TigerSoft News Service 3/27/2010

www.tigersoft.com

TigerSoft News Service 3/27/2010

www.tigersoft.com

BIG PROFITS in GERMANY's

STOCK MARKET MADE BY TIGERSOFT'S

PEERLESS STOCK MARKET

TIMING

for Period - 1997-2012

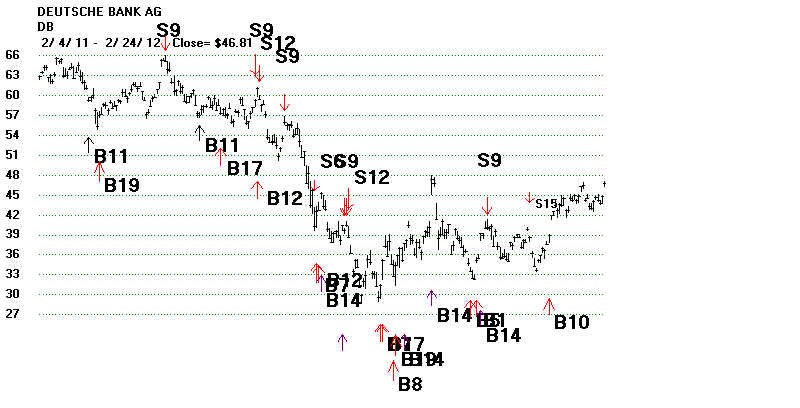

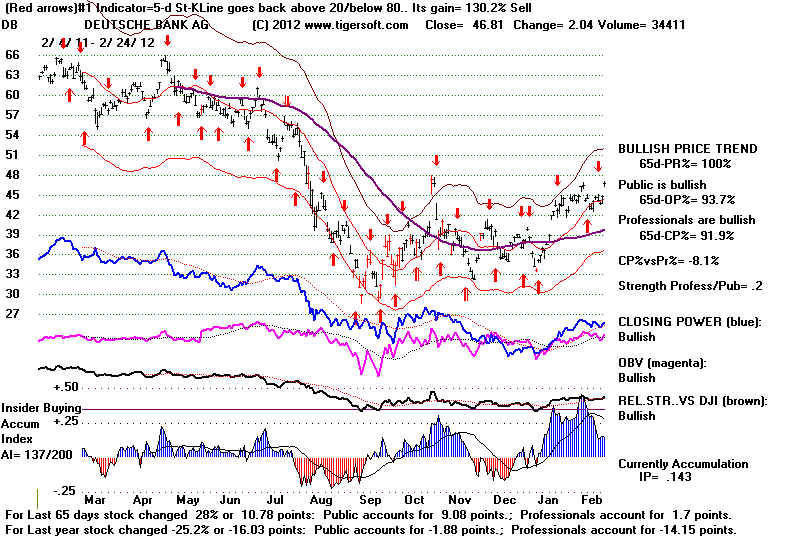

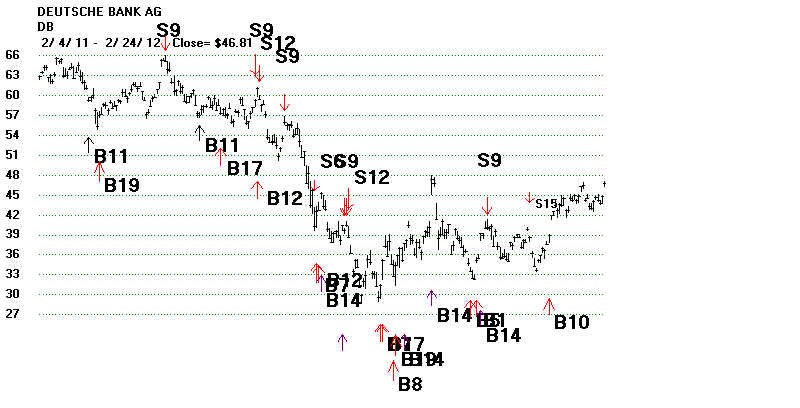

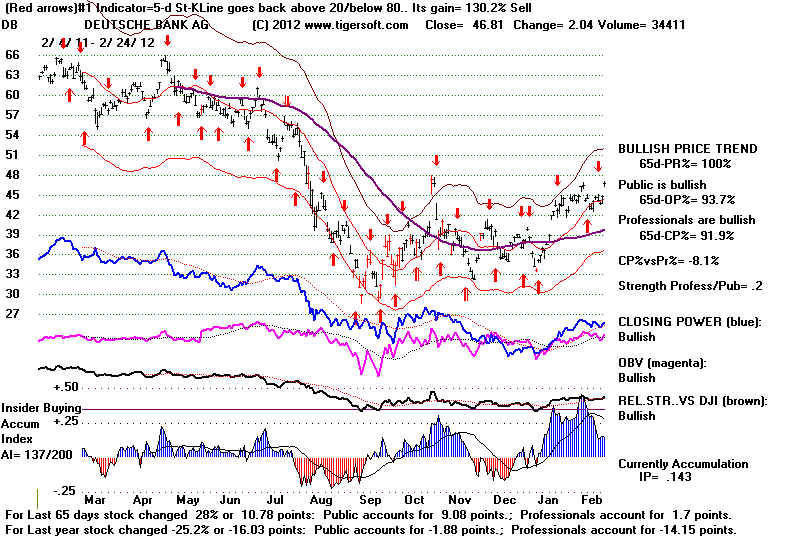

Peerless Buys and Sells on DB - Deutche Bank

DB's

Trading Gain = +116.%,

Long

and Short using next day's openings following a Peerless signal.

In Tandem, Not Random

TigerSoft's Peerless has had a

fine track record in trading the US stock market

since its creation in 1981. What is

becoming very clear is that Peerless can be used very

profitably with all

foreign ETFs and most stocks, too. The world's stock markets move much

more in tandem than

ever before. They do not move in a random walk.

Germany's restrained market volatility is a perfect place for conservative but savvy

traders

and investors to apply

Peerless and TigerSoft. Here we show how advantageously the German stock

market and its key etf EWG may be traded by superimposing on its charts the

Peerless Buy and Sell

signals which are

derived from the DJIA. Trading EWG is both representative and easily done.

Liquidity is high, too.

Tiger's software allows a user to quickly compute the Long (Buy and then Sell) and the

Short (Sell and then

Buy) gains using the next day's opening price and allowing

$40 for

commissions and

slippage when it is assumed that $10,000 is initially invested and all proceeds

also fully invested.

The

US traded ETF EWG

is a closed end fund that only invests in German stocks.

Its 10 biggets

positions now, 2/25/2012, are:

SIEMENS

9.5%

SI

(ADRs) http://www.siemens.com

BASF DE

8.8%

BAYER

N

7.9%

SAP AG

6.7%

http://www.sap.com

DAIMLER

6.1%

DAI.DE http://www.daimler.com

ALLIANZ

6.1%

DEUTCHE BANK

4.8% DB

http://www.deutsche-bank.de

EOAN.DE

4.7%

http://www.eon.com

DEUTSCHE

TEL. 3.9%

BAYER.

