Tiger Software Blog CASE 1: RYLAND GROUP (RYL)

There are many,

many cases. RYL has a history of insider trading ahead

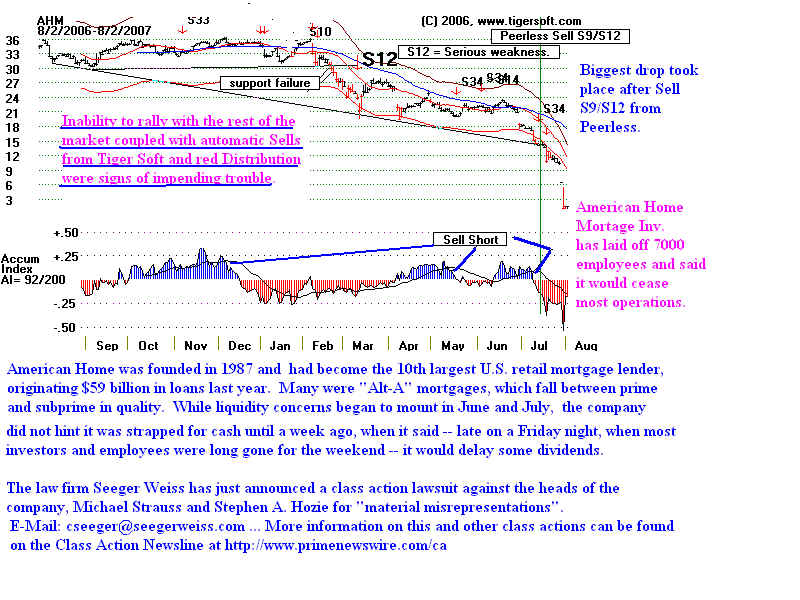

of bad news. INSIDER RUSH TO DUMP RYL IN 2007-2008 The CEO of RYL was one of the highest compensated CEOs, receiving $56.47 million over the 5-year period ending in 2007. Vastly over-paid, he lost his shareholders 70% of the value of their stock, between 2005 amd 2009. Not one to go down with his own ship, RYL CEO, Dreier Chad, sold $13 million of RYL before the collaspe of his company's stock..  Early in 2005,the SEC did what it rarely does. Early in 2005,the SEC did what it rarely does.It brought charges of insider trading against executoves at Ryland. This was a token effort by the SEC's part. A comparatively small fine was paid and no admission of guilt was required. The stock quickly recovered Los Angeles Business Journal, March 7, 2005 by Andy Fixmer, Kate Berry "Last week, a Ryland division president in Dallas, John Hutchinson, agreed to settle insider trading charges brought by the Securities and Exchange Commission, after he sold shares in January 2004--just days before Ryland announced a sharp decline in new home orders, with the biggest drop in Texas. The SEC accused Hutchinson of using non-public information to avoid a $100,000 loss when the shares subsequently dropped 12.2 percent. In the settlement, Hutchinson agreed to pay $205,000 without a dmitting or denying guilt."  Note the very red readingd from our Accumulation Index. This shows big-money distribution. Insiders here were alledged to have informed big owners of RYL stock of the troubles to come.  Insider trading in the narrowest, legal sense usually refers to what the company's directors and bosses are required to register. But, the reality is that there are many insider-informed indivudals and funds that get to act on non-public information. They learn that earnings will be declining months, very often, before the news actually comes out. As Tiger users, we see this technically in the way the stock fails to go up in a rising market, shows steady and heavy red distributioon from our Tiger Accumulation Index (S12), forms top patterns (like head and shoulders tops), breaks support (S10) and then falls sharply as the bad news comes out. See our book on Short Selling. CASE 2: AMERICAN HOME FINANCIAL (AHM) AHM - American Home Financial is a stock to study. It just filed for bankruptcy. See the red down days on its chart below This represents big-money dumping. They got wind from insiders how bad things were with the company. This was a very bullish general market environment; but they still could not sell fast enough. They dumped shares and then sold still more.  The moral of this lesson is to sell short the stocks insiders have been selling most heavily when Peerless gives a major Sell and the general market looks vulnerable.

