---- TIGERSOFT/PEERLESS

HOTLINE ----

(C)

1985-2020 William Schmidt, Ph.D. www.tigersoft.com

william_schmidt@hotmail.com All rights

strictly reserved

HOTLINE

IMPORTANT

- Always CLICK REFRESH.

Server problem

here? Old images of this page may appear.

Always refresh this page and any other page that

seems incomplete or not up to date...

To refresh - Point mouse

at page and Hold down Control Key and hit F-5.

======================================================

10/29/2020

(Data used) 10/30/2020 5:25 AM. DJI down 150.

======================================================

IMPORTANT

Earlier Hotlines:

www.tigersoft.com/1919H/OLDINDEX.htm

May - Oct 2020

www.tigersoft.com/777BLM/INDEX.htm

www.tigersoft.com/20HLM/INDEX.htm

www.tigersoft.com/2020NIGHT/INDEX.htm

www.tigersoft.com/4ACES1/INDEX.htm

www.tigersoft.com/48HLA/INDEX.htm

www.tigersoft.com/QUICKER/INDEX.htm

www.tigersoft.com/QUICK/INDEX.htm

www.tigersoft.com/77HLZ/INDEX.htm

www.tigersoft.com/44THL/INDEX.htm

www.tigersoft.com/21PEY3/INDEX-2.htm

www.tigersoft.com/19HLK5/INDEX.htm

www.tigersoft.com/44UHL/INDEX.htm

www.tigersoft.com/NHLP/INDEX.htm

www.tigersoft.com/7LHL/INDEX.htm

www.tigersoft.com/NHL718/INDEX.htm

www.tigersoft.com/21MAY18/INDEX.htm

www.tigersoft.com/55HEP/INDEX.htm

www.tigersoft.com/44H4L/INDEX2.htm

Earlier still: Go here...

HELP

A Guide

To Profitably Using The Tiger Nightly HOTLINE

Introduction to Tiger/Peerless Buys and

Sells.

Peerless Buy and

Sell Signals: 1928-2016

Individual Peerless signals explained:

http://tigersoftware.com/PeerlessStudies/Signals-Res/index.htm

http://www.tigersoft.com/PeerInst-2012-2013/

Explanation of each Peerless signal. http://www.tigersoft.com/PeerInst-2012-2013/

Different Types of

TigerSoft/Peerless CHARTS, Signals and Indicators

-----> More HELP LINKS

Documentation for

TigerSoft Automatic and Optimized Signals.

How reliable support is the

DJI's rising 200-day ma?

SPY Charts since

1994: Advisory Closing Power S7s, Accum. Index, 65-dma, Optimized Signals.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

1/19/2016 ---> Corrections,Deeper

Declines and Bear Markets since 1945.

1/21/2016

---> High

Velocity Declines since 1929

2/12/2016 ---> Presidential

Elections Years and Bullish IP21 Positive Non-Confirmations at Lower Band.

2/12/2016 ---> OBV NNCs on DJI's Rally to

2.7% Upper Band when DJI's 65-dma is falling.

11/6/2016 --->

Killer Short Selling

Techniques: ===> Order Here ($42.50)

It's As Easy as 1,2,3

TigerSoft "Combination" Short-Selling... Easy as 1-2-3 Short Sales

Earlier Q-Answers

QuickSilver Documentation (1/11/2016)

Our Different

Signals

Better understand the difference between

Peerless DJI-based signals,

the one-year optimized red Signals and the fixed signals based

on technical developments.

Introduction to Tiger/Peerless Buys and Sells.

Different Types of

TigerSoft/Peerless CHARTS, Signals and Indicators

New TigerPeerless Installation and

Basic Uses' Instruction

See the re-written materials on TigerSoft Buys and Sells.

Study- Trading SPY

WITHOUT Peerless - Some Guidelines.

When completed this will be a new Tiger Trading E-Book.

Study- Examples of

"Hands above the Head" top patterns.

Study- 9/3/2017 TigerSoft (not

Peerless) charts of Major Tops as they occurred.

===> Please report any broken or out-of-date links. william_schmidt@hotmail.com

====================================================================

====================================================================

10/29/2020 The 26000 support brought in

buyers before the opening Friday.

Early on, the DJI was down 500 points this morning. It is now

down only 224. But there is no well-tested support at 26000, so

we will probably need to see more backing and filling there.

Breadth was good on today's rebound. There were nearly 1000

more up than down on the NYSE and the A/D Line did not confirm

Wednesday's minor new low. This produced a Buy B11 on the

2006 version of Peerless. Our recent Buy B2 and Buy B21

are close to showing their past maximum paper losses. A decline to

26000 would achieve that and it would represent a 10% decline

from the recent high. Such a decline usually represents a good

buying opportunity.

But I worry that the market is making it too easy for us to

buy in here

and that another February-March decline might start if the round

number 26000 is decisively penetrated. Having grown up in the

1950s, it is not in my DNA to believe the country will fall apart

because Republicans and Democrats cannot agree on the outcome

of the Presidential Election, whatever it is. So,

buying near DJIA - 26000

or when the Closing Powers shown below break their downtrend-line seems

to be a good strategy now for adding to the strongest, high Accumulation

techs and ETFs, which have been shown among the bullish MAXCPs

recently. Stay short the bearish MINCPs and lowest Accumulation

big banks (like WFC) and oil stocks for now. Let's wait to buy these

when we see if the falling Closing Powers shown below are broken.

And if you want to play it safer, wait until we see how the Election

plays out on Tuesday.

Using the Candlestick charts lets us focus most easily

on the falling price and Closign Power trends. We need

to see more 'Blue' candle-sticks now.

| DJIA and DIA |

| SPY |

| QQQ |

| NASDAQ (COMPQX) |

| NASDAQ |

|

Charts 10/29/2020 (Click on Underlined link.) 2020 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol Stoch-20 Inverted Traders Index Graph of Pct of All Stocks above 65-dma Cum. Inverted Traders Index NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30 DIA QQQ MDY SPY IWM TNA Short-Term Rates DOLLAR-UUP recent 2006 vers-Peerless signals -- http://tigersoft.com/NEWPEER/UPD61029.BMP USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH PALL RSX RETL SDS AGQ SLV SOXL TAN TECL TLT TMF TNA UGA (gasoline) USO (oil) and China: YINN CHAU Commodities: CANE CORN DBC JJC, NIB CORN, CUT (paper) MOO, SOYB WEAT UUP (Dollar) LIT (Lithium) Stocks AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA BAC BIDU BLDP CAT CRM CVX CMG DE ENPH FB GILD GOOG GS HD IBM INTU JPM LRCX M (Macy's) MSFT NEM NFLX NKE NVDA PG REGN REV SO SQ QCOM QDEL TSLA TXN XOM V VRTX WFC WMT TOWN ZM New highs and Bullish MAXCPs http://tigersoft.com/UP/10-29/BULLISH.htm Bearish MAXCPs - http://tigersoft.com/DOWN/10-29/BEARISH.htm |

Table 1

10/29/2018 QUICKSILVER on DJI-30 STOCKS.

P21 + ITRS score >+.25 is bullish

1 Bullish ( TRV )

9 Bearish (AMGN, BA, CSCO, MRK, IBM INTC JNJ MRK WBA)

HIGHEST AI/200 = CRM STOCKS CLOSECHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE AI/200 IP21 ITRS ------------------------------------------------------------------------------------------------------- ------------------------------------------------------------------------------------------------------- AAPL 115.32 4.12 115.75 -18.7% Bearish BLUE 152 -.077 .036 ---------------------------------------------------------------------------------------------------------- AMGN 217.82 1.44 227.98 -226.8% Bearish BLUE 124 -.273 -.055 --- ---------------------------------------------------------------------------------------------------------- AXP 91.07 -.53 104.79 -701.2% Bearish RED 85 -.166 -.021 ---------------------------------------------------------------------------------------------------------- BA 148.29 .15 169.07 -648.9% Bearish BLUE 33 -.281 -.085 --- ---------------------------------------------------------------------------------------------------------- CAT 154.67 3.51 169.66 -462.4% Bullish BLUE 115 .009 .16 ---------------------------------------------------------------------------------------------------------- CRM 237.14 -1.29 249.67 -254.5% Bearish RED 189 -.133 .195 ---------------------------------------------------------------------------------------------------------- CSCO 35.69 -.02 38.82 -416.5% Bearish BLUE 109 -.181 -.109 --- ---------------------------------------------------------------------------------------------------------- CVX 68.8 1.92 73.4 -325.5% Bullish BLUE 77 -.074 -.165 ---------------------------------------------------------------------------------------------------------- DIS 121.54 3.07 127.56 -242.1% Bearish BLUE 102 -.05 -.01 ---------------------------------------------------------------------------------------------------------- DOW 46.25 1.07 48.82 -272% Bearish BLUE 59 -.157 .075 ---------------------------------------------------------------------------------------------------------- GS 189.94 .17 205.4 -387.7% Bearish BLUE 61 -.193 -.025 ---------------------------------------------------------------------------------------------------------- HD 269.63 -.09 281.16 -207.9% Bearish BLUE 151 -.117 -.008 ---------------------------------------------------------------------------------------------------------- HON 164.6 3.44 176.85 -360.1% Bullish BLUE 101 -.101 .088 ---------------------------------------------------------------------------------------------------------- IBM 108.91 2.26 115.76 -305.2% Bearish BLUE 106 -.339 -.081 --- ---------------------------------------------------------------------------------------------------------- INTC 44.11 -.14 53.9 -1025.3% ------- ---- 83 -.232 -.048 --- ---------------------------------------------------------------------------------------------------------- JNJ 137.19 -1.17 145.08 -275.6% Bearish RED 101 -.242 -.049 --- ------------------------------------------------------------------------------------------------------ --- JPM 97.17 .63 102.88 -283.3% Bullish BLUE 32 -.013 .025 ---------------------------------------------------------------------------------------------------------- KO 48.02 .06 50.68 -267.2% Bearish BLUE 77 -.106 .053 ---------------------------------------------------------------------------------------------------------- MCD 214.95 .26 229.15 -317% Bearish BLUE 126 -.071 .065 ---------------------------------------------------------------------------------------------------------- MMM 158.48 -.05 170.71 -370.1% ------- BLUE 86 -.193 .006 ---------------------------------------------------------------------------------------------------------- MRK 75.89 -.29 79.21 -211.7% Bearish RED 86 -.29 -.068 --- ---------------------------------------------------------------------------------------------------------- MSFT 204.72 2.04 214.89 -240.5% Bearish BLUE 152 -.06 .015 ---------------------------------------------------------------------------------------------------------- NKE 122.86 .78 130.02 -280.4% Bearish BLUE 121 -.04 .173 ---------------------------------------------------------------------------------------------------------- PG 137.57 -.09 141.45 -137.6% Bearish BLUE 98 -.078 .052 ---------------------------------------------------------------------------------------------------------- TRV 122.46 .96 126.14 -149.8% Bullish BLUE 80 .28 .121 ---------------------------------------------------------------------------------------------------------- UNH 303.68 -4.32 325.73 -342.8% Bullish RED 110 -.16 .002 ---------------------------------------------------------------------------------------------------------- V 184.87 4 197.99 -341.7% Bearish BLUE 89 -.118 -.041 ---------------------------------------------------------------------------------------------------------- VZ 56.76 .45 57.33 -49.7% Bearish BLUE 111 -.056 0 ---------------------------------------------------------------------------------------------------------- WBA 33.52 -1.07 37.51 -544% Bearish RED 82 -.164 -.128 --- ---------------------------------------------------------------------------------------------------------- WMT 139.92 -.12 143.55 -127.4% Bearish RED 128 -.151 .096 |