MOT. WERKE 3.5%

The

US ADRs of these stocks can be graphed with TigerSoft quite readily. The

automatic

and optimized TigerSoft

signals show first. Its gain (red Buys and Sells) was +36.7% using

a 50-day Stochastic.

In the case of SI (Siemens) we added the Peerless DJI based automatic

Buys and Sells.

That boosts the gain buying and selling short at the next day's opening

to +47%.

DEUTCHE

BANK ADRs (DB), we discover with TigerSoft, was extremely profitably traded

using short-term

automatic Tiger Buys and Sells based on a 5-day Stochastic. The gain here

was +130%. Understand this involved 41 trades in a year.

23 were winning trades. 18 were

losing trades. Our

software shows that the trader would have had to withstand as much as a

27.1% paper loss on a

long trade and 12.5% paper loss on a short trade.

By

comparison, one could have used the Peerless automatic Buys and Sells on DB. These would

have gained one 116.9%

on 11 trades. The biggest paper loss would have been 13.8% on a

long trade and 2.4% on

a short trade.

|

|

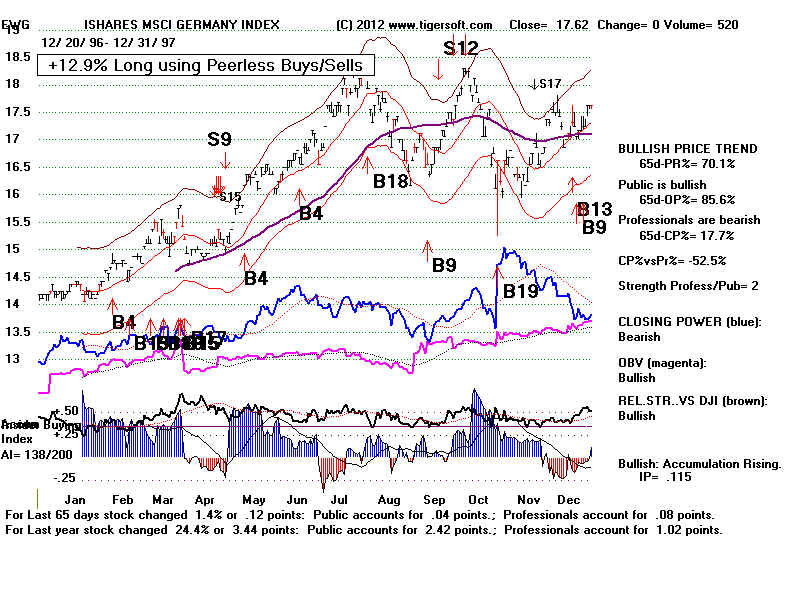

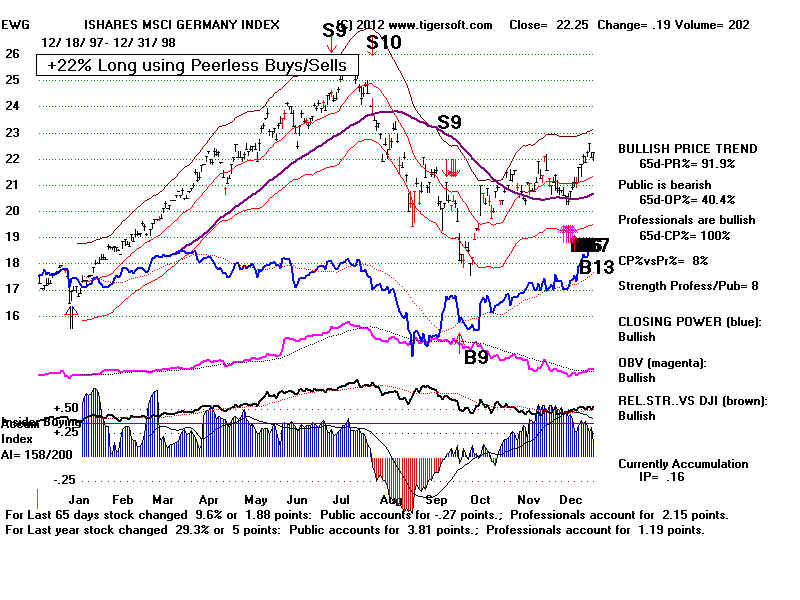

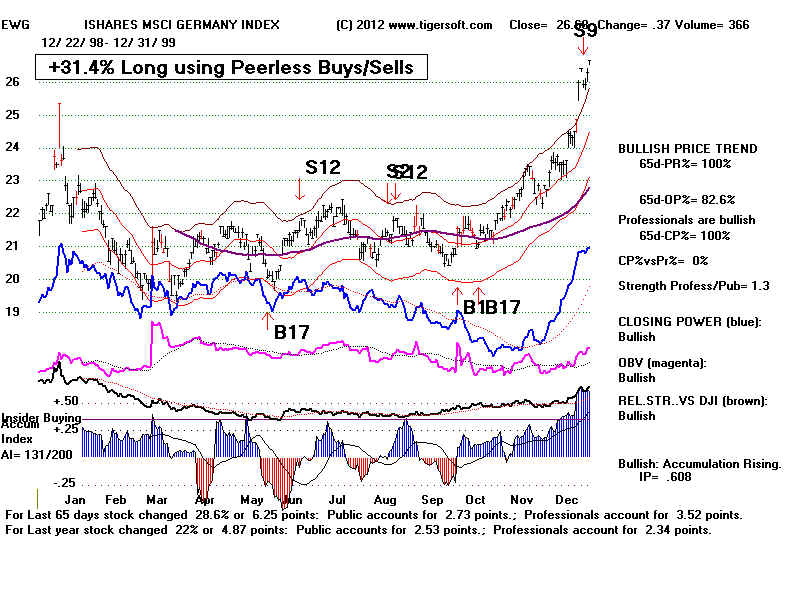

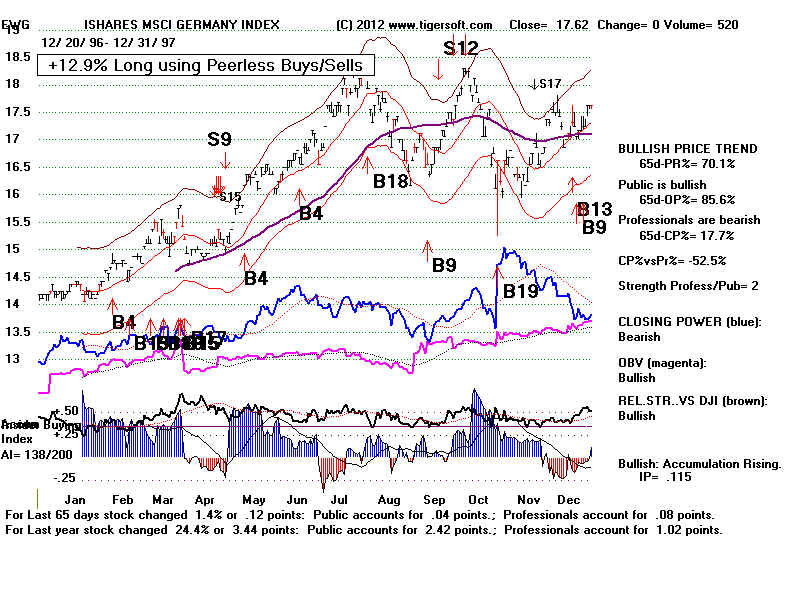

PEERLESS SIGNALS' TRADING GAINS THE GERMAN

ETF

EWG

Charts for

Long Only Short Only Long and Short

----------------------------------------------------------------------------------------------------------------------------------------

