|

Tiger Software's Biotech Series Continued

- Part 2

AMGEN's Take-Off Phase: 1990

When The Tide Goes Out, You Can See the Rocks

When The Stock Market Falls, The Very Strongest Stocks Stand Out. When The Stock Market Falls, The Very Strongest Stocks Stand Out.

Tiger's Accumulation Index Made Us A Lot of Money Here.

We said last time that Biotechs as a group move in sudden sweeps upward that last a year

and half to two years. The

advances are then followed by seven or eight years of stagnancy.

When the Biotechs as a group do

start a move upwards by making a breakout new high above

a series of previous peaks at about

the same level, it will pay to be in the right biotechs.

Amgen's success is instructive.

And it is a stock we made a lot of money in for ourselves and

for our subscribers back in 1990

and 1991.

Formed in 1980 by some scientists and venture capitalists with a $19 million private

placement, Amgen (AMGN) is surely one of

the very best performing biotechs of all time. It is one

of the only biotech companies to grow

from being a drug development company into a pharmaceutical

manufacturer. It owes its success

to two gene spliced drugs, Neupogen

and Epogen.

Additional

public offerings were required in 1983,

1986 and 1987.

The first

time AMGN stood out to us was back in late 1989. In the chart below you can see

the stock fell the lower band with

the Accumulation Index still in positive territory. This often

indicates an intermediate term

bottom, just like in May when it hit the upper band with

the Accumulation Index in negative

territory and then declined for two months. The stock

at the time of the October 1989

bullish divergence was only .98, when adjusted for all the splits

since then.

AMGEN 1989-1990

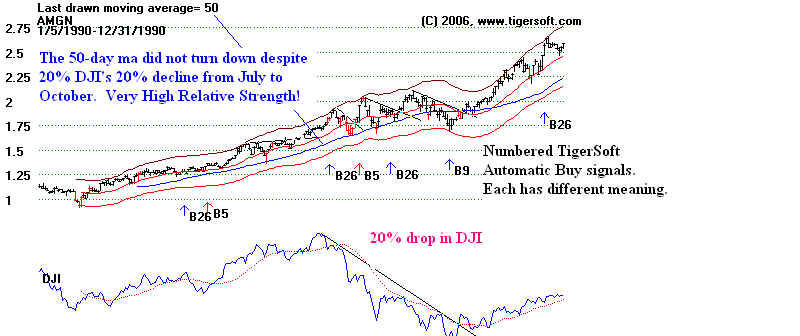

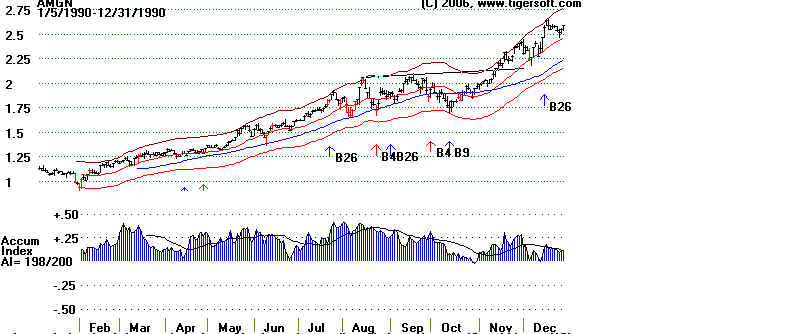

More obvious, in the next TigerSoft chart, below, you will want to note how AMGN

looked in 1990 as its big move began in

earnest. We can easily guess that doctors and

researchers must have been buying the

stock after seeing how efficacious its new test drugs,

Neupogen and Epogen, were. We can tell

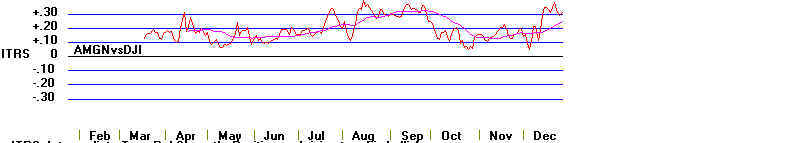

this because the overall stock market was actually

quite weak in January, as the DJI fell

more than 10% until February and again from July to

October, as the DJI plunged almost 20%.

So, most investors would have been holding back.

