---- TIGERSOFT/PEERLESS HOTLINE ----------------

(C)

1985-2018 William Schmidt, Ph.D. www.tigersoft.com

All rights

strictly reserved.

You are now at www.tigersoft.com/21PEY3/INDEX.htm

(Do not use the suffix ".html")

===> Always CLICK REFRESH to be sure you are

looking at latest version of Hotline

Data used through 4/3/2019

4/4/2019 4:55 AM

PCT

IMPORTANT - Look for an EMAIL sent earlier tonight.

This HOTLINE's address will change Friday AM.

------------------------------------------------------------------------------------------------------------------------

Earlier Hotlines

www.tigersoft.com/21PEY3/INDEX-2.htm

(most recent Hotlines before

current ones)

......................................................................

www.tigersoft.com/19HLK5/INDEX.htm

www.tigersoft.com/44UHL/INDEX.htm

www.tigersoft.com/NHLP/INDEX.htm

www.tigersoft.com/7LHL/INDEX.htm

www.tigersoft.com/NHL718/INDEX.htm

www.tigersoft.com/21MAY18/INDEX.htm

www.tigersoft.com/55HEP/INDEX.htm

www.tigersoft.com/44H4L/INDEX2.htm

Earlier still: Go here...

HELP

A Guide

To Profitably Using The Tiger Nightly HOTLINE

Introduction to Tiger/Peerless Buys and

Sells.

Peerless Buy and

Sell Signals: 1928-2016

Individual Peerless signals explained:

http://tigersoftware.com/PeerlessStudies/Signals-Res/index.htm

http://www.tigersoft.com/PeerInst-2012-2013/

Explanation of each Peerless signal. http://www.tigersoft.com/PeerInst-2012-2013/

Different Types of

TigerSoft/Peerless CHARTS, Signals and Indicators

-----> More HELP LINKS

Documentation for

TigerSoft Automatic and Optimized Signals.

How reliable support is the

DJI's rising 200-day ma?

SPY Charts since

1994: Advisory Closing Power S7s, Accum. Index, 65-dma, Optimized Signals.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

1/19/2016 ---> Corrections,Deeper

Declines and Bear Markets since 1945.

1/21/2016

---> High

Velocity Declines since 1929

2/12/2016 ---> Presidential

Elections Years and Bullish IP21 Positive Non-Confirmations at Lower Band.

2/12/2016 ---> OBV NNCs on DJI's Rally to

2.7% Upper Band when DJI's 65-dma is falling.

11/6/2016 --->

Killer Short Selling

Techniques: ===> Order Here ($42.50)

It's As Easy as 1,2,3

TigerSoft "Combination" Short-Selling... Easy as 1-2-3 Short Sales

Earlier Q-Answers

QuickSilver Documentation (1/11/2016)

Our Different

Signals

Better understand the difference between

Peerless DJI-based signals,

the one-year optimized red Signals and the fixed signals based

on technical developments.

Introduction to Tiger/Peerless Buys and Sells.

Different Types of

TigerSoft/Peerless CHARTS, Signals and Indicators

New TigerPeerless Installation and

Basic Uses' Instruction

See the re-written materials on TigerSoft Buys and Sells.

Study- Trading SPY

WITHOUT Peerless - Some Guidelines.

When completed this will be a new Tiger Trading E-Book.

Study- Examples of

"Hands above the Head" top patterns.

Study- 9/3/2017 TigerSoft (not

Peerless) charts of Major Tops as they occurred.

===> Please report any broken or out-of-date links. william_schmidt@hotmail.com

--->>> Order New E-Book: "New Tiger Tahiti

System's Stocks: 2000-2018", $50.00

> When to

start avoiding the long side altogether because of Peerless signals.

> When to

start buying Tahiti stocks after the start of a Bear Market.

> When to

avoid a weaker high AI/200 stock and use the second choice.

> When to exit

Tahiti stocks before the normal 21-month holding period is over.

> The special

benefits of working with major Tahiti tech stocks.

> Watch for Head/Shoulders tops with these stocks.

> Using the

90-day Stochastic to time the purchase of Safer Tahiti Stocks

> The Tahiti

Tech System's track record using these rules matches closely the 24%/year gain that

the

blue chip Tahiti system did between 1970 and 2000.

> Tiger Software 858-273-5900 PO Box 22784 San

Diego, CA 92192 Email william_schmidt@hotmail.com

====================================================================

====================================================================

4/3/2019 The January B4, B18 and B15 Peerless Buy

signals remain un-reversed

even

though the DJI has made it to the 2.0% upper band. The market is moving

steadily

higher, almost day by day. Yes, the DJI has reached well-tested flat resistance/

But

this type of formation favors upside breakouts. Its pause now reflects normal

caution

until the Jobs' Report comes out Friday morning. Since the Buy signals' average

gains

large enough to take the DJI above 27000, since the Closing Powers are still rising

for

the major ETFs, since the Hourly DISI is in an uptrend and since 39 of the 45 groups we

follow

show more than half of their component-stocks above the support of their

65-day

ma, it is important now that we be patient and expect a good Jobs' Report

(whatever

that is!).

Don't worry that Democrats in the House now are grabbing some of the

Headlines.

The

political reality remains one that Wall Street likes and depends on, namely that

the

Trump forces control the Senate and the Supreme Court. There is very little the

Democrats

can do except to make a lot of noise. Meanwhile, Trump's budget priorites

will

continue, so will de-Regulation and so will spending on the military. Nothing is on

the

horizon that should disturb Wall Street's priorities. At least, not so long as the stock

market

and the economy keep growing. Don't worry about the FED. Chairman Powell

knows

his job now is to not rock the boat. As a Washington lawyer who made $100,000,000

from

the system, he knows how to get along. He knows his job is to boost the market

in

time for the 2020 Election. The Dollar is strong. There is little inflation. So, low

rates

are

as they say, "a no brainer". Oh, one more thing. Labor remains very

docile. That's

important

because Labor costs are the one variable that corporations must control.

What's

not to like for the stock market? Be patient, the DJI is aimed at new highs and

the

Peerless Buy signals are there for good reason. DIA, SPY and QQQ should all

keep

rising.

Charts

4/3/2019

2018 PEERLESS DJI, Signals,

Indicators Daily DJI Volume 10-DayUp/Down Vol

Hourly DJIA A/D Line for All Stocks

Inverted Traders Index

NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30

DIA SPY QQQ MDY IWM TNA

Short-Term Rates

USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL RSX RETL

SDS AGQ SLV SOXL TECL TLT TMF TNA UGA (gasoline) XIV YINN

Commodities: CANE

CORN DBC JJC, NIB, CHOC CORN, CUT (paper)

MOO, SOYB WEAT UUP (Dollar) LIT

(Lithium)

AAPL ADBE ALXN AMAT AMGN AMD AMZN BA BABA BAC BIDU CAT CVX DE

FB GOOG GS HD IBM INTU JPM M (Macy's) MSFT NFLX NVDA QCOM TSLA TXN

XOM WMT CMG , LRCX, SWKS, MDGL

SPPI WATT SQ TOWN

4/3/19 (Click

on Underlined link.)

Bullish MAXCPs - http://tigersoft.com/MAXCPS/Apr-3/BULLISH.htm

Bearish MAXCPs - http://tigersoft.com/MINCPs/Apr-3/BEARISH.htm

|

Table 1 QUICKSILVER on ETFS - 4/3/19

ETF CLOSE CHANGE PIVOT-PT 5-dmaAROC CL-PWR CANDLE IP21 ITRS

---------------------------------------------------------------------------------------------

DIA 262 .31 257.08 113.6% ------- RED .184 =====

^^^^^

---------------------------------------------------------------------------------------------

BA 384.74 -6.01 374.44 137.7% ------- RED .134 .001

---------------------------------------------------------------------------------------------

SPY 286.42 .45 280.71 119.6% ------- RED .064 .016

---------------------------------------------------------------------------------------------

QQQ 183.78 1.05 178.31 163.2% ------- ---- .087 .061

---------------------------------------------------------------------------------------------

MDY 350.45 1.86 344.1 133.1% Bearish RED .044 .002

---------------------------------------------------------------------------------------------

IWM 155.16 .8 152.62 126.9% Bearish RED -.077 -.004

---------------------------------------------------------------------------------------------

FAS 65.68 .47 61.35 462.9% ------- RED .043 .123

---------------------------------------------------------------------------------------------

RETL 29.89 .45 29.5 123.2% Bearish BLUE-.149 .002

---------------------------------------------------------------------------------------------

SOXL 158.23 10.09 131.49 934.3% ------- BLUE .028 .698

---------------------------------------------------------------------------------------------

TECL 149.34 3.49 134.89 570.9% ------- BLUE .113 .541 strongest combined

---------------------------------------------------------------------------------------------

IBB 113.49 .67 109.46 211.3% Bearish ---- .088 -.03

---------------------------------------------------------------------------------------------

GLD 121.8 -.18 121.9 -75.7% Bearish BLUE -.02 -.071

---------------------------------------------------------------------------------------------

RSX 21.02 -.09 20.82 50.3% Bearish RED .062 -.037

|

Table 2 Count of Stocks in Key Directories

2019-04-03

-------------------------------

NEWHIGHS 182

NEWLOWS 21

MAXCP 25

MINCP 18

TTTNH 10

TTTNL 28

FASTUP 97

FASTDOWN 49

CPCROSSA 63

CPCROSSD 126

BIGVOLUP 4

BIGVODN 11

ACCUMVER 14

HIGHIP21 11

HIUPPCT 8

VHIP21 34

LOWACCUM 184

REDSELL 46

AUGSELS7 38

TRAPDOOR 15

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

4/3/19

Bullish = 39

Bearish = 6

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BONDFUND .99 .98 .98 .99 .99 .99