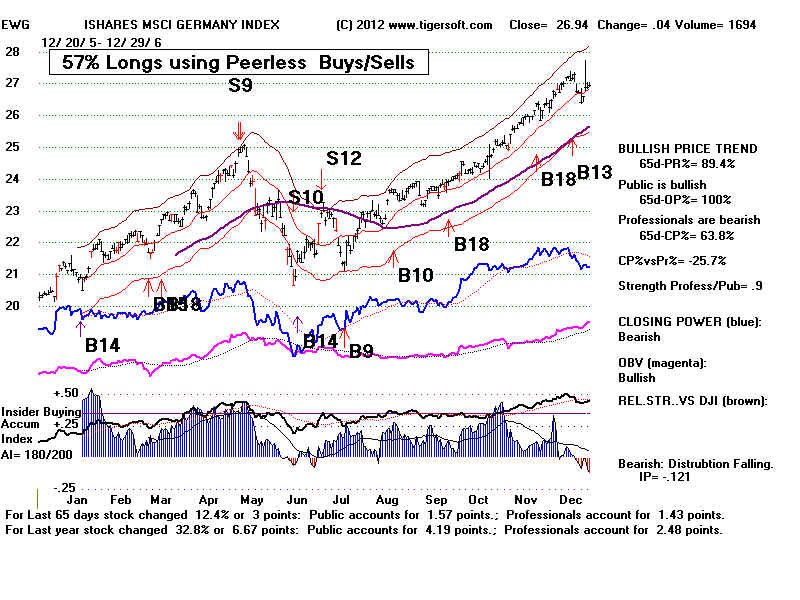

1997

+13%

-6%

+6%

1998

+61%

+26% +121%

1999

+31%

+14% +45%

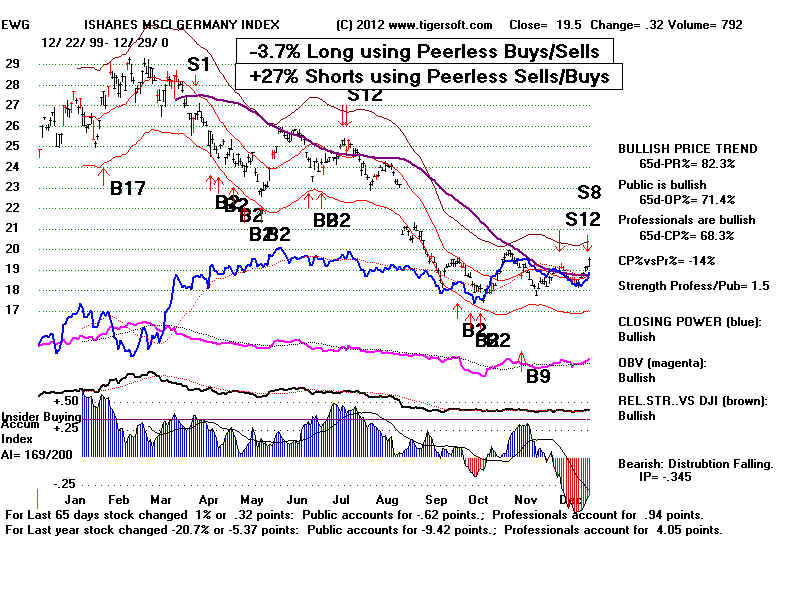

2000

-4%

+27% +22%

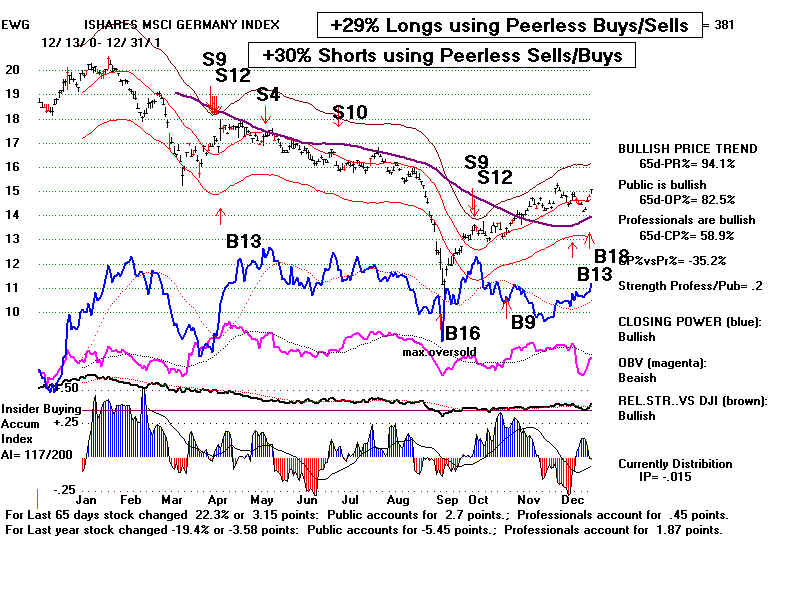

2001

+29%

+30% +67%

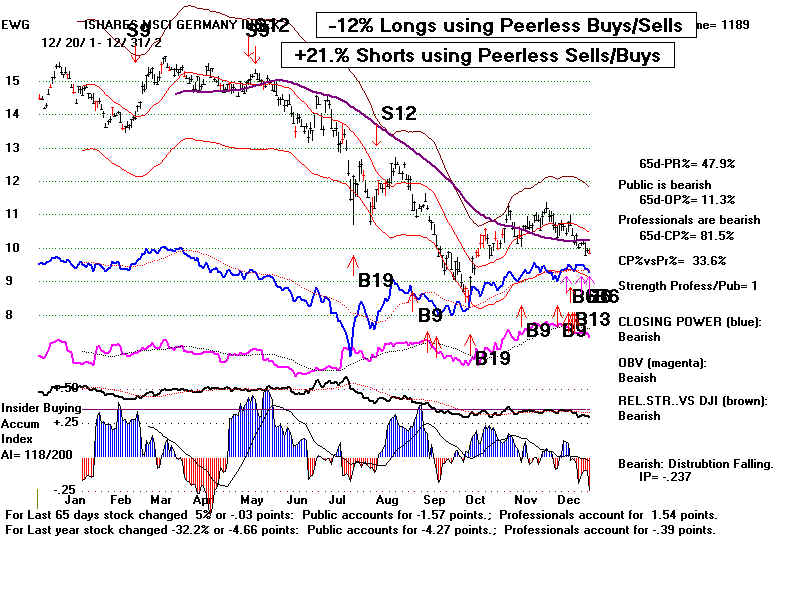

2002

