Earlier Hotlines

www.tigersoft.com/19HLK5/INDEX.htm

www.tigersoft.com/44UHL/INDEX.htm

www.tigersoft.com/NHLP/INDEX.htm

www.tigersoft.com/7LHL/INDEX.htm

www.tigersoft.com/NHL718/INDEX.htm

www.tigersoft.com/21MAY18/INDEX.htm

www.tigersoft.com/55HEP/INDEX.htm

www.tigersoft.com/44H4L/INDEX2.htm

Earlier still: Go here...

HELP

A Guide

To Profitably Using The Tiger Nightly HOTLINE

Introduction to Tiger/Peerless Buys and

Sells.

Peerless Buy and

Sell Signals: 1928-2016

Individual Peerless signals explained:

http://tigersoftware.com/PeerlessStudies/Signals-Res/index.htm

http://www.tigersoft.com/PeerInst-2012-2013/

Explanation of each Peerless signal. http://www.tigersoft.com/PeerInst-2012-2013/

Different Types of

TigerSoft/Peerless CHARTS, Signals and Indicators

-----> More HELP LINKS

Documentation for

TigerSoft Automatic and Optimized Signals.

How reliable support is the

DJI's rising 200-day ma?

SPY Charts since

1994: Advisory Closing Power S7s, Accum. Index, 65-dma, Optimized Signals.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

1/19/2016 ---> Corrections,Deeper

Declines and Bear Markets since 1945.

1/21/2016

---> High

Velocity Declines since 1929

2/12/2016 ---> Presidential

Elections Years and Bullish IP21 Positive Non-Confirmations at Lower Band.

2/12/2016 ---> OBV NNCs on DJI's Rally to

2.7% Upper Band when DJI's 65-dma is falling.

11/6/2016 --->

Killer Short Selling

Techniques: ===> Order Here ($42.50)

It's As Easy as 1,2,3

TigerSoft "Combination" Short-Selling... Easy as 1-2-3 Short Sales

Earlier Q-Answers

QuickSilver Documentation (1/11/2016)

Our Different

Signals

Better understand the difference between

Peerless DJI-based signals,

the one-year optimized red Signals and the fixed signals based

on technical developments.

Introduction to Tiger/Peerless Buys and Sells.

Different Types of

TigerSoft/Peerless CHARTS, Signals and Indicators

New TigerPeerless Installation and

Basic Uses' Instruction

See the re-written materials on TigerSoft Buys and Sells.

Study- Trading SPY

WITHOUT Peerless - Some Guidelines.

When completed this will be a new Tiger Trading E-Book.

Study- Examples of

"Hands above the Head" top patterns.

Study- 9/3/2017 TigerSoft (not

Peerless) charts of Major Tops as they occurred.

===> Please report any broken or out-of-date links. william_schmidt@hotmail.com

--->>> Order New E-Book: "New Tiger Tahiti

System's Stocks: 2000-2018", $50.00

> When to

start avoiding the long side altogether because of Peerless signals.

> When to

start buying Tahiti stocks after the start of a Bear Market.

> When to

avoid a weaker high AI/200 stock and use the second choice.

> When to exit

Tahiti stocks before the normal 21-month holding period is over.

> The special

benefits of working with major Tahiti tech stocks.

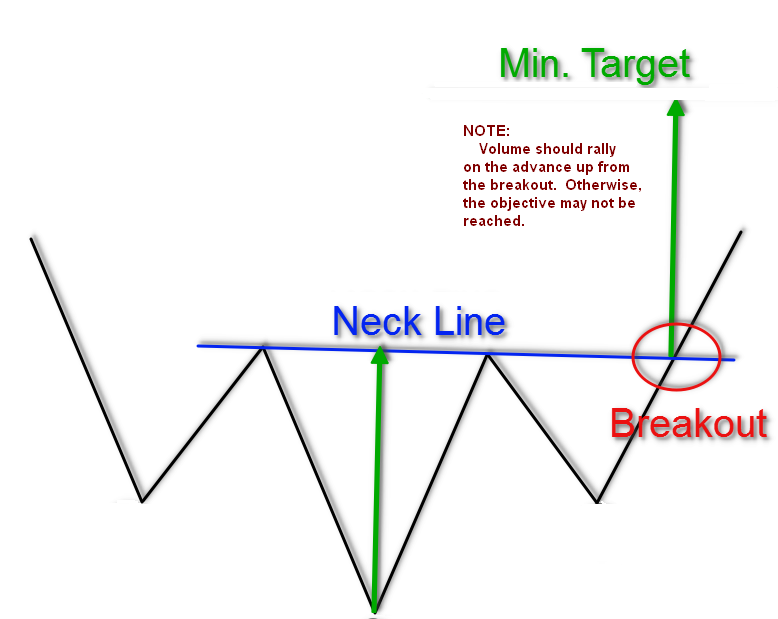

> Watch for Head/Shoulders tops with these stocks.

> Using the

90-day Stochastic to time the purchase of Safer Tahiti Stocks

> The Tahiti

Tech System's track record using these rules matches closely the 24%/year gain that

the

blue chip Tahiti system did between 1970 and 2000.

> Tiger Software 858-273-5900 PO Box 22784 San

Diego, CA 92192 Email william_schmidt@hotmail.com

====================================================================

====================================================================

3/12/2019 The Buy B4 and the V-formation

are still in place. But the DJI is being

held back by Boeing and by the technical problems created by its

potential head and shoulders pattern. A closing by the DJI below the

H/S would have to be judged a Sell S10. But that could also bring a

nullifying Buy B9 since the P-I would likely be positive a the lower

band.... The DJI will be doing well just to rally given Boeing's situation

and the uncertainties that introduces. Each 10 points that Boeing falls

drops the DJI by 70.

Fortunately, the V-formation and the January Buy B4 argue for a move

to 27000. Signals on the DJI chart are shown just below. It does show a

potential H/S. But understand that very often a bearish-looking head/shoulders

pattern becomes short-term bullish when prices go above the apex of the right

shoulders. (Presumably, it is at this point that shorts become very nervous.)

The NYSE A/D Line remains bullish and 87% of all the trading instruments

we follow are above their 65-dma. Seasonality is bullish and so are most stocks.

Assuming the DJI can stay above 25000, it will next challenge

26100 and when that is conquered, we will see a move to 27000.

If the FED cooperates and BA is exonerated, we should see an

exciting move past 27000 to 30000.

Right now, there is still a certain amount of caution. But I take it as a

good sign about interest rates that the DJI-Untilities Index has just made a new

12-month high and the interest rates on 10-year bonds have just made a

new low.

I would prefer to stay long the tech ETFs, SOXL or TECL. They will

hold up better than the DJI. So should IWM. Each of these shows a

rising Closing Power.

It is very rare for the DJI to lead the rest of the market lower. There

are only a handful of cases, most notably 1977 and 2001. Much

more likely would for Peerless to give a Buy B9 based on positive

breadth (P-I) as the DJI tags the lower band. But US intervention

in Venezuela could create a whote batch of new uncertainties that would

likely hold back the market in what should be a normally bullish period of time.

SPY - 281-282 is important overhead resistance.

IWM - working on surpassing its 21-dma

SOXL- Very close to breaking downtrend

and bullishly destroying a potential H/S/

TECL - Big Move up Today

|

Charts 3/12/2019 2018 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol Hourly DJIA A/D Line for All Stocks Inverted Traders Index NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30 DIA SPY QQQ MDY IWM TNA Short-Term Rates USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL RSX RETL SDS AGQ SLV SOXL TECL TLT TMF TNA UGA (gasoline) XIV YINN Commodities: CANE CORN DBC JJC, NIB, CHOC CORN, CUT (paper) MOO, SOYB WEAT UUP (Dollar) LIT (Lithium) AAPL ADBE ALXN AMAT AMGN AMD AMZN BA BABA BAC BIDU CAT CVX DE FB GOOG GS HD IBM INTU JPM M (Macy's) MSFT NFLX NVDA QCOM TSLA TXN XOM WMT CMG , LRCX, SWKS, MDGL SPPI WATT SQ TOWN 3/12/19 (Click on Underlined link.) Bullish MAXCPs - http://tigersoft.com/MAXCPS/Mar-12/BULLISH.htm Bearish MAXCPs - http://tigersoft.com/MINCPs/Mar-12/BEARISH.htm |

Table 1 QUICKSILVER on ETFS - 3/12/19 ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS --------------------------------------------------------------------------------------------- DIA 255.86 -.9 256.87 -45.5% Bullish RED .138 ------ --------------------------------------------------------------------------------------------- BA 375.41 -24.6 424.46 -651.4% Bullish RED .158 .077 --------------------------------------------------------------------------------------------- SPY 279.49 1.05 277.33 8.5% Bullish BLUE .154 .02 --------------------------------------------------------------------------------------------- QQQ 175.69 .96 173.56 32.9% Bullish BLUE .179 .042 --------------------------------------------------------------------------------------------- MDY 344.2 .49 343.07 -51.8% Bullish BLUE .175 .042 --------------------------------------------------------------------------------------------- IWM 154.37 .08 153.02 -55.8% Bullish ---- .18 .059 --------------------------------------------------------------------------------------------- FAS 62.44 .62 61.33 -3.3% Bullish BLUE .09 .321 --------------------------------------------------------------------------------------------- SOXL 127.5 1.47 121.98 -30.7% ------- BLUE .058 .486 --------------------------------------------------------------------------------------------- TECL 126.46 2.07 120.31 172.7% Bullish BLUE .185 .408 --------------------------------------------------------------------------------------------- IBB 111.84 .91 109.87 -71.6% Bullish BLUE .086 .069 --------------------------------------------------------------------------------------------- GLD 122.98 .74 121.61 51.6% Bearish BLUE .006 -.086 --------------------------------------------------------------------------------------------- OIH 16.8 .27 16.78 -159.3% ------- BLUE -.022 .094 --------------------------------------------------------------------------------------------- GASL 7.03 .46 7.12 -463.1% ------- BLUE .017 .203 --------------------------------------------------------------------------------------------- RSX 20.56 .07 20.62 -17.1% ------- ---- -.165 .005 |

| Table 2

Count of Stocks in Key Directories 2019-03-12 ------------------------------- NEWHIGHS 195 Bullish NEWLOWS 12 MAXCP 53 MINCP 6 TTTNH 16 TTTNL 11 FASTUP 50 FASTDOWN 90 CPCROSSA 107 CPCROSSD 42 BIGVOLUP 5 BIGVODN 8 ACCUMVER 24 HIGHIP21 8 HIUPPCT 11 VHIP21 31 LOWACCUM 152 REDSELL 32 AUGSELS7 17 TRAPDOOR 20 |

