Earlier Hotlines

www.tigersoft.com/NHL718/INDEX.htm

www.tigersoft.com/21MAY18/INDEX.htm

www.tigersoft.com/55HEP/INDEX.htm

www.tigersoft.com/44H4L/INDEX2.htm

Earlier still: Go

here...

HELP

A Guide

To Profitably Using The Tiger Nightly HOTLINE

Introduction to Tiger/Peerless Buys and

Sells.

Peerless Buy and

Sell Signals: 1928-2016

Individual Peerless signals explained:

http://tigersoftware.com/PeerlessStudies/Signals-Res/index.htm

http://www.tigersoft.com/PeerInst-2012-2013/

Explanation of each Peerless signal. http://www.tigersoft.com/PeerInst-2012-2013/

Different Types of

TigerSoft/Peerless CHARTS, Signals and Indicators

-----> More HELP LINKS

Documentation for TigerSoft

Automatic and Optimized Signals.

How reliable support is the

DJI's rising 200-day ma?

SPY Charts since

1994: Advisory Closing Power S7s, Accum. Index, 65-dma, Optimized Signals.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

1/19/2016 ---> Corrections,Deeper

Declines and Bear Markets since 1945.

1/21/2016

---> High

Velocity Declines since 1929

2/12/2016 ---> Presidential

Elections Years and Bullish IP21 Positive Non-Confirmations at Lower Band.

2/12/2016 ---> OBV NNCs on DJI's Rally to

2.7% Upper Band when DJI's 65-dma is falling.

11/6/2016 --->

Killer Short Selling

Techniques: ===> Order Here ($42.50)

It's As Easy as 1,2,3

TigerSoft "Combination" Short-Selling... Easy as 1-2-3 Short Sales

Earlier Q-Answers

QuickSilver Documentation (1/11/2016)

Our Different

Signals

Better understand the difference between

Peerless DJI-based signals,

the one-year optimized red Signals and the fixed signals based

on technical developments.

Introduction to Tiger/Peerless Buys and Sells.

Different Types of

TigerSoft/Peerless CHARTS, Signals and Indicators

New TigerPeerless Installation and

Basic Uses' Instruction

See the re-written materials on TigerSoft Buys and Sells.

Study- Trading SPY

WITHOUT Peerless - Some Guidelines.

When completed this will be a new Tiger Trading E-Book.

Study- Examples of

"Hands above the Head" top patterns.

Study- 9/3/2017 TigerSoft (not

Peerless) charts of Major Tops as they occurred.

===> Please report any broken or out-of-date links. william_schmidt@hotmail.com

--->>> Order New E-Book: "New Tiger Tahiti

System's Stocks: 2000-2018", $50.00

> When to

start avoiding the long side altogether because of Peerless signals.

> When to

start buying Tahiti stocks after the start of a Bear Market.

> When to

avoid a weaker high AI/200 stock and use the second choice.

> When to exit

Tahiti stocks before the normal 21-month holding period is over.

> The special

benefits of working with major Tahiti tech stocks.

> Watch for Head/Shoulders tops with these stocks.

> Using the

90-day Stochastic to time the purchase of Safer Tahiti Stocks

> The Tahiti

Tech System's track record using these rules matches closely the 24%/year gain that

the

blue chip Tahiti system did between 1970 and 2000.

> Tiger Software 858-273-5900 PO Box 22784 San

Diego, CA 92192 Email william_schmidt@hotmail.com

====================================================================

====================================================================

8-23-2018 Volume remains low, but now our Accumulation Index (IP21) and

as

our V-I (Up minus Down Volume) in our Peerless

DJI

chart are both negative. In addition, the DISI-OBV Line on the

DJI is dangerously weak, almost making new lows ahead of price.

This adds a lot to the bearishness of the multiple Sell S9-V. Fortunately,

DIA's Closing Power is still up-trending and volatile stocks like AMD

and

NVDA are showing by their breakouts today that speculators are

still optimistic. And usually, when the NYSE A/D Line is able to make new

highs in August, the DJI does not top out until September or October.

It is these considerations which have caused me to recommend short sales

in

some of our fairly numerous Bearish MINCPs, rather than shorting DIA

right

now.

|

|

The price and internal weakness in the DJI-30 put

great pressure on

IWM, SPY and leading tech stocks to make new highs soon on their own.

If

they do not, the technical situation of the overall market will become

dangerous

and look even more like it did in mid 2011 just before a bad

sell-off.

Last night, I showed the 2011 DJI chart with its set of three S9-Vs, the last of

which took place with the NYSE ADL failing confirm.. Tonight look at the how

the failure by the NASDAQ, SPY, QQQ and IWM to breakout in July 2011

was quickly followed by the steep general market sell-off in August. See also

how in several instances, the Tiger Closing Power uptrends were each violated

following some CP non-confirmations of new price high. These added to our

certainty of a decline because it showed that Professionals had shifted decisively

from being bullish to bearish. I think we should use these insights to guide us

now.

4 Key Tops in 2011 - Each called by the 3rd S9V,

failures to make new highs, Closing Power non-confirmations

and then a breaking of steep CP uptrend just before

the big decline began.

Short-term, there is still a very good chance of a pre-Labor Day

rally.

To play it

long, I would look at our Bullish MAXCPs, IWM (providing it does not

fail its

recent breakout) and the most bullish of the "NIFTY" hightechs we use

in our

"TAHITI TECHs" system. Note that the highest Power Ranked is

not

usually the

same as the highest AI/200 ranked stock. The Power Ranker is more

short-term

term. It factors in relative strength as well as the current IP21 value

as much as

the long term positive consistency of our Accumulation. Index.

In any

case, cCompare the highest Power-Ranked with the lowest Power-Ranked

MINCP

stock. What a difference! Very often hedging works very well and both

sides are

profitable.

MOST BEARISH MINCP STOCK TODAY.

Charts 8/22/2018

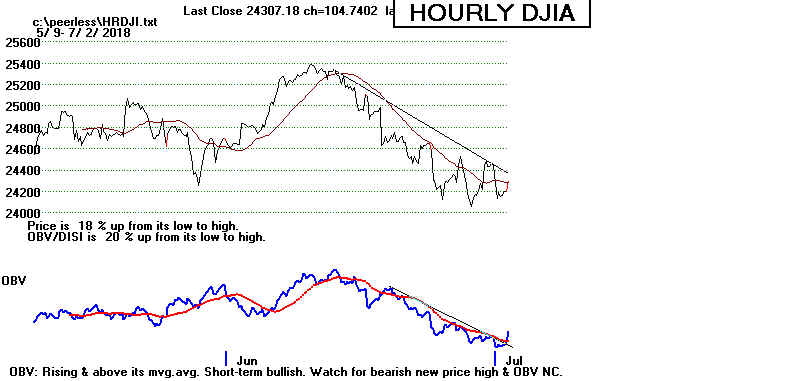

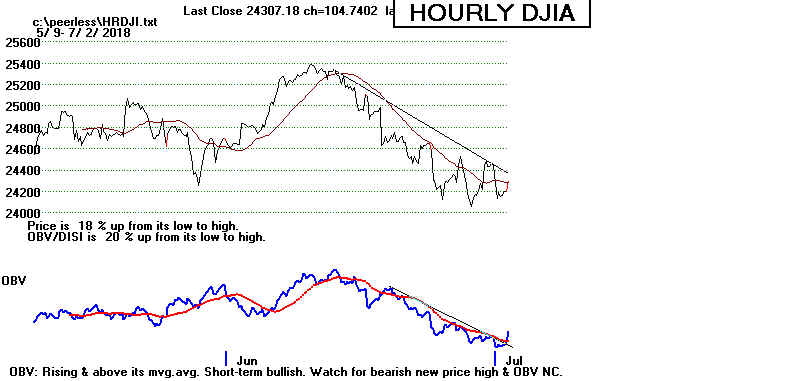

PEERLESS DJI, Signals,

Indicators Daily DJI Volume 10-DayUp/Down Vol

Hourly DJIA A/D Line for All

Stocks

NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30

DIA SPY QQQ MDY IWM TNA

Short-Term Rates

USO-CrudeOil FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL RSX RETL

SDS SLV SOXL TECL TMF TNA UGA (gasoline) XIV YINN

Commodities: CANE

JJC, NIB, CHOC CORN, CUT (paper) WEAT UUP (Dollar)

AAPL ADBE ALXN AMAT AMGN AMD AMZN BA BABA BAC BIDU CAT CVX DE

FB GOOG GS HD IBM INTU (new) JPM M (Macy's) MSFT NFLX NVDA QCOM TSLA TXN

XOM WMT ANDV (refinery), CMG (Chipotle), LRCX, SWKS, MDGL

SPPI WATT

SQ TOWN

8/23/2018 (Click on Underlined link.)