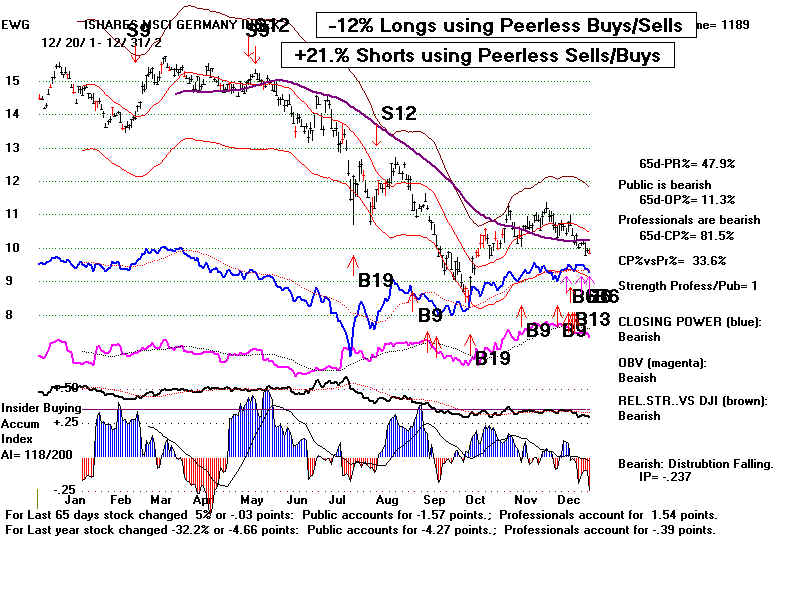

-12%

+21% +6%

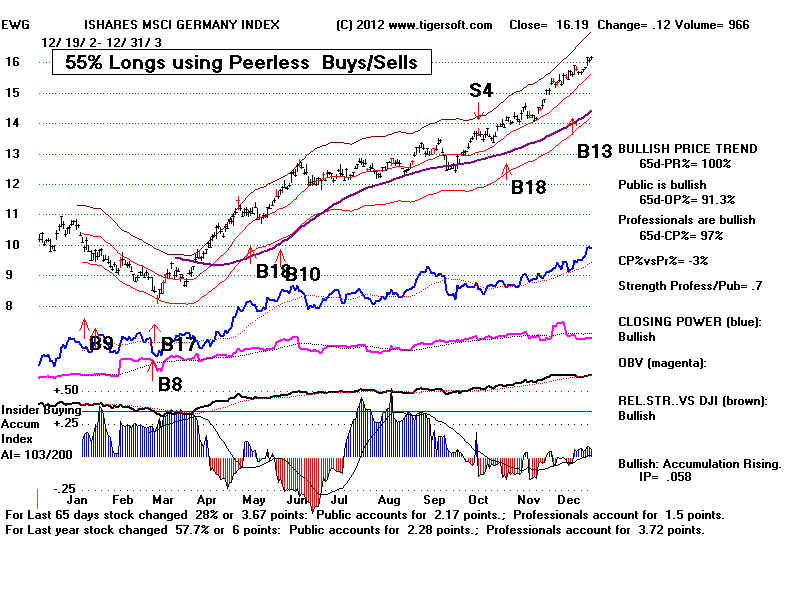

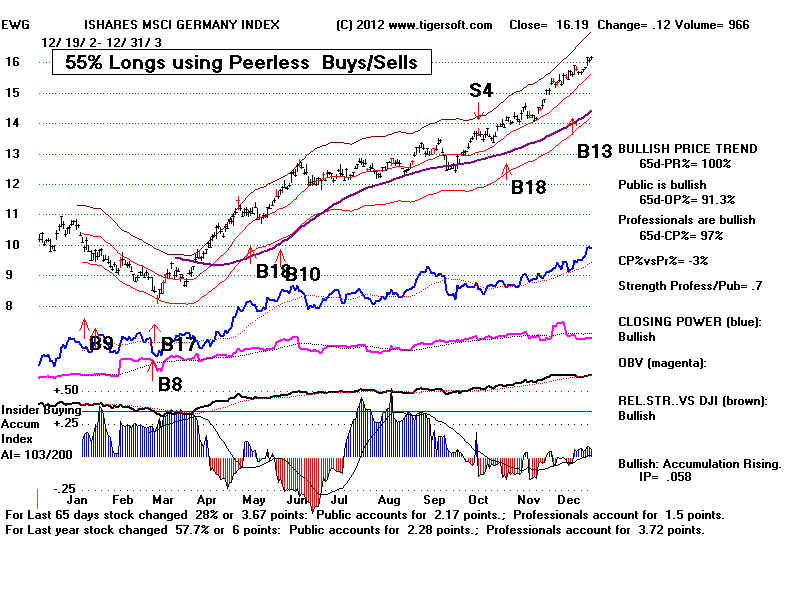

2003

+55% -3%

+50%

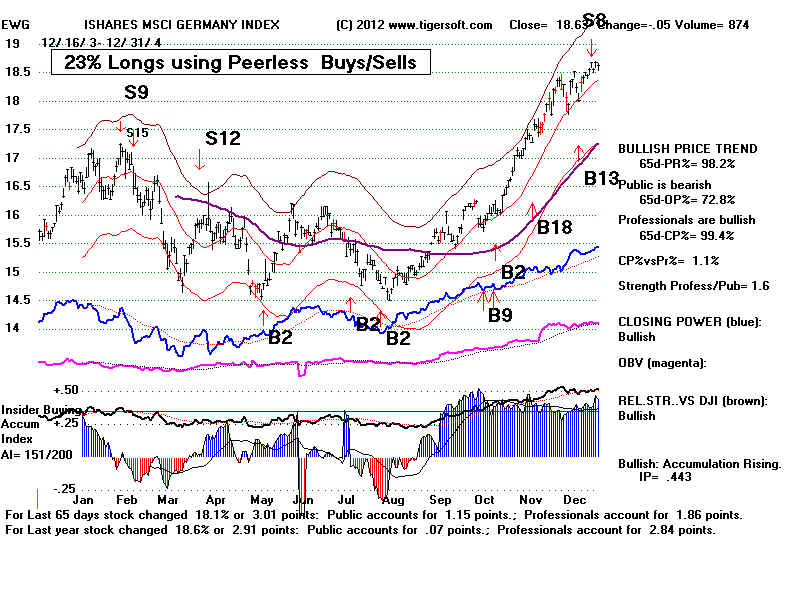

2004

+23%

+11% +38%

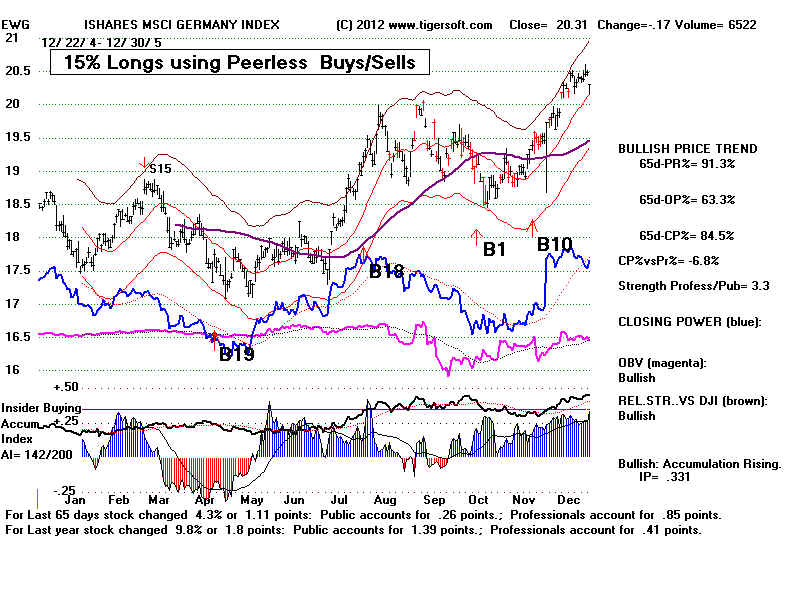

2005

+15%

+6% +22%

2006

+57%

