|

TigerSoft Studies of Insider Trading ======================================= William Schmidt, - Tiger Software's Creator (C) 2012 William Schmidt, Ph. D. - All Rights Reserved. Last updated 6/30/2012 "Use TigerSoft and you'll see what insiders are doing, rather than be fooled by what they are saying." Send any comments or questions to william_schmidt@hotmail.com TigerSoft Offers: Peerless Stock Market Timing: 1928-1966 Track Record of Major Peerless Signals Earlier Peerless-DJIA charts 7 Paths To Making 25+%/Yr. Using TigerSoft Index Options FOREX trading Investing Longer-Term Mutual Funds Speculative Stocks Swing Trading Day Trading Stock Options Commodity Trading

|

"INSIDER Trading" IS RAMPANT!

Don't Get Mad, Get Even!

Watch for Insider Trading and

Watch if Wall Street Professionals are buying or selling.

We at TigerSoft are interested first in the UNREPORTED, UNOFFICIAL

INSIDER TRADING in stocks & commodities done by the associates, colleagues

and friends of the corporate insiders who are legally obliged to (and usually do)

report their own scheduled insider stock transactions in the companies they run.

We are interested second in how Professionals view the the stock.

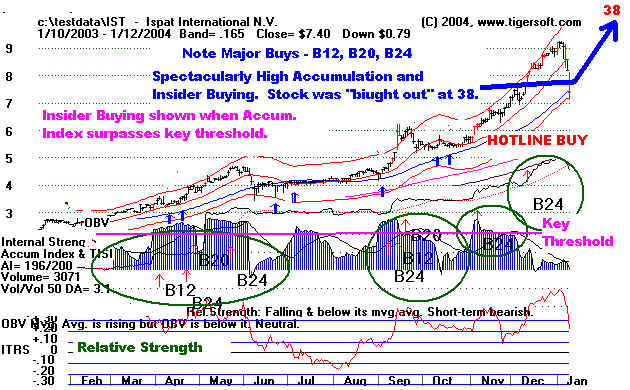

Sample TigerSoft Chart

Watch for::

>1. Bulges of Insider Buying and Insider Selling with Tiger Accumulation Index surpassing key thresholds..

>2. when Institutional buying (blue Accum Index) turns to Institutional Selling (red Accum. Index).

>3. changes in trends of the blue Tiger Closing power.

>4. changes in trends of the blue Tiger Day Traders' Tool.

It is this UNREPORTED and UNOFFICIAL Insider Buying which gobbles up

the available float of a stock and puts it into tightly controlling hands that are not quick

to sell with only small gains and usually wait a year to sell. With the float reduced,

the stock can rise much more easily. It is this insider buying or selling which

Professionals become aware of and partake in, the buying often in a carefully

controlled way to prevent the stock from rising too much at first, so that they can keep

accumulating it.

We look for the signs of the unreported and unofficial Insider Buying by friends

and associates of the higher-ups in a corporation when the fortunes of their company

are about to improve dramatically. We spot this in the form of bulges from our

Tiger Accumulation Index above the +.375 threshold. Such buying should be

confirmed by buying by Wall Street Professionals, who typically quickly become aware

of any significant insider buying. Accordingly, the Tiger Pro-Closing Power, which

registers what professionals are doing, should turn up. In cases where a significant

stock rise becomes expected by Professionals, our Tiger Day Traders' Tool will

break its downtrend and start rising.

| Links to Explore: Explosive Super Stocks Killer Short Sales in Any Market Contrast the TigerSoft Charts of the biggest winners, ACAT, AKRX, ASPS, LQDT, MNST, MNTG, PCYC, SCSS with the biggest losers, ALSK, DRIV, FRO, FSLR, FTR, GERN, HL MOTR, RIMM, STP, SYNT Watch out for Heavy Scheduled Reported Insider Selling and Use TigerSoft's Closing Power To Know When To Sell. Insider Trading - "part of the fabric" and culture of Wall Street...It has become institutionalized." (NY Times 5/19/2012). Be A Whistle Blower on Inside Trading and Get Paid for It. |

Buy with The Insiders

Tiger Software's Power Ranker

searches for stocks to buy whose price up-trends

are confirmed by heavy (blue)

Accumulation and rising Closing Power. For purposes of

selling stocks short. we look for

stocks whose price breakdowns and downtrends are

confirmed by very negative (red)

Distribution and falling Closing Power.

We usually demand that

Professionals agree with what the Insiders are doing. So, we

trade the price waves up using the

TigerSoft Closing Power's turns upward from support

and the price waves down by

watching for signs that the Tiger Closing Power and the

Accumulation Index are turning down

again.

---> TigerSoft spots Insider Buying as spikes in our TigerSoft

Accumulation Index above

a key threshold which we have

extensively back-tested. See the many examples below.

The best way to trade such spikes

is with Tiger's Closing Power. Buy when the

Closing Power turns back up after

such a bullish spike of Accumulation. See this in

the chart below.

Selling

Short with The Insiders

---> TigerSoft spots Insider Selling as deeply negative (red) readings

from our

TigerSoft Accumulation Index.

Greater price weakness than the Dow Jones is

normally required to take action.

too. When we see heavy red Distribution, we

short each new wave down. We

watch for Tiger Accumulation Index falling back

below its own moving average and

for the Tiger Closing Power violating its own

minor uptrend or

support.

Watch The Wall Street Professionals

using Tiger's Closing Power.

Market makers, hedge fund operators and

institutional professionals watch for

new developments that will impact

the companies they trade. They stay abreast

of significant scheduled insider

trading as reported by the SEC. They read the industry

journals and reports by Wall Street

security analysts. Their Washington representatives

tell them when prospective

government regulation changes or pending new legislation

will have an impact. We

should add that many of these Pros are not above

manipulating stocks by planting

news on Yahoo or CNBC to take advantage of

public fears and public

greed. So, we watch our Tiger Closing Power to see if they

change their minds about a stock,

regardless of what they may publicly say.

To see what they're really doing,

not what they say, we watch Tiger's Pro-Closing Power.

When it is rising, they are net

buyers. When it is falling they are net sellers. When

it changes direction, the

Professionals are reversing their position, from long to

short or short to long, and we

should think about doing the same, especially if

we see signs of insider buying or

selling from the readings of our Tiger Accumulation

Index.

Main Street is far away and those

living there are often the last to find out what is

really going on with a rising

stock. Seeing unusual patterns of insider buying, Professionals

make inquiries about the stock.

They exploit the network of informally exchanged

information that is Wall Street.

Usually, they discover the basis of the insider buying.

even when the Insiders have not

directly involved them, as they often do in the

case of mergers, takeovers, splits

and public offerings. These Professionals then

take positions in the same stock,

cover their short sales and trade predominately in the

direction that the Insider expect

the stock to move, using every advantage of leverage

the Federal Reserve gives them.

