TIGER

HOTLINE

TIGER

HOTLINE

william_schmidt@hotmail.com

HOTLINES from 1/30/2012 to 3/22/2012

A Guide To Profitably Using The

Tiger Nightly HOTLINE

A Guide To Profitably Using The

Tiger Nightly HOTLINE TIGER

HOTLINE

TIGER

HOTLINE

william_schmidt@hotmail.com

HOTLINES from 1/30/2012 to

3/22/2012

A Guide To Profitably Using The

Tiger Nightly HOTLINE

A Guide To Profitably Using The

Tiger Nightly HOTLINE

TigerSoft and

Peerless Daily Hotline

(C)

1985-2012 William Schmidt, Ph.D. www.tigersoft.com

All rights

strictly reserved.

|

NOTES: ---> To renew this Hotline, order here $350 (check) - $360(Visa/MC) slow or unavailable briefly as I post updates. It may be necessary in an emmergency to use the other web-page at tigersoftware.com If that happens, I will post the Tiger Data on www.tigersoftware.com/92-12HL/index.html instead of here. Notice the difference is only a matter of adding "soft" to "tigersoft". It will be there only if I have problem here. |

3/22/2011

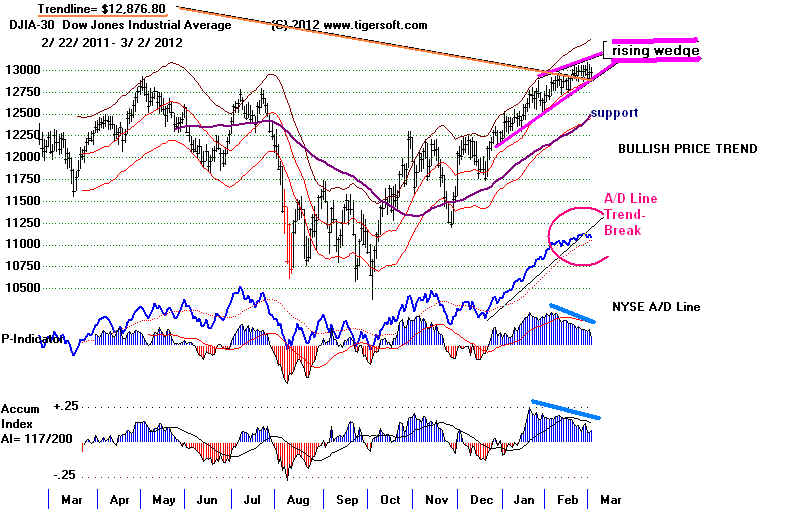

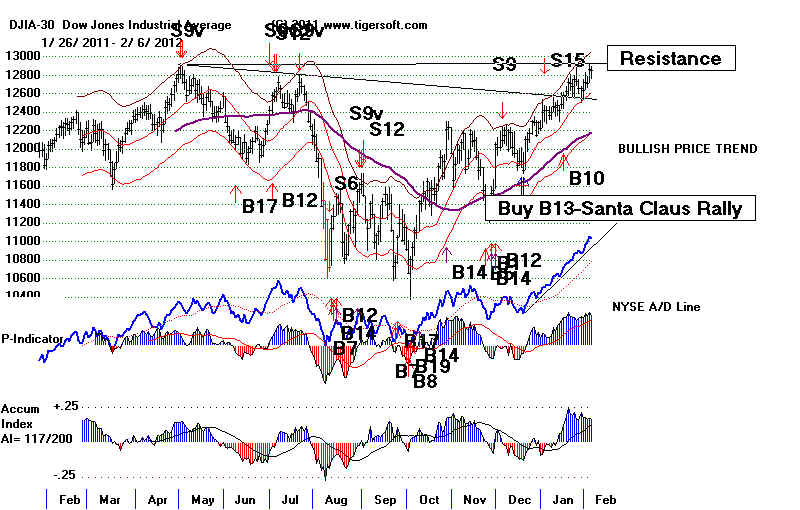

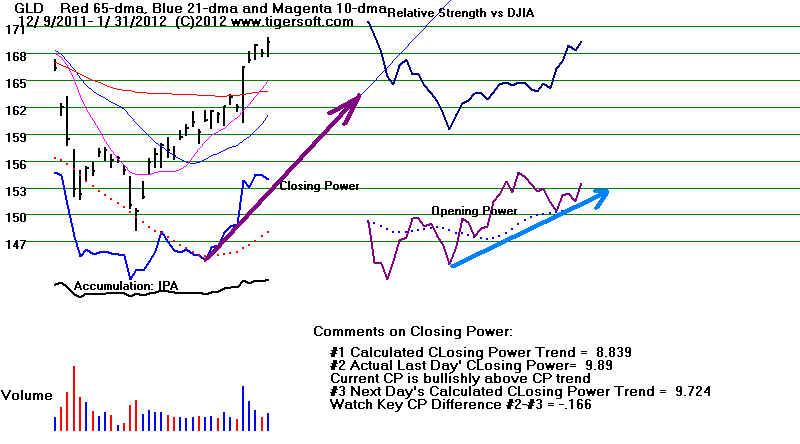

Hotline Peerless Sell S15 and Sell S1 Still Operate.

|

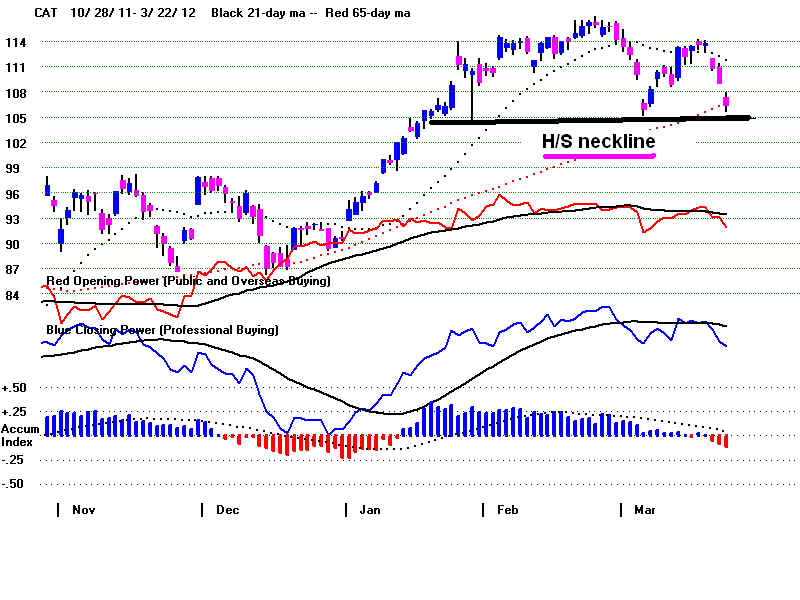

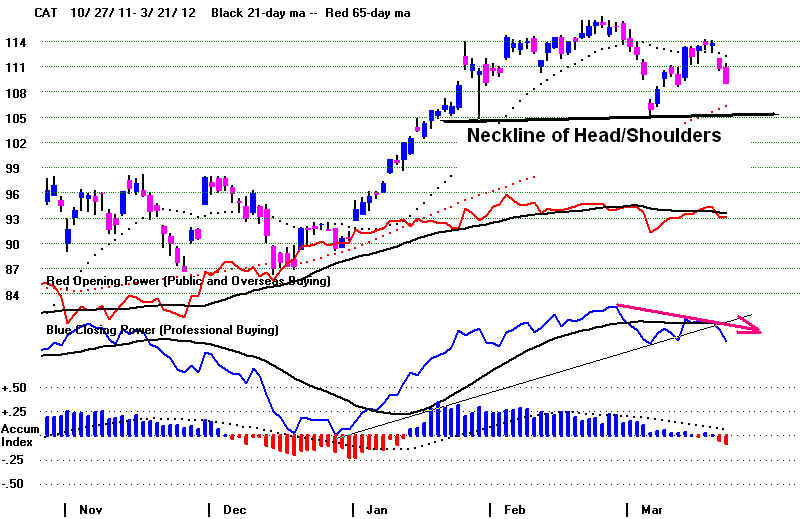

Watch CAT to see if it penetrates its H/S Patern's Neckline |

|

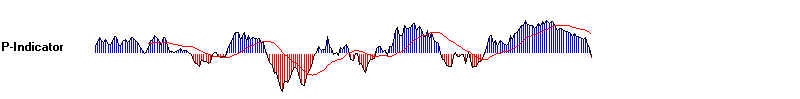

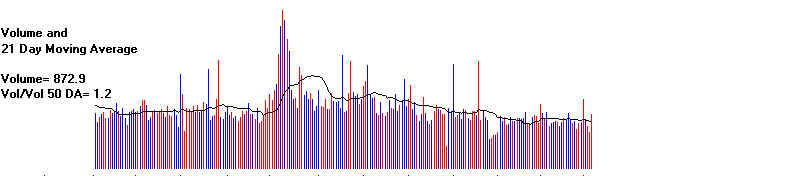

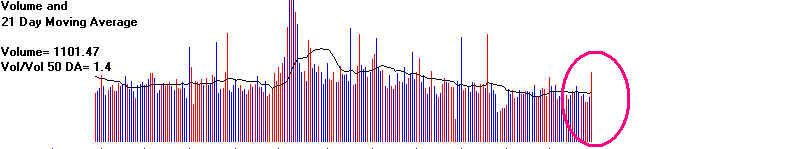

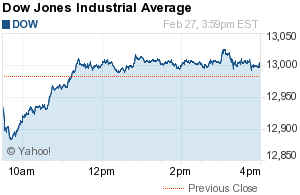

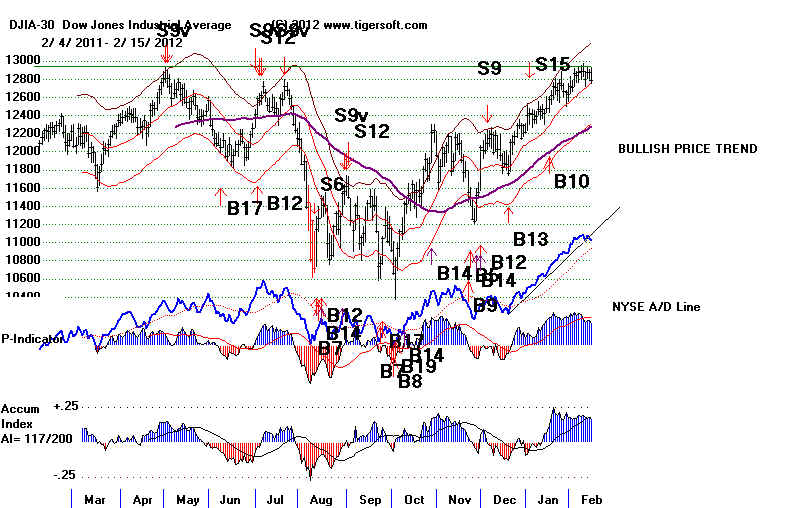

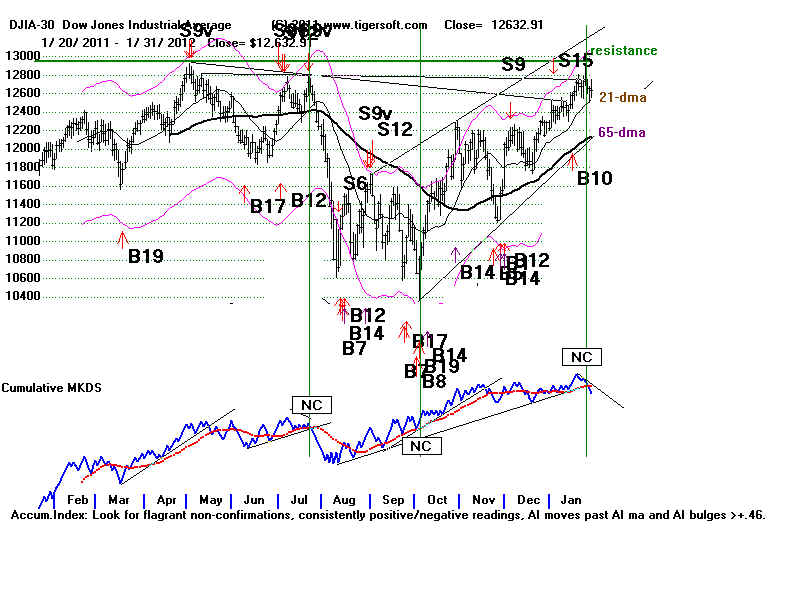

DJI 13046 la/ma = 1.001 21dmaROC=.098

P=60 P-Ch= -38 IP21=.002 (low) V= -32 OP= .002

BREADTH

STATISTICS: Advance=

786 Declines=2231 UpVol =119.38 DownVol= 637.87

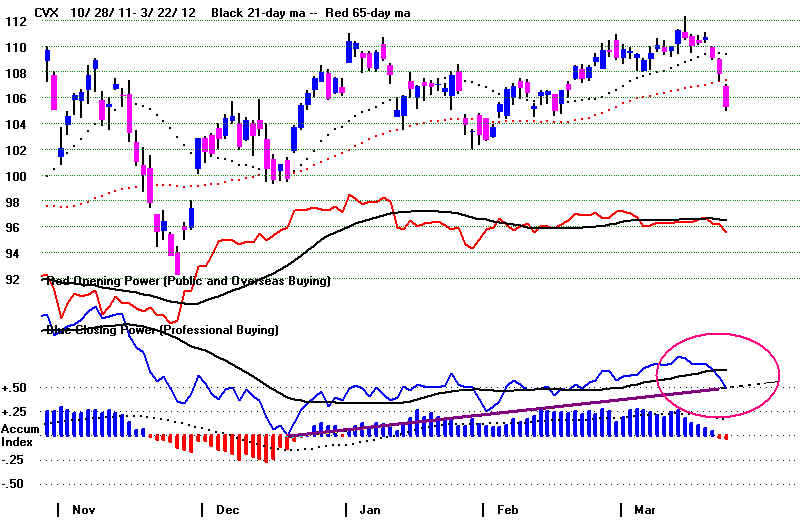

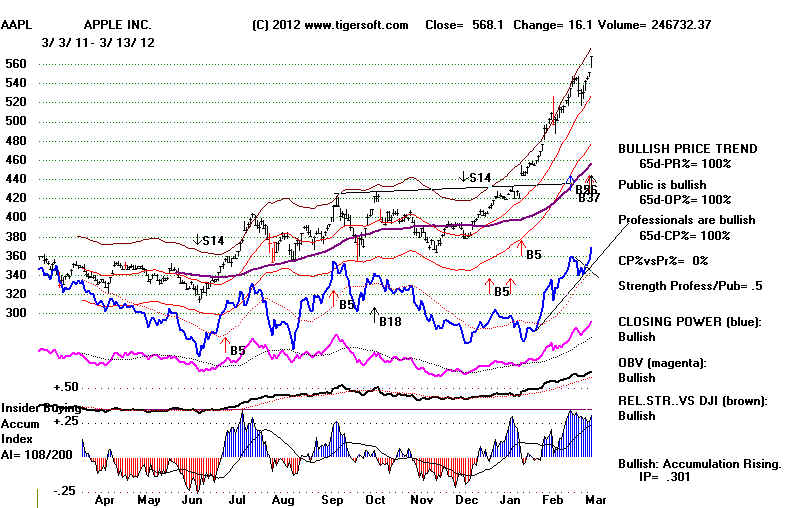

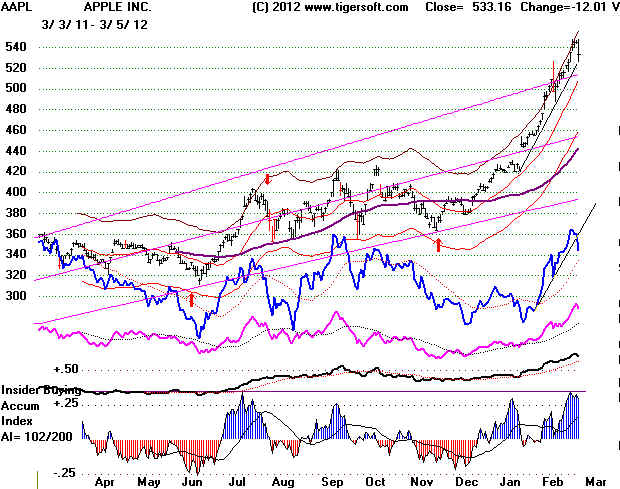

Key Stocks: AAPL and 4 highest priced DJI

stocks: IBM, CAT,

CVX, MCD and XOM

.

--->

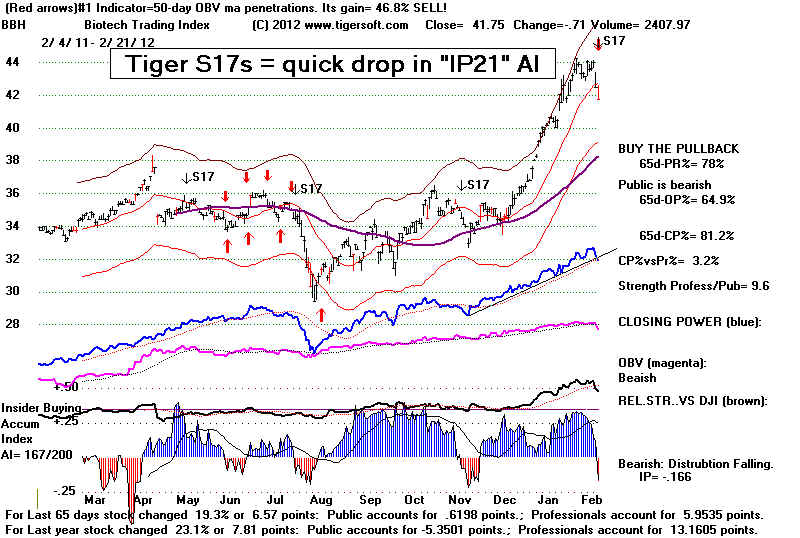

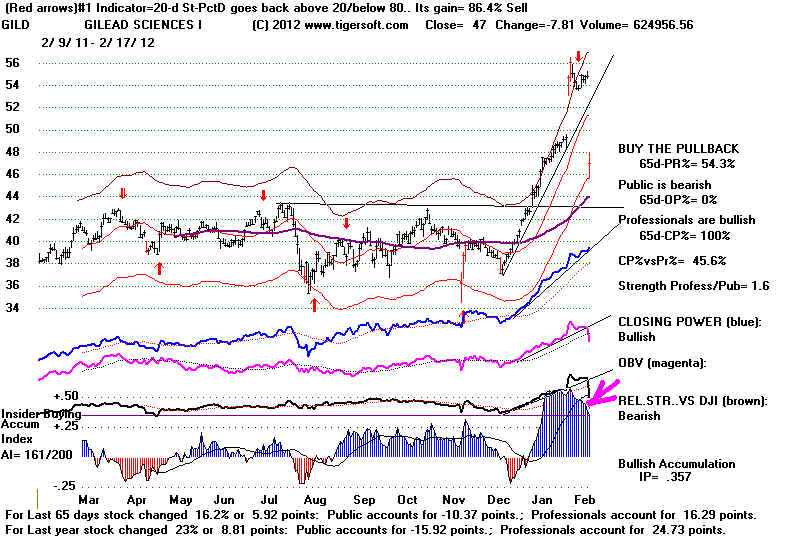

181 (+4) MAXCP stocks Bullish MAXCP Stocks Bullish.

---> 52 (+7 ) MINCP stocks Bearish MINCP

Stocks

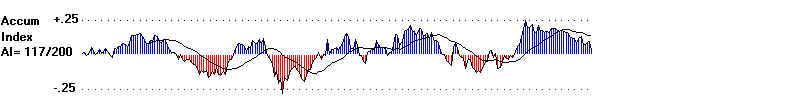

MAXCP stocks are those showing Tiger Closing Power making new

highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

---> 27(-30) new

highs on NASDAQ. 15 (+5) new lows on NASDAQ Bullish.

---> 20(-11 ) new

highs NYSE 10 (+1) new lows on NYSE

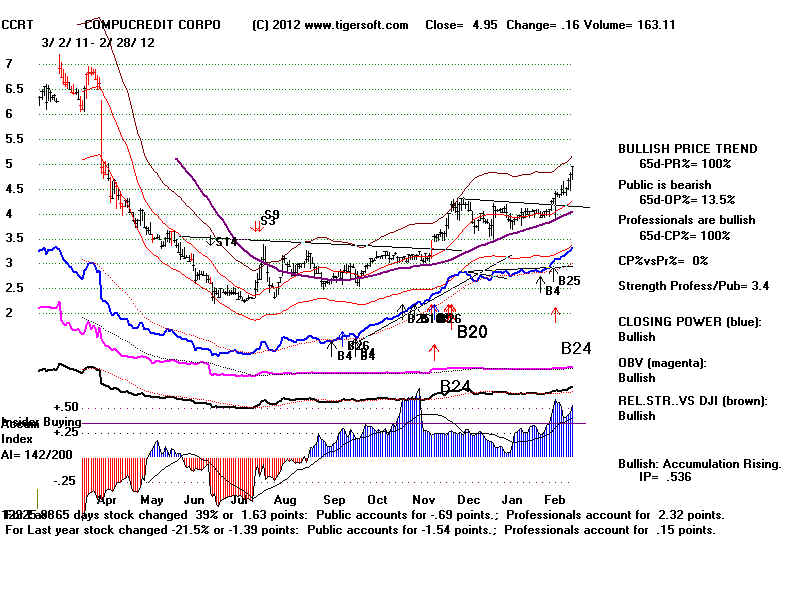

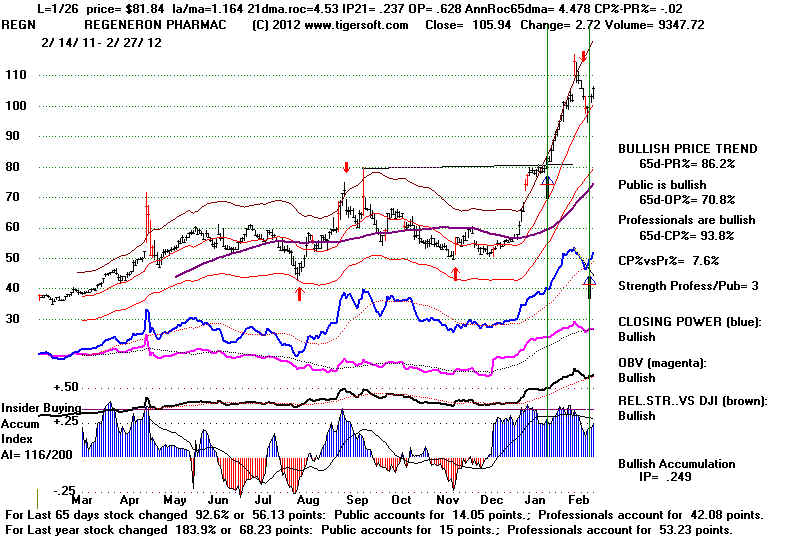

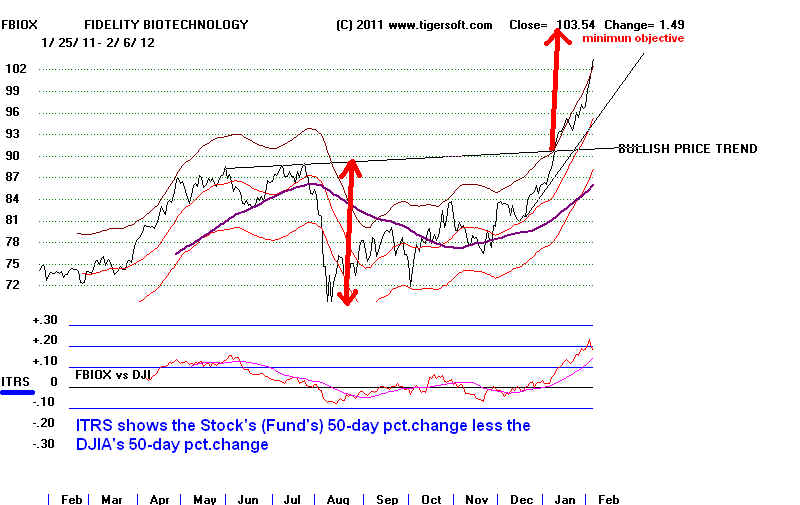

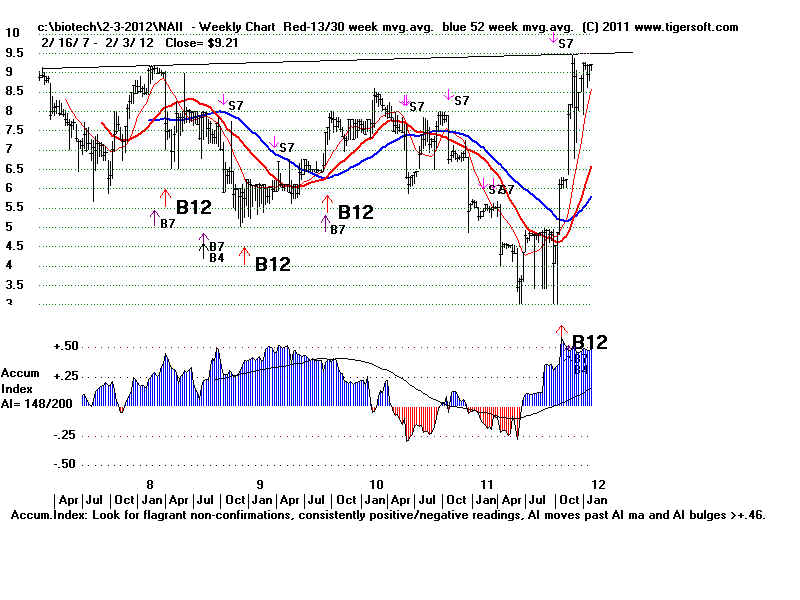

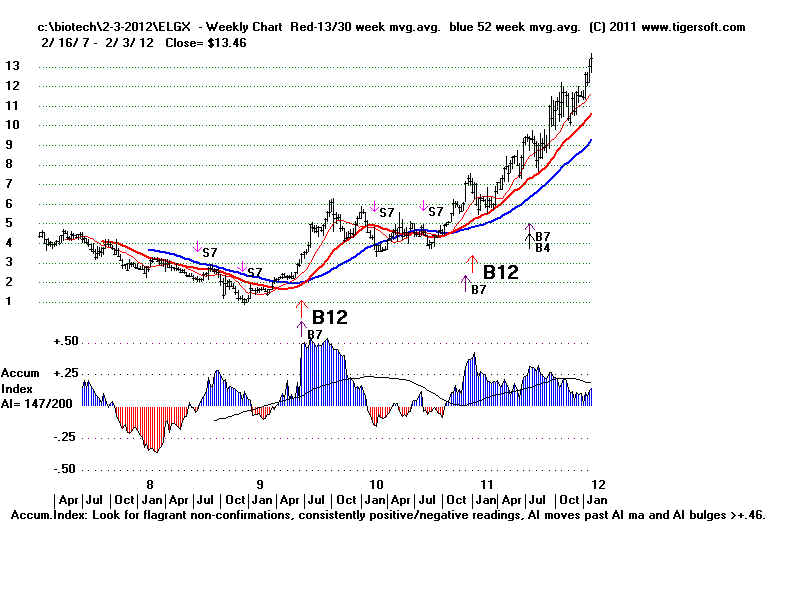

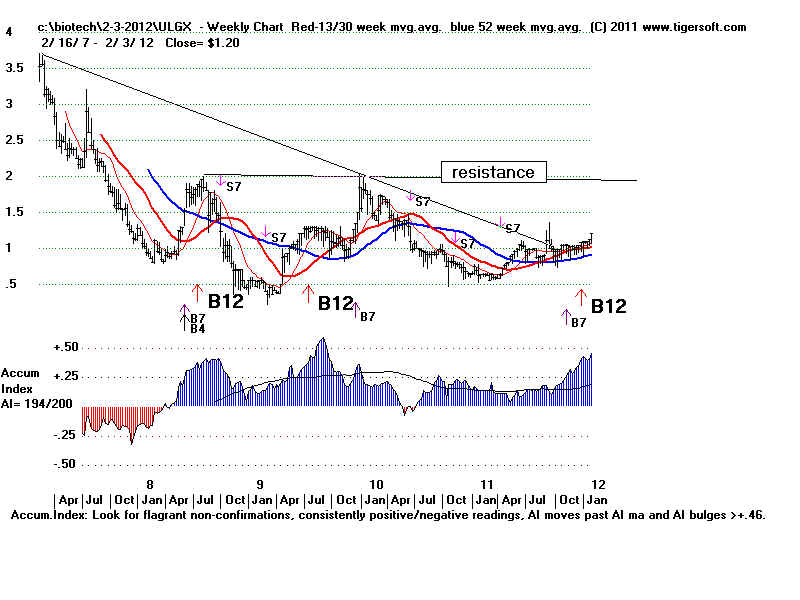

3/21/2012 Consider Low Priced

High Accummulation speculations in

the third wave

general market advance since 2009. Trade these with the trend of the 21-day ma of