+23% +98%

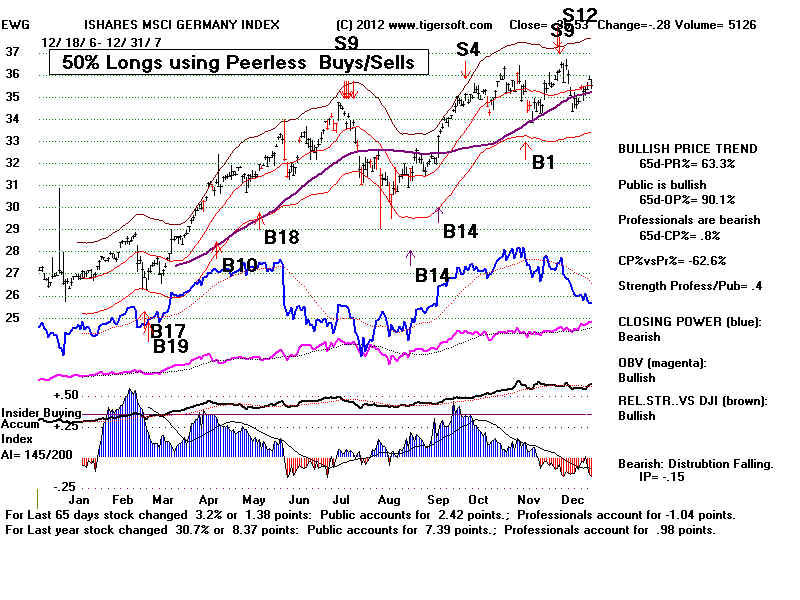

2007

+50%

+10% +66%

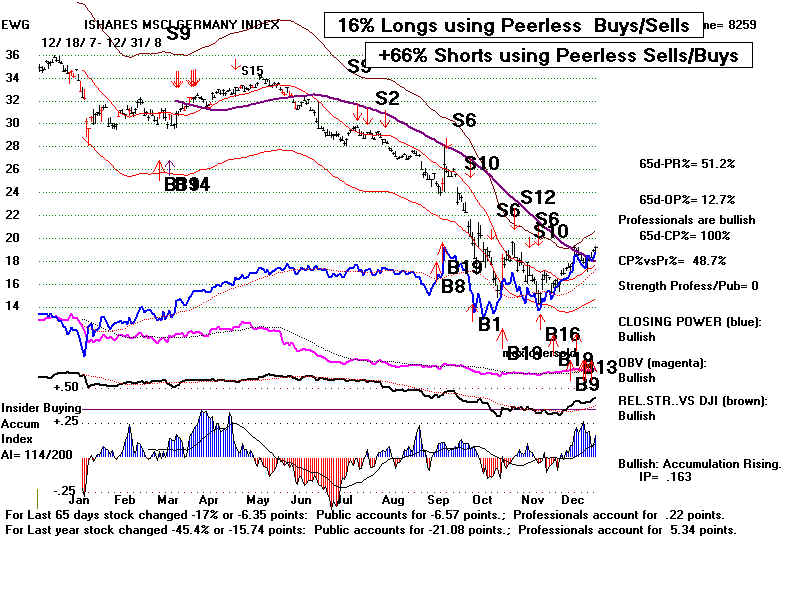

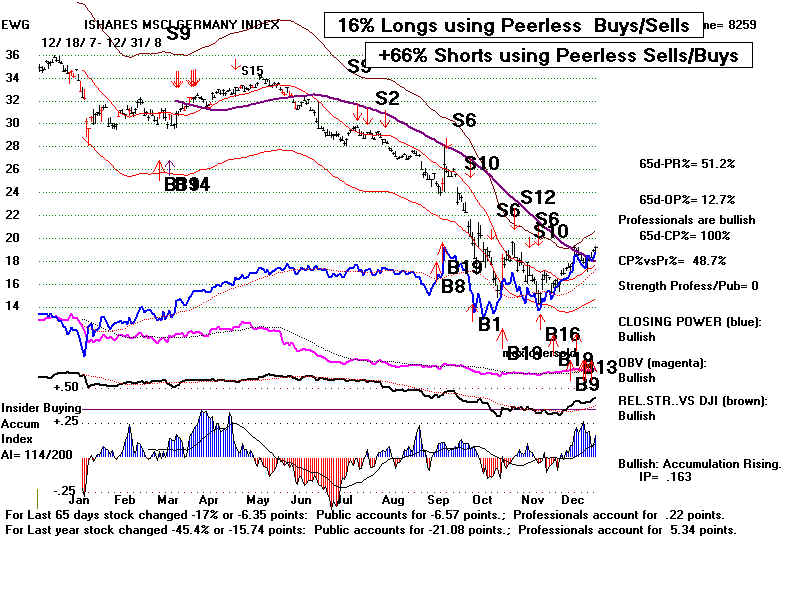

2008

+16%

+66% +93%

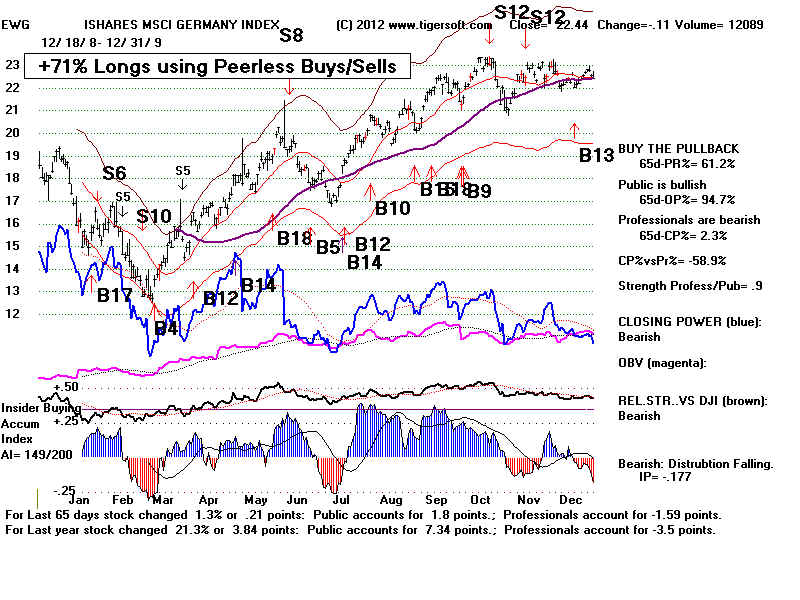

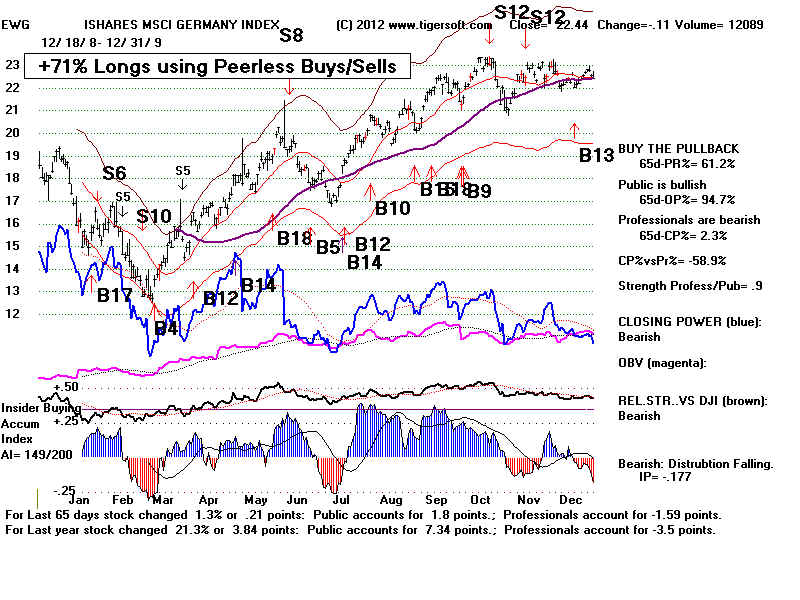

2009

+71%

+16% +97%

2010