Bullish MAXCPs - http://tigersoft.com/MAXCPZ/823/BULLISH.htm

Bearish MAXCPs - http://tigersoft.com/MINCPZ/823/BEARISH.htm

|

| |

Table 1 QUICKSILVER on ETFS - 08/23/18

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS

---------------------------------------------------------------------------------------------

---------------------------------------------------------------------------------------------

DIA 256.49 -.69 256.51 10.7% Bullish RED .038 -----

---------------------------------------------------------------------------------------------

COMPQX 7878.46 -10.64 7816.33 45.9% ---- RED .037 .007

---------------------------------------------------------------------------------------------

SPY 285.79 -.38 285.06 30.3% Bullish RED .016 .011

---------------------------------------------------------------------------------------------

QQQ 180.8 -.26 179.86 27.2% ---- BLUE .025 .011

---------------------------------------------------------------------------------------------

MDY 369.2 -1.29 366.22 65.7% Bullish RED .041 0

---------------------------------------------------------------------------------------------

IWM 170.66 -.52 168.35 89.5% Bullish RED .039 .006

---------------------------------------------------------------------------------------------

FAS 72.53 -.68 72.74 40.4% Bullish RED -.104 .045

---------------------------------------------------------------------------------------------

RETL 51.92 .28 48.34 503.2% Bullish BLUE .014 .144

---------------------------------------------------------------------------------------------

SOXL 152.61 .52 142.06 247.1% Bullish BLUE .089 -.158

---------------------------------------------------------------------------------------------

TECL 155.7 .87 153.68 89.5% Bullish BLUE .038 .043

---------------------------------------------------------------------------------------------

IBB 117.32 -.68 116.29 45% Bullish RED -.009 .045

---------------------------------------------------------------------------------------------

GLD 112.2 -1.07 112.13 48.9% Bearish RED -.412 -.106

---------------------------------------------------------------------------------------------

OIL 7.61 .04 6.89 339.4% Bullish BLUE .263 .044

---------------------------------------------------------------------------------------------

OIH 24.93 -.18 24.02 229.5% Bearish ---- -.106 -.081

---------------------------------------------------------------------------------------------

GASL 21.41 -.44 19.44 544.4% Bearish RED -.079 -.092

---------------------------------------------------------------------------------------------

UGA 33.64 -.11 32.3 179.7% Bearish BLUE -.152 -.026

---------------------------------------------------------------------------------------------

UUP 25.32 .16 25.44 -49.3% ---- ---- .081 .009

---------------------------------------------------------------------------------------------

Table 2

Count of Stocks in Key Directories

20180823

-------------------------------

NEWHIGHS 212 Bullish

NEWLOWS 51

MAXCP 132 Bullish

MINCP 82

TTTNH 116

TTTNL 106

FASTUP 348 Swing Traders are quite bullish.

FASTDOWN 108

CPCROSSA 151

CPCROSSD 253

BIGVOLUP 2

BIGVODN 10

|

|

Table 3

Count of Stocks and New Highs in Key Tiger Directories

Date = 180822

No. NHs Pct

-------------------------------------------------------------------

MAXCP 147 100 68 %

REGBANKS 30 6 20 %

HACKERS 22 4 18 %

COMPUTER 23 4 17 %

NIFTY 58 10 17 %

SOFTWARE 65 11 17 %

RETAIL 53 8 15 %

INDEXES 189 25 13 %

HOSPITAL 26 3 12 %

CHEM 61 5 8 %

BIOTECH 407 28 7 %

FINANCE 90 6 7 %

GAMING 28 2 7 %

GREEN 28 2 7 %

NASD-100 89 6 7 %

PIPELINE 29 2 7 %

BIG17 48 3 6 %

ELECTRON 170 10 6 %

RUS-1000 815 42 5 %

SP-100 94 5 5 %

TRANSP 20 1 5 %

INDMATER 82 3 4 %

SEMI 123 5 4 %

SP500 476 19 4 %

DOWJONES 30 1 3 %

FIDSTKS 186 6 3 %

INSURANC 30 1 3 %

OILGAS 155 3 2 %

REIT 172 4 2 %

UTILITY 41 1 2 %Count of Stocks and New Highs in Key Tiger Directories

Date = 180823

-------------------------------------------------------------------

MAXCP 132 93 70 %

RETAIL 53 15 28 %

HACKERS 22 5 23 %

COMPUTER 23 4 17 %

SOFTWARE 65 11 17 %

NIFTY 58 7 12 %

NASD-100 89 8 9 %

BIOTECH 407 28 7 %

GAMING 28 2 7 %

HOMEBLDG 17 1 6 %

ELECTRON 169 8 5 %

FIDSTKS 186 10 5 %

RUS-1000 814 44 5 %

SP500 476 25 5 %

BIG17 46 2 4 %

SP-100 94 4 4 %

AUTO 40 1 3 %

FINANCE 90 3 3 %

REGBANKS 30 1 3 %

SEMI 122 4 3 %

CHEM 60 1 2 %

INDEXES 189 3 2 %

REIT 170 4 2 %

UTILITY 41 1 2 %

OILGAS 155 2 1 %

BEVERAGE 18 0 %

BIGBANKS 7 0 %

BONDFUND 111 0 %

CHINA 60 0 %

COAL 8 0 %

COMODITY 56 0 %

DJI-13 13 0 %

DOWJONES 30 0 %

EDU 6 0 %

ETFS 61 0 %

FIDELITY 1 0 %

FOOD 9 0 %

GOLD 50 0 %

GREEN 28 0 %

HOSPITAL 26 0 %

INDMATER 81 0 %

INFRA 36 0 %

INSURANC 30 0 %

JETS 10 0 %

MILITARY 37 0 %

PIPELINE 29 0 %

SOLAR 18 0 %

TRANSP 20 0 %

MINCP 82 0 %

|

Table 4 Count of Stocks and New Lows in Key Tiger Directories

Date = 180823

No NLs Pct

--------------------------------------------------------------------

MINCP 82 21 26 %

FOOD 9 2 22 %

GOLD 50 5 10 %

JETS 10 1 10 %

HOSPITAL 26 2 8 %

CHINA 60 4 7 %

SOLAR 18 1 6 %

UTILITY 41 2 5 %

BIOTECH 407 16 4 %

COMODITY 56 2 4 %

COMPUTER 23 1 4 %

GAMING 28 1 4 %

INDMATER 81 3 4 %

NASD-100 89 4 4 %

CHEM 60 2 3 %

ELECTRON 169 5 3 %

ETFS 61 2 3 %

INSURANC 30 1 3 %

MILITARY 37 1 3 %

PIPELINE 29 1 3 %

BIG17 46 1 2 %

BONDFUND 111 2 2 %

FIDSTKS 186 4 2 %

FINANCE 90 2 2 %

NIFTY 58 1 2 %

RETAIL 53 1 2 %

SEMI 122 3 2 %

SOFTWARE 65 1 2 %

OILGAS 155 1 1 %

RUS-1000 814 12 1 %

SP500 476 7 1 %

|

Table 5

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

8/23/18

Bullish = 29 Bearish = 17

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BIGBANKS .857 .857 .857 .857 .857 .714

INSURANC .833 .833 .833 .833 .833 .833

DOWJONES .8 .833 .866 .866 .8 .8

TRANSP .8 .9 .9 .85 .7 .7

PIPELINE .793 .793 .793 .827 .793 .724

GUNS .777 .833 .833 .722 .777 .722

RETAIL .773 .735 .773 .735 .698 .66

UTILITY .756 .78 .804 .829 .853 .878

REIT .705 .741 .752 .776 .788 .735

SP-100 .702 .723 .734 .744 .723 .702

REGBANKS .7 .833 .8 .733 .733 .7

COMPUTER .695 .695 .652 .652 .652 .652

DJI-13 .692 .769 .846 .846 .692 .692

FIDSTKS .672 .715 .715 .698 .672 .655

EDU .666 .666 .666 .666 .666 .833

SP500 .649 .678 .693 .676 .657 .621

SOFTWARE .646 .646 .661 .584 .584 .569

NIFTY .637 .637 .62 .551 .5 .551

HACKERS .636 .545 .59 .5 .5 .5

RUS-1000 .622 .654 .667 .647 .628 .589

INDEXES .619 .65 .629 .592 .576 .576

BEVERAGE .611 .611 .666 .666 .666 .555

JETS .6 .6 .6 .6 .5 .5

MILITARY .594 .594 .675 .675 .567 .513

NASD-100 .584 .629 .617 .595 .573 .584

HOSPITAL .576 .576 .538 .5 .5 .538

GREEN .535 .5 .571 .428 .392 .392

FINANCE .522 .555 .611 .588 .6 .544

BONDFUND .504 .603 .603 .612 .567 .531

N=29

=========================================================================================

BIG17 .5 .5 .456 .413 .434 .413

==========================================================================================

CHEM .483 .5 .566 .5 .483 .45

HOMEBLDG .47 .47 .588 .411 .352 .352

GAMING .464 .464 .428 .392 .321 .357

AUTO .45 .5 .55 .5 .475 .425

ELECTRON .449 .455 .443 .384 .384 .396

BIOTECH .444 .471 .434 .405 .415 .402

OILGAS .419 .438 .361 .303 .277 .225

INFRA .416 .5 .5 .416 .416 .361

SEMI .352 .368 .368 .295 .295 .303

COMODITY .321 .285 .178 .196 .196 .178

INDMATER .32 .37 .395 .345 .32 .32

ETFS .278 .311 .295 .245 .229 .196

COAL .25 .375 .375 .375 .25 .375

FOOD .222 .222 .222 .222 .222 .111

SOLAR .166 .166 .166 .166 .111 .111

CHINA .133 .15 .133 .116 .083 .083

GOLD .02 .06 .02 .04 .04 .06

N=17

|

=========================================================================

8-22-2018

Volume is low and the DJI seems stalled below the last

apparent

resistance level below its January peak at 26616.71. See the chart

below. On this chart, the recent Peerless Sell S9-V (negative V-I at 2.4%

upper band above 21-dma) and the now negative IP21 (current Accumulation

Index) warn that any DJI rally now of about 300 points will probably

bring a new Peerless S9-V. All

this should limit the DJI's upside potential

to about 3%.

Current Peerless DJI Chart.

The DJI is 1% over its 21-dma and the V-Indicator remains negative.