Table 3

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

3/12/19

Bullish 43

Bearish 1

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BIGBANKS 1 1 .857 .857 1 1

BONDFUND .98 .99 .99 .98 .971 .971

UTILITY .975 .95 .95 .9 .925 .95

HOMEBLDG .941 .941 .941 .941 .823 .941

REGBANKS .928 .928 .857 .821 .892 1

DJI-13 .923 .923 .846 .923 .923 .923

SOLAR .882 .941 .882 .823 .882 .882

ETFS .879 .879 .672 .706 .827 .896

NIFTY .877 .877 .824 .824 .877 .877

DOWJONES .866 .866 .833 .866 .8 .833

FINANCE .855 .844 .788 .755 .855 .877

FIDSTKS .854 .827 .783 .8 .816 .837

SP-100 .838 .827 .741 .784 .795 .838

SEMI .836 .862 .793 .801 .853 .87

SP500 .836 .824 .775 .793 .81 .844

GREEN .826 .826 .826 .826 .826 .826

NASD-100 .82 .79 .75 .75 .81 .82

HACKERS .818 .818 .772 .772 .772 .818

REIT .812 .765 .704 .684 .738 .785

ELECTRON .808 .814 .771 .771 .808 .839

INFRA .805 .777 .75 .75 .75 .861

INSURANC .8 .8 .733 .7 .766 .766

CHEM .796 .814 .777 .814 .814 .796

RUS-1000 .792 .78 .727 .747 .767 .811

GOLD .784 .705 .745 .568 .588 .803

INDEXES .768 .758 .725 .725 .747 .784

CHINA .762 .796 .694 .762 .864 .847

SOFTWARE .761 .809 .73 .698 .73 .746

MILITARY .75 .718 .718 .718 .75 .781

TRANSP .75 .7 .55 .6 .7 .75

INDMATER .746 .721 .721 .734 .734 .848

BIG17 .717 .673 .652 .652 .63 .695

RETAIL .716 .716 .679 .698 .716 .754

OILGAS .687 .624 .56 .638 .638 .73

BIOTECH .685 .666 .605 .608 .605 .695

COMPUTER .681 .727 .681 .727 .772 .772

EDU .666 .666 .666 .666 .833 .833

GUNS .647 .647 .647 .647 .647 .764

AUTO .641 .615 .538 .589 .641 .692

COAL .571 .428 .428 .428 .428 .428

COMODITY .56 .536 .512 .487 .56 .609

BEVERAGE .555 .666 .555 .555 .611 .722

FOOD .527 .472 .472 .418 .49 .527

==============================================================================================

GAMING .5 .583 .5 .5 .625 .625

JETS .5 .5 .3 .3 .4 .4

==============================================================================================

HOSPITAL .416 .375 .375 .333 .375 .5

|

====================================================================

3/11/2019 The Buy B4 and the V-formation

still rule our market. The first

shallow 3% decline in a V-formation has three times before been followed

by an upside breakout which leads to new 12-month highs. A continued

rally now would destroy an appearance of a possible bearish head/shoulders

pattern now in DIA and SOXL. Following my suggestions of last night,

traders should have retaken long positions in IWM and SOXL. TECL

also looks quite bullish. I would stay away from DIA for now. Boeing's

bearish news is apparently not over and Day-traders will be whipping it

around wildly for now.

The emotional stock selling induced by Friday's weak Jobs' report and the

Boeing jet crash on Sunday in Ethiopia seems to have left shares in much

stronger hands, namely those Professionals who sense the extra power of

the stock market in the third year of a Presidential Election.

Of interest, for

us was how the decline from the DJI's February peak to yesterday's low closely

matched the 3% to 3.5% declines after each of the three previous V-formation

bottoms after a larger decline of 18% or more in the DJI. We can these three

cases below: 1942, 1949 and 1971. In each case, the first decline in the

fast-up rallies of these earlier cases of V-formations was between 3% and 3.5%.

There buyers were eagerly waiting to buy on the first pull-back and the turn

upwards sent the DJI quickly much higher. We should

expect that now.

1941-1942

1949

1971-1972

Buy IWM,

SOXL and TECL.

The high volume ETFs in Table 1 had their Closing

Power downtrends broken

today. This shows Professionals are done with the downside for now and are

aggressively buying again. Last night, I suggested that this action should get

us

to purchase the ETFs with the highest IP21 and the highest ITRS in Table 1.

Using Sunday night's Hotline that would have meant buying MDY or IWM and

SOXL. Using the Table 1 tonight, that would mean buying SOXL and TECL.

If you are using TigerSoft charts, you should have taken the positions in IWM

and SOXL when you saw intra-day the clear breaks in the Closing Power

downtrends. This is much preferable to waiting to buy the next day. Below

are the enlarged CP charts of IWM, SOXL and TECL.

|

Charts 3/11/2019 2018 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol Hourly DJIA A/D Line for All Stocks Inverted Traders Index NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30 DIA SPY QQQ MDY IWM TNA Short-Term Rates USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL RSX RETL SDS AGQ SLV SOXL TECL TLT TMF TNA UGA (gasoline) XIV YINN Commodities: CANE CORN DBC JJC, NIB, CHOC CORN, CUT (paper) MOO, SOYB WEAT UUP (Dollar) LIT (Lithium) AAPL ADBE ALXN AMAT AMGN AMD AMZN BA BABA BAC BIDU CAT CVX DE FB GOOG GS HD IBM INTU JPM M (Macy's) MSFT NFLX NVDA QCOM TSLA TXN XOM WMT CMG , LRCX, SWKS, MDGL SPPI WATT SQ TOWN 3/11/19 (Click on Underlined link.) Bullish MAXCPs - http://tigersoft.com/MAXCPS/Mar-11/BULLISH.htm Bearish MAXCPs - http://tigersoft.com/MINCPs/Mar-11/BEARISH.htm |

Table 1 QUICKSILVER on ETFS - 3/11/19 ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS

---------------------------------------------------------------------------------------------

DIA 256.76 2.05 258.19 -29.6% Bullish BLUE .223 -----

---------------------------------------------------------------------------------------------

BA 400.01 -22.53 430.12 -383.1% Bullish BLUE .359 .152

---------------------------------------------------------------------------------------------

SPY 278.44 3.98 279.02 -17.3% Bullish BLUE .196 .008

---------------------------------------------------------------------------------------------

QQQ 174.73 3.56 174.55 9% Bullish BLUE .207 .023

---------------------------------------------------------------------------------------------

MDY 343.71 4.49 347.75 -80.1% Bullish BLUE .196 .031

---------------------------------------------------------------------------------------------

IWM 154.29 2.65 156.08 -81.9% Bullish BLUE .214 .047

---------------------------------------------------------------------------------------------

FAS 61.82 2.08 62.48 -84.9% Bullish BLUE .141 .327

---------------------------------------------------------------------------------------------

RETL 30.02 1.51 31.23 -80% ------- BLUE .157 .193

---------------------------------------------------------------------------------------------

SOXL 126.03 8.39 128.25 -165.6% Bullish BLUE .082 .481

^^^^^

---------------------------------------------------------------------------------------------

TECL 124.39 7.62 122.31 36.3% Bullish BLUE .232 .408

^^^^

---------------------------------------------------------------------------------------------

IBB 110.93 2.32 113.42 -138.7% Bullish BLUE .121 .047

---------------------------------------------------------------------------------------------

GLD 122.24 -.6 121.72 27.9% Bearish RED -.018 -.101

---------------------------------------------------------------------------------------------

OIH 16.53 .46 17.33 -282.3% Bearish BLUE -.041 .044

---------------------------------------------------------------------------------------------

RSX 20.49 .32 20.63 -2.4% ------- BLUE -.155 -.035

|

Table 2 Count of Stocks in Key Directories

2019-03-11

-------------------------------

NEWHIGHS 166 Bullish 10x new lows.

NEWLOWS 14

MAXCP 49 Rising quickly.

MINCP 6

TTTNH 21

TTTNL 18

FASTUP 57

FASTDOWN 119

CPCROSSA 361 Bullish Ratio of 10x.