HOW TIGER IMPROVES

GREATLY UPON THE AXIOM,

"BUYING ON THE RUMOR AND SELLING ON THE NEWS"

Just about every study of stocks and even

cursory reviews show that "Insider Buying"

quite commonly appears in a stock in the

months, days or weeks before it makes a big price

advance on a bullish public announcement

(i.e. stock split, good earnings, new discovery,

takeover, public subsidy, etc.).

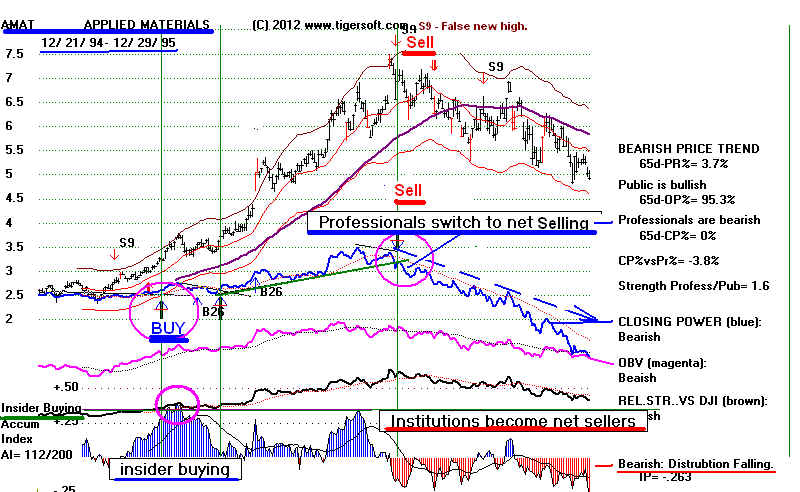

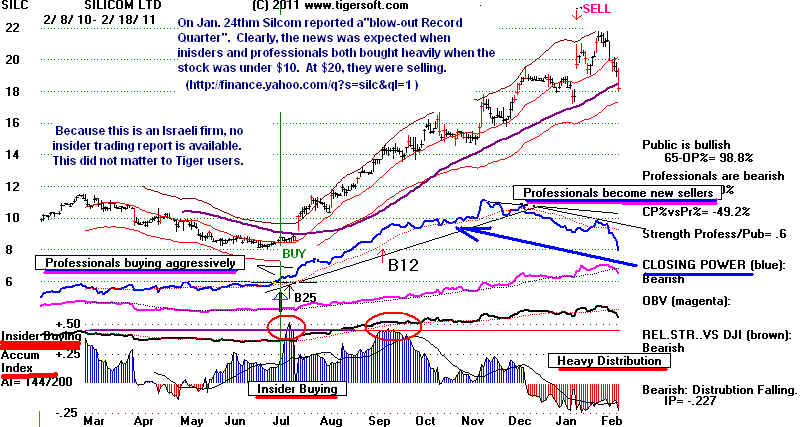

Insiders and Professionals got a quick double out of SILC

shown above.

Not surprisingly, the stock sold off with heavy (red) distribution and falling (net

negative)

Professional Selling at 20 when the

news came out. This is exactly why cynics say

"Buy on the rumor and sell on

the news". Actually, this axiom has a long history,

because insiders and professionals

have been playing this one-sided game a long time.

For example, on December 13,

1956, the NY Times wrote "In the Bethlehem-Youngstown

situation, Wall Street held to its

old apothegm, “Buy on the rumor,

sell on the news.” This

expresses the often observed fact

that stocks involved in merger negotiations do considerably

better than the market as a whole

between the time the merger is first rumored and the time

the companies announce it, and

considerably worse between the announcement and the

consummation."

Some go so far as to say: "always" buy before there is any public announcement

of

a company’s earnings.

By the time the news is published, it is too late to buy, they say.

Too many savvy traders will have

already anticipated the news by hearing about it from

insiders, from fellow-stock brokers

or their associates, by in-depth research or, perhaps,

by observing the stocks unusual

price behavior and buying. Moreover, insider trading is

now so widespread, they insist,

that it's best to always automatically sell on good news

when the stock is probably up.

Such advise is problematic. The first problem with such approach is that there are

always about a million

semi-plausible rumors floating around. How does one decide

when a rumor should be acted upon

or which is the rumor that might turn out to be true?

Should we always Sell on the news?

We think always selling on the news is a mistake. Some of the news is truly

not widely anticipated. Often

still better news is going to come out. Without TigerSoft's

Professional Closing Power to show

whether Professionals are actually jumping ship

and are c;learly net sellers. the

Selling part of the axiom is probably a pretty good idea.

See: http://www.barrypopik.com/index.php/new_york_city/entry/buy_on_the_rumor_sell_on_the_news_wall_street_proverb/

But we at TigerSoft would rather just

let the Professionals, using the trend of the blue

Tiger Closing Power, tell us

whether we should sell, hold or perhaps buy more.

Sometimes, Professionals do

sell. But sometimes they are still heavily buying. So, we

always watch the trend of our

Tiger Closing Power. In addition, we have formulated some

trading strategies that use the amount of insider buying to tell us how long to expect

optimally hold.

Example: We were initially

told JP Morgan's trading loss in May 2012

was more than a $2 Billion by its CEO. The stock kept falling. Then it

was disclosed that the

loss would be more than $3 billion. The the Wall Street

Journal reported it could

reach $5 Billion. Most recently, we are told

the loss will be as much as $7 billion. Who knows? To trade it, all we

had to is watch the falling Blue Closing Power and stay short until the

Closing Power downtrend broke its downtrendline. The Professionals,

as represented by the Tiger Closing Power, will tell us when the

stock has bottomed and the news, in fact, is not getting worse.

THE MORE

ACCUMULATION, THE MORE BULLISH THE STOCK,

PROVIDED PROFESSIONALS KEEP ON BUYING, TOO.