DJI-13 .923 .923 .923 .923 .846 .692

HACKERS .863 .772 .818 .818 .681 .681

DOWJONES .862 .862 .896 .862 .793 .689

NIFTY .859 .894 .894 .824 .807 .789

BIGBANKS .857 .714 .857 .428 .571 0

NASD-100 .855 .814 .835 .762 .711 .731

ETFS .844 .827 .827 .793 .775 .758

SEMI .827 .81 .836 .767 .715 .698

UTILITY .825 .8 .875 .875 .825 .825

HOMEBLDG .823 .823 .823 .823 .823 .823

AUTO .82 .692 .717 .538 .512 .435

SP500 .82 .802 .826 .763 .739 .71

SP-100 .819 .787 .84 .755 .744 .659

TRANSP .8 .75 .75 .65 .65 .65

INDEXES .79 .784 .774 .752 .731 .731

REIT .79 .81 .79 .756 .797 .783

FIDSTKS .783 .794 .832 .751 .735 .681

INFRA .777 .777 .805 .666 .527 .444

COMPUTER .772 .772 .772 .681 .636 .636

SOLAR .764 .823 .823 .823 .823 .705

RUS-1000 .763 .754 .793 .723 .701 .667

SOFTWARE .746 .746 .714 .714 .666 .65

CHINA .745 .762 .745 .694 .694 .644

INSURANC .733 .7 .7 .666 .766 .766

ELECTRON .728 .703 .746 .679 .648 .635

BIG17 .717 .695 .673 .608 .63 .565

OILGAS .697 .732 .816 .739 .76 .725

BIOTECH .685 .685 .674 .658 .648 .613

CHEM .685 .648 .666 .629 .574 .518

INDMATER .683 .683 .683 .607 .544 .544

EDU .666 .666 .666 .666 .666 .666

RETAIL .66 .622 .679 .641 .641 .641

GREEN .652 .652 .695 .652 .695 .695

BEVERAGE .611 .611 .611 .666 .611 .611

MILITARY .548 .677 .741 .645 .58 .483

GUNS .529 .47 .588 .47 .47 .47

FINANCE .522 .522 .566 .366 .444 .344

COMODITY .512 .536 .512 .463 .439 .512

============================================================================================

JETS .5 .5 .5 .5 .5 .5

============================================================================================

FOOD .481 .518 .5 .444 .444 .518

GAMING .458 .458 .458 .375 .333 .333

GOLD .411 .392 .431 .49 .47 .705

HOSPITAL .291 .25 .291 .291 .291 .291

COAL .285 .428 .428 .428 .428 .428

REGBANKS .285 .321 .285 .214 .214 .178

|

====================================================================

4/2/2019 The January B4, B18 and B15 Peerless Buy signals all point to the DJI

reaching 28000 by this Summer. The abiding strength shown by the NYSE A/D,

which is running in all-time high territory ahead of the DJI and all the other ETFs is

impressive. It shows how important low interest rates are. The DJI remains

the

leader in the sense that it is closest to its high of last year. The DJI also

now shows

the highest IP21. The main ETFs we are long still are in price and Closing Power

uptrends

as is the Hourly DJI's DISI Line. The futures are up. April has strong

seasonality.

Trump is backing away from his ill-advised plan to shut the Mexican border and

Chinese stocks are acting like there may soon be a tariffs' agreement. Meanwhile,

the Dollar is strong and interest rates are low. Foreign money should continue to

flow into the major ETFs that we are long, DIA, SPY and QQQ. The futures look

good for the much more speculative SOXL. This shows confidence in US equities

remains strong. Hold for DJI 27000 soon.

Five of the DJI-30 stocks, CSCO, MRK, MSFT, PG and V are now making

new highs, just two seem particularly weak and holding it back. They are Walgreen

(-7

today) and United Healthcare (very weak Closing Power). Now oil is moving up.

So, XOM and CVX should help lift the DJI-30. Goldman Sachs could turn weak

again, but its rising 65-dma is will act as support. Altogether, there are no

dangerous

looking head and shoulders patterns and I see nothing in the blue chips which will

prevent the DJI from making a nominal new high close above 27000. Nothing, unless

it is high priced Boeing which is enjoying a rebound and is trying to close its downside

gap.

Hold onto DIA as well as SPY and QQQ. The A/D Lines of their components is

is each making new highs. But it would be better if these ETFs were making new

highs

ahead of prices or their Opening Powers. But for now their Closing Powers' uptrends

are intact and that will have to do. They should soon reach their highs.

Charts 4/2/2019

2018 PEERLESS DJI, Signals,

Indicators Daily DJI Volume 10-DayUp/Down Vol

Hourly DJIA A/D Line for All Stocks

Inverted Traders Index

NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30

DIA SPY QQQ MDY IWM TNA

Short-Term Rates

USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL RSX RETL

SDS AGQ SLV SOXL TECL TLT TMF TNA UGA (gasoline) XIV YINN

Commodities: CANE

CORN DBC JJC, NIB, CHOC CORN, CUT (paper)

MOO, SOYB WEAT UUP (Dollar) LIT

(Lithium)

AAPL ADBE ALXN AMAT AMGN AMD AMZN BA BABA BAC BIDU CAT CVX DE

FB GOOG GS HD IBM INTU JPM M (Macy's) MSFT NFLX NVDA QCOM TSLA TXN

XOM WMT CMG , LRCX, SWKS, MDGL

SPPI WATT SQ TOWN

4/2/19 (Click

on Underlined link.)

Bullish MAXCPs - http://tigersoft.com/MAXCPS/Apr-2/BULLISH.htm

Bearish MAXCPs - http://tigersoft.com/MINCPs/Apr-2/BEARISH.htm

|

Table 1 QUICKSILVER on ETFS - 4/2/19

ETF CLOSE CHANGE PIVOT-PT 5-dmaAROC CL-PWR CANDLE IP21 ITRS

---------------------------------------------------------------------------------------------

DIA 261.69 -.7 256.11 101.3% ------- RED .187 =====

^^^^^

---------------------------------------------------------------------------------------------

BA 390.75 -.79 374.21 269.2% ------- BLUE .154 .012

---------------------------------------------------------------------------------------------

SPY 285.97 .14 279.65 86% ------- RED .075 .014

---------------------------------------------------------------------------------------------

QQQ 182.73 .69 177.9 102.6% ------- BLUE .108 .047

---------------------------------------------------------------------------------------------

MDY 348.59 -1.41 341.24 103.2% Bearish RED .02 -.005

---------------------------------------------------------------------------------------------

IWM 154.36 -.4 151.27 81.8% Bearish RED -.089 -.012

---------------------------------------------------------------------------------------------

FAS 65.21 .24 59.88 379.1% ------- BLUE .064 .095

---------------------------------------------------------------------------------------------

RETL 29.44 -.89 29.16 199.1% Bearish RED -.106 -.079

---------------------------------------------------------------------------------------------

SOXL 148.14 .47 132.18 360.2% ------- BLUE .011 .46

^^^^

---------------------------------------------------------------------------------------------

TECL 145.85 1.53 133.42 372% ------- BLUE .125 .436

---------------------------------------------------------------------------------------------

IBB 112.82 .91 108.8 112.7% Bearish BLUE .027 -.038

---------------------------------------------------------------------------------------------

GLD 121.98 .45 123.65 -94.6% Bearish BLUE .03 -.051

---------------------------------------------------------------------------------------------

RSX 21.11 .08 20.81 -2.4% Bearish BLUE .125 -.03

|

Table 2 Count of Stocks in Key Directories

20190402

-------------------------------

NEWHIGHS 169 Bullish

NEWLOWS 16

MAXCP 23

MINCP 15

TTTNH 8

TTTNL 35

FASTUP 58

FASTDOWN 52

CPCROSSA 82

CPCROSSD 143

BIGVOLUP 4

BIGVODN 176

ACCUMVER 11

HIGHIP21 11

HIUPPCT 8

VHIP21 34

LOWACCUM 176

REDSELL 44

AUGSELS7 30

TRAPDOOR 15

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

4/2/19

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BONDFUND .98 .98 .99 .99 .99 .99

DJI-13 .923 .923 .923 .846 .692 .769

NIFTY .894 .894 .824 .807 .789 .824

DOWJONES .862 .896 .862 .793 .689 .758

ETFS .827 .827 .793 .775 .758 .81

HOMEBLDG .823 .823 .823 .823 .823 .764

SOLAR .823 .823 .823 .823 .764 .705

REIT .81 .79 .756 .797 .797 .817

SEMI .81 .836 .767 .715 .706 .775

NASD-100 .808 .828 .757 .707 .727 .777

SP500 .804 .828 .765 .74 .718 .738

UTILITY .8 .875 .875 .825 .825 .875

SP-100 .795 .849 .763 .752 .666 .731

FIDSTKS .794 .832 .751 .735 .697 .735

INDEXES .784 .774 .752 .731 .736 .747

INFRA .777 .805 .666 .527 .472 .472

COMPUTER .772 .772 .681 .636 .636 .681

HACKERS .772 .818 .818 .681 .681 .772

CHINA .762 .745 .694 .694 .661 .644

RUS-1000 .754 .793 .722 .702 .677 .692

TRANSP .75 .75 .65 .65 .65 .6

SOFTWARE .746 .714 .714 .666 .666 .714

OILGAS .732 .816 .739 .76 .739 .767

BIGBANKS .714 .857 .428 .571 0 .571

ELECTRON .703 .746 .679 .648 .641 .703

INSURANC .7 .7 .666 .766 .766 .766

BIG17 .695 .673 .608 .63 .586 .652

AUTO .692 .717 .538 .512 .461 .435

INDMATER .683 .683 .607 .544 .556 .531

BIOTECH .682 .674 .658 .648 .619 .666

MILITARY .677 .741 .645 .58 .483 .516

EDU .666 .666 .666 .666 .666 .666

GREEN .652 .695 .652 .695 .695 .695

CHEM .648 .666 .629 .574 .555 .555

RETAIL .622 .679 .641 .641 .641 .584

BEVERAGE .611 .611 .666 .611 .611 .611

COMODITY .536 .512 .463 .439 .512 .56

FINANCE .522 .555 .366 .444 .344 .444

FOOD .518 .5 .444 .444 .518 .555

=========================================================================================