Closing Power

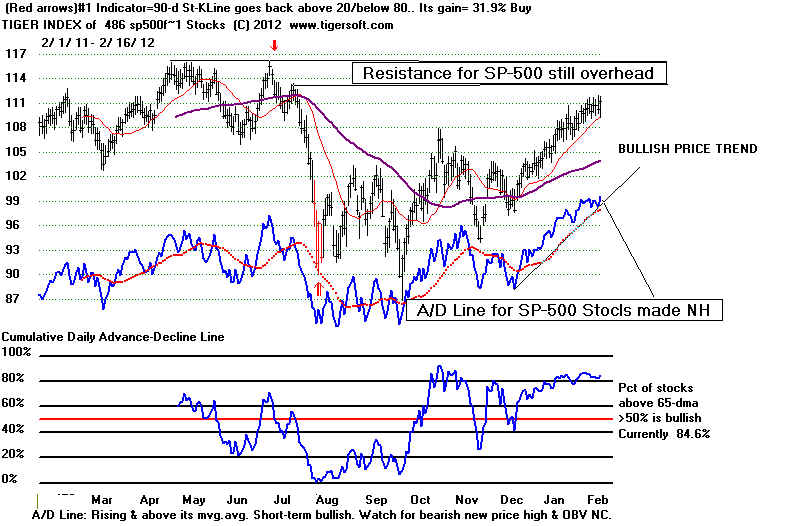

3/22/2012 KEY CHARTS OF INDUSTRY INDICES

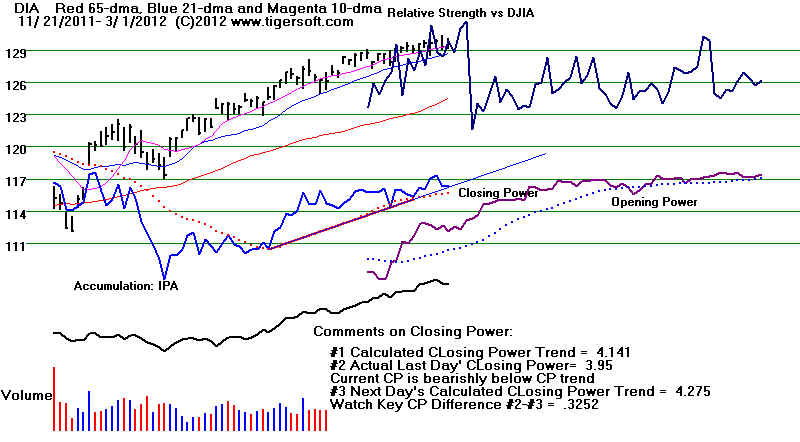

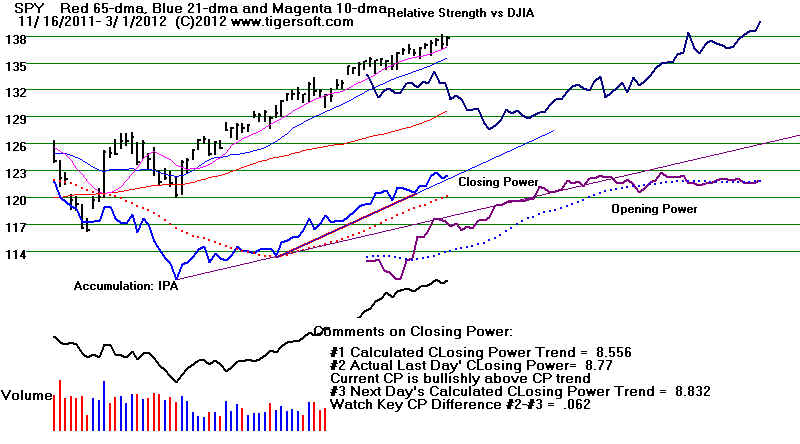

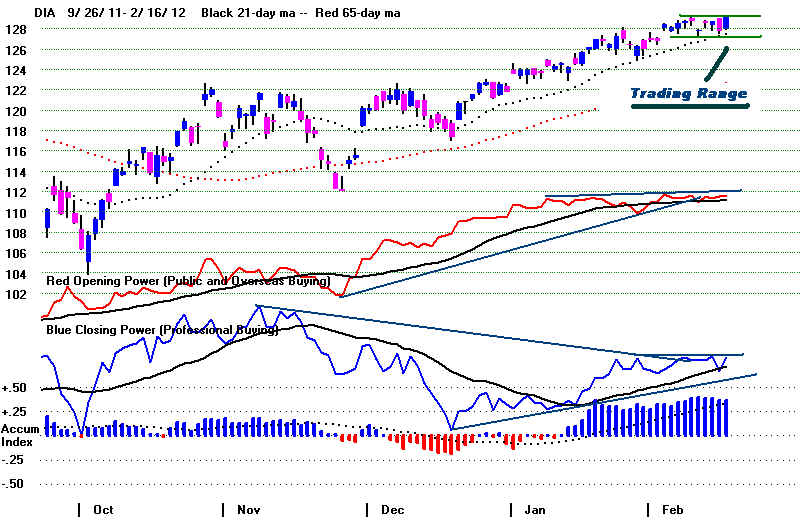

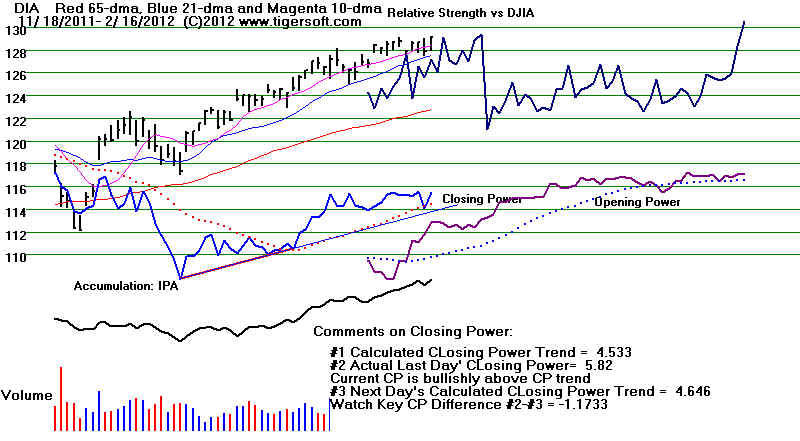

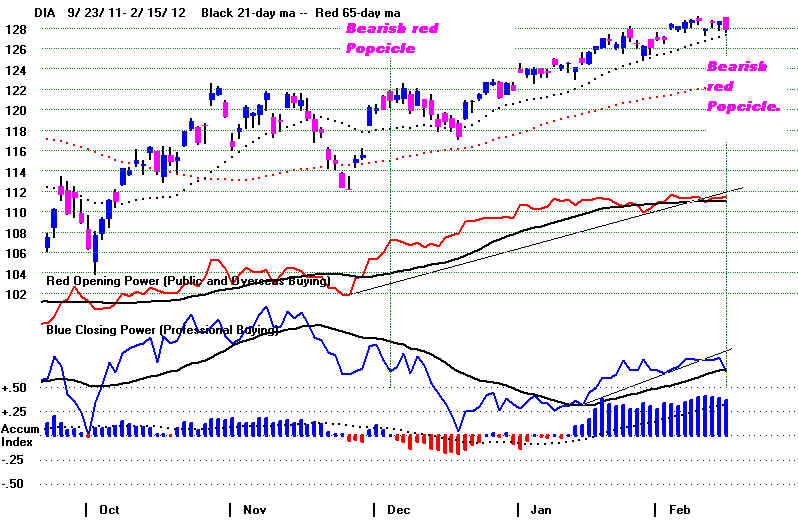

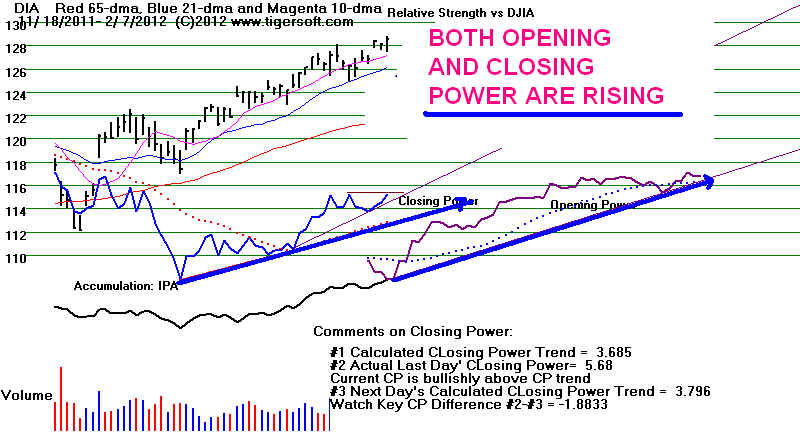

DIA SPY

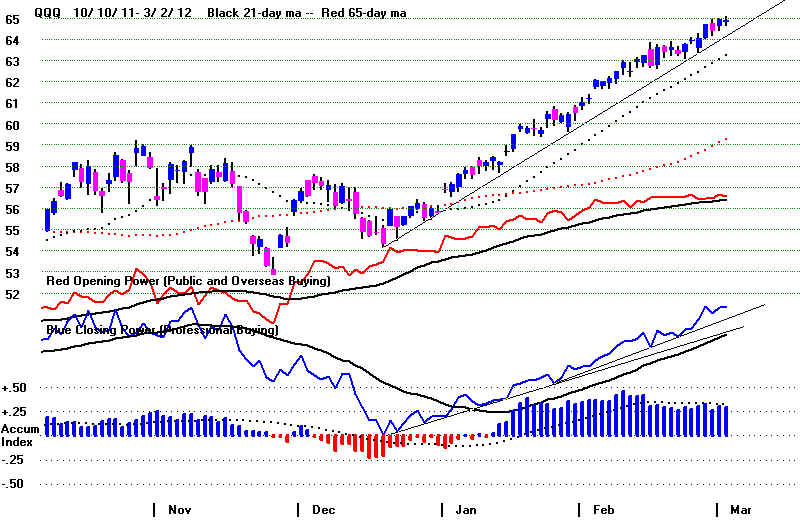

QQQ

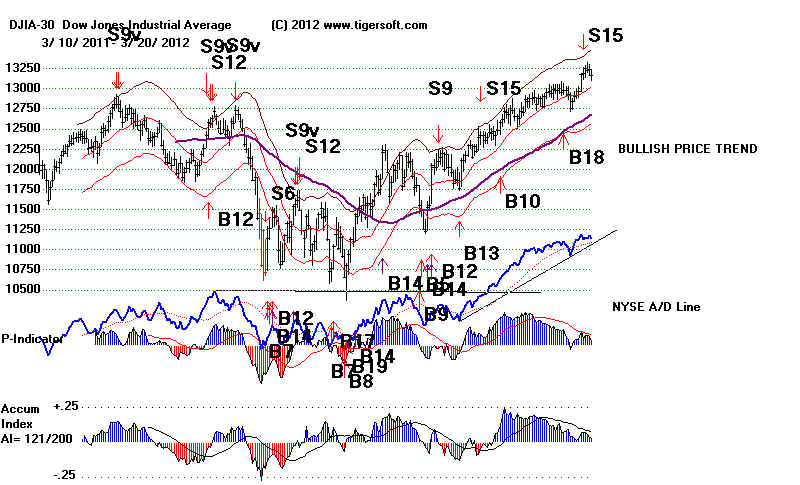

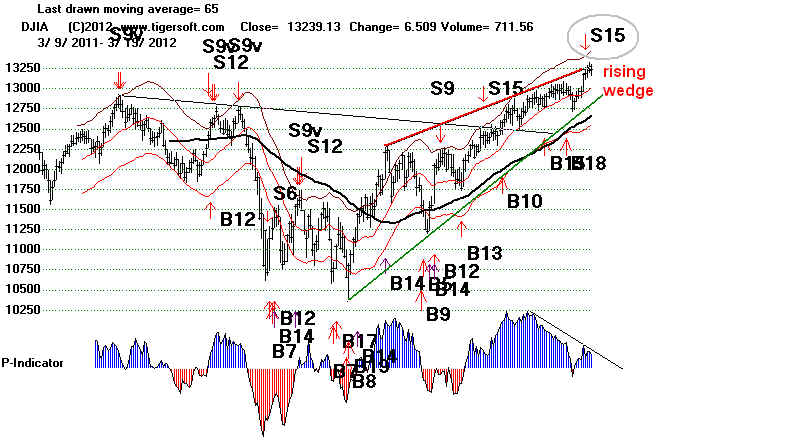

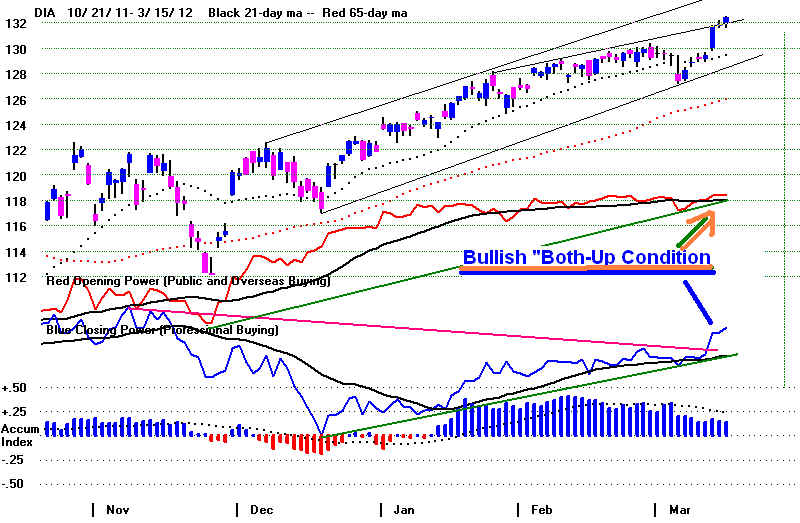

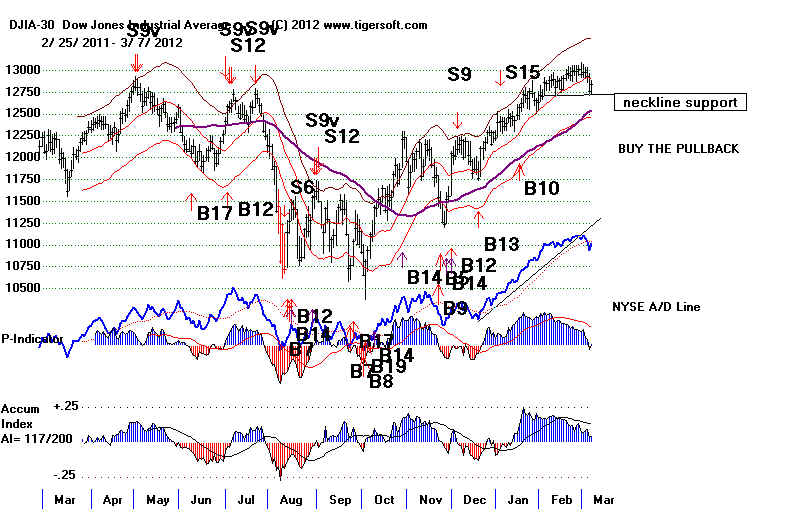

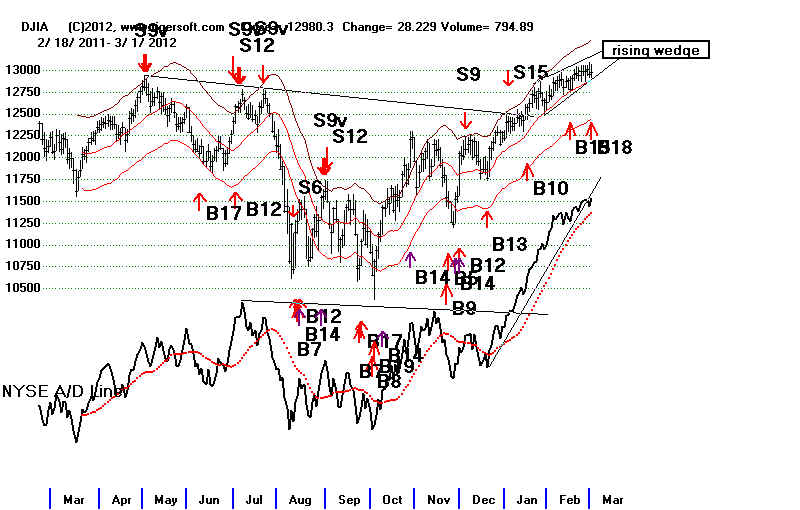

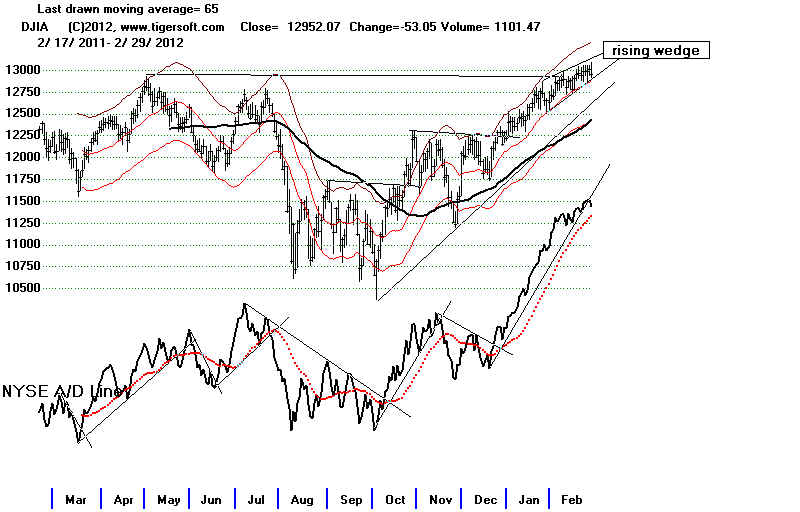

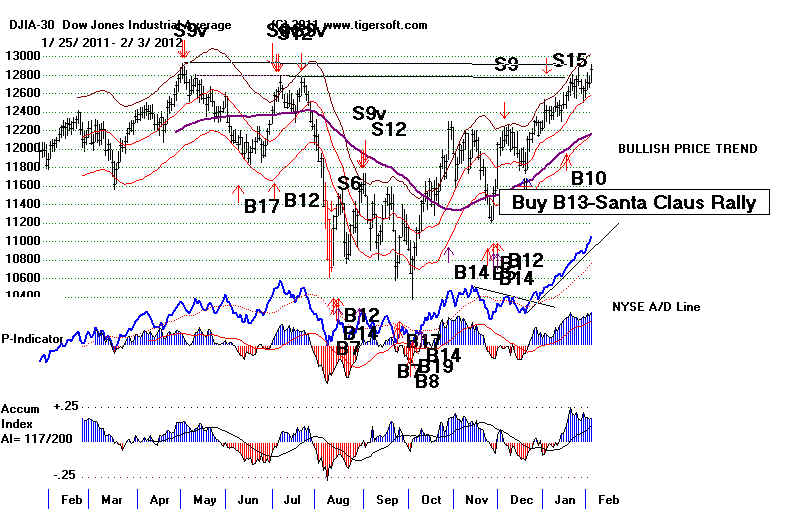

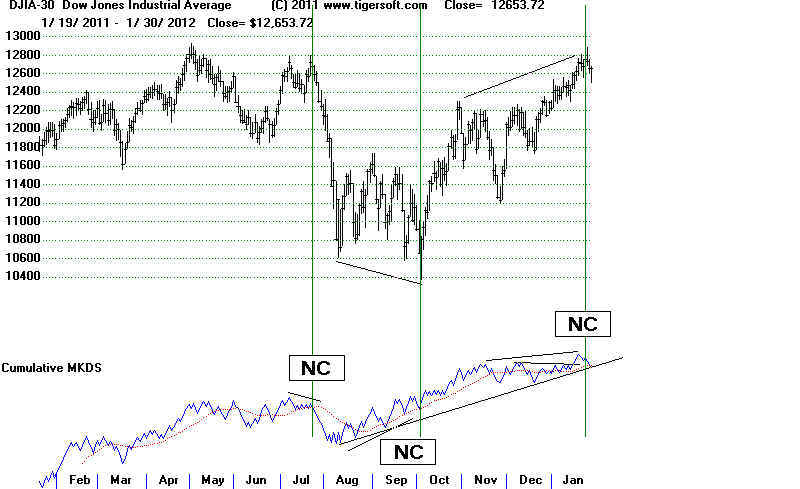

DJIA-Peerless

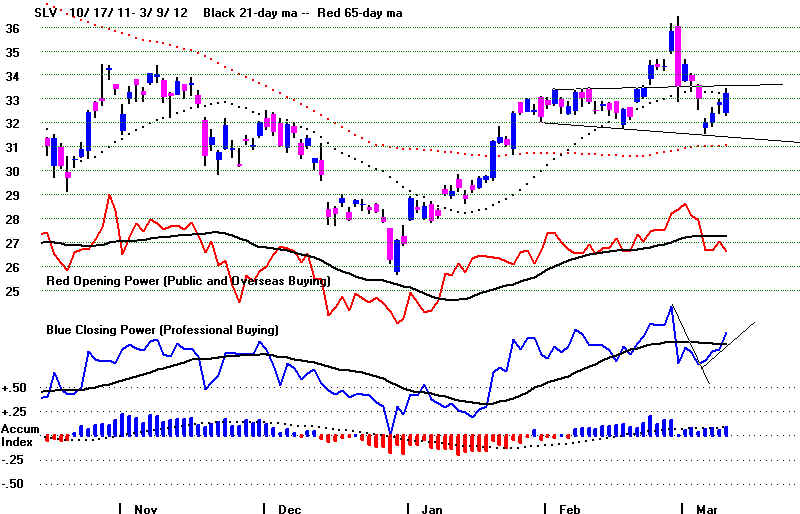

TigerDJI TigerSPY TigerQQQ GLD SLV Crude Oil

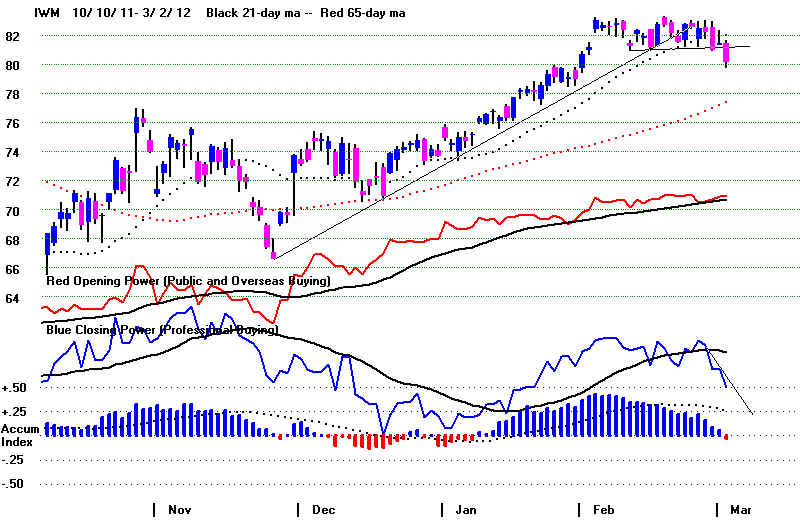

IWM-Russell-2000

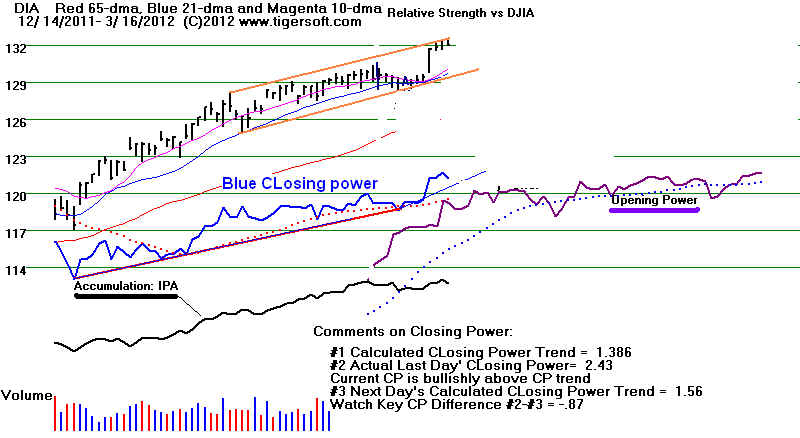

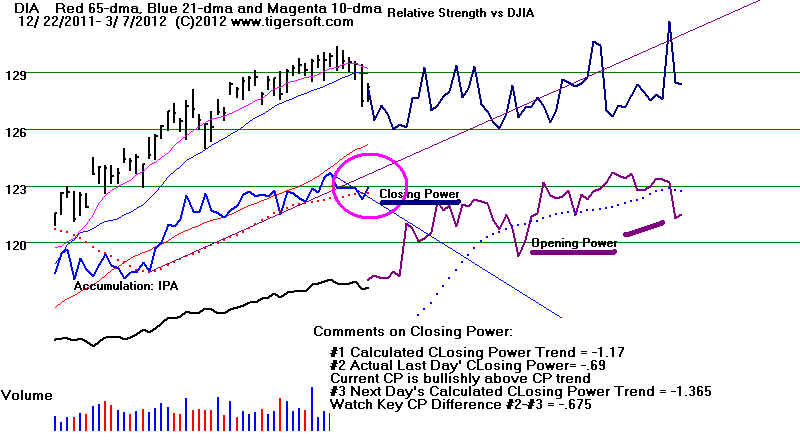

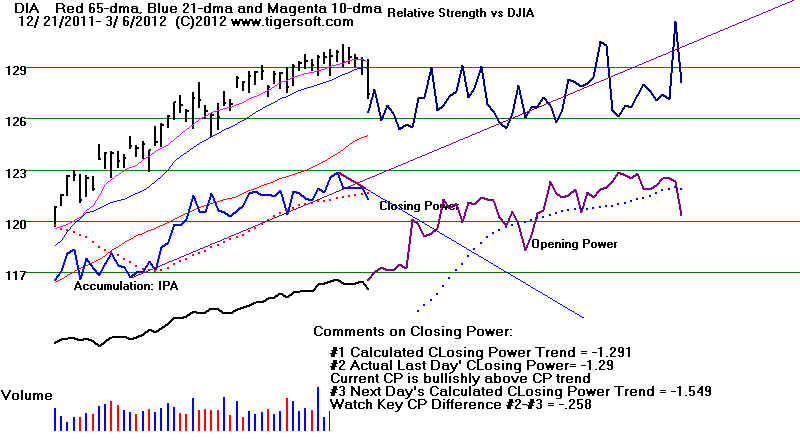

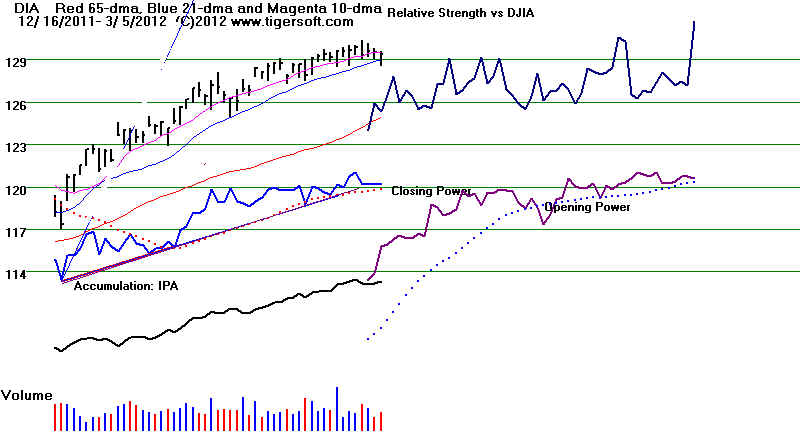

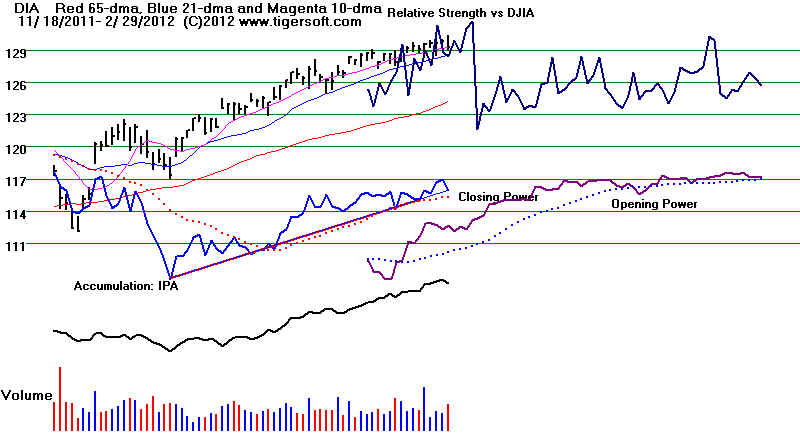

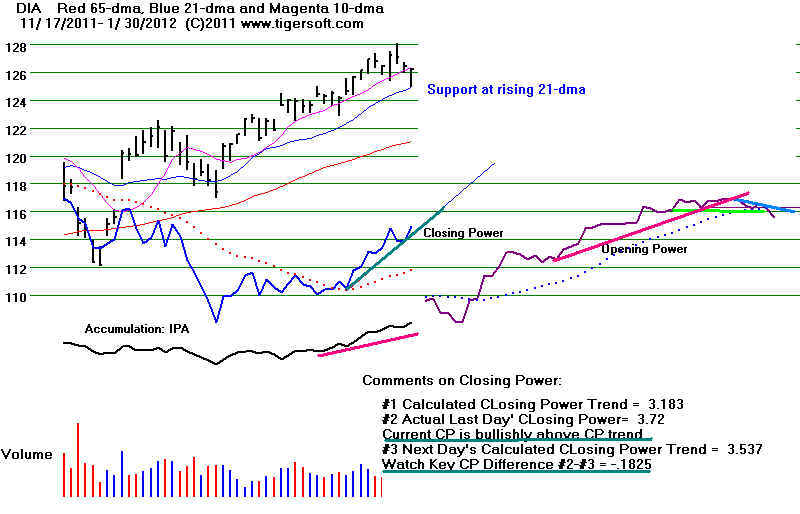

DIA' s CP

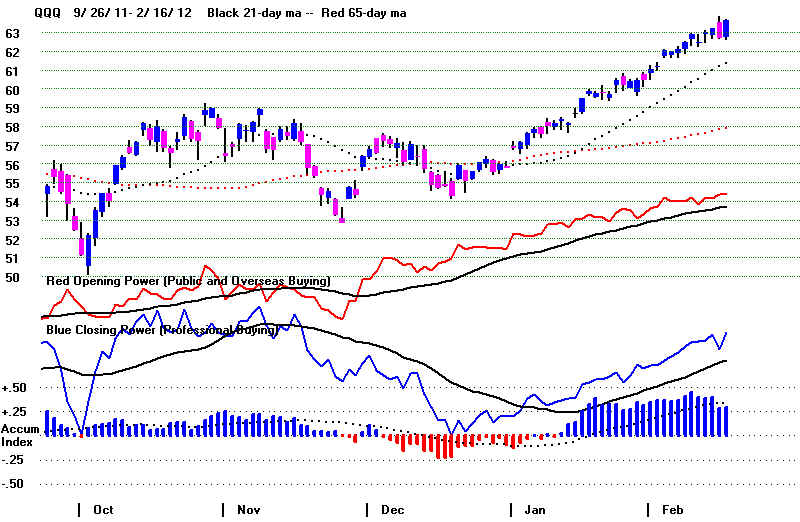

is uptrending It

would take a close of more than 0.31

below the opening to break the

longer term CP uptrend. The Opening Power

is flat. The DJI is caught

in another rising wedge

price pattern. These usually bring a downaisde break. .