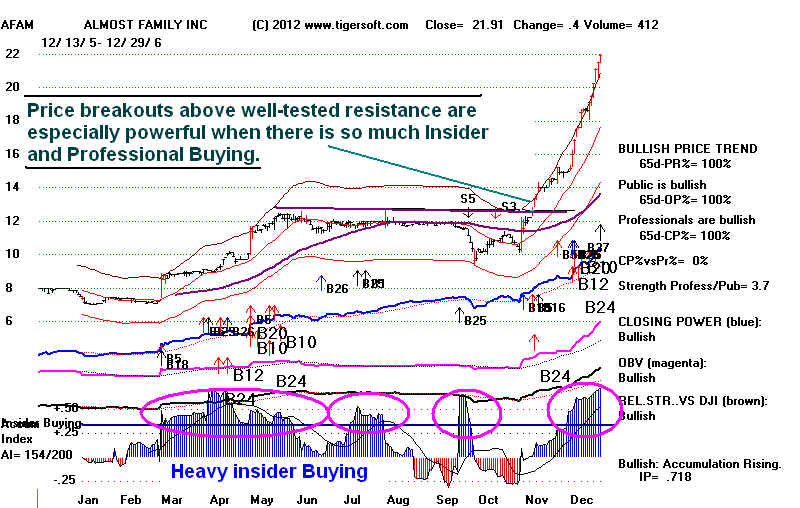

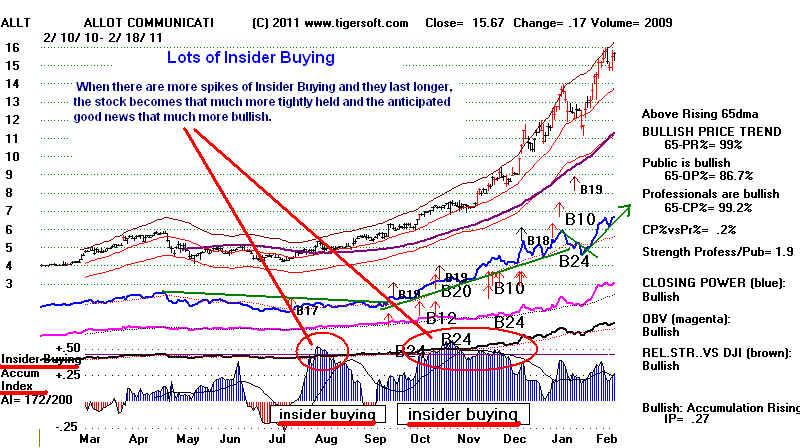

When there are more spikes of

"Insider Buying", as we measure it, and they

last longer, the stock

typically becomes that much more tightly held and the anticipated

good news that much more

bullish. Such situations also produce more automatic

Buy signals. ALLT shows

much more insider buying than SILC and, so, we would

expect it to outrun to upside

the first or even the second good earnings' reports

as the stock moves up.

The

announcements about ALLT show: improved earnings

were reported on

November 9, 2010, but even better earnings were reported on February 8, 2011.

Selling in November would

have meant missing the best part of the rally to date.

ALLT is also an Israeli

firm. If we tried to rely upon reported Insider trading transactions,

we would not have bought this

stock. Clearly using TigerSoft, made it easy to see all the

heavy Accumulation in ALLT's

case. With such stocks, we expect bigger moves

and it has paid off.

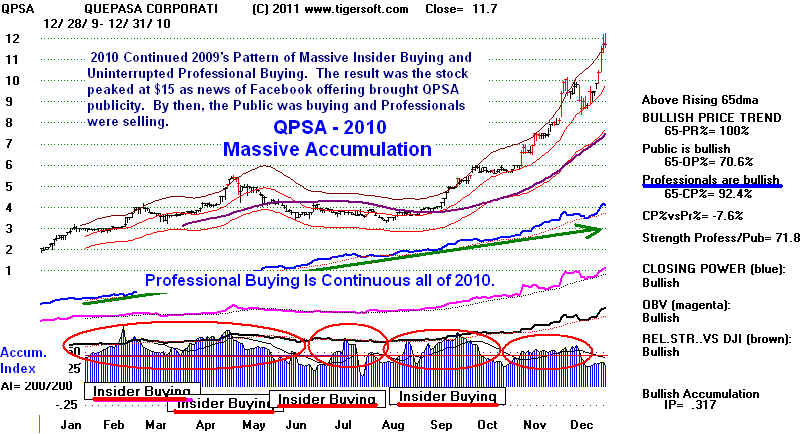

Sometimes, the Insider Buying

continues for month after month, always

with it confirmed by a

rising trend in the Tiger Closing Power. QPSA was

bought by us initially

at $1.60 in December 2009. See how the Accumulation

stayed very high for

most of that year and the following year, too. As long

as Professionals were

net buyers and the Tiger Closing Power kept rising,

we held or bought more.

Eventually, in January 2011, QPSA peaked at 15,

after moving from the

pink sheets to the American Stock Exchange and getting

lots of bullish

publicity for being the Spanish language equivalent to Facebook.

INSIDER SELLING

CONFIRMED BY PROFESSIONAL SELLING

MAKE AN EXCELLENT SHORT SALES

It should go without saying,

but all our studies and most others, too, show that

"Insider Selling"

occurs quite commonly in stocks that will soon fall precipitously

on a bearish public

announcement (i.e. sharply lower earnings or lowered estimate

of future earnings, law suit,

governmental investigation or bankruptcy).

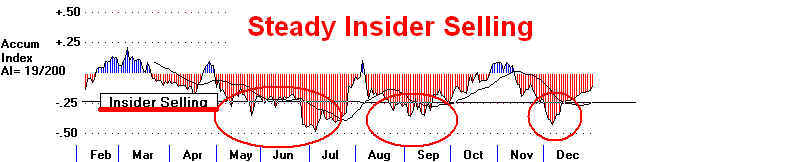

In most cases, there is also a pattern of official or reported insider selling. What

counts most is that

Insiders and Professionals are both very bearish. See below

in the case of Seahawk

Drilling (HAWK) how the Tiger Accumulation Index stayed

s negative (red) and

frequently falls below -.25, our provisional threshold for signifying

important unofficial

and official insider selling when Tiger's Closing Power confirms

the trend. We

want Wall Street Professionals to confirm the insider selling. The price

decline was remarkable,

because this was a period of rising stock and oil prices.

See how the blue Tiger

Closing Power kept falling and falling, all the while the general

Public were fooled by

the apparent "cheapness" of the stock and steadily buy all the way

down, judging from

Tiger's Public Opening Power.

The behavior of the Tiger Internal Strength Indicators is quite typical when very

bad news is about to

befall a stock. Insiders do not tell the public the bad news,

before they themselves

sell. Though this is a violation of their fiduciary responsibilities

to their shareholders

in a publicly traded company and even though they pay

themselves enormous

salaries and bonuses, they seem too greedy to give their

shareholders a fair

shake. They and their friends always seem to help themselves first.

