Earlier Hotlines www.tigersoft.com/44H4L/INDEX2.htm

Earlier still: Go

here...

HELP

A Guide

To Profitably Using The Tiger Nightly HOTLINE

Introduction to Tiger/Peerless Buys and

Sells.

Peerless Buy and

Sell Signals: 1928-2016

Individual Peerless signals explained:

http://tigersoftware.com/PeerlessStudies/Signals-Res/index.htm

http://www.tigersoft.com/PeerInst-2012-2013/

Explanation of each Peerless signal. http://www.tigersoft.com/PeerInst-2012-2013/

Different Types of

TigerSoft/Peerless CHARTS, Signals and Indicators

-----> More HELP LINKS

Documentation for TigerSoft

Automatic and Optimized Signals.

How reliable support is the

DJI's rising 200-day ma?

SPY Charts since

1994: Advisory Closing Power S7s, Accum. Index, 65-dma, Optimized Signals.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

1/19/2016 ---> Corrections,Deeper

Declines and Bear Markets since 1945.

1/21/2016

---> High

Velocity Declines since 1929

2/12/2016 ---> Presidential

Elections Years and Bullish IP21 Positive Non-Confirmations at Lower Band.

2/12/2016 ---> OBV NNCs on DJI's Rally to

2.7% Upper Band when DJI's 65-dma is falling.

11/6/2016 --->

Killer Short Selling

Techniques: ===> Order Here ($42.50)

It's As Easy as 1,2,3

TigerSoft "Combination" Short-Selling... Easy as 1-2-3 Short Sales

Earlier Q-Answers

QuickSilver Documentation (1/11/2016)

Our Different

Signals

Better understand the difference between

Peerless DJI-based signals,

the one-year optimized red Signals and the fixed signals based

on technical developments.

Introduction to Tiger/Peerless Buys and Sells.

Different Types of

TigerSoft/Peerless CHARTS, Signals and Indicators

New TigerPeerless Installation and

Basic Uses' Instruction (11/25/2016)

See the re-written materials on TigerSoft Buys and Sells.

A few more pages will be added. But users could print this

main Installation and Uses' Page for reference.

Study- Trading SPY

WITHOUT Peerless - Some Guidelines.

When completed this will be a new Tiger Trading E-Book.

Study- Examples of

"Hands above the Head" top patterns.

Study- 9/3/2017 TigerSoft (not

Peerless) charts of Major Tops as they occurred.

===> Please report any broken or out-of-date links. william_schmidt@hotmail.com

==============================================================================

==============================================================================

====>LOOK

An email was sent out give the new Hotline address to start this weekend.

An email giving new Data Page address will be sent out Sunday day afternoon.

The

new address will be used starting Monday.

If you do not get them, email us.

==============================================================================

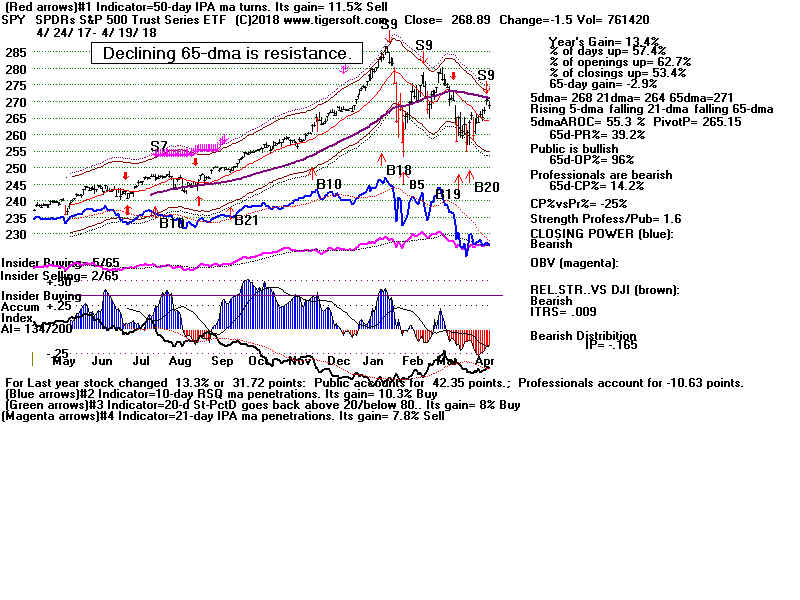

5/10/2018 Our

Peerless Buy B9 still stands. So higher prices are

likely. In fact,

if Friday were to produce another rise just like today, there would be no

Sell even though the DJI would be closing above 25000. We have to

be pleased that not only has DIA (representing the DJI) and SPY (representing

SP-500) gotten back more convincingly above their 65-dma, but their

Closing Powers have now risen above their still falling Closing Powers.

This is good. But the most bullish aspect of the market now is that the NYSE

A/D Line has just made a new far ahead of the DJI. For the last few years, these

ADL NH's have been very reliable harbingers of much higher prices by the DJI.

Should we take profits in

IWM?

A small and brief pullback is certainly possible. IWM is back to its 159-160

resistance and the DJI has now risen 6 straight days. Still, I would suggest we simply

rely on Peerless when to sell.

What has been boosting IWM technically has been its many excellent looking breakouts

. Our Bullish MINCPS have pointed to them. But IWM's volume was

low today. That

will most likely not allow it to breakout over 160 right away. In addition, the

total

number of new highs today remained at Wednesday's levels, 345, rather than bullishly

expand as it has been doing since May 4th. Still, "345" is a very bullish

number. It

shows speculative enthusiasm is strong and it shows fears of interest rate rises is

still not a limiting factor. Earnings should keep rising and bonds are not a threat

to

stocks.

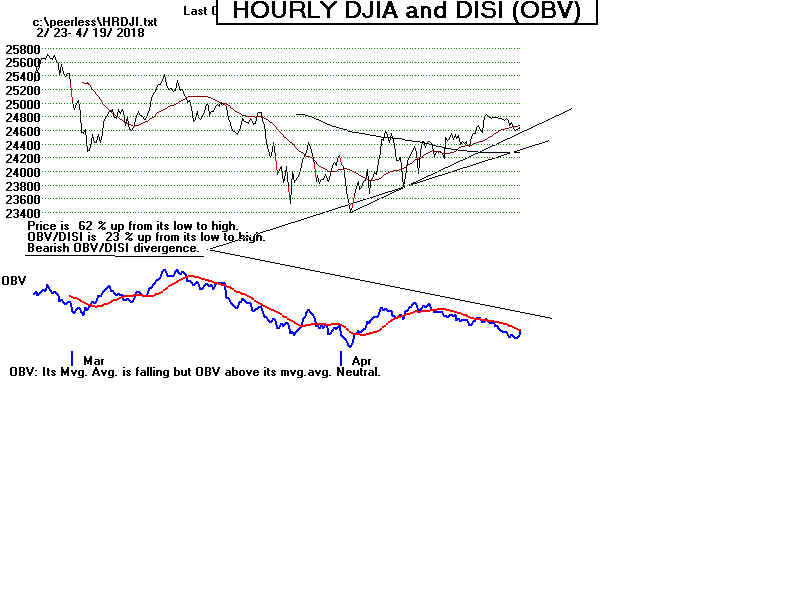

However, when we look at the Hourly DJI, we see that the OBV-DISI Line is

not matching the size of the DJI's advance. So, a brief retreat by the DJI would

be no surprise.

Because IWM's flat top "beckons for a breakout", as I like to say, and

because of the strong NYSE ADL and the operative B9, I think most traders will

want to just continue to hold IWM long in expectation of a bullish breakout run to new

highs. Our Bullish MAXCPs continue to do well. Let me call your attention to

a particularly bullish pattern of Accumulation, strong Closing Power the red

high volume breakout in MIXT, the top ranked Bullish MAXCP stock.

Short-term interest rates did not rise today. That will help the market. Oil

was strong

once again. Bullish performance-minded institutions must put their money into this

sector. So, once again I want to advocate on behalf of low priced oil stocks like

PES (5.0). I also want to point out the bearish potential in airlines' stocks.

In addition, note how the rising prices of Grains and Sugar are also pushing up

commodity prices. This explains the weakness in beverage and beer stocks. Stay

short

a few of these is my suggestion. This is a market tailor made for our Power Ranker

program run against MAXCPs and MINCPs.

If we are about to get a new leg up in more speculative stocks, let me suggest looking

at the NEWHIGHs download and then using the older charting program to inspect

the stocks that are up the biggest percentage and show a high IP21 (above +.35).

Ideally, they will also have an AI/200 above 147 and show a recent B24, B20 or

B12. These may become this year's Explosive Super Stocks.

Commands with TigerSoft

Peercomm

Select Folder

New Highs

Older Charting

Ranking Results

User Set Rankings

"1" + "1"

|

Charts 5/10/2018 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol V-Indicator Hourly DJIA A/D Line for All Stocks NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30 DIA SPY QQQ MDY IWM TNA USO-CrudeOil FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL RSX RETL SDS SLV SOXL TECL TMF TNA UGA (gasoline) XIV YINN Commodities: JJC, NIB, CHOC CORN, CUT (paper) WEAT UUP (Dollar) AAPL ADBE ALXN AMAT AMGN AMD AMZN BA BABA BAC BIDU CAT CVX DE FB GOOG GS HD IBM JPM M (Macy's) MSFT NFLX NVDA QCOM TSLA TXN XOM WMT ANDV (refinery), CMG (Chipotle), LRCX, SWKS, MDGL SPPI WATT SQ TOWN 5/10/2018 (Click on Underlined link.) Bullish MAXCPs - http://tigersoft.com/4XXH/MAXCPS/510/BULLISH.htm Bearish MAXCPs - http://tigersoft.com/4XXH/MINCPS/510/BEARISH.htm |

Table 1 QUICKSILVER on ETFS - 05/10/18 DIA and FAS show weak relative strength.

IWM has an ITRS, 7.2%, showing it is strongest general mkt ETF over last 50 trading days.

SPY now has the highest IP21 among the 6 general market ETFs.