Table 2 QUICKSILVER on ETFS - 10/29/20 Bullish = 0

Bearish = 0

ITRS + IP21>.25 is considered "Bullish"

<-.25 is considered bearish

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS --------------------------------------------------------------------------------------------- --------------------------------------------------------------------------------------------- DIA 266.59 1.11 283.34 -308.1% Bearish BLUE-.155 0 --------------------------------------------------------------------------------------------- SPY 329.98 3.32 345.78 -215.8% Bearish BLUE-.143 .018 --------------------------------------------------------------------------------------------- QQQ 276.39 4.75 284.74 -138.7% Bearish BLUE-.091 .04 --------------------------------------------------------------------------------------------- MDY 348.71 3.28 367.49 -230% ------- BLUE .057 .031 --------------------------------------------------------------------------------------------- IWM 155.14 1.83 163.07 -219.5% ------- BLUE .068 .031 --------------------------------------------------------------------------------------------- FAS 33.33 .77 39.8 -801.1% Bearish BLUE-.058 -.054 --------------------------------------------------------------------------------------------- SOXL 261.69 19.3 290.55 -605.9% Bearish BLUE-.05 .098 --------------------------------------------------------------------------------------------- TECL 274.71 13.37 315.99 -723% Bearish BLUE-.143 -.053 --------------------------------------------------------------------------------------------- IBB 133.06 .7 136.49 -114.3% Bearish BLUE-.035 .034 --------------------------------------------------------------------------------------------- GLD 175.4 -.73 178.64 -96.2% Bearish BLUE-.028 .002 --------------------------------------------------------------------------------------------- OIH 92.64 1.92 102.11 -446.6% Bullish BLUE .052 -.266 --------------------------------------------------------------------------------------------- |

Table 3 Count of Stocks in Key Directories

20201029

-------------------------------

NEWHIGHS 60

NEWLOWS 174 fast growing

MAXCP 19

MINCP 49

TTTNH 17

TTTNL 47

FASTUP 49

FASTDOWN 264

CPCROSSA 271

CPCROSSD 18

BIGVOLUP 1

BIGVODN 8

ACCUMVER 153

HIGHIP21 10

HIUPPCT 46

VHIP21 112

LOWACCUM 213

REDSELL 126

AUGSELS7 36

TRAPDOOR 9

|

Table 3RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA 10/29/20 --------------------------------------------------------------------------------------- Directory Current day-1 day-2 day-3 day-4 day-5 ---------------------------------------------------------------------------------------- SOLAR .818 .818 .818 .818 .818 .909 UTILITY .657 .657 .868 .894 .894 .868 INFRA .628 .485 .657 .714 .8 .8 SEMI .605 .423 .586 .644 .74 .769 CHEM .583 .375 .583 .687 .833 .791 REGBANKS .576 .384 .615 .692 .807 .807 AUTO .564 .41 .615 .743 .82 .82 CHINA .56 .52 .64 .62 .64 .64 INDMATER .56 .44 .6 .64 .706 .693 ELECTRON .557 .408 .591 .646 .741 .748 NIFTY .511 .355 .6 .622 .777 .755 COPPER .5 .5 .5 .5 .625 .625 RETAIL .489 .469 .551 .632 .795 .714 FINANCE .487 .414 .56 .658 .743 .719 GREEN .476 .476 .571 .619 .761 .761 NASD-100 .45 .28 .53 .54 .7 .68 SOFTWARE .45 .4 .483 .466 .616 .616 GUNS .428 .142 .428 .571 .571 .5 FOOD .415 .396 .509 .528 .584 .547 COMPUTER .4 .4 .5 .55 .7 .75 TRANSP .4 .25 .6 .85 .9 .9 COMODITY .39 .39 .512 .56 .609 .585 SP500 .371 .304 .474 .542 .672 .659 RUS-1000 .367 .298 .46 .532 .65 .631 BIOTECH .364 .335 .439 .426 .474 .482 INSURANC .346 .307 .384 .461 .653 .576 HOSPITAL .333 .333 .333 .619 .571 .571 INDEXES .322 .265 .576 .621 .723 .734 ETFS .321 .285 .5 .482 .678 .607 FIDSTKS .291 .222 .417 .445 .617 .588 COAL .285 .285 .285 .571 .571 .428 GAMING .285 .19 .333 .476 .619 .571 SP-100 .23 .208 .384 .439 .582 .593 BEVERAGE .214 .214 .357 .428 .571 .428 JETS .214 0 .5 .857 .928 .928 HACKERS .2 .2 .15 .15 .25 .3 OILGAS .196 .188 .236 .251 .291 .283 REIT .177 .113 .184 .29 .397 .361 HOMEBLDG .176 .176 .235 .294 .647 .47 DOWJONES .166 .166 .433 .466 .666 .7 EDU .166 .333 .333 .333 .333 .333 DJI-13 .153 .23 .461 .538 .769 .769 MILITARY .142 .071 .142 .214 .357 .321 GOLD .102 .081 .183 .163 .163 .163 BONDFUND .049 .059 .059 .089 .128 .138 BIGBANKS 0 0 .142 .285 .571 .571 |

========================================================================

10/28/2020 The Peerless Buys and the

generally strong NYSE A/D Line have

produced a premature Buy B21 and a Buy B2 in here. This was

not unexpected, given the price gaps down, the falling Closing Powers and

the dynamics of a broad trading range. 26000 in the DJI is where

support should be strongest. That is the level

that must not be

significantly broken.

Very real technical damage was done today. See in Table 3 the

big

jump in new yearly lows. Another sign that supports are breaking,

only 3 groups (Chinese, solar and utility stocks) show a majority of

their components are above their key 65-dma. Even AAPL has

fallen below its 65-dma.

The Buy B2-B21 is based on very good breadth at the 3.5% lower band.

But we are now 5.7% below the 21-day ma. None of the many B2s earlier

this year saw such a deep decline. In addition, the NYSE A/D Line

has bearishly broken its 7 month uptrend, as has the DJI's. Staying hedged

again seems best. A DJI drop much below 26000 on a closing basis

would produce a paper loss of more than 5% on the Peerless Sells.

This would be highly atypical and cast doubt on them. A close much below

26000 would have to be treated as a fail-safe Sell S10.

In a broad trading range, like we have now between 29000 and

26000,

which is 9%-10% wide, once prices start falling back from the top of

the range, they tend very easily to fall through the middle of the range

and test the bottom of the range. That is what is happening now.

Professionals have not stepped in and become buyers

yet. The

Closing Powers are all falling. The candle-sticks are red. So, I think we have

to wait another day, at least, to buy. A strong closing above the opening

would be bullish now. But it will likely take more backing and filling around

DJI-26000 to build a solid base. The oil stocks are very weak. Hold them

short and the big banks. Consumer debt is a very big problem for the banks.

Let's hold off on new buying another day.

