Futures

Trading with TigerSoft.

TigerSoft

provided you data for Perpetual Commodity Contracts.

The

basic TigerSoft program lets you get automatic Buys and Sells for

the

SP-500 (W-Minis), metals, currencies and food commodities. Food

commodities

are discussed in this Blog. But first let me show you the

current

chart for the E-Mini. Note that these automatic Buys and Sells

are

optimized automatically. For more information, please see the

Introductory TigerSoft discussion and Special

Price.

General

market timing is the province of our Peerless Stock

Market

Timing ($295). Peerless has now been back-tested

to 1915. A new book is

is

coming out for Peerless.

-----------------------------------

E-Mini ---------------------------------------------------------------------

Simple Ways To Trade Food Commodities

with TigerSoft Accumulation Index and TigerSoft Buys/Sells

See also

2/26/2008 Food Commodities Streak

Upwards. TigerSoft Easily Spotted The Start of Their Moves..

In the past, I have always

said that Tiger's internal strength indicators work best with stocks, indices, metals,

currencies and interest rate driven futures but less well with food

commodities.which are heavily affected by weather

conditions, which no one can predict very well. However, because World Demand has become so important

to food commodities in this Global Economy, Tiger is now doing a fine

job in predicting their movement.

The rules we can set out for trading commodities here, will help you

when they are applied to stocks, ETFs, currencies,

metals and indices. Commodity

traders know that gains like we show below mean very big profits because of

the leverage a trader gets here.

There are many of examples of

the how well Tiger and Peerless work with stocks, indices, metals, currencies

and interest rate driven investment vehicles. What missing is an exposition of TigerSoft and food commodities. This

page will try to remedy that. This page will grow in the course

of the week as time permits. So come back often.

I will set out basic rules in the first commodity to be examined, CORN,

and then we will see how well they work

with the others. We'll see what revisions and supplemental rules

are needed, too.

This should make a

reading of my Explosive

Super Stocks and Short Selling books more

valuable. I hope it

will make some you want to get our software. The Tiger

Accumulation Index was first invented by me in

1981. We have had years of experience using it. The

automatic Buys and Sells are unique to TigerSoft. A fuller

explanation of our indicators and the best way to trade them are in my

books and the Help routines of the

software.

Here we will use at

"perpetual contracts". For prices these employ the contract to expire closest

to,

but at least 16 days away and for volume, they use all months'

contracts' volume. We go back about two years.

We look at 7 commodities: corn, coffee, cocoa, live cattle, orange

juice, pork bellies, soybeans, sugar and wheat.

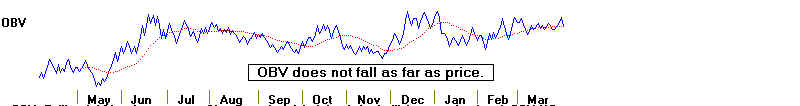

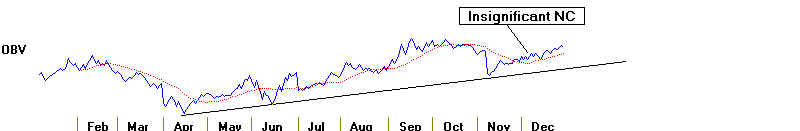

We will be most interested how well price patterns, the Tiger

Accumulation Index, OBV and automatic signals work..

Corn (C_1620) - done

Coffee (CC1620) -

done

Cocoa (CO1620)

Live Cattle (LC1620) -

done

Orange Juice (OJ1620) -

done

Pork Bellies (PB1620)

Soybeans (S_1620)

Sugar (SU1620)

Wheat (W_1620)

================================================================================

=========================

CORN =================================

Corn C_1620 - 2005

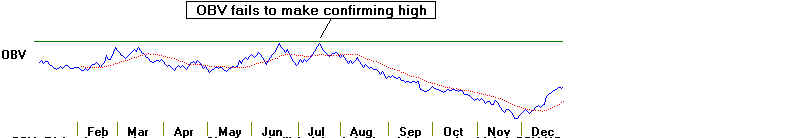

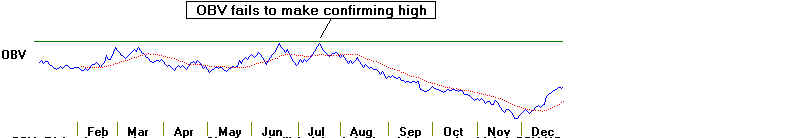

The chart

below for corn in 2005 illustrates some basic rules for calling a top with the TigerSoft

tools.

(1) The July peak was not confirmed by a higher Tiger

Accumulation Index.

(2) The July peak was not confirmed by a higher OBV

(aggressive buying).

(3) The breakout quickly failed to stay above the

breakpoint at 235. This is a "false breakout".

(4) An upsloping head and shoulders pattern is traced out.

The breaking of the neckline at 227 is bearish.

(5) Prices quickly fell back below the blue 50-day ma and

the Accumulaton index turned negative (red) to confirm

the breakdown.

(6) A simple 20-day Stochastic using the K-Line gave the

best signals in this period. That was the optimized best system.

(7) Prices crossing back above the 50-day ma with the

Accumulaton turning positive signals an upturn. More

evidence of an upturn

would be desirable.