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS

---------------------------------------------------------------------------------------------

---------------------------------------------------------------------------------------------

DIA 247.46 2.06 242.52 172.2% ---- BLUE .103 ----

---------------------------------------------------------------------------------------------

COMPQX 7404.97 65.06 7209.62 219% ---- BLUE .092 .029

---------------------------------------------------------------------------------------------

SPY 272.02 2.52 266.02 176.4% ---- BLUE .124 .012

---------------------------------------------------------------------------------------------

QQQ 169.62 1.74 164.87 236.4% ---- BLUE .102 .025

---------------------------------------------------------------------------------------------

MDY 352.55 2.6 345.19 172.7% Bullish BLUE .029 .05

---------------------------------------------------------------------------------------------

IWM 159.53 .85 155.73 182.6% Bullish BLUE .11 .072

---------------------------------------------------------------------------------------------

FAS 69.51 1.57 63.55 620.8% ---- BLUE .036 .005

---------------------------------------------------------------------------------------------

RETL 34.1 .06 33.66 139.2% ---- BLUE -.079 -.02

---------------------------------------------------------------------------------------------

SOXL 158.79 8.05 137.72 1078.7% ---- BLUE .107 -.049

---------------------------------------------------------------------------------------------

TECL 137.28 5.2 124.27 784.4% Bullish BLUE .178 .058

high

---------------------------------------------------------------------------------------------

IBB 103.73 -.06 102.35 119.4% Bearish RED -.088 -.029

---------------------------------------------------------------------------------------------

GLD 125.18 .85 124.54 36.2% Bullish ---- -.076 .012

---------------------------------------------------------------------------------------------

OIL 7.61 .04 6.89 339.4% Bullish BLUE .263 .072

high

---------------------------------------------------------------------------------------------

OIH 28.17 .04 27.2 237% Bullish ---- .14 .197

---------------------------------------------------------------------------------------------

GASL 23 .12 20.46 831.2% Bullish RED .053 .388

high

---------------------------------------------------------------------------------------------

UGA 34.91 .29 33.7 227.4% Bullish BLUE .431 .141

high

---------------------------------------------------------------------------------------------

UUP 24.36 -.11 24.33 12.3% Bullish ---- .144 .039

---------------------------------------------------------------------------------------------

IEF 101.4 .21 101.64 -11.3% Bearish ---- -.106 .003

---------------------------------------------------------------------------------------------

XLU 50.31 .7 51.51 -95.6% Bearish BLUE -.029 .036

---------------------------------------------------------------------------------------------

WEAT 6.69 -.04 6.88 -256% Bullish ---- .287 .014

high

---------------------------------------------------------------------------------------------

YINN 35.05 1.28 32 500.3% Bullish BLUE .223 .018

---------------------------------------------------------------------------------------------

RSX 21.67 .55 21.14 168.8% Bullish BLUE .175 -.053

---------------------------------------------------------------------------------------------

AAPL 190.04 2.68 183.83 357.6% Bullish BLUE .122 .078

---------------------------------------------------------------------------------------------

GOOG 1097.57 14.81 1048.21 350.8% Bullish BLUE .021 .004

---------------------------------------------------------------------------------------------

MSFT 97.91 .97 95.16 200.8% ---- BLUE .133 .055

---------------------------------------------------------------------------------------------

AMZN 1609.08 1.08 1580.95 116.3% Bearish BLUE .053 .075

---------------------------------------------------------------------------------------------

FB 185.53 2.87 176.61 323.2% ---- BLUE .058 .051

---------------------------------------------------------------------------------------------

NVDA 260.13 4.35 239.06 553% Bullish BLUE .293 .086

---------------------------------------------------------------------------------------------

BA 344.07 -.43 334.43 198.1% ---- BLUE .129 -.039

---------------------------------------------------------------------------------------------

GS 243.44 1.71 234.94 211.7% Bearish BLUE -.249 -.063

---------------------------------------------------------------------------------------------

HD 187.16 .8 185.03 107.5% Bullish BLUE .192 .038

---------------------------------------------------------------------------------------------

CAT 153.97 1.36 146.37 343.1% ---- BLUE -.096 .007

|

Table 2 Count of Stocks in Key Directories

20180510

-------------------------------

NEWHIGHS 345 bullish...unchanged from previous day

NEWLOWS 36

MAXCP 135 Professions are switching sides!

MINCP 81

TTTNH 113 Day Traders are Bullish

TTTNL 98

FASTUP 320 Swing Traders are bullish

FASTDOWN 116

CPCROSSA 51

CPCROSSD 74 Some Pros are not convinced, still

BIGVOLUP 2

BIGVODN 11 Big money is still dumping, not chasing.

|

Table 3

Count of Stocks and NEW HIGHS in Key Tiger Directories

Date = 180510

No. NHs Pct.

===============================================================

MAXCP 135 99 73 %

NIFTY-30 30 9 30 %

HACKERS 24 7 29 %

HOSPITAL 7 2 29 %

SOFTWARE 65 19 29 %

COMPUTER 23 5 22 %

COMODITY 56 12 21 %

REGBANKS 33 7 21 %

NASD-100 89 16 18 %

DOWJONES 30 5 17 %

MILITARY 38 6 16 %

OILGAS 135 21 16 %

TRANSP 20 3 15 %

---------------------------------------------------

GAMING 28 4 14 %

SOLAR 21 3 14 %

FIDSTKS 189 25 13 %

FINANCE 91 10 11 %

ELECTRON 177 17 10 %

RUS-1000 825 80 10 %

SP-100 96 10 10 %

SP500 481 48 10 %

SEMI 129 11 9 %

CHINA 62 5 8 %

DJI-13 13 1 8 %

INDEXES 195 15 8 %

GREEN 30 2 7 %

BIG17 48 3 6 %

CHEM 71 4 6 %

INDMATER 85 5 6 %

INSURANC 32 2 6 %

BEVERAGE 20 1 5 %

BIOTECH 382 18 5 %

GOLD 50 2 4 %

REIT 175 7 4 %

RETAIL 53 2 4 %

AUTO 40 1 3 %

ETFS 61 1 2 %

UTILITY 42 1 2 %

|

Table 4

Count of Stocks and New Lows in Key Tiger Directories

Date = 180510

No. NHs Pct.

--------------------------------------------------

--------------------------------------------------

MINCP 81 15 19 %

CHEM 71 4 6 %

COMODITY 56 3 5 %

AUTO 40 1 3 %

BIOTECH 382 10 3 %

INFRA 35 1 3 %

MILITARY 38 1 3 %

NASD-100 89 3 3 %

FIDSTKS 189 3 2 %

GOLD 50 1 2 %

OILGAS 135 3 2 %

RETAIL 53 1 2 %

SOFTWARE 65 1 2 %

ELECTRON 177 1 1 %

REIT 175 1 1 %

SEMI 129 1 1 %

RUS-1000 825 4 0 %

SP500 481 2 0 %

|

Table 5 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

5/10/18

Bullish = 34

Bearish = 12

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

EDU 1 1 1 1 1 1

SOLAR .904 .714 .571 .571 .476 .476

REIT .868 .828 .8 .862 .8 .731

OILGAS .8 .777 .785 .74 .725 .696

HACKERS .791 .875 .791 .791 .75 .583

COMPUTER .782 .782 .652 .652 .608 .565 NIFTY .766 .666 .6 .6 .6 .5 SOFTWARE .723 .723 .707 .723 .707 .615 BIGBANKS .714 .285 .142 .142 0 0 HOSPITAL .714 .714 .571 .714 .714 .714 GREEN .7 .7 .6 .566 .5 .466 COMODITY .678 .571 .571 .553 .535 .535 FOOD .666 .555 .666 .555 .555 .666 INDEXES .641 .569 .507 .482 .415 .271 GOLD .64 .56 .58 .58 .54 .56 GAMING .607 .571 .571 .571 .535 .357 NASD-100 .606 .528 .46 .471 .483 .382 REGBANKS .606 .606 .606 .575 .575 .393 RUS-1000 .601 .55 .523 .528 .495 .414 INDMATER .6 .576 .517 .494 .458 .411 SP-100 .583 .5 .447 .427 .416 .343 FINANCE .571 .45 .428 .439 .351 .307 INFRA .571 .514 .542 .4 .342 .342 UTILITY .571 .523 .523 .738 .785 .714 DOWJONES .566 .566 .466 .5 .433 .4 SP500 .565 .488 .453 .461 .455 .378 SEMI .558 .511 .434 .403 .395 .333 COAL .555 .555 .555 .555 .555 .333 GUNS .555 .5 .555 .555 .555 .444 CHEM .549 .521 .492 .478 .45 .394 FIDSTKS .544 .481 .417 .46 .439 .375 ELECTRON .542 .508 .423 .395 .389 .322 DJI-13 .538 .538 .384 .461 .384 .384 CHINA .532 .419 .435 .419 .403 .354 N = 34 ============================================================================================ TRANSP .5 .55 .45 .35 .45 .35 ============================================================================================ RETAIL .49 .49 .49 .452 .509 .49 ETFS .475 .393 .377 .36 .36 .344 MILITARY .473 .473 .421 .421 .315 .236 BIOTECH .442 .463 .418 .452 .397 .387 BIG17 .437 .437 .437 .479 .416 .395 PIPELINE .428 .428 .428 .428 .142 .142 HOMEBLDG .352 .352 .529 .588 .529 .588 AUTO .35 .325 .325 .3 .3 .25 BEVERAGE .35 .35 .35 .4 .3 .25 INSURANC .343 .312 .281 .25 .25 .187 BONDFUND .306 .225 .243 .243 .243 .216 JETS .2 .2 .2 .1 .3 .3 N=12 |

==============================================================================

==============================================================================

5/9/2018

Our Peerless Buy B9 tells us that higher prices are coming,

especially

if the DJI and SP-500 can convincingly get up past their rising 65-dma resistance

levels and their downtrends. The A/D Line rose bullishly today and could

make a 12-month high if we get another good day or two. Hold your

long positions. Meanwhile, some of our bearish MINCPs remain very

weak. The rising prices in Commodities and in Oil are bound to create new

big winners and losers. Interest rates are not yet so high as to be a threat.