They sell before they

let the bad news out. We can always count on their greed

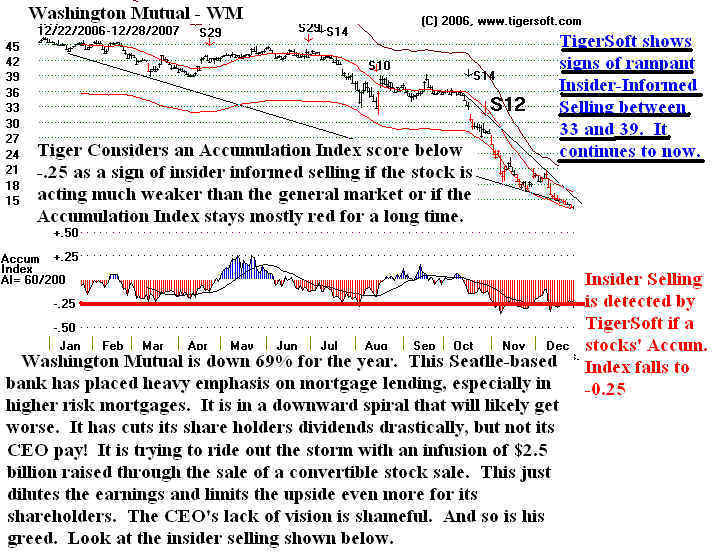

and the lack of SEC

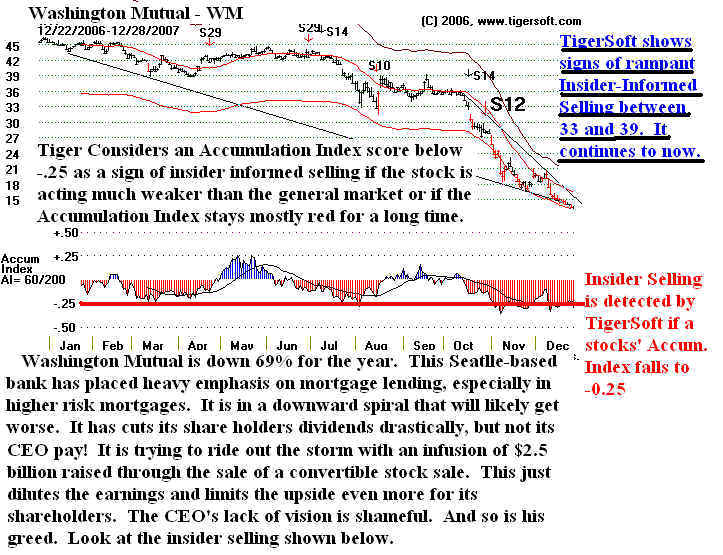

enforcement to tell us what to sell short. Compare SEAHAWK's case

below with the insider

selling by Peter

Sperling, CEO of Apollo. Or the bankers' insider

selling at CitiGroup or Washington

Mutual long before their stocks plunged into the abyss

because of the

recklessness of their use of leverage in the mortgage debacle of 2008-2009.

SEAHAWK's PLUNGE INTO BANKRUPTCY

WAS

ANTICIPATED BY ITS INSIDERS AND WATCHFUL PROFESSIONALS

We think these concepts and our practical measures for identifying

Insider and Professional trading are the most important keys to your making |

big

money in stocks that you will find... Certainly, I have found nothing like

this

since1967, when the author first began reading about the stock market

in

the library of Columbia University's Business School..

Read more. Visit as long as you

like at our Main Web-Site www.tigersoft.com,

our TigerSoft Blog

and Daily

Comments on News with TIger's Insider Trading Charts

and TigerSoft's

Keys To Tracking ALL Insider Buying and Selling.

Then

get TigerSoft

or subscribe to our Nightly

On-Line Hotline. You'll wish you had

gotten Tiger years ago.

==================================================================================

MORE EXAMPLES OF INSIDER SELLING

Don't Get Mad, Get Even!

There

are so many examples of what should be illegal insider selling. But

crystal clear are the cases of WAMU's Killington and Rubin's CitiGroup.

See also the Blog I wrote in late 2007, long before these stocks collapsed.

December 30, 2007 Insider

Selling at Washington Mutual and CitiGroup

Should

Make Shareholders "Mad as Hell".

It predicted WAMU's bankruptcy and exposed Killington's

insider

selling, based on how extensive the insider selling was.

The

TigerSoft chart below shows you exactly what to look for.

TigerSoft Rules Are

Simple:

>>>Intensive Negative (Red) Distribution in Tiger's Invention,

the Tiger Accumulation Index, Means Insider Selling

>>>The steady red AI readings show heavy Institutional Selling.

>>>Sell these stocks short on rallies that fail. Our automatic signals

show you when.

Rubin sold millions of Citigroup stock at it top near 55. As it fell, down,

down, down, it might have looked cheap. But it hit ONE DOLLAR.

It was never cheap enough!. Don't rely on emotional hunches to buy!

Watch the insiders. What what they do

with their own money, not what they

say to the media..

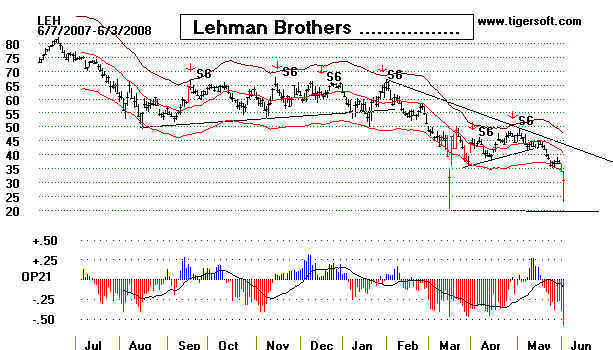

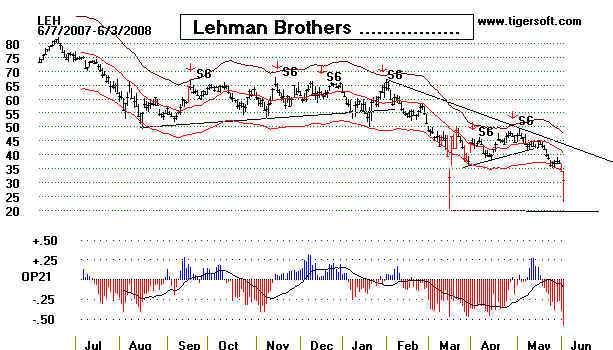

LEH on the road to

bankruptcy!

For more examples of insider selling, continue reading and see -

For more examples of insider selling, continue reading and see -

> Let TigerSoft Find Killer Short

Sales.

> 2010's

Worst Performing Stocks

> December 26, 2007

Insider Selling:

British Style. Is Northern Rock The Tip of The UK Ice Berg?

MORE EXAMPLES OF INSIDER

BUYING

Again, Apply The Simple TigerSoft

Rules:

>>>Intensive Positive (Blue) Accumulation in Tiger's Invention,

the Tiger Accumulation Index, Means Insider Buying

>>>The steady blue AI readings show heavy Institutional Buying

Buying with the insiders from March to

July 2009 proved ideal,

just as we predicted it would at the time. Please look at some of the stocks

our software found for customers to buy back then. They were exactly

what we have been looking for since 1990s when we formulated the rules

for the major Buys you see on this chart. Please go to the link below.

June 6, 2009

The Great 2009 Bull

Market.

Why Is Wall

Street Concealing The Huge Surges in Low Priced Stocks?

DDRX was finally bought out at 35.

For more examples of insider buying continue reading and see -

For more examples of insider buying continue reading and see -

> Let TigerSoft Find The Next

Explosive Super Stocks.

> 2010's Best Performing

Stocks

HOW TIGERSOFT TRACKs ALL INSIDERS

TigerSoft's Keys To Tracking ALL Insider Buying and Selling

Besides official insiders, Tigersoft profitably also tracks the insider-informed

stock trading by the associates of Corporate Insiders and ALL Key

UNREPORTED Insider-Informed Buying and Selling by Wall Street Professionals.

Advance information about buy outs. secondaries, splits, earnings, bond

issues always either leaks out in advance to someone in the company and

their friends and business associates. It is often deliberately leaked to the chose

few on Wall Street in order to get favorable treatment in brokerage recommendations

and analysis. The SEC cannot change this. So, use TigerSoft. Level the

playing field.