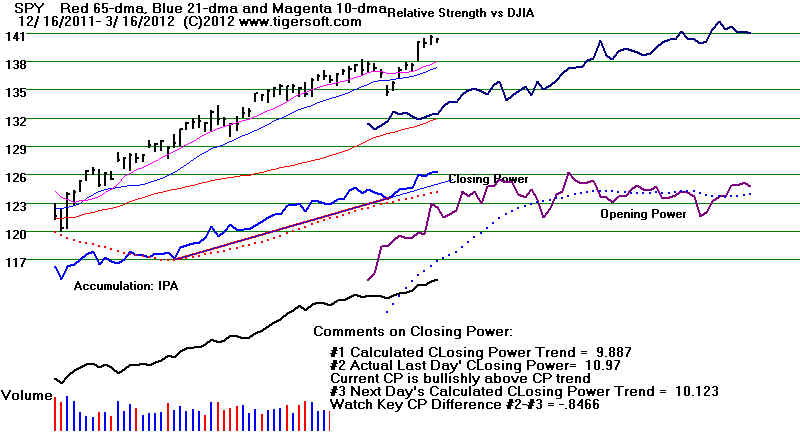

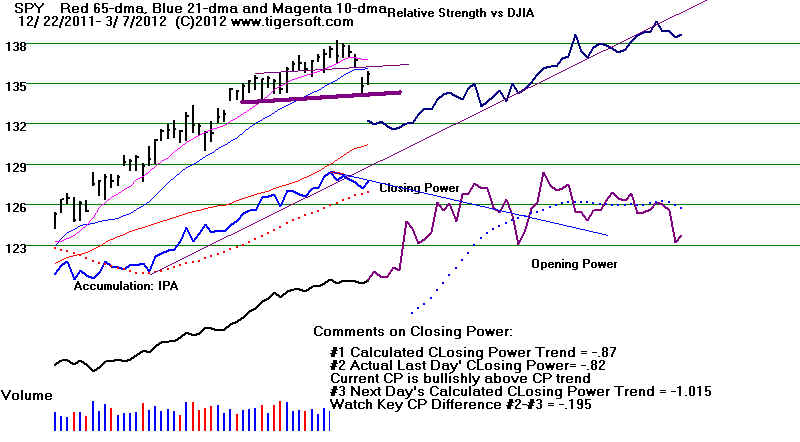

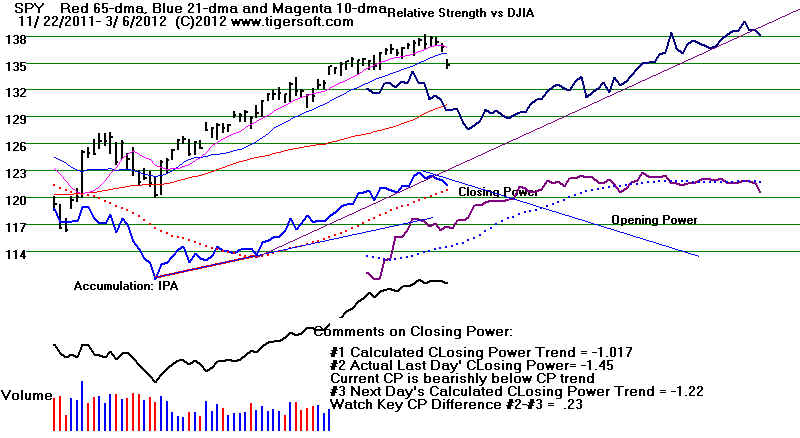

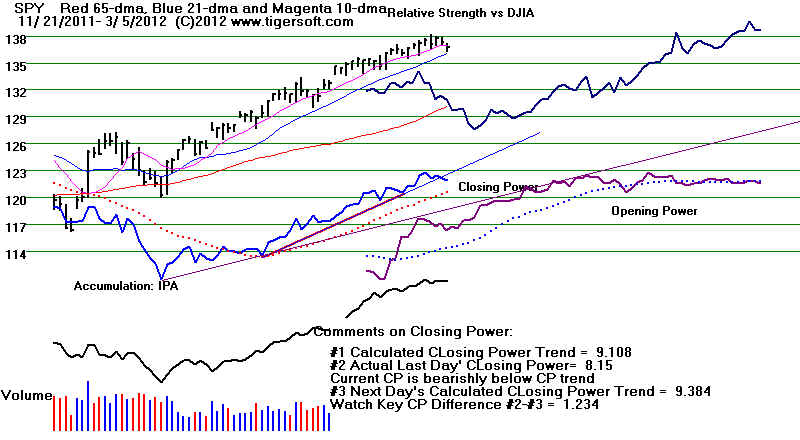

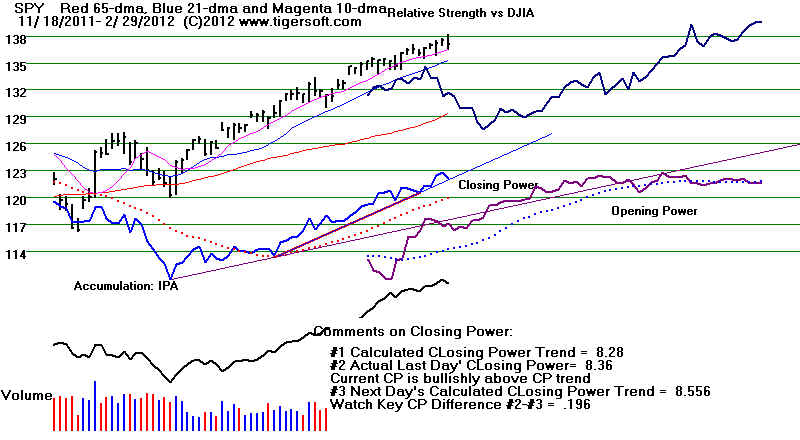

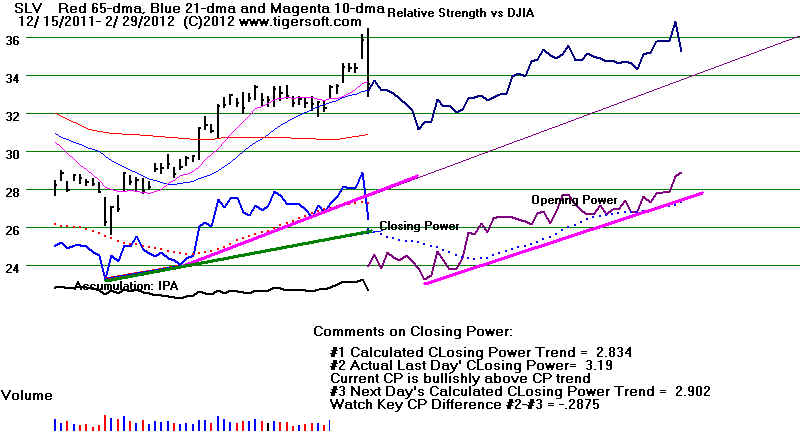

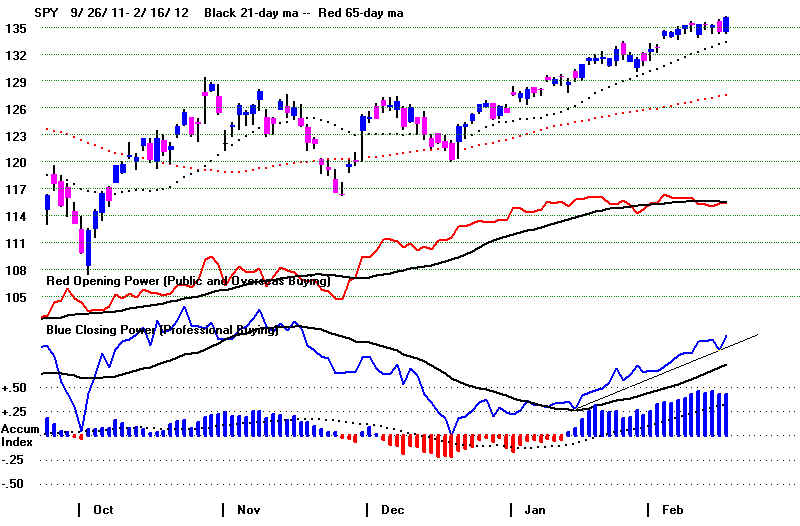

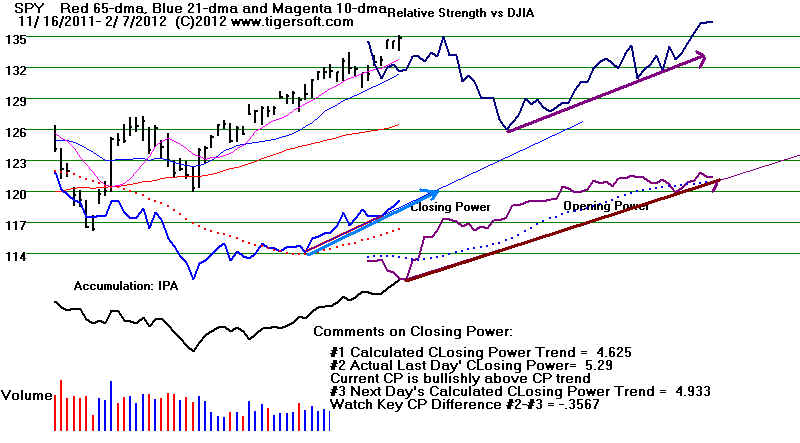

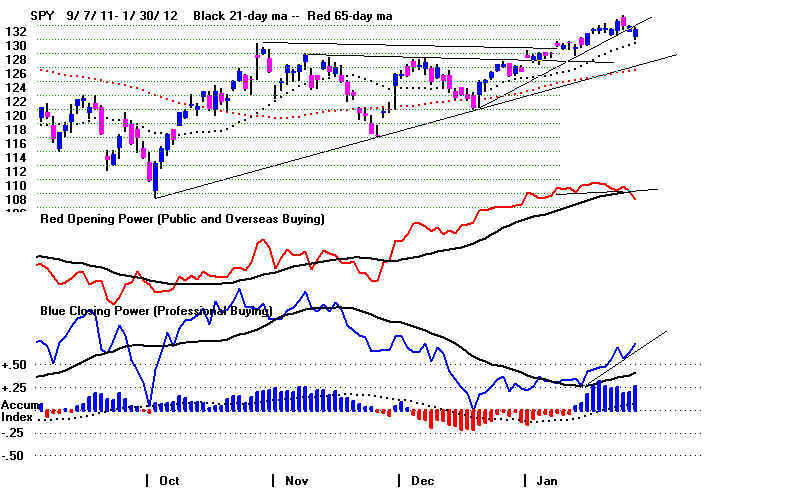

SPY's

CP's is uptrending. It would take a close of more than 0.21 below the

opening to break

the steeper CP uptrend. Opening

Power is back below its rising ma.