Today's Producer Prices shows 2.6% inflation. This should be tolerable.

https://outlook.live.com/owa/?path=/mail/inbox/rp

But if our FOMC now acts like most of those in the past, it will pay more

attention to the rise in Crude Oil. So we must watch for signs that the Short

Term Interest Rate trend is accelerating.

The DJI's downtrend-line remains an obstacle. But history shows us examples

of the DJI moving higher after a 3-4 month delay even though there have been

Sell S9s after a very long uptrend. Unfortunately, two of the best examples

are

from 1929 and 1987. But the point here is that the DJI may surprise people and

rise to new highs. In both cases, it was the FED which decided to boost the

market.

Hold IWM. It remains the strongest major market ETF. See Table 1 below.

Hold the oil stocks, especially low priced ones like PTE. And continue to hold

a few bearish MINCPs. Some of these are being hit hard, as their weakness

becomes more and more apparent. The higher Oil prices are going to create

real problems for the airlines industry just as the higher prices for grains are

hurting brewers and higher sugar prices are hurting soft drink stocks. The Bearish

MINCPs and today's new lows reflect these higher commodity price

pressures.

|

Charts 5/9/2018 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol V-Indicator Hourly DJIA A/D Line for All Stocks NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30 DIA SPY QQQ MDY IWM TNA USO-CrudeOil FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL RSX RETL SDS SLV SOXL TECL TMF TNA UGA (gasoline) XIV YINN Commodities: JJC, NIB, CHOC CORN, CUT (paper) WEAT UUP (Dollar) AAPL ADBE ALXN AMAT AMGN AMD AMZN BA BABA BAC BIDU CAT CVX DE FB GOOG GS HD IBM JPM M (Macy's) MSFT NFLX NVDA QCOM TSLA TXN XOM WMT ANDV (refinery), CMG (Chipotle), LRCX, SWKS, MDGL SPPI WATT SQ TOWN 5/9/2018 (Click on Underlined link.) Bullish MAXCPs - http://tigersoft.com/4XXH/MAXCPS/509/BULLISH.htm Bearish MAXCPs - http://tigersoft.com/4XXH/MINCPS/509/BEARISH.htm |

Table 1 QUICKSILVER on ETFS - 05/09/18 DIA and FAS show weak relative strength.

IWM is 7.2% stronger over last 50 trading days. It has the highest IP21 among

the 6 general market ETFs at top in table below.

IWM remains favored.

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS --------------------------------------------------------------------------------------------- --------------------------------------------------------------------------------------------- DIA 245.4 1.98 239.1 130.2% ---- BLUE .053 ------ --------------------------------------------------------------------------------------------- COMPQX 7339.91 73.01 7088.15 166.3% ---- BLUE .061 .035 --------------------------------------------------------------------------------------------- SPY 269.5 2.58 262.62 118.8% ---- BLUE .058 .016 --------------------------------------------------------------------------------------------- QQQ 167.88 1.81 161.8 184.6% ---- BLUE .034 .031 --------------------------------------------------------------------------------------------- MDY 349.95 1.72 340.59 128.8% Bullish BLUE .015 .053 --------------------------------------------------------------------------------------------- IWM 158.68 .85 153.81 129.3% Bullish BLUE .118 .072 --------------------------------------------------------------------------------------------- --------------------------------------------------------------------------------------------- FAS 67.94 2.3 61.48 440.6% ---- BLUE -.027 -.025 --------------------------------------------------------------------------------------------- RETL 34.04 1.04 33.17 -28.4% Bearish BLUE -.129 .01 --------------------------------------------------------------------------------------------- SOXL 150.74 6.24 128.46 905.1% ---- BLUE .069 -.098 --------------------------------------------------------------------------------------------- TECL 132.08 4.7 117.57 630% ---- BLUE .112 .017 --------------------------------------------------------------------------------------------- IBB 103.79 1.38 101.28 54.2% Bearish BLUE -.073 -.024 --------------------------------------------------------------------------------------------- GLD 124.33 -.26 124.28 27.3% Bullish RED -.14 .027 --------------------------------------------------------------------------------------------- OIL 7.61 .04 6.89 339.4% Bullish BLUE .263 .095 --------------------------------------------------------------------------------------------- OIH 28.13 .54 26.87 180% Bullish BLUE .173 .18 --------------------------------------------------------------------------------------------- GASL 22.88 1.02 19.49 445.9% Bullish BLUE .092 .311 --------------------------------------------------------------------------------------------- UGA 34.62 .75 33.37 234% Bullish BLUE .391 .122 --------------------------------------------------------------------------------------------- UUP 24.47 0 24.3 14.4% Bullish ---- .17 .07 --------------------------------------------------------------------------------------------- IEF 101.19 -.23 101.63 -8.9% Bearish ---- -.124 .026 --------------------------------------------------------------------------------------------- XLU 49.61 -.35 51.28 -170.4% Bearish RED -.08 .038 --------------------------------------------------------------------------------------------- WEAT 6.73 -.07 7.04 -131% Bullish ---- .286 .068 --------------------------------------------------------------------------------------------- YINN 33.77 .99 31.81 210.2% Bullish BLUE .204 -.053 --------------------------------------------------------------------------------------------- RSX 21.12 .04 20.96 102.6% ---- ---- .211 -.073 --------------------------------------------------------------------------------------------- AAPL 187.36 1.31 176.89 296.9% Bullish BLUE .085 .084 --------------------------------------------------------------------------------------------- GOOG 1082.76 28.85 1023.72 280.4% Bullish BLUE -.02 .002 --------------------------------------------------------------------------------------------- MSFT 96.94 1.13 94.07 180.6% Bearish BLUE .075 .063 --------------------------------------------------------------------------------------------- AMZN 1608 15.61 1572.07 121% Bearish BLUE .028 .097 --------------------------------------------------------------------------------------------- FB 182.66 3.74 174.02 186.5% ---- BLUE .044 .04 --------------------------------------------------------------------------------------------- NVDA 255.78 5.38 232.99 615.3% Bullish BLUE .213 .073 --------------------------------------------------------------------------------------------- BA 344.5 6.13 330.69 304.4% ---- BLUE .108 -.022 --------------------------------------------------------------------------------------------- GS 241.73 4.73 233.41 163.2% Bearish BLUE -.244 -.064 --------------------------------------------------------------------------------------------- HD 186.36 1.32 183.19 12.2% Bullish BLUE .167 .041 --------------------------------------------------------------------------------------------- CAT 152.61 2.68 143.78 298.1% ---- BLUE -.106 -.02 |

Table 2 Count of Stocks in Key Directories

20180509

-------------------------------

NEWHIGHS 345 Bullish

NEWLOWS 75

MAXCP 138 Mildly Bullish

MINCP 122

TTTNH 112

TTTNL 151

FASTUP 250 Swing Traders are bullish.

FASTDOWN 133

CPCROSSA 90 Not enough improvement

CPCROSSD 83

BIGVOLUP 7 Big Buyers are becoming more aggressive.

BIGVODN 17

|

Table 3

Count of Stocks and NEW HIGHS in Key Tiger Directories

Date = 180509

No. NHs Pct.

===============================================================

MAXCP 138 101 73 %

HACKERS 24 9 38 %

COMPUTER 23 8 35 %

NIFTY 30 9 30 %

HOSPITAL 7 2 29 %

SOFTWARE 65 19 29 %

REGBANKS 33 7 21 %

COMODITY 56 11 20 %

NASD-100 89 16 18 %

DOWJONES 30 5 17 %

OILGAS 136 23 17 %

MILITARY 38 6 16 %

TRANSP 20 3 15 %

------------------------------------------------------

GAMING 28 4 14 %

FIDSTKS 189 24 13 %

FINANCE 91 12 13 %

RUS-1000 825 81 10 %

SP-100 96 9 9 %

SP500 481 45 9 %

BIG17 48 4 8 %

CHINA 62 5 8 %

DJI-13 13 1 8 %

BIOTECH 381 25 7 %

ELECTRON 177 11 6 %

INDEXES 195 12 6 %

INSURANC 32 2 6 %

RETAIL 53 3 6 %

INDMATER 85 4 5 %

SEMI 129 7 5 %

CHEM 62 2 3 %

REIT 175 6 3 %

GOLD 50 1 2 %

UTILITY 42 1 2 %

|

Table 4

Count of Stocks and New Lows in Key Tiger Directories

Date = 180509

No. NHs Pct.