CPCROSSD 35

BIGVOLUP 8

BIGVODN 9

ACCUMVER 30

HIGHIP21 13

HIUPPCT 11

VHIP21 30

LOWACCUM 151

REDSELL 40

AUGSELS7 15

TRAPDOOR 24

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

3/11/19

Bullish = 42

Bearish = 3

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BIGBANKS 1 .857 .857 1 1 1

BONDFUND .99 .99 .98 .971 .971 .971

UTILITY .95 .95 .9 .925 .925 .925

HOMEBLDG .941 .941 .941 .823 .941 .941

SOLAR .941 .882 .823 .882 .882 .882

REGBANKS .928 .857 .821 .892 1 1

DJI-13 .923 .846 .923 .923 .923 .923

ETFS .879 .672 .706 .827 .896 .896

NIFTY .877 .824 .824 .877 .877 .859

DOWJONES .866 .833 .866 .8 .833 .833

SEMI .862 .793 .801 .853 .87 .896

FINANCE .844 .788 .755 .855 .877 .888

FIDSTKS .827 .783 .8 .816 .827 .832

SP-100 .827 .741 .784 .795 .827 .827

GREEN .826 .826 .826 .826 .826 .869

SP500 .824 .775 .793 .81 .84 .846

HACKERS .818 .772 .772 .772 .772 .818

CHEM .814 .777 .814 .814 .814 .796

ELECTRON .814 .771 .771 .808 .839 .864

SOFTWARE .809 .73 .698 .73 .761 .809

INSURANC .8 .733 .7 .766 .766 .766

CHINA .796 .694 .762 .864 .847 .847

NASD-100 .79 .75 .75 .81 .82 .82

RUS-1000 .78 .727 .745 .769 .811 .816

INFRA .777 .75 .75 .75 .861 .861

REIT .765 .704 .684 .738 .785 .798

INDEXES .763 .725 .725 .747 .784 .79

COMPUTER .727 .681 .727 .772 .772 .772

INDMATER .721 .721 .734 .734 .848 .848

MILITARY .718 .718 .718 .75 .781 .781

RETAIL .716 .679 .698 .716 .754 .754

GOLD .705 .745 .568 .588 .803 .803

TRANSP .7 .55 .6 .7 .7 .75

BIG17 .673 .652 .652 .63 .695 .695

BEVERAGE .666 .555 .555 .611 .722 .722

EDU .666 .666 .666 .833 .833 .666

BIOTECH .664 .605 .608 .605 .685 .706

GUNS .647 .647 .647 .647 .764 .764

OILGAS .624 .56 .638 .638 .716 .751

AUTO .615 .538 .589 .641 .692 .692

GAMING .583 .5 .5 .625 .625 .666

COMODITY .536 .512 .487 .56 .56 .585

=============================================================================================

JETS .5 .3 .3 .4 .4 .4

=============================================================================================

FOOD .472 .472 .418 .49 .49 .509

COAL .428 .428 .428 .428 .428 .428

HOSPITAL .375 .375 .333 .375 .458 .5

|

======================================================================

3/8/2019 Use any early weakness on

Monday to cover the short sales in FAS and SOXL.

When

their short-term Closing Power downtrends are broken, we will

consider

buying the highest ranked ETFs in Table 1, based on IP21 and ITRS.

There

should be very good support for the DJI between 24500 and 25000.

As

the P-I and IP21 are both positive, a 1.5% decline will probably bring

a

bullish Buy B9.

Boeing's stock is down 9% at this writing. By itself, a drop in a single DJI

stock of 52 points would make the DJI fall by more than 319 points. But

the DJI is down "only" 170 right now. So clearly, the rest of the DJI

stocks

are being bought by contrarians on this news that a second Boeing 737-max

has crashed shortly after take-off in Addis Ababa. The experts have hardly

begun to investigate and already these Boeing jets are being grounded and the

worst-case scenarios for BA's stock are being discussed. But what if the plane

went down because of terrorism? The US and Ethiopia are allies in a very active

and bloody campaign against Somalia. BA would go right back up. We

will watch BA's Closing Power downtrend and probably buy it when its CP

downtrend

ends. This worked very well in British Petroleum's case in 2010 after its big and

totally unexpected oil spill in the Gulf of Mexico.

Watch BA's Closing Power.

When BP's Closing Power's downtrend ended,

it again should have been bought back in 2010.

------------------------------------------------ Sources

---------------------------------------------

https://www.nytimes.com/2019/03/10/business/boeing-737-max.html?emc=edit_th_190311&nl=todaysheadlines&nlid=582238940311

www.africanews.com/.../ethiopia-air-force-bombards-al-shabaab-in-somalia-two-leade...

U.S.

Airstrikes Kill Hundreds in Somalia as Shadowy Conflict Ramps Up

--------------------------------------------------------------------------------------------------------

I take the operative Peerless signal to still be the January B4. Ordinarily,

this signal leads us to expect a move up by more than 10%. So, unless the

unexpected happens, the DJI should reach 27800. Peerless emphasizes

seasonality, the Federal Reserve and politics. Usually, because of politics,

the third year of a Presidential Election is nearly 3x more bullish more than

the year of the Election or the first year afterwards, or the second year

afterwards. Trump's contentious relationship with Congressional Democrats

could bring a decline. But Senate Republicans are not ready to vote

for impeachment and Bill Cinton's impeachment in 1999 did not stop

the DJI from rallying in a strong market when short-term interest rates were

falling.

So, I've suggested the FED is the most important element in the picture now.

Since Fed Chairman says short-term rates are, in effect, frozen, that he not worried

about an economic slow-down and that the Fed will only make decisions based

on what the economic data show, I would think the Buy B4 will produce signifiantly

higher prices.

A decline by SPY to 268 could set up

a new H/S pattern. The best support

here should be at 265.

We have just seen a "straight-up" advance of nearly 20% in a V-formation.

Such price action in 1942, 1949 and 1971-2 always brought new highs after

a 20% decline, I think we have to remain bullish. But seasonality needs to

be allowed to play out without bearish exogenous influences intruding.

The appearance of a quick head and shoulders pattern in the DJI is a warning

that the market has had to quickly adjust to some new unexpected bearish

non-economic and exogenous news. When past head/shoulders formations

have quickly appeared in the past - in under 15 days - most often they bring a

DJI

decline to the 65-dma. That is what seems most likely here. Keep in mind

that the rapid advance has left many traders and investors on the sideline

waiting for a pull-back to take their positions. In addition, any DJI close

near the 65-dma will almost certainly bring new Peerless Buys.

See the charts of all the DJI's H/S patterns since 1915 here.

http://tigersoft.com/H-S/H-S.htm

The Dollar remains very strong. One would think this that would give

the FED some room to lower interest rates if the economy weakens or

stocks go down.

|

Charts 3/8/2019 2018 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol Hourly DJIA A/D Line for All Stocks Inverted Traders Index NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30 DIA SPY QQQ MDY IWM TNA Short-Term Rates USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL RSX RETL SDS AGQ SLV SOXL TECL TLT TMF TNA UGA (gasoline) XIV YINN Commodities: CANE CORN DBC JJC, NIB, CHOC CORN, CUT (paper) MOO, SOYB WEAT UUP (Dollar) LIT (Lithium) AAPL ADBE ALXN AMAT AMGN AMD AMZN BA BABA BAC BIDU CAT CVX DE FB GOOG GS HD IBM INTU JPM M (Macy's) MSFT NFLX NVDA QCOM TSLA TXN XOM WMT CMG , LRCX, SWKS, MDGL SPPI WATT SQ TOWN 3/8/19 (Click on Underlined link.) Bullish MAXCPs - http://tigersoft.com/MAXCPS/Mar-8/BULLISH.htm Bearish MAXCPs - http://tigersoft.com/MINCPs/Mar-8/BEARISH.htm |

Table 1 QUICKSILVER on ETFS - 3/8/19 ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS

---------------------------------------------------------------------------------------------

DIA 254.71 -.1 258.28 -110.8% Bullish BLUE .161 -----

---------------------------------------------------------------------------------------------

BA 422.54 -.02 432.69 -210.2% Bullish BLUE .094 .269

---------------------------------------------------------------------------------------------

SPY 274.46 -.55 279.4 -107.1% Bullish BLUE .164 .003

---------------------------------------------------------------------------------------------

QQQ 171.17 -.26 174.42 -92.7% Bullish BLUE .159 .025

---------------------------------------------------------------------------------------------

MDY 339.22 -.97 349.22 -168% ------- BLUE .171 .023

^^^^

---------------------------------------------------------------------------------------------

IWM 151.64 -.04 156.81 -212.7% Bullish BLUE .171 .037

^^^^

---------------------------------------------------------------------------------------------

FAS 59.74 -.04 62.86 -328% Bullish BLUE .138 .423

---------------------------------------------------------------------------------------------

SOXL 117.64 -.19 130.11 -493.9% ------- BLUE .027 .586

^^^^^

---------------------------------------------------------------------------------------------

TECL 116.77 -.15 123.52 -330.3% Bullish BLUE .165 .525

---------------------------------------------------------------------------------------------

IBB 108.61 -.53 114.01 -289.4% ------- BLUE .041 .044

---------------------------------------------------------------------------------------------

GLD 122.84 1.33 121.56 39.5% Bearish BLUE-.013 -.144

---------------------------------------------------------------------------------------------

OIH 16.07 -.4 17.48 -394.8% Bearish --- -.086 .039

---------------------------------------------------------------------------------------------

GASL 6.31 -.57 7.83 -882.3% ------- RED -.097 .303

---------------------------------------------------------------------------------------------

RSX 20.17 -.14 20.5 -65.9% ------- --- -.188 -.074

|

Table 2 Count of Stocks in Key Directories

20190308

-------------------------------

NEWHIGHS 94

NEWLOWS 36

MAXCP 22

MINCP 17

TTTNH 6

TTTNL 55

FASTUP 42

FASTDOWN 206

CPCROSSA 187

CPCROSSD 33

BIGVOLUP 6

BIGVODN 16

ACCUMVER 46

HIGHIP21 15

HIUPPCT 10

VHIP21 31

LOWACCUM 152

REDSELL 41

AUGSELS7 17

TRAPDOOR 25

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

3/8/19

Bullish = 41

Bearish = 4

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BONDFUND .99 .98 .971 .971 .971 .952

