Insider Selling: British Style:

Is Northern Rock The Tip of The UK Ice Berg?

Heavy Insider Selling Is Shown in These Stocks.

Barclay's Bank

Barratt Dev.

British Land Development

Daily Mail

Experian

Hammerson REIT

Home Retail Group

Intercontinental Hotels

Kingfisher

Royal Bank of Scotland

Wolseley

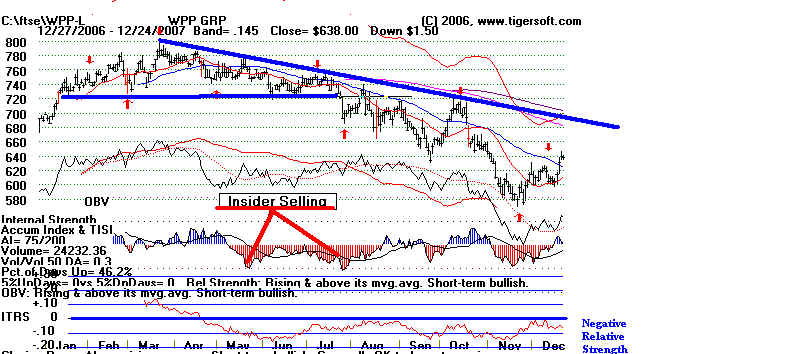

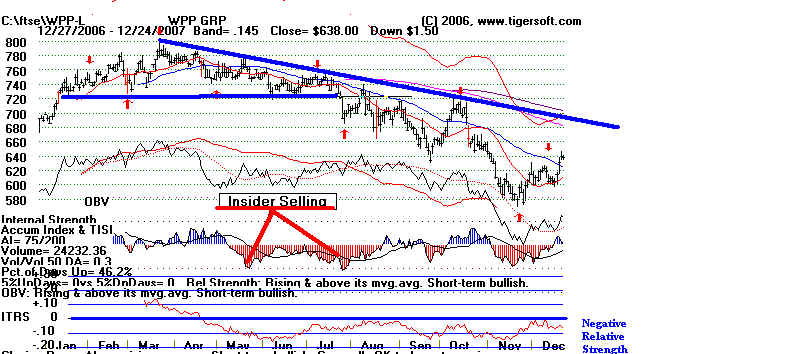

WPP Group

Insider trading can help you make a lot of money. Use

TigerSoft to find stocks like

those shown below. Do what the insiders are doing. Buy what they're buying and

sell

short what they're selling. This is especially true for trading non-US markets,

where

insider trading is, if possible, even more rampant than in the

US.

"Let's

Keep This between just Us." (See artcile by

David Weidner of Market Watch..)

American "insider trading" is illegal according to the SEC. But it's

clearly

rampant. The

SEC admits insider trading on Wall Street is rampant. It seems that

the SEC is mostly concerned with policing corporate insiders who sit on the

Board of Directors or who own more than 10% of a company's stock. Shares traded

in their own companies must generally be promptly reported. although the George Bushes

of this world are given special treatment.

Wall Street continues to be an "old boys' network." Who you know is very

important.

Assume you are a hedge fund manager. The sense I get is that, as long as you show

some discretion,

restraint and prudence, you will seek insider information and rationalize it that you

are doing this to stay competitive. As long as you don't mention your sources and

don't

act too wildly on the information, the SEC will not have your trade flagged and you're

probably home-free.

The number of insider trading violations they pursue is quite limited.

Some glaring cases do pop up from time to time - as when (1) the NY Attorney General

(not the SEC initially) accused brokers of

"front-running" mutual buying, when (2) the

number

of calls traded jumps from 5,000 to 18,000 just before a buy

out or when (3)

a printer

gets wind of a Buy Out or a national financial magazine's stock recommendation.

But mostly the SEC, as presently directed and staffed, does not knock itself out to track

down trading that people normally would consider to be trading based on special, insider-

based information. There's just too much of it. Look at all the TigerSoft

charts!

What about Canada?

"A report prepared Measuredmarkets Inc. by a

Port Hope, Ont.-based student of

unusual securities-trading activity, commissioned by Bloomberg News, depicted the Canadian

securities market as the black sheep among its G-7 counterparts. The evidence was the

observation by Measuredmarkets of "aberrant trading patterns" preceding

33 of the 52

Canadian mergers last year with a value of $200 million or more."

(Source: http://www.thestar.com/article/200828

)

The American, Canadian and British markets give much more lip

service to

policing insider trading than do other countries. If insider trading can be shown to

be

rampant in the UK, too, imagine how helpful TigerSoft will be for someone trading

in another market. Here are articles about truly rampant

insider trading in South

Africa (1988).

Casino capitalism in

Australia. 1991 and Hong

Kong (2007).

How do the British handle such cases? James Lumley of Bloomberg News

reports: "Insider trading may have occurred before almost a quarter

of British takeover announcements

in 2005 and a third in 2004, the country's market regulator said Wednesday. The

frequency of "informed

price movements" in advance of takeovers is little changed since 2000, the regulator,

the Financial

Services Authority in London, said in a "market cleanliness" survey...In 2005,

there were unexplained

stock movements before 24 percent of takeover announcements relating to companies on the

London

Stock Exchange, the FSA said. In 2004, the figure was 32 percent. There were suspicious

trades

before 24 percent of announced transactions in 2000. "These results are really

only the tip of the iceberg,"

said Ian Mason, a former enforcement lawyer with the regulator who is now a lawyer at

Barlow Lyde &

Gilbert in London. "They don't look at things like debt markets, swaps and

derivatives where a lot of

insider trading is probably going on, but is harder to detect." In 2005, there

were 177 takeover

announcements, the FSA said. There were unexplained price movements before 42 of them. In

connection

with the 102 takeover announcements of 2004, 33 showed unexplained movement. The FSA

must secure

a high- profile prosecution if it wants to have more success in stopping insider trading,

Mason said.