--------------------------------------------------

MINCP 122 35 29 %

BEVERAGE 20 4 20 %

BONDFUND 111 8 7 %

COMODITY 56 3 5 %

BIOTECH 381 14 4 %

FIDSTKS 189 8 4 %

GAMING 28 1 4 %

SP-100 96 4 4 %

AUTO 40 1 3 %

DOWJONES 30 1 3 %

ELECTRON 177 5 3 %

ETFS 61 2 3 %

SEMI 129 4 3 %

CHEM 62 1 2 %

NASD-100 89 2 2 %

OILGAS 136 3 2 %

RETAIL 53 1 2 %

RUS-1000 825 16 2 %

SOFTWARE 65 1 2 %

SP500 481 12 2 %

UTILITY 42 1 2 %

INDMATER 85 1 1 %

INDEXES 195 2 1 %

|

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

5/9/18

Bullish = 28

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

EDU 1 1 1 1 1 1

HACKERS .875 .791 .791 .75 .625 .625

REIT .828 .8 .862 .8 .731 .697

COMPUTER .782 .652 .652 .608 .565 .521

OILGAS .779 .779 .735 .72 .683 .735

SOFTWARE .723 .707 .723 .707 .63 .646 HOSPITAL .714 .571 .714 .714 .714 .714 SOLAR .714 .571 .571 .476 .476 .476 GREEN .7 .6 .566 .5 .466 .4 NIFTY .666 .6 .6 .6 .5 .5 REGBANKS .606 .606 .575 .575 .393 .424 INDMATER .576 .517 .494 .458 .4 .4 COMODITY .571 .571 .553 .535 .535 .535 GAMING .571 .571 .571 .535 .357 .357 INDEXES .569 .507 .482 .415 .266 .312 DOWJONES .566 .466 .5 .433 .4 .433 GOLD .56 .58 .58 .54 .54 .5 COAL .555 .555 .555 .555 .333 .333 FOOD .555 .666 .555 .555 .666 .666 RUS-1000 .55 .523 .528 .495 .41 .426 TRANSP .55 .45 .35 .45 .35 .4 DJI-13 .538 .384 .461 .384 .384 .384 CHEM .532 .516 .483 .451 .37 .403 NASD-100 .528 .46 .471 .483 .393 .404 UTILITY .523 .523 .738 .785 .714 .738 INFRA .514 .542 .4 .342 .342 .314 SEMI .511 .434 .403 .395 .333 .31 ELECTRON .508 .423 .395 .389 .322 .327 N=28 ============================================================================================= GUNS .5 .555 .555 .555 .444 .388 SP-100 .5 .447 .427 .416 .343 .354 ============================================================================================= RETAIL .49 .49 .452 .509 .49 .547 SP500 .488 .453 .461 .455 .374 .39 FIDSTKS .481 .417 .46 .439 .37 .354 MILITARY .473 .421 .421 .315 .236 .21 BIOTECH .464 .419 .454 .398 .383 .422 FINANCE .45 .428 .439 .351 .307 .362 BIG17 .437 .437 .479 .437 .354 .416 PIPELINE .428 .428 .428 .142 .142 .285 CHINA .419 .435 .419 .403 .354 .338 ETFS .393 .377 .36 .36 .344 .295 HOMEBLDG .352 .529 .588 .529 .529 .411 BEVERAGE .35 .35 .4 .3 .25 .25 AUTO .325 .325 .3 .3 .25 .25 INSURANC .312 .281 .25 .25 .187 .218 BIGBANKS .285 .142 .142 0 0 0 BONDFUND .225 .243 .243 .243 .207 .18 JETS .2 .2 .1 .3 .3 .3 N=17 |

.

==============================================================================

5/8/2018

Our Peerless Buy B9 tells us that higher prices are coming,

especially

if the DJI and SP-500 can get up past their rising 65-dma resistance levels.

A good strong opening and close tomorrow may do that. Note also in the

DJI chart below how our IP21 and V-Indicators moved much closer to positive

territory today. If this internal improvement continues, there may well be no

Peerless

Sell signal at the upper 2.4% band. The DJI seems on target

to get back to 25000.

If the internals are good enough, we will not get a Sell signal there. Let's let

Peerless

tell us when to sell.

IWM is, by far the strongest of the major market ETFs.

It seems ready to

challenge its recent highs just above 160. Let's not sell it there yet.

Today's

market refused to sell off despite the sabre-rattling from Washington versus Iran

and despite the jump of short-term interest rates to a new high. Instead, our

examination of new highs tonight shows a number of bullish flat top breakouts

on (red) high volume. This often happens just as the market begins a new

surge.

Stay long IWM, WEAT, some low priced Oil stocks and the most bullish MAXCP

ETFs and stocks. Since many of our bearish MINCPs have remained quite weak,

hold a few of these as long as their Closing Powers stay below their 21-dma

and their IP21s do not turn positive.

|

Charts 5/8/2018 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol V-Indicator Hourly DJIA A/D Line for All Stocks NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30 DIA SPY QQQ MDY IWM TNA USO-CrudeOil FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL RSX RETL SDS SLV SOXL TECL TMF TNA UGA (gasoline) XIV YINN Commodities: JJC, NIB, CHOC CORN, CUT (paper) WEAT UUP (Dollar) AAPL ADBE ALXN AMAT AMGN AMD AMZN BA BABA BAC BIDU CAT CVX DE FB GOOG GS HD IBM JPM M (Macy's) MSFT NFLX NVDA QCOM TSLA TXN XOM WMT ANDV (refinery), CMG (Chipotle), LRCX, SWKS, MDGL SPPI WATT SQ TOWN 5/8/2018 (Click on Underlined link.) Bullish MAXCPs - http://tigersoft.com/4XXH/MAXCPS/508/BULLISH.htm Bearish MAXCPs - http://tigersoft.com/4XXH/MINCPS/508/BEARISH.htm |

Table 1 QUICKSILVER on ETFS - 05/08/18 DIA and FAS show weak relative strength.

IWM is 7.1% stronger over last 50 trading days. It has the highest IP21 among

the 6 general market ETFs at top in table below.

MDY and IWM show rising Closing Powers.

IWM remains favored.

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS --------------------------------------------------------------------------------------------- --------------------------------------------------------------------------------------------- DIA 243.42 0 239.11 55.2% Bearish BLUE .044 ----- --------------------------------------------------------------------------------------------- COMPQX 7266.9 1.69 7100.9 95.1% ---- BLUE .043 .032 --------------------------------------------------------------------------------------------- SPY 266.92 0 263.2 36.6% Bearish BLUE .056 .013 --------------------------------------------------------------------------------------------- QQQ 166.07 -.17 161.82 100.6% ---- BLUE .037 .027 --------------------------------------------------------------------------------------------- MDY 348.23 1.16 341.08 95% Bullish BLUE .019 .052 --------------------------------------------------------------------------------------------- IWM 157.83 .78 154.65 121.2% Bullish BLUE .126 .071 --------------------------------------------------------------------------------------------- --------------------------------------------------------------------------------------------- --------------------------------------------------------------------------------------------- FAS 65.64 .87 62.34 129.7% ---- BLUE -.073 -.066 --------------------------------------------------------------------------------------------- RETL 33 -.21 34.23 -129.4% Bearish ---- -.105 -.06 --------------------------------------------------------------------------------------------- SOXL 144.5 3.01 126.18 625.6% ---- BLUE .057 -.123 --------------------------------------------------------------------------------------------- TECL 127.38 .5 116.64 428.3% ---- BLUE .09 -.026 --------------------------------------------------------------------------------------------- IBB 102.41 -.59 102.68 -79.9% Bearish RED -.057 -.029 --------------------------------------------------------------------------------------------- GLD 124.59 .02 123.65 35.4% Bullish BLUE -.101 .038 --------------------------------------------------------------------------------------------- OIL 7.61 .04 6.89 339.4% Bullish BLUE .263 .114 --------------------------------------------------------------------------------------------- OIH 27.59 .26 27.15 125.5% Bullish BLUE .243 .158 --------------------------------------------------------------------------------------------- GASL 21.86 .98 21.03 140.6% Bullish BLUE .211 .202 --------------------------------------------------------------------------------------------- UGA 33.87 .12 33.05 85.2% Bullish RED .367 .106 --------------------------------------------------------------------------------------------- UUP 24.47 .09 24.4 37% Bullish ---- .144 .095 --------------------------------------------------------------------------------------------- IEF 101.42 -.17 101.37 3.4% Bearish ---- -.103 .044 --------------------------------------------------------------------------------------------- XLU 49.96 -1.28 51.35 -140.2% Bearish RED -.081 .048 --------------------------------------------------------------------------------------------- WEAT 6.8 .07 6.91 -101.4% Bullish BLUE .304 .104 --------------------------------------------------------------------------------------------- YINN 32.78 1.25 32.42 9.3% Bullish RED .199 -.169 --------------------------------------------------------------------------------------------- RSX 21.08 .2 20.69 47.8% ---- BLUE .281 -.08 --------------------------------------------------------------------------------------------- AAPL 186.05 .89 176.57 475.3% Bullish BLUE .069 .092 --------------------------------------------------------------------------------------------- GOOG 1053.91 -.88 1024.38 80% Bullish RED -.031 -.026 --------------------------------------------------------------------------------------------- MSFT 95.81 -.41 93.51 42.7% Bearish RED .054 .057 --------------------------------------------------------------------------------------------- AMZN 1592.39 -7.75 1569.68 32% Bearish RED .026 .099 --------------------------------------------------------------------------------------------- FB 178.92 .95 176.07 144% ---- BLUE .083 .02 --------------------------------------------------------------------------------------------- NVDA 250.4 1.72 226.31 495.2% Bullish BLUE .203 .068 --------------------------------------------------------------------------------------------- BA 338.37 -2.06 324.19 133% Bearish RED .116 -.017 --------------------------------------------------------------------------------------------- GS 237 -.2 234.05 7% Bearish RED -.297 -.074 --------------------------------------------------------------------------------------------- HD 185.04 1.48 185.91 11.1% Bullish BLUE .146 .034 --------------------------------------------------------------------------------------------- CAT 149.93 .11 143.86 189.2% Bearish RED -.11 -.032 |

Table 2 Count of Stocks in Key Directories

20180508

-------------------------------

NEWHIGHS 251 Bullish

NEWLOWS 95

MAXCP 105

MINCP 141 Professionals are still net bearish.

TTTNH 104

TTTNL 160 Day Traders are still net bearish

FASTUP 225 Swing-traders are bullish.

FASTDOWN 133

CPCROSSA 112 Professionals are shifting positively

CPCROSSD 106

BIGVOLUP 3

BIGVODN 22 Big Money is still dumping numerous stocks.

|

Table 3

Count of Stocks and NEW HIGHS in Key Tiger Directories

Date = 180508

No. NHs Pct.

===============================================================

MAXCP 105 64 61 %

COMPUTER 23 7 30 %

HACKERS 24 6 25 %

REGBANKS 33 7 21 %

SOFTWARE 65 13 20 %

NIFTY-30 29 5 17 %

MILITARY 38 6 16 % HOSPITAL 7 1 14 % FINANCE 91 10 11 % DOWJONES 30 3 10 % NASD-100 89 9 10 % OILGAS 135 14 10 % FIDSTKS 189 17 9 % DJI-13 13 1 8 % COMODITY 56 4 7 % BIG17 48 3 6 % RUS-1000 825 46 6 % SP-100 96 6 6 % BEVERAGE 20 1 5 % BIOTECH 382 20 5 % ELECTRON 177 9 5 % SP500 481 23 5 % TRANSP 20 1 5 % UTILITY 42 2 5 % GAMING 28 1 4 % SEMI 129 5 4 % CHEM 62 2 3 % INDEXES 195 6 3 % INSURANC 32 1 3 % REIT 175 5 3 % CHINA 62 1 2 % GOLD 50 1 2 % INDMATER 85 2 2 % |

Table 4

Count of Stocks and New Lows in Key Tiger Directories

Date = 180508

No. NHs Pct.