Though the P-I shows positive breadth, the current Accumulation

Index stands only at +.007. It will be hard for the DJI to make

much upside progress. It is the rising NYSE ADL which keeps

saving the market in here. As long as interest rates do not get

pushed up much, the ADL should stay in its uptrend. But a rise

in interest rates or an intensification of Trump's tariff wars would

be very problematic. These

developments might break the ADL's

uptrend. On the other hand, Professionals are still bullish. They

apparently do not foresell problems here.

Most likely, the DJI's downside is also

probably limited.

More DJI zig-zags higher seem likely until we see a new September

or October DJI peak, in which the NYSE A/D Line fails to make a

corresponding new high on its own and then breaks its own uptrend.

See in the 2011 Peerless chart below, it was the third Sell S9-V on a

DJI new high which was not confirmed by a confirming A/D Line that

brought on the DJI's rapid 17% decline. in 2011.

2011 Peerless Chart of DJI.

.

What The Bulls Need To Accomplish Now.

What would help the overall market's resilience now would be if the

broader market (represented by IWM, the NASDAQ, the SP-500

and MDY) get past their recent peaks and make breakout runs

in all-time high territory. IWM has done that hesitatingly. Now

we must wait and see if the NASDAQ and SPY can do the same.

If they fail to breakout, it will be a bearish sign. When they failed to

breakout and the A/D Line broke its steep uptrend, the DJI plunged

18% very quickly in the Summer of 2011.

Watch the Professionals closely now.

They have the best insider information direct from the White House and

the Federal Reserve. They are also the ones that can rig higher or lower

openings to serve their needs to distribute or accumulate. And they have,

I have argued, more than most others, a vested interest in having the

stock market make new highs as the November Elections take place.

Instead of playing the DJI's (or DIA's) small zigs and zags, I would suggest

shorting those bearish MINCP (Closing Power new lows and steady

red Distribution) and holding them short so long as their Closing Powers

remain at below the 21-dma. And at the same time, I would prefer to

buy IWM, which has made a flat-topped breakout into all-time high territory

and buy some of the bullish MAXCPs and stay long them so long as their

Closing Powers are in uptrends.

Our reliance now is on trends of Tiger's Closing Power. We do this

out of the belief that this is a market controlled by Professionals who are

most likely to be busy buying all-day long when they are very bullish and

most likely to be busy selling all-day long when they are very bearish.

The openings are less important to them unless they are manipulated.

Candle-stick charts by their color show this on a day to day basis, but

we are more interested in the short-term and intermediate-term trends.

When we look at DIA, SPY, QQQ, MDY, IWM and TECL, we

see

Closing Power uptrends. These are summarized in Table 1 below and each

night. From this, I would conclude Professionals are still bullish. So, we

should be, too. But I must add, now we must not see IWM fail its

breakout. That would be a bearish development.

Charts 8/22/2018

PEERLESS DJI, Signals,

Indicators Daily DJI Volume 10-DayUp/Down Vol

Hourly DJIA A/D Line for All

Stocks

NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30

DIA SPY QQQ MDY IWM TNA

Short-Term Rates

USO-CrudeOil FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL RSX RETL

SDS SLV SOXL TECL TMF TNA UGA (gasoline) XIV YINN

Commodities: CANE

JJC, NIB, CHOC CORN, CUT (paper) WEAT UUP (Dollar)

AAPL ADBE ALXN AMAT AMGN AMD AMZN BA BABA BAC BIDU CAT CVX DE

FB GOOG GS HD IBM INTU (new) JPM M (Macy's) MSFT NFLX NVDA QCOM TSLA TXN

XOM WMT ANDV (refinery), CMG (Chipotle), LRCX, SWKS, MDGL

SPPI WATT

SQ TOWN

8/22/2018 (Click on Underlined link.)

Bullish MAXCPs - http://tigersoft.com/MAXCPZ/822/BULLISH.htm

Bearish MAXCPs - http://tigersoft.com/MINCPZ/822/BEARISH.htm

|

Table 1 QUICKSILVER on ETFS - 08/21/18

Explanation:

Pivot-Point is the price at which the short-term 5-dma will change direction.

Cl-Pwr = 21-dma trend of Closing Power.

Candle = red means close below opening today and blue means close was above opening.

IP21 is our proprietary Accum. Index. It ranges from -1.0 to +1.0.

ITRS shows the 50-day rate of change for the ETF minus the DJI's 50-day pct. change.

We sometimes combine IP21 and ITRS to find the most powerful but keep in mind some

of the ETFs (SOXL and TECL) are leveraged.

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS

---------------------------------------------------------------------------------------------

---------------------------------------------------------------------------------------------

DIA 257.18 -.89 255.94 105.9% Bullish RED .103 ----

---------------------------------------------------------------------------------------------

COMPQX 7889.1 29.93 7806.52 73.6% Bullish BLUE .107 .009

---------------------------------------------------------------------------------------------

SPY 286.17 -.17 284.06 77.1% Bullish BLUE .085 .011

---------------------------------------------------------------------------------------------

QQQ 181.06 .7 179.82 50.9% Bullish BLUE .091 .014

---------------------------------------------------------------------------------------------

MDY 370.49 -.05 364.37 124.4% Bullish BLUE .105 -.001

---------------------------------------------------------------------------------------------

IWM 171.18 .42 167.63 151.2% Bullish BLUE .095 .006

---------------------------------------------------------------------------------------------

FAS 73.21 -.41 71.94 242.9% Bullish BLUE -.018 .039

---------------------------------------------------------------------------------------------

RETL 51.64 .04 46.91 512.4% Bullish RED .025 .098

---------------------------------------------------------------------------------------------

SOXL 152.09 1.97 145.38 196% Bullish BLUE .183 -.162

---------------------------------------------------------------------------------------------

TECL 154.83 1.34 152.95 117.8% Bullish BLUE .077 .022

---------------------------------------------------------------------------------------------

IBB 118 .83 116.27 112.7% Bullish BLUE .044 .049

---------------------------------------------------------------------------------------------

GLD 113.27 .25 111.1 92.8% Bearish RED -.367 -.093

---------------------------------------------------------------------------------------------

OIL 7.61 .04 6.89 339.4% Bullish BLUE .263 .046

---------------------------------------------------------------------------------------------

OIH 25.11 .37 23.81 292.3% Bearish BLUE -.073 -.077

---------------------------------------------------------------------------------------------

GASL 21.85 1.14 19.21 762.4% Bearish BLUE -.058 -.072

---------------------------------------------------------------------------------------------

UGA 33.75 .96 32.46 167.1% Bearish BLUE -.17 -.004

---------------------------------------------------------------------------------------------

UUP 25.16 -.07 25.57 -84.5% Bearish ---- .028 .003

---------------------------------------------------------------------------------------------

|

Explanation:

Tiger has directories populated as shown by certain groups of stocks.

Thus, a ratio of 10:1 of new highs is bullish. Table 2

Count of Stocks in Key Directories

20180822

-------------------------------

NEWHIGHS 282 Quite Bullish

NEWLOWS 20

MAXCP 147 Professionals are bullish

MINCP 25

TTTNH 128 Professionals are

TTTNL 39

FASTUP 201 Swing Traders are Bullish

FASTDOWN 52

CPCROSSA 126

CPCROSSD 140

BIGVOLUP 3

BIGVODN 5 Big Money Dumping is lessening.

|

Explanation:

We want to see which groups of stocks show the most new highs.

One day's results are less significant than seeing a pattern here over time.Table 3

Count of Stocks and New Highs in Key Tiger Directories

Date = 180822

No. NHs Pct

-------------------------------------------------------------------

MAXCP 147 100 68 %

REGBANKS 30 6 20 %

HACKERS 22 4 18 %

COMPUTER 23 4 17 %

NIFTY 58 10 17 %

SOFTWARE 65 11 17 %

RETAIL 53 8 15 %

INDEXES 189 25 13 %

HOSPITAL 26 3 12 %

CHEM 61 5 8 %

BIOTECH 407 28 7 %

FINANCE 90 6 7 %

GAMING 28 2 7 %

GREEN 28 2 7 %

NASD-100 89 6 7 %

PIPELINE 29 2 7 %

BIG17 48 3 6 %

ELECTRON 170 10 6 %

RUS-1000 815 42 5 %

SP-100 94 5 5 %

TRANSP 20 1 5 %

INDMATER 82 3 4 %

SEMI 123 5 4 %

SP500 476 19 4 %

DOWJONES 30 1 3 %

FIDSTKS 186 6 3 %

INSURANC 30 1 3 %

OILGAS 155 3 2 %

REIT 172 4 2 %

UTILITY 41 1 2 %

|

Table 4 Count of Stocks and New Lows in Key Tiger Directories

Date = 180822

No NLs Pct

--------------------------------------------------------------------

MINCP 25 4 16 %

JETS 10 1 10 %

HOSPITAL 26 2 8 %

SOLAR 18 1 6 %

BONDFUND 111 4 4 %

GAMING 28 1 4 %

CHINA 60 2 3 %

MILITARY 37 1 3 %

BIG17 48 1 2 %

BIOTECH 407 8 2 %

ELECTRON 170 4 2 %

ETFS 61 1 2 %

NASD-100 89 2 2 %

NIFTY 58 1 2 %

RETAIL 53 1 2 %

SEMI 123 2 2 %

SOFTWARE 65 1 2 %

RUS-1000 815 5 1 %

SP500 476 3 1 %

|

Table 5

Explanation: We want to see which groups of stocks show the most

above and below their 65-dma and what the trend is here...