>Our tools uniquely contrast

Professional and Public Buying and Selling.

>Tiger screens All Stocks for key

levels of insider and professional

Buying and Selling.

How TigerSoft Flags

Savvy Insider Buying

We at TigerSoft are

privy to no insider tips or secrets. But over the

years, we have learned how to spot savvy insider trading that is

about to send the stock up and up and up! This pattern of buying

repeats over and over again, year after year, in all markets, because

someone on the inside knows something very good will happen to a

company in the not too distant future. They know this with a certainty

that is reflected in their manner of buying.

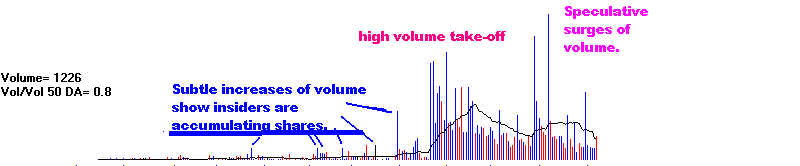

The Four Key Stages To Watch for

First, they quietly accumulate all the shares they can. A weak general

market environment makes this a relatively easy pursuit. See the

tell-tale bulges in the

TigerSoft Accumulation Index

in the chart below.

When no more shares are available this way, they become more

aggressive, because they know there is a very high probability that

the stock will be much higher in six months or a year. We spot this

stage technically, using our Accumulation Index, price patterns, volume

and the automatic Buy signals which we have back-tested for the

this purpose over more than 30 years of time with thousands of stocks'

charts.

Thirdly, because the stock is tightly held and the insiders have been

quite shrewd, prices rise

very sharply on high (red) volume, as more

and more professionals and a handful of public speculators jump aboard.

Fourthly, watch to see if the Professionals agree with what Insiders

are doing. We want to buy stocks showing high levels of insider buying

and an up-slanting blue Tiger

Professional Closing Power.

Our Hotline

post these "Bullish

MAXCP" stocks' Tiger

charts for your inspection

each night, along with the opposite appearing stocks, those with heavy

red Distribution and a down-sloping Professional Closing Power that

is weaker than the stock's price action. These are the "Bearish MINCP stocks".

If you look closely, you can see all this in the DDRX chart below.

In particular, see how our TigerSoft Accumulation Index spots the

earlier periods of insider accumulation by rising above the +.5 threshold.

The indicator varies from -1.0 to +1.0. It is quite bullish that there were

three periods when it rose above +.50. A lot of stock was accumulated.

The many automatic Buys are our alerts to buy the stock. The rising

prices show us we were quite right; this was very savvy insider buying.

Who were the insiders here? Sometimes, you can tell by looking

at

the official inside trading records that corporate insiders must report

to the SEC. More often, there is no easy way to know. But make

no mistake about it, someone on the inside knew. That's why the

trading patterns matched so exactly the model we have constructed

to spot savvy insider buying. .

Wall Street's 'Dirty Little Secret'

INSIDER TRADING IS RAMPANT!

I have been writing for four years about

how the SEC

is worse than useless and toothless, because it still gives

the least informed members of the public the dangerous illusion

that there is a governmental agency effectively policing and

preventing investment fraud and insider trading. There is

so much proof of how rampant is insider trading that one hardly

knows where to begin to discuss it. And, with each new day

more examples emerge, along with governmental officials

decrying the state of affairs.

The US law itself seems clear. While corporate insiders,

key employees, directors and officials may buy or sell their

company's shares, they must not do so based on material

non-public information about their company and when they

do make a trade, they must report it to the SEC, which then

allows the public to see what they are up to. If insiders do

make trades based on non-public information, the trades

are considered fraudulent and the insiders are judged to

have violated their fiduciary responsibilities. In addition,

trades made by insiders tips to friends and associates are

illegal. Again, the insider's duty to public shareholders is

considered to have been violated by such tips. Stock brokers,

analysts and journalists who in the course of their duties, discover

and then trade upon non-public information that materially affects

a company's stock also break the law, if they "had

reason the

believe

that the tipper had breached a fiduciary duty in disclosing

information"

Federal Court decisions have further clarified what the law

considers insider trading. The SEC v. Texas Gulf Sulfur (1966)

is the most important case in setting the law. TGS found an unusually

rich deposit of ores near Timmins, Ontario. Initially, the company

issued discouraging press releases about the discovery, all the

while several directors for the company loaded up on call options

and stock. The press releases were meant to dupe the Canadian

farmers into selling or leasing their land at a fraction of its probable

values.

The 1934 Securities and Exchange Act gives the SEC the authority

to demand that violators give up their trading profits. They may

also ask a court to impose a penalty of up to 3 times the profit

realized by their insider trading. The sane law gives the US Justice

Department the authority to bring criminal prosecutions against

inside traders. In 2002, an inside trader could be given a 20-year

jail sentence and be fined up to $5 million. In practice, criminal

penalties are rarely sought, except in a few high profile cases. As

a consequence, such penalties act as very little deterrent.

Unfortunately for investors, the SEC acquired a reputation between

2000 and 2008 of being all but toothless. Too often they decided, while

the trading may have looked suspicious, it would been too hard

or too politically inconvenient to prove that the insider trading was

done because of illegal use of non-public information. The weaker

the SEC's enforcement looked, the bigger the problem became.

In August 2006, the NY

Times ran a lead story on page 1 that Wall

Street insider trading had "gone wild". "41% of all mergers worth

$1 billion or more over the last 12 months show signs of insider trading

ahead of the deals."

On October

26, 2007, the NY Post quoted a senior SEC official as

saying that insider trading was "rampant"

among Wall Street professionals.

"I am disappointed in

the number of cases we are seeing by people who

make an abundant livelihood in the market..."

In another example, a 5/18/2008 GA0 (Government Accounting) report on the

SEC wrote:

"In one case, an

enforcement attorney told the GAO that a

company offered to pay $1 million to settle a case, but the attorney

recommended no penalty because "they did not believe the commission

would approve the company offer."

See -

http://www.star-telegram.com/business/v-print/story/1380769.html

John Mack, the CEO of investment bank, Morgan Stanley is

apparently above

the law. Gary Aguirre, a former

SEC investigator, told a Congressional committee

that he was fired when he tried to

interview Mack about tipping off the

hedge fund Pequot Capital Management

about a 2001 merger deal between

GE Capital and Heller Financial.

Pequot netted $18 million in profits

from the tips. A Congrsssional

Investigation was launched. It

ended up

siding

with Aguierre against his bosses at the SEC

In July 2009, the

Seattle Times noted that the SEC typically goes after the small fries

for insider trading, while well placed insiders and institutions often get off without

even a warning. Insider trading, the articles concludes is rampant. Even former

SEC Chairman Cox admitted this: "There is ample

empirical evidence that there is

significant trading in securities markets on the basis of secret advance knowledge".