--------------------------------------------------

MINCP 141 53 38 %

BEVERAGE 20 3 15 %

PIPELINE 7 1 14 %

CHEM 62 5 8 %

DJI-13 13 1 8 %

DOWJONES 30 2 7 %

ETFS 61 4 7 %

SP-100 96 7 7 %

FIDSTKS 189 12 6 %

AUTO 40 2 5 %

BIOTECH 382 18 5 %

BONDFUND 111 4 4 %

GAMING 28 1 4 %

INDMATER 85 3 4 %

SP500 481 20 4 %

GREEN 30 1 3 %

INFRA 35 1 3 %

MILITARY 38 1 3 %

NASD-100 89 3 3 %

RUS-1000 825 28 3 %

ELECTRON 177 3 2 %

FINANCE 91 2 2 %

GOLD 50 1 2 %

RETAIL 53 1 2 %

INDEXES 195 2 1 %

OILGAS 135 2 1 %

SEMI 129 1 1 %

|

Table 5 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

5/8/18

Bullish = 24

Bearish = 23

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

EDU 1 1 1 1 1 .857

REIT .8 .862 .8 .731 .691 .714

HACKERS .791 .791 .75 .625 .625 .666

OILGAS .785 .74 .725 .688 .74 .733

SOFTWARE .707 .723 .707 .63 .646 .661

FOOD .666 .555 .555 .666 .666 .666 COMPUTER .652 .652 .608 .565 .521 .434 REGBANKS .606 .575 .575 .393 .424 .515 GREEN .6 .566 .5 .466 .366 .4 NIFTY .586 .586 .586 .482 .482 .517 GOLD .58 .58 .54 .54 .5 .44 COMODITY .571 .553 .535 .535 .535 .517 GAMING .571 .571 .535 .357 .357 .321 HOSPITAL .571 .714 .714 .714 .714 .428 SOLAR .571 .571 .476 .476 .476 .476 COAL .555 .555 .555 .333 .333 .222 GUNS .555 .555 .555 .444 .388 .388 INFRA .542 .4 .342 .342 .314 .285 HOMEBLDG .529 .588 .529 .529 .411 .411 RUS-1000 .523 .528 .495 .41 .421 .466 UTILITY .523 .738 .785 .714 .738 .761 INDMATER .517 .494 .458 .4 .388 .388 CHEM .516 .483 .451 .37 .387 .403 INDEXES .507 .482 .415 .266 .307 .317 N=24 =========================================================================================== RETAIL .49 .452 .509 .49 .528 .584 DOWJONES .466 .5 .433 .4 .4 .4 NASD-100 .46 .471 .483 .393 .404 .438 SP500 .453 .461 .455 .374 .386 .451 TRANSP .45 .35 .45 .35 .4 .5 SP-100 .447 .427 .416 .343 .343 .395 BIG17 .437 .479 .437 .375 .395 .354 CHINA .435 .419 .403 .354 .338 .338 SEMI .434 .403 .395 .333 .31 .255 FINANCE .428 .439 .351 .307 .362 .34 PIPELINE .428 .428 .142 .142 .285 .285 ELECTRON .423 .395 .389 .322 .322 .271 MILITARY .421 .421 .315 .236 .236 .263 BIOTECH .418 .452 .397 .382 .421 .4 FIDSTKS .417 .46 .439 .37 .349 .417 DJI-13 .384 .461 .384 .384 .384 .307 ETFS .377 .36 .36 .344 .278 .278 BEVERAGE .35 .4 .3 .25 .25 .4 AUTO .325 .3 .3 .25 .25 .225 INSURANC .281 .25 .25 .187 .218 .343 BONDFUND .243 .243 .243 .207 .18 .18 JETS .2 .1 .3 .3 .3 .5 BIGBANKS .142 .142 0 0 0 .142 N=23 |

---------------------------------------------------------------------------------------------------------------------

5/7/2018

Our Peerless Buy B9 did bring a broad rally today. But as

was feared might

happen, the DJI and SP-500 seem to have hit a barrier at their falling 65-dma.

Now we must wait and see if they can regroup for another try to the upside.

That rally may well fail at the upper 2.4% band since the IP21 and V-I Indicators

may still be negative when the DJI gets there.

Fortunately, the Russell-2000's ETF, IWM, was our choice for playing the Buy

B9 as it was already above its own 65-dma and also showed better internals. Over

the last 50-days, IWM has out-performed the DJI by +5.7% and it is the only major

market ETF to show a positive IP21 (current Accummulation). IWM,

I suspect,

is more likely to rally now until it reaches its own resistance, which is based on

its recent highs.

Let's Plan to sell IWM at 159.5

Hang onto your longs. The average DJI gain after a Peerless Buy

signal is more

than 10%. A little sidewise digestion of the recent gains would be contructive.

Watch the number of the NYSE Advances and Declines. That is important now.

Today there were 784 more up than down. This reflects both good economic

growth and a view that much higher interest rates do not lie immediately ahead.

If rates stay low, that will help smaller companies and if inflation does heat up,

traders will need to play smaller growth stocks and bullish special situations,

like the oil stocks I have mentioned. 74% of the 135 Oil/Gas stocks we have

in that select directory are now above their 65-dma and the group is

out-performing the DJI by 7.4% over the last 50 trading days. In the past,

a good way to play the advance here is to watch Crude Oil. So long as

its IP21 is positive and it says above its 65-dma, look for higher prices.

|

Charts 5/7/2018 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol V-Indicator Hourly DJIA A/D Line for All Stocks NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30 DIA SPY QQQ MDY IWM TNA USO-CrudeOil FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL RSX RETL SDS SLV SOXL TECL TMF TNA UGA (gasoline) XIV YINN Commodities: JJC, NIB, CHOC CORN, CUT (paper) WEAT UUP (Dollar) AAPL ADBE ALXN AMAT AMGN AMD AMZN BA BABA BAC BIDU CAT CVX DE FB GOOG GS HD IBM JPM M (Macy's) MSFT NFLX NVDA QCOM TSLA TXN XOM WMT ANDV (refinery), CMG (Chipotle), LRCX, SWKS, MDGL SPPI WATT SQ TOWN 5/7/2018 (Click on Underlined link.) Bullish MAXCPs - http://tigersoft.com/4XXH/MAXCPS/507/BULLISH.htm Bearish MAXCPs - http://tigersoft.com/4XXH/MINCPS/507/BEARISH.htm |

A Wild Advance in Select Lower Priced Stocks May Be

Coming.

It has been a long time since low-priced stocks have caught the fancy of traders.

That occasionally happens at the end of a long bull markets (notably 1968 - electronics

stocks, 1976-1977 - oil stocks, 1999 - biotech and internet stocks and 2008 - oil stocks)

when the Public finally is invited to the party and gets excited about by the hype in

a particular industry. My guess now is that low-priced oil stocks are the most

likely

to play this role again.

A May 2008 TigerSoft Hotline shows the way Oil Stocks surged wildly

just as the

overall market was topping out.

http://www.tigersoftware.com/00XXX2008hlmarch/index.html

In the next chart, we see how easy it was to sell when to sell Crude Oil at or very

near the top in 2008. USO is still in the run-up stage now.

Low Priced stocks are still weak.

Our index of 225 Low Priced stocks still looks very

weak. Its own A/D Line

is falling and its IP21 (not shown here) has been negative for months. So, we are

not yet at a point we the Public is interested in speculating. Perhaps, they just

are too much in debt or lack the funds. This suggests to me that we should

simply be selling IWM on its rally up to its recent highs. (I do not have

a Tiger Index of the 2000 stocks that make up the Russell-2000.)

My Russell-1000 (actually only 800) Index chart also shows prices caught in a

trading range with very negative Accumulation).

Table 1 QUICKSILVER on ETFS - 05/07/18 Closing Powers are still apt to falter when they meet their

falling 21-dma.

DIA and FAS show weak relative strength.

IWM is 5.7% stronger over last 50 trading days. Only it has positive IP21

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS --------------------------------------------------------------------------------------------- --------------------------------------------------------------------------------------------- DIA 243.42 .9 240.76 39.1% Bearish RED -.021 ==== --------------------------------------------------------------------------------------------- COMPQX 7265.21 55.59 7130.7 139.7% Bearish BLUE -.03 .028 --------------------------------------------------------------------------------------------- SPY 266.92 .9 264.98 45.6% Bearish ---- -.003 .009 --------------------------------------------------------------------------------------------- QQQ 166.24 1.37 162.78 163.1% ---- BLUE -.019 .026 --------------------------------------------------------------------------------------------- MDY 347.07 1.88 341.71 96% Bullish BLUE -.054 .039 --------------------------------------------------------------------------------------------- IWM 157.05 1.32 154.07 120.9% Bullish BLUE .038 .057 --------------------------------------------------------------------------------------------- FAS 64.77 1.22 64 104% Bearish BLUE -.123 -.063 --------------------------------------------------------------------------------------------- RETL 33.21 -.45 33.87 -141.9% Bearish RED -.134 -.058 --------------------------------------------------------------------------------------------- SOXL 141.49 3.77 127.94 762.2% Bearish BLUE -.023 -.104 --------------------------------------------------------------------------------------------- TECL 126.88 2.61 117.06 600% ---- BLUE .023 -.001 --------------------------------------------------------------------------------------------- IBB 103 .65 104.05 -31.6% Bearish BLUE -.077 -.032 --------------------------------------------------------------------------------------------- GLD 124.57 .03 123.71 -.8% Bullish BLUE -.091 .025 --------------------------------------------------------------------------------------------- OIL 7.61 .04 6.89 339.4% Bullish BLUE .263 .099 --------------------------------------------------------------------------------------------- OIH 27.33 .13 26.91 35.1% Bullish RED .171 .134 --------------------------------------------------------------------------------------------- GASL 20.88 .42 21.28 -118.2% Bullish RED .062 .16 --------------------------------------------------------------------------------------------- UGA 33.75 .05 33.3 -22.4% Bullish RED .372 .095 --------------------------------------------------------------------------------------------- UUP 24.38 .05 24.29 51.5% Bullish ---- .172 .075 --------------------------------------------------------------------------------------------- IEF 101.59 -.05 101.35 -5.4% Bearish ---- -.066 .032 --------------------------------------------------------------------------------------------- XLU 51.24 -.27 51.4 -31.1% Bullish RED -.021 .055 --------------------------------------------------------------------------------------------- WEAT 6.73 -.15 6.94 7.2% Bullish RED .327 .101 --------------------------------------------------------------------------------------------- YINN 31.53 -.47 32.72 -199.4% Bullish BLUE .145 -.186 --------------------------------------------------------------------------------------------- RSX 20.88 -.26 20.88 -33.4% ---- RED .087 -.084 --------------------------------------------------------------------------------------------- AAPL 185.16 1.33 169.1 570.8% Bullish ---- .003 .093 --------------------------------------------------------------------------------------------- GOOG 1054.79 6.58 1037.31 181.8% Bullish BLUE -.07 -.026 --------------------------------------------------------------------------------------------- MSFT 96.22 1.06 95 143.2% Bearish BLUE -.006 .06 --------------------------------------------------------------------------------------------- AMZN 1600.14 19.19 1582.26 108% Bearish BLUE -.016 .104 --------------------------------------------------------------------------------------------- FB 177.97 1.36 173.86 171% ---- BLUE .052 .008 --------------------------------------------------------------------------------------------- NVDA 248.68 9.62 227.14 516.8% Bullish BLUE .111 .049 --------------------------------------------------------------------------------------------- BA 340.43 6 329.54 103.9% Bearish BLUE .081 -.008 --------------------------------------------------------------------------------------------- GS 237.2 2.26 236.67 -24% Bearish BLUE -.285 -.073 --------------------------------------------------------------------------------------------- HD 183.56 -1.47 184.63 -33.6% Bullish RED .059 .012 --------------------------------------------------------------------------------------------- CAT 149.82 3.45 144.42 188.9% Bearish BLUE -.142 -.04 |