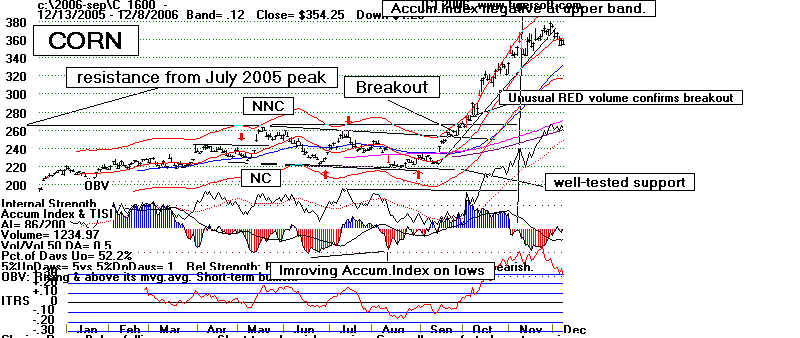

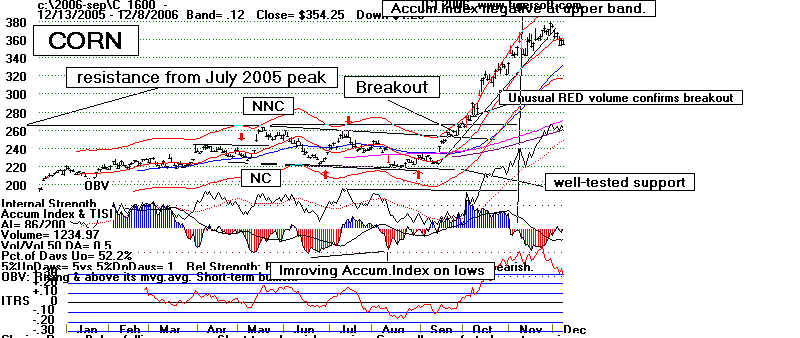

Corn C_1620 -

2005-2006

8) Buy on first

pullback to rising 50-day ma if Tiger Accumulation Index is positive. January 2006.

9) Expect resistance at

point where prices previously broke down. 230.

10) Use Automatic Red

Buys to trade price uptrend.

11) Prepare to sell if

new is made with Tiger Accumulation Index is negative and OBV does

not confirm. Note non-confirmations on last day of chart.

Corn C_1620 -

2006

(12) The May peak was not confirmed by OBV and the Tiger Accumulation Index was

negative.

That is a reliable Sell signal.

(13) Resistance is often created by earlier peaks. The 260 level resistance

started

in July 2005 and stoipped two 3006 rallies.

(14) Buy at well tested support if the Accumulation Index and OBV are not

confirming the price

weakness. This is short-term because of the well-tested horizontal support fails,

it is

best to sell.

(15) Buy on price breakout above well tested resistance ay 260. September 2006.

(16) The price breakout above 260 causes the previously best trading range BUY/SELL system

not to work. Use a trend-following system or a longer-term Stochastic.

(17) Red high volume confirms the breakout and makes it more reliable.

(18) The rising of the Tiger Accumulation Index above the first dotted line confirms the

breakout, too.

(19) When breakout advance takes place without a pullback, you can add to positions at

price uptrend-line.

(20 The November peak at the upper band showed negative readings from the Tiger

Accumulation

Index. This would be a good place to take profits.

SELL

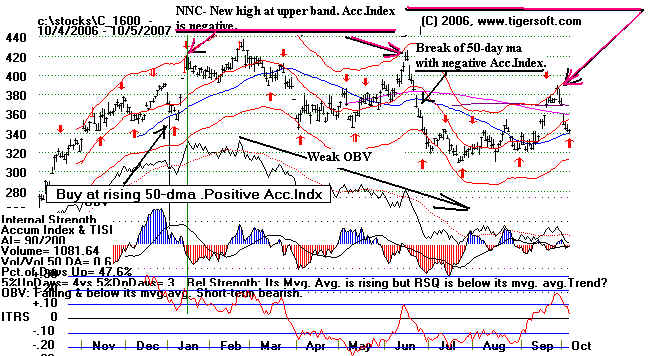

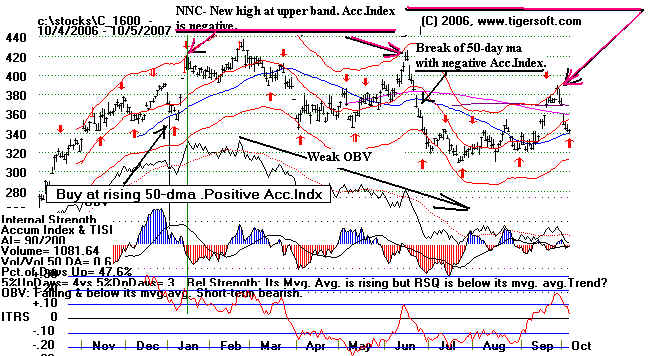

Corn C_1620 -

2006-2007

(21) Buy at rising blue 50-day ma when current Accumulaton Index is very positive.

(22) Prepare to Sell at upper band if Tiger Accumulation is negative. Jan., June and Sept.

