------------------------------------------------------------------------------------------------------

BA 171.2 3.12 166.08 154.1% Bullish BLUE 33 -.009 -.078

----------------------------------------------------------------------------------------------------------

CAT 153.49 3.55 147.68 196% ------- BLUE 122 -.075 .052

----------------------------------------------------------------------------------------------------------

CRM 251.53 3.68 246.67 97.5% Bearish BLUE 193 -.062 .271

----------------------------------------------------------------------------------------------------------

CSCO 38.57 .3 39.13 -71.9% Bearish ---- 119 -.109 -.232

Bearish

----------------------------------------------------------------------------------------------------------

CVX 72.7 1.51 73.93 -85.5% Bearish BLUE 77 -.125 -.257

Bearish

----------------------------------------------------------------------------------------------------------

DIS 123.37 .82 125.99 -105.4% Bearish ---- 100 -.158 -.015

----------------------------------------------------------------------------------------------------------

DOW 48.58 1.27 47.48 117.3% Bullish BLUE 64 -.114 .077

----------------------------------------------------------------------------------------------------------

GS 201.8 1.9 199.07 68.6% Bearish RED 59 -.1 -.062

----------------------------------------------------------------------------------------------------------

HD 282.1 2.79 272.33 177.1% Bullish BLUE 153 .123 0

----------------------------------------------------------------------------------------------------------

HON 168.72 3.11 164.64 123.9% Bearish BLUE 108 -.066 .066

----------------------------------------------------------------------------------------------------------

IBM 122.01 1.44 121.73 11.6% Bearish BLUE 111 -.201 -.094

Bearish

----------------------------------------------------------------------------------------------------------

INTC 51.69 .68 51.43 25.2% Bullish BLUE 91 -.056 -.042

----------------------------------------------------------------------------------------------------------

JNJ 148.23 1.99 147.11 38% Bearish BLUE 119 -.151 -.063

----------------------------------------------------------------------------------------------------------

JPM 99.04 1.15 96.16 149.2% ------- BLUE 24 -.042 -.056

----------------------------------------------------------------------------------------------------------

KO 49.38 .02 49.28 10.2% Bearish RED 91 -.077 -.045

----------------------------------------------------------------------------------------------------------

MCD 226.07 3.4 220.26 132% Bullish BLUE 141 -.064 .074

----------------------------------------------------------------------------------------------------------

MMM 162.75 2.39 161.66 34% Bearish BLUE 104 -.2 -.045

----------------------------------------------------------------------------------------------------------

MRK 81.24 .44 82.76 -92.7% Bearish ---- 98 -.072 -.01

----------------------------------------------------------------------------------------------------------

MSFT 210.38 4.19 209.44 22.5% Bearish BLUE 158 -.039 -.018

----------------------------------------------------------------------------------------------------------

NKE 127.91 1.27 124.32 142.6% Bullish BLUE 138 -.075 .236

----------------------------------------------------------------------------------------------------------

PG 139.39 1.27 138.01 49.9% ------- BLUE 98 -.015 .043

----------------------------------------------------------------------------------------------------------

TRV 111.91 3.33 110.22 77.9% ------- BLUE 90 -.15 -.117

Bearish

----------------------------------------------------------------------------------------------------------

UNH 318.15 6.17 303.23 241.5% Bearish BLUE 115 -.044 -.006

----------------------------------------------------------------------------------------------------------

V 203.54 2.08 200.32 80.1% Bearish BLUE 107 -.116 -.021

----------------------------------------------------------------------------------------------------------

VZ 59.66 .42 59.36 25.3% Bearish ---- 123 -.193 -.014

----------------------------------------------------------------------------------------------------------

WBA 36.62 .85 36.07 76.8% Bearish BLUE 79 -.061 -.16

----------------------------------------------------------------------------------------------------------

WMT 141.8 1.3 137.25 163% ------- BLUE 127 -.165 .017

|

Table 2 QUICKSILVER on ETFS - 10/5/20 Bullish = 2 SOXL, TECL

Bearish = 1 OIH

ITRS + IP21>.25 is considered "Bullish"