Count of Stocks in Key Directories

20180507

---------------------- --------

NEWHIGHS 225 Bullish

NEWLOWS 63

MAXCP 79

MINCP 99 Professionals are still more bearish.

TTTNH 108

TTTNL 97

FASTUP 241 Swing traders are still bullish.

FASTDOWN 108

CPCROSSA 65

CPCROSSD 63

BIGVOLUP 0 There were none Monday.

BIGVODN 10

ACCUMVER 10

HIGHIP21 56

HIUPPCT 146

VHIP21 28

LOWACCUM 405

REDSELL 203

AUGSELS7 38

TRAPDOOR 34

|

Table 3

Count of Stocks and NEW HIGHS in Key Tiger Directories

Date = 180507

No. NHs Pct.

===============================================================-

MAXCP 79 54 68 %

COMPUTER 23 5 22 %

HACKERS 24 5 21 %

COMODITY 56 9 16 %

SOFTWARE 65 10 15 %

HOSPITAL 7 1 14 %

NIFTY 30 4 13 %

DOWJONES 30 3 10 %

NASD-100 89 8 9 %

REGBANKS 33 3 9 %

DJI-13 13 1 8 %

BIG17 46 3 7 %

FIDSTKS 189 13 7 %

OILGAS 135 10 7 %

INSURANC 32 2 6 %

BIOTECH 382 21 5 %

CHINA 62 3 5 %

FINANCE 91 5 5 %

MILITARY 38 2 5 %

REIT 176 9 5 %

RUS-1000 825 39 5 %

SP-100 96 5 5 %

UTILITY 42 2 5 %

GAMING 28 1 4 %

GOLD 50 2 4 %

SP500 481 20 4 %

CHEM 62 2 3 %

INDEXES 195 6 3 %

ELECTRON 177 4 2 %

INDMATER 85 2 2 %

RETAIL 53 1 2 %

SEMI 128 2 2 %

|

Table 4

Count of Stocks and New Lows in Key Tiger Directories

Date = 180507

No. NHs Pct.

--------------------------------------------------

PIPELINE 7 2 29 %

MINCP 99 29 29 %

ETFS 61 5 8 %

BEVERAGE 20 1 5 %

BONDFUND 111 5 5 %

COMODITY 56 3 5 %

INDMATER 85 4 5 %

GOLD 50 2 4 %

ELECTRON 177 5 3 %

INFRA 35 1 3 %

INSURANC 32 1 3 %

MILITARY 38 1 3 %

BIOTECH 382 9 2 %

CHEM 62 1 2 %

FIDSTKS 189 4 2 %

NASD-100 89 2 2 %

OILGAS 135 3 2 %

SEMI 128 3 2 %

SP500 481 9 2 %

FINANCE 91 1 1 %

INDEXES 195 1 1 %

RUS-1000 825 11 1 %

SP-100 96 1 1 %

|

Table 4

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

5/7/18

Bearish = 26 - This is still a problem.

Bullish = 20

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

EDU 1 1 1 1 .857 .857

REIT .863 .801 .732 .693 .71 .67

HACKERS .791 .75 .625 .625 .625 .708

OILGAS .74 .725 .688 .74 .725 .733

UTILITY .738 .785 .714 .738 .761 .738

SOFTWARE .723 .707 .63 .646 .661 .646 HOSPITAL .714 .714 .714 .714 .428 .428 COMPUTER .652 .608 .565 .521 .478 .391 NIFTY .6 .6 .5 .5 .533 .466 HOMEBLDG .588 .529 .529 .411 .411 .411 GOLD .58 .54 .54 .5 .4 .42 REGBANKS .575 .575 .393 .424 .484 .484 GAMING .571 .535 .357 .357 .321 .321 SOLAR .571 .476 .476 .476 .476 .523 GREEN .566 .5 .466 .366 .4 .433 COAL .555 .555 .333 .333 .222 .333 FOOD .555 .555 .666 .666 .666 .777 GUNS .555 .555 .444 .388 .388 .277 COMODITY .553 .535 .535 .535 .517 .517 RUS-1000 .528 .495 .41 .421 .463 .449 N=20 =============================================================================================== DOWJONES .5 .433 .4 .4 .366 .466 =============================================================================================== INDMATER .494 .458 .4 .388 .376 .388 CHEM .483 .451 .37 .387 .403 .338 INDEXES .482 .415 .266 .307 .312 .297 NASD-100 .471 .483 .393 .404 .438 .426 DJI-13 .461 .384 .384 .384 .307 .307 SP500 .461 .455 .374 .386 .446 .449 FIDSTKS .46 .439 .37 .349 .412 .407 BIG17 .456 .413 .347 .391 .326 .304 BIOTECH .452 .397 .382 .421 .392 .374 RETAIL .452 .509 .49 .528 .584 .622 FINANCE .439 .351 .307 .362 .34 .34 PIPELINE .428 .142 .142 .285 .285 .428 SP-100 .427 .416 .343 .343 .385 .437 MILITARY .421 .315 .236 .236 .263 .263 CHINA .419 .403 .354 .338 .338 .354 SEMI .406 .398 .335 .312 .25 .187 BEVERAGE .4 .3 .25 .25 .4 .4 INFRA .4 .342 .342 .314 .257 .314 ELECTRON .395 .389 .322 .322 .265 .203 ETFS .36 .36 .344 .278 .278 .327 TRANSP .35 .45 .35 .4 .5 .5 AUTO .282 .282 .23 .23 .205 .153 INSURANC .25 .25 .187 .218 .343 .343 BONDFUND .243 .243 .207 .18 .162 .126 BIGBANKS .142 0 0 0 .142 .142 JETS .1 .3 .3 .3 .5 .4 N=26 |

==============================================================================

5/4/2018 Our Peerless Buy B9 got a real nice boost Friday from the Jobs Report number,

+164,000, for April. The figure was not so high as to give the FED reason to rush to

raise rates or so low as to suggest the economy is slowing down dangerously.

Bullishly, the March jobs' estimate was revised up +32,000. The Public saw the

new 3.9% unemployment level and quickly concluded that this is bullish for the

market. For now they are right. But if the DJI closes 2.4% over the 21-day ma,

about 25,000, we will likely see a new S12 and an S9-V.

As I've been saying, there is considerably more upside potential elsewhere,

notably in IWM, in Oils and even the NASDAQ now.

Buy More IWM and Oil Stocks

Because of the B9, I recommended buying IWM on Wednesday. If

you bought it at the

opening the next day, you paid no more than 154.11. And I also suggested buying

more USO. It opened the next day at 13.63. On Friday, IWM moved back above

its 65-dma and USO made a bullish flat-top breakout. Both are looking good for

new week. The best stock recommendation here was in PES. This is a very, very

volatile oil stock. With Crude on the rise, its leverage should bring another move

back up

to resistance at $6.50. Of course, if oil can rise a little more and stay up there,

it will

go much higher. GTE is another small oil stock that typically rises and falls a lot

with oil prices. In 2008, with the DJI having topped out, oil stocks and Crude Oil

got a

very big run, as the "last game in town" for big institutions. I expect a

re-run of this.

PES was above $20 and GTE almost reached $9.00 back then.

DJI's Target Now Is 25,000

Although, a Buy B9 brings an average DJI gain of more than

10%, we still have

to be concerned that DIA and SPY are below the resistance of their 65-dma. Profit-

taking there is certainly a possibility. But, for now, we have to be encouraged by

the fact

that the steep Closing Power downtrends for DIA and SPY have been broken.

As for what is bringing about the rally, let us hope that the market is correctly

anticipating peaceful changes on the Korean Penninsula. I'm also thinking that

Trumps recent appointments to the FOMC clearly understand the importance to

Trump and the Republican Party that the economy not be allowed to falter now

because of a market decline of more than 10% from its highs.

Whatever, the thinking behind the rally, most chartists have spotted the just completed

fifth

successful test of 23400-23500. There is no point in being short the general market.

We will cover most of our shorts on the Tiger Stocks' Hotline. Technically,

the market

must now rally to determine where the overhead resistance is.