UTILITY .95 .9 .925 .925 .925 .925

HOMEBLDG .941 .941 .823 .941 .941 .882

SOLAR .882 .823 .882 .882 .882 .882

BIGBANKS .857 .857 1 1 1 1

REGBANKS .857 .821 .892 1 1 1

DJI-13 .846 .923 .923 .923 .846 .923

DOWJONES .833 .866 .8 .833 .8 .866

GREEN .826 .826 .826 .826 .869 .826

NIFTY .824 .824 .877 .877 .859 .912

SEMI .793 .801 .853 .87 .896 .862

FINANCE .788 .755 .855 .877 .888 .888

FIDSTKS .783 .8 .816 .827 .821 .854

CHEM .777 .814 .814 .814 .814 .833

SP500 .775 .793 .81 .84 .844 .869

HACKERS .772 .772 .772 .772 .818 .863

ELECTRON .771 .771 .808 .839 .864 .851

INFRA .75 .75 .75 .861 .861 .861

NASD-100 .75 .75 .81 .82 .81 .83

GOLD .745 .568 .588 .803 .803 .823

SP-100 .741 .784 .795 .827 .817 .881

INSURANC .733 .7 .766 .766 .8 .866

SOFTWARE .73 .698 .73 .761 .809 .873

RUS-1000 .727 .745 .767 .812 .815 .834

INDEXES .724 .729 .751 .789 .8 .821

INDMATER .721 .734 .734 .848 .848 .822

MILITARY .718 .718 .75 .781 .781 .812

REIT .704 .684 .738 .785 .791 .778

CHINA .694 .762 .864 .847 .83 .813

COMPUTER .681 .727 .772 .772 .772 .772

RETAIL .679 .698 .716 .754 .754 .754

ETFS .672 .706 .827 .896 .896 .913

EDU .666 .666 .833 .833 .666 .833

BIG17 .652 .652 .63 .695 .695 .695

GUNS .647 .647 .647 .764 .764 .882

BIOTECH .603 .608 .605 .685 .703 .716

OILGAS .56 .638 .638 .716 .751 .751

BEVERAGE .555 .555 .611 .722 .722 .722

TRANSP .55 .6 .7 .7 .75 .8

AUTO .538 .589 .641 .692 .666 .794

COMODITY .512 .487 .56 .56 .536 .585

GAMING .5 .5 .625 .625 .666 .666

===============================================================================================

FOOD .464 .41 .482 .482 .464 .517

COAL .428 .428 .428 .428 .428 .714

HOSPITAL .375 .333 .375 .458 .5 .583

JETS .3 .3 .4 .4 .4 .5

|

====================================================================

3/7/2019 The Dollar surged to a new

high. One would think this that would give

the FED some room to lower interest rates if the decline consinues.

But the experience of March 2002 warns that lowering rates may not be

enough if the Corruption circles around the President tighten and involve

more of his close associates. ( More about this on Sunday night.) A head/

shoulders pattern then brought on a bear market decline. The previous

bottom was after 9/11 and the rally had V-bottom characteristics like now.|

Look for a DJI decline to the 65-dma. At that

point, we may get a new

Peerless Buy and the Closing Powers may break their downtrends. Meanwhile

avoid most of the ETFs and stay short FAS and SOXL.

Small (under 6 weeks in length) head and shoulders patterns like we

now see in most of the indexes and general market ETFs are reliably

bearish. I have counted 54 such DJI mini-H/S patterns since 1915. I count

only 6 failures. This means that they are almost 90% reliable in bringing

significant declines that short sellers can take advantage of.

Look back at the 5 cases in Marches. We do see 2 failures, but both were in

World War II. More important, 2 of the 3 successfully bearish March H/S patterns

featured corruption among the then President's close associates, Harding in 1923 and

Bush Jr. with Ken Lay of Enron in 2002. Below are the 5 DJI short-term H/S

patterns in March. It would seem that these patterns should be judged as special

Sell S5s, at least for trading purposes now and at least until the Closing Powers

break their down trends.

DJI-now

Past March Mini-Head/Shoulders

|

Cabinet Corruption and Rising Interest Rates |

|

War Year(Not very relevant) |

|

War Year(Not very relevant) |

|

Corruption and Falling Interest Rates Follows speculative stock bubble. |

|

Peerless Sell at top. P-I and IP21 divergence. |

FAS, SPY, IWM and SOXL

|

Charts 3/7/2019 2018 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol Hourly DJIA A/D Line for All Stocks Inverted Traders Index NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30 DIA SPY QQQ MDY IWM TNA Short-Term Rates USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL RSX RETL SDS AGQ SLV SOXL TECL TLT TMF TNA UGA (gasoline) XIV YINN Commodities: CANE CORN DBC JJC, NIB, CHOC CORN, CUT (paper) MOO, SOYB WEAT UUP (Dollar) LIT (Lithium) AAPL ADBE ALXN AMAT AMGN AMD AMZN BA BABA BAC BIDU CAT CVX DE FB GOOG GS HD IBM INTU JPM M (Macy's) MSFT NFLX NVDA QCOM TSLA TXN XOM WMT CMG , LRCX, SWKS, MDGL SPPI WATT SQ TOWN 3/7/19 (Click on Underlined link.) Bullish MAXCPs - http://tigersoft.com/MAXCPS/Mar-7/BULLISH.htm Bearish MAXCPs - http://tigersoft.com/MINCPs/Mar-7/BEARISH.htm |

Table 1 QUICKSILVER on ETFS - 3/7/19 ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS --------------------------------------------------------------------------------------------- DIA 254.81 -2.06 260.42 -86.4% ------- RED .111 ---- --------------------------------------------------------------------------------------------- BA 422.56 -1.9 440.62 -200.7% ------- RED .08 .25 --------------------------------------------------------------------------------------------- SPY 275.01 -2.32 280.42 -65.8% ------- RED .128 .005 --------------------------------------------------------------------------------------------- QQQ 171.43 -2.13 174.39 -50.6% ------- RED .102 .025 --------------------------------------------------------------------------------------------- MDY 340.19 -2.88 350.85 -115.4% ------- RED .137 .024 --------------------------------------------------------------------------------------------- IWM 151.68 -1.34 158.24 -163.3% ------- RED .145 .044 --------------------------------------------------------------------------------------------- FAS 59.78 -1.55 63.81 -252.8% ------- RED .086 .338 --------------------------------------------------------------------------------------------- RETL 29.21 -1.33 32.37 -410.8% Bearish RED .148 .356 --------------------------------------------------------------------------------------------- SOXL 117.83 -4.15 130.05 -349.6% ------- RED .004 .467 --------------------------------------------------------------------------------------------- TECL 116.92 -3.39 124.8 -227.4% Bullish RED .138 .426 --------------------------------------------------------------------------------------------- IBB 109.14 -.73 115.11 -159.2% ------- RED -.002 .064 --------------------------------------------------------------------------------------------- GLD 121.51 -.1 121.88 -101.5% Bearish BLUE-.104 -.114 --------------------------------------------------------------------------------------------- OIH 16.47 -.31 17.42 -182.9% Bearish RED -.096 .07 --------------------------------------------------------------------------------------------- RSX 20.31 -.31 20.44 -26.8% ------- RED -.239 -.046 |

Table 2 Count of Stocks in Key Directories

20190307

-------------------------------

NEWHIGHS 86

NEWLOWS 28

MAXCP 9

MINCP 29 Bearish

TTTNH 7

TTTNL 73

FASTUP 49

FASTDOWN 142 Bearish

CPCROSSA 65

CPCROSSD 54

BIGVOLUP 6

BIGVODN 14

ACCUMVER 44

HIGHIP21 16

HIUPPCT 9

VHIP21 30

LOWACCUM 156

REDSELL 44

AUGSELS7 27

TRAPDOOR 23

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

Bullish 40

Bearish = 5

3/7/19

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BONDFUND .98 .971 .971 .971 .961 .971

HOMEBLDG .941 .823 .941 .941 .882 .941

DJI-13 .923 .923 .923 .846 .923 .923

UTILITY .9 .925 .925 .925 .925 .925

DOWJONES .866 .8 .833 .8 .866 .866

BIGBANKS .857 1 1 1 1 1

GREEN .826 .826 .826 .869 .826 .782

NIFTY .824 .877 .877 .859 .912 .894

REGBANKS .821 .892 1 1 1 1

CHEM .814 .814 .814 .814 .851 .814

SEMI .801 .853 .87 .896 .862 .862

FIDSTKS .8 .816 .827 .821 .854 .848

SP500 .787 .803 .833 .839 .859 .851

SP-100 .784 .795 .827 .817 .87 .86

SOLAR .777 .833 .833 .833 .833 .833

HACKERS .772 .772 .772 .818 .863 .772

ELECTRON .771 .808 .839 .864 .851 .845

CHINA .762 .864 .847 .83 .813 .83

FINANCE .755 .855 .877 .888 .888 .922

INFRA .75 .75 .861 .861 .861 .888

NASD-100 .75 .81 .82 .81 .83 .81

RUS-1000 .745 .767 .811 .816 .832 .824

INDMATER .734 .734 .848 .848 .81 .835

COMPUTER .727 .772 .772 .772 .772 .772

INDEXES .725 .747 .784 .795 .817 .801

MILITARY .718 .75 .781 .781 .812 .843

SOFTWARE .707 .738 .769 .815 .876 .83

ETFS .706 .827 .896 .896 .913 .913

INSURANC .7 .766 .766 .8 .833 .8

RETAIL .698 .716 .754 .754 .754 .754

EDU .666 .833 .833 .666 .833 .833

REIT .666 .718 .764 .771 .764 .79

BIG17 .652 .63 .695 .695 .695 .673

GUNS .647 .647 .764 .764 .882 .823

OILGAS .62 .62 .693 .726 .7 .673

BIOTECH .605 .605 .685 .703 .714 .679

TRANSP .6 .7 .7 .75 .8 .75

AUTO .589 .641 .692 .666 .794 .82

GOLD .568 .588 .803 .803 .823 .862

BEVERAGE .555 .611 .722 .722 .722 .722

GAMING .5 .625 .625 .666 .666 .666

-----------------------------------------------------------------------------------------

COMODITY .487 .56 .56 .536 .585 .707

COAL .428 .428 .428 .428 .571 .571

FOOD .41 .482 .482 .464 .535 .642

HOSPITAL .333 .375 .458 .5 .583 .458

JETS .3 .4 .4 .4 .5 .6

|

====================================================================

3/6/2019 The

head/shoulders top in April 2010 brought on a 13.5% decline

fueled by rapid-fire use of leveraged negative ETFs. We cannot

rule out the same thing happening here. I've suggested shorting FAS.