+36%

+13% +54%

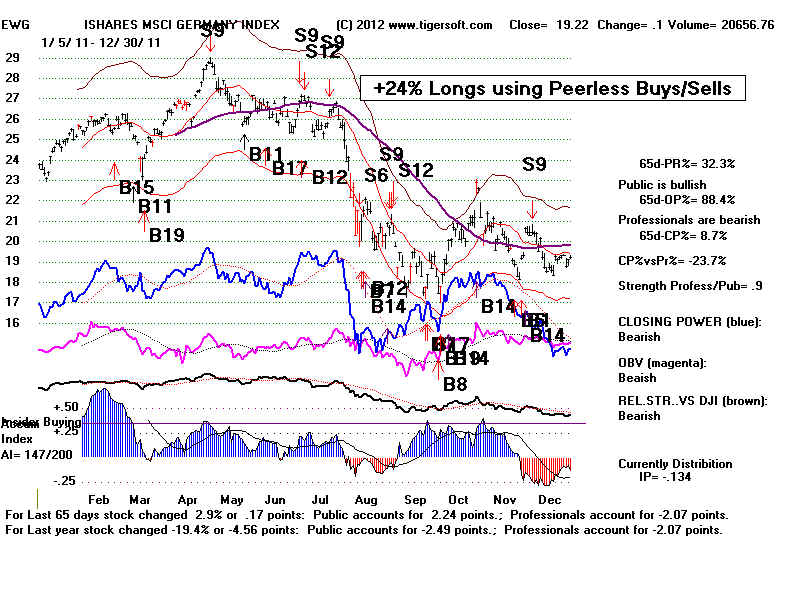

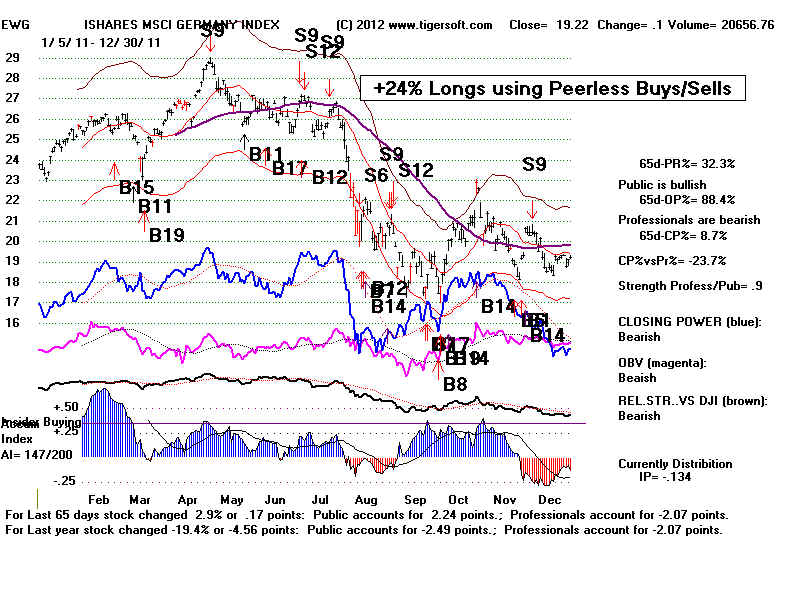

2011

+24%

+57% +94%

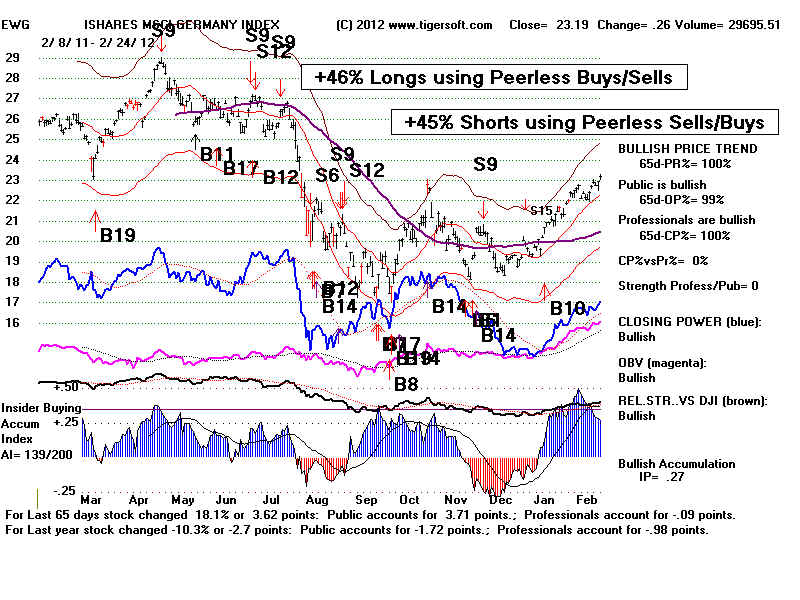

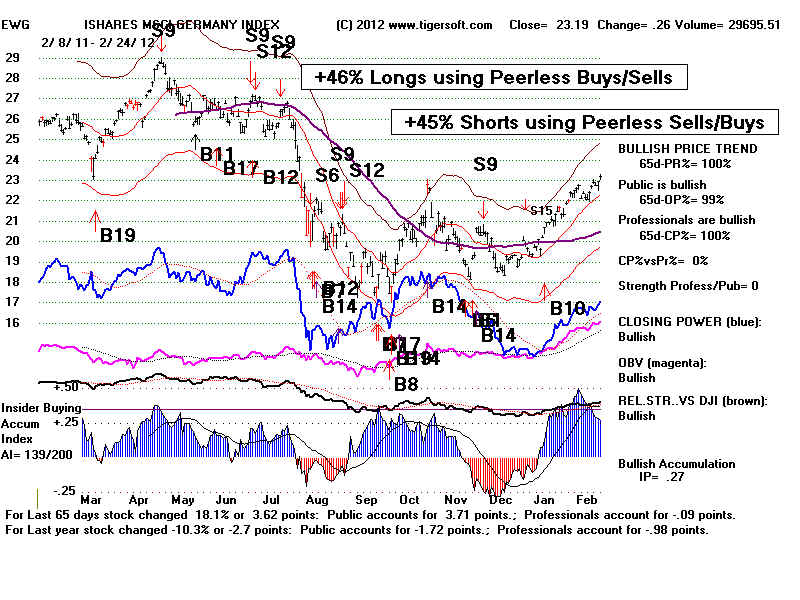

2011-2012 2/24/2012 +46%

+45% +112%

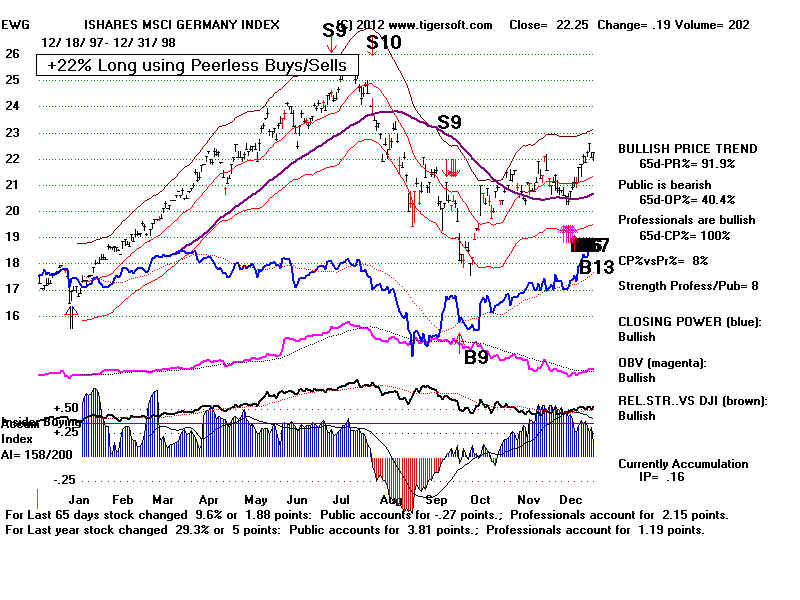