Watch AAPL. This

stock played a big role in last week's turnaround. The news

there is that both Warren Buffett and AAPL itself are big buyers. It is reported

that the company has using its repartiated billions of dollars in overseas profits

to purchasing massive amounts of its own shares, more shares in the last three

months

than ever before. AAPL, of course, plays a big role in the QQQ and the NASDAQ,

both of which are bullishly back above their 65-dma and also in the DJIA. AAPL

made a new high on Friday but still shows a negative IP21. That makes it risky to

chase in here.

|

Charts 5/4/2018 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol V-Indicator Hourly DJIA A/D Line for All Stocks NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30 DIA SPY QQQ MDY IWM TNA USO-CrudeOil FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL RSX RETL SDS SLV SOXL TECL TMF TNA UGA (gasoline) XIV YINN Commodities: JJC, NIB, CHOC CORN, CUT (paper) WEAT UUP (Dollar) AAPL ADBE ALXN AMAT AMGN AMD AMZN BA BABA BAC BIDU CAT CVX DE FB GOOG GS HD IBM JPM M (Macy's) MSFT NFLX NVDA QCOM TSLA TXN XOM WMT ANDV (refinery), CMG (Chipotle), LRCX, SWKS, MDGL SPPI WATT SQ TOWN 5/4/2018 (Click on Underlined link.) Bullish MAXCPs - http://tigersoft.com/4XXH/MAXCPS/504/BULLISH.htm Bearish MAXCPs - http://tigersoft.com/4XXH/MINCPS/504/BEARISH.htm |

Table 1 QUICKSILVER on ETFS - 05/04/18 Closing Powers are still apt to falter when they meet their

falling 21-dma.

DIA and FAS show weak relative strength.

IWM is 5.2% stronger over last 50 trading days. Only it has positive IP21

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS --------------------------------------------------------------------------------------------- --------------------------------------------------------------------------------------------- DIA 242.52 3.42 241.54 -8.9% Bearish BLUE -.05 ------ --------------------------------------------------------------------------------------------- COMPQX 7209.62 121.47 7066.27 63.2% Bearish BLUE -.066 .028 --------------------------------------------------------------------------------------------- SPY 266.02 3.4 264.51 -10.2% Bearish BLUE -.05 .012 --------------------------------------------------------------------------------------------- QQQ 164.87 3.07 160.94 85.9% Bearish BLUE -.069 .028 --------------------------------------------------------------------------------------------- MDY 345.19 4.6 340.51 16% ---- BLUE -.077 .037 --------------------------------------------------- ------------------------------------------ IWM 155.73 1.92 153.32 33.7% ---- BLUE .006 .052 --------------------------------------------------------------------------------------------- FAS 63.55 2.07 63.46 -80.7% Bearish BLUE -.162 -.049 --------------------------------------------------------------------------------------------- RETL 33.66 .49 34.17 -251.7% Bearish BLUE -.149 -.014 --------------------------------------------------------------------------------------------- SOXL 137.72 9.26 121.91 461.1% Bearish BLUE -.057 -.082 --------------------------------------------------------------------------------------------- TECL 124.27 6.7 112.76 398.9% Bearish BLUE -.015 .027 --------------------------------------------------------------------------------------------- IBB 102.35 1.07 103.65 -157.6% Bearish BLUE -.119 -.028 --------------------------------------------------------------------------------------------- GLD 124.54 .26 124.59 -38.6% ---- BLUE -.093 .014 --------------------------------------------------------------------------------------------- OIL 7.61 .04 6.89 339.4% Bullish BLUE .263 .089 --------------------------------------------------------------------------------------------- OIH 27.2 .33 27.14 -3.7% Bullish BLUE .217 .146 --------------------------------------------------------------------------------------------- GASL 20.46 .97 21.37 -132% Bullish BLUE .074 .22 --------------------------------------------------------------------------------------------- UGA 33.7 .33 33.9 -17.9% Bullish BLUE .431 .1 --------------------------------------------------------------------------------------------- UUP 24.33 .03 24.13 61.9% Bullish RED .162 .065 --------------------------------------------------------------------------------------------- IEF 101.64 .01 101.7 2.5% Bearish RED -.026 .027 --------------------------------------------------------------------------------------------- XLU 51.51 .23 51.56 -19.4% Bullish BLUE -.035 .078 --------------------------------------------------------------------------------------------- WEAT 6.88 -.16 6.72 219.4% Bullish RED .43 .113 --------------------------------------------------------------------------------------------- YINN 32 .19 32.82 -104.6% Bullish BLUE .132 -.142 --------------------------------------------------------------------------------------------- RSX 21.14 .18 21.02 -35.8% ---- BLUE .075 -.082 --------------------------------------------------------------------------------------------- AAPL 183.83 6.94 165.26 632.5% Bullish BLUE .001 .094 --------------------------------------------------------------------------------------------- GOOG 1048.21 24.49 1017.33 88.5% ---- BLUE -.104 -.025 --------------------------------------------------------------------------------------------- MSFT 95.16 1.09 93.52 -35% Bearish BLUE -.05 .065 --------------------------------------------------------------------------------------------- AMZN 1580.95 8.88 1566.13 26.5% Bearish BLUE -.068 .092 --------------------------------------------------------------------------------------------- FB 176.61 2.59 172 86.8% ---- BLUE .007 .015 --------------------------------------------------------------------------------------------- NVDA 239.06 6.07 224.9 279.7% ---- BLUE .029 .015 --------------------------------------------------------------------------------------------- BA 334.43 3.74 333.56 -97.2% Bearish BLUE .043 -.032 --------------------------------------------------------------------------------------------- GS 234.94 1.53 238.33 -102.8% Bearish BLUE -.298 -.073 --------------------------------------------------------------------------------------------- HD 185.03 1.84 184.8 -38.6% Bullish BLUE .041 .026 --------------------------------------------------------------------------------------------- CAT 146.37 2.59 144.36 57.2% Bearish BLUE -.161 -.051 |

Table 2 Count of Stocks in Key Directories

20180504

-------------------------------

NEWHIGHS 190 OK

NEWLOWS 45

MAXCP 99 OK

MINCP 56

TTTNH 104 OK

TTTNL 84

FASTUP 159 positive

FASTDOWN 140

CPCROSSA 151 Bullish

CPCROSSD 27

BIGVOLUP 4

BIGVODN 10

|

Table 3

Count of Stocks and NEW HIGHS in Key Tiger Directories

Date = 180504

No. NHs Pct.

===============================================================

MAXCP 99 67 68 %

COMODITY 56 11 20 %

HACKERS 24 4 17 %

COMPUTER 23 3 13 %

SOFTWARE 65 8 12 %

OILGAS 136 12 9 %

DJI-13 13 1 8 %

DOWJONES 30 2 7 %

NIFTY 29 2 7 %

UTILITY 42 3 7 %

GOLD 50 3 6 %

INSURANC 32 2 6 %

NASD-100 89 5 6 %

BIOTECH 383 18 5 %

FIDSTKS 189 9 5 %

RUS-1000 825 41 5 %

TRANSP 20 1 5 %

FINANCE 91 4 4 %

GAMING 28 1 4 %

SP-100 96 4 4 %

SP500 481 21 4 %

CHEM 62 2 3 %

MILITARY 38 1 3 %

REGBANKS 33 1 3 %

REIT 176 6 3 %

CHINA 62 1 2 %

ELECTRON 177 4 2 %

RETAIL 53 1 2 %

SEMI 128 3 2 %

INDMATER 85 1 1 %

INDEXES 195 2 1 %

|

Table 4

Count of Stocks and New Lows in Key Tiger Directories

Date = 180504

No. NHs Pct.

--------------------------------------------------

MINCP 56 14 25 %

PIPELINE 7 1 14 %

BEVERAGE 20 1 5 %

COMODITY 56 3 5 %

MILITARY 38 2 5 %

SOFTWARE 65 3 5 %

ETFS 61 2 3 %

INFRA 35 1 3 %

INSURANC 32 1 3 %

BONDFUND 111 2 2 %

GOLD 50 1 2 %

INDMATER 85 2 2 %

RETAIL 53 1 2 %

SEMI 128 2 2 %

BIOTECH 383 5 1 %

ELECTRON 177 1 1 %

FIDSTKS 189 2 1 %

FINANCE 91 1 1 %

INDEXES 195 1 1 %

OILGAS 136 2 1 %

RUS-1000 825 10 1 %

SP500 481 4 1 %

|

TABLE 5

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

5/4/18

BEARISH = 28 BULLISH = 18 --------------------------------------------------------------------------------------- Directory Current day-1 day-2 day-3 day-4 day-5 ---------------------------------------------------------------------------------------- EDU 1 1 1 .857 .857 1 REIT .801 .732 .693 .71 .659 .715 UTILITY .785 .714 .738 .761 .738 .738 HACKERS .75 .625 .625 .625 .708 .708 OILGAS .72 .683 .735 .72 .727 .705 HOSPITAL .714 .714 .714 .428 .428 .571 SOFTWARE .707 .63 .646 .661 .646 .661 COMPUTER .608 .565 .521 .478 .391 .478 NIFTY .586 .482 .482 .517 .448 .551 REGBANKS .575 .393 .424 .484 .484 .545 COAL .555 .333 .333 .222 .333 .222 FOOD .555 .666 .666 .666 .777 .888 GUNS .555 .444 .388 .388 .277 .277 GOLD .54 .54 .5 .4 .42 .58 COMODITY .535 .535 .535 .517 .517 .571 GAMING .535 .357 .357 .321 .321 .285 HOMEBLDG .529 .529 .411 .411 .411 .647 RETAIL .509 .49 .528 .584 .622 .698 N=18 ============================================================================================ GREEN .5 .466 .366 .4 .433 .5 ============================================================================================ RUS-1000 .495 .41 .421 .463 .447 .496 NASD-100 .483 .393 .404 .438 .426 .46 SOLAR .476 .476 .476 .476 .523 .571 INDMATER .458 .4 .388 .376 .376 .423 SP500 .455 .374 .386 .446 .446 .48 CHEM .451 .37 .387 .403 .338 .451 TRANSP .45 .35 .4 .5 .5 .6 FIDSTKS .439 .37 .349 .412 .407 .423 DOWJONES .433 .4 .4 .366 .466 .5 SP-100 .416 .343 .343 .385 .427 .468 INDEXES .415 .266 .307 .312 .292 .348 BIG17 .413 .347 .391 .326 .304 .304 CHINA .403 .354 .338 .338 .338 .338 SEMI .398 .335 .312 .25 .171 .203 BIOTECH .396 .381 .422 .394 .37 .42 ELECTRON .389 .322 .322 .265 .192 .242 DJI-13 .384 .384 .384 .307 .307 .307 ETFS .36 .344 .278 .278 .311 .36 FINANCE .351 .307 .362 .34 .329 .439 INFRA .342 .342 .314 .257 .314 .314 MILITARY .315 .236 .236 .263 .263 .394 AUTO .3 .25 .25 .225 .175 .225 BEVERAGE .3 .25 .25 .4 .4 .4 JETS .3 .3 .3 .5 .4 .4 INSURANC .25 .187 .218 .343 .343 .437 BONDFUND .243 .207 .18 .162 .126 .126 PIPELINE .142 .142 .285 .285 .428 .285 BIGBANKS 0 0 0 .142 .142 .142 N=28 |

==============================================================================

5/3/2018 Yesterday's Buy B9 was repeated today. The track record

of Buy B9s

is very good, but as I noted last night, none of the past B9s in May had such

a low IP21 (current Accumulation Index reading). That could create a

problem here, just as the three S9s in the last three months might.

