|

Daily Blog - Tiger Software Send any comments or questions |

|

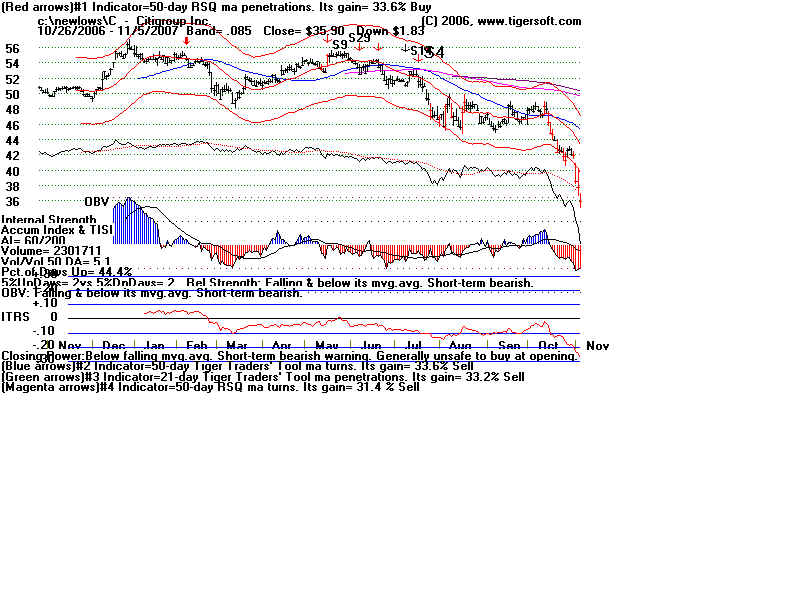

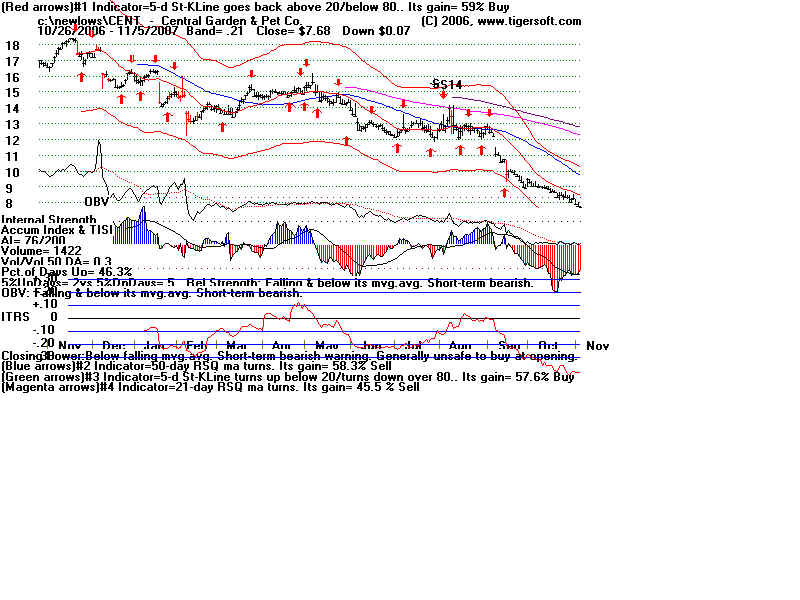

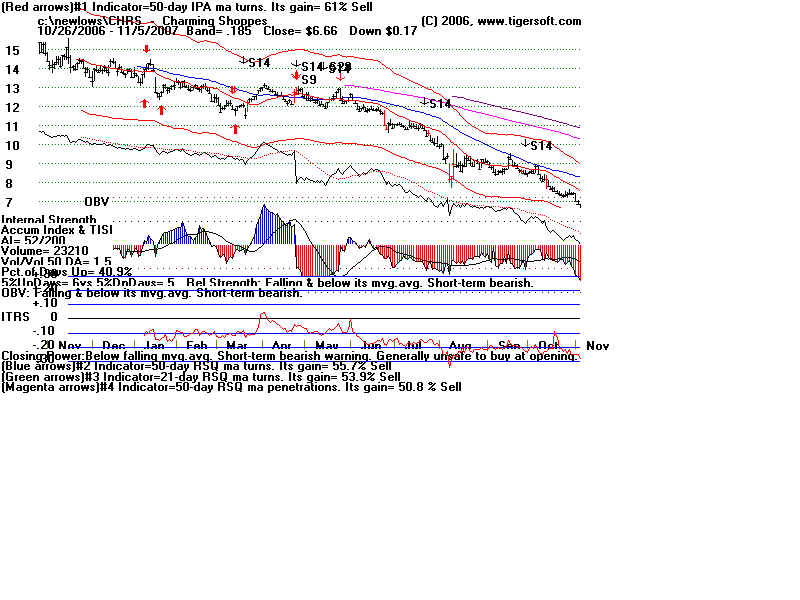

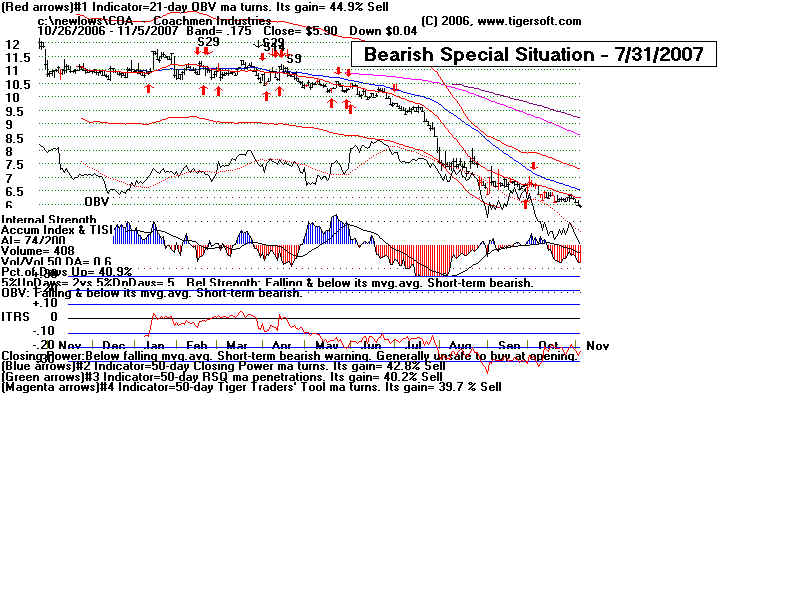

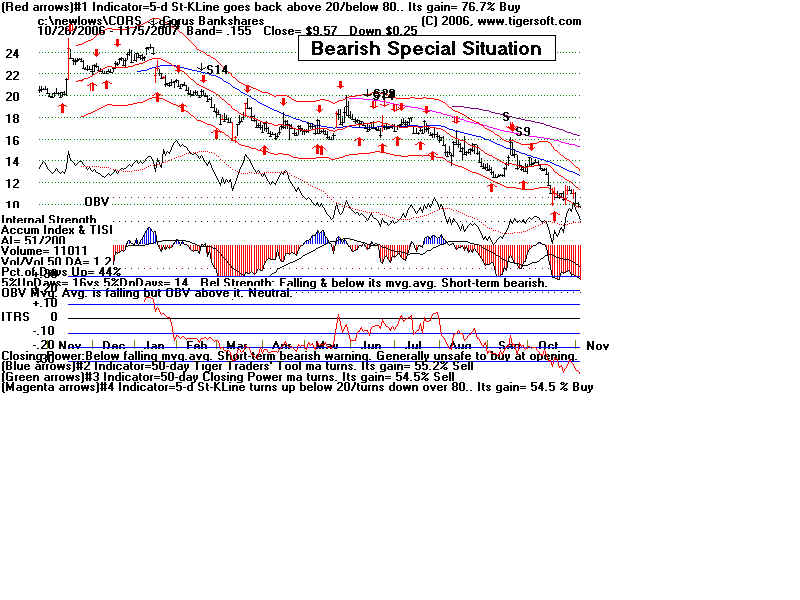

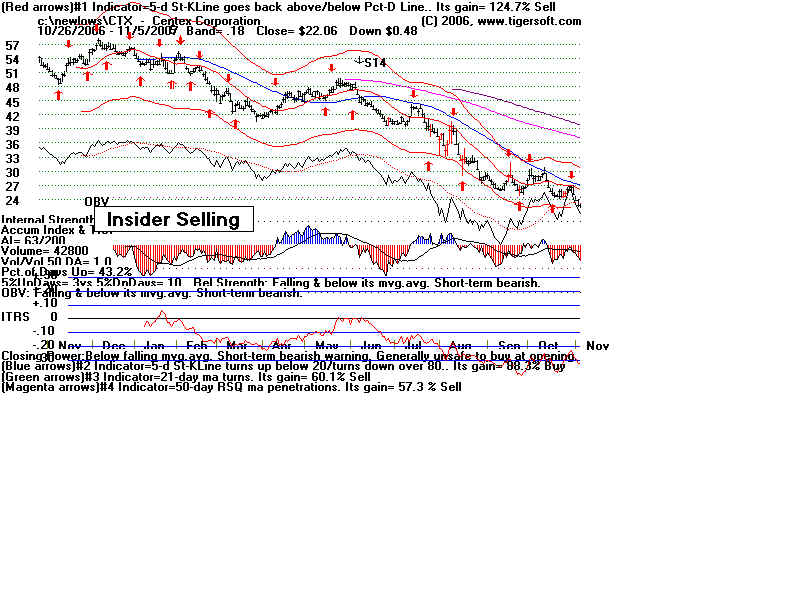

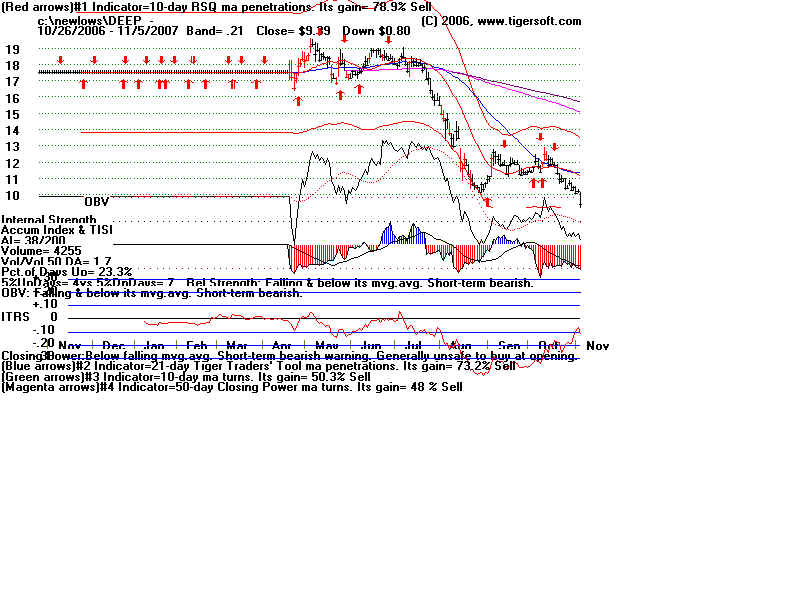

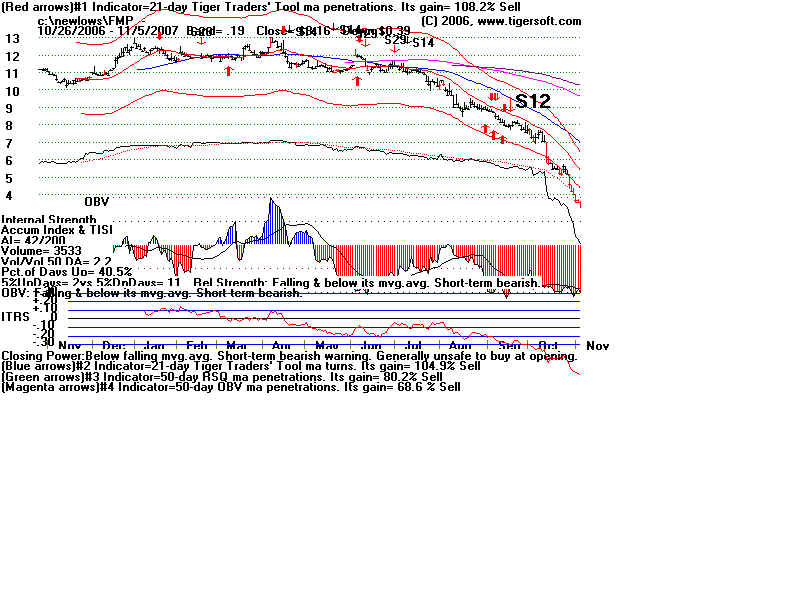

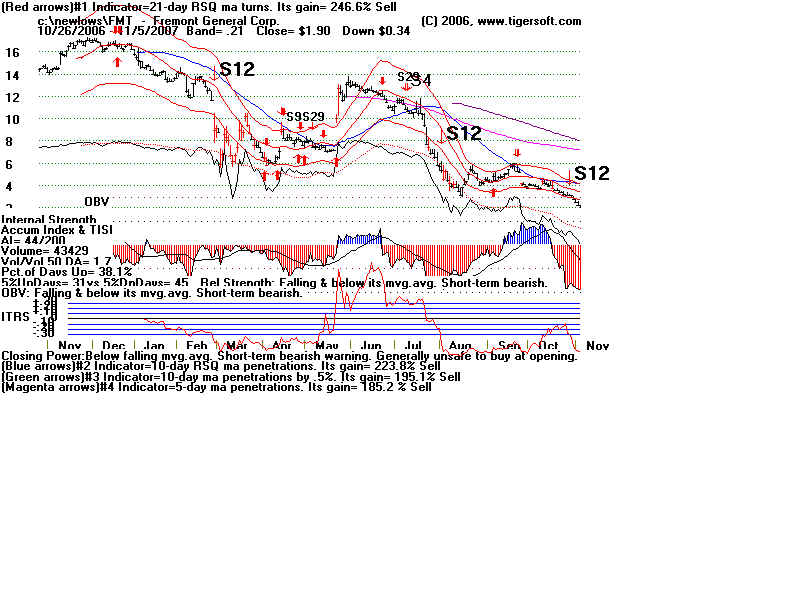

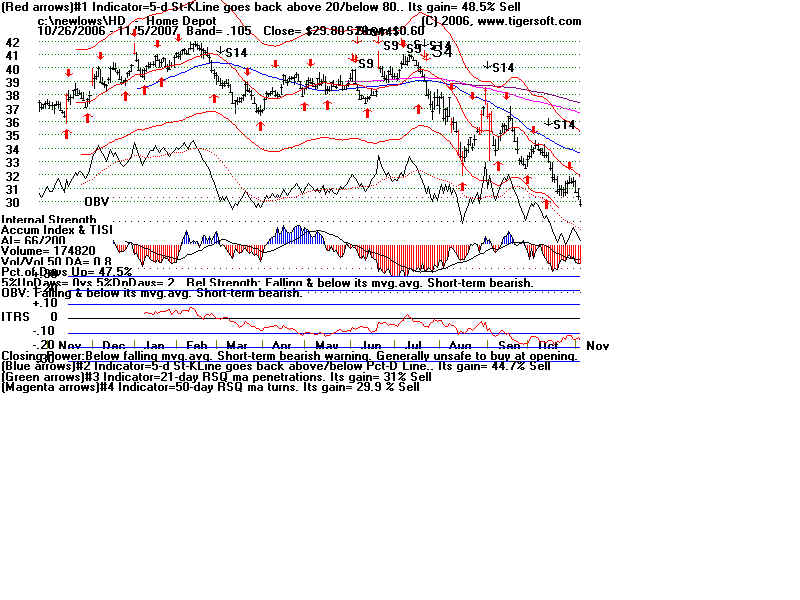

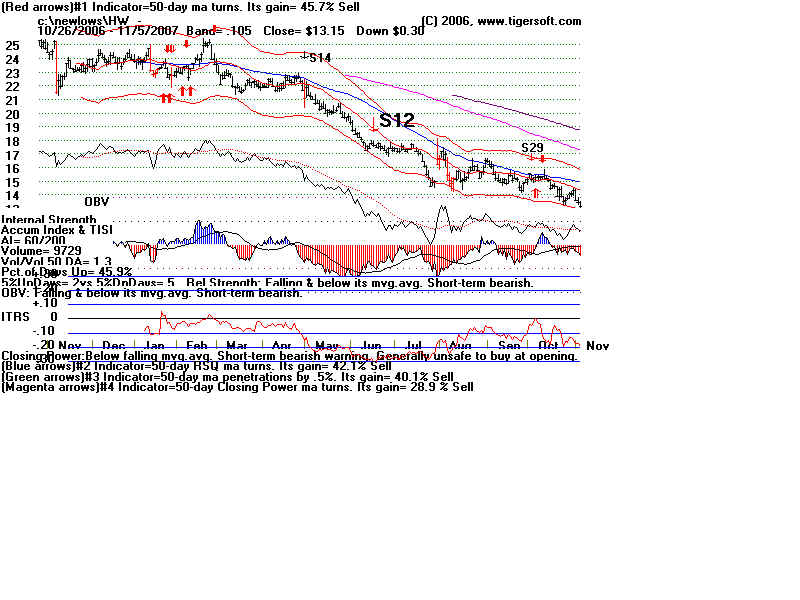

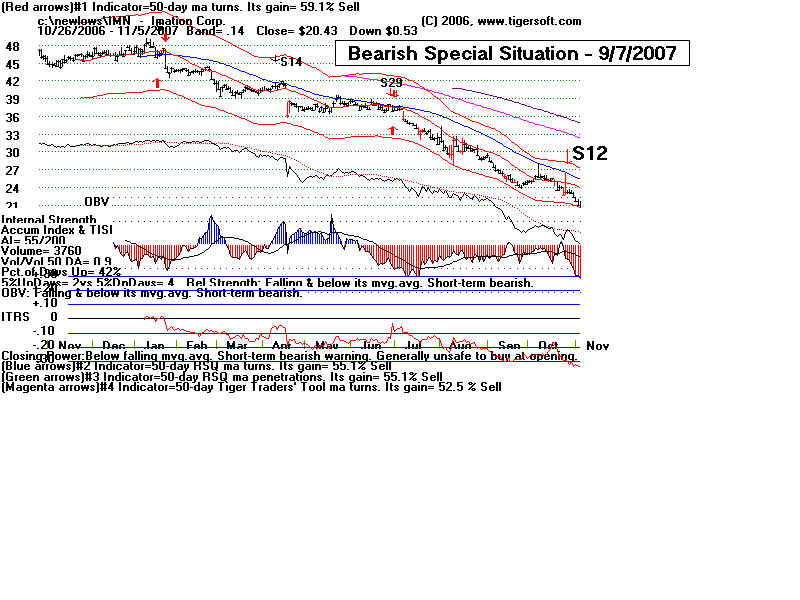

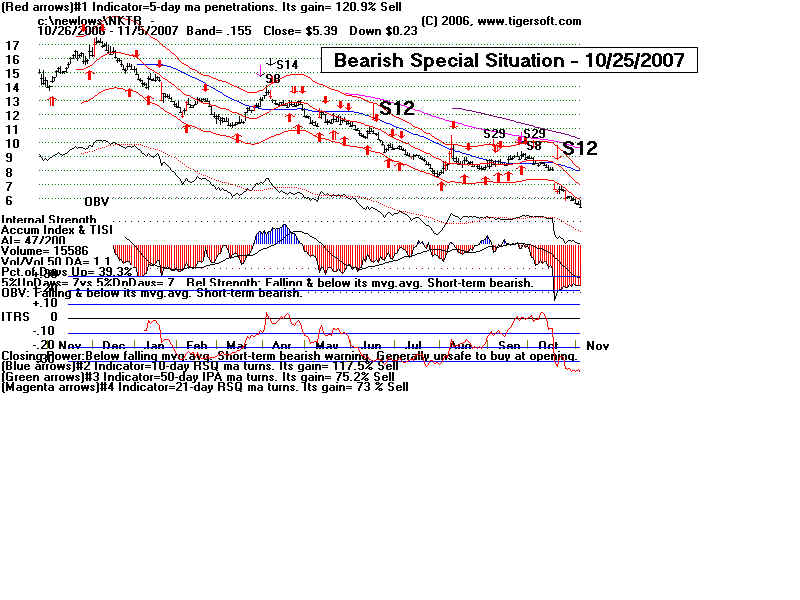

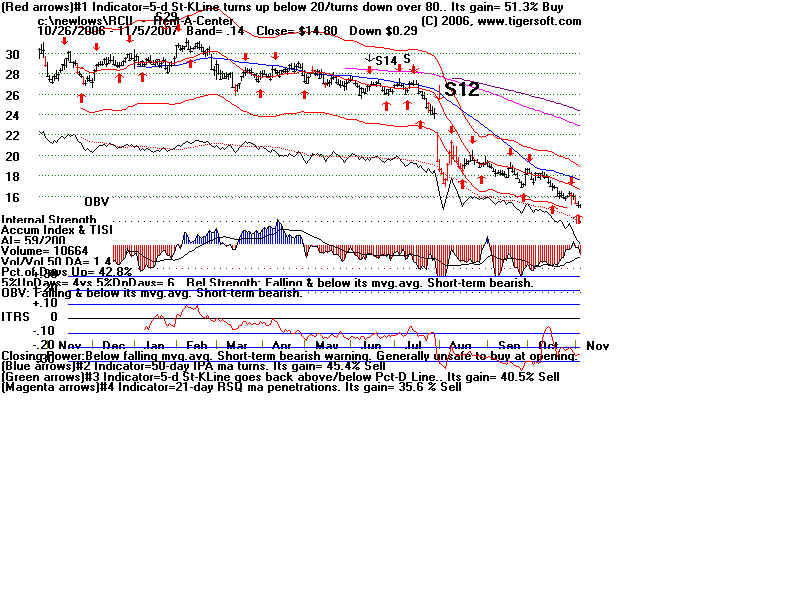

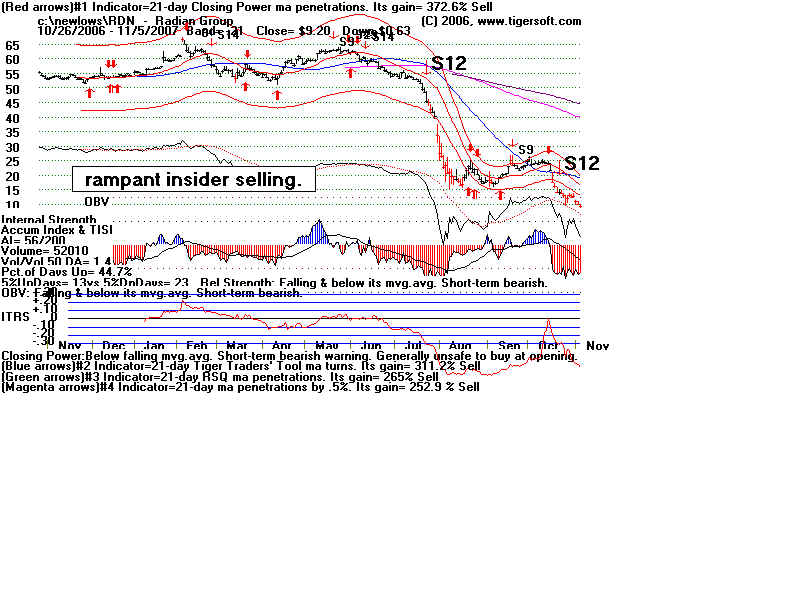

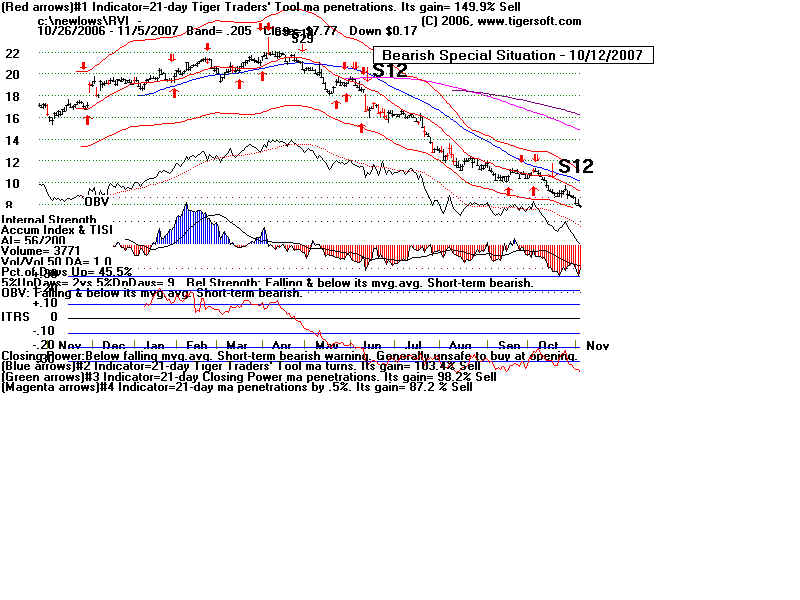

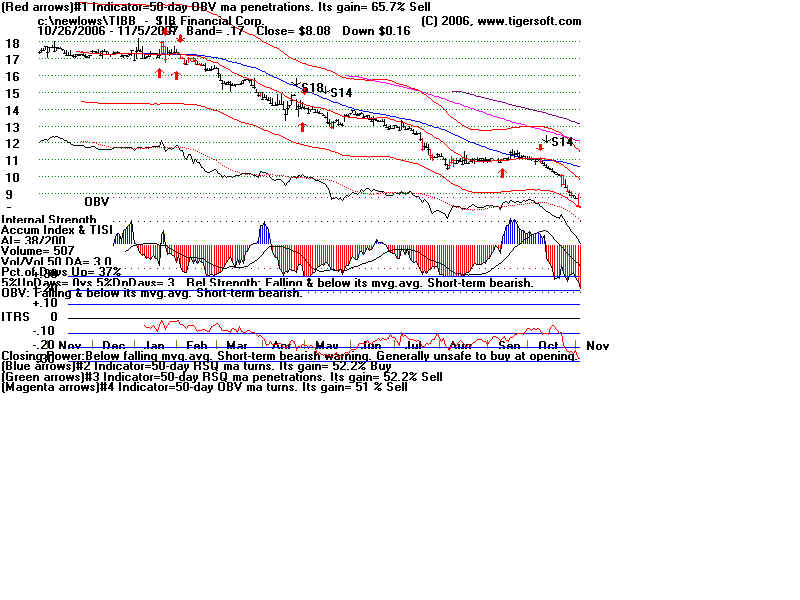

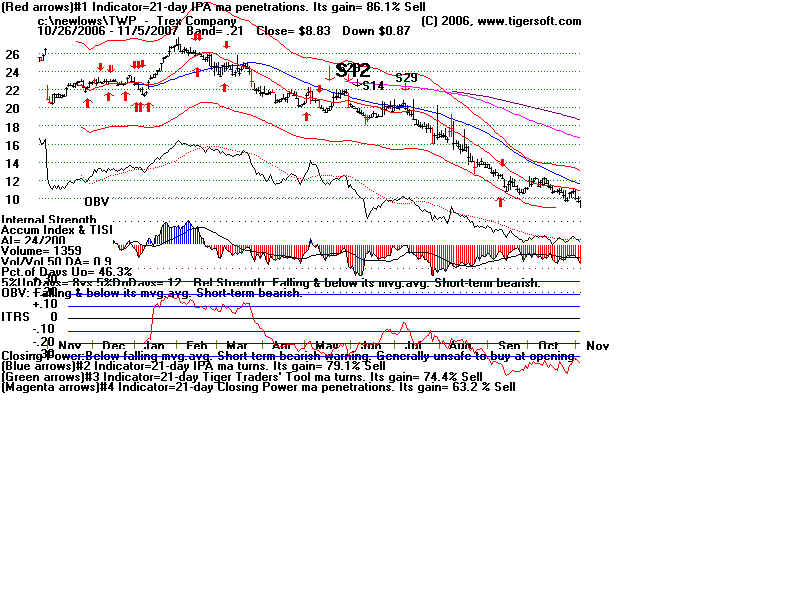

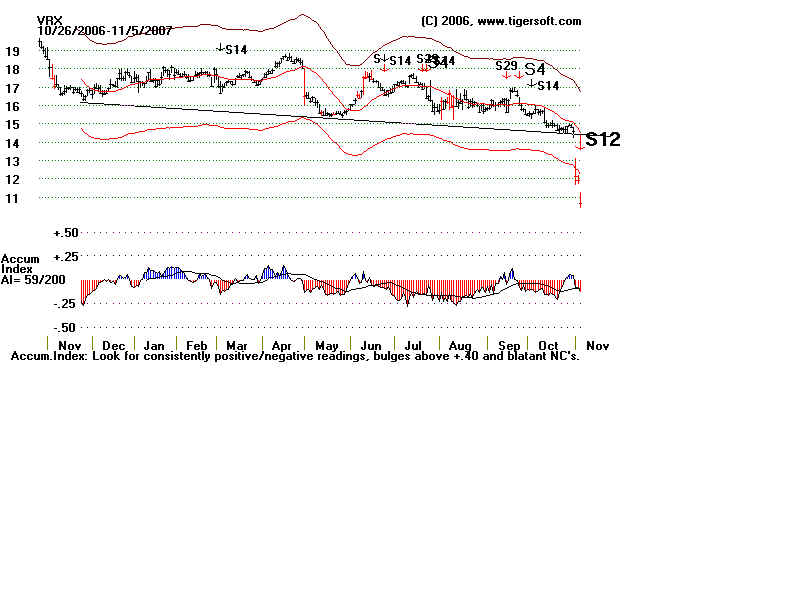

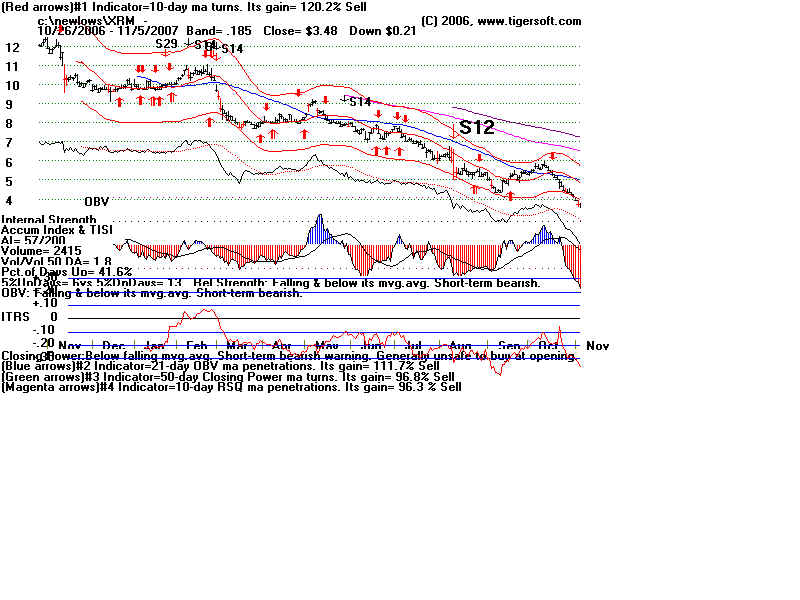