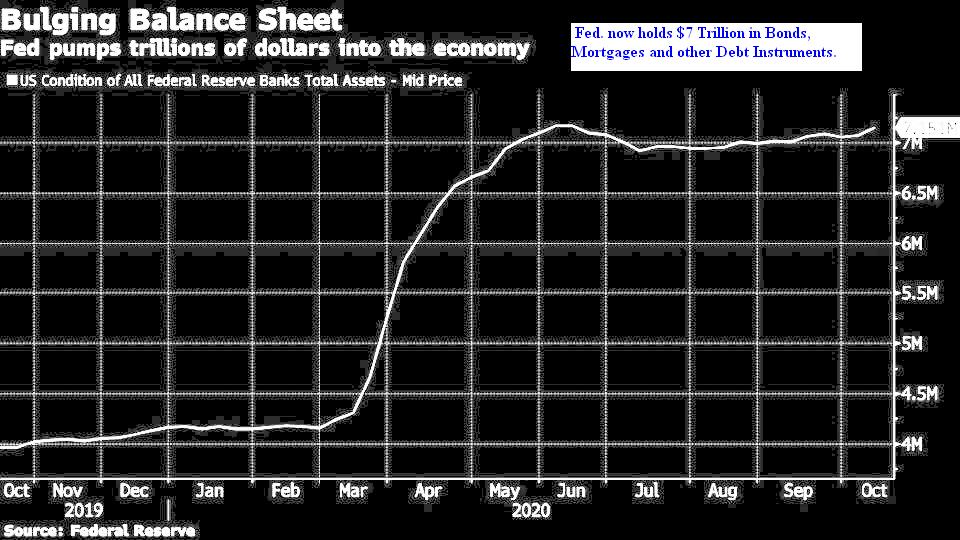

A 38-year long Bull Market on Steroids and Stilts

Thirty eight years ago, back in August of 1982, the DJI was

below

800, now it's 25000+ points higher. That's a rise of more than 3100%.

In many ways, the market's phenomenol rise has been built on the Fed's

regular cuts in interest rates in this time, so that they are almost zero. They

can't go much lower. It's been built on business friendly tax cuts, deregulation,

anti-union policies and lots and lots of debt, consumer and governmental.

So, when I think of the DJI's rise, I picture a beach house on very high stilts.

It could all come tumbling down with a new Administration.

Dare the many friends of Wall Street in government really let that happen. Well,

it looks like they are taking really big chances now by not passing a new

Relief Bill through Congress. Is the Federal Debt now so high that they dare

not let it increase another $2 trillion? The risks are high if they sit on their

hands. So, we have plenty of drama now in what is playing out.

Take heart. History has a number of cases when an overextended DJI turns back up

one last time from key support in a broad 9%-10% trading range. In May

1929, May 1987 and October 2000 this is what happened. But the NYSE

A/D Line now is much stronger than in those cases. The A/D Line is not now

in a big downtrend. Such breadth is much more like it was in September

1986. That was a full year before an important market top. This should

give us so confidence now. Unfortunately, the February 2020 top was

quite sudden. News of the Covid-19 plague spread a panic. People tend

to have short memories. They remember the crushing series of big down-days

in late February and March. They naturally worry that we may see the same thing

here if the round-numbered support at 26000 fails. Those fears, justified or not,

are dangerous now.

|

Charts 10/28/2020 (Click on Underlined link.) 2020 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol Stoch-20 Inverted Traders Index Graph of Pct of All Stocks above 65-dma Cum. Inverted Traders Index NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30 DIA QQQ MDY SPY IWM TNA Short-Term Rates DOLLAR-UUP recent 2006 vers-Peerless signals -- http://tigersoft.com/NEWPEER/UPD61028.BMP USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH PALL RSX RETL SDS AGQ SLV SOXL TAN TECL TLT TMF TNA UGA (gasoline) USO (oil) and China: YINN CHAU Commodities: CANE CORN DBC JJC, NIB CORN, CUT (paper) MOO, SOYB WEAT UUP (Dollar) LIT (Lithium) Stocks AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA BAC BIDU BLDP CAT CRM CVX CMG DE ENPH FB GILD GOOG GS HD IBM INTU JPM LRCX M (Macy's) MSFT NEM NFLX NKE NVDA PG REGN REV SO SQ QCOM QDEL TSLA TXN XOM V VRTX WFC WMT TOWN ZM New highs and Bullish MAXCPs http://tigersoft.com/UP/10-28/BULLISH.htm Bearish MAXCPs - http://tigersoft.com/DOWN/10-28/BEARISH.htm |

Table 1

10/28/2018 QUICKSILVER on DJI-30 STOCKS.

P21 + ITRS score >+.25 is bullish

1 Bullish ( TRV )

6 Bearish (AMGN, BA, CSCO, CVX, MRK, IBM INTC)

HIGHEST AI/200 = CRM STOCKS CLOSECHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE AI/200 IP21 ITRS ------------------------------------------------------------------------------------------------------- ------------------------------------------------------------------------------------------------------- AAPL 111.2 -5.4 116.87 -244.7% Bearish RED 153 -.081 .008 ---------------------------------------------------------------------------------------------------------- AMGN 216.38 -7.08 228.97 -277.9% Bearish RED 125 -.268 -.058 ---------------------------------------------------------------------------------------------------------- AXP 91.6 -3.33 101.43 -492.5% Bearish RED 86 -.146 -.007 ---------------------------------------------------------------------------------------------------------- BA 148.14 -7.1 163.86 -481.4% Bearish RED 33 -.323 -.084 ---------------------------------------------------------------------------------------------------------- CAT 151.16 -6.75 167.4 -491.1% Bullish RED 115 -.036 .138 ---------------------------------------------------------------------------------------------------------- CRM 238.43 -11.87 254.23 -316.8% Bearish RED 190 -.067 .214 ---------------------------------------------------------------------------------------------------------- CSCO 35.71 -1.16 39.06 -437.9% Bearish RED 110 -.182 -.104 ---------------------------------------------------------------------------------------------------------- CVX 66.88 -2.63 70.87 -279.2% Bearish RED 77 -.137 -.191 ---------------------------------------------------------------------------------------------------------- DIS 118.47 -4.84 126.63 -323.9% Bearish RED 102 -.096 -.035 ---------------------------------------------------------------------------------------------------------- DOW 45.18 -1.39 48.55 -351.6% Bearish BLUE 59 -.21 .056 ---------------------------------------------------------------------------------------------------------- GS 189.77 -5.91 202.91 -325.2% Bearish RED 61 -.196 -.012 ---------------------------------------------------------------------------------------------------------- HD 269.72 -7.12 284.51 -263.8% Bearish RED 152 -.066 -.008 ---------------------------------------------------------------------------------------------------------- HON 161.16 -5.59 172.87 -339.5% Bearish RED 102 -.163 .07 ---------------------------------------------------------------------------------------------------------- IBM 106.65 -3.91 115.06 -369.1% Bearish RED 107 -.375 -.101 ---------------------------------------------------------------------------------------------------------- INTC 44.25 -1.39 53.5 -932.6% ------- RED 84 -.217 -.045 ---------------------------------------------------------------------------------------------------------- JNJ 138.36 -4.79 143.93 -193% Bearish RED 102 -.205 -.032 ---------------------------------------------------------------------------------------------------------- JPM 96.54 -2.79 99.37 -139.6% Bullish RED 32 -.029 .028 ---------------------------------------------------------------------------------------------------------- KO 47.96 -1.94 49.99 -202.3% Bearish RED 78 -.099 .036 ---------------------------------------------------------------------------------------------------------- MCD 214.69 -8.28 228.19 -297.8% Bearish RED 127 -.087 .067 ---------------------------------------------------------------------------------------------------------- MMM 158.53 -2.5 169.17 -317.9% ------- RED 87 -.22 .01 ---------------------------------------------------------------------------------------------------------- MRK 76.18 -1.81 78.07 -119.9% Bearish RED 87 -.273 -.053 ---------------------------------------------------------------------------------------------------------- MSFT 202.68 -10.57 214.8 -283.4% Bearish RED 153 -.02 .004 ---------------------------------------------------------------------------------------------------------- NKE 122.08 -5.91 129.43 -284.5% Bearish RED 122 -.095 .187 ---------------------------------------------------------------------------------------------------------- PG 137.66 -4.7 143.25 -196.6% Bearish RED 98 -.068 .054 ---------------------------------------------------------------------------------------------------------- TRV 121.5 2.41 125 -141.6% Bullish BLUE 80 .252 .103 ---------------------------------------------------------------------------------------------------------- UNH 308 -12.51 322.79 -227.9% Bullish RED 111 -.103 .018 ---------------------------------------------------------------------------------------------------------- V 180.87 -9.19 198.43 -449.1% Bearish RED 90 -.197 -.045 ---------------------------------------------------------------------------------------------------------- VZ 56.31 -1.07 56.75 -38.3% Bearish RED 111 -.047 -.003 ---------------------------------------------------------------------------------------------------------- WBA 34.59 -1.41 37.39 -376% Bearish RED 82 -.106 -.106 ---------------------------------------------------------------------------------------------------------- WMT 140.04 -2.83 144.4 -152.1% ------- RED 128 -.127 .085 |

Table 2 QUICKSILVER on ETFS - 10/28/20 Bullish = 0

Bearish = 1 OIH

ITRS + IP21>.25 is considered "Bullish"

<-.25 is considered bearish

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS --------------------------------------------------------------------------------------------- --------------------------------------------------------------------------------------------- DIA 265.48 -9.18 283.65 -294.3% Bearish RED -.178 0 --------------------------------------------------------------------------------------------- SPY 326.66 -11.56 344.61 -234.8% Bearish RED -.172 .01 --------------------------------------------------------------------------------------------- QQQ 271.64 -11.02 284.18 -221.5% Bearish RED -.109 .023 --------------------------------------------------------------------------------------------- MDY 345.43 -9.43 365.2 -189.7% ------- RED .009 .024 --------------------------------------------------------------------------------------------- IWM 153.31 -4.87 162.13 -189.1% ------- RED .017 .026 --------------------------------------------------------------------------------------------- FAS 32.56 -2.46 39.22 -632.3% Bearish RED -.089 -.08 --------------------------------------------------------------------------------------------- SOXL 242.39 -26.79 294.87 -905.5% Bearish RED -.089 .008 --------------------------------------------------------------------------------------------- TECL 261.34 -38.81 317.82 -980.8% Bearish RED -.148 -.096 --------------------------------------------------------------------------------------------- IBB 132.36 -3.51 136.15 -67.5% Bearish RED -.062 .025 --------------------------------------------------------------------------------------------- GLD 176.13 -2.89 178.83 -124.8% Bearish RED -.048 -.018 --------------------------------------------------------------------------------------------- OIH 90.72 -6.14 101.38 -416% Bearish RED -.038 -.277 Bearish --------------------------------------------------------------------------------------------- |