Flagrantly Illegal

insider Trading is rampant and commonplace. This is the

inescapable conclusion we reach looking at all the evidence. The SEC exists mostly

to

give the appearance of fairness for all investors on Wall Street. Insiders sell out

on

when

false, exaggerated and distorted "good news" comes out that they know will soon

turn

bad. Earnings and earnings' estimates cannot be safely trusted.

After-the-fact

discoveries of "Cooked Books" and CEO Lies and cover-ups are very common.

Since 2001, the SEC has prosecuted

about 50 cases of insider trading per year.

That is not nearly enough to stem the tide. Insiders who use a modicum of discretion

have no fear, especially if their gains are not out of the ordinary. The SEC picks a

minute

number of high profile individuals to prosecute for insider trading. This is for

show!

99.9% of the other cases where big gains are made flagrantly using insider trading

are ignored. The prosecution of a very few well known people is done for public

consumption, to make it seem that the SEC is protecting the public. This was

mainly true

in the Clinton Administration, too.

Certainly, the SEC rarely goes after the biggest investment banks, where so much

of the insider trading takes place. Look at the steadily red negative readings from

the TigerSoft Accumulation Index, for example, in Citigroup. These were

insiders

and their friends selling out. Even using the official records, insiders sold 1 million shares

in 2007 at or near the top!

See Tiger Blog 11/25/2008

RECKLESS

CITIGROUP INSIDERS SOLD 1,000,000 SHARES IN 2007.

Now taxpayers are bailing out

the company with more than $45 billion.

Why does the SEC not go after insiders like these?

Why not Kellinger (Washington Mutual) or Rubin or Prince (Citigroup)?

Just below is the WM chart I put on our Blog for 12/28/2007, nine months before I

warned it might go bankrupt, based on how extensive the insider selling was.

The TigerSoft chart shows you exactly what to look for.

See also

- SEC charges Mark Cuban

with insider trading... He is the best known figure to be accused

by the SEC since its 2002

case against Martha Stewart. - Sacramento News ...

- The Undercurrent | insider

trading (April 6, 2008)

- A Financial History of

Modern U.S. Corporate Scandals: Since Enron

- Insiders

circumvent insider trading regulations...

Insider selling is

rampant and goes unpoliced. The

evidence is in the TigerSoft

charts. "Someone always knows", we say. Use the TigerSoft charts to see if

insiders are buying or selling and you will do very well in the stock market.

The Scandals of ImClone, Enron, Arthur Andersen, Health South, Homestore.com,

K-Mart, Martha Stewart, Merrill Lynch, Qwest, Jack Grubman of Smith Barney,

Tyco,

US

Technologies and WorldComm are the tips of the ice berg. They have just whetted the

appetites

of a new generation of Corporate CEOs, Presidents and Board Members.

Some history, lest we

forget.

IMPORTANT: "Fortunately, savvy TigerSoft users can readily spot what Big

Money

and Insiders are doing with their own money. It is only when we buy when they

buy and sell when they sell, altogether disregarding what CEOs say, that we can make

some real money." William Schmidt, TigerSoft

Check back here for More Studies.

See NY

Times List of Insider Trading News.

Another possible source of data on insider trading is http://www.biginsiders.com/index.php

InsiderTrading Studies by

TigerSoft

InsiderTrading Studies by

TigerSoft"Insiders always know in advance."

Never forget that phrase. Let TigerSoft show you how to reap the rewards that come from closely

following the tell-tale signs of insider buying, insider accumulation, insider selling and insider distribution.

See below for more details.

$75 - TigerSoft Books by William Schmidt, Ph.D. (Columbia Univ.)

"How To Spot Insider Selling and Make Killer Short Sales in Any Market"

===> Order Book

"Explosive Super Stocks: How To Spot Them at The Start of Their Move:

The Conditions That Launch Each Year's Biggest Gainers and Then How Not

To OverstayOne's Welcome." --> Order book.

"Tiger's Tahiti System: 24.4%/Year: 1970-2007: Buying The Most Accumulated

DJI-30 Stock." -> Order here.

TIGERSOFT STUDIES OF INSIDER TRADING

>>> 11/25/2008 Easily Spot Key

Insider Selling Using TigerSoft. Compare The Insider Selling

Shown on The

TigerSoft Charts of Citibank with Those of Bear Stearns,

Lehman Brothers,

Washington Mutual, Freddie Mac, Fannie Mae, Trump,

Northern Rock and

General Motors.

>>> November 21, 2008

Four Phases of A Typical

Speculative Stock:

Take Off, Topping Out,

Collapse, Base Re-Building.

Examples of DRYS and TASR.

>>> June 4, 2008 Far from Over, The

Credit Crunch Is Worsening:

Charts Showing heavy distribution: NEXC, ABK, MBI, LEH, FCFC, CORS, CCBO

CNB, WM, IBCP, GSBC,

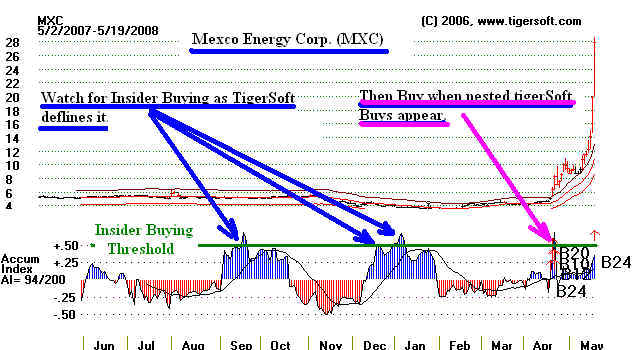

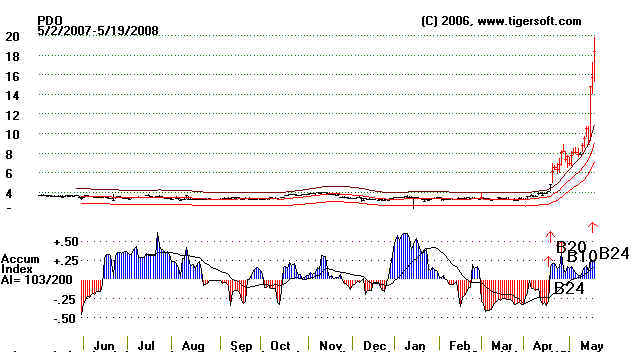

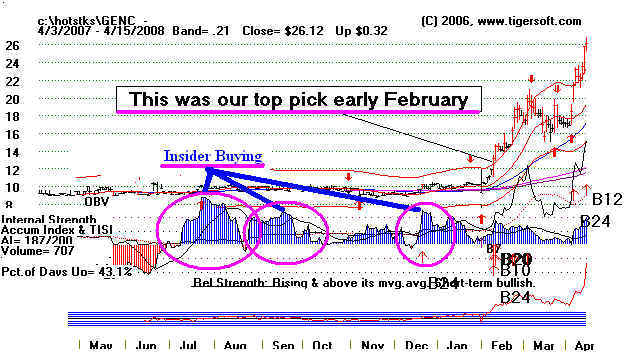

>>> 5/20/2008 Oil Stocks: TigerSoft

Charts show how Insider Buying put us on high alert

in the year's biggest

gainers.