JETS .5 .5 .5 .5 .5 .3

=========================================================================================

GUNS .47 .588 .47 .47 .47 .529

GAMING .458 .458 .375 .333 .333 .333

COAL .428 .428 .428 .428 .428 .428

GOLD .392 .431 .49 .47 .705 .725

REGBANKS .321 .285 .214 .214 .178 .214

HOSPITAL .25 .291 .291 .291 .291 .333

|

==========================================================================

4/1/2019 No thanks to JP Morgan's misleading talk of

an inversion of interest rates,

we got our rally back above 26000. Professionals were correctly bullish about

Boeing.

Today's overall volume could have been higher and more of the Russell-2000 stocks could

have

participated, but the DJIA is once again the leader. As I showed last night, the market

could

could go wildly up if it can get past 27000 on a lowering of interest rates. But that

won't

happen, at least, not until we see from this Friday's Jobs' Report if the US economy is

slowing down. The Peerless Buy signals all suggest we will see 27000 before we get a

Peerless

Sell.

What is clear from today's action is that no inflation is expected. Gold and silver

show bearish head/shoulders patterns. And Chinese and Semi-conductor stocks

are moving up again. So, the advance is a lot broader than just the DJIA stocks.

See how the NYSE AD line made a new 12-month high today. Only in 1976-1977

and August 2001 (a month before the 9/11 attack) was this true before a bear market.

Most of the advance recently has come from higher openings. I woudn't take this

as bearish yet. But we should see more Closing Power Strength if the resistance-levels we

have reached are going to be overcome.

Stay long DIA, SPY and QQQ. There are very few appealing short sale

candidates among

our Bearish MINCPs. The shorts are being run in. Cover any shorts if their Closing

Powers are violated.

Charts 4/1/2019

2018 PEERLESS DJI, Signals,

Indicators Daily DJI Volume 10-DayUp/Down Vol

Hourly DJIA A/D Line for All Stocks

Inverted Traders Index

NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30

DIA SPY QQQ MDY IWM TNA

Short-Term Rates

USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL RSX RETL

SDS AGQ SLV SOXL TECL TLT TMF TNA UGA (gasoline) XIV YINN

Commodities: CANE

CORN DBC JJC, NIB, CHOC CORN, CUT (paper)

MOO, SOYB WEAT UUP (Dollar) LIT

(Lithium)

AAPL ADBE ALXN AMAT AMGN AMD AMZN BA BABA BAC BIDU CAT CVX DE

FB GOOG GS HD IBM INTU JPM M (Macy's) MSFT NFLX NVDA QCOM TSLA TXN

XOM WMT CMG , LRCX, SWKS, MDGL

SPPI WATT SQ TOWN

4/1/19 (Click

on Underlined link.)

Bullish MAXCPs - http://tigersoft.com/MAXCPS/Apr-1/BULLISH.htm

Bearish MAXCPs - http://tigersoft.com/MINCPs/Apr-1/BEARISH.htm

|

Table 1 QUICKSILVER on ETFS - 4/1/19

ETF CLOSE CHANGE PIVOT-PT 5-dmaAROC CL-PWR CANDLE IP21 ITRS

---------------------------------------------------------------------------------------------

DIA 262.39 3.26 256.46 142.5% ------- BLUE .163 0

---------------------------------------------------------------------------------------------

BA 391.54 10.12 370.38 281.7% ------- BLUE .155 .014

---------------------------------------------------------------------------------------------

SPY 285.83 3.35 281.12 121% Bearish BLUE .06 .011

---------------------------------------------------------------------------------------------

QQQ 182.04 2.38 179.05 106.9% ------- BLUE .094 .036

---------------------------------------------------------------------------------------------

MDY 350 4.6 341.48 173.4% Bearish BLUE .02 -.004

---------------------------------------------------------------------------------------------

IWM 154.76 1.67 151.86 147.5% Bearish BLUE-.108 -.015

---------------------------------------------------------------------------------------------

FAS 64.97 3.11 60.53 523.6% Bearish BLUE .039 .123

---------------------------------------------------------------------------------------------

RETL 30.33 .66 28.27 457.4% Bearish BLUE-.132 -.013

---------------------------------------------------------------------------------------------

SOXL 147.67 10.13 138.24 501.4% Bearish BLUE .006 .542

---------------------------------------------------------------------------------------------

TECL 144.32 5.69 135.63 401.6% ------- BLUE .105 .47

---------------------------------------------------------------------------------------------

IBB 111.91 .11 110.33 163.6% Bearish RED -.001 -.057

---------------------------------------------------------------------------------------------

GLD 121.53 -.48 124.3 -137.4% Bearish RED .017 -.081

---------------------------------------------------------------------------------------------

OIL 121.53 -.48 124.3 -137.4% Bullish RED -.032 11.052

---------------------------------------------------------------------------------------------

OIH 17.75 .52 17.13 245.6% Bearish BLUE-.025 -.004

---------------------------------------------------------------------------------------------

GASL 8.09 .26 7.73 468.9% Bearish ---- .041 -.109

---------------------------------------------------------------------------------------------

UGA 8.09 .26 7.73 468.9% Bullish -----.002 -.767

---------------------------------------------------------------------------------------------

UUP 26.01 -.02 25.88 40.5% Bullish ---- .054 -.055

---------------------------------------------------------------------------------------------

IEF 26.01 -.02 25.88 40.5% Bearish -----.204 -.827

---------------------------------------------------------------------------------------------

CORN 26.01 -.02 25.88 40.5% Bullish ---- .057 .535

---------------------------------------------------------------------------------------------

WEAT 26.01 -.02 25.88 40.5% Bullish ---- .082 3.325

---------------------------------------------------------------------------------------------

YINN 26.01 -.02 25.88 40.5% ------- ---- .304 .08

---------------------------------------------------------------------------------------------

RSX 21.03 .43 21.12 -40.7% Bearish BLUE .096 -.042

|

Table 2 Count of Stocks in Key Directories

20190401

-------------------------------

NEWHIGHS 187 Bullish

NEWLOWS 8

MAXCP 19

MINCP 12

TTTNH 11

TTTNL 23

FASTUP 74

FASTDOWN 55

CPCROSSA 114

CPCROSSD 75

BIGVOLUP 4

BIGVODN 9

ACCUMVER 11

HIGHIP21 11

HIUPPCT 8

VHIP21 33

LOWACCUM 184

REDSELL 44

AUGSELS7 37

TRAPDOOR 15

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

4/1/19

Bullish = 39

Bearish = 5

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BONDFUND .98 .99 .99 .99 .99 .99

DJI-13 .923 .923 .846 .692 .846 .692

NIFTY .894 .824 .807 .789 .842 .807

UTILITY .875 .875 .825 .825 .875 .85

DOWJONES .866 .833 .766 .666 .766 .666

BIGBANKS .857 .428 .571 0 .571 0

SP-100 .849 .763 .752 .666 .752 .645

SEMI .836 .767 .715 .706 .775 .793

FIDSTKS .832 .751 .735 .697 .751 .686

NASD-100 .828 .757 .707 .727 .787 .757

SP500 .828 .765 .74 .718 .748 .702

ETFS .827 .793 .775 .758 .81 .775

HOMEBLDG .823 .823 .823 .823 .764 .764

SOLAR .823 .823 .823 .764 .705 .823

HACKERS .818 .818 .681 .681 .772 .772

OILGAS .816 .739 .76 .739 .767 .683

INFRA .805 .666 .527 .472 .527 .444

RUS-1000 .793 .722 .701 .678 .7 .649

REIT .79 .756 .797 .797 .824 .75

COMPUTER .772 .681 .636 .636 .681 .636

INDEXES .768 .752 .731 .736 .752 .736

TRANSP .75 .65 .65 .65 .6 .55

ELECTRON .746 .679 .648 .641 .703 .703

CHINA .745 .694 .694 .661 .644 .711

MILITARY .741 .645 .58 .483 .548 .516

AUTO .717 .538 .512 .461 .435 .384

SOFTWARE .714 .714 .666 .666 .714 .714

INSURANC .7 .666 .766 .766 .766 .666

GREEN .695 .652 .695 .695 .695 .695

INDMATER .683 .607 .544 .556 .569 .544

RETAIL .679 .641 .641 .641 .603 .509

BIG17 .673 .608 .63 .586 .652 .608

BIOTECH .671 .658 .648 .619 .669 .648

CHEM .666 .629 .574 .555 .574 .555

EDU .666 .666 .666 .666 .666 .5

BEVERAGE .611 .666 .611 .611 .611 .611

GUNS .588 .47 .47 .47 .529 .47

FINANCE .555 .355 .444 .344 .444 .355

COMODITY .512 .463 .439 .512 .56 .536

FOOD .5 .444 .444 .518 .555 .518

JETS .5 .5 .5 .5 .3 .3

===============================================================================================

GAMING .458 .375 .333 .333 .333 .333

GOLD .431 .49 .47 .705 .725 .745

COAL .428 .428 .428 .428 .428 .428

HOSPITAL .291 .291 .291 .291 .333 .416

REGBANKS .285 .214 .214 .178 .214 0

|

====================================================================

3/29/2019 Short-Term rates are going down. This

should be bullish.