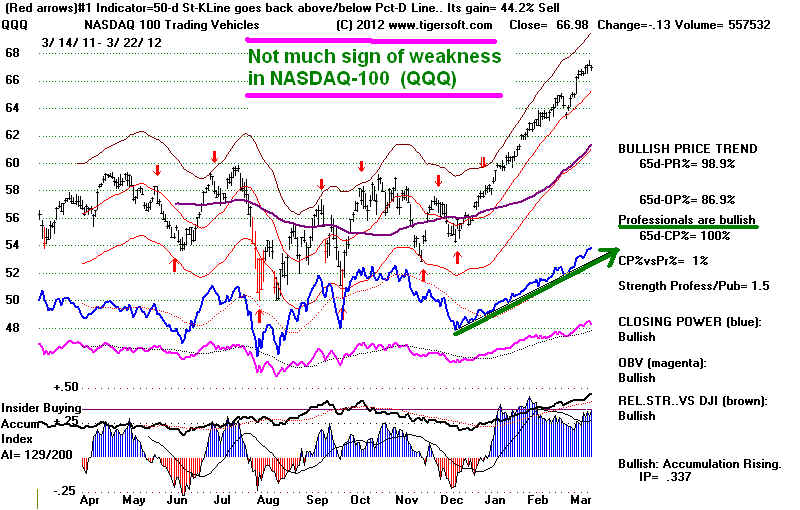

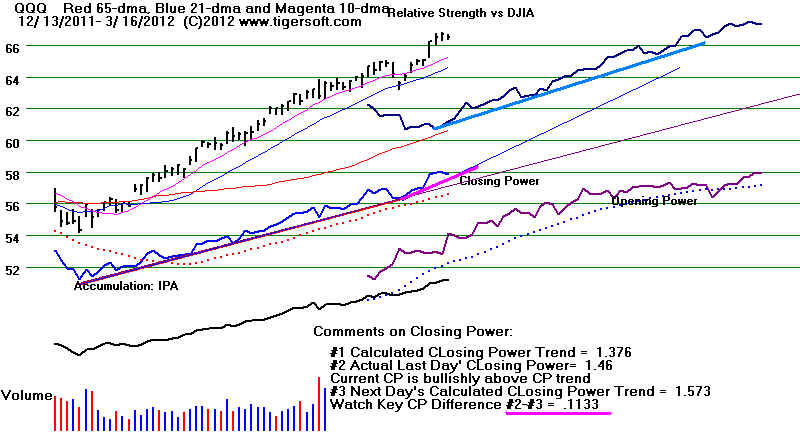

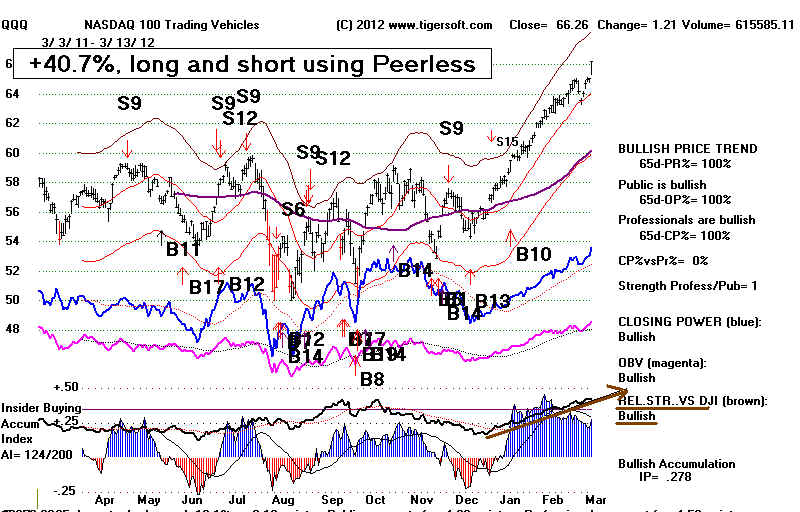

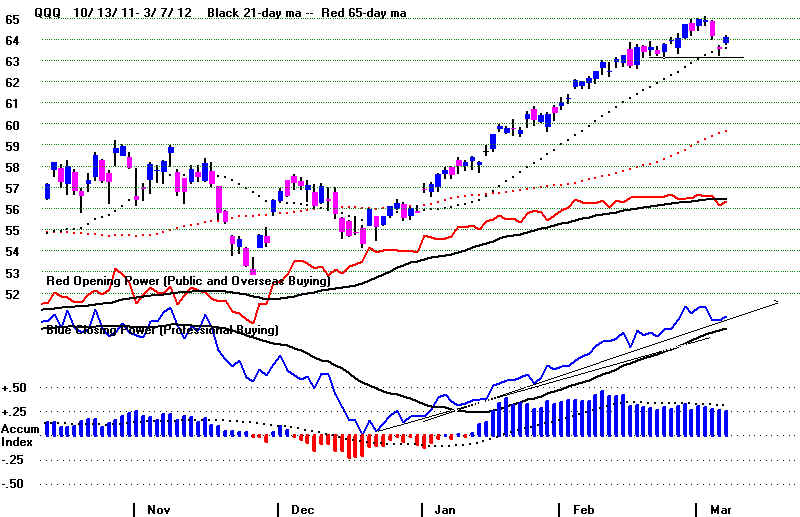

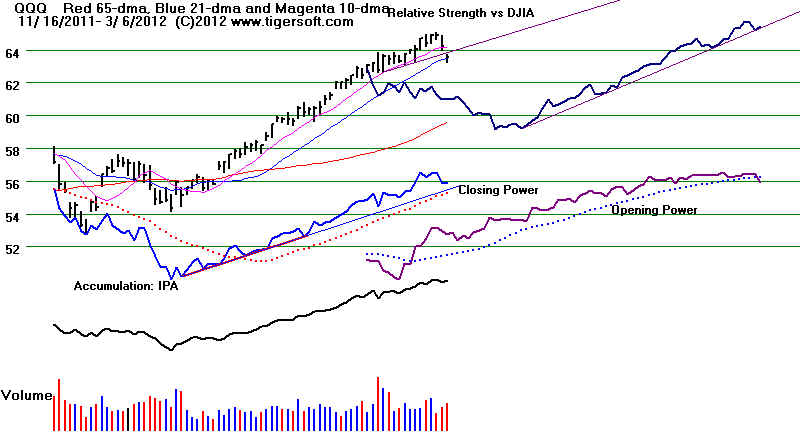

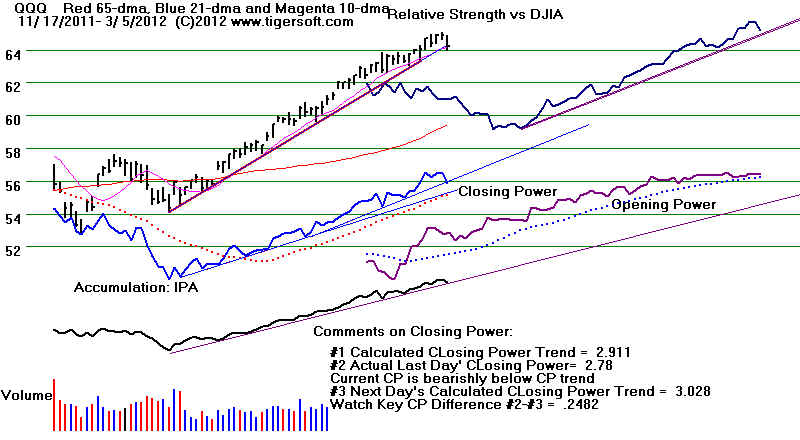

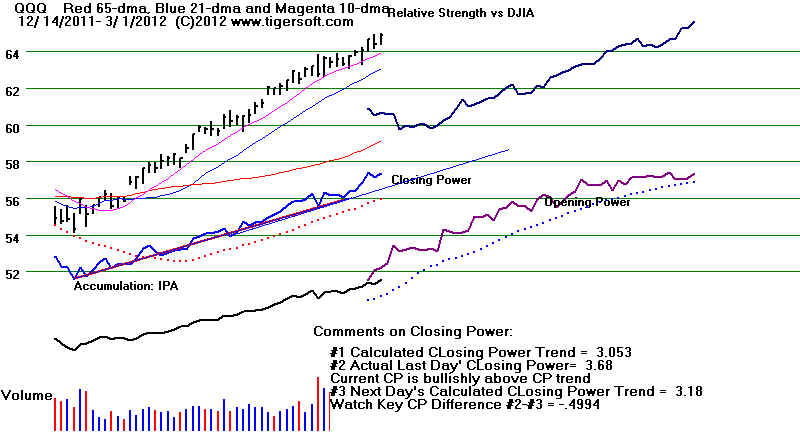

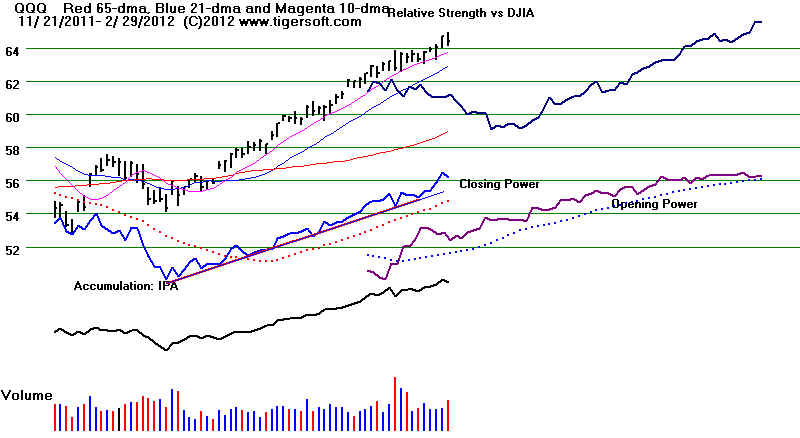

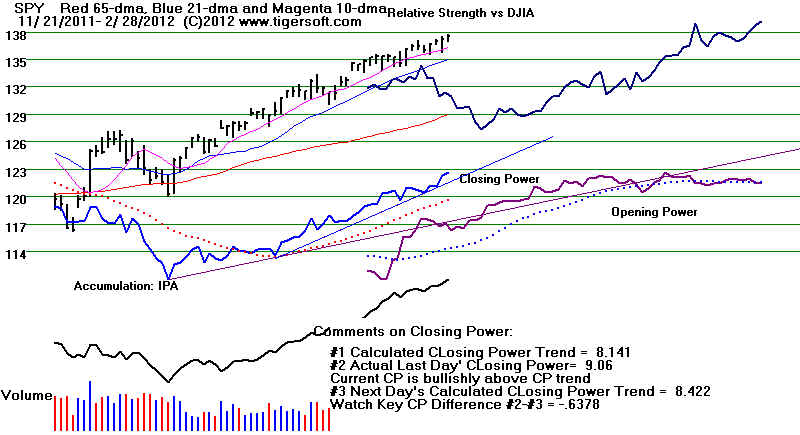

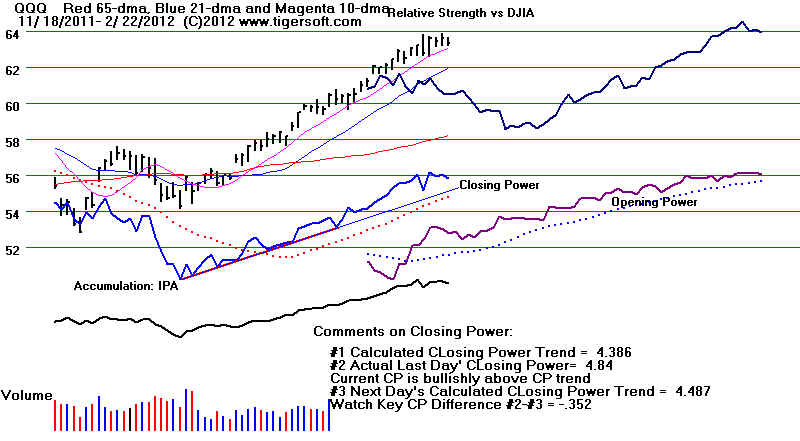

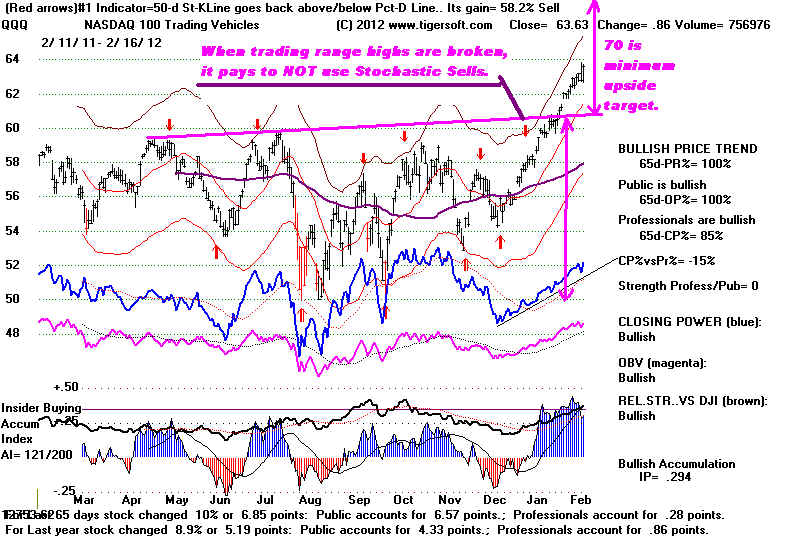

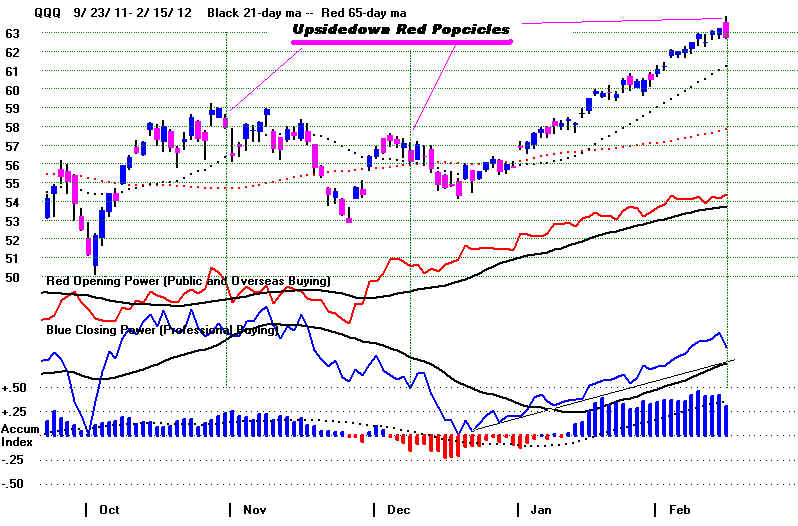

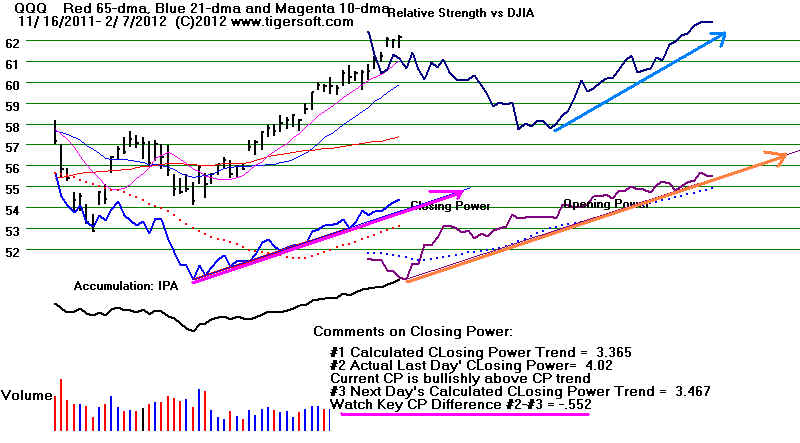

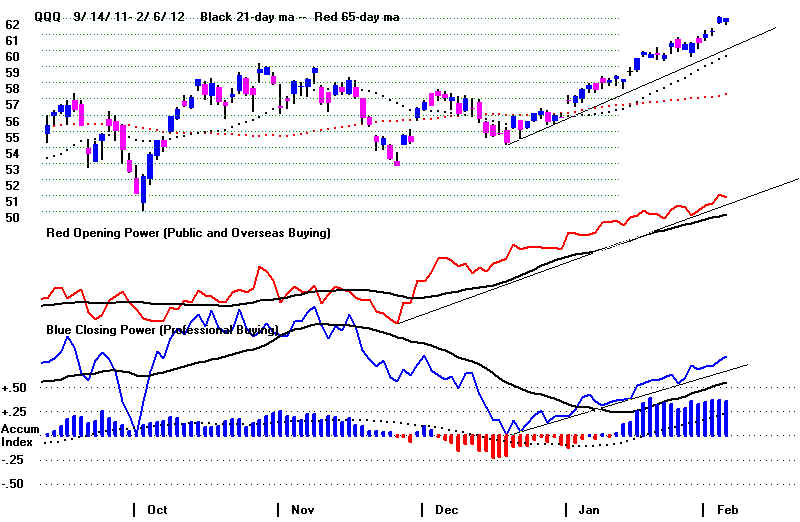

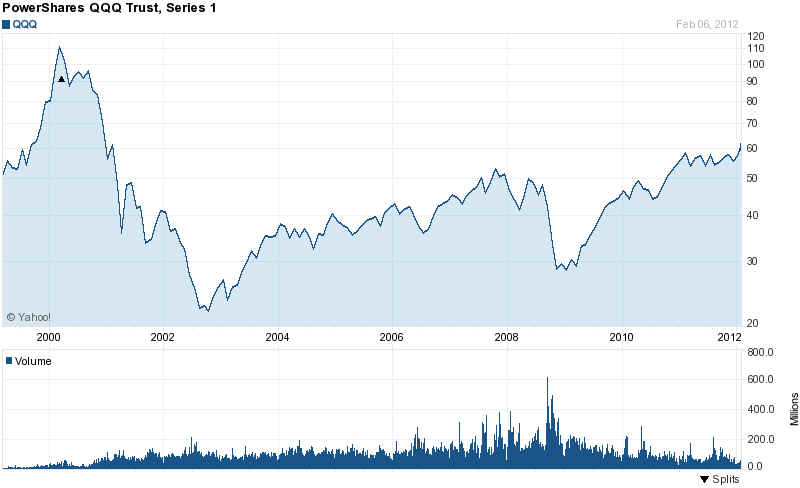

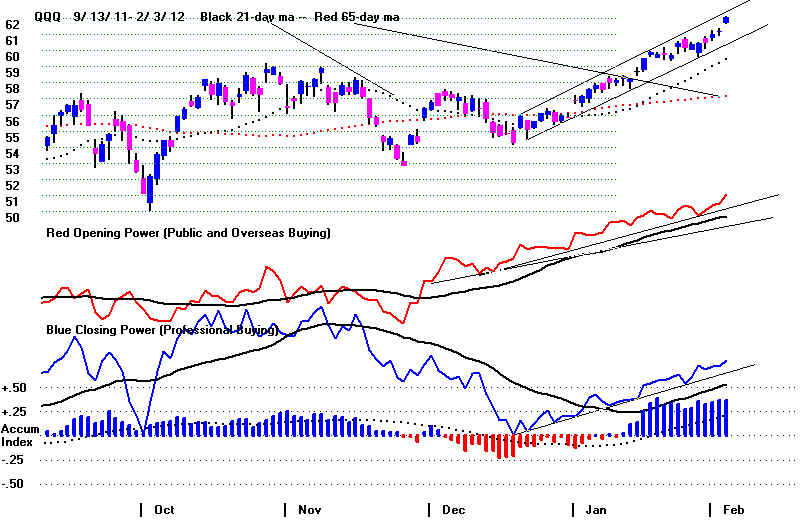

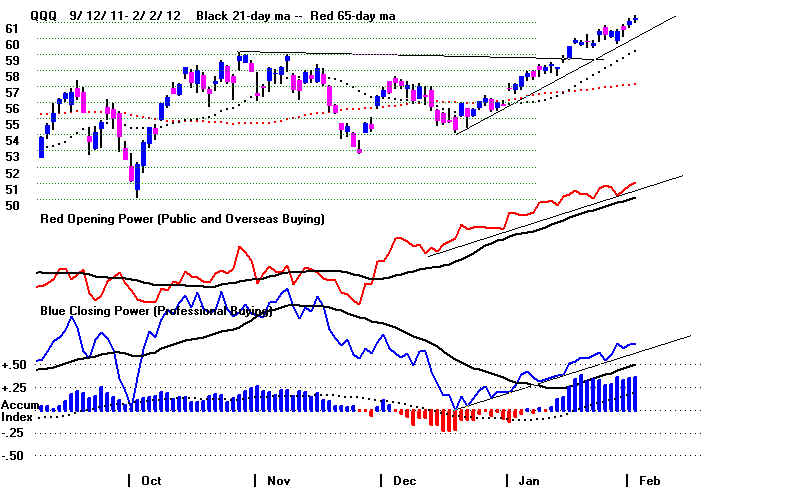

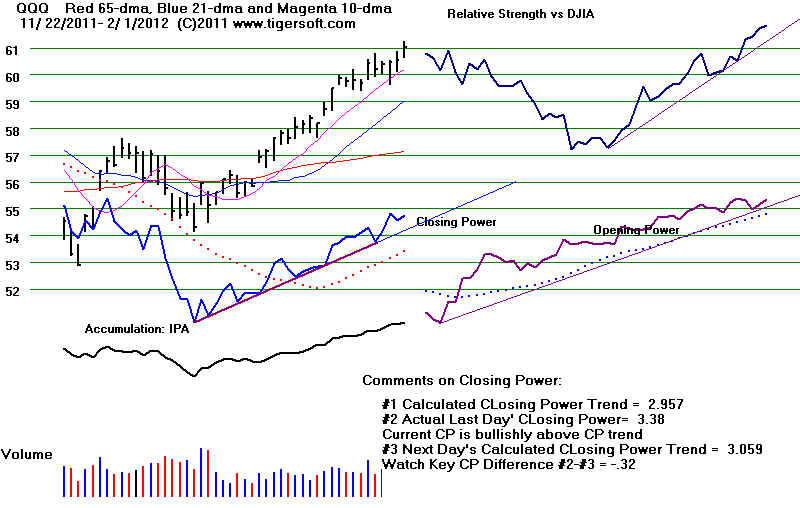

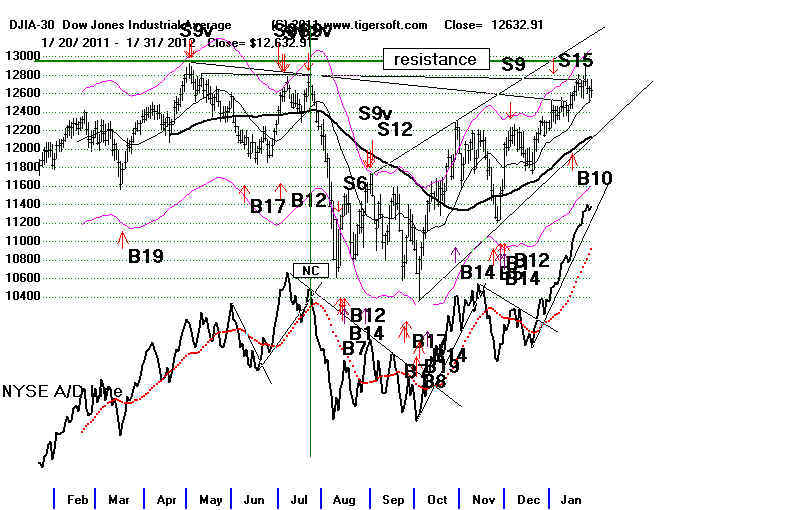

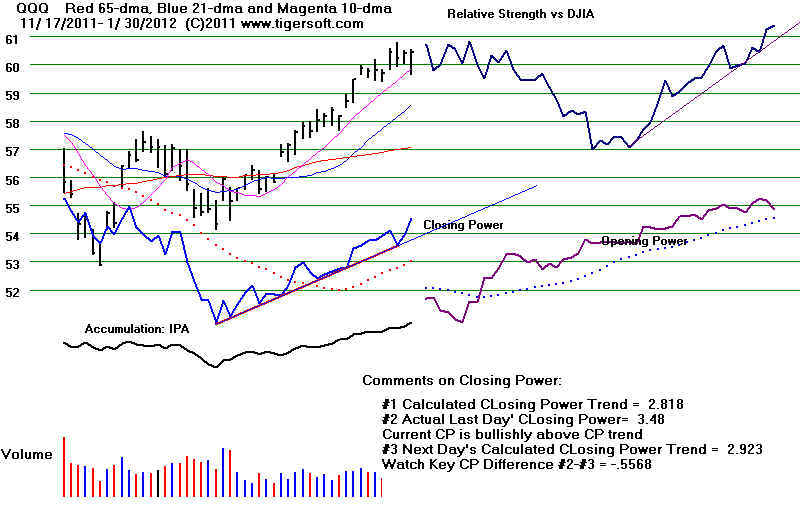

QQQ's CP is

uptrending. QQQ is much stronger than the DJI.

It will take a close of more than 0.11 BELOW the Opening to break the STEEPER CP UP-trendline.

Opening Power is uptrending. BOTH

Opening Power and Closing Power are RISING.

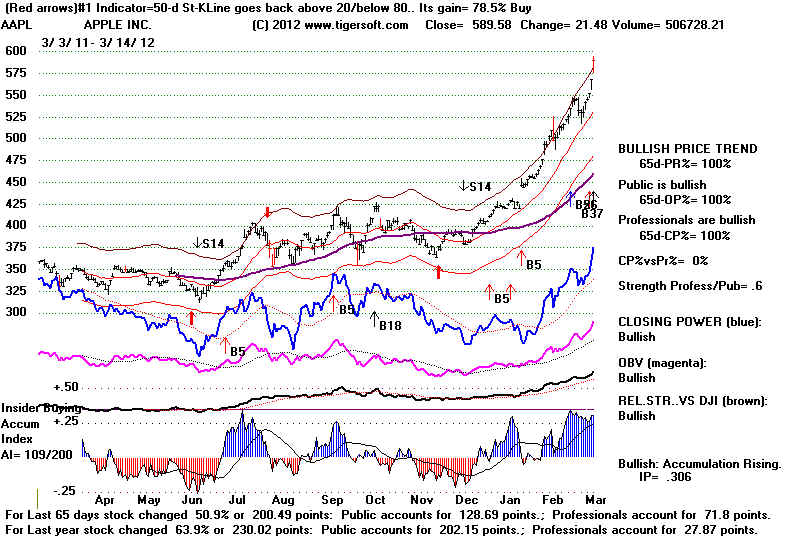

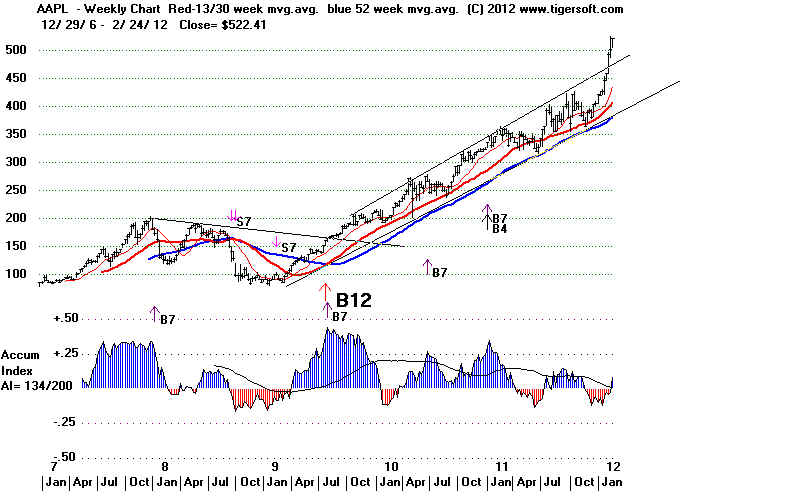

The QQQ is being boosted considerably by AAPL's

powerful advance.

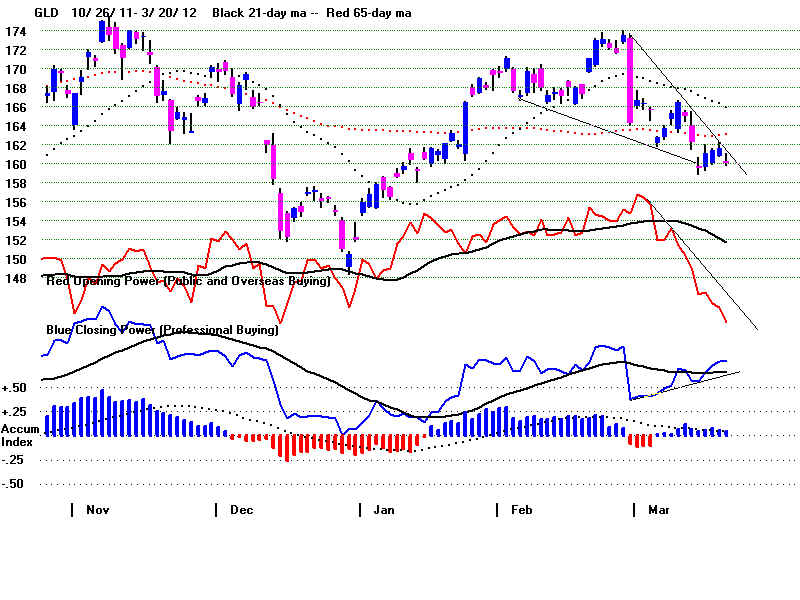

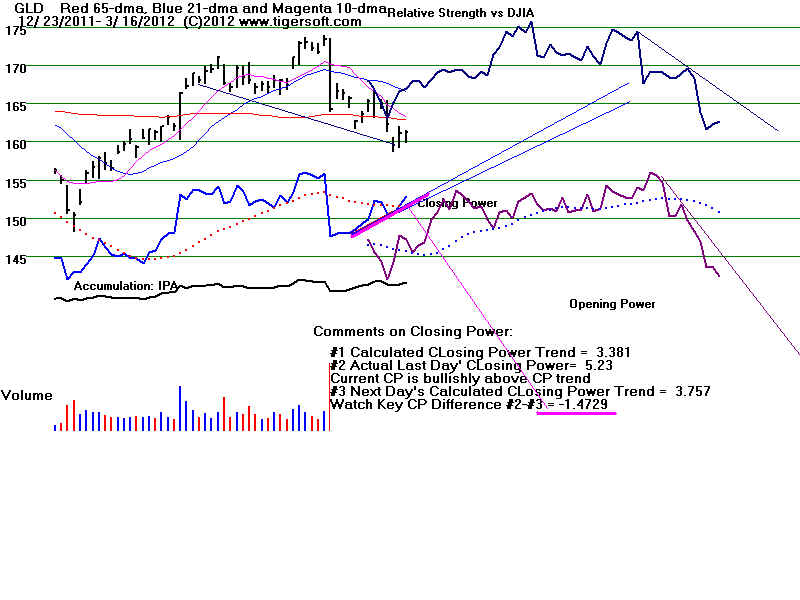

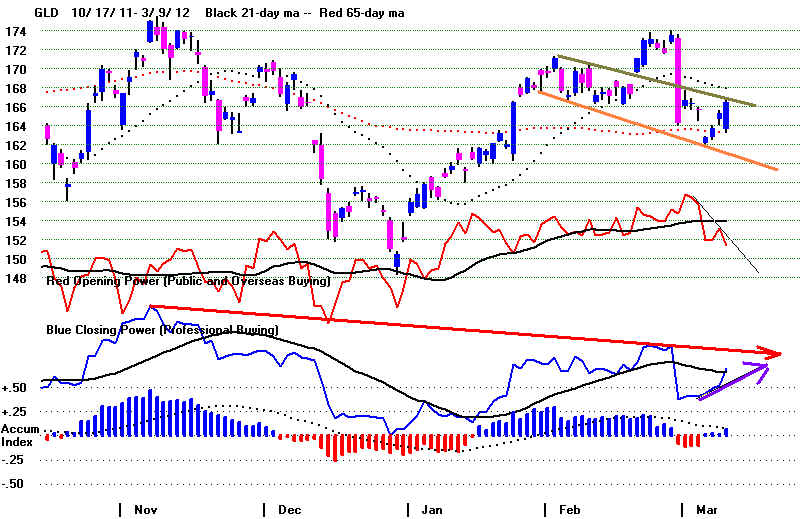

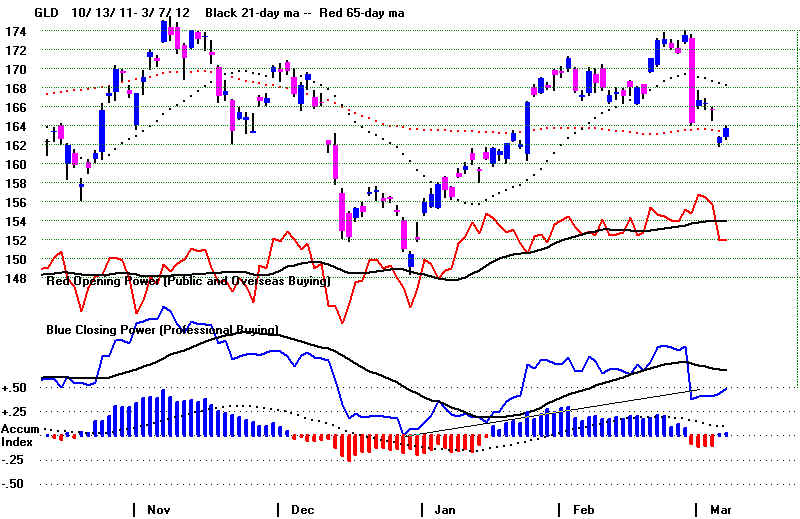

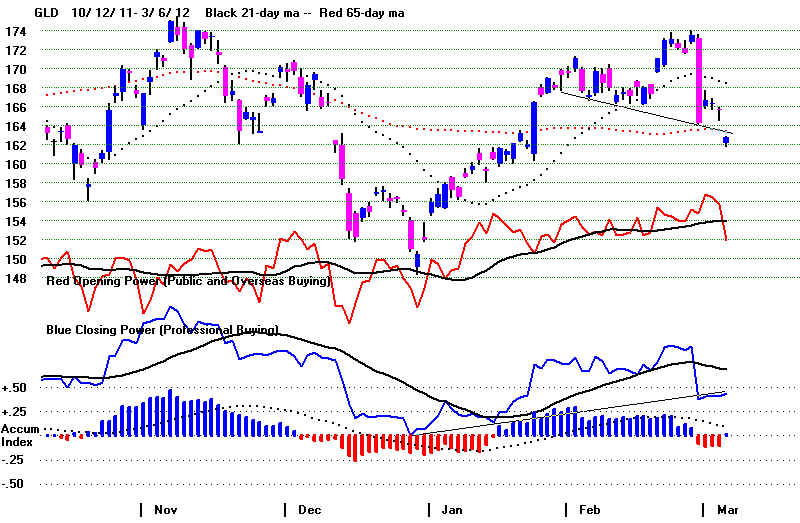

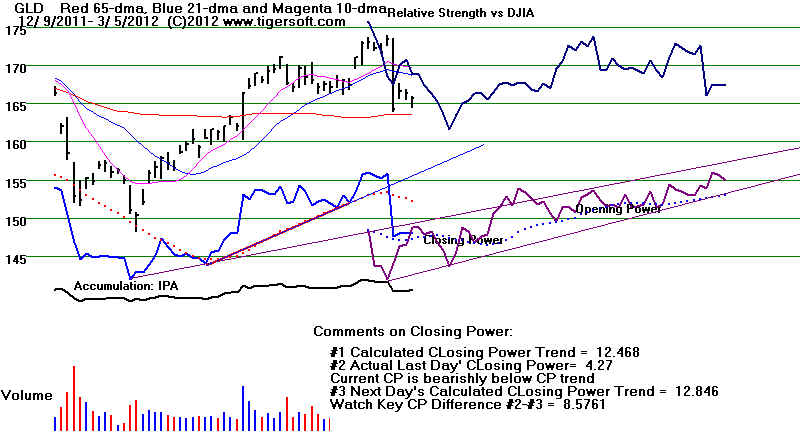

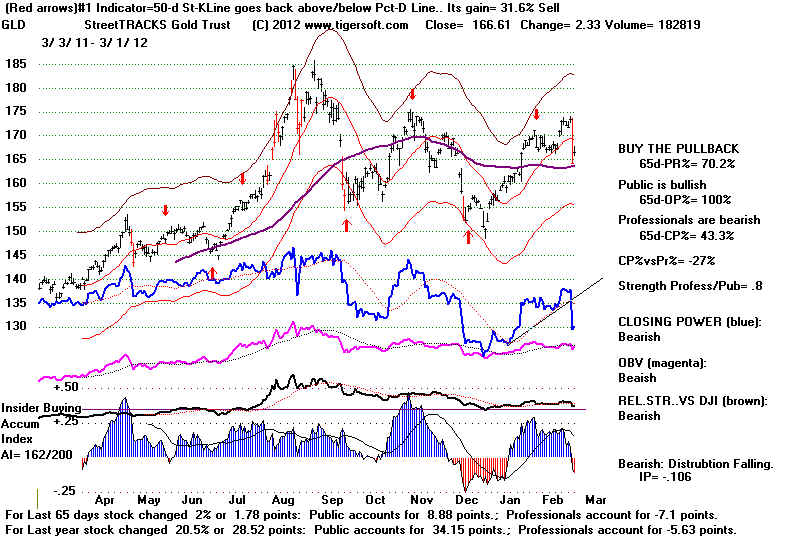

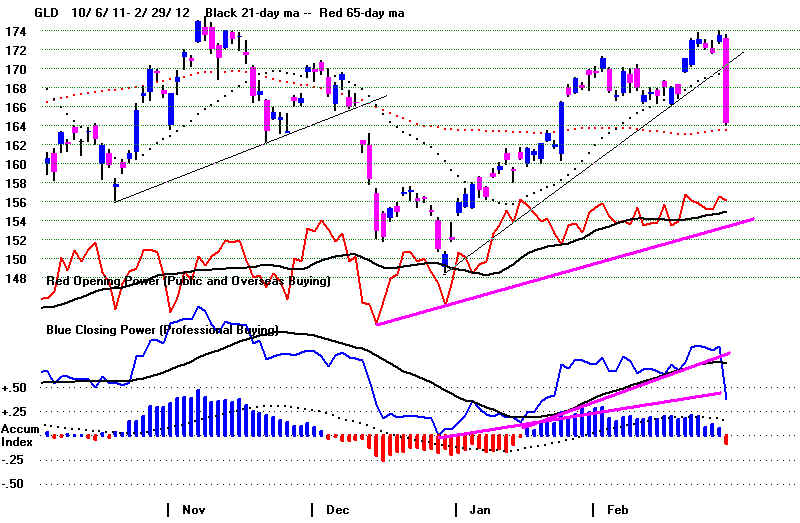

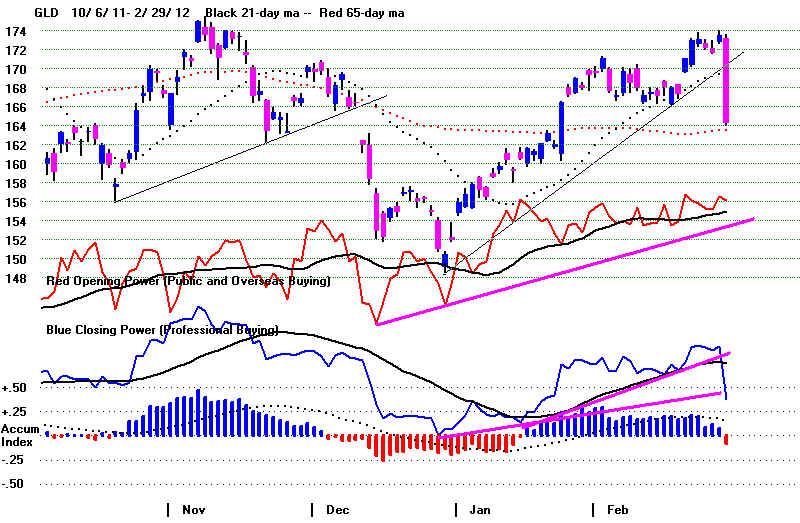

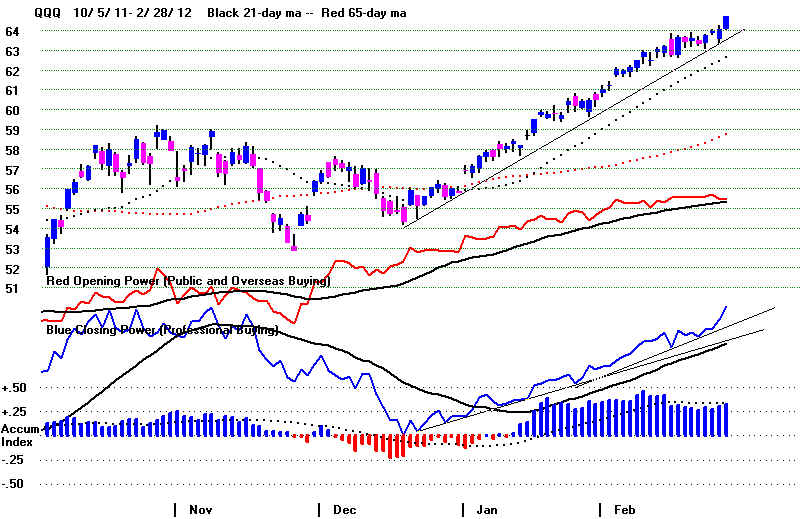

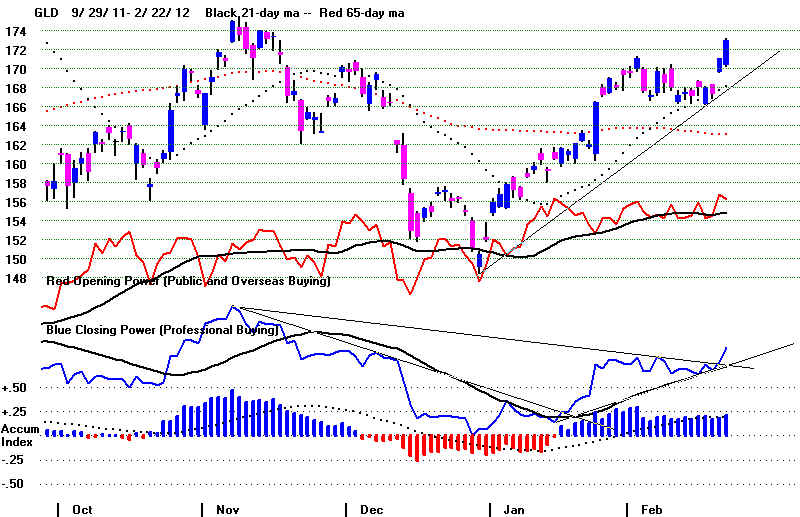

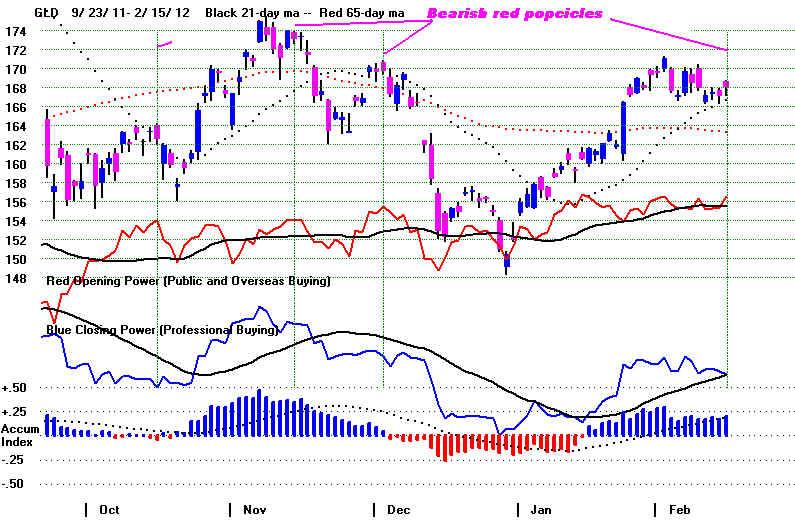

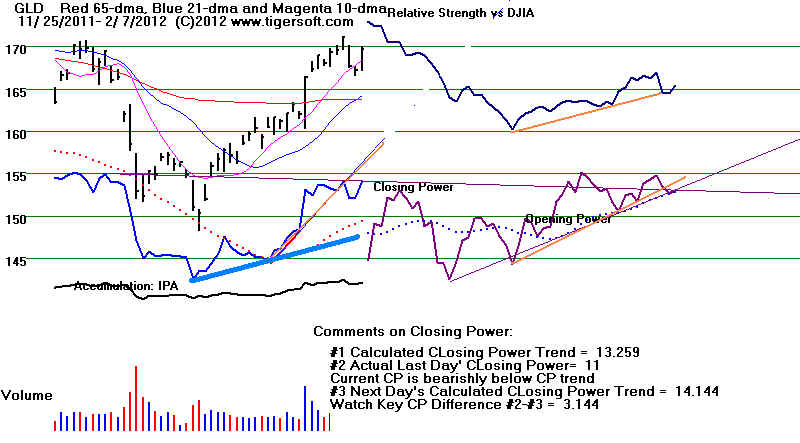

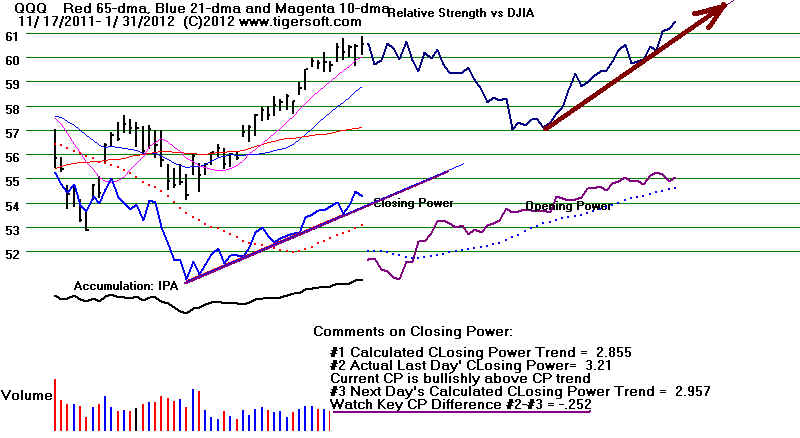

GLD's CP is above its

rising CP uptrend The less steep CP uptrendline is far below the current CP

. Its

Opening Power is falling. Note the bearish

head/shoulder price pattern, the price

downtrendline and the bullish Closing Power divergence Buy B7s.