I would add SOXL to that list and sell long ETFs if the DJI closes

below 25500 and SOXL is comparably weak tomorrow.

IWM's unusual weakness today makes it too risky to hold. Note

its H/S

and falling Closing Power. Something has happened this week that is

spooking the markets. It may be the evidence of Trump's personal check

to Cohen last April while he was President is a "smoking gun". Or it

may be Trump's jacking up the value of one of his residential West

Chester properties by $200 million in seeking a loan from Deutsche Bank

is "criminal fraud". But it may also may the FED has decided to risk a

big sell-off and is hurredly selling off financial assets from their $4 trillion reserves.

Whatever it is, the H/S patterns have appeared very quickly. This is the

way the market quickly makes its own bearish adjustments. It is not a

good sign.

2009-2010 DJI Chart

Breadth worsened a lot today. There were

1421 more down than

up today compared to yesterday's 142 more down. Now the DJI

and most of the other key ETFs and Indexes are close to breaking

the necklines in their head and shoulders. This would give us a TigerSoft

Sell S5

and very likely bring the DJI and the other ETFs down to

their

65-dma. Since, we still do not have a Peerless Sell, there should then

be a good rebound. The TigerSoft S5 shows a break in a short-term

support using the Tiger charting programs. There is exactly similar Sell

for the more intermediate-term Peerless. However, the Peerless chart of

the DJI back in March 2010 would show a Tiger S5 if one was requested

using

A close below 25550 would break the

current DJI's H/S pattern and call for

a decline to 65-dma at 24600. It would

be a TigerSoft S5. That is not a Peerless

Sell. So, we would still have to expect

a good recovery when the Closing Powers

turn back upwards.

Current DJIA Charts

At this point, traders should do more reducing of their long

positions.

Until the Closing Powers hook back up, early rallies will probably fail.

The House Democrats have uncovered some more incriminating evidence

against the President. But my research suggests, the rally will not

be over until April, at the earliest, and only after there is another rally, probably

to 26800. More important than the Democrats' challenges to Trump

are what the Federal Reserve and Chairman Powell decide about raising

or lowering short-term interest rates. The Federal Funds rate is back to its high

of 2.4% and the Dollar was unchanged today.

Traders should short SOXL if it breaks its recent price

uptrend-line

and DJI decisively breaks its own neckline.

|

Charts 3/6/2019 2018 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol Hourly DJIA A/D Line for All Stocks Inverted Traders Index NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30 DIA SPY QQQ MDY IWM TNA Short-Term Rates USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL RSX RETL SDS AGQ SLV SOXL TECL TLT TMF TNA UGA (gasoline) XIV YINN Commodities: CANE CORN DBC JJC, NIB, CHOC CORN, CUT (paper) MOO, SOYB WEAT UUP (Dollar) LIT (Lithium) AAPL ADBE ALXN AMAT AMGN AMD AMZN BA BABA BAC BIDU CAT CVX DE FB GOOG GS HD IBM INTU JPM M (Macy's) MSFT NFLX NVDA QCOM TSLA TXN XOM WMT CMG , LRCX, SWKS, MDGL SPPI WATT SQ TOWN 3/6/19 (Click on Underlined link.) Bullish MAXCPs - http://tigersoft.com/MAXCPS/Mar-6/BULLISH.htm Bearish MAXCPs - http://tigersoft.com/MINCPs/Mar-6/BEARISH.htm |

Table 1 QUICKSILVER on ETFS - 3/5/19 ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS --------------------------------------------------------------------------------------------- DIA 256.87 -1.32 259.28 -57.9% ------- RED .153 ----- --------------------------------------------------------------------------------------------- BA 424.46 -5.66 439.96 -126% ------- RED .173 .234 --------------------------------------------------------------------------------------------- SPY 277.33 -1.69 278.68 -33.5% ------- RED .181 0 --------------------------------------------------------------------------------------------- QQQ 173.56 -.99 173.19 -.9% Bullish RED .172 .017 --------------------------------------------------------------------------------------------- MDY 343.07 -4.68 348.22 -94.1% ------- RED .184 .021 --------------------------------------------------------------------------------------------- IWM 153.02 -3.06 156.78 -136.9% ------- RED .206 .039 --------------------------------------------------------------------------------------------- FAS 61.33 -1.15 62.95 -130.9% Bearish RED .148 .3 --------------------------------------------------------------------------------------------- RETL 30.54 -.69 31.78 -256.3% Bearish RED .184 .296 --------------------------------------------------------------------------------------------- SOXL 121.98 -6.27 126.74 -173.4% Bearish RED .019 .462 --------------------------------------------------------------------------------------------- TECL 120.31 -2 122.5 -131.8% Bullish RED .186 .332 --------------------------------------------------------------------------------------------- IBB 109.87 -3.55 112.74 -187.5% Bearish RED -.014 .04 --------------------------------------------------------------------------------------------- GLD 121.61 -.11 123.99 -125.4% Bearish BLUE -.103 -.102 --------------------------------------------------------------------------------------------- OIH 16.78 -.55 17.1 -161.5% Bearish RED -.038 .084 -------------------------------------------------------------------------------------------- GASL 7.12 -.55 7.17 -106.5% Bearish RED -.094 .206 --------------------------------------------------------------------------------------------- RSX 20.62 -.01 20.42 7.3% Bearish RED -.187 -.036 |

Table 2 Count of Stocks in Key Directories

2019 03-06

-------------------------------

NEWHIGHS 54

NEWLOWS 27

MAXCP 9

MINCP 22 Bearish

TTTNH 4

TTTNL 51

FASTUP 38

FASTDOWN 135

CPCROSSA 27

CPCROSSD 155 Bearish

BIGVOLUP 3

BIGVODN 12

ACCUMVER 55

HIGHIP21 12

HIUPPCT 9

VHIP21 28

LOWACCUM 158

REDSELL 45

AUGSELS7 36

TRAPDOOR 24

|

Table 3

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

3/6/19

Bullish = 41

Bearish = 4

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BIGBANKS 1 1 1 1 1 1

BONDFUND .971 .971 .971 .961 .971 .98

UTILITY .925 .925 .925 .925 .925 .925

DJI-13 .923 .923 .846 .923 .923 .923

REGBANKS .892 1 1 1 1 1

SOLAR .882 .882 .882 .882 .882 .941

NIFTY .877 .877 .859 .912 .894 .894

CHINA .864 .847 .83 .813 .83 .813

FINANCE .855 .877 .888 .888 .922 .9

SEMI .853 .87 .896 .862 .862 .862

EDU .833 .833 .666 .833 .833 .833

ETFS .827 .896 .896 .913 .913 .931

GREEN .826 .826 .869 .826 .782 .869

HOMEBLDG .823 .941 .941 .882 .941 .941

FIDSTKS .81 .821 .816 .854 .848 .87

NASD-100 .81 .82 .81 .83 .81 .83

ELECTRON .808 .839 .864 .851 .845 .851

SP500 .808 .838 .842 .865 .855 .867

DOWJONES .8 .833 .8 .866 .866 .9

CHEM .796 .796 .796 .851 .833 .87

SP-100 .795 .827 .817 .87 .86 .881

COMPUTER .772 .772 .772 .772 .772 .818

HACKERS .772 .772 .818 .863 .772 .818

INSURANC .766 .766 .8 .833 .8 .833

RUS-1000 .766 .81 .814 .833 .825 .832

INDEXES .752 .784 .795 .817 .801 .811

INFRA .75 .861 .861 .861 .888 .888

MILITARY .75 .781 .781 .812 .843 .812

REIT .738 .785 .791 .785 .812 .818

INDMATER .734 .848 .848 .81 .835 .898

SOFTWARE .73 .761 .809 .873 .825 .825

RETAIL .716 .754 .754 .754 .754 .735

TRANSP .7 .7 .75 .8 .75 .75

GUNS .647 .764 .764 .882 .823 .882

AUTO .641 .692 .666 .794 .82 .794

OILGAS .638 .716 .751 .723 .687 .73

BIG17 .63 .695 .695 .695 .652 .695

GAMING .625 .625 .666 .666 .666 .75

BEVERAGE .611 .722 .722 .722 .722 .666

BIOTECH .603 .685 .703 .714 .671 .701

GOLD .588 .803 .803 .823 .862 .882

COMODITY .56 .56 .536 .585 .707 .731

================================================================================================

FOOD .482 .482 .464 .535 .642 .66

COAL .428 .428 .428 .571 .571 .571

JETS .4 .4 .4 .5 .6 .6

HOSPITAL .375 .458 .5 .583 .458 .458

|

====================================================================

3/5/2019 Short-term traders should

be a little guarded in here, but the Peerless

Buy B4 still stands and the seasonality is still quite bullish. Traders should

considering selling short FAS. See below how successful the optimized

red Tiger signals have been. Conveniently, one can cover if the flat

resistance just overhead is violated.