------------------------------------------------------------------------------------------------------------

Flash: Boosting the market today is the Labor Department's Job Report

Payroll

employment increases by 164,000 in April; unemployment rate edges down to 3.9%

---------------------------------------------------------------------------------------------------------------------------------

I also admit to being worried also by the fact that resistance posed the falling

65-dma in the DJI is not far enough overhead to permit much of a rally and

also by how quickly the DJI jumped up 350 points in only two hours from its

critical support level. It was as though someone with a lot of money drove the

DJI up away from the key support just so that that key level might not be taken

out by big sellers playing with leveraged ETFs and futures.

|

Charts 5/3/2018 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol V-Indicator Hourly DJIA A/D Line for All Stocks NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30 DIA SPY QQQ MDY IWM TNA USO-CrudeOil FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL RSX RETL SDS SLV SOXL TECL TMF TNA UGA (gasoline) XIV YINN Commodities: JJC, NIB, CHOC CORN, CUT (paper) WEAT UUP (Dollar) AAPL ADBE ALXN AMAT AMGN AMD AMZN BA BABA BAC BIDU CAT CVX DE FB GOOG GS HD IBM JPM M (Macy's) MSFT NFLX NVDA QCOM TSLA TXN XOM WMT ANDV (refinery), CMG (Chipotle), LRCX, SWKS, MDGL SPPI WATT SQ TOWN 5/2/2018 (Click on Underlined link.) Bullish MAXCPs - http://tigersoft.com/4XXH/MAXCPS/503/BULLISH.htm Bearish MAXCPs - http://tigersoft.com/4XXH/MINCPS/503/BEARISH.htm |

I would suggest that another test of 23200-23500 would seem likely. If you look

back at other recent cases where we had a highly visible, well-tested support, it may

be that the DJI will have to make a nominal new closing low just below the support

before it can turn up. This would be a "bear trap". See some

examples below.

| 2010

Bear Trap |

| 2011

Bear Trap |

| 2013

Bear Trap |

Another Failed Rally?

And who's to say, tomorrow will be an up-day. I keep

saying that Professionals

seem very bearish and are very quick to sell into all rallies. We see this in lots

of the statistics again tonight. Most of the recent Candle-Sticks for the major

market ETFs have been red (bearish). Secondly, the key ETFs' Closing Powers are

still in downtrends and at 12-month lows. Thirdly, the number of MINCPS still

dwarfes

the number of MAXCPs. Fourthly, Day Traders are bearish many more stocks than

they are bullish. And fifth, big down-day stocks vastly outnumber the stocks making

big gains on high volume. (See these statistics in Table 2).

Very Weak Closing Powers - Professional Selling

Strong Openings - Public Buying

Charts of DIA and SPY

Limited Upside Potential?

The increasing pace downward of the 65-dma for DIA, NASDAQ, QQQ

and SPY show that the upside potential now is strictly limited. It's not clear

at this point how Peerless can profitably get a Sell signal to reverse the

present Buy B9. As a result, I think that we should still want the CP

downtrend-

lines to break before we can turn bullish on a particular ETF, especially DIA.

There appears to be a lot more upside potential in Oil

Stocks. But that

will work against the general market because it signifies inflation and rising

interest rates.

Why Are Professionals Still Selling?

The reason is still not clear. More important is that

they are.

We can guess, though. Today's surprise admission by the President that he personally

was responsible for paying off a porn star right before the last election so she would

not reveal his infidelity to his family-values supporters and that his personal lawyer

lied about making the pay-off himself, brings, I would think, the Special

Prosecutor's

noose that much closer to Trump. This cannot help the market. Perhaps, this is

the

sort of news that Professionals are expecting.

But it may be something else is causing Prodessional selling. To impeach Trump in

1919 (and that's a year away), the Democrats will need to win back the House of

Representatives in the Fall. The President could still pull off two diplomatic

successes that would make all the talk about "Russia-Gate" pale. He just

might

be able to bring about the de-nuclearization of North Korea and he may gain

some bragging rights in the coming Chinese trade talks.

Most Americans vote their pocket books. If the DJI does

not hold above 23200-

23400, I would think it will fall back to 20500. That could lose the control of

the House for Republicans. So, a lot depends on whether this support that is

being tested will hold. And Wall Street is of two minds about it, right now.

The Oil stocks still look like the best longs. There remain lots of Bearish MINCPs

to hedge with while holding long IWM, because it has been the best perfoming

major market ETF for the last two months.

Table 1 QUICKSILVER on ETFS - 05/03/18 ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS --------------------------------------------------------------------------------------------- --------------------------------------------------------------------------------------------- --------------------------------------------------------------------------------------------- DIA 239.1 -.01 242.95 -83.2% Bearish BLUE -.071 0 --------------------------------------------------------------------------------------------- COMPQX 7088.15 -12.75 7119.8 -21.5% Bearish BLUE -.101 .017 --------------------------------------------------------------------------------------------- SPY 262.62 -.58 266.56 -69.6% Bearish BLUE -.078 .007 --------------------------------------------------------------------------------------------- QQQ 161.8 -.02 162.09 -5.9% Bearish BLUE -.101 .016 --------------------------------------------------------------------------------------------- MDY 340.59 -.49 344.1 -59.3% Bearish BLUE -.082 .029 --------------------------------------------------------------------------------------------- IWM 153.81 -.84 154.69 -35.6% Bearish RED .009 .045 --------------------------------------------------------------------------------------------- FAS 61.48 -.86 64.57 -213.5% Bearish RED -.205 -.082 --------------------------------------------------------------------------------------------- RETL 33.17 -1.06 35.38 -165.7% Bearish RED -.116 -.027 --------------------------------------------------------------------------------------------- SOXL 128.46 2.28 126.09 -19% Bearish BLUE -.133 -.141 --------------------------------------------------------------------------------------------- TECL 117.57 .93 115.03 74.5% Bearish BLUE -.075 -.017 --------------------------------------------------------------------------------------------- IBB 101.28 -1.4 105.61 -192.8% Bearish RED -.178 -.037 --------------------------------------------------------------------------------------------- GLD 124.28 .63 125.5 -27.7% Bearish RED -.115 .024 --------------------------------------------------------------------------------------------- OIL 7.61 .04 6.89 339.4% Bullish BLUE .263 .096 --------------------------------------------------------------------------------------------- OIH 26.87 -.28 27.22 -93.9% Bullish RED .209 .165 --------------------------------------------------------------------------------------------- GASL 19.49 -1.54 21.01 -517% Bullish RED .112 .183 --------------------------------------------------------------------------------------------- UGA 33.37 .32 33.82 -56.6% Bullish BLUE .404 .111 --------------------------------------------------------------------------------------------- UUP 24.3 -.1 24.03 51.7% Bullish ---- .197 .068 --------------------------------------------------------------------------------------------- IEF 101.63 .26 101.59 10.3% Bearish ---- -.044 .035 --------------------------------------------------------------------------------------------- XLU 51.28 -.07 51.71 8.7% Bullish ---- .012 .085 --------------------------------------------------------------------------------------------- WEAT 7.04 .13 6.58 439% Bullish BLUE .477 .158 --------------------------------------------------------------------------------------------- YINN 31.81 -.61 32.68 -114.9% Bearish BLUE .085 -.155 --------------------------------------------------------------------------------------------- RSX 20.96 .27 21.29 -66.6% ---- ---- .068 -.063 --------------------------------------------------------------------------------------------- AAPL 176.89 .32 162.32 378.2% ---- BLUE -.079 .069 --------------------------------------------------------------------------------------------- GOOG 1023.72 -.66 1030.05 -79.2% Bearish BLUE -.165 -.044 --------------------------------------------------------------------------------------------- MSFT 94.07 .56 95.82 -10.1% Bearish BLUE -.071 .063 --------------------------------------------------------------------------------------------- AMZN 1572.07 2.39 1572.62 173.2% Bearish BLUE -.057 .095 --------------------------------------------------------------------------------------------- FB 174.02 -2.05 173.59 -4% Bearish RED -.008 .013 --------------------------------------------------------------------------------------------- NVDA 232.99 6.68 226.33 171.9% Bearish BLUE -.044 0 --------------------------------------------------------------------------------------------- BA 330.69 6.5 340.88 -181% Bearish BLUE .045 -.027 --------------------------------------------------------------------------------------------- GS 233.41 -.64 239.8 -140.5% Bearish BLUE -.306 -.079 --------------------------------------------------------------------------------------------- HD 183.19 -2.72 186.46 -68.2% ---- RED .037 .036 --------------------------------------------------------------------------------------------- CAT 143.78 -.08 144.72 -87.4% Bearish BLUE -.175 -.039 |

Table 2 Count of Stocks in Key Directories

20180503