===================================================================================

OLDER HOTLINES

===================================================================================

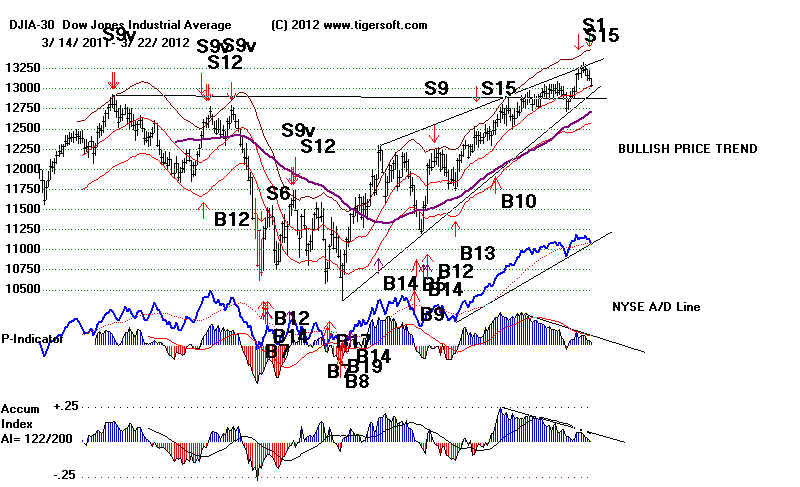

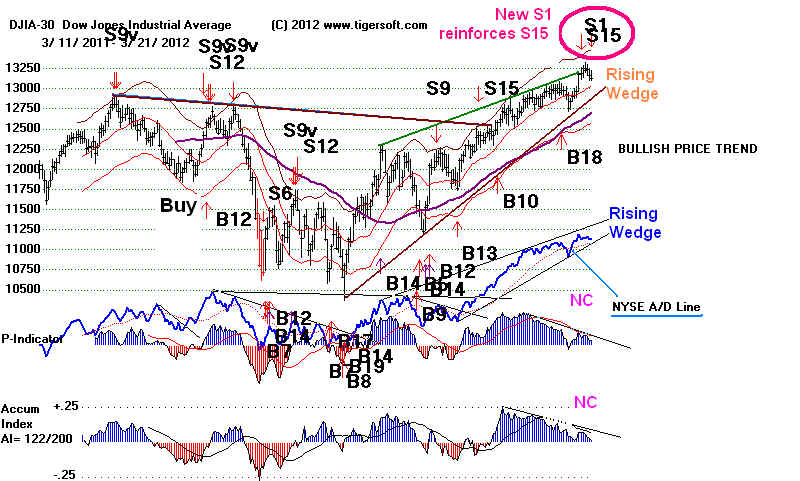

3/21/2011

Hotline

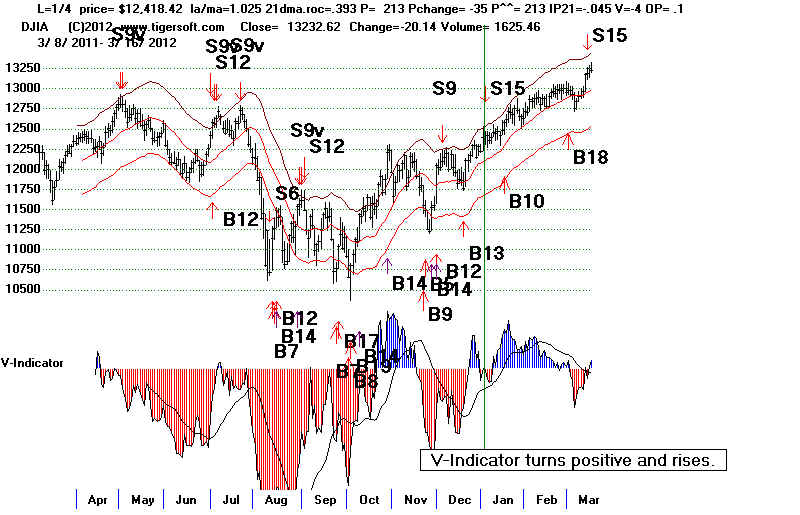

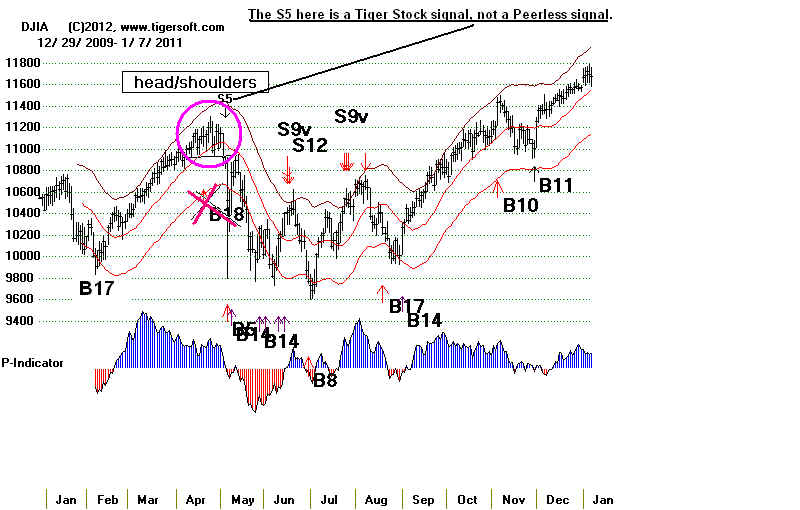

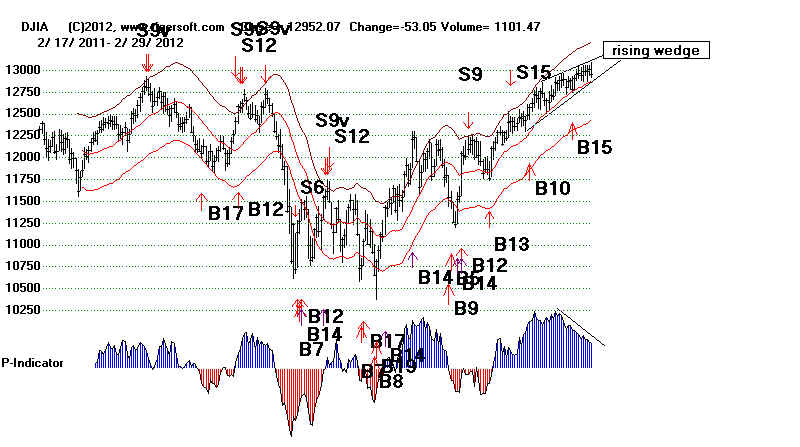

The DJI's weakness

brought a Peerless Sell S1. This occurs because the Stochastic-Pct-D

falls below 80 with accompanying internal weakness. This

signal can only take place in a

Presidential Election year. There have been 26 Sell S1s since

1928. 23 of the 26 would have

brought gains to the short seller who covered at the next

Peerless Buy signal. The average

gain was only +3.4%. See http://tigersoft.com/PeerInst-2012/-Sell-S1.htm

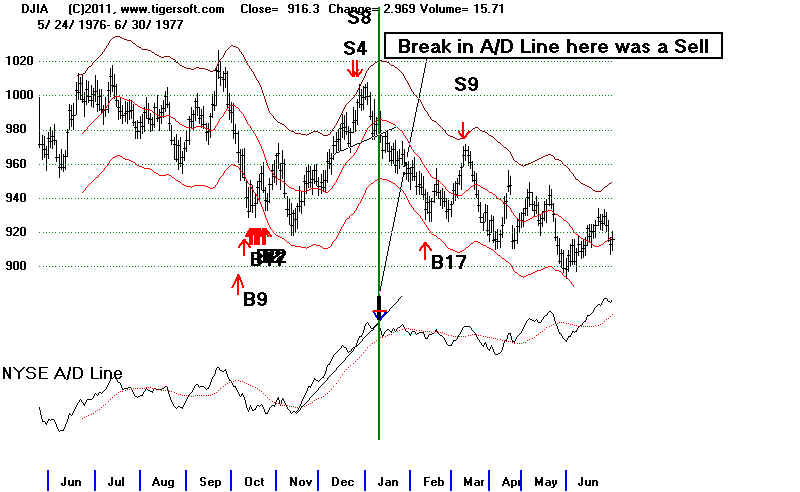

Below is the only Sell S1 in March.

3/11/1988

Gain = +2.8%

DJI

la/ms AnnROC P

IP21 Opct

2034.98 1.0

.428 160

.094 -.052

The DJI rallied to 2090

before falling to the lower band

and a Buy signal. 3% Paper Loss

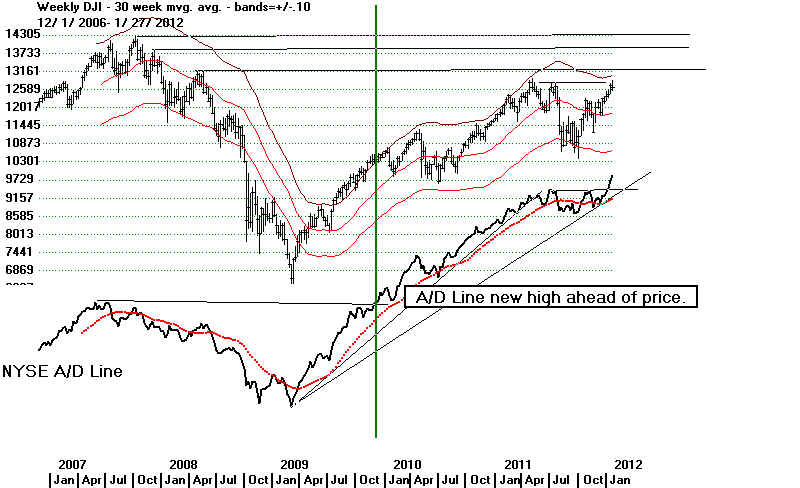

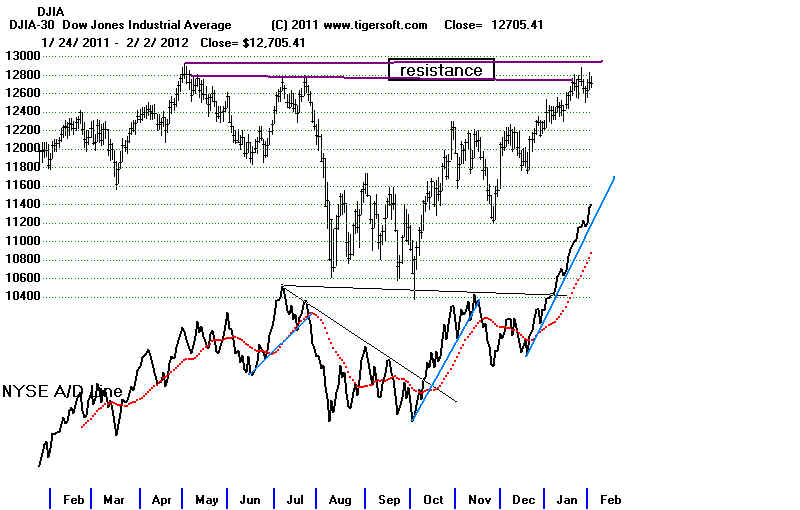

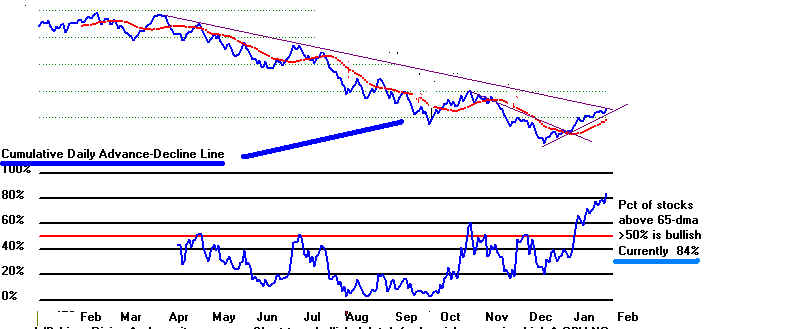

With the NYSE

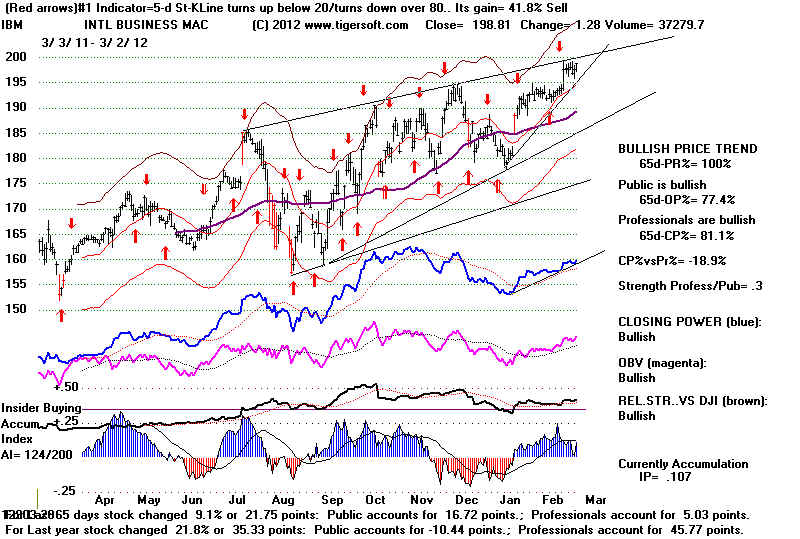

A/D Line still rising and the Closing Powers in uptrends, the market

still has a chance to rally again. A break in the rising

Closing Powers of IBM and AAPL

would certainly hurt the still strong tech sector. I

would stay hedged now. But

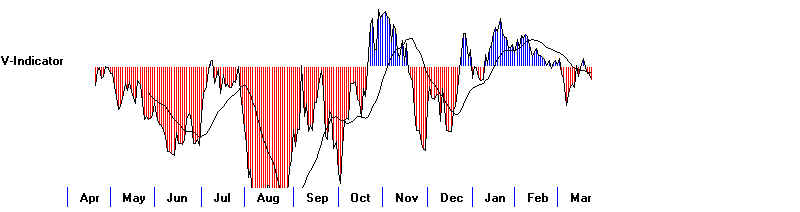

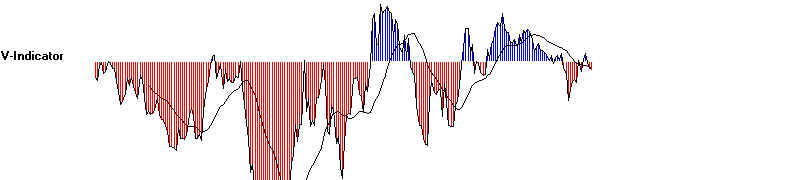

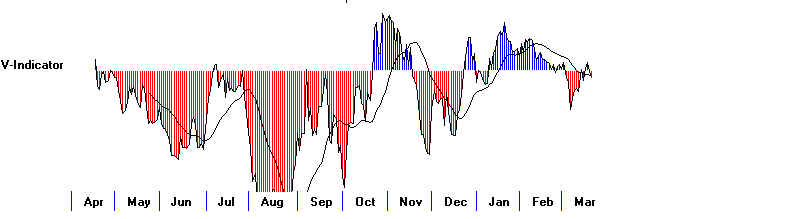

the new Peerless Sell signal and the negative V-Indicator

probably justifies shorting

DIA now. We

will probably get a new Buy signal at the rising 65-day around 13000. But that

cannot be assumed. If the DJI were to knife through it,

there would then be no Buy there.

The DJI's rising wedge pattern is bearish. So is the

head/shoulders in CAT, a leading

high priced DJI stock. Bearish head/shoulders patterns are

developing in EWZ

(Brazil ETF), FXI (China), Latin America (ILF), Instead of shortng DIA, these ETFs

might work out better because their chart patterns are also

bearish.

DJI 13125 la/ma = 1.008 21dmaROC=.145

P=97 P-Ch= -1 IP21=.011 (low) V= -19 OP= .004

BREADTH

STATISTICS:

Advance= 1492 Declines=1519 UpVol = 312.88 DownVol= 388.89

Key Stocks: AAPL and 4 highest priced DJI

stocks: IBM, CAT,

CVX, MCD and XOM

Watch CAT to see if

it completes its developing head/shoulders.

--->

177 (-38) MAXCP stocks

Bullish MAXCP Stocks Bullish.

---> 45 (+8 ) MINCP stocks Bearish MINCP

Stocks

MAXCP stocks are those showing Tiger Closing Power making new

highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

---> 57

new

highs on NASDAQ. 10 (-1) new lows on NASDAQ Bullish.

---> 31(+17 ) new

highs NYSE 9(+1) new lows on NYSE

3/21/2012 Consider Low Priced

High Accummulation speculations in

the third wave

general market advance since 2009. Trade these with the trend of the 21-day ma of

Closing Power

3/21/2012 KEY CHARTS OF INDUSTRY INDICES

DIA SPY

QQQ

DJIA-Peerless

TigerDJI TigerSPY TigerQQQ GLD SLV Crude Oil

IWM-Russell-2000

DIA' s CP

is uptrending It

would take a close of more than 0.68

below the opening to break the

longer term CP uptrend. The Opening Power

is flat. The DJI is caught

in another rising wedge

price pattern. These usually bring a downaisde break. .

SPY's

CP's is uptrending. It would take a close of more than 1.48 below the opening

to break

the longer term CP uptrend. Opening

Power is back below its rising ma.

QQQ's CP is

uptrending. QQQ is much stronger than the DJI.

It will take a close of more than 0.10 BELOW the Opening to break the STEEPER CP UP-trendline.

Opening Power is uptrending. BOTH

Opening Power and Closing Power are RISING.

The QQQ is being boosted considerably by AAPL's

powerful advance.

GLD's CP is above its

rising CP uptrend The less steep CP uptrendline is far below the current CP

. Its

Opening Power is falling. Note the bearish

head/shoulder price pattern and price

downtrendline.

===================================================================================

OLDER HOTLINES

===================================================================================

3/20/2011

DJI 13170 -69 la/ma = 1.012 21dmaROC=.202 P=98

P-Ch= -73 IP21=.026 (low) V= -15

OP= .088

BREADTH

STATISTICS:

Advance= 1000 Declines=2031 UpVol = 240.86 DownVol= 460.0

Key Stocks: AAPL and 4 highest priced DJI

stocks: IBM, CAT,

CVX, MCD and XOM

Hotline

Sell S15 -> DJI Sell Off to Lower

Band?

Russell-2000- IWM Flat-Topped Breakout

False?

AAPL's rocket keeps boosting the NASDAQ and QQQ.

There

have been 14 reversing S15s like the current signal. They averaged drops of 7.3%

in the DJI at the time of the

next reversing Peerless Buy. If a cluster of new major Sells

were to follow, such as S9s

or S12s, it would make the present Sell S15 more bearish.

Note that reversing S15s in a Presidential Election year averaged

only declines

of 3.3% at the time of the

next Peeless Buy. There were 6 cases.

All occurred between

January and April 14th, This

suggests that any DJI decline to the rising 65-day ma will

likely find very good support

and a new Buy from Peerless.

I

continue to think that secondary stocks showing high levels of Accumulation and

rising Closing Powers will do well

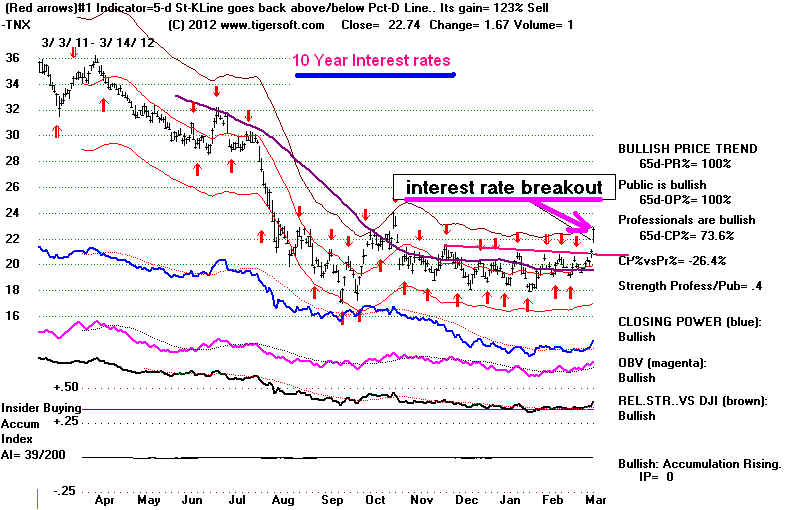

at this time. The rise in interest rates from such a

low level will have little effect

on them, unlike bonds. This is the third leg up since

the bottom in March 2009.

Such "legs" tend of bring big gains in many of the more

speculative and lower priced

stocks. Our Stocks' Hotline, accordingly, is hedged

and not short any of the major

market ETFs yet.

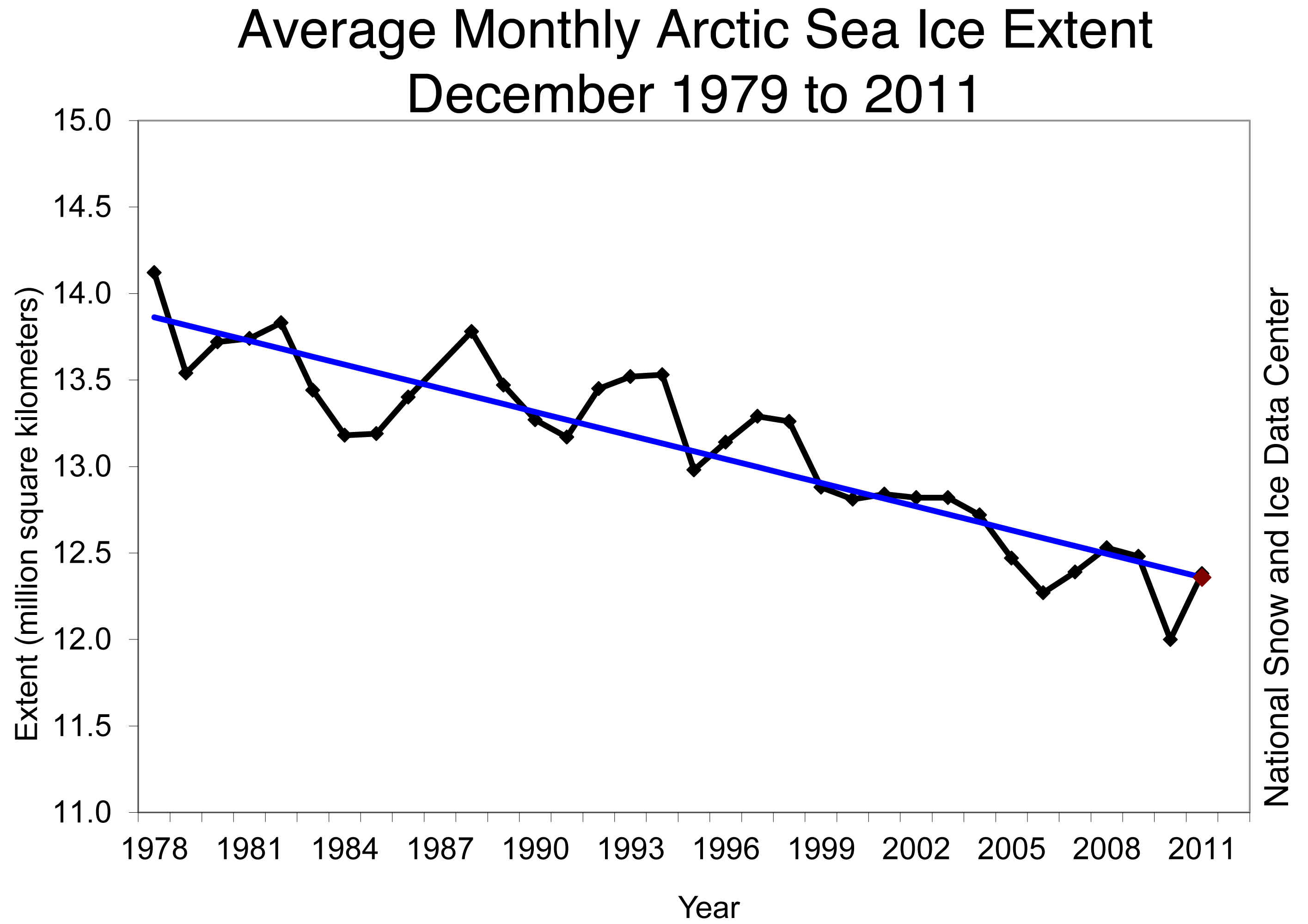

The recovery in Housing Stocks

is certainly bullish. So is the decline in Gold.

If inflation is seen as less of a

problem and there is an economic recovery, Gold

will drop much more. A

recovering economy, like in 1995-1996, would leave Gold

and SIlver far behind. My

sense is that they have made their moves and, for now,

they are not as attractive as low

priced stock special situations. .

With the NYSE A/D Line and ETFs' CLosing Powers still rising it is

probably rash to call a top

just now in the general market.

Sell S15s by themselves can be a 1% to 5% premature. An

additional Peerless Sell signal based on

greater Accum. Index and P-Indicator divergences

(i.e. S12s and S9s) are sometimes needed.

I pointed this out a few days ago. Below are the

cases where the S15s were premature and

there was sometimes a paper loss because the DJI

did not reverse until there were other

Peerless Sell signals. The biggest such loss was

back in 1936, 5.1%, also early in a

Presidential Election year and at a time of recovery

from a Depression and extemely high

unemployment.

As our Sell S15 here occurred with the

DJI at 13194, we could assume that there is

a slight possibility of the DJI rallying

another 5% more before turning down. That would

mean it would reach 13750.

Much more commonly, there is little additional rally by the

DJI after a Sell S15, but it does take a

week or so for the market to turn down. The

V-Indicator has moved into more deeply

negative territory. This is associated with a DJI

which will not make much more of an

advance. We should, though, keep watching the

highest priced DJI-30 stocks for clues.

CAT seems to be forming a bearish H/S pattern.

Only IBM has made a sustained price

breakout on this advance.

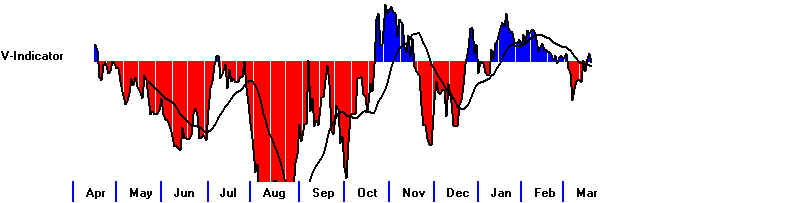

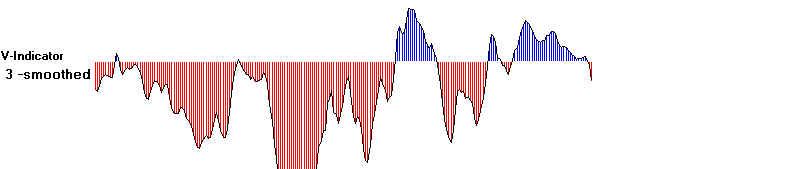

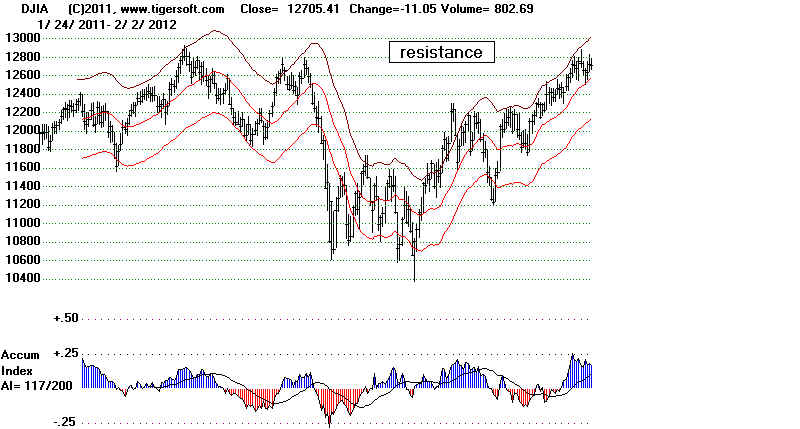

See how V-Indicator has turned more deeply negative.

Reversing S15s, Paper Losses,

Subsequent Peerless Sells and Only Then a DJI Decline/

^ = Reversing Sell.

S15s

Next Reversing Sell Signal

Date

DJI

la/ma ann

roc. P-I P-ch AI V-I

OPct Date

DJI Gain

Signal

------------------------------------------------------------------------------------------------------------------------

^2/18/36 153.4

1.029 .608 57

17 .016 -28 .18

5/5/36

148.6 +3.1.%

B2

This was first of a cluster of Peerless Sells. DJI rallied to

160.90 on 4/7/1936 before falling below lower band and reaching 143.70 on

4/29/1936. Paper loss = 7.9/153.4 =

5.1%

V-Indicator went more deeply negative on the rally.