I believe the Federal Reserve "holds the cards" when it somes to the

market now. Not the Democrats in the House, not Muller and not

Bloomberg news.

I do not trust Fed Chairman Powell. He seems erratic and inexperienced

in dealing with the divergent pressures upon him, namely stock traders,

bond traders, the New York Banks, regional banks, Congress and the

President. Right now, the short-term rates' chart (above) shows a yield that is

back

up to its high of 2.4% even though the Dollar is very strong. I would take a

breakout in this day-to-day measure of the Federal Funds rate as

troubling. Perhaps. the "gentleman" (Trump's term for Powell) is selling

a lot more US Treasuries' debt instruments than has been publicly acknowledged.

Bloomerg's website is lopsidedly bearish in its stories this

morning. Let's

see if the DJI can shrug off this slant.

1)Trump Pushes for China Deal in Hope of Fueling

Market Rally

2)Trump Presides Over $100 Billion Jump in

Trade Gap

3) Wall Street Regulators Could

Take a Fresh Look at Bonuses

4) Trump’s Big Tax Cuts Did Little to Boost

Economic Growth

5) A $1 Trillion Rally Is Rewarded

With Billions of ETF Outflows

6) It's Payback Time for Stocks as

Balance-Sheet-Be-Damned Ends

7) John Bolton Shows the Dangers

of a Weak President

8) Health-Insurance Stocks Have

Been Selling Off on Fears of ‘Medicare for All’

9) White House Warns Carmakers on

Emissions in Tense Call

(I admit I do not study Bloomberg every night. Maybe,

some of you know

if such a bearish line-up of stories is unusual. Perhaps, he is just feeling

unusually

"irked" tonight because he had to bow out of his bid to be President.) .

A DIA decline below 255 would complete

a bear-looking head/shoulders pattern that

"bears" some similarities to the one completed

in early 2010 that set off a "flash crash" of 10%

in the DJI. The event that triggered the decline

was the very big oil spill in the Gulf of Mexico

by a British Petroleum deep-water oil drilling rig.

In any case, the breaks in the Closing Power uptrends for the

DJI, SPY, MDY,

IWM and the NASDAQ warn us to expect more of a pull-back. But without

clear-cut head and shoulders patterns (like last Fall or in 2010), or much

poorer daily breadth than we have seen so far on this retreat, or much heavier

down-volume and/or a Peerless Sell signal, the decline now will probably be

shallow and probably not take the DJI more than a percent below its 21-dma or

not more than 3.5% down from the peaks of this recovery rally.

Traders looking for a way to hedge might short

FAS. Note the success this past year with its red

(optimized Stochastic-20) sells. But cover quickly

is prices close above 66.

Appreciate, too, that the current decline could end quite

quickly as soon as the

Closing Powers turn sharply, showing that Professionals have again started to

buy again.

At most, I would think any deeper decline would be stopped by the good support

expected at the DJI's rising 65-dma.

Things could change. So we muct watch the daily breadth, the color of our

Tiger candle-stick charts, what Closing Powers are doing, the slope of the

DJI's Accumulation Index and P-Indicator. And we must be alert for head/

shoulders patterns quick developing, since they show the arrival of previously

unexpected bearish news that Wall Street has not anticipated.

|

Charts 3/5/2019 2018 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol Hourly DJIA A/D Line for All Stocks Inverted Traders Index NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30 DIA SPY QQQ MDY IWM TNA Short-Term Rates USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL RSX RETL SDS AGQ SLV SOXL TECL TLT TMF TNA UGA (gasoline) XIV YINN Commodities: CANE CORN DBC JJC, NIB, CHOC CORN, CUT (paper) MOO, SOYB WEAT UUP (Dollar) LIT (Lithium) AAPL ADBE ALXN AMAT AMGN AMD AMZN BA BABA BAC BIDU CAT CVX DE FB GOOG GS HD IBM INTU JPM M (Macy's) MSFT NFLX NVDA QCOM TSLA TXN XOM WMT CMG , LRCX, SWKS, MDGL SPPI WATT SQ TOWN 3/5/19 (Click on Underlined link.) Bullish MAXCPs - http://tigersoft.com/MAXCPS/Mar-5/BULLISH.htm Bearish MAXCPs - http://tigersoft.com/MINCPs/Mar-5/BEARISH.htm |

Table 1 QUICKSILVER on ETFS - 3/5/19 ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS

---------------------------------------------------------------------------------------------

DIA 258.19 -.09 259.87 -45.2% ------- ---- .22 -----

---------------------------------------------------------------------------------------------

BA 430.12 -2.57 435.44 38.5% Bullish RED .248 .24

---------------------------------------------------------------------------------------------

SPY 279.02 -.38 279.2 -5.4% ------- RED .252 .004

---------------------------------------------------------------------------------------------

QQQ 174.55 .13 173.59 24.4% ------- ---- .246 .023

---------------------------------------------------------------------------------------------

MDY 347.75 -1.47 349.64 -21.6% Bullish RED .25 .037

---------------------------------------------------------------------------------------------

IWM 156.08 -.73 157.32 -32.4% Bullish RED .33 .059

^^^^^

---------------------------------------------------------------------------------------------

FAS 62.48 -.38 62.98 -8.7% ------- RED .21 .294

---------------------------------------------------------------------------------------------

RETL 31.23 .73 32.16 14.2% Bearish BLUE .211 .261

---------------------------------------------------------------------------------------------

SOXL 128.25 -1.86 126.43 -109% ------- RED .099 .517

^^^^^

---------------------------------------------------------------------------------------------

TECL 122.31 -1.21 123.56 -64.3% ------- RED .244 .291

---------------------------------------------------------------------------------------------

IBB 113.42 -.59 114.14 40.5% Bullish RED .127 .073

---------------------------------------------------------------------------------------------

GLD 121.72 .16 124.69 -156.2% Bearish BLUE-.144 -.07

---------------------------------------------------------------------------------------------

OIH 17.33 -.15 17.34 23.1% ------- RED .057 .068

---------------------------------------------------------------------------------------------

GASL 7.67 -.16 7.28 235.1% Bearish RED -.013 .172

---------------------------------------------------------------------------------------------

RSX 20.63 .13 20.59 -31.6% Bearish BLUE-.162 -.069

|

Table 2 Count of Stocks in Key Directories

2019 03-05

-------------------------------

NEWHIGHS 84

NEWLOWS 17

MAXCP 10

MINCP 13 Bearish

TTTNH 6

TTTNL 26

FASTUP 69

FASTDOWN 98

CPCROSSA 78

CPCROSSD 34

BIGVOLUP 4

BIGVODN 12

ACCUMVER 46

HIGHIP21 30

HIUPPCT 10

VHIP21 27

LOWACCUM 156

REDSELL 44

AUGSELS7 30

TRAPDOOR 24

|

Table 1

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

3/5/19

Bullish = 42

Bearish= 4

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BIGBANKS 1 1 1 1 1 1

REGBANKS 1 1 1 1 1 1

BONDFUND .971 .971 .961 .971 .98 .98

HOMEBLDG .941 .941 .882 .941 .941 .941

UTILITY .925 .925 .925 .925 .925 .925

DJI-13 .923 .846 .923 .923 .923 1

ETFS .896 .896 .913 .913 .931 .931

SOLAR .882 .882 .882 .882 .941 .882

FINANCE .877 .888 .888 .922 .9 .9

NIFTY .877 .859 .912 .894 .894 .894

SEMI .87 .896 .862 .862 .862 .887

INFRA .861 .861 .861 .888 .888 .888

INDMATER .848 .848 .81 .835 .898 .898

CHINA .847 .83 .813 .83 .813 .813

ELECTRON .839 .864 .851 .845 .851 .87

SP500 .838 .842 .865 .855 .865 .869

DOWJONES .833 .8 .866 .866 .866 .933

^^^^^^^^

EDU .833 .666 .833 .833 .833 .666

SP-100 .827 .817 .87 .86 .87 .881

GREEN .826 .869 .826 .782 .869 .826

FIDSTKS .821 .816 .854 .848 .87 .87

NASD-100 .82 .81 .83 .81 .83 .82

RUS-1000 .81 .814 .832 .827 .832 .824

GOLD .803 .803 .823 .862 .882 .921

CHEM .796 .796 .851 .833 .888 .888

REIT .785 .791 .785 .812 .812 .838

INDEXES .784 .795 .817 .801 .811 .833

MILITARY .781 .781 .812 .843 .843 .843

COMPUTER .772 .772 .772 .772 .818 .909

HACKERS .772 .818 .863 .772 .818 .818

INSURANC .766 .8 .833 .8 .833 .8

GUNS .764 .764 .882 .823 .882 .823

SOFTWARE .761 .809 .873 .825 .825 .841

RETAIL .754 .754 .754 .754 .735 .698

BEVERAGE .722 .722 .722 .722 .666 .666

OILGAS .716 .751 .723 .687 .723 .716

TRANSP .7 .75 .8 .75 .75 .75

BIG17 .695 .695 .695 .652 .673 .673

AUTO .692 .666 .794 .82 .794 .82

BIOTECH .682 .703 .714 .671 .695 .669

GAMING .625 .666 .666 .666 .75 .791

COMODITY .56 .536 .585 .707 .731 .707

============================================================================================

FOOD .482 .464 .535 .642 .66 .642

HOSPITAL .458 .5 .583 .458 .458 .5

COAL .428 .428 .571 .571 .571 .571

JETS .4 .4 .5 .6 .6 .6

|

========================================================================

3/4/2019 The January Peerless B4

signal tells us the 200-point decline today is not

the start of a big drop. But other considerations suggest the DJI is in short-term

trouble. Most important, DIA's Closing Power uptrend has been broken and

it could be forming a mini bearish head/shoulders pattern like it did last Fall and

in February 2010. A decline to 24500 seems likely if the DJI's neckline

at 25500 is broken after a brief one or two day rally from here. Otherwise,

weakness tomorrow should only mean a decline to 25000.