CASE 3: TRUMP CASINO/REAL ESTATE (TRMP) TRMP started making new lows in March 2007, before Peerless gave its Sell S9 on July 17th. Key support was broken and the Tiger Accumulation Index was very negative. "Donald, You're Fired!" for Insider Trading in TRMP - Trump Casinos You knew TRMP would go bankrupt and you wanted "out" before the news would make your shares worthless. Why are you not prosecuted? You say, "The SEC never touches those in the penthouse". So, you have no special business acumen. Sounds to me that "you're just as phoney as your hair-piece." ________________________________ |

| HALL OF INSIDER SHAME Insider Selling just before Their Stocks Crash Unlike Captains of A Ship, These Companies Dumped Their Shares onto The General Public At Top Prices. (c) 2007 William Schmidt, Ph.D. The largely useless SEC prosecuted none of the insiders in the stocks below who sold shares to members of the public at the top. The public thought they were getting a bargain! They were getting screwed! Over and over, this is the way Distribution from Insiders to the public takes place. Just as Bush, Paulson, Obama and Geithner have stolen nearly a trillion dollars from American taz payers and given the money to monopoly mega banks on terms you and I would love to be able to borrow money at, so too, the transfer of wealth from the middle class to the very rich takes place because Wall Street goes almost totally unregulated. Insider Selling at the top in 2007 and continuing throughout 2008 was rampant. Insiders sold stocks to members of the public in collosal amounts. They knew their shares were worthless and going to drop. They knew the bursting of the housing bubble would bring down their over-leveraged shell companies. These insiders wanted out while they still could sell. This should be a high crime. Instead, in the US the millionaires and billionaires who did this are given a FREE PASS by Obama, who assures us without a thorough public investigation that these insiders committed no crimes. These insiders are no different than Bernie Madoff, who got 150 years for his crime. Why is this not a capital crime? How many lives did they knowingly destroy by their fraud, lies and greed? Yes, I rant and rave. Americans should be furious. But the cover-up by the corporate media and most politicians keeps them in the dark. The public blame themselves, because they have lost money in the market or lost their jobs. They are not at fault. It is the super rich and their politcal cronies, like Obama who masquerades as a reformer. At least, Bush never pretended to represent the average worker. The only chance a member of the public has in fighting these callous, selfish monsters is to use TigerSoft and Sell when the insiders do and Buy when they do. Don't expect Obama to fix things. His economic advisors are bought and paid for by the very crooks that have caused the current financial calamity. His largest corporate campaign contributor was Goldman Sachs, the grand master of financial bubbles and insider influence. Insider Selling before A Big Decline Recent Examples of Insider Inspired Big Money Selling, from a TigerSoft perspective. AHP AHM BAC (see below) C CC COLY CTX GM HOV IDIX JRC JRT LEND MTH PHM RDN RMBS RYL (see below) TRMP WM WMG .Many more will be added. If you owned these shares, have your lawyer contact us. 858-273-5900. We now offer expert witness services. TigerSoft can show you whether your stocks are under heavy insider-informed selling.

BANK OF AMERICA

|

| 17-Aug-07 | GIFFORD CHARLES K Director |

333,180 | Indirect | Sale at $51.30 - $51.41 per share. | $17,110,0002 |

| 4-Sep-07 | MCGEE LIAM E Officer |

97,500 | Direct | Automatic Sale at $50.62 - $51 per share. | $4,954,0002 |

| 30-Nov-07 | GIFFORD CHARLES K Director |

359,918 | Indirect | Sale at $46 - $46.06 per share. | $16,567,0002 |

| 15-Feb-08 | BRINKLEY AMY WOODS Officer |

28,775 | Direct | Disposition (Non Open Market) at $42.70 per share. |

$1,228,69 |

CEO KEN LEWIS SOLD $4.5 Million of BA AT $42.70

CEO KEN LEWIS BOUGHT $2 Million of BA AT $23.15

BAC EXECs START BUYING Under $6.00.

|

Want to do more research?

Insider informed selling is rampant. Here is a

blog devoted to such cases.

http://lawprofessors.typepad.com/whitecollarcrime_blog/insider_trading/index.html