Table 3 Count of Stocks in Key Directories

20201028

-------------------------------

NEWHIGHS 35

NEWLOWS 232 big jump

MAXCP 12

MINCP 253

TTTNH 12

TTTNL 145

FASTUP 46

FASTDOWN 221

CPCROSSA 92

CPCROSSD 151

BIGVOLUP 1

BIGVODN 13

ACCUMVER 153

HIGHIP21 8

HIUPPCT 38

REDSELL 115

AUGSELS7 72

TRAPDOOR 8

|

Table 4 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

10/28/20

Bullish = 3

Bearish = 42

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

SOLAR .818 .818 .818 .818 .909 .909

UTILITY .657 .868 .894 .894 .868 .763

CHINA .51 .632 .612 .632 .632 .591

============================================================================================

COPPER .5 .5 .5 .625 .625 .625

===========================================================================================

INFRA .485 .657 .714 .8 .8 .771

GREEN .476 .571 .619 .761 .761 .761

RETAIL .469 .551 .632 .795 .734 .673

INDMATER .44 .6 .64 .706 .68 .653

SEMI .423 .586 .644 .74 .769 .73

FINANCE .414 .56 .658 .743 .719 .621

AUTO .41 .615 .743 .82 .82 .82

ELECTRON .408 .591 .646 .741 .748 .7

COMPUTER .4 .5 .55 .7 .75 .7

SOFTWARE .4 .5 .466 .616 .616 .616

FOOD .396 .509 .528 .584 .547 .566

COMODITY .39 .512 .56 .609 .585 .585

REGBANKS .384 .615 .692 .807 .807 .692

CHEM .375 .583 .687 .833 .812 .77

NIFTY .355 .6 .622 .777 .733 .755

BIOTECH .335 .439 .428 .474 .477 .418

EDU .333 .333 .333 .333 .333 .333

HOSPITAL .333 .333 .619 .619 .571 .571

INSURANC .307 .384 .461 .653 .576 .538

SP500 .304 .476 .542 .672 .659 .617

RUS-1000 .298 .462 .532 .65 .631 .583

COAL .285 .285 .571 .571 .428 .285

ETFS .285 .5 .482 .678 .625 .589

NASD-100 .28 .53 .54 .7 .68 .67

INDEXES .265 .576 .621 .723 .734 .723

TRANSP .25 .6 .85 .9 .9 .8

DJI-13 .23 .461 .538 .769 .769 .615

FIDSTKS .222 .417 .445 .617 .588 .537

BEVERAGE .214 .357 .428 .571 .428 .357

SP-100 .208 .384 .439 .582 .593 .527

HACKERS .2 .2 .15 .25 .3 .3

GAMING .19 .333 .476 .619 .571 .476

OILGAS .188 .236 .244 .291 .275 .244

HOMEBLDG .176 .235 .294 .647 .47 .705

DOWJONES .166 .433 .466 .666 .7 .6

GUNS .142 .428 .571 .571 .5 .5

REIT .113 .184 .29 .397 .361 .29

GOLD .081 .183 .163 .163 .163 .204

MILITARY .071 .142 .214 .357 .321 .178

BONDFUND .059 .059 .089 .128 .138 .168

BIGBANKS 0 .142 .285 .571 .571 .428

JETS 0 .5 .857 .928 .928 .714

|

=========================================================================

10/27/2020 Peerless Buy B2 from All

Versions of Peerless. But a test of

DJI-27000 and full 3.5% lower band is under way. Closing Powers

and Candle-Sticks advise waiting and staying hedged, as suggested belore.

The DJI zig-zagged lower all day and closed down at

the -2.5% lower

band. That produced a new Buy B2 to match yesterday's Buy B21.

The opening looks much lower. For several reasons, that it not surprising.

First, the Buy B21s and B2s together have paper losses 2/3 of the

time since the year, 2000. But, they all were eventually closed out at a profit.

See table just below. Second, the volume was very high in the last hour

of trading today. This shows the over-hang of stock to be sold was large.

Third, the Closing Powers are in downtrends, having broken to new lows.

Fourth, when we see a double-top, we should be ready for a test of

a developing trading range's lows and a full test of the 3.5% lower band.

And fifth, the DJI-30 is weaker than the NASDAQ, QQQ and SP-500.

It has now broken its long price-uptrendline and rising 65-dma. So,

a paper loss should come as no surprise in here, regardless of the

news. And the news about the Election, no fiscal relief in sight (McConnell

says it will not come until next year) and Covid's increase) is plenty

to worry about. What if Trump loses big? What if Trump wins?

There is precedent, 1938 for example, for having 5 successful Buy B2 signals

in one year. But there is no point in hurrying into the market now. We need

to see, at least, a good reversal up from a weak opening, to produce a big blue

candle-stick and then a break in the Closing Power downtrends. Stay hedged.

The oils and banks are under pressure and have not bottomed yet and

may be under increasing tax loss selling. Stay short them and some of

the bearish MINCPs. Stay long the highest AI/200 techs and Chinese stocks.

Do not let losses get to be more than 10%.

|

Buys B2s and Buy B21s since the Year 2000. Year Signal DJIA Gain Maximum Paper Loss ------------------------------------------------------------------------------------------------- 20000505 B2 10577.86 .038 paper loss -.0263 5/26 20001020 B2 10226.59 .06 none 0 20001122 B2 10399.32 .049 paper loss -.0077 12/20 20001220 B2 10318.93 .058 none 0 20011022 B21 9377.03 .079 paper loss -.0321 10/31 20021105 B21 8678.27 .011 paper loss -.0431 12/27 20021213 B2 8433.71 .040 paper loss -.0154 12/27 20040726 B2 9961.92 .033 paper loss -.0147 8/9 20041022 B2 9757.81 .118 paper loss -.0008 10/25 20060926 B21 11669.39 .062 none 0 20070301 B2 12234.34 .137 paper loss -.015 3/5 20091201 B21 10471.58 .052 none 0 20100520 B2 10068.01 .034 paper loss -.0249 6/7 20100827 B2 10150.65 .262 none 0 20100929 B21 10835.28 .182 paper loss -.0077 10/4 20101202 B21 11362.41 .127 none 0 20110603 B2 12151.26 .022 paper loss -.0209 6/15 20121112 B2 12815.08 .184 paper loss -.0212 11/15 20130826 B2 14946.46 .016 paper loss -.0113 8/27 20141111 B21 17614.90 .040 paper loss -.0309 12/16 20141212 B2 17280.83 .060 paper loss -.0122 12/16 20151026 B21 17623.05 .006 paper loss -.028 12/18 20151211 B2 17265.21 .026 paper loss -.0079 12/18 20170925 B21 22296.09 .170 none 0 20181120 B2 24465.64 .056 paper loss -.0074 11/23 20190509 B2 25967.73 .009 paper loss -.0443 6/3 20190603 B2 24819.78 .050 none 0 20190806 B2 26029.52 .031 paper loss -.023 20200624 B2 25445.92 .047 --------------------------------------------------------------------------------- 29 B2s and B210s - All were profitable when reversed, but 19 of 29, almost 2/3 were not reversed with out a paper loss of as much as 4.1 points, or moe than 1000 points here. 20201026 B21 27685.38 paper loss open 20201027 B2 27463.19 |

|

Charts 10/27/2020 (Click on Underlined link.) 2020 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol Stoch-20 Inverted Traders Index Graph of Pct of All Stocks above 65-dma Cum. Inverted Traders Index NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30 DIA QQQ MDY SPY IWM TNA Short-Term Rates DOLLAR-UUP recent 2006 vers-Peerless signals -- http://tigersoft.com/NEWPEER/UPD61027.BMP USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH PALL RSX RETL SDS AGQ SLV SOXL TAN TECL TLT TMF TNA UGA (gasoline) USO (oil) and China: YINN CHAU Commodities: CANE CORN DBC JJC, NIB CORN, CUT (paper) MOO, SOYB WEAT UUP (Dollar) LIT (Lithium) Stocks AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA BAC BIDU BLDP CAT CRM CVX CMG DE ENPH FB GILD GOOG GS HD IBM INTU JPM LRCX M (Macy's) MSFT NEM NFLX NKE NVDA PG REGN REV SO SQ QCOM QDEL TSLA TXN XOM V VRTX WFC WMT TOWN ZM New highs and Bullish MAXCPs http://tigersoft.com/UP/10-27/BULLISH.htm Bearish MAXCPs - http://tigersoft.com/DOWN/10-27/BEARISH.htm |

Table 1

10/27/2018 QUICKSILVER on DJI-30 STOCKS.