The Peerless Buy B4, B18 and B15 signals stand. Seasonality is bullish for the

next two weeks. Since 1965, the DJI has risen 65% of the time in this period.

In the third year of the 4-year Presidential cycle, like now, the odds of a DJI

rally jump to 75% of the time and DJI shows an average gain of 1.6%. If this were

a typical year, the DJI should then be up 2.1% in a month, 4.2% in two months

and 6% in three months. The DJI's head and shoulder pattern looks like it will

not play out. As traders realize this, the shorts among them will have to

cover.

So, what was a hesitant rally back up to resistance could quickly get a lot more

exciting when recovery new highs are made. Defintely, continue to hold the major

ETFs, DIA, SPY and QQQ.

Parallel to 1927

In many ways, the market is behaving as it did in the Spring

of 1927. See the

weekly chart below of that era. Back then, rates were dropped in the Summer of 1927,

also a year before the Presidential Election. That allowed the DJI to begin a wild

advance into all-time high territory. The DJI then doubled and did not stop until

September 1929.

What's To Prevent Another 1929 Crash?

I believe the political and economic parallels between then

and now are worth

considering; the most important being that, like now, the bull market has already made

a long run, the gap between the super wealthy and the rest of Americans is

very wide and most of the new wealth was by 1929 going back into the stock market

In addition, the Coolidge and Trump economic agendas match up closely: tax cuts for

corporations and the wealthy, de-regulation of industry/Wall Street and bigger tariffs.

Two other similarities: Labor was weak and Unemployment was low.

There were, of course, many important differences. Coolidge's stock market did have

two advantages over Trump's: Coolidge's Party controlled both the Senate and the

House and in the 1920s, there was a much bigger array of new consumer goods that

assured a high level of consumer demand. Of course, the Federal Government now

plays

a much bigger role in the whole Economy. Trump's budgets guarantee two million

military

and civilian jobs while Social Security, welfare and Medicare prevent most extreme poverty

and offer a safety-net underneath the Economy.

The big problem for Coolidge and possibly Trump will - if

history repeats - be that the

stock market rally will turn into a wildly speculative bubble. Back in the late

1920s,

the broader public was drawn like moths to a flame. They were allowed to buy stock

with as

little as 10% down. As a result, the Public drove the DJI up 50% in 1928 despite the

FED's raising the Discount Rate four times. That was the year the FED lost control.

The market's advance, however, was very convenient for the Hoover Presidential campaign,

but it soon posed a serious dilema. By 1929, the FED knew quite well that the

stock market's

bubble was becoming dangerous. One half of all the money that was loaned in 1929

went into stock speculation. "Legitimate" commerce and construction began

suffering from

a lack of capital. Many big corporations even found it very profitable to loan for

stock

speculation. They could borrow it for 5 1/2% to 6% and loan it out for more than

double

that for stock speculation. But the FED did not want to raise rates. They knew

from the

depression of 1920-1921, that if they raised the Discount Rate much above 5%, it could

lead

to another deep recession. They also had no authority to raise margin requirements.

And when

Hoover asked JP Morgan to stop making so many loans for stock speculation, Morgan

just laughed at him.

Finally, after the DJI had risen from to 360 in August 1929,

they raised rates from

5% to 6% even though the first signs of an economic slow down were already occurring

in new home permits, housing construction and auto/steel production. This had a

double-barreled effect; it hit stocks hard and it forced a weakening economy to

begin

to retrench. So two weeks later, the market peaked and JP Morgan, for one, took big

short

positions and stopped supporting the DJI whose strength throughout 929 had been

very usefully concealing the rapid fall in the NYSE A/D Line. A month later, with

support

for the DJIA withdrawn, the whole market crashed.

Of course, we don't allow buying stocks with just

10% or 20% down. Or do we? A lot of

traders now buy leveraged long ETFs on margin. The margin requirement when buying 3x

leveraged Exchange Traded Funds (ETF's) overnight is 75% on the the long

side. This

means $33,000 of SOXL (or $100,000 worth of TXN, INTC and NVDA, etc.can be bought

for $22500. In effect, the margin requirement now is 22.5%. It does not take

much of a

decline in one's SOXL long position to get a margin call or even be sold out. This

is

exactly what happened in October and November 1929 to lots and lots of people who

were bankrupted by the plunge..

SOXL is still on a number of TigerSoft Sells.

Charts 3/29/2019

2018 PEERLESS DJI, Signals,

Indicators Daily DJI Volume 10-DayUp/Down Vol

Hourly DJIA A/D Line for All Stocks

Inverted Traders Index

NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30

DIA SPY QQQ MDY IWM TNA

Short-Term Rates

USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL RSX RETL

SDS AGQ SLV SOXL TECL TLT TMF TNA UGA (gasoline) XIV YINN

Commodities: CANE

CORN DBC JJC, NIB, CHOC CORN, CUT (paper)

MOO, SOYB WEAT UUP (Dollar) LIT

(Lithium)

AAPL ADBE ALXN AMAT AMGN AMD AMZN BA BABA BAC BIDU CAT CVX DE

FB GOOG GS HD IBM INTU JPM M (Macy's) MSFT NFLX NVDA QCOM TSLA TXN

XOM WMT CMG , LRCX, SWKS, MDGL

SPPI WATT SQ TOWN

3/29/19 (Click

on Underlined link.)

Bullish MAXCPs - http://tigersoft.com/MAXCPS/Mar-29/BULLISH.htm

Bearish MAXCPs - http://tigersoft.com/MINCPs/Mar-29/BEARISH.htm

|

Table 1 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

3/29/19

Bullish = 35

Bearish = 10

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BONDFUND .99 .99 .99 .99 .99 .99

DJI-13 .923 .846 .692 .846 .692 .692

UTILITY .875 .825 .825 .875 .85 .825

DOWJONES .833 .766 .666 .766 .666 .666

NIFTY .824 .807 .789 .842 .807 .824

HOMEBLDG .823 .823 .823 .764 .764 .705

SOLAR .823 .823 .764 .705 .823 .764

HACKERS .818 .681 .681 .772 .772 .727

ETFS .793 .775 .758 .81 .793 .775

SEMI .767 .715 .706 .775 .793 .784

SP500 .765 .74 .718 .748 .71 .708

SP-100 .763 .752 .666 .752 .645 .666

REIT .758 .798 .798 .825 .751 .731

NASD-100 .757 .707 .727 .787 .757 .767

INDEXES .752 .731 .736 .752 .741 .731

FIDSTKS .751 .735 .697 .751 .691 .708

OILGAS .739 .76 .739 .767 .69 .732

RUS-1000 .722 .701 .677 .701 .658 .658

SOFTWARE .714 .666 .666 .714 .714 .714

CHINA .694 .694 .661 .644 .711 .677

COMPUTER .681 .636 .636 .681 .636 .681

ELECTRON .679 .648 .641 .703 .703 .716

BEVERAGE .666 .611 .611 .611 .611 .611

EDU .666 .666 .666 .666 .5 .666

INFRA .666 .527 .472 .527 .472 .416

INSURANC .666 .766 .766 .766 .7 .633

BIOTECH .656 .648 .619 .669 .658 .653

GREEN .652 .695 .695 .695 .695 .695

TRANSP .65 .65 .65 .6 .55 .6

MILITARY .645 .58 .483 .548 .516 .548

RETAIL .641 .641 .641 .603 .509 .433

CHEM .629 .574 .555 .574 .611 .611

BIG17 .608 .63 .586 .652 .608 .63

INDMATER .607 .544 .556 .569 .544 .556

AUTO .538 .512 .461 .435 .384 .358

============================================================================================

JETS .5 .5 .5 .3 .3 .4

===========================================================================================

GOLD .49 .47 .705 .725 .764 .725

GUNS .47 .47 .47 .529 .47 .411

COMODITY .463 .439 .512 .56 .585 .56

FOOD .444 .444 .518 .555 .555 .555

BIGBANKS .428 .571 0 .571 0 .285

COAL .428 .428 .428 .428 .428 .428

GAMING .375 .333 .333 .333 .333 .333

FINANCE .355 .433 .344 .444 .377 .344

HOSPITAL .291 .291 .291 .333 .416 .5

REGBANKS .214 .214 .178 .214 .035 .035

|

TABLE 2 Count of Stocks in Key Directories

20190329

-------------------------------

NEWHIGHS 149 Bullish

NEWLOWS 2

MAXCP 27

MINCP 15

TTTNH 18

TTTNL 28

FASTUP 47

FASTDOWN 66

CPCROSSA 62

CPCROSSD 125

BIGVOLUP 5

BIGVODN 7

ACCUMVER 8

HIGHIP21 9

HIUPPCT 8

VHIP21 33

LOWACCUM 185

REDSELL 45

AUGSELS7 32

TRAPDOOR 16

|

Table 3 QUICKSILVER on ETFS - 3/29/19

ETF CLOSE CHANGE PIVOT-PT 5-dmaAROC CL-PWR CANDLE IP21 ITRS

---------------------------------------------------------------------------------------------