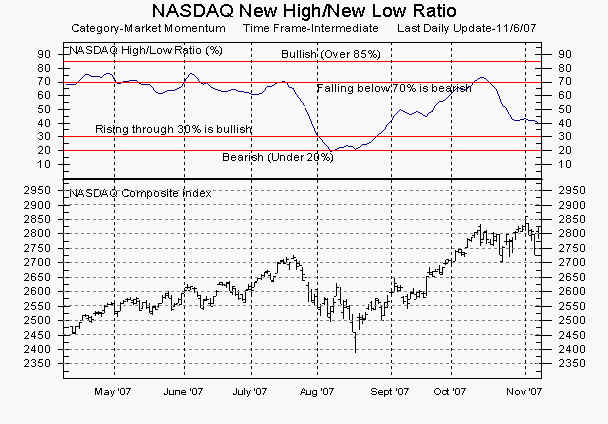

This Market Has Problems: The Stocks below Look Awful! Picking Great Short Sales As A Hedge Our Hotline looks at NYSE New Lows every day, the total count and the individual stocks on the list. One of the key ways to spot an intermediate term decline or a bear market is to note how quickly NYSE new lows exceed new highs very soon after the DJI makes a new high. I read this in an article in Barons many years ago, so I can't tell you whose idea this first was or gives its historical pedigree. But you can see it worked this summer. As the DJI was making a new all time high on 7/17/07 and we were getting a major Sell from Peerless, we noted that NYSE new lows were 80 and new highs were only 45. This was a very bearish sign. Another way to view new highs and lows is simply to go to: http://tal.marketgauge.com/dvMGPro/gauges/TodaysGauges.asp The two