P21 + ITRS score >+.25 is bullish

1 Bullish ( CRM )

6 Bearish (AMGN, BA, CSCO, CVX, MRK, IBM )

HIGHEST AI/200 = CRM Second Highest Tied = AAPL and MSFT STOCKS CLOSECHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE AI/200 IP21 ITRS ------------------------------------------------------------------------------------------------------- ------------------------------------------------------------------------------------------------------- AAPL 116.6 1.55 117.51 -39.2% ------- BLUE 154 -.045 .033 ---------------------------------------------------------------------------------------------------------- AMGN 223.46 -1.43 231.1 -167.5% Bearish RED 126 -.207 -.065 --- ---------------------------------------------------------------------------------------------------------- AXP 94.93 -1.95 103.14 -404.7% Bearish RED 87 -.126 -.011 ---------------------------------------------------------------------------------------------------------- BA 155.24 -5.59 167.24 -362.2% Bearish RED 33 -.282 -.082 --- ---------------------------------------------------------------------------------------------------------- CAT 157.91 -5.29 168.99 -330.6% Bullish RED 116 .021 .154 ---------------------------------------------------------------------------------------------------------- CRM 250.3 8.32 255.97 -113.2% Bearish BLUE 191 .009 .288 +++ ---------------------------------------------------------------------------------------------------------- CSCO 36.87 -.8 39.2 -300.9% Bearish RED 111 -.123 -.109 --- ---------------------------------------------------------------------------------------------------------- CVX 69.51 -1.43 71.68 -150.9% Bearish RED 77 -.137 -.219 --- ---------------------------------------------------------------------------------------------------------- DIS 123.31 -.75 124.95 -64.9% Bearish RED 102 -.031 -.031 ---------------------------------------------------------------------------------------------------------- DOW 46.57 -.58 49.34 -285.7% Bearish RED 59 -.256 .063 ---------------------------------------------------------------------------------------------------------- GS 195.68 -5.46 208.03 -302% ------- RED 61 -.168 -.021 ---------------------------------------------------------------------------------------------------------- HD 276.84 .8 286.04 -163% Bearish RED 153 -.043 -.024 ---------------------------------------------------------------------------------------------------------- HON 166.75 -3.42 173.26 -187.4% Bearish RED 103 -.116 .066 ---------------------------------------------------------------------------------------------------------- IBM 110.56 -1.66 117.37 -295.4% Bearish RED 108 -.357 -.096 --- ---------------------------------------------------------------------------------------------------------- INTC 45.64 -1.08 53.43 -761.5% ------- RED 85 -.176 -.052 ---------------------------------------------------------------------------------------------------------- JNJ 143.15 -.82 144.55 -48.4% Bearish RED 103 -.144 -.024 ---------------------------------------------------------------------------------------------------------- JPM 99.33 -1.91 100.37 -51.2% Bullish RED 32 .01 .012 ---------------------------------------------------------------------------------------------------------- KO 49.9 .1 50.25 -34.8% Bearish BLUE 79 -.092 .05 ---------------------------------------------------------------------------------------------------------- MCD 222.97 -1.3 227.45 -98.4% Bearish RED 128 -.058 .084 ---------------------------------------------------------------------------------------------------------- MMM 161.03 -5.13 170.95 -292.9% ------- RED 88 -.183 -.007 ---------------------------------------------------------------------------------------------------------- MRK 77.99 -.85 78.27 -17.8% Bearish RED 87 -.263 -.064 --- ---------------------------------------------------------------------------------------------------------- MSFT 213.25 3.17 214.65 -32.7% ------- BLUE 154 .026 .03 ---------------------------------------------------------------------------------------------------------- NKE 127.99 -.38 128.49 -19.3% ------- RED 123 -.01 .227 ---------------------------------------------------------------------------------------------------------- PG 142.36 1.06 142.48 -4.2% ------- BLUE 98 -.026 .066 ---------------------------------------------------------------------------------------------------------- TRV 119.09 -2.45 118.11 39.7% Bullish RED 80 .174 .043 ---------------------------------------------------------------------------------------------------------- UNH 320.51 -2.55 323.41 -44.6% Bullish RED 111 -.035 .015 ---------------------------------------------------------------------------------------------------------- V 190.06 -3.01 197.7 -193.9% Bearish RED 91 -.197 -.032 ---------------------------------------------------------------------------------------------------------- VZ 57.38 -.43 57.25 11.3% ------- RED 111 -.016 -.008 ---------------------------------------------------------------------------------------------------------- WBA 36 -1.21 37.49 -198.5% ------- RED 82 -.093 -.11 ---------------------------------------------------------------------------------------------------------- WMT 142.87 .71 143.9 -35.9% Bullish BLUE 128 -.097 .069 |

Table 2 QUICKSILVER on ETFS - 10/27/20 Bullish = 0

Bearish = 1 OIH

ITRS + IP21>.25 is considered "Bullish"

<-.25 is considered bearish

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS --------------------------------------------------------------------------------------------- --------------------------------------------------------------------------------------------- DIA 274.66 -2.34 281.97 -147.1% Bearish RED -.115 ----- --------------------------------------------------------------------------------------------- SPY 338.22 -1.17 342.73 -75.2% Bearish RED -.119 .016 --------------------------------------------------------------------------------------------- QQQ 282.66 2.19 284.19 -30.9% Bearish BLUE -.071 .042 --------------------------------------------------------------------------------------------- MDY 354.86 -4.88 359.14 -91.6% Bullish RED .06 .011 --------------------------------------------------------------------------------------------- IWM 158.18 -1.37 159.38 -80.1% ------- RED .075 .017 --------------------------------------------------------------------------------------------- FAS 35.02 -2.2 37.33 -325.8% ------- RED -.081 -.058 --------------------------------------------------------------------------------------------- SOXL 269.18 -2.81 293.84 -534% Bearish RED -.057 .066 --------------------------------------------------------------------------------------------- TECL 300.15 4.75 322.21 -365.8% Bearish BLUE -.098 .013 --------------------------------------------------------------------------------------------- IBB 135.87 .76 134.19 -24.3% Bearish BLUE -.022 .014 --------------------------------------------------------------------------------------------- GLD 179.02 .47 180.6 -6.4% Bearish BLUE -.005 -.025 --------------------------------------------------------------------------------------------- OIH 96.86 -1.37 99 -169.7% Bearish RED -.007 -.282 Bearish --------------------------------------------------------------------------------------------- GASL 3440 285 3685 -325.1% ------- RED -.021 .129 --------------------------------------------------------------------------------------------- |

Table 3 Count of Stocks in Key Directories

20201027

-------------------------------

NEWHIGHS 74

NEWLOWS 98 Bearish plurality

MAXCP 18

MINCP 143

TTTNH 17

TTTNL 97

FASTUP 45

FASTDOWN 107

CPCROSSA 49

CPCROSSD 95

BIGVOLUP 2

BIGVODN 10

ACCUMVER 151

HIGHIP21 9

HIUPPCT 38

REDSELL 111

AUGSELS7 57

TRAPDOOR 9

|

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA 10/27/20 --------------------------------------------------------------------------------------- Directory Current day-1 day-2 day-3 day-4 day-5 ---------------------------------------------------------------------------------------- UTILITY .868 .894 .894 .868 .736 .815 SOLAR .818 .818 .818 .909 .909 .909 INFRA .657 .714 .8 .8 .771 .714 CHINA .632 .612 .632 .632 .591 .591 AUTO .615 .743 .82 .82 .82 .769 REGBANKS .615 .692 .807 .807 .692 .615 INDMATER .6 .64 .706 .68 .653 .64 NIFTY .6 .622 .777 .733 .755 .822 TRANSP .6 .85 .9 .9 .8 .8 ELECTRON .591 .646 .741 .748 .7 .734 SEMI .586 .644 .74 .769 .721 .769 CHEM .583 .687 .833 .812 .77 .75 INDEXES .576 .621 .723 .734 .723 .717 GREEN .571 .619 .761 .761 .761 .857 FINANCE .56 .658 .743 .719 .621 .597 RETAIL .551 .632 .795 .734 .673 .673 NASD-100 .53 .54 .7 .68 .67 .71 COMODITY .512 .56 .609 .585 .585 .585 FOOD .509 .528 .584 .547 .566 .584 COMPUTER .5 .55 .7 .75 .7 .75 COPPER .5 .5 .625 .625 .625 .5 ETFS .5 .482 .678 .625 .589 .607 JETS .5 .857 .928 .928 .714 .785 SOFTWARE .5 .483 .616 .616 .616 .616 SP500 .476 .544 .672 .659 .619 .632 RUS-1000 .462 .533 .65 .631 .592 .606 DJI-13 .461 .538 .769 .769 .615 .692 BIOTECH .44 .43 .478 .478 .413 .481 DOWJONES .433 .466 .666 .7 .6 .633 GUNS .428 .571 .571 .5 .5 .571 FIDSTKS .417 .445 .617 .588 .542 .577 INSURANC .384 .461 .653 .576 .576 .461 SP-100 .384 .439 .582 .593 .527 .56 BEVERAGE .357 .428 .571 .428 .357 .428 EDU .333 .333 .333 .333 .333 .333 GAMING .333 .476 .619 .571 .523 .476 HOSPITAL .333 .619 .619 .619 .571 .571 COAL .285 .571 .571 .428 .285 .285 OILGAS .236 .244 .283 .275 .244 .259 HOMEBLDG .235 .294 .647 .47 .705 .823 HACKERS .2 .2 .25 .3 .3 .3 REIT .184 .29 .397 .361 .297 .312 GOLD .183 .163 .163 .163 .204 .183 BIGBANKS .142 .285 .571 .571 .428 .571 MILITARY .142 .214 .357 .321 .214 .285 BONDFUND .059 .089 .128 .138 .168 .178 |

====================================================================

10/26/2020 Peerless Buy B21

(2020 version) Buy B20 (2006 version).