Recall the DJI's H/S 2010 occurrence. That was when the unexpected

British Petroleum oil spill in the Gulf of Mexico caused a quick mini-head/shoulders in

the DJIA and SP-500. See further below.. When these patterns were completed

with

the DJI and SP-500 closing below their necklines, a "flash crash"

followed. It

was blamed on faulty trading orders and computerized trading. But cynics believed

that the real reason was how hedge funds quickly played the short side with

leveraged trading vehicles on down-ticks.

See below how the Hourly DJI shows increasing down-hour volume.

A head/shoulders pattern in it has already been completed.

We are getting to the point where we can not trust strong openings.

That is the message from the break in the CP uptrend and the

bearish "red popcicle" on the SPY candle-stick chart.

A few other bearish signs did appear today. Mighty Boeing broke its very

steep uptrendline. It less steep rising trends are all intact. High priced

United

Health Care lost 10-points as the cost of healthcare seems now to be the second

biggest item that almost all the Democrats are talking about. (The President,

of course, is their #1 target.) JET, the airlines's ETF has completed a bearish

looking head and shoulders pattern.

I am also concerned that the number of our MINCPs (Closing Power

new lows) and MAXCP (Closing Power new highs) is now tied and the

ratio of new highs to new lows has fallen below 10:1. See Table 2.

Fortunately, NYSE Breadth is usually the most important internal strength

indicator and the NYSE A/D Line remains in its very steep uptrend. Despite

the DJI's big decline today, there were only 334 more down than up. This

reflects, I think, the unlikelihood of any rise in interest rates soon, though

Fed Chairman continues to want to continue to slowly unload the trillions of

debt instruments, some toxic and some not, that it carries on its books.

But there was no good reasons in the news for today's decline. That is usually not

a good sign.

I now see potential mini-head and shoulders patterns in the

DJI, SP-500, MDY

and IWM. These can be surprisingly bearish, considering their small size, but

usually Peerless gives a Sell, like it did this past fall, When breadth is good and

the IP21 is still positive, such small H/S patterns are seldom significant. But

there

is one exception. That was in February 2010. See in the DJIA charts, Peerless

and TigerSoft, how the bearish potency of the head/shoulders back then produced

a very swift 10% meltdown. This means we must watch prices

now very closely

and reduce holdings quickly in trading accounts if the DJI's price pattern takes on

more similarities with a classic head/shoulders pattern with a flat neckline. After

a long rally, hedge funds must be expected to swiftly sell stocks and very aggressively

buy all sorts of leveraged short ETFs and other bearish instruments.

Use the Lesson of 2010's Head/shoulders

|

TOP |

|

TOP |

|

Charts 3/4/2019 2018 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol Hourly DJIA A/D Line for All Stocks Inverted Traders Index NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30 DIA SPY QQQ MDY IWM TNA Short-Term Rates USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL RSX RETL SDS AGQ SLV SOXL TECL TLT TMF TNA UGA (gasoline) XIV YINN Commodities: CANE CORN DBC JJC, NIB, CHOC CORN, CUT (paper) MOO, SOYB WEAT UUP (Dollar) LIT (Lithium) AAPL ADBE ALXN AMAT AMGN AMD AMZN BA BABA BAC BIDU CAT CVX DE FB GOOG GS HD IBM INTU JPM M (Macy's) MSFT NFLX NVDA QCOM TSLA TXN XOM WMT CMG , LRCX, SWKS, MDGL SPPI WATT SQ TOWN 3/4/19 (Click on Underlined link.) Bullish MAXCPs - http://tigersoft.com/MAXCPS/Mar-4/BULLISH.htm Bearish MAXCPs - http://tigersoft.com/MINCPs/Mar-4/BEARISH.htm |

Table 1 QUICKSILVER on ETFS - 3/4/19 ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS --------------------------------------------------------------------------------------------- DIA 258.28 -2.14 260.54 -50.2% Bullish RED .194 ==== --------------------------------------------------------------------------------------------- BA 432.69 -7.93 426.77 67.1% Bullish RED .235 .231 --------------------------------------------------------------------------------------------- SPY 279.4 -1.02 279.32 -2.1% Bullish RED .244 .007 --------------------------------------------------------------------------------------------- QQQ 174.42 .03 173.7 25.9% Bullish RED .211 .013 --------------------------------------------------------------------------------------------- MDY 349.22 -1.63 349.26 -43% Bullish RED .301 .041 --------------------------------------------------------------------------------------------- IWM 156.81 -1.43 157.1 -43.8% Bullish RED .368 .058 --------------------------------------------------------------------------------------------- FAS 62.86 -.95 62.59 .8% Bullish RED .211 .269 --------------------------------------------------------------------------------------------- RETL 30.5 -1.87 31.14 -3.2% ------- RED .198 .189 --------------------------------------------------------------------------------------------- SOXL 130.11 .06 131.06 -143.5% Bullish RED .125 .35 --------------------------------------------------------------------------------------------- TECL 123.52 -1.28 123.9 13.8% Bullish RED .246 .241 --------------------------------------------------------------------------------------------- IBB 114.01 -1.1 112.5 46.3% Bullish RED .206 .072 --------------------------------------------------------------------------------------------- GLD 121.56 -.32 125.58 -153.3% Bearish ----- .224 -.059 --------------------------------------------------------------------------------------------- OIH 17.48 .06 17.25 11.6% ------- RED .073 .062 --------------------------------------------------------------------------------------------- RSX 20.5 .06 20.76 -58.3% Bearish RED -.211 -.059 |

Table 2 Count of Stocks in Key Directories

20190304

-------------------------------

NEWHIGHS 98

NEWLOWS 16

MAXCP 14 Professionals have stopped most aggressive buying.

MINCP 14

TTTNH 10

TTTNL 42

FASTUP 307

FASTDOWN 233

CPCROSSA 497

CPCROSSD 462

BIGVOLUP 3

BIGVODN 12

ACCUMVER 63

HIGHIP21 36

HIUPPCT 10

VHIP21 27

LOWACCUM 161

REDSELL 56

AUGSELS7 27

TRAPDOOR 23

|

Table 3

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

Bullish = 43

Bearish = 3

3/4/19

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BIGBANKS 1 1 1 1 1 1

REGBANKS 1 1 1 1 1 1

BONDFUND .971 .961 .971 .98 .98 .98

HOMEBLDG .941 .882 .941 .941 .941 .941

UTILITY .925 .925 .925 .925 .925 .925

ETFS .896 .913 .913 .931 .931 .948

SEMI .896 .862 .862 .862 .887 .896

FINANCE .888 .888 .922 .9 .9 .9

SOLAR .882 .882 .882 .941 .882 .882

GREEN .869 .826 .782 .869 .826 .869

ELECTRON .864 .851 .845 .851 .87 .876 INFRA .861 .861 .888 .888 .888 .888 NIFTY .859 .912 .894 .894 .894 .894 INDMATER .848 .81 .835 .898 .898 .911 DJI-13 .846 .923 .923 .923 1 1 SP500 .842 .865 .855 .865 .869 .873 CHINA .83 .813 .83 .813 .813 .83 HACKERS .818 .863 .772 .818 .818 .818 SP-100 .817 .87 .86 .87 .881 .892 FIDSTKS .816 .854 .848 .87 .87 .881 RUS-1000 .814 .832 .825 .833 .824 .84 NASD-100 .81 .83 .81 .83 .82 .84 SOFTWARE .809 .873 .825 .825 .841 .857 GOLD .803 .823 .862 .882 .921 .921 DOWJONES .8 .866 .866 .866 .933 .933 INSURANC .8 .833 .8 .833 .8 .9 CHEM .796 .851 .833 .888 .907 .87 INDEXES .795 .817 .801 .811 .833 .822 REIT .791 .785 .812 .812 .832 .859 MILITARY .781 .812 .843 .843 .843 .906 COMPUTER .772 .772 .772 .818 .909 .909 GUNS .764 .882 .823 .882 .823 .882 RETAIL .754 .754 .754 .735 .698 .679 TRANSP .75 .8 .75 .75 .75 .8 OILGAS .748 .72 .685 .72 .706 .741 BEVERAGE .722 .722 .722 .666 .666 .666 BIOTECH .701 .714 .671 .695 .669 .679 BIG17 .695 .695 .652 .673 .673 .717 AUTO .666 .794 .82 .794 .82 .794 EDU .666 .833 .833 .833 .666 .833 GAMING .666 .666 .666 .75 .791 .833 COMODITY .536 .585 .707 .731 .707 .731 HOSPITAL .5 .583 .458 .458 .5 .541 ===================================================================================================== FOOD .464 .535 .642 .66 .642 .66 COAL .428 .571 .571 .571 .571 .428 JETS .4 .5 .6 .6 .6 .7 |

====================================================================

3/1/2019 The January Peerless

B4 signal is still far from playing itself out. See

below how the DJI's "straight-up" V-advance is now challenging its

resistance just overhead. The DJI still needs to breakout past 26371

and the SP-500 needs to overcome its flat resistance at 2814. I consider

the Russell-2000 ETF, IWM, to be currently showing the strongest combined

internal among the ETFs shown in Table 1 below. Usually flat resistance

levels are overcome.