charts below are explained on-line. A falling below 70 gave a fine sell signal at the most recent peak, though the June Sell signal was premature. This also tells you when it is safe to buy again. A variation of this tool I used for many years when Harry Lankford published his little weekly pocket charts. I would simply look for the NH/NL ratio drop below 75 and stop chasing breakouts. At that point there was too little follow-through and too many false breakouts. But the beauty of the indicator was that it kept us properly bullish for long periods of time when a bull market made that appropriate. -------------------------------- NYSE New highs and Lows -----------------------------------------  -------------------------------- NASDAQ New highs and Lows -----------------------------------------  (Source: http://tal.marketgauge.com/dvMGPro/Charts/Charts.asp?chart=NYHILO ) New Highs Systems Abound. People have all sorts of systems for buying new highs and seeking gains from the huge gainers. This works superbly, of course in a bull market. We have our Tiger Insider-Buying system using augmented Buy B24s and holding automatically a year, but using a stop loss of 10% below the first augmented B24. That system is now explained in the back of my Explosive Super Stocks book. Just to get you thinking I set forth one such system. It is called Haller's 200 Profit Strategy. A goal of 200% is sought when buying a stock making a new high. A stop loss is used 20% below the purchase price and as the stock trend upward, one uses a stop loss 26% below the highest intra-day price achieved. Buying strong stocks on 15% pullbacks from their highs is part of this system. In that case, use a 15% stop loss. The stop losses are on a closing basis. Investors Daily has publicized the notion of buying