The DJI's big decline today took it down to a close 1.8% below the

21-day ma. Because we are in a normally bullish period of time at the

end of October and the P-Indicator stands at a very positive +163

and the V-Indicator is positive, Peerless generated a Buy B21 at the

close today. AAPL refused to break its rising 65-dma. When traders

saw this, they scrambled to buy again. A quick rally would seem to be

shaping up back to the price-downtrendlines shown in the DIA and

QQQ charts below.

Below are the Buy B21s since 1965. We have earlier Buy B21s

but the

data is not as reliable. Actually, I would pay most attention to the fact that

the average Buy B21 gained about 8% on average since 2000 and had

an average paper loss of only 1.2%. There were no losing trades. If the

DJI turns weak again, and the Closing Powers remain in a downtrend,

keep in mind that the QE-Infinity program will give a Buy B2 at the lower

3.5% band and we will probably get a Buy B9 on more weakness because

breadth remains very positive. Stay hedged a little

longer. The weakest

MINCPs will likely stay under pressure. There was only one PEY (Presideential

Election Year) Buy B21. It gained 6% and showed no paper loss.

Closed Out Buy B21s since 1965Date DJI Gain Biggest Paper Loss --------------------------------------------------------------------------- 19651029 B21 960.82 .026 926.5 -.038 9/21 19731001 B21 948.83 .04 none 0 19851111 B21 1440.02 .268 none 0 19861202 B21 1955.57 .230 1895.91 -.0305 12/31 19881219 PEY B21 2172.36 .069 none 0 20011022 B21 9377.03 .079 9075.14 -.0321 10/31 20021105 B21 8678.27 .011 8303.78 -.0431 12/27 20060926 B21 11669.39 .062 none 0 20091201 B21 10471.58 .052 none 0 20100929 B21 10835.28 .182 10751.2 -.0077 10/4 20101202 B21 11362.41 .127 none 0 20141111 B21 17614.90 .040 17068.8 -.0309 12/16 20151026 B21 17623.05 .006 17128.5 -.028 12/18 20170925 B21 22296.09 .170 none 0 ---------------------------------------------------------------------------------------------- |

|

Charts 10/26/2020 (Click on Underlined link.) 2020 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol Stoch-20 Inverted Traders Index Graph of Pct of All Stocks above 65-dma Cum. Inverted Traders Index NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30 DIA QQQ MDY SPY IWM TNA Short-Term Rates DOLLAR-UUP recent 2006 vers-Peerless signals -- http://tigersoft.com/NEWPEER/UPD61026.BMP USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH PALL RSX RETL SDS AGQ SLV SOXL TAN TECL TLT TMF TNA UGA (gasoline) USO (oil) and China: YINN CHAU Commodities: CANE CORN DBC JJC, NIB CORN, CUT (paper) MOO, SOYB WEAT UUP (Dollar) LIT (Lithium) Stocks AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA BAC BIDU BLDP CAT CRM CVX CMG DE ENPH FB GILD GOOG GS HD IBM INTU JPM LRCX M (Macy's) MSFT NEM NFLX NKE NVDA PG REGN REV SO SQ QCOM QDEL TSLA TXN XOM V VRTX WFC WMT TOWN ZM New highs and Bullish MAXCPs http://tigersoft.com/UP/10-26/BULLISH.htm Bearish MAXCPs - http://tigersoft.com/DOWN/10-26/BEARISH.htm |

Table 1

10/26/2018 QUICKSILVER on DJI-30 STOCKS.

P21 + ITRS score >+.25 is bullish

1 Bullish ( CRM TRV)

1 Bearish (BA CVX, MRK, IBM )

HIGHEST AI/200 = CRM Second Highest Tied = AAPL and MSFT STOCKS CLOSECHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE AI/200 IP21 ITRS ------------------------------------------------------------------------------------------------------- ------------------------------------------------------------------------------------------------------- AAPL 115.05 .01 115.98 -40% Bearish BLUE 155 -.025 .011 ---------------------------------------------------------------------------------------------------------- AMGN 224.89 -2.27 230.71 -127% Bearish RED 127 -.178 -.052 ---------------------------------------------------------------------------------------------------------- AXP 96.88 -4.1 102.47 -272.5% Bearish RED 88 -.11 -.025 ---------------------------------------------------------------------------------------------------------- BA 160.83 -6.53 167.11 -188.1% Bearish RED 33 -.188 -.087 --- ---------------------------------------------------------------------------------------------------------- CAT 163.2 -5.39 167.53 -128.5% Bullish RED 116 .041 .176 ---------------------------------------------------------------------------------------------------------- CRM 241.98 -8.54 255.01 -257.4% Bearish RED 191 .003 .261 +++ ---------------------------------------------------------------------------------------------------------- CSCO 37.67 -1.15 39.3 -208.8% Bearish RED 112 -.073 -.104 ---------------------------------------------------------------------------------------------------------- CVX 70.94 -1.63 71.28 -23.6% ------- RED 77 -.08 -.205 --- ---------------------------------------------------------------------------------------------------------- DIS 124.06 -4.29 124.23 -6.7% Bearish RED 102 -.013 -.04 ---------------------------------------------------------------------------------------------------------- DOW 47.15 -1.38 48.84 -173.1% Bearish RED 59 -.224 .061 ---------------------------------------------------------------------------------------------------------- GS 201.14 -3.9 205.69 -110.8% ------- RED 62 -.131 -.023 ---------------------------------------------------------------------------------------------------------- HD 276.04 -6.96 283.73 -135.5% Bearish RED 154 -.011 -.006 ---------------------------------------------------------------------------------------------------------- HON 170.17 -5.37 171.59 -40.8% Bullish RED 104 -.078 .072 ---------------------------------------------------------------------------------------------------------- IBM 112.22 -3.78 125.52 -563.8% Bearish RED 109 -.331 -.094 --- ---------------------------------------------------------------------------------------------------------- INTC 46.72 -1.48 54.58 -745.4% Bullish RED 86 -.1 -.034 ---------------------------------------------------------------------------------------------------------- JNJ 143.97 -1.27 144.32 -12.1% Bearish RED 104 -.129 -.019 ---------------------------------------------------------------------------------------------------------- JPM 101.24 -2.57 99.8 71.1% Bullish RED 31 .062 -.001 ---------------------------------------------------------------------------------------------------------- KO 49.8 -.72 49.62 17.9% Bearish RED 80 -.112 .038 ---------------------------------------------------------------------------------------------------------- MCD 224.27 -4.44 226 -38% Bearish RED 129 -.035 .093 ---------------------------------------------------------------------------------------------------------- MMM 166.16 -3.64 169.55 -99.7% ------- RED 89 -.152 .01 ---------------------------------------------------------------------------------------------------------- MRK 78.84 -.99 78.67 10.8% Bearish RED 87 -.225 -.046 --- ---------------------------------------------------------------------------------------------------------- MSFT 210.08 -6.15 214.22 -96.3% Bearish RED 154 -.016 .016 ---------------------------------------------------------------------------------------------------------- NKE 128.37 -1.62 127.43 36.4% Bullish RED 124 -.027 .216 ---------------------------------------------------------------------------------------------------------- PG 141.3 -1.08 141.91 -21.4% ------- ---- 98 -.056 .056 ---------------------------------------------------------------------------------------------------------- TRV 121.54 -4.43 111.84 399.5% Bullish RED 80 .196 .035 ---------------------------------------------------------------------------------------------------------- UNH 323.06 -7.54 324.22 -17.8% Bullish RED 111 -.056 .008 ---------------------------------------------------------------------------------------------------------- V 193.07 -4.94 196.97 -98.6% Bearish RED 92 -.182 -.008 ---------------------------------------------------------------------------------------------------------- VZ 57.81 -.15 57.3 44.5% ------- BLUE 111 -.003 -.007 ---------------------------------------------------------------------------------------------------------- WBA 37.21 -.83 36.97 32% Bullish RED 82 -.067 -.102 ---------------------------------------------------------------------------------------------------------- WMT 142.16 -1.69 142.95 -27.5% Bullish RED 128 -.107 .082 |

Table 2 QUICKSILVER on ETFS - 10/23/20 Bullish = 0

Bearish = 1 OIH

ITRS + IP21>.25 is considered "Bullish"