DIA 259.13 2.05 255.07 81.5% Bearish BLUE .119 -----

---------------------------------------------------------------------------------------------

BA 381.42 6.98 370.46 259.9% ------- BLUE .118 .012

---------------------------------------------------------------------------------------------

SPY 282.48 1.77 279.04 57.7% Bearish BLUE .058 .011

---------------------------------------------------------------------------------------------

QQQ 179.66 1.35 178.22 30.8% ------- ---- .092 .035

---------------------------------------------------------------------------------------------

MDY 345.4 1.3 338.14 118.4% Bearish RED -.012 -.003

---------------------------------------------------------------------------------------------

IWM 153.09 .47 150.28 114.8% Bearish RED -.103 -.012

---------------------------------------------------------------------------------------------

FAS 61.86 .51 58.64 230.4% Bearish RED -.007 .088

---------------------------------------------------------------------------------------------

RETL 29.67 .17 27.69 516.4% Bearish ---- -.326 -.008

---------------------------------------------------------------------------------------------

SOXL 137.54 6.05 134.16 -71.8% Bearish BLUE -.033 .488

---------------------------------------------------------------------------------------------

TECL 138.63 3.74 133.46 135.3% ------- BLUE .097 .444

^^^^^^^^^^^

---------------------------------------------------------------------------------------------

IBB 111.8 2.34 108.32 166.5% Bearish BLUE .062 -.042

---------------------------------------------------------------------------------------------

GLD 122.01 .11 124.92 -79.2% Bearish RED -.016 -.074

---------------------------------------------------------------------------------------------

RSX 20.6 -.22 21.2 -71.5% Bearish RED .033 -.053

|

====================================================================

3/28/2019 Volume is low, but the DJI's Hourly

OBV is showing the type of

bullish improvement that brings a short-term rally. Also bullish, heavily weighted

Boeing has done very well holding up, despite the continuing negative fallout of the

two crashes of its MAX Jet airlines. I particularly find encouragement in the NYSE

A/D Line's 12-month new high today. Hold DIA, SPY and QQQ.

Hourly DJIA

DJIA

Significant tops seldom occur in the Spring when the ADL is so strong

unless Peerless gives a Sell Signal. Notice, too, how the Advance-Decline for the

DJI-30, SP-500 and Nasdaq-100 are all in strong uprends.

ADL for DJI-30 is rising.

ADL for SP-500 is rising.

ADL for QQQ is rising.

Falling 10-Yr Rates

It remains amazing to me that the Interest Rate on 10-Year Bonds remains in such

a steep downtrend and is below 3%. There are no cases from 1965 to 2008 of the

10-year

Bond dropping below 2.8%. See for yourself. Here are the 10-year rates

going back to 1970.

https://fred.stlouisfed.org/series/IRLTLT01USM156N

Cases where 10-Yr Rates fell below 2.8%

2008-11-01,3.53

2008-12-01,2.42 One month DJI rally

2009-01-01,2.52 Bear Market bottom made a month later,

2010-07-01,3.01

2010-08-01,2.7 Decline to lower band

2010-09-01,2.65 Strong advance follows

2011-07-01,3

2011-08-01,2.3 Steep decline

2011-09-01,1.98 Basing until Oct 4

2014-01-01,2.86

2014-02-01,2.71 Decline until Feb 3

2014-03-01,2.72 Strong rally

2018-12-01,2.83

2019-01-01,2.71 Strong advance

2019-02-01,2.68 Advance

The US Dollar ( UUP ) is also still in a strong uptrend. One would think that this will give

the FED

plenty of room to short-term rates if it wanted to help push up stocks to new highs.

Charts 3/28/2019

2018 PEERLESS DJI, Signals,

Indicators Daily DJI Volume 10-DayUp/Down Vol

Hourly DJIA A/D Line for All Stocks

Inverted Traders Index

NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30

DIA SPY QQQ MDY IWM TNA

Short-Term Rates

USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL RSX RETL

SDS AGQ SLV SOXL TECL TLT TMF TNA UGA (gasoline) XIV YINN

Commodities: CANE

CORN DBC JJC, NIB, CHOC CORN, CUT (paper)

MOO, SOYB WEAT UUP (Dollar) LIT

(Lithium)

AAPL ADBE ALXN AMAT AMGN AMD AMZN BA BABA BAC BIDU CAT CVX DE

FB GOOG GS HD IBM INTU JPM M (Macy's) MSFT NFLX NVDA QCOM TSLA TXN

XOM WMT CMG , LRCX, SWKS, MDGL

SPPI WATT SQ TOWN

3/28/19 (Click

on Underlined link.)

Bullish MAXCPs - http://tigersoft.com/MAXCPS/Mar-28/BULLISH.htm

Bearish MAXCPs - http://tigersoft.com/MINCPs/Mar-28/BEARISH.htm

|

Table 1 QUICKSILVER on ETFS - 3/28/19

ETF CLOSE CHANGE PIVOT-PT 5-dmaAROC CL-PWR CANDLE IP21 ITRS

---------------------------------------------------------------------------------------------

DIA 257.08 .97 254.96 -48.7% Bearish BLUE .062 ----

---------------------------------------------------------------------------------------------

BA 374.44 .23 362.17 23.5% Bullish RED .102 -.005

---------------------------------------------------------------------------------------------

SPY 280.71 1.06 279.25 -71.6% Bearish BLUE .015 .01

---------------------------------------------------------------------------------------------

QQQ 178.31 .41 178.56 -118.8% ------- RED .057 .03

---------------------------------------------------------------------------------------------

MDY 344.1 2.86 337.34 -48.7% ------- BLUE -.028 .004

---------------------------------------------------------------------------------------------

IWM 152.62 1.35 149.62 -87.4% Bearish BLUE -.119 -.004

---------------------------------------------------------------------------------------------

FAS 61.35 1.47 59.1 -155.9% Bearish BLUE -.024 .137

---------------------------------------------------------------------------------------------

RETL 29.5 .34 26.75 85.2% Bearish RED -.32 -.004

---------------------------------------------------------------------------------------------

SOXL 131.49 -.69 139.48 -752.3% Bearish RED -.046 .386

---------------------------------------------------------------------------------------------

TECL 134.89 1.47 134.99 -393% ------- BLUE .062 .409

---------------------------------------------------------------------------------------------

IBB 109.46 .66 108.17 -114.6% Bearish BLUE .029 -.066

---------------------------------------------------------------------------------------------

GLD 121.9 -1.75 123.97 -71.7% Bearish RED -.021 -.068

---------------------------------------------------------------------------------------------

OIH 17.26 .27 16.95 -142.9% ------- BLUE-.024 -.02

---------------------------------------------------------------------------------------------

RSX 20.82 .01 20.9 -154% Bearish BLUE .036 -.03

|

Table 2 Count of Stocks in Key Directories

2019 03 28

-------------------------------

NEWHIGHS 139 Bullish

NEWLOWS 9

MAXCP 24

MINCP 21

TTTNH 17

TTTNL 28

FASTUP 27

FASTDOWN 145

CPCROSSA 79

CPCROSSD 54

BIGVOLUP 1

BIGVODN 8

ACCUMVER 5

HIGHIP21 7

HIUPPCT 8

VHIP21 33

LOWACCUM 163

REDSELL 40

AUGSELS7 17

TRAPDOOR 16

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

3/28/19

Bullish = 36

Bearish = 9

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BONDFUND .99 .99 .99 .99 .99 .99

DJI-13 .846 .692 .846 .692 .692 .846

UTILITY .825 .825 .875 .85 .825 .9

HOMEBLDG .823 .823 .764 .764 .705 .823

SOLAR .823 .764 .705 .823 .823 .823

NIFTY .807 .789 .842 .807 .824 .877

REIT .798 .798 .825 .751 .738 .845

ETFS .775 .758 .81 .793 .775 .982

DOWJONES .766 .666 .766 .666 .666 .833

INSURANC .766 .766 .766 .7 .666 .766

OILGAS .76 .739 .767 .69 .739 .873

SP-100 .752 .666 .752 .645 .666 .86

SP500 .74 .718 .748 .71 .71 .834

FIDSTKS .735 .697 .751 .691 .713 .848

INDEXES .731 .736 .752 .741 .731 .795

SEMI .715 .706 .775 .793 .801 .844

NASD-100 .707 .727 .787 .757 .777 .848

RUS-1000 .701 .677 .7 .66 .665 .785

GREEN .695 .695 .695 .695 .695 .695

CHINA .694 .661 .644 .711 .694 .779

HACKERS .681 .681 .772 .772 .727 .818

EDU .666 .666 .666 .5 .666 .666

SOFTWARE .666 .666 .714 .714 .714 .777

TRANSP .65 .65 .6 .55 .6 .7

ELECTRON .648 .641 .703 .703 .728 .79

BIOTECH .645 .619 .669 .658 .658 .767

RETAIL .641 .641 .603 .509 .433 .603

COMPUTER .636 .636 .681 .636 .681 .681

BIG17 .63 .586 .652 .608 .63 .739

BEVERAGE .611 .611 .611 .611 .611 .666

MILITARY .58 .483 .548 .516 .548 .709

CHEM .574 .555 .574 .611 .629 .722

BIGBANKS .571 0 .571 0 .285 .857

INDMATER .544 .556 .569 .544 .556 .797

INFRA .527 .472 .527 .472 .416 .833

AUTO .512 .461 .435 .384 .358 .589

==========================================================================================

JETS .5 .5 .3 .3 .4 .5

=========================================================================================

GOLD .47 .705 .725 .764 .745 .725

GUNS .47 .47 .529 .47 .411 .588

COMODITY .439 .512 .56 .585 .56 .585

FOOD .436 .509 .545 .545 .545 .545

FINANCE .431 .329 .431 .363 .329 .568

COAL .428 .428 .428 .428 .428 .428

GAMING .333 .333 .333 .333 .333 .416

HOSPITAL .291 .291 .333 .416 .5 .541

REGBANKS .214 .178 .214 .035 .035 .285

|

=======================================================================

3/27/2019 The DJI's Head/Shoulders has NOT

been completed. So, trust our

Buy signals. The Closing Powers for DIA and QQQ continue to rise. The

all-important A/D Line is still rising. When the fall-out from Brexit is over,

I expect the rush into 10-year Bonds will subside along with all the discussion

about inversions of long and short-term yields. From my research, so long as

short-term

rates stay below 4%, corrections will likely be buying opportunities. All the past

cases of "Inversions" involved te Federal Fund Rates being well above 5% and

rising.