The cases of MXC, PDO, ROYL, GENC and MPET

>>> 4/13/2008 Significant Insider

Buying - as Tiger defines it - is present in best

performing stocks

of the last year. This

is true in every study we do. is Dey

>>> 3/16/2008 Insider Selling at

Bear Stearns

>>> 2/26/2008 Big Money Accumulation

in Food Commodities.

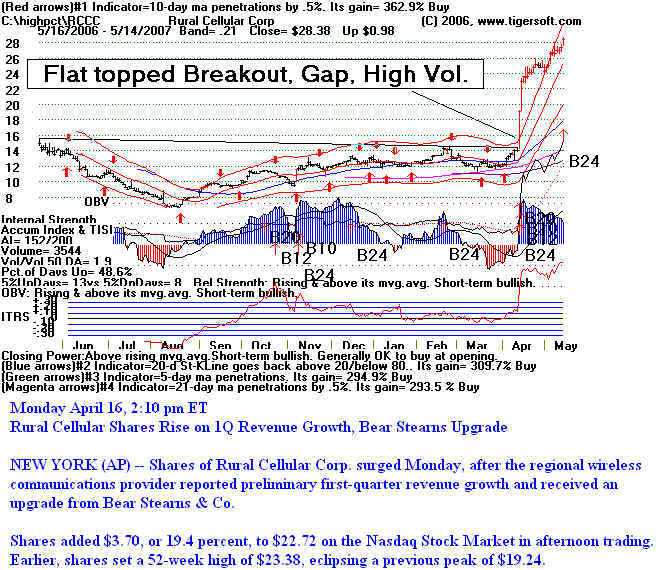

>>> 1/24/2008 JPM

Morgan and Rural Cellular.

We detect insider buying by the Accumulation Index surpassing .50.

Notice the bulges in November and April below...

More examples - http://www.tigersoft.com/Tiger-Blogs/12-31-2007/index.htm

>>> Schering

Pl;ough Accused of withholding data showing its anti-cholesterol drug, Vytorin, is no more

effective than Merck's older,

cheaper Zocor. Schering-Plough's President is accused of selling 900,000

shares seven months before these

results were made public. CBS News Story.

9/16/2008.

>>> Insider Trading at The Fed.

Only occasionally are charges brought against Fed officials, as in 1988.

Did you see how the market turned

up the day before Bernacke said he would lower rates.

His cronies on Wall Street got the

word a day ahead of the rest of us. This is exactly what happened

back last August. This is

clearly "insider trading". But the SEC is not going to investigate

the FED! The little guy just

has to take it! What's worse, the little guy on a fixed income

just must accept the +10% fall in

the Dollar for the last 12 months and all the inflation that

necessarily brings as Bernacke

lowers rates to bail out mortgage lenders and banks. Bernacke is

the pawn of Wall Street. He

clearly seeks their approval with every utterance. The little guy plays no

role in his political

calculus. I predicted Bernacke would do all he could to avert a stock market decline

until after a Democrat was in the

White House in 2009. That is Bernacke's prime directive. The problem

is that the dollar's decline is

accelerating now. At some point soon, investors in US stocks will

decide to jump ship. rather than

hold US denominated assets. That will cause an even bigger massacre

of stock prices.

William - tigersoft.com 1/12/2008 See my Blog of 10/31/2007

http://www.tigersoft.com/Tiger-Blogs/10-31-2007/index.html

Take a look at Paul Erdman’s 1997

"fictional" novel, The Set-Up.

where an ex-Fed Chairman is accused

of insider trading.

,

>>> Insider

Activity for week ending January 4, 2008 - by Wall Street Journal

>>> Must be nice to be so

lucky! New

Imclone CEO, Johnson, bought $500,000 worth of ImClone stock 4 days before

it

announced its lead drug, Erbitux, has been shown to prolong the lives of lung cancer

patient/ Stock

jumped

18% on news. "Tell us another bed-time

story." "How dumb do they think we are?"

"They're also offering the

Broklyn bridge." "Incredulous = "incredible, unbelievable - beyond

belief or

understanding; "at

incredible speed"; "the book's plot is simply incredible"

>>> Insider

Selling Crunches Confidence in Shoe Stocks: Crocs (CROX) and Brown Shoes (BVS) 1/9/2008

>>> Erik Sirri, The SEC's Top Insider Trading Regulator Dismisses The

Desirability

of Regulating Insider Trading. 1/8/2008

>>> Insider

Seling at Bear Stearns (BSC) and How TigerSoft Spots and Trades It.

1/4/2008

>>> Insider

Selling by Dow Jones Insider Only Brings SEC Insider Trading Charges against

The "Little Guys" 1/3/2007

>>> Insider

Selling at Washington Mutual and CitiGroup Should Make Shareholders "Mad as

Hell" 12/30/2007

>>>

Law Suit "MATTEL

( MAT ) HIDES TOY RECALLS

UNTIL INSIDERS CAN SELL."

Santa's Toy Makers May Go To Jail? 12/27/2007

>>> Insider

Selling at Quest in 2001-2003. 12/27/2007

CEO Lies, Bullying,

Greed and Insider Trading... "To Hell with the

Widows and Orphans" Is CEO's attitude."

>>>

Insider Trading in the News MSN - A

New Wave of Insider Trading and ONXX 12/26/2007

>>> Insider Selling: British

Style. Is Northern Rock The Tip of The UK Ice Berg?

http://tigersoft.com/Tiger-Blogs/index.htm

12/26/2007

>>>

Insider Selling and Heavy

Institutional Buying: The

Case of KTEC

http://tigersoft.com/Tiger-Blogs/12-22-2007/index.html

12/22/2007

>>> Insider Selling in Chinese

Stocks Rivals US in 1929.

http://tigersoft.com/Tiger-Blogs/11-27-2007/index.html

11/27/2007

>>>

How To Spot and Easily

Survive Dangerous False Breakouts.

http://tigersoft.com/Tiger-Blogs/11-15-2007/index.html

11/15/2007

>>> Reliably

Profitable TigerSoft Short Selling Tools and Techniques

http://tigersoft.com/Tiger-Blogs/11-9-2007/index.html

11/9/2007

>>> Lots of Stocks Look Like Good

Short Sales

http://tigersoft.com/Tiger-Blogs/11-6-2007/index.htm

11/6/2007

>>> Rules for Trading Food

Commodities with TigerSoft's

Accumulation Index To Spot Big

Money Buying/Selling.

http://tigersoft.com/Tiger-Blogs/10-7-2007/index.htm

10/7/2007

>>> Insider

Selling and Data Falsification at ImClone in 2001

http://tigersoft.com/Tiger-Blogs/9-17-2007/index.html

9/27/2007

>>> Biotech Series: Insiders Rule:

The Amgen Take-Off: 1990-1991

http://tigersoft.com/Tiger-Blogs/9-6-2007/index.htm

9/7/2007

>>> 2007's Best and Worst

Performing Stocks.