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS --------------------------------------------------------------------------------------------- --------------------------------------------------------------------------------------------- DIA 283.34 -.31 282.03 -46.4% ------- RED -.022 ----- --------------------------------------------------------------------------------------------- SPY 345.78 1.17 342.01 -21.9% ------- RED -.031 .013 --------------------------------------------------------------------------------------------- QQQ 284.74 .56 283.8 -66.1% Bearish ---- .032 .031 --------------------------------------------------------------------------------------------- MDY 367.49 2.29 359.82 48.1% Bullish BLUE .158 .017 --------------------------------------------------------------------------------------------- IWM 163.07 .94 160.41 22.4% Bullish ---- .164 .023 --------------------------------------------------------------------------------------------- FAS 39.8 .58 36.59 207.8% Bullish BLUE .017 .029 --------------------------------------------------------------------------------------------- SOXL 290.55 -4.32 301.14 -259.3% ------- RED .062 .159 --------------------------------------------------------------------------------------------- TECL 315.99 -1.83 320.25 -352.1% ------- RED .029 .057 --------------------------------------------------------------------------------------------- IBB 136.49 .34 137.43 -117.7% Bearish RED .036 .005 --------------------------------------------------------------------------------------------- GLD 178.64 -.19 178.39 9.5% Bearish RED .058 -.04 --------------------------------------------------------------------------------------------- OIH 102.11 .73 96.99 253.2% Bullish BLUE-.012 -.276 Bearish --------------------------------------------------------------------------------------------- QUICKSILVER on ETFS - 10/26/20 ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS --------------------------------------------------------------------------------------------- DIA 277 -6.34 282.95 -88.9% Bearish RED -.07 0 --------------------------------------------------------------------------------------------- BA 160.83 -6.53 167.24 -188.1% Bearish RED -.188 -.087 --------------------------------------------------------------------------------------------- SPY 339.39 -6.39 343.38 -38.1% ------- RED -.065 .018 --------------------------------------------------------------------------------------------- QQQ 280.47 -4.27 284.41 -58.6% Bearish RED -.02 .041 --------------------------------------------------------------------------------------------- MDY 359.74 -7.75 361.5 -1.1% Bullish RED .127 .022 --------------------------------------------------------------------------------------------- IWM 159.55 -3.52 160.76 -26.7% Bullish RED .136 .026 --------------------------------------------------------------------------------------------- FAS 37.22 -2.58 37.51 82.7% Bullish RED -.024 -.017 --------------------------------------------------------------------------------------------- RETL 259.16 -21.23 272.22 -181.5% Bearish RED .038 .062 --------------------------------------------------------------------------------------------- SOXL 271.99 -18.56 300.18 -492.2% Bearish RED .009 .112 --------------------------------------------------------------------------------------------- TECL 295.4 -20.59 323.19 -388.4% Bearish RED -.047 .013 --------------------------------------------------------------------------------------------- IBB 135.11 -1.38 136.53 -85.2% Bearish -----.019 .023 --------------------------------------------------------------------------------------------- GLD 178.55 -.09 179.25 4.5% Bearish RED .03 -.012 --------------------------------------------------------------------------------------------- OIL 178.55 -.09 179.25 4.5% Bullish RED -.06 24.887 --------------------------------------------------------------------------------------------- OIH 98.23 -3.88 100.26 62% ------- RED -.023 -.286 --------------------------------------------------------------------------------------------- GASL 3440 285 3685 -325.1% ------- RED -.021 .123 --------------------------------------------------------------------------------------------- UGA 3440 285 3685 -325.1% ------- RED -.614 186.068 --------------------------------------------------------------------------------------------- UUP 25.98 -.06 26.26 -53.5% ------- -----.019 -.011 --------------------------------------------------------------------------------------------- IEF 25.98 -.06 26.26 -53.5% Bullish ---- .079 -.777 --------------------------------------------------------------------------------------------- CORN 25.98 -.06 26.26 -53.5% ------- ---- .053 1.01 --------------------------------------------------------------------------------------------- WEAT 25.98 -.06 26.26 -53.5% ------- ---- .041 3.777 --------------------------------------------------------------------------------------------- YINN 25.98 -.06 26.26 -53.5% Bearish ---- .166 .708 --------------------------------------------------------------------------------------------- RSX 21.04 -.4 20.97 80.7% Bullish RED .054 -.095 |

Table 3 Count of Stocks in Key Directories

20201026

-------------------------------

NEWHIGHS 52

NEWLOWS 197

MAXCP 10

MINCP 104 Bearish 10x

TTTNH 9

TTTNL 87

FASTUP 46

FASTDOWN 68

CPCROSSA 42

CPCROSSD 114

BIGVOLUP 1

BIGVODN 8

ACCUMVER 149

HIGHIP21 11

HIUPPCT 41

REDSELL 99

AUGSELS7 57

TRAPDOOR 10

|

Table 4 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

10/26/20

Bullish 27

Bearish 18

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

UTILITY .894 .894 .868 .736 .789 .815

JETS .857 .928 .928 .714 .785 .642

TRANSP .85 .9 .9 .8 .8 .75

SOLAR .818 .818 .909 .909 .909 .909

AUTO .743 .82 .82 .82 .794 .717

INFRA .714 .8 .8 .771 .714 .714

REGBANKS .692 .807 .807 .692 .615 .5

CHEM .687 .833 .812 .77 .75 .75

FINANCE .654 .74 .728 .617 .604 .58

SEMI .644 .74 .769 .721 .769 .75

ELECTRON .643 .739 .746 .698 .732 .719

INDMATER .64 .706 .68 .653 .653 .613

RETAIL .632 .795 .734 .673 .673 .693

NIFTY .622 .777 .733 .755 .822 .777

INDEXES .621 .723 .734 .723 .717 .706

CHINA .62 .64 .64 .6 .6 .6

GREEN .619 .761 .761 .761 .809 .761

HOSPITAL .619 .619 .619 .619 .571 .619

COAL .571 .571 .428 .285 .285 .285

GUNS .571 .571 .5 .5 .571 .5

COMODITY .56 .609 .585 .585 .585 .585

COMPUTER .55 .7 .75 .7 .75 .8

SP500 .544 .674 .659 .619 .636 .617

NASD-100 .54 .7 .68 .67 .72 .7

DJI-13 .538 .769 .769 .615 .692 .692

RUS-1000 .533 .652 .631 .592 .608 .572

FOOD .528 .584 .547 .566 .584 .566

=================================================================================================

COPPER .5 .625 .625 .625 .5 .5

=================================================================================================

SOFTWARE .483 .633 .616 .616 .616 .6

ETFS .482 .678 .625 .589 .589 .535

GAMING .476 .619 .571 .523 .476 .476

DOWJONES .466 .666 .7 .6 .633 .633

INSURANC .461 .653 .576 .576 .461 .307

FIDSTKS .445 .617 .588 .542 .582 .565 SP-100 .439 .582 .593 .527 .56 .571 BEVERAGE .428 .571 .428 .357 .428 .357 BIOTECH .428 .477 .479 .412 .471 .498 EDU .333 .333 .333 .333 .333 .333 HOMEBLDG .294 .647 .47 .705 .823 .823 REIT .29 .397 .361 .297 .312 .241 BIGBANKS .285 .571 .571 .428 .571 .571 OILGAS .244 .283 .267 .244 .259 .251 MILITARY .214 .357 .321 .214 .285 .321 HACKERS .2 .3 .3 .3 .3 .3 GOLD .163 .163 .163 .204 .204 .122 BONDFUND .089 .128 .138 .168 .168 .118 |

=========================================================================

10/23/2020 Stay hedged. Combine the QE-Infinity signals with Peerless-2000.

The risk of a big Democrat victory has finally got Wall Street's attnetion.

The futures are down 200. The explosion of the Covid-19 is reason

to be plenty worried, too. A decline to the lower band is probably

on its way. Then at the lower band, the FED will likely provide

more liquidity to hold the market up. Stay hedged, as previously

suggested. Chinese stocks may provide as escape from the nervousness

of the DJIA.

Tonight I want to unveil our Tiger Power Index graph. Use its

trendlines and cross-over above and below zero. I think it

will turn volatility to our advantage a meaningful amount. Here is an example.

|

NEW TIGERSOFT Silver ETFS are very volatile. Use our Tiger Power Index to track and master them. The new ESP page has the new TigerSoftware to do this and produce the QE-Infinity signals. I've sent links to many of you to use this. If you did not get the link, I can supply it for $85. |

| Peerless

2020 and QE-Infinity Signals on DJI - 27000 seems a good target for this

decline. |

|

DIA-Candle-Stick |

|

QQQ-Candle-Stick. |

Chinese ETFs are at the top of our Bullish MAXCPs.

| CHN |

Oil and Gas Funds are near the bottom of our internal strength rankings.

|

Sell Short BOIL |

New Tiger Power Index

The new oscillator, which is the first item under Indic-2, simply

combines ITRS and IP21. You can see their values on the right-most two

columns of table 1 (DJI-30 stocks) and 2 (major ETFs), below. The links

to the graphs tonight here just below show this indicator with many

comments on how to use it best.

|

Charts 10/23/2020 (Click on Underlined link.) 2020 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol Stoch-20 Inverted Traders Index Graph of Pct of All Stocks above 65-dma Cum. Inverted Traders Index NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30 DIA QQQ MDY IWM TNA Short-Term Rates DOLLAR-UUP SPY http://tigersoft.com/2121CST/SPY.GIF recent 2006 vers-Peerless signals -- http://tigersoft.com/NEWPEER/UPD61023.BMP ------------------------------------ The charts below tonight show the Tiger Power Index ------------------------------------- (We will go back to the regular format tomorrow night) USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH PALL RSX RETL SDS AGQ SLV SOXL TAN TECL TLT TMF TNA UGA (gasoline) USO (oil) and China: YINN CHAU Commodities: CANE CORN DBC JJC, NIB, CHOC CORN, CUT (paper) MOO, SOYB WEAT UUP (Dollar) LIT (Lithium) Stocks AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA BAC BIDU BLDP CAT CRM CVX CMG DE ENPH FB GILD GOOG GS HD IBM INTU JPM LRCX M (Macy's) MSFT NEM NFLX NKE NVDA PG REGN REV SO SQ QCOM QDEL TSLA TXN XOM V VRTX WFC WMT TOWN ZM -------------------------- Resume regular TigerSoft Charts ---------------------------------------- New highs and Bullish MAXCPs http://tigersoft.com/UP/10-23/BULLISH.htm Bearish MAXCPs - http://tigersoft.com/DOWN/10-23/BEARISH.htm

|

How To Use The Tiger Power Index.