I suspect all the scare-talk about these rates now just serves the needs of JP Morgan and

Friends. But I could be wrong. We do not want to

see a lot of potential head/shoulders,

like Steel's, the DJI's and AAPL's bring breaks below their necklines. Watch

them and the Big Banks' stocks especially.

Stay mostly long. Our PEERLESS B4 and B18-B15 are fighting the very rapid fall of

the rates on the 10-year Bond and the failure of the Fed to lower short-term

rates.

When the 10-year rates drop below the 3-month rates, like now, we have what

is called an "Inversion" of rates. The track-record of this is said

to be bearish.

A lot of publicity is being given this pattern's bearish track record by big banks

like JP Morgan. But they may want to help their bond sales more than their

stock customers. See below link to the standard case for selling stocks now

because of the "Inversion Curve".

https://seekingalpha.com/article/4251080-inverted-yield-curve-important

Here is half of the Problem - the rush into Government 10-yr Bonds.

The other half is that the FED should, but is not, lowering its Federal

Funds Rate.

Hooey!

applesauce

[slang], balderdash, baloney

(also boloney), beans, bilge, blah

(also blah-blah),

blarney, blather, blatherskite, blither, bosh, bull

[slang], bunk,

bunkum (or buncombe),

claptrap, codswallop

[British], crapola [slang], crock, drivel, drool, fiddle, fiddle-faddle,

fiddlesticks, flannel

[British], flapdoodle, folderol

(also falderal), folly, foolishness, fudge,

garbage, guff, hogwash, hokeypokey, hokum, hoodoo, horsefeathers

[slang], humbug,

humbuggery, jazz, malarkey

(also malarky), moonshine, muck, nerts

[slang], nonsense,

nuts,

piffle,

poppycock, punk, rot, rubbish, senselessness, silliness, slush, stupidity, taradiddle

(or tarradiddle), tommyrot, tosh, trash, trumpery, twaddle

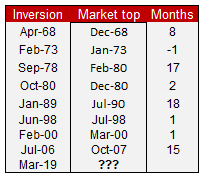

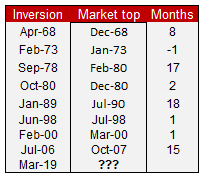

But is the "INVERSION CURVE" reliable and should

it be applied now? I don't think so.

I did some new research on these past inversions. See the table below. In the first

place, the

maximum paper loss from using the inversions on the first of the month after they occur

is whopping 12.7% if one had sold short the DJI. This is way too much for us.

Peerless can

do much better.

Secondly, in each of the previous Inversion cases the Federal Funds Rate was at least

5.05%

and rising. The Federal Funds Rate now is now 2.378% and falling.

Thirdly, none of these "Inversions" since 1968 took place in the year before a

Presidential

Election. This matters because most often the incumbent Party in the White House

pulls out

all the stops to boost the economy and the stockmarket before the Election. The Fed

is also

particularly dovish, too, when that Party happens to be the Republican Party. And

usually,

the party out of power goes to great lengths to boost the economy, too. It wants

some of the

credit for a strong economy.

Fourth, I would suggest that it is Brexit's uncertainty that is the biggest reason that

10-year bonds are being so eagerly bought now and their rates have fallen so fast.

It is not that wealthy folks fear a recession next year. If that were true, I think

that the

market would already be in a big free-fall for fear that the Democrats would win back

the White House and, perhaps, the Senate in 2020. And then re-establish higher

corporate taxes and a lot more government regulations. Take a look at the similar

comments here:

https://www.cnbc.com/2019/03/26/el-erian-no-way-the-us-will-have-a-recession-this-year-or-in-2020.html

| Inversion DJIA |

10-year

Rate |

Fed.

Funds

Rate |

Market

Top |

Months |

%Decline |

Paper

Loss |

Peerless |

| Apr 1 1968 861 |

5.64 |

5.76+.72 |

Dec-68 |

8 |

861-637 |

861-983

-14.2% |

Buy B17 |

Feb 1 1973

986 |

6.64 |

6.58+.64 |

Jan-73 |

-1 |

986-578 |

zero |

4 S9s at

Jan.top |

Sept 1 1978

879 |

8.42 |

8.45+.41 |

Sept-78 |

1 |

879-785 |

879-908

-3.3% |

S9 at top |

Oc 1 1980

939 |

11.75 |

12.81+1.94 |

Apr-81 |

7 |

939-777 |

939-1024

-8.3% |

S15 at

top |

Jan 1 1989

2169 |

9.09 |

9.12 +.36 |

Jul-90 |

18 |

2169-2365

LOSS |

2169-3000

-38.3% |

S9 at top |

Jun 1 1998

8922 |

5.50 |

5.56 +.07 |

Jul-98 |

1 |

8922-7539 |

8922-9338

-4.7% |

S12 just

before top. |

Feb 1 2000

11041 |

6.52 |

5.73 +.28 |

Jan-00 |

-.5 |

11041-7286 |

11041-11723

-6.2% |

S9 at top |

July 1 2006

11191 |

5.09 |

5.24 +.25 |

Oct-07 |

15 |

11191-6547 |

11192-14165

-26.6% |

S4 at top |

https://fred.stlouisfed.org/series/IRLTLT01USM156N

https://fred.stlouisfed.org/series/FEDFUNDS

Charts 3/27/2019

2018 PEERLESS DJI, Signals,

Indicators Daily DJI Volume 10-DayUp/Down Vol

Hourly DJIA A/D Line for All Stocks

Inverted Traders Index

NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30

DIA SPY QQQ MDY IWM TNA

Short-Term Rates

USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL RSX RETL

SDS AGQ SLV SOXL TECL TLT TMF TNA UGA (gasoline) XIV YINN

Commodities: CANE

CORN DBC JJC, NIB, CHOC CORN, CUT (paper)

MOO, SOYB WEAT UUP (Dollar) LIT

(Lithium)

AAPL ADBE ALXN AMAT AMGN AMD AMZN BA BABA BAC BIDU CAT CVX DE

FB GOOG GS HD IBM INTU JPM M (Macy's) MSFT NFLX NVDA QCOM TSLA TXN

XOM WMT CMG , LRCX, SWKS, MDGL

SPPI WATT SQ TOWN

3/27/19 (Click

on Underlined link.)

Bullish MAXCPs - http://tigersoft.com/MAXCPS/Mar-27/BULLISH.htm

Bearish MAXCPs - http://tigersoft.com/MINCPs/Mar-27/BEARISH.htm

|

Table 1 QUICKSILVER on ETFS - 3/27/19

ETF CLOSE CHANGE PIVOT-PT 5-dmaAROC CL-PWR CANDLE IP21 ITRS

---------------------------------------------------------------------------------------------

DIA 256.11 -.35 259.58 -23% Bearish RED .051 ------

---------------------------------------------------------------------------------------------

BA 374.21 3.83 372.7 -26.3% Bullish BLUE .117 -.004

---------------------------------------------------------------------------------------------

SPY 279.65 -1.47 284.73 -33.8% ------- RED .018 .015

---------------------------------------------------------------------------------------------

QQQ 177.9 -1.15 182.57 -51.8% Bullish RED .073 .045

---------------------------------------------------------------------------------------------

MDY 341.24 -.24 347.42 -21.5% ------- RED -.041 -.002

---------------------------------------------------------------------------------------------

IWM 151.27 -.59 155.27 -65.4% ------- RED -.116 -.008

---------------------------------------------------------------------------------------------

FAS 59.88 -.65 63.23 -202.4% Bearish RED -.053 .134

---------------------------------------------------------------------------------------------

RETL 29.16 .89 29.02 158.9% Bearish BLUE-.275 -.009

---------------------------------------------------------------------------------------------

SOXL 132.18 -6.06 152.45 -211.8% ------- RED -.024 .4

---------------------------------------------------------------------------------------------

TECL 133.42 -2.21 145.63 -65.7% Bullish RED .079 .453

---------------------------------------------------------------------------------------------

IBB 108.8 -1.53 111.97 -198.4% ------- RED .038 -.057

---------------------------------------------------------------------------------------------

GLD 123.65 -.65 123.68 -21.3% Bearish RED -.007 -.059

---------------------------------------------------------------------------------------------

OIH 16.99 -.14 17.75 -219.7% ------- RED -.076 -.033

---------------------------------------------------------------------------------------------