2007.

(23) Drop below 50-dma with Accum. Index negative is usually a reliable Sell.

(24) When OBV in declining for more than 2-3 months, prices usually subside.

(25) The basis for the optimized Tiger's Automatic Buys and Sells has switched to

short term trading because Corn has stopped trending.

================================================================================

============================ COFFEE

============================

2005 Coffee - CC1620

The March top and December bottom conform exactly to our rule to sell at the

upper band when the Tiger Accumulation is negative (NNC) and Buy at the lower band

when the Accumulation Index is positive (PNC). These rules are made more epmphatic

when the OBV faile to confirm the high or low, as is true in the chart below.

In December 2005, we see another classic Sell based on the same conditions that

appeares at the March top: a new high at the upper band.with the Accum. Index negative

and the OBV not confirming. But you will also notice that the 110 level was

tested five

times.from July to December. In the graph below the one below prices achieve a breakout

above the 110 resistance and rise quickly, Perhaps, this is just short-covering.

2005 -2006 Coffee - CC1620

See the short-covering breakout above 119 below. Then a quick top formation appears.

Corn

then breaks below its 50 dsy ma eith the Accumulation Index negative, for a Sell.

2006 Coffee - CC1620

Do you see how the internal strength indicators grew more and more positive before the

price breakout at 111-114 in October? Buying the breakout there was definitely the

right thing

to do. As long as the Accumulation Index stayed positive on the rally, the odds

favored

prices would challenging the yearly highs near 129. That is what happened.

2007 Coffee - CC1620

Coffee's rising internal strength indicators predicted September price

breakout above 130.

Two months before this,

the OBV Line was making new highs and a month before the surge

past 130, the Tiger

Accumulation Index soared to levels signifying informed, big money buying.

Note the bullish breakaway

gaps, too. This presently looks quite strong.

2007 Coffee - CC1620

================================================================================

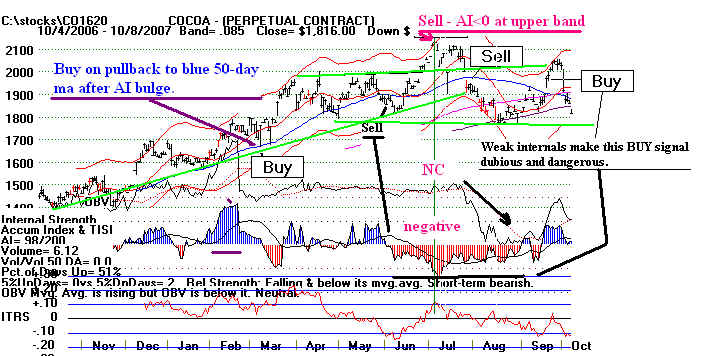

========================= LIVE COCOA

============================

Cocoa - CO1620 2005

Cocoa - CO1620 2005 - 2006

Not remarked on the

chart below is the normally bearish head and shoulders pattern, from

December to February. This chart

shows mostly red distribution. Longs should have avoided it,

unless it breaks out unexpectedly above

1600. And that might well be simply a short squeeze

if the Tiger Accumulation Index does not

improve markedly.

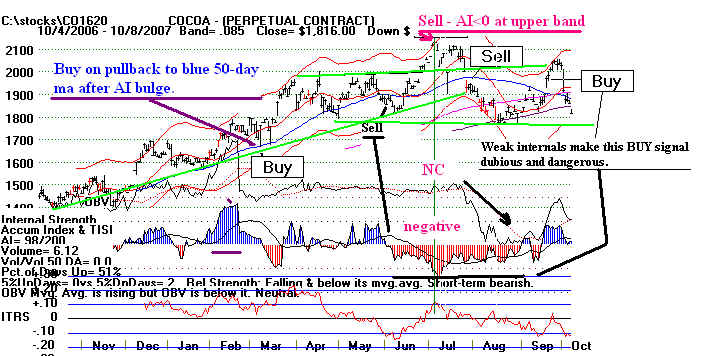

Cocoa - CO1620 2006

False rallies, based on short squeezes are sometimes attmpted in a rising commodities

market among those

commodites which have the weakest internals. The downtrending OBV

is a major sign of

weakness. The steadily negative Accumulation Index is as important. And

it too is bearishly negative.

Cocoa - CO1620 2007

We have found pullbacks to the blue 50-dma soon after a bulge from the Tiger Accumulation

Index to be good Buys. You can see that

in early March. But the rally soon ran out of steam.

The final high occurred in early July as COCOA

reached the upper band with the Accumulation

Index negative. The pattern now developing

looks like an extended head and shoulders pattern.

The neckline is the flat green support line.

The key resistance is the green line going through the

pattern's shoulders.

To avoid whip-saws around the 50-day ma, make sure the internals of the commodity support

the trend you expect.

