New TigerSoft Short Selling

Tools and Techniques

Only $98.====> Get our TigerSoft Special Here

and run the same programs shown here.

We always look at the weakest stocks in order to

to make the lessons

as clear as possible. As the DJI has now

gone 55 months without a decline of more

than 10%, it would be wise to consider some short selling

techniques. Of course,

there are ETFs that now

let you be long on a short sale. And these are fine for many accounts.

But we make much more

money using the approaches outlined below and expanded in my book,

Killer Profits in Any Market using Tiger's Original

Accumulation Index.

In the

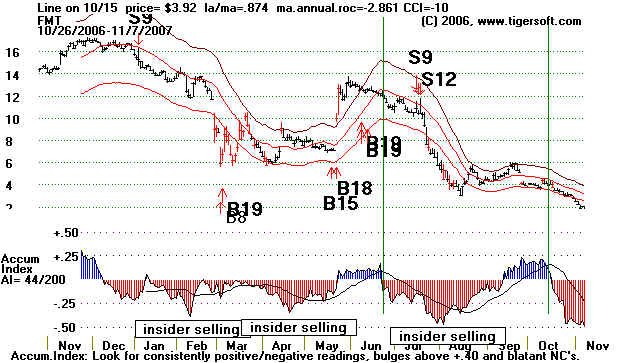

chart below, notice first the bold major Peerless S9 and S12 Sell signals.

These are our most bearish general

market signals. The software lets you impose

them on any chart. The first

thing you will want to do when we get a reversing

Peerless Sell signal is to look at

the weakest stocks, stocks making new lows and

stocks in the weak groups.

It usually takes a few days for the market to roll over.

So you have a little time.

Selling FMT short on the January and June Sell signals

would have worked perfectly.

A

second powerful system is based on the original Tiger Accumulation. When it

dips below -.25, wait for the

next recovery. Then when the Accumulation Index goes back

below its moving average, sell

short. The vertical lines illustrate where short sales

would have been made using this

system. The best such "Accumulation Index MA

penetration Sells" take

place between 4 and 8 weaks of the previous dip and coincide

closely in time with a price

violation of the 50-day ma.

A third, very simple approach also based

on the original Tiger Accumulation

is to sell short when our index is

deeply negative and the stock violates its 50-day ma.

Very negative Accumulation Index

readings below -.25 show, we postulate, informed

insider selling if the stock

then starts to weaken more than the market as a whole.

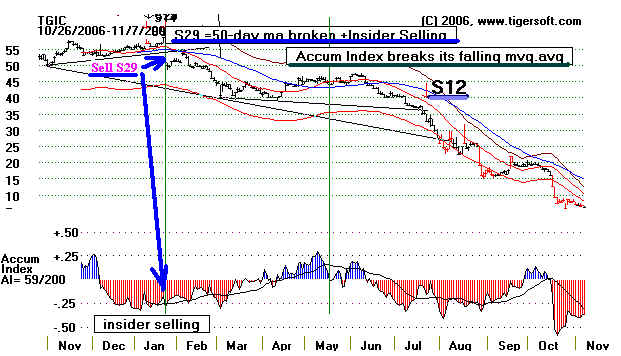

That is true for TGIC below

in January. The rest of the market turned up in February,

but not TGIC. A

fourth system is based on our proprietary S12 Sell for stocks.

You will see that in many of

of the charts here and charts that show weakness that

is exploitable by the

short seller using TigerSoft. The Tiger S12 is not the same as the

Peerless S12. It

is based on the stock's behavior, not the Dow Jones, as is the case

with the Peerless S12.

In May, the Accumulation Index falls back below its moving

average after

previously dipping beloiw -.25. This constitutes a great place to

go short a stock that

is clearly underperforming the market. It means the effort to

support the stock is

ending. So, it becomes vulnerable. It did hold up for a few weeks.

That was because the

overall market was strong until our July 17th major Peerless Sell.

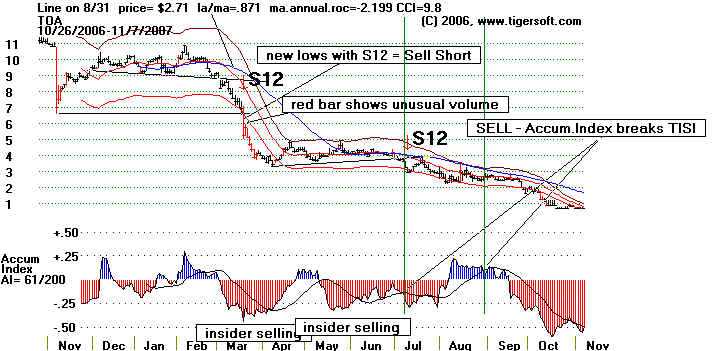

The chart of TOA shows the same principles. To that

we add the idea of looking at our

Tiger

charts to see if the daily price bars turn red. If that happens on a new low, as it

did in March

you

have another sign to sell short immediately. Here it was augmented with a Tiger

Sell. In

all

these charts the preponderance of color from the Accumulation Index is red. That is

the most reliable

sign

of all that the stock is under big money distribution and it will probably trend lower.

Look

for more materials here, late this weekend.

|