RSX 20.81 -.31 21.47 -141.4% Bearish RED .031 -.027

|

Table 2 Count of Stocks in Key Directories

2019-03-27

-------------------------------

NEWHIGHS 139 Bullish

NEWLOWS 15

MAXCP 21

MINCP 16

TTTNH 20

TTTNL 44

FASTUP 29

FASTDOWN 132

CPCROSSA 41

CPCROSSD 146

BIGVOLUP 1

BIGVODN 11

ACCUMVER 4

HIGHIP21 11

HIUPPCT 8

VHIP21 31

LOWACCUM 165

REDSELL 39

AUGSELS7 16

TRAPDOOR 19

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

3/27/19

Bullish = 35

Bearish - 10

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BONDFUND .99 .99 .99 .99 .99 .99

UTILITY .825 .875 .85 .825 .9 .9

HOMEBLDG .823 .764 .764 .705 .823 .705

REIT .798 .825 .751 .738 .852 .765

NIFTY .789 .842 .807 .824 .877 .894

INSURANC .766 .766 .7 .666 .766 .7

SOLAR .764 .705 .823 .823 .823 .882

ETFS .758 .81 .793 .775 .982 .965

INDEXES .74 .756 .745 .735 .8 .794

OILGAS .739 .767 .69 .739 .859 .845

NASD-100 .727 .787 .757 .777 .848 .828

SP500 .718 .748 .71 .71 .832 .81

SEMI .706 .775 .793 .801 .844 .836

GOLD .705 .725 .764 .745 .725 .764

FIDSTKS .697 .751 .691 .713 .843 .854

GREEN .695 .695 .695 .695 .695 .782

DJI-13 .692 .846 .692 .692 .846 .923

HACKERS .681 .772 .772 .727 .818 .818

RUS-1000 .677 .7 .658 .666 .784 .754

DOWJONES .666 .766 .666 .666 .833 .833

EDU .666 .666 .5 .666 .666 .666

SOFTWARE .666 .714 .714 .714 .777 .761

SP-100 .666 .752 .645 .666 .849 .86

CHINA .661 .644 .711 .694 .779 .762

TRANSP .65 .6 .55 .6 .7 .65

ELECTRON .641 .703 .703 .728 .79 .796

RETAIL .641 .603 .509 .433 .603 .584

COMPUTER .636 .681 .636 .681 .681 .681

BIOTECH .616 .669 .658 .658 .764 .748

BEVERAGE .611 .611 .611 .611 .666 .611

BIG17 .586 .652 .608 .63 .739 .739

INDMATER .556 .569 .544 .556 .797 .759

CHEM .555 .574 .611 .629 .74 .703

FOOD .517 .553 .553 .553 .553 .607

COMODITY .512 .56 .585 .56 .585 .634

===========================================================================================

JETS .5 .3 .3 .4 .5 .5

===========================================================================================

MILITARY .483 .548 .516 .548 .709 .709

INFRA .472 .527 .472 .416 .833 .75

GUNS .47 .529 .47 .411 .647 .588

AUTO .461 .435 .384 .358 .589 .461

COAL .428 .428 .428 .428 .428 .428

FINANCE .333 .433 .377 .344 .588 .711

GAMING .333 .333 .333 .333 .416 .416

HOSPITAL .291 .333 .416 .5 .541 .5

REGBANKS .178 .214 .035 .035 .321 .357

BIGBANKS 0 .571 0 .285 .857 .857

|

========================================================================

3/26/2019 The PEERLESS B4,

B18-B15 combination should take the DJI

higher. Probably to 27000 by the Summer. But

we will need to see the DJI close

back above its 21-dma soon or else the (green) neckline near 25000 will

have to be tested. A close below the neckline at 25000 would have to be treated

as a Sell S10. It would also show us

that something unexpected and bearish is

troubling the market. Below I ask the question: Why is the Justice Department

switching tracks now so quickly to Obama Care when Trump is in a position to

do more victory laps about the Democrat's failure to prove any "Russia-Gate"?

Is it Brexit and overseas' selling that is causing the DJI now to be down 70? Is

it that passengers don't want to fly the Boeing MAX 747? That shouldn't be

a surprise. Is the vast amount of Debt suddenly a problem now because the inverted

yield curve is causing loans to be called in from fear of a recession?

Or perhaps this will prove a better time to buy. After all. the all-important A/D

Line is

confirming the advance at a rate that matches the bullish parallel case of a March

B18-B15 in 1975. Keep in mind that any DJI

move above the right shoulder apex

at 26300 should motivate the shorts to rush to cover and then we will likely see 27000

in May. But any break below 25000 would

complete a DJI head and shoulders

pattern and have to be used by us to sell and sell short.

Typically the DJI rallies nicely

after March 26th in the 3rd Year

of the Presidential Cycle. See the

data from 1965 - 2018 in our software.

Avg DJI Gain Pct of time DJI Rallies

10 days 1.6%

75%

21days 2.1%

75%

42 days 4.2%

75%

65 days 6.0%

81.3%

While it is true that the DJI and the other indexes could not hold their big early gains

today.

Still, there were nearly 1400 more up than down and the big bank stocks did not fall

further.

The Closing Powers for DIA, SPY and QQQ are still in uptrends. The leading tech stocks

did very well today, thus showing that speculative energies are still very much alive.

See the

QQQ and TECH charts via our links. I especially like the rising trend of our Index

of the "NIFTY" high volume tech stocks, whose chart is shown below.

NIFTY's Niftiest C:\nifty Days back= 62 Top 25 Pct. Gainers since Rally Started.

12 / 24 / 2018 - 3 / 26 / 2019

Rank Symbol Name Price Pct.Gain AI/200

--------- ----------------------------------- ---------- ------------ ---------

1 PAYC Paycom Software Inc 185.71 66% 133

2 ANET Arista Networks Inc 309.8 64% 70

3 XLNX Xilinx Inc 126.63 59% 166

4 AMD Advanced Micro Devices 25.69 54% 137

5 NFLX Netflix Inc 359.97 53% 105

6 RNG RingCentral` Inc. 108.19 53% 137

7 KLAC Kla-Tencor Corp 120.04 47% 111

8 LRCX Lam Research Corp 180.05 46% 64

9 COHR Coherent Inc 136.56 44% 128

10 CREE Cree Incorporated 55.82 44% 137

11 PANW Palo Alto Networks` Inc. 244.2 43% 89

12 ALGN Align Tech Inc 274.27 41% 170

13 SNPS Synopsys Inc 112.4 41% 152

14 INTU Intuit Inc 255.99 40% 161

15 NVDA NVIDIA Corporation 176.87 39% 94

16 MU Micron Technology Inc 40.32 38% 86

17 AMAT Applied Materials Inc 39.63 36% 80

18 ALRM Alarm.com Holdings Inc 62.72 35% 138

19 BABA Alibaba Group Holding Ltd 178.08 35% 100

20 FB Facebook Inc 167.68 35% 89

21 ADI Analog Devices Inc 107.1 33% 135

22 AMZN Amazon-Com Inc 1783.76 32% 122

23 CSCO Cisco Systems Inc 53.23 32% 131

24 ADSK Autodesk Inc 155.91 31% 116

25 CRM Salesforce.com Inc 159.4 31% 149

|

Giving The Democrats Something To Campaign

On:

Why? What's The Problem?

I

Small intra-day pullbacks, like today's are fairly common when the market must eat up

over-head supplies of stock. There does seem to be quite a bit of resistance up to

26000,

but I would trust the bullish seasonality of Spring and the politics of the year before

the Presidential

Election Year along with interest rates that are well below the 4% danger-level. But, as

always, we should be watchful of the market it when it fails to achive our expections.

Trump's Justice Department now wants to throw out all of Obamacare. Health care for all

would

seem to a very strong card for the Democrats. I always thought that Social Security

and

Medicare were the "third rail" of politcs. In other words, he who

threatens to take away these

benefits from seniors and near-seniors could be politically electrocuted.

Just why would Trump give the Democrats a new issue to run with? Why not relax a

little

and let the Democrats squirm a little longer on their failure to prove a link between the

President and the Russian Government in the 2016 Election? That coupled with a

strong

economy could be all he needs in 2020.

It's odd, I've been thinking all day about this. Do they not want to win

because they know

a market Crash is coming? Ideological purity? An out of control Justice

Department?

I don't know. The New York Times raised the very same question tonight. Does

it

mean that the Federal Budget's deficit is ballooning so much that soon we will see more

and

more efforts to cut popular Federal Government spending, possibly in ways that could

back-fire

on Republicans just when they should be able to get lots of credit for a strong economy

and

stock market? Perhaps, this will prevent the usual Spring Rally in this the third

year of the

four-year cycle. Since Insiders will probably

know first, we must watch the Professionals through

our Closing Power and we should probably consider any decline much below the lower band

in the next few weeks to be a bad sign, a sign that the normally bullish Spring

seasonality

is being challenged by something abnormal, bearish and unexpected. .

https://www.nytimes.com/2019/03/26/us/politics/democrats-trump-affordable-care-act.html

Charts 3/25/2019

2018 PEERLESS DJI, Signals,

Indicators Daily DJI Volume 10-DayUp/Down Vol

Hourly DJIA A/D Line for All Stocks

Inverted Traders Index

NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30

DIA SPY QQQ MDY IWM TNA

Short-Term Rates

USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL RSX RETL

SDS AGQ SLV SOXL TECL TLT TMF TNA UGA (gasoline) XIV YINN

Commodities: CANE

CORN DBC JJC, NIB, CHOC CORN, CUT (paper)

MOO, SOYB WEAT UUP (Dollar) LIT

(Lithium)

AAPL ADBE ALXN AMAT AMGN AMD AMZN BA BABA BAC BIDU CAT CVX DE

FB GOOG GS HD IBM INTU JPM M (Macy's) MSFT NFLX NVDA QCOM TSLA TXN

XOM WMT CMG , LRCX, SWKS, MDGL

SPPI WATT SQ TOWN

3/26/19 (Click

on Underlined link.)