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

8/22/18

Bullish = 30

Bearish = 14

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

TRANSP .9 .9 .85 .7 .7 .65

BIGBANKS .857 .857 .857 .857 .714 .428

DOWJONES .833 .866 .866 .8 .8 .666

GUNS .833 .833 .722 .777 .722 .666

INSURANC .833 .833 .833 .833 .833 .766

REGBANKS .833 .8 .733 .733 .7 .5

PIPELINE .793 .793 .827 .793 .724 .655

UTILITY .78 .804 .829 .853 .853 .878

DJI-13 .769 .846 .846 .692 .692 .461

REIT .744 .755 .779 .79 .744 .68

RETAIL .735 .773 .735 .698 .66 .622

SP-100 .723 .734 .744 .723 .702 .627

FIDSTKS .715 .715 .698 .672 .655 .575

COMPUTER .695 .652 .652 .652 .652 .565

SP500 .678 .693 .676 .657 .623 .567

EDU .666 .666 .666 .666 .833 .833

RUS-1000 .655 .667 .647 .629 .592 .549

INDEXES .65 .629 .592 .576 .571 .582

SOFTWARE .646 .661 .584 .584 .569 .569

NIFTY .637 .62 .551 .5 .551 .568

NASD-100 .629 .617 .595 .573 .584 .595

BEVERAGE .611 .666 .666 .666 .555 .555

BONDFUND .603 .603 .612 .567 .54 .603

JETS .6 .6 .6 .5 .5 .5

MILITARY .594 .675 .675 .567 .513 .54

HOSPITAL .576 .538 .5 .5 .538 .461

FINANCE .555 .611 .588 .6 .544 .444

HACKERS .545 .59 .5 .5 .5 .363

BIG17 .52 .479 .437 .458 .416 .437

CHEM .508 .573 .508 .475 .442 .377

N=25

=============================================================================================

AUTO .5 .55 .5 .475 .425 .375

GREEN .5 .571 .428 .392 .392 .392

INFRA .5 .5 .416 .416 .361 .388

============================================================================================

BIOTECH .471 .434 .405 .415 .405 .385

HOMEBLDG .47 .588 .411 .352 .352 .294

GAMING .464 .428 .392 .321 .357 .285

ELECTRON .452 .441 .382 .382 .4 .394

OILGAS .438 .361 .303 .277 .232 .206

INDMATER .378 .402 .353 .317 .317 .292

COAL .375 .375 .375 .25 .375 .375

SEMI .365 .365 .292 .292 .308 .317

ETFS .311 .295 .245 .229 .196 .147

COMODITY .285 .178 .196 .196 .178 .178

FOOD .222 .222 .222 .222 .111 .111

SOLAR .166 .166 .166 .111 .111 .055

CHINA .15 .133 .116 .083 .083 .066

GOLD .06 .02 .04 .04 .06 .06

N=14

|

=======================================================================

8-21-2018

The Peerless-S9V still remains at odds with the very strong

NYSE A/D Line.

The V-I was negative for another day, but there were 853 more up than

down even when short-term interest rates rose back above 2%, Such a

a clash by these indicators in August is usually not resolved until September

or October with a DJI decline to the lower band. For the Sell-S9V to win

the battle at this time, I would require the Closing Powers of the major market

ETFs to break their uptrends AND for the NYSE A/F Line to break its 6-month

uptrend.

The News Is Misleading... Be Cynical.

As for all the news about political corruption, the market does not seem much

concerned. If anything, as Wall Street represents those most able to do the

corrupting, the news today can be viewed as yet one more sign that Wall Street

has everything under control and the news is to get the "little people" to sell.

(Compare this with Leona

Helmsley's famous remark: "We don't pay taxes;

only the little people pay taxes.")

Wall Street Professionals seem not to care tha the

President's

campaign manager has been found guilty by a jury of eight felonies

that could put him in jail a long, long time and that Trump's

personal lawyer has plead guilty to misusing Campaign funds

to pay off one Trump's consorts just as the President, himself, had ordered.

Complain as much as you may about a "witch hunt" or "fake

news", Mueller's investigations are producing convictions which

are getting closer and closer to the big man himself.

But as both the Special Prosecutor's Office and the Republicans in Congress

know full well, the President himself is safe as long as the House of Represtatives

does not swing Democratic this Fall. Even then, it takes a 2/3 Senate Vote to

actually impeach. So Impeachment seems unlikely.

Even so, all this makes the November Election very important. Wall Street

and the Federal Reserve, too, know that the best way

for the Republicans

to be kept in office in sufficient numbers to fend off an Impeachment is to keep

the economy strong and the stock market making new highs. You can bet that

enormous pressure behind the scenes is being placed on the FED. We will be

eager to see tomorrow what the most recent FOMC minutes reveal.

Professionals mostly are Republican. Nearly all support his lower

taxes and reduced regulation. By persuasion, they want not to believe

Trump should be impeached and by interest, they are very likely

to do all they can to support the market and keep their Buy Programs

running just as they have since our Buy B9 on July 3rd. As a result,

I doubt if our key Closing Powers will break their uptrend even

with today's double victory for the Special Prosecutor.

Buy IWM

It's true that the DJI is still below its January peak by 3%, but today

IWM, representing the Russell-2000 broke very bullishly above its

flat resistance into all-time high territory, thereby earning it a trading

Buy from us even without our Sell S9-V on the DJI having been reversed.

IWM's strength shows speculative energies are still very much alive.

Charts 8/21/2018

PEERLESS DJI, Signals,

Indicators Daily DJI Volume 10-DayUp/Down Vol

Hourly DJIA A/D Line for All

Stocks

NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30

DIA SPY QQQ MDY IWM TNA

Short-Term Rates

USO-CrudeOil FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL RSX RETL

SDS SLV SOXL TECL TMF TNA UGA (gasoline) XIV YINN

Commodities: CANE

JJC, NIB, CHOC CORN, CUT (paper) WEAT UUP (Dollar)

AAPL ADBE ALXN AMAT AMGN AMD AMZN BA BABA BAC BIDU CAT CVX DE

FB GOOG GS HD IBM INTU (new) JPM M (Macy's) MSFT NFLX NVDA QCOM TSLA TXN

XOM WMT ANDV (refinery), CMG (Chipotle), LRCX, SWKS, MDGL

SPPI WATT

SQ TOWN

8/21/2018 (Click on Underlined link.)

Bullish MAXCPs - http://tigersoft.com/MAXCPZ/821/BULLISH.htm

Bearish MAXCPs - http://tigersoft.com/MINCPZ/821/BEARISH.htm

|

Table 1 QUICKSILVER on ETFS - 08/21/18

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS

---------------------------------------------------------------------------------------------

---------------------------------------------------------------------------------------------

DIA 258.07 .64 251.76 95.3% Bullish BLUE .167 ----

---------------------------------------------------------------------------------------------

COMPQX 7859.17 38.16 7774.12 -7.5% ---- BLUE .053 .008

---------------------------------------------------------------------------------------------

SPY 286.34 .67 281.78 42.9% Bullish BLUE .084 .009

---------------------------------------------------------------------------------------------

QQQ 180.36 .66 179.23 -30.3% ---- BLUE .051 .013

---------------------------------------------------------------------------------------------

MDY 370.54 2.95 361.38 78.8% Bullish BLUE .087 -.002

---------------------------------------------------------------------------------------------

IWM 170.76 1.94 166.09 76.3% Bullish BLUE .037 .005

---------------------------------------------------------------------------------------------

FAS 73.62 .35 69.7 204.4% Bullish BLUE -.056 .04

---------------------------------------------------------------------------------------------

RETL 51.6 1.16 46.64 111.2% ---- BLUE .034 .104

---------------------------------------------------------------------------------------------

SOXL 150.12 8.39 146.4 -88.2% ---- BLUE .098 -.163

---------------------------------------------------------------------------------------------

TECL 153.49 .62 151.23 -60% Bullish RED .034 .021

---------------------------------------------------------------------------------------------

IBB 117.17 1.08 115.38 -1.7% Bullish BLUE -.016 .047

---------------------------------------------------------------------------------------------

GLD 113.02 .33 111.19 -2.2% Bearish BLUE -.387 -.101

---------------------------------------------------------------------------------------------

OIL 7.61 .04 6.89 339.4% Bullish BLUE .263 .043

---------------------------------------------------------------------------------------------

OIH 24.74 .41 23.7 -12.4% Bearish BLUE -.154 -.102

---------------------------------------------------------------------------------------------

GASL 20.71 .89 18.86 -81.3% Bearish BLUE -.113 -.111

---------------------------------------------------------------------------------------------

UGA 32.79 -.03 32.66 -73.4% Bearish RED -.314 -.042

---------------------------------------------------------------------------------------------

UUP 25.23 -.15 25.59 -70.5% Bearish RED .073 .005

---------------------------------------------------------------------------------------------

|

Table 2 Count of Stocks in Key Directories

20180821

-------------------------------

NEWHIGHS 382 Bullish Ratio.