EWG 1997 |

EWG 1998 |

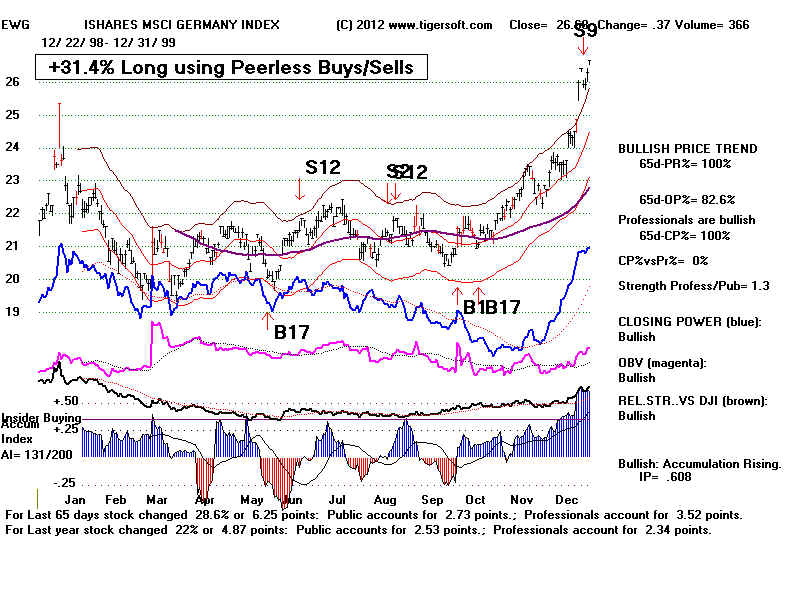

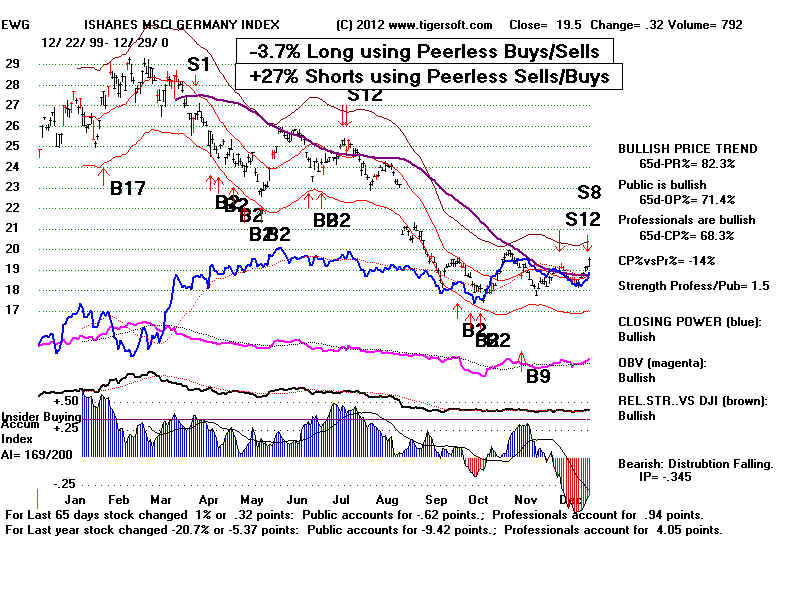

EWG 1999 |

EWG 2000 |

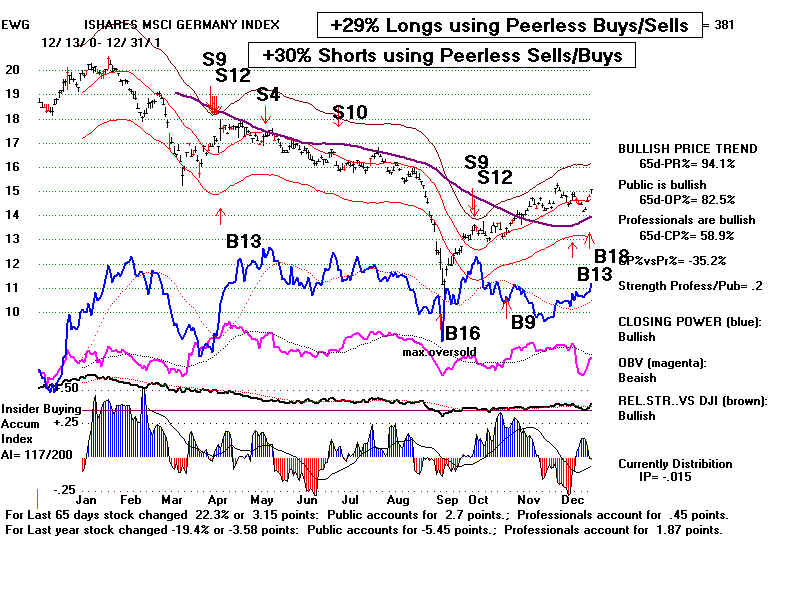

EWG 2001 |

EWG 2002 |

EWG 2003 |

EWG 2004 |

EWG 2005 |

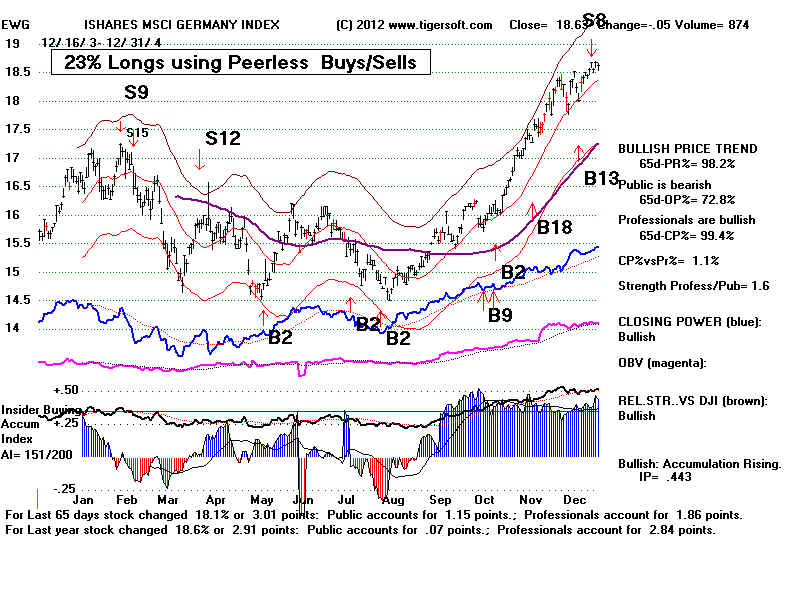

EWG 2006

|