Tiger's Accumulation Index Makes The Difference 8/29/2007

http://tigersoft.com/Tiger-Blogs/8-30-2007/index.htm

>>> Widespread Insider

Selling before The Bad News Comes out. The Hall of Shame!

http://tigersoft.com/Tiger-Blogs/8-3-2007/index.htm

8/3/2007

>>> Housing Correction Continues.

No Bottom In Sight, Yet

http://tigersoft.com/Tiger-Blogs/6-28-2007B/index.htm

7/28/2007

>>> Tiger's Tahiti System Keeps

Churning Out 20%/Year Gains Using the DJI-30..

http://tigersoft.com/Tiger-Blogs/6-15-2007/index.htm

6/15/2007

>>> Insider Buying Is Very

Evident in San Diego's Top Performing Stocks - 6/11/2007

>>> Tiger's Sunken Treasure Stock, OMR - Odyssey Marine

Exploration doubled in one day 5/18/2007

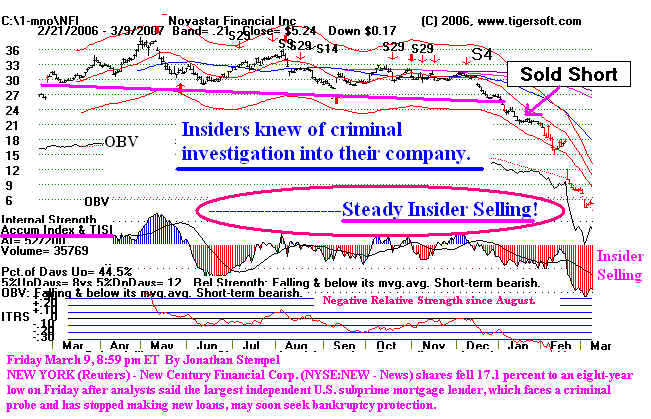

>>> Flagrant Insider Trading at Novastar. Criminal Investigation 3/9/2007 See chart and story

below

>>> Biggest Gainers since July

2006 Bottom: The Tell-Tale Signs of Insider Buying, 2/26/2007

>>> Insider Selling at NEM - Newmont

Mining... 10/2/2006

|

Tiger Blogs about Insider Buying Explosive

Super Stocks Contrast the TigerSoft Charts of the biggest winners in 2011-2012, ACAT, AKRX, ASPS, LQDT, MNST, MNTG, PCYC, SCSS with the biggest losers, ALSK, DRIV, FRO, FSLR, FTR, GERN, HL MOTR, RIMM, STP, SYNT February 7, 2011 QPSA - Insider and Professional Buying Bring Us A 10-Bagger.Now after the stock has risen 10x, Professionals are selling to the Public.

September 30, 2010 Biotechs

Showing Heavy Insider and Professional Buying August 14, 2010 APOLLO SHAREHOLDERS SHOULD BE MAD AS HELL ATPETER SPERLING's INSIDER SELLING! July 24, 2010 2010's Worst Performing Stocks and The Technical Factors That Predicted TheirDeclines January 26, 2010 Rampant Insider Selling Replaced Insider Buying in Goldman Sachs. Nov. 25, 2008 Easily Spot Key Insider Selling Using TigerSoft. January 9, 2008 Insider Selling Crunches Confidence in Shoe Stocks: January 6, 2008 - Insider Selling at Bear Stearns (BSC) and How TigerSoft Spots and Trades It. December 30, 2007 Insider Selling at Washington Mutual and CitiGroup December 27, 2007 Insider Selling at Quest in 2001-2003: Nov. 6, 2007 Lots of Stocks Look Like Good Short Sales September 7, 2007 The Lesson of ImClone: CEOs Should Not Be Trusted |

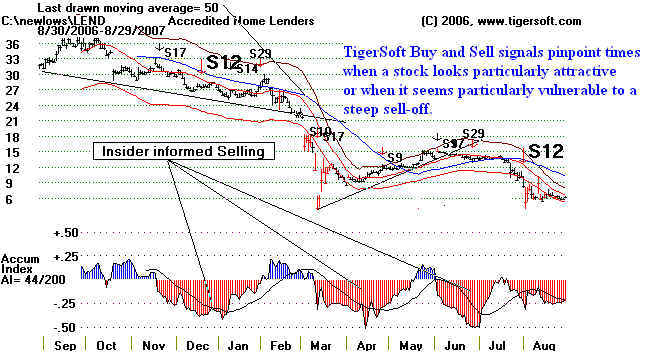

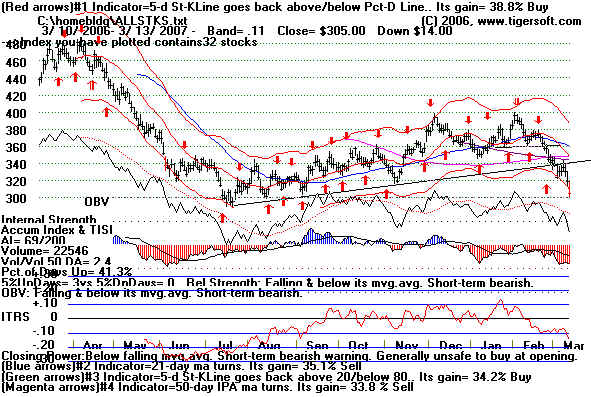

| Flagrant "Insider-Informed Selling" Apparent at Novastar Insiders and "Insider-Informed" Big Money knew of Criminal Investigation into mortgage lender - Novastar Financial - months before the public did. Tiger Software Users were apprised of the massive insider dumping as it fell below 20. Short positions were recommended. The stock has fallen 75% in two months. Perhaps, it was the outside lawyers who told the Big Holders of NFI to sell... Perhaps, it was the executives. Or their secretaries... We may never know. But the massive Big Money Distribution was very apparent on a Tiger Software chart of NFI. And some of our users are up 70% in two months here! 7/5/2007 - False takeover rumor planted. Trust TigerSoft instead. 11/14/2007 - NovaStar reports $598 million quarterly loss Subprime mortgage lender says shares may be de-listed from NYSE 12/11/2007 - Law Suit on NovaStar's mismanaged retirement account. On-Going Complaints about Nova Star's over-charging its borrowers. 12/19/2007 - Nova Star CEO, Scott Hartman, finally "retires". Scott Hartman ======================== NOVASTAR NFI =====================================  ------------------------ LEND ----------------------------------------------------------------------------------  ============ HOUSING STOCK CARNAGE PREDICTED BY TIGERSOFT ========== 3/13/2007 ----- "Another Leg Down for Housing Stocks" The decline in these stocks spells big troubles for housing stocks generally. Our Tiger Index of 32 housing stocks looks ready to start another leg down. Note the false January peak. It showed a new high with the Tiger Accumulation Index negative. Traders who bought on the last short-term Buy are being forced to sell. A new low will be bearish for housing stocks and the whole market. Already a number of housing stocks are making new lows. They are the "leaders downward." ------------------------- Tiger Index of 32 Housing Stocks ----------------------------

|