^2/10/37

189.4 1.019

.391 -10

12 .034 -202 .116

2/10/37 189.4 +12.6% B8

This was first of a cluster of Peerless Sells. DJI rallied

to 194.40 on 3/10/1937 before falling below lower band and reaching 143.70 on

4/29/1936. Paper loss = 5/189.4 = 2.6%

V-Indicator went more deeply negative on the rally.

^4/6/72 959.44

1.02 .159

-70 15 .036

-1

.086 7/18/72

911.72 +5.0% B2

An Sell S9 occurred a week later. After S9, the DJI fell

immediately to the lower band. .

Paper loss = 0

The V-Indicatator turned positive for only one day and then fell more

deeply negative,

^1/5/1973 1047.49

1.023 .238

-77 -7 .039

-2 .053 2/26/73 953.79 + 8.9%

B16

A Sell S9 quickly followed. The DJI then started a, 23

month long bear market.

Paper loss = 0

The V-Indicator went more deeply negative

^1/2/90

2810.15 1.028 .453

50 30

.108 -1

.02 1/22/90 2600.45

+7.5% B5

DJI fell immediately below to the lower band. An S4 occurred the

next day.

Paper loss = 0

The V-Indicator turned more deeply negative.

See the definition and

research on this B15 signal.

--->

215 (-1) MAXCP stocks Bullish MAXCP Stocks Bullish.

---> 37 (-21 ) MINCP stocks Bearish MINCP

Stocks

MAXCP stocks are those showing Tiger Closing Power making new

highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

---> 33 (-74) new

highs on NASDAQ. 11 (+1) new lows on NASDAQ Bullish.

---> 14(-41 ) new

highs NYSE 8(+4) new lows on NYSE

3/20/2012 Consider Low Priced

High Accummulation speculations in

the third wave

general market advance since 2009. Trade these with the trend of the 21-day ma of

Closing Power

3/20/2012 KEY CHARTS OF INDUSTRY INDICES

DIA SPY

QQQ

DJIA-Peerless

TigerDJI TigerSPY TigerQQQ GLD SLV Crude Oil

IWM-Russell-2000

DIA' s CP is uptrending It would

take a close of more than 1.57 below the opening to break the

longer term CP uptrend. The Opening Power

is flat. The DJI is caught

in another rising wedge

price pattern. These usually bring a downaisde break. .

SPY's CP's is uptrending.

It would take a close of more than 0.57 below the

opening to break

the steeper

CP uptrend. Opening Power is back below its rising ma. Accumulation is at a level

high enough to

indicate good support.

QQQ's CP is uptrending. QQQ

is much stronger than the DJI.

It will

take a close of more than 0.21 BELOW the Opening to break the STEEPER CP

UP-trendline.

Opening

Power is uptrending. BOTH Opening Power and Closing Power are RISING.

The QQQ is being

boosted considerably by AAPL's powerful advance.

GLD's CP is above its

rising CP uptrend The less steep CP uptrendline is far below the current CP

. Its Opening Power is falling.

Note the bearish head/shoulder price pattern and price

downtrendline.

=====================================================================================

OLDER HOTLINES

=====================================================================================

3/19/2011 Hotline

Sell S15 DJI Sell Off to Lower Band?

Russell-2000- IWM Flat-Topped

Breakout?

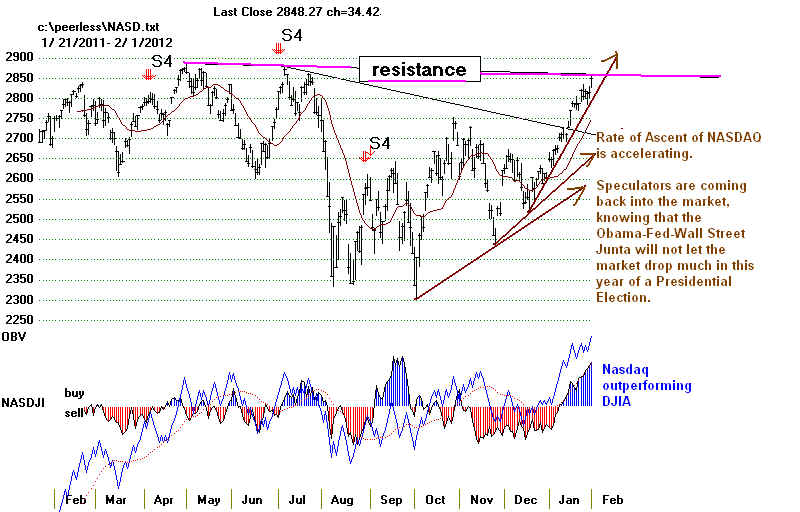

AAPL's rocket is boosting the NASDAQ.

But IBM was down today, Down Volume was high

and IWM sold off from its highs. Stay hedged.

DJI

13239+7 la/ma = 1.018 21dmaROC=.307 P=170 P-Ch= -35

IP21=.033 (low) V= -2

OP= .189

BREADTH STATISTICS: Advance= 1907 Declines=1109 UpVol = 391.99 DownVol= 319.57

--->

216 (+55) MAXCP stocks Bullish MAXCP Stocks Bullish.

---> 58 (+24 ) MINCP stocks Bearish MINCP

Stocks

MAXCP stocks are those showing Tiger Closing Power making new

highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

---> 105 (+32)

new

highs on NASDAQ. 10 (-1) new lows on NASDAQ Bullish.

---> 55(+19 ) new

highs NYSE 4(-2) new lows on NYSE

3/19/2012 Consider Low Priced

High Accummulation speculations in

the third wave

general market advance since 2009. Trade these with the trend of the 21-day ma of

Closing Power

3/19/2012 KEY CHARTS OF INDUSTRY INDICES

DIA SPY

QQQ

DJIA-Peerless

TigerDJI TigerSPY TigerQQQ GLD SLV Crude Oil

IWM-Russell-2000

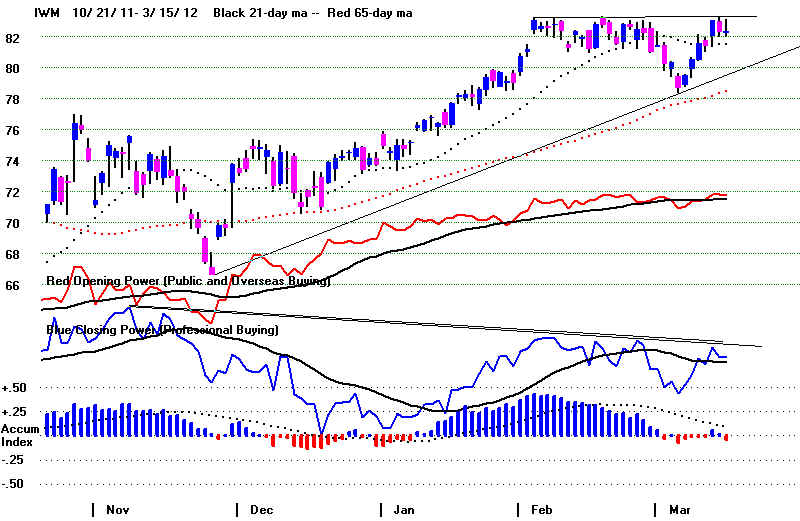

HOTLINE See below that the Russell-2000

ETF (IWM) has moved above

its resistance line. At this time, too, the NYSE A/D

Line and Closing

Powers for the major market ETFs are all rising. It

is also hard now to

find good short sales among the bearish MINCP stocks.

That puts

the bearish Sell S15 in a largely isolated technical

position, except that

bonds and utilities have weakened as interest

rates have risen

from their extremely low levels. Our stocks'

Hotline is hedged,

as we wait for either a more decisive breakout or a market

pullback.

Sell S15 -

research on this signal and charts of earlier cases

"The V-Indicator Should Not Turn Positive

for More Than A Few Days"

======================================================================================

OLDER HOTLINES

======================================================================================

3/16/2011 Hotline

What's Next?

Sell S15 DJI Sell Off to Lower Band?

Russell-2000- IWM Flat-Topped Breakout?

Selective Mild Decline in Bonds and Dividend Stocks

on NYSE?

All of the above?

3/16/2011 DJI

13293 -20 la/ma = 1.019 21dmaROC=.415 P=205 P-Ch= 8

IP21=.055 V=19 OP= .189

BREADTH STATISTICS: Advance= 1391 Declines=1657 UpVol = 897.44 DownVol= 728.06

--->

161 (+30) MAXCP stocks Bullish MAXCP Stocks Bullish.

---> 34 (+6 ) MINCP stocks Bearish MINCP

Stocks

MAXCP stocks are those showing Tiger Closing Power making new

highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

---> 72 (+7)

new

highs on NASDAQ. 11 (+8) new lows on NASDAQ Bullish.

---> 36(-54 ) new

highs NYSE 6(+2) new lows on NYSE

3/16/2012 Consider Low Priced

High Accummulation speculations in

the third wave

general market advance since 2009. Trade these with the trend of the 21-day ma of

Closing Power

3/16/2012

KEY CHARTS OF INDISTRY INDICES

DIA SPY

QQQ

DJIA-Peerless

TigerDJI TigerSPY TigerQQQ GLD SLV Crude Oil

IWM-Russell-2000

HOTLINE

Sell S15 -

research on this signal and charts of earlier cases

"The V-Indicator Should Not Turn Positive

for More Than A Few Days"

"Usually after an S15, the

V-Indicator stays negative and falls more deeply so

after the Sell S15. See the tables

and charts at the bottom of this

page. The V-Indicator

can sometimes turn positive for a

few days. When it turns positive for a week,

as in 1992 and 2008, if there is no

Peerless Buy signal, consider the DJI decline delayed

and about to start in earnest as

soon as the V-Indicator turns negative again. On the

other hand, if it turns positive

and keeps rising for more than a week, I would suggest

doubting the Sell S15 and waiting

for new signal. This occurred in January 2012 and

may be occurring again in March

2012."

V-Indicator has just turned positive.

I have not yet suggested selling

short any of the major market ETFs.

The rising Closing Powers and

rising NYSE A/D Line leave the Sell S15

"unclinched". The

now positive and rising V-Indicator is a warning, too.

DJI is up 23% since its October

low. The momentum and

internal strength indicators have

been weakening, but they are

not yet negative. The recent

bulges of Accumulation suggest the ETFs

are in strong hands. So,

any decline will find good support at the

rising 65-day ma. APPL's

weakness on a Friday is not a good

indication it has peaked.

Meanwhile, IBM is advancing steadily

and the oil stocks in the DJI-30

(XOM and CVX) may still make

breakouts above their well-tested

flat resistance. It is from secondary

stocks that I would expect the

biggest move if IWM breaks out above 84.

The current advance represents the

3rd wave up since the bottom in March 2009.

This often send a lot of hot money

into the "cats and dogs", low priced

and technology stocks. 1968

and 1999-2000 are the two best examples.

Watch closely IWM, the Russell-2000. It closed at

83. It will not take much of an advance to

bring a flat-topped breakout.

These breakouts are usually reliable, because the selling has been

done too simply and lazily done.

If there is a breakout, everyone sees the breakout. A diagonal

trane-break is harder to see.

Be very careful with any short sales that get past their 21-day ma if

this breakout takes place.

They are apt to rally 10% higher, at least. I would suggest putting

asside the Sell S15 for the time

being if there is such a closing breakout if you are trading secondary

stocks. I would expect

Professionals to jump aboard and bring a much higher closing. That would

mean breakout also in the long

Closing Power resistance lines. This has not happened yet.

But it looks like it will, despite

the frequency with which March brings tops in the DJI in a Presidential

Election year.

It is the dividend paying stocks

that are in most trrouble right now, as interest rates rise.

See how weak the Utilities and

Bonds have been.

March Tops

have been much more frequent than March Advances in a Presidential Election Year

since 1916. In this period,

there have been only 6 advances by the DJI in March in a Presidential

Election year. By contrast,

in 16 instances since 1916 the DJI or the A/D Line peaked or fell in

March. In 6 of these it fell

below the lower band.

March

and DJI:1886-2012

UP DOWN

-------------------------------------------------------------------------------

1888

down

1892

DJI peak on 3/4/1892

1896

DJI peak on 3/4/1896

1900 up

down first half of month.

1904 up

down first half of month.

1908 up

1912 up

-------------------------------------------------------------------------------

1916

DJI peak and decline to LB

(lower band)

1920

DJI decline and decline

below LB and bear market.

1924 -

DJI peak and decline to LB

1928 - up

1932 -

down steeply and DJI fall far beloe lower band.

1936 -

DJI peak - 3/6/36...decline to

LB and back up

1940 - flat

1944

DJI peak 3/13/1944...decline to

LB

1948 - up

1952 -

DJI peak 3/31/1951 top

...decline to LB

1956 -

3/23/ A/D top. DJI peaked

4/9 and fell below LB.

1960 -

3/24/ A/D top. DJI peaked

4/16 and fell below LB.

1964 - up (4/6

peak in A/D Line. DJI peaked on 5/8 and almost to LB

1968 - up

1972 -

3/6 peak in A/D Line.

DJI peaked on 4/17 and fell to LB

1976 -

DJI - 3/24 peak. DJI fell

to lower band.

1980 -

breakdown below H/D neckine and decline below LB

1984 -

DJI 3/16 peak - DJI fell to LB

1988 -

DJI 3/17 peak - DJI fell to LB.

1992 -

DJI 3/4/ peak - DJI fell nearly

to LB

1996 -

DJI 3/18 peak - DJI fell to LB

2004 - up

2008 - up

2012

KEY

ETFS - 3/15/2012

DIA' s CP and Opening Power are Both uptrending

BOTH RISING.

Any close of more than 0 below

the opening will break the steeper CP uptrend.

SPY's CP's is uptrending.

It would take a close of more than 0.47 below the

opening to bring

a break in the less steep CP uptrend. Opening Power is back above its rising

ma. BOTH RISING.

QQQ's Steeper CP is uptrending. QQQ

is much stronger than the DJI.

It will take a close of more than 0.12

BELOW the Opening to break the

STEEPERCP UP-trendline.

Opening Power is uptrending. BOTH RISING.

GLD's CP broke its steeper

rising CP uptrend The less steep CP uptrendline is far below

Its Opening Power is falling.

BOTH RISING. A clos emore than

1.48 below the Opening will

break

the newest CP uptrendline. Note the bearish head/shoulder price pattern

================================================================

================================================================

OLDER HOTLINES

================================================================

3/15/2012

DJI= 13253 la/ma = 1.022

21dmaROC= +.344 P=+196

(+67) IP21=.071

V= +5 OP= .235

New: 5 Highest Priced DJI Stocks have the most weight in DJI-30 we track/trade with

Peerless

IBM running CAT potential H/S CVX

failed at 111 resistance

XOM potential H/S MCD below 65-dma

plus AAPL running

but -4 today.

BREADTH

New Highs New Lows

NASDAQ 73

13

bullish

plurality

NYSE

70

5 bullish plurality

MAXCP Stocks = 206 (-17)

MINCP Stocks =94 (+6) Bullish pluralitu

of MAXCP>MINCP

3/15/2012 Consider

buying Bullish MAXCPs on confirmed price breakouts and CP

hooks back up

3/15/2012 Consider

shorting Bearish MINCPS as hedges

when CP makes new lows ahead of price

and breaks CP support. Coal stocks are showing unusual weakness.

3/15/2012 Consider Low Priced

High Accummulation speculations in

the third wave

general market advance since 2009. Trade these with the trend of the 21-day ma of

Closing Power

as much as possible Selling 50% when one has a 50% profit is suggested as good

money

management with very low-priced stocks.

HOTLINE - "Beware

the Ides of March"

HOTLINE - "Beware

the Ides of March"

I like the

quote below from Shakespeare about Caesars who would be dictators.

"CAESAR: Let me have men about me that are fat,

Sleek-headed (i.e. bald) men, and such as sleep a-nights.

Yond Cassicus has a lean and hungry look;

He thinks too much: such men are dangerous".

( Julius Caesar Act

1, scene 2, 190–195 )

Stay Hedged with some shorts among the Bearish MINCP stocks.

I would not yet go short any of the major market ETFs.

The internal strength indicators are falling, but are still not

negative. At 2.2% over the 21-day ma, the DJI is about 1%

below "over-bought" status. I would think that is the upside

potential right now, though that could change if IBM accelerates upwards.

Watch IWM (Russell-2000 ETF).

A breakout in IWM could force us to reconsider

many of our recent short sales. Breakouts above

well-tested flat resistance lines are reliably bullish

if the Accumulation Index is positive and the CLosing

Power confirms the new high. Presently IWM's Accum. Index

is negative and its CP is lagging prices.

NEW SELL S15 from PEERLESS Yesterday

See the newly updated definition

and research on this signal.

There have been 14 reversing S15s like the current signal.

They

averaged gains of 7.3%. A cluster of major Sells which might follow,

including

S9s and S12s would make the Sell S15 more bearish.

Note that reversing S15s in a Presidential Election year averaged only gains

of 3.3%.

There were 6 cases. All occurred between January and April 14th,

This

suggests that a DJI decline to the rising 65-day ma would likely find

very good

support and probably a new Buy from Peerless.

Closing Power and A/D Lines Have Not Clinched This Sell Signal.

Though Apple was down today, IBM moved

higher. I have suggested

buying IBM or buying calls in it, because of its breakout above

a

well-tested, rising resistance line.

Bearishly, we still have not seen the broader

market, as measured by the

Russell-2000, IWM, make a new

high to match the DIA, SPY and QQQ's.

The fact that the ETFs' Opening and Closing Powers show Both-Up trajectories

invites caution about shorting prematurely. Certainly, a breakout by

IWM

above its flat resistance would be very bullish short-term for less

seasoned and lower priced stocks.

Rising Interest Rates.

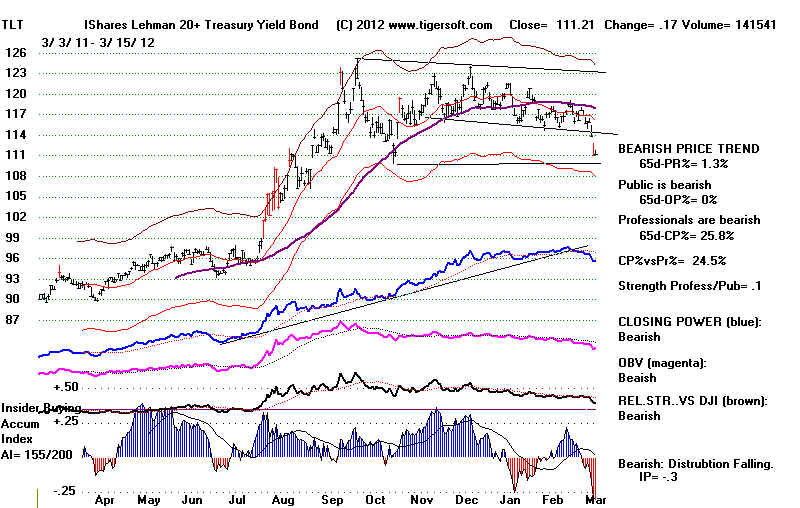

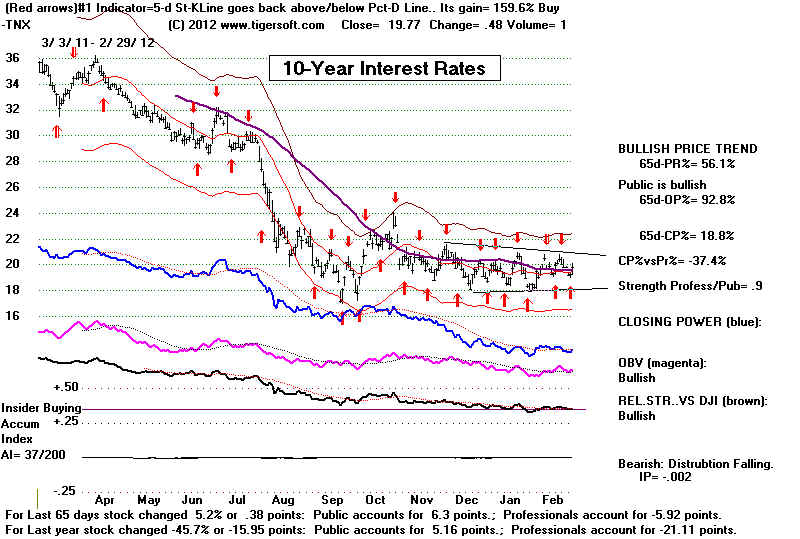

The most likely cause for the next intermediate decline is rising interest rates.

See the sharp drop below the 65-day ma by 20-year notes.

By itself, a drop below 20-year bonds below its 65-dma has produced a mix

of gains and losses since 2000. At times, the selling in bonds reflects the lure

of stocks over bonds, as business conditions improve. In our case, that is

a factor, but the bigger element is a nuanced tightening by the Fed with

Paul Volcker giving new expression of fears withing the Fed of inflation

and a speculative bubble in stocks.

| What Happens to the DIA when 20 Year Treasury

Bonds (TLT) Drop Sharply below Their 65-dma? Answer: The DIA was just as likely to rally as fall! Compare the present TLT (because of penetration downward of 65-dma) with past cases of it breaking 65-dma AND see what happens to DIA ...Red means DIA fell and short sales on DIA would have been profitable. 7 cases. ... Green means DIA rose and short sales would have NOT been profitable. 7 cases.. 10/14/2010 - DIA rallied from 111.07 to 114.54 on 11/6/2010 11/3/2009 - DIA rallied from 104.65 to 111.21 on 11/16/2009 4/17/2008 - DIA fell from126.70 to 109.30 on 7/15/2008 (-2% paper loss) 7/26/2007 - DIA fell from 134.71 to 129.15 on 8/16/2007 (no paper loss) 7/20/2006 - DIA rallied from 109.42 to 123.36 on 11/16/2006 12/23/2005 - DIA fell from 108.75 to 106.95 on 12/30/2005 (no paper loss) 8/30/2005 - DIA rallied from 104.00 to 106.81on 9/12/2005 4/18/2005 - DIA rallied from 100.55 to 105.78 on 6/16/2005 7/2/3004 - DIA fell from 103.30 to 99.72 on 8/5/2004 (no paper loss) 9/26/2003 - DIA rallied from 83.30 to 98.22 on 10/15/2003 5/7/2003 - DIA went sidewise for 7 days and rallied from 85.86 to93.50 on 6/16/2003 5/31/2002 - DIA fell from 99.25 to 77.17 on 7/23/2002 (no paper loss) 7/19/2001 - DIA fell from 106.40 to 83.65 on 9/20/2001 (no paper loss) 6/2/2000 - DIA fell from 107.51 to 104.00 on 6/22/2000 (no paper loss) |

Bond funds and utililities have been the main casualty, so far of the Sell S12.

Bonds tend to move all together, at once, as they adjust to interest rate changes.

Utilities' yields relative to bonds are a key element in their investment appeal.

There usually is a lag of a few weeks between

rising rates, as expressed

in Discount Rate and Overnight Fed Funds' Rates and a market sell-off.

The Overnikght Fed Funds' rates are still so

low, it is hard to see their rise

as being significant in supressing bank speculations in equities.

Read TigerSoft

Blog 8/18/2007: Federal Reserve Discount

Rate Changes

and Stock Price

Movements: 1955-2008

=====================================================================================

OLDER HOTLINES

=====================================================================================

3/14/2012

DJI= 13194

+16 la/ma = 1.019 21dmaROC= +.295 P=+129 (-148) IP21=.069 V=-24 OP= .23

DIA SPY QQQ DJIA-Peerless TigerDJI TigerSPY TigerQQQ

GLD SLV

Crude Oil

IWM-Russell-2000

STATUSES of

CLOSING POWERs of ETFs

DIA' s CP is rising

and above its 21-DMA. Breakout

Opening Power above its rising 21-dma. This is Bullish

BOTH UP condition.

Only a close of more than 1.82 below the Opening would break the CP uptrendline.

SPY's main CP is rising

and above its rising 21-DMA. Breakout. It would

take a

Close of more than 1.36 belowthe Opening to break the CP uptrendline.

Opening Power is above its 21-dma. This is Bullish BOTH

UP condition.

Colossal Annual Gains

Trading EWZ (ETF for Brazil - NYSE) from 2001-2012

Simply Super-imposing Automatic Peerless Buys and Sells on EWZ

"Long and Short" "Long"

Short

2001

+78.6%

+31.5% +35.8%

2002

+62.1%

+8.1% +50.0%

2003

+122.8%

+124.9% -0.9%

2004

+87.2%

+63.5% +14.5%

2005

+45.6%

+45.6%

no trades

2006

+133.7%

+74.3% +34.1%

2007

+141.1%

+119.8%

+12.5%

2008

+155.3%

+18.8% +115.0%

2009

+110.2%

+108.8% +1.0%

2010

+29.3%

+18.5% +9.2%

2011

+87.2%

+24.3% +50.6%

2011-2012

+73.7%

+32.8% +30.5%

3/9/2012 HOTLINE

DJI= 12922 +14

la/ma = 1.001 21dmaROC= +.035 P=+124 (+34) IP21=.014 V= -43 OP= .133

Peerless Remains on a Buy despite

Rising Wedge. Now

the DJI's head/shoulders pattern is

a visible threat to the

rally. People still remember

the quick H/S shoulders pattern

in early 2010 that dropped the DJI

quickly back 13.5%. The

price pattern then looks like what

is emerging now. The A/D

Line was weaker then. Our

current P-Indicator and Accum. Index,

however, are weaker than back when

the 2010 right shoulder

was formed.

The Completed DJI 2010

Head/Shoulders Pattern led to 13.5% Decline

So the DJI really needs to keep advancing. A reversal now

would

defintely keep alive the Bears'

hopes of a Head/Shoulders pattern

being completed.

The DJI does look like it will open lower. But the bulls have

not

been overcome. Breadth was

excellent on the rally and the major

market ETFs' Closing Powers are

Rising.

The A/D Line has bullishly made

another 12-month high.

But the P-Indicator and

Accumulation Index below on the

Peerless chart show considerable

deterioration. The

DJI has reached the apex of a right

shoulder in what could

become a head/shoulders pattern.

Chartists often go short here.

My expecation is that the pattern

will not be completed with

a drop below the neckline at 12750.

Usually, the A/D Line does

not make a new high on the making

of a valid DJI head/shoulders

pattern.

The foreign news is bearish.

A lower opening is to be expected.

Afghan civilian deaths could delay

strategic pact with U.S.

China sacrifices growth to satiate

inflation dragon

Greek debt swap could be short-lived

reprieve

France's Sarkozy defies Europe with

protectionist push

The US news is mixed. Housing stocks are quite

strong now. See

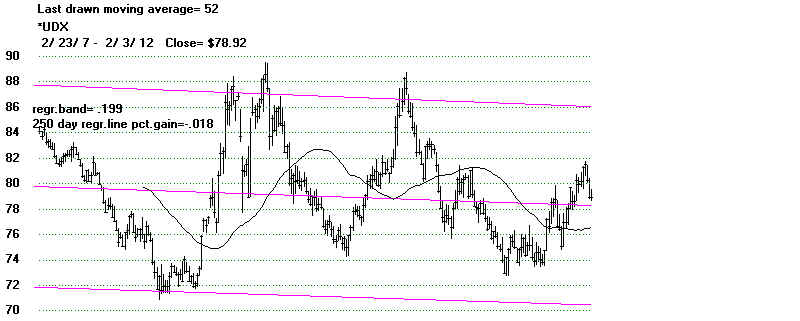

the Tiger Index of Housing Stocks. The Dollar's strength helps the

FED keep interest rates low.

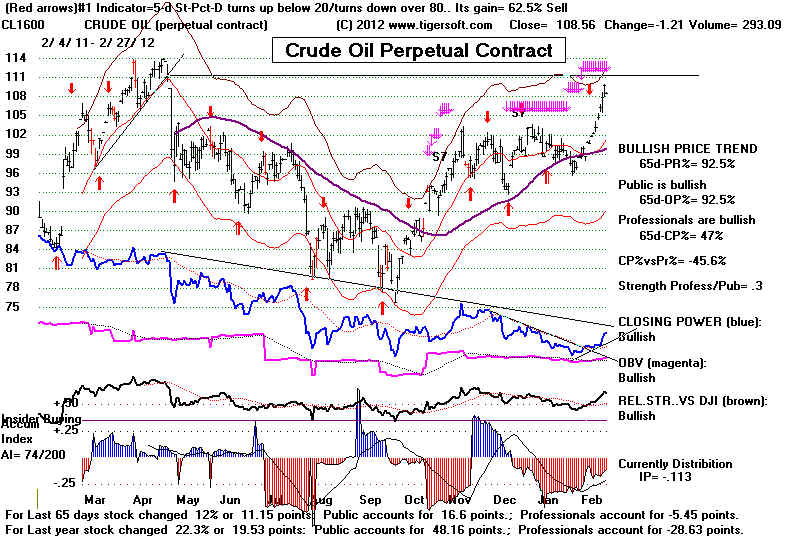

But a decline

in oil prices will hurt

two of the highest priced DJI

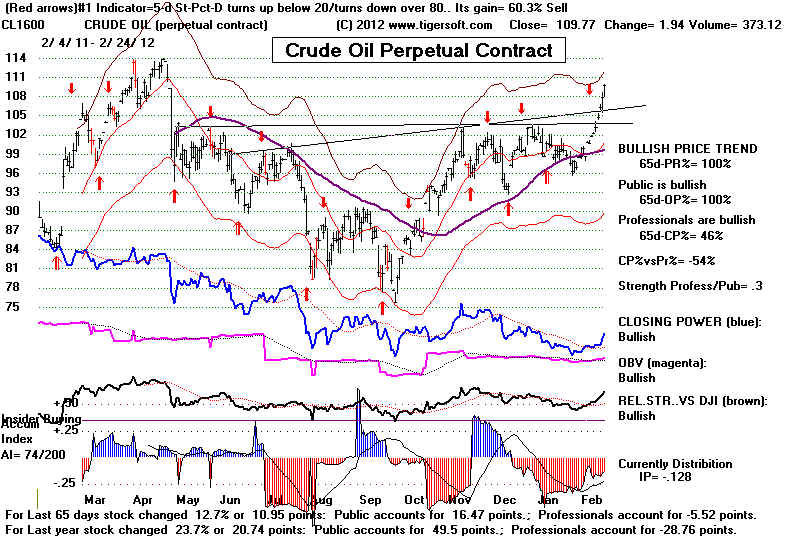

components. The perpetual Crude Oil

chart shows considerable

Professional selling. I take it as a bullish

sign for the economic

recovery that Gold itself could be forming a

down-sloping head/shoulders

pattern. Gold's is strong when Inflation

and Fear are rising.