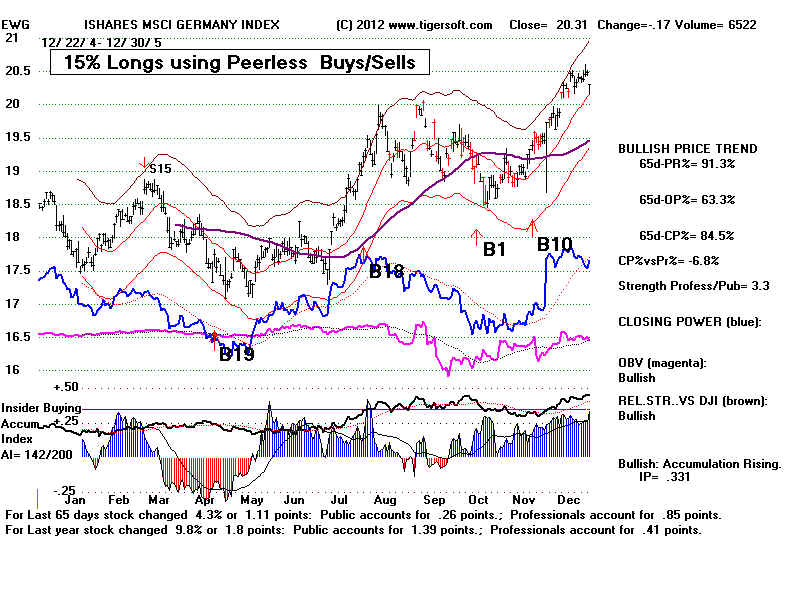

EWG 2007 |

EWG 2008 |

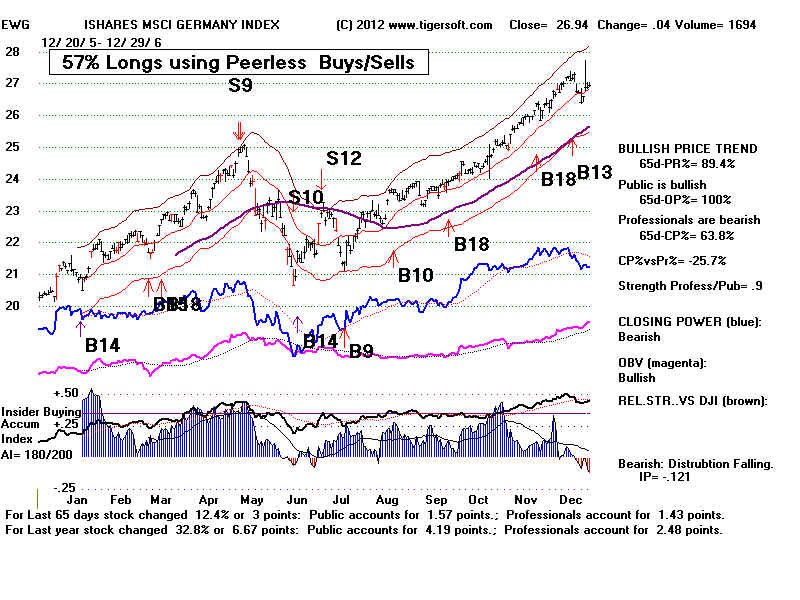

EWG 2009 |

EWG 2010 |

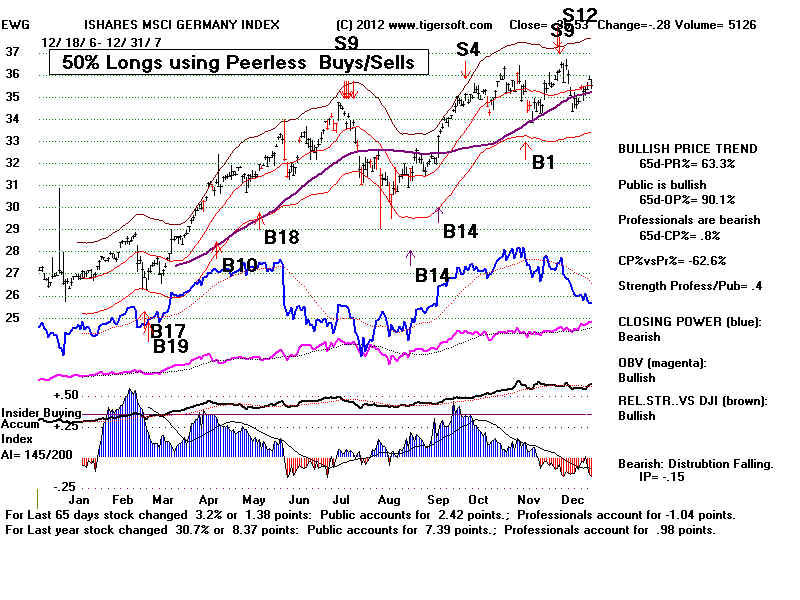

EWG 2011 |

EWG 2011-2012  |

TigerSoft News Service 3/27/2010

www.tigersoft.com

TigerSoft News Service 3/27/2010

www.tigersoft.com