Bullish MAXCPs - http://tigersoft.com/MAXCPS/Mar-26/BULLISH.htm

Bearish MAXCPs - http://tigersoft.com/MINCPs/Mar-26/BEARISH.htm

|

Table 1 QUICKSILVER on ETFS - 3/26/19

ETF CLOSE CHANGE PIVOT-PT 5-dmaAROC CL-PWR CANDLE IP21 ITRS

---------------------------------------------------------------------------------------------

DIA 256.46 1.39 257.29 -47.1% Bearish RED .043 ----

---------------------------------------------------------------------------------------------

BA 370.38 -.08 376.16 -41.1% ------- RED .099 -.02

---------------------------------------------------------------------------------------------

SPY 281.12 2.08 281.55 -22.7% ------- BLUE .009 .016

---------------------------------------------------------------------------------------------

QQQ 179.05 .83 179.76 0% Bullish RED .09 .045

---------------------------------------------------------------------------------------------

MDY 341.48 3.34 342.71 -60.2% ------- BLUE -.116 -.005

---------------------------------------------------------------------------------------------

IWM 151.86 1.58 153.26 -101.5% ------- BLUE -.162 -.012

---------------------------------------------------------------------------------------------

FAS 60.53 1.89 62.34 -364.9% Bearish BLUE -.052 .16

---------------------------------------------------------------------------------------------

RETL 28.27 .58 28.27 -124.4% Bearish ---- -.276 -.063

---------------------------------------------------------------------------------------------

SOXL 138.24 4.08 138.13 -139.4% ------- RED -.01 .397

---------------------------------------------------------------------------------------------

TECL 135.63 2.17 135.22 -35.4% Bullish RED .094 .439

---------------------------------------------------------------------------------------------

IBB 110.33 2.01 113.18 -158.4% ------- BLUE .045 -.057

---------------------------------------------------------------------------------------------

GLD 124.3 -.62 124.18 37.1% ------- RED .05 -.049

---------------------------------------------------------------------------------------------

OIH 17.13 .22 17.75 -92.2% ------- ---- -.094 -.023

---------------------------------------------------------------------------------------------

GASL 7.73 .36 8.14 129.2% ------- --- - .008 -.074

---------------------------------------------------------------------------------------------

RSX 21.12 -.08 21.41 -25.9% ------- RED .077 -.016

|

Table 2 Count of Stocks in Key Directories

2019-03-26

-------------------------------

NEWHIGHS 199 Bullish

NEWLOWS 11

MAXCP 49

MINCP 23

TTTNH 32

TTTNL 34

FASTUP 34

FASTDOWN 130

CPCROSSA 61

CPCROSSD 55

BIGVOLUP 7

BIGVODN 7

ACCUMVER 8

HIGHIP21 9

HIUPPCT 12

VHIP21 33

LOWACCUM 165

REDSELL 40

AUGSELS7 16

TRAPDOOR 18

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

3/26/19

Bullish =39

Bearish = 7

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BONDFUND .99 .99 .99 .99 .99 .98

UTILITY .875 .85 .825 .9 .9 .925

DJI-13 .846 .692 .692 .846 .923 .923

NIFTY .842 .807 .824 .877 .894 .877

REIT .825 .751 .738 .852 .765 .758

ETFS .81 .793 .775 .982 .965 .982

NASD-100 .787 .757 .777 .848 .818 .858

SEMI .775 .793 .801 .844 .836 .853

HACKERS .772 .772 .727 .818 .818 .818

DOWJONES .766 .666 .666 .833 .833 .866

INSURANC .766 .7 .666 .766 .7 .8

HOMEBLDG .764 .764 .705 .823 .705 .764

OILGAS .762 .685 .734 .853 .832 .783

INDEXES .758 .741 .731 .795 .79 .811

SP-100 .752 .645 .666 .849 .838 .881

FIDSTKS .751 .691 .713 .843 .843 .875

SP500 .748 .71 .71 .832 .806 .855

GOLD .725 .764 .745 .725 .764 .666

SOFTWARE .714 .714 .714 .777 .761 .809

SOLAR .705 .823 .823 .823 .882 .941

ELECTRON .703 .703 .728 .79 .796 .802

RUS-1000 .7 .658 .665 .785 .753 .803

GREEN .695 .695 .695 .695 .782 .826

COMPUTER .681 .636 .681 .681 .681 .681

BIOTECH .666 .658 .658 .764 .743 .759

EDU .666 .5 .666 .666 .666 .666

BIG17 .652 .608 .63 .739 .739 .76

CHINA .644 .711 .694 .779 .762 .796

BEVERAGE .611 .611 .611 .666 .611 .666

RETAIL .603 .509 .433 .603 .584 .716

TRANSP .6 .55 .6 .7 .65 .7

CHEM .574 .611 .629 .74 .722 .722

BIGBANKS .571 0 .285 .857 .857 1

INDMATER .569 .544 .556 .797 .759 .759

COMODITY .56 .585 .56 .585 .634 .609

FOOD .553 .553 .553 .553 .607 .571

MILITARY .548 .516 .548 .709 .709 .709

GUNS .529 .47 .411 .647 .588 .588

INFRA .527 .472 .416 .833 .75 .805

==============================================================================================

AUTO .435 .384 .358 .589 .461 .564

FINANCE .433 .366 .344 .588 .722 .877

COAL .428 .428 .428 .428 .428 .428

GAMING .333 .333 .333 .416 .416 .416

HOSPITAL .333 .416 .5 .541 .5 .5

JETS .3 .3 .4 .5 .5 .5

REGBANKS .214 .035 .035 .321 .357 .857

|

========================================================================

3/25/2019 We should be

buyers of DIA, SPY and QQQ again. Seasonality is

short-term now very bullish. The Closing Powers for DIA, SPY and QQQ are still

rising.

I would rate Peerless as very bullish, especially when you look at how many ways the

charts of March 1975 and March March 2019 look alike. Peerless is still operating

under

a reliable and quite B4, B18-B15 combination. Usually when this Peerless

combination, the B18-B15 buy signals, is at work in March, the DJI is making 12 month

highs. But there are two exceptions, now and that of March 1975. The earlier

instance

turned out to have been an excellent place to Buy. We should not that now.

It's true that there was no interest rate "inversion" back then. Rates were

then simply coming

down from very high levels. It's also true that 1974 represented the end of a long

24-month

bear market. But the similarities between March 1975 and

March 2019 are striking, Both had

January take-offs. Both had B18-B15s as of March. Both showed potential

up-sloping Head and Shoulders that were never completed! And most important, both

benefitted from the same strongly bullish seasonality of occurring in the third year of

the four

year cycle. In addition, their OBV had already made 9-month new highs in March.

Compare the Peerless charts of March 1975 and March

2019 just below.

1975

2019

The Closing Powers for DIA, SPY and QQQ are still in

rising trends.

Let's see if Big Banks can turn up soon.

That could become quite bullish. As I've

said, short-term interest rates may fall to get

back below the 10-year rates. With Inflation

so low, I can't see the 10-year rates falling much

lower.

Charts 3/25/2019

2018 PEERLESS DJI, Signals,

Indicators Daily DJI Volume 10-DayUp/Down Vol

Hourly DJIA A/D Line for All Stocks

Inverted Traders Index

NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30

DIA SPY QQQ MDY IWM TNA

Short-Term Rates

USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL RSX RETL

SDS AGQ SLV SOXL TECL TLT TMF TNA UGA (gasoline) XIV YINN

Commodities: CANE

CORN DBC JJC, NIB, CHOC CORN, CUT (paper)

MOO, SOYB WEAT UUP (Dollar) LIT

(Lithium)

AAPL ADBE ALXN AMAT AMGN AMD AMZN BA BABA BAC BIDU CAT CVX DE

FB GOOG GS HD IBM INTU JPM M (Macy's) MSFT NFLX NVDA QCOM TSLA TXN

XOM WMT CMG , LRCX, SWKS, MDGL

SPPI WATT SQ TOWN

3/25/19 (Click

on Underlined link.)

Bullish MAXCPs - http://tigersoft.com/MAXCPS/Mar-25/BULLISH.htm

Bearish MAXCPs - http://tigersoft.com/MINCPs/Mar-25/BEARISH.htm

|

Table 1 QUICKSILVER on ETFS - 3/25/19

ETF CLOSE CHANGE PIVOT-PT 5-dmaAROC CL-PWR CANDLE IP21 ITRS

---------------------------------------------------------------------------------------------

DIA 255.07 .11 258.88 -76% Bearish BLUE .013 -----

---------------------------------------------------------------------------------------------

BA 370.46 8.29 373.43 -24.5% ------- BLUE .097 -.012

---------------------------------------------------------------------------------------------

SPY 279.04 -.21 282.4 -58.3% Bearish BLUE-.038 .015

---------------------------------------------------------------------------------------------

QQQ 178.22 -.34 179.05 -6.4% Bullish BLUE .067 .042

---------------------------------------------------------------------------------------------

MDY 338.14 .8 345.6 -134.1% Bearish BLUE-.148 -.008

---------------------------------------------------------------------------------------------

IWM 150.28 .66 154.96 -177.9% Bearish BLUE-.197 -.017