Economic recoveries as in the mid 1980s and

from 1995-1999 hurt Gold.

The DJI futures at this

writing are down 24. One could short some

of the bearish MINCP stocks

as a hedge against weakness. Our Stocks'

Hotline has simple stopped

buying for a day or two to see what happens

next.

Historically, from 1965-2011, the DHI rallies 63% of the time

over the next week and

58.7% of the time over the next two weeks.

BREADTH

New Highs New Lows

NASDAQ 66

8 bullish plurality

NYSE

86

2 bullish

plurality

MAXCP Stocks = 189 (+59) MINCP Stocks = 35

(-35) Bullish plurality of 60.

3/9/2012 Consider

buying Bullish

MAXCPs on confirmed

price breakouts and CP hooks back up

3/9/2012 Consider

shorting Bearish MINCPS as hedges

when CP makes new lows ahead of price

and breaks CP support. Coal stocks are showing unusual weakness.

3/9/2012 Consider Low Priced

High Accummulation speculations in

the third wave

general market advance since 2009. Trade these with the trend of the 21-day ma of

Closing Power

as much as possible Selling 50% when one has a 50% profit is suggested as good

money

management with very low-priced stocks.

3/9/2012 KEY CHARTS OF INDUSTRY INDICES

DIA SPY QQQ DJIA-Peerless TigerDJI TigerSPY TigerQQQ

GLD SLV

Crude Oil

IWM-Russell-2000

DIA' s CP broke its steep downtrend-line and got back above

its 21-DMA.

Opening Power is at its 21-dma. Watch for a

head/shoulders pattern

which peaks at 129 on the current rally and then turns down.

SPY's main CP's is

rising-line and is above its rising 21-DMA. It would

take a

Close 0.49 below the Opening to break the new, steeper CP uptrendline.

Opening Power is below its 21-dma. The 138 resistance of the SPY has now been

tagged,

QQQ's more gradual CP has

held. The QQQ CP is above its rising 21-dma.

Opening Power is below its 21-dma. The QQQ has

reached the resistance of its highs of last week.

A Close 0.17 below the Opening would break the new, steeper CP uptrendline.

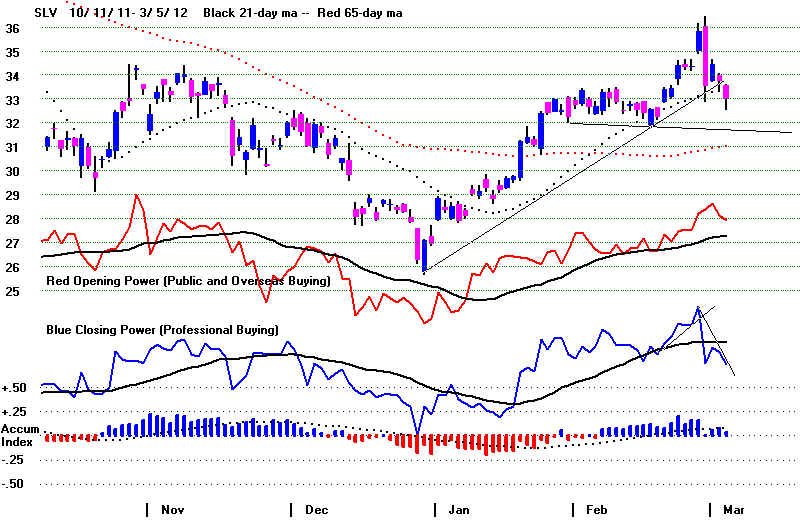

GLD's CP is caught in a

triangle with converging uptrend and downtrendlines.

Its Opening Power is bearishly below

its 21-dma. It must resolve its head/shoulder pattern

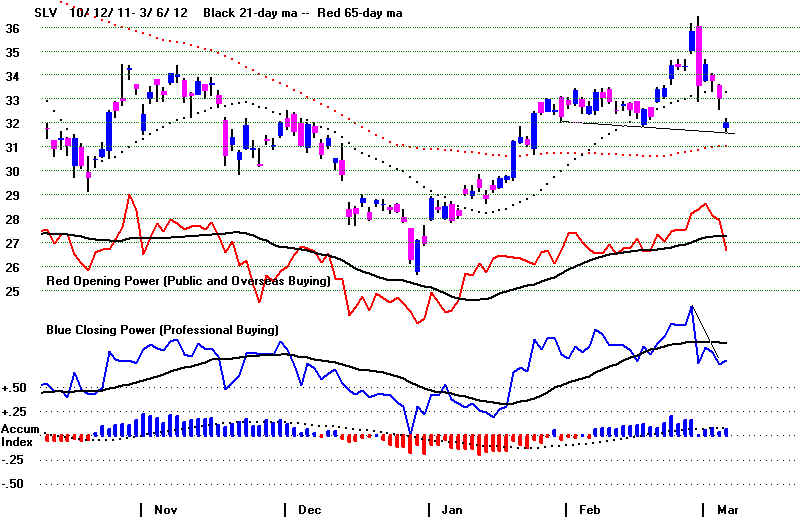

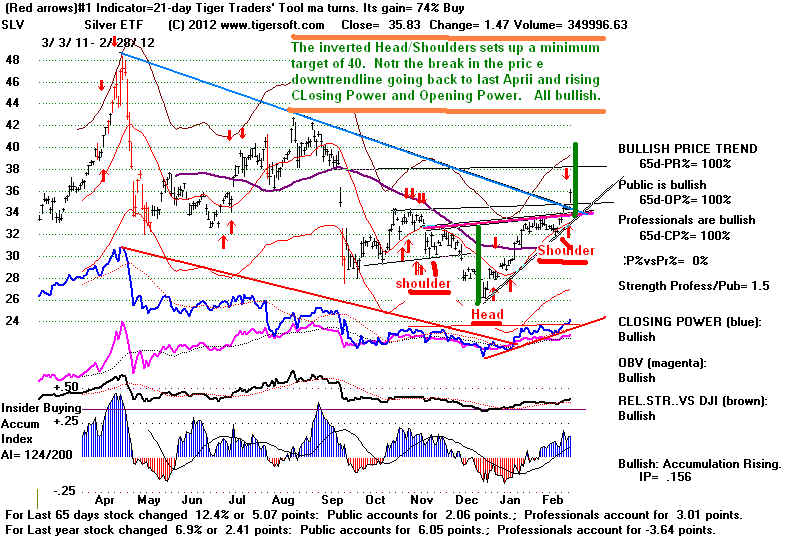

SLV must also resolve its head/shoulder pattern soon.

====================================================================================

OLDER HOTLINES

====================================================================================

3/8/2012 HOTLINE

DJI= 12910 la/ma = 1.00 21dmaROC= +.027 P=+89 (+65) IP21=.030 V= -48 OP= .134

Peerless Remains on a Buy despite

Rising Wedge.

DJI Needs to Keep Advancing.

A Reversal Now Would

Keep Alive The Bears' Hopes of A

Head/Shoulders Pattern.

Breadth was good. Closing

Powers are Rising.

BREADTH

New Highs New Lows

NASDAQ 50

8 bullish plurality

NYSE

62

3 bullish

plurality

MAXCP Stocks = 130 (+48) MINCP Stocks = 70

(-15) Bullish plurality of 60.

3/8/2012 Consider

buying Bullish

MAXCPs on confirmed

price breakouts and CP hooks back up

3/8/2012 Consider

shorting Bearish MINCPS as hedges

when CP makes new lows ahead of price

and breaks CP support. Coal stocks are showing unusual weakness.

3/8/2012 Consider Low Priced

High Accummulation speculations in

the third wave

general market advance since 2009. Trade these with the trend of the 21-day ma of

Closing Power

as much as possible Selling 50% when one has a 50% profit is suggested as good

money

management with very low-priced stocks.

3/8/2012 KEY CHARTS OF INDUSTRY INDICES

DIA SPY QQQ DJIA-Peerless TigerDJI TigerSPY TigerQQQ

GLD SLV

Crude Oil

IWM-Russell-2000

DIA' s CP broke its steep downtrend-line and got back above its

21-DMA.

Opening Power is below its 21-dma. Watch for a

head/shoulders pattern

which peaks at 129 on the current rally and then turns down.

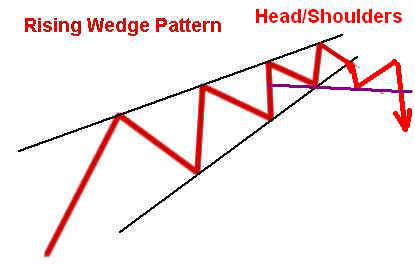

Has Rising Wedge Pattern Played Itself Out in A

One Day Decline?

Peerless Has Not Given A New Sell Signal.

"The

Esperanto Award": Peerless as Candidate for the New Universal

Language of Trading.

Yesterday's comments apply:

Note that there is still a chance that the DJI will roll over again and

complete a bearish

Head/Shoulders pattern, perhaps like it did in April 2010. DJI Rising

Wedge patterns often turn into head/shoulders patterns. The result,

then, is

more likely to be a decline below the lower band. On the other

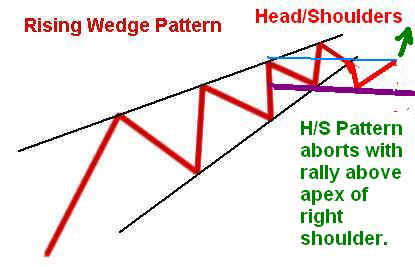

hand, a move above

the apex of a potential right shoulder would bullishly abort the

bearish H/D pattern.

See how this happened in May 2003

with a very bullish outcome.

There are other

scenarios. But these two stand out as the most likely given the

reveral-rally). It can happen that the DJI will quickly get past

the apex of the right shoulder

in a potential H/S pattern. This nearly always forces shorts to cover

and sends up

prices up quickly. In our case now, a DJI close above 13000 would

likely have this effect.

If this IS to be a valid rising wedge breakdown, the DJI should not be

able to get

past the point of breakdown, about 12980. Because Peerless is

still on a Buy

and the A/D Line is strong, I would emphasize the long side.

We covered most of our

short sales, including the coal and solar energy stocks. They did

not rally today.

The shorts are not giving up! We can retake them if the

head/shoulders pattern is

not aborted by this rally.

Watch the bank stocks as a group.

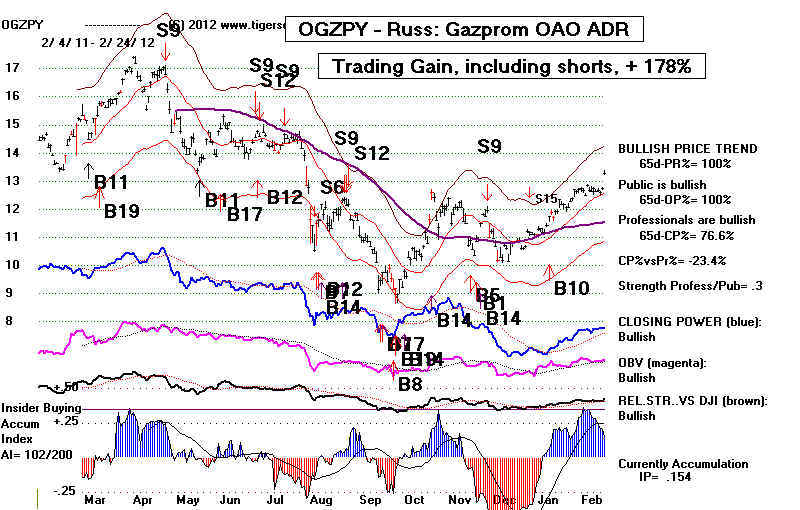

Foreign ETFs Performance in 2012

96% of foreign ETFs are above their 65-day ma. This ranks

their stocks now #1 among

the 28 industry groups I regulalry

track here.

.

In the second column below, you can

compare the results of trading the Peerless reversing

Buys and Sell signals with the

various NON-US ETFs and DIA, SPY, QQQ and IWM.

Instead of buying DIA when Peerless

gives a reversing Buy, consider a set of the best

performing that also trade well

with Peerless. TRE-Russia and RSX stand out. here.

I have no custiomers in Russia

presently. So this is a virgin field for us "tigers".

Note that the Peerless performance here

does not include the excellent Buy B13 on

December 17th which we suggested using on

the Hotline. That would have added

+11% to the DJI's results and on average,

at least, as much to the others. Here we

are assuming positions are being taken at

the opening the day after the signal, that

$10,000 is the original investment, with

all proceeds reinvested in longs and shorts, too.

$40 per round trip is allowed for

commissions, too. This is realistic.

Because of the success of Peerless

over time with so many countries, I have translated

the story of Peerless into Russian,

German, French (France and Belgium), Spanish

(Spain as well as Mexico), Italian

and Portuguese (Brazil as well as Portugal). I used

a machine translator. If you

speak these languanges, have a look and feel free to

make suggestions. I would

also be interested in helping. for a small fee, other website

owners into doing what I have done.

C:\etfs Days back= 46

----------- RANKED BY 2012 PERFORMANCE --------------------------------------------

12/30/2011 - 3/8/2012

Rank Peerless Symbol Name Price Pct.Gain

Pct Gain

---- -------- --------------------------------- ---------- ------------

1 +12.0% TGA TRANSGLOBE ENERGY 11.76 48%

2 +89.2% TRF TEMPLETON RUSSIA FUND 17.39 27%

3 +100.0% CEE CENTRAL EUROPEAN EQUITY FUND 35.2

4 +32.0% INP PACIFIC-ASIA ex Japan 57.65 23%

5 +104.7% RSX MKT VCTR RUSSIA S 32.65 22%

6 +40.4% SGF SINGAPORE FUND 13.33 22%

7 +3.3% TF THAI CAPITAL FUND 10.44 21%

8 +85.4% HAO CLAYMORE/ALPHASHA 23.33 20%

9 +22.7% IIF MS INDIA INVESTMT FUND 16.82 20%

10 +66.9% GF NEW GERMANY FUND 14.59 19%

11 +23.5% IFN INDIA FUND 22.71 19% 3.3%

12 +64.3% EWG ISHARES MSCI GERMANY INDEX 22.87 18%

13 +60.4% EWZ ISHARES MSCI BRAZIL INDEX 68.02 18%

14 +45.6% JFC J FLEMING CHINA REGION FUND 13.03

15 +32.5% TWN TAIWAN FUND 17.12 18%

16 +32.9% EWS ISHAR SINGAPORE INDEX 12.76 17%

17 +48.3% CH CHILE FUND 17.47 16%

18 +20.7% CAF MORGAN STANLEY CHINA 22.27 15%

19 +48.9% ECH ISHARES MSCI CHILE 66.66 15%

20 +57.4% EEM ISHARES MSCI EMERGING MKTS 43.81 15%

21 +34.0% EWH ISHARES MSCI HONG KONG INDEX 17.86 15%

22 +42.1% EWT ISHARES MSCI TAIWAN INDEX 13.48 15%

23 +48.9% GCH GREATER CHINA FUND 11.59 15%

24 +60.6% VWO Vanguard Emerging Markets 44.2 15%

---- +23.9% QQQ ETF for NASDAQ-100 64.75 15%

25 +43.1% EWD ISHARES MSCI SWEDEN INDEX 28.77 14%

26 +66.5% EWO ISHARES MSCI AUSTRIA INDEX 16.27 14%

27 +98.0% EWY ISHARES MSCI SO KOREA INDEX 59.71 14%

28 +44.9% GMF ST SP EM AS PACIFIC E 75.7 14%

29 +49.9% GXC STRK SPDR S&P CH 71.16 14%

30 +30.9% IXN ISHARES S&P GLOBAL TECHN. 67.45 14%

31 +68.8% EWI ISHARES MSCI ITALY INDEX 13.6 13%

32 +75.1% EWQ IShares MSCI France 22.25 13%

33 +55.0% ILF ISHARES S&P LATIN AMERICA 40 48.16 13%

34 +35.5% JEQ JAPAN EQUITY FUND 5.65 13%

35 +37.7% PGJ Gldn Dragon USX China 22.22 13%

36 +42.4% EWK ISHARES MSCI BELGIUM INDEX 11.9 12%

37 +55.4% EWW ISHARES MSCI MEXICO 60.25 12%

38 +29.1% MXF MEXICO FUND 24.57 12%

39 +59.8% CHN CHINA FUND 22.94 11%

40 +70.0% FEZ FRESCO DOW JONES EURO 50 32.88 11%

41 +48.2% FXI iShares FTSE/Xinhua China 25 38.81 11%

42 +56.9% GRR ASIA TIGERS FUNDS 13.43 11%

43 +30.4% ITF ISHARES S&P-TOPIX 150 INDEX 43.06 11%

44 +25.2% EWJ ISHARES MSCI JAPAN INDEX 10.03 10%

45 +54.8% EWM ISHARES MSCI MALAYSIA 14.76 10%

46 +48.4% IEV ISHARES S&P EUROPE 350 FUND 37.25 10%

47 +55.9% VGK Vanguard European Stock 45.92 10%

48 +37.9% VPL Vanguard Pacific Stock 52.61 10%

-- +33.1% SPY ETF for SP-500 137.04 9%

-- +51.4% IWM ETF for Russell-2000 80.51 9%

50 +63.4% EWA ISHARES MSCI AUSTRALIA 23.2 8%

51 +23.2% EWL ISHARES MSCI SWITZERLAND 24.56 8%

52 +34.1% IF INDONESIA FUND 12.74 8%

53 +21.0% JOF JAPAN OTC EQUITY FUND 7.78 8%

54 +31.9% EWC ISHARES MSCI CANADA INDEX 28.48 7%

55 +37.0% EWU ISHARES MSCI UK INDEX 17.32 7%

56 +44.2% KEF KOREA EQUITY FUND 9.72 7%

-- +32.5% DIA DJI-30 ETF 128.91 5%

57 +39.5% IDX Vectors INDONESIA 29.18 2%

58 +57.9% EWP ISHARES MSCI SPAIN INDEX 30.4 0% 59 IXP ISHARES S&P GLOBAL TELECOMM 56.14 0%

|

====================================================================================

OLDER HOTLINES

====================================================================================

3/7/2012 HOTLINE

BREADTH

New Highs New Lows

NASDAQ 20

14 bullish plurality

NYSE

31

6 bullish

plurality

MAXCP Stocks = 82 (+36) MINCP Stocks = 85

(-37) BEARISH MINCP PLURALITY = only 3

3/7/2012 Consider

buying Bullish

MAXCPs on confirmed

price breakouts and CP hooks back up

3/7/2012 Consider

shorting Bearish MINCPS as hedges

when CP makes new lows ahead of price

and breaks CP support. Coal stocks are showing unusual weakness.

3/7/2012 Consider Low Priced High Accummulation speculations in the

third wave advance.

Trade

these with the trend of the 21-day ma of Closing Power as much as possible

3/7/2012 KEY CHARTS OF INDUSTRY INDICES

DIA SPY QQQ DJIA-Peerless TigerDJI TigerSPY TigerQQQ

GLD SLV

Crude Oil

IWM-Russell-2000

Has

Rising Wedge Pattern Played Itself Out in One Day?.

Peerless Has Not Given A New Sell Signal.

Our Stocks Hotline Will

Reduce Short Sales Tommorw.

Most were weaker today, but DJI Futures

are Up +86

Tiger's Closing

Powers moved up nicely today and broke the CP downtrends in

for DIA and SPY.

Note that there is still a chance that the DJI will roll over again and

complete a bearish

Head/Shoulders pattern, perhaps like it did in April 2010. DJI Rising

Wedge patterns often turn into head/shoulders patterns. The

result, then, is more likely to be a decline below the lower band. On

the

other hand, a move above the apex of a potential right shoulder would

bullishly abort the bearish H/D pattern. See how this happened in May 2003 with

a very bullish outcome. There are other scenarios.

But these two stand out

as the most likely given the reveral-rally today. It can

happen that the DJI will

quickly get past the apex of the right shoulder in a potential H/S

pattern. This

nearly always forces shorts to cover and sends up prices up quickly.

In our case now,

a DJI close above 13000 would likely have this effect.

If this IS to be a valid rising wedge breakdown, the DJI should not be

able to get

past the point of breakdown, about 12980. Because Peerless is

still on a Buy

and the A/D Line is strong, I would cover most of the short sales used

for hedging.

We can retake them if the head/shoulders pattern is not aborted by this

rally.

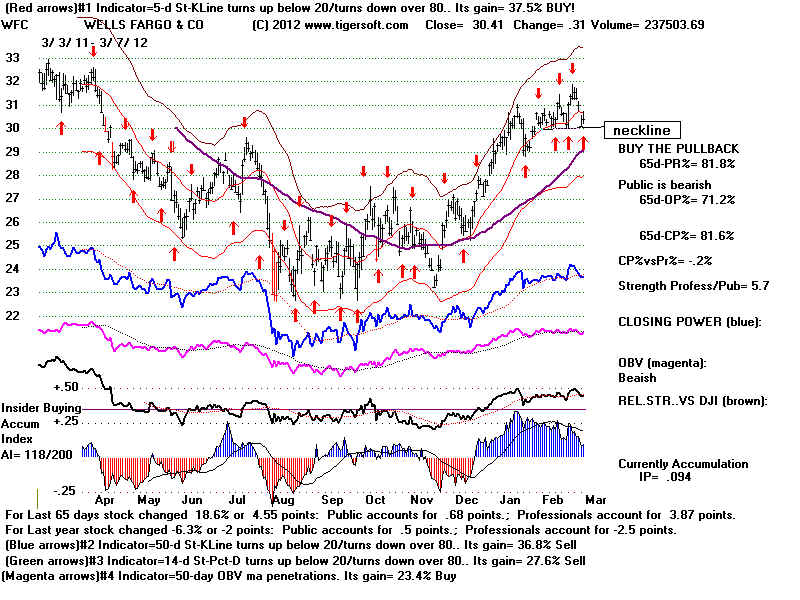

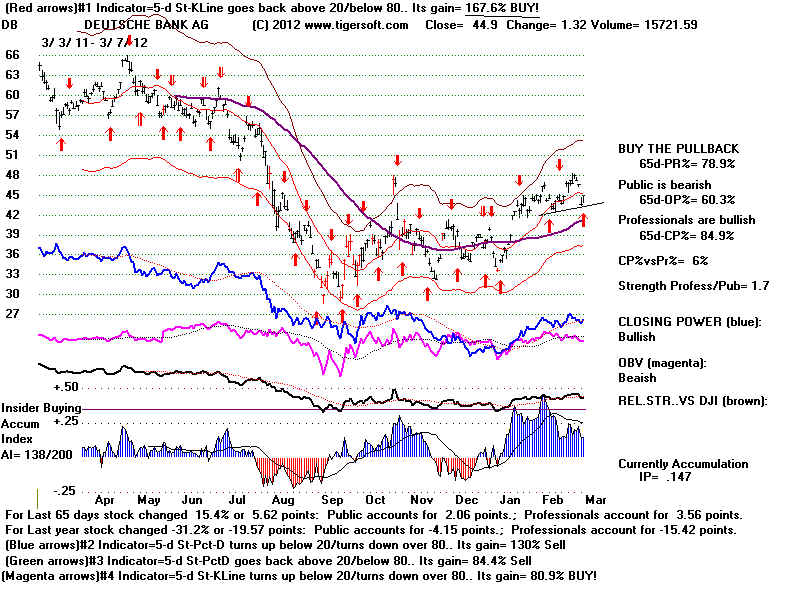

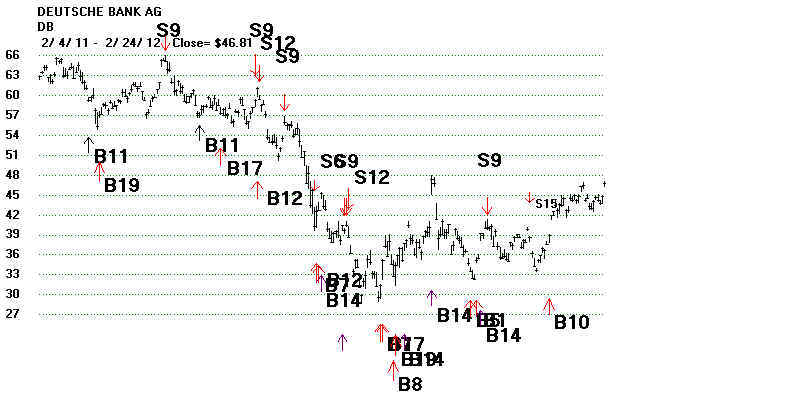

Watch the bank stocks as a group. See the charts of Wells Fargo

and Deutsche

Banks at the bottom of this Hotline. They reversed upwards today

and show

Red short-term Buys. Buys and Sells from DB's 5-day stochastic would

have

gained a trader +167.6% for the last year. Clearly professionals are

whipping the

stock up and dwon to serve their own trading purposes. This

pattern is more likely

to continue than end.

Will DJI Turn Down at 12950?

Or Surpass 13000?

Bearish Scenario

Bullish Scenario

Rising Wedge Patterns That

Morphed into Head/Shoulders Patterns

March 2012 No Peerless Automatic Sell Outcome?

April 2010 No Peerless Automatic Sell except H/S Bear Market continued.

August 2008 Peerless Sell.

Extreme Bear Market followed.

May 2008 Peerless Sell. Extreme

Bear Market followed.

May 2006 Peerless Sell.

6% decline from peak to lower band

August 2002 Peerless Sell.

Bear Market continued.

May 1999 No Peerless Automatic Sell except H/S. 2-week decline to lower band

July 1977 Peerless Sell.

Bear Market continued.

Sept 1971 13.2% decline followed. DJI

fell below lower band.

Jan 1959 No Peerless Automatic Sell except H/S 2-week decline to lower band

Aug 1932 Peerless Sell.

Extreme Bear Market followed.

May 1930 Peerless Sell.

Extreme Bear Market followed.

Unless the DJI repeats what happened in

April-May 2010, a completed head/shoulders

here should be expected only to bring a

quick test of the lower band.

.

BREADTH

New Highs New Lows

NASDAQ 20

14 bullish plurality

NYSE

31

6 bullish

plurality

MAXCP Stocks = 82 (+36) MINCP Stocks = 85

(-37) BEARISH MINCP PLURALITY = only 3

3/8/2012 Consider

buying Bullish

MAXCPs on confirmed

price breakouts and CP hooks back up

3/8/2012 Consider

shorting Bearish MINCPS as hedges

when CP makes new lows ahead of price

and breaks CP support. Coal stocks are showing unusual weakness.

3/8/2012 Consider Low Priced High Accummulation speculations in the

third wave advance.

Trade

these with the trend of the 21-day ma of Closing Power as much as possible

3/7/2012 KEY CHARTS OF INDUSTRY INDICES

DIA SPY QQQ DJIA-Peerless TigerDJI TigerSPY TigerQQQ

GLD SLV

Crude Oil

IWM-Russell-2000

DIA' s CP broke its steep downtrend-line and got back above

its 21-DMA.

Opening Power is below its 21-dma. Watch for a

head/shoulders pattern

which peaks at 129 on the current rally and then turns down.

SPY's main CP's

slightly broke its steep downtrend-line and is above its rising 21-DMA.

Opening Power is below its 21-dma. Watch for a

head/shoulders pattern

which peaks at 137 on the current rally and then turns down.

QQQ's more gradual CP has

held. The QQQ CP is still above its rising 21-dma.

Opening Power is below its 21-dma. A further QQQ 1 point rhigher close would bullishly

destroy any

potential H/S top here.

GLD's CP sharp

trend-break has not yet based. The less steep CP uptrendline was also violated.

Its Opening Power is bearishly below

its 21-dma

SILVER - BOTH DOWN BEARISH

condition. Now testing Support at 31.70-32.

CRUDE OIL - USO is recovering from its rising 21-day ma with a CP uptrend

in place

and showing high Accumulation. The corresponding Crude Perpetual Contract chart -

CL1600 is

much weaker. It would be more bullish if they were in synch.

TWO KEY BANK STOCKS

|

|

-------------------------------------------------------------------------------------------------------------------------------------------------------

OLDER HOTLINES

-------------------------------------------------------------------------------------------------------------------------------------------------------

3/6/2012 HOTLINE

Rising Wedge Pattern Must Play Out.