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS --------------------------------------------------------------------------------------------- --------------------------------------------------------------------------------------------- DIA 281.51 4.71 274.42 101.4% ------- BLUE .007 0 --------------------------------------------------------------------------------------------- SPY 339.76 5.92 332.37 83.3% ------- BLUE-.037 -.005 --------------------------------------------------------------------------------------------- QQQ 280.16 5.85 275.95 53.3% ------- BLUE .01 .033 --------------------------------------------------------------------------------------------- MDY 354.68 8.16 336.66 234.6% Bullish BLUE .137 -.012 --------------------------------------------------------------------------------------------- IWM 157.07 4.22 149.34 233.7% Bullish BLUE .08 .012 --------------------------------------------------------------------------------------------- FAS 36.86 1.82 32.87 418.9% ------- BLUE-.039 .014 --------------------------------------------------------------------------------------------- SOXL 268.85 23.91 252.85 355.9% Bullish BLUE .072 .291 Bullish --------------------------------------------------------------------------------------------- TECL 310.93 19.69 298.39 155.9% ------- BLUE .006 .259 Bullish --------------------------------------------------------------------------------------------- IBB 139.57 5.7 134.61 188.5% Bullish BLUE .166 -.04 --------------------------------------------------------------------------------------------- GLD 179.41 .87 178.19 76.2% Bearish BLUE .066 -.06 --------------------------------------------------------------------------------------------- OIH 100.13 3.38 98.46 -52.7% Bearish BLUE-.188 -.306 Bearish --------------------------------------------------------------------------------------------- |

Table 3 Count of Stocks in Key Directories

20201005

-------------------------------

NEWHIGHS 242

NEWLOWS 44

MAXCP 70

MINCP 5

TTTNH 48

TTTNL 8

FASTUP 143

FASTDOWN 26

CPCROSSA 60

CPCROSSD 43

BIGVOLUP 4

BIGVODN 9

ACCUMVER 127

HIGHIP21 18

HIUPPCT 34

REDSELL 76

AUGSELS7 23

TRAPDOOR 12

|

Tablle 4 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

10/5/20

Bullish = 32

Bearish = 12

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

HOMEBLDG .882 .764 .764 .764 .764 .764

SOLAR .8 .8 .733 .733 .666 .666

TRANSP .8 .8 .65 .65 .65 .75

DJI-13 .769 .461 .538 .615 .461 .461

INDEXES .74 .627 .655 .587 .508 .559

GUNS .733 .733 .6 .533 .533 .533

GREEN .714 .571 .619 .571 .476 .523

JETS .714 .714 .571 .428 .428 .714

DOWJONES .7 .5 .6 .633 .466 .566

AUTO .692 .615 .589 .487 .435 .461

INFRA .685 .6 .571 .457 .457 .514

RETAIL .673 .612 .653 .632 .571 .632

CHEM .666 .562 .52 .5 .5 .479

NIFTY .644 .466 .666 .6 .533 .533

SP500 .634 .544 .531 .514 .464 .512

NASD-100 .63 .47 .67 .58 .57 .59

HOSPITAL .619 .571 .476 .476 .333 .19

RUS-1000 .601 .506 .473 .437 .403 .455

SP-100 .593 .461 .494 .527 .461 .494

FIDSTKS .59 .505 .511 .528 .471 .511

INDMATER .586 .506 .506 .466 .506 .506

BEVERAGE .571 .5 .571 .428 .428 .428

COAL .571 .571 .571 .571 .571 .857

REIT .56 .517 .347 .234 .241 .382

ETFS .553 .375 .428 .321 .214 .267

UTILITY .552 .552 .526 .421 .315 .394

FOOD .538 .48 .48 .557 .538 .538

INSURANC .538 .423 .307 .384 .346 .384

GAMING .523 .476 .523 .476 .523 .619

CHINA .52 .46 .52 .46 .36 .38

ELECTRON .517 .442 .476 .394 .435 .408

FINANCE .512 .402 .292 .256 .195 .317

===============================================================================================

COMPUTER .5 .5 .5 .55 .55 .5

SEMI .5 .423 .5 .413 .442 .423

===============================================================================================

COMODITY .487 .463 .439 .56 .536 .536

SOFTWARE .483 .416 .483 .416 .366 .4

REGBANKS .461 .192 .115 .115 .076 .076

BIOTECH .456 .325 .394 .336 .338 .328

EDU .333 .333 .333 .333 .333 .333

MILITARY .321 .178 .178 .214 .25 .285 BIGBANKS .285 0 0 0 0 0 COPPER .25 .375 .125 .5 .375 .5 BONDFUND .227 .267 .297 .267 .247 .257 GOLD .224 .183 .244 .244 .244 .224 HACKERS .2 .1 .25 .1 .1 .15 OILGAS .182 .158 .158 .142 .166 .158 |

=====================================================================

10/2/2020 Wall Street

seems to be growing infatuated with Biden. But there are

too many technical problems to become really bullish. Above all, the

The multiple Sells from Peerless-2020 have not been reversed. As a result,

hedging is still advised while the DJI decides which way it wants to go in

earnest. Listen for hints from Biden what industry groups he will favor most.

And watch GS and JPM. They are now at the high inflection point of their