It is not meant

to replace the existing Power Ranker, which uses

the same concepts a little differently. We do want to use this Power

Index along with the other Tiger tools and signals. Since, it does

not factor in Opening and Closing Power, but combine IP21 (Accumulation)

and ITRS (relative strength versus the DJI), it can nicely supplement our

Opening and Closing Power concepts, as well as chart patterns and trends,

key moving averages, non-cofirmations, automatic signals, etc..

With high Accumulation stocks, when the new Power Index crosses

above +.5, we often see very big vertical advances. We should take

advantage of the steep Power Index uptrends as long as they last.

With the best of these stocks we will see flat-top breakouts and

both Opening and Closing Power rising and only small sized red

Tiger "popsicles" in our candle-stock charts. A change in the color

of the candle-stick from blue to red gives a good sell, especially if

the Power Index has failed to confirm a move to new highs. All this

will be familiar to traders using our "Explosive Super Stocks".ideas.

But there are two other major uses for the new Tiger Power Index chart.

Look for volatility in this indicator. We want to see declines in stocks

that previously showed Power Index readings above +.5 or -.5. Find those

stocks that have had their Tiger Power Index drop back slightly below 0

and then turn up past zero. Do not apply this if your chart gives

you a warning that there have been too many cross-overs around zero.

In this case, use the cross-over above zero by the Tiger Power Index's

pink 21-day ma. See the examples below.

Last and probably the most useful way to employ the new Tiger

Index is just to draw simple trendlines on it. Again, we want to see

past volatility, where the high was above +.5, and well-tested downtrend-

line breaks to the upside. In a bear market, the downtrend-line

break can occur way below zero. But in a bull market, it is best not

to buy stocks whose Tiger Index downtrend is broken below -.25.

Again volatility is our friend here. So is a rising 65-dma or a well-

tested support and a break in a Closing Power downtrend.

I have first drawn the Power Index using Ind-2 + Draw Power

Index.

Then I have drawn rubber-bandlines using Lines. Then I placed

buy and sell signals on these lines as I thought would be instructive.

Table 3 Oct. 23 Count of Stocks in Key Directories

20201023

-------------------------------

NEWHIGHS 144

NEWLOWS 50

MAXCP 11

MINCP 38

TTTNH 12

TTTNL 36

FASTUP 105

FASTDOWN 60

CPCROSSA 99

CPCROSSD 31

BIGVOLUP 2

BIGVODN 6

ACCUMVER 148

HIGHIP21 11

HIUPPCT 52

REDSELL 99

AUGSELS7 131

TRAPDOOR 9

|

Table 4 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

Bullish = 38

Bearish = 8

10/23/20

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

JETS .928 .928 .714 .785 .714 .642

TRANSP .9 .9 .8 .8 .8 .75

UTILITY .894 .868 .736 .789 .815 .789

CHEM .833 .812 .77 .75 .77 .812

AUTO .82 .82 .82 .794 .717 .769

SOLAR .818 .909 .909 .909 .909 .909

REGBANKS .807 .807 .692 .615 .5 .692

INFRA .8 .8 .771 .714 .714 .742

RETAIL .795 .734 .673 .673 .673 .755

NIFTY .777 .733 .755 .822 .777 .777

DJI-13 .769 .769 .615 .692 .692 .692

GREEN .761 .761 .761 .809 .761 .809

FINANCE .743 .719 .621 .597 .573 .585

ELECTRON .741 .748 .7 .734 .721 .721

SEMI .74 .769 .721 .769 .75 .74

INDEXES .723 .734 .723 .717 .706 .717

INDMATER .706 .68 .653 .653 .626 .666

COMPUTER .7 .75 .7 .75 .8 .7

NASD-100 .7 .68 .67 .72 .7 .79

ETFS .678 .625 .589 .589 .535 .517

SP500 .674 .661 .619 .636 .623 .689

DOWJONES .666 .7 .6 .633 .633 .666

INSURANC .653 .576 .576 .461 .307 .5

RUS-1000 .652 .632 .592 .608 .575 .649

HOMEBLDG .647 .47 .705 .823 .823 .823

CHINA .64 .64 .6 .6 .6 .66

SOFTWARE .633 .633 .616 .616 .6 .666

COPPER .625 .625 .625 .5 .5 .5

GAMING .619 .571 .523 .476 .523 .523

HOSPITAL .619 .619 .619 .619 .619 .619

FIDSTKS .617 .588 .542 .582 .571 .634

COMODITY .609 .585 .585 .585 .585 .56

GUNS .6 .533 .533 .6 .6 .6

FOOD .584 .547 .566 .584 .566 .547

SP-100 .582 .593 .527 .56 .56 .637

BEVERAGE .571 .428 .357 .428 .357 .571

BIGBANKS .571 .571 .428 .571 .571 .571

COAL .571 .428 .285 .285 .285 .285

============================================================================================

BIOTECH .477 .479 .415 .471 .493 .554

REIT .397 .361 .297 .312 .241 .333

MILITARY .357 .321 .214 .285 .321 .321

EDU .333 .333 .333 .333 .333 .333

HACKERS .3 .35 .3 .3 .3 .45

OILGAS .285 .261 .23 .253 .246 .253

GOLD .163 .163 .204 .204 .142 .183

BONDFUND .128 .138 .168 .168 .118 .118

|

=====================================================================

10/22/2020 Stay hedged. Combine the QE-Infinity signals with Peerless-2020.

Trump says a Biden victory will crash the stock market. Big Money

agrees. But the FED will probably fight that and support the DJI at

the 3.5% lower band. Biden will also likely use a big Public Works'

program as a fiscal stimulus that Trump has avoided. The DJI can rally

when a Democrat wins. The rising markets in 1933, 1961, 1965, 1993,

1997 and 2013 show that. Don't bet on a big decline if Biden wins

unless we see new bearish technical readings. Perhaps, Wall Street

is giving Biden "access" contributions, but perhaps, too, it sees that Biden

will "heal" the country better than Trump.

Opening Powers and the NYSE A/D Line are rising but our

Accumulation Index is negative and the Closing Powers are downtrending.

There remains considerable resistance for the DJI at 29000 where we

see a double top. The long history of past Presidential Election years'

fourth quarter tops before 2000 shows that they mostly waited until

November

or later. I have ascribed this to the tendency of partisans to eagerly be

buyers

throughout October in anticipation of their favorite Presidential Candidate's

victory in the November Election.

But when we look at the behavior of the DJIA or DIA in the fourth quarter

of Presidential Election years only since 2000, we

see the odds are 3 of 5 that

there will be an October top. That is what happened in 2000, 2008 and 2012.

In the two cases, where there was no October top, 2004 and 2016, the DJI

shot upwards through flat resistance and ran upwards into the next year. These

two cases of October-November breakouts in DJIA-DIA show two technical

characteristics that are now missing. The first is an IP21 surge and the second is

a rising Closing Power. So, at this point, it seems quite possible that an

October top may already have been made.

I do not think we will see a big decline, however. The DJI is just too stymied

and stalemated by contradictory forces: on the one hand, we see heavy selling by

"big money" in anticipation of new taxes on corporations and the wealthy by a

President Biden in 2021 and, on the other hand, we note the unprecedented

readiness of the FED to support the market with QE infinity. It is this FED support

that has made every decline to the 3.5% lower band a very good time to buy

the DJI, DIA, SPY, QQQ or the most bullish stocks ever since March 2020.

New TigerSoft

Hedging continues to be called for, in my opinion, to take advantage of Tiger's

Power Ranker. At the same time, we do need a market timing program that

tests well since 1929. So, I have incorporated QE-Infinity signals into the

regular Peerless. I'm still adding some new ideas to it, including a graph

of a "Power Indicator", IP21 + ITRS. More on this next week.

| Current DJI with all Peerless Signals - normal markets and QE- Infinity |

| Current DIA Opening and Closing Power |

DIA Charts 2000, 2004, 2008, 2012 and 2016

Since 2000, the DJI has topped out in three of the five October. Let's look

at the DJI's of 2000, 2004, 2008, 2012 and 2016 along with the Closing

Power and Accumulation Index for DIA.

| 2000 |

| 2004 |

| 2008 |

| 2012 |

| 2016 |

|

Charts 10/22/2020 (Click on Underlined link.) 2020 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol Stoch-20 Inverted Traders Index Graph of Pct of All Stocks above 65-dma Cum. Inverted Traders Index NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30 DIA QQQ MDY IWM TNA Short-Term Rates DOLLAR-UUP SPY http://tigersoft.com/2121CST/SPY.GIF recent 2006 vers-Peerless signals -- http://tigersoft.com/NEWPEER/UPD61022.BMP USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH PALL RSX RETL SDS AGQ SLV SOXL TAN TECL TLT TMF TNA UGA (gasoline) USO (oil) and China: YINN CHAU Commodities: CANE CORN DBC JJC, NIB, CHOC CORN, CUT (paper) MOO, SOYB WEAT UUP (Dollar) LIT (Lithium) Stocks AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA BAC BIDU BLDP CAT CRM CVX CMG DE ENPH FB GILD GOOG GS HD IBM INTU JPM LRCX M (Macy's) MSFT NEM NFLX NKE NVDA PG REGN REV SO SQ QCOM QDEL TSLA TXN XOM V VRTX WFC WMT TOWN ZM New highs and Bullish MAXCPs http://tigersoft.com/MAXCP/10-22/BULLISH.htm Bearish MAXCPs - http://tigersoft.com/MINCP/10-22/BEARISH.htm |

Table 1

10/22/2018 QUICKSILVER on DJI-30 STOCKS.

P21 + ITRS score >+.25 is bullish 3 Bullish (CAT CRM TRV) Bullish CHange

1 Bearish ( IBM )