But Peerless Has Not Given A New Sell Signal.

So, Watch for A Reversal Back Upwards Using Tiger's Closing Powers.

Stay Hedged f\or Now with Some Short Sales from Bearish MINCP

DJI and Peerless Signals. Notice that the recent

B15 and B18 have

been removed. These are not to be trusted when Peerless is

already

on a Buy, especially in a Presidential Election year from February to

September. See: Revisions to Peerless Buy B15s

and Buy B18s 3/7/2012

As I have said before in this Hotline,

the recent Buy B15s and B18s are not significant. They are there

in case Peerless had not

already turned bullish. I will re-work the software to only show them if Peerless

is on a Sell when they occur.

(This black Comment added Tuesday morning)

DJI= 12759 la/ma = 0.988 21dmaROC= -.095 P= -89 (-204) IP21=.037 V= -92 OP= .049

3/6/2012 KEY CHARTS OF INDUSTRY INDICES

DIA SPY QQQ DJIA-Peerless TigerDJI TigerSPY TigerQQQ

GLD SLV

Crude Oil

IWM-Russell-2000

----------------------------------------------------------------------------------------------------------------------------------------------------------------

BREADTH

MAXCP Stocks =46 (-31) MINCP Stocks = 122 (+28) BEARISH

MINCP PLURALITY =76

Consider buying Bullish MAXCPs on breakouts and CP hooks back up

Consider shorting Bearish MINCPS

as hedges when CP makes new lows ahead of price

and breaks CP support. Coal stocks are showing unusual weakness.

Consider Low Priced High Accummulation speculations in

the third wave advance.

Trade

these with the trend of the 21-day ma of Closing Power as much as possible

Bearish Ttianic Effect

= New Lows outnumbering new highs with the DJI

Bearish Ttianic Effect

= New Lows outnumbering new highs with the DJI

only a week away from its high, I remember reading about this in Barrons 20 years

ago, Stocks/Commodities

article.

New Highs New Lows

NASDAQ 12

28

bearish plurality

NYSE

12

15

bearish plurality

DIA' s CP broke its rising uptrend-line and

its 21-DMA. Opening Power is also below

its

21-dma. This is the BOTH DOWN BEARISH condition. A Close by DIA 0.25 above its

Opening would break the CP downtrend-line.

SPY's main CP's has been violated but its CP is still above its

rising 21-dma.

SPY's Opening Power is below its

21-dma. A Close by SPY 0.24 above its

Opening would break the CP downtrend-line.

QQQ's Steeper CP

has been violated. The QQQ CP is still above its rising 21-dma.

Opening Power is below its

21-dma.

GLD's

CP sharp trend-break has not yet based. The less steep CP uptrendline was

also violated.

Its Opening Power is bearishly below

its 21-dma

SILVER

- BOTH DOWN BEARISH condition. Now testing Support at

31.70-32.

3/6/2012 HOTLINE - Because of the typical bearishness of the rising

wedge pattern in the

DJI, I suggested Sunday night that

it was "Time To Do Some Hedging by Short Selling some of the Bearish

MINCPs, to Sell Major Market

ETFs and to Profit-Taking in over-extended stocks." Our Stocks' Hotline

went more short than long on Monday

morning. The downside target now is 12500, where the support

from the rising 65-day ma and lower

band converge.

But since we have no new Peerless

Sell, other than the low volatility/rising wedge pattern, I would think

the DJI will to turn around and

make more new highs. It will probably do so ahead of the A/D Line after the

Closing Power downtrends for DIA

and SPY are broken. We will watch DIA, SPY and QQQ charts closely

for this. The weakness is

most apparent in Industrial Materials, Gold Stocks, Utilities,

Coal Stocks (ACI, JRCC, BTU) AND Europe where the EFFs for Russia, Germany, Italy, France,

Austria,

Spain and Sweden each fell more

than 5%, ostensibly because of the bankers' concerns that they might default

on their own debt but actually

because of the deepening recession there caused by the austerity measures

taken by the governments at the

bankers' behest. Inflation is not the problem, though that is what bankers

will always tell you. Rather,

it is chronic, high and growing unemployment. Sadly, the 1930s did not teach

Europeans that economics is too

important to be left to bankers. History clearly shows that

government austerity measures in an era of high

unemployment led directly to the Great Depression.

Below the DJI charts are some

weak-looking banks with head and shoulders patterns. If they break or

are below their 65-dma and show

negative red Distribution and a falling Closing Power weaker than

their price action (S7s), I would

think they would make good short sales, provided one covers if the

Closing Power breaks its downtrend.

Banks with Head and Shoulders Patterns.

=====================================================================================

OLDER HOTLINES

=====================================================================================

3/5/2012 HOTLINE

Because of Rising

Wedge, We Are More Short than Long

DJI= 12926.01 la/ma = 1.001 21dmaROC=.204

P= 118 -49 IP21=.094 V= -26 OP= .152

3/5/2012 KEY CHARTS OF INDUSTRY INDICES

DIA SPY QQQ DJIA-Peerless TigerDJI TigerSPY TigerQQQ

GLD

SLV

Crude Oil

IWM-Russell-2000

Rising Wedge Patterns are reliably bearish DJIA

patterns.

----------------------------------------------------------------------------------------------------------------------------------------------------------------

BREADTH

MAXCP Stocks =77 -20 MINCP Stocks = 94 +4 BEARISH

Consider buying Bullish MAXCPs on breakouts and CP hooks back up

Consider shorting Bearish MINCPS as hedges when CP makes new lows ahead of price

and breaks CP support. Coal stocks are showing unusual weakness.

Consider Low Priced High Accummulation speculations in

the third wave advance.

Trade

these with the trend of the 21-day ma of Closing Power as much as possible

New Highs New Lows

NASDAQ 31

16

bullish plurality

NYSE

38

16

bullish plurality

DIA' s CP is just

above its rising 21-DMA. The Closing Power uptrend has been

violated, but has not turned down. It is at the support of its rising 21-dma.

Opening Power is flat and just above its 21-dma.

SPY's main CP's has been violated

CPis still above its rising 21-dma.

SPY's Opening Power has turned

flat and is below its 21-dma

.

QQQ's Main CP was slightly

violated today. The QQQ CP is still above its rising 21-dma.

The QQQ Opening Power is slightly above

its MA.

GLD's CP sharp trend-break

has not yet based. The less steep CP uptrendline was also violated.

Its Opening Power is still rising.

SILVER - Note the bearish "red popcicle" CP is falling but Opening Power

is rising.

Support appears to be at 32..

3/5/2012 HOTLINE - Because of the typical bearishness of the rising wedge pattern in

the

DJI, I suggested Sunday night that

it was "Time To Do Some Hedging by Short Selling some of the Bearish

MINCPs, to Sell Major Market

ETFs and to Profit-Taking in over-extended stocks." Our Stocks' Hotline

went more short than long on Monday

morning. That is looking like a good move. The DJI Futures

are down 102, at this writing.

Particularly weak are the several coal stocks mentioned Sunday night

here in the Bearish MINCP page.

The Giant (Apple) is Falling and

the Beanstock Is Coming

Down

We need to see if APPL's decline

today continues or IBM's rally goes higher. Both are leaders. A break

in the A/D Line in March after a

rally usually causes breadth to weaken for a month, or a little more.

The DJI's CP has slightly broken,

and closed below, the uptrend-line. It would be surprising if the DJI did not

next test the 65-day ma at

12550. A decline to that point will provide a good re-entry point for traders

wanting to buy DIA.

Though secondary stocks are apt to

weaken for a month, or so, I would recommend considering

buying some very low-priced stock

special situations that show heavy (very positive) Accumulation

and are acting well. I gave a

list of five stocks to my mechanic Sunday.

I will update their progress

for a while. The plan is to

allow the stocks to show why they were under so much insider buying.

I believe that 2012 will be a

generally good year for these stocks. The year could produce the

third leg up since March 2009.

These produce much more speculation in low priced stocks. My sense

is that the "Obama-Fed-Wall

Street Junta" will not allow the stock market to go down more than 7%

from any high this year, in order

to continue the political-financial status quo.

That does not mean that there will not be some swings down. Breaks in the A/D Line

in March

without multiple major Peerless

Sell S9s typically drop the NYSE A/D Line only for a month if there

has been an A/D rally.

Below are the cases since 1933. There

were 24 March A/D Line

trend-breaks. In 8 cases the

A/D Line quickly turned up; in 5 , it turned up 5 times in Aprill.

So, in 2/3 of the cases, the A/D

Line does not fall for more than 8 weeks.

A/D

Line Trend-Breaks February and April since 1934

A/D Line Peak Next Subsequent Bottom

1934

April

July

1936

March

April

1937

February

June

1939

March

April

1940

April

May

1944

March

April

1946 April

November

1947 April

May

1950

February

April

1951 February

June

1952 March

May

1953

March

June

1954

April

resumed advance

1955

March

March resumed advance

1956 March

May

1958

March

advance

quickly resumed

1959

March

June - DJI kept rising

throughout this period.

1963 February

March - 12 day decline

only.

1964 April

June

1965

March

advance

quickly resumed until May and mighty but minature H/S top..

1967 March

advance

quickly resumed until May

1971

February

advance quickly resumed until April

1972

March

October

1974 March

October

1975

March

advance quickly resumed until July

1976 February June

1979

April

May

1980

February March

1983

March

advance quickly resumed

1986

April

May

1987 March

May

1988 March

May

1989

February

March

1991 April

June

1992

February

April

1993

March

Advance

quickly resumed

1995

March

Advance

immediately resumed

1996

March

Advance

immediately resumed

1997

March

April

1998

April

October

2001 February March

2004

March

May

2005 March

April

2006

April

June

2010 April

July

2011 March

Advance

immediately resumed

To be continued tomorrow.

=====================================================================================

OLDER HOTLINES

=====================================================================================

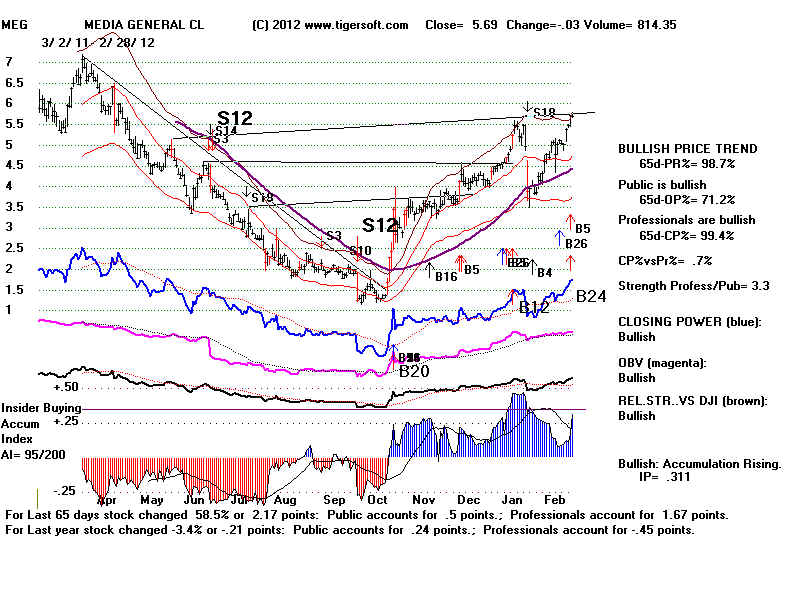

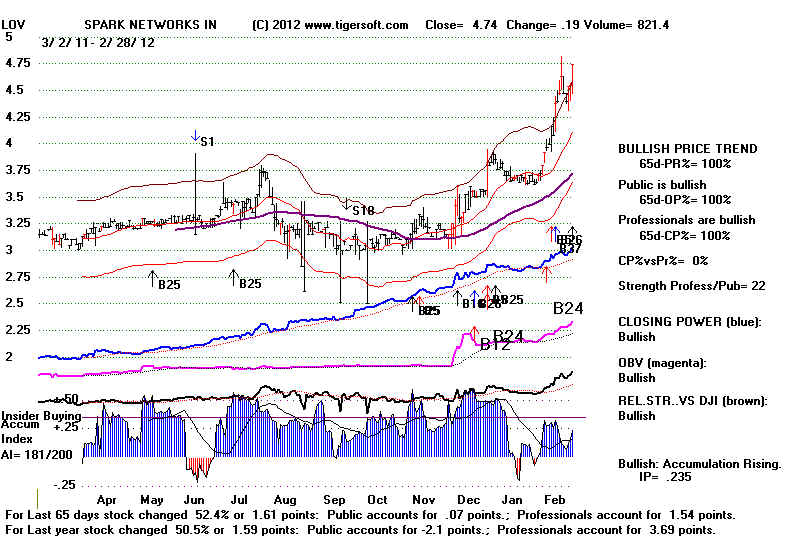

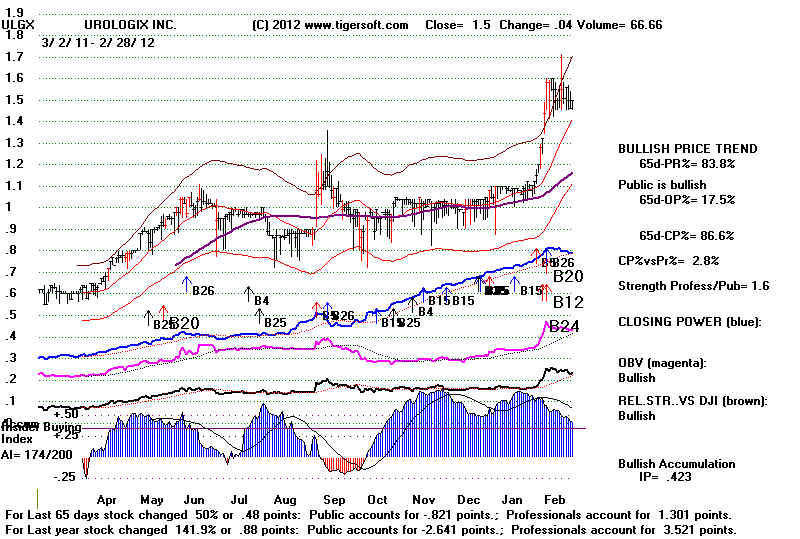

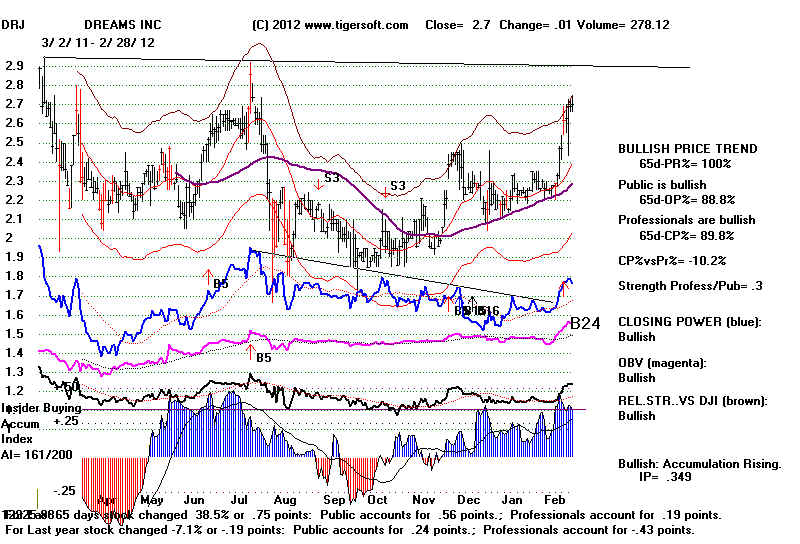

3/2/2012

DJI= 12977.57 la/ma = 1.006 21dmaROC=.241

P= 1660 -144 IP21=.089 V= -16 OP= .148

3/2/2012

KEY CHARTS OF INDUSTRY INDICES

DIA SPY

QQQ DJIA-Peerless TigerDJI TigerSPY TigerQQQ

GLD

SLV

Crude Oil

IWM-Russell-2000

MAXCP

Stocks = 97 MINCP Stocks = 90 Still a bullish plurality, but BEARISH

considering where DJI is.

Consider buying Bullish MAXCPs on breakouts and

CP hooks back up

Consider shorting Bearish MINCPS as hedges when CP

makes new lows ahead of price

and breaks CP support. Coal stocks are showing unusual weakness.

New Highs New Lows

NASDAQ 37

16

bullish plurality

NYSE

48

16

bullish plurality

3/2/2012 HOTLINE - Time To Do Some Hedging by Short Selling some of the Bearish

MINCPs,

to Sell Major Market ETFs and

Profit-Taking in over-extended stocks.

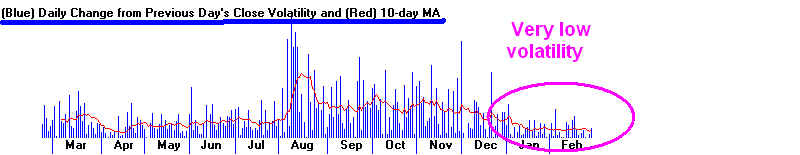

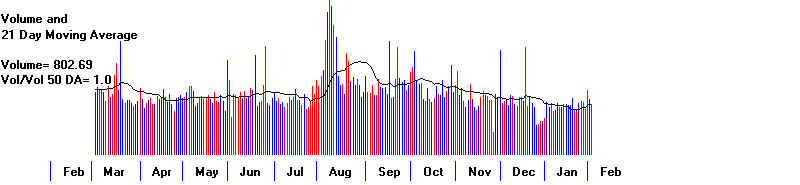

Peerless BUY B10. But Rising Wedge

Patterns in DJI bring DJI decline

at least to the

lower band 85% of the time since

1928. Low Volatility after a Rally and NYSE A/D Line

uptrend Break are undeniably

Bearish. I can not help wondering how much the market

is being held up by the strength in

computer stocks like IBM and MSFT as well as APPL.

If they started to show weakness,

along with Banks and Home Building stocks which have

been strong this year, what would

hold the market up? Wouldn't the rising wedge pattern

then have to breakdown. In

that case, a decline to the DJI's lower band would seem highly

likely, given the history of these

things. It occurs to me that Wall Street wants to hold

the market up until Facebook is

offered the public. A successful offering of it will bring

its underwriters millions.

After a Peerless Sell signal these

rising wedge patterns are reliably very bearish. If

you have any doubts, see the one in

1930 that started the three year bear market and

Great Depression.

Fortunately, without a Peerless Sell signal they are much more benign.

I have numbered the cases below.

There were 14 instances of a rising wedge breakdown

without a Peerless Sell.

A decline to the lower band followed by a recovery occurred

in 6 cases (43 %). There were

also 6cases when the DJI went down less than 2% more

and then rallied. In 2

cases, the most recent, the DJI fell below the lower band. But this was

only after a bearish head/shoulders

pattern also appeared.

I think from this we have to

conclude that there is not much chance of a deep sell-off.

And the DJI is as likely to rally

as go to the lower band. There are no cases where March

breakdowns from rising wedge

patterns broke below the lower band.

Bull Market Rising Wedge Patterns: 1929-2012

Breakdown

DJI

Peerless

Outcome

Date

Level Signals

March

2012

1 April 2010

11000 no Sells but H/S Decline

quickly to 9800

2 Jan 2010

10500 no Sells since 11/09

Decline quickly to 9800

May 2009

12700 Sell S9/S15

Decline quickly to 10900 in 6 weeks.

Oct 2007

13800 Sell S2/S4

Decline quickly to 12800 in 4 weeks.

May 2006

11100 Sell S9/S9V

Decline quickly to 10700 in 3 weeks.

3 May 1999

10750 no

Sells

Decline quickly to 10500

- only to lower band.

4 Dec 1998

9000 no Sells

Decline quickly to 8700

- only to lower band

Dec 1992

3350 Sell S9/S15

Decline quickly to 3150 -

below lower band

5 Jan 1991

2600 no Sells

Decline quickly to 2480

- only to lower band

Dec 1992

3350 Sell S9/S15

Decline quickly to 3150 -

below lower band

Dec 1987

2550 Sell S9/S15

Decline quickly to 1750 -

below lower band

6 March 1987

2300 no

Sells

This was bottom and DJI rallied.

Dec 1992

3350 Sell S9/S15

Decline quickly to 3150 -

below lower band

June 1986

1860 Sell S9/S5

Decline quickly to 1770 in 2 weeks.

7 Aug 1985

1330

Simulataneous Buy B11

Decline only to

1300 and then rally.

Jan 1984

1245

Sell S4/S12

Decline quickly to 11400 in 3 weeks.

July

1975

860

Sell S8

Decline quickly to 790 in 4 weeks.

8 Dec 1973

1020 no Sells

DJI rallied to 1050 and S9 and then started bear market.

Sept

1971

900 Sell S9v/S9.S2

Decline quickly to 900 in 10 weeks.

Feb 1969

935 Sell S8

Decline quickly to 800 - lowerband

9 Jan 1963

675 Simulataneous Buy B11 Decline quickly to 660 - lowerband

10 Jan 1959

590 no Sells

Decline quickly to 575 - lowerband

11 June 1954

320 no Sells

DJI rallied strongly from 320

12 June 1952

278 Simulataneous Buy B11 Decline

quickly to 262 - near lowerband

13 Jan 1950

195 no Sells

DJI rallied strongly from 195

May 1945

164 Sell

S9v/SS

DJI went sidewise. 2 months later rallied strongly.

14 March 1945

157 no Sells

Decline quickly to 153 - lowerband

Oct 1940

132 Sell

S4

DJI rallied to 138 and

then fell below lower band.

Aug 1937

186

Sell S9

Decline quickly to 115 in 3 months.

Apr 1930

284

Sell S9

Decline quickly to 215 in 6 months.

The break in the A/D Line uptrend is

expected to bring weakness to secondary stocks.

The A/D Line should be weak

for a month or so, if history repeats the most frequent pattern

after March A/D Line in the

past. (This was discussed a week or so ago in our Hotline.

Friday, despite the DJI being

down 3, there were 1021 more down than up on the NYSE,

only the Russell 2000 fell

1.5% and broke down below its recent support. The read

bearish "popcicle"

candlestick of two days ago was correct.

The QQQ chart's uptrend reminds be of Jack's beanstock. If APPL were to

start falling, the

whole thing would come down. We shoud watch APPL, IBM,

Finance and Housing

Stocks for signs of weakness.

AAPL

IBM

TIGER INDEX of FINANCE STOCKS

TIGER INDEX of HOMEBUILDING STOCKS

DJIA, Peerless Signals and Rising Wedge Pattern.

===================================================================================

OLDER HOTLINES

===================================================================================

3/1/2012

DJI= 12952.07 la/ma = 1.006 21dmaROC=.276

P= 283 -9 IP21=.069 V= +6

OP= .121

BUY B10 reinforced by Buy B18.

HOTLINE The BUY B10 Still operates, but

the very steep A/D Line uptrend was violated

yesterday, By itself, this is not reliably very bearish for the DJI in the first

half of a Presidential

Election year. But LOW VOLATILITY AFTER A BIG RALLY is. It is a 70% reliable

warning of a reversal

later in two to three weeks. For now the upwards momentum is bullish. That is

the meaning of

the B15 and B18. (The earlier Buy B15 which just appeared belatedly comes about

because of a small

Peerless program change just made and possibly because some earlier data was corrected

today

in a minor way.)

Results of Low Volality such as just Seen

in February and March since 1931

Yesterday, I reported that the DJI had closed 5 times within 0.075% of the day before's

close -

a very small daily change - over the previous 15 trading days. Below is the record

of what

has happened when this occurs after a DJI rally. In the charts linked to here, the

low volatility

signals are labelled S1s. This has occurred 11 times since 1928. In 3 cases

(27.3% of the time)

this would have given a very bad sell signal. In 8 cases (72.7% of the time), the

DJI was at or

within 3 weeks of peaking and about to decline to near the lower band, at least. My

impression

of this experimental signal is that when it works well as a Sell, the DJI still usually

must

have a final rally to the upper band. See the two

cases in 1994, for example.

Feb 1950 Bad - DJI rose for 4 more months.

March 1952 DJI peaked a

weak later and fell to almost to lower

band and support.

March

1953 - DJI fell below lower

band after 5 days more rallying.

Feb 1964 Bad DJI rose for 6 more months.

March 1964 Bad DJI rose for 6 more months.

March 1971 DJI peaked 3 weaks later

and fell below lower band.

March 1988 DJI fell to lower band (perfect sell)

March 1992 DJI fell nearly to lower band

March 2004 - DJI peaked 1 weak

later and fell below lower band.

Feb 2007 - DJI fell to lower band after peaking 2 weeks later. .

Feb 2011 - DJI peaked

1 weak later and fell below lower band.

Today's Buy B18 is not meant to time new Buys. Rather within

Peerless, it is to guarantee that

Peerless has switched to a Buy signal when momentum is very strong. Actually, B18s since 2010

have been better at calling tops.

But going back to 1928, they are reliably profitable.

B18 11/3/2003 9850.46 Reversed

Sell...> rally to 10737.7 (gain

of +8.9%)

B18 1/2/04

10409.85 ...> .> rally to 10737.7 (gain of +3.1%)

B18 12/1/04

10590.22 ...> .> rally to 10854.54 (gain of +5.9%)

B18 8/1/05

10623.15 ...>.. .> fell to

10216.59 before rallying.

B18 1/27/06

10409.85 ...> .> rally to 11577.74 (gain of +6.1%)

B18 4/4/06

11203.85 ...> .> rally to 11577.74 (gain of +3.3%)

B18 10/5/06

11866.69 ...> .> rally to 12398.01 (gain of +6.1%)

B18 12/4/06

12283.85 ...> .> rally to 12398.01 (gain of +3.3%)

B18 5/18/07

13556.53 ...> .> rally to 12398.01 (gain of +3.1%)

B18 4/21/2010 11124.92...>H/S

Stop...> decline to low of 9816 (below lower band)

B18 2/17/2011 12318.14...>decline to low of 11613.30 (to lower band)

The key ETF's Closing Powers are each still in uptrends.

---> 123 (+23) MAXCP stocks Bullish MAXCP Stocks

Still Bullish.

3 (+1 ) SUPER2011 Stocks making New Highs: ISRG +9.71

ULTA 85.31 +2.07

---> 75 (-6) MINCP stocks Bearish MINCP Stocks

MAXCP stocks are those showing Tiger Closing Power

making new highs.

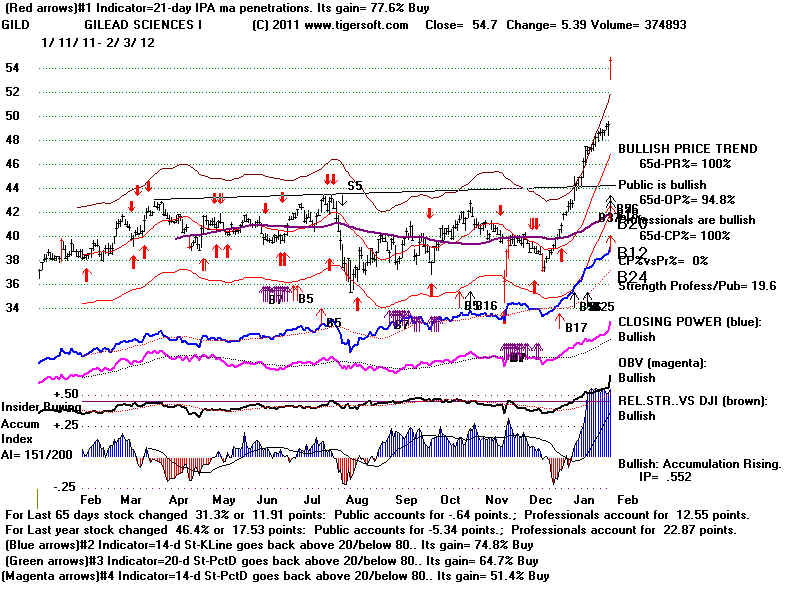

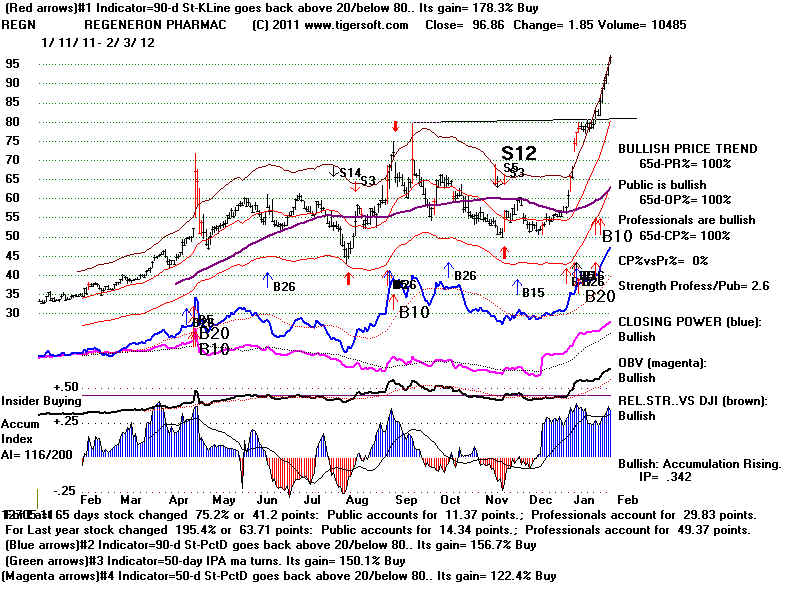

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's