When

the stock market falls like this, the strongest stocks stand out, like rocks in a cove

with the tide out. We use a simple

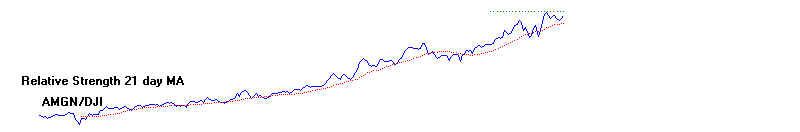

ratio of the stock and the DJI. That is shown below. And

we compare the stock's gain over a fixed

period of time with the DJI's gain over the same

duration. The second approach we

call "ITRS", for intermediate-term relative strength. The

"ITRS" for Amgen was positive

for the whole year. This is usually very bullish.

AMGEN and DJIA: 1990

Relative Strength Indicators

You can search the new highs list in a bear market and sometimes a stock like Amgen.

But it is better to be sure that the stock shows very positive readings from our

"Tiger Accumulation

Index". Look at the spectacularly bullish chart below. All but two days

produced a positive

Accumulation Index. The stock's decline to the lower band in October with the

Accumulation

Index positive gave us the "B9" signal shown above. The turning positive

by this indicator

after being negative for just a day is also a positive development. We see this in

October

and December. Tiger's Accumulation index was invented by William Schmidt in 1981.

AMGEN and Tiger's Accumulation Index: 1990

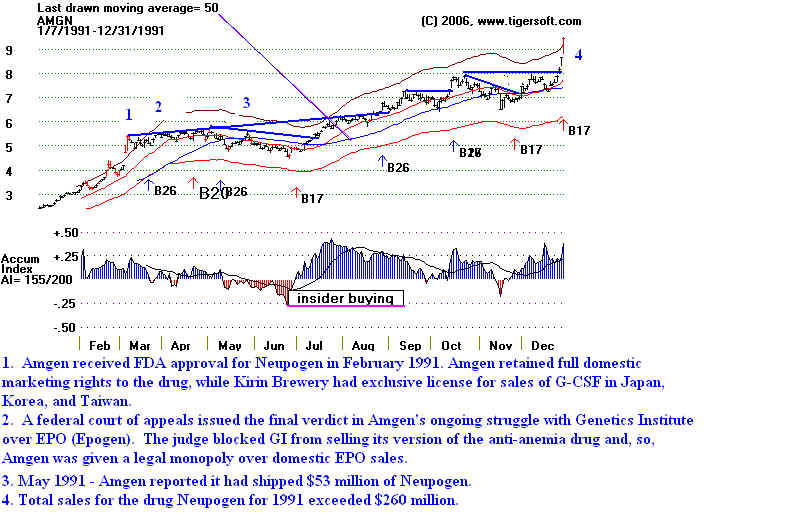

Now look at how AMGEN did with FDA approval for Neopogen in

February.

In May it won a court battle for exclusive rights to market

its drug Epogen.

Amgen and Tiger's Accumulation Index: 1991

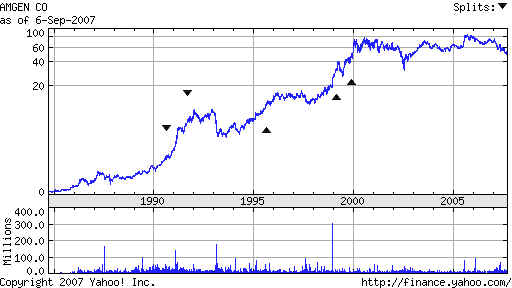

Amgen 's 20 year chart is shown below

Amgen

1998-2002: A Roller Coaster Ride with Ample Road Signs.

Note Amgen's steep advance

from 1998 to 2000. Its sales had by then passed

$3 billion. The FDA approved its ENBREL to treat moderately to

severely active

polyarticular-course juvenile rheumatoid arthritis. This

was unanimously recommended

for FDA approval on September 16, 1998. It was awarded FDA

approval on November

2, 1998. (Source:

http://arthritis.about.com/od/enbrel/a/enbrelrecommend.htm

and http://arthritis.about.com/od/enbrel/a/enbrelapproved.htm

)