Though it is slipping for the DJIA, the IP21s are still quite

high for the ETFs

we track in Table 1. Boeing, the leader in the DJIA made another new

high. There are no very weak groups of stocks in Table 3. None have

have a majority of their stocks below their 65-dma. Most have a big

majority above it, and so should expect strong support were there to be

a wave of profit-taking. The ratio of new highs to new lows in Table 2

remains more than 10:1.

But, as I must, I keep looking for impending problems.

The only thing I

noticed tonight is that a few of the South American bank stocks show

head/shoulders patterns, something which no doubt stems from the stronger

Dollar. (See the Bearish MINCPs.)

I 've looked in vain for signs of impending tops, such as

head and shoulders

patterns, in individual DJI and SP-500 stocks. The major ETFs'

Closing Powers are rising. 80% of all 5000+ stocks and ETFs we

track are above their 65-dma. Many of the exceptions are negative

ETFs.

There is another sign of trouble that I cannot find.

This is failed breakouts

above well-tested flat resistance levels. These are the indivdual stocks

that usually do best in strongly uptrending markets. In particular, watch

CDNA, ABT and FE in the Bullish MAXCPs. Breakouts by them that

now fail would be unexpected and a sign of impending trouble for the

market as a whole.

The Dollar was strong and jumped back above its 65-dma.

In fact,

it was so strong that it worries President Trump about US exports.

But its strength would seem to make the DOVISH case that there should

be room for a cut in very short-term rates. And this could coincide

with a very bullish advance by the DJI to new highs. That would also life

take IWM and the other major ETFs very nicely.

We've taken trading profits in SOXL because its steep Closing Power

uptrend has been broken. Let's see if it can get past its well-tested

falling resistance line. Semi-conductors are usually seen as leaders of

the general market.

|

Charts 3/1/2019 2018 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol Hourly DJIA A/D Line for All Stocks Inverted Traders Index NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30 DIA SPY QQQ MDY IWM TNA Short-Term Rates USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH OIL RSX RETL SDS AGQ SLV SOXL TECL TLT TMF TNA UGA (gasoline) XIV YINN Commodities: CANE CORN DBC JJC, NIB, CHOC CORN, CUT (paper) MOO, SOYB WEAT UUP (Dollar) LIT (Lithium) AAPL ADBE ALXN AMAT AMGN AMD AMZN BA BABA BAC BIDU CAT CVX DE FB GOOG GS HD IBM INTU JPM M (Macy's) MSFT NFLX NVDA QCOM TSLA TXN XOM WMT CMG , LRCX, SWKS, MDGL SPPI WATT SQ TOWN 3/1/19 (Click on Underlined link.) Bullish MAXCPs - http://tigersoft.com/MAXCPS/Mar-1/BULLISH.htm Bearish MAXCPs - http://tigersoft.com/MINCPs/Mar-1/BEARISH.htm |

Table 1 QUICKSILVER on ETFS - 3/3/19 ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS

---------------------------------------------------------------------------------------------

DIA 260.42 1.14 260.89 4.8% Bullish RED .265 -----

---------------------------------------------------------------------------------------------

BA 440.62 .66 426.87 192.4% Bullish RED .255 .292

---------------------------------------------------------------------------------------------

SPY 280.42 1.74 279.52 22.9% ------- ---- .287 -.003

---------------------------------------------------------------------------------------------

QQQ 174.39 1.2 173.52 43.3% Bullish ---- .221 .006

---------------------------------------------------------------------------------------------

MDY 350.85 2.63 352.23 -20.1% Bullish BLUE .331 .033

---------------------------------------------------------------------------------------------

IWM 158.24 1.46 158.19 2.9% Bullish BLUE .428 .053

^^^^^

---------------------------------------------------------------------------------------------

FAS 63.81 .86 62.85 95.5% ------- RED .248 .268

---------------------------------------------------------------------------------------------

RETL 32.37 .59 30.52 341.7% Bullish RED .272 .278

---------------------------------------------------------------------------------------------

SOXL 130.05 3.31 133.83 -19.3% Bullish RED .121 .393

---------------------------------------------------------------------------------------------

TECL 124.8 2.3 123.18 142.4% Bullish RED .25 .272

---------------------------------------------------------------------------------------------

IBB 115.11 2.37 112.96 195.4% Bullish BLUE .281 .047

---------------------------------------------------------------------------------------------

GLD 121.88 -2.11 125.37 -144.8% Bearish RED -.268 -.067

---------------------------------------------------------------------------------------------

OIH 17.42 .32 17.44 34.7% ------- BLUE .047 .022

---------------------------------------------------------------------------------------------

GASL 7.62 .45 7.71 33.7% Bearish BLUE-.102 .038

---------------------------------------------------------------------------------------------

RSX 20.44 .02 20.74 -70.2% Bearish RED -.154 -.086

|

Table 2 Count of Stocks in Key Directories

2019-0301

-------------------------------

NEWHIGHS 186 Bullish

NEWLOWS 11

MAXCP 49

MINCP 14

TTTNH 33

TTTNL 29

FASTUP 295

FASTDOWN 193

CPCROSSA 450

CPCROSSD 384

BIGVOLUP 6

BIGVODN 13

ACCUMVER 85

HIGHIP21 47

HIUPPCT 10

VHIP21 29

LOWACCUM 157

REDSELL 54

AUGSELS7 23

TRAPDOOR 24

|

Table 3

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

3/1/19

No groups are considered Bearish

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BIGBANKS 1 1 1 1 1 .857

REGBANKS 1 1 1 1 1 1

BONDFUND .961 .971 .98 .98 .98 .99

UTILITY .925 .925 .925 .925 .925 .925

DJI-13 .923 .923 .923 1 1 1

ETFS .913 .913 .931 .931 .948 .931

NIFTY .912 .894 .894 .894 .894 .894

FINANCE .888 .922 .9 .9 .877 .866

GUNS .882 .823 .882 .823 .882 .941

HOMEBLDG .882 .941 .941 .941 .941 .941

SOLAR .882 .882 .941 .882 .882 .941

SOFTWARE .873 .825 .825 .841 .857 .841

SP-100 .87 .86 .87 .881 .892 .881

DOWJONES .866 .866 .866 .933 .933 .933

SP500 .865 .855 .865 .869 .873 .869

HACKERS .863 .772 .818 .818 .818 .818

SEMI .862 .862 .862 .887 .896 .887

INFRA .861 .888 .888 .888 .888 .861

FIDSTKS .854 .848 .87 .87 .881 .875

CHEM .851 .833 .888 .907 .888 .87

ELECTRON .851 .845 .851 .87 .876 .87

EDU .833 .833 .833 .666 .833 .833

INSURANC .833 .8 .833 .8 .9 .933

RUS-1000 .832 .825 .832 .825 .841 .834

NASD-100 .83 .81 .83 .82 .84 .83

GREEN .826 .782 .869 .826 .869 .913

GOLD .823 .862 .882 .921 .921 .941

INDEXES .822 .801 .811 .833 .822 .817

CHINA .813 .83 .813 .813 .83 .83

MILITARY .812 .843 .843 .843 .906 .906

INDMATER .81 .835 .898 .898 .911 .924

TRANSP .8 .75 .75 .75 .8 .8

AUTO .794 .82 .794 .82 .794 .897

REIT .785 .812 .812 .832 .859 .899

COMPUTER .772 .772 .818 .909 .909 .909

RETAIL .754 .754 .735 .698 .679 .679

BEVERAGE .722 .722 .666 .666 .666 .666

OILGAS .715 .68 .715 .701 .729 .715

BIOTECH .712 .672 .696 .67 .678 .649

BIG17 .695 .652 .673 .673 .717 .652

GAMING .666 .666 .75 .791 .833 .833

COMODITY .585 .707 .731 .707 .731 .78

HOSPITAL .583 .458 .458 .5 .541 .583

COAL .571 .571 .571 .571 .428 .428

FOOD .535 .642 .66 .642 .66 .714

JETS .5 .6 .6 .6 .7 .7

|

====================================================================

2/28/2019 The DJI's uptrend was not

violated despite news which weakens the

President and might at another time cause some serious profit-taking.

Michael Cohen's testimony and the unexpected failure of the US-NK

de-nuclearization talks hardly hurt the market, at all. Now overnight

another rally is developing. The January Buy B4, the V-formation

and the nearly 20% "straight-up" rally will soon take out the over-head

resistance levels shown below for all the major Indexes. This should start

them rushing upwards back to their highs of last September-October.

See if the resistance levels just overhead for

these indexes and ETFs can be broken. That

would show that the next target is their 12 month highs,

in my judgment.

| DJIA |

| SP-500 |

| NASDAQ |

| IWM |

| UTILITIES |

Bullish seasonality continues for March. A 2.1% DJI gain is

the average and a DJI rise should be expected 75% of the time

.

in the 3rd year of the 4-year Presidential cycle, using the period

from 1967 to 2015 for our data base. In these year, the next two

months' average gain is +4.2% and the next three month's average

gain is +6%. Six months from now the DJI should be +11% higher

if this history of the 3rd year of the 4-year Presidential cycle

repeats.

I mentioned last night how all the usual warnings of a big decline were absent.

And even on today's decline the number of new highs was still 10 times

the number of new lows.

The durability and resiliance of our rally must be driving the bears crazy.

But the trend is our friend. What we know that they do not seem to

appreciate is how bullish the third year in the four-year Presidential cycle

can be as the politicians in Congress and the FED strive especially hard

to boost the stock market and the economy this year. The Peerless

program makes special allowances for this. It is much harder to get

a Peerless Sell in March and April in the third year of the Presidential

cycle. See this in the data below. As long as the P-I and IP21 remain

so positive, we should be very safe still buying.

Of the 22 3rd Years since 1931, when was the first Peerless

Sell?:

Number of Cases

February 1

March

2 (1931 and 1935)

April

3 (1951, 1967 and, 1979)

May