NEWLOWS 28

MAXCP 156 Professionals are bullish

MINCP 35

TTTNH 154 Day Traders are bullish

TTTNL 43

FASTUP 101

FASTDOWN 89

CPCROSSA 144

CPCROSSD 96

BIGVOLUP 4

BIGVODN 14

|

Table 3

Count of Stocks and New Highs in Key Tiger Directories

Date = 180821

No. NHs Pct

-------------------------------------------------------------------

MAXCP 156 115 74 %

EDU 6 2 33 %

REGBANKS 30 9 30 %

TRANSP 20 5 25 %

RETAIL 53 12 23 %

COMPUTER 23 5 22 %

JETS 10 2 20 %

INDEXES 189 33 17 %

NIFTY 58 8 14 %

INSURANC 30 4 13 %

FINANCE 90 11 12 %

SOFTWARE 65 8 12 %

MILITARY 37 4 11 %

DOWJONES 30 3 10 %

RUS-1000 815 78 10 %

SP-100 94 8 9 %

FIDSTKS 184 14 8 %

NASD-100 89 7 8 %

SP500 476 39 8 %

AUTO 40 3 7 %

GREEN 28 2 7 %

REIT 172 12 7 %

BIOTECH 407 24 6 %

ELECTRON 170 10 6 %

HOMEBLDG 17 1 6 %

SEMI 123 7 6 %

HACKERS 22 1 5 %

BIG17 46 2 4 %

GAMING 28 1 4 %

HOSPITAL 26 1 4 %

CHEM 61 2 3 %

INFRA 36 1 3 %

OILGAS 155 3 2 %

UTILITY 41 1 2 %

INDMATER 82 1 1 %

|

Table 4 Count of Stocks and New Lows in Key Tiger Directories

Date = 180821

No NLs Pct

--------------------------------------------------------------------

MINCP 35 6 17 %

HOSPITAL 26 3 12 %

MILITARY 37 2 5 %

GAMING 28 1 4 %

PIPELINE 29 1 3 %

BIG17 46 1 2 %

BIOTECH 407 9 2 %

CHEM 61 1 2 %

CHINA 60 1 2 %

ELECTRON 170 3 2 %

GOLD 50 1 2 %

INDMATER 82 2 2 %

RETAIL 53 1 2 %

SEMI 123 2 2 %

UTILITY 41 1 2 %

BONDFUND 111 1 1 %

INDEXES 189 1 1 %

NASD-100 89 1 1 %

OILGAS 155 1 1 %

RUS-1000 815 2 0 %

SP500 476 1 0 %

|

Table 5

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

8/21/18

Bullish = 32 Bearish = 14

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

TRANSP .9 .85 .7 .7 .65 .7

DOWJONES .866 .866 .8 .8 .666 .666

BIGBANKS .857 .857 .857 .714 .428 .571

DJI-13 .846 .846 .692 .692 .461 .384

GUNS .833 .722 .777 .722 .666 .666

INSURANC .833 .833 .833 .833 .766 .733

UTILITY .804 .829 .853 .853 .878 .878

REGBANKS .8 .733 .733 .7 .5 .7

PIPELINE .793 .827 .793 .724 .655 .793

RETAIL .773 .735 .698 .66 .622 .773

REIT .755 .779 .79 .744 .691 .633

SP-100 .734 .744 .723 .702 .627 .648

FIDSTKS .717 .701 .673 .657 .576 .635

SP500 .693 .676 .657 .623 .567 .602

MILITARY .675 .675 .567 .513 .54 .594

RUS-1000 .667 .647 .629 .592 .549 .59

BEVERAGE .666 .666 .666 .555 .555 .722

EDU .666 .666 .666 .833 .833 .833

SOFTWARE .661 .584 .584 .569 .584 .6

COMPUTER .652 .652 .652 .652 .565 .608

INDEXES .629 .592 .576 .571 .587 .571

NIFTY .62 .551 .5 .551 .568 .637

NASD-100 .617 .595 .573 .584 .595 .606

FINANCE .611 .588 .6 .544 .433 .544

BONDFUND .603 .612 .567 .54 .621 .522

JETS .6 .6 .5 .5 .5 .5

HACKERS .59 .5 .5 .5 .363 .454

HOMEBLDG .588 .411 .352 .352 .294 .352

CHEM .573 .508 .475 .442 .377 .459

GREEN .571 .428 .392 .392 .392 .464

AUTO .55 .5 .475 .425 .375 .4

HOSPITAL .538 .5 .5 .538 .461 .461

N=32

============================================================================================

INFRA .5 .416 .416 .361 .388 .416

============================================================================================

BIG17 .456 .413 .434 .413 .413 .478

ELECTRON .441 .382 .382 .4 .388 .458

BIOTECH .434 .405 .415 .405 .39 .432

GAMING .428 .392 .321 .357 .285 .285

INDMATER .402 .353 .317 .317 .292 .353

COAL .375 .375 .25 .375 .375 .375

SEMI .365 .292 .292 .308 .317 .373

OILGAS .361 .303 .277 .232 .193 .309

ETFS .295 .245 .229 .196 .147 .245

FOOD .222 .222 .222 .111 .111 .111

COMODITY .178 .196 .196 .178 .178 .16

SOLAR .166 .166 .111 .111 .055 .055

CHINA .133 .116 .083 .083 .066 .066

GOLD .02 .04 .04 .06 .06 .06

N=14

|

======================================================================

8-20-2018

For several weeks I have opined that the current S9-V was not strong

enough to short DIA or any other other major ETFs. Weak MINCPs

were preferred for shorting. Until we get another Sell S9v, I would avoid

shorting the major market ETFs. Professionals are too bullish. See the

rising

Closing Powers and the statistics in Table 2.

(The DJI chart below uses trading highs and lows, unlike the

normal Peerless chart further down.)

To cause a Sell S9v tomorrow, the DJI would need to rally about 270 points

on mediocre volume. Below is normal Peerless chart using DJI's hypothetical

highs and lows. An advance tomorrow should put the DJI decisively above

the top of its resistance zone and launch the DJI upwards to 26700. It is

not clear if the DJI's advance will bring along the NASDAQ and tech stocks.

Watch the Closing Powers for TECL and QQQ, shown below.

|

SPY - rising Closing Power

|

QQQ - rising Closing Power trend.

|

TECL - rising Closing Power

|

Most Professionals on Wall Street want the DJI in all-time high

ground when

the November election comes around. At least, that is the script that

the market seems to be following. But they may not be all-powerful. So,

we should watch the uptrendlines of the Closing Power of the DJI and

NYSE A/D Line to see if there is any sudden change of plan.

With the DJI now almost clearly above its well-tested resistance, 25650-25750,

it seems likely the DJI will next rise 3.3% over the next month and reach

its January peak of 26616.71. More than that seems unlikely. Volume remains

low and the V-I is still negative. When we study what happens when the A/D

Line is making new highs in August, as now we find 19 cases since 1965.

Six (31.6%) of these immediately peaked and then declined to the lower

band. But of these six, in only two instances did the DJI make their peaks

late in the month of August, which is what we must be concerned about.

Five times (26.3%) the DJI did not peak until September (9/7 to 9/25).

Four times (21.1%), the DJI did not peak until Octover. And on four

occasions (21.1%), the DJI kept rising.

| |

August A/D NH

Next Top and Decline to Lower Band.

8/29/2018 25759 P=162 IP21=.039 V=-22 ?????????????????????????

---------------------------------------------------------------------------------------------------

1 8/9/1967 927 P=73, IP21=.068,

VI=+8 9/25/1967 943 Sell S2 ---> LB

very small additional advance before decline

---------------------------------------------------------------------------------------------------

2 8/25/1978 906 P=238 IP21=-.036 VI=+6

9/11/1978

908 Sell S12 ---->LB

very small additional advance before decline

---------------------------------------------------------------------------------------------------

3 8/22/1979 886 P=246 IP21=.263

VI=+6 10/5/1979 898 Sell S9 ->11% fall

very small additional advance before big decline

-----------------------------------------------------------------------------------------------------

4 8/15/1980 967 P=93 IP21=.153

VI=+2 10/16/1980 959 Sell S9 ---> LB

No additional DJI gains before decline.

-----------------------------------------------------------------------------------------------------

5 8/25/1987

2680 P=109 IP21=.241 VI=+21 8/26/1987 2702 Sell S4 ->8-9% fall

very small additional advance before big decline

--------------------------------------------------------------------------------------------------------

6 8/9/1989 2686 P=130

IP21=.171 VI=+16 10/09/1989 2791

Sell S9 ->8% fall

very small additional advance before big decline

--------------------------------------------------------------------------------------------------------

7 8/28/1991 3055 P=83

IP21=.032 VI=+6 10/31/1991 3069 Earl S1 ->5.5% fall

No additional DJI gains before decline.

--------------------------------------------------------------------------------------------------------

8 8/24/1993 3639 P=132 IP21=.074 VI=+5 8/26/1993

3648 no Sell ->3.5%

No additional DJI gains before decline.

--------------------------------------------------------------------------------------------------------

9 8/21/1995

4615 P=113 IP21=-.024 V=+1

9/14/1995 B10 6 mo. flat, then up.

--------------------------------------------------------------------------------------------------------

10 8/6/1997 8259 P=213 IP21=.105 V=+17 8/6/1996 No Sell. --> 7%

fall.

No additional DJI gains before decline.

--------------------------------------------------------------------------------------------------------

11

8/16/2001 10393 P=176 IP21=.024 V=-94 8/16/2001 (9/11 Crash to 8400.)

No additional DJI gains before very big decline.

--------------------------------------------------------------------------------------------------------

12 8/20/2004 10110 P=209 IP21=.108 V=-101 9/7/2004 10343 S9-V ---->LB.

very small additional advance before big decline

-------------------------------------------------------------------------------------------------------

13

8/2/2005 10698 P=396 IP21=.076 V=+47 8/9/2005 10615 No Sell --->5% fall.

No additional DJI gains before decline.

-------------------------------------------------------------------------------------------------------

14 8/29/2006 11370

P=+294 IP21=.051 V=-21 B21 and B18 brought rally to Dec.

-----------------------------------------------------------------------------------------------------

15 8/13/2009 9398

P=+625 IP21=.206 V=175 B14 launched rally to year-end.

-----------------------------------------------------------------------------------------------------

16

8/9/2010 10699 P=+477 IP21=.246 V=-15 8/9/2010 S9V ---->LB.

No additional DJI gains before decline

-----------------------------------------------------------------------------------------------------

17 8/16/2012 13250 P=+155 IP21=.007 V=-23 9/14/2012 13593 S4/S8->7.5% down

Very small additional advance before decline

-----------------------------------------------------------------------------------------------------

18 8/25/2014 17077 P=148 IP21=-.019 V=-43 9/19/2014 17280 S17 -->7% down.