strength, namely buying new highs and using a 7% stop loss. William O'Neill should give more credit to his source of this trading approach, Nicholas Darvas who wrote two books: You can see something about this icon of technical trading immediately below. New Lows Trading Systems I appreciate that short selling is not something some of you do much of. But I think it is timely. More and more stocks are making new lows. You can see some of the more bearish charts below the section on Darvas. Since bear market seems unavoidable given the dramatic fall of the dollar, I think a study of new lows will be helpful. This extends what I have written in my book on Short Selling using Tiger's Accumulation Index. For the materials on new lows, please skip the section on Nicholas Darvas just below.. ==================================================================================== NICHOLAS DARVAS - Author of A Very Influential System for Trading New Highs  Nicholas Darvas How I made $2,000,000 in the stock market , 1964 and revised and updated 1975. Also: Wall Street The Other Las Vegas. Before Darvas came to America he studied economics at the University of Budapest. In1951, he immigrated to the United States, where he trained with his half-sister, Julia, to be a ballroom dancer. And he was a very good dancer, touring the world by 1956. He started investing in 1952, a ballroom dancer who had never invested in the stock market. But a Toronto nightclub couldn't pay him in cash, so they paid him with three thousand shares of a Canadian mining company called Brilund. Two months later, the stock tripled and Darvas made a tidy profit. An investor was born. Like anyone beginning to trade on the stock market, Darvas made his mistakes. When he started out, many of his trades were gambles. He would