The FSA fined a former GLF Partners LP director, Philippe Jabre, £750,000 for trading on

confidential

information about a stock sale in its most successful case last year.

(Source: http://www.iht.com/articles/2007/03/07/bloomberg/bxinvest.php

)

I decided to write this essay after looking at the Northern

Rock chart shown below.

Clearly insiders got wind of the precarious state of the bank's finances. They sold

and their

hedge fund chums sold short. We spot insider selling at TigerSoft by seeing the

stock

underperform the market and then show a TigerSoft Accumulation Index reading drop

below -.25. (We have found readings above +.50 to be more reliable in detecting

insider

buying). The Tiger Sell S12 with accompanying readings

below -.25 by the Tiger Accumulation

index, shown below, took place with Northern Rock shares above 800 pence. They fell

75%

in three months. (TigerSoft provides users data on 1400

stocks, etc, including most of the FTE-100.)

Heavy Shorting of The Rock

"As queues of worried savers snaked

around branches of Northern Rock last week, bottles of

Cristal champagne were put on ice in the wine bars of Mayfair. The upmarket district

in the West End of

London is home to many of the financial speculators who have made a mint out of the

mortgage bank's woes.

Hedge funds - as well as traders in some of the big City investment banks - have been

betting heavily for

months that Northern Rock was facing serious funding problems and its shares were on their

way south.

Their concerns proved well founded. The collapse in Northern Rock's share-price has

been spectacular

since the BBC revealed that the Newcastle-based lender had applied to the Bank of England

for emergency

funding...

"Shorting the Rock. Last Thursday, Mervyn King,

the governor of the Bank of England, said that he became

aware that Northern Rock was facing serious difficulties only in August. The hedge

fund community seems

to have sensed that something was seriously awry much sooner. At the end of June,

rising interest rates

triggered a profits warning from Northern Rock and prompted renewed questions about the

bank's business model.

At that time only about 7% of Northern Rock's shares had been "shorted",

according figures from Data Explorers,

which collects securities-lending information for investors. By the end of July,

that short-position had grown to

some 15% of the bank's shares, and ahead of last week's announcement from the Bank of

England it has passed the

20% mark (with a single hedge fund said to have been behind almost half that position).

That compares to an

average of short-position of about 3.5%across the banking sector as a whole. Data

Explorers puts the overall

profits for those short-sellers of Northern Rock shares back in June at somewhere just

north of £100m. Others in

the hedge fund community reckon the overall profit from shorting Northern Rock is much

higher, and could be

as much as £1bn. " (Source: http://news.bbc.co.uk/1/hi/business/7007116.stm

)

For more comments on insider selling at Northern Rock, go to

http://www.order-order.com/2007/11/northern-rock-ceo-sold-millions-in.html

==================== British

Northern Rock Debacle ===================================

Black Rock has gotten all the publicity. But a number of other British stocks int he

FTSE-100

show a

similar technical pattern: heavy distribution and insider selling. They start to

underperform

the general

market and the Tiger Accumulation Index drops below -.25. The sell signals gives

Tiger

users

additonal points when to sell these stocks short.

--------------------------------- BARCLAY's BANK

-------------------------------------------------

======================== BDEV

Barratt Dev ===============================

======================== BLND

British Land ===================

======================== DMGT ===================

===================

================================ EXPN

==========================================

====================== HMSO ========================================

====================== HOME

========================================

========================== IHG =====================================

================ KGP ==============================================

===================== RBS - Royal Bank of Scotland

=================================

=================== WOS

=================================================

======================= WPP ==========================================

"Yes! We finally captured Martha Stewart. You know, with all the massive and

almost completely

unpunished fraud perpetrated on the

public by companies like Enron, Global Crossing, and Tyco

we finally got the ring leader.

—Jon Stewart

|

Martha Goes To The Big

House for Insider Trading.

Martha Stewart was convicted Friday of obstructing justice and lying

to the government about a superbly timed stock sale, a devastating

verdict that probably means prison for the woman who epitomizes

meticulous homemaking and gracious living.

The jury of eight women and four men deliberated three days

before convicting Stewart of all counts against her. The charges

carry up to 20 years in prison, but Stewart will most certainly get much less than that

under federal sentencing guidelines.

Her ex-stockbroker Peter Bacanovic, 41, was convicted on all but

one count against him, making a false statement.

The charges centered on why Stewart dumped about $228,000

worth of ImClone Systems stock on Dec. 27, 2001, just a day before

it was announced that the Food and Drug Administration had rejected

ImClone's application for approval of a cancer drug, an announcement

sent ImClone's stock plummeting.

Stewart and Bacanovic claimed they had a standing agreement

to sell when the price fell below $60. But the government contended

that was a phony cover story and that Stewart sold because she was

tipped by her broker that ImClone CEO Sam Waksal was frantically trying to dump his own

holdings. |

|