Very small additional advance before decline

-----------------------------------------------------------------------------------------------------

19 8/1/2017

21964 P=274 IP21=.045 V=-20 9/13/2017 breakout /big advance.

|

Charts 8/20/2018

PEERLESS DJI, Signals,

Indicators Daily DJI Volume 10-DayUp/Down Vol

Hourly DJIA A/D Line for All

Stocks

NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30

DIA SPY QQQ MDY IWM TNA

Short-Term Rates

USO-CrudeOil FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL RSX RETL

SDS SLV SOXL TECL TMF TNA UGA (gasoline) XIV YINN

Commodities: CANE

JJC, NIB, CHOC CORN, CUT (paper) WEAT UUP (Dollar)

AAPL ADBE ALXN AMAT AMGN AMD AMZN BA BABA BAC BIDU CAT CVX DE

FB GOOG GS HD IBM INTU (new) JPM M (Macy's) MSFT NFLX NVDA QCOM TSLA TXN

XOM WMT ANDV (refinery), CMG (Chipotle), LRCX, SWKS, MDGL

SPPI WATT

SQ TOWN

8/20/2018 (Click on Underlined link.)

Bullish MAXCPs - http://tigersoft.com/MAXCPZ/820/BULLISH.htm

Bearish MAXCPs - http://tigersoft.com/MINCPZ/820/BEARISH.htm

|

Table 1 QUICKSILVER on ETFS - 08/20/18

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS

---------------------------------------------------------------------------------------------

---------------------------------------------------------------------------------------------

DIA 257.43 .92 253.21 106.1% Bullish BLUE .191 ----

---------------------------------------------------------------------------------------------

COMPQX 7821.01 4.68 7870.89 .8% ---- RED .098 .007

---------------------------------------------------------------------------------------------

SPY 285.67 .61 283.9 63% Bullish BLUE .121 .01

---------------------------------------------------------------------------------------------

QQQ 179.7 -.16 181.45 -17.2% ---- RED .102 .014

---------------------------------------------------------------------------------------------

MDY 367.59 1.37 364.79 84.4% Bullish BLUE .076 -.008

---------------------------------------------------------------------------------------------

IWM 168.82 .47 168.2 67.8% ---- ---- .024 -.003

---------------------------------------------------------------------------------------------

FAS 73.27 .53 70.69 289.4% Bullish BLUE .024 .03

---------------------------------------------------------------------------------------------

RETL 50.44 2.1 50.52 330.6% ---- BLUE -.002 .117

---------------------------------------------------------------------------------------------

SOXL 141.73 -.33 152.69 -386% Bearish RED .097 -.215

---------------------------------------------------------------------------------------------

TECL 152.87 -.81 155.33 9.8% Bullish RED .094 .027

---------------------------------------------------------------------------------------------

IBB 116.09 -.2 117.21 -20.2% Bullish RED -.05 .038

---------------------------------------------------------------------------------------------

GLD 112.69 .56 113.07 -12% Bearish BLUE -.418 -.1

---------------------------------------------------------------------------------------------

OIL 7.61 .04 6.89 339.4% Bullish BLUE .263 .045

---------------------------------------------------------------------------------------------

OIH 24.33 .31 24.8 -101.1% Bearish BLUE -.183 -.118

---------------------------------------------------------------------------------------------

GASL 19.82 .38 21.03 -209.2% Bearish BLUE -.144 -.117

---------------------------------------------------------------------------------------------

UGA 32.82 .52 33.27 -35.1% Bearish BLUE -.25 -.045

---------------------------------------------------------------------------------------------

UUP 25.38 -.06 25.59 -21.5% ---- RED .108 .014

---------------------------------------------------------------------------------------------

|

Table 2

Count of Stocks in Key Directories

20180820

-------------------------------

NEWHIGHS 291 Sizeable Bullish Plurality

NEWLOWS 33

MAXCP 135 2:1 Professional Bullishness.

MINCP 62

TTTNH 131 Daya Traders are net bullish.

TTTNL 92

FASTUP 88

FASTDOWN 119 Swing traders are still more bearish.

CPCROSSA 57

CPCROSSD 60

BIGVOLUP 4

BIGVODN 2

|

Table 3

Count of Stocks and New Highs in Key Tiger Directories

Date = 180820

No. NHs Pct

-------------------------------------------------------------------

MAXCP 135 84 62 %

JETS 10 3 30 %

TRANSP 20 5 25 %

RETAIL 53 11 21 %

EDU 6 1 17 %

AUTO 40 6 15 %

INDEXES 189 27 14 %

INSURANC 30 4 13 %

REGBANKS 30 4 13 %

GREEN 28 3 11 %

SP-100 94 10 11 %

DOWJONES 30 3 10 %

NIFTY 58 6 10 %

RUS-1000 815 83 10 %

SP500 476 48 10 %

COMPUTER 23 2 9 %

NASD-100 89 8 9 %

SOFTWARE 65 6 9 %

MILITARY 37 3 8 %

REIT 171 12 7 %

CHEM 61 3 5 %

FIDSTKS 184 9 5 %

HACKERS 22 1 5 %

ELECTRON 170 7 4 %

FINANCE 90 4 4 %

HOSPITAL 26 1 4 %

BIOTECH 407 14 3 %

PIPELINE 29 1 3 %

BIG17 46 1 2 %

ETFS 61 1 2 %

SEMI 123 3 2 %

UTILITY 41 1 2 %

OILGAS 155 2 1 %

|

Table 4 Count of Stocks and New Lows in Key Tiger Directories

Date = 180820

No NLs Pct

--------------------------------------------------------------------

MINCP 62 17 27 %

FOOD 9 1 11 %

BIOTECH 407 23 6 %

HOMEBLDG 17 1 6 %

GAMING 28 1 4 %

GOLD 50 2 4 %

HOSPITAL 26 1 4 %

RETAIL 53 2 4 %

SEMI 123 5 4 %

CHINA 60 2 3 %

PIPELINE 29 1 3 %

BONDFUND 111 2 2 %

CHEM 61 1 2 %

COMODITY 56 1 2 %

ELECTRON 170 4 2 %

ETFS 61 1 2 %

FINANCE 90 2 2 %

INDMATER 82 2 2 %

OILGAS 155 3 2 %

SOFTWARE 65 1 2 %

FIDSTKS 184 1 1 %

INDEXES 189 2 1 %

NASD-100 89 1 1 %

RUS-1000 815 4 0 %

SP500 476 1 0 %

|

Table 5 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

8/20/18

Bullish = 27 Bearish = 17

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

DOWJONES .866 .8 .8 .666 .666 .633

BIGBANKS .857 .857 .714 .428 .571 .571

TRANSP .85 .7 .7 .65 .7 .65

DJI-13 .846 .692 .692 .461 .384 .384

INSURANC .833 .833 .833 .766 .733 .766

UTILITY .829 .853 .853 .878 .878 .756

PIPELINE .827 .793 .724 .655 .793 .758

REIT .783 .795 .748 .69 .631 .584

SP-100 .744 .723 .702 .627 .659 .617

RETAIL .735 .698 .66 .622 .773 .754

REGBANKS .733 .733 .7 .5 .666 .533

GUNS .722 .777 .722 .666 .666 .666

FIDSTKS .701 .673 .657 .576 .63 .614

SP500 .676 .657 .623 .567 .605 .565

MILITARY .675 .567 .513 .54 .594 .54

BEVERAGE .666 .666 .555 .555 .722 .444

EDU .666 .666 .833 .833 .833 .833

COMPUTER .652 .652 .652 .565 .652 .608

RUS-1000 .647 .629 .592 .549 .588 .555

BONDFUND .612 .567 .54 .621 .522 .594

JETS .6 .5 .5 .5 .5 .5

NASD-100 .595 .573 .584 .595 .606 .595

INDEXES .592 .576 .571 .587 .571 .592

FINANCE .588 .6 .544 .433 .522 .444

SOFTWARE .584 .584 .569 .584 .6 .6

NIFTY .551 .5 .551 .568 .637 .62

CHEM .508 .475 .442 .377 .459 .442

N=27

=============================================================================================

AUTO .5 .475 .425 .375 .4 .375

HACKERS .5 .5 .5 .363 .454 .5

HOSPITAL .5 .5 .538 .461 .5 .5

=============================================================================================

GREEN .428 .392 .392 .392 .464 .5

INFRA .416 .416 .361 .388 .416 .416

BIG17 .413 .434 .413 .413 .478 .434

HOMEBLDG .411 .352 .352 .294 .352 .352

BIOTECH .405 .415 .405 .39 .432 .425

GAMING .392 .321 .357 .285 .285 .25

ELECTRON .382 .382 .4 .388 .464 .447

COAL .375 .25 .375 .375 .375 .375

INDMATER .353 .317 .317 .292 .353 .341

OILGAS .303 .277 .232 .193 .309 .264

SEMI .292 .292 .308 .317 .373 .373

ETFS .245 .229 .196 .147 .213 .18

FOOD .222 .222 .111 .111 .111 .111

COMODITY .196 .196 .178 .178 .178 .125

SOLAR .166 .111 .111 .055 .055 .055

CHINA .116 .083 .083 .066 .066 .05

GOLD .04 .04 .06 .06 .06 .06

M=17

|

=======================================================================

8-17-2018

The Sell S9-V is not working right now.