================================================================================

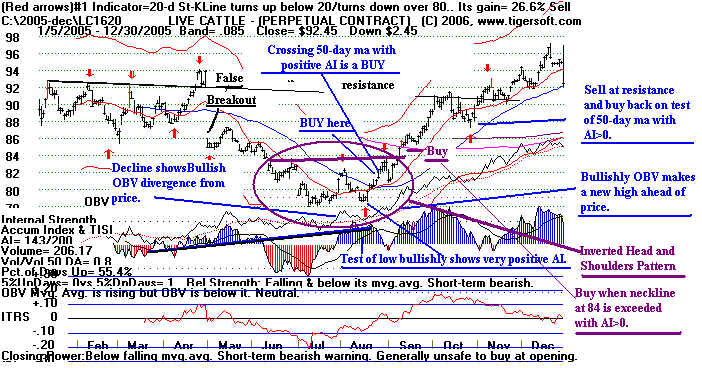

========================= LIVE CATTLE

============================

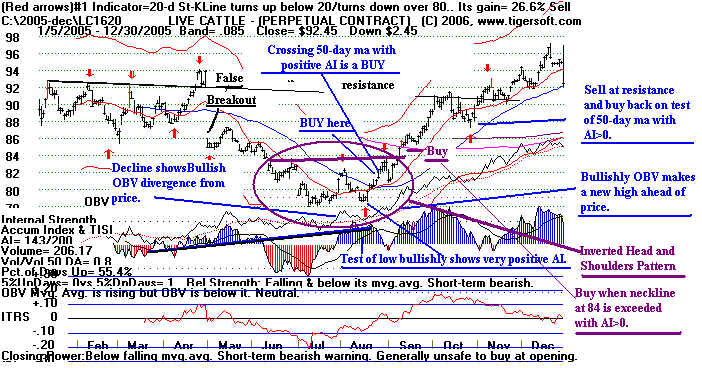

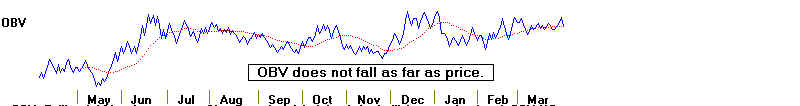

Study the

chart below. It illustrates a lot. It begins with a false breakout above 92.

The gap down a few days later would

have meant a loss. But the bottom was easily

recognized in August Note the

rising OBV line, despite the price decline. This is a

bullish divergence. The Tiger

Accumulation Index was positive on the test of the lows

in August. We recommend

buying also on a close above the blue 50-day ma with the

Tiger Accum. Index positive. See

the inverted head and shoulders pattern. Buy on a

close above the neckline, at 84 in

the chart below, if the AI is positive. You can see at

the resistance line as it is

extended the right. The level of the false breakout will be

resistance on the first rally up to

it.. The retreat to 88 and reversal day up there, just

above the rising 50-day ma is a BUY

with the Accumulation Index positive.

Corn in the chart below had an optimized 20-day Stochastic Buy/Sell system.

This

works fine until there is a breakout.

Trust the breakouts when they are confirmed.

2005 Live Cattle - LC1620

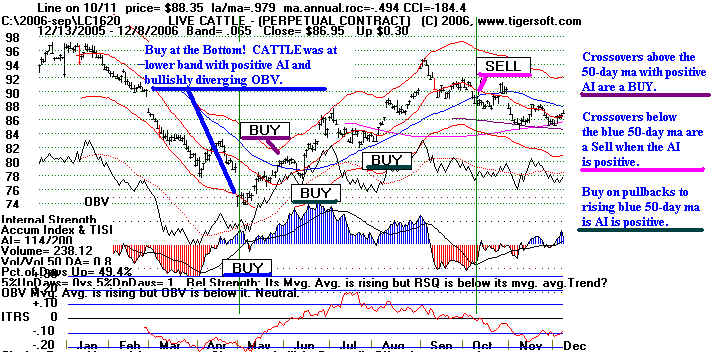

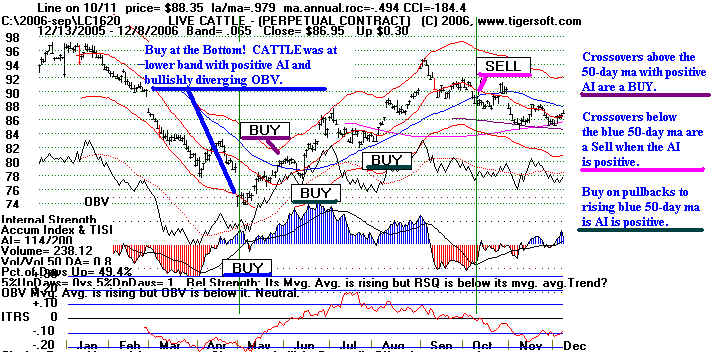

2005 -2006 Live Cattle - LC1620

2006 Live Cattle - LC1620

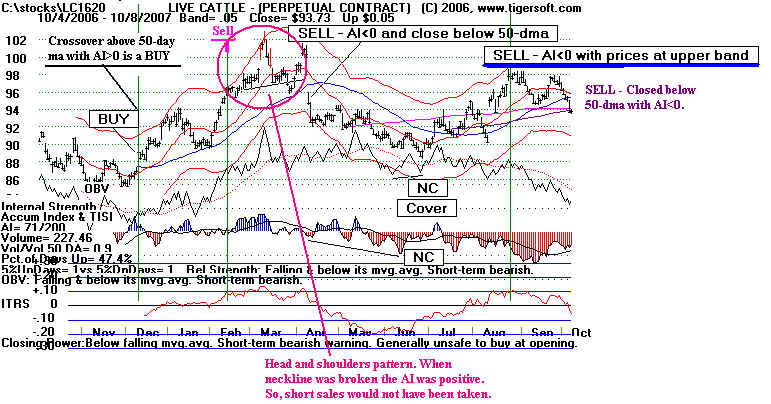

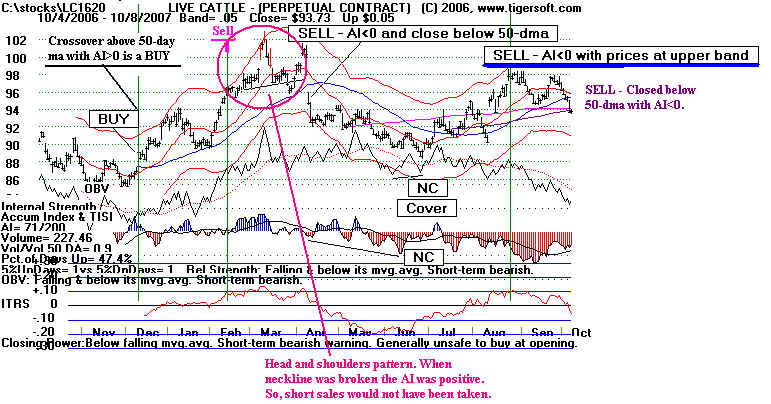

2006 - 2007 Live Cattle - LC1620

The crossover of the 50-day ma in July did have a positive Tiger Accumulation Index

and, so, could have been

bought by our rules. But the prior readings from the Accumulation

Index were not very good,

showing only non-confirmations of new lows, rather than positive

non-confirmations.

Selling or selling short at the upper band with the Accumulation Index

negative is in accordance

with our rules here. Note the resistance at 98 from the previous

reversal pattern in February

and March.

===============================================================================

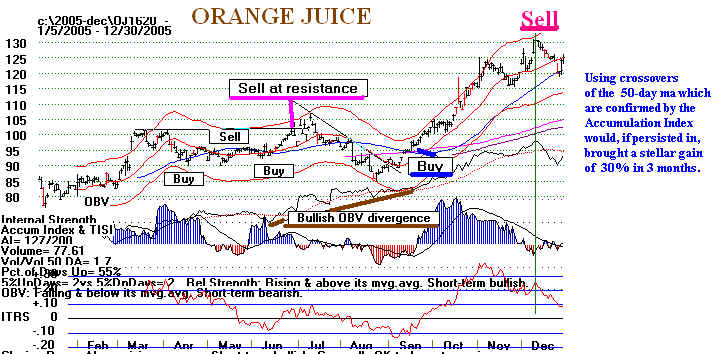

========================= ORANGE JUICE

============================

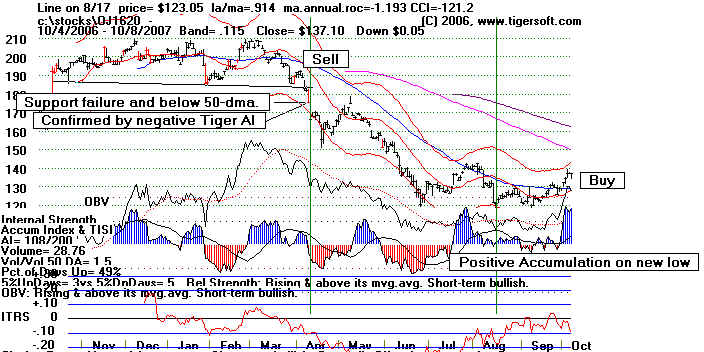

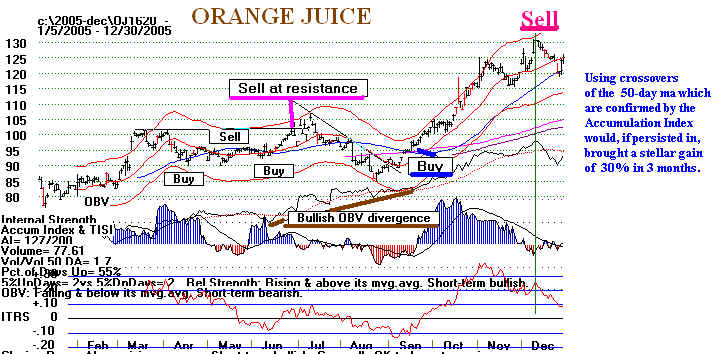

2005 Orange Juice -

OJ1620

2005 -2006 Orange Juice - OJ1620

When you see this much blue Accumulation and the OBV is matching price in strength,

use thee crossover of the

50-day ma with a positive Tiger Accumulation Index to take a

bullish long position.

Here we could have sold on strength at the upper band at 130 and then

retaken the long position at

125 two months later..

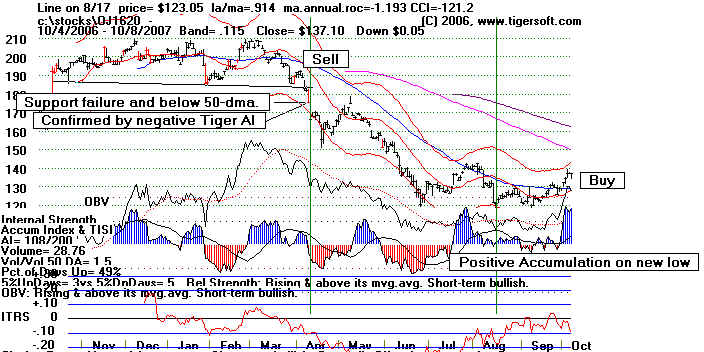

2006 Orange Juice - OJ1620

Stick with the trend

when it is supported by a mostly very blue Tiger Accumulation Index.

Here that would

have meant buying in February at 130, selling at 175 in July and buying

back the long

position at 193 in October.

2007 Orange Juice - OJ1620

Use negative readings from the Tiger Accumulation index to confirm a breakdown by

prices below support.

Accordingly, one might have sold or sold short Orange Juice

at 175 in August.

In July it rose slightly above its falling blue 50-day ma with the Accumulation

Index positive.

This might have been used to vicer the short sale. The rate of change of the

50-day ma should also

be considered. It was falling very fast. That means more resistance.

The subsequent tests of

the lows occurred with a very positive Accumulation Index. Buying

here would have been

the correct response to these readings.

===============================================================================

========================= PORK BELLIES

============================

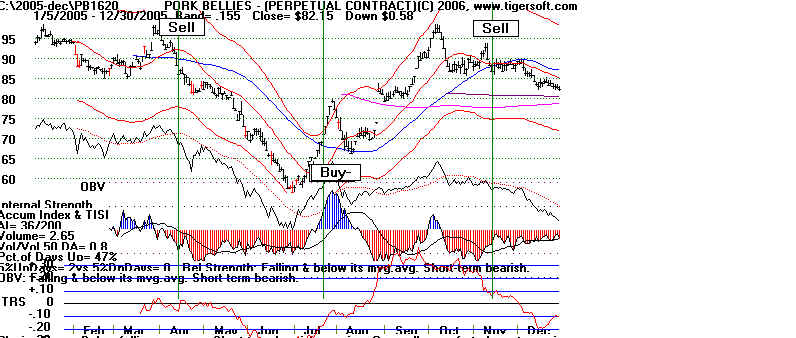

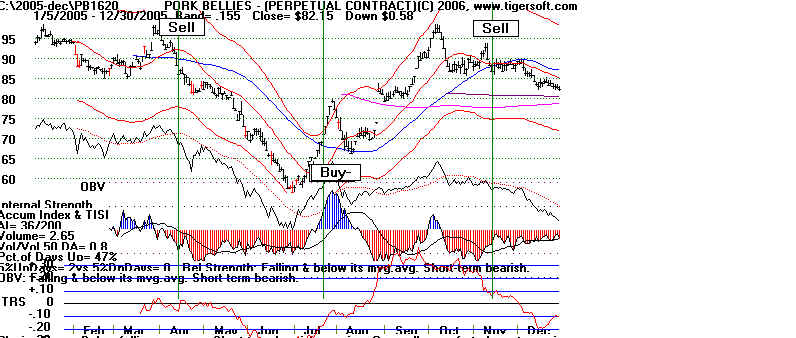

2005 Pork Bellies -

PB1620

Prk bellys' zigs and

zags here can be traded nicely using the crossovers of the blue 50-day ma

when the Tiger Accumulation Index confirms it.

This swings wildly and a simple system is best.

Sell 97

Buy 73

Sell 88

2006 Pork Bellies -

PB1620

Using the same crossover rules and cover at support, these are the trades.

Buy 83 - Feb

Sell 79 - March

Buy 87

Sell 90

Cover 78

2007 Pork Bellies - PB1620

===============================================================================

========================= PORK BELLIES

============================

2005 Pork Bellies -

PB1620

The bearish June-July top pattern should stand out to any serious TigerSoft trader.

You should also see that it takes months for the pattern to be completed and prices to

sell off.

===============================================================================

========================= SOY BEANS

============================

2005 Soy Beans- S 1620

2005 -

2006 Soy Beans- S 1620

The Tiger Accumulation Index stays preponderately negative throughout the span

of time shown in the chart below. This dominates. The OBV Line is stronger.

But the

Accumulation Index tells the story. I would not take moves past the 50-day ma as

points

of entry for a purchase, though short sales might be covered then.

2006 Soy Beans- S 1620

Price breakouts from long bases have to be respected

enough to cover any

short

sales. But with such negative Accumulation, I would not go long on the

breakout in

October at 620.

2006 - 2007 Soy Beans- S 1620

The July 2007 breakout of the OBV Line for Soy Beans coincided with its first

post breakout pullback towards its 50-day ma. This is the first reliably entry

point.

The rising Accumulation Index and OBV justify holding the long position though

taking profits at the upper band would have been tempting.

The May breakout above a flat top would have made me hesitate to sell short

even though the upper band is reached with the Accumulation Index negative.

================================================================================

======================

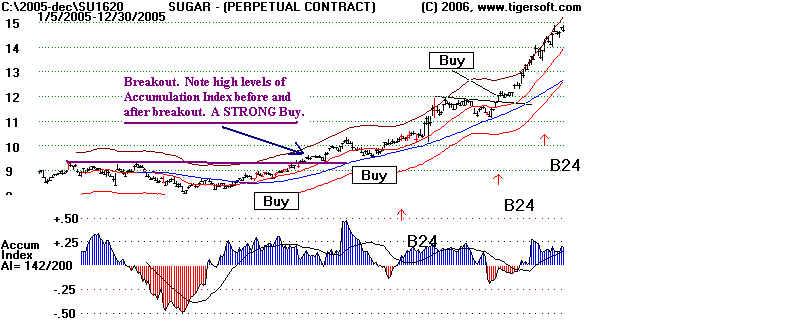

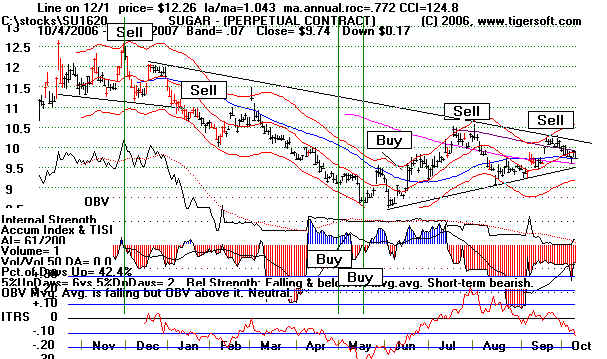

SUGAR ============================

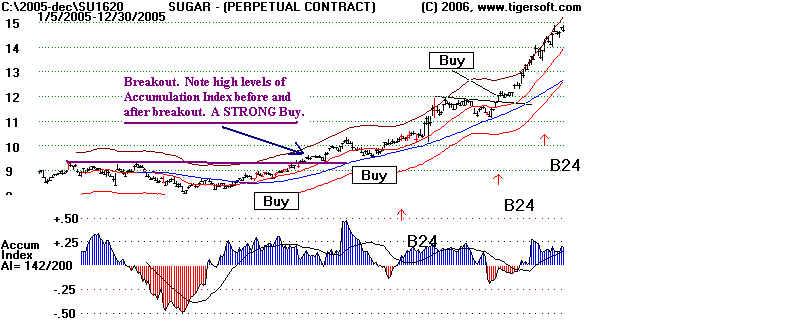

2005 Sugar- SU1620

The power of Sugar's move upwards in 2005 was foretold by the breakout above flat

resistance

preceded and followed by high levels of

(blue) Tiger Accumulation. First, we get a BUY

simply upon the penetration of the blue

50-day ma. Then, give a Buy to the breakout. Next is

a Buy on the first retreat to the rising

50-day ma following the breakout. The flat topped .

breakout is the next point where we would

BUY more. You may use the automatic Buy B24

signals.

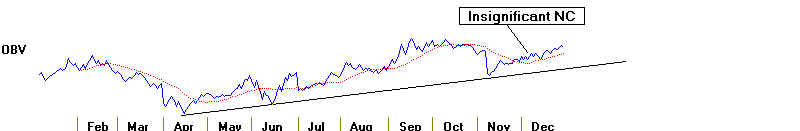

2005 - 2006 Sugar- SU1620

The bulge in the Tiger Accumulation produces a 100% advance in sugar in 6 months.

The lengthy duration of (blue) positive Accumulation is rare. It puts the odds in a

favor

even when there are retreats to a rising 21-day ma and even on the decline to the blue

50-day ma in February.

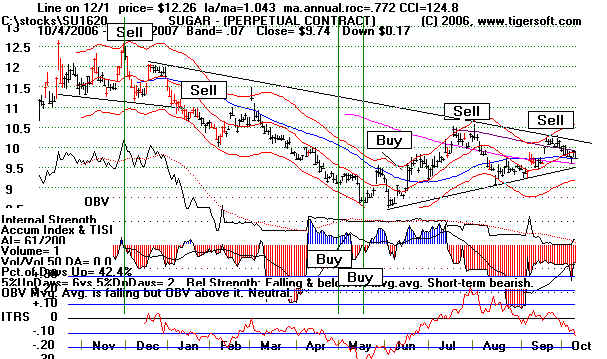

2006

Sugar- SU1620

There are times when the automatic red Buys and Sells work perfectly for a lengthy

period of time.

I suggest this is true after a big advance. Professionals are retaking

control.

A quick double in

a food commodity is a very good move. After that, be prepared for a

retracement.

In June Sugar's price drops below the falling (blue) 50-day ma. with the

Tiger

Accumulation negative. This is an emphatic Sell. There is no reason to take a

long

position at the

end of the year, as the commodity goes sidewise. The Tiger Accumulation

Index is too

negative.

2006 - 2007 Sugar- SU1620

At the end of

2006 and the start of 2007, Sugar develops a bearish head and shoulders

pattern. Red distribution

predominates. Sell short on the breaking of the neckline and on the

first pullback upwards to the falling

50-day ma. At 9 Sugar has fallen to the lower band

with the Accumulation Index positive.

This is a Buy. So is its rise in these conditions back

above the 50-day ma, It is a Sell

at the upper band when the Accumulation Index is negative.

================================================================================

======================

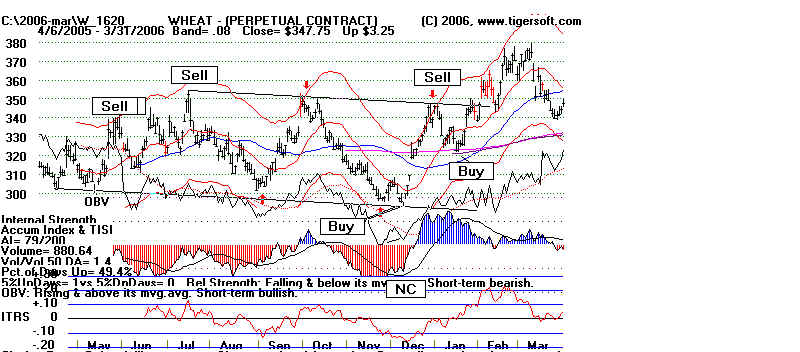

WHEAT ============================

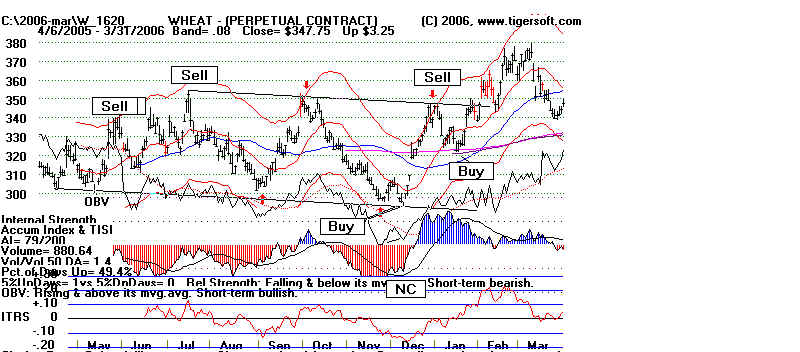

2005 Wheat- W 1620

Recognizing a trading range early-on helps a lot here. Unless the commodities'

markets are weak a whole, it

is usually best to cover short sales on tests of lows.

The mostly red distribution

shown in the Tiger Accumulation Index warns about

going long on moves past the

blue 50-day ma.

2005 - 2006 Wheat - W 1620

I would not buy in December when prices cross the 50-day ma; the Tiger Accumulation

Index has been

far too negative. The next pullback towards the 50 day ma with the

Accumulation

Index having

turned positive does represent a good Buy.for a quick trade back to the resistance

at 348. One

could reasonably Buy on the breakout over 360 but the Accumulation Index has

weakened

substantially, so that this is viewed as only a quick trade to be sold as soon as the

red 21-day ma is

violated.

2006 Wheat - W 1620

The September breakout was accompanied by a very negative Accumulation

Index. I

would not have bought this breakout. But I would also not have shorted

it until prices

were much higher. Breakouts past a line srawn so precisely through 3

separateshould be

respected. Note the bottoms kept rising.

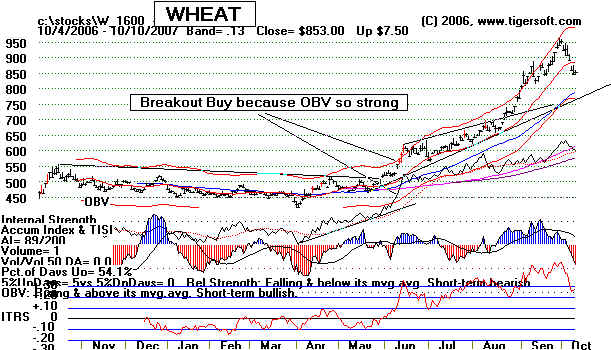

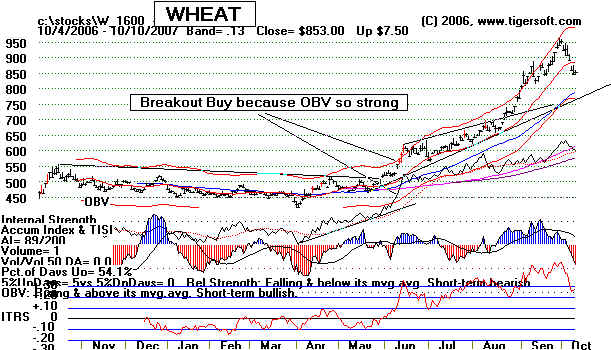

2006 - 2007 Wheat- W 1620

Sometimes prices rise without prior or accompanying high Accumulation.

In that case, we would normally expect to see hte OBV Line rising steeply.

This means there are no dips to buy patiently. Aggressive buying is predominates.

Look closely and you will see a gap on high volume in June. After such a long

sidewise pattern, the breakout must be respected. The high volume gap and strong

OBV can be taken as a Buy, but added care must be taken.

.

|

Longer term Investing How To Make Your Retirement Nest-Egg

Grow: Rates of Return Tables

Longer term Investing How To Make Your Retirement Nest-Egg

Grow: Rates of Return Tables