pick companies that were the next big thing, or that came recommended by other traders. Many of his first large trades resulted in a huge losses. But cheered on by whatever small profits he did make, Darvas began asking questions about why stocks behaved the way they did. Realizing that even experts couldn't predict the market, Darvas decided that he needed to acquire his own understanding. He began devouring newsletters, books, tip sheets, “hot tips”, and so-called insider information, in his quest to understand the market. Yet, despite his arsenal of knowledge Darvas continued to lose money. In 1955, he purchased over fifty thousand dollars worth of a company called Jones and Laughlin. Jones and Laughlin had an excellent price to earnings ratio, high dividends, and was in a strong industry group. He was so confident in his analysis, that he bought most of this stock on margin. Then Jones and Laughlin began to fall. Jones and Laughlin`s price fell far enough to account for a $9,000 loss. In a desperate attempt to recoup his losses Darvas bought a stock he knew virtually nothing about. Soon it had risen to a point where he regained about half of his losses.

At this point in his career, Darvas was frustrated with his attempts at analyzing stocks.

With

In 1956 Darvas embarked on a two-year tour of the world to showcase his ballroom dancing.

Without brokers, friends, or other investors to influence him, Darvas developed a method

of picking

Realizing that it was the human element in stock trading that was his downfall, Darvas sequestered ===================================================================================

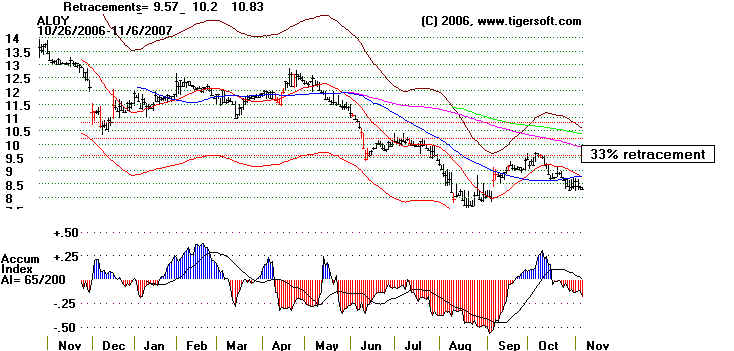

Short sellers will often pounce on a weak stock that makes a 33%

|

||||||||||||||||||||||||||||||||||||

|

|