I show below that there is

some precedent for this, though it is abnormal. The DJI seems bent

on getting back to its high. This has become a dividend-paying, blue-chip

and defensive stock rally. Watch the NASDAQ and tech stocks, other than

AAPL and BA, to see if there really is enough money still coming into the

market to lift both tech stocks and defensive stocks after another boosted

opening.

So long as the Closing Powers for DIA, SPY and QQQ are in

rising

trends and the A/D Line is in its uptend, I would expect the current rally

to zig-zag higher until after Labor Day. But September does usually

bring a decline. So, the gains are apt to be small playing DIA, SPY and QQQ.

Watch their Closing Power trends. I would suggest being long some of the

Bullish MAXCPs that have recently made breakouts above flat tops.

The NYSE Adv-Decl. Line made a new all-time high Friday. There have

been 19 cases of ADL new highs in August since 1965. In 15 cases (79%),

the DJI topped out either immediately, in September or by the end of October

and then fell, at least, to the lower 3% lower band. The additional gains in

all these cases where the DJI soon topped out were under 2%. But note

that there were four cases when the DJI kept rising and two of these were

cases where the V-I was negative and one was last year.

(See the next Table where these are posted in green.) So, as long as the ADL

is in a rising trend, I think we must give the DJI more room to advance.

Only Bearish MINCPs are recommended as shorts at this point, not DIA...

But know that we willlikely get a new Sell S9-V if the DJI closes 2.4%

over the 21-dma. That is about 1.3% higher than where we closed today.

This would seem to limit the upside for now.

There 7 instances cases where the V-I was negative, as now, as the

the A/D Line made a new high in August. In 5 cases, the DJI quickly

declines to the lower band, at least. But in 2 cases, 2006 and 2017,

the DJI made a series of new highs and kept rising through the end

of the year.

August A/D NH

Next Top and Decline to Lower Band.

8/17/2018 25669 P=101 IP21=.044 V=-35 ?????????????????????????

---------------------------------------------------------------------------------------------------

1 8/9/1967 927 P=73, IP21=.068,

VI=+8 9/25/1967 943 Sell S2 ---> LB

very small additional advance before decline

---------------------------------------------------------------------------------------------------

2 8/25/1978 906 P=238 IP21=-.036 VI=+6

9/11/1978 908 Sell S12 ---->LB

very small additional advance before decline

---------------------------------------------------------------------------------------------------

3 8/22/1979 886 P=246 IP21=.263

VI=+6 10/5/1979 898 Sell S9 ->11% fall

very small additional advance before big decline

-----------------------------------------------------------------------------------------------------

4 8/15/1980 967 P=93 IP21=.153

VI=+2 10/16/1980 959 Sell S9 ---> LB

No additional DJI gains before decline.

-----------------------------------------------------------------------------------------------------

5 8/25/1987 2680 P=109 IP21=.241 VI=+21

8/26/1987 2702 Sell S4 ->8-9% fall

very small additional advance before big decline

--------------------------------------------------------------------------------------------------------

6 8/9/1989 2686 P=130

IP21=.171 VI=+16 10/09/1989 2791 Sell S9 ->8% fall

very small additional advance before big decline

--------------------------------------------------------------------------------------------------------

7 8/28/1991 3055 P=83

IP21=.032 VI=+6 10/31/1991 3069 Earl S1 ->5.5% fall

No additional DJI gains before decline.

--------------------------------------------------------------------------------------------------------

8 8/24/1993 3639 P=132 IP21=.074

VI=+5 8/26/1993 3648 no Sell ->3.5%

No additional DJI gains before decline.

--------------------------------------------------------------------------------------------------------

9 8/21/1995

4615 P=113 IP21=-.024 V=+1

9/14/1995 B10 6 mo. flat, then up.

--------------------------------------------------------------------------------------------------------

10 8/6/1997 8259

P=213 IP21=.105 V=+17 8/6/1996 No Sell. --> 7% fall.

No additional DJI gains before decline.

--------------------------------------------------------------------------------------------------------

11 8/16/2001 10393 P=176 IP21=.024 V=-94 8/16/2001 (9/11 Crash to

8400.)

No additional DJI gains before very big decline.

--------------------------------------------------------------------------------------------------------

12 8/20/2004 10110 P=209 IP21=.108 V=-101 9/7/2004 10343 S9-V ---->LB.

very small additional advance before big decline

-------------------------------------------------------------------------------------------------------

13 8/2/2005 10698 P=396 IP21=.076 V=+47

8/9/2005 10615 No Sell --->5% fall.

No additional DJI gains before decline.

-------------------------------------------------------------------------------------------------------

14 8/29/2006 11370

P=+294 IP21=.051 V=-21 B21 and B18 brought rally to Dec.

-----------------------------------------------------------------------------------------------------

15 8/13/2009 9398

P=+625 IP21=.206 V=175 B14 launched rally to year-end.

-----------------------------------------------------------------------------------------------------

16 8/9/2010 10699 P=+477 IP21=.246 V=-15 8/9/2010 S9V ---->LB.

No additional DJI gains before decline

-----------------------------------------------------------------------------------------------------

17 8/16/2012 13250 P=+155 IP21=.007 V=-23 9/14/2012 13593 S4/S8->7.5%

down

Very small additional advance before decline

-----------------------------------------------------------------------------------------------------

18 8/25/2014 17077 P=148 IP21=-.019 V=-43 9/19/2014 17280 S17

-->7% down.

Very small additional advance before decline

-----------------------------------------------------------------------------------------------------

19 8/1/2017

21964 P=274 IP21=.045 V=-20 9/13/2017 breakout /big advance.

==================================================================================

The Fed is slow to raise rates. Hence the strength in Utilities and REITs,

as well as the A/D line. Watch the Professionals action in SPY, DIA and QQQ.

Do not fight the the FED or these Professionals, at this time.

The odds do favor the DJI stalling out in the next month without much additional

gain. But the cases of 2006 and 2017 show that it is possible for the DJI to

keep rising

even in the normally bearish month of September. We can understand this to be the

result of the strong Dollar and the limited rise in interest rates, so far. Weakness

in mnay foreign markets right now is attracting foreign funds and also allowing the

Big Banks and performance-minded fund managers to keep the bull market going,

for at least a while longer.

Charts 8/17/2018

PEERLESS DJI, Signals,

Indicators Daily DJI Volume 10-DayUp/Down Vol

Hourly DJIA A/D Line for All

Stocks

NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30

DIA SPY QQQ MDY IWM TNA

Short-Term Rates

USO-CrudeOil FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL RSX RETL

SDS SLV SOXL TECL TMF TNA UGA (gasoline) XIV YINN

Commodities: CANE

JJC, NIB, CHOC CORN, CUT (paper) WEAT UUP (Dollar)

AAPL ADBE ALXN AMAT AMGN AMD AMZN BA BABA BAC BIDU CAT CVX DE

FB GOOG GS HD IBM INTU (new) JPM M (Macy's) MSFT NFLX NVDA QCOM TSLA TXN

XOM WMT ANDV (refinery), CMG (Chipotle), LRCX, SWKS, MDGL

SPPI WATT

SQ TOWN

8/17/2018 (Click on Underlined link.)

Bullish MAXCPs - http://tigersoft.com/MAXCPZ/817/BULLISH.htm

Bearish MAXCPs - http://tigersoft.com/MINCPZ/817/BEARISH.htm

|

Table 1 QUICKSILVER on ETFS - 08/17/18

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS

---------------------------------------------------------------------------------------------

---------------------------------------------------------------------------------------------

DIA 256.51 .57 252.04 63.4% Bullish BLUE .187 ----

---------------------------------------------------------------------------------------------

COMPQX 7816.33 9.81 7819.71 -14.6% ---- BLUE .05 .008

---------------------------------------------------------------------------------------------

SPY 285.06 1 282.1 33.6% Bullish BLUE .066 .012

---------------------------------------------------------------------------------------------

QQQ 179.86 .04 180.32 -18.3% Bullish BLUE .064 .015

---------------------------------------------------------------------------------------------

MDY 366.22 1.85 361.45 40.2% Bullish BLUE -.005 -.006

---------------------------------------------------------------------------------------------

IWM 168.35 .72 166.55 24.5% ---- BLUE -.023 -.002

---------------------------------------------------------------------------------------------

FAS 72.74 .8 69.17 153.4% Bullish BLUE .033 .033

---------------------------------------------------------------------------------------------

RETL 48.34 1.43 47.27 28.2% Bearish BLUE -.152 .101

---------------------------------------------------------------------------------------------

SOXL 142.06 -3.32 153.15 -349.6% Bearish BLUE .081 -.233

---------------------------------------------------------------------------------------------

TECL 153.68 .73 152.57 17% Bullish BLUE .072 .032

---------------------------------------------------------------------------------------------

IBB 116.29 .02 116.56 -18.9% Bullish BLUE -.054 .044

---------------------------------------------------------------------------------------------

GLD 112.13 1.03 112.96 -113.7% Bearish BLUE -.422 -.103 very Weak.

---------------------------------------------------------------------------------------------

OIL 7.61 .04 6.89 339.4% Bullish BLUE .263 .046

---------------------------------------------------------------------------------------------

OIH 24.02 .21 24.82 -297.7% Bearish BLUE -.225 -.144

---------------------------------------------------------------------------------------------

GASL 19.44 .23 20.65 -650.5% Bearish RED -.171 -.149

---------------------------------------------------------------------------------------------

UGA 32.3 -.16 33.05 -153.3% Bearish RED -.222 -.062

---------------------------------------------------------------------------------------------

|

Table 2 Count of Stocks in Key Directories

20180817

-------------------------------

NEWHIGHS 261 Bullish ratio.

NEWLOWS 43

MAXCP 171 Bullish Plurality.

MINCP 57

TTTNH 152 Even day traders are optimistic.

TTTNL 92

FASTUP 65

FASTDOWN 211 Swing Traders are still bearish.

CPCROSSA 128 Professionals are busy buying again.

CPCROSSD 39

BIGVOLUP 1

BIGVODN 8

|

Table 3

Count of Stocks and New Highs in Key Tiger Directories

Date = 180817

No. NHs Pct

-------------------------------------------------------------------

MAXCP 171 100 58 %

HOSPITAL 7 3 43 %

REGBANKS 30 5 17 %

RETAIL 53 8 15 %

COMPUTER 23 3 13 %

DOWJONES 30 4 13 %

NASD-100 89 11 12 %

REIT 172 21 12 %

SP-100 94 11 12 %

UTILITY 41 5 12 %

RUS-1000 815 82 10 %

SP500 476 48 10 %

HACKERS 22 2 9 %

SOFTWARE 65 6 9 %

DJI-13 13 1 8 %

INDEXES 189 16 8 %

MILITARY 37 3 8 %

AUTO 40 3 7 %

FIDSTKS 184 13 7 %

GREEN 28 2 7 %

NIFTY 58 4 7 %

HOMEBLDG 17 1 6 %

TRANSP 20 1 5 %

GAMING 28 1 4 %

BIOTECH 407 14 3 %

CHEM 61 2 3 %

INSURANC 30 1 3 %

ELECTRON 170 4 2 %

ETFS 61 1 2 %

FINANCE 90 2 2 %

INDMATER 82 1 1 %

OILGAS 155 2 1 %

SEMI 123 1 1 %

|

Table 4 Count of Stocks and New Lows in Key Tiger Directories

Date = 180817

No NLs Pct

--------------------------------------------------------------------

MINCP 57 21 37 %

HOMEBLDG 17 2 12 %

FOOD 9 1 11 %

PIPELINE 29 2 7 %

BIOTECH 407 25 6 %

CHINA 60 3 5 %

GAMING 28 1 4 %

SEMI 123 5 4 %

AUTO 40 1 3 %

BONDFUND 111 3 3 %

ELECTRON 170 5 3 %

FINANCE 90 3 3 %

CHEM 61 1 2 %

COMODITY 56 1 2 %

NASD-100 89 2 2 %

RETAIL 53 1 2 %

SOFTWARE 65 1 2 %

FIDSTKS 184 2 1 %

INDMATER 82 1 1 %

INDEXES 189 2 1 %

OILGAS 155 1 1 %

RUS-1000 815 8 1 %

SP500 476 4 1 %

|

Table 5 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

8/17/18

Bullish = 25

Bearish = 19

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BIGBANKS .857 .714 .428 .571 .571 .571

UTILITY .853 .853 .878 .878 .756 .804

INSURANC .833 .833 .766 .733 .766 .8

DOWJONES .8 .8 .666 .666 .633 .766

PIPELINE .793 .724 .655 .793 .758 .793

REIT .79 .744 .691 .633 .581 .616

GUNS .777 .722 .666 .666 .666 .666

REGBANKS .733 .7 .5 .666 .533 .566

SP-100 .723 .702 .627 .659 .617 .68

HOSPITAL .714 .714 .714 .714 .714 .714

TRANSP .7 .7 .65 .7 .65 .65

RETAIL .698 .66 .622 .773 .754 .716

DJI-13 .692 .692 .461 .384 .384 .615

FIDSTKS .673 .657 .576 .63 .614 .668

BEVERAGE .666 .555 .555 .722 .5 .555

EDU .666 .833 .833 .833 .833 .833

SP500 .657 .623 .567 .605 .567 .621

COMPUTER .652 .652 .565 .652 .608 .695

RUS-1000 .629 .592 .549 .588 .557 .593

FINANCE .6 .544 .433 .522 .444 .455

SOFTWARE .584 .569 .584 .6 .6 .615

INDEXES .576 .571 .587 .571 .587 .576

NASD-100 .573 .584 .595 .606 .595 .606

BONDFUND .567 .54 .621 .522 .585 .594

MILITARY .567 .513 .54 .594 .54 .513

N=25

===============================================================================================

HACKERS .5 .5 .363 .454 .5 .59

JETS .5 .5 .5 .5 .5 .5

NIFTY .5 .551 .568 .637 .62 .637

===============================================================================================

AUTO .475 .425 .375 .4 .375 .5

CHEM .475 .442 .377 .459 .442 .475

BIG17 .434 .413 .413 .478 .434 .478

INFRA .416 .361 .388 .416 .416 .444

BIOTECH .415 .405 .39 .432 .434 .444

GREEN .392 .392 .392 .464 .5 .535

ELECTRON .382 .4 .388 .464 .452 .482

HOMEBLDG .352 .352 .294 .352 .352 .47

GAMING .321 .357 .285 .285 .25 .25

INDMATER .317 .317 .292 .353 .341 .353

SEMI .292 .308 .317 .373 .373 .455

OILGAS .277 .232 .193 .309 .264 .367

COAL .25 .375 .375 .375 .375 .375

ETFS .229 .196 .147 .213 .18 .229

FOOD .222 .111 .111 .111 .111 .222

COMODITY .196 .178 .178 .178 .125 .196

SOLAR .111 .111 .055 .055 .055 .166

CHINA .083 .083 .066 .066 .05 .066

GOLD .04 .06 .06 .06 .06 .12

N=19

|

====================================================================

====================================================================

8-16-2018

Our Peerless S9-v still operates. The

V-Indicator is still

quite negative; so with the DJI back to its recent highs, it will

be much harder for the DJI to advance unless there is concrete

evidence that the trade wars are actually ending.

But make no mistake about it, the big Banks do not want much of

a sell-off now before the November Election. They apparently,

do not want to take a chance on even a small decline. Hence, the

manipulated, much higher opening today using the highest priced

DJI stocks as their agents. With Professionals doing their best

to hold the DIA up, I would prefer not to short DIA in these conditions.

The NASDAQ and tech stocks made much smaller gains. ADBE,

FB, GOOG, NFLX, NVDA and most semi-conductors fell today.

The SP-500 and SPY have reached the apex of potential head/shoulders.

They would seem more vulnerable than the DJI. But I would prefer

to short the weakest MINCPs and use breaks of the Closing Power

downtrends with these to tell us when to cover.

NASDAQ is in a narrowing trading range. Support is at its rising 65-dma

but there is a lot of resistance at 8000. Our Nifty Tech Stocks show quite

similar boundaries, for now.

Manipulation?

How dare we say that the market is being heavily "manipulated" now?

Perhaps, the big DJI gain today was simply the result of relief

that there might be a cessation in the trade war, which would especially

hurt many big DJI stocks like BA and CAT. That could also explain why

the DJI's rise was much bigger than the other indexes'.

I still favor the "manipulation" explanation.

1) The Big Banks have a vested interest in keeping Trumps' supporters

in Congress for another term. The strong "economy" is their most

compelling argument. Why risk a market melt-down?

2) Is there any proof that the Big Banks' trading for their own accounts is

seriously limited or regulated? There is no public scrutiny. And

they have virtually unlimited trading funds, also courtesy of the FED.

3) They only need to buy in the lighter-trading Futures market and then

later push up the prices of a handful of individual DJI stocks at the

opening in collusion with market makers to bring about a big advance.

I think that's what we saw today "in spades"!

Most of today's big rally took place because of just five stocks in the DJIA:

(BA +14.20), WMT (8.42), CAT (4.24), GS (+3.75) and AAPL (+3.08).

These accounted for 229 of the DJI's 398 point rise. One other stock,

WMT (+8.42) added 51 more points to the DJIA.

Short Sales Anyone?

Gold fell again today. I would hold by my

asessment that a number of foreign

countries

are slipping closer to recession. The decline in Gold reflects

their

need to raise funds. I would put India, Japan and Russia in that camp.

More

weakness in Gold, Oil and Gas, which Russia produces a lot of,

could easily cause another recession there. Putin recently has had to increase

the retirement age, all the while he must spend very large sums to match

the Americans' build-up. All this should make RSX a good short sale. It

could collapse again, as it did in 1998. In general, look at the stocks making

new lows for ideas here. The Closing Power should be making a new low.

Ideally, the AI/200 should be below 65 and the IP21 should be below its

own 21-dma.

| |

Table 1 QUICKSILVER on ETFS - 08/16/18

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS

---------------------------------------------------------------------------------------------

---------------------------------------------------------------------------------------------

DIA 255.94 4.18 253.3 15.4% Bullish BLUE .149 -----

---------------------------------------------------------------------------------------------

COMPQX 7806.52 32.4 7839.11 -54.4% Bearish RED .012 -.002

---------------------------------------------------------------------------------------------

SPY 284.06 2.28 283.16 -17.8% Bullish BLUE .032 .006

---------------------------------------------------------------------------------------------

QQQ 179.82 .59 180.52 -57.8% ---- RED .013 .005

---------------------------------------------------------------------------------------------

MDY 364.37 2.99 363.3 -13.8% Bullish BLUE -.005 -.012

---------------------------------------------------------------------------------------------

IWM 167.63 1.54 167.53 -11.1% ---- BLUE -.013 -.013

---------------------------------------------------------------------------------------------

FAS 71.94 2.24 70.58 -38.3% Bullish BLUE -.032 .015

---------------------------------------------------------------------------------------------

RETL 46.91 .27 48.07 -101.9% Bearish RED -.163 .087

---------------------------------------------------------------------------------------------

SOXL 145.38 -1.02 152.55 -636.6% Bearish RED .046 -.238

---------------------------------------------------------------------------------------------

TECL 152.95 1.72 153.16 -126.8% Bullish RED .038 -.003