Amgen and Tiger's Accumulation Index: 1998

Amgen and Tiger's Accumulation Index: 1999

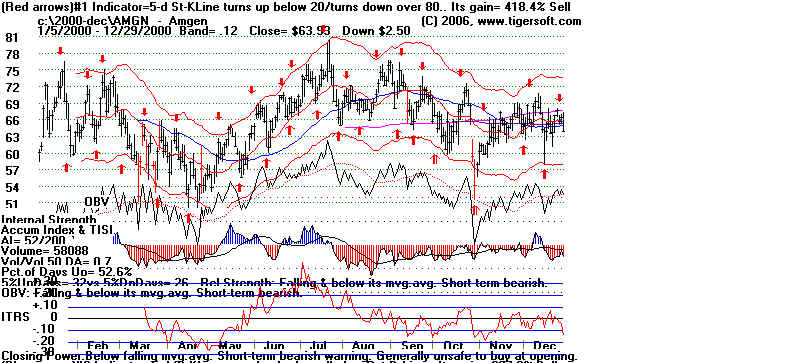

Amgen and Tiger's Accumulation Index: 2000

Note Steady Red Distribution

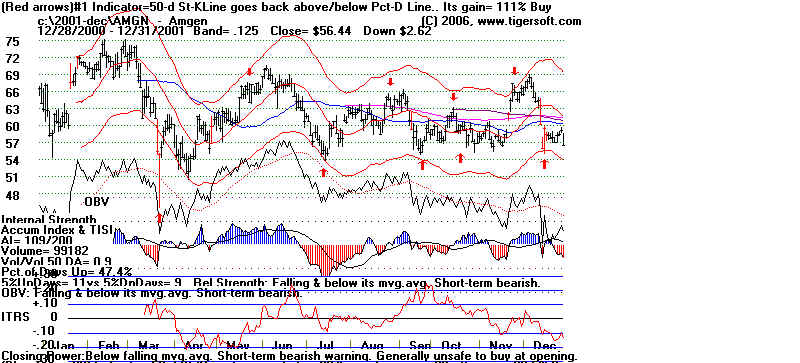

Amgen and Tiger's Accumulation Index: 2001

Amgen and Tiger's Accumulation Index: 2002

Amgen's Story

--- See http://www.answers.com/topic/amgen-inc?cat=biz-fin

The not-so-pretty picture of Amgen Lobbying

Thursday September 6, 3:42 pm ET

http://www.fool.com/investing/high-growth/2007/09/06/amgens-congressional-helpers.aspx

http://biz.yahoo.com/ap/070906/amgen_lobbying.html?.v=1 |

Amgen Paid Firm $480,000 to Lobby the Federal

Government

The Associated Press reported yesterday that the Senate

passed a resolution calling for the reversal of strict

reimbursement rules by the Centers for Medicare and Medicaid Services (CMMS) on Amgen's

lead drugs.

It has been a long year for Amgen and its two anemia-treating compounds, Epogen and

Aranesp. First, a Danish

study came out showing Aranesp did not improve quality of life or reduce the risk of blood

transfusions for those

with noncancer-related anemia. This put a serious dent in Amgen's plans to expand the use

of Aranesp, and sales

of the drug fell 10% year over year in the second quarter.

Shortly thereafter, the FDA slapped a stronger black

box safety warning on Amgen's two anemia compounds as

well as Johnson and Johnson's (NYSE: JNJ) anemia-treating Procrit.

The final nail in Amgen's erythropoiesis-

stimulating agents (ESA) growth plans came in July when the CMMS enacted stricter

reimbursement rules for

the ESA drug class that would curtail some usage in patients reliant on these government

insurance programs.

Amgen has argued that the CMMS reimbursement rules are unduly strict and don't follow

clinical practice guidelines

from leading doctors groups such as the American Society of Hematology. The CMMS and Amgen

have been going

back and forth on reimbursement rules for the ESAs for years.

Together, Aranesp and Epogen accounted for 44% of Amgen's sales in the latest quarter,

but times have been

tough for Amgen's top two compounds. In Europe, no fewer than three new competing agents

will be muscling these

drugs for market share by the end of next year, including Shire's (Nasdaq: SHPGY)

Dynepo, Novartis' (NYSE: NVS)

biosimilar

Epogen and Roche's Micera.

Amgen will get another chance to argue its case to the FDA about the risks and benefits

of its ESA drugs next week

during an FDA advisory committee meeting. The agency will take the recommendations from

this meeting into

consideration in developing new treatment guidelines for the ESAs, so Amgen could be in

for one more kick

in the tail this year.

WASHINGTON (AP) -- Drug maker Amgen Inc. paid Covington & Burling

LLP $480,000 in the first half of 2007

to lobby the federal government, according to a recent disclosure form.

The firm lobbied Congress on unspecified policy matters, according to the form posted

online Aug. 13 by the

Senate's public records office. Under a federal law enacted in 1995, lobbyists are

required to disclose activities that

could influence members of the executive and legislative branches. They must register with

Congress within 45 days

of